Welcome to the Hedge Fund Telemetry Currency Weekly note! We are very excited about this weekly note that will be a good overview of the major currency markets using our charts with DeMark analysis, charts of bullish sentiment, and the weekly Commitment of Traders data. We have been urged for a while by our subscribers to launch this stand-alone research product offering. We also launched a Commodity Weekly with similar analysis. Both of these new research weekly reports will require a separate subscription and as a current subscriber to Hedge Fund Telemetry, we have discounted the notes by 50%. These are available “a la carte” for a yearly rate of $500 each however we are offering them at $250 each. For “small institutions” and “large institutions” subscribers these reports are included in your subscription.

If you would like to sign up now (which would be most appreciated) here is the link to find the offerings. Your discount will apply at checkout.

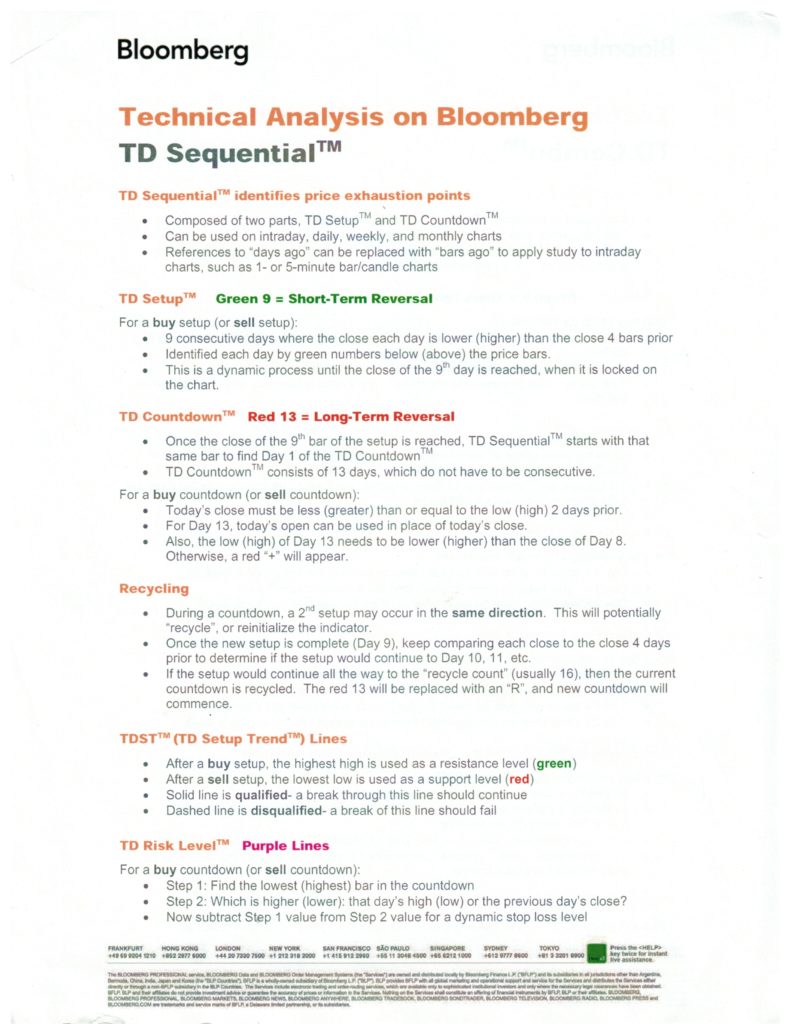

There are also detailed explanations of Commitment of Trader data and a DeMark Sequential primer at the bottom of this note.

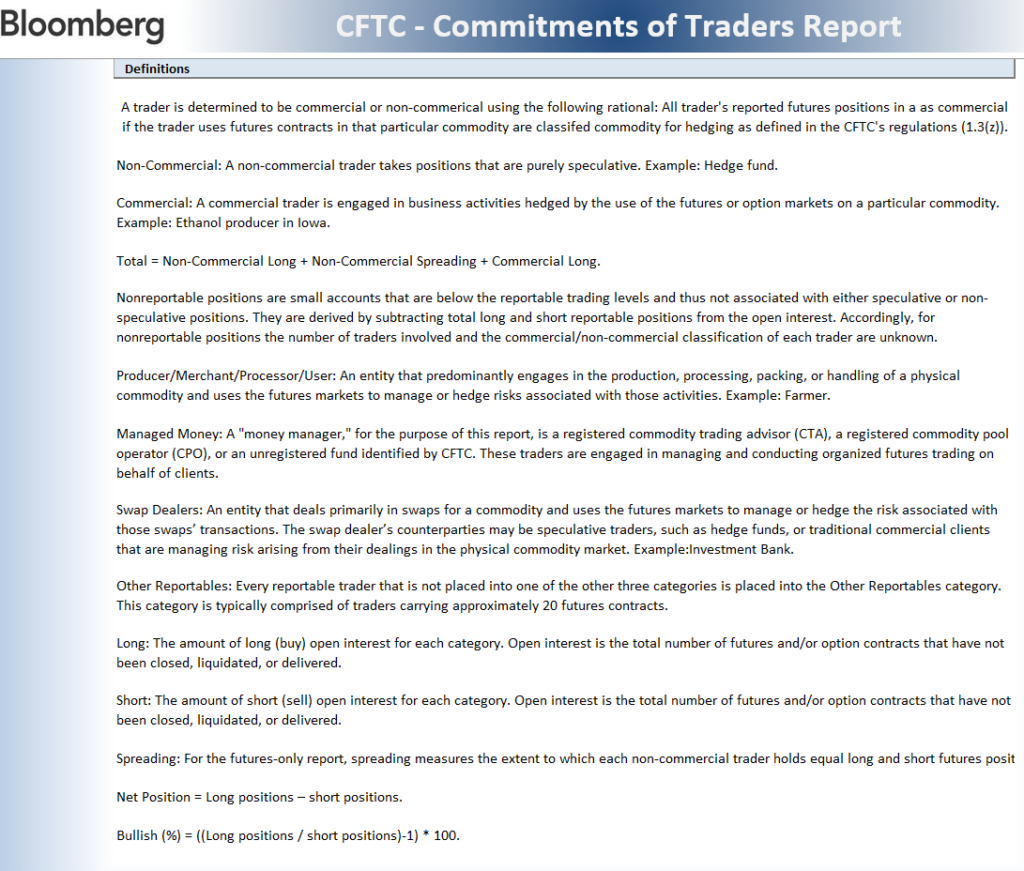

Commitment of Traders – The Basics

The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different types of traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the actual producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are thought of as the “smart money” since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, is composed of hedge funds, mutual funds, and commodity trading advisors. These are speculative traders who have no interest in the underlying physical commodity business.

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation please see the bottom of this note.

Highlights and themes

Another week of US Dollar risk haven bid.

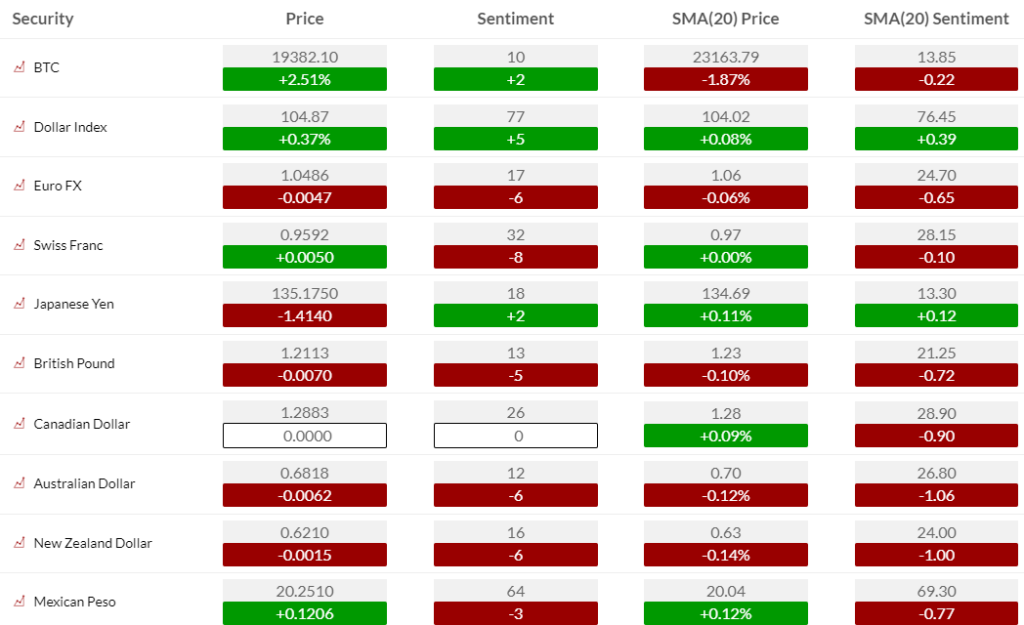

Currency Sentiment Overview

Currency sentiment highlights

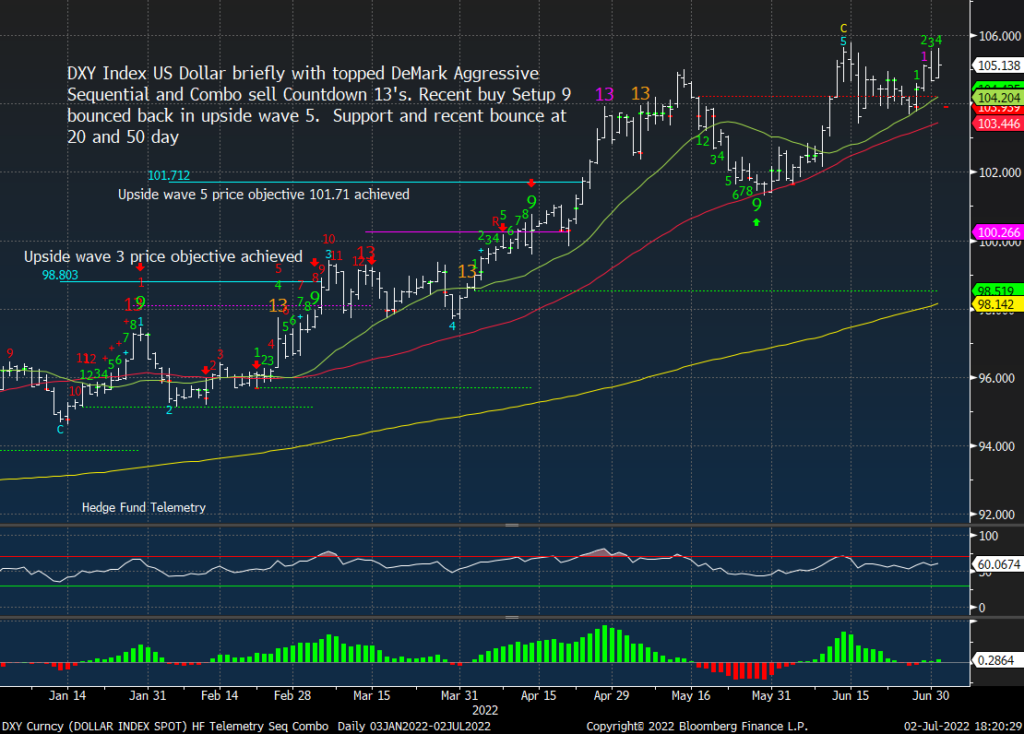

US Dollar Indexes

DXY US Dollar Index daily continues to remain the safe haven

DXY US Dollar Index weekly did get the sell Countdown 13’s with some residual momentum and remains under the DeMark risk level of 106.63

Bloomberg US Dollar Index daily

Bloomberg US Dollar Index weekly

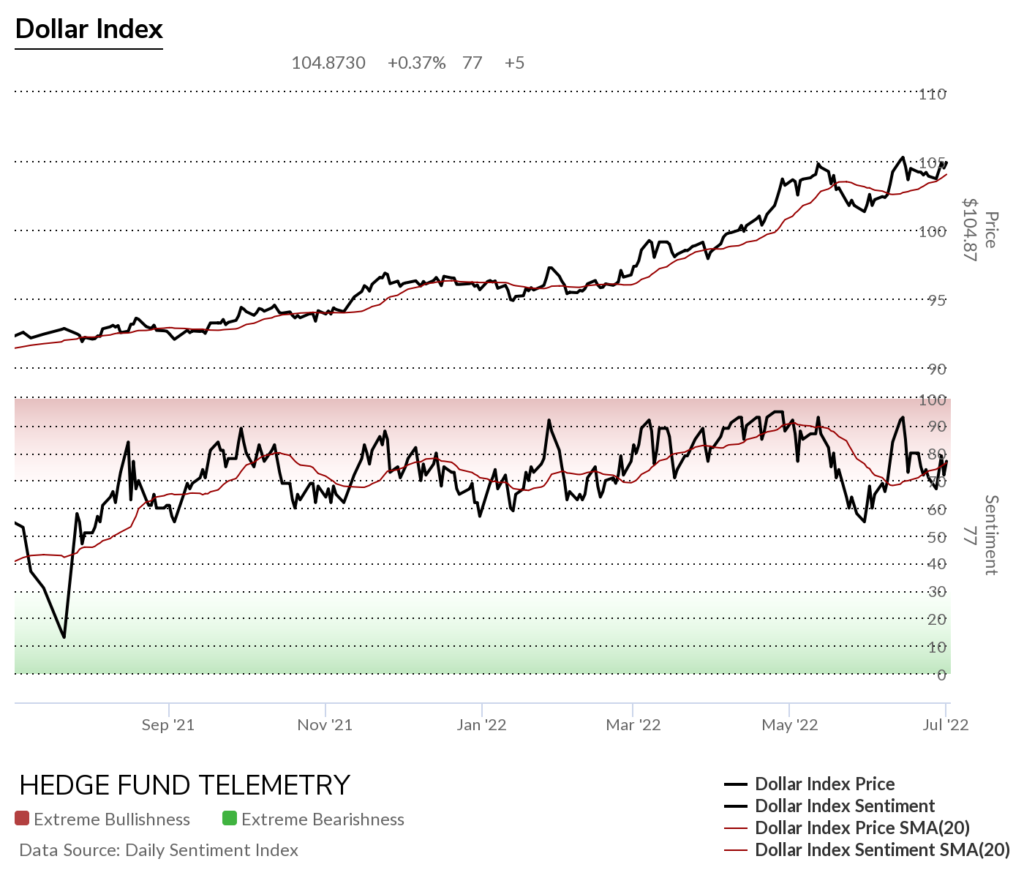

US Dollar bullish sentiment continues to hold in the elevated zone over 70%

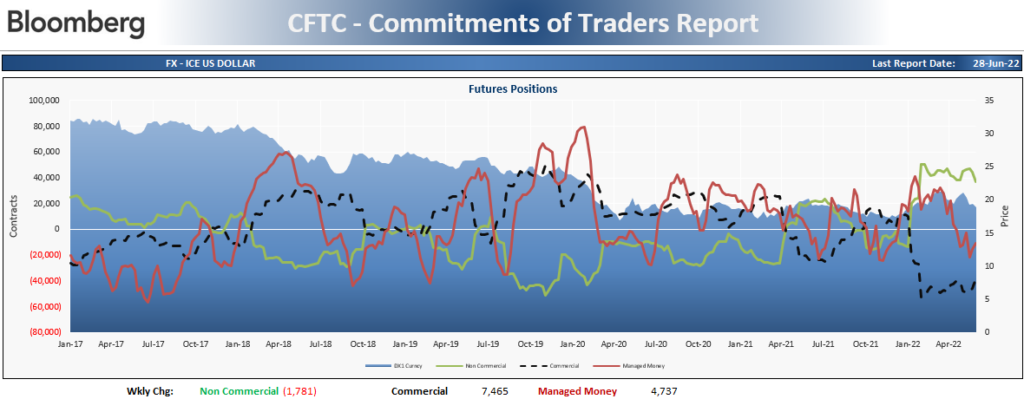

US Dollar Commitment of Traders shows speculators decreasing long exposure

crypto

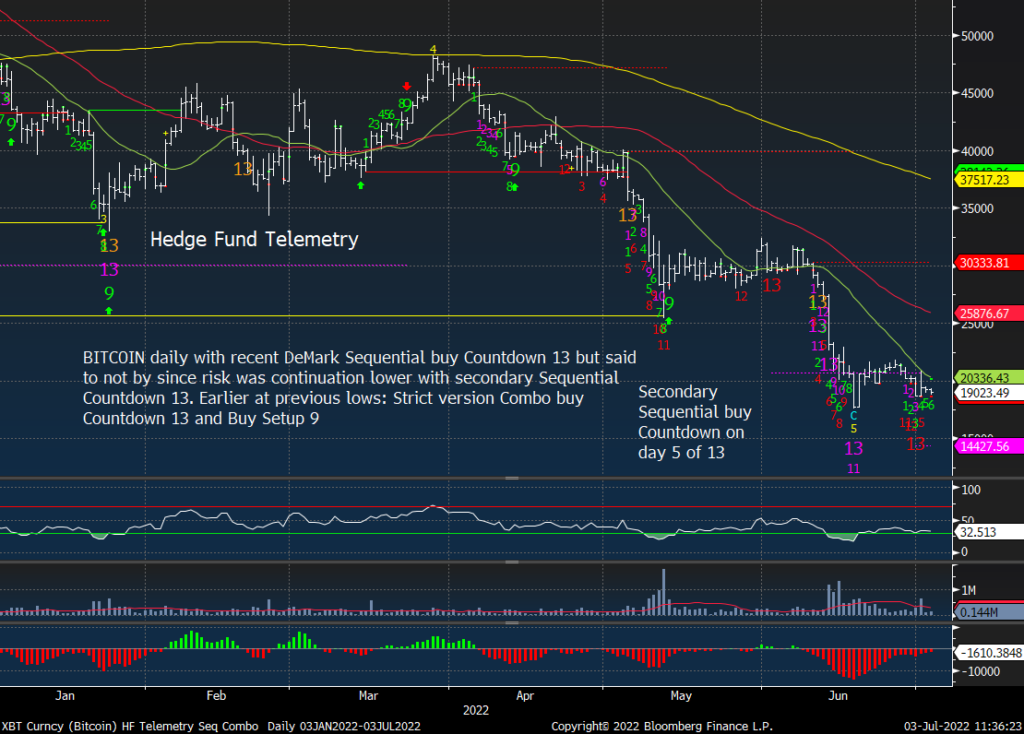

Both Bitcoin and Ethereum have more risk lower on the daily charts with secondary DeMark Countdowns in progress while there have been some weekly buy Countdown 13s in play however there has been no reversal response.

Major USD Crosses

EURUSD Euro / US Dollar continues to make lower highs and can’t seem to turn

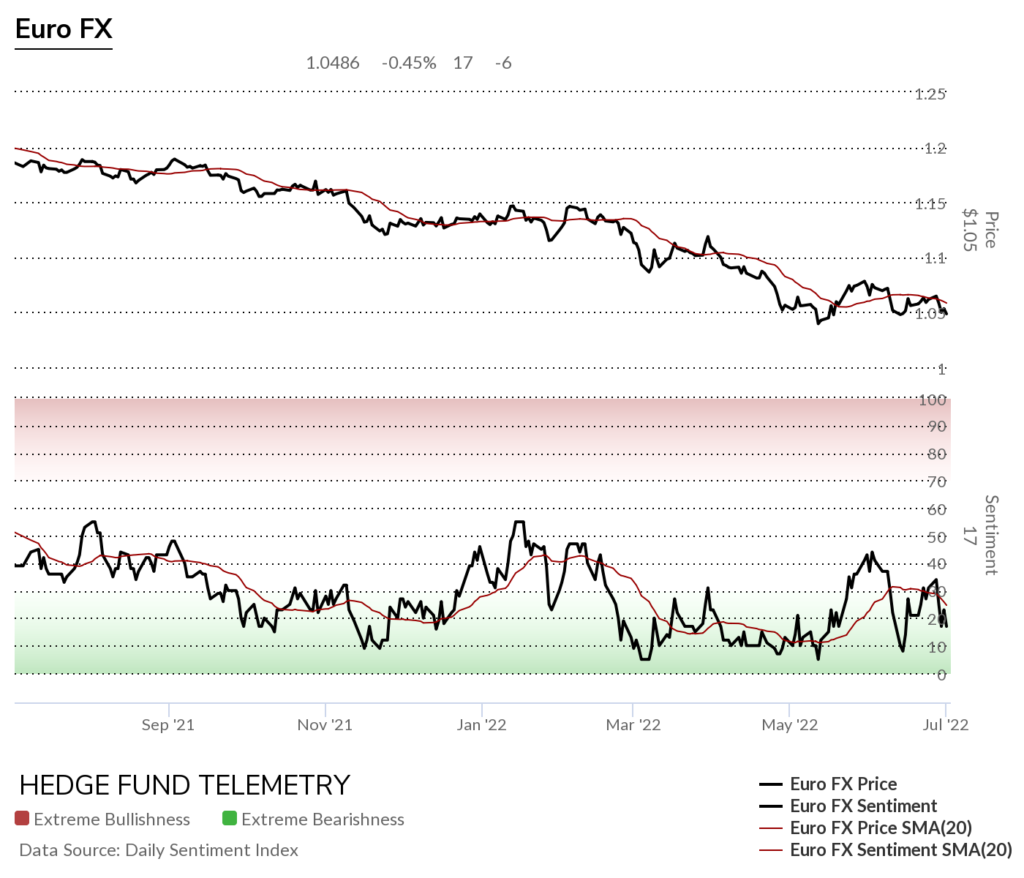

Euro bullish sentiment remains under pressure

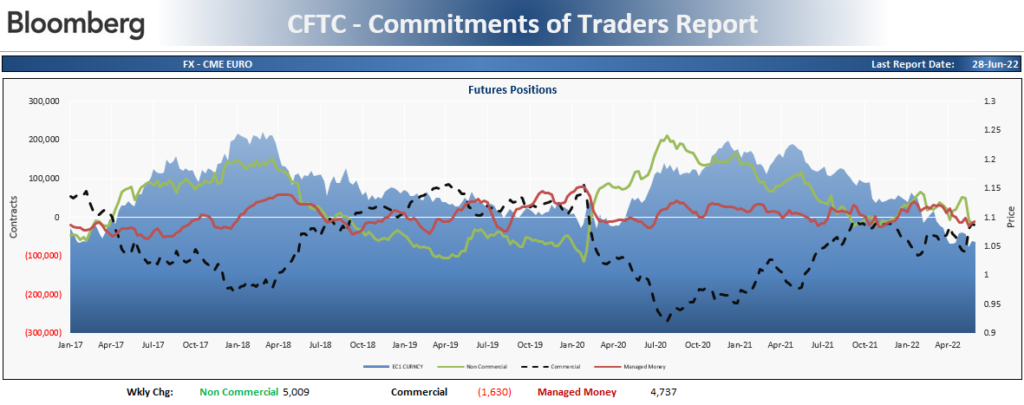

Euro Commitment of Traders shows speculators increasing long exposure barely

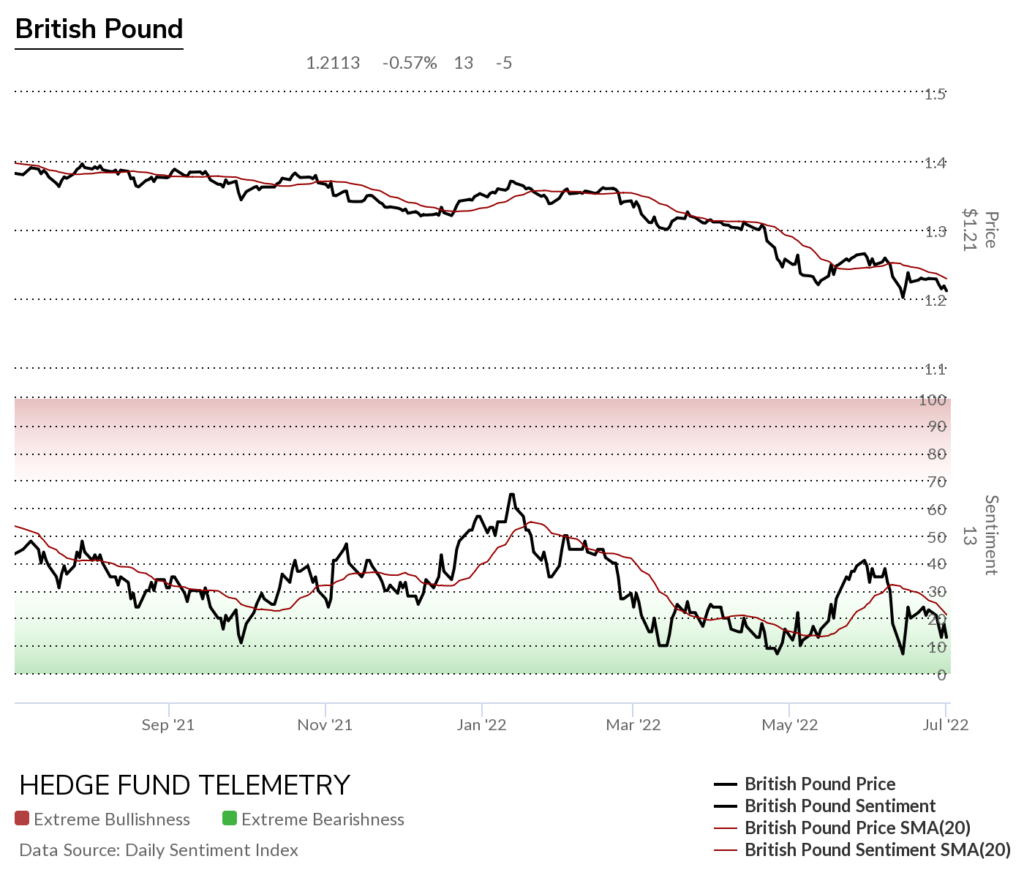

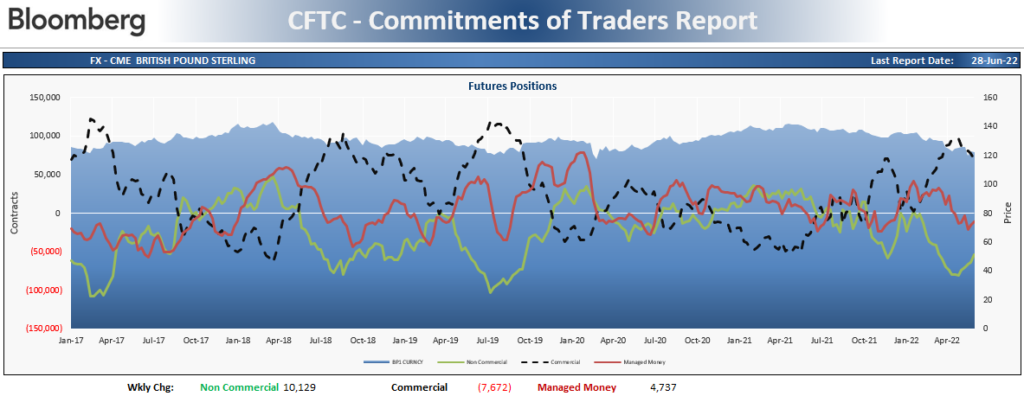

GBPUSD British Pound Sterling / US Dollar also continued trending weaker

British Pound Sterling bullish sentiment remains under pressure

British Pound Sterling Commitment of Traders shows speculators decreasing SHORT exposure

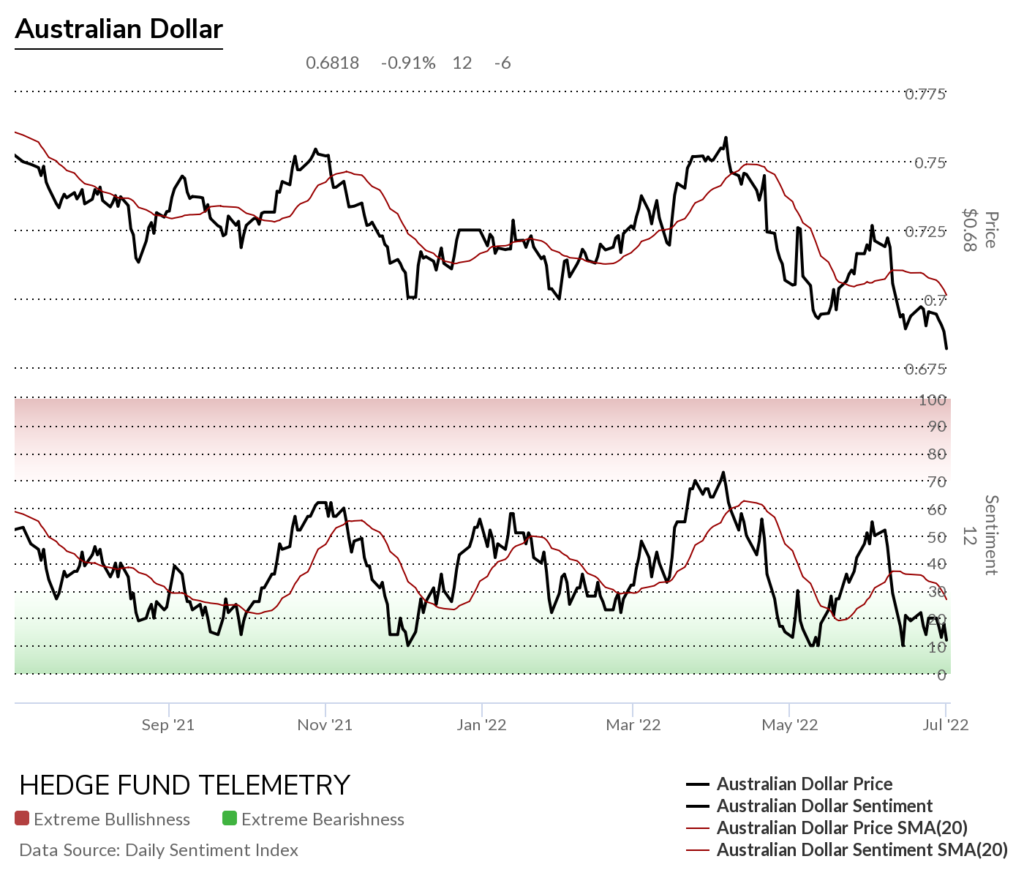

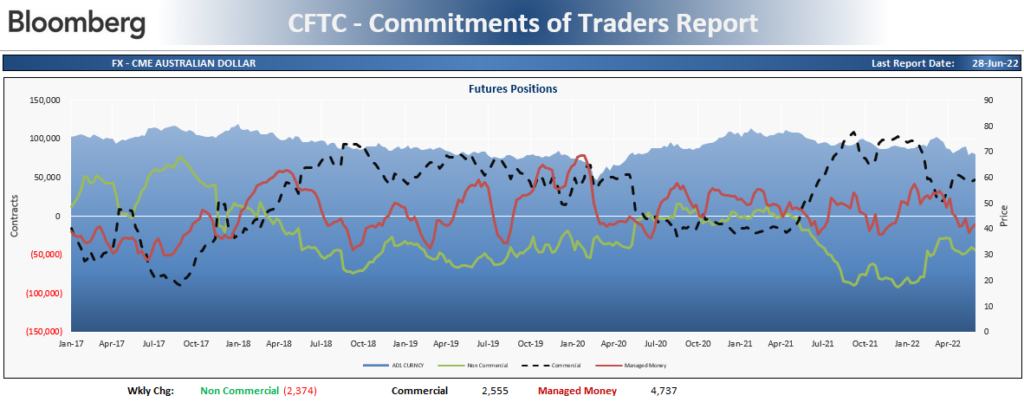

AUDUSD Australian Dollar / US Dollar with new lows

Australian Dollar bullish sentiment remains under pressure

Australian Dollar Commitment of Traders shows speculators increasing SHORT exposure

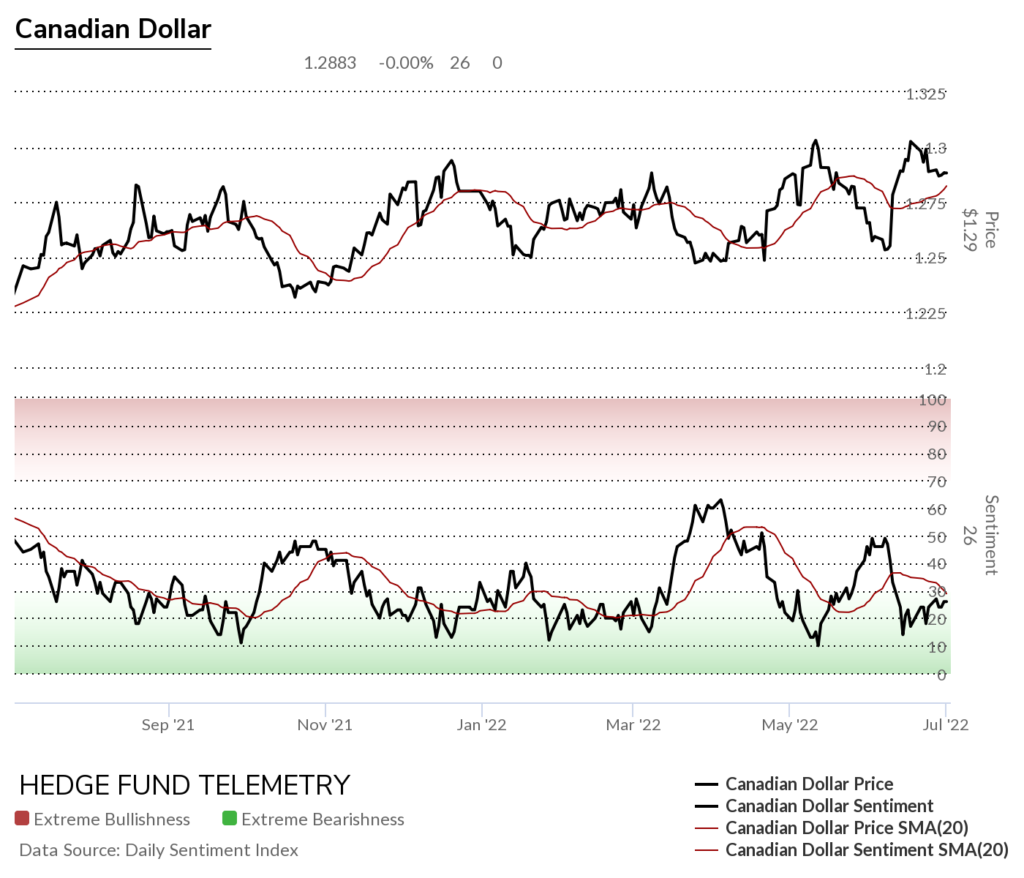

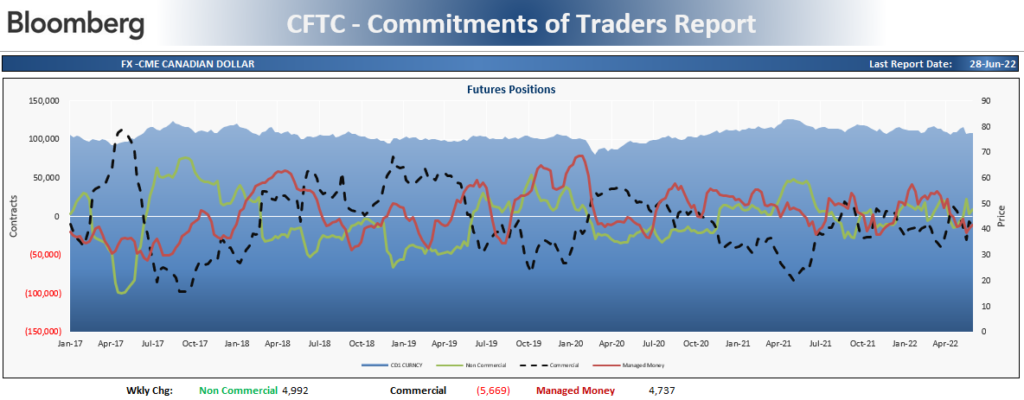

USDCAD US Dollar / Canadian Dollar

Canadian Dollar bullish sentiment remains under pressure

Canadian Dollar Commitment of Traders shows speculators increasing long exposure

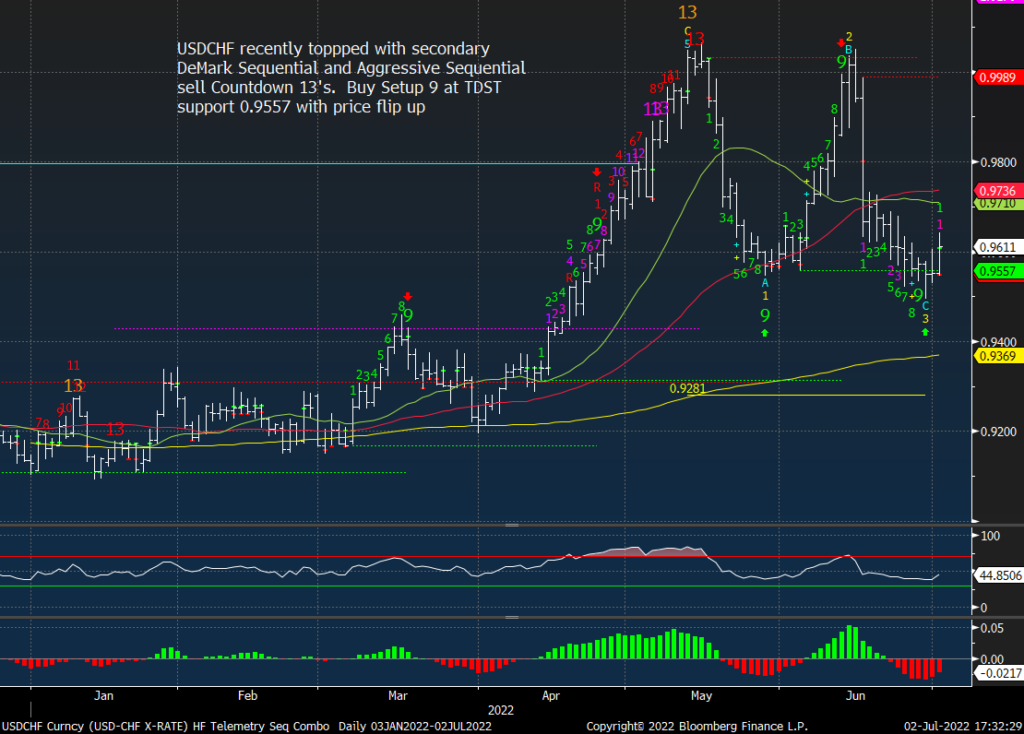

USDCHF US Dollar / Swiss Franc now with buy Setup 9

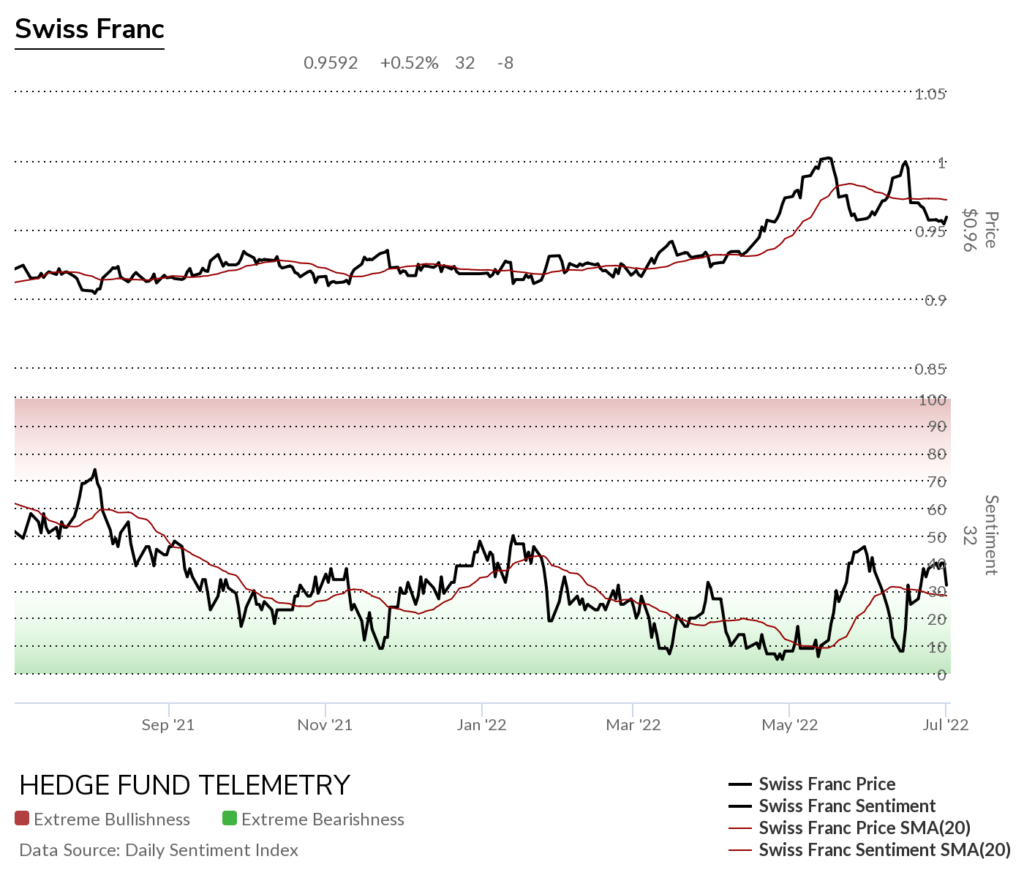

Swiss Franc bullish sentiment stalling

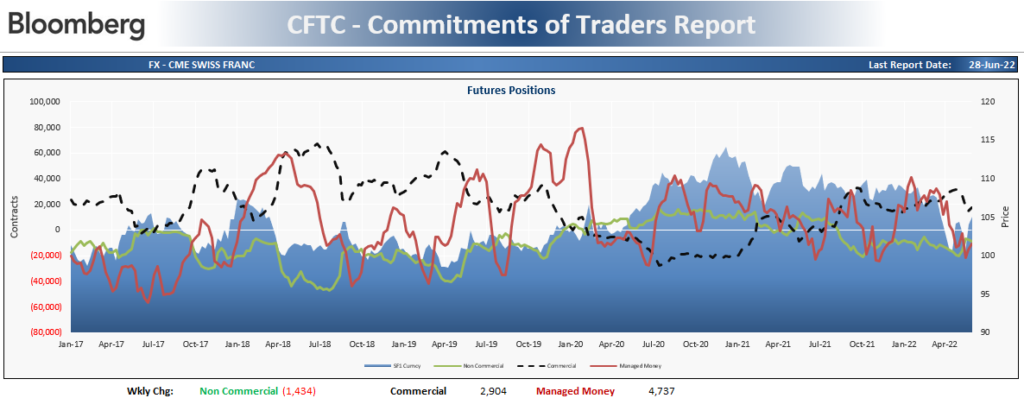

Swiss Franc Commitment of Traders shows speculators increasing SHORT exposure

RISK On Risk Off

This cross is often used as a risk-on / risk-off indicator

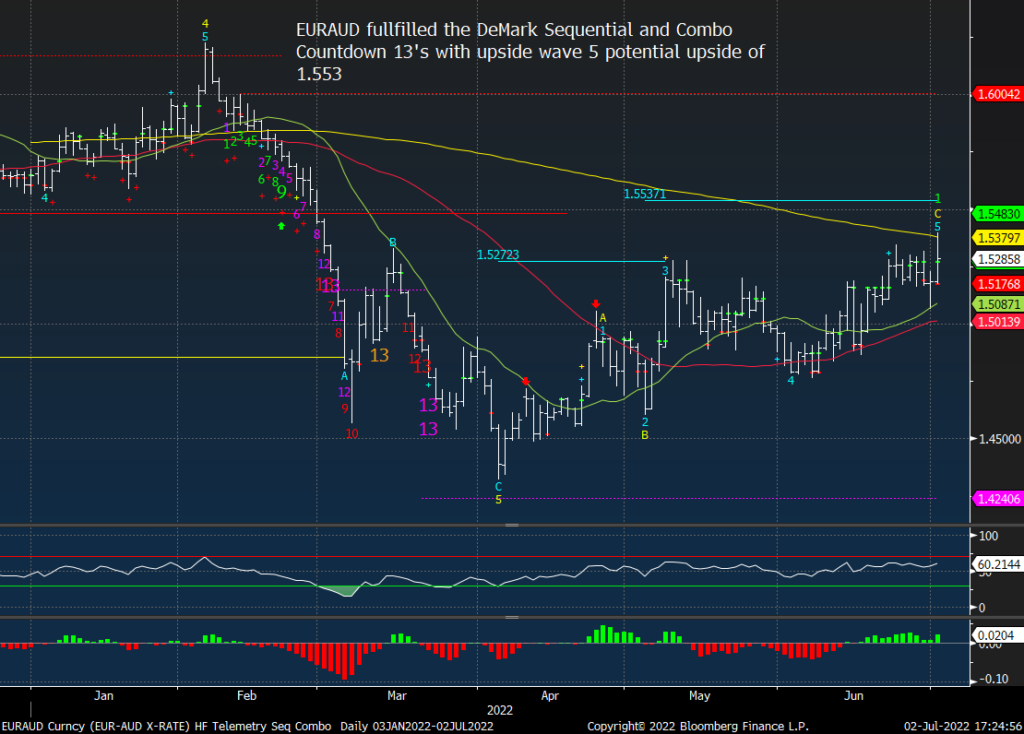

EURAUD Euro / Australian Dollar

Three major Yen crosses

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

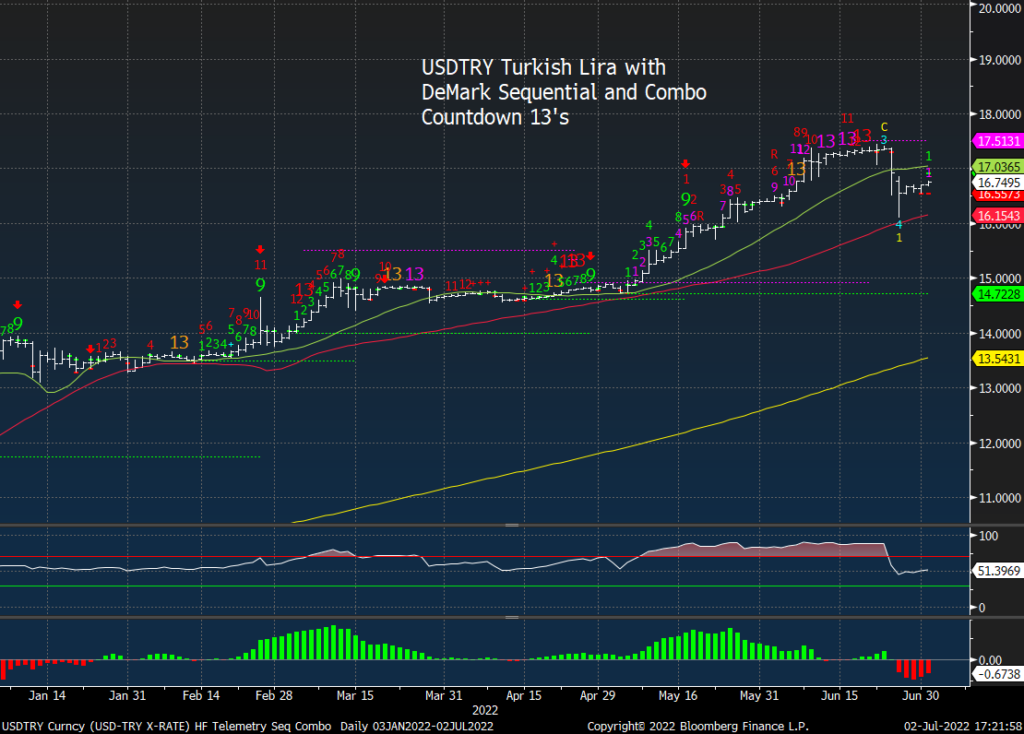

USDTRY US Dollar / Turkish Lira

USDBRL US Dollar / Brazilian Real

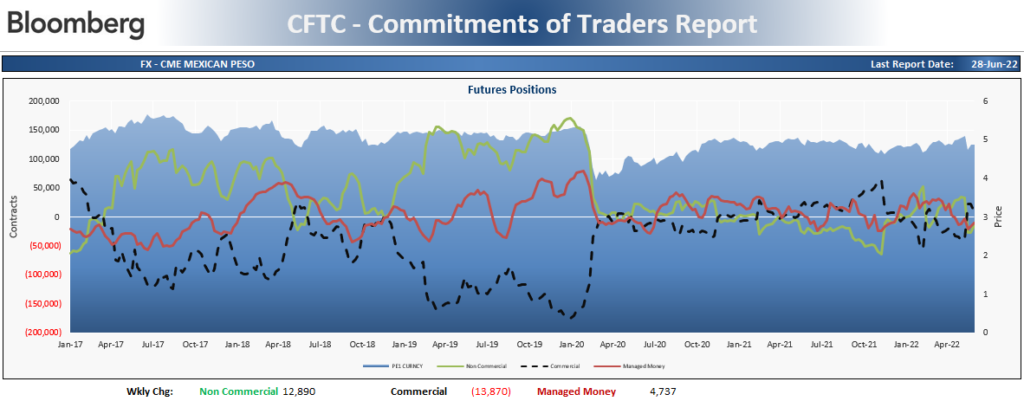

USDMXN US Dollar / Mexican Peso

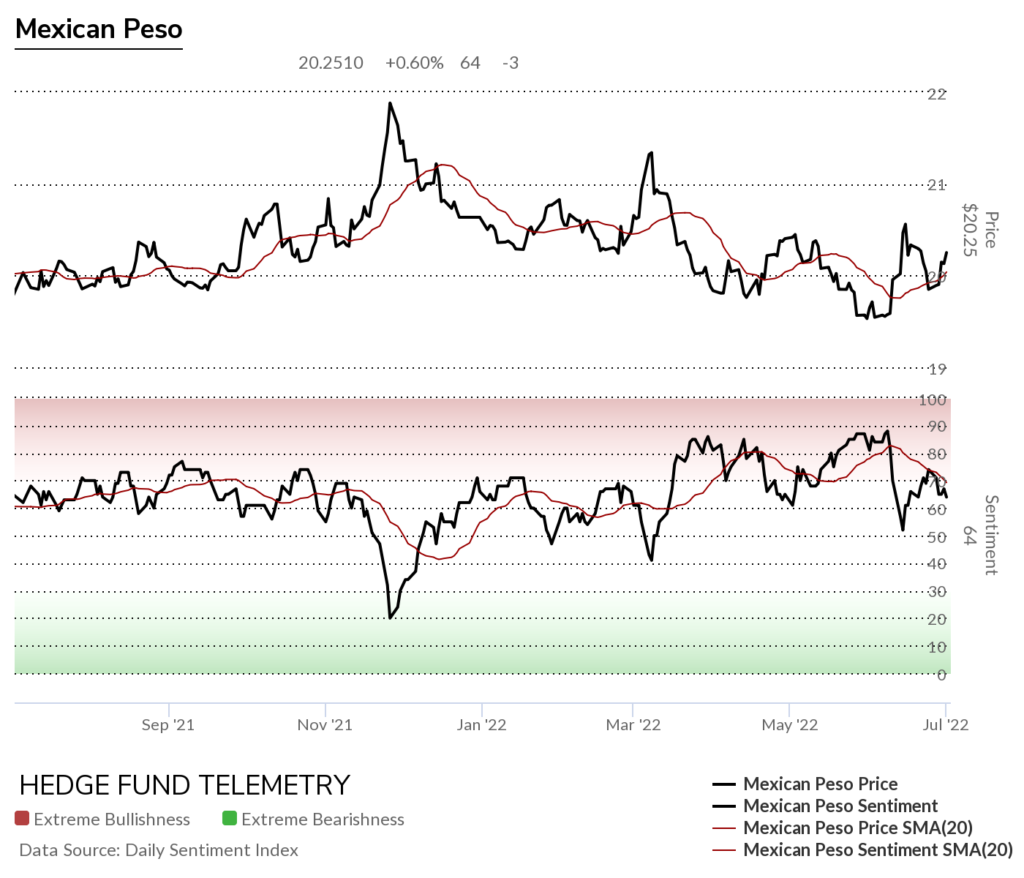

Mexican Peso bullish sentiment made a lower high last week

Mexican Peso Commitment of Traders shows speculators decreasing SHORT exposure

USDZAR US Dollar / South African Rand

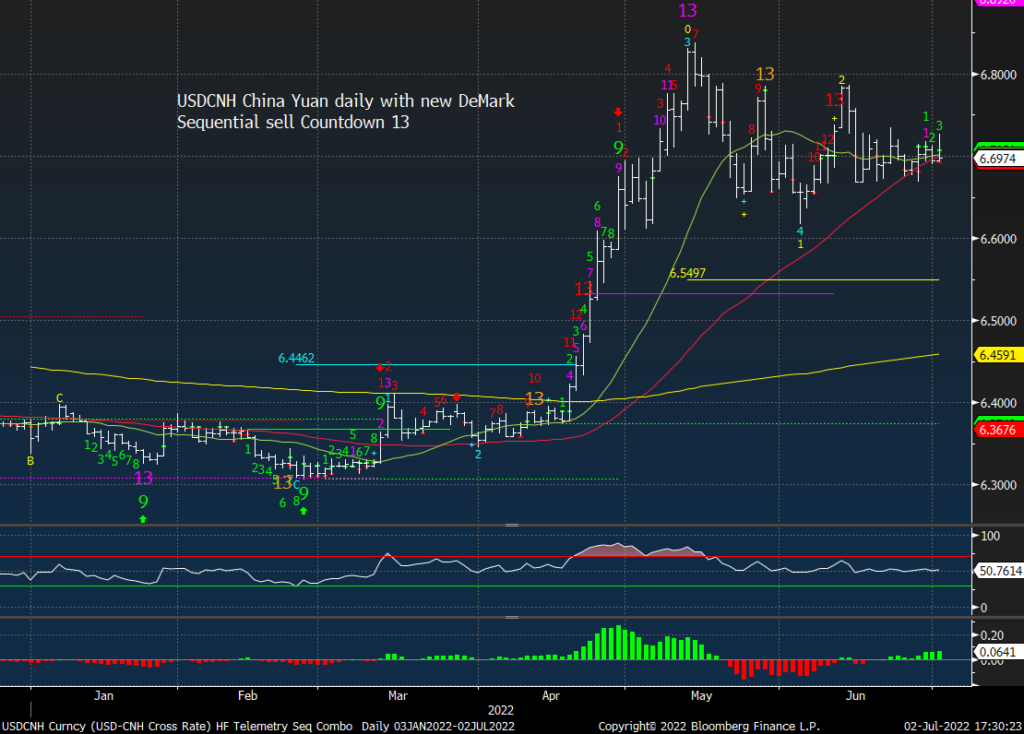

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan)

DeMark Sequential Basics from Bloomberg

More detailed Commitment of Traders explanation