“We value virtue but do not discuss it. The honest bookkeeper, the faithful wife, the earnest scholar get little of our attention compared to the embezzler, the tramp, the cheat.” John Steinbeck

As I wrote last week, Michigan and Ohio State played in “The Game” – and lest there be any doubt about whether it was THE GAME, it was the highest-rated college game on TV by Fox Sports ever, and the highest-rated game this season (see below). But, the Michigan surprising (but oh so sweet) win took a back seat early in the week as two renowned coaches left their programs early (Oklahoma’s Lincoln Riley and Notre Dame’s Brian Kelly) to seek literally greener pastures. In the case of Brian Kelly, he was leaving a storied and unique (but stringently run) program to coach a team that could more easily (in-state talent, lower academic standards) and consistently compete for national championships. He made this move now – despite the fact that ND could still make the playoffs – because of the need to manage the early signing period for recruits, even though he finalized the deal with LSU while he was out recruiting for Notre Dame!

In contrast, what got very little notice was that Michigan coach Jim Harbaugh, who took a 50% salary cut after a horrible CoVid impacted 2020 season, decided to donate his 2021 incentive bonuses (his new contract was incentive laden to make up for salary hit) back to the athletic department to those that took pay cuts during CoVid. That number could reach $3.5m if the stars align (fingers crossed)! The point of all of this is that as things swirl around and there is a ton of money being thrown around, it is all too easy to lose the plot. Of course, Riley and Kelly cannot be faulted for doing what they want (and let’s face it, a bad season can result in quick dismissal), but it is still refreshing – whether it is a corporate CEO, a politician, or football coach – making decisions based upon broader considerations than optimizing immediate self-interest.

I listened to a great podcast this week called Capitalisnt (UChicago) with UofC Professor Luis Zingales and Bethany McLean, that explored the concept of “Woke Capitalism” which veers into the concepts of shareholder v stakeholder capitalism, as well as the enlarged importance of the corporation overall. One thing the guest, author of “Woke Inc” Vivek Ramaswamy, said that resonated was that capitalism does not produce virtue, but that virtue is required for capitalism. The basic idea of virtue is doing the moral and just things, even when they are not required, costless nor convenient. In a system of self-interest, markets, profits, negative externalities, ESG greenwashing, poorly constructed regulations, government activism, one could be forgiven for losing sight of virtue and integrity. Every agent is trying to maximize value given this Byzantine system, and as we see with college football, Elon Musk, or Apes trying to smoke out short sellers, dislocations (and poor oversight) are fodder for degeneration. Here is a good thread by Josh Wolfe at Lux Capital contrasting hype versus reality (Musk vs Buffet) on the matter.

For the rest of us as investors and traders, we have to appreciate – as I wrote last week – the game in front of us. Virtue and integrity are not really drivers of what I do day to day as an investor. I am just trying to structure a portfolio that makes money and tries to filter the signals from the noise. While I am glad I wasn’t questioned into defending China’s system as Ray Dalio was (see below Mitt Romney response), I do appreciate that those investing (or running businesses – ie. Blackrock) on a global scale, are in a tough spot, but it is amazing at times to see the hypocrisy of ESG and helping China attract capital on a global scale. I don’t invest in China for governance / structural reasons mainly (VIE’s are a joke), and it happens to have the benefit of fitting my value system, but I do agree that every country is stained (historically and currently) and investing with purity in mind can keep you from some good opportunities.

But, when I see market actors (investors, companies, officials) verbalizing nonsense/speaking out of both sides of their mouth out of self interest, while at the same time seeing one actor (the Fed) finally acknowledge that managing inflation might be of importance, I take notice. And, on that that score, while the latest CoVid variant seems to have served to remind everybody that there are dangers out there and that we are going to have to live with this virus having economic impacts for quite a while, I do believe the bigger news is Powell’s hawkishness. The market (primarily the treasury curve) seems to be of the opinion that despite being a debt trap, the Fed will tighten too much. I don’t believe that’s correct. I think the economy has imbalances and trade-offs that can be managed – as it always does. And, I think Powell is doing the right thing (if 6 months late) in terms of moving policy from super easy to easy,. As such, we can see some flow reversals, and particularly after a strong two-year period for every asset. I don’t believe the economic picture reflected in the flattening of the yield curve is a sign that recession is imminent, but we are about to enter 2022 with about $5T less fiscal and monetary policy support than we have had, and with it, some froth being taken out of risk markets. My first piece for HFT spoke about the structure of Cathie Wood’s ARK funds, and it appears to be an epicenter for the froth reduction (ht, the great Julian Brigden @ MI2).

Some things that caught my attention this week:

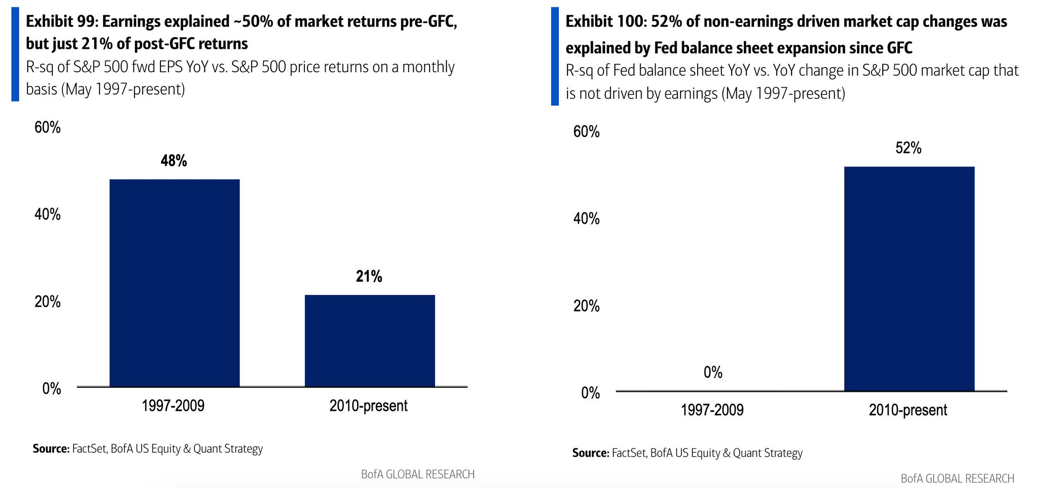

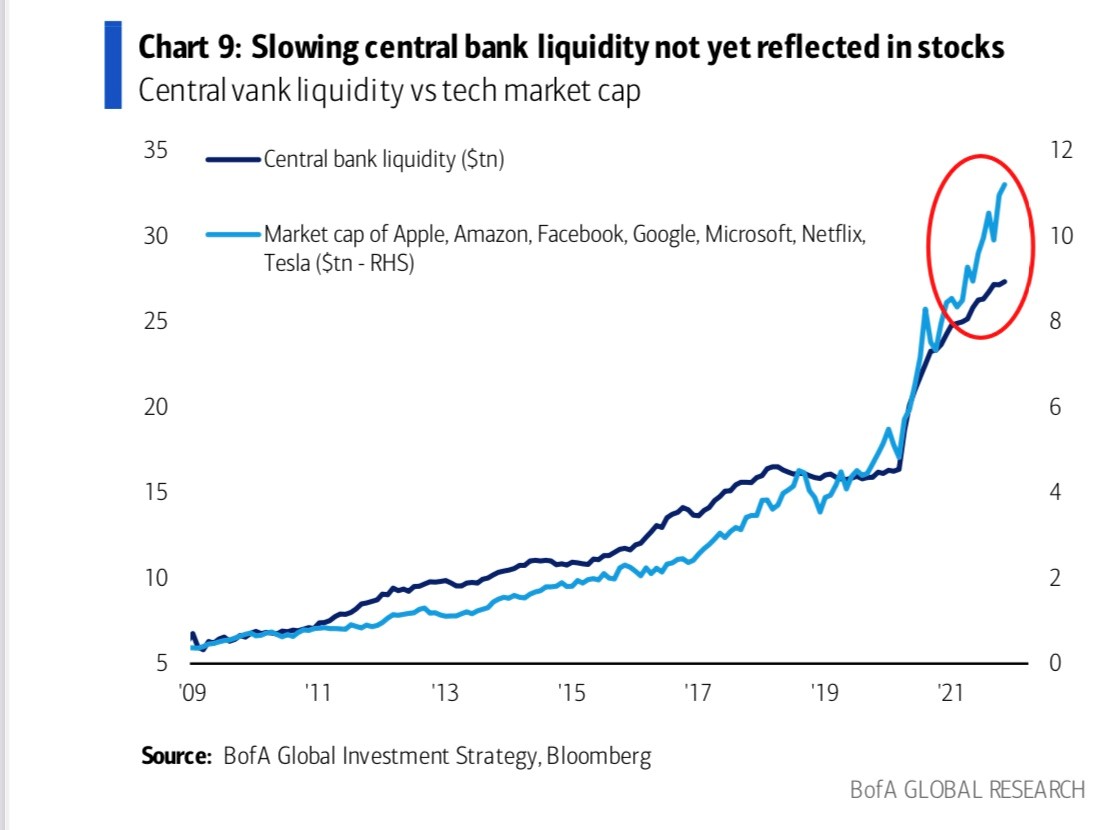

Slowing CB liquidity.

As James Carville once said, “It’s the economy stupid”, it’s pretty clear that equity markets have been explained by QE and balance sheet expansion (vs earnings) as shown below. I heard a great line by James Grant this week, where he said that extremely low rates are the lifeblood for narrative/imagination-based investing. That is correct because the cost of speculation and spreading the gospel is near zero. Of course, in a debt trap, it will be hard for CB’s to act like Volcker (or materially reduce the balance sheet), but the direction for slowing liquidity is obviously upon us, and things could get interesting as a result.

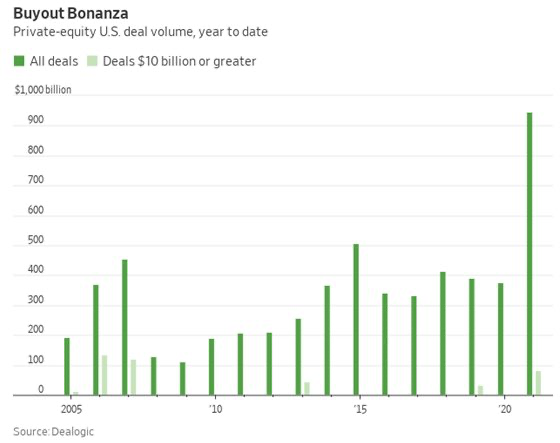

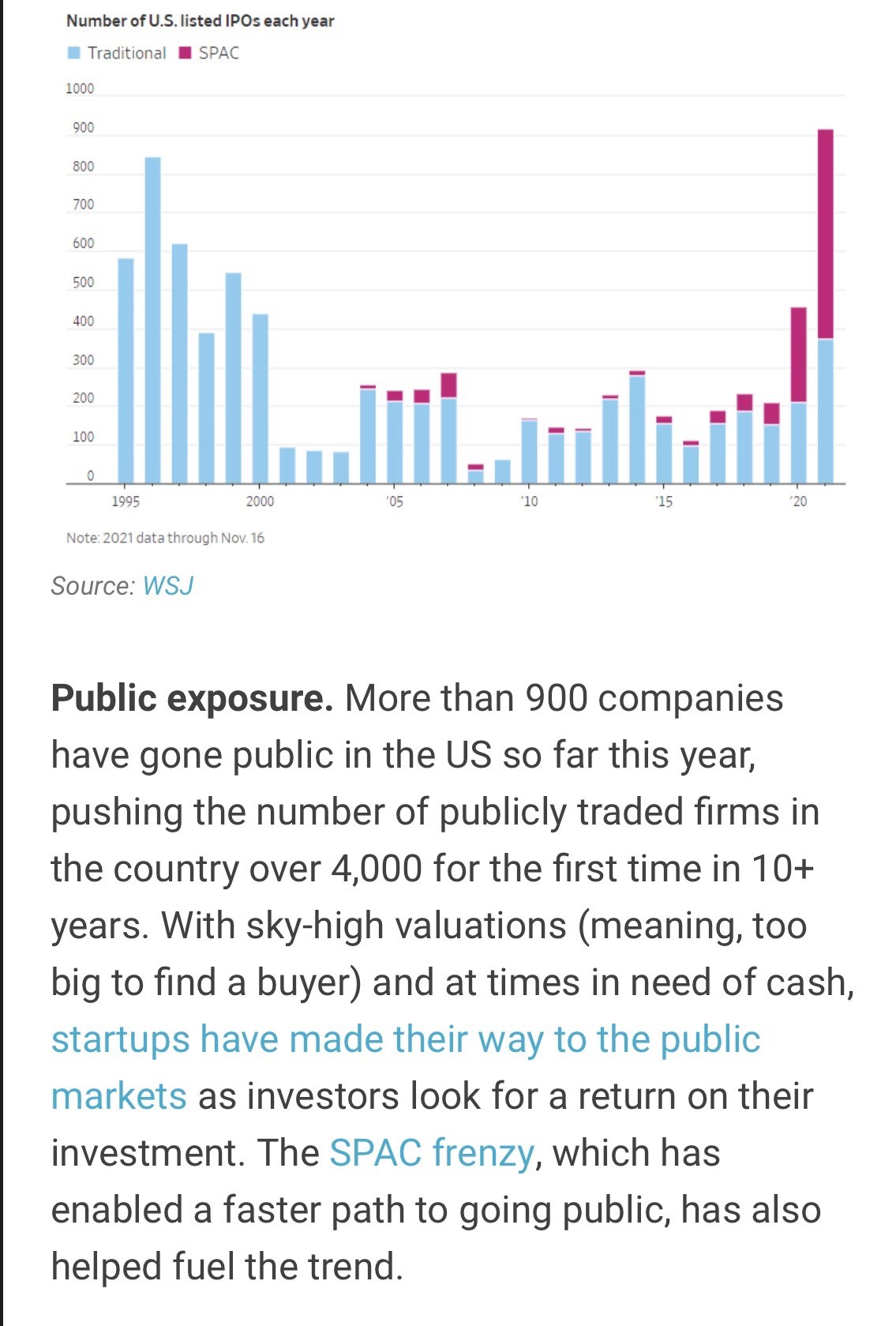

Deal Bonanza:

One of the problems with high valuations and easy money/excess powder is the loss of investor discipline. It is why blowing asset bubbles is fraught. Smart people are well aware of this, and they take advantage while the going is good. ie. Soros, “I run into a bubble when I see it forming” – but always have in the back of their mind the dangers. How many retail investors, many chasing narratives and sitting on gains propelled by leverage, are going to be left holding the bag?

In Defense of Public Debt:

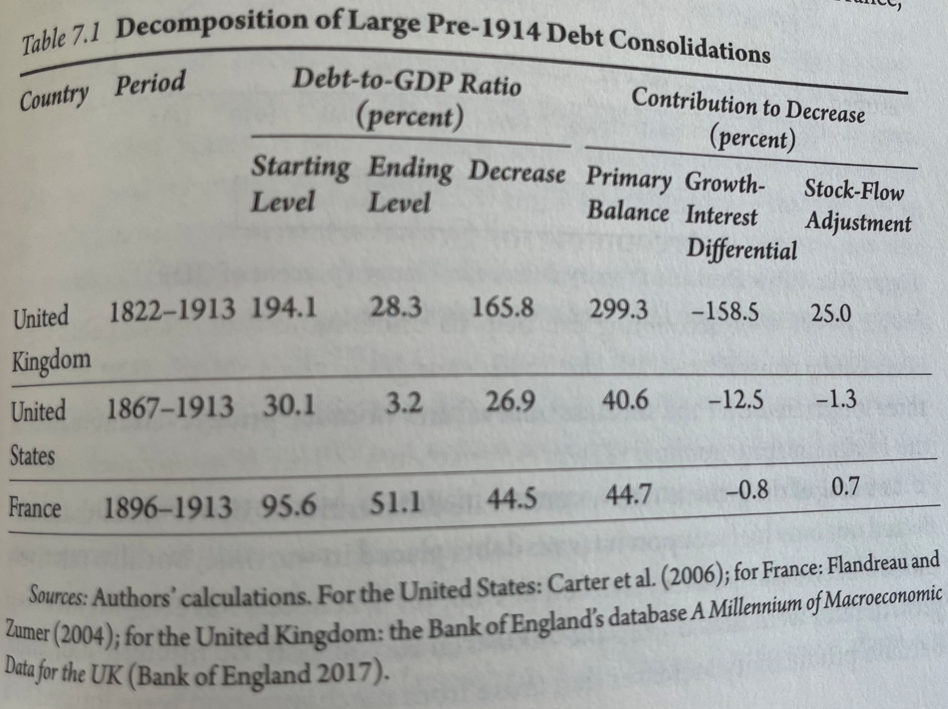

When I picked up the book by Barry Eichengreen of Berkely, I thought it would be an entirely boring read. But, I was pleasantly surprised. It goes through the historical justification for public debt, which mainly was to secure borders of cities and nation states. What matters, and coming back to the notion of virtue, is that historically, nations took somewhat great pains (via running primary surpluses) to whittle their debts down. Pre 1914 wars of France, the UK, and the US (civil war) were largely repaid via primary surplus.

In fact, the UK Napoleonic Wars began in 1822, and fiscal rectitude was the norm there to bring debt/GDP for 194% to 28% to pre 1822 levels for 91 years! Here is a good presentation / discussion of the book,

Some things to note:

1. International investing in public debt was a critical part of its growth, but domestic wealth also played a key role for the richer nations, and that added broad stability of finance. Countries that were weaker institutionally, poorer, but yet needed finance for infrastructure, etc, were prone to default.

2. Fixed Money (Gold) standards were often temporarily relaxed, but every nation sought to re-institute the rules of hard money to retain investor confidence.

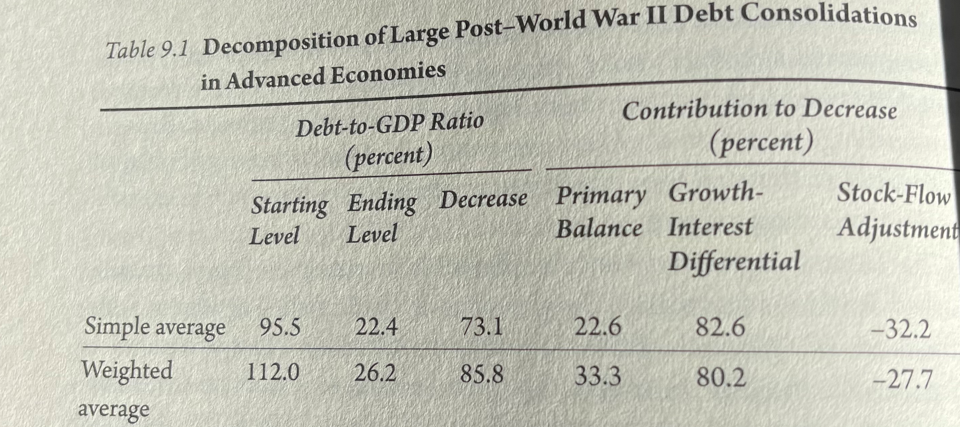

3. The growth of the welfare state changed the compact of citizens and government, and it has changed which tools have been used to reduce debt/GDP. See the post-WWII role of growth vs rate differential (ie. Financial repression; g>r) versus primary surpluses as the main tool.

4. The post-WWII period of financial repression, also coincided with the Bretton Woods period of $ centrality and fixed exchange rates (with very careful and strict rules for devaluation/revaluation). This was a unique period in that way for the world to recover but eventually ran its course primarily due to US balance of payments deficits and insufficient gold holdings. Japan and Germany grew very quickly after the war and did so on the back of the US willing to supply the world with $’s (and thus into gold) via BOP deficits. China, it could be argued, has used similar devices to grow and expand its wealth. The role of the US is critical and has been criticized for decades, but if the history of Japan and Germany (and France) are any guide, the pathway to broadening out financial responsibility and economic fairness around the globe will be challenging.

5. The gold standard has been replaced via a “trust” standard – that governments and CB’s will retain the credibility of operating prudently. Nobody would question whether the Fed or government was justified in acting post-CoVid. It had a moral obligation to its citizens. The interesting story is how to manage out of it. As the authors state in their conclusion: “Countries that have successfully addressed problems of debt sustainability without major economic, financial, and political dislocations have done so by maintaining stable financial conditions, turning to fiscal restraint when the time was right (not before), and growing their economies. Failing to address the problem from all three angles is a recipe for disaster.”

I underlined the stable financial conditions bit because stability generally WAS a condition post-WWII. The polity was much more coherent and unified, and the form of capitalism was closer to stakeholder capitalism (pre Friedman/Chicago School), inequality much less pronounced, historical nihilism limited, enemies defined, power/credibility clearer. Dalio can be a bit of a tosser, but I don’t believe he is dramatically wrong about the idea of further splintering and reductions of civil discourse. On that, I find the possibility of Roe v Wade being overturned or the Supreme Court allowing states to choose different standards (Texas, Mississippi) to be a possible catalyst for further devolution of civic society. Already, just based upon oral arguments and questions, the issue is quite contentious and can lead to some unstable actions and outcomes.