highlights and themes

I’m watching for the potential for lower highs – either corrective lower high wave 2 of 5 or on some more further along in the downside wave patterns wave 4 of 5. The Bloomberg Commodity Index daily is a good example of this thesis. If commodity prices can hold at the end of July prices, one has to start to think about the August CPI report coming in a little higher than the expected lower July report.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily

Bloomberg Commodity Index Weekly

COMMODITY SENTIMENT OVERVIEW

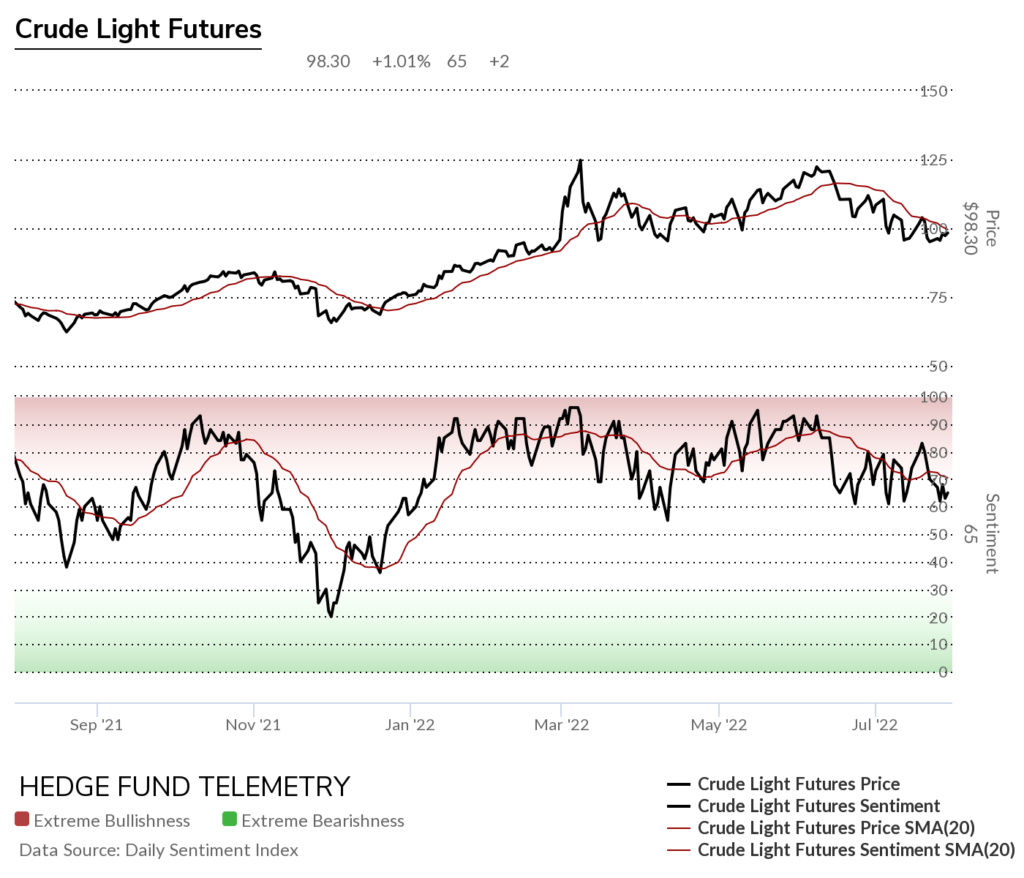

OIL AND ENERGY

WTI Crude futures daily

Brent Crude futures daily

WTI Crude futures bullish sentiment at the low end of the range.

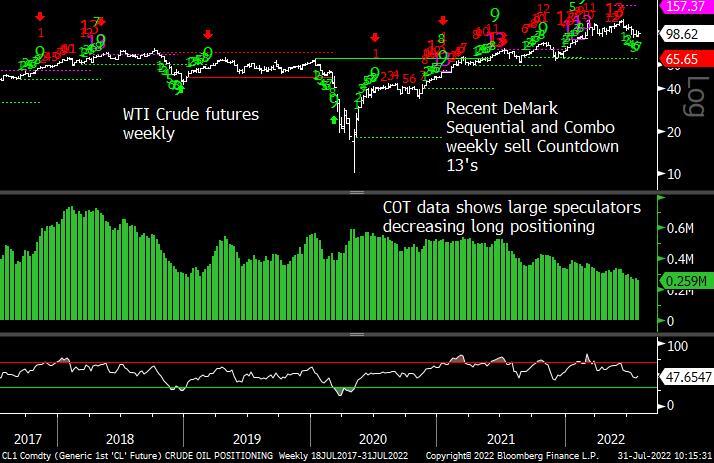

WTI Crude futures Commitment of Traders

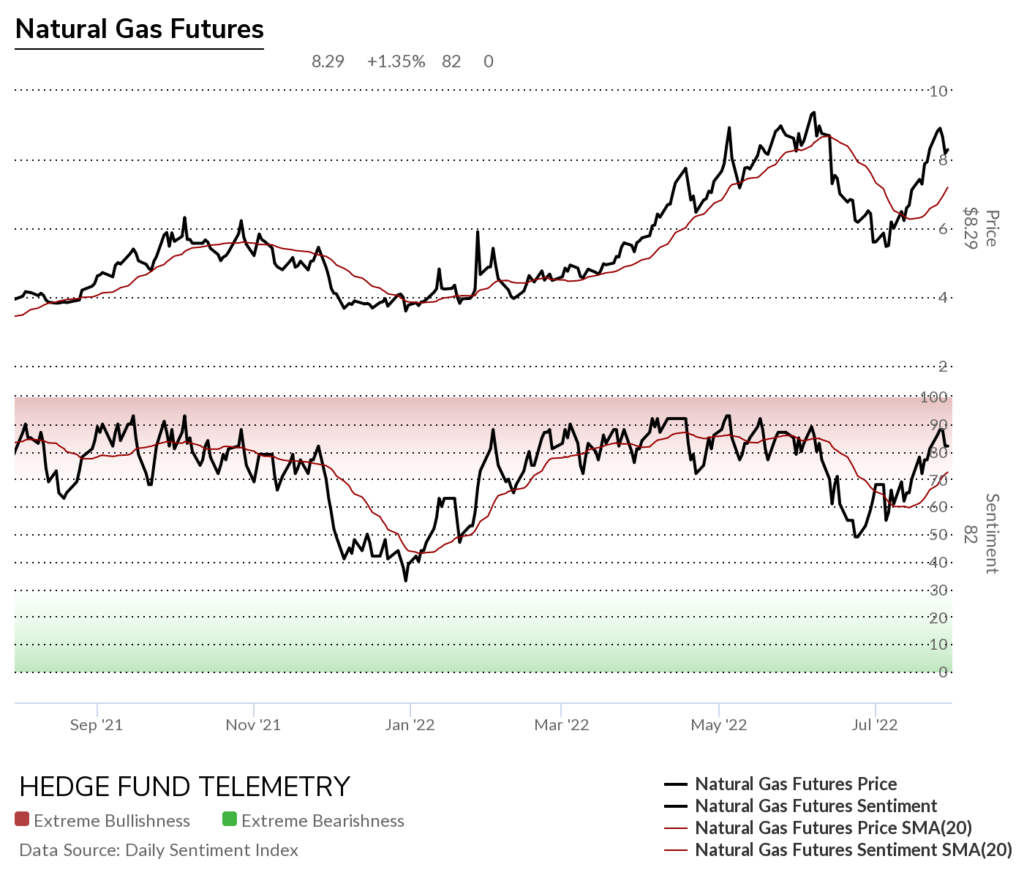

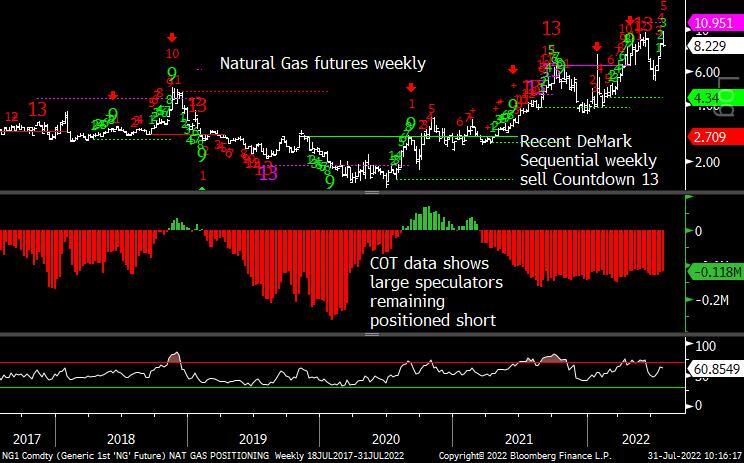

Natural Gas futures daily

Natural Gas futures bullish sentiment reversed late in the week and remains in the extreme zone over 80%

Natural Gas futures Commitment of Traders

Metals

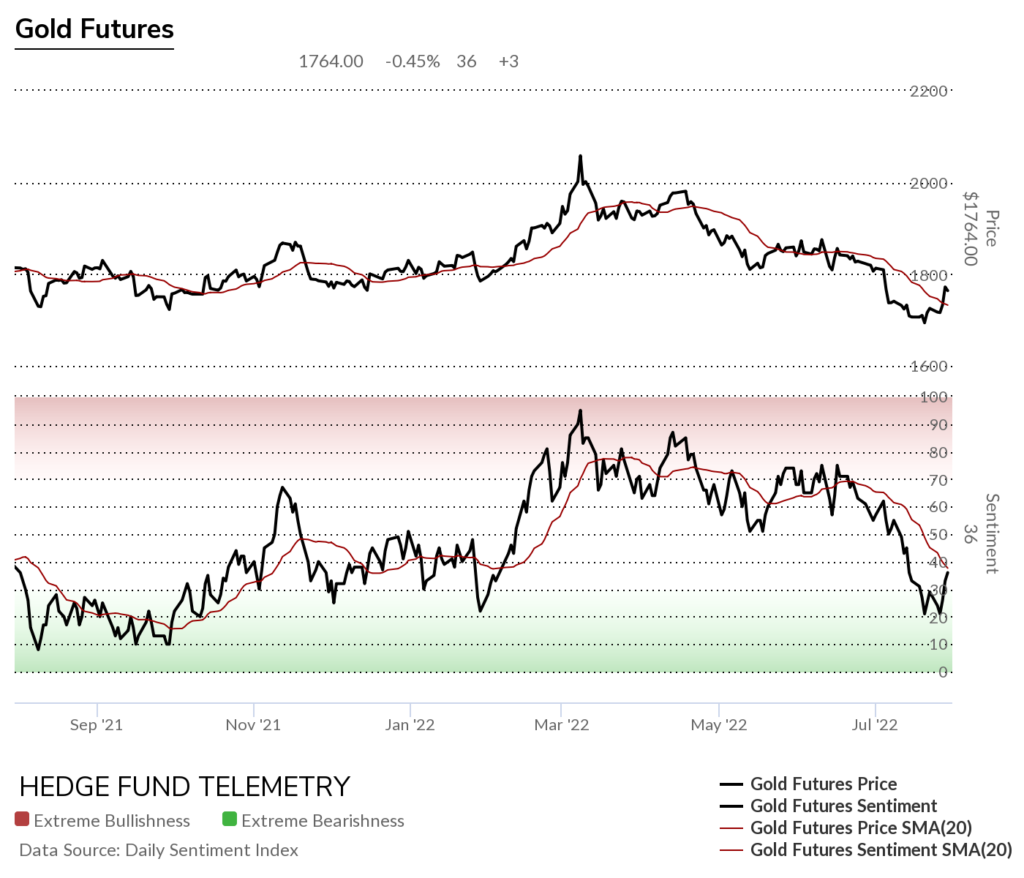

Gold futures daily

Gold futures bullish sentiment reversed off oversold levels and still has some work to confirm upside

Gold futures Commitment of Traders

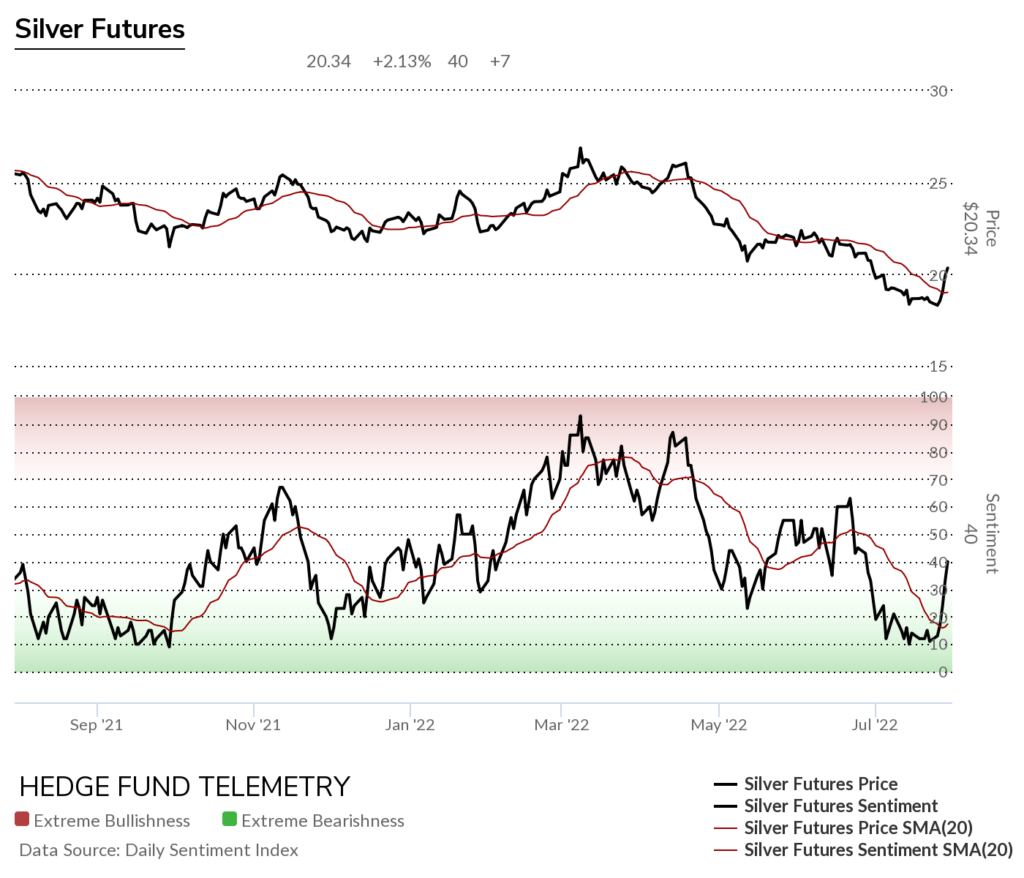

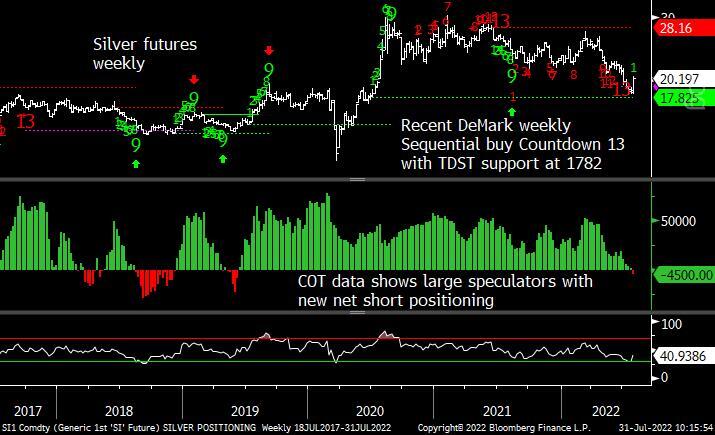

Silver futures daily spiked and now it’s a show me situation as we have seen spikes fail

Silver Bullish Sentiment also was oversold and had a strong reversal up

Silver futures Commitment of Traders

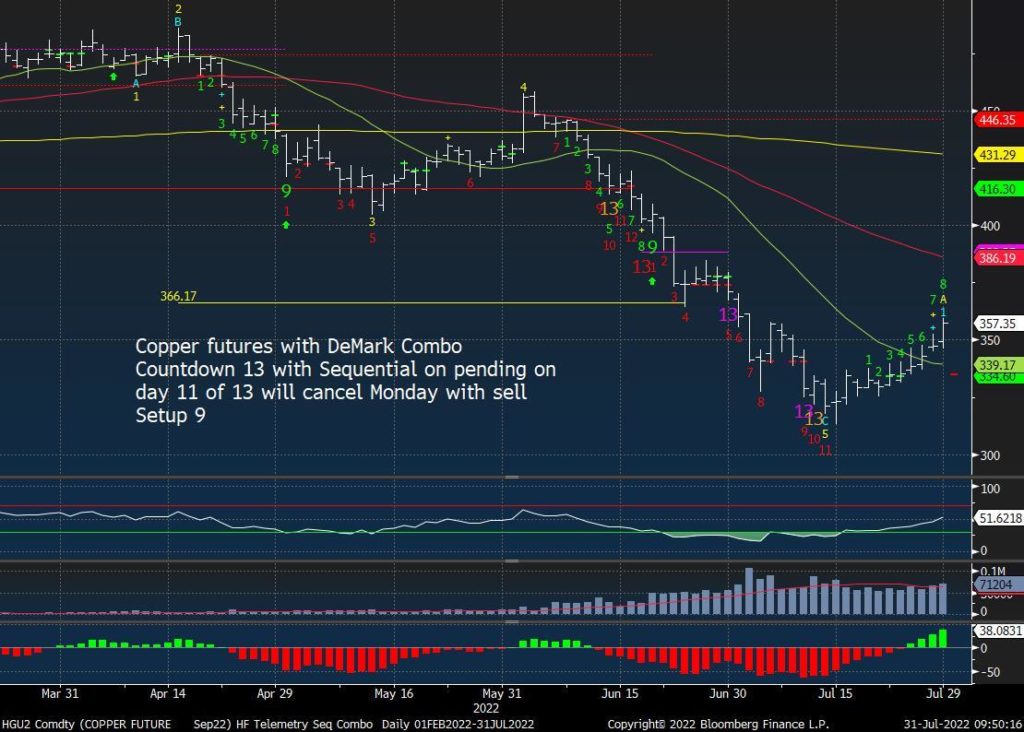

Copper futures daily will get the sell Setup 9 on Monday

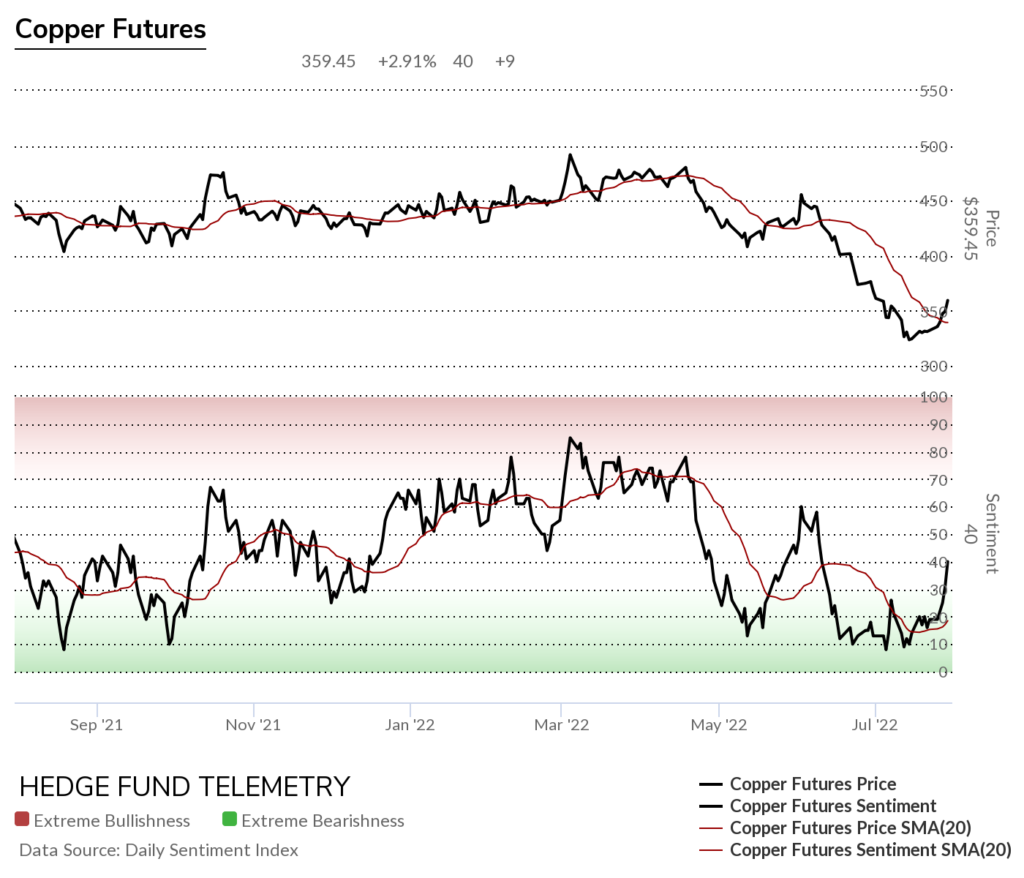

Copper futures bullish sentiment was also very oversold and reversed strong last week

Copper futures Commitment of Traders

Platinum daily

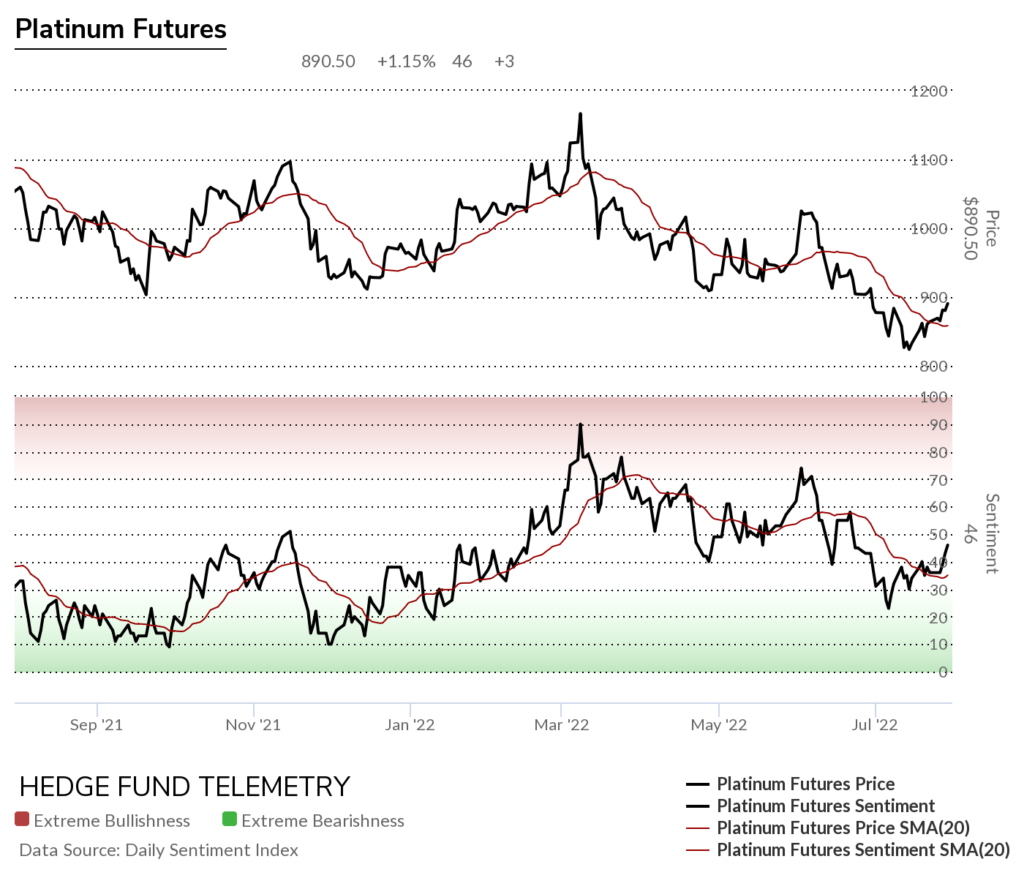

Platinum bullish sentiment has been quietly improving with 50% resistance above

Platinum Commitment of Traders

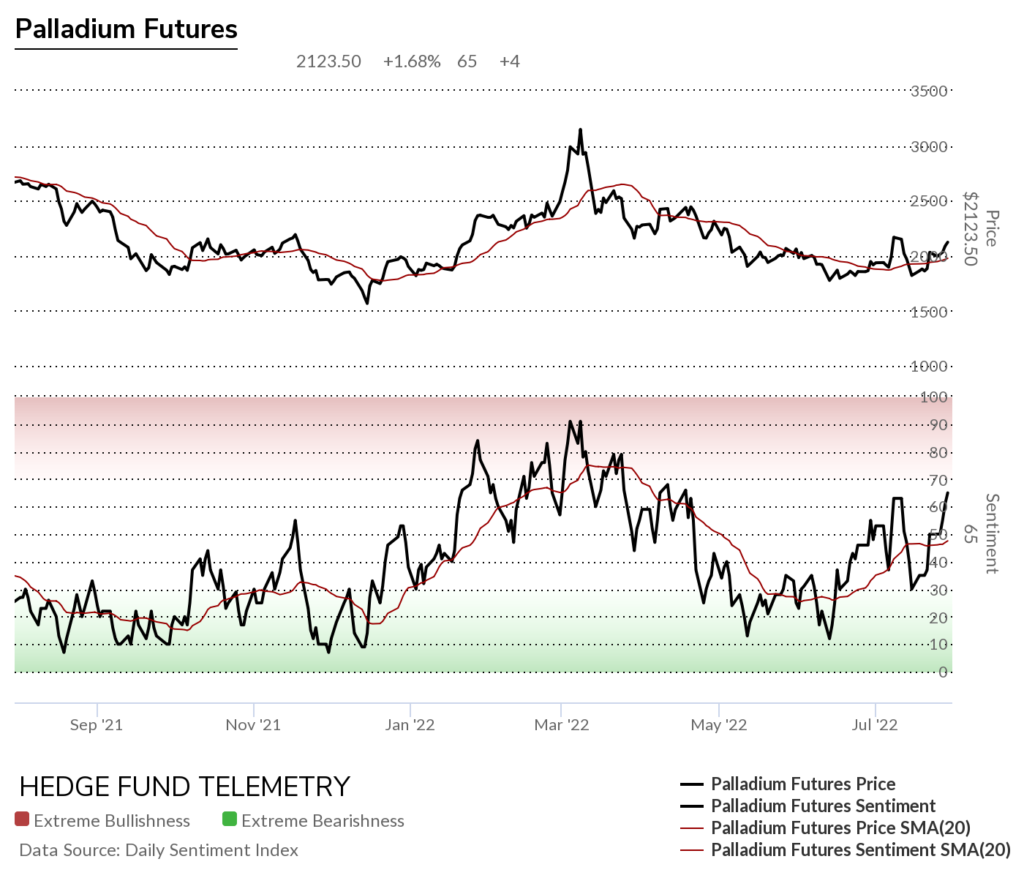

Palladium daily making a large base with 2200 resistance

Palladium bullish sentiment improving and gives hopes for a move higher in price

Palladium Commitment of Traders

Grains

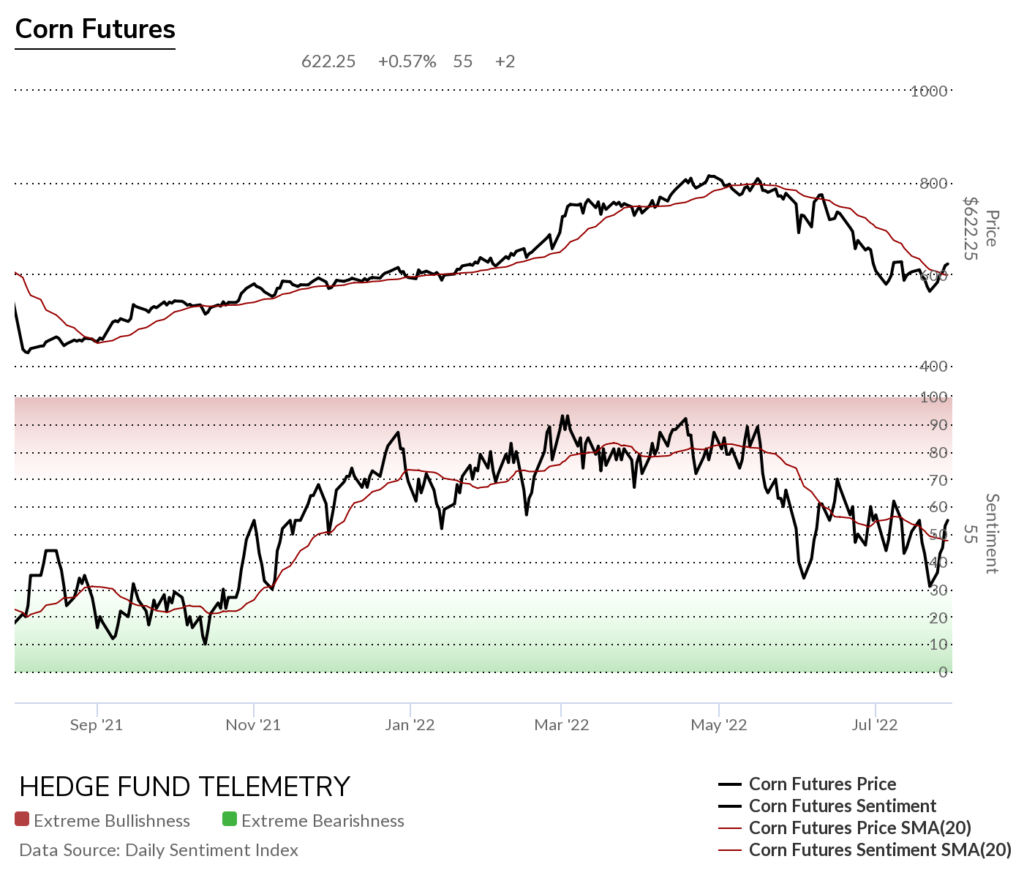

Corn futures daily with wave 4 of 5

Corn futures bullish sentiment improved yet still has to follow through

Corn futures Commitment of Traders

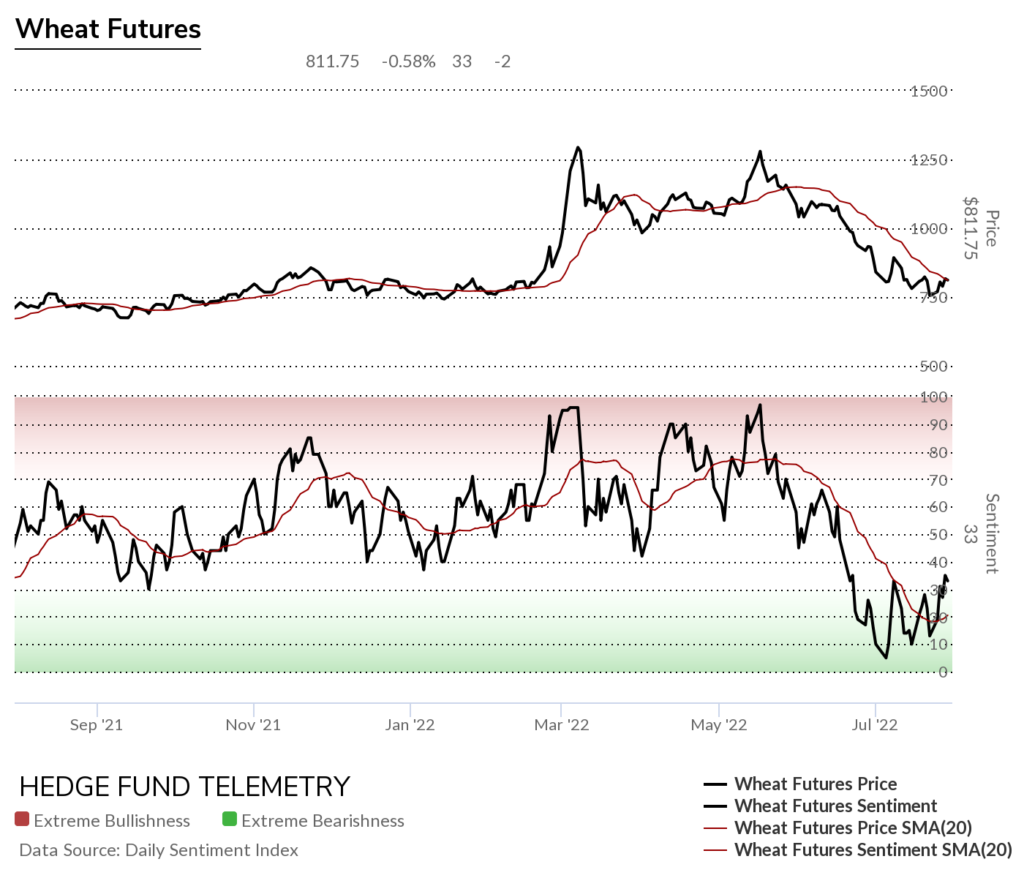

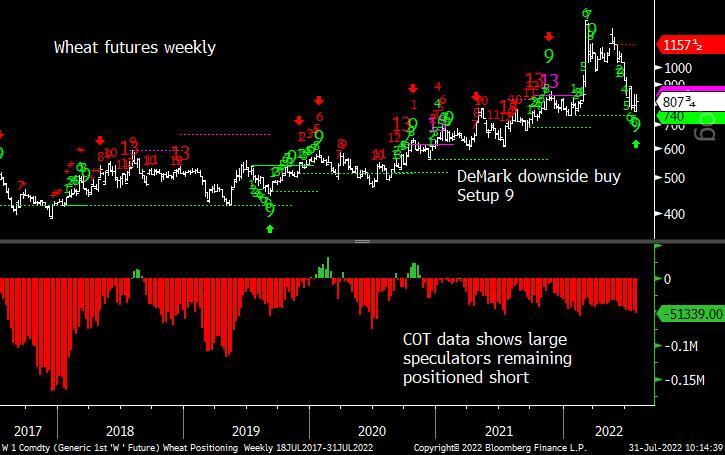

Wheat futures daily still has a Sequential in progress

Wheat futures bullish sentiment remains under pressure

Wheat futures Commitment of Traders

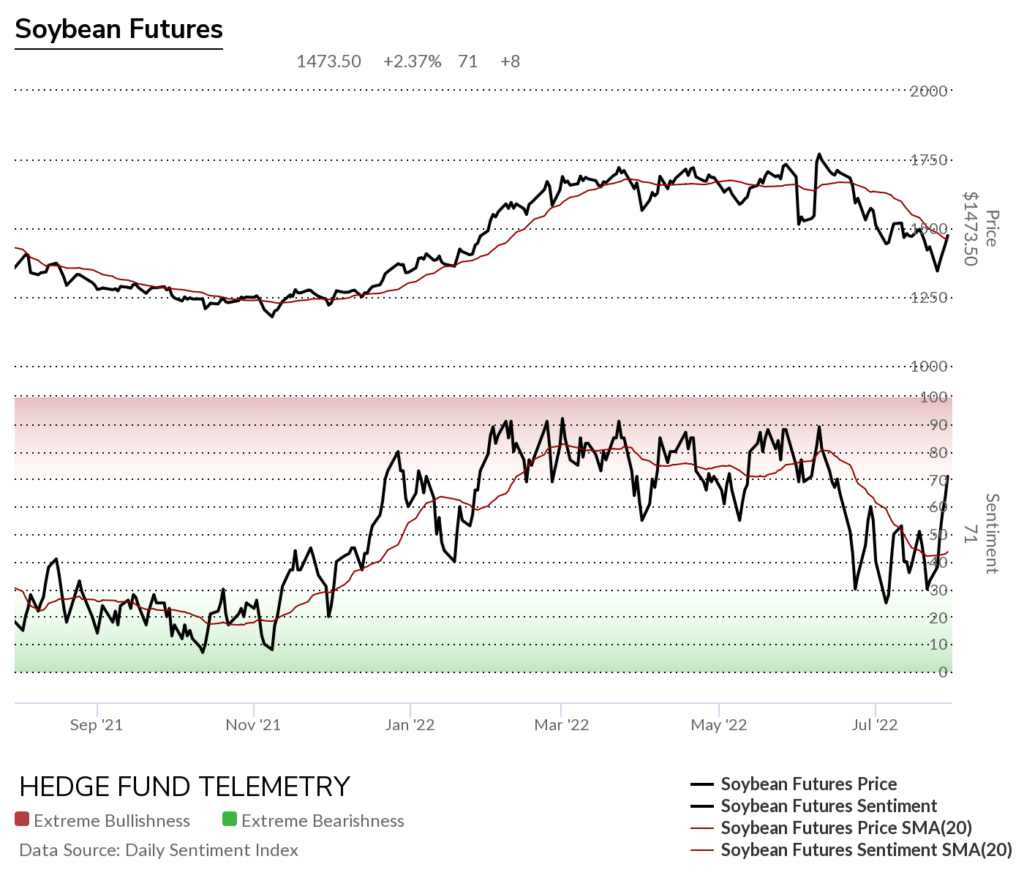

Soybean futures daily

Soybean futures bullish sentiment with a big reversal up

Soybean futures Commitment of Traders

Livestock

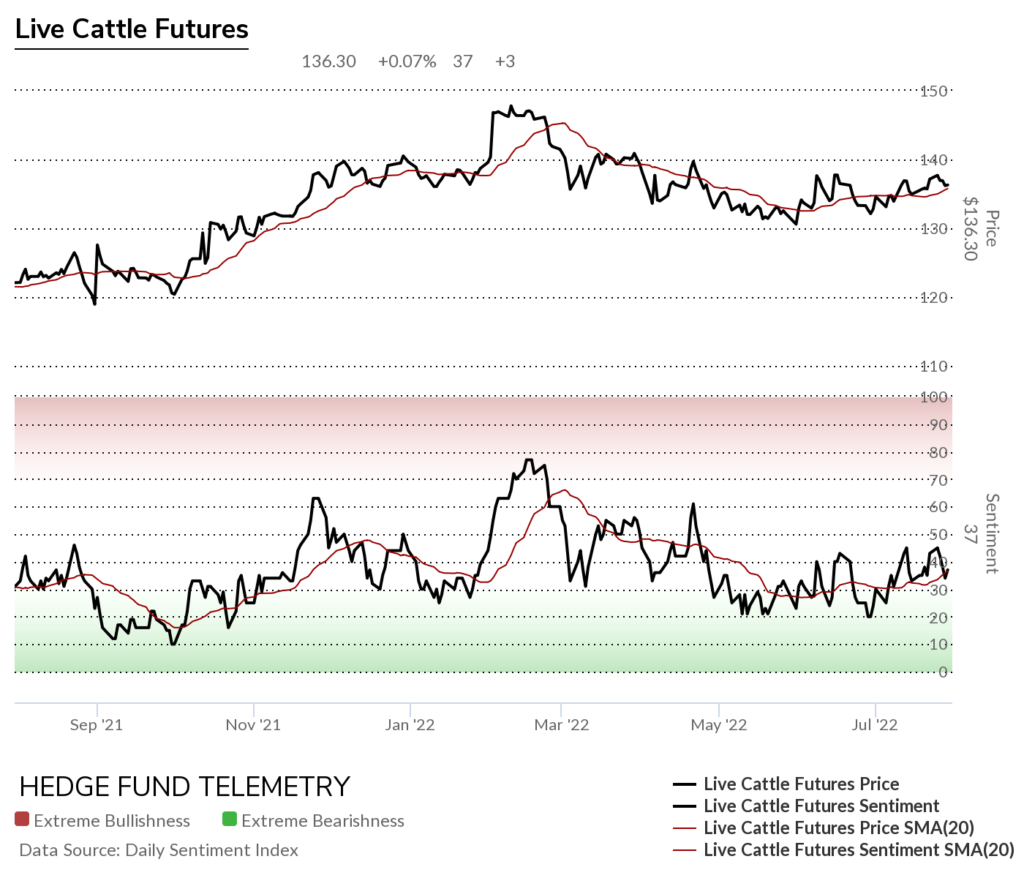

Cattle futures daily with with lower high wave 2 of 5

Cattle futures bullish sentiment remains under pressure

Cattle futures Commitment of Traders

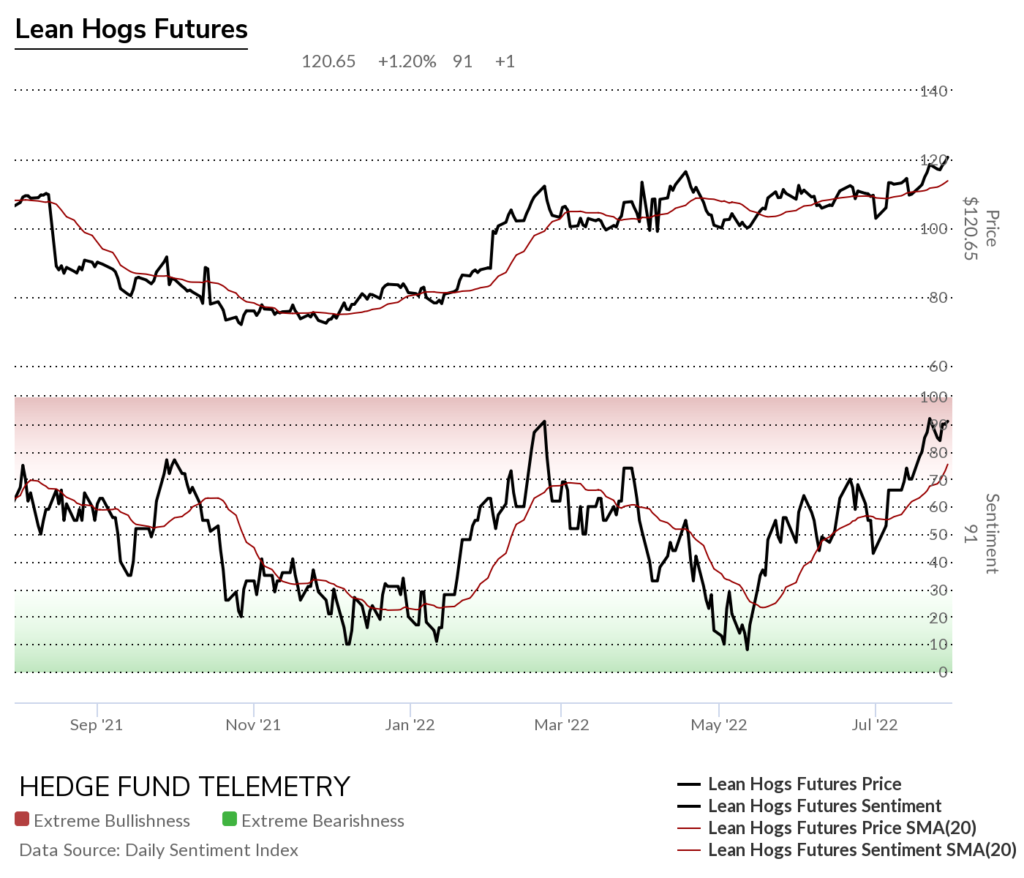

Lean Hogs futures daily with new Sequential sell Countdown 13

Lean Hogs bullish sentiment is at peak extreme levels at 91%

Lean Hogs Commitment of Traders

Softs

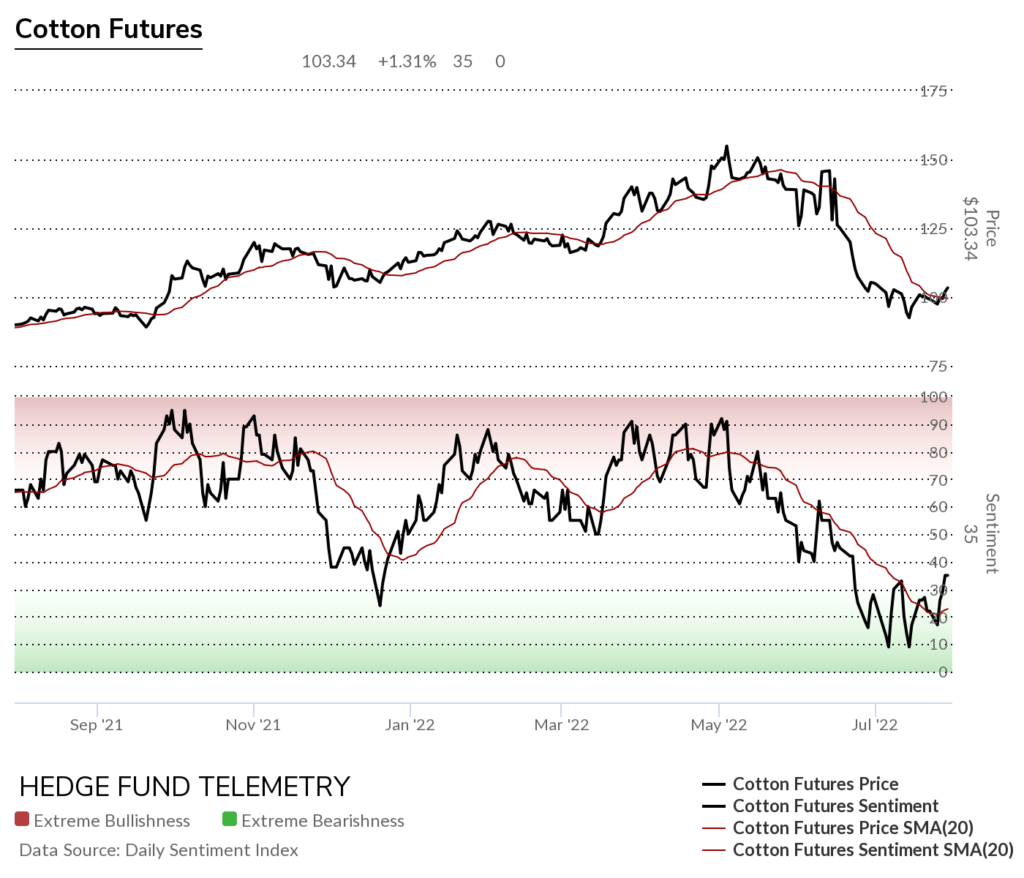

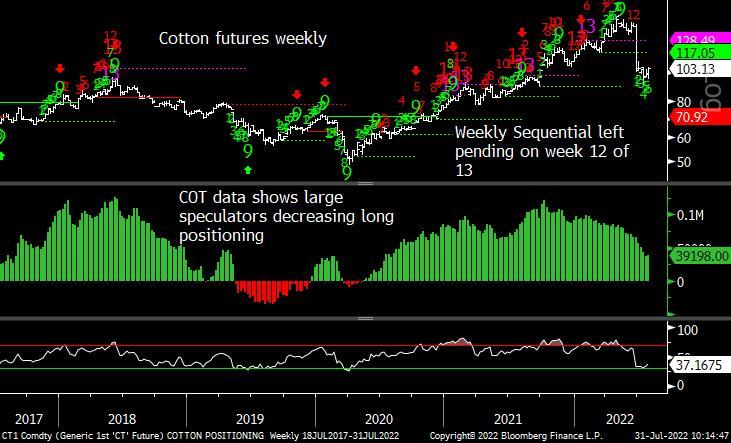

Cotton futures daily with lower high wave 4 of 5

Cotton futures bullish sentiment moved up yet not convinced this can continue

Cotton Futures Commitment of Traders

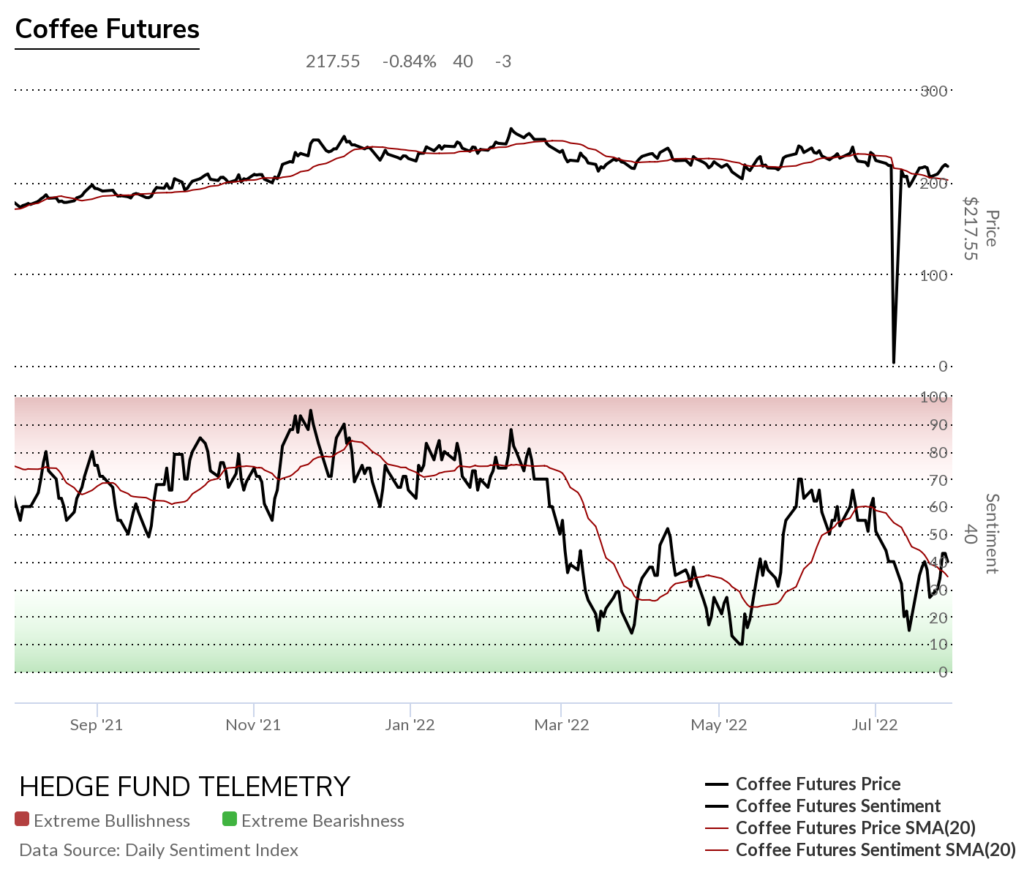

Coffee futures daily

Coffee futures bullish sentiment still needs to clear over 50%

Coffee futures Commitment of Traders – having a data issue with this one today

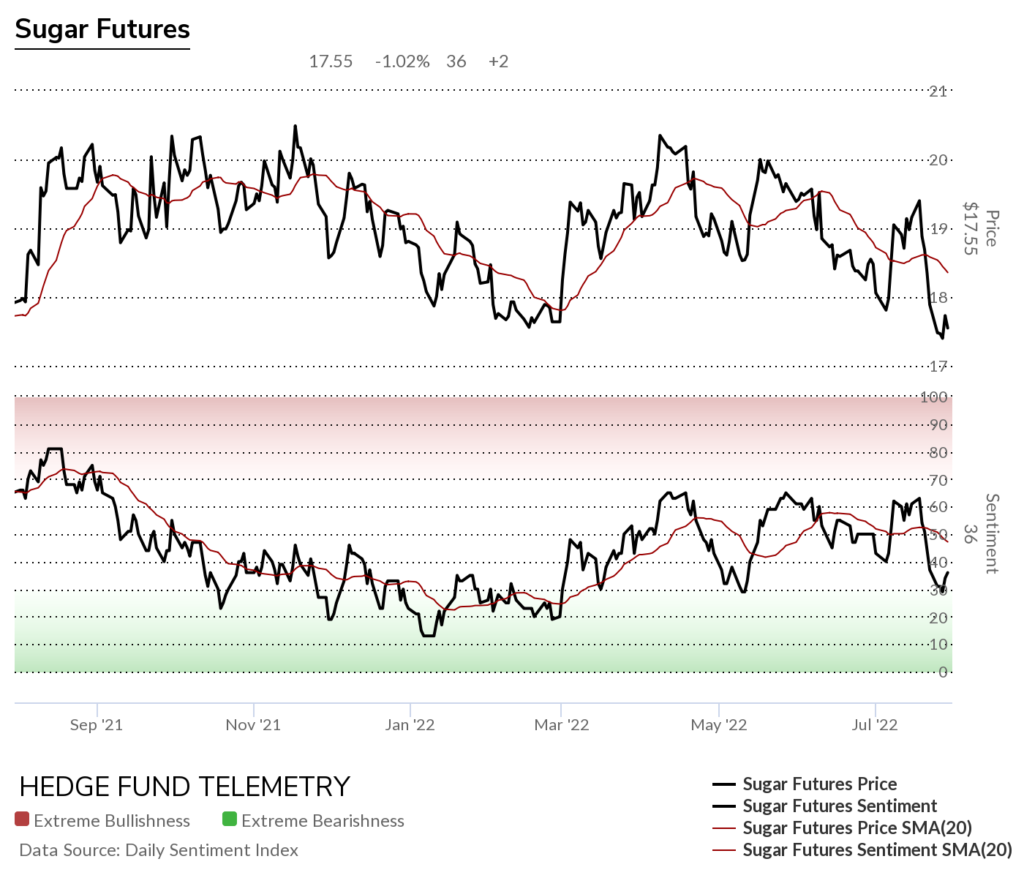

Sugar futures daily with new DeMark Sequential and Combo buy Countdown 13’s. Friday’s very weak action is a concern so a move over 18 is needed if looking to buy Sugar

Sugar futures bullish sentiment is at May lows and needs to continue the upside move

Sugar futures Commitment of Traders

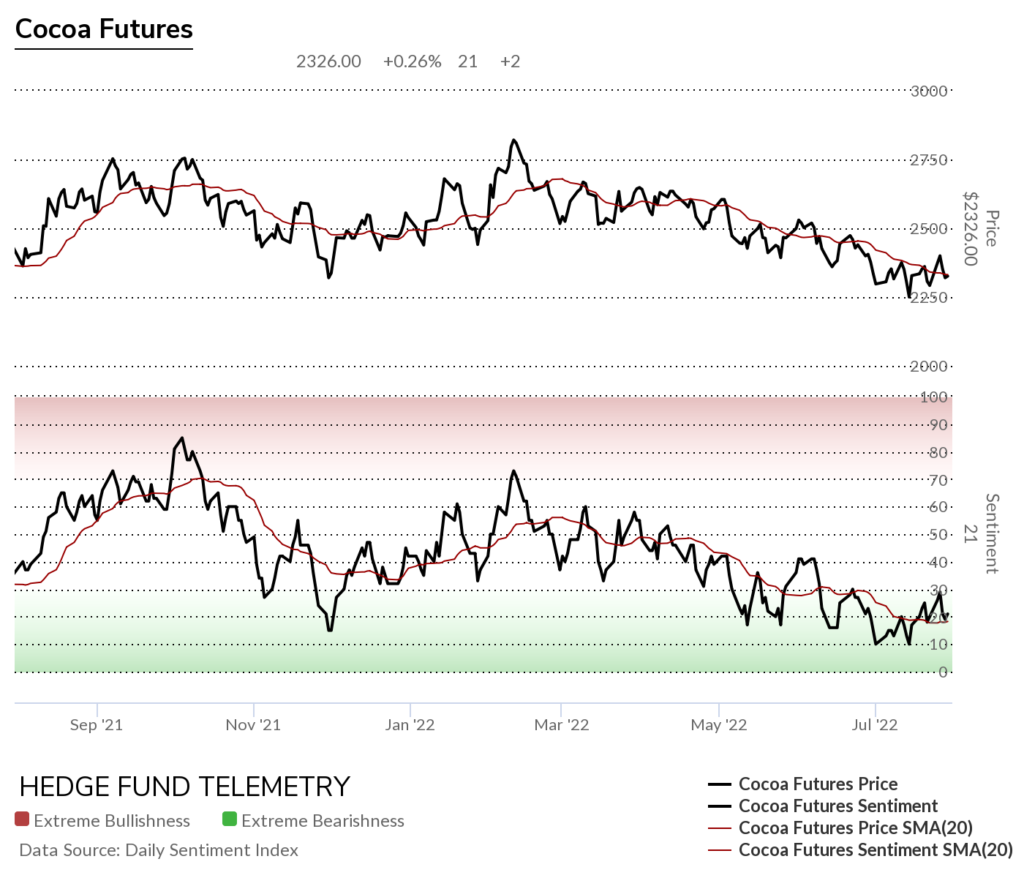

Cocoa futures daily lacking a price reversal above the 50 day

Cocoa futures bullish sentiment remains under pressure

Cocoa futures Commitment of Traders

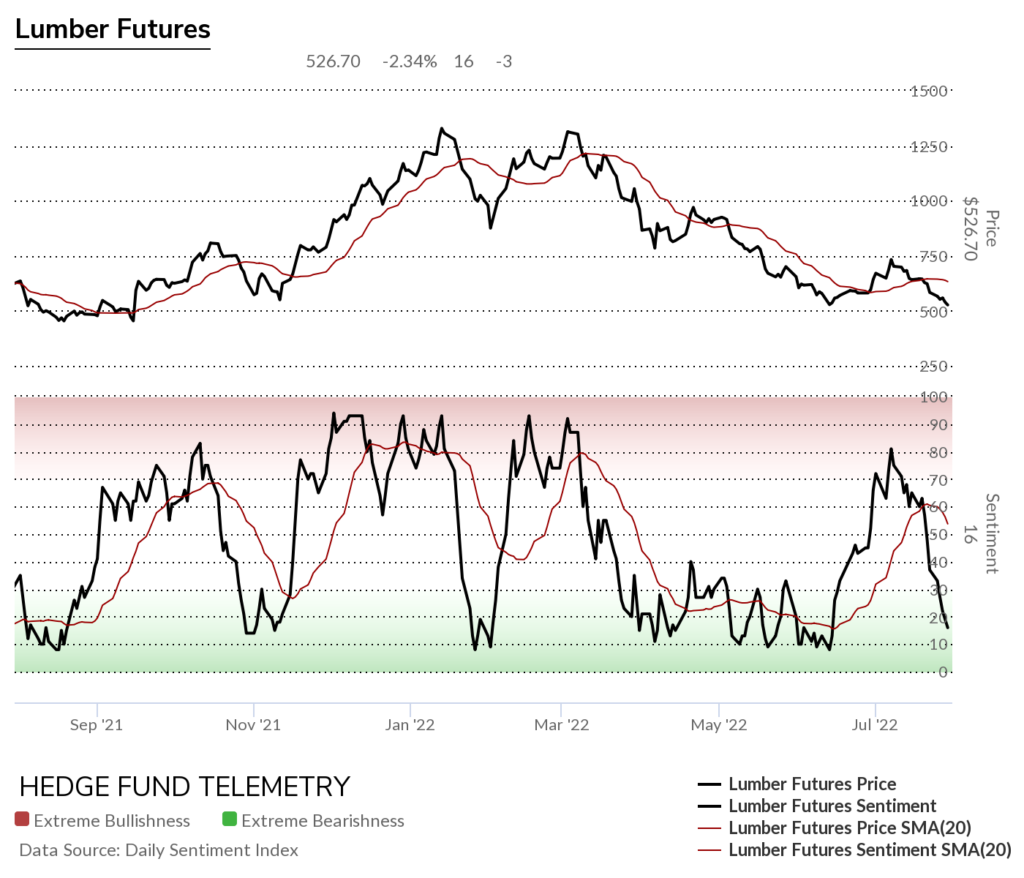

Lumber futures daily with another lower high. Watch for a break lower or turn up early this week – with the buy Setup 9

Lumber bullish sentiment getting back to the oversold levels – and can go lower

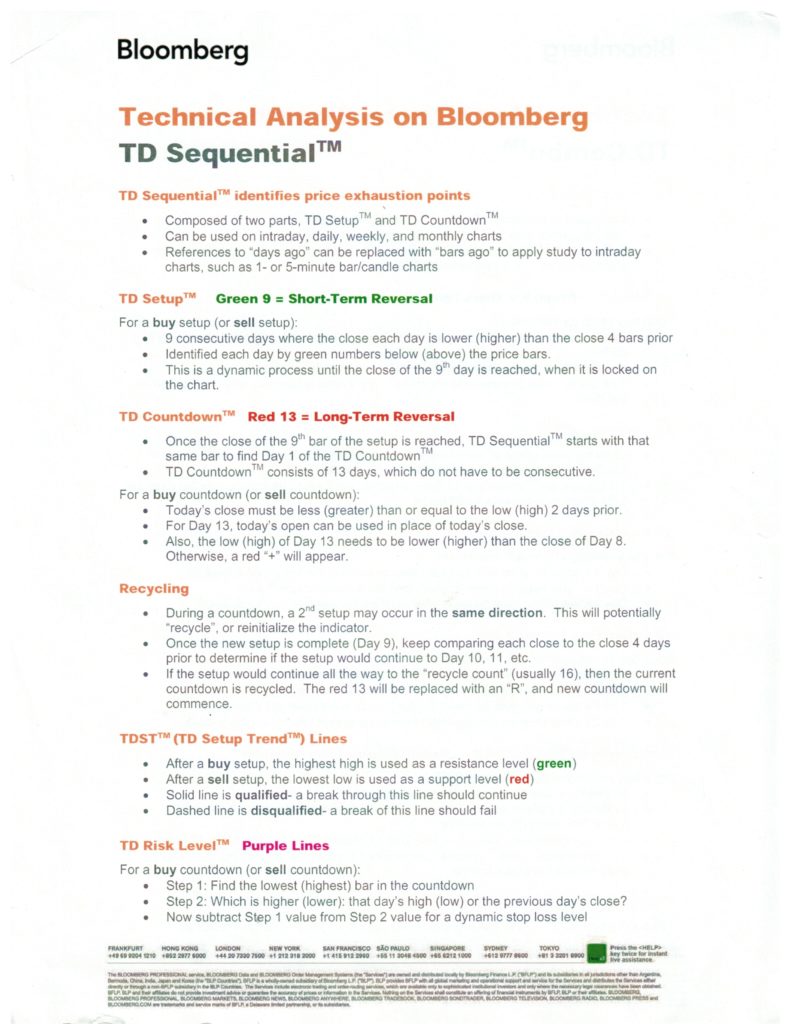

DeMark Sequential Basics

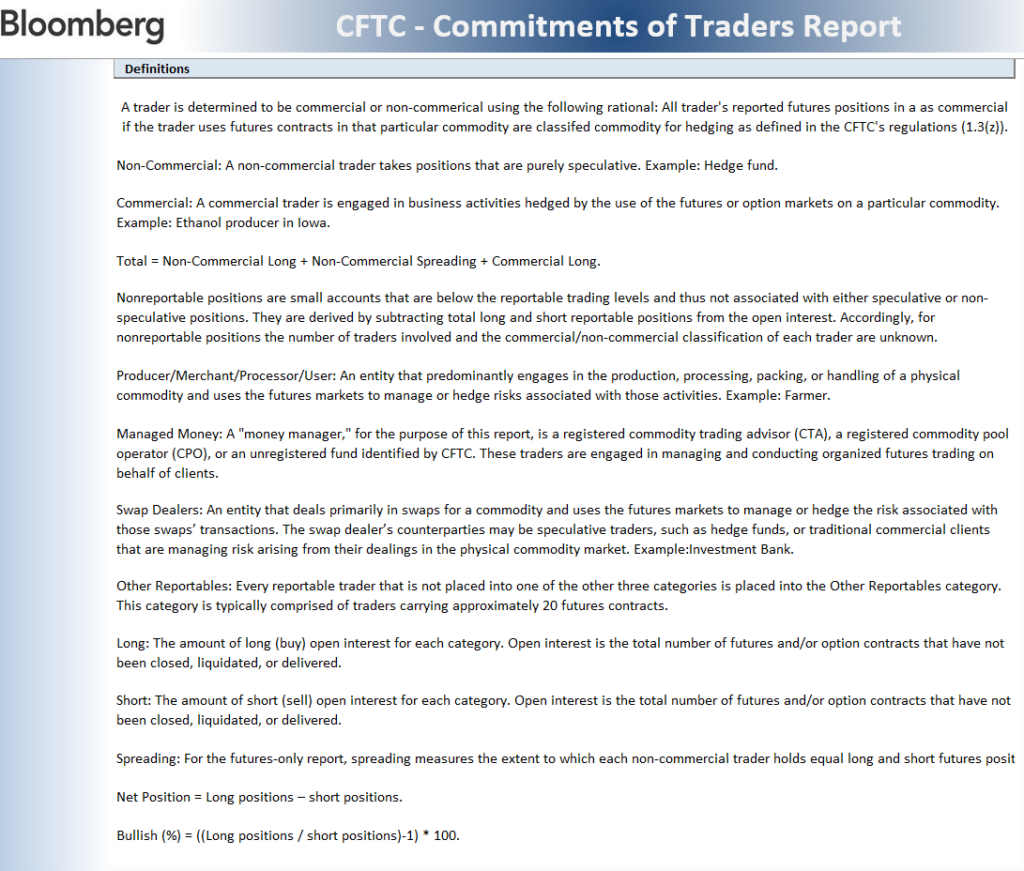

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS