Every company is talking about supply chain constraints on conference calls. It will be the most discussed issue on conference calls this quarter. Inflation will be mentioned secondarily. There will be winners and losers that will come out of this period. The winners will be the companies that can pass through the increased costs of the shortages and materials. The losers will be the companies that can’t get items to sell to the consumer. I think it will be a difficult holiday season with many retailers lacking inventory. The later in the supply chain the worse.

It really is an unprecedented situation because there is a lot of demand for products with consumers flush with cash while the economies around the world are recovering from being shut down due to last year’s pandemic.

In the last year, market participants have accepted (and bought) the semiconductor shortages, and now the supply chain problems are accepted shown with stocks holding up (and going up) despite these problems. How long will the markets give a pass to these problems is something I’m pondering. For example, if a major department store doesn’t have items in stock in the next month, how bad could their holiday shopping season be? What if Best Buy, Target, or even Walmart runs out of hot toys this year such as the G.I. Joe with the Kung Fu grip or 70-inch flat-screen TVs that it seems everyone has now, or perhaps just the basic staples needed to feed a family? We now know Apple will be shipping 10 million fewer iPhones and just announced some new products yesterday but will there be supply constraints limiting supply? The point is this will be difficult to work through and the free pass the markets have given to companies will start to wane when it becomes very clear how bad the situation really is.

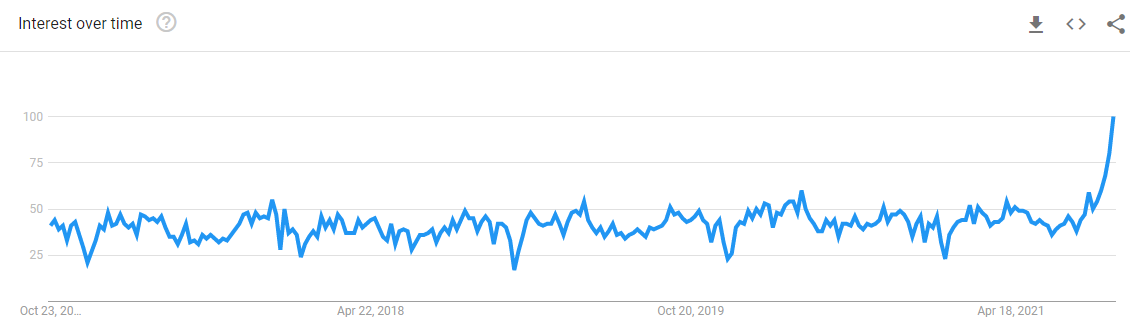

There are stories now about consumers stockpiling items and shopping early for the holiday season. The contrarian in me starts to think this is overblown with it being discussed frequently in the media. If that’s the case then the next issue will be about a lack of demand and that’s for another time. Here’s the Google Trends for “supply chain”.

Interestingly I received the latest Bank of America fund managers survey and it is always loaded with really valuable information and data. One question in the survey is what are tail risks? Inflation has been recently and continues to be the number one issue with supply chain constraints not making the list. Covid nearly dropped off the list as a risk with it dropping to 3% from 17% and that’s the lowest since it became a risk answer on the survey. I have as usual 10 key charts out of 40+ they put out. This month’s survey results are really interesting.

trade ideas

I have a consumer discretionary short bias as you might have noticed. I will remain short retail with the risk of supply chain disruptions. I am holding all shorts and adding AFRM as a new 2% weighted short idea. Adding DASH as a new 2% weighted short idea. Adding 1% to the TGT short and adding back BBY as a short with a 2% weight after covering is successfully lower. Finally, I am adding FDX as a 2% long idea as a pair trade with DASH. All charts are below. Trade Ideas sheet will be updated in a little while.