I hope everybody had an enjoyable holiday period. Although I took a week off from writing, I thought much about the past year and the “calls” I have made within these notes. Much of my time has been spent on the question of inflation and as result interest rates and some more interest-rate sensitive areas like high duration equities. In the past few notes, I have put some distance between myself and the yield curve flattening signal, because I believe yield curves (or even pricing of inflation expectations) are a bit tainted right given CB involvement in those markets, bank balance sheet management, and as a portfolio ballast in many portfolios – a topic I covered extensively.

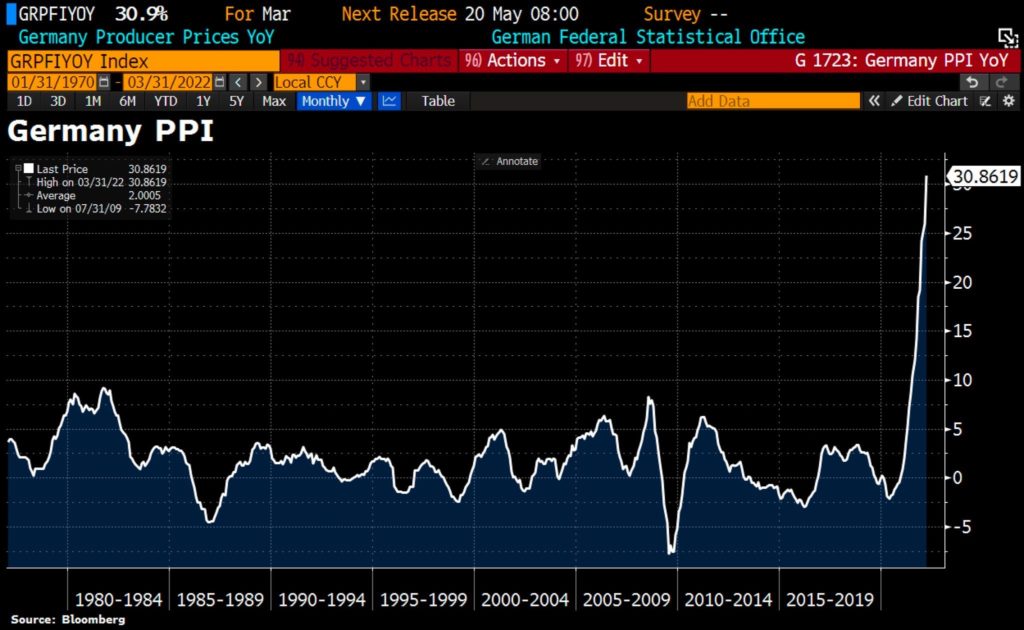

Thematically, I delved a bit into the notion of ESG on two fronts. First, the idea that people quite involved with the movement believed that this effort was a bit of theater and that government(s) should be more central to the effort through regulation, taxation, and incentives. Second, it could starve some industries – energy in particular – of much-needed investment and capacity. To be sure, climate change is important, but making good policy and sequencing initiatives that do not create undue risk should a disturbance occur is just common sense. Germany is caught in that perfect storm or vicious cycle at present.

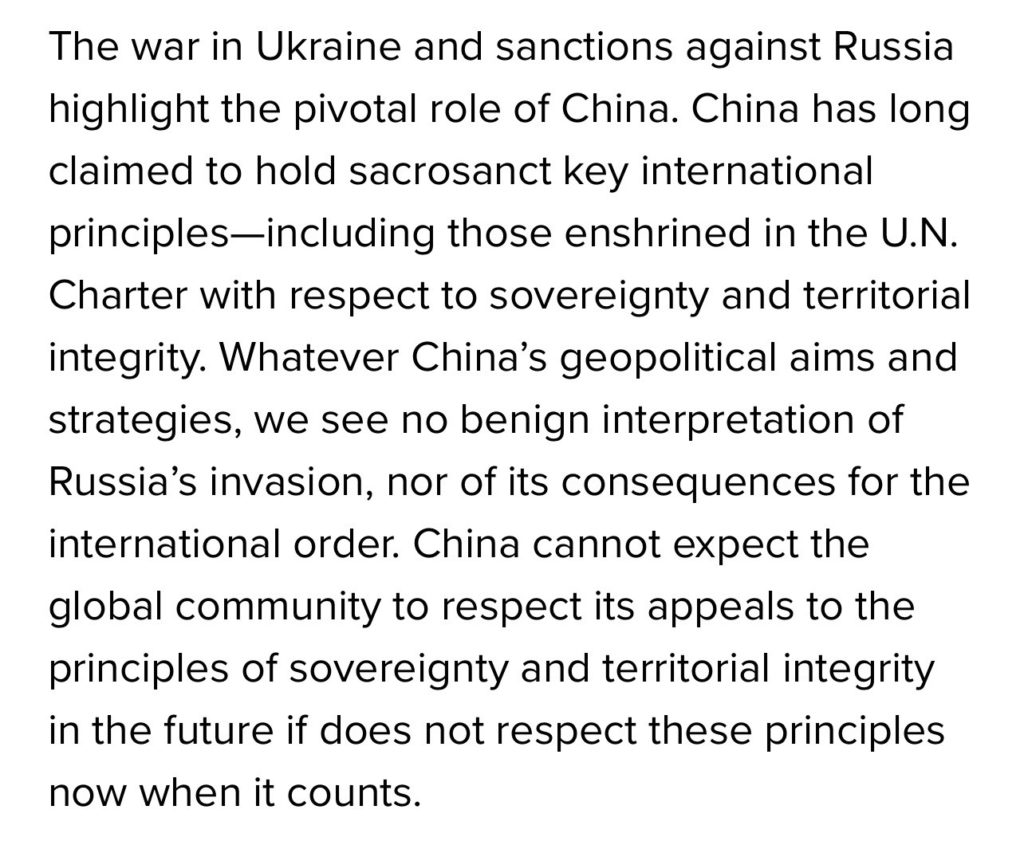

Internationally, I spent some time on China and the Evergrande situation, and in so doing, remarked that while there would be no Lehman moment in China (they are experts at watching what others do and try to incorporate lessons into their approach), there was still a large overhang given the importance of the property/development market to its overall economic growth story. Although 4.8% growth is not terrible for China, it is below CCP targets and who knows if that number is even valid. And, if China’s approach to Covid (in spite of starting the mess and covering it up) was supposed to show its superior governance model, well, that is not looking too hot either given the stories out of Shanghai. The renminbi is a heavily managed currency, but China cannot be pleased to see the JPY in free fall. I had mentioned recently I saw very little about the JPY move that would be overly concerning to the US – although we are probably near the end of the move at 130. The point is, that China – as I allude to below from Yellen – has chosen sides, and that will have ramifications.

More recently, I discussed how the Russian-Ukrainian War was bringing forth a new Cold War, geopolitical fragmentation, and the unraveling of globalization as we knew it post the fall of the Berlin Wall and China’s admittance into the WTO. The net result of this will be further destabilization of supply chains, “Friendshoring,” but it could generate opportunities for other EM nations such as Mexico or Brazil. Either way, the problem is not going away.

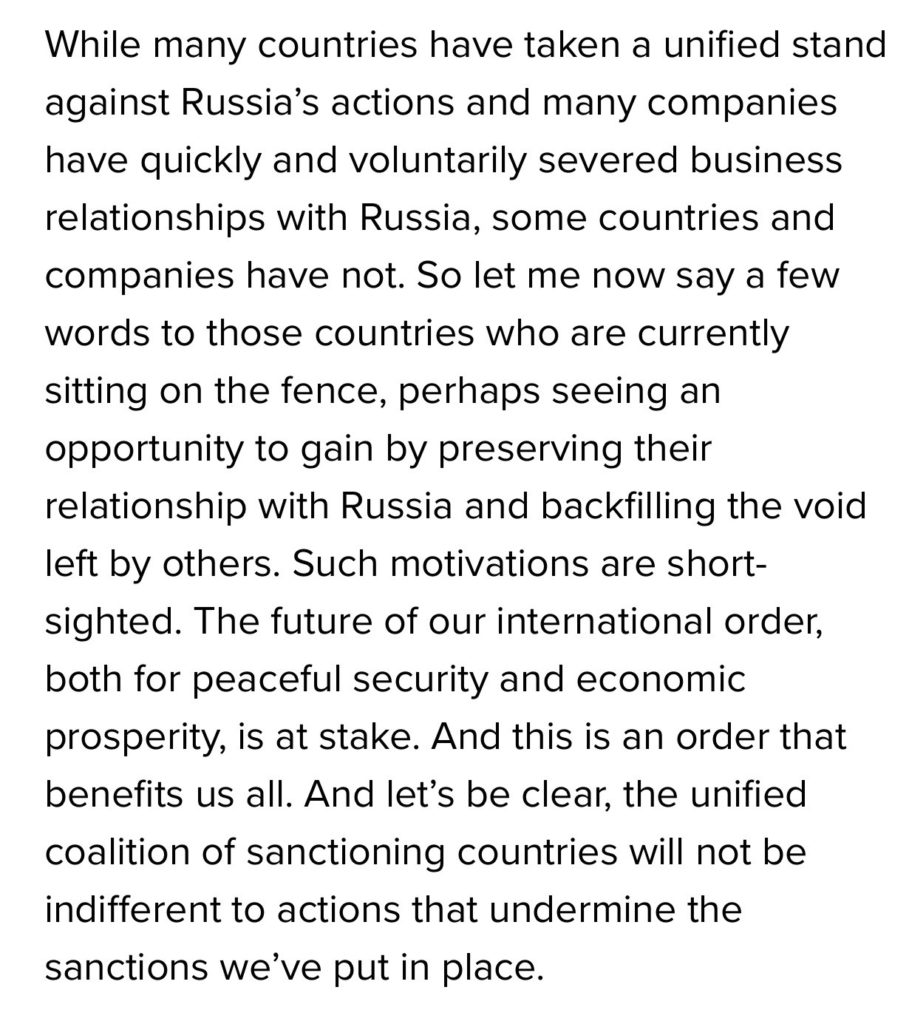

Treasury Secretary Yellen, in an interview with FT’s Rana Foroohar is very telling as she is super clear that the world economy is fracturing, and that there can be no fence-sitters in this conflict, calling out China in particular.

In the early part of 2022, I spent a fair bit of time talking about the need to stay invested in equities given the alternatives, but much of that was driven by long-term wealth creation considerations and the difficulties of market timing. This is a lesson I have earned over my too many times. Equities tend to generate real returns over long time periods and the power of compounding is indeed a wondrous thing.

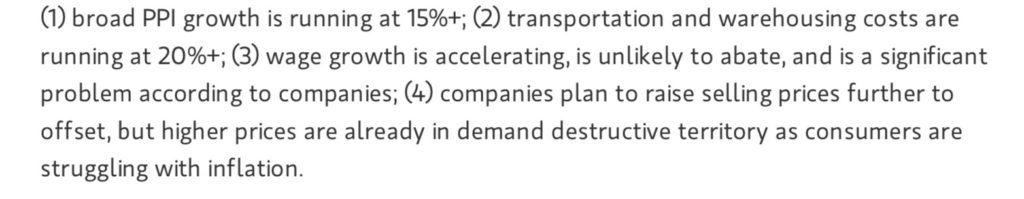

But, there are times when you have to find ways to mitigate risk. I do have an actively managed portfolio (in a hedge fund structure) that is designed to overlay against my wider asset holdings, whether it be equities – public and private, or real estate (I added some real estate last January). There are times when I actively add risk and others when I hedge my risky asset portfolio or go short. This year, I have been reaping the benefits of short positions in fixed income, long $’s vs Euro and Yen (now flat), long CCJ, DBA, XLE, XLM, CRWD, MGDB, FCX vs short ARKK. I also have had on Russell value vs growth. I do trade sometimes in and out of some things or put some trades in that TT recommends, but by and large, my portfolio horizon is 3-6months. In the past few months, I have done less trading and gotten pretty decent results (up 9%). I have in the past week added an SPX and IWM short position so that I am now tilted short risk. Not that I think the market is going to crater absent a recession because real rates are still risk supportive (although declining – see chart below of 10y real rates using expected 10y annual CPI), but that earnings growth and ability to pass on added costs to consumers/retail margins is likely peaking. For example, P&G reporting 7% higher revenues but margins fell by 4%.

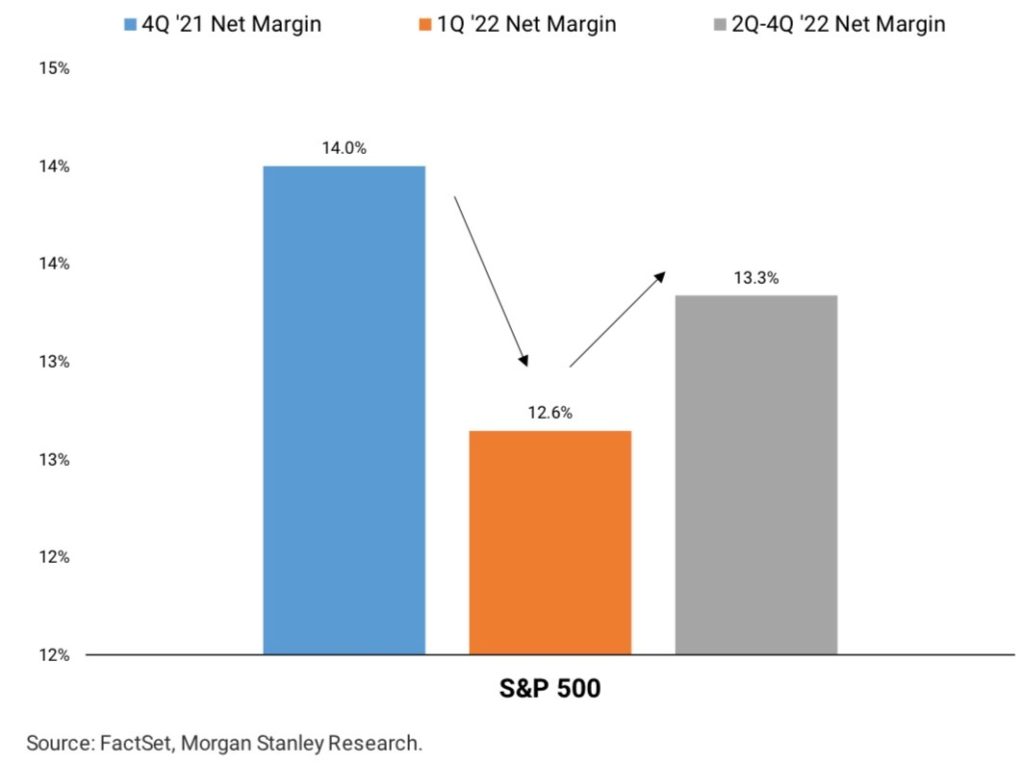

As this chart from MS shows, margin compression from Q421 to Q122 is priced to reverse. Not sure that fits the picture given continued cost and supply issues as MS notes:

Additionally, as I wrote a few weeks back, Bill Dudley is what Fed governors would say if they could. I am just finishing up a really good book called “The Lords of Easy Money” by Christopher Leonard, where he tries to understand\/convey the institutional framework for Bernanke’s march to QE post-GFC and subsequent efforts. The author follows the voices of dissenters during that time frame such as ex-Governor Thomas Hoenig, whose career began at the KC Fed doing bank supervision during the 1970s and had first-hand experience of how devastating easy money is and subsequent withdrawal was could be. In Hoenig’s mind, QE creates “allocative” distortions and is extremely difficult to reverse. If I am taking away anything from the book, it is that the Fed: a. works hard to address internal dissent and show a unified face; b. has drifted into the vacuum possibly created by inadequate or unproductive fiscal policy, and c. has tied its wagon to financial markets/conditions. Much time in the book is taken to outline Powell, his business roots, and his early days at the Fed where he was distinctly in the more hawkish, concerned about QE camp. And now, he is well in the Bernanke/Yellen dovish and mission creep camp. Unfortunately, the inflation genie is out of the bottle, and although they have moved incredibly slowly, they have no choice now but to act more aggressively. And, as I alluded to last note, there is one thing to prepare for a storm, and then there is the actual devastation from the storm. We don’t know what will happen as rates move up, and QT is initiated, but we do know there will be some carnage. As an aside, take a look at the scorecard on QE:

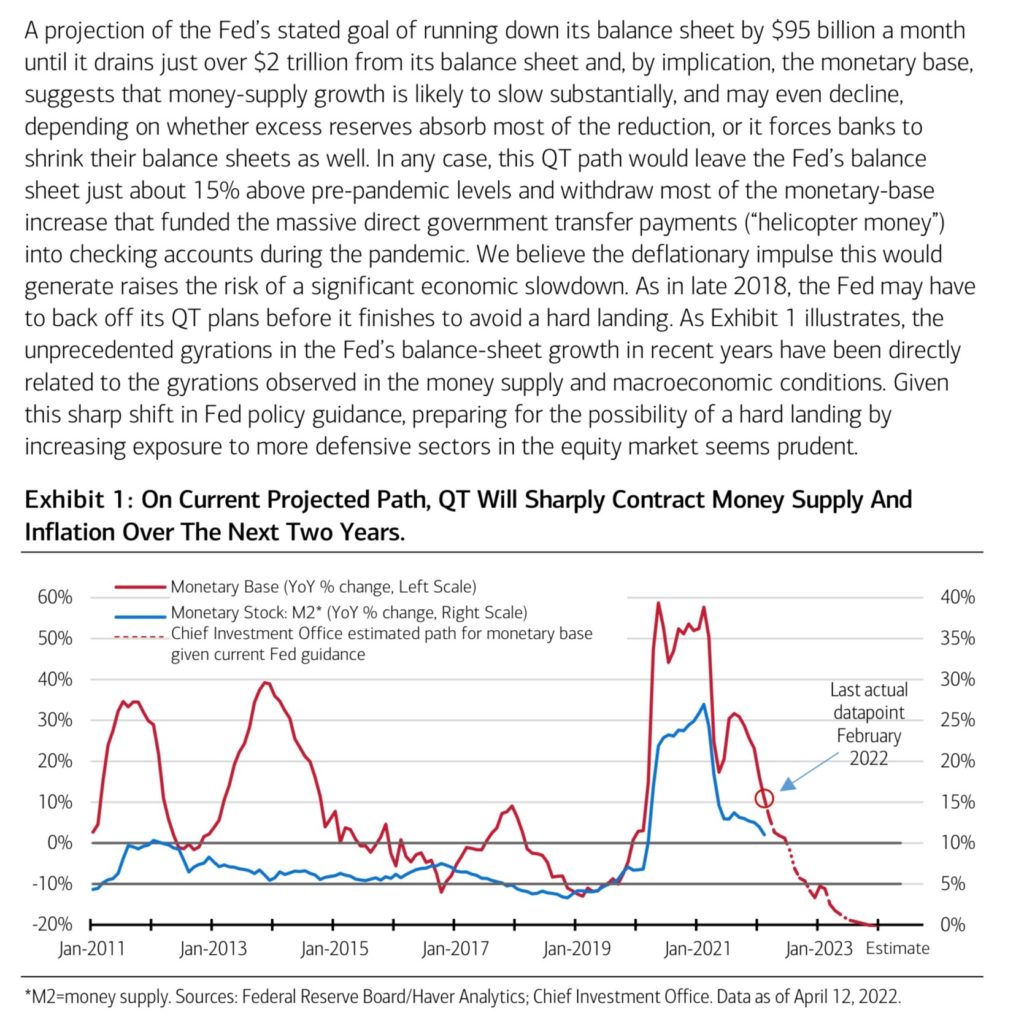

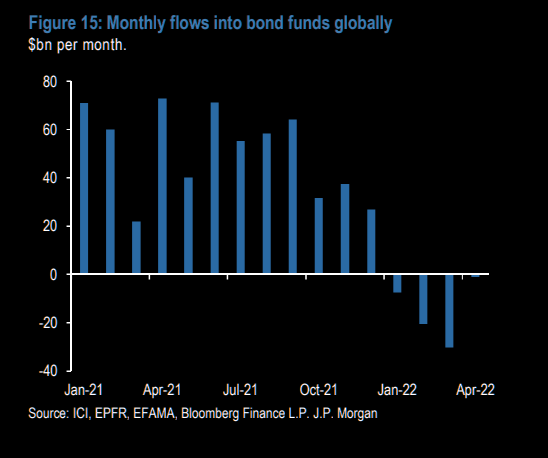

Also, here is a good snippet from ML Private Wealth Management on the topic of monetary withdrawal. Back in 2017/2018, we were tightening more so to add bullets in the chamber, not so much tightening to address an inflation problem, which is what we have now.

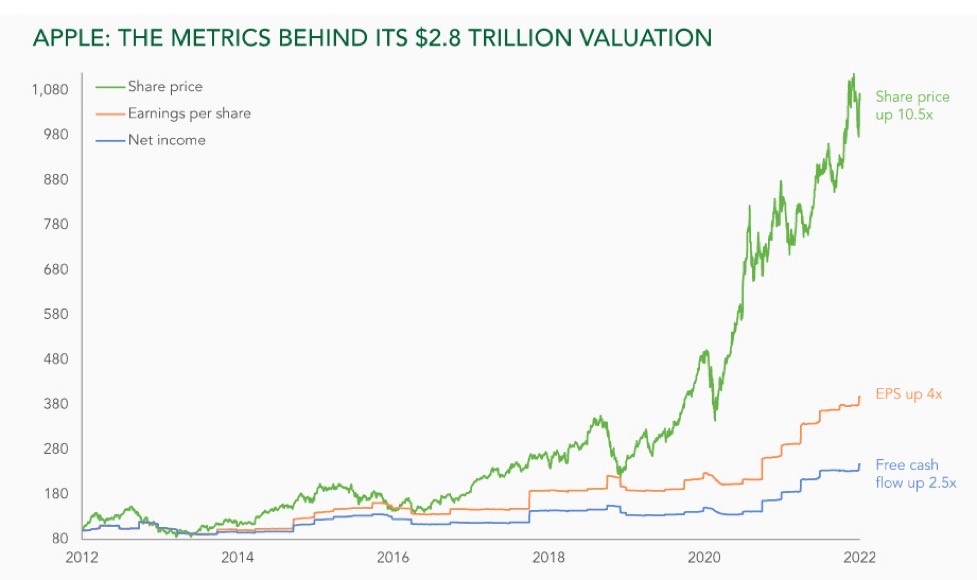

I suspect what keeps the markets relatively frothy (at least from an ERP perspective) is the notion that the Fed will tighten, but is not going to stand idly by (per 2018) if the markets get crushed, given its shift since QE to managing financial conditions. But, when I saw that Dudley note, I had to get some index shorts on. I simply don’t believe the idea of “don’t fight the Fed” only applies to when they are adding liquidity. The Fed may engineer a soft landing eventually, but I think it’s going to be a “white knuckler” that will become much more obvious in the next few months. And even as much as I love Apple as a stock – which I own as a core holding and have for 20 years – it is charts like this that give me material pause.

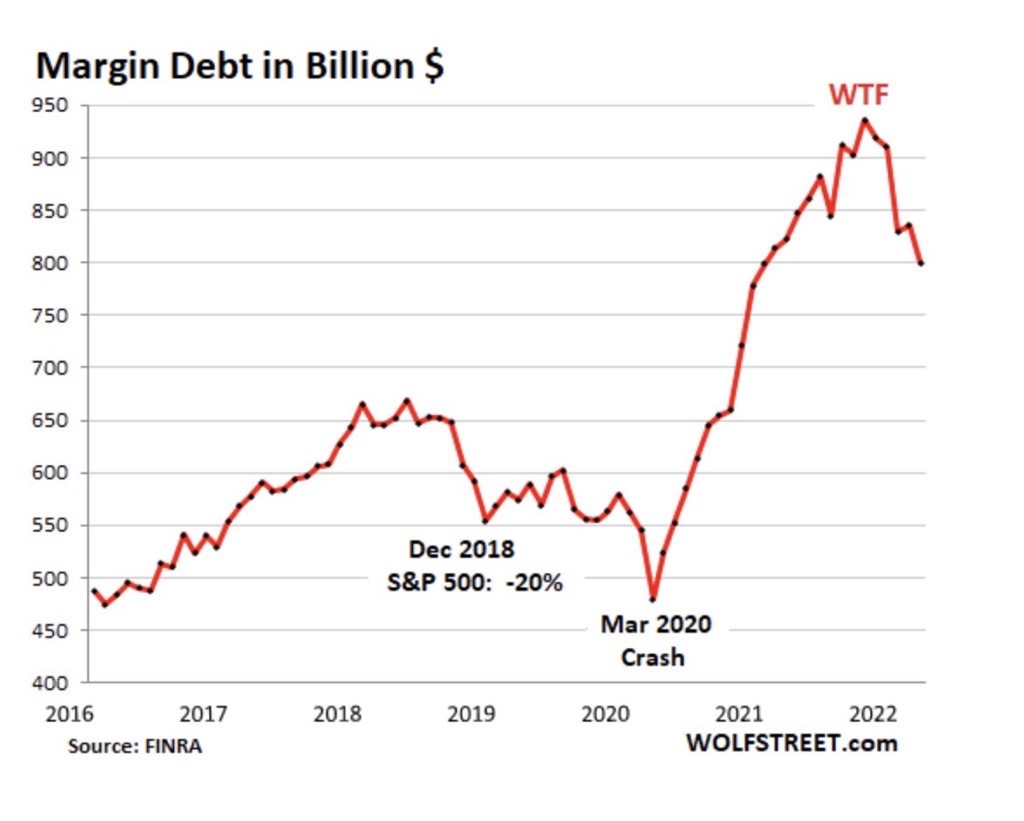

As does this chart:

Other things that caught my attention this past week:

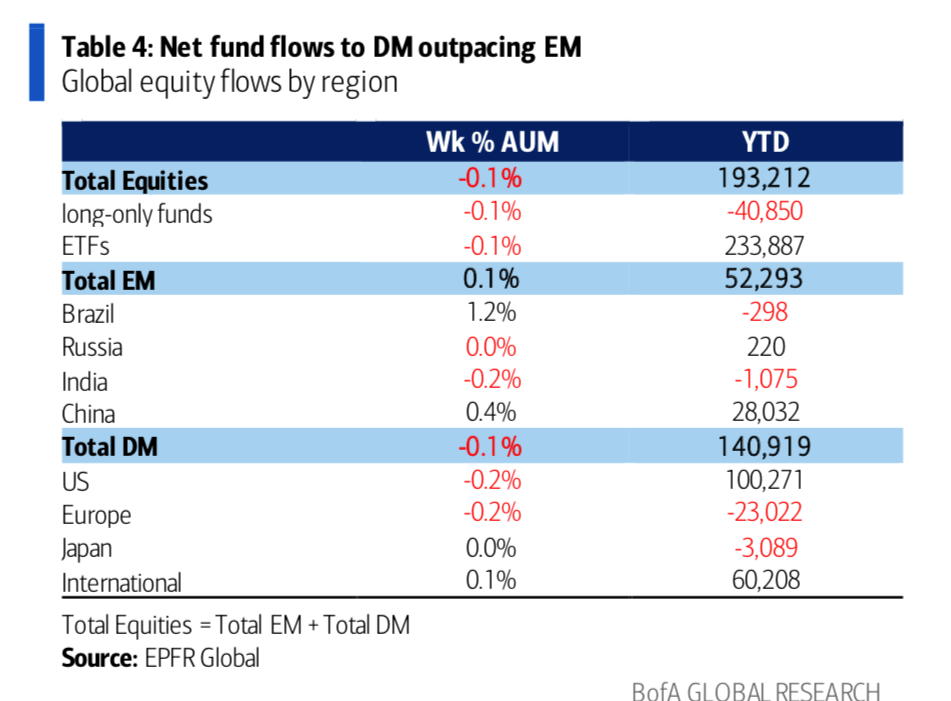

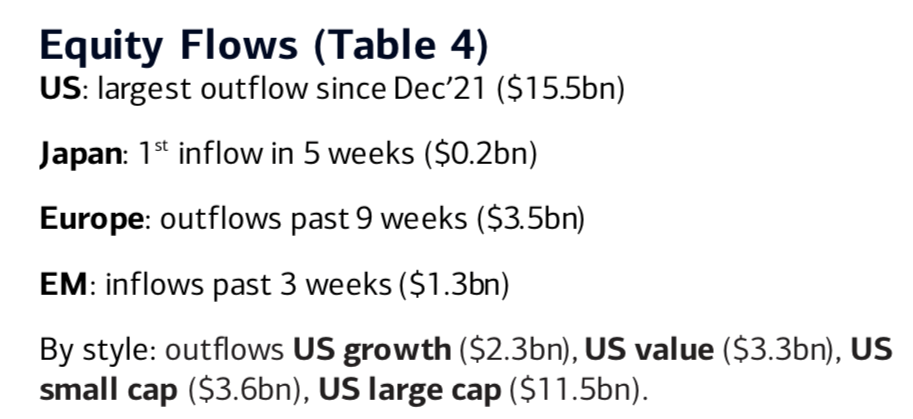

Flows:

Large US outflows were reported as of last Thursday. All this suggests is that what we are seeing this week is more of the same bish bash position squeeze and short gamma trading.

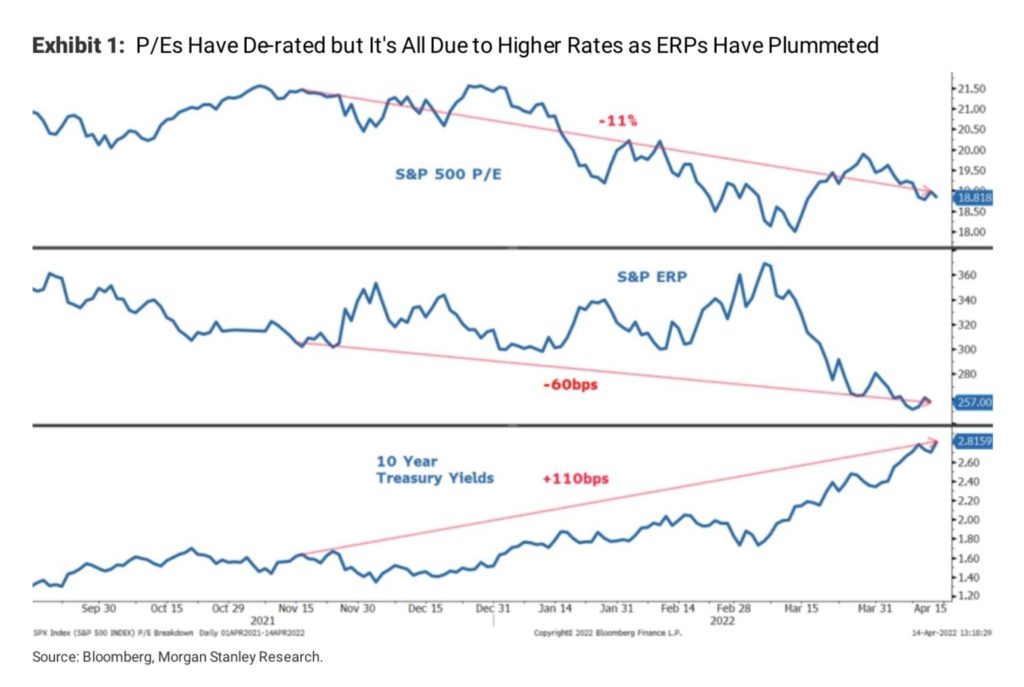

Equity Risk Premium (ERP):

I wrote not that long ago referencing Mike Wilson at Morgan Stanley and his views that equity risk premiums are too low. In other words, rates have had an impact on P/E’s but investors are staying with equities and accepting reduced risk premiums.

Dissonance:

This relates to my ESG point above. While firms like Calpers are trying to push companies to disclose more about climate risks (see their attempt to unseat Warren Buffet), there is not a lot of capital being thrown into the innovation space, say relative to blockchain and cryptocurrency.

JPY Moves and its relation to UST’s:

Some commentators and firms like GS have said there is scope for Japan to intervene in the FX markets to limit the fall or put a ceiling for the JPY move at 130. And, others are remarking that with the cost of hedging FX now wide thus mitigating some/most of the pickup in Treasuries vs JGB (which the BOJ is still containing via YCC), this could have marginal demand for UST by the Japanese, who are large holders.

Not so sure the answer is to intervene in currency markets as the basis is driven by interest rate differentials which are dollar supportive. Never a good idea to intervene contrary to the fundamentals. Also, Japanese investors, in my experience, can adjust hedge ratios – ie. take currency risk and the 250-275 basis point pick up in relative 10yr yields can be managed. It is not a neat package of yield pickup right now, but hedging costs can adjust over time.

As I wrote a few notes back, I believed the JPY move was likely a point of the official US and Japanese discussion and fits with the relative inflation differentials and policy actions with the added benefit of putting some pressure on China and its relative export advantages as well as push down the idea that economic sanctions would impact the attractiveness of the USD. I accept the current cost of hedging may be of marginal importance, but the number of Twitter threads I have seen suggests this is the beginning of Japanese non-support for USTs (an ally, and a country we are going to increasingly rely on to contain China) is hard to fathom over a medium-term time frame. Nevertheless, it is useful to keep in mind that as we go through QT amidst large budget deficits, there are factors that can limit external demand for USTs, and this may be one of them.

Anyway, here is a good piece from Adam Tooze on the subject.

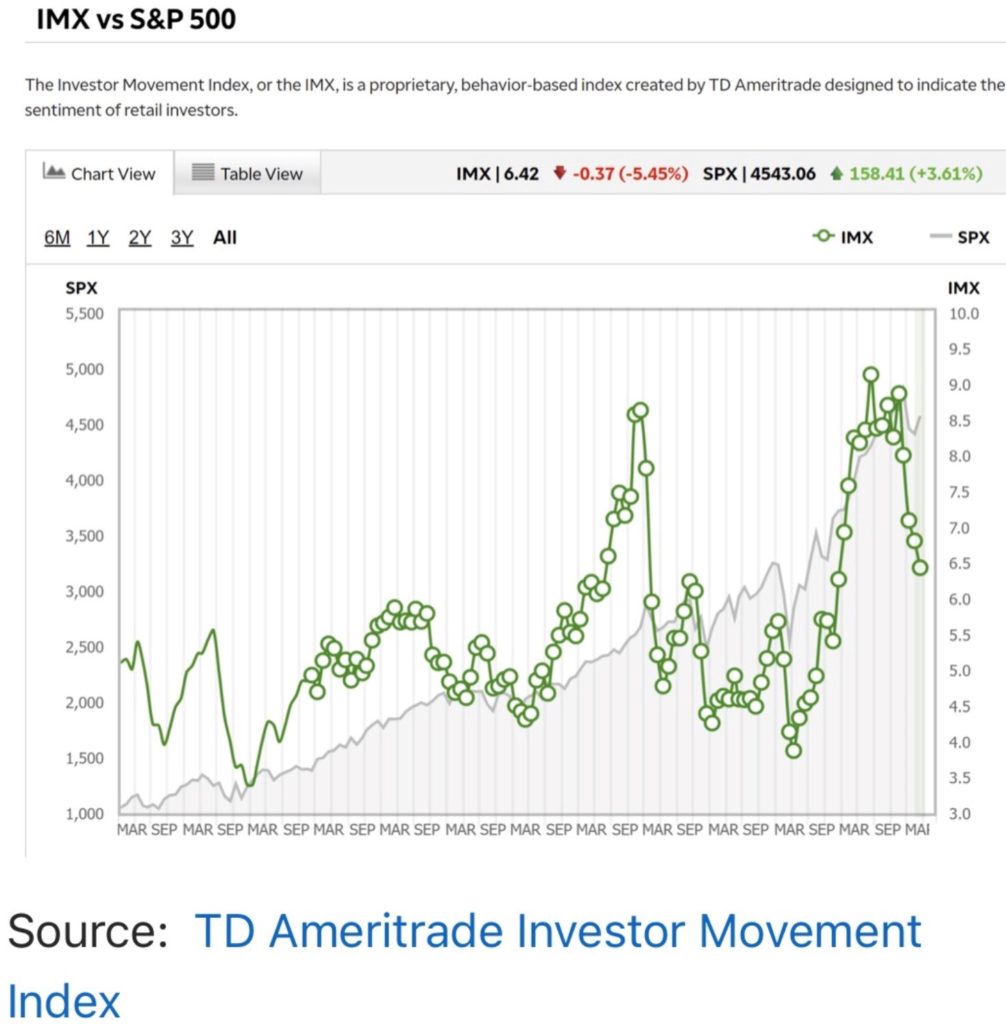

Retail sentiment:

Not entirely sure what to make of this given the equity moves this week, but then again, some of the hottest stocks and funds (ARKK) have been hit hard this year, and nonretail is well aware of the tendencies of the retail community (ie. staying away from potential squeeze situations).

Other Tidbits:

The past 10 years of American life have been uniquely stupid:

So says my friend Jonathan Haidt, who is a Professor at NYU Stern and social psychologist in an excellent missive he wrote for the Atlantic. Jonathan is the brother of a good friend and a 20-year next-door neighbor in CT. I started reading his stuff not knowing they were related but was struck by his writings in explaining physiological/psychological differences that can cause tribalism/polarization. I have had the good fortune to meet him and chat with him. He is extremely thoughtful and measured. Bari Weiss had him on to discuss the article and up-and-coming book he is writing on the subject if that is preferable. One strand that comes across from his work is his belief that society is being negatively impacted in a big way by social media.

Fwiw, I don’t have an enormous opinion about Musk and Twitter, although would tend to side with TT that it is a ploy to gain attention. That he is backing off (only willing to commit $10bln) and is unlikely to be able to fund this thing in full on his own w/o negatively impacting Tesla investors anyway, suggests as much.

Crypto:

Everybody by now knows I am not the biggest fan. I happened to be sitting next to a really sharp and successful 81-year-old last Friday down here in Florida who remarked he held about 5% of his assets in crypto, so I thought some about whether to put some of my money into it. Then I read this article about Jordan Belfort and his foray into crypto and thought otherwise.

$1k Fines for Restaurants for Offering Unsolicited Plastic Straws: In my WTF for the week, I ran across this story. This reminded me of a town council meeting I went to recently here in Vero. The issue is related to when dogs can be on the beach unleashed. Some people were adamantly against it (and even dogs on the beach leashed) noting that they poop on the beach and owners don’t clean it up. One town council member noted that the community should ask all dog owners to submit DNA to get a license to walk their dogs. Why? Well, poop that was uncovered (not cleaned up by the owner, which I always do) would be sent to a lab and checked against the DNA database, and the owner severely fined and their license revoked. That idea got jettisoned pretty quickly as dramatic overkill.

Market Reader:

I have referenced a few times my friends at Ex Ante Data in a few stories. It was started by Jens Nordvig, an extremely competent and good guy I worked with when I was at Moore and he was at GS. I always found his research to be insightful and value-added. He left investment banking research and struck out on his own, focusing on building data analytics to improve research insights a number of years ago, and Ex Ante has been a success with the largest asset managers in the world. His work during the Covid period was outstanding. Jens gets it.

He asked me about a year ago to get involved with a new venture of his called Market Reader, and after he showed me his business plan, the people he had working on the matter – specifically Evan Schnidman, a Ph.D. from Harvard who also started and sold a fintech company called Prattle – I decided to become an early investor.

The basic value proposition of Market Reader is to help investors of all types understand what was moving across all asset classes and why. It is still early days, but I am highly encouraged by their progress. Anyway, you can connect to their insights here and they are posting regularly on Twitter.