Highlights and themes

There are two main things traders are watching closest. First, if the US Dollar’s recent weakness will continue as it’s been here before and then the dollar reversed. Second, will the Yen continue to increase, and considering this would be negative risk assets will traders take notice?

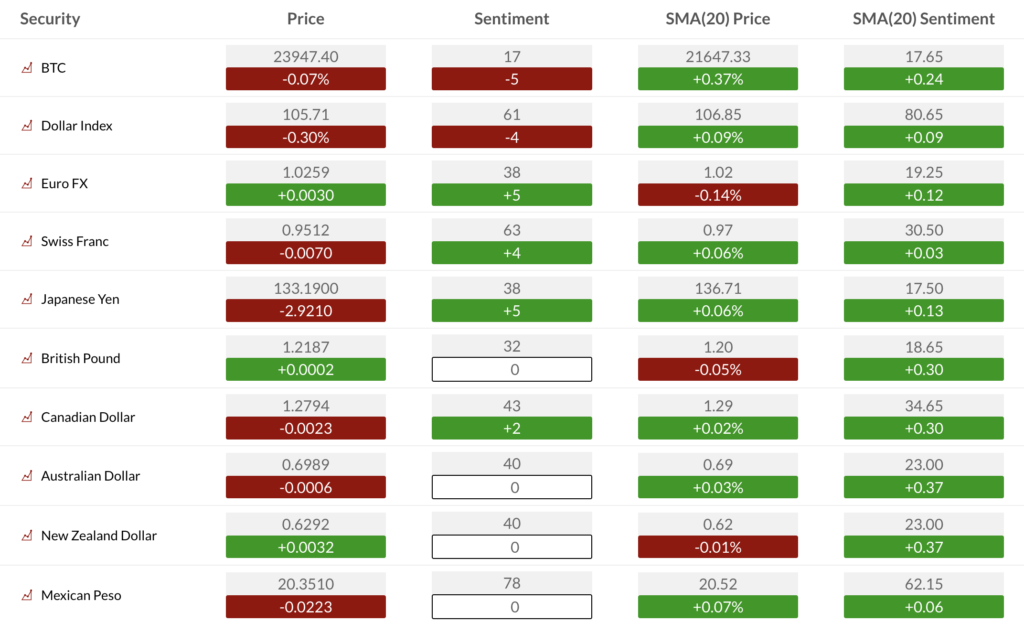

Currency Sentiment Overview

Currency sentiment highlights show the US Dollar sentiment nearing the low end of the one-year range. Will it finally break?

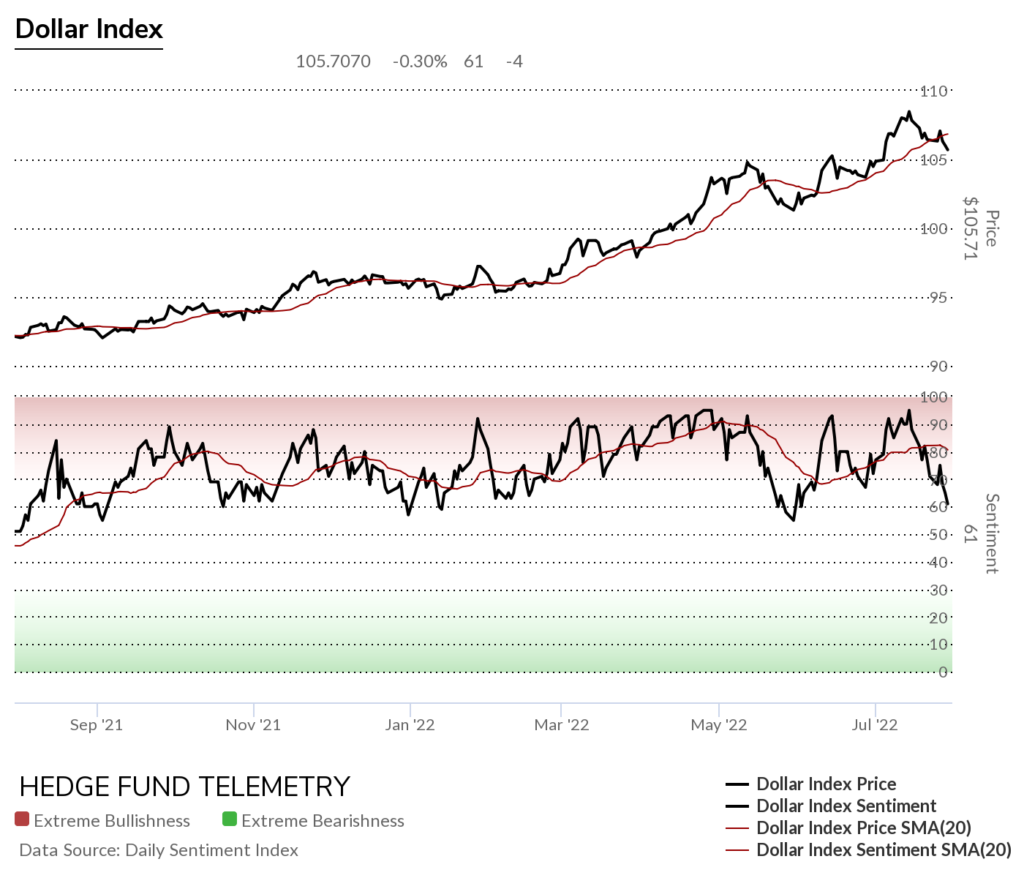

US Dollar Indexes

DXY US Dollar Index daily

DXY US Dollar Index weekly

US Dollar bullish sentiment nearing the low of the one year range

US Dollar Commitment of Traders shows speculators increasing long exposure

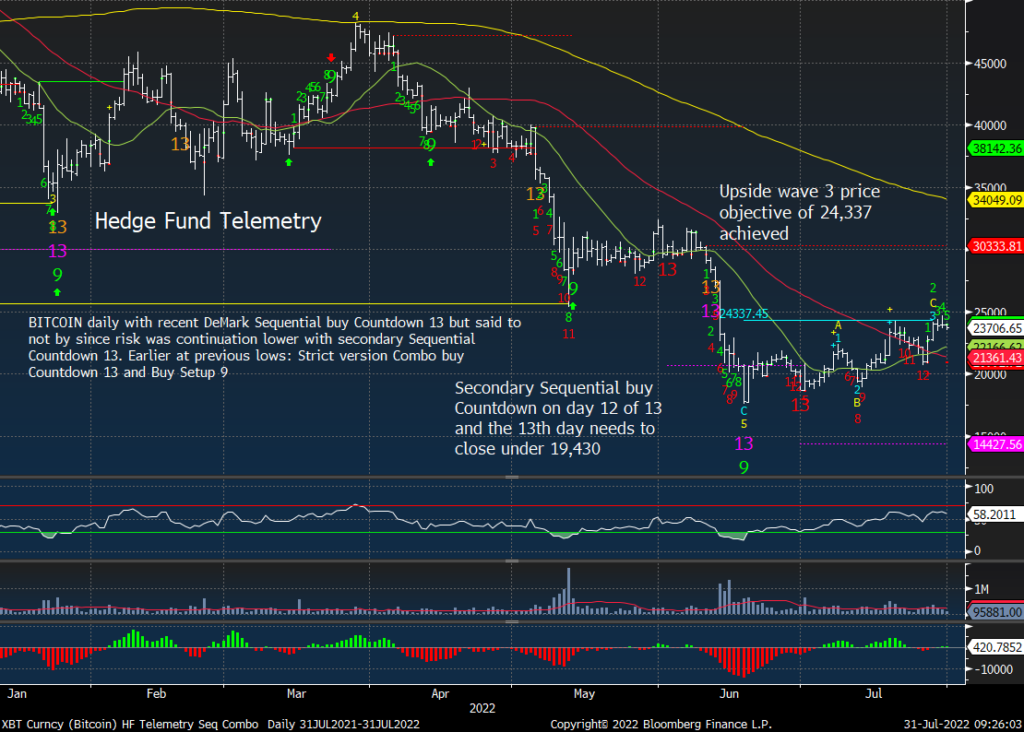

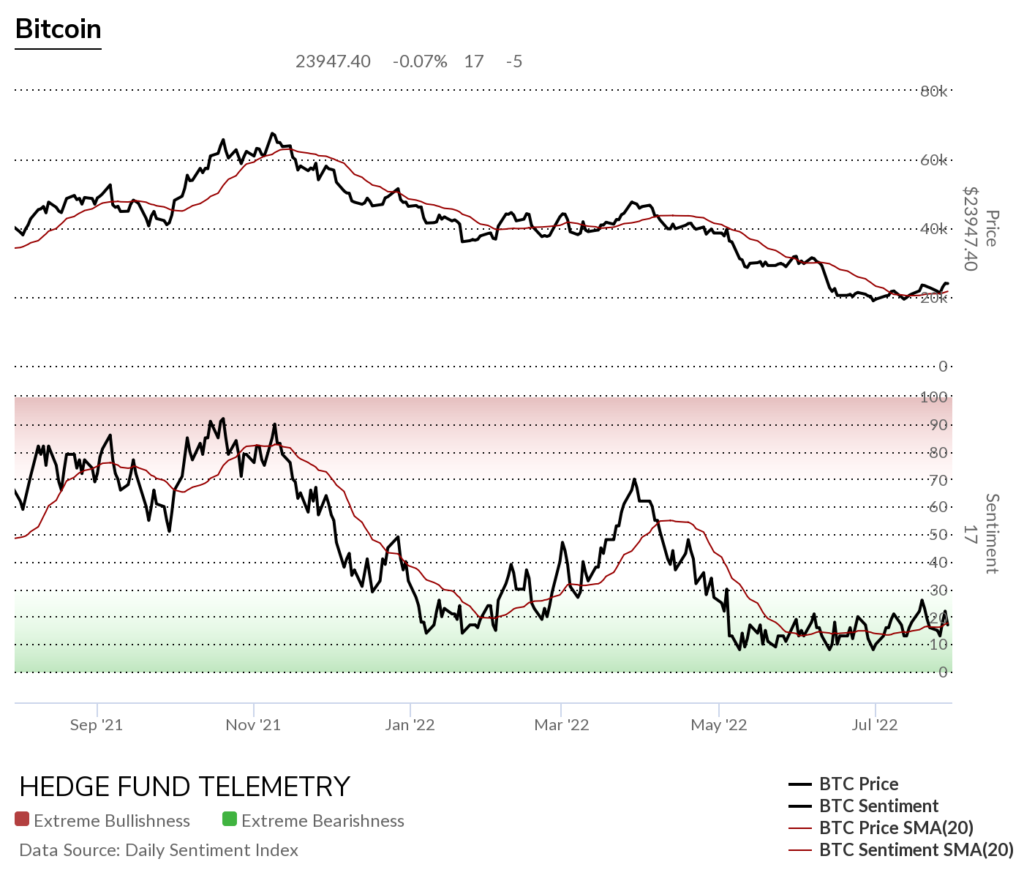

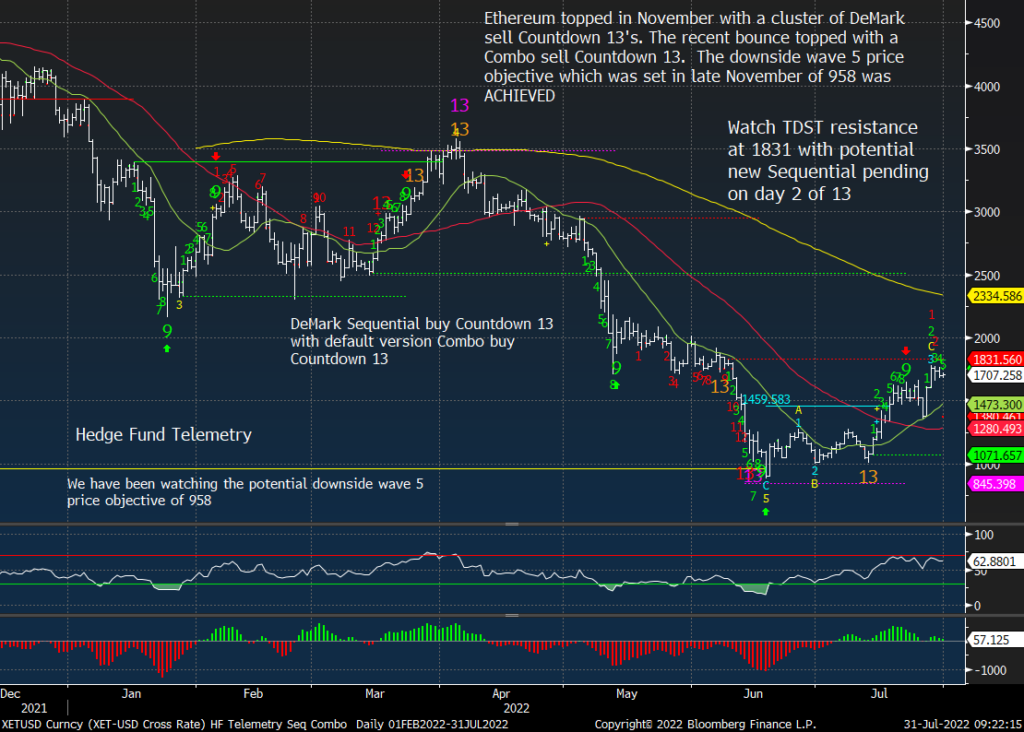

Bitcoin and Ethereum

Bitcoin Daily

Bitcoin Weekly needs a 13 week closing high to qualify the wave 4 of 5

Bitcoin Bullish Sentiment remains under pressure

Ethereum Daily has several resistance levels – the TDST line and the big round number 2000

Ethereum Weekly also on watch for the wave 4 of 5

Major USD Crosses

EURUSD Euro / US Dollar

Euro bullish sentiment making a move just like the US Dollar. A lot will matter with this week’s action.

Euro Commitment of Traders

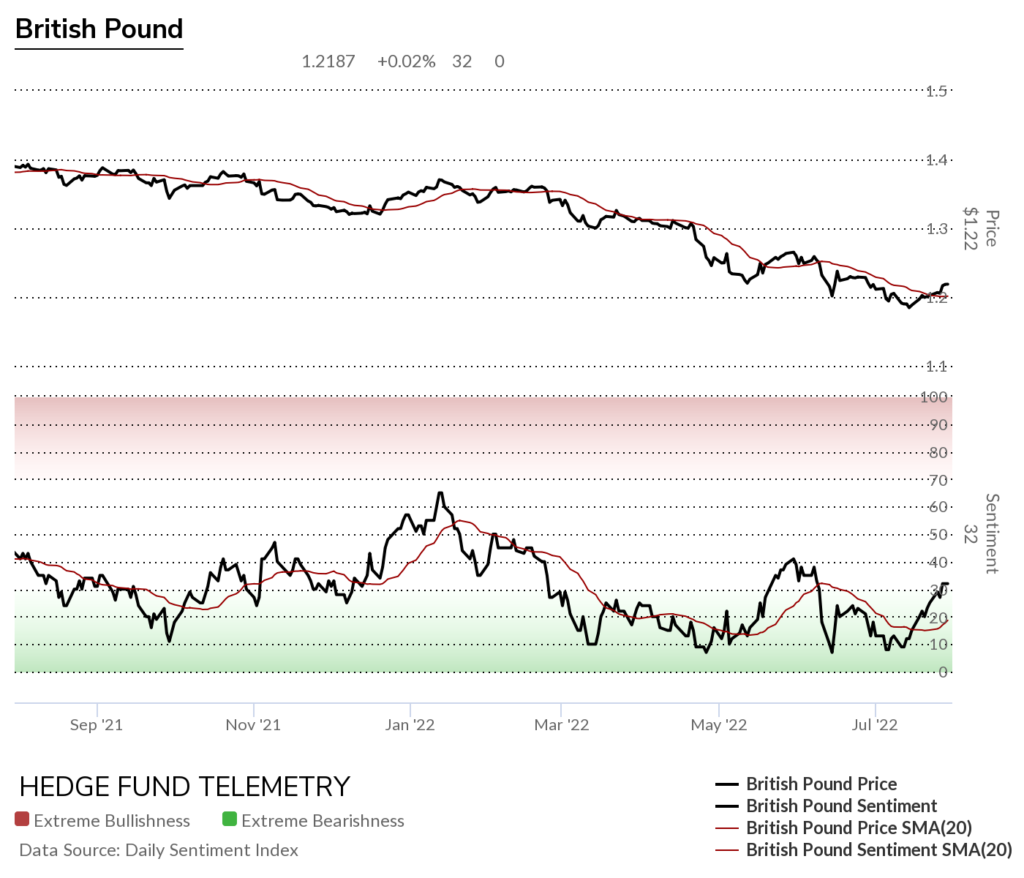

GBPUSD British Pound Sterling / US Dollar

British Pound Sterling bullish sentiment trying to lift as well

British Pound Sterling Commitment of Traders

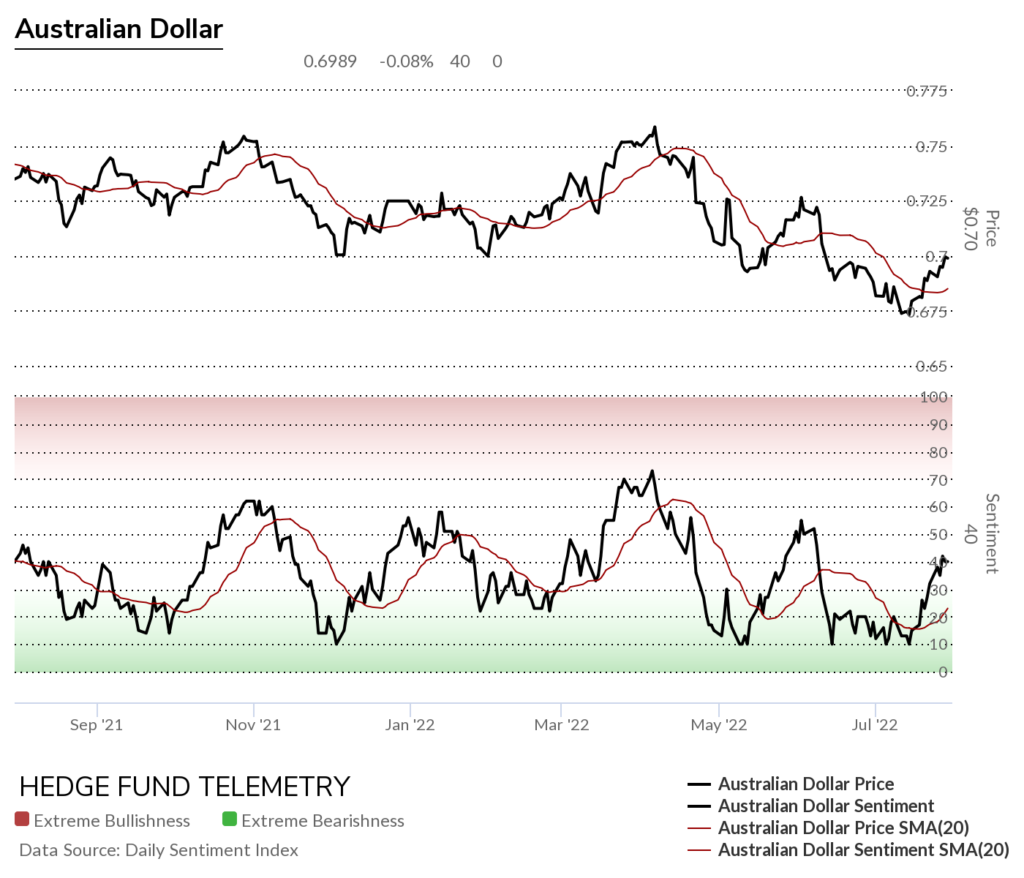

AUDUSD Australian Dollar / US Dollar

Australian Dollar bullish sentiment stalled late in the week with a lower high

Australian Dollar Commitment of Traders

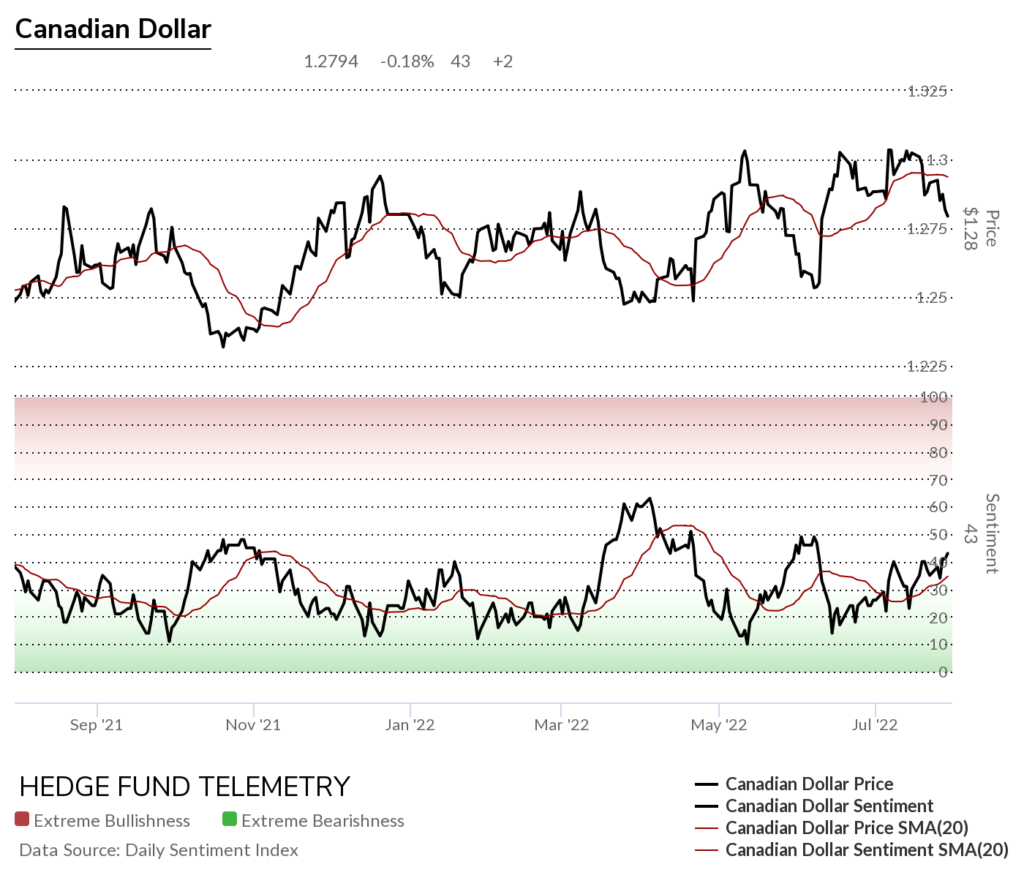

USDCAD US Dollar / Canadian Dollar

Canadian Dollar bullish sentiment has 50% resistance to watch

Canadian Dollar Commitment of Traders

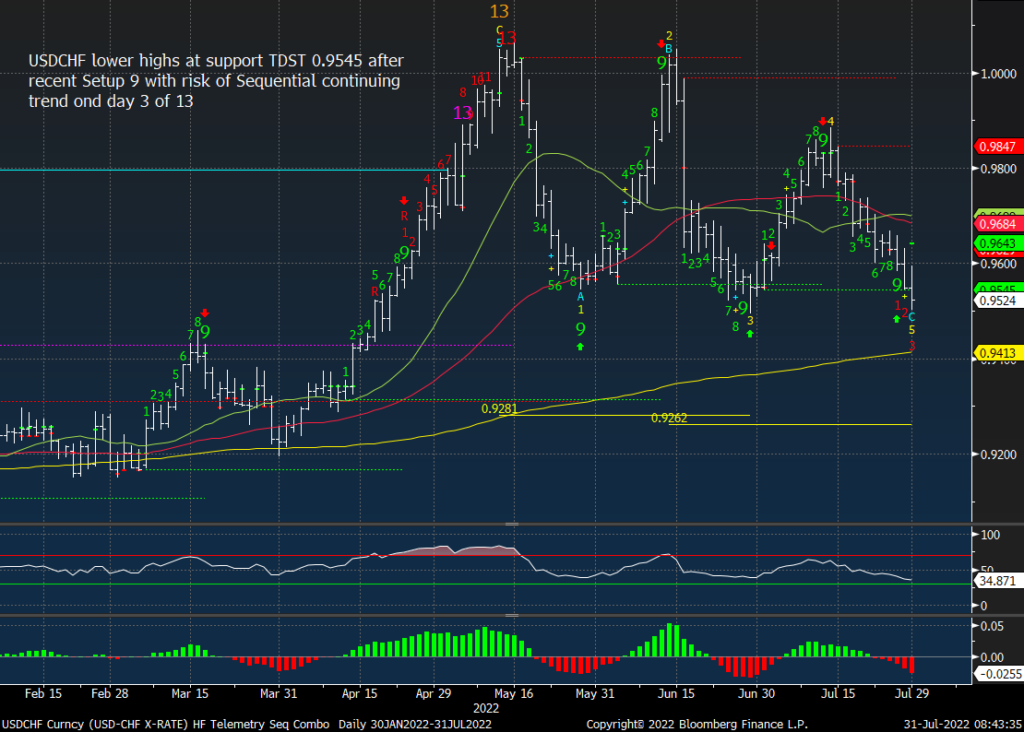

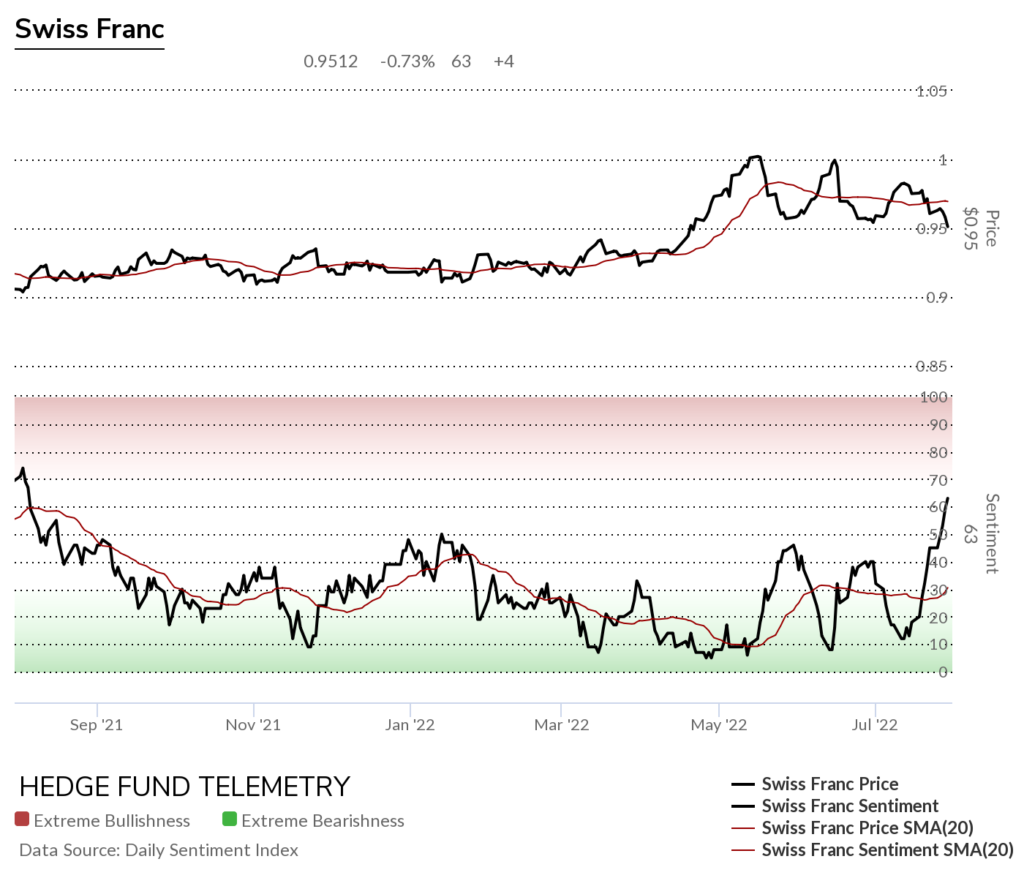

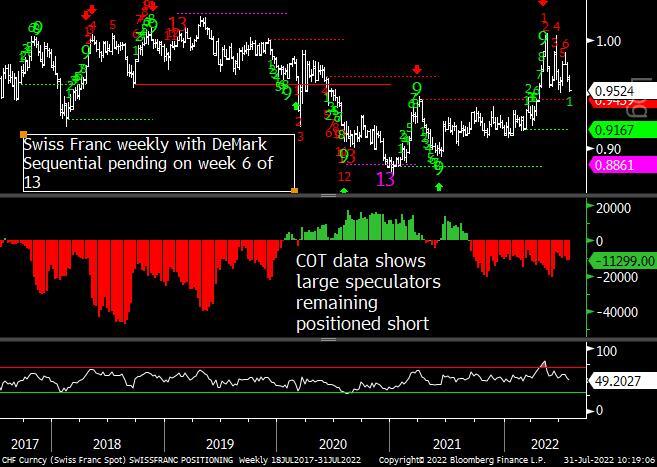

USDCHF US Dollar / Swiss Franc

Swiss Franc bullish sentiment spiking with a new high in sentiment

Swiss Franc Commitment of Traders

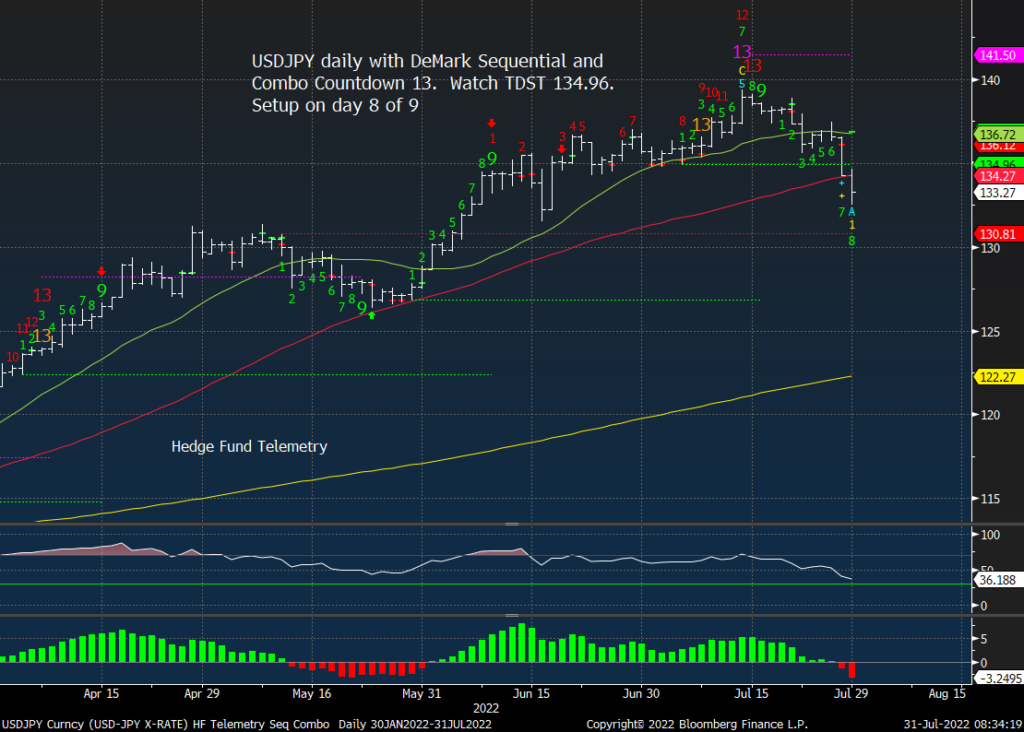

JPY/USD Japanese Yen broke hard this week. Watch for the Setup 9 tomorrow

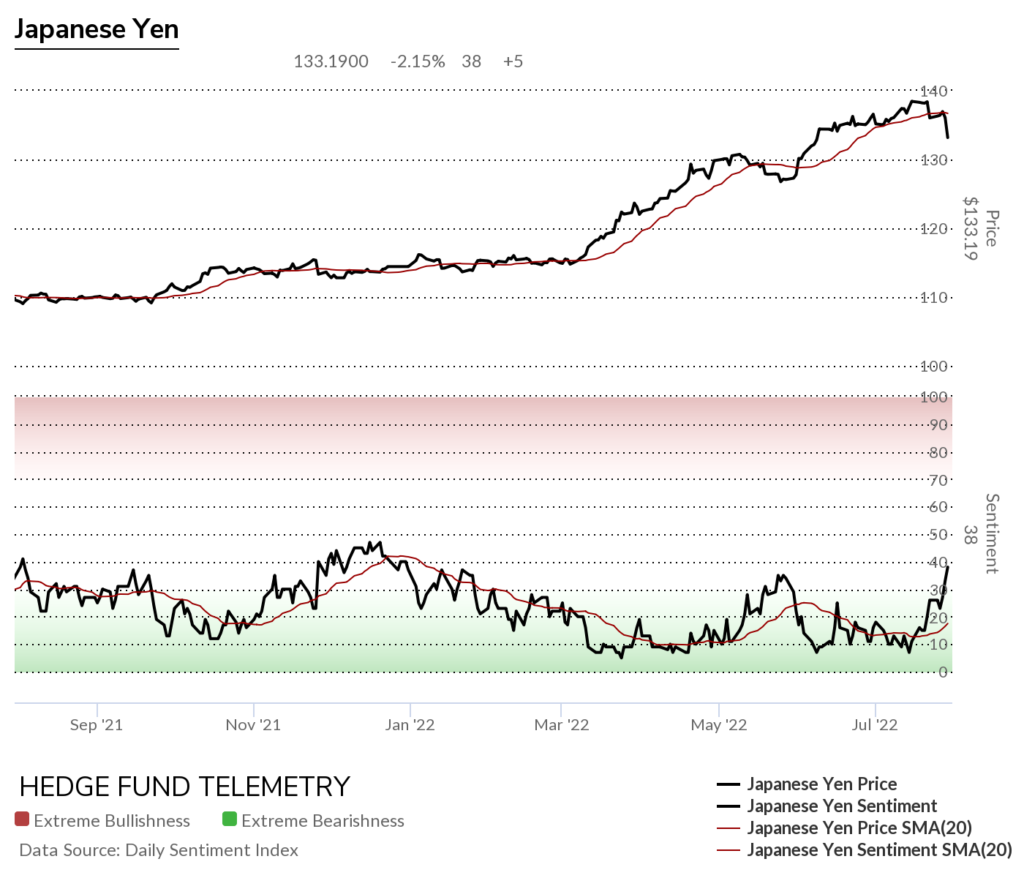

Japanese Yen bullish sentiment making a new higher high – this is negative risk assets but will traders notice it?

Japanese Yen commitment of traders

RISK On Risk Off

This cross is often used as a risk-on / risk-off indicator

EURAUD Euro / Australian Dollar

Three major Yen crosses

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

USDTRY US Dollar / Turkish Lira

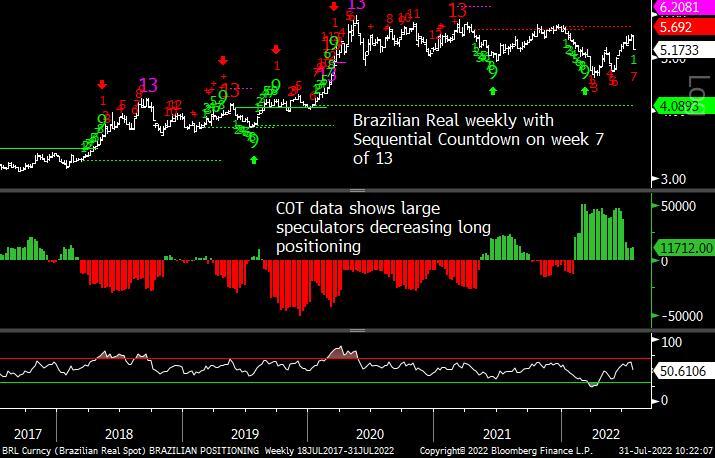

USDBRL US Dollar / Brazilian Real

Brazilian Real Commitment of Traders

USDMXN US Dollar / Mexican Peso

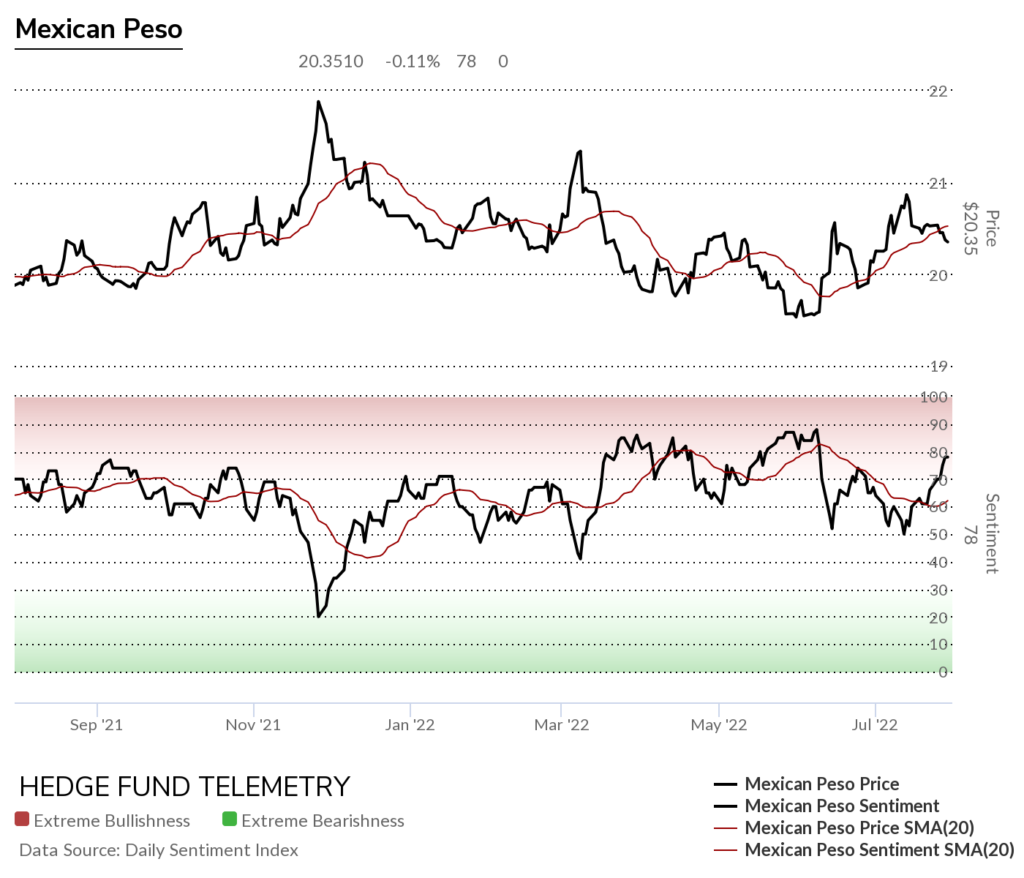

Mexican Peso bullish sentiment held 50% the majority line again. Good example of why I watch this 50% so closely

Mexican Peso Commitment of Traders

USDZAR US Dollar / South African Rand

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan)

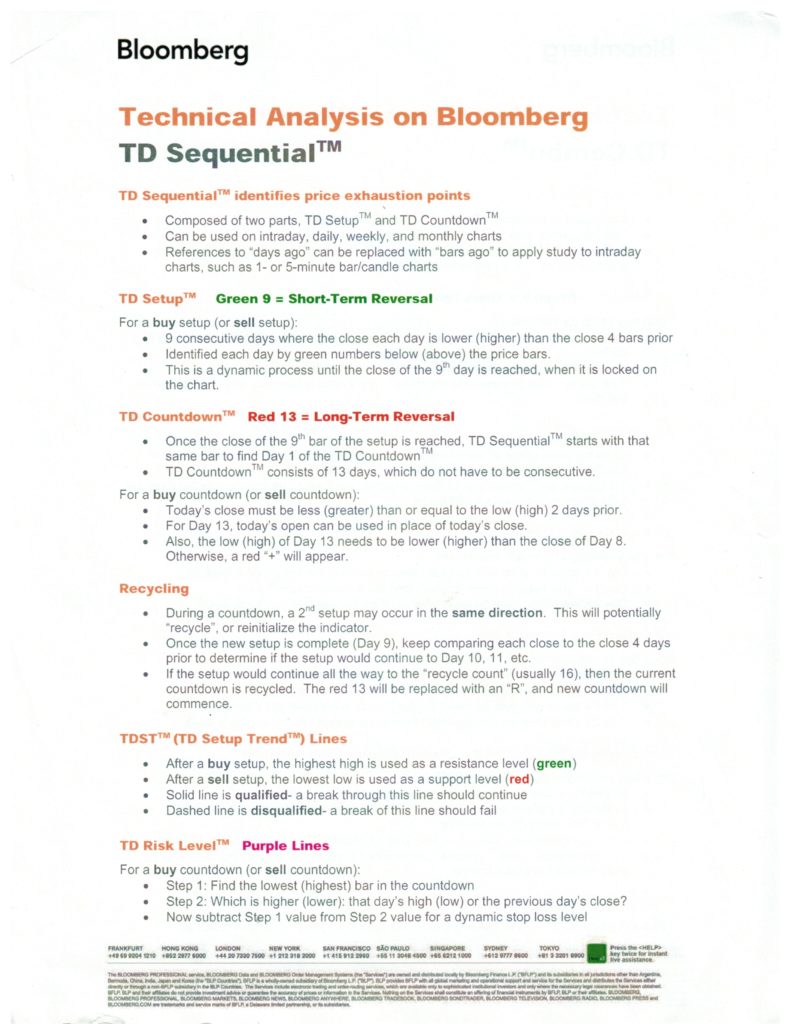

DeMark Sequential Basics from Bloomberg

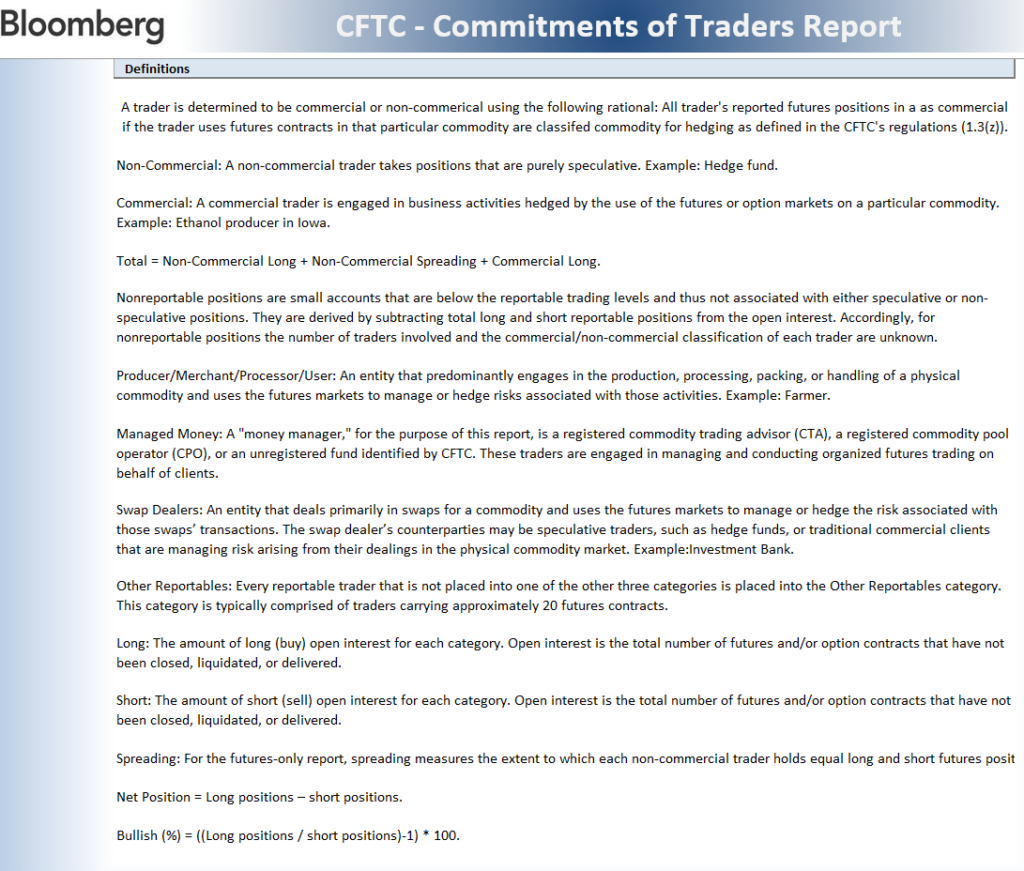

More detailed Commitment of Traders explanation