Highlights

Energy and metals charts have been breaking down and should work lower. COT data is collected on Tuesday and many who were buyers got hit with the late week slam. Watching a lot of markets that might have made a lower high potentially trapping the dip buyers. I will have updates on notes this week.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily peaked again with the recent Combo and Aggressive Sequential sell Countdown 13’s

Bloomberg Commodity Index Weekly also has a new Combo sell Countdown 13 in play

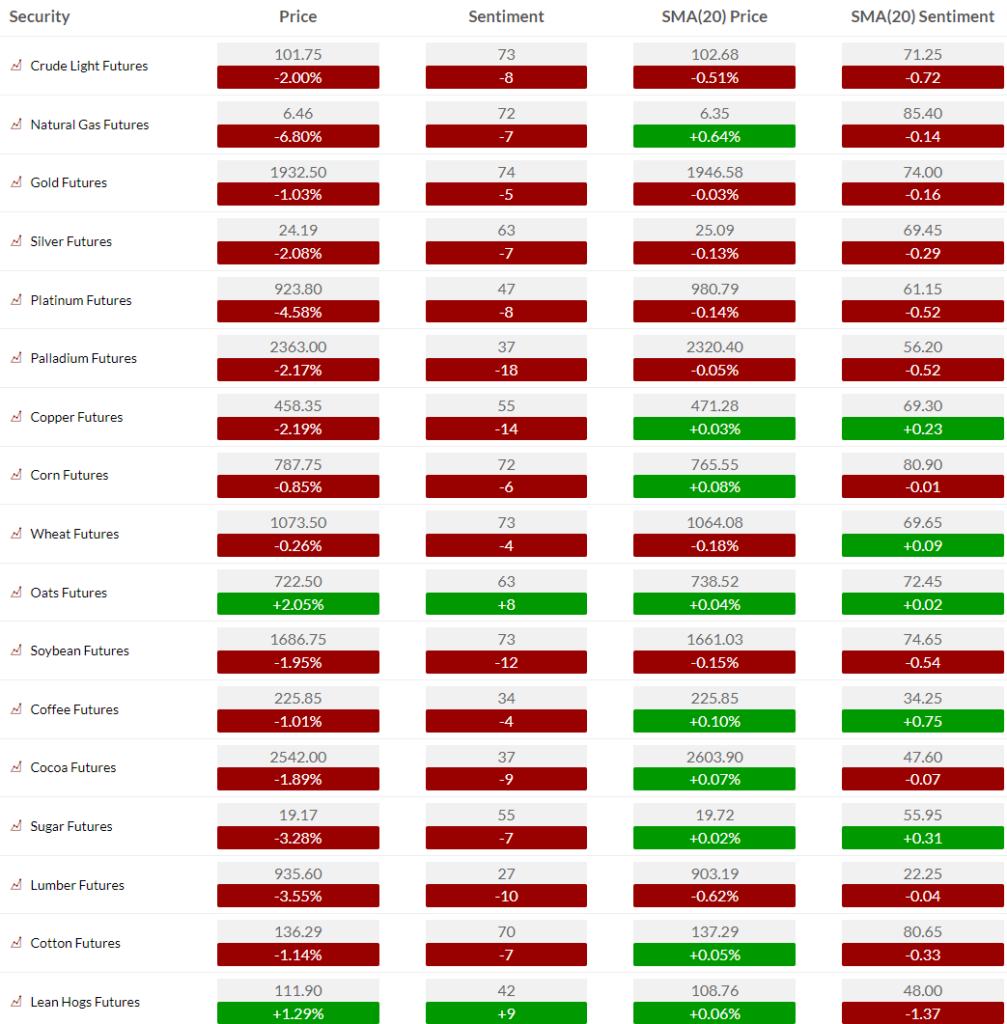

COMMODITY SENTIMENT OVERVIEW

A rough Friday

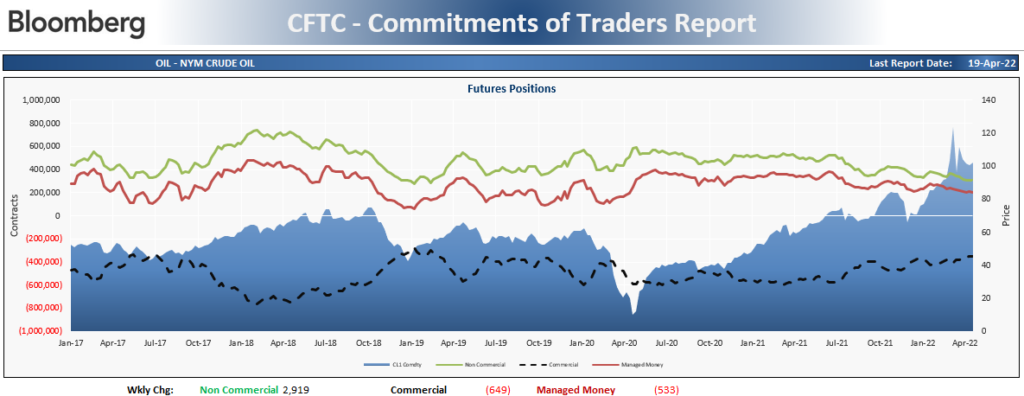

OIL AND ENERGY

The Bloomberg Energy Subindex daily also peaked with some recent exhaustion signals and are still in play after a little residual momentum. The weekly below is on week 11 of 13 and it’s late there. keep in mind it might not make a new high and still get the Sell Countdown 13 as long as it’s above the 8th red bar close under 45

WTI Crude futures daily with a lower high wave 2. A break of wave 1 (yellow 1) low would qualify wave 3 and has a potential downside wave 3 price objective of 80.76

Brent Crude futures daily similar to WTI

WTI Crude futures bullish sentiment also shows lower highs with support at 70 (20 day moving average) and 55 the recent low

WTI Crude futures Commitment of Traders shows speculators increasing long exposure

