“The greater the mania, the higher the intellect of those who succumb to it.” – Bernard Baruch

“If there is one common theme to the vast range of the world’s financial crises, it is that excessive debt accumulation, whether by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom.” — Carmen Reinhart.

“Inflation is the one form of taxation that can be imposed without legislation.” Milton Friedman.

In the last few days, I watched and was riveted by the Hulu series “Dopesick” and the HBO documentary “Crime of the Century” on the story of our opioid epidemic. I had read about the Sackler family of Purdue Pharma for the first time when I read a book called “Winners Take All” by Anand Giriharadas where he basically takes a bat to the elites by suggesting they make billions, give some away to ease their conscience and keep the pitchforks at bay, pollute the democratic process through lobbying, minimize their taxes, and sometimes get away with murder.

The quick story of the Sacklers goes back a long time, to Arthur Sackler, who revolutionized pharmaceuticals advertising. What was probably a useful idea given the ways in which doctors got their information, pharmaceutical companies sold their products, and to ensure that medical treatment was current. But, like many, many good ideas and innovations in our history – social media for example – poorly regulated, they can turn into too complex to understand, too big to fail disasters.

In this case, one of the scions of the Sackler family, Richard, an MD, was looking to make a name for himself and to manage the downside of an expiring patent. He took OxyContin from a narrowly used post-operation, end of life care drug to an omnipresent blockbuster through shady FDA dealings, use of aggressive sales tactics, data manipulation, advocacy groups, congressional lobbying, philanthropy, and legal escapades. It is a gripping story of system failure, of pure greed and roughly 500K dead, countless lives impacted. This drug has re-engaged the heroin (and fentanyl) epidemic and has ruined countless lives and families. It should have never happened. We gave it some air time for a bit, but not nearly enough. Reading through the Harvard piece on detoxification, addiction seems like a life sentence.

OK, so why am I writing about this? Well, because like Bruce Springsteen has written in many of his songs, the country and its leaders get things wrong. The system is ripe for manipulation, of suspension of collective common sense, and polarization makes it worse.

And, to bring it back to the critical matter of the day – inflation – here is a quick and dirty logical takedown of the average inflation targeting regime.

Things that caught my attention this week:

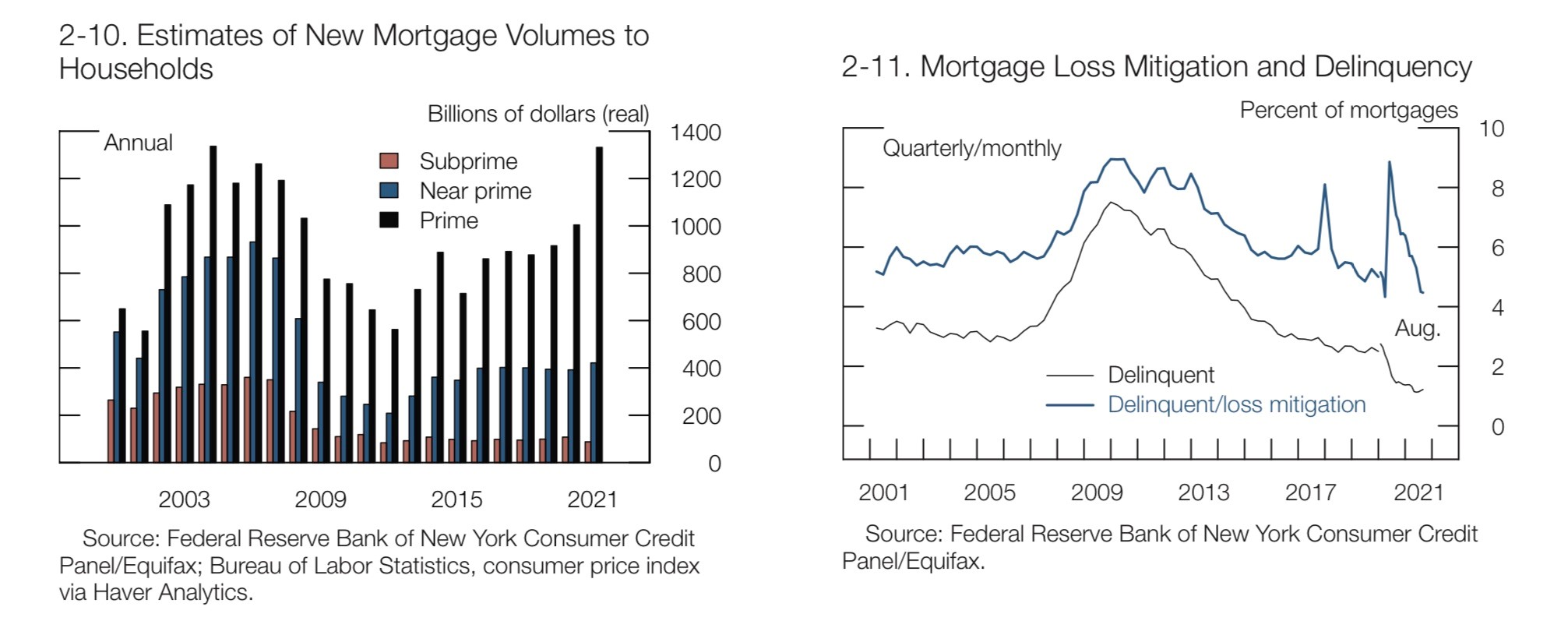

Fed Report on Financial Stability:

The report got a little bit of play recently, so I thought it made sense to go through it.

Overall, it reads as consistent as what Powell and others suggest, that we are generally in OK shape and that we know where the risks are. They spent some extra time looking at retail participation in equity markets, what happened in March 2020, non-cash collateral holdings at central clearing parties, and of course, climate. One risk it didn’t go through, although it was implied because rising interest rates would have an impact on elevated asset valuations, was inflation. But, here are some things in the study that I highlighted:

Fiscal Theory of the Price Level (FTPL) and Fiscal Dominance:

I have written a bit about this before when discussing how US Treasuries are not priced as one would price typical assets. The general idea is that the price of a bond should relate to getting paid back by the government in like-for-like terms. In other words, money borrowed by the government today would be paid back by running primary surpluses in the future. Since we have not run a surplus for a long time (late 1990’s), academics argue there is a convenience factor (collateral), portfolio factor (negative beta), and global relative demand that may partially explain pricing.

But, what the general FTPL speaks to is a part of understanding inflation dynamics, and there are competing camps that are out there (Keynesian, Monetarism), often causing confusion, and not fully relevant across a myriad of economic fact patterns and picking up the interactions.

The FTPL essentially discusses that in the absence of future surpluses (austerity) and/or credibility to act, fiscal expansion and dominance (impacting Fed behavior) would raise the price level via the wealth channel (does that sound familiar?). I have included a very digestible read on the history of fiscal deficits and inflation that should be enlightening and give more texture to the pickle our officials are in, and maybe why they almost have no choice but to suggest this will all work itself out.

Another piece I included is from Eric Leeper that suggests monetary policy should be more in tune with fiscal policy, particularly given recent actions. This was taken from his recent paper, but these remarks were from 2011 when things were a whole lot less concerning.

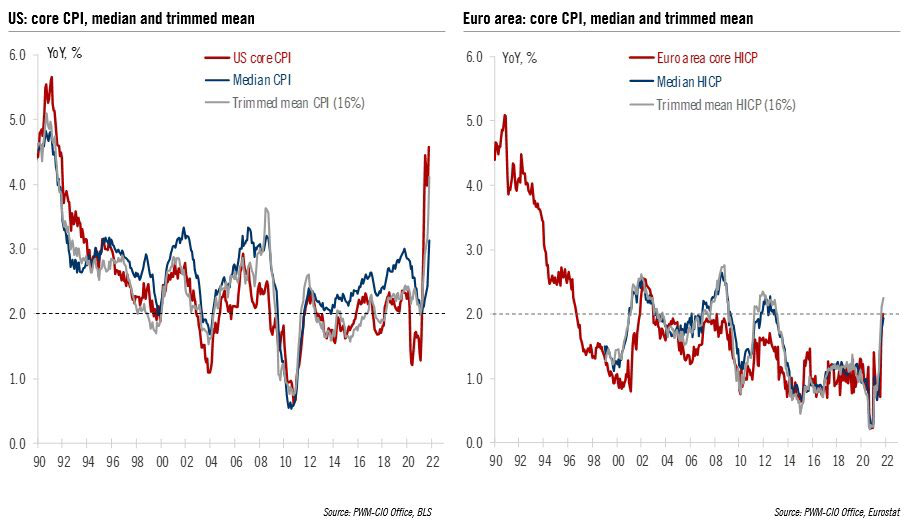

Today, I was reading a piece from Paul Krugman (Keynesian) that acknowledges he got some things about inflation wrong (because he wanted to see large government expansion), but ultimately (as Yellen suggested on Sunday), expects the issue to resolve itself as supply comes back on stream. But, just looking at the US vs Europe inflation, where supply issues should also be prevalent, shows that there is more going on.

Anyhow, It does not matter as the ball has been put in motion, and the topic is ubiquitous, exactly what officials should not want. Nobody knows anything for sure how this plays out – because inflation is part science, and part behavioral/psychological – but it would appear to me that the near-term science part is highly inflationary (aggregate demand > supply; money supply growth; wealth effects, fiscal dominance).

I am in the camp that if our economy is going to grow nominally north of 6% or so (likely higher), why are we so afraid to remove some accommodation when clearly, as per Summers, we may have done too much and put too much pressure on supply? Official reactions are bringing credibility concerns directly into the sunlight. For example, why is the administration trying to sell us that more fiscal expansion to lower child care, etc (taking from corporations – who can pass along tax hikes through higher prices, or from wealthy who are not spending it) will help bring inflation down?

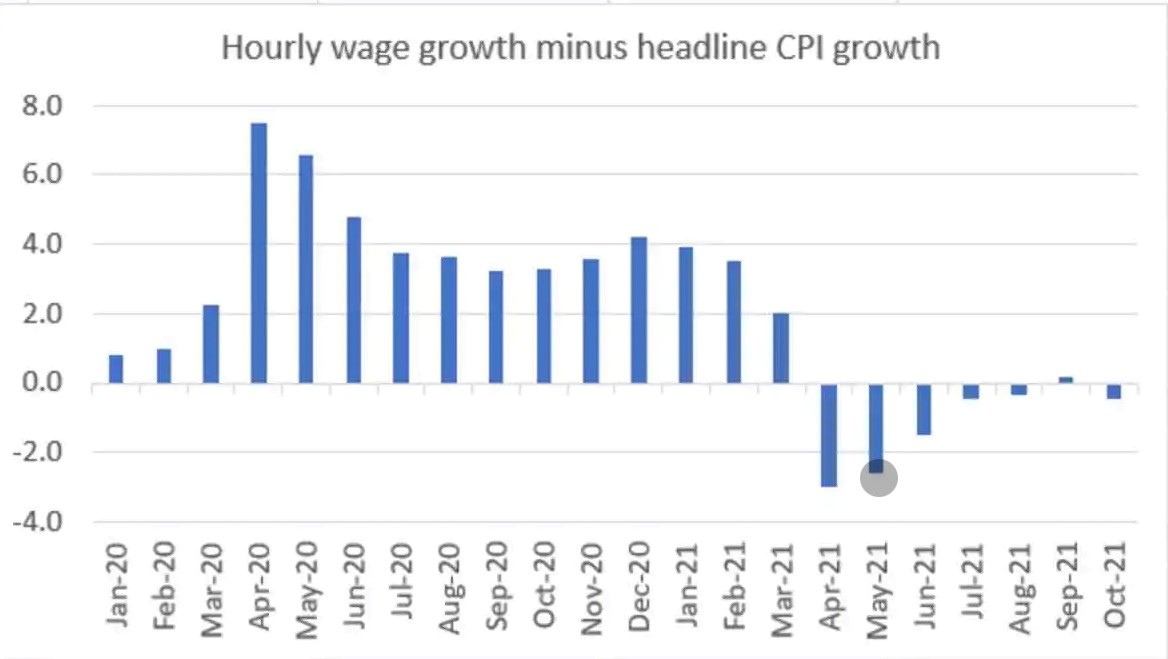

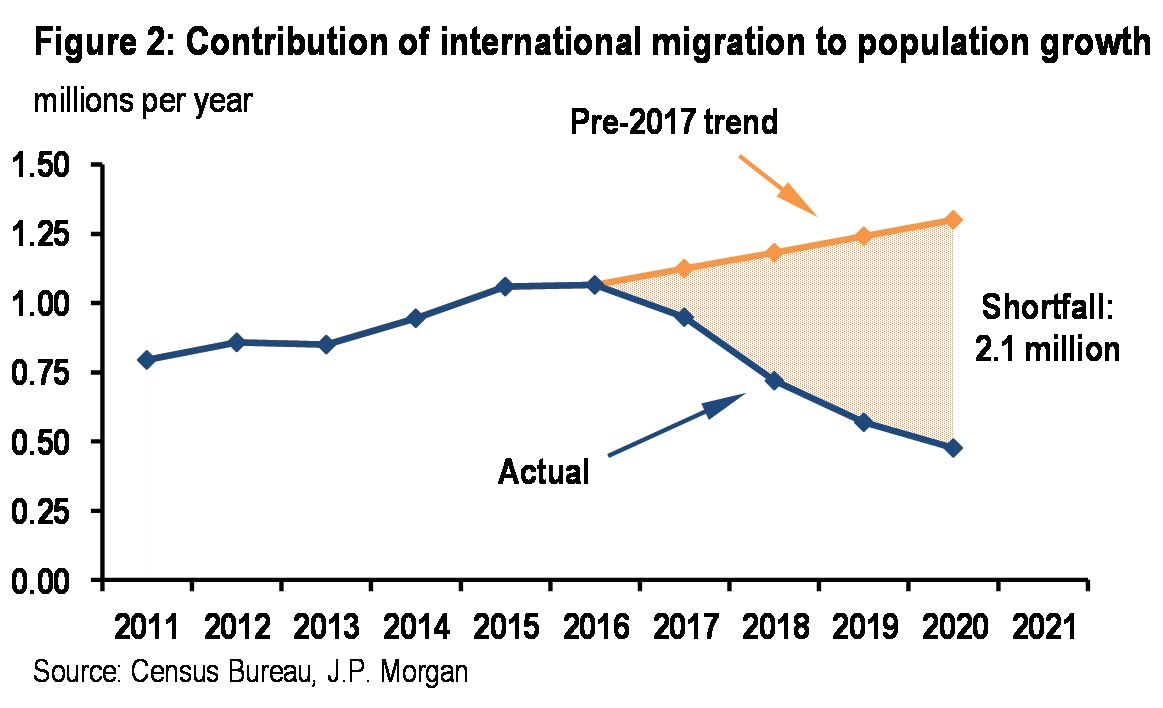

A part of that Democrat CoVid passing argument relates to labor supply, but it is not very convincing to me, given the tightness of the labor market, the lack of immigration, worker demographics, changes to supply chain dynamics, fiscal expansion requiring more workers and supplies, lack of investment due to ESG, and of course, real wages requiring some catch-up.

On consumers, there is research suggesting that prices of they purchase frequently (food, gasoline) items that play a big role in expectations and it will be extremely hard for firms, some who have been kept afloat with PPP and other support, and others thriving with high margins, to be stingy with labor – existing or new personnel.

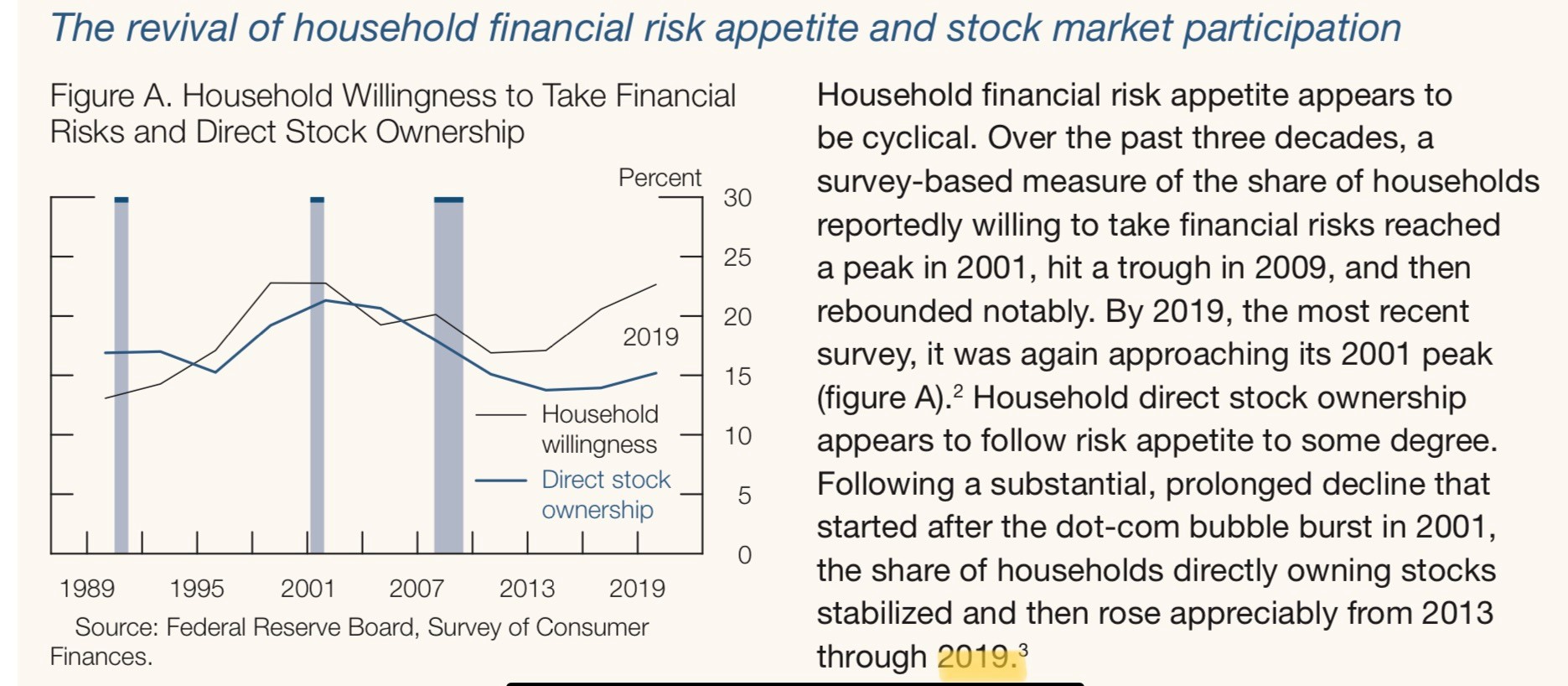

New ideas on equity valuation:

I have written in a few of my pieces about equity valuations generally, and about changing micro-market structure and dynamics. There are a lot of ideas that are percolating out there at all times to try to explain why something is happening. With valuations as they are, we search for clues as to whether the age-old axiom of “trees don’t grow to the sky” still applies. My view is generally that most people don’t dig enough through the basics and use mental shortcuts to rationalize a phenomenon without investigating the costs and stability of the paradigm shift.

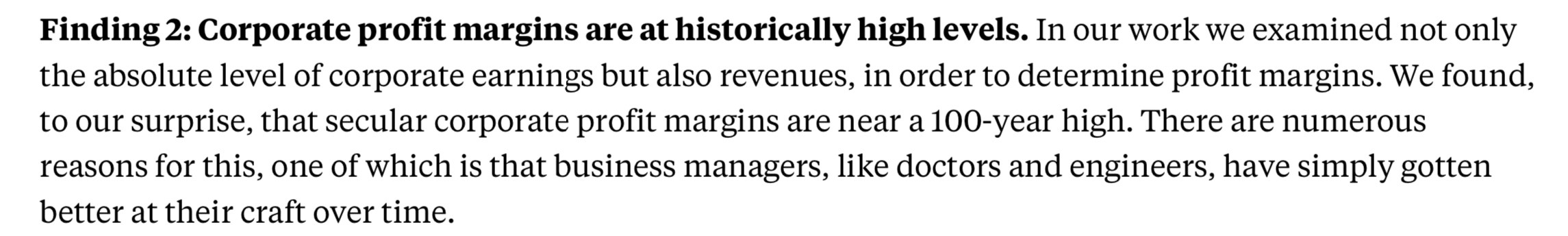

So, here is a piece that I think has some good texture to think through the issues generally, written by consultant Oliver Wyman. Here are two snippets that I wanted to highlight:

I would agree that business managers improve over time, but a lot of that improvement is system exploitation, whether regulations, anti-trust regimes, outsourcing, accounting, offshoring, labor power destruction, tax codes, etc.

None of this leads me to any call – I still think US equities are a magnet for flows, and I, while I am cognizant of the factors that could reverse the flows, fighting these, is foolhardy. But, if the man in Omaha is flush with cash, it is quite likely there is a good reason.

On that, here is a bit of research that highlights how perhaps operating margins may be artificially higher because D&A underestimates maintenance Capex. In this researcher’s model, he suggests such under amortization of D&A – particularly given quicker technological obsolescence, inflates operating earnings by roughly 7%. He breaks these out by industry, so well worth the look.

Is Crypto really worth $3B

The quick answer from me is I have no clue. But, this is a somewhat smart piece on the matter and explains why it is likely to suck in more participants.