Themes and highlights

Finally, some of the strongest commodity markets pulled back with some rather sharp. Energy and Grains are now vulnerable to more downside. The potential for upside includes cocoa, lean hogs, live cattle, and Copper. There were several markets that saw large COT decreases in long exposure.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily finally broke the drift higher

Bloomberg Commodity Index Weekly

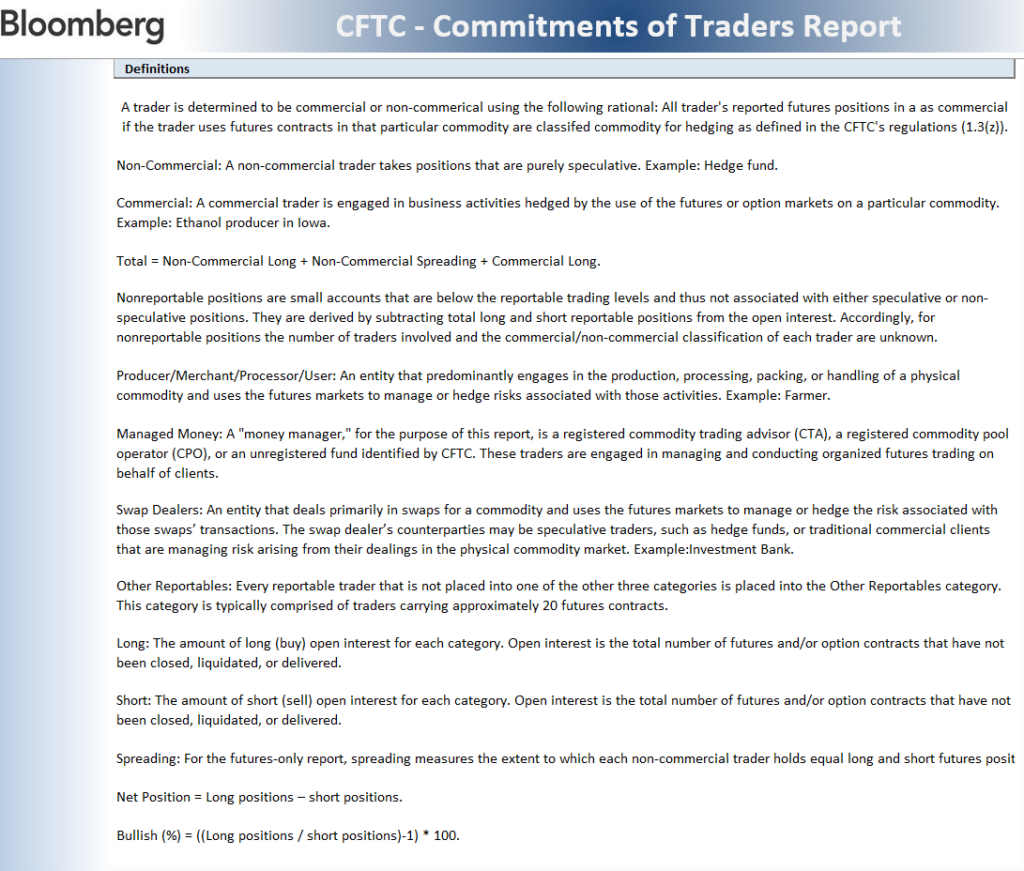

COMMODITY SENTIMENT OVERVIEW

A large broad drop in sentiment

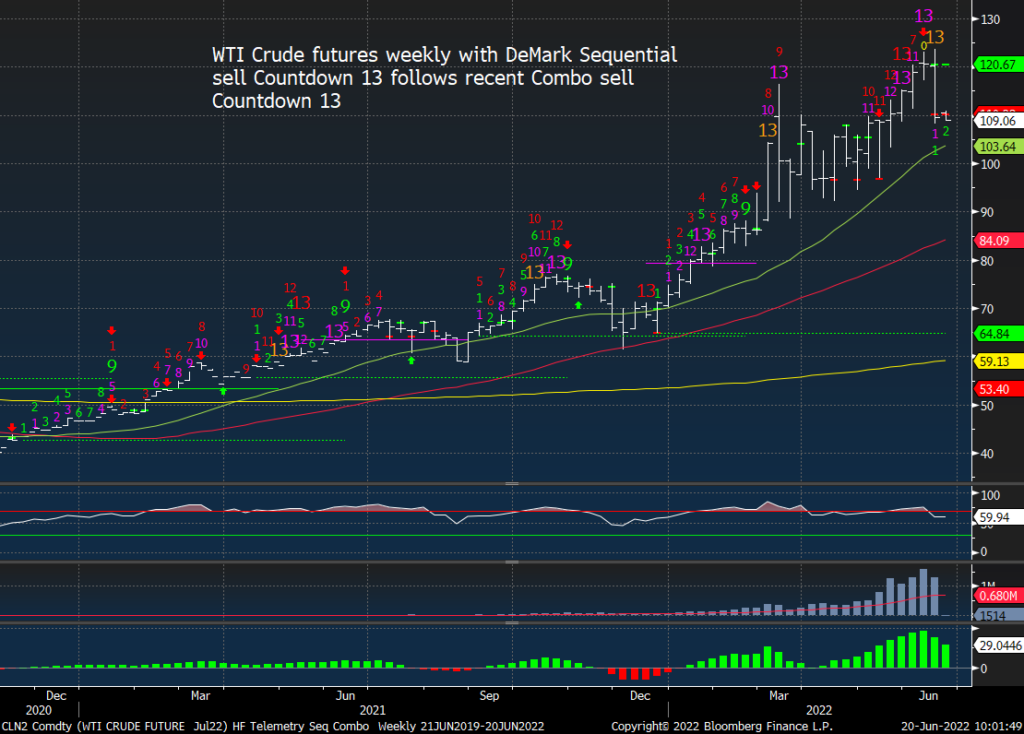

OIL AND ENERGY

Bloomberg Energy Subindex Daily

Bloomberg Energy Subindex Weekly worked rather sharply

WTI Crude futures daily

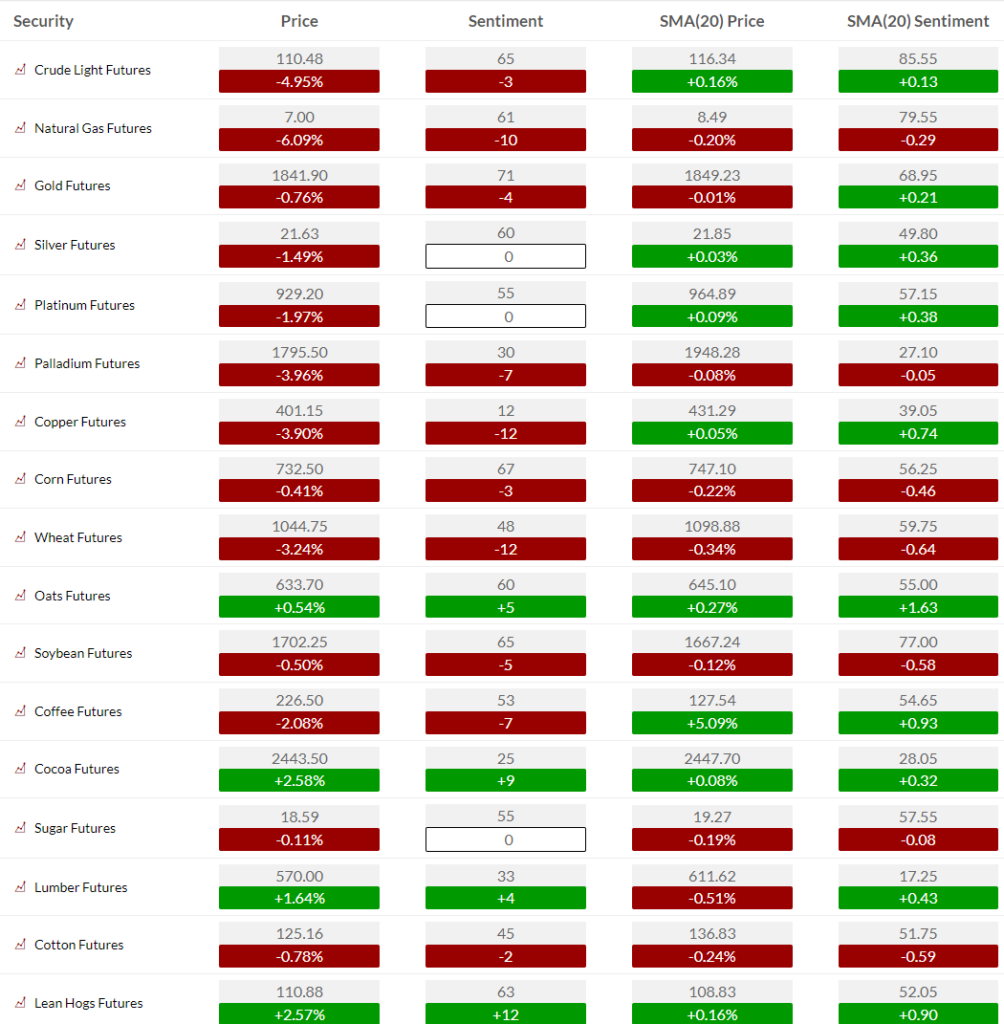

WTI Crude Futures Weekly

WTI Crude futures bullish sentiment reversed but did not break the May lows yet

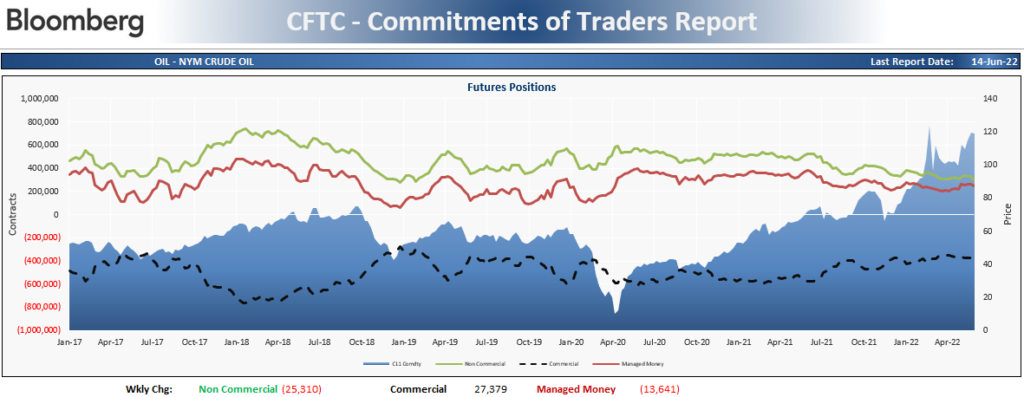

WTI Crude futures Commitment of Traders shows speculators significantly decreasing long exposure

Gasoline Futures started to break over a week ago

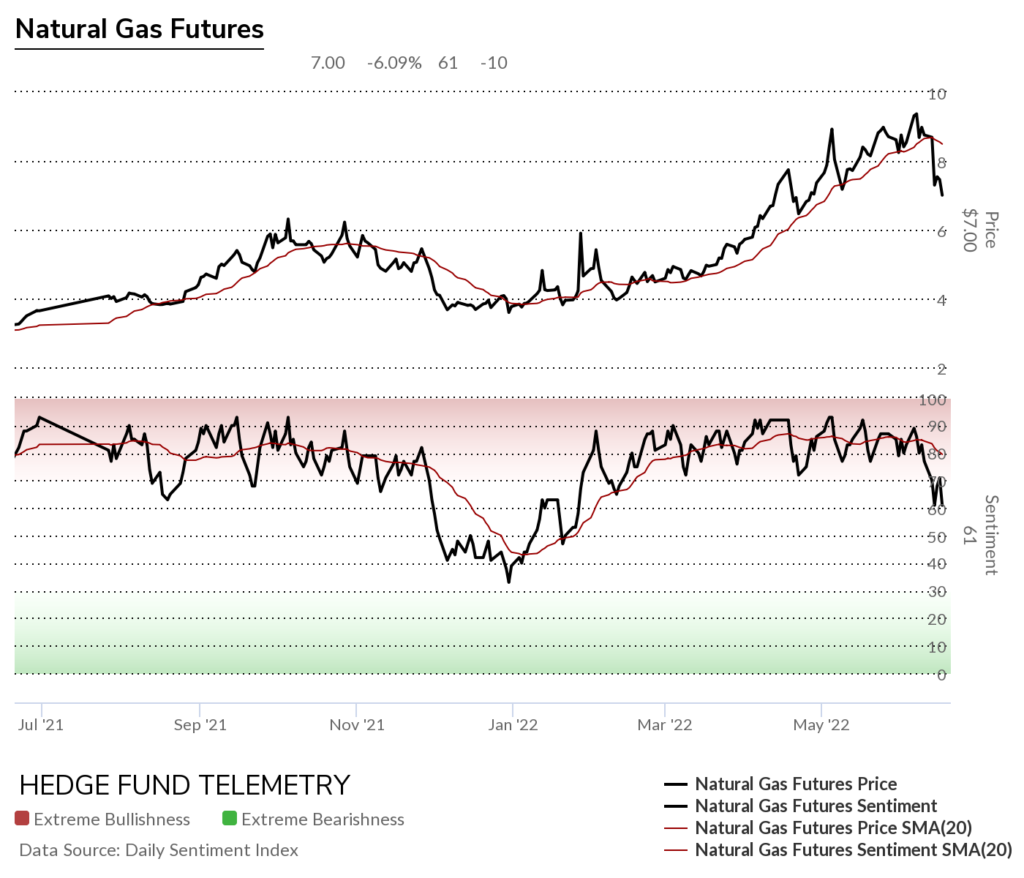

Natural Gas futures daily

Natural Gas futures bullish sentiment broke the recent overbought range

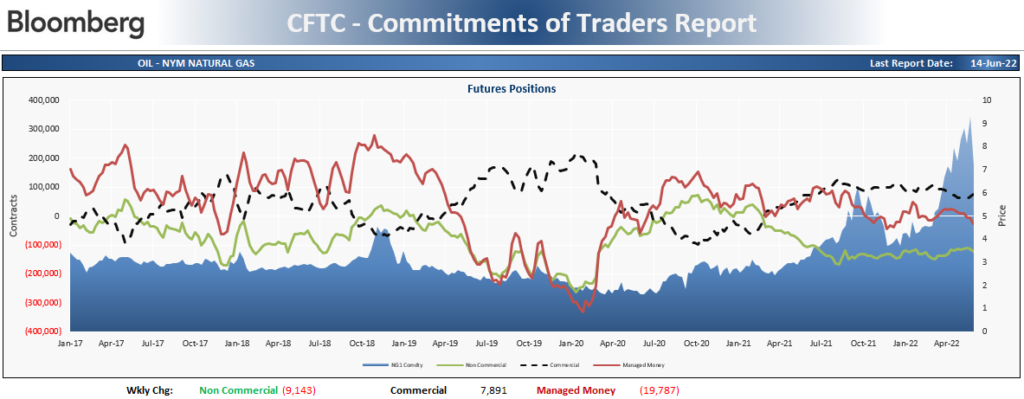

Natural Gas futures Commitment of Traders shows speculators increasing SHORT exposure

Metals

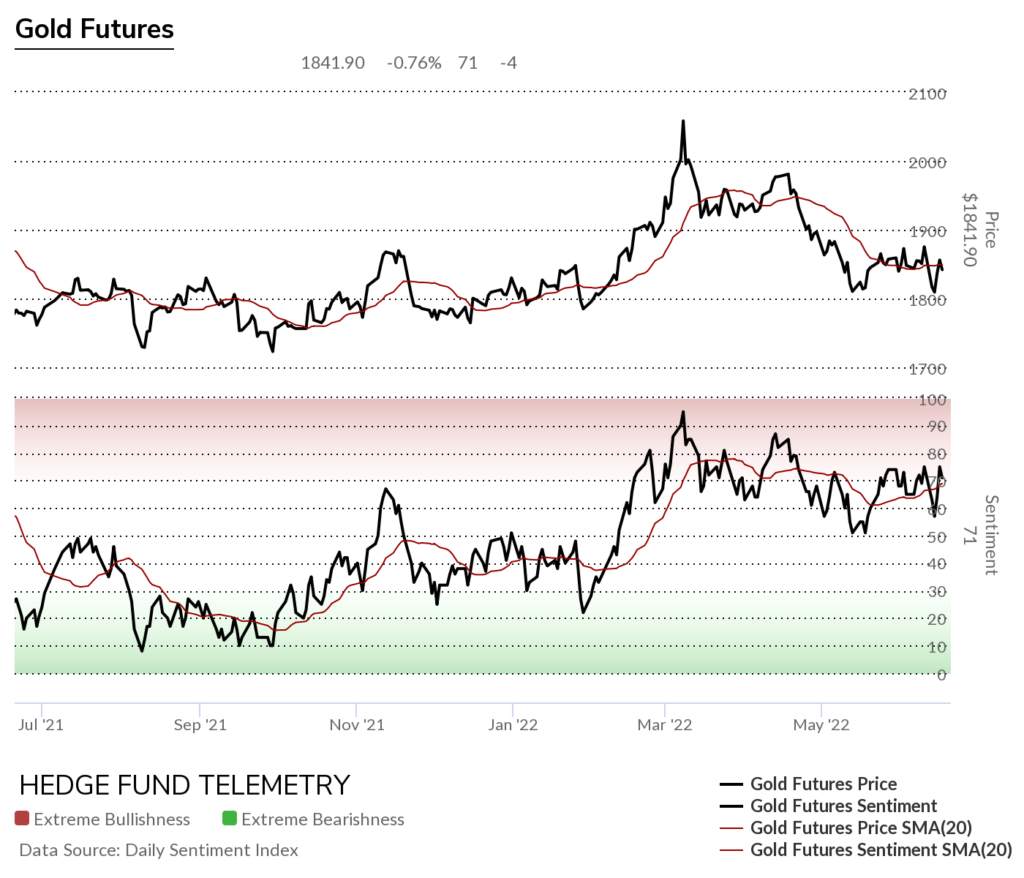

Gold futures daily no changes withing short term range

Gold futures bullish sentiment despite the price action remains elevated

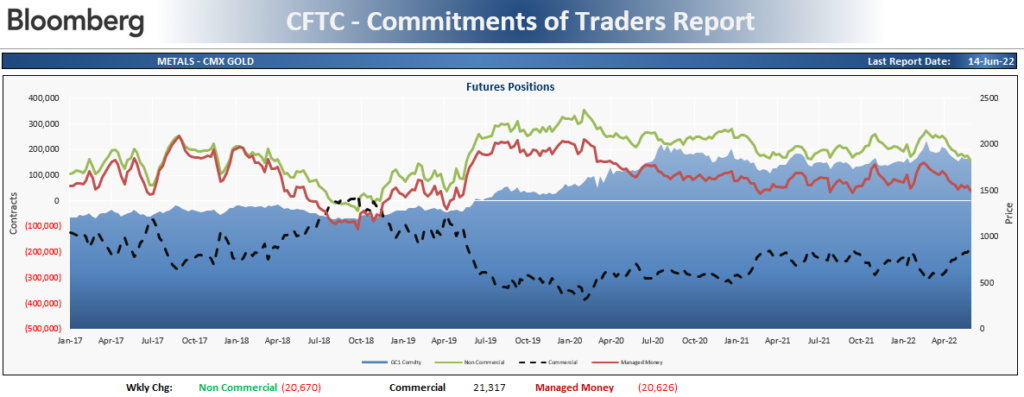

Gold futures Commitment of Traders shows speculators significantly decreasing long exposure

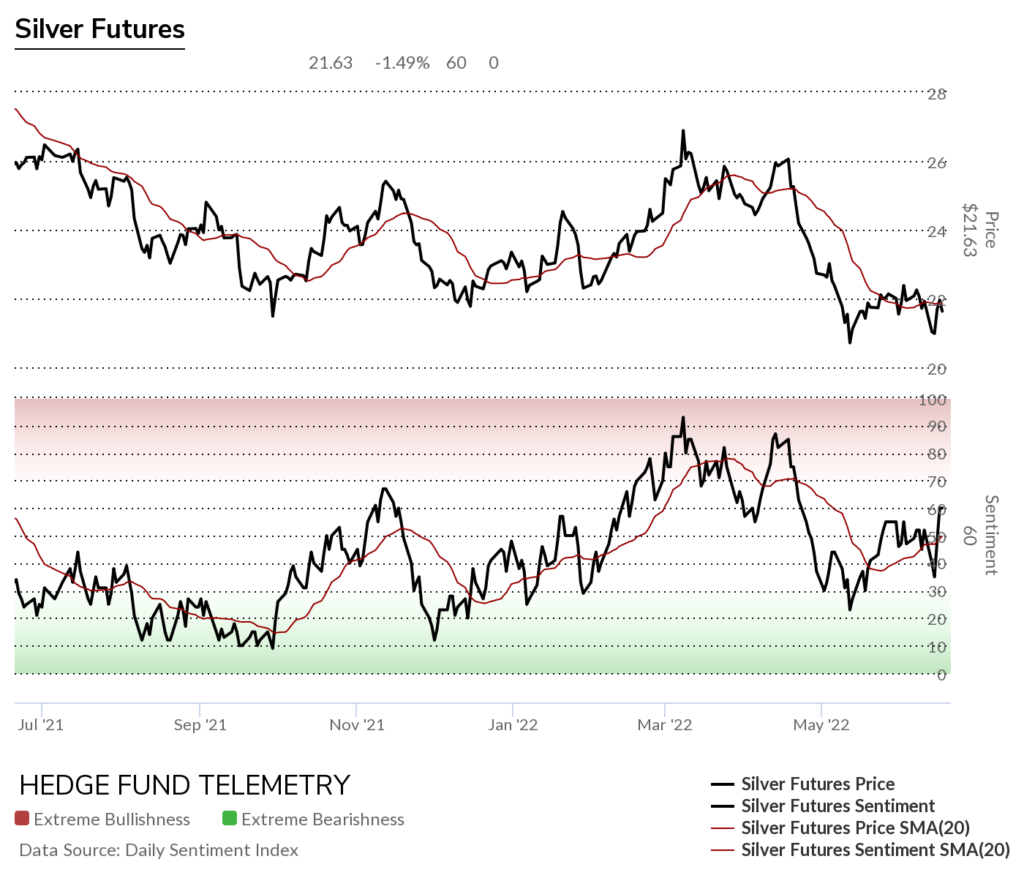

Silver futures daily needs to rise to confirm the buy Countdown 13

Silver Bullish Sentiment did get a nice spike

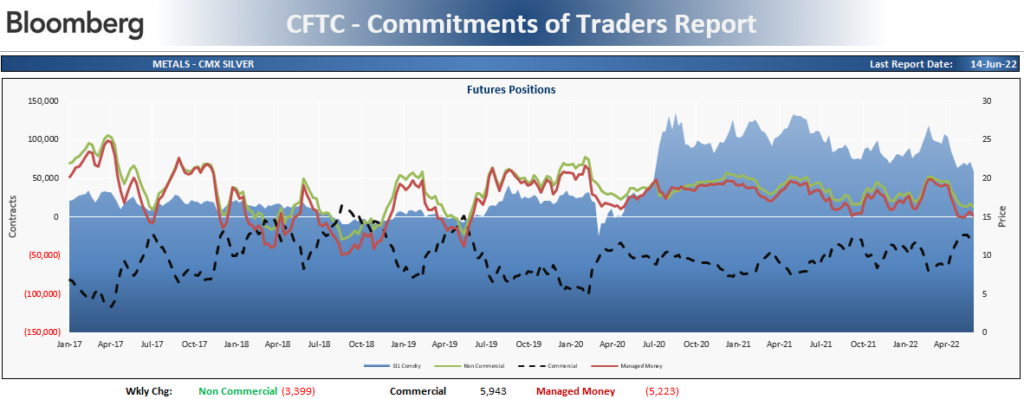

Silver futures Commitment of Traders shows speculators decreasing long exposure and is neutral

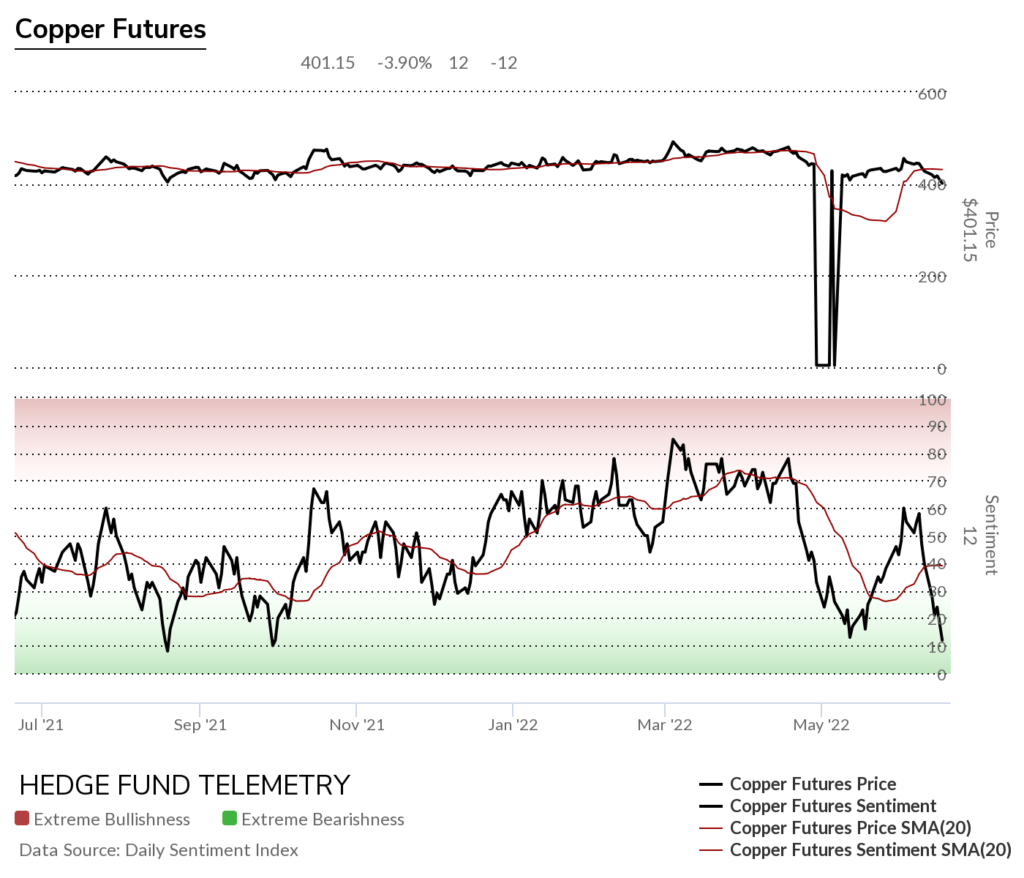

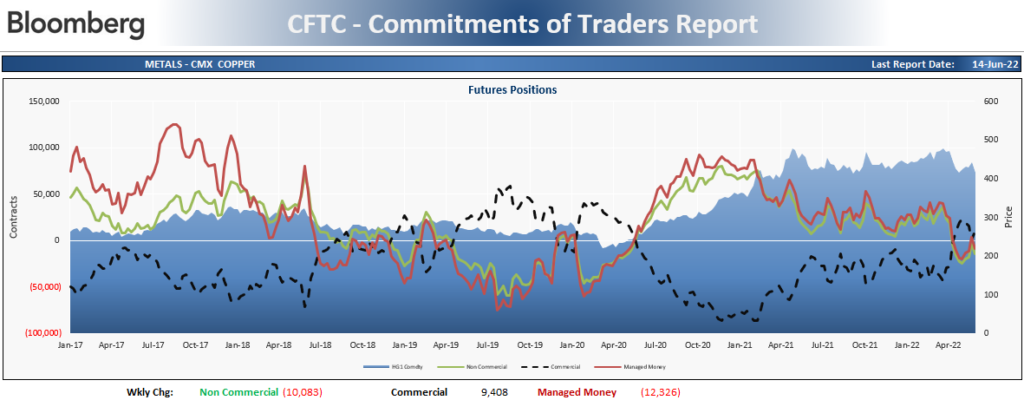

Copper futures daily has some buy signals

Copper futures bullish sentiment is at peak oversold levels now.

Copper futures Commitment of Traders shows speculators significantly increasing SHORT exposure

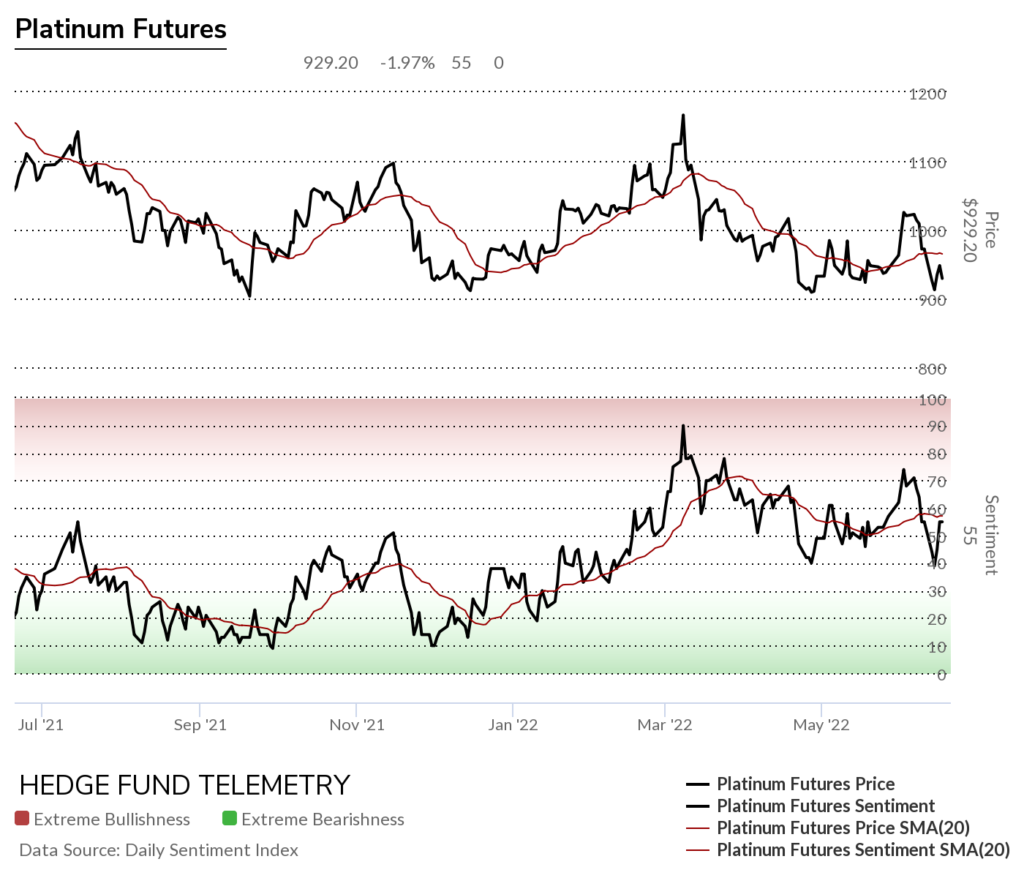

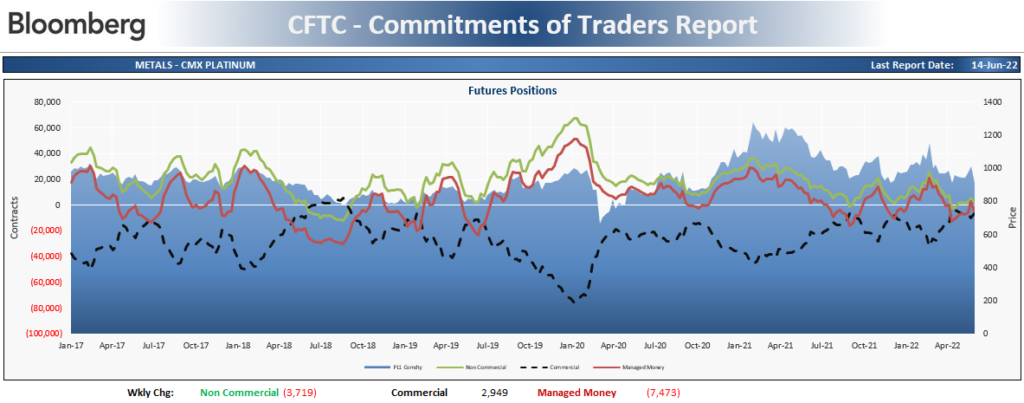

Platinum daily

Platinum bullish sentiment is neutral

Platinum Commitment of Traders shows speculators increasing SHORT exposure

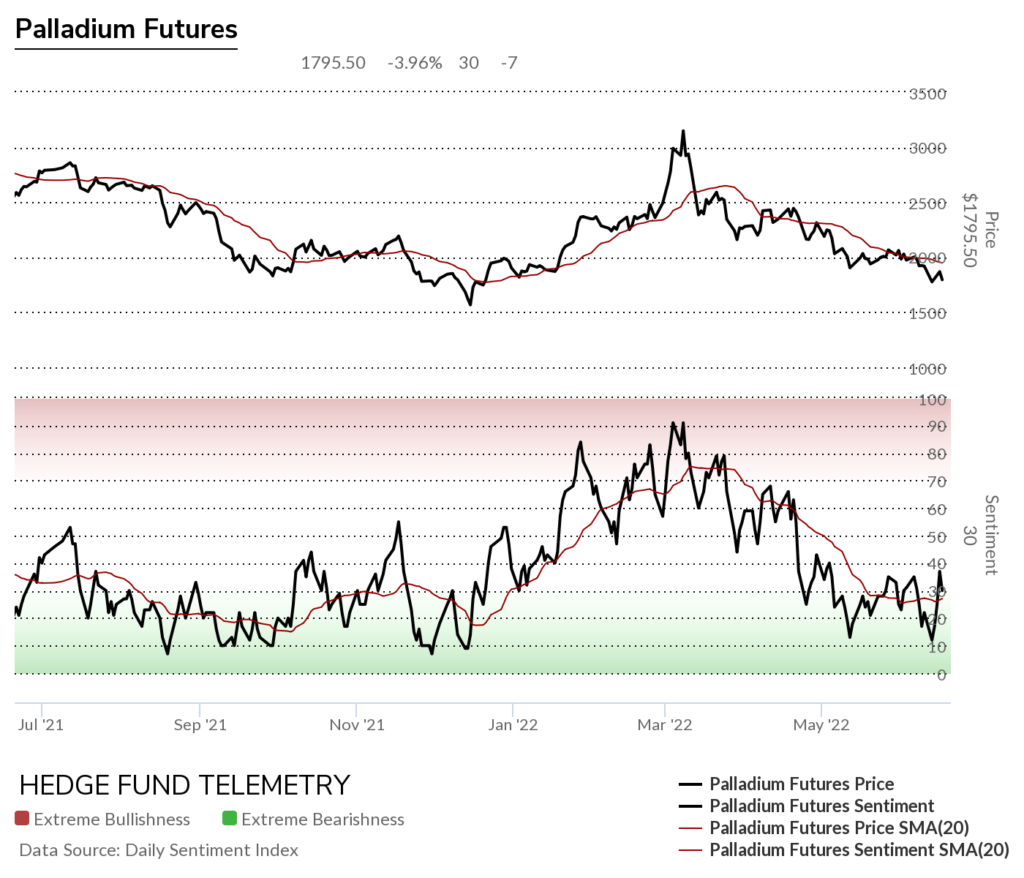

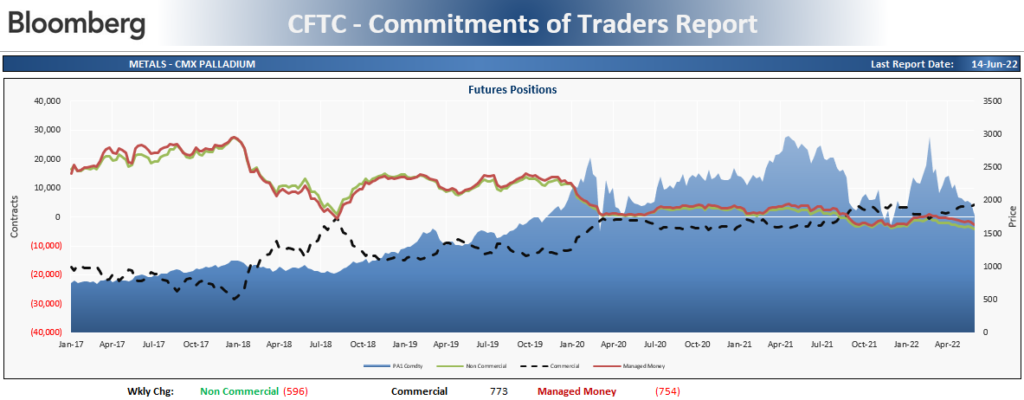

Palladium daily

Palladium bullish sentiment has remained under pressure

Palladium Commitment of Traders shows speculators increasing SHORT exposure small

Grains

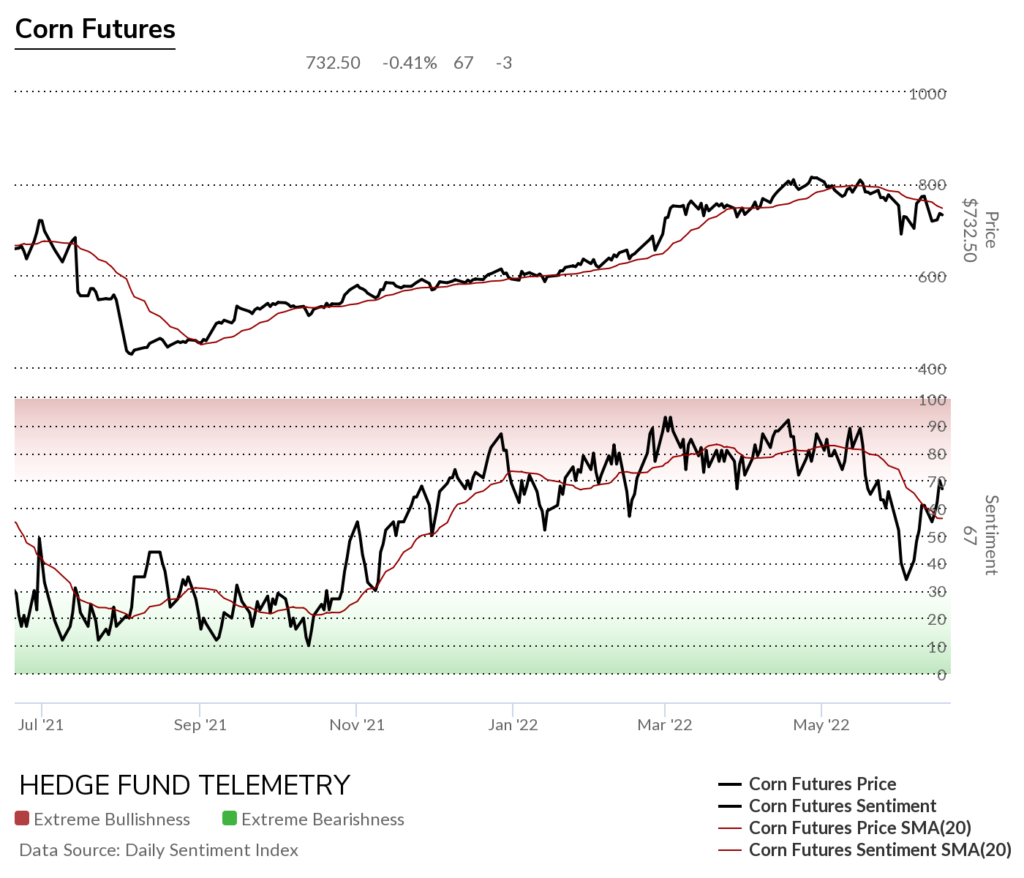

Corn futures daily

Corn futures bullish sentiment with possible lower high here too

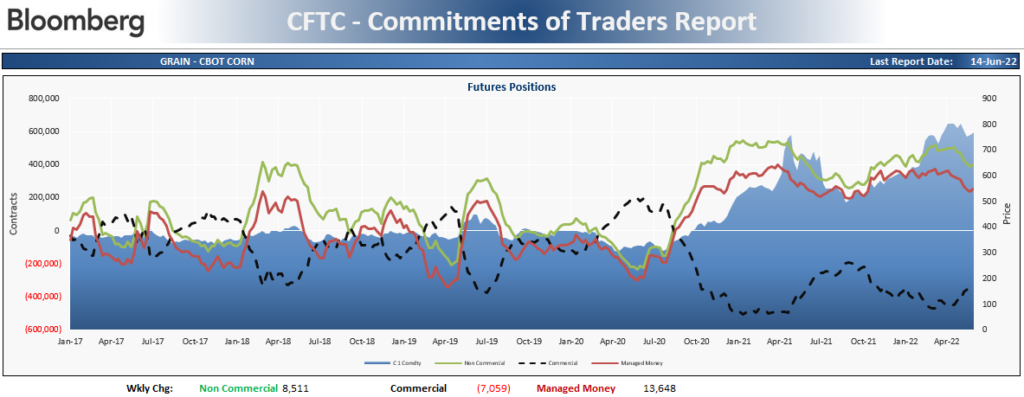

Corn futures Commitment of Traders shows speculators increasing long exposure

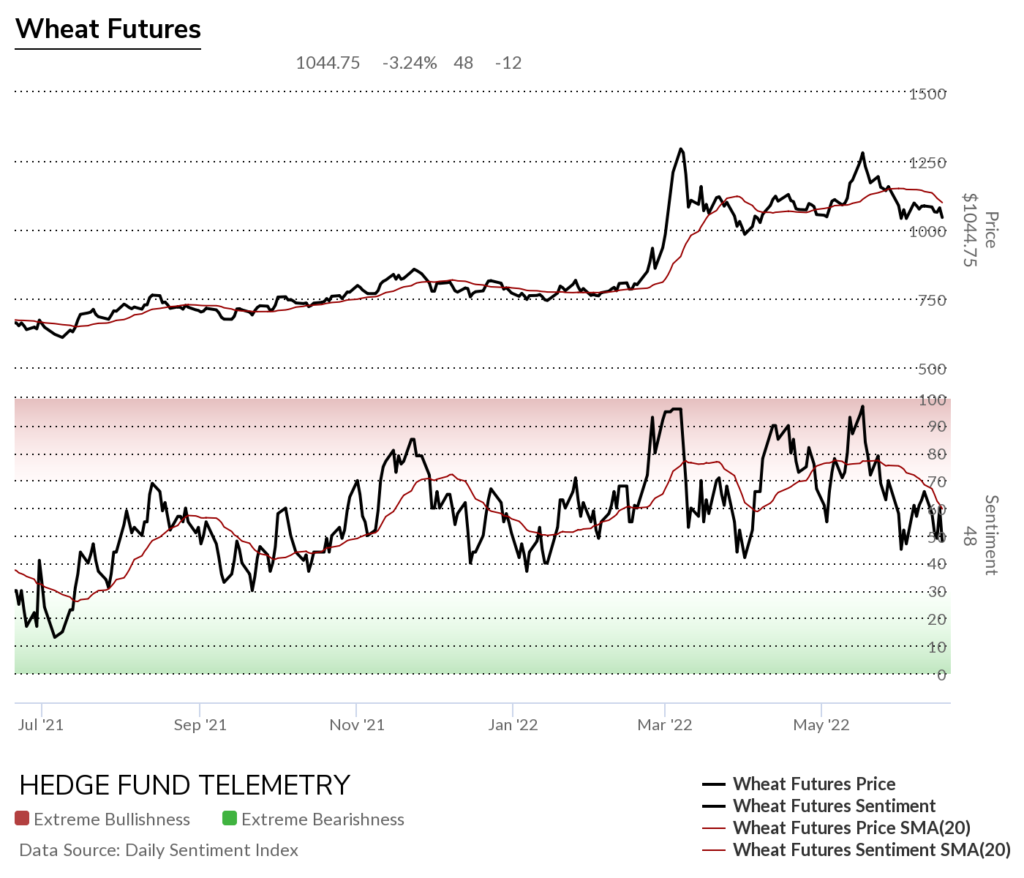

Wheat futures daily breaking down

Wheat futures bullish sentiment at support at ~50%

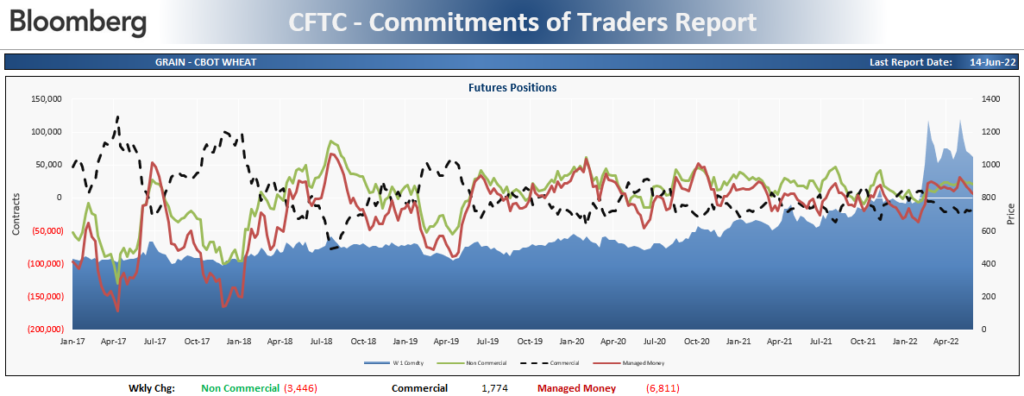

Wheat futures Commitment of Traders shows speculators decreasing long exposure

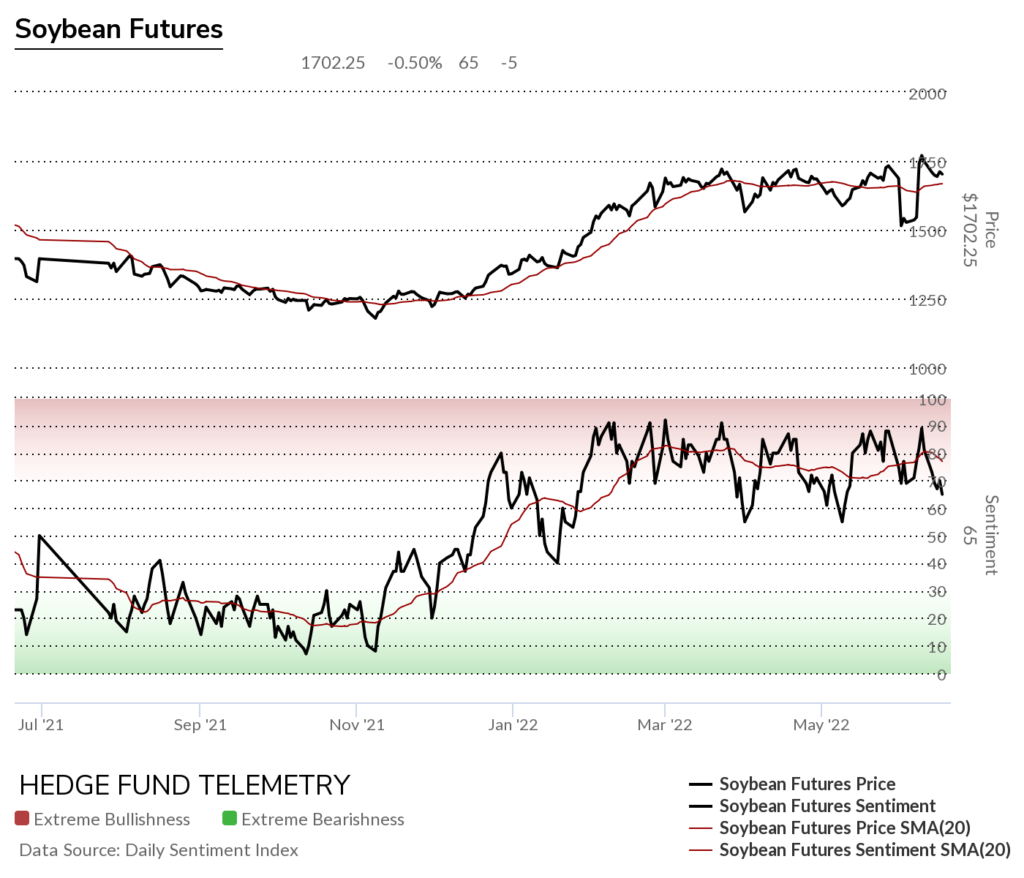

Soybean futures daily still sideways with 1500 support

Soybean futures bullish sentiment nearing the low end of the elevated range

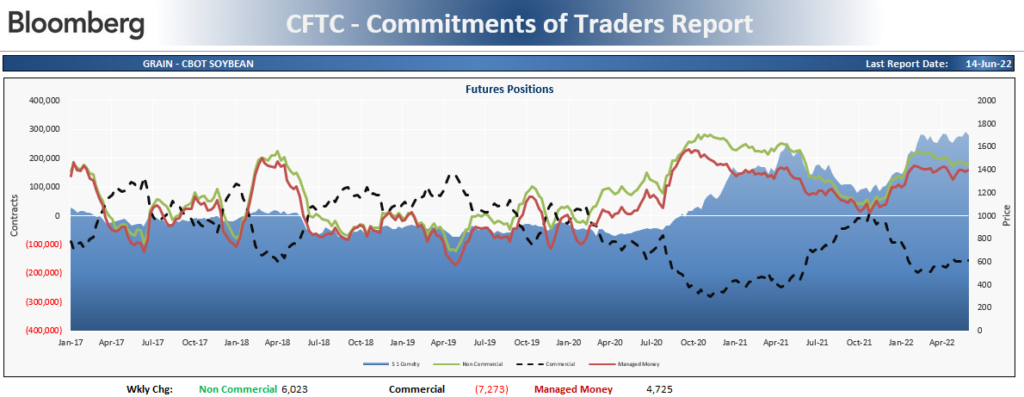

Soybean futures Commitment of Traders shows speculators increasing long exposure

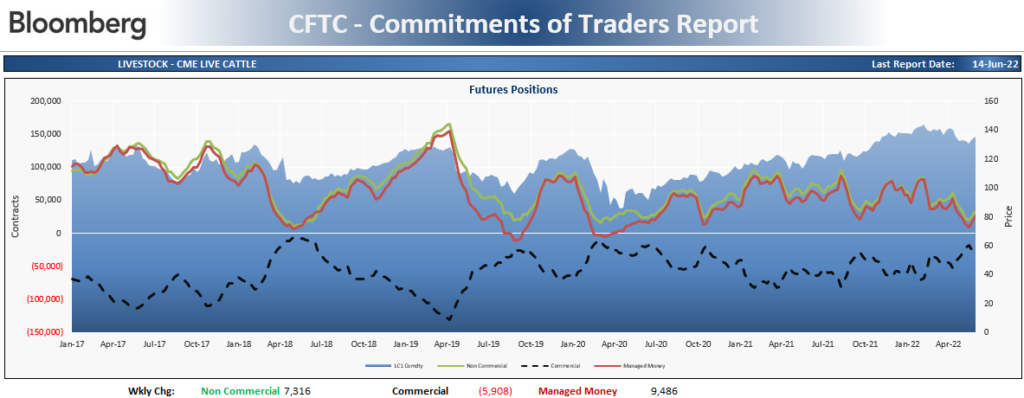

Livestock

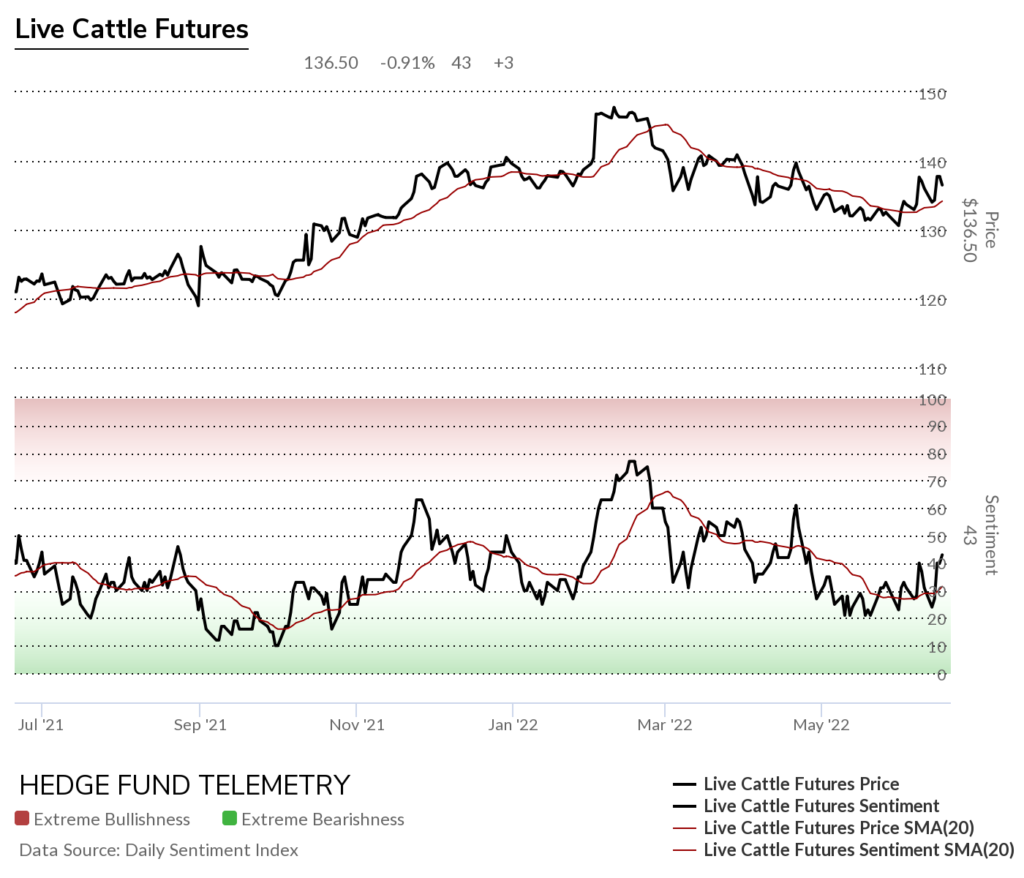

Cattle futures daily

Cattle futures bullish sentiment trying to lift but needs to get over 50%

Cattle futures Commitment of Traders shows speculators increasing long exposure

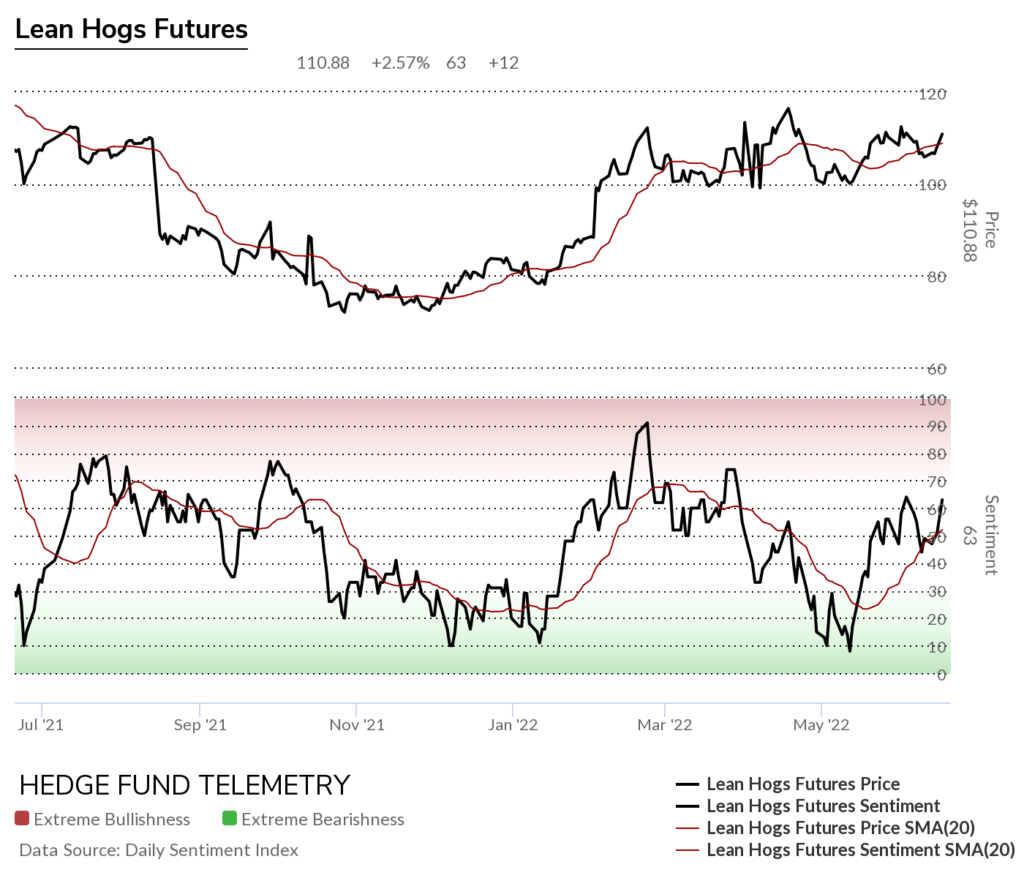

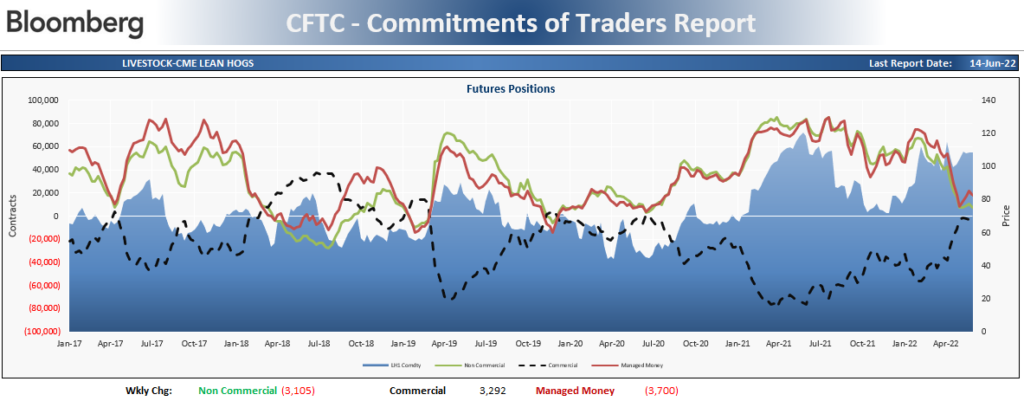

Lean Hogs futures daily with potential upside if 101 can hold

Lean Hogs bullish sentiment improving

Lean Hogs Commitment of Traders shows speculators decreasing long exposure

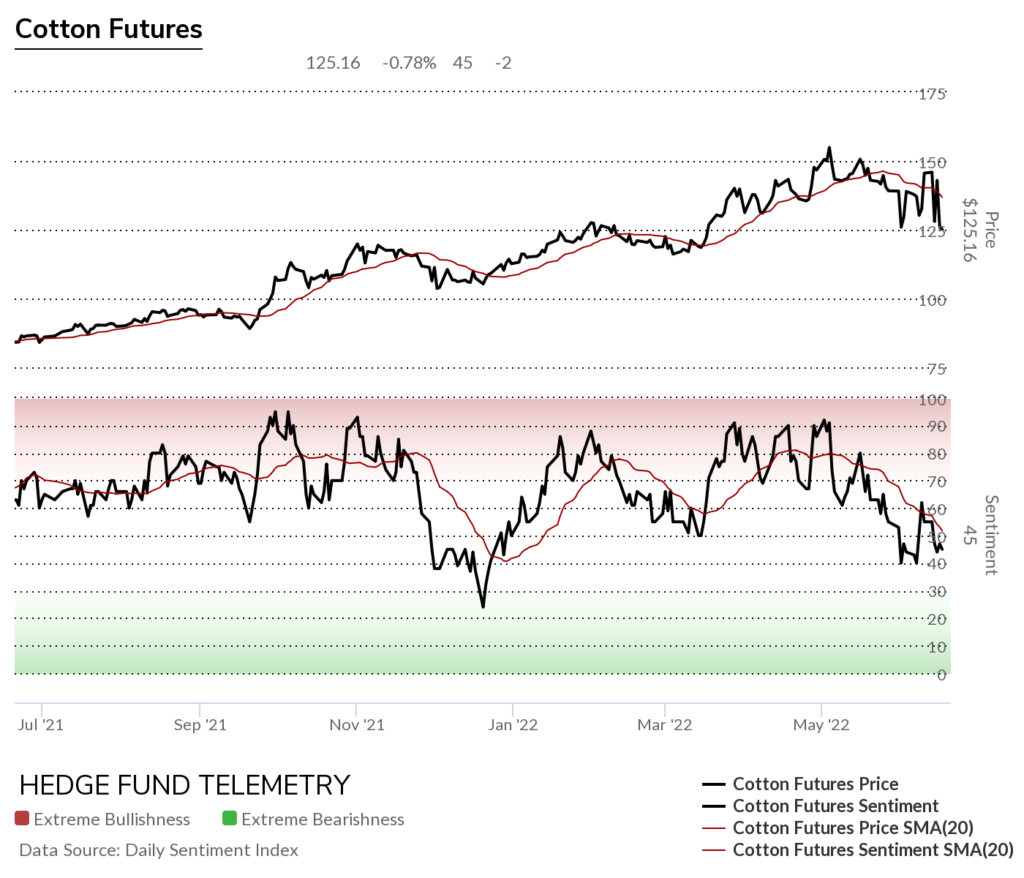

Softs

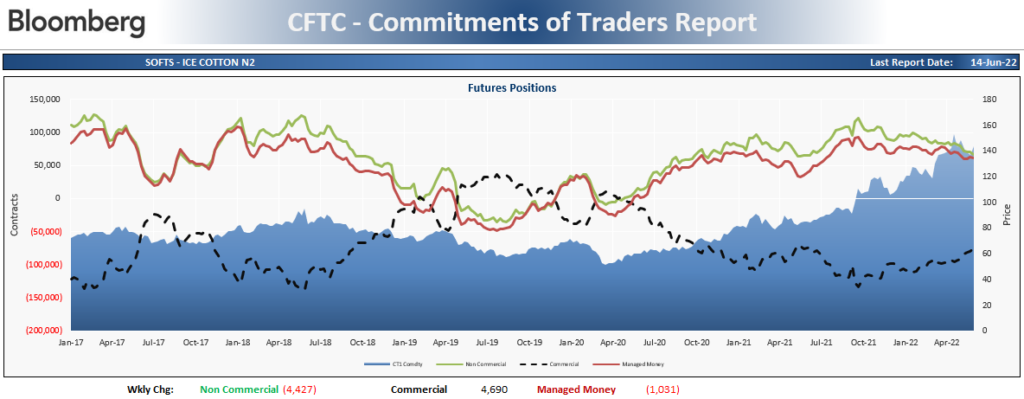

Cotton futures daily looks lower

Cotton futures bullish sentiment with lower highs and support at 40%

Cotton Futures Commitment of Traders shows speculators decreasing long exposure

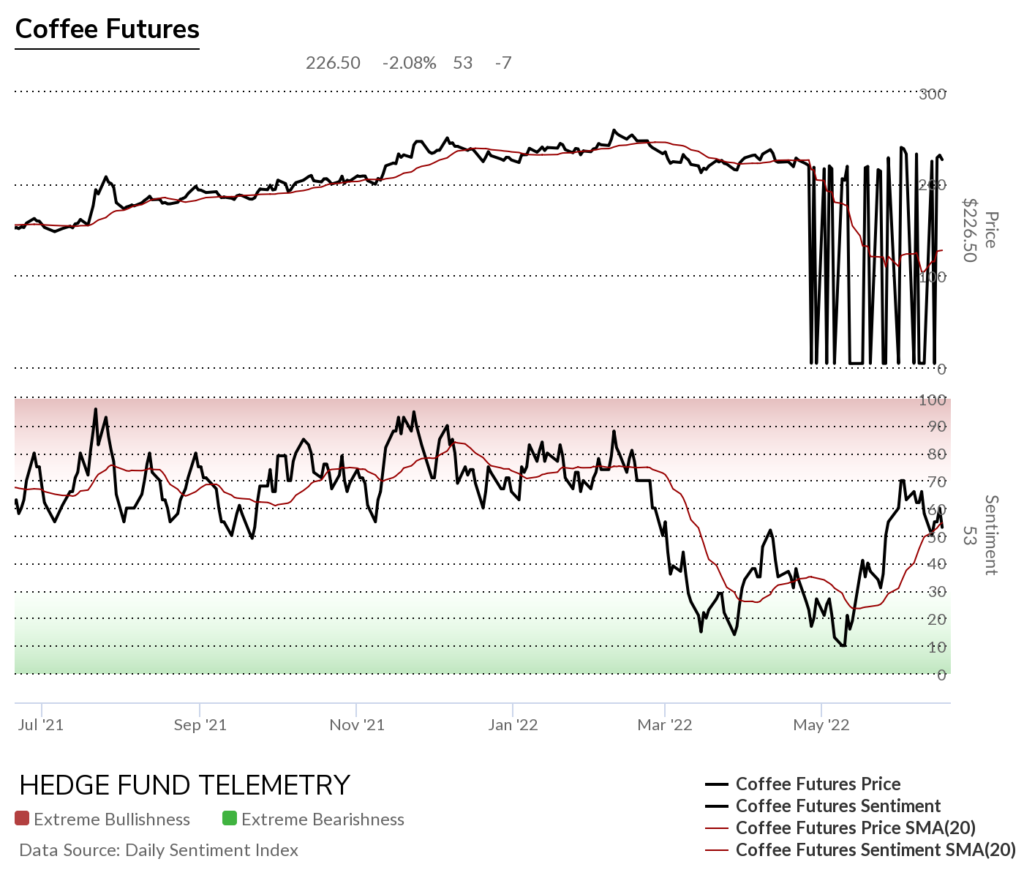

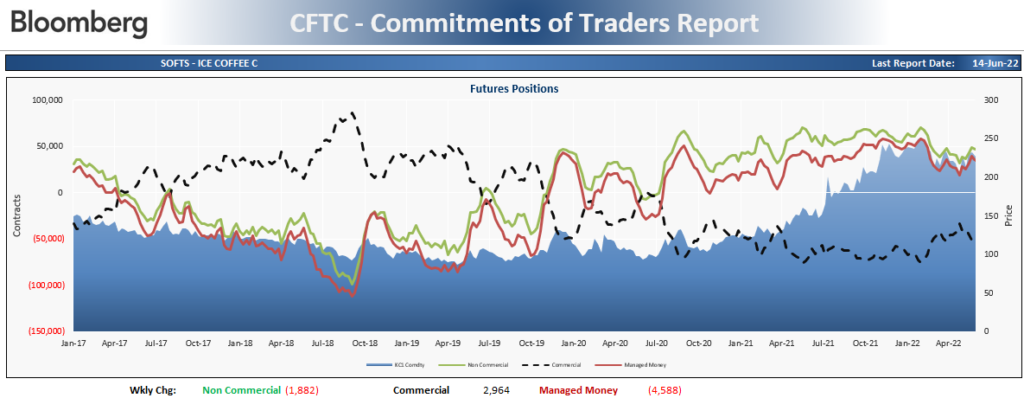

Coffee futures daily still sideways with lower highs

Coffee futures bullish sentiment holding 50% for now. Sorry for the pricing mess here. For some reason our data provider likes to play tricks on us

Coffee futures Commitment of Traders shows speculators decreasing long exposure

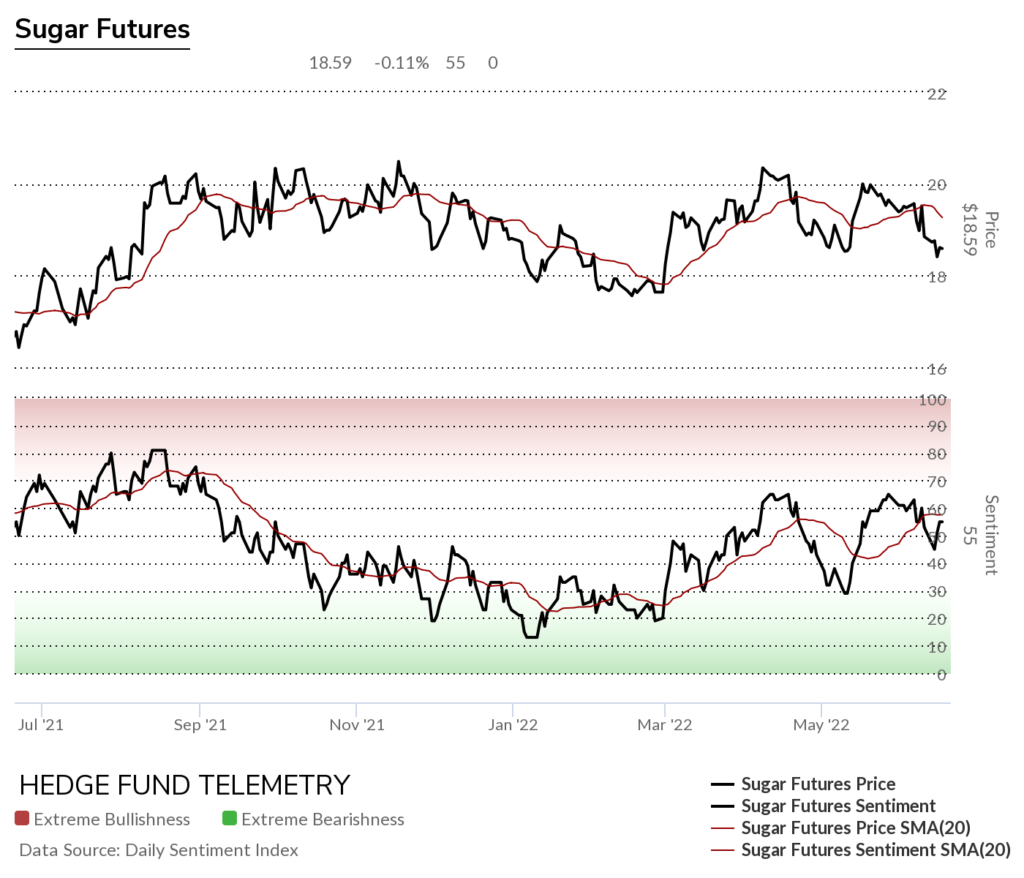

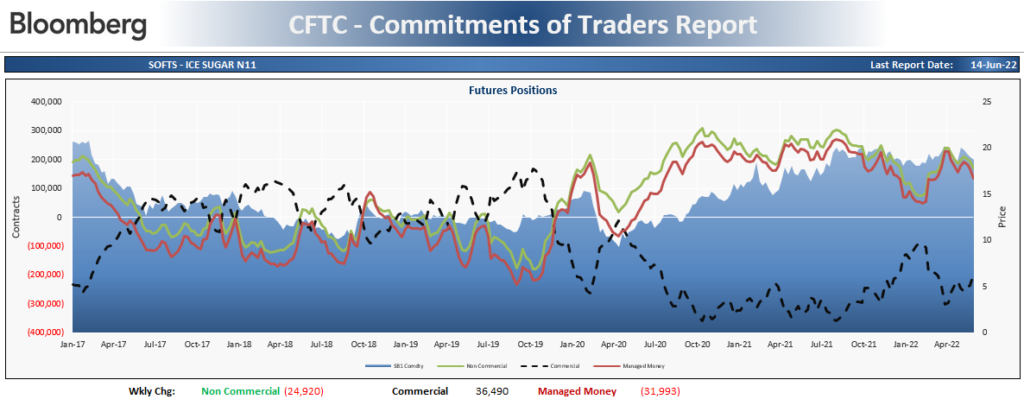

Sugar futures daily still has a downside Sequential in progress

Sugar futures bullish sentiment trying to hold at the midpoint

Sugar futures Commitment of Traders shows speculators significantly decreasing long exposure

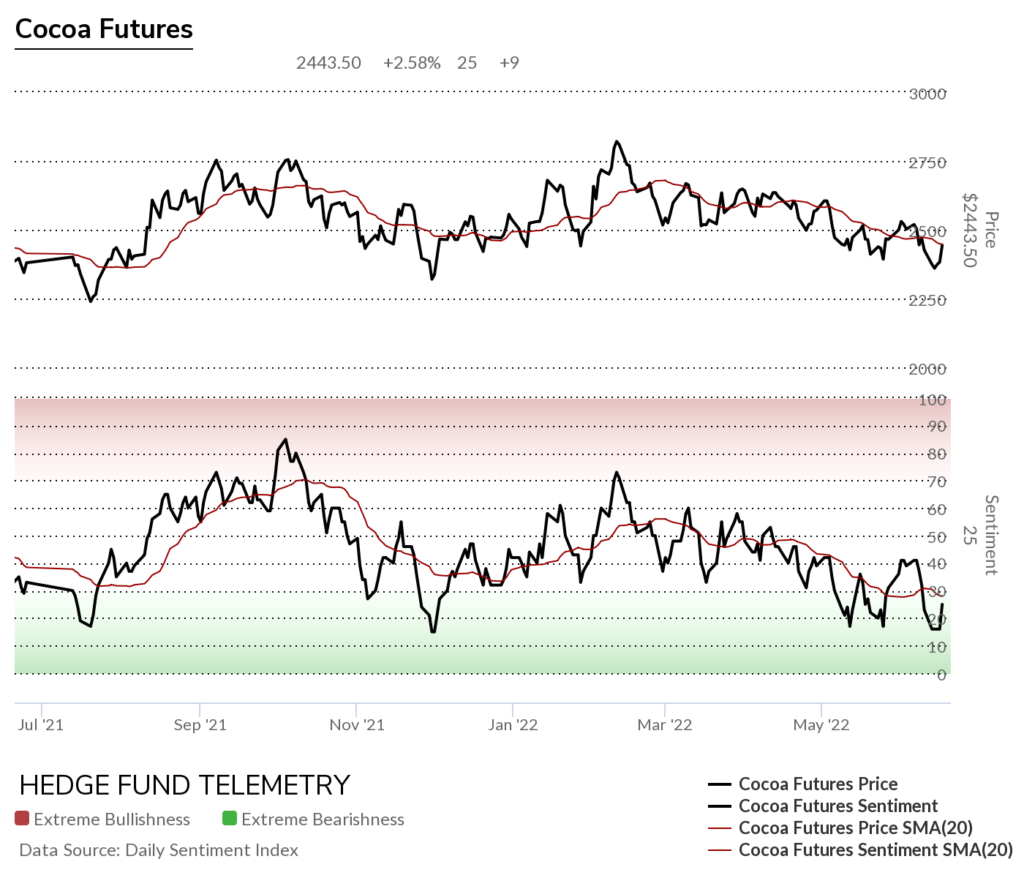

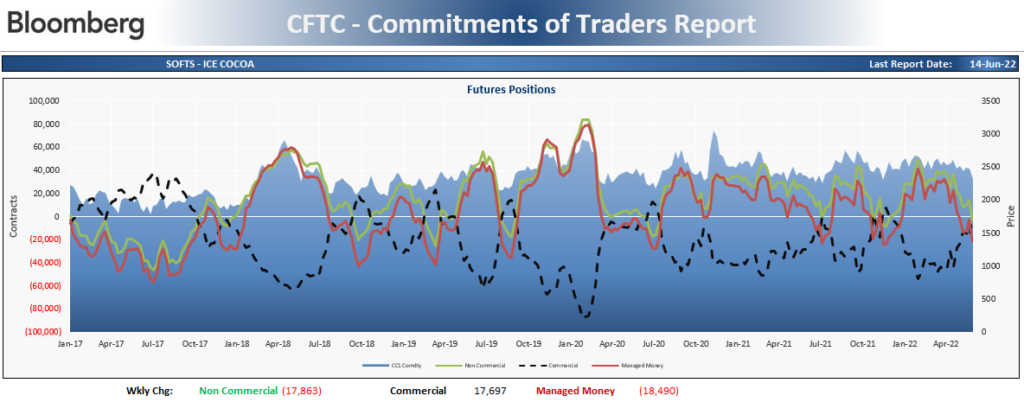

Cocoa futures daily could rise from here at the DeMark Sequential buy Countdown 13

Cocoa futures bullish sentiment has been under pressure and oversold

Cocoa futures Commitment of Traders shows speculators significantly increasing SHORT exposure

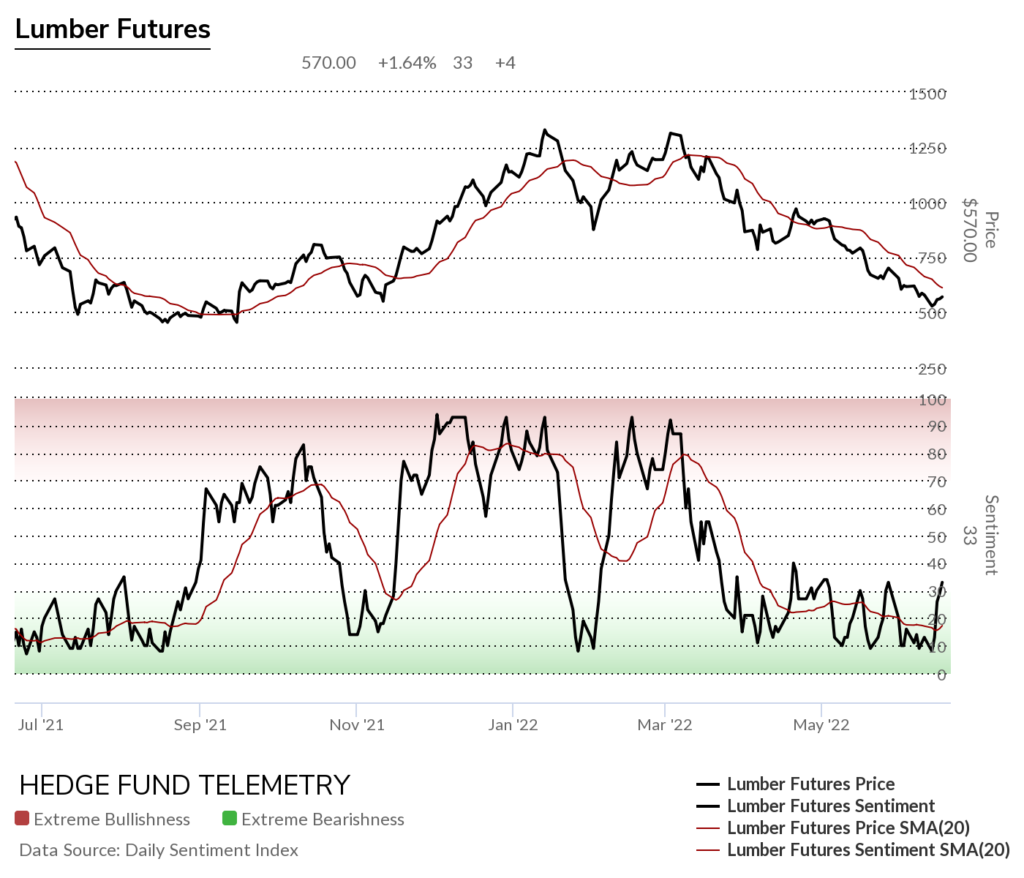

Lumber futures daily

Lumber bullish sentiment spiked from oversold levels for the last 3 months

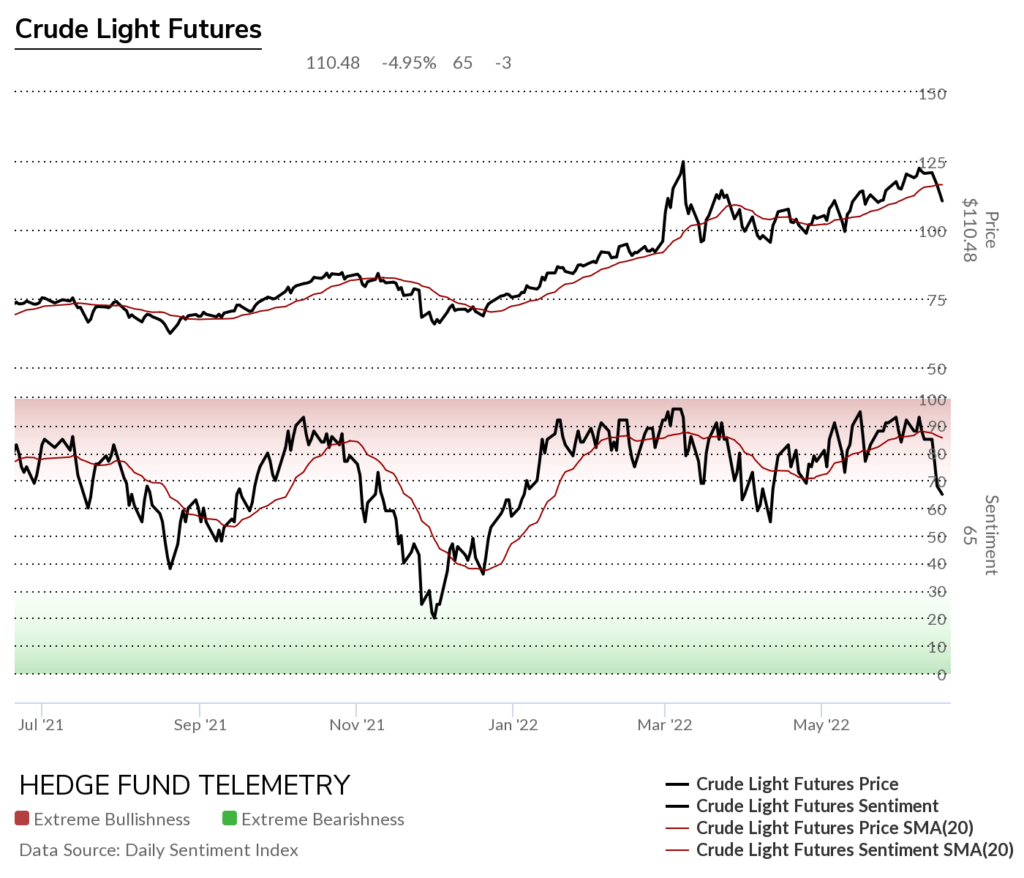

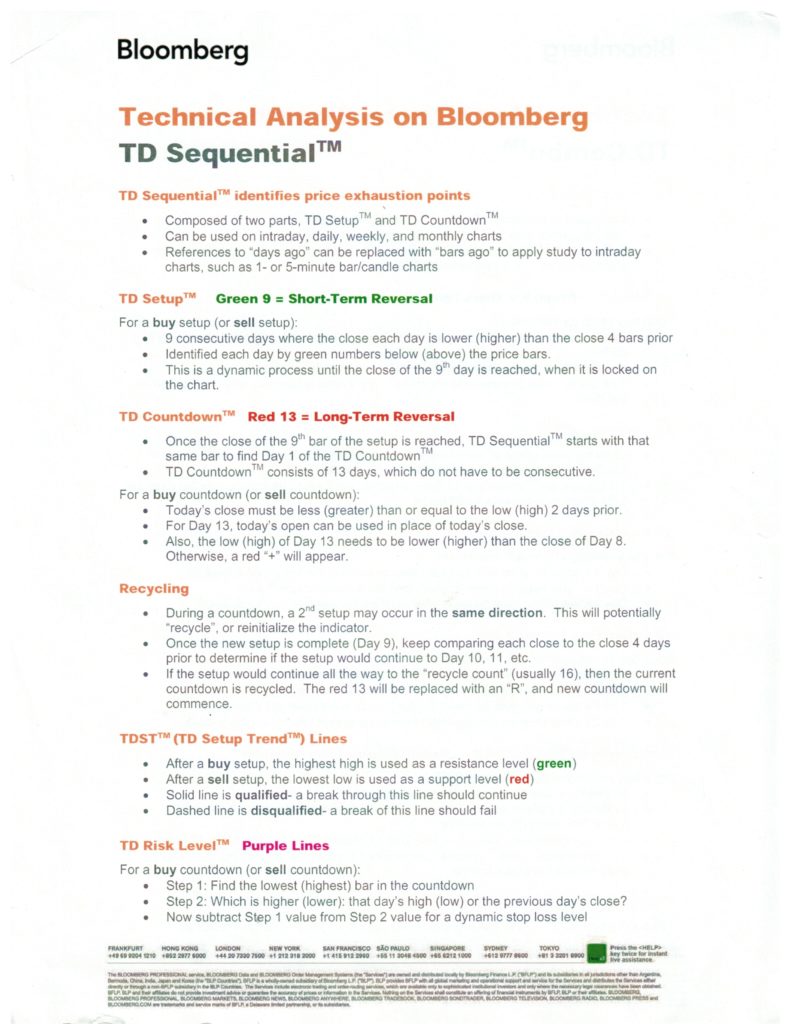

DeMark Sequential Basics

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS