“The time to repair the roof is when the sun is shining” John Kennedy, 1962

“In the short run, the markets are a voting machine, but in the long run, they are a weighing machine.” Benjamin Graham

One of the most challenging things for non-systematic discretionary traders is to trade against their broader instincts, particularly if the broader instincts and muscle memory are developed over the years.

When I was at SAC, now Point 72, I was responsible for hiring portfolio managers into a newly formed segment I would run. In hiring non-discretionary macro managers, the trick was determining whether they had good results/track record that met the firm’s standards and could consistently make money – had a discernible edge with strong risk management skills. Given macro had a different/lower profile (Sharpe, etc.), there was a fair bit of skepticism as to whether the track record was transferable (particularly if coming from a sell-side shop), could be consistent, and whether it was durable. Durability means that managers can be good, have a legitimate edge for a bit, but don’t find new areas of edge as their initial edge wanes. This waning tends to show up in longer track records as the inability to make money irrespective of market environment/regimes and structural shifts. A prospective PM saying, “well, I missed this or that and had poor returns,” could be looked through, but we rarely did. We believed it was incredibly rare for managers to re-define themselves once they lost their edge (for whatever reason). SAC had enough good opportunities outside of macro to place capital.

When running money, you need to show evidence of skill and the ability to refine and develop more skills that can be monetized, no matter what. Like the hitter that has a few good seasons in the MLB, other teams figure them out, and he cannot make the adjustments – next!! The returns are high in professional sports or running money at a hedge fund because not only is true skill rare, but rarer skill is the long track record evidence of an ability to adjust style and approach to capture alpha. If you watch NY Yankees Aaron Judge this year, the most noticeable trait is the ability to lay off pitches he would flail at seasons before. That is the expectation for managing money. You figure it out, or you get designated for assignment.

Macro managers are unique in that they are generally unconstrained (across markets) trying to ascertain where the best bang for the buck is and put the chips there. It is not easy to do, and it requires an almost non-stop puzzle-solving mindset, discerning a big theme with great risk-reward with strong catalysts, and ranking what matters in a market at a particular point in time. For example, when Stanley Druckenmiller says – as he has – that liquidity/financial conditions are the most important feature for equity market returns, he essentially says there is a hierarchy of importance. It is almost like PPMDAS (power, parenthesis, multiply, etc.); there is just an order to it all. Ideally, the consumption of information, research, presentations, surveys, positioning, sentiment, technicals, policy, etc. helps define what investors are focused on so you can zero in on what the market is expecting and contrast that with your own assessments and figure out if its the right time to put on the trade, and in size.

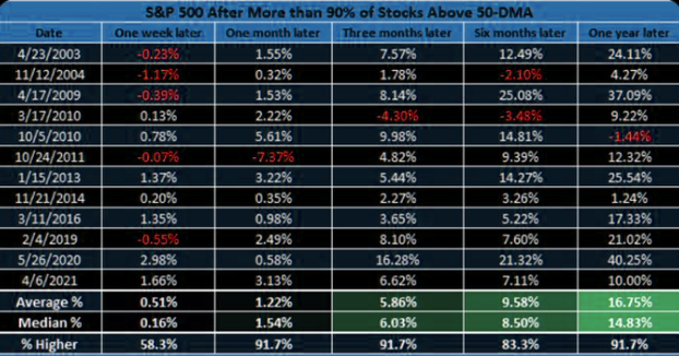

At present, risk markets are rallying, with 90% of the SPX currently trading above their 50D moving average, which historically has been quite bullish (see below) for subsequent months. Many ask if this is a bear market rally (I tend to think so) or the beginning of a new bull market.

The one thing that every investor/portfolio manager has to do is respect price and cut distractions and losses. Sometimes, when things are not working and you are not seeing the ball well, cutting risk and doing nothing can allow you to have a more open mind and view incoming information with considerably less bias. Doing things like doubling down, and adding to losers in a tape not going your way, is a recipe for disaster. Sometimes, it is hard to jump in, particularly if you have the view that the market may be a bit exuberant or expecting outcomes (soft landing) that are historically very difficult to engineer, and even more so with inflation > 5%. That being said, the old adage that the “market can be irrational longer than one can stay solvent” is critical to appreciate. Benjamin Graham’s adage of voting vs weighing rings true as well, that eventually, the true weight matters.

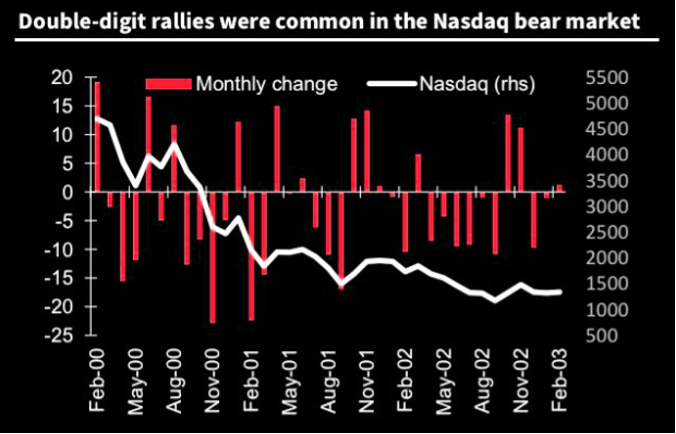

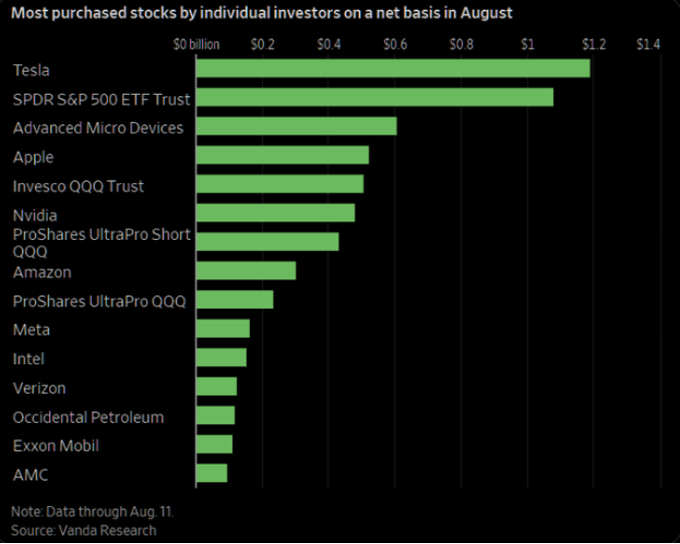

Personally, although I didn’t see this degree of the rally, particularly after the employment report (although I did caution that as long as the economy was posting positive nominal GDP, earnings/FCF growth and inflation were not causing rates to spike further, money was going to come into the market), I appreciate that the extent of short covering and now FOMO like 2021 type retail participation, coupled with low to moderate positioning/cash on the sidelines, still decent EPS growth (although to be fair, much is in the energy space, and not so hot overall in real terms), buybacks back in play (possibly accelerated due to IRA 1% tax) in a summer/illiquid must be respected. The seasonal trends are also decent for the next few months as well. For the most part, I have steered clear of this market from an active management perspective, given I am always long risk assets. It is fine to trade it from the long-risk side, but all of the work and analysis I have done suggests this is more the absence of increasingly bad news and less the existence of really good news. Additionally, it seems as if we are in Goldilocks right now, where inflation is expected to moderate, the Fed can save the day, and multiples are expanding. Still, nobody is wondering whether earnings can suffer. In 2011 and 2018, we did get Q3, and Q4 Double-digit rallies are common in bear markets, as the following chart shows.

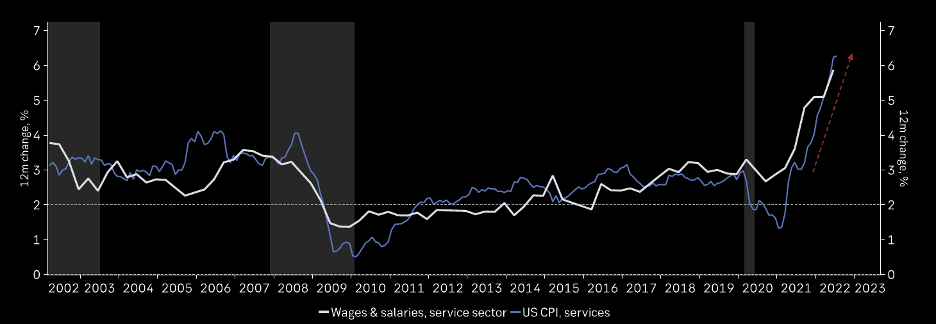

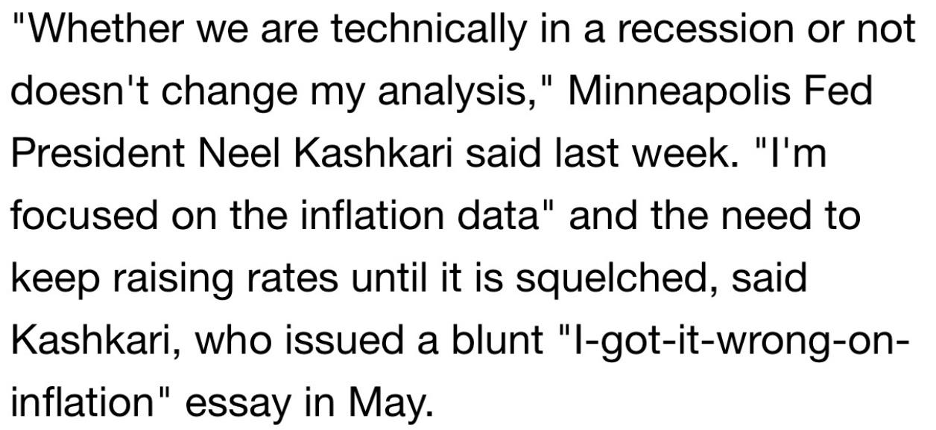

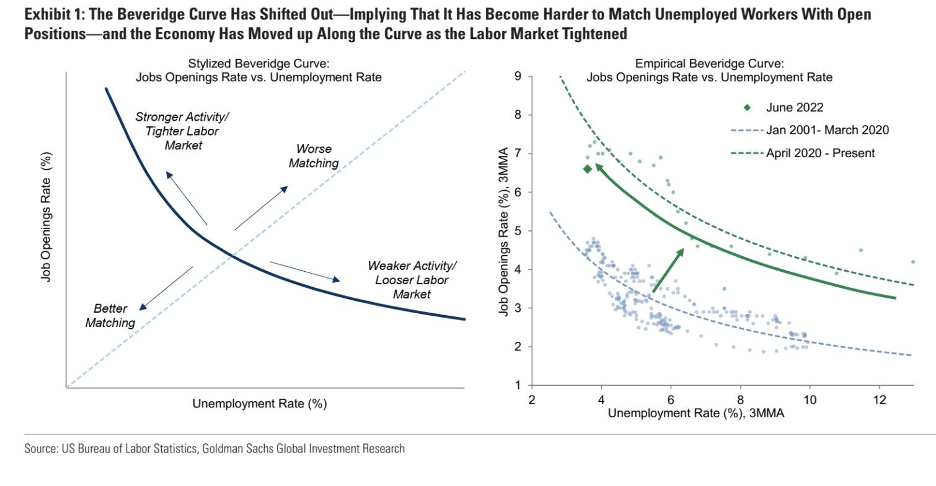

I don’t like to get into the fact that the yield curve is telling us there is a recession on the horizon (largely because the best indicator – 3m/10y – is not there yet), but some of the information coming out of China (see Yuan, Fed hiking,China cutting, property sector a mess), the devilish situation Europe will face come this fall (energy costs are being prepared across Europe to increase by 4X for consumers, businesses, which has to bite), the fact that consumer credit in the US is expanding while wage growth is still negative in real terms (are household balance sheets really that strong?), all while the Fed continues to raise rates (see Kashkari – 4.4% by end of 2023 & not priced in the market), services inflation stays reasonably sticky and well above 2% target, labor markets remain tight (see below), and do QT (there are limits to how much they can go, but most estimates see $1-1.5T), means that this is not the best environment to putting the big bets down in favor of risky assets. Once again, respect the price action and trade it if that suits your style, but keep in mind the challenges that the risk asset markets are likely to face, where critically, marginal liquidity is a headwind.

Things that caught my attention this week:

Flows/Positioning:

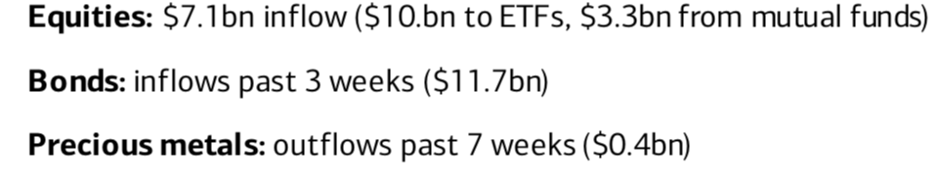

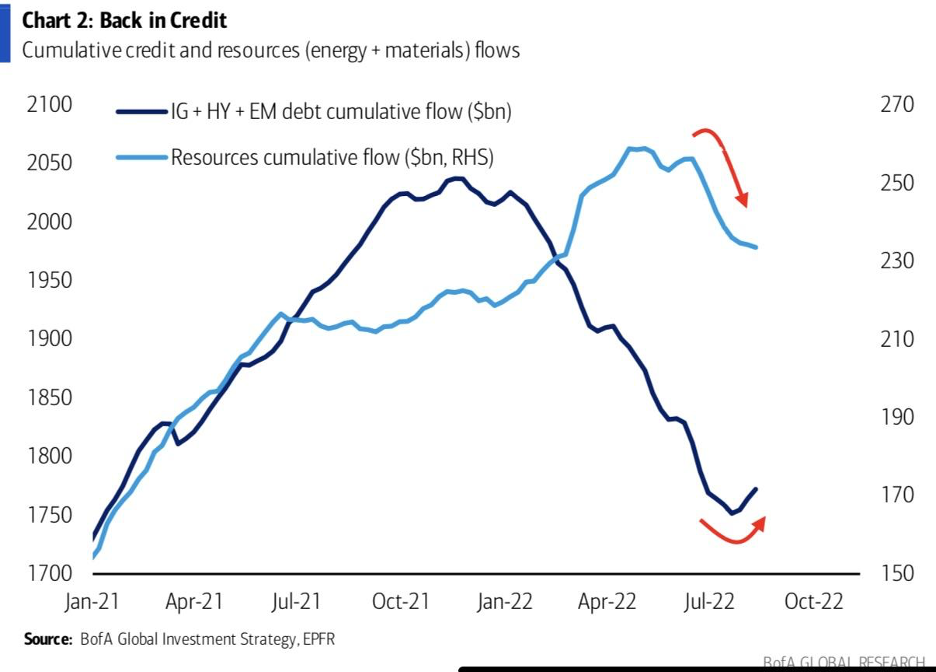

Certainly more positive for equity and credit from the EPFR and other source perspectives. One important point to keep in mind is that non $ global equity investors are now likely positive for the year, given the recovery of equities/credit and the strength of the dollar.

I have seen a bunch of sell-side trading desk notes, but I think this one encapsulates the ideas well:

Some melt-up poetry via Goldman’s Michael Nociro:

1. volumes are light (- 21% vs. 20dma)

2. good luck trading size…SPX liquidity (touch sizes) is -40% over the last week

3. CTAs and buybacks still buying… in a flat tape in a week +$22bn to Buy. In a flat tape, in a month, they buy $37bn

4. corporates…increase in volume over the past week… ~93% of the S&P 500 are estimated to be in their open window with ~96% by the end of the week…remember this crowd is happy to fill up the VWAP machine and do not care much about price impact…

5. retail is back and active….inflows last week of around $17bn

6. “…participation is light, and investor sentiment remains wary of this rally despite the forces at work.”

On retail, although options flows have not been as strong as last year, as GS notes, they are back. Not sure exactly why so much volume went through in BBBY but judging by financing rates at IB and how hard it was to borrow, suffice it to say it was a 2021-type squeeze.

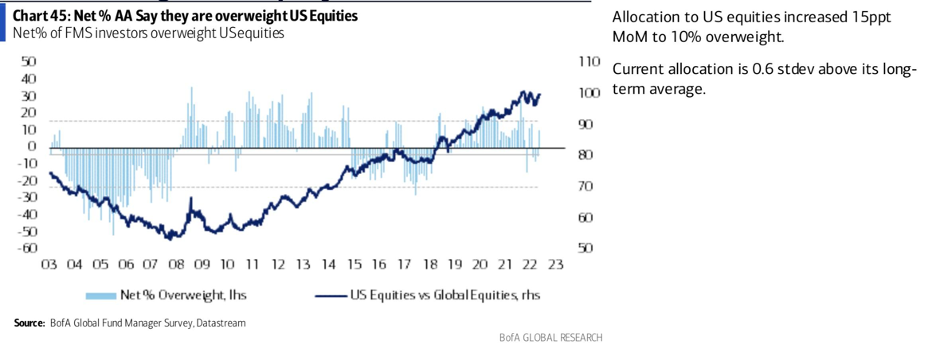

But, in this chart from ML FMS (FWIW, there is a large (2 std) underweight in Europe, which makes sense, as well as 1.3 std underweight in EM, and .5 std underweightJapan) still poses some danger. It is probably not wrong, given higher returns on capital, the composition of US indices, and a strong dollar, but worth keeping in mind.

Ugh, Inflation again?

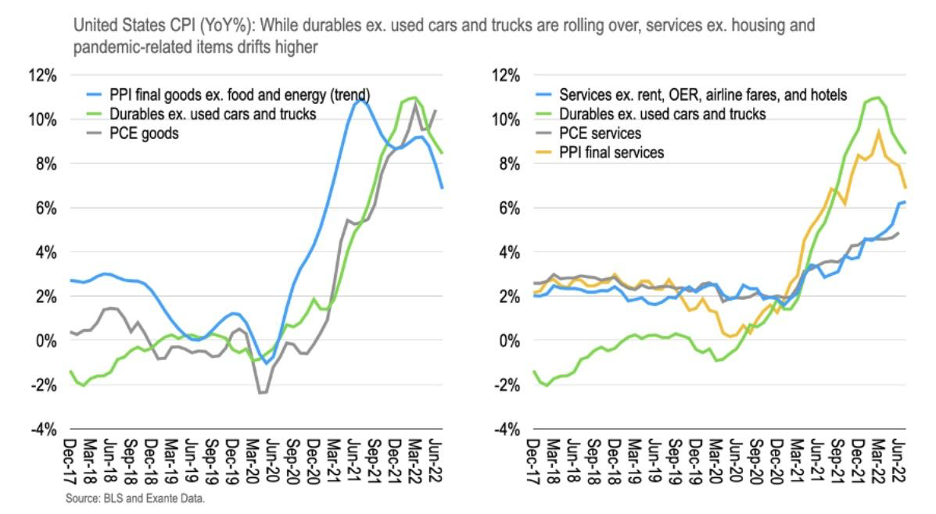

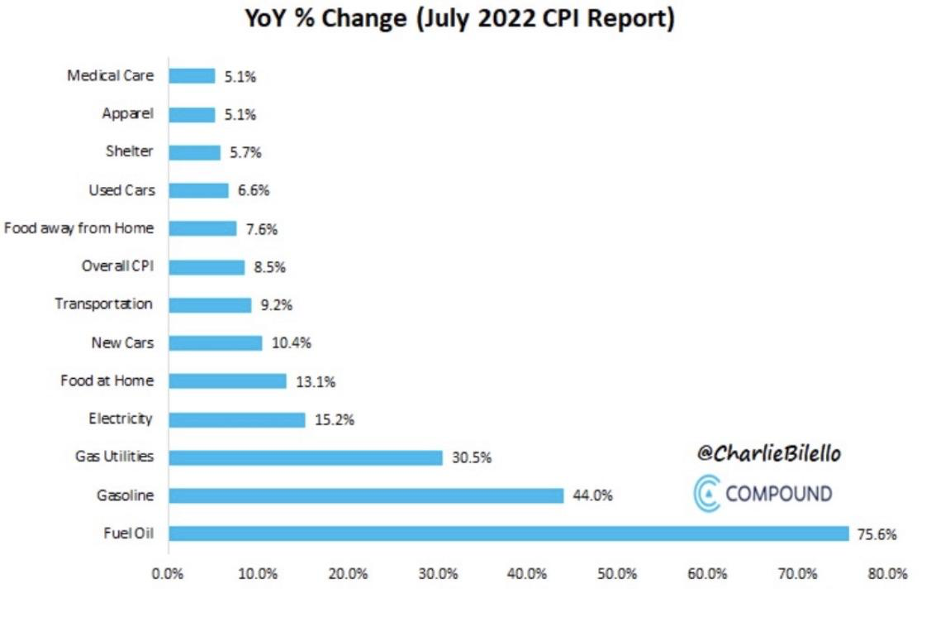

Not to beat a dead horse, but as I note above, we are far from out of the woods on inflation – see below from Ex Ante. The goods section, driven primarily by a reduction in energy price (well, not in Europe), has improved.

But, one possible secular shift that I am hearing and reading about is that the labor market tightness given how difficult it has been to find, attract, and retain (matching rates – see below) quality staff, could mean employment responses to increased rates may be less sensitive than historically, and with it, have some earnings impact if firms decide to retain more staff than is typical in a downturn.

And another area and something I have mentioned about inflation becoming unanchored are that it tends to move around. One area that is currently running below broad inflation is health care. I find that odd since my insurance premiums keep going up by double digits, but here is an article in Politico suggesting that health care providers are no longer going to shoulder the burden.

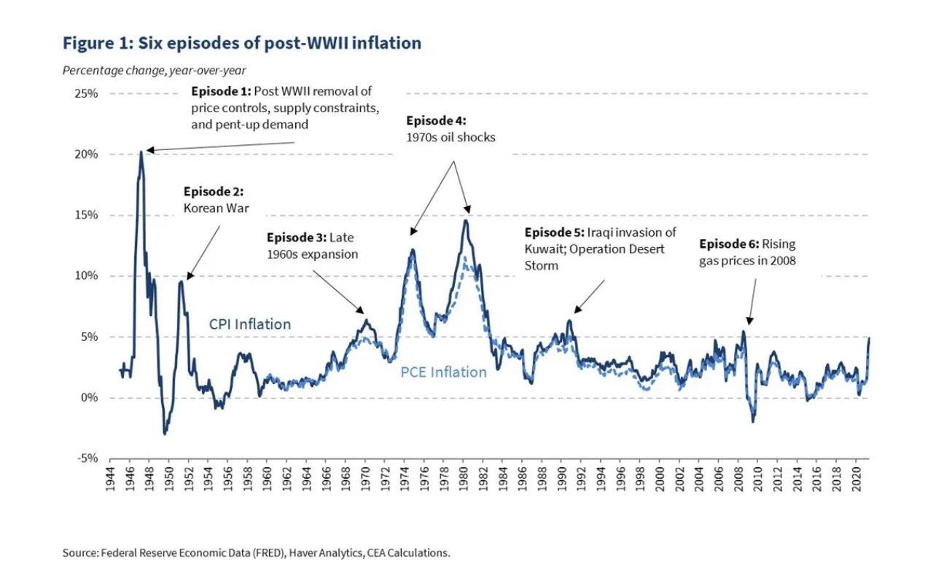

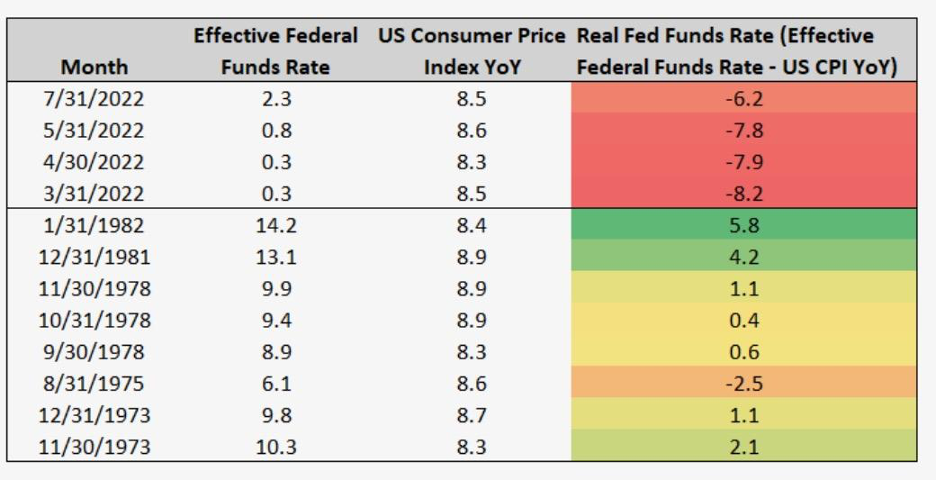

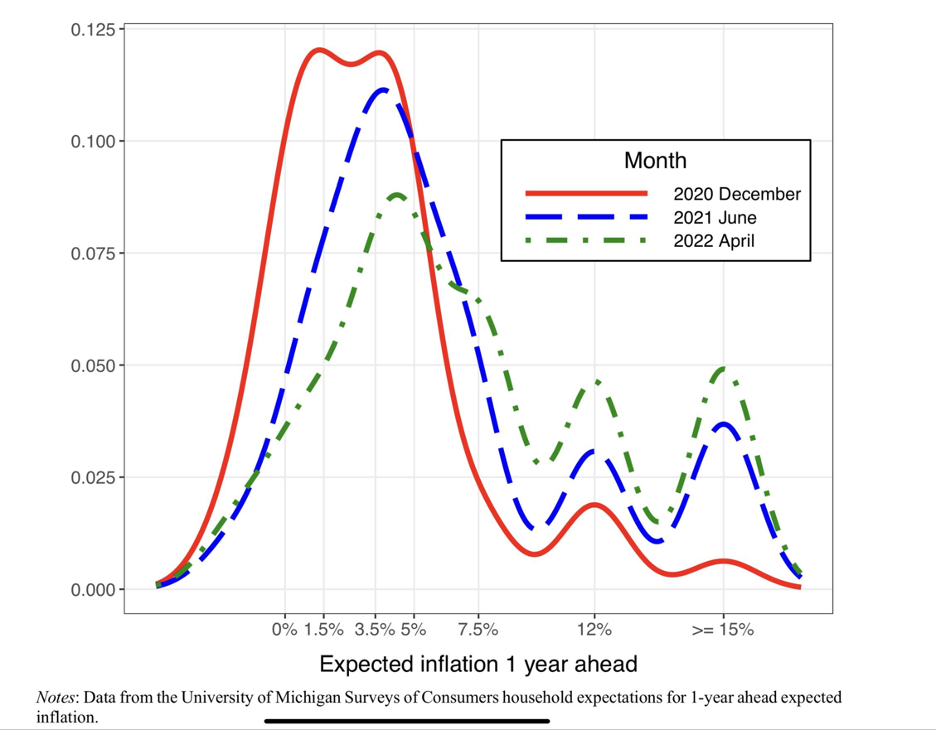

The generic point I have been making, and I included a piece from the BIS last note, is whether or not inflation regimes are generally stable (near target). Once inflation is unstable and pervasive, the second round effects are harder to predict. The markets liked seeing inflation expectations easing, but I still think we are in the early to middle days of the fight. While I also pointed to the John Cochrane piece on why nominal rates may NOT have to go above current inflation rates (Taylor rules have required short-term rates close to 8%), the simple fact is that we are not in an environment where the Fed is entirely comfortable. Their policy, while tighter, is not remotely tight.

The cause of that discomfort is multi-faceted, and reading Bernanke’s book “21st Century Monetary Policy” provides a tremendous amount of good insight into some of the Fed’s very important structural shifts (2012 2% inflation target, broad use of QE; 2015 Yellen running hot labor markets good for lower rung cohorts; 2020 FAIT – which is asymmetrical; 2019/2020 – stabilization of repo markets, treasury market functioning, direct lending, credit support). For a good read, that kind of summarizes many of Bernanke’s points, see the following from Bloomberg.

But, every institutional change that has been made is derived from 4 key concerns:

- Inflation running below 2% target

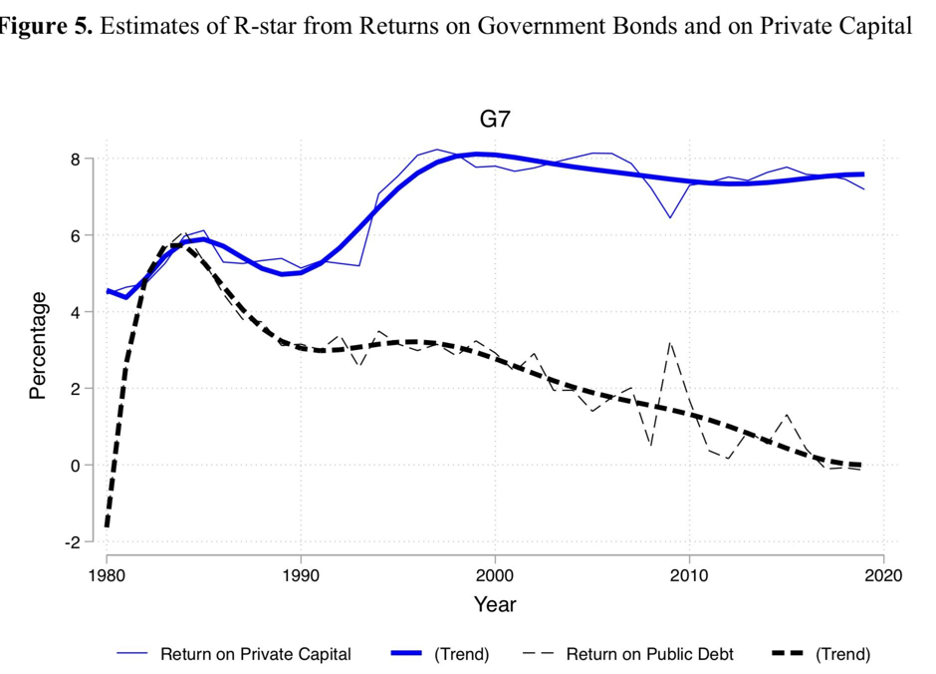

- The declining neutral rate of interest (r*)

- Under-employment of the bottom half of the population

- Japan’s experience with QE (deflation trap)

And inflation running as it is now – even if one accepts the role of supply chains, pandemic impacts, Russia / Ukraine will resolve themselves – runs against an extremely dovish and asymmetrical easy money bias, which DOES have the capacity to de-anchor inflation expectations. (One good historical piece worth reading is the speech Arthur Burns gave post-retirement, “The Anguish of Central Banking.” when you read it, it is easy to see some similarities/challenges with the current era, and as I wrote about last week, stems from the New Deal era and Fed’s dual mandate).

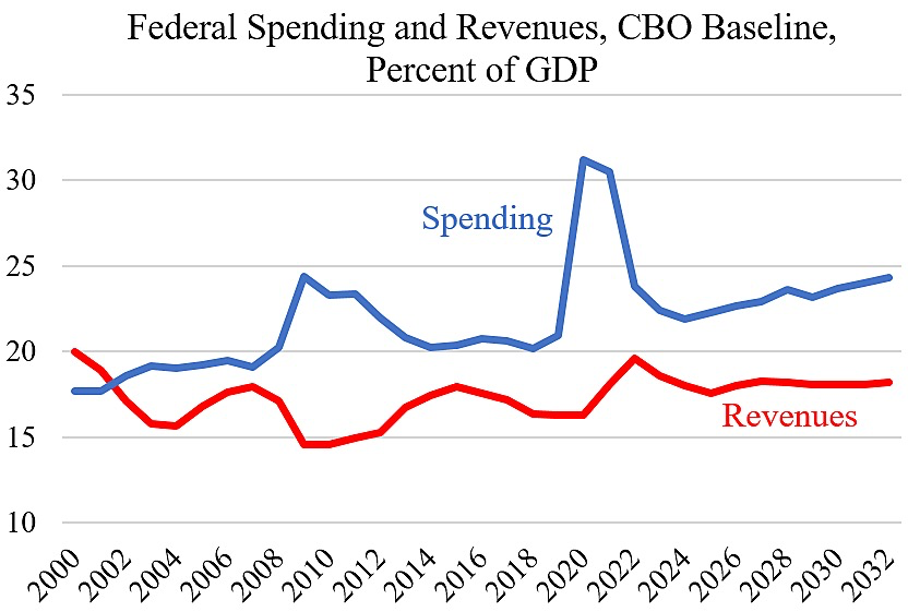

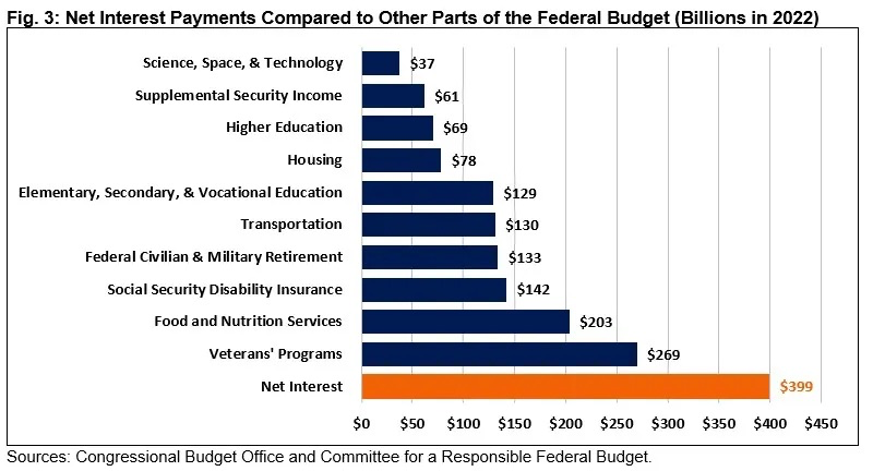

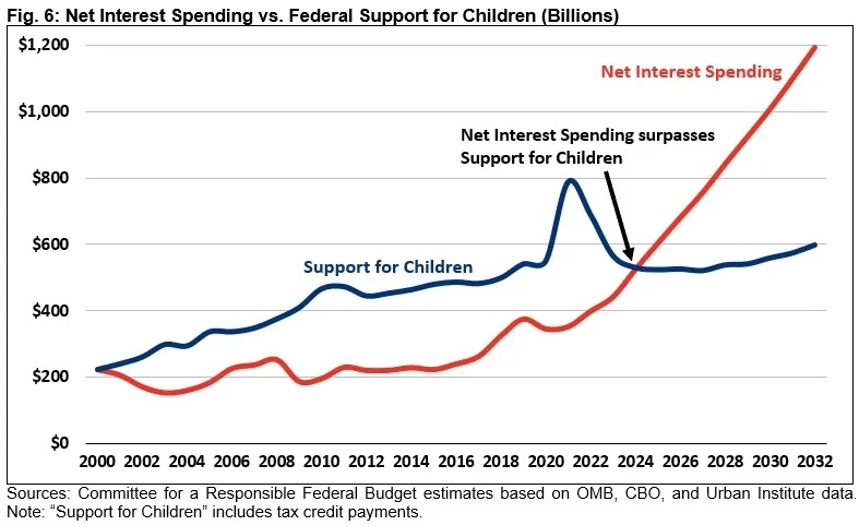

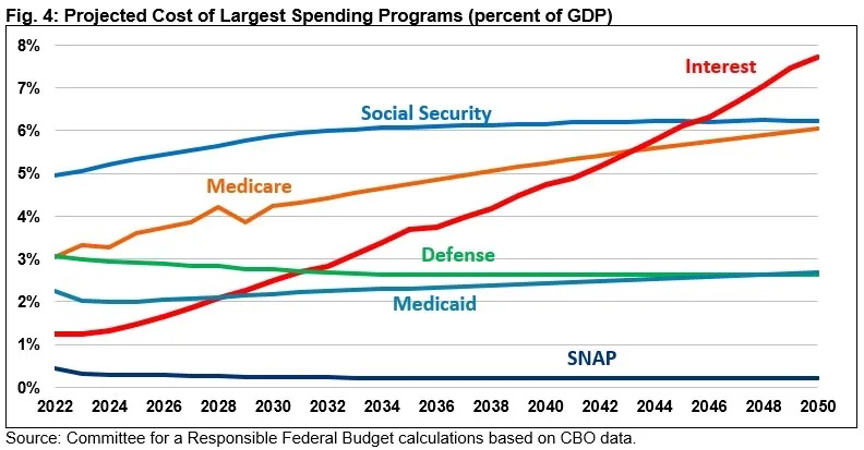

Add into that the Fed going back to the post-GFC use of QE as insurance, was always concerned about the political issues of sending losses back to the Treasury. While true, it has sent quite a bit to Treasury in the past decade (roughly $800bln, as per Bernanke), paying interest to banks for their excess reserves while sending losses to Treasury (taxpayers) and as well as the growing disproportionate role interest expense will have in the budget (see below), means that there is likely a lingering (and in my mind, realistic) doubt that the Fed can stay the course. (For more on managing monetary policy via r*, see Claudia Borio at the BIS that also paints a different picture about navigating monetary policy via this unobservable r*, particularly since returns on private capital have been extremely stable)

The simple fact is the Fed is very much stuck (perhaps rightly, I don’t know) in a bet that the post-GFC world (secular stagnation) would be the new norm, that there is an asymmetrical danger to deflation (even though all we had was below 2% target inflation, big whoop), and thus should be systematically guarded against, which was the purpose of FAIT, to begin with. Suppose Powell is not offering forward guidance (a strong tool) and proxies are trying to reinforce their inflation-fighting bonafide. In that case, they are truly uncertain/concerned that they are in a bad quadrant (stagflation), worsened by debt/GDP dynamics.

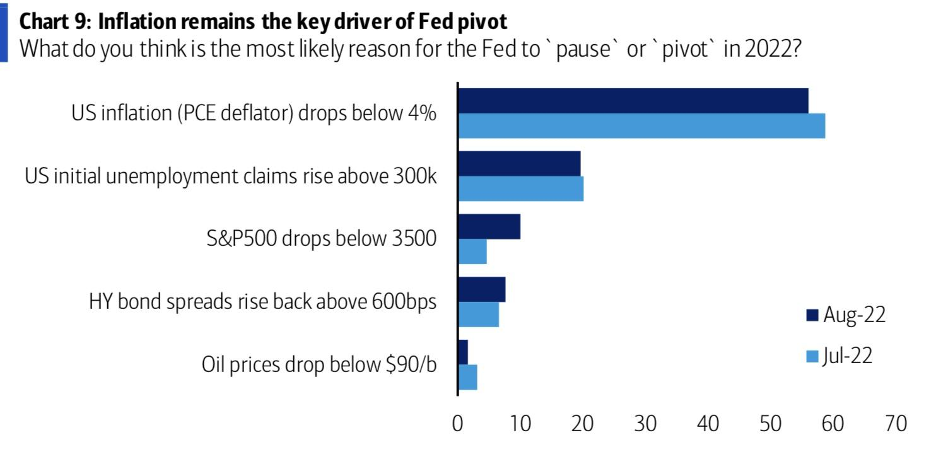

As noted above, financial market conditions unwinding some tightening could be quite a plus for the Fed. Why? It goes back to the quote from John Kennedy above. It pays to fix the roof when the sun is out. The Fed can do more to reload the chambers with ammunition against future downturns. It is generally accepted that 500-600bps of easing is required in a moderate recession, so the more space it can get, the better, particularly if there is a side benefit of proving they are capable of managing inflation, then not a bad trade-off. Here is a good table from ML Hartnett on pressure points from their survey of roughly $850bln in AUM that suggests the PCE below 4% (2% lower) should be when the Fed pivots. We are not that close, and listening to Jan Hatzius on the Bloomberg Odd Lots podcast, it’s generally expected that the low-hanging fruit is getting to 4% PCE, and the tougher bit is getting down to 2%. Either way, it’s hard to see them cutting rates with PCE at 4%.

In any case, 2-year rates are picking back up, even though equity markets ignore them.

Do deficits and debt matter?

Of course, they do. But, we simply don’t know when. Before I move on, here is a quick piece and snippet on debt from John Cochrane (yes, big fan).

The IRA is being hailed as proof that the government can get big things done. To determine what its long-term effects will be, and there are some supply-side incentives in there, so remain hopeful. But, that aside, I am becoming less comfortable with our debt loads.

As we know, there are four ways to manage this:

- GDP growth over debt growth (we have increased debt 4X since 2005)

- Run primary surpluses (as we did for most of post-WWII)

- Inflation

- Restructuring or default

Running real GDP higher than debt growth, well, real GDP is somewhat constrained, but certainly would be a plus if we could. Austerity (primary surpluses) doesn’t appear to be on the agenda, and if they were, it would not be great for asset prices (growth, after-tax cash flows). Inflation, check. Restructuring or default: hard to imagine.

Once again, the problem with such debt loads and inflation is that keeping interest expenses from having a deleterious impact means material trade-offs have to take place, and the path forward is extremely challenging. Add into that demographic challenges reports of a $7T shortfall for baby boomer retirees and the need to thwart climate change, and you get the picture. We have some real work to do. Notice that the fiscal drag we have been experiencing this year is set to reverse. For that keeping score, those deficits of 5% or so of GDP are above $1T.

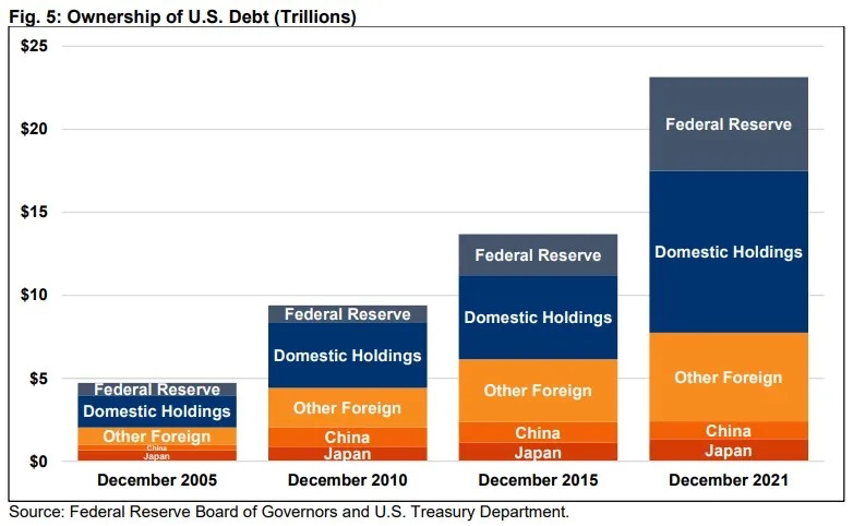

We can always kick the can down the road, but then again, we have foreigners that hold our debt, so we have to pay attention to keeping our house in order.

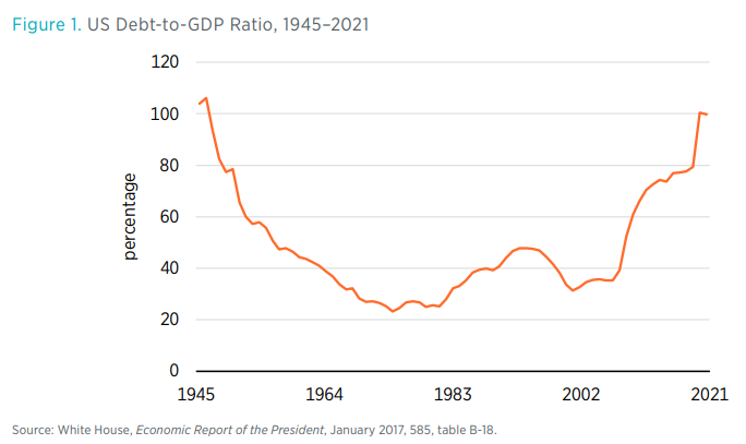

In 2010, after the GFC, our GDP/Debt ratio was near 60%. The Fed’s balance sheet was much smaller. In the past 12 years, we have grown GDP by 43% and debt by 2X that number. I sure hope that was money well spent, but probably not. But, one thing is for sure, there has been a fair bit of winners from this debt binge. The sectoral math is that if the public sector is running deficits, the private sector is running surpluses. How can anybody with a straight face on the winning side of the ledger argue that without government support in the GFC and pandemic, they would be better off? It stands to reason the government will find a way to tilt the field.

Anyhow, there are different ways to think about public debt and netting out debt held by social security trust and the Fed (for more insight into differences, but that still doesn’t negate the following issues:

- We are losing precious fiscal space.

- It is unclear whether the spending over the past decade has been productive.

- One could argue it is just delaying the realization of pre-GFC nonproductive and slowing growth/productivity trends (or moving from weakened private balance sheets to the public)

- It prevents the US from doing the hard work/sacrifices to change the trajectory.

- Our politics/polarization and lack of market vigilance mean it will likely take a black swan crisis to deal with it.

What does this all mean? It is not positive. The mechanics of it all, the evergreen nature of an own currency-issuing sovereign with all sorts of confusing cross holdings/accounting, can be spun to suggest it is a manageable problem. But, common sense suggests otherwise, partly because historically, these issues have resulted in bad outcomes, sometimes really bad, particularly when the CB loses independence/credibility.

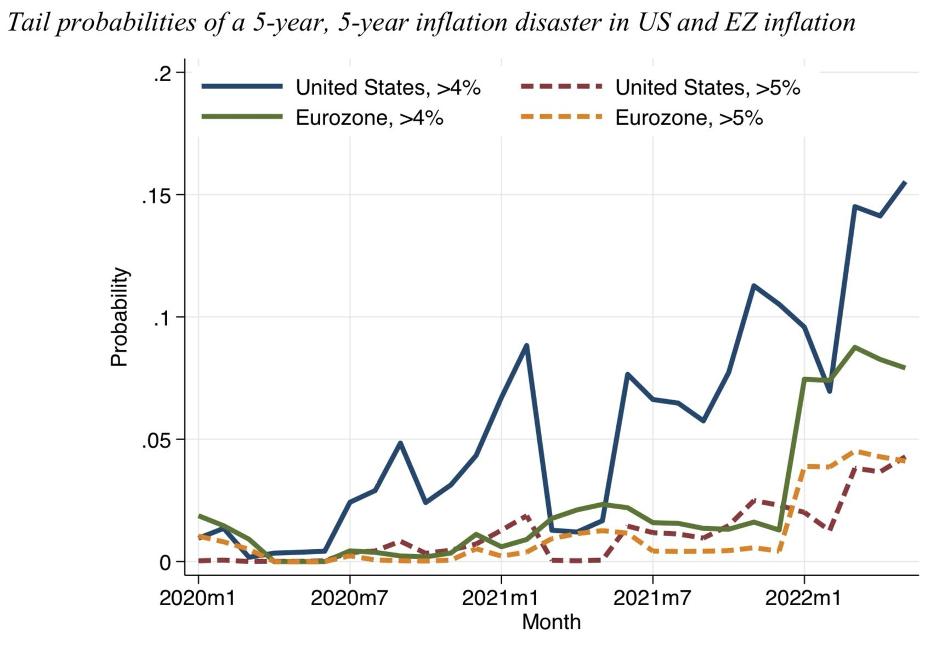

And, on that point, lest anybody believe that inflation expectations are anchored, here are some charts to raise some concern from the Ricardo Reis piece. The net of all of this is that the markets may be discounting a very rosy scenario in an extremely challenging situation that is likely to go through many more bumps, fits, and starts.

I take this all as the Fed needs to be extremely careful not only about a hard landing type recession and perhaps some loosening of tight labor markets but ultimately of not doing the job on inflation. They are structurally quite dovish. As noted above, some believe (and even the Fed July minutes imply) that the Fed will take the foot off the brake and that the era of large hikes is behind us, which helps to explain continued strength in risk. The remaining question is whether the expected 3.625% FFR is enough to get us to a soft landing. I am hopeful but very skeptical.