Highlights

A relatively calm week with commodities. Energy and metals still look like they can work lower but they held recent lows. Corn and wheat look like short ideas

BLOOMBERG COMMODITY INDEX

Bloomberg Commodity Index daily still could be in a topping pattern

Bloomberg Commodity Index Weekly is one of the big reasons why I believe commodities might have topped

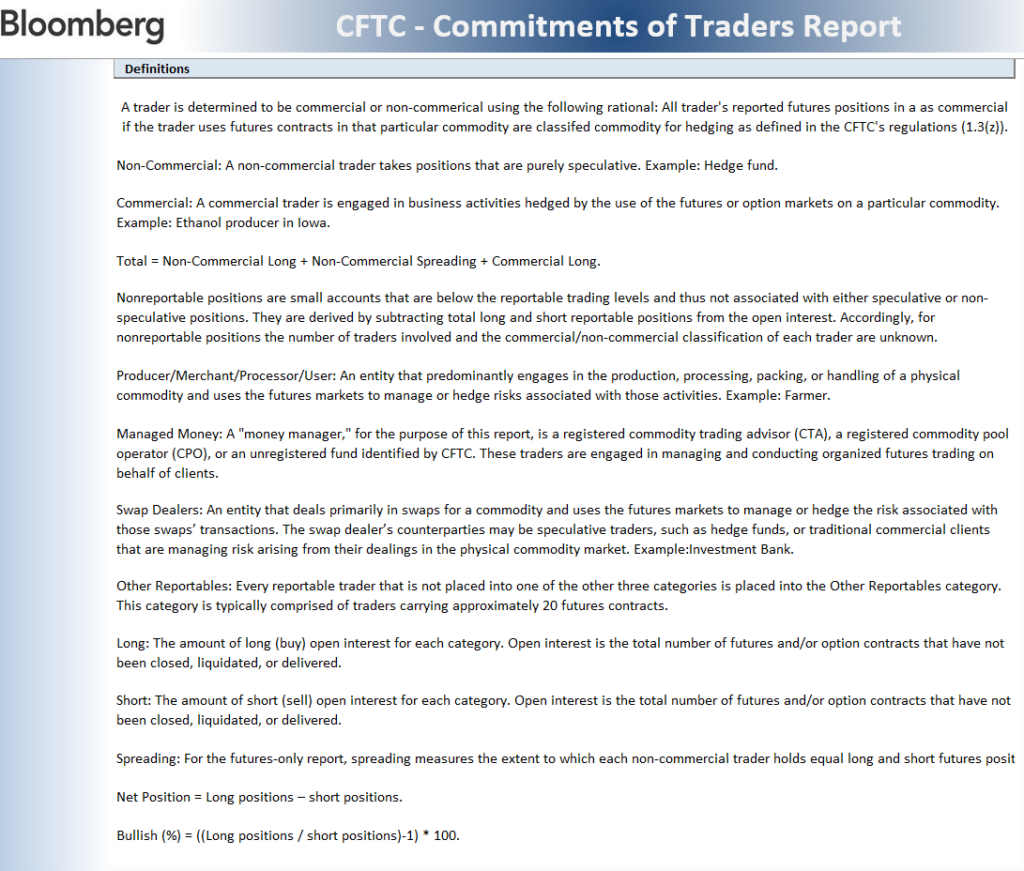

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

Bloomberg Energy Subindex Daily held the 20 day and that’s been the moving average to watch

Bloomberg Energy Subindex Weekly still has a Sequential in progress albeit it’s late in the Countdown.

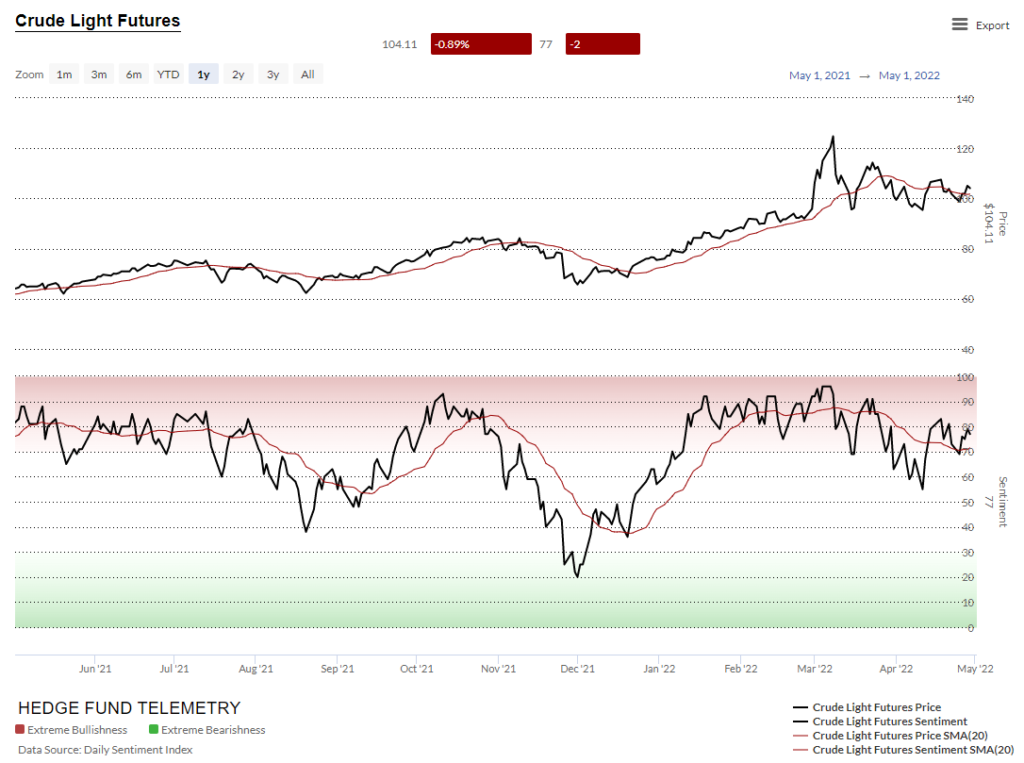

WTI Crude futures daily

Brent Crude futures daily

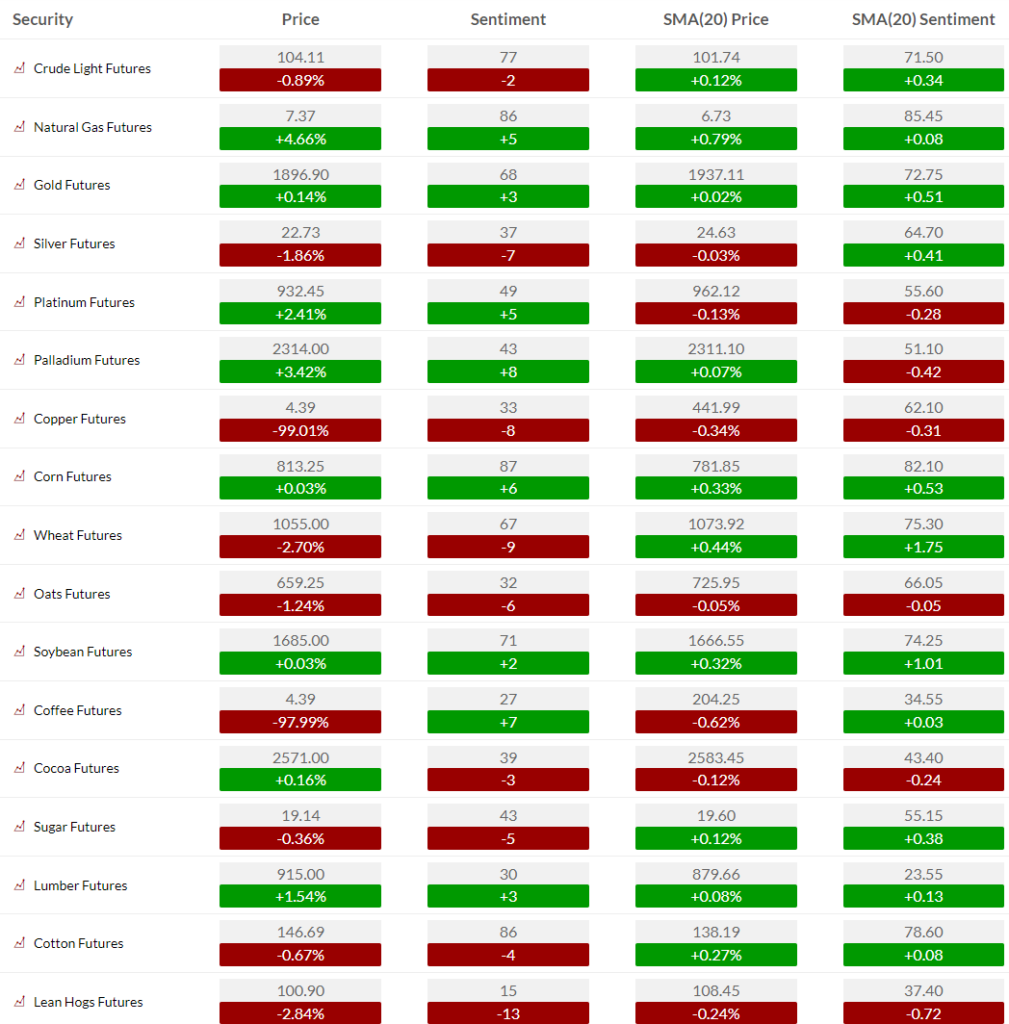

WTI Crude futures bullish sentiment with lower highs

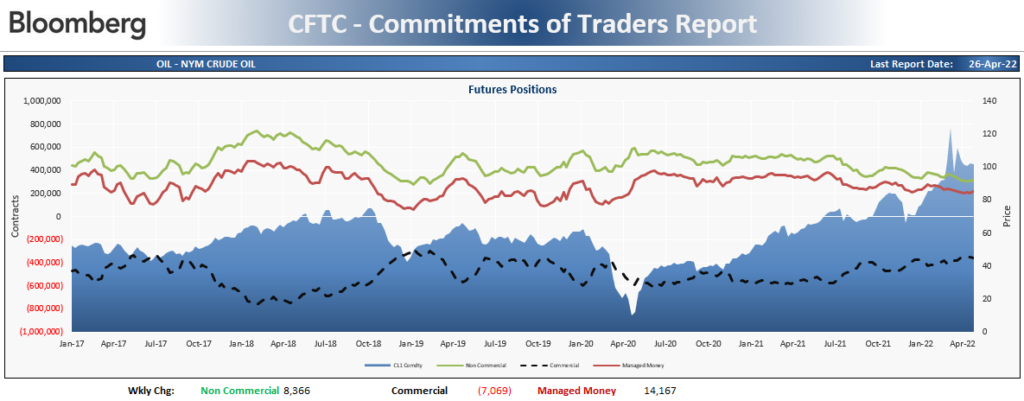

WTI Crude futures Commitment of Traders shows speculators increasing long exposure

Natural Gas futures daily

Natural Gas futures bullish sentiment still overbought

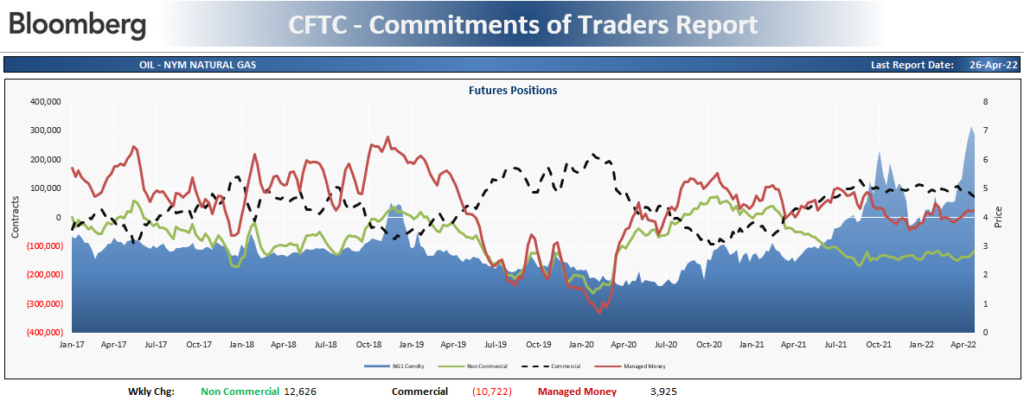

Natural Gas futures Commitment of Traders shows speculators covering some of the short

