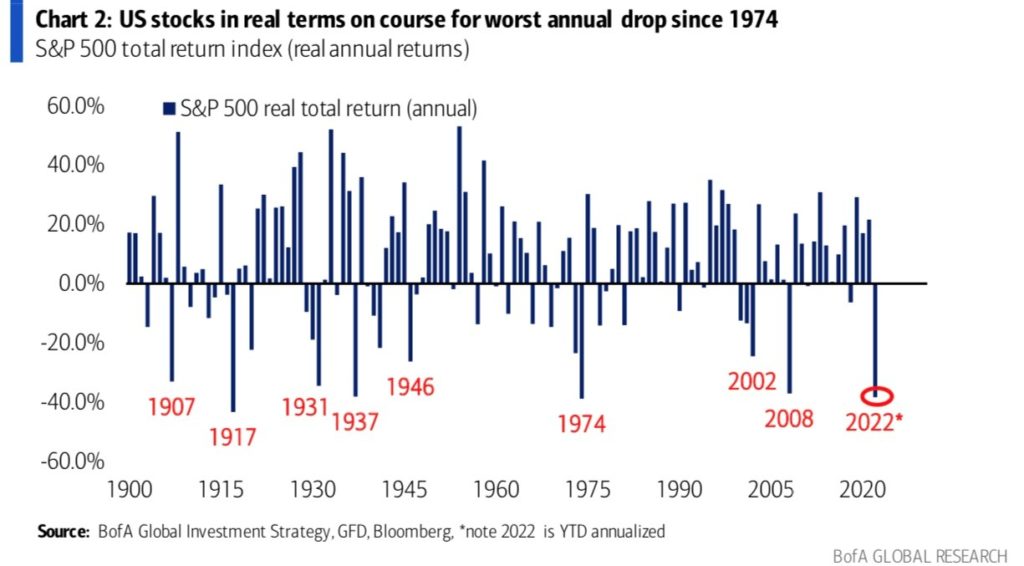

Well, that was one awful start of the year for asset holders, by and large. It begs the question “are we there yet?” As in, have we reached the bottom? My sense is still no.

One of the phrases you hear or read a lot these days is that “risk happens fast.” There is much truth in that. But, in reality, risks are always there. It is not like hurricane season in the Southeastern US, where it is just a matter of how bad, not if. In markets, things are sunny – money needs to generate returns – until one of the many risks that are under the surface pierces through and causes havoc. It harkens back to the Hyman Minsky comment that “stability breeds instability.” Keeping rates low for long or engaging in what seems like continuous QE serves to keep the economy and markets from doling out pain, but it can bring about misallocation of capital and store energy for another and more painful crisis.

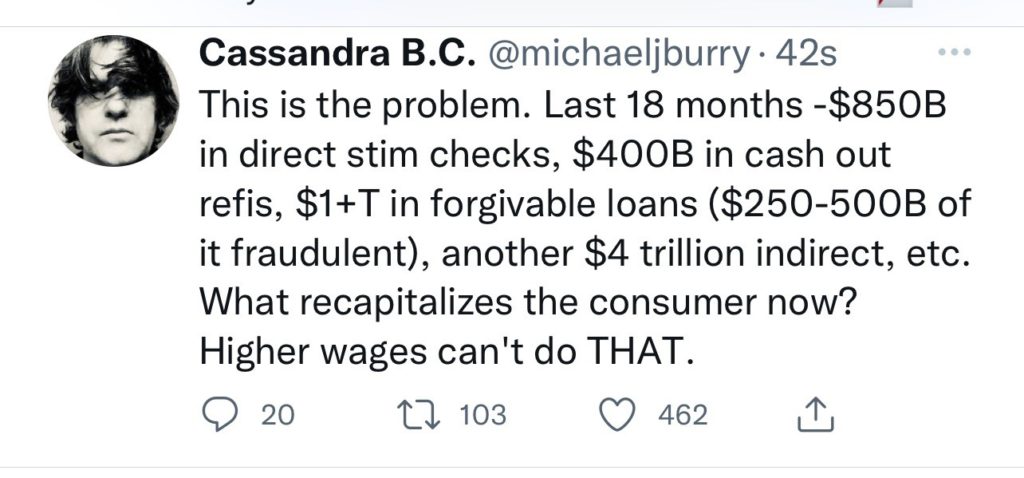

There are risks because very few choices in the economic/political realm are a clear win-win. They are almost always trade-offs and bets that the risks can be minimized. One would be hard-pressed to argue that material government intervention in the throes of the pandemic was unwise. But, the simple reality is that the market and the economy were held up artificially, with the idea that over time, we would seep back to the normalcy of full freedom of movement and productivity, and with that, a reversal of monetary and fiscal largesse. That was always the game plan. Get the economy on firm footing, and remove accommodation as the underlying private sector economy was recovering. Having said, that, as this tweet suggests, that is going to be hard.

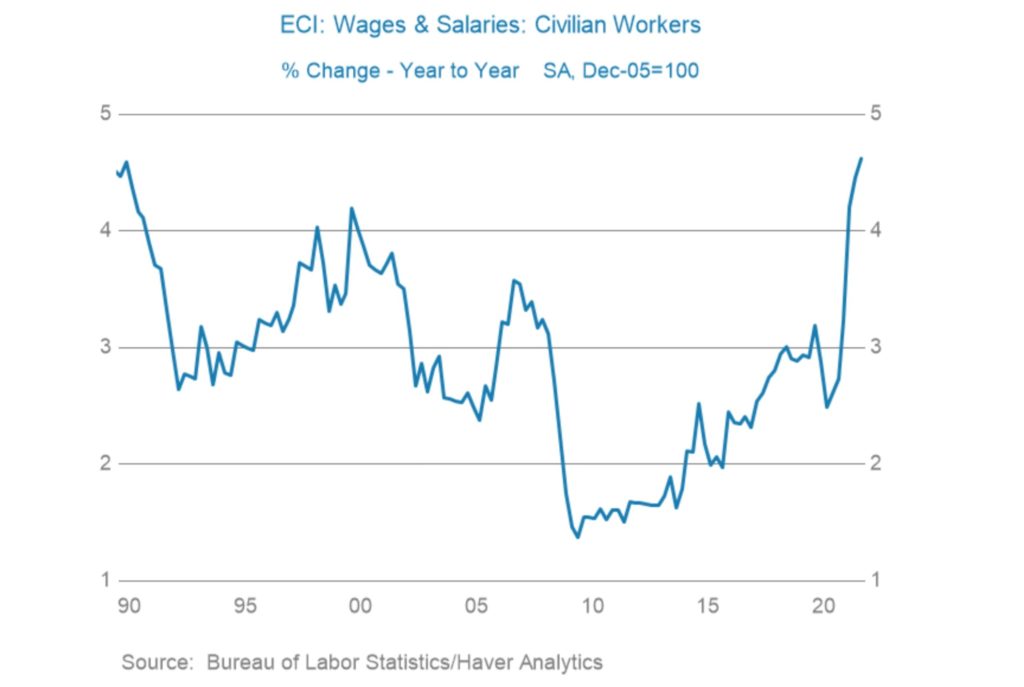

But, in attempting to not repeat mistakes post the GFC of under-stimulation, this time they massively overdid it. These arguments were made by Larry Summers and others. So the extent of the spending and printing along with supply chain bottlenecks worsened by the situation in Ukraine, and we have found ourselves with inflation and the mother of all binds (as the Burry tweet implies). It was this bind that many foresaw back in the early QE debates (of which Powell was very concerned about moral hazard, exit strategy, inflation), but was rationalized away initially as an “insurance policy,“ or “the courage to act” given fiscal gridlock and a slow recovery in the early part of last decade, and in Sept 0f 2019, the need to act as the all-important repo market was printing at 9% rates for overnight funding. But, when faced with the following, and after 40+ years of keeping inflation at bay, they are forced to choose between the devil and the deep blue sea.

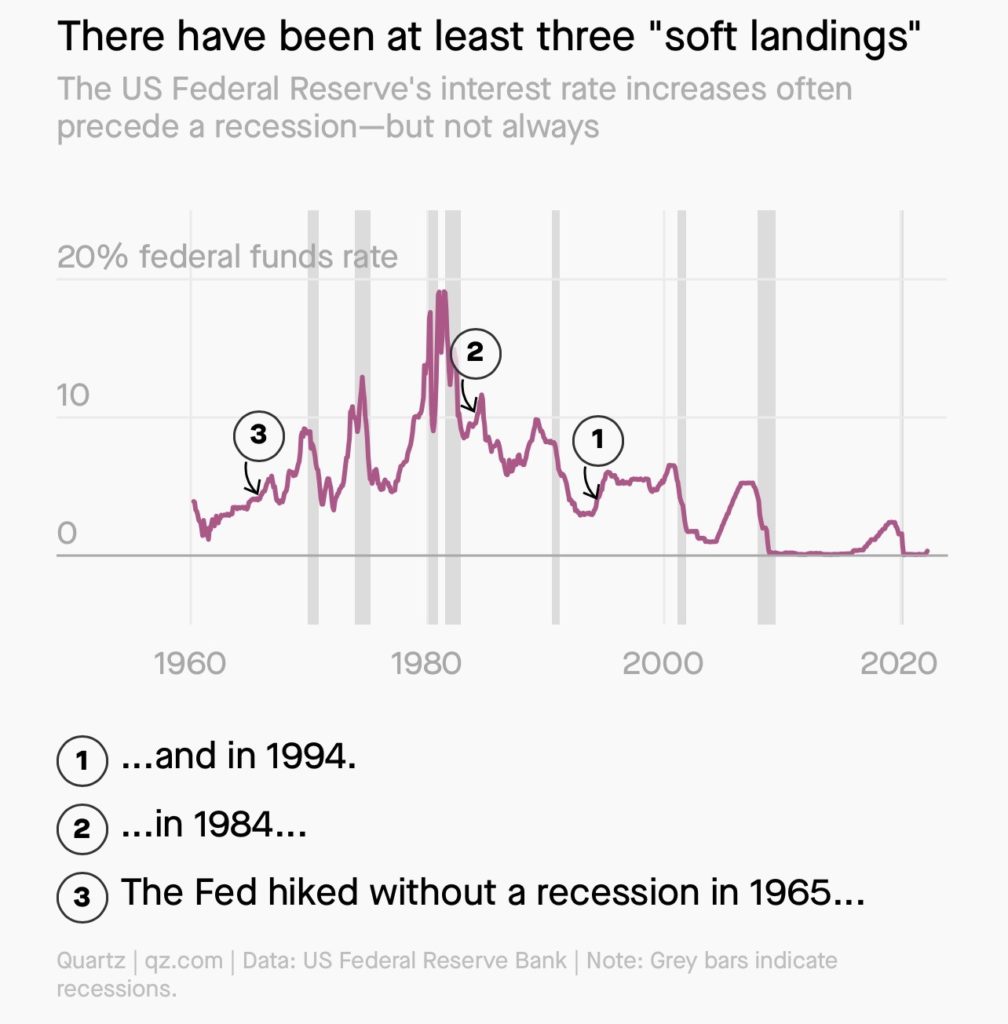

Since the GFC, governments and central banks have become required participants in the economy and markets. As Draghi said in trying to prevent a calamity across Europe – “whatever it takes.” All of that assumed that once a crisis had passed, official participation would revert into the background once again. But, that is wishful thinking. Yes, Central Banks will tighten, and we will get the Fed this week going 50bps and continuing to signal for further tightening including QT. But, they are chasing after the elusive “soft landing” that while plausible, has not had this challenging a setup (inflation + fiscal/monetary largesse in a time of significant polarization + wealth channel usage). It is not implausible that the Fed at some time backs off, but to think YTD asset returns (which Dalio chimes in on his Linked in feed have moved the market out of bubble territory, but by no means cheap are sufficient to cause the Fed to blink. Nevertheless, here is a good chart of the history of soft landings in the recent past

At the low of 666 in SPX in 2008, the markets have gone up more than 6X in the past 13 years, or an almost 15% CAGR for asset owners. In that time frame, public debt has gone from around $10T to $30T to undergird the economy, but the median wage has barely budged. That is just not a sustainable model. And, as Buffett suggested over the weekend, inflation is a scourge that impacts everybody, but much more so to those less well off. So, that has to be dealt with, but so does reconfigure the pie. As I will discuss a bit more on this below in other tidbits, this is not a party issue. Growth alone does not solve this, because, for many decades, growth and prosperity have not been trickling down nearly far enough.

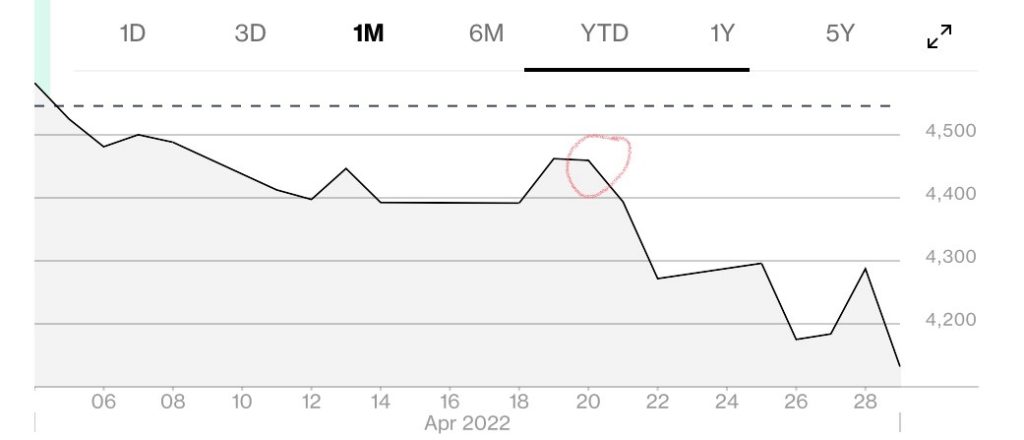

In my last note, I remarked that I had shifted to being a short risk (SPX). The SPX was around 4450 or so at the time. I am now closer to neutral given sentiment being stretched and obvious early month buying near technical support, but looking to reload, as I think ultimately we head down to the 3700-3800 level.

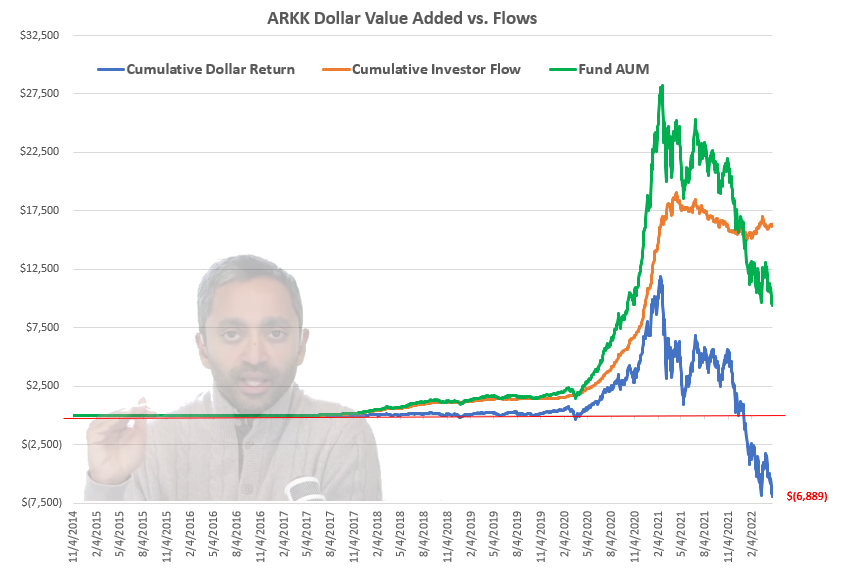

What I saw then was excess exuberance coming into the earnings period, but longer-term money moving out of equities, even if at a slow pace. I also noted that equity risk premiums were very low given inflation risks and that the tightening cycle can unearth some surprises via the financing, and collateral channel. It is very easy to look at yield curves and suggests tightening is priced and get comfortable with risk. Many believe that if tightening is expected, and the Fed doesn’t unnerve the market, things will all work out fine. My view is that while fair and plausible, tightening cycles are like hurricanes where poor preparation and building structures can wreak more than expected havoc. The idea that all the excesses that Minsky warned about are fully unwound, is naive. GameStop is still trading over $100 and Cathie’s funds have been attracting assets recently. That she is given airtime by so many still confuses me. Glad she has the courage of her conviction, but at this point, it is silly as she says nothing new or insightful. The one argument that seems to be working, however, is that she is suggesting investors not sell at the bottom.

But, then you read this snippet and you just shake your head:

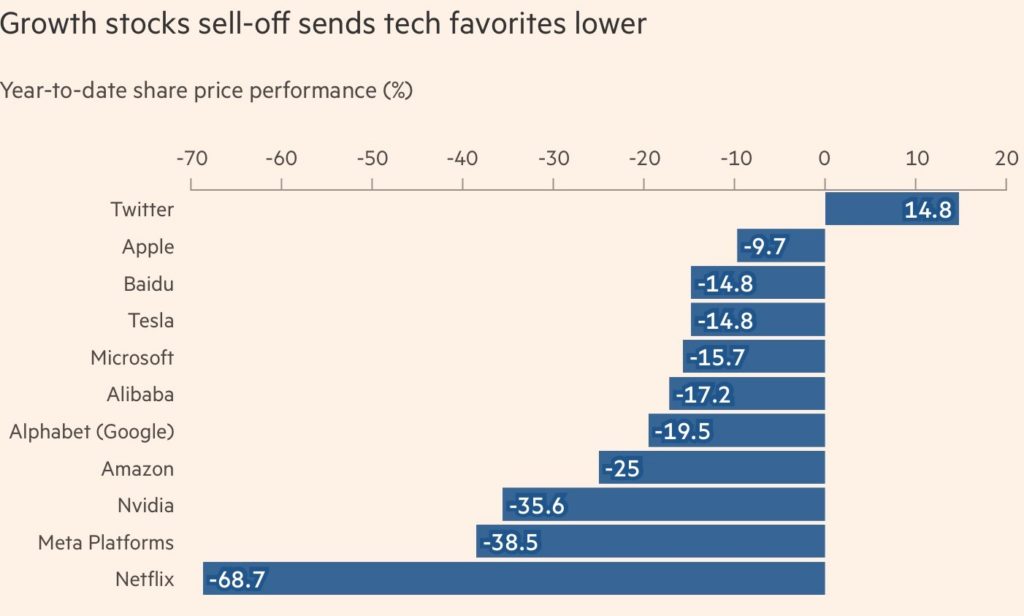

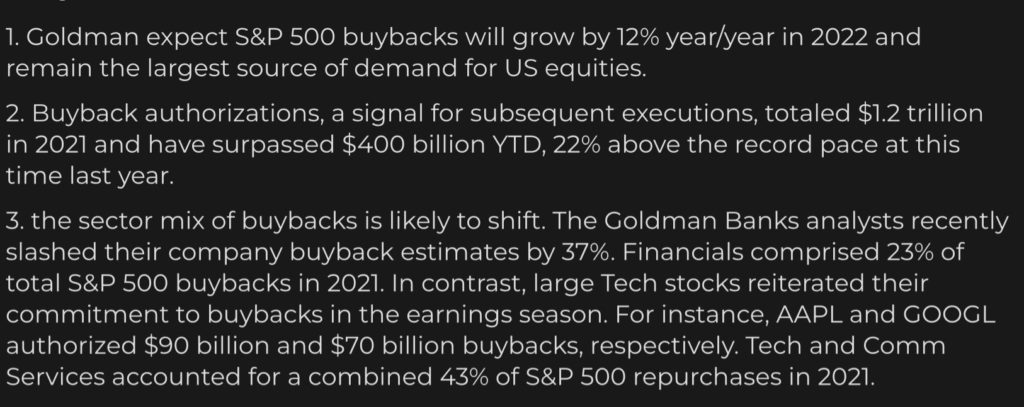

On the earnings and guidance front, Netflix changed the sentiment and they have been especially hard hit, but they are not alone. Buybacks will continue to help, no doubt. But, like FX intervention, it only has a lasting impact if it is in the direction of policy. So, the BOJ may talk and the market may get nervous about intervention, but if the Fed is tightening and the BOJ is engaged in full-throated YCC, it won’t matter. Same with buybacks. Not that I want to aggressively short Apple, Microsoft, or Google, three firms that are cementing their commitment to capital return, but if their businesses are slowing, and facing challenges, their stocks will fall.

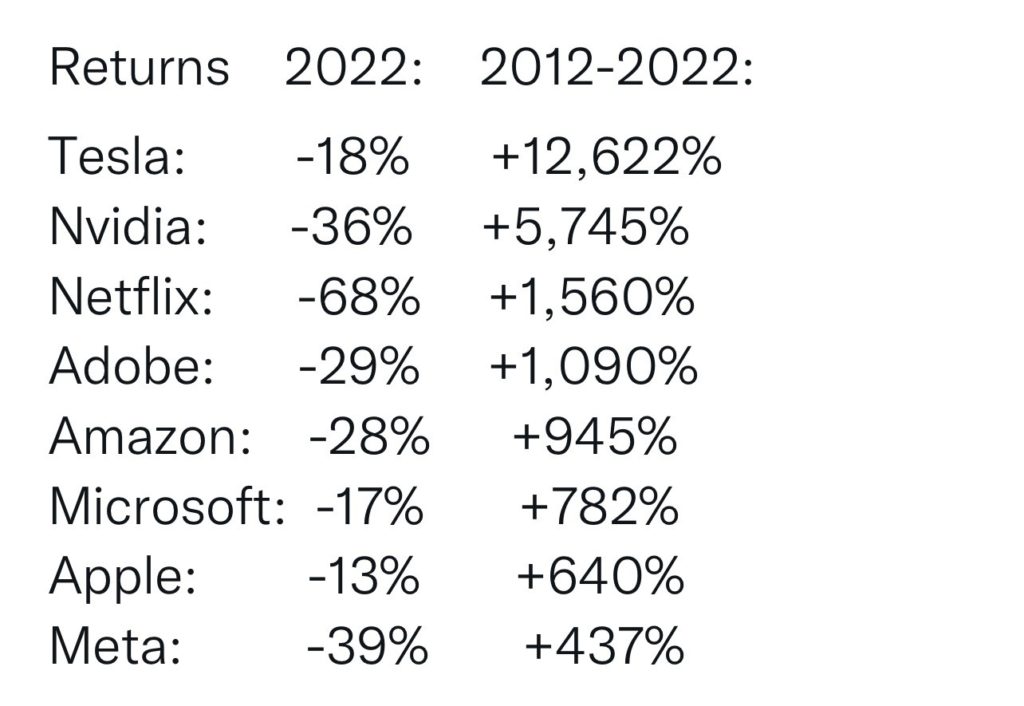

Just to put some of that into context, here is what some of those names have produced since 2012. Not that much of those returns are not matched with strong brands, execution, and performance – ie. deserved – but as I noted with an Apple chart showing massive re-rating amidst declining shares outstanding – these things do correctly when the Fed is tightening and the economy is slowing.

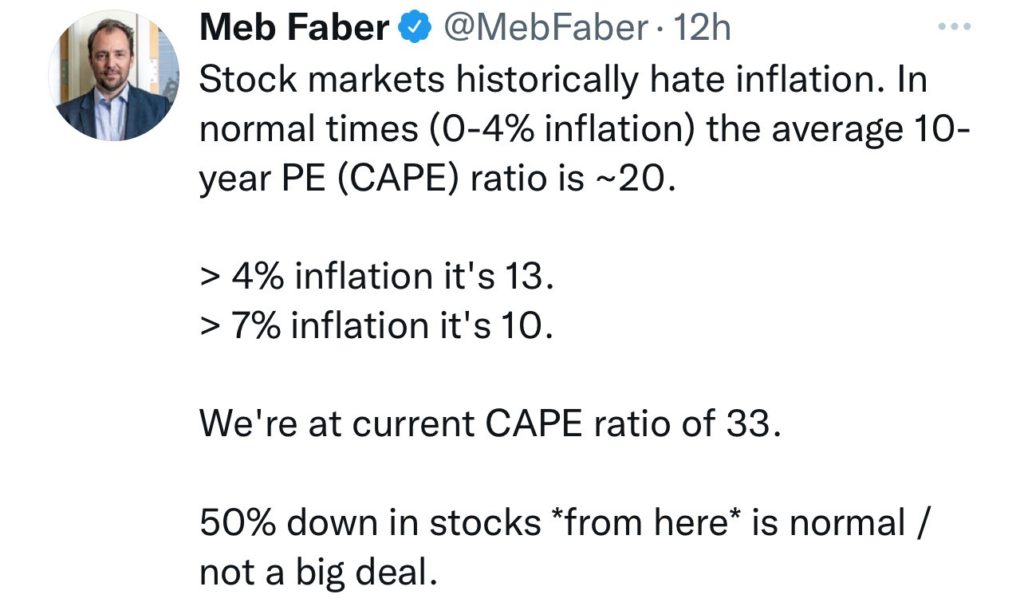

While it is possible that the market recover from here, here is a good tweet about inflation and market returns:

Which dovetails nicely with the comment that equities are not as safe a place to be when inflation concerns strike as the talking heads would have you believe.

Other things that caught my attention this past week:

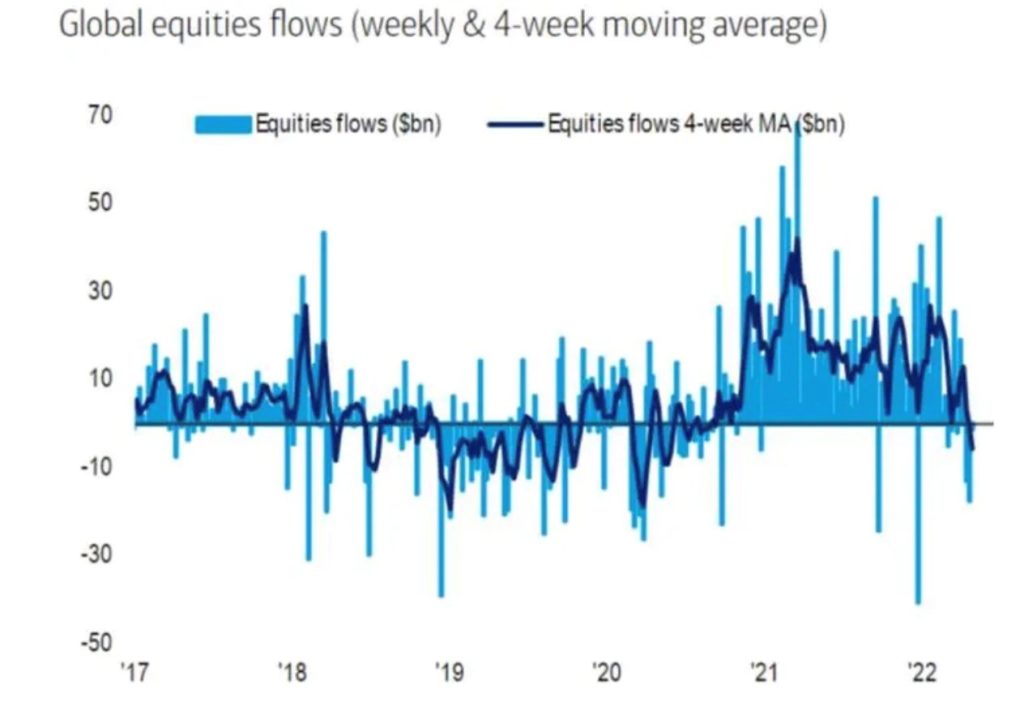

Flows:

As the chart alludes to, equity flows have been turning negative. The critical concern is that if we are tightening as we did in ‘18, we can go through a period of further outflows, except in this instance, the reversal, given the inflow path in 20 and 21 would be larger.

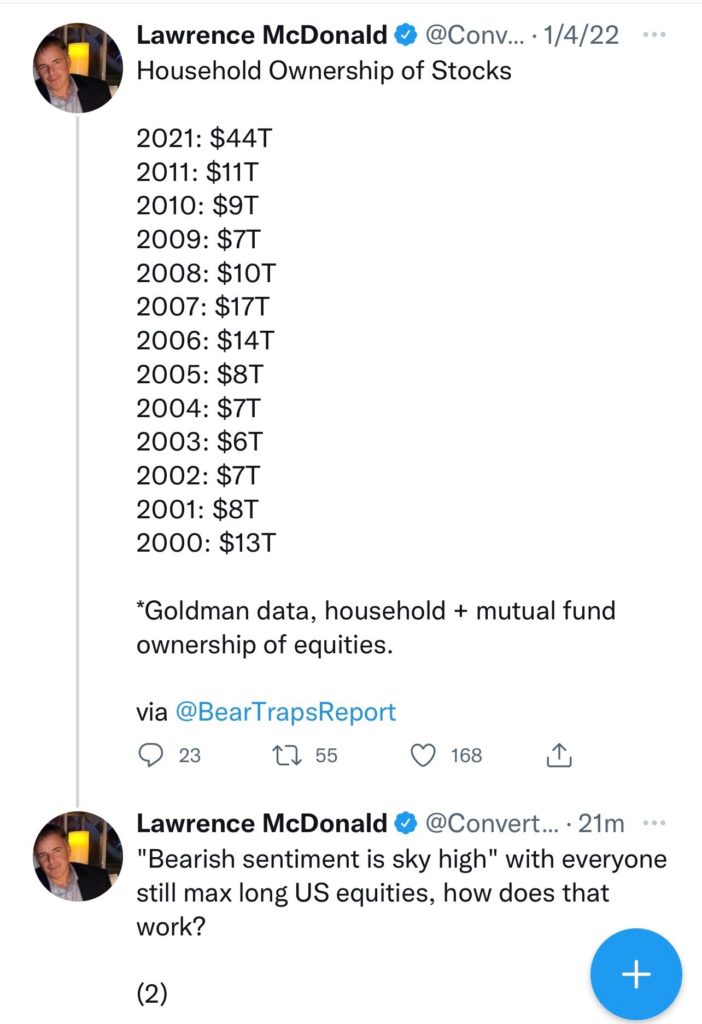

Here is a good comment on the dissonance between sentiment and exposure.

The case for buying?:

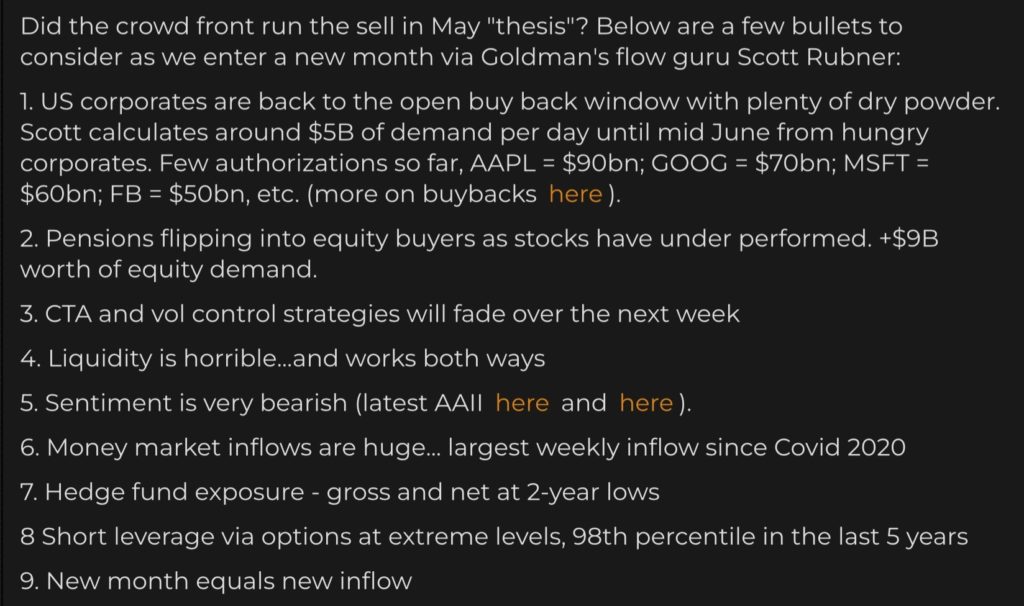

I admit I am not painting an inspiring picture to jump back into the market with conviction. But, from a “trader” perspective – and why I covered my shorts and went neutral – we can shift the other way for a bit given the shorter-term setup that GS outlines well.

On buybacks, GS has the following if you want to go along with that, but note their comment on the financial side.

Ukraine, sanctions, China, and the $:

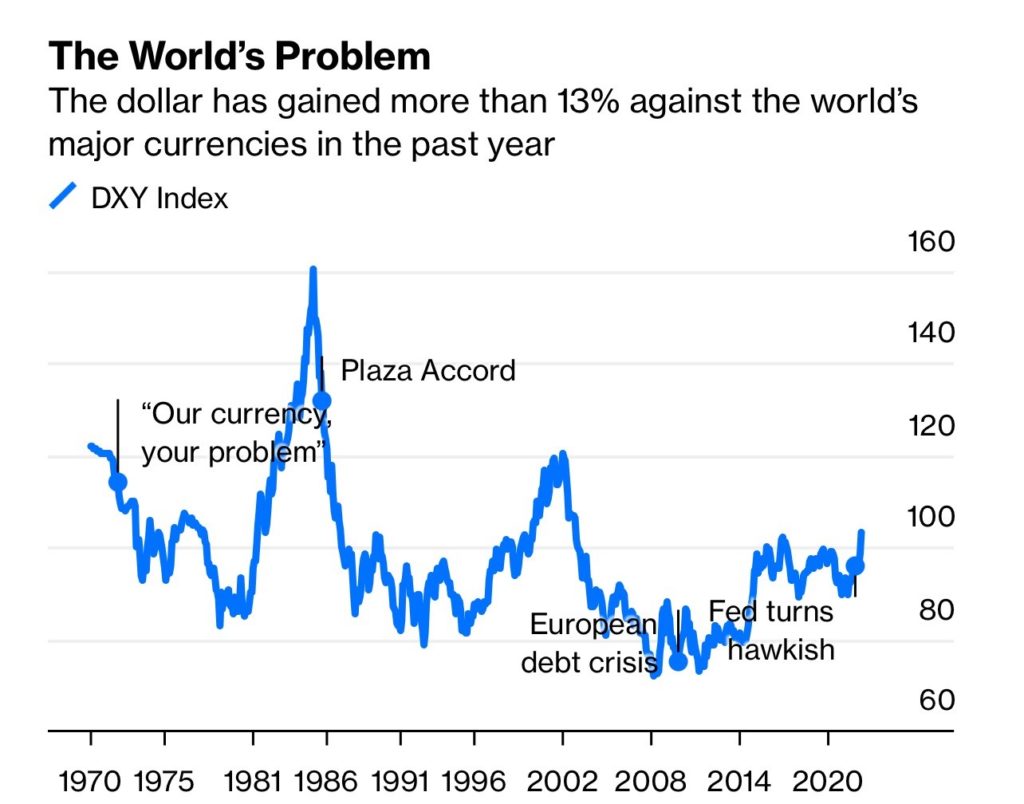

When the US and the West decided to freeze Russian assets/reserves, many noted that this would mark the beginning of the end of $ hegemony. I argued the opposite. A few months of $ strength doesn’t settle the question, and currency markets can be extremely tough to predict. Ultimately, these questions have been asked and answered since Nixon closed the gold window and ushered in the period of floating currencies, and yet the $ is still standing and doing fine, perhaps even if it is the cleanest of the dirtiest shirts.

A part of the argument for $ depreciation is that sanctions/seizure makes holding $ assets riskier. And, in fact, there were reports that the Chinese are noted to be trying to figure out how to protect their holdings from sanctions (some are suggesting this is a prelude to more Russian support or imminent movement against Taiwan), and as this Barron’s article notes, China has indeed been focusing on generating alternatives to $ hegemony. So, while this issue continues to be worth watching given recent events, it is not as simple as it seems largely because China and its autocratic cohort have zero credibility. The most basic way to explain $ and western currency hegemony is that each country has a citizenship premium – ie. people from autocratic countries want to emigrate there. The reverse is obviously not true.

Anyway, my sense is that China has in the immortal words of Herb Brooks, “has enough there to keep them busy” and is not seeking further inflame their predicament (good piece on that in Foreign Affairs, at least in the short run. And, as their economic situation continues to struggle, and with Russia not easily dispatching Ukraine, maybe they ought to think longer and harder about a. The company they keep; b. The future they want and their role in it.

Other Tidbits:

The Once and Future Worker:

Oren Cass, who was an advisor to Mitt Romney, wrote a book a few years back called “The Once and Future Worker” that is well worth the read. It goes back to the first principles of what prosperity in a nation-state should be about – which he believes is the dignity of work and rewards for productivity. Here is a good synopsis of the book by the NYT’s David Brooks.

Cass was on a UChicago podcast this past week called Capitalist that I have referenced before. Cass uses the simple logic that if there are 2 countries, one that produced 100 and shares 50 with the other country that produces 0 and receives 50 in transfers, that setup is inferior to 2 countries that each produce 40. The key insight, of course, is that productivity can be enhanced through effort and over time, should yield better, more widely shared results. Eventually, the producing country will resent the nonproducing one, and the nonproducing one will have no skills with which to produce marketable goods or services.

Of course, this all comes back to the idea of optimizing GDP, financialization, and corporate profits at the expense of distributional considerations. In other words, if country B is not producing for a reason other than it is getting paid to sit and do nothing, then those reasons ought to be considered and addressed intelligently and compassionately.

I have often written about the pie of capital, labor, and profits and about the declining labor share of the pie. I still think this is an issue that needs to be resolved, and it is a medium-term risk to corporate profitability and returns to capital. Also, that Cass is making these arguments from the right, was interesting as well.

More polarization ahead?:

I don’t want to and won’t wade into the Roe V Wade debate, except to say 3. things:

1. It will further polarize the country

2. It speaks to the lurking risks that are out there

3. It has the potential to galvanize the Democrats ahead of the midterms

So, while many polls have predicted Republican control of Congress after the midterms, thus further thwarting Biden’s agenda, the market may need to recalibrate odds.

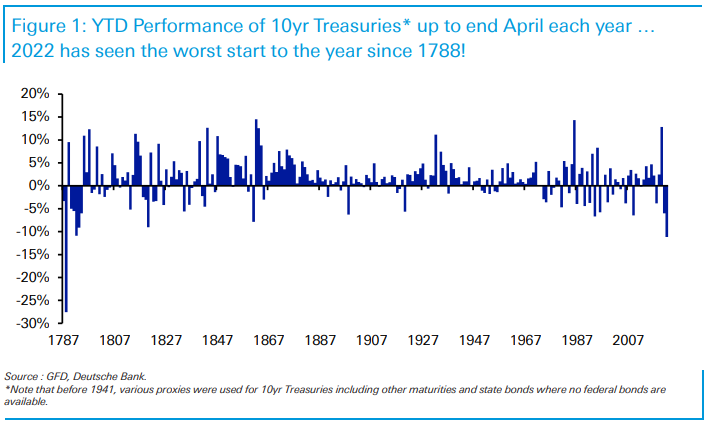

Really, 1788?

Well, that’s a fun one. That was pre Constitution days, and the US was an emerging market.