Inspiration, move me brightly

light the song with sense and color

Hold away despair

more than this, I will not ask

Faced with mysteries dark and vast

statements just seem vain at last

I have a group of friends from college that gather every year to take in a Dead show (now Dead and Company) and have been doing this for a long time, although I don’t always make it. Some within the group arrived at Brown in the late 70s and early 80s, already part of the community. But, for me, it was a slow burn into it. The music I listened to early in university was John Cougar, Bruce Springsteen, Dire Straits, REM, and U2, and it evolved over time to include the Talking Heads and the Grateful Dead.

Everybody’s immersion into the band is a bit different, but I believe at its core is the acceptance that there is value in unstructured and unconventional things. It is not for everybody. The best part of this year’s concert was having many of my friend’s kids join. I don’t believe that there are many opportunities to see such a cross-generational music experience, all-around songs that were written, on average, about 40 years ago.

Reading about the history of the band, the unconventional approach was by design, even if it caused commercial problems. They tried to replicate the success of Jefferson Airplane, which sold albums and toured occasionally, only to find out that they optimized their brand and earnings (not that they were particularly driven by money) by touring regularly and even allowing for bootleg tapes of its followers (to build a community around the idea that no two shows were the same). Not until the Touch of Grey album, 22 years after they began in 1965, did they find commercial success outside of touring.

Everybody has their favorite songs, and Terrapin Station is one of mine. When you see a gray-haired and bearded Bob Weir sing the lyrics above, lit brightly, it reminds me that we are all in search of clarity and of being in the zone where things just click. As an athlete, I often thought about that. Why some days, I would go 4-4, play perfectly in the field, and on others, not so much. Why was it so hard to replicate? Why is it so hard to replicate trading success day to day? They say professional golfers are a 50-50 proposition within 12 feet, and I am 50-50 within 3 feet! One day I shoot a 77, and the next day I shoot an 88. Being part of the community is about being able to accept imperfections (as their music often did) and yet still move forward. You know, just keep ‘Truckin.

On a separate note, I moved my son to Austin, Texas, last week, which is why I didn’t write a piece. I drive every year now back and forth to Florida from Connecticut, so long drives don’t bother me, and that route is now familiar. The trip to Texas, however, was next level. We left Connecticut and arrived in Nashville 14 hours later. I hung out in Nashville (a cool town) for a day as neither my son nor I had been there before and then drove 10 hours to Dallas (Arkansas is as one would expect it to be). I woke up the next day and did the stint to a blazing hot Austin, stopping at Buc-Eee’s (that’s an interesting place) for some jerky. 28 hours all told. Luckily, gas got cheaper (I saw sub $4.00 in Texas) along the trip.

Austin is a neat city, and it has changed a lot (cranes everywhere there and in Nashville) since I called on the Texas Teachers Retirement Fund while working at JPMorgan. Young, vibrant with a somewhat diversified economy and a great music/food scene. But 110 degrees is crazy hot. I will go back there when it cools off.

But, as we were riding the interstate highway (pretty cool how the system was devised, funded, and built – we googled it) in the western part of Virginia, we noticed that the next big town was Roanoke Virginia. I wondered to myself, what made Roanoke noteworthy? Well, it was known as the “Big Lick” because of its salt deposits which attracted animals to the area, and because it was a bit of a gateway with train service from the coast as part of the movement of coal and with it, nicer shops and good paying jobs. That being said, the city peaked in the 1880s, when it was the fastest growing urban area in the South. And yet, there are still 100K that live there, and it is the biggest city in western Virginia. It is like my wife’s hometown of Muskegon, Michigan, whose best days were tied to an ascendant Detroit and the automotive industry but struggles now. Roanoke is like many cities with little if any population growth and decaying urban centers and opportunity. But as one travels across the country – one that is vast and underpopulated in many places and overpopulated in others, with some experiencing rapid growth while others deplete further – you get a real sense of the complexity of the society (winners, losers, leaders, followers, etc.), and the challenges we will always face politically and economically.

The country can come together in moments of clarity and purpose (WWII, Interstate Highway system, 9/11, CoVid), but even there, the nation’s attention span is much shorter than it once was. Having said that, I do believe we are at an inflection point, with everybody feeling the effects of inflation as a community, even if most don’t agree on how we got here and how to get it under control.

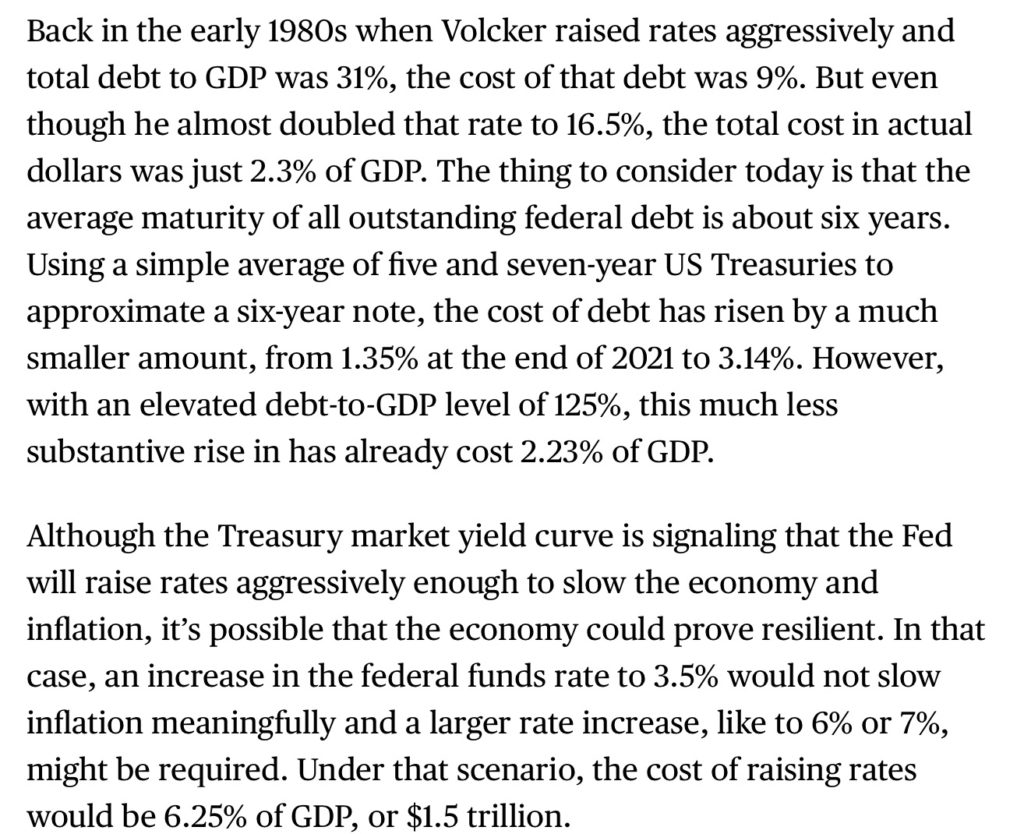

This brings me to last week’s rally after another bad CPI print, which was after a solid payroll report. Not that I cannot construct/internalize the recent narrative of peak inflation and 2023 cutting of rates and a soft landing or shallow recession, which seemed to be in vogue, particularly after the market priced out 100bps vs. the initial 75bps expectation for July 27. It is because those narratives seem a bit short-sighted about the real challenges facing the economy, the problems with taking rates too high given debt loads (unlike the Volcker period – see below), and the complexity of the inflation equation. In fact, after the report, the Administration (and Jim Cramer) were quick to point out that gas prices (and other items in the basket) have fallen and were not reflected in released data, daring the market to take in risk assets (or cover shorts) thinking inflation would come down in a nice smooth line, and we can go back to smooth sailing for risk assets.

But maybe these two bits of information offer a different perspective or at least give one pause about jumping onto the latest market is short, sentiment is stretched, and disruptive innovation is the future trade.

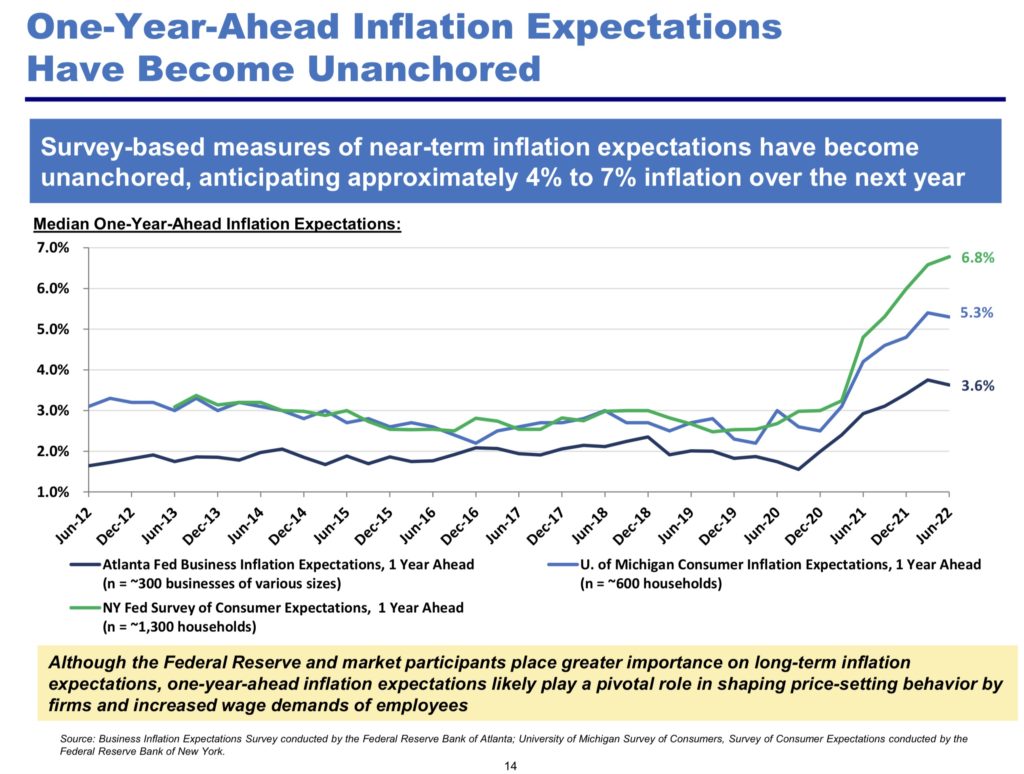

One is from Bill Ackman, and it is well worth reading through. The one slide that really caught my attention related to the idea of inflation expectations. The CB’s like to talk about LT expectations, but Ackman would rather focus on the year ahead, which more predictably feeds into consumer and business choices.

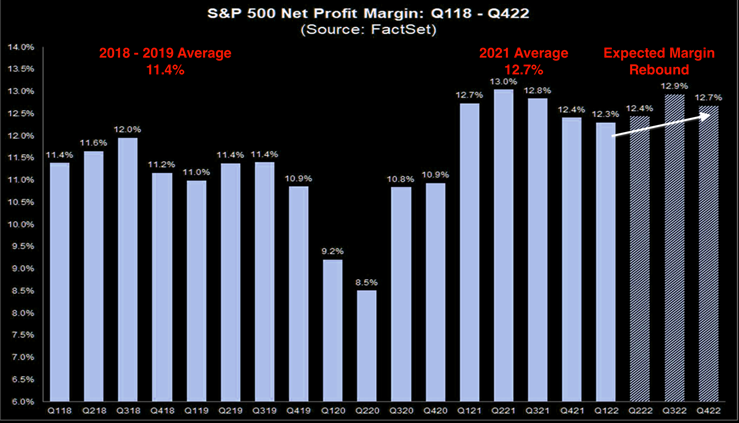

And while the market is currently excited that we won’t get 100bps in July, earnings are OK, and the Fed will get to 3-3.5%, and that is it; the market also needs to keep in mind that the Fed HAS to be serious here and price in some possibility that inflation doesn’t move meaningfully lower (i.e. secular stagflation – for a good look at that, read this from FedGuy. One thing about secular stagflation is that margins will not stay buoyant.

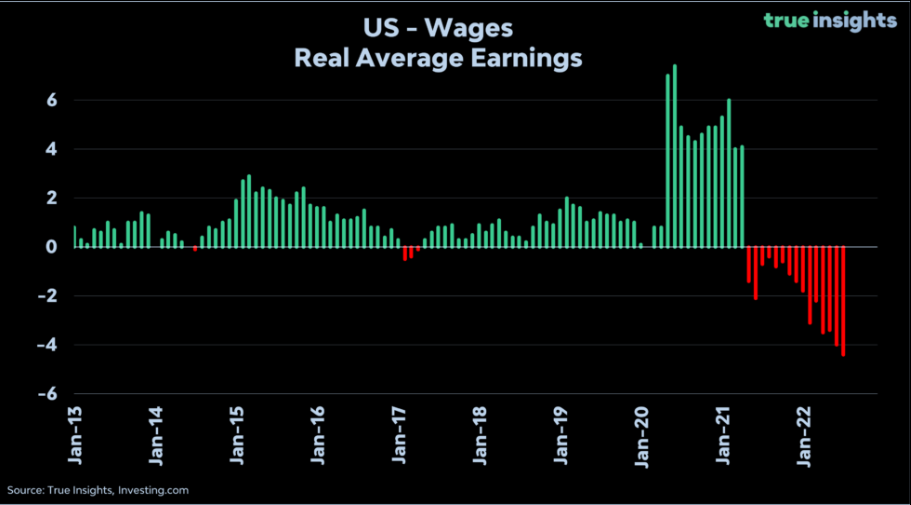

Additionally, as real wages have taken a hit, there is likely still some catch-up to be had, and that is unlikely to be constructive for margins, but we can assume much less visibility on the future of corporate cash flows.

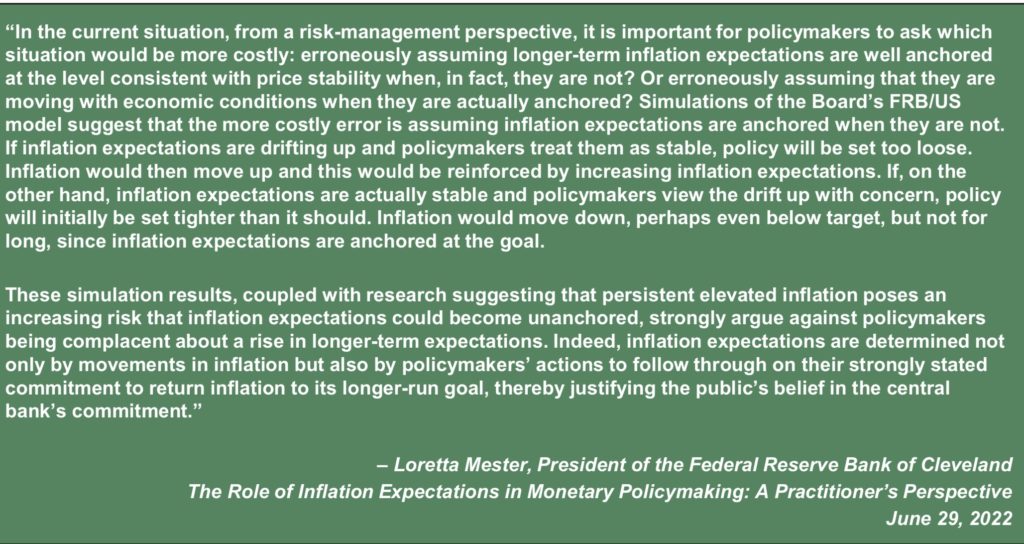

Last week, some officials threw the market a bone by seeming to throw cold water on 100bps, but let’s take a step back and realize this is a tightening process with A LOT of moving parts that are not being managed by CB’ers that are ahead of the game. That means they have no choice but to make up for lost ground and then some to re-cement its inflation righting credibility. Remember – positive real rates across the curve is what Powell said. Here is a quote from Cleveland Fed’s Meester on why (also from the presentation) the challenge needs to be confronted now and forcefully.

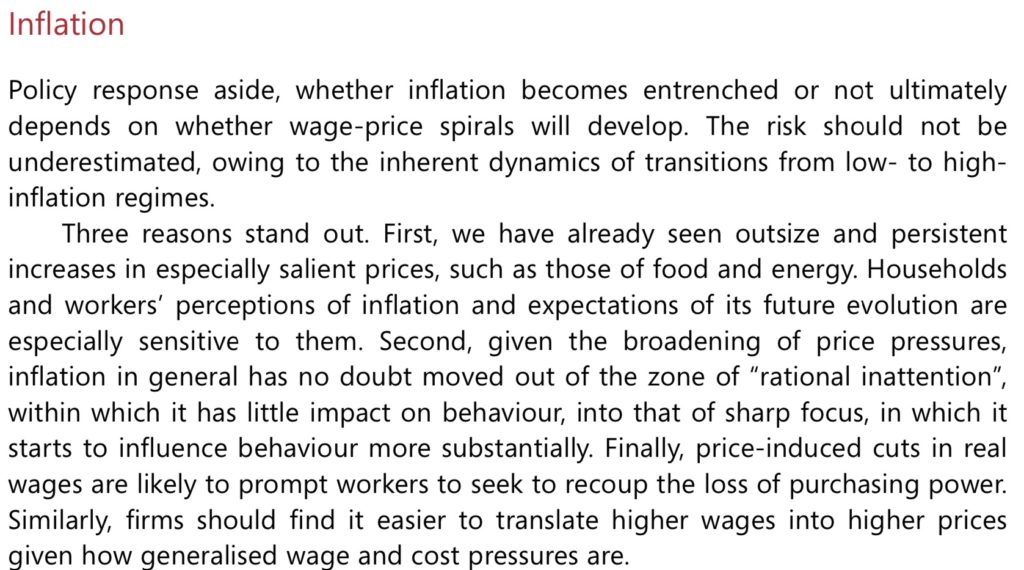

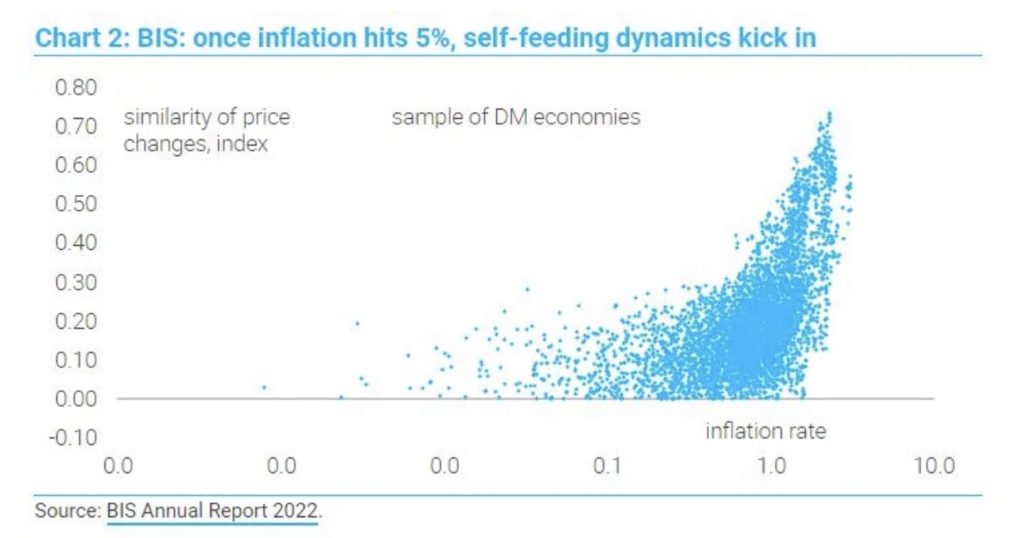

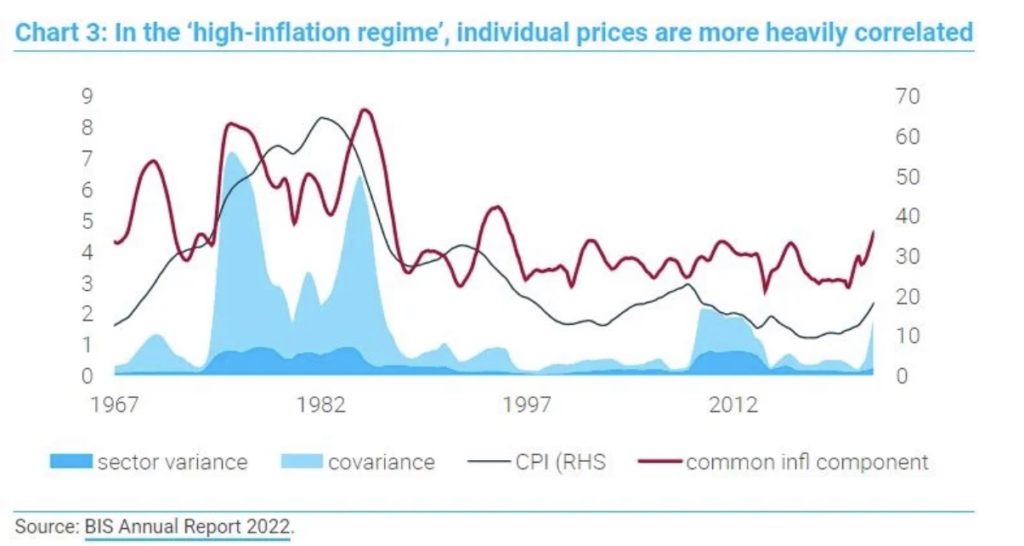

The other piece is from TSLombard which talks about the nightmare scenario the BIS has outlined (being in a high inflation regime) in its annual report. The article discusses caveats (it is the 1970s, and there is a different capital v labor dynamic), but it is something I have been worried about for a while – don’t let the inflation genie out of the bottle.

From the BIS:

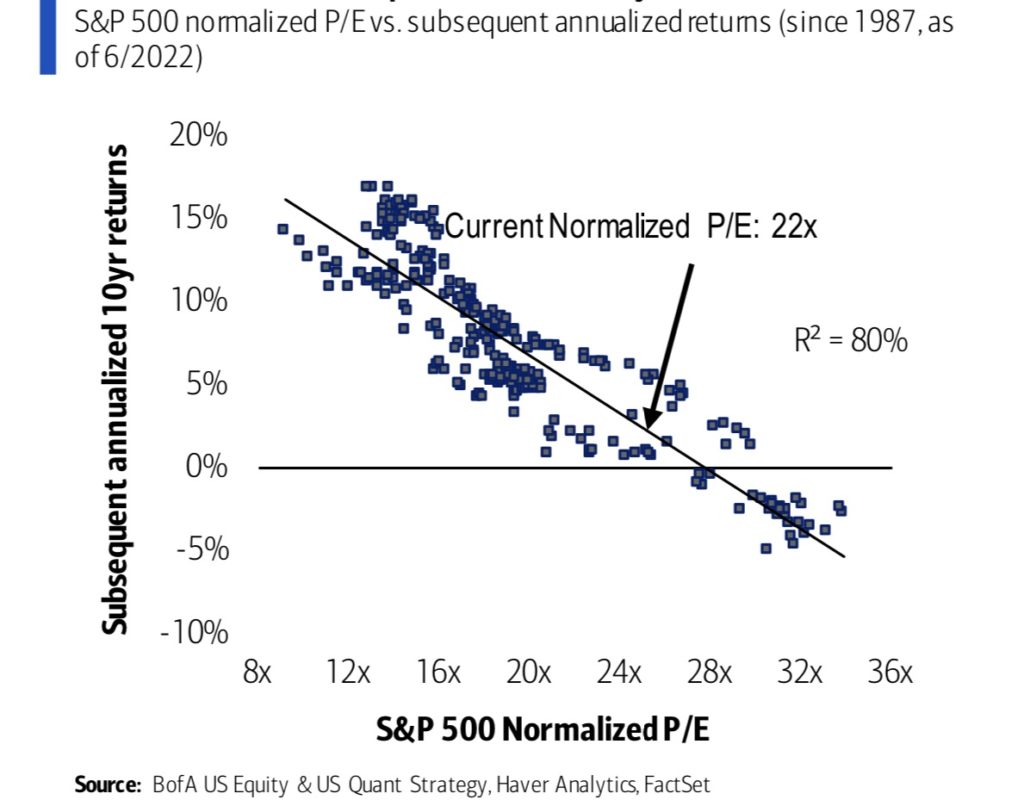

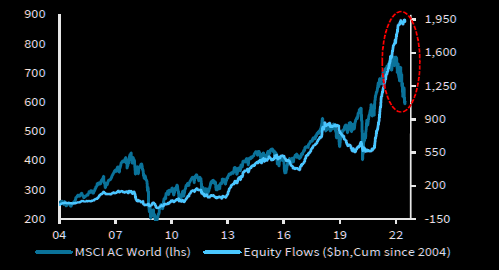

The net of all of this is that I am STILL not doing much in my portfolio. This chart is one of the reasons why.

Other things that caught my attention this past week (or 2):

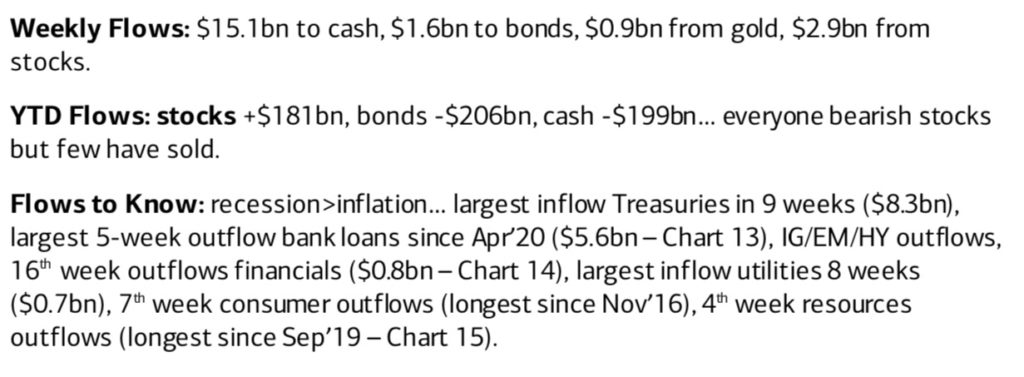

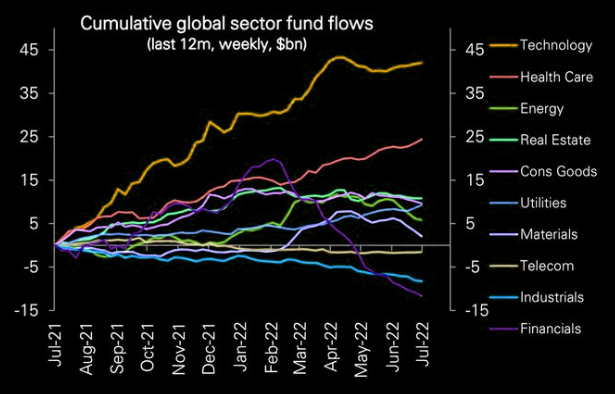

Flows:

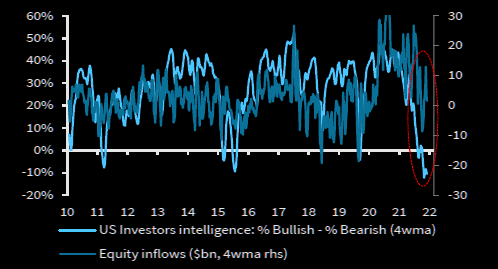

I was playing golf last week with a wealth manager friend, and he’s been doing this since 1983. Said his clients have a generally nonchalant view these days, in that they believe they have over earned post-Covid, and a bit of give back is to be expected, so taking the moves in stride. The critical point he made is that “I usually know it is a bottom when >25% of them are telling me to get them out.” That has not happened.

From EPFR and ML

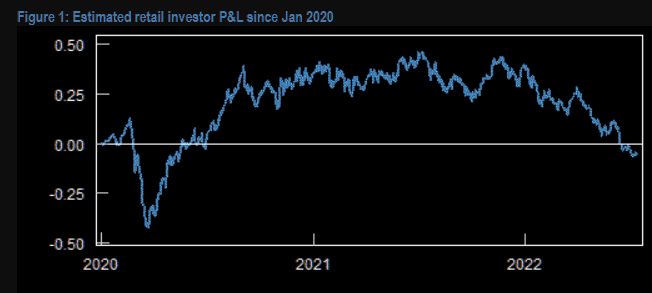

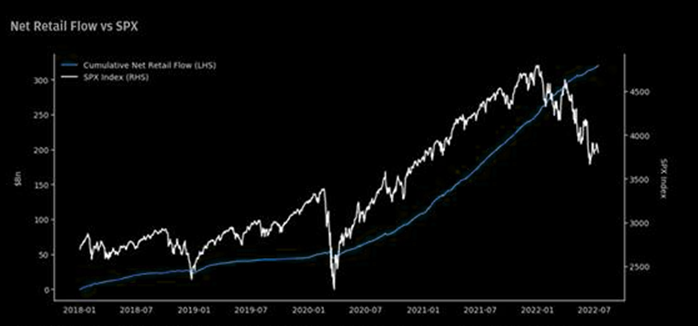

And on the retail trading side, we have the following:

What kind of market is this?

This is from a blog that I thought was interesting (and I share a lot of their sentiments)

From having “two centuries of experience” trading macro, we would argue that this is, from one aspect, the most confused market we have ever seen. Why is that? Because of the simple reason that inflation is one of the top important factors driving macro right now and “nobody knows nothing” when it comes to inflation. First, very few have any experience of a high inflation environment. Second, future inflation is probably the hardest thing out there in financial markets to estimate and analyze. You can trust no one when it comes to inflation estimates and insights. Consensus and changes in consensus do not matter. Therefore, peak confusion and expect markets to continue to behave erratic on incoming data.

Is the market at a bottom?

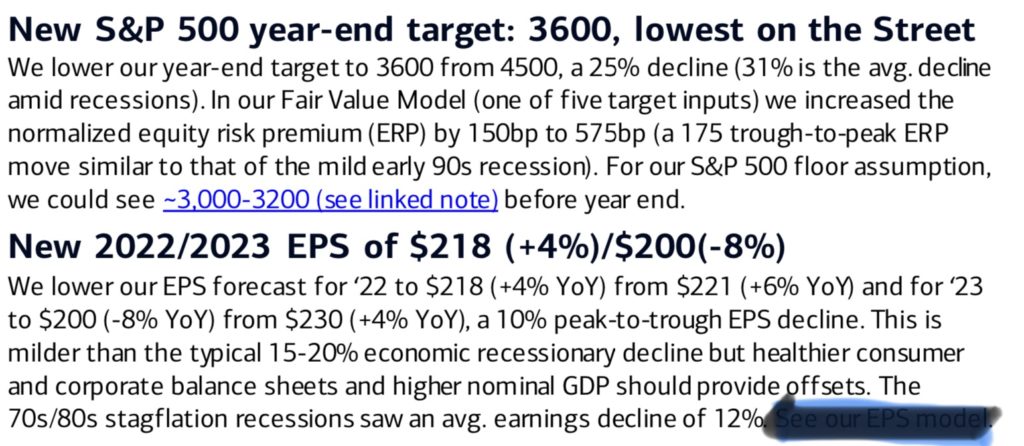

This past week, we saw BofA/Merrill come out with a call for SPX3600 for year-end, coming down from 4500. As I wrote last time, estimates are still a bit too elevated, and not surprised to see analysts taking their end-of-year forecasts down. In this particular case, ML has $218 of earnings for this year and $200 for 2023, which is a material downward adjustment.

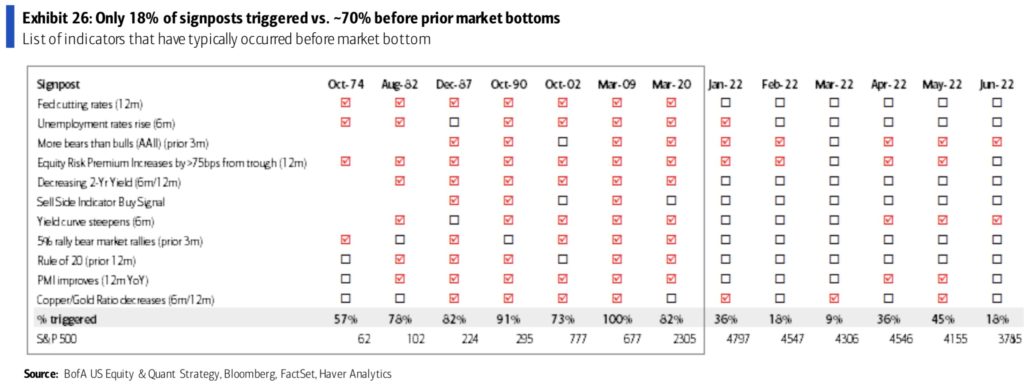

Savita Subramanian’s group had a very good table on whether conditions were in place for a bottom, noting that currently, only 25% of the average 70% signposts (there are 11 of them they look at) have been triggered.

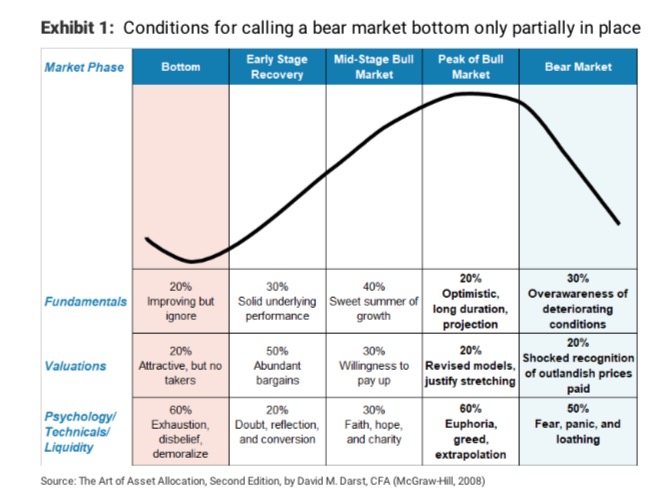

Another way to think about this is detailed below from a 2008 book called “The Art of Asset Allocation,” which suggests the bottoming conditions are not in place.

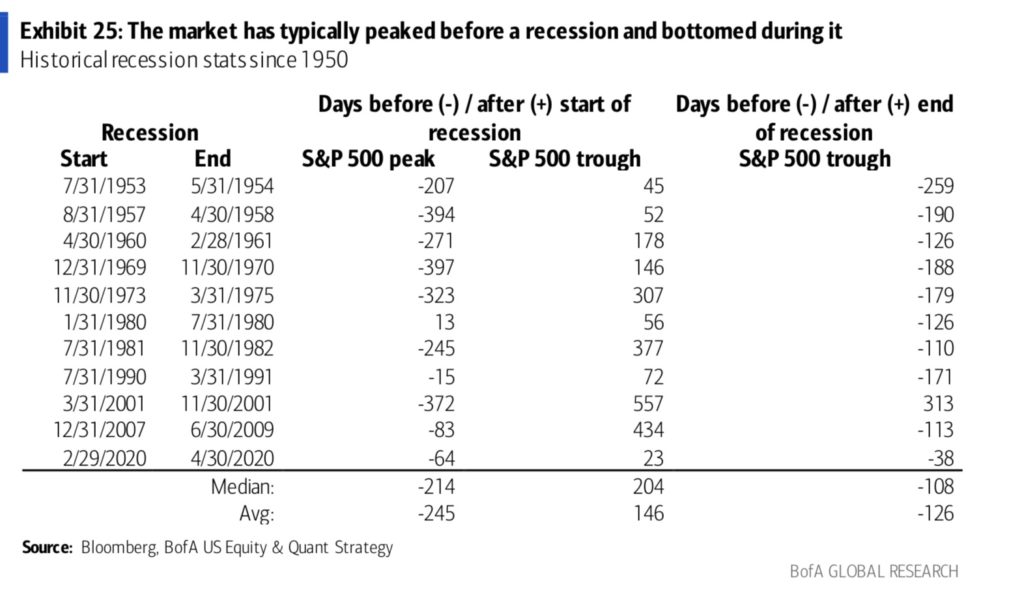

Here is another table from Savita that I thought was solid, which suggests that until we get into a recession (and see broader capitulation in equity flows) we will find a bottom.

And lastly, here is a snippet from BofA’s Mike Hartnett, who I think provides a useful guidepost and one I am likely to follow.

Why getting this inflation situation sorted is so important:

This is all really tricky:

From Bloomberg:

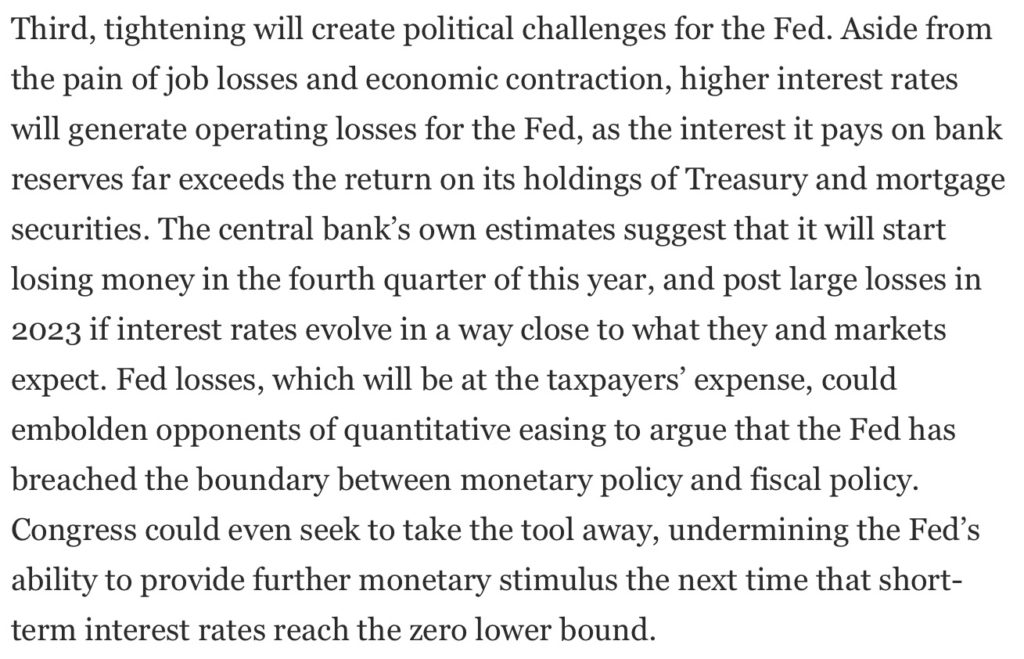

And as Bill Dudley opined recently one thing to keep in mind is that the Fed is about to take losses on its portfolio. That could have the impact of reducing the QE tool down the road. As he states:

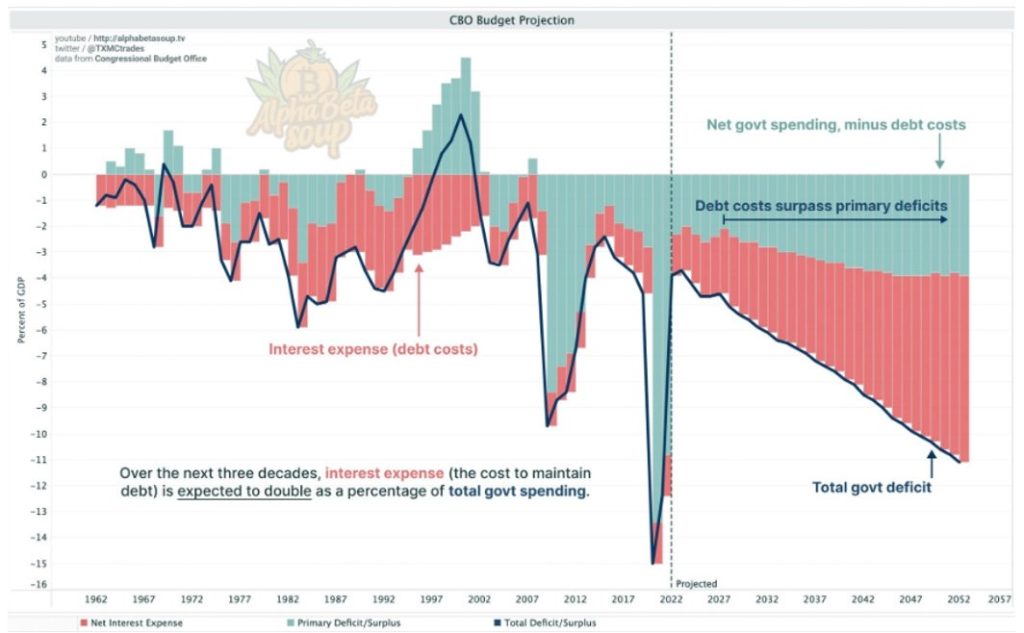

As we can see below, we have some serious work to do to get our house in order, and it is not just the Fed. There are some that believe the Fed will not go as much as it may need to (should inflation prove stickier than expected), in which case the long end may be too optimistically priced.

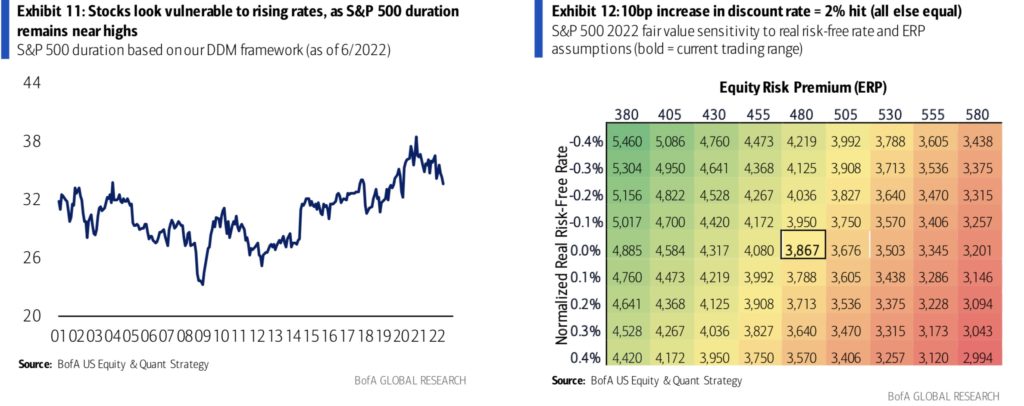

And, for an equity market that is very long duration, that can be a problem.

Other tidbits:

The Musk Twitter Saga:

I have spent a bit of time reading up about this all, listening to various podcasts, and speaking with my sister, who is a corporate attorney and an adjunct professor at Fordham Law. Matt Levine at Bloomberg (as ex-attorney and GS banker) has a very good take on it, and listening to the odd lots podcast he was on recently is well worth it.

Tesla is one of those stocks that galvanizes, but this is extremely interesting. Delaware is the primary incorporation home for many, and while the numbers involved are large, it is hard to argue that the law is not on Twitter’s side. Not worth getting into the debate because a lot will be revealed shortly (July 19th) as to whether the case will be heard soon (September). If it is, you can rest assured it is because the judge says there is no reason to discuss bot approximations which would require a lot of back and forth, discovery, etc., as it is a clear case of not meeting the specific performance clause.

Now, whether Musk will actually be forced to buy a company it no longer wants is a question with a lot of speculation, but the numbers (his wealth + committed financing) are unlikely to matter to the judge. Unclear to me why Delaware would want to inject these types of outs and risk its cash cow, but then again, it may try to be reasonable. Either way, popcorn is ready for this one. It is possible the court suggests to the parties that they ought to work out a side arrangement given that Musk has a limited case, but I highly doubt the manner in which Musk has gone about things is going to make Twitter (remember, he is the one who moved quickly and aggressively, not the other way around) that charitable.

I have some shorts on in Tesla (nothing earth-shattering) largely because I take Elon at his word that he has two plants burning cash, BTC write-downs, and because I think any settlement with Twitter is likely to bring about some additional Form 4’s (Elon selling).

Sri Lanka

I worked with a guy at Moore who is from Sri Lanka. One of the nicest guys I have met left Moore and went to work with Rob Citrone at Discovery Capital and left there to do a fintech startup. Born in Sri Lanka, educated in the UK, worked at Goldman, and was just a really good and sharp guy. Obviously, things in Sri Lanka are messy, and it really boils down to a country with an exposed position to energy and food, too much debt, and too little foreign exchange. The ensuing crisis is a part of the dollar wrecking ball scenario, which was partially put in motion by Covid and the events in Russia/Ukraine. Hard not to feel for the population there.

Nuclear is a part of the solution:

I hate to bang on about this each and every week, but then again, I just find it freaking remarkable that there is even a question about this. Given what Europe may be faced with, will any nation that does not have ample and diverse sources of energy look at this as a part of the solution? Anyway, here is a report from the IEA suggesting as much.