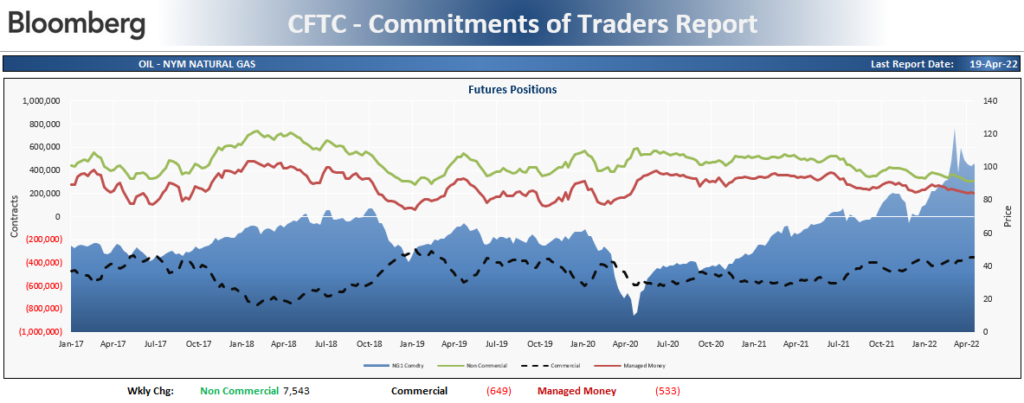

Natural Gas futures daily peaked with the Sequential and Combo sell Countdown 13’s. I took off half of my short position on Friday. I still believe this can work lower

Natural Gas futures bullish sentiment peaked with 4 days at 92% and reversed. Again this might move even lower as it’s not oversold with sentiment here at 72%

Natural Gas futures Commitment of Traders shows speculators increasing long exposure

Metals

Gold futures daily has important support at 1900

Gold futures bullish sentiment remains elevated at 74%

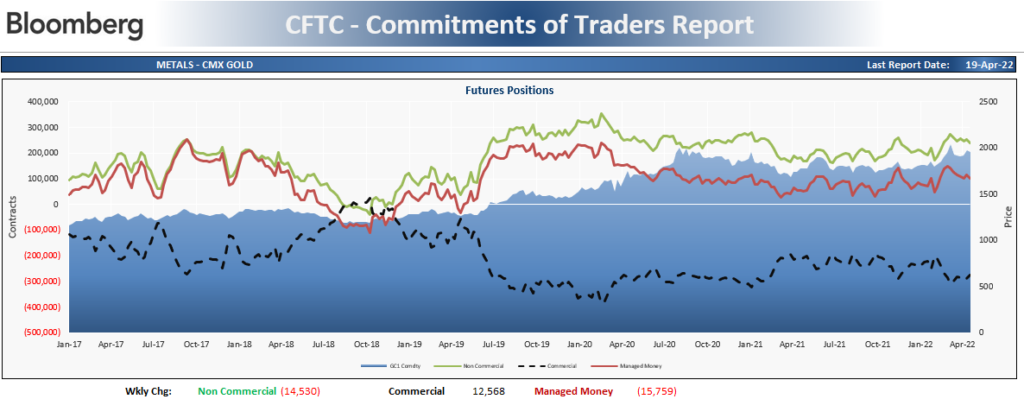

Gold futures Commitment of Traders shows speculators decreasing long exposure

Silver futures daily also broke down hard with support at 24

Silver Futures sentiment still above March lows

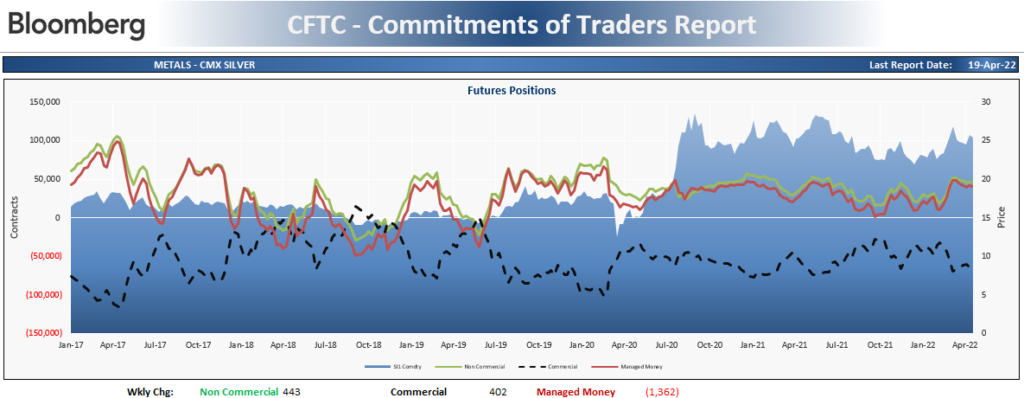

Silver COT shows speculators increasing small long exposure

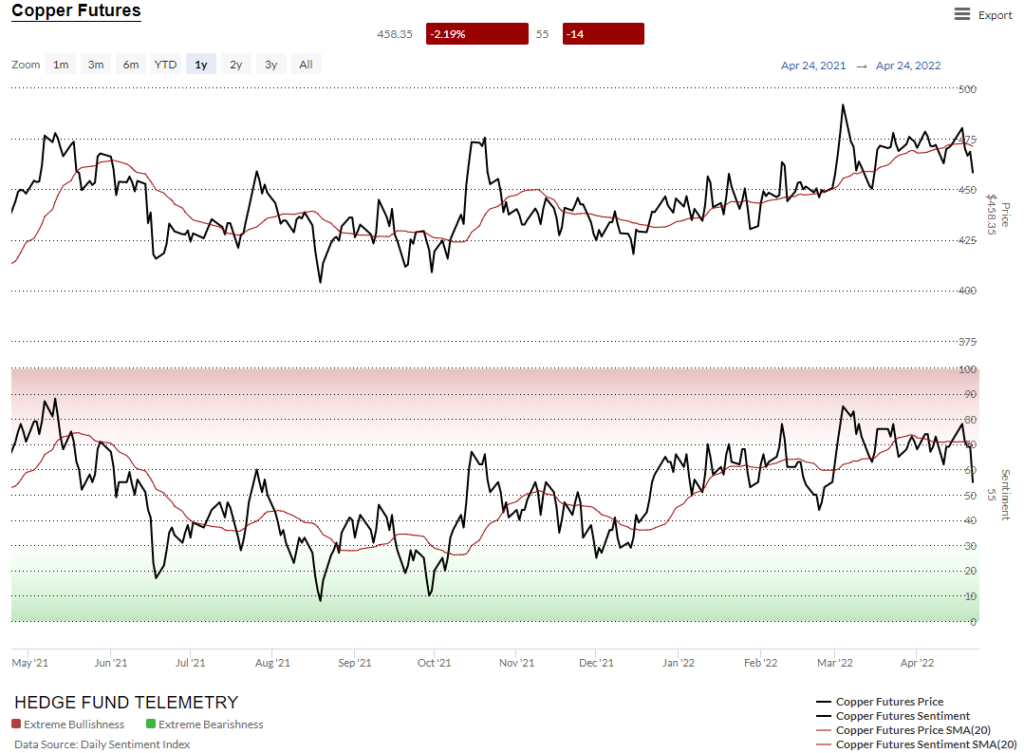

Copper futures daily has been sideways doing little with a nasty drop on Friday

Copper futures bullish sentiment broke March lows

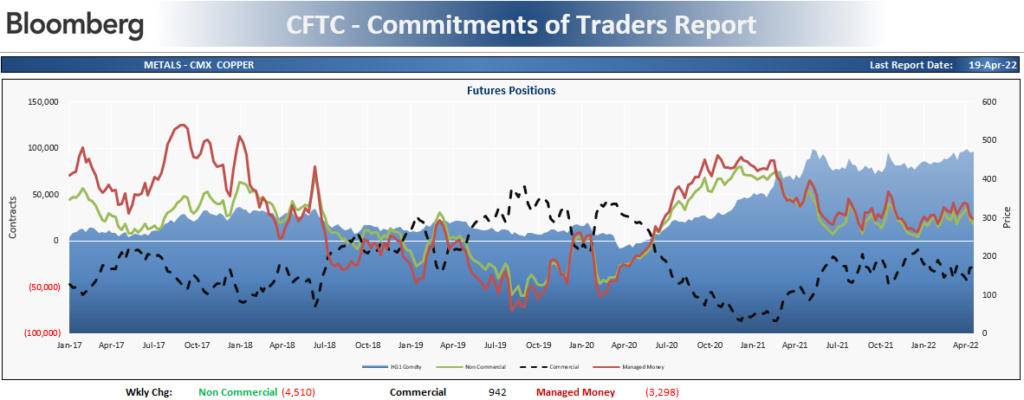

Copper futures Commitment of Traders shows speculators decreasing long exposure

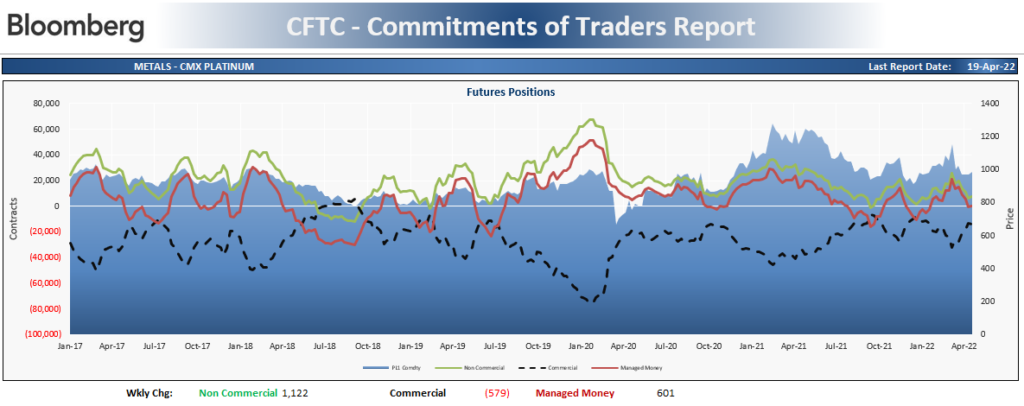

Platinum daily looks like someone big was force liquidated

Platinum bullish sentiment down hard but not oversold

Platinum Commitment of Traders shows speculators increasing long exposure OUCH

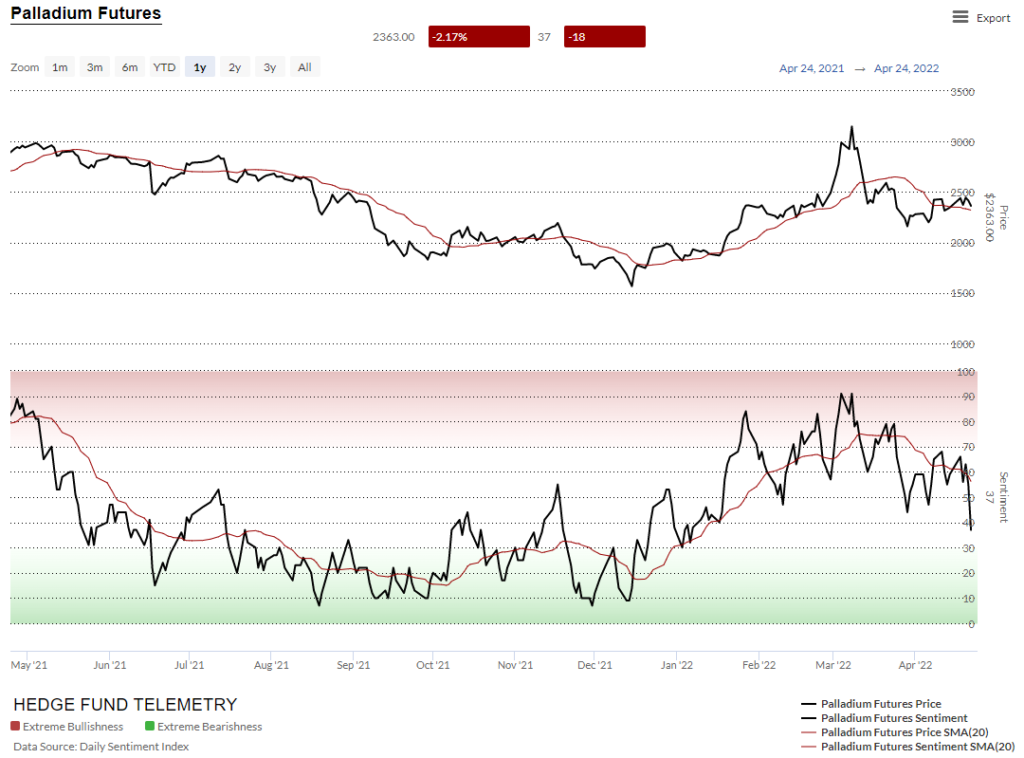

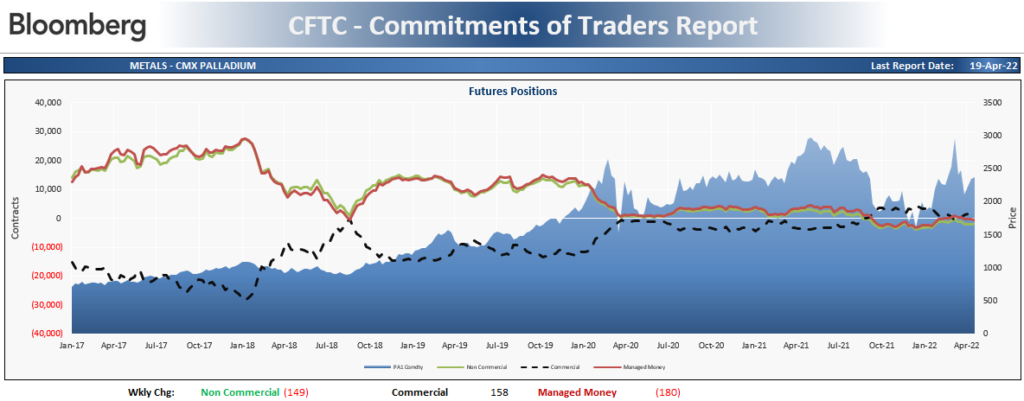

Palladium daily steady but gave up all Ukraine gains

Palladium bullish sentiment dropped hard despite sideways action

Palladium Commitment of Traders shows a more neutral set up for both speculators and commercials

Grains

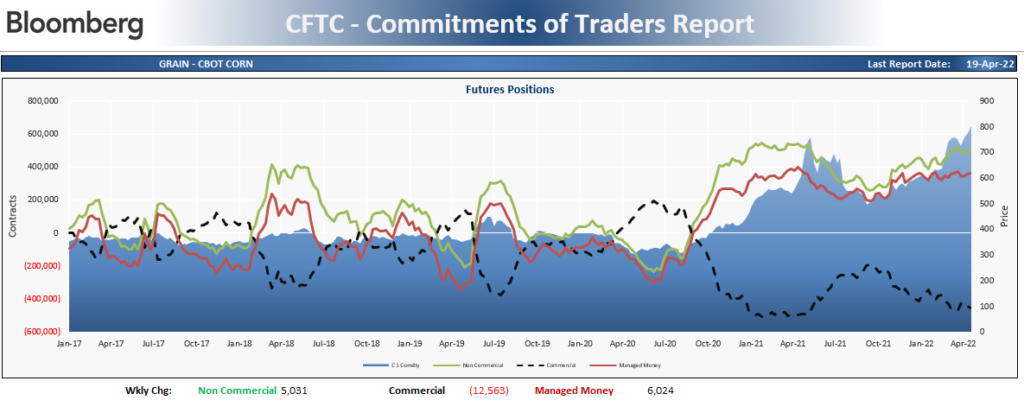

Corn futures daily peaked with the Sequential 13 as shown midweek on the Daily Note

Corn futures bullish sentiment has been very extreme with a big drop last week

Corn futures Commitment of Traders shows speculators increasing long exposure

Wheat futures daily with a lower high wave 2

Wheat futures bullish sentiment with a big drop last week from the extreme levels over 90%

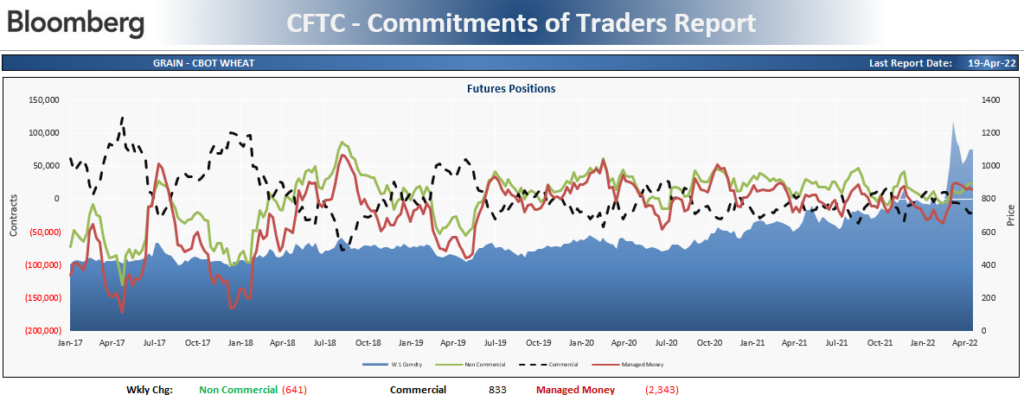

Wheat futures Commitment of Traders tightly wound with speculators decreasing long exposure

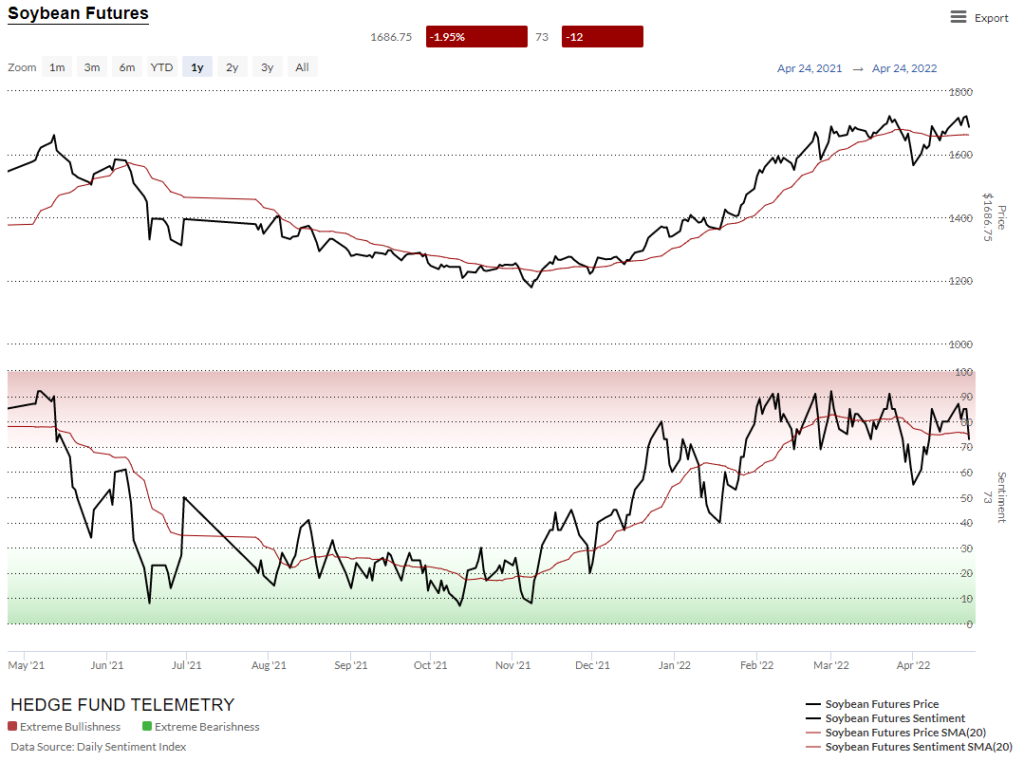

Soybean futures daily drifted higher until Friday. Watch if this continues lower this week

Soybean futures bullish sentiment also has been extreme dropping hard Friday

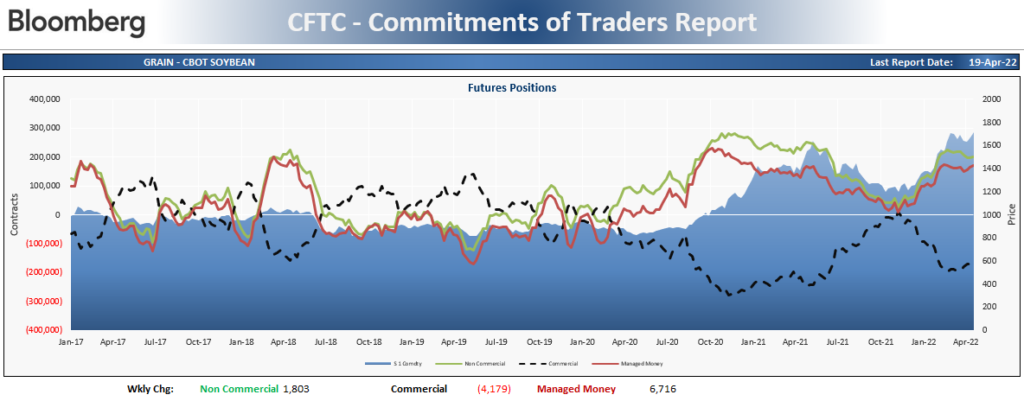

Soybean futures Commitment of Traders shows speculators increasing long positions

Livestock

Cattle futures daily might stop here with the sell Setup 9

Cattle futures bullish sentiment has been somewhat muted even after the big two week lift

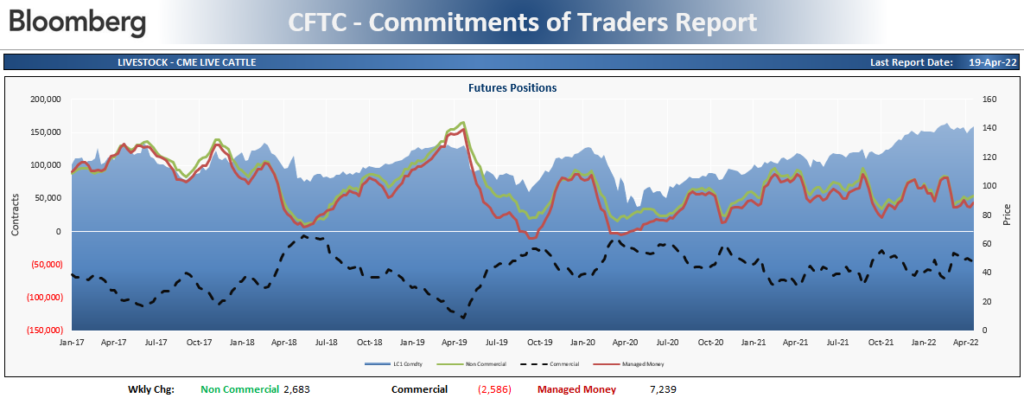

Cattle futures Commitment of Traders shows speculators increasing long exposure

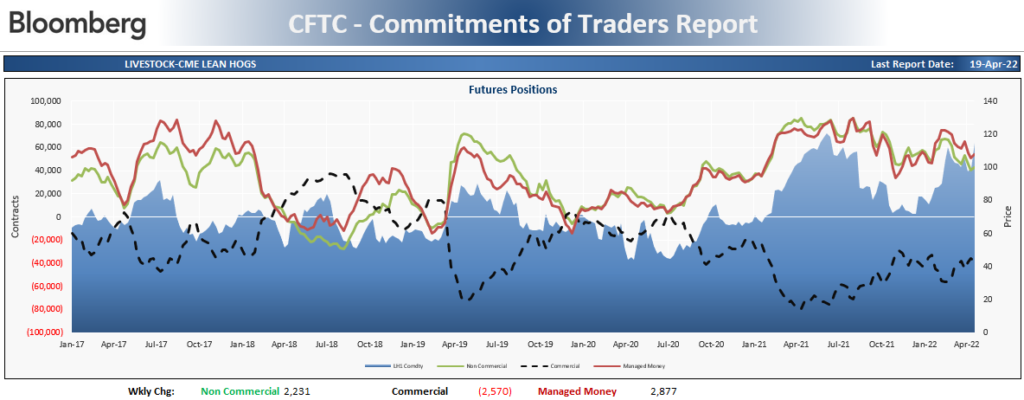

Lean Hogs futures daily with a potential lower high wave 3

Lean Hogs bullish sentiment rose on Friday bucking the trend of commodity sentiment getting hit

Lean Hogs Commitment of Traders had speculators very long (and caught out). They increased long exposure a little last week

Softs

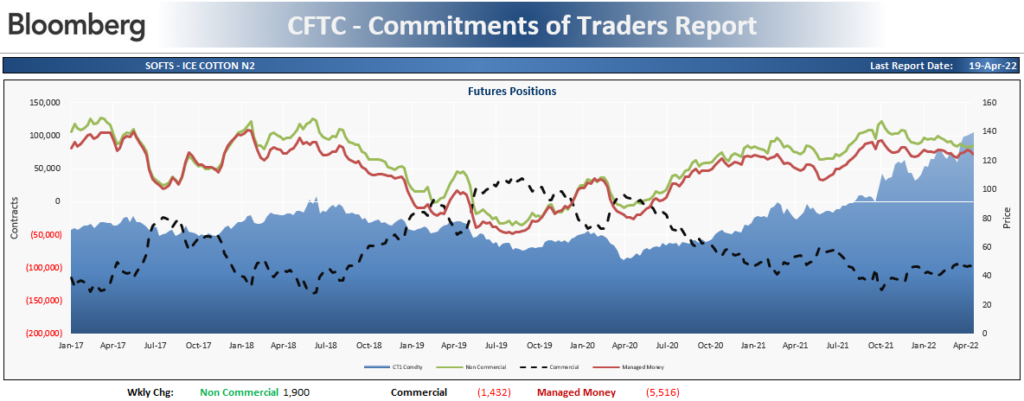

Cotton futures daily still has the DeMark Sequential in progress

Cotton futures bullish sentiment also fell hard after hitting 90% last week

Cotton Futures Commitment of Traders shows speculators remaining very long adding long exposure

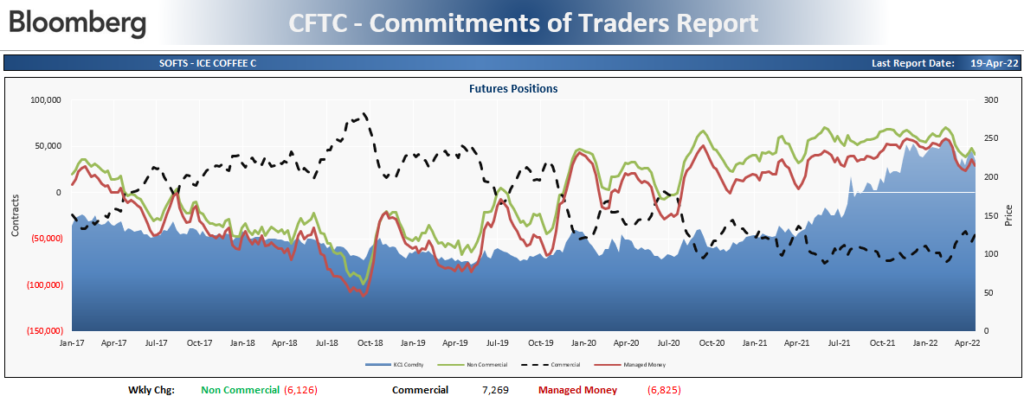

Coffee futures daily steady

Coffee futures bullish sentiment remains under some pressure and is not oversold

Coffee futures Commitment of Traders shows speculators continuing to decrease long exposure

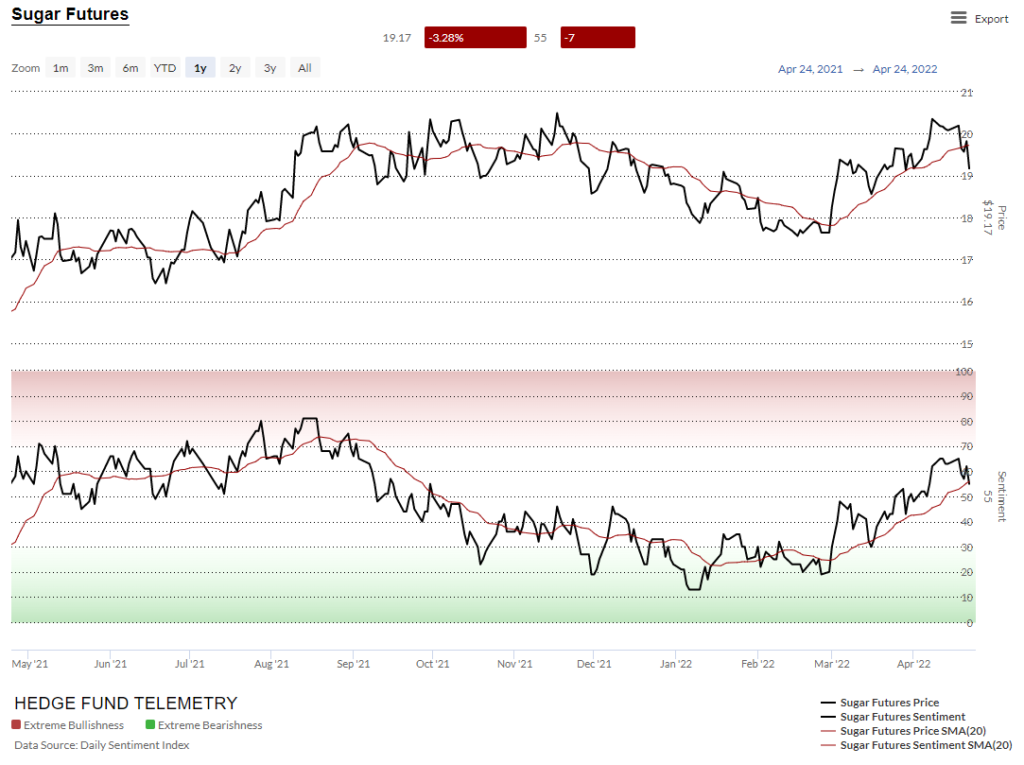

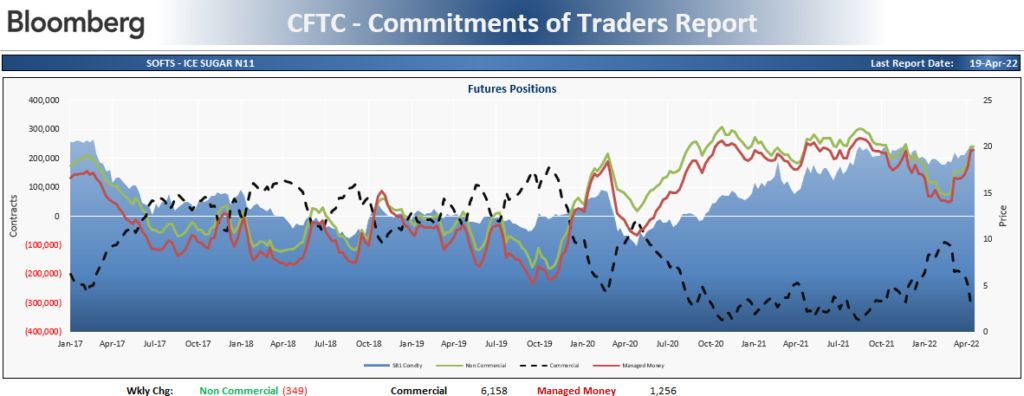

Sugar futures daily with a big drop as I mentioned last week could happen that might set up a good long entry. Not quite ready to pull the trigger and will give an update this week

Sugar futures bullish sentiment stalled

Sugar futures Commitment of Traders shows speculators slightly decreasing long exposure for the first time in 2 months

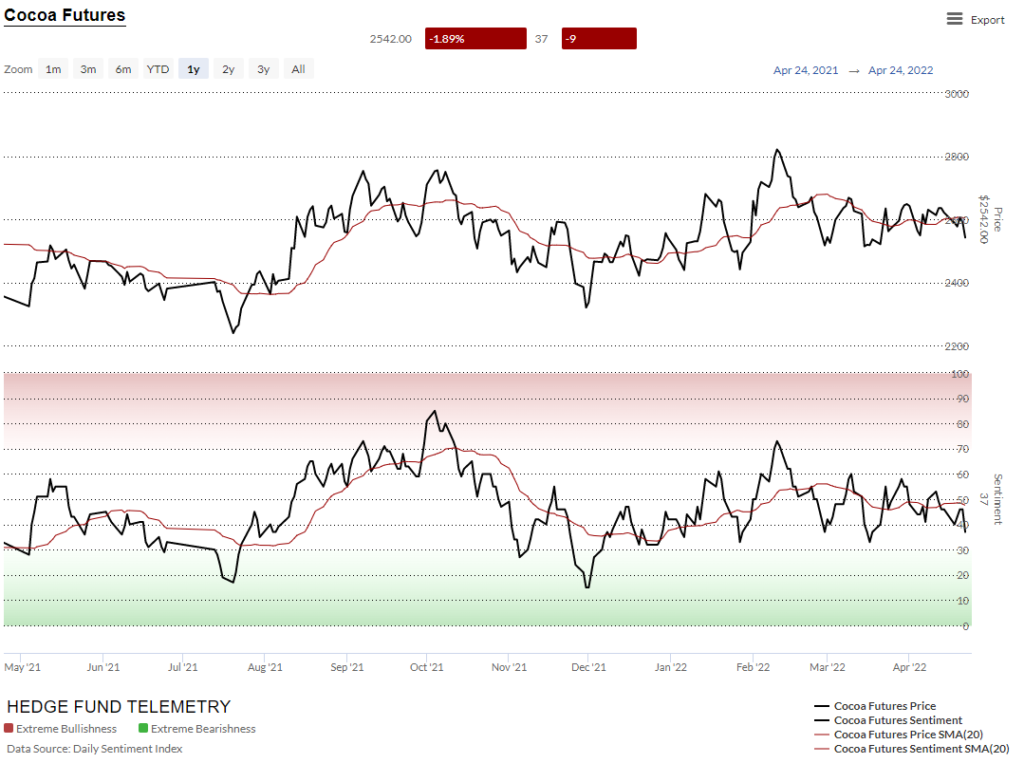

Cocoa futures daily continues to chop

Cocoa futures bullish sentiment chopping under 50%

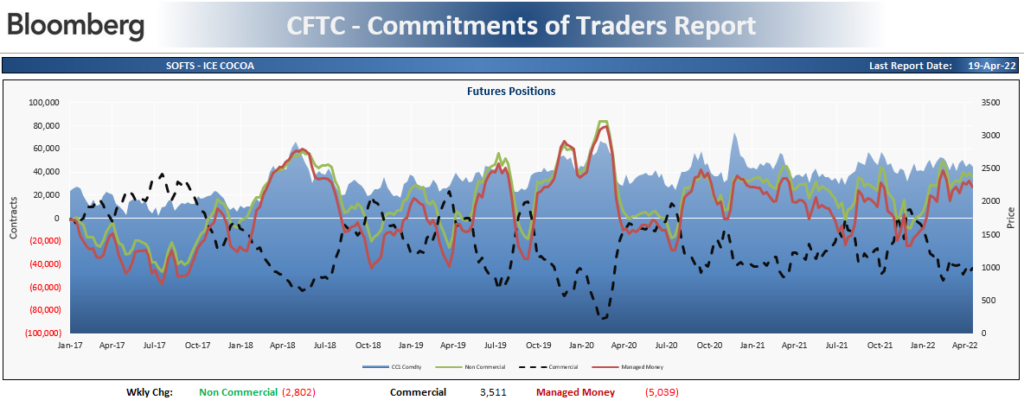

Cocoa futures Commitment of Traders shows speculators decreasing long exposure

Lumber futures daily holding the 200 day

Lumber bullish sentiment backed off after a lift off oversold zone

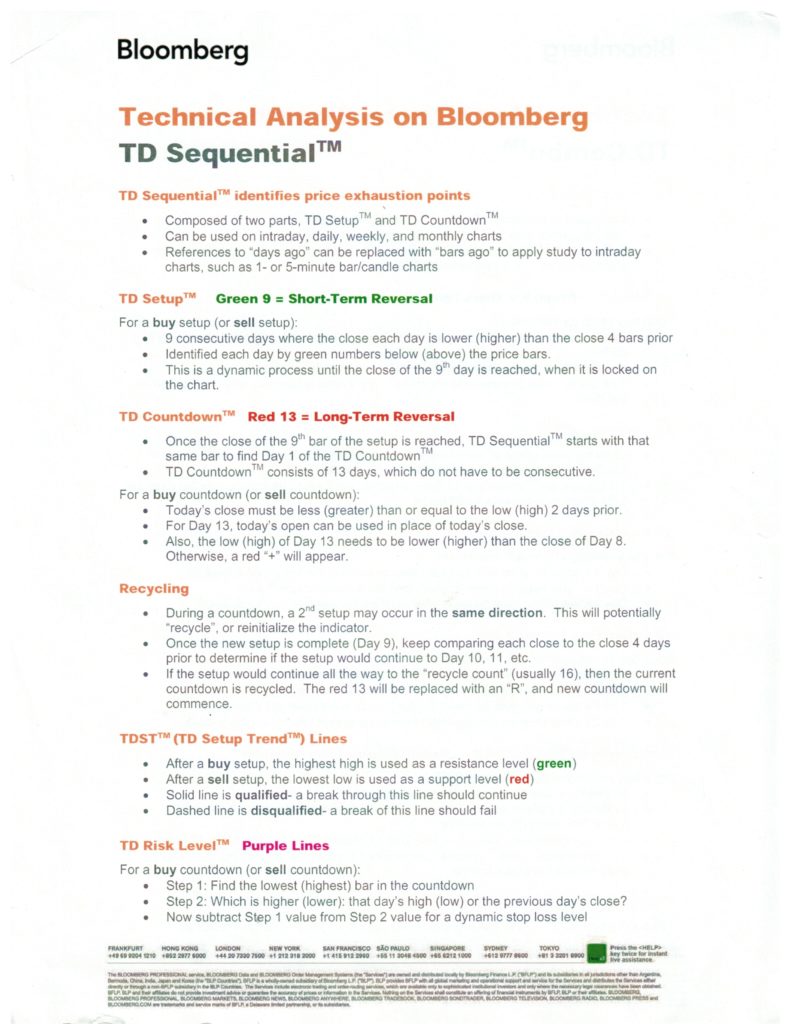

DeMark Sequential Basics

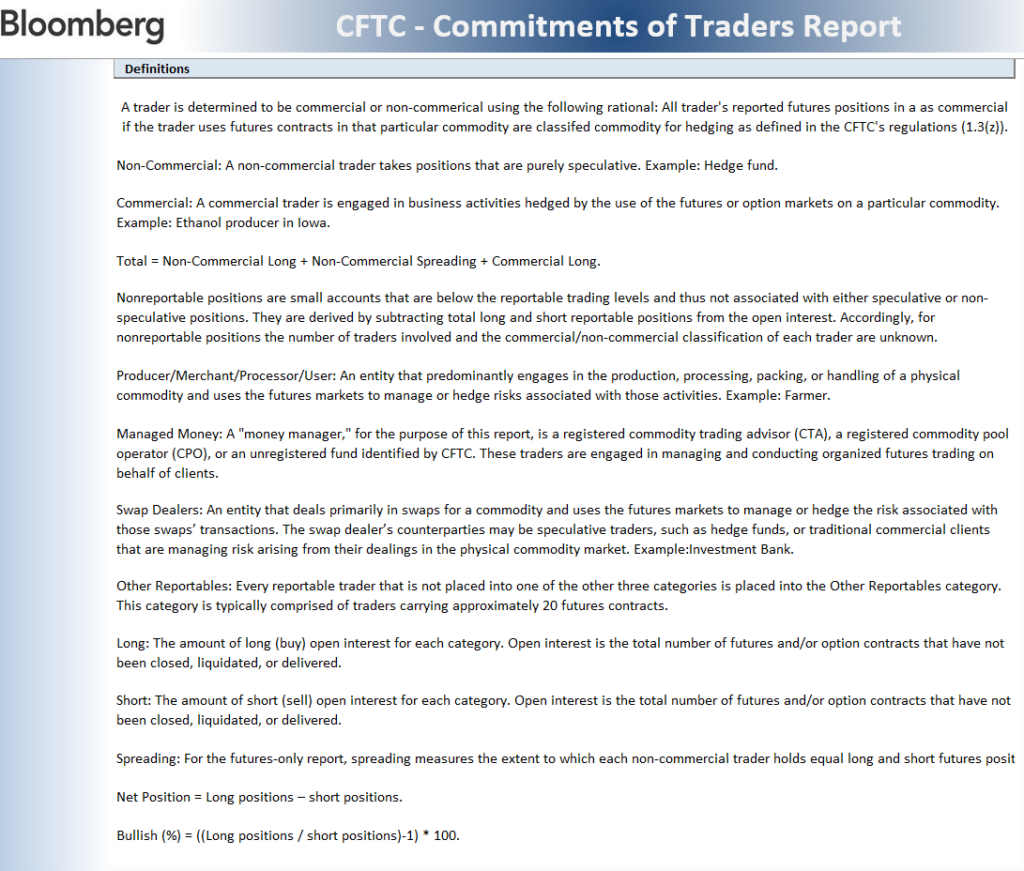

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS