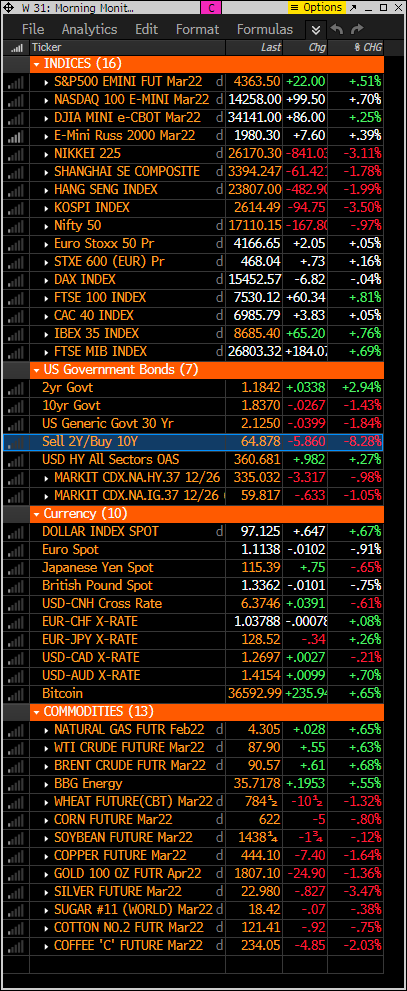

- S&P futures are up 0.4% in Thursday morning trading after US equities finished mostly lower in the prior session, reversing a pre-FOMC rally that saw the S&P up just over 2% at one point. Asian equities finished sharply lower overnight with Japan down over 3% and China’s CSI 300 entering bear market territory. European markets mixed. Treasuries mostly weaker with another big curve flattening move. (see charts below) Two-year yields at 23-month highs. Dollar seeing good gains on the major crosses and up over 1% this week. (see charts below) Gold down 1%. Bitcoin up 0.75% (see charts below). WTI crude up 0.9%.

- All eyes on Apple earnings later today

- As posted yesterday I pivoted during the Fed presser and took profits on the SPY, QQQ, IWM trading longs and added them back as shorts with only 3% weights vs the 5%. It’s a tactical play.

- No dovish surprises from FOMC statement yesterday though Powell’s comments play into concerns hawkish Fed repricing has more room to run. Takeaways flagged upside risk to current consensus for four rate hikes this year, lingering potential for tightening in 50 bp increments, and more aggressive balance sheet runoff. Earnings takeaways mixed with no change in the big themes surrounding a solid demand backdrop, lingering supply chain and input price pressures and dampened revision momentum. Omicron-driven growth slowdown another area of scrutiny though expected to be short-lived. Still too many plenty of buy-the-dip calls on oversold conditions, depressed sentiment indicators, strong corporate balance sheets, Omicron peak and China policy shift.

- TSLA earnings and FCF better but supply chain headwinds to continue through 2022. INTC beat on strength in enterprise and desktop though takeaways focused on GM and competitive concerns. NOW beat on all key metrics and noted expectations for strong 2022 subscription revenues growth. LRCX said supply chain conditions worsened in late December. EW missed on weaker TAVR sales. XLNX highlighted robust demand while AMD secured Chinese approval for its acquisition. URI beat, guided above and announced $1B buyback. STX highlighted strong cloud center demand. XM revenue and revenue guidance ahead. LEVI Q4 results narrowly mixed while guidance a touch better. LC hit by softer 2022 net income guidance. NFLX boosted by Ackman stake.

- I’m on Real Vision Daily Briefing later today after the close. You can watch free on YouTube.

market snapshot

economic reports today – gdp at 6.9% !

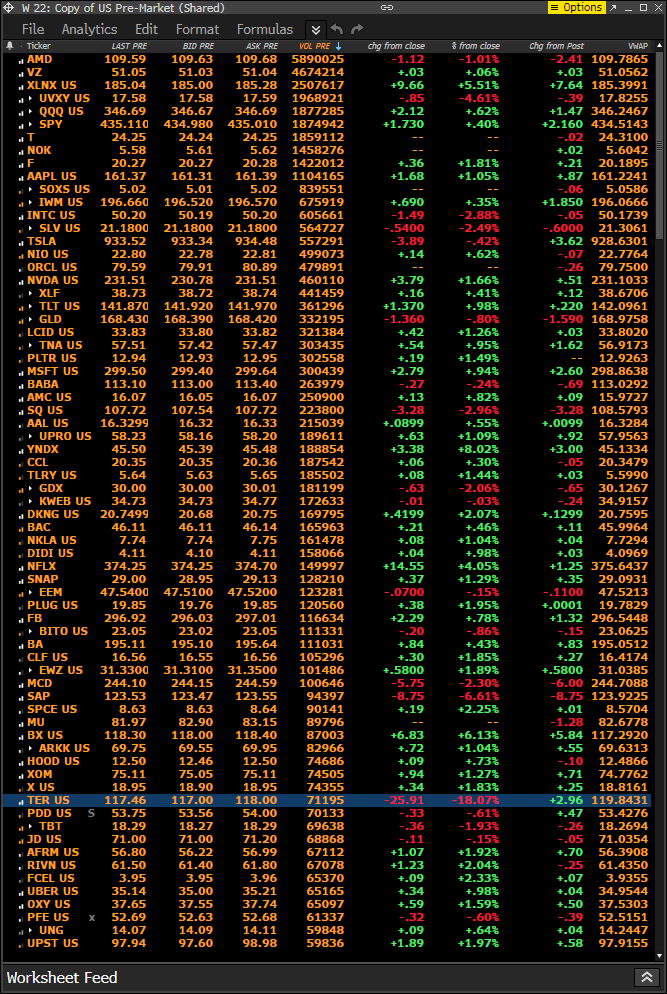

premarket trading

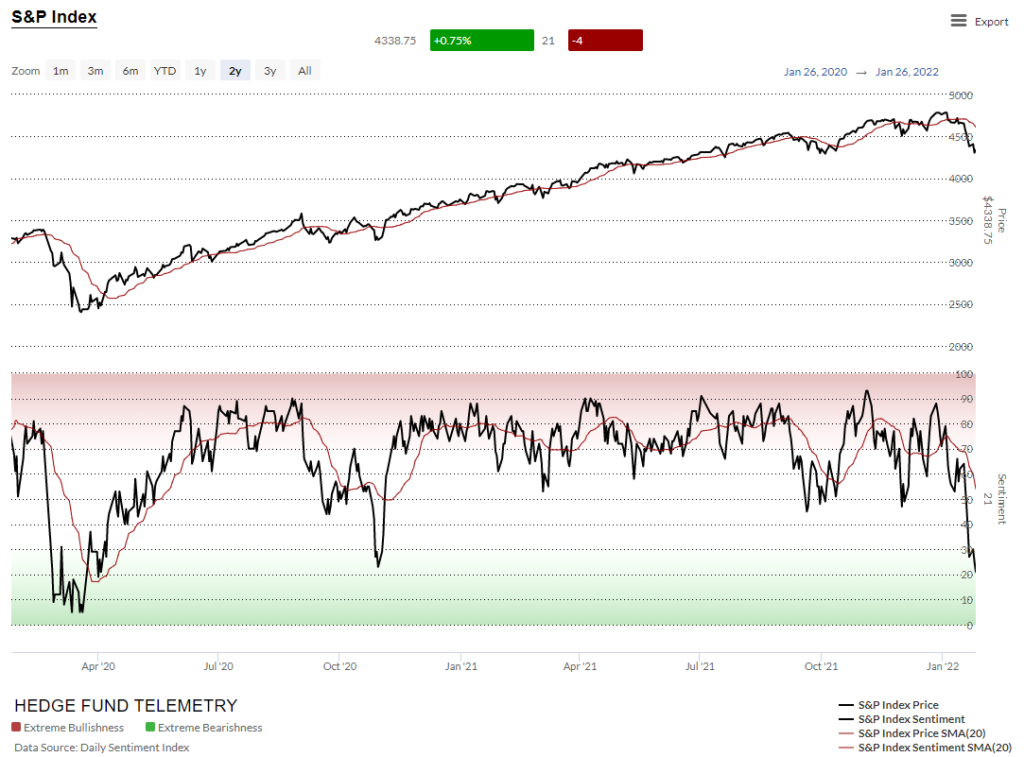

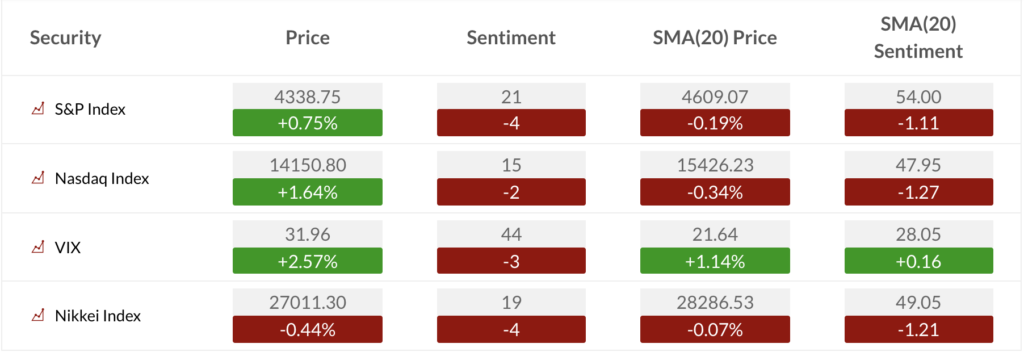

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment remains in the oversold zone as both the S&P and Nasdaq dropped again. This is not a signal but a condition. It can and might stay oversold for a little while

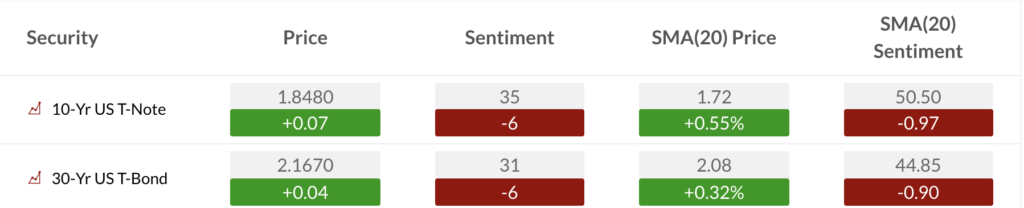

Bond bullish sentiment also dropped and is at the lowest level in over 4 months

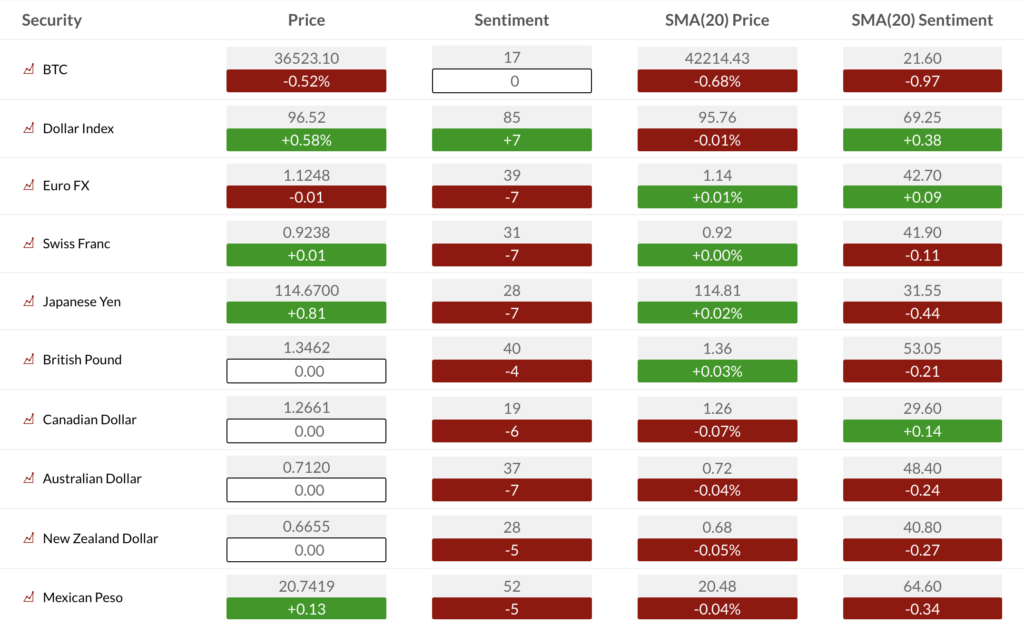

Currency bullish sentiment shows the US Dollar at 85% and firmly in the extreme zone. The pricing on a few currencies is off. We will be addressing it today.

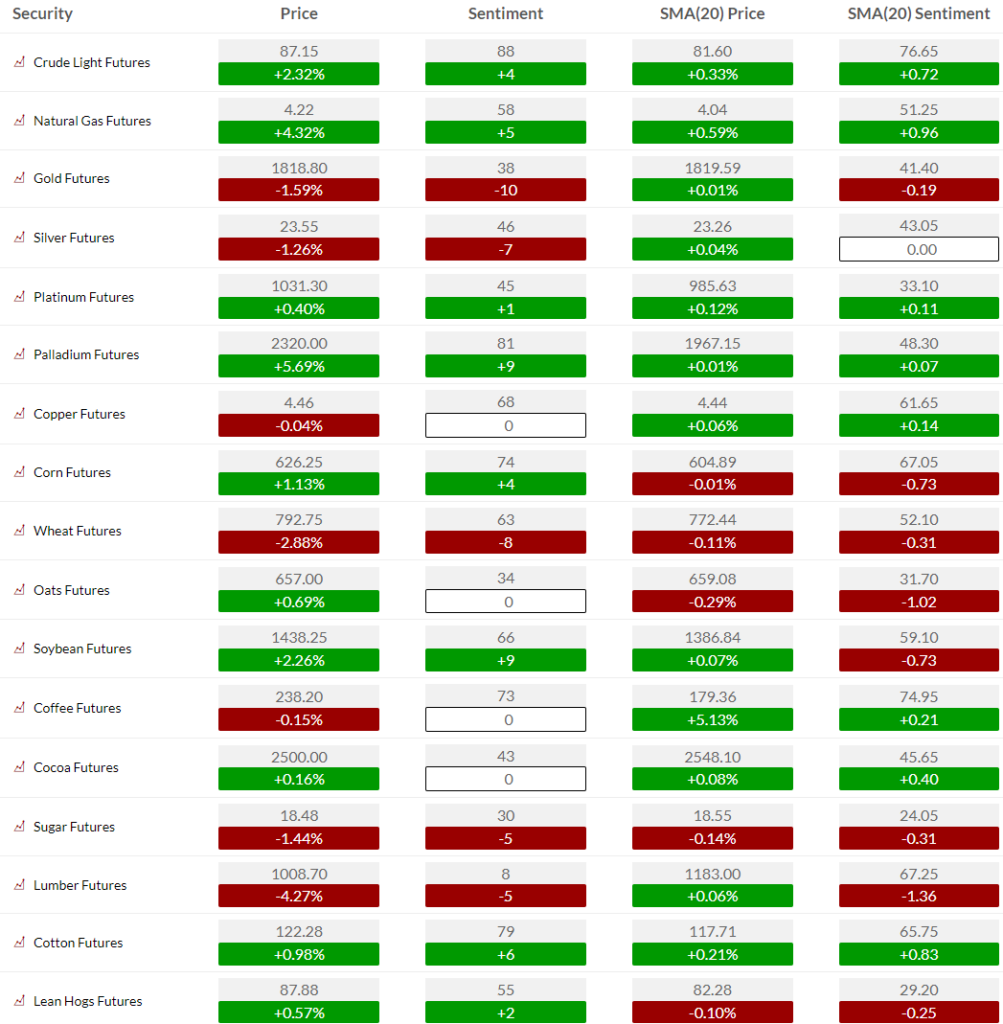

Commodity bullish sentiment highlights crude at 88% and I expect this to continue higher combined with the DeMark Countdown signals in play on the upside. See yesterday’s note for charts of WTI and Brent

US MARKETS

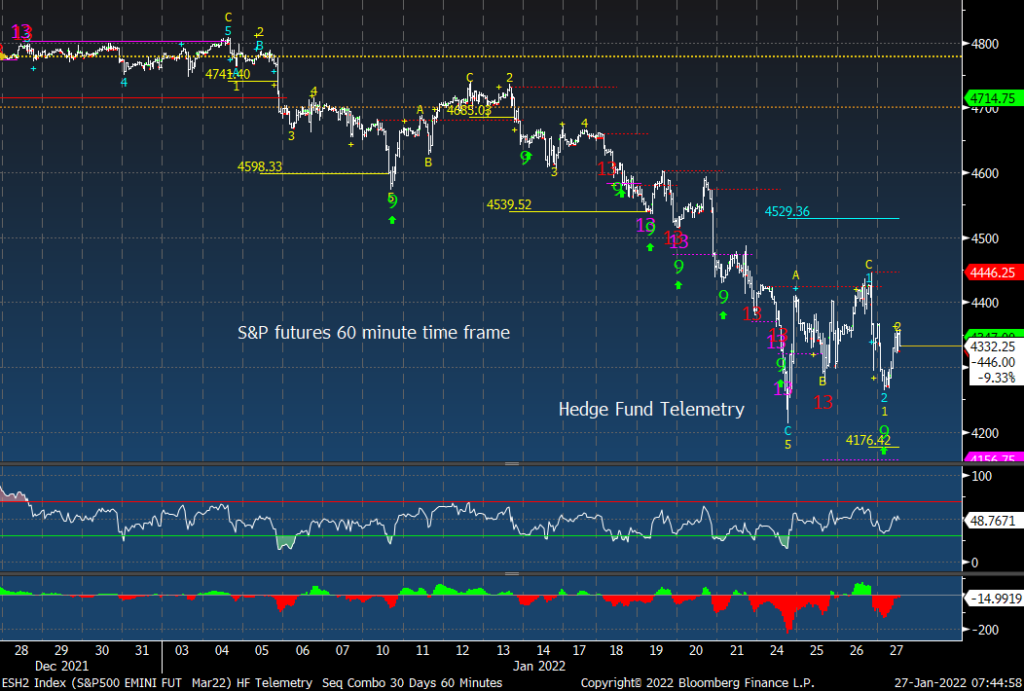

S&P futures 60-minute time frame needed to clear the faint red dotted line TDST resistance but it failed and dropped lower confusing the wave pattern. An upside wave 3 price objective remains at 4529 only if yesterday’s highs are surpassed but there also is a new downside wave pattern potentially starting and if the overnight low is broken a downside wave 3 price objective of 4176 comes into play. A lot to think about

S&P futures daily did get the buy Setup however it wasn’t ‘perfected’ which Setups can be classified as either “perfected” or “Im-perfected.” The Setup is classified as “Perfected” when the 9 is completed and the 6 and 7th bars have been exceeded either on the upside or downside. When the Setup is perfected there is either a green arrow on the downside or a red arrow on the upside. And we want to see a price flip up. A “price flip” is defined as a contra-trend move identified by a close that is higher/lower than the close four price bars earlier. In order to complete the Setup 9 there must be nine consecutive closes higher/lower than the close four price bars earlier

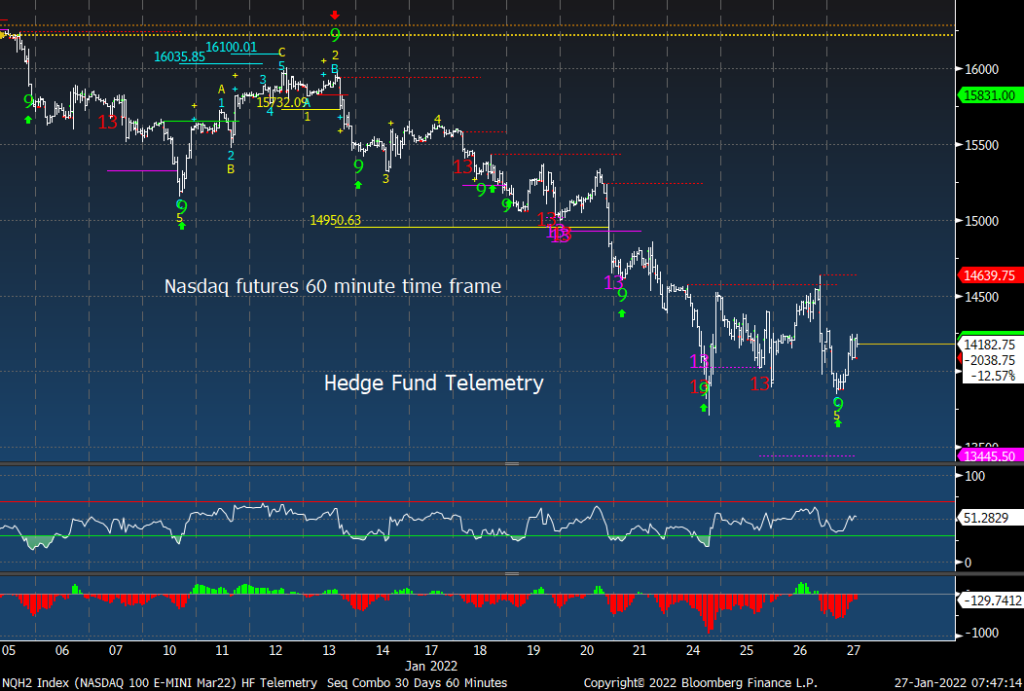

NDX 60 minute time frame does not have the same wave pattern as the S&P futures and this just continues to make a series of lower highs and lower lows. A mover over yesterday’s high would rebuild some confidence

NDX futures daily similar story as posted above with the S&P futures daily

extra Charts we’re watching

US Dollar Index daily has a DeMark sell Countdown 13 and with a sell Setup on day 8 of 9. A reversal in the coming days is probable

Bloomberg US Dollar Index also has a pending sell Setup 9 for tomorrow.

US 10 year yield is getting closer to an upside DeMark Sell Countdown 13 while there are some sell Countdown 13’s near with the 2, 5 year yields. More detail on today’s Daily Note

The 2/10 yield spread is also getting some exhaustion and near exhaustion

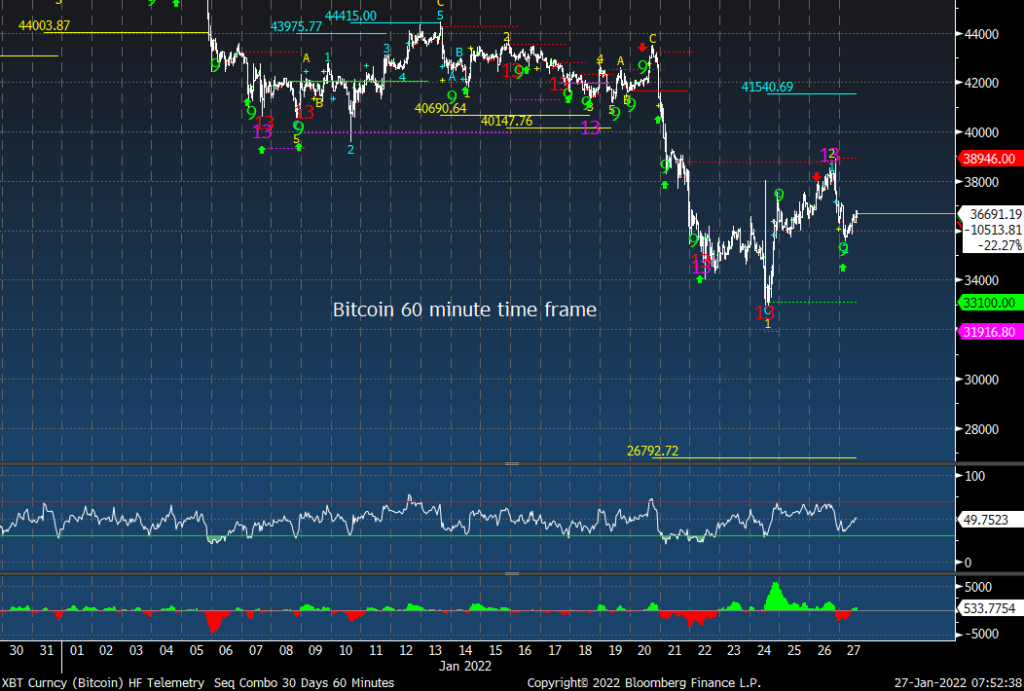

Bitcoin daily should bounce here but I expect a lower high bounce to sell

Bitcoin 60 minute is mixed with an upside wave 3 price objective of 41,540 or if the lows break a downside wave 3 price objective of 26,793. If you want volatility this has the potential.

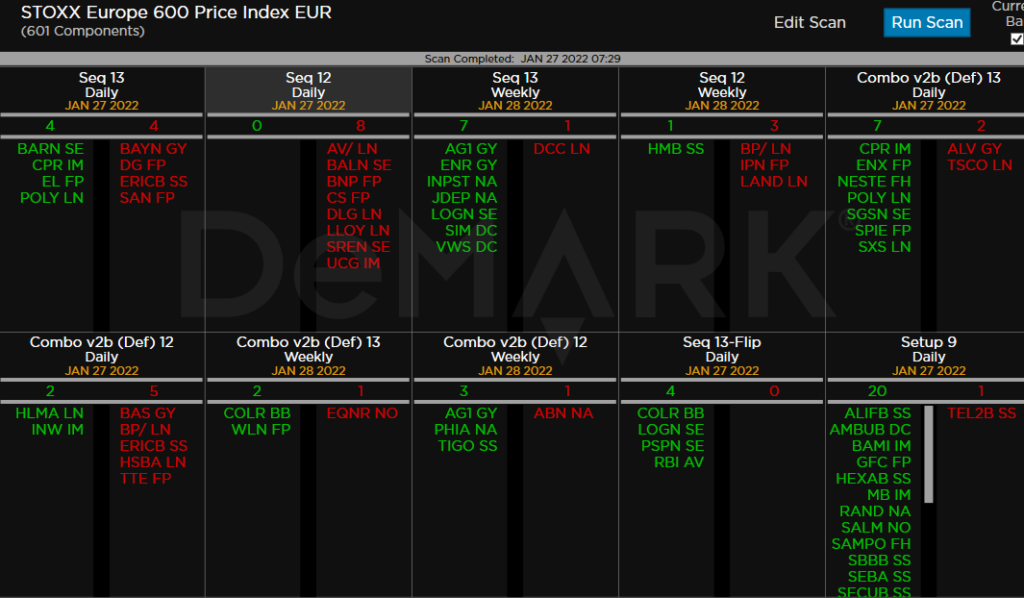

EURo STOXX 600 Demark observations