2021 has been a year, unlike any other year I’ve ever seen in the markets. I was trading very actively in the 90s and I’ve been asked a hundred times if today’s market resembles the late 90s market. It’s similar in many ways with new investors coming into the markets for the first time hoping to get rich or if I can be hopeful looking to forge a long-term investment plan. We’ve seen all of the charts and data of the massive inflows in 2021 that surpass cumulative inflows from the past 20 years. One risk is that these new investors see a pullback and hit the sell button all at once. Another risk is that they start to lose interest in trading as it’s not as easy as it seems. FOMO (fear of missing out) has been the lure for the majority of these new investors to pile into risky momentum stocks and crypto coins as they will say YOLO (you only live once). Investing or trading in this market is a casino for many people. If you ever have spent time in Las Vegas or at a casino there are a lot of broken people who tried their luck as YOLO bets didn’t quite work out for them.

Below I have some stunning charts from Goldman Sachs illustrating how this market has turned into a casino showing massive options trading by retail accounts concentrated in very few stocks. This is one very different aspect of the markets today vs the 90s and this is a big potential risk. Naturally, it’s a risk to the retail traders who are taking massive risks but it’s also a risk to brokerages who are enabling this type of risk.

Last January, Robinhood nearly went under when the Game Stop trading phenomena happened. Hedge funds were caught short and the retail investors (and some large institutional investors) pounced on the opportunity to make huge gains in a short period of time. Minutes, hours, overnight could turn someone into a millionaire. What could go wrong? Robinhood had accounts concentrated in very few stocks and mostly in GME using leverage and call options. The risk to those investors happened with wild overnight swings lower causing margin calls and forced liquidations when GME gapped down more than 20% several days in a row. Robinhood needed to raise capital immediately because they were ultimately on the hook as their clients couldn’t pay their margin calls. Game Stop had a ~$25 billion market cap and now mega-cap stocks like Tesla, Amazon, Apple, Shopify, Nvidia trade like Game Stop with gains of 100’s of billions in market cap in a day. The options activity in those names is massive as mentioned above and yes the options activity is likely causing the gamma squeeze in those names. It’s all fine and good until those names gap down and the casino keeps your chips.

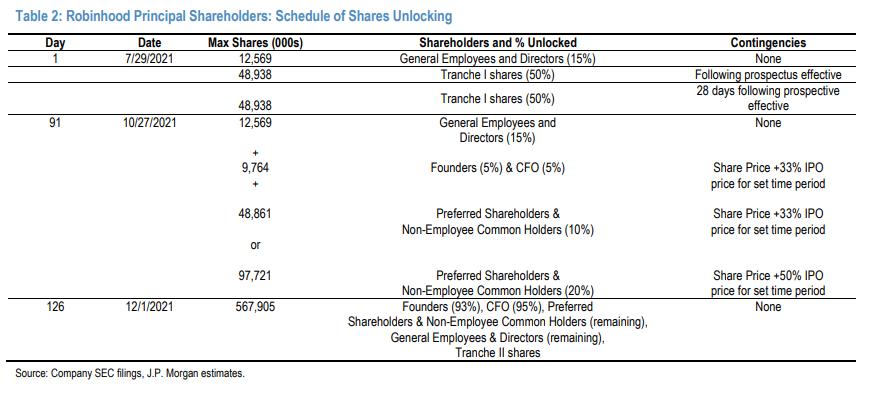

Robinhood is most at risk due to what their clients are doing with their money which I find ironic. I’m adding HOOD as a new short idea today with a 3% sized position. I am also buying the December 17th expiration 30 puts for ~$1.00 and for my own YOLO trade the 25 puts for ~$0.23. Don’t go nuts with your sizing on those puts as HOOD could easily become a Meme stock once again for no apparent reason. Here are some more thoughts on HOOD and why I like it as a short. The float is increasing tomorrow. When it was listed only 7.4% of the float was traded. On 9/2 the float doubled to 13.5%, then on 10/26, it increased to 15.1%. Tomorrow another 48.9 million shares will be unlocked with preferred shareholders and non-employee common holders bringing the float to 21.2%. HOOD is trading near the all-time lows so more shares for sale is the last thing HODL’ers need. On 12/1 the motherlode of shares will be unlocked. The float will go from 21.2% to 92.3% with founders, employees, and directors remaining shares will be free to trade.

Robinhood has a few significant problems and one big potential problem. First of all, the company is unprofitable. (I know that’s a ‘positive’ for a tech company). It trades at a price to sales at 17x. Ok, I won’t start with boring metrics. The second issue, growth is slowing. Data providers who track app downloads clearly show people are not downloading the app as downloads are down 78% and DAU’s (daily active users) are down 40% both from the previous quarter 2Q21. Third, crypto trading is a large percentage of Robinhood’s business model, and the rise in Bitcoin and some other coins have been a positive yet last quarter the majority of crypto trading at Robinhood was in Elon Musk’s Dogecoin and that one has all but died. Coinbase’s numbers missed badly just like Robinhood’s recent quarter was a total disaster reported on 10/26. Even more, bad news happened with a security breach of client information and the EU is planning on banning payment for order flow. Gary Gensler, the new SEC chief has discussed the need to either ban or reform payment for order flow. The big potential negative obviously would be if payment for order flow is banned. It’s possible. My bet would be it’s reformed in the US and although that might see some relief with the shares popping short term, the reformed business model will crimp earnings going forward when growth is already slowing.

Today’s action is getting a bounce after yesterday’s drop caused by the CPI report and the horrible 30-year bond auction. The bond market is closed today for Veteran’s Day. Personally, I think all markets should be closed to honor all veterans. The action is lackluster with many stocks and indexes now trading under today’s gap-up opening print. People are buying gold and silver again today and as I said I favor silver over gold.

Trade ideas

As mentioned above I am adding a 3% short position in HOOD. DASH continues to bug me but I will stick with it as short. I might add more since this is now worth more than $15 billion more than FedEx. I’m covering my AFRM short with a 4% gain. Last night I was so annoyed with myself and despite my view, this is a great short I’m taking it off for now with a gain that I didn’t think I would have today. I showed DIS as a potential buy as there was a pending DeMark buy Countdown 13 and today after their terrible earnings it’s gapped down hard and qualified the buy Countdown 13. I’m going to be monitoring this one as a long candidate to allow it to stabilize in the coming days.