On the First Call note today I wondered if the equity markets would notice the rise in rates. The good news is yes because it’s helped move the value factors including financials (we are long) and energy up nicely and tech and mega-cap (we are short) are selling down positions. Can you believe there was a time when one had to fill out a ticket that was routed to order takers and eventually to the NYSE floor or electronically with Nasdaq?

I’ve been very clear with my directional calls with bonds. It took a while after consolidating after peaking in Q1 last year which I also expected with all of the DeMark Countdown 13 signals on the 10 year and 30 year. The economic data came in today with the ISM a little light of estimates but still solid. The inflation gauges such as prices paid dropped hard which is a good thing overall and new orders were inline (solid) while the employment component was a little better than expected. I expect a strong ADP jobs report tomorrow and a blowout employment report on Friday (keep in mind this missed big time last month). This should keep pressure on bonds and yields on the long end should continue higher.

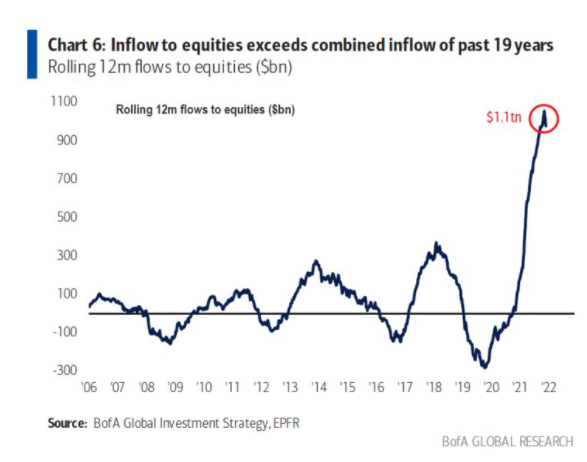

Last year inflows into equities exceeded $1 trillion. More than two decades of inflows combined. I’ve talked about this a lot and have named the 2021 buyers of equities as “future sellers.” Sellers get motivated only when they see the risk of losing money. They are generally very complacent on the way up and only notice when there are drawdowns that get picked up in the media. The progression of how things unwind starts with the marginal companies that typically have big runs higher luring in people with hopes of some sort of big payoff. Many of the companies like this have already fallen off the highs. That’s why you see a lot of weakness continuing with a lack of support. The other stage is money moving into passive funds and the large indexes ETF’s. In reality, the money moves into the largest weights and most stable companies. It works for a while until the damn breaks and those leaders start to fall. I’ve heard people call the mega-cap stocks “a bond alternative” and that might be true until they fall. Over my career, I’ve seen some deep moves with the mega-cap “bond alternatives.” It can happen. Lastly, I can recall a thousand times I would be on the phone with a sell-side trader with me trying to buy a sizable amount of a stock and the trader had a seller also with size. “He wants to hang higher” I was told. They always sell lower. We just need to be patient.

trade ideas

I bought some as I called “knife catchers” recently that if I wasn’t clear about the risk I’m not sure how I could have been more clear. Not all worked. They were all small 2% sized. I’m cutting SNAP -9% and PTON -11%. I’m going to hold SQ, PYPL for now. Paypal is flat and Square or Block as it’s now called is down 9%. SQ has a lot of shorts in this who have been correct however they might overstay their positive trade. I might add to it or cut it. I’m holding for now. I’m holding the four banks and added more earlier today as mentioned on yesterday’s note. They should do well with a now steepening yield curve. I added REKR today and it’s down 4%. It’s a $6 stock and very volatile. It’s not a quick trade, nor a conservative investment yet I like the company. I have some thoughts on it below. I said I would buy Bitcoin earlier today with the DeMark buy Countdown 13’s. This signal did not tick every box that I would want and my stop is at 43,000. Don’t go crazy with your sizing because if the Nasdaq gets hit so will just about everything else like Bitcoin. And Bitcoin could be down pretty quick as you know. Lastly, I’m buying more TWTR. This is a broken idea that isn’t as bad since it was the long side of two very strong short positions that worked out very well. SNAP and FB which I covered at good profits. Regardless I like TWTR and nobody likes TWTR. There’s a new DeMark Sequential buy Countdown 13. Moving up to full 5% max size from 4%. I’m going to be patient with this one.