Dinner with JPM market strategist

From my notes: “Every meeting inflation is the most asked question” “Consumer is in good shape” “Inflation will be mostly transitory except for sticky housing, wages” “consumer doesn’t need to go back to work” “skills mismatch with open jobs” “child care is a real drag and problem for the consumer” “rates will go higher” “fly in the ointment: valuations are too expensive, people reaching for yield in wrong places, higher volatility is ahead” “Powell will be Fed Chair” Nothing overly surprising. Thank you to David Leibowitz from JPM and Jeff Gaggin from Morgan Stanley Wealth Management Greenwich. If you want someone who is a specialist with alternative assets, he’s the best. Let me know and I will connect you or go to Linkedin

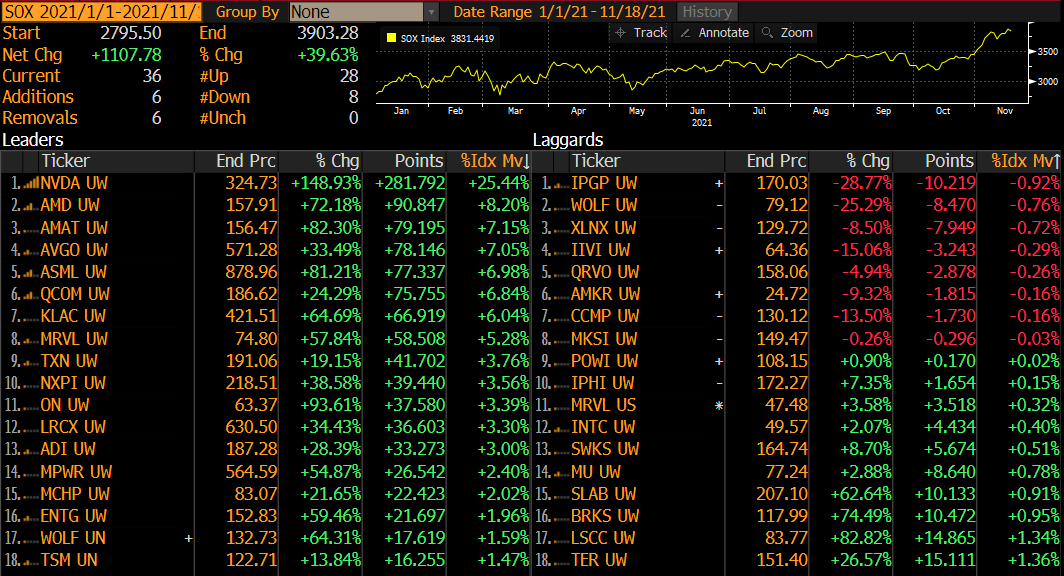

Semiconductors – nvda dominance but it’s expensive

Nvidia has dominated the semiconductor space. It’s up 8% today and up over 45% in the last month. It trades at 75x earnings with nearly an $800 billion market cap. Intel which has been trying to rebuild their business with a new (very good) CEO trades at 9x earnings with a $200 billion market cap. Here’s is an attribution study with YTD performance. 25% of the total attribution up 148%. I keep thinking the retail trader in Singapore who came out as the big Tesla billionaire is the gamma squeeze character as he mentioned not only Tesla as what he trades but Nvidia too

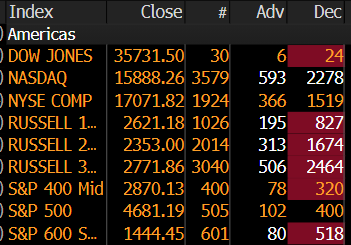

Breadth and asset allocation

Today’s action is very heavy. You wouldn’t know that if you were looking at the S&P and Nasdaq 100 indexes but here’s market breadth on all of the major US indexes. It’s not easy out there owning stocks especially those that are getting or are oversold. Every sector has negative breadth while the tech and consumer discretionary indexes are trading up. The financial media will focus on only a few outsized winners today which are the mega-cap NDX stocks.

Perhaps this is an asset allocation program hitting the market today.

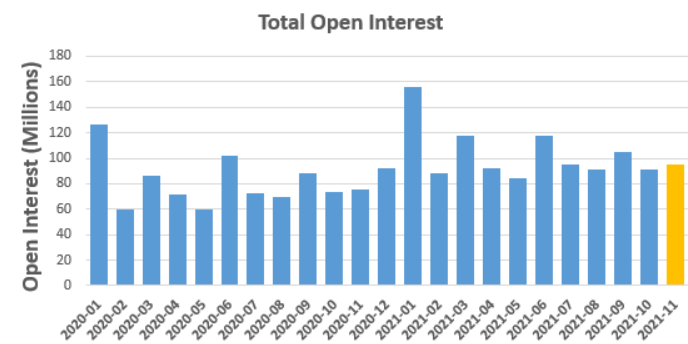

options expiration and open interest

A lot has been written about the huge options volumes seen this year and on weekly expirations in single name stocks. Tomorrow’s expiration (normal 3rd Friday) will be the second largest number of expiring options for a non LEAP expiration. We’ve seen some volatility after these expirations so it could happen next week or perhaps some of the weakness today is partly dealers selling hedges.

market webinar tomorrow

Tomorrow I am doing a market webinar at 11 am ET. It’s overdue and timely. I will also go over some of the new features on the website. If you have something you want me to look at please email by the close today. This is a subscriber-only webinar. Here’s the link to sign up. I will have a replay if you can’t make the time work.

trade ideas

HD finally got the Sequential sell Countdown 13 and I increased my short to 4%. Long exposure is very difficult right now with stocks that are oversold in an overbought market fading is tricky. I’m committed to the cannabis trade for 2022 and as I explained at the start these will be volatile up and down. ATVI is still under pressure but my entry isn’t so bad considering how far down it dropped before I bought it. I will probably add more with some more clarity. Twitter is one I’m getting more intrigued with under 50 and I will also be adding to this one. Keep in mind this was paired with FB and SNAP shorts which SNAP was taken off with a 17% gain. China tech is down hard today and I have no positions and believe these are not buys yet. HOOD is making all-time lows and I remain short. It’s not easy to borrow shares and that’s why I suggested the Dec 30 puts which are doing well. The mega lock-up on December 1st will change the float from currently 21% to 93%.