Metals

Gold futures daily has a 1900 level to watch

Gold futures bullish sentiment backed off and held the 60% level

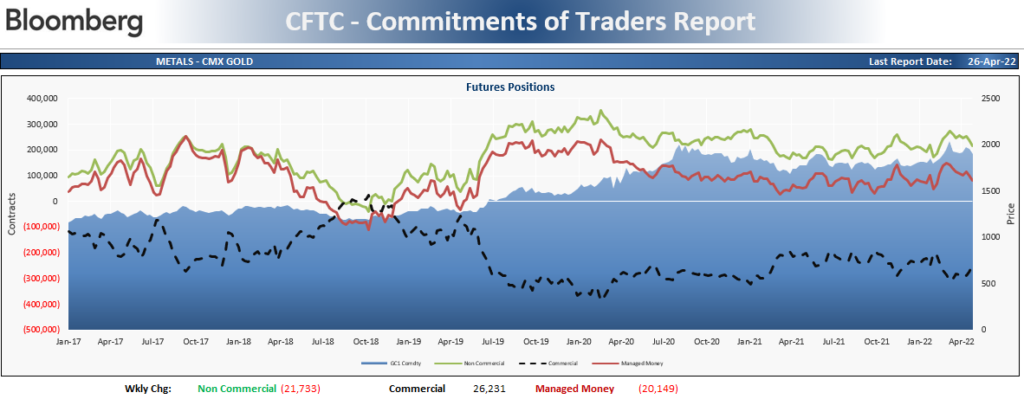

Gold futures Commitment of Traders shows speculators decreasing long exposure

Silver futures daily continues to break bullish hearts

Silver bullish sentiment slammed

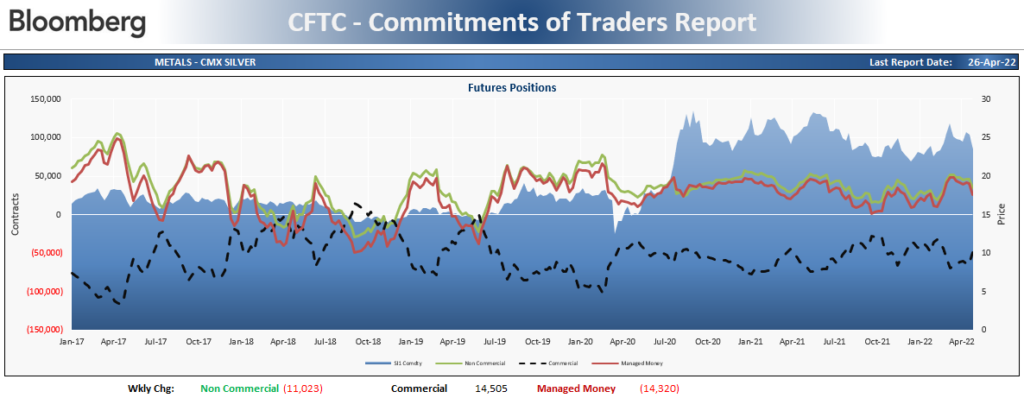

Silver futures Commitment of Traders shows speculators decreasing long exposure

Copper futures daily has been a difficult long for a while

Copper futures bullish sentiment dropped hard now well under the 50% level. I’m not sure why the Copper and Coffee pricing breaks so often. We will fix

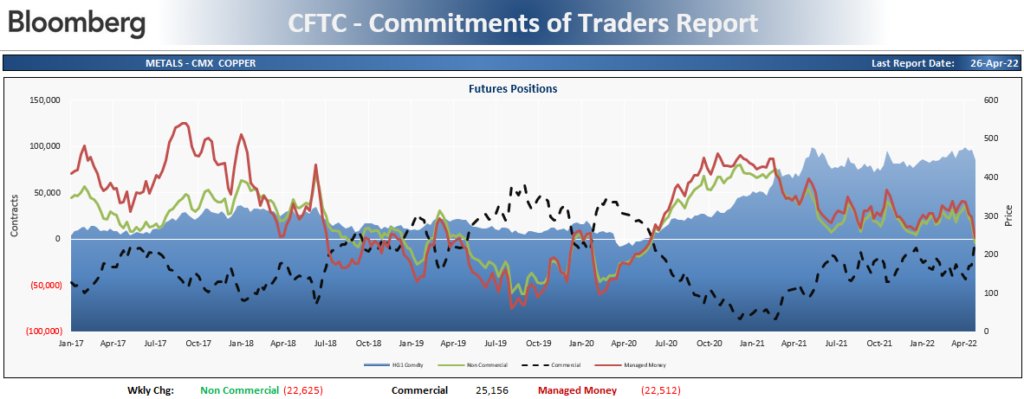

Copper futures Commitment of Traders shows speculators selling hard and now turning negative

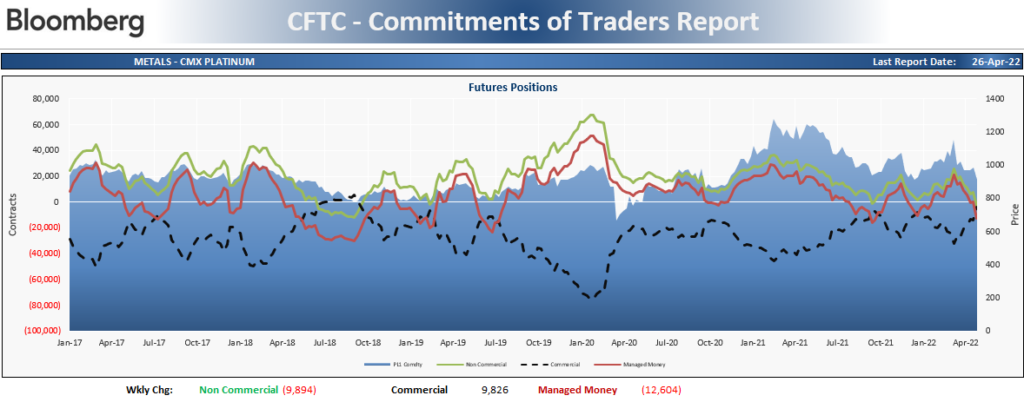

Platinum daily gave up all Ukraine move

Platinum bullish sentiment looks better than the price action

Platinum Commitment of Traders shows speculators decreasing long exposure and turning negative

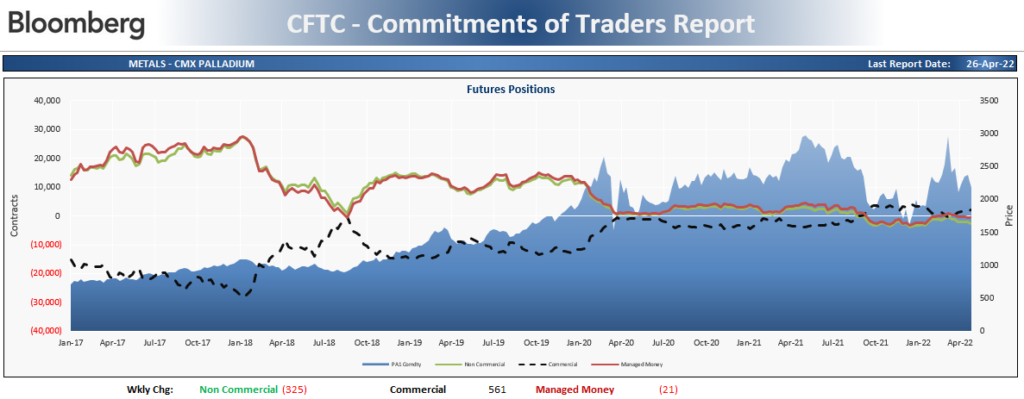

Palladium daily also lost all Ukraine gains

Palladium bullish sentiment also looks better than the price action

Palladium Commitment of Traders shows a more neutral setup for both speculators and commercials

Grains

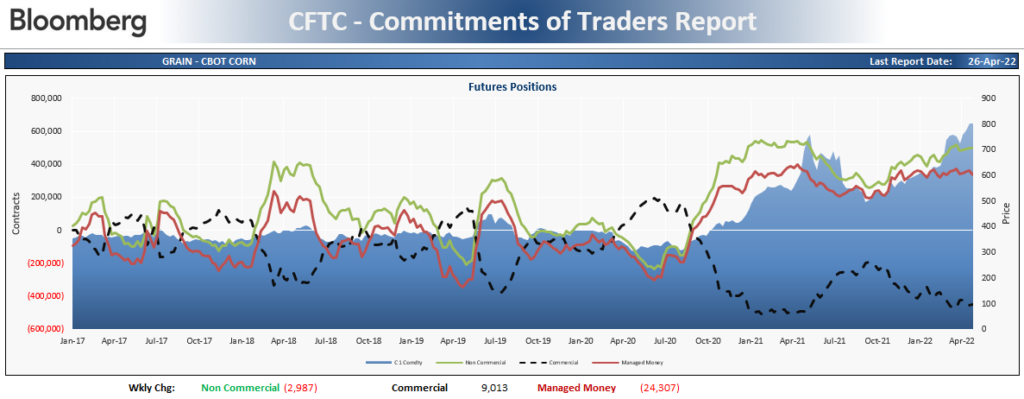

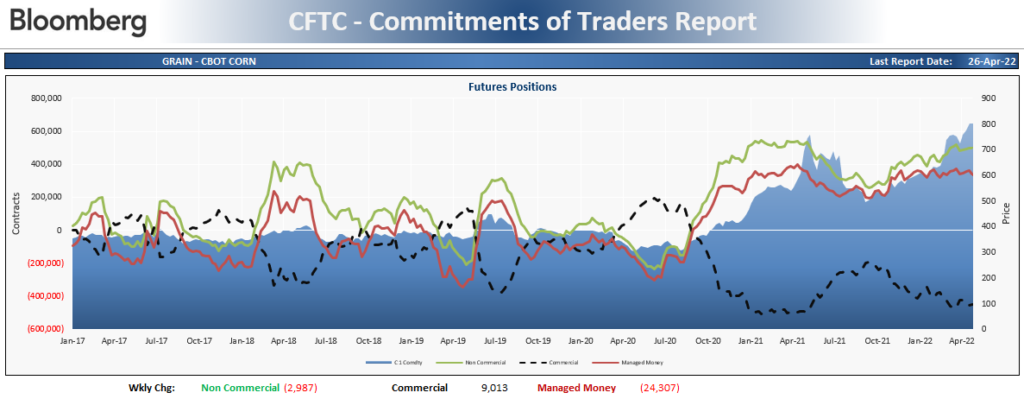

Corn futures daily is overbought and could be shorted here

Corn futures bullish sentiment has been and remains extreme

Corn futures Commitment of Traders shows speculators decreasing long exposure

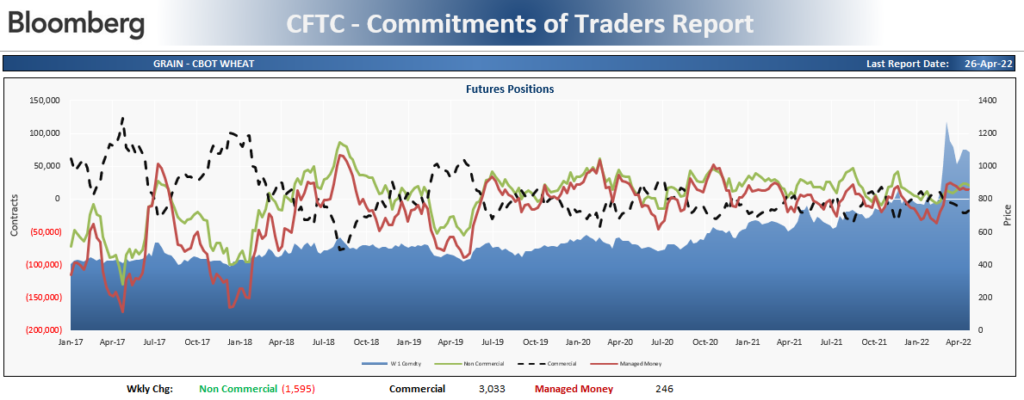

Wheat futures daily can be shorted

Wheat futures bullish sentiment breaking the 20 day moving average of bullish sentiment

Wheat futures Commitment of Traders tightly wound with speculators decreasing long exposure

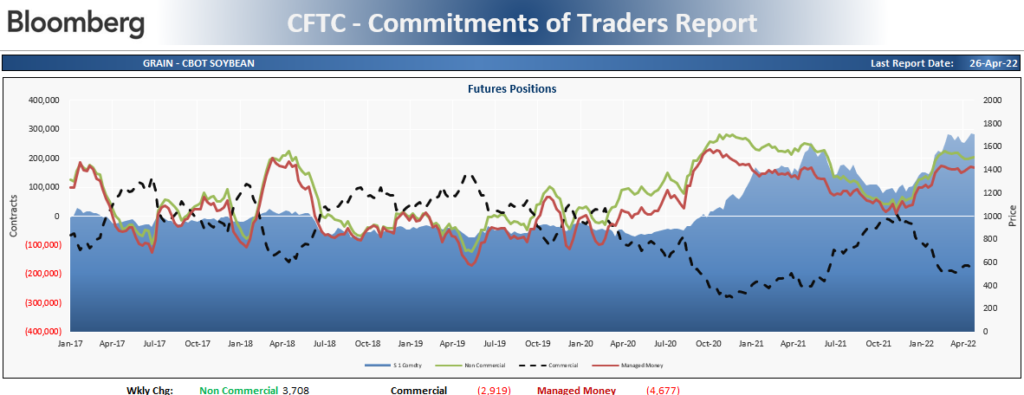

Soybean futures daily sideways

Soybean futures bullish sentiment decreasing vs the pricing which holds steady

Soybean futures Commitment of Traders shows speculators increasing long positions

Livestock

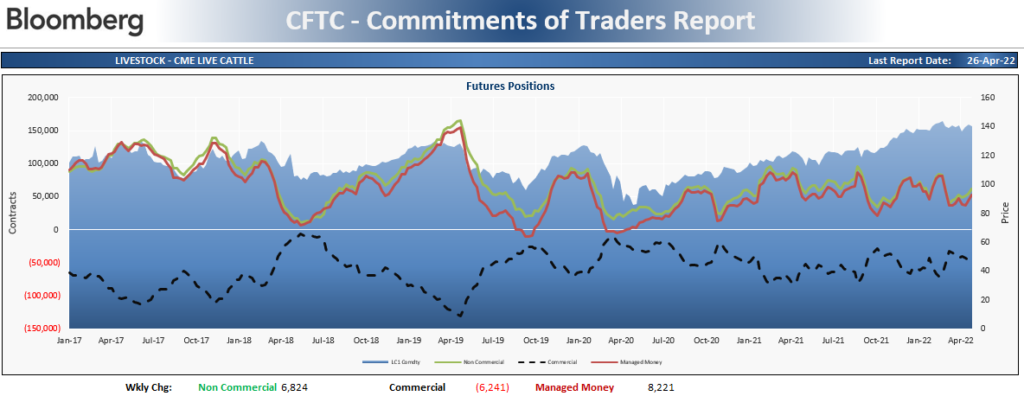

Cattle futures daily remains weak

Cattle futures bullish sentiment with a new recent low

Cattle futures Commitment of Traders shows speculators adding to long exposure

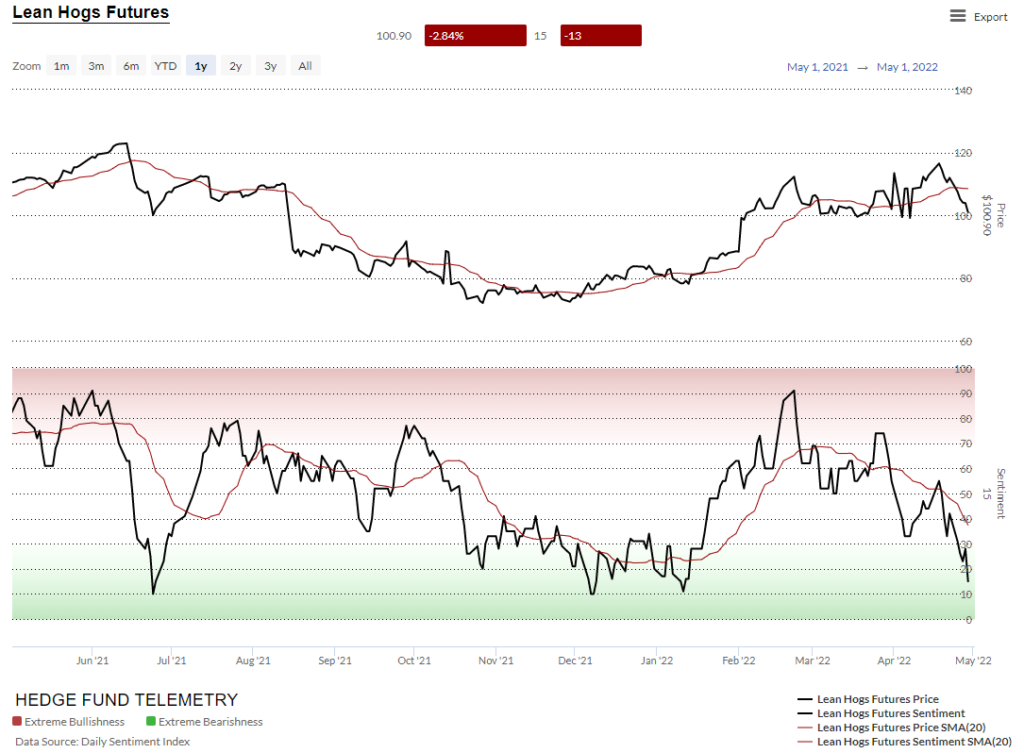

Lean Hogs futures daily also remains under severe pressure

Lean Hogs bullish sentiment getting back of extreme oversold levels

Lean Hogs Commitment of Traders had speculators setup long selling down exposure

Softs

Cotton futures daily is really getting close to exhaustion

Cotton futures bullish sentiment has been in the extreme zone

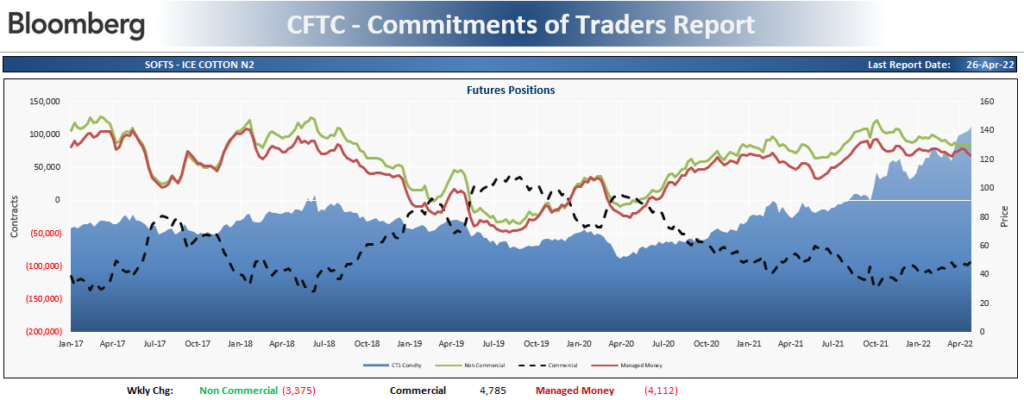

Cotton Futures Commitment of Traders shows speculators setup long and decreasing long exposure

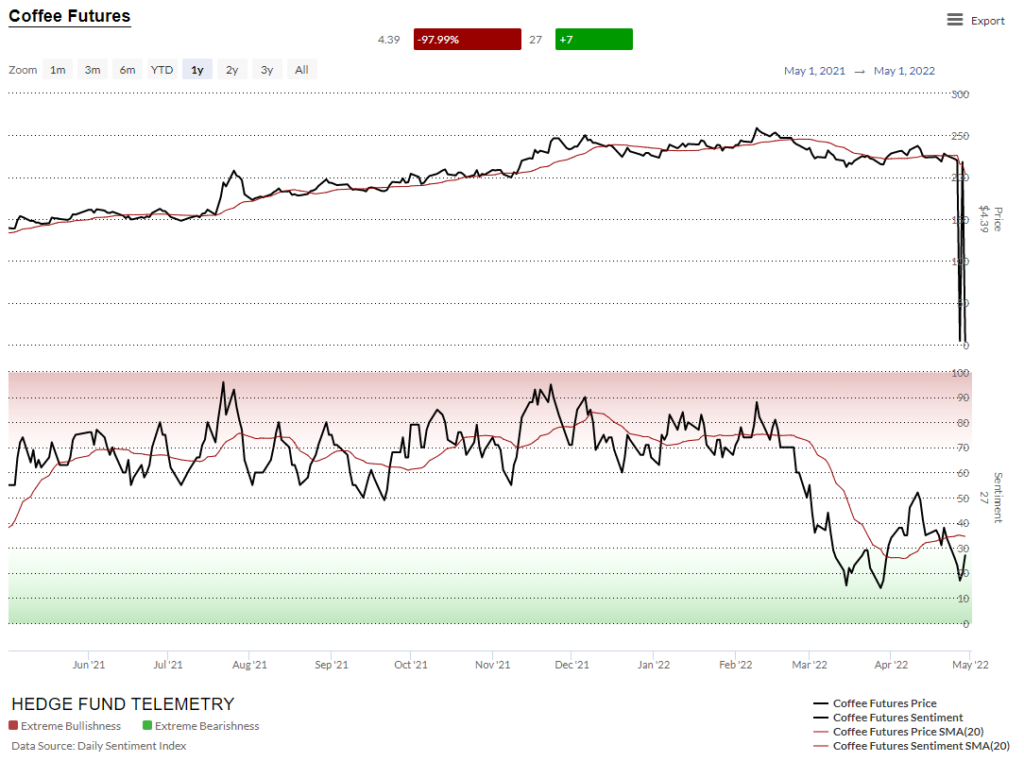

Coffee futures daily has held the 200 day after making a lower low

Coffee futures bullish sentiment chart like copper has some bug. What is important is the sentiment has been trending lower

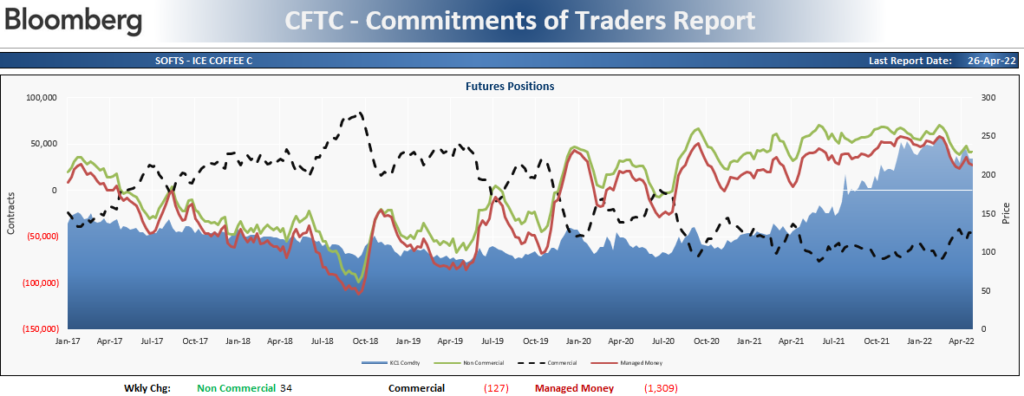

Coffee futures Commitment of Traders shows speculators setup long and mostly unch last week

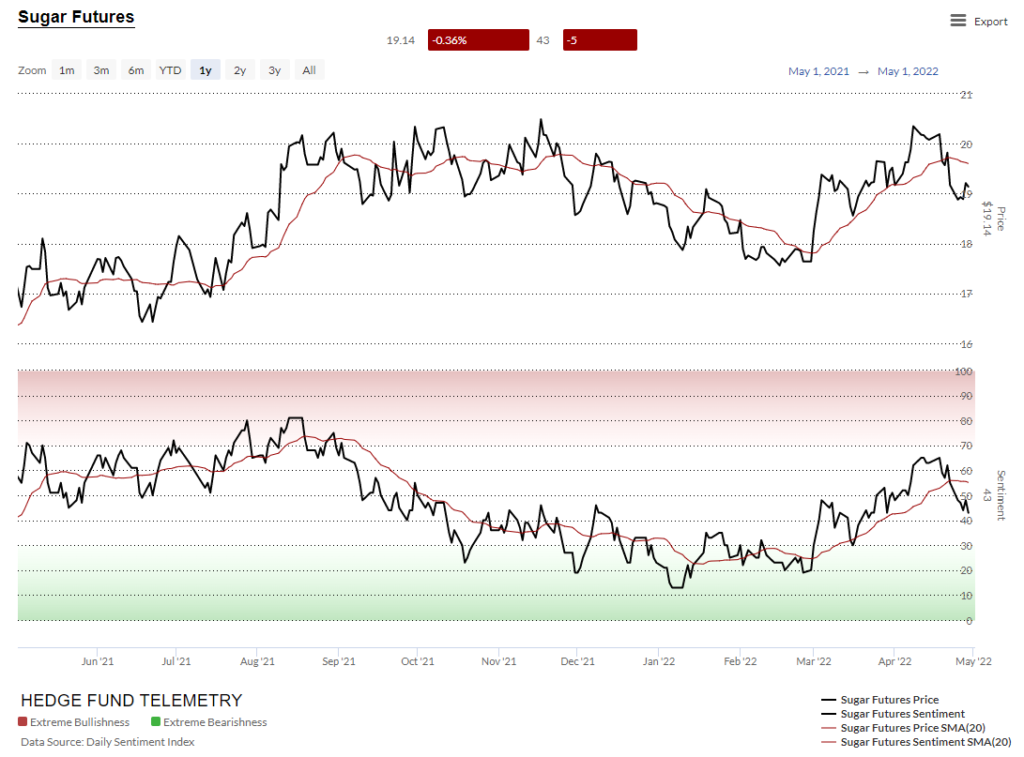

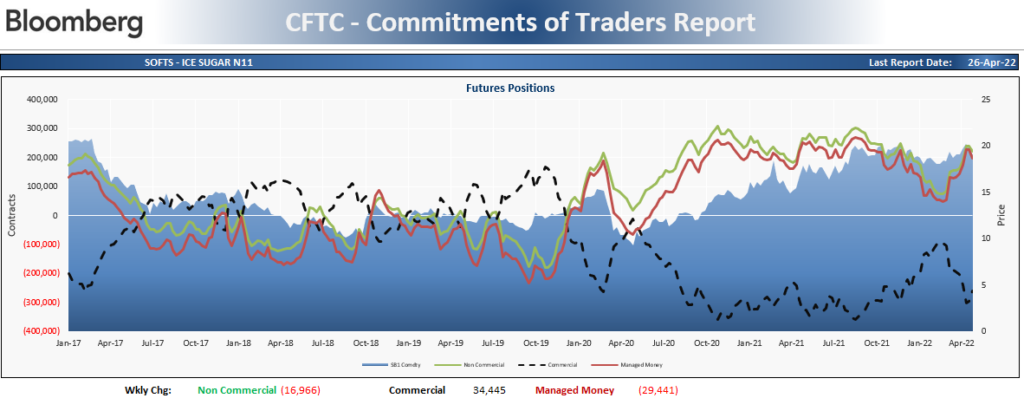

Sugar futures daily backed off as expected

Sugar futures bullish sentiment broke 50% and could dip further

Sugar futures Commitment of Traders shows speculators set up long reversing and decreasing long exposure

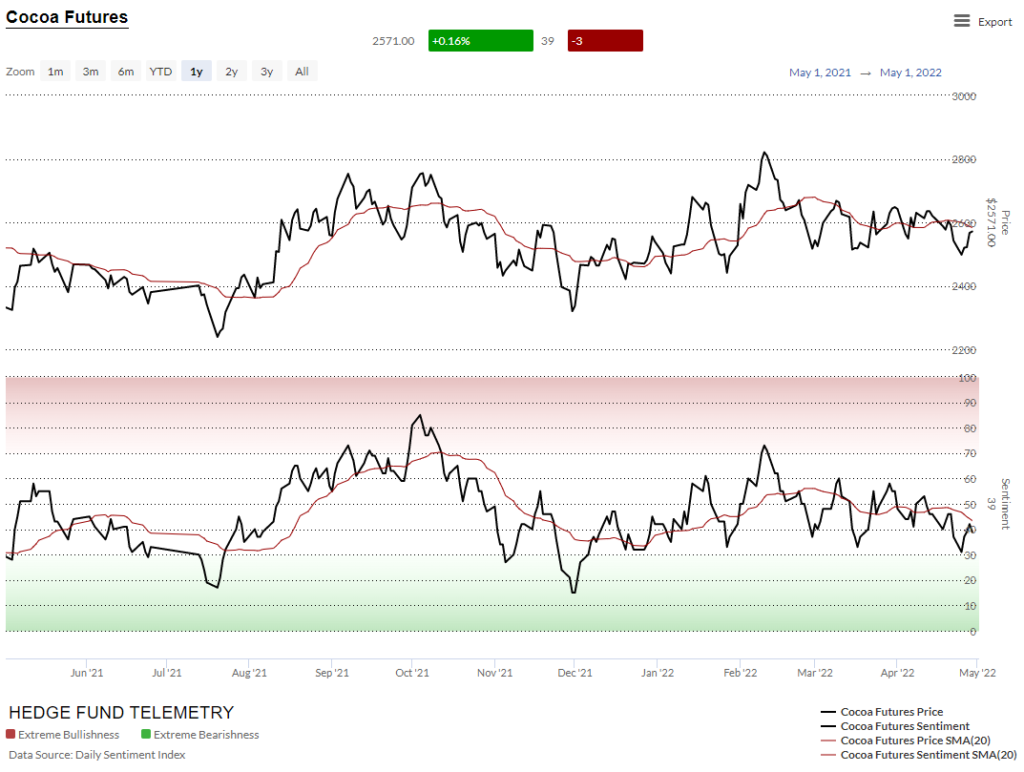

Cocoa futures daily chop fest

Cocoa futures bullish sentiment also trend less

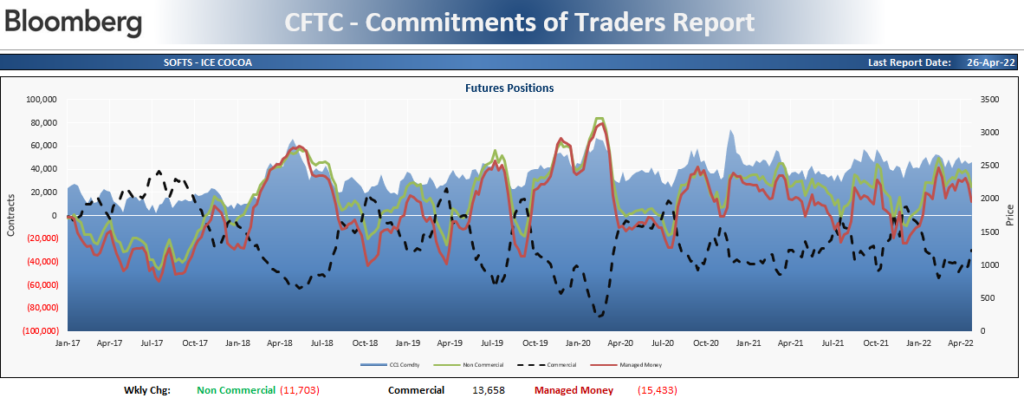

Cocoa futures Commitment of Traders shows speculators decreasing long exposure

Lumber futures daily held the 200 day

Lumber bullish sentiment is one of the more fun sentiment charts

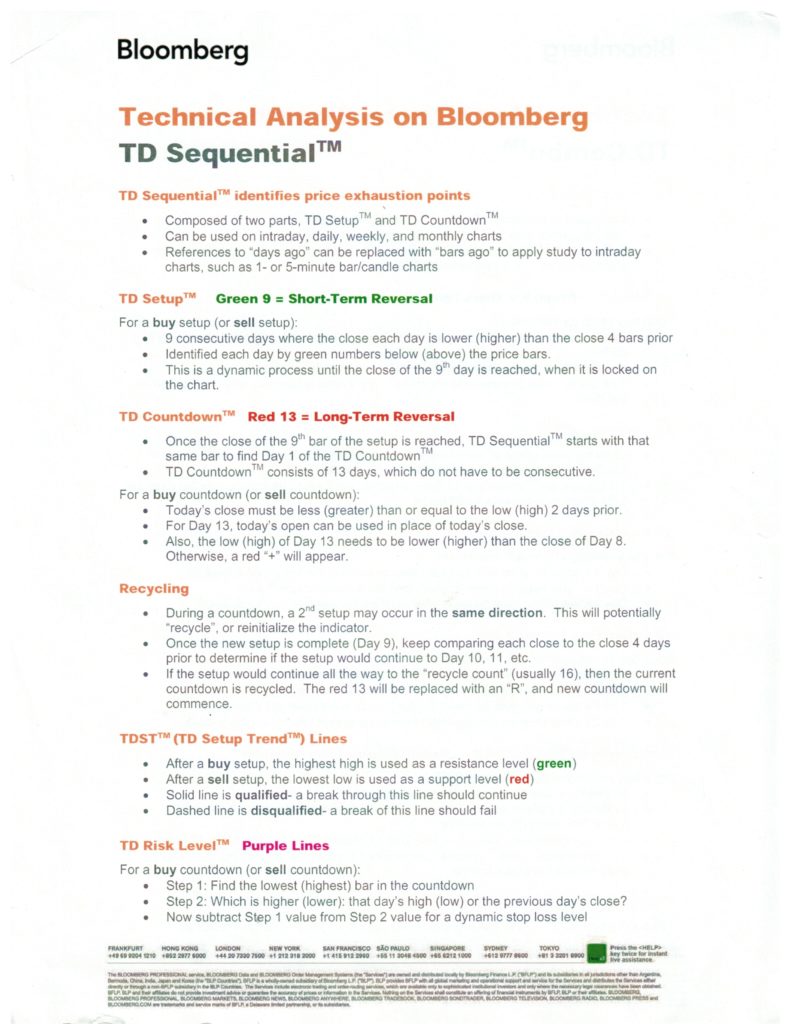

DeMark Sequential Basics

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS