highlights and themes

The hopes for lower commodity prices for the August CPI are at risk, with many commodities reemerging higher. Energy is the big focus for everyone looking at inflation. Natural Gas looks like it could make a new high while crude and gasoline futures are off their lows and are having trouble getting through the 20-day moving average. Metals ex silver look good as long ideas, although Gold tends to disappoint, failing to break out several times in the last year. Sugar, cotton, wheat, and corn are decent-looking long ideas. I have liked for weeks sugar and wheat. The risk is the bounce in progress will be another lower high corrective move.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily with a lower high wave developing?

Bloomberg Commodity Index Weekly

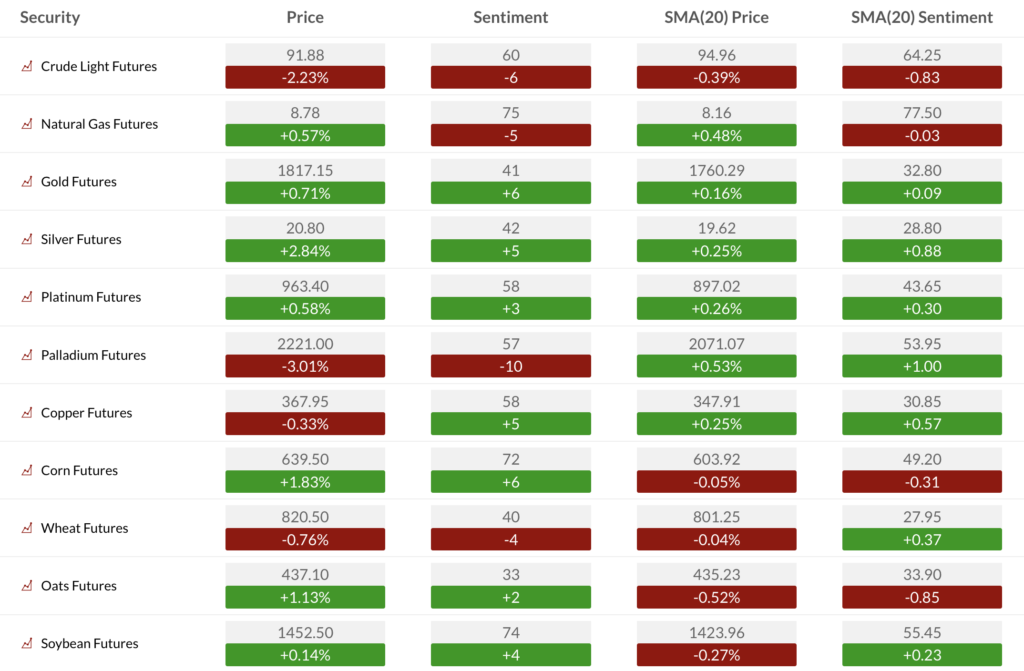

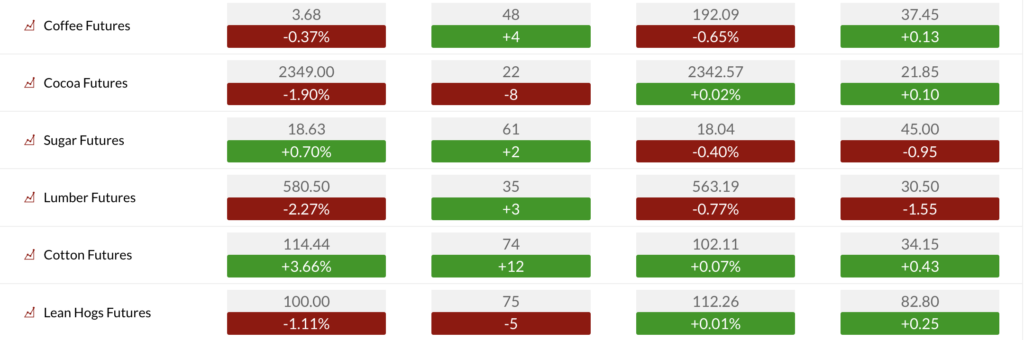

COMMODITY SENTIMENT OVERVIEW

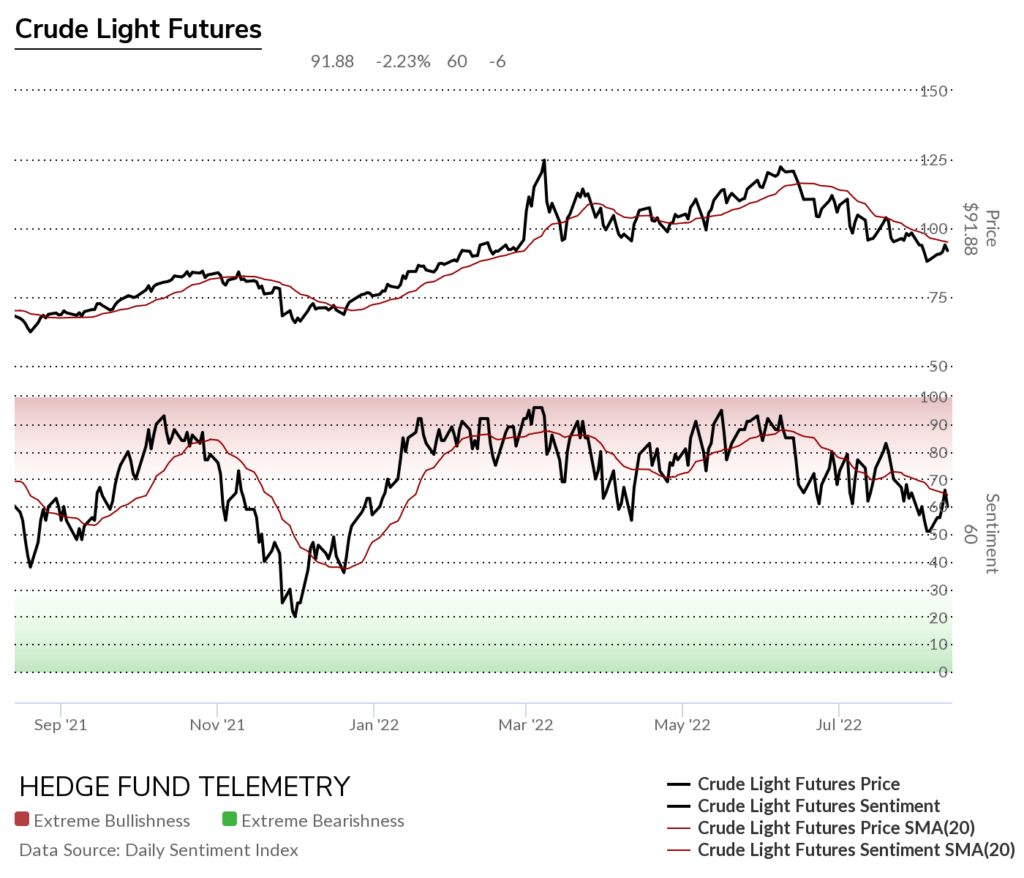

OIL AND ENERGY

Bloomberg Energy Subindex has the upside Sequential in progress. A move over the recent high would increase my conviction.

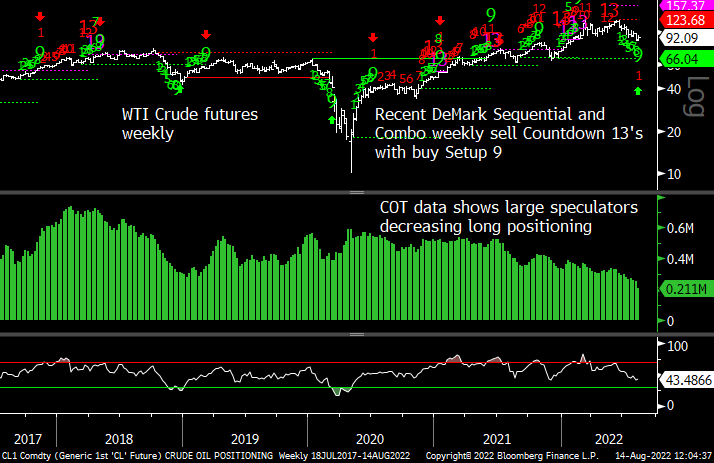

WTI Crude futures daily having problems at the 20 day moving average again

Brent Crude futures daily

WTI Crude futures bullish sentiment held the 50% level and at the 20 day moving average of sentiment like the price action

WTI Crude futures Commitment of Traders

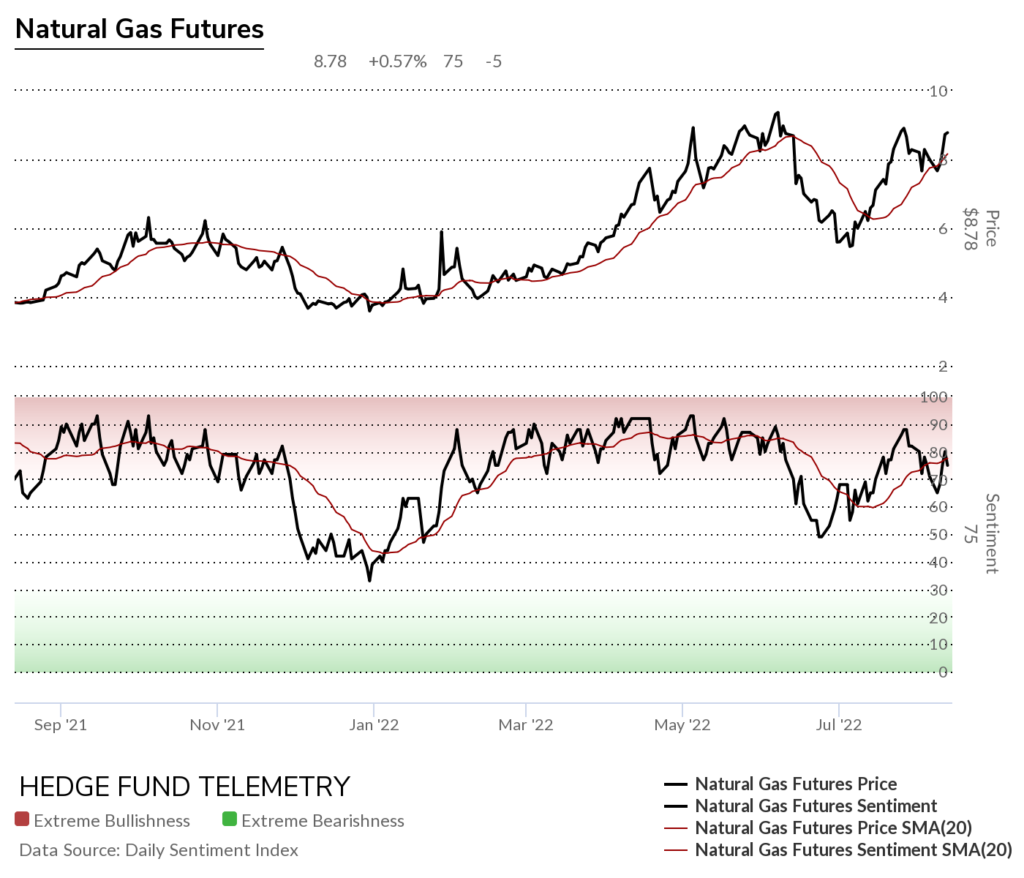

Natural Gas futures daily has the potential to move to new highs with the Sequential in progress

Natural Gas futures bullish sentiment has made a lower high yet remains in the extreme zone

Natural Gas futures Commitment of Traders

Gasoline futures RBOB Daily is stuck at the 20 day moving average and off the recent lows

Gasoline Commitment of Traders

Metals

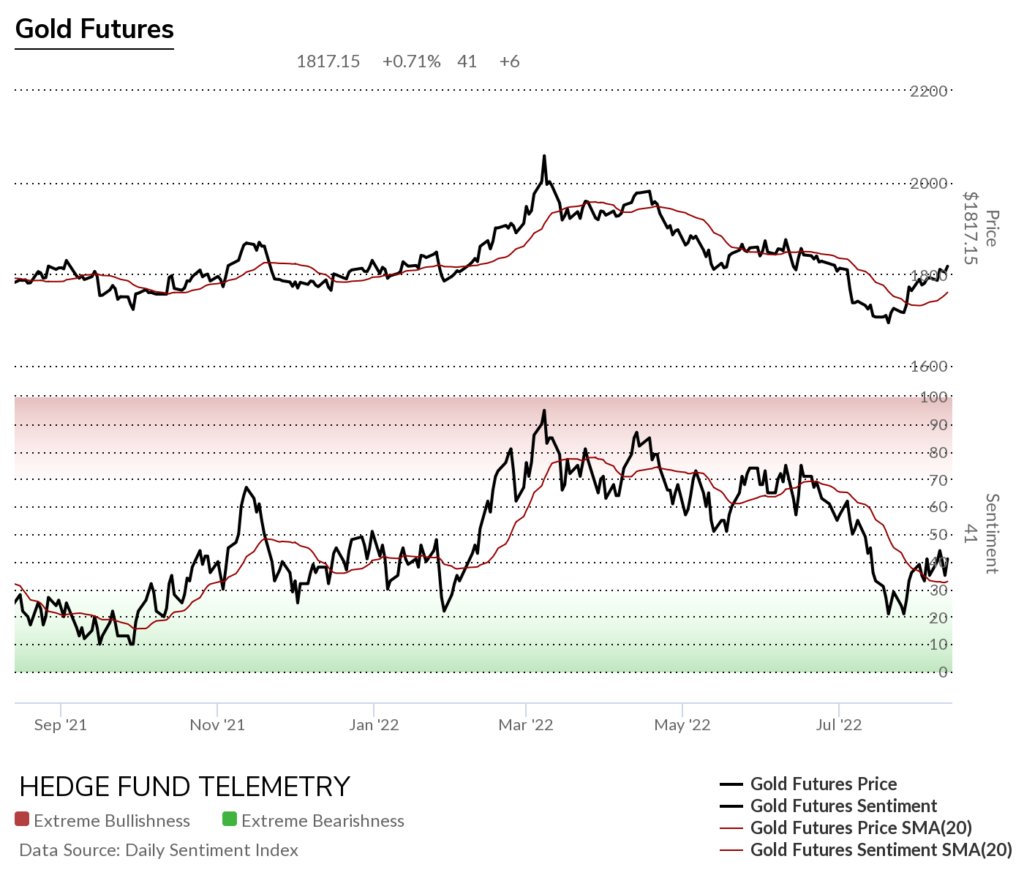

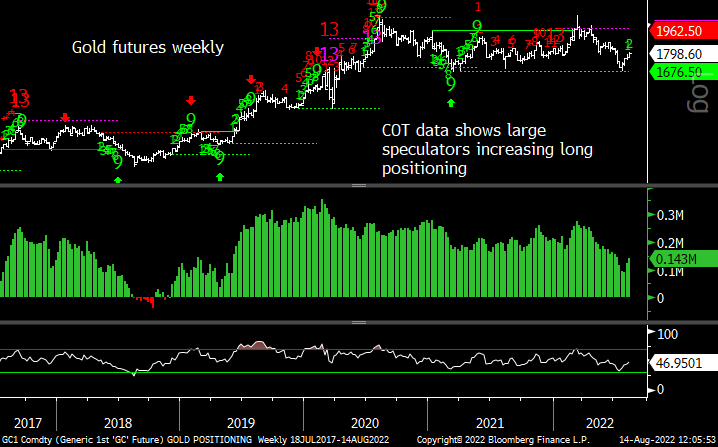

Gold futures daily has the potential to trend higher with the Sequential in progress however it remains in corrective lower high wave 4 of 5

Gold futures bullish sentiment still lacking upside momentum

Gold futures Commitment of Traders

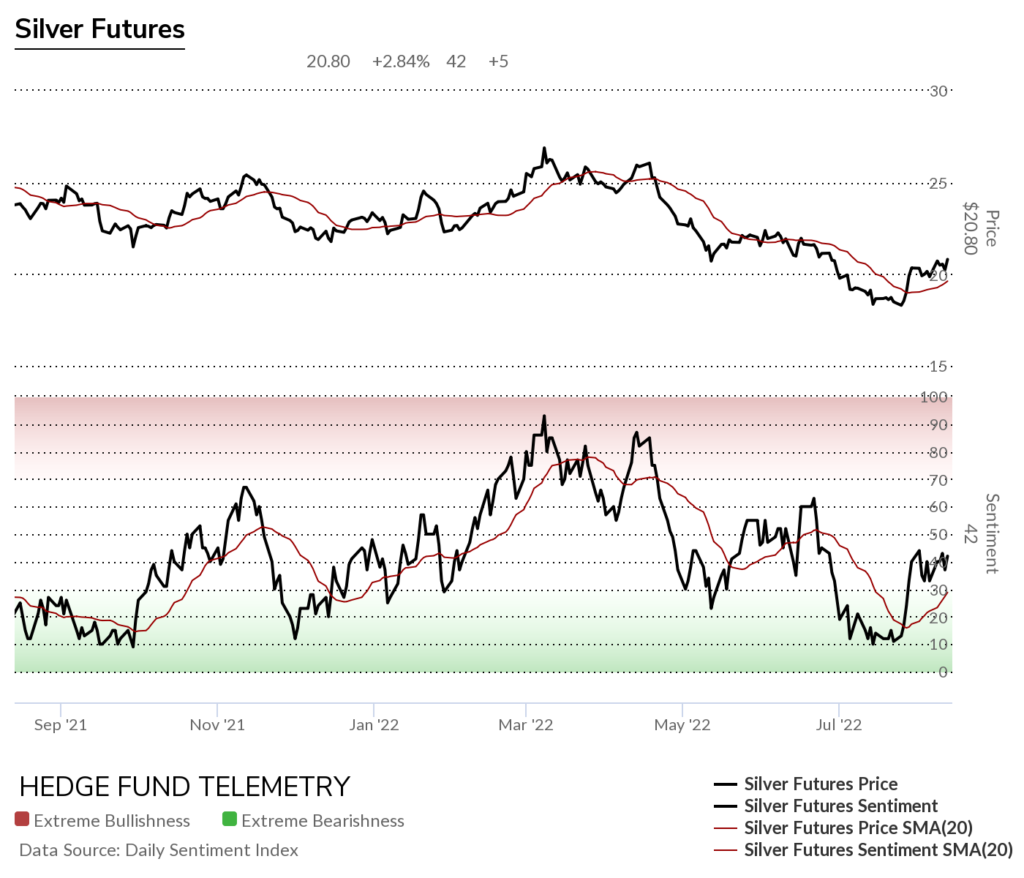

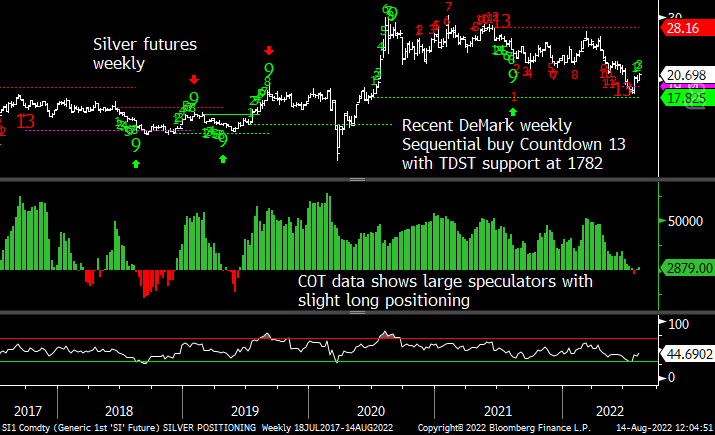

Silver futures daily

Silver Bullish Sentiment stalled like Gold

Silver futures Commitment of Traders

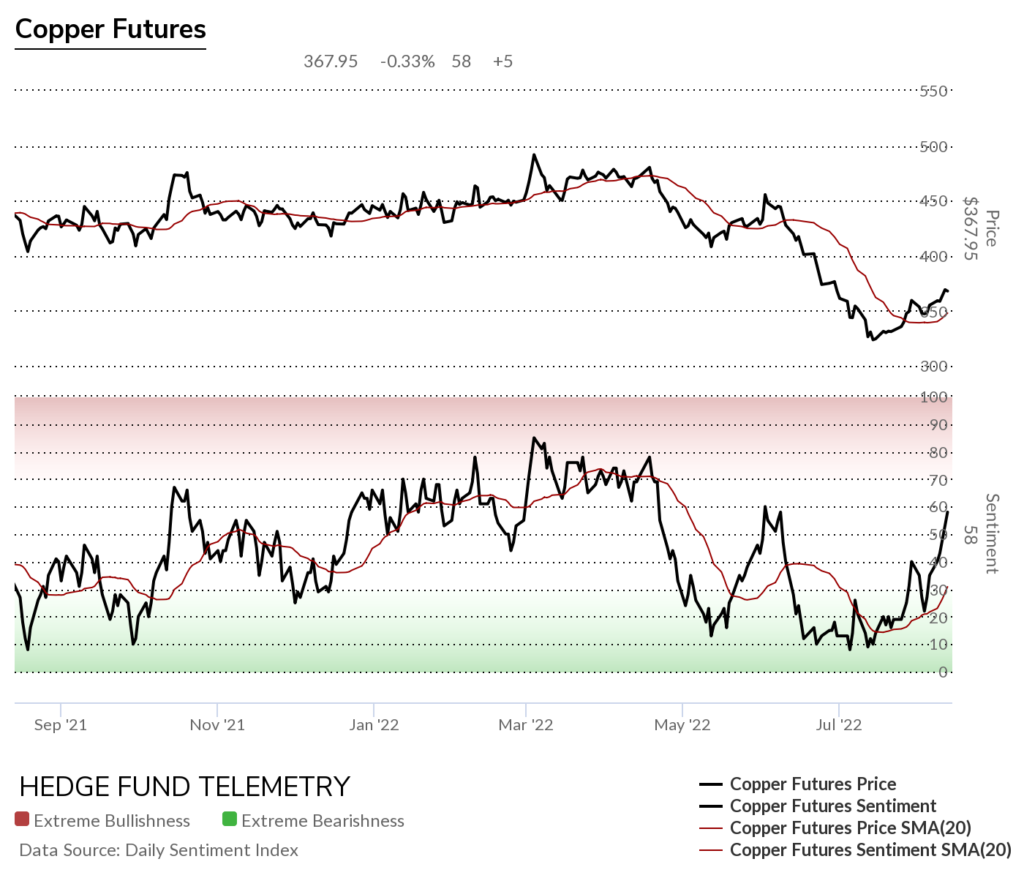

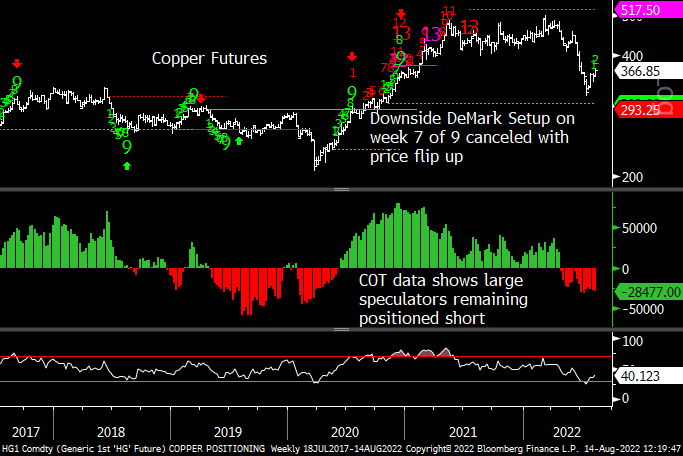

Copper futures daily also has an upside DeMark Sequential in progress

Copper futures bullish sentiment spiking with strong momentum

Copper futures Commitment of Traders

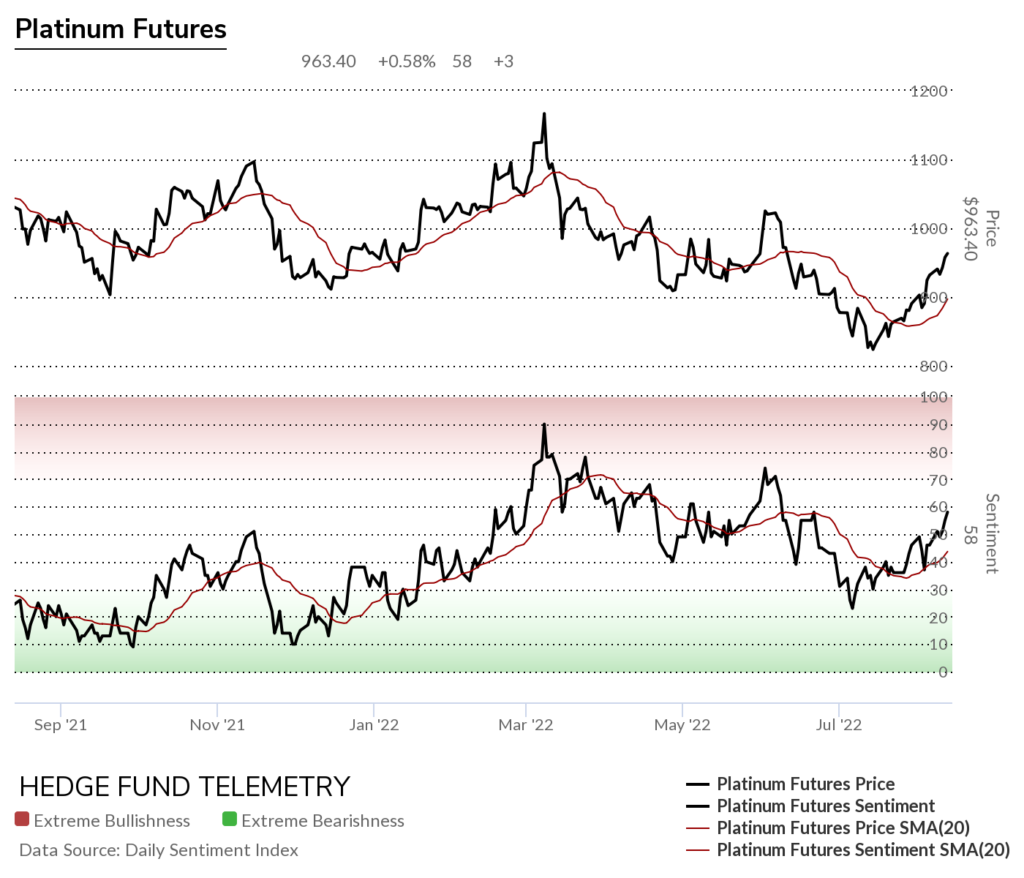

Platinum daily has a DeMark Sequential in progress

Platinum bullish sentiment improving

Platinum Commitment of Traders

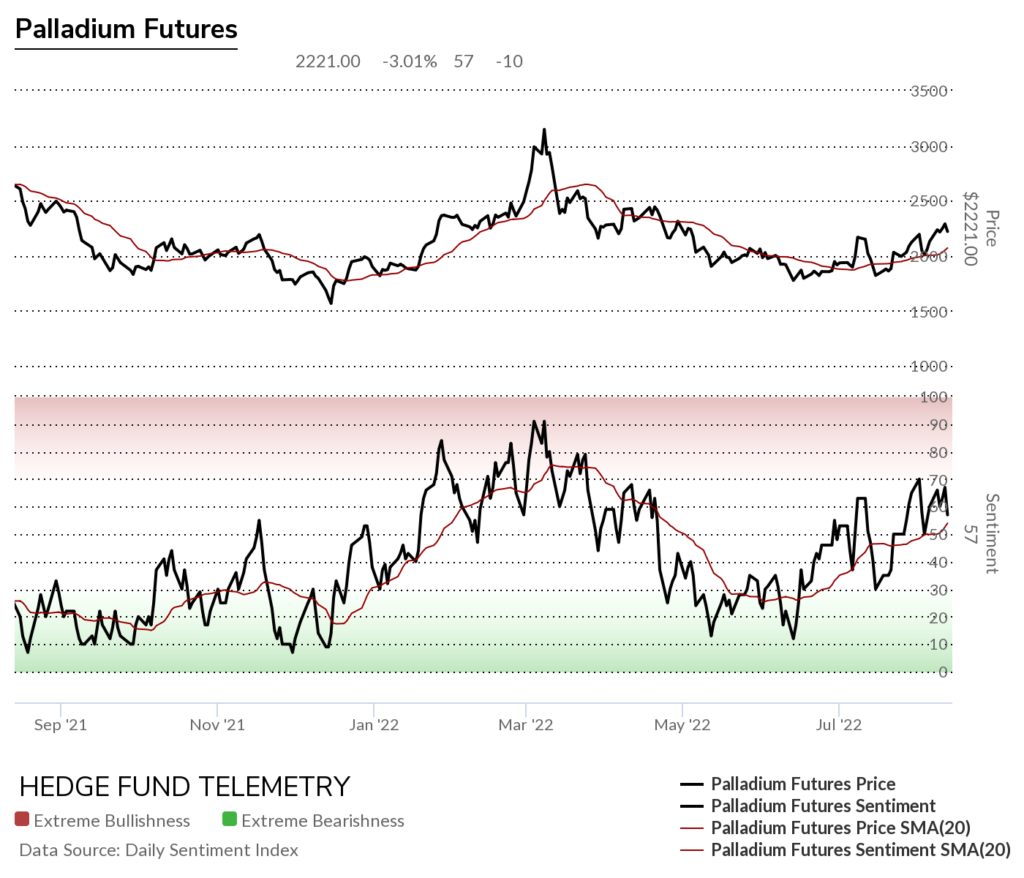

Palladium daily with a long base and DeMark Sequential in progress

Palladium bullish sentiment has been stronger than price

Palladium Commitment of Traders

Grains

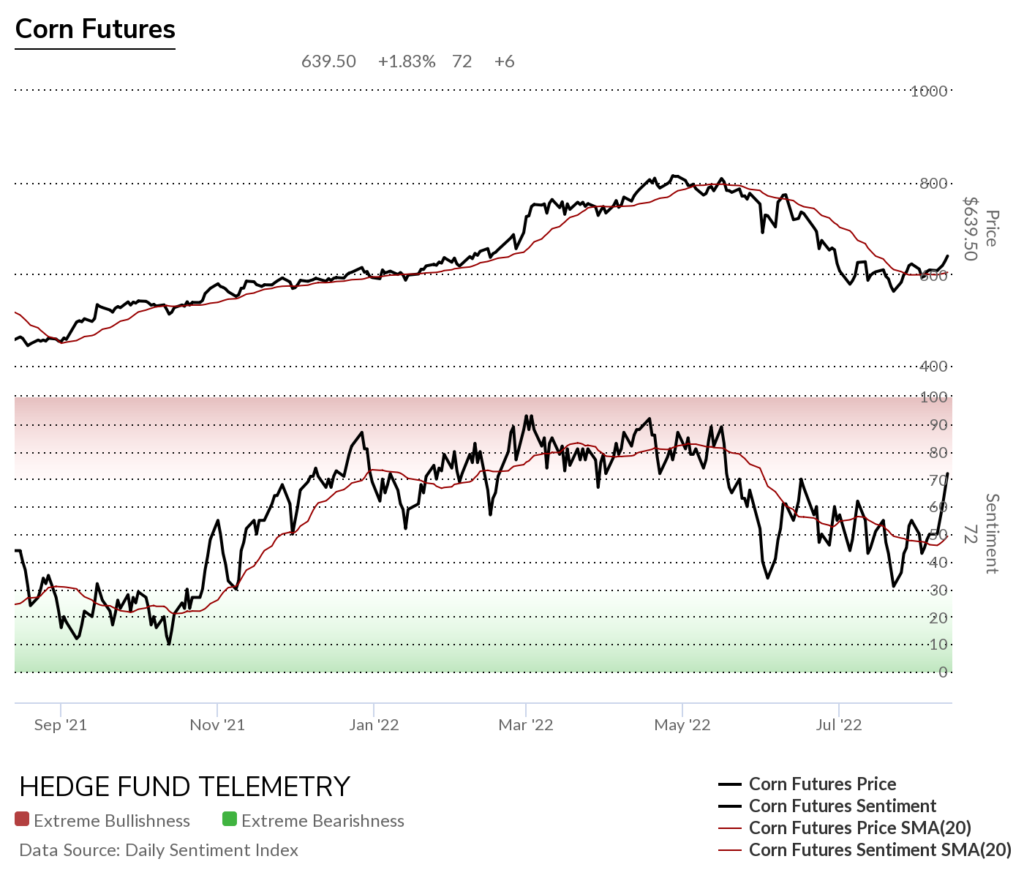

Corn futures daily has a DeMark Sequential pending however this upside move with the Setup on day 6 of 9 looks positive

Corn futures bullish sentiment improving with strong momentum

Corn futures Commitment of Traders

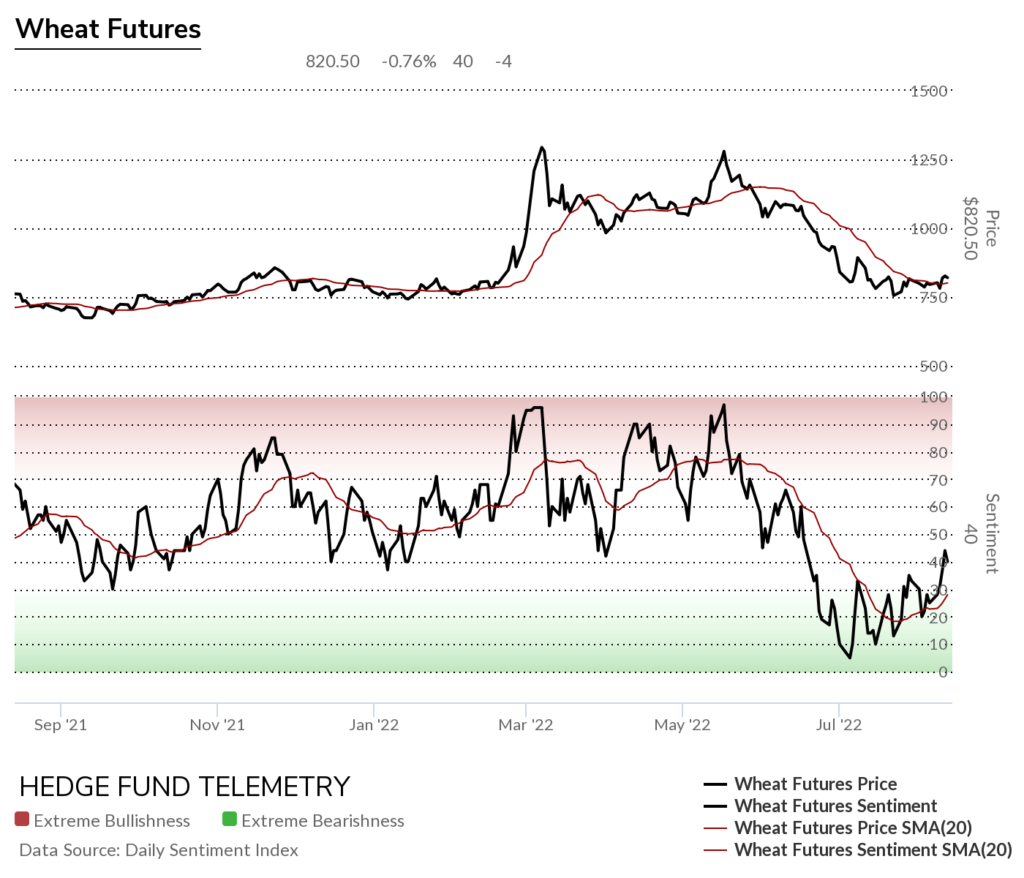

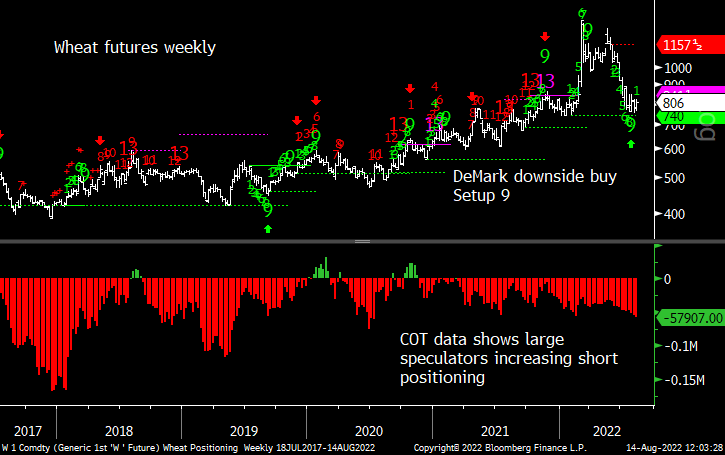

Wheat futures daily has a DeMark Sequential in progress and needs upside momentum to kick in

Wheat futures bullish sentiment trying to make a move over 50%

Wheat futures Commitment of Traders

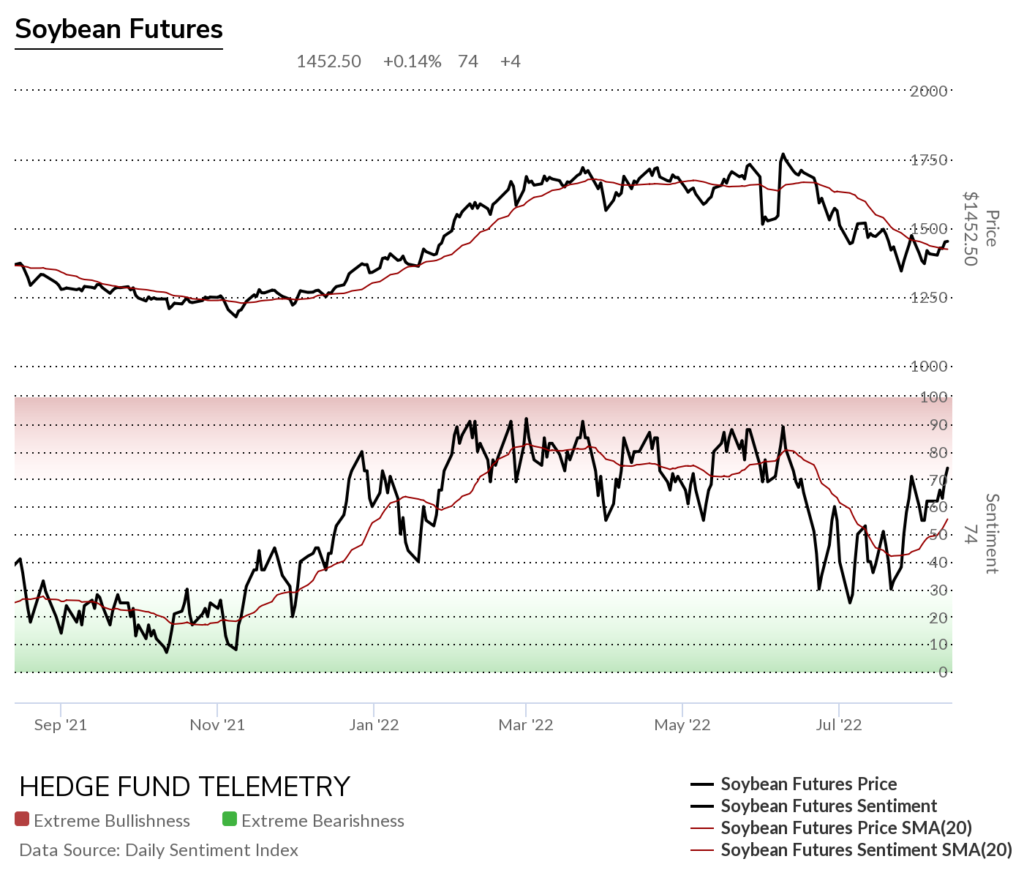

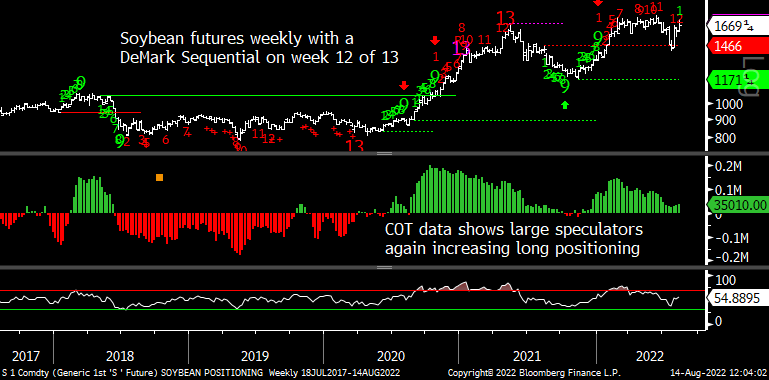

Soybean futures daily with a higher low and needs to clear 1500

Soybean futures bullish sentiment improving

Soybean futures Commitment of Traders

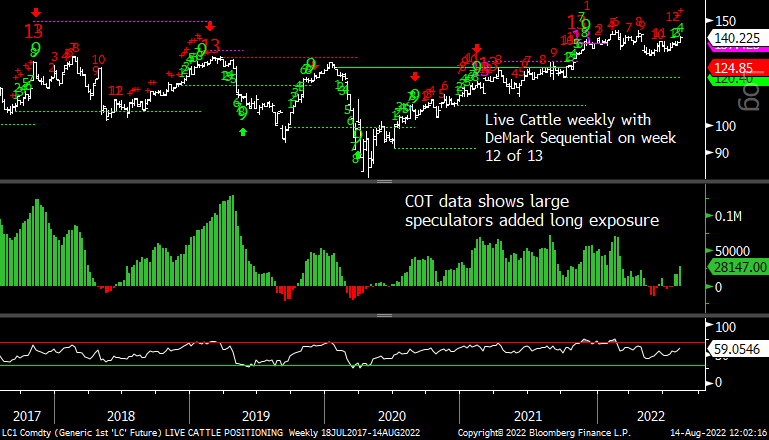

Livestock

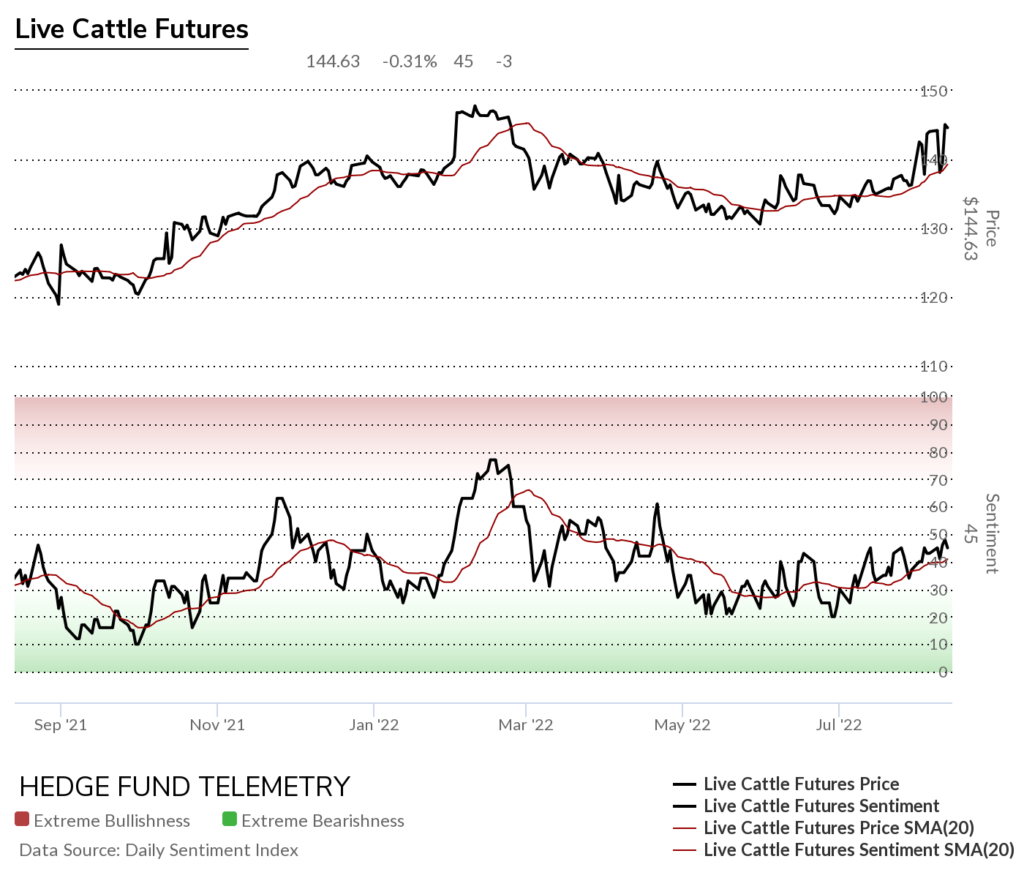

Cattle futures daily still below the peak in April drifting higher

Cattle futures bullish sentiment has not moved like price

Cattle futures Commitment of Traders

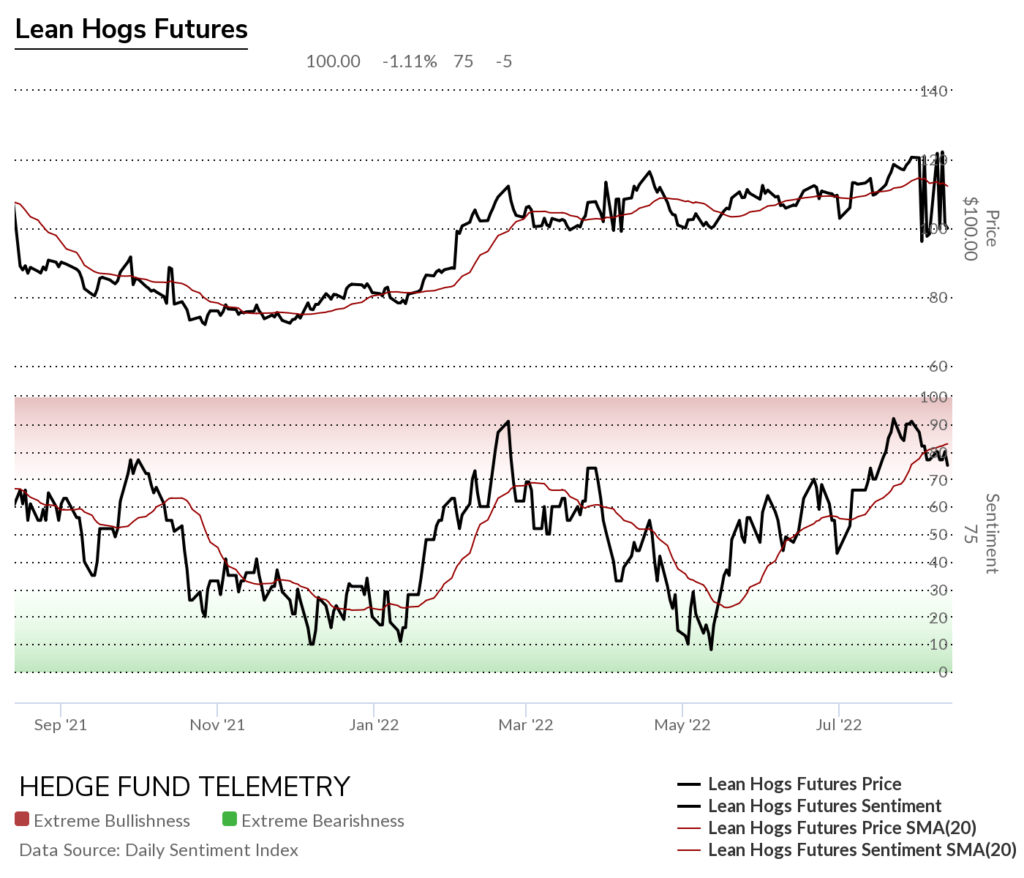

Lean Hogs futures daily did not get the reaction lower after the Sequential 13 yet

Lean Hogs bullish sentiment slipping after making extreme readings over 90%

Lean Hogs Commitment of Traders

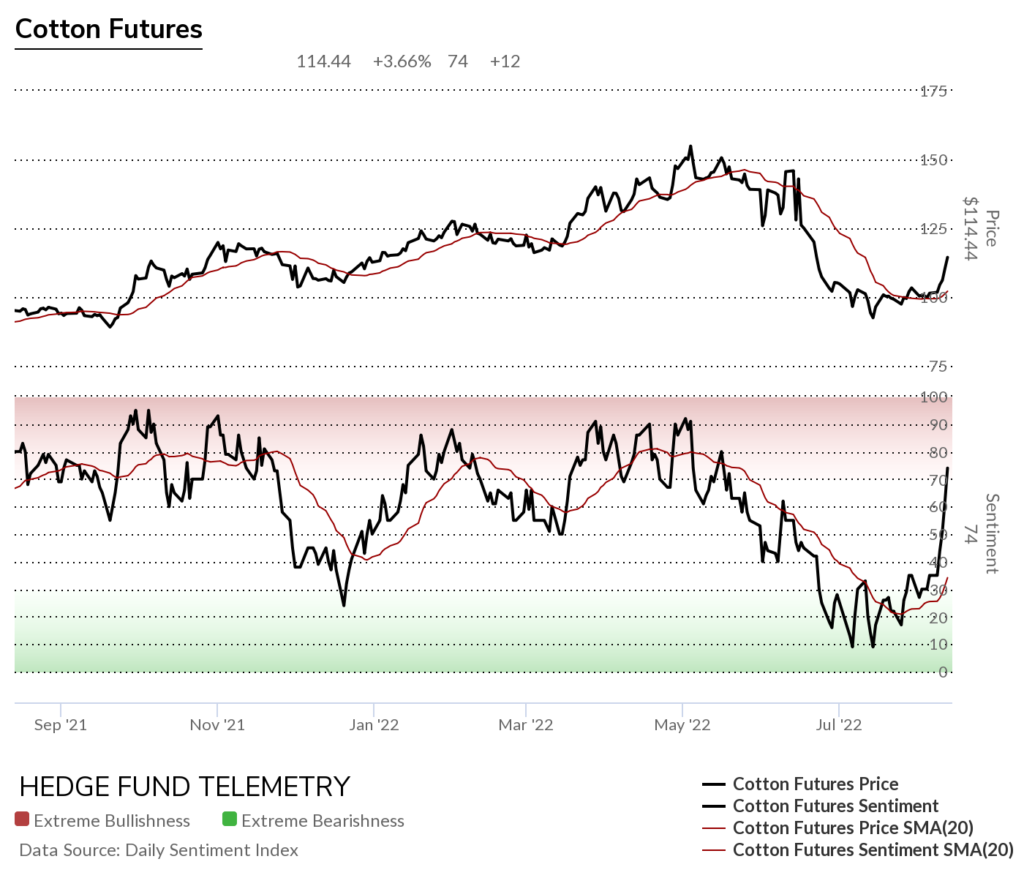

Softs

Cotton futures daily has a pending Sequential however, the spike on day 6 of 9 could complete this week, canceling the pending Sequential Countdown

Cotton futures bullish sentiment spiked wow!

Cotton Futures Commitment of Traders

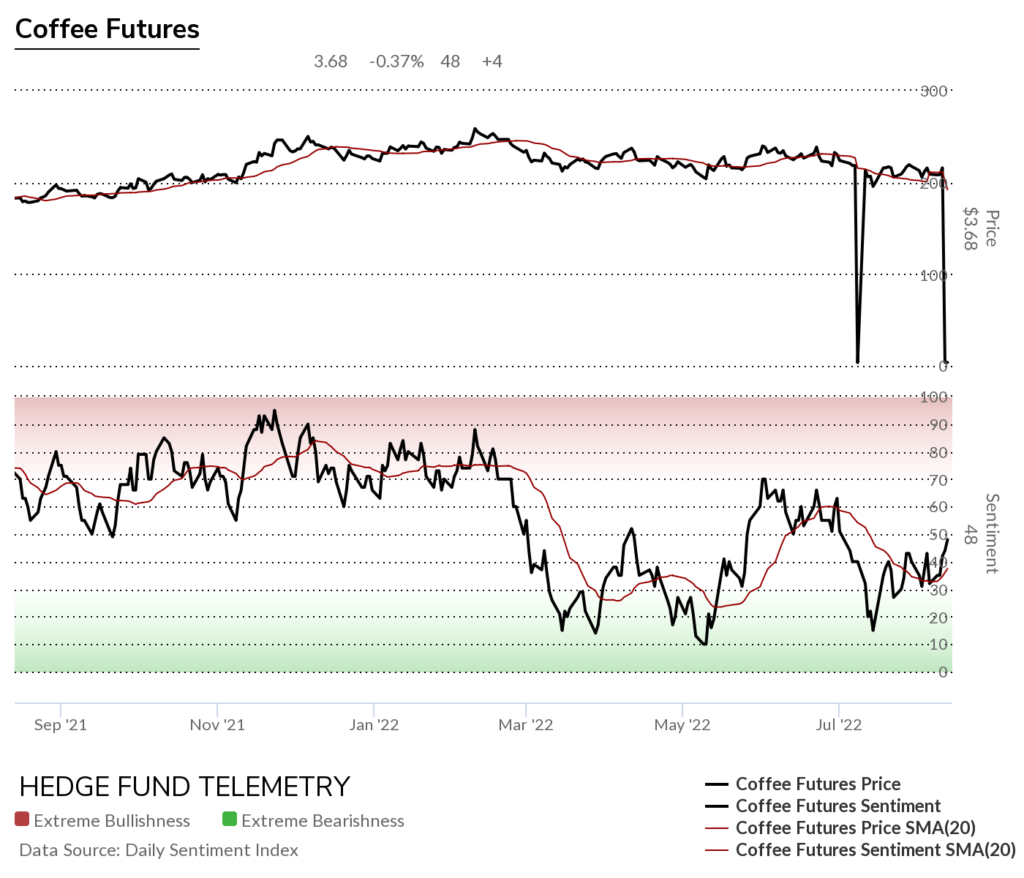

Coffee futures daily

Coffee futures bullish sentiment needs more momentum over 50%

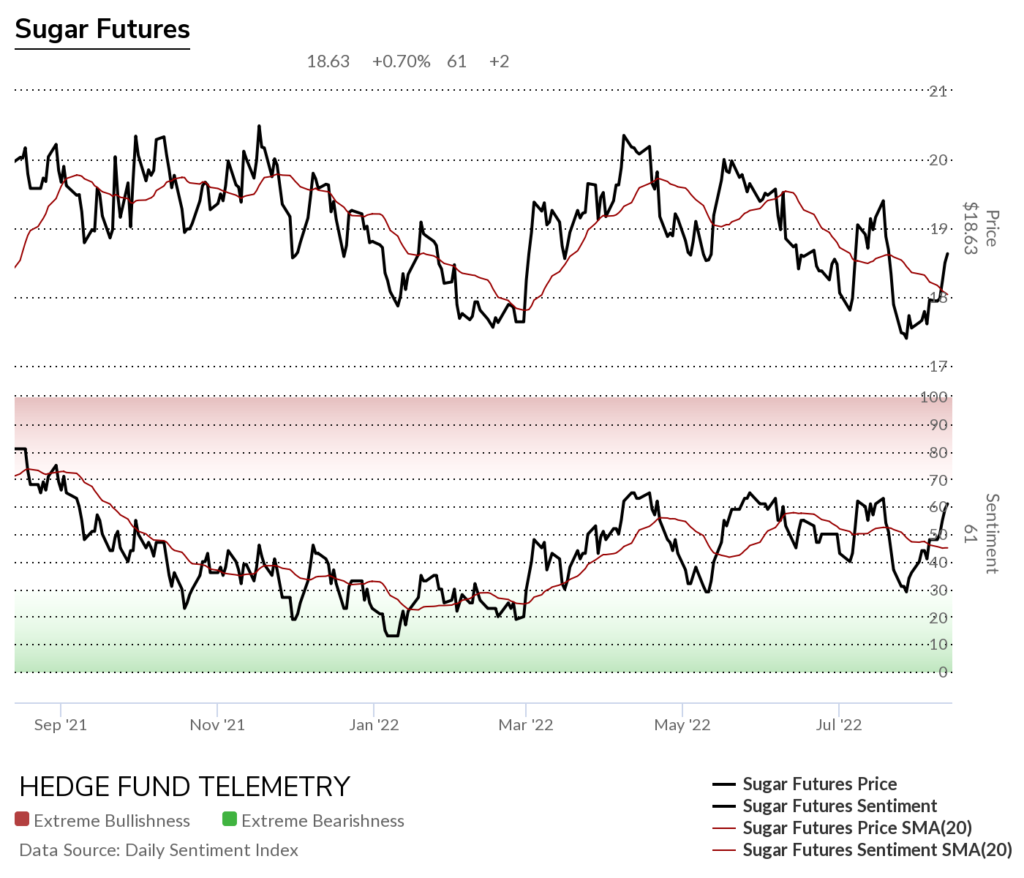

Sugar futures daily has been one I have liked on the long side and believe this can continue

Sugar futures bullish sentiment nearing the high end of the recent high in sentiment

Sugar futures Commitment of Traders

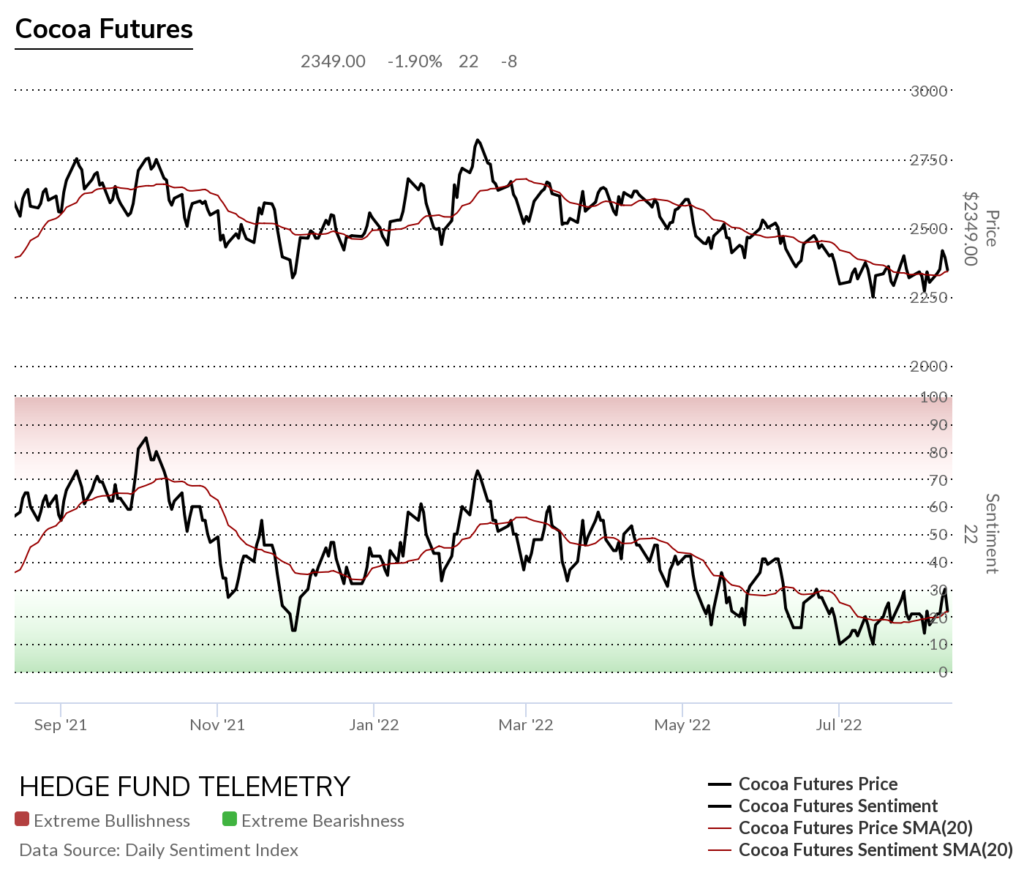

Cocoa futures daily

Cocoa futures bullish sentiment remains under pressure

Cocoa futures Commitment of Traders

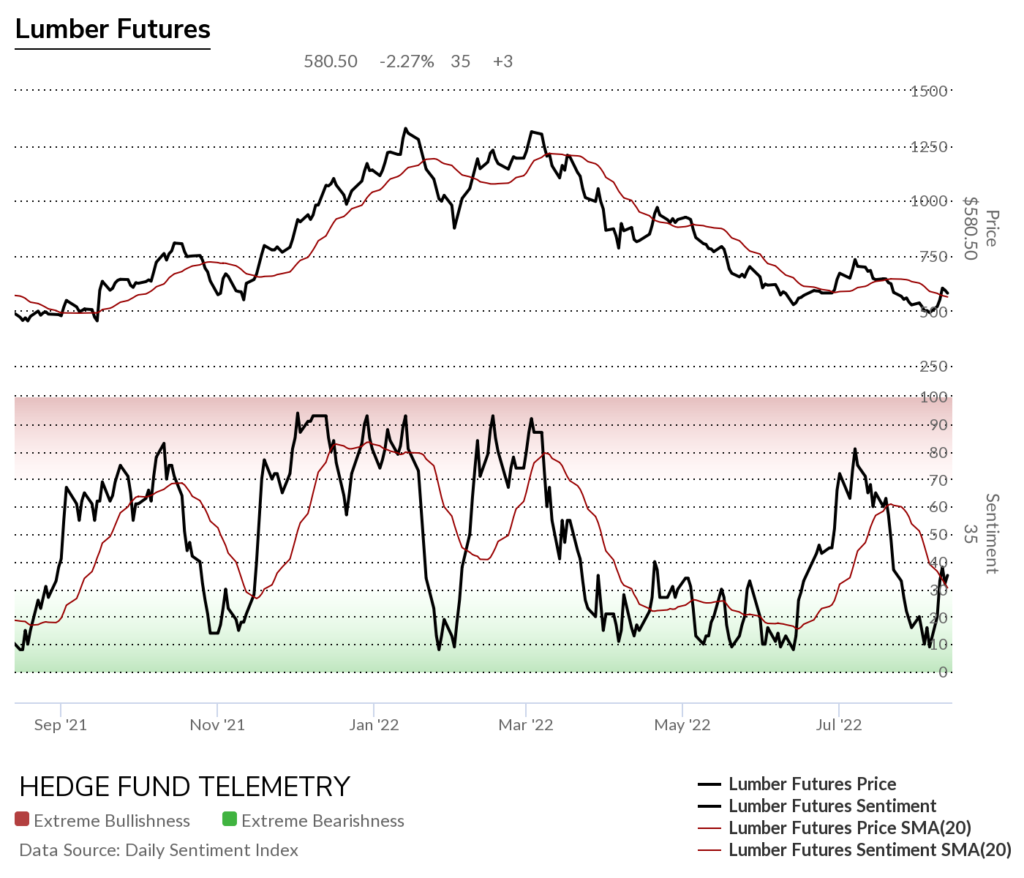

Lumber futures daily still has risk lower with the Sequential and lower high

Lumber bullish sentiment stalled and typically this runs from lows to highs quickly

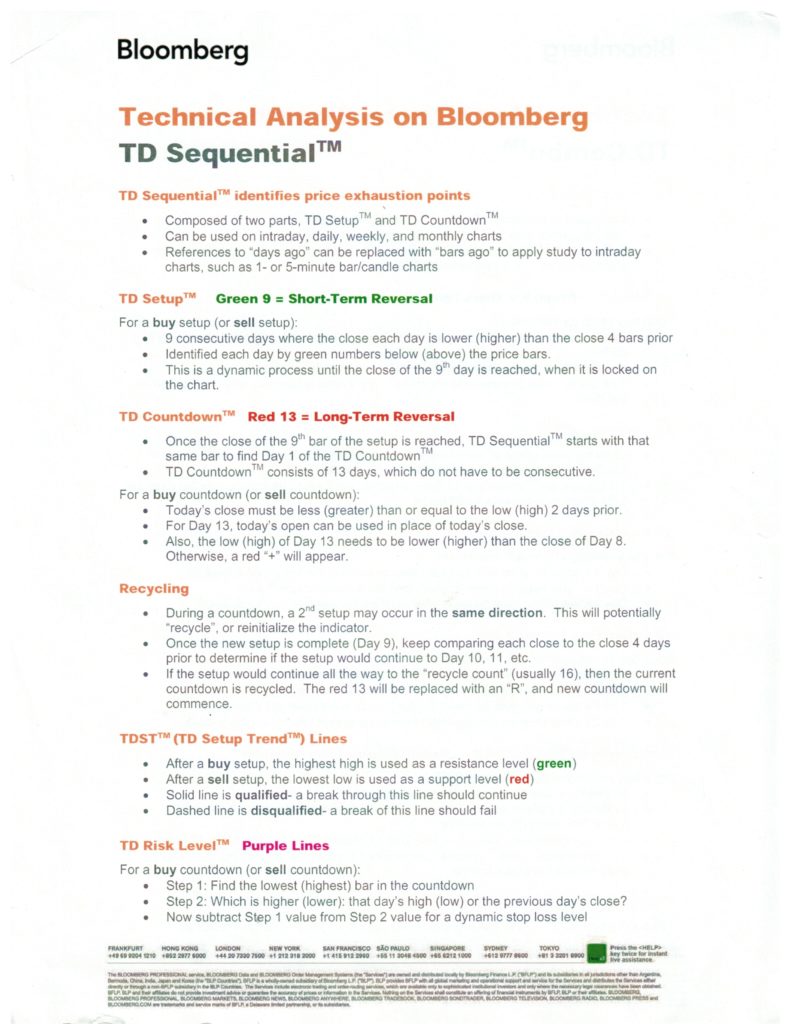

DeMark Sequential Basics

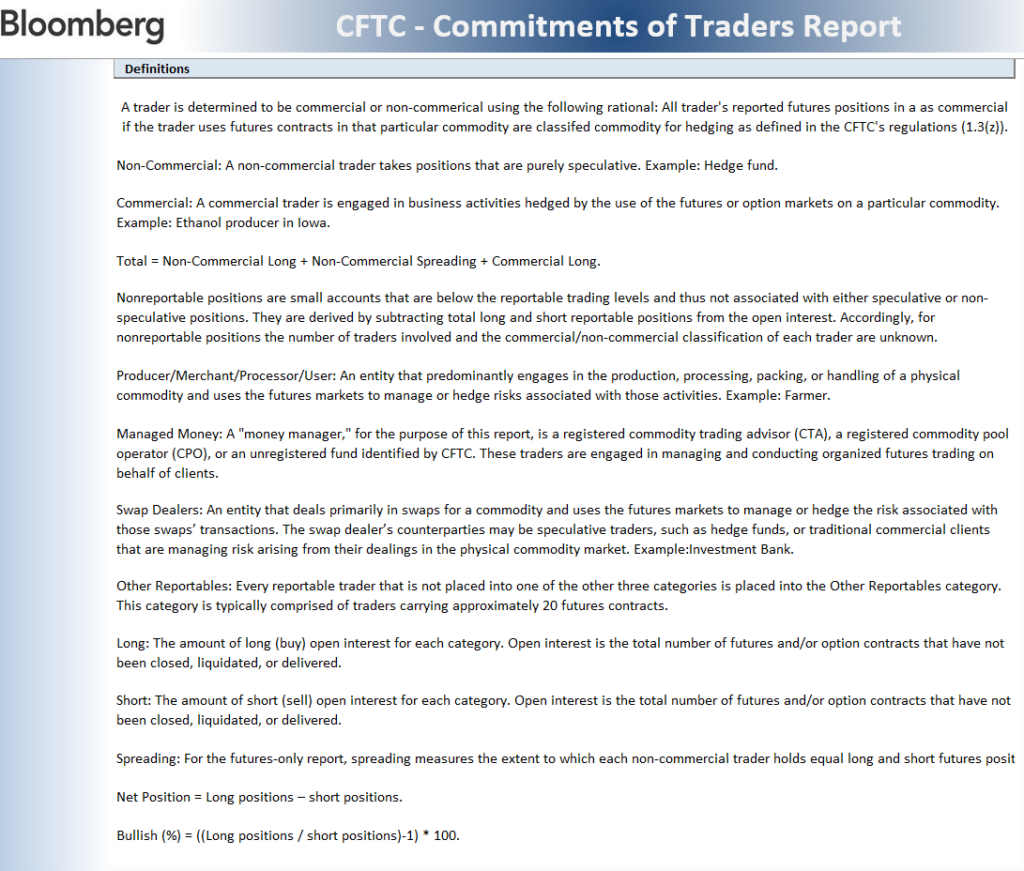

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS