Last week due to delayed travel I couldn’t get the notes completed. This weekend I came into the office and some of my Bloomberg charts are missing. I worked with Bloomberg support and hope to get the charts back tomorrow when they elevated my issue. With that in mind, I have some other charts that are different and give a good overview with fewer indicators. There are also on the sentiment charts a few data feed errors which will be fixed tomorrow.

Highlights and themes

With the volatility in the equity and bond markets, the US dollar continues to be the risk-off go-to hiding place. The demand for US dollars remains strong globally. This week’s Fed meeting will be a good test.

Currency Sentiment Overview

Currency sentiment highlights show the US Dollar remaining the currency with the highest bullish sentiment. Bitcoin remains under pressure.

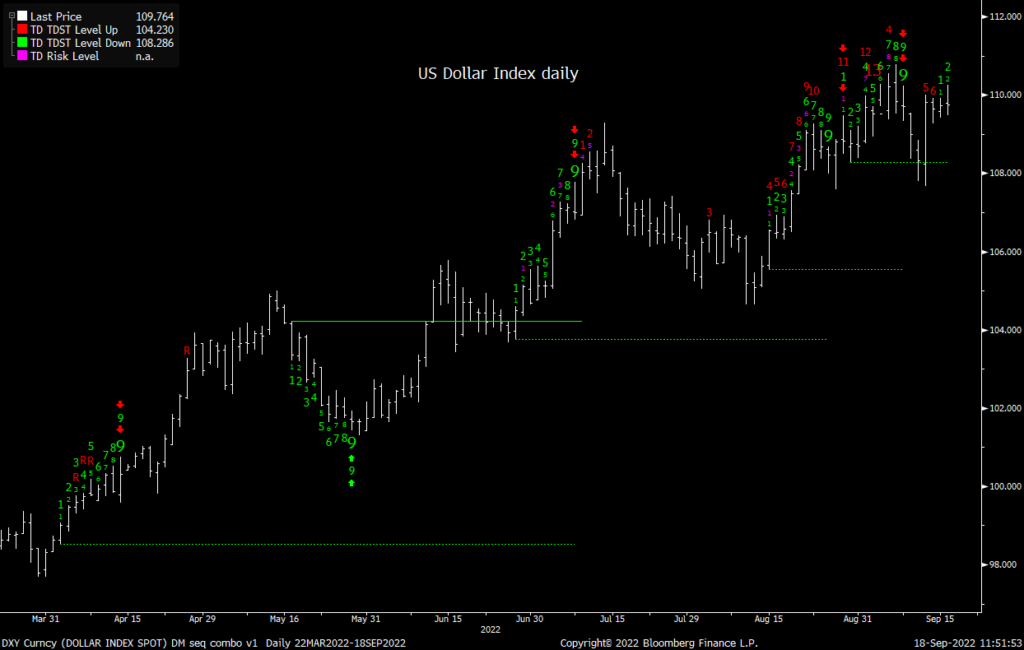

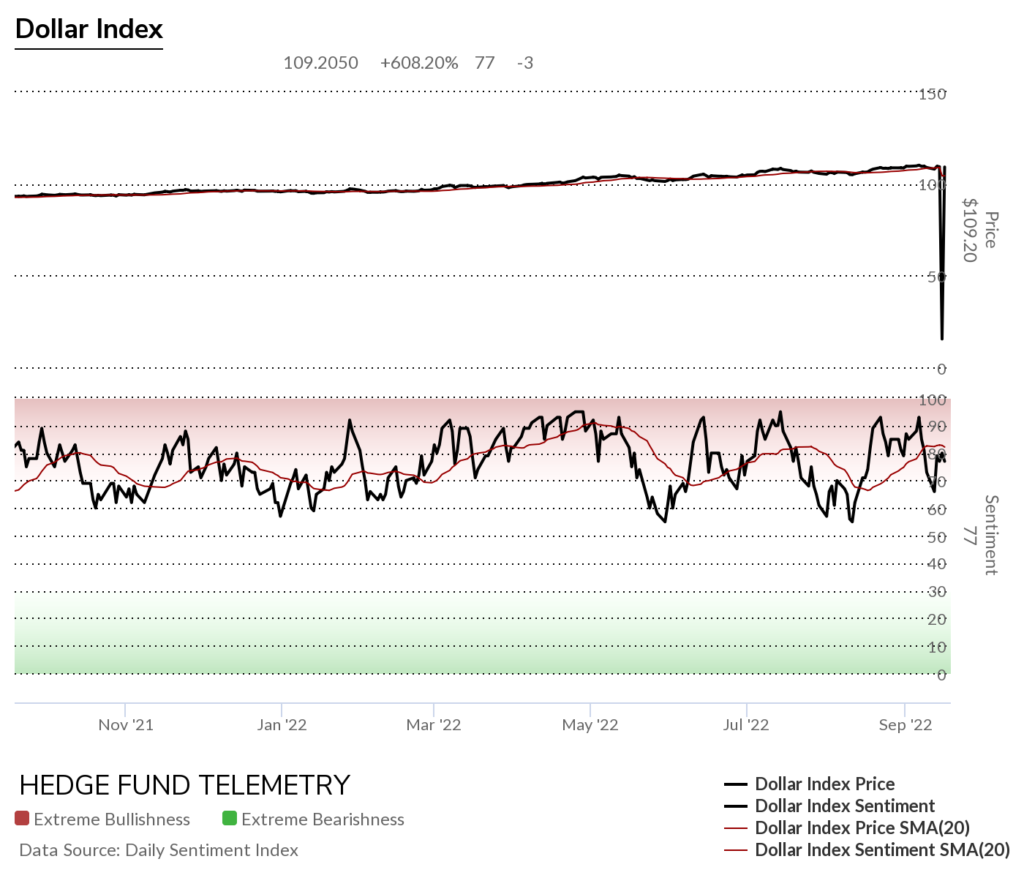

US Dollar Indexes

DXY US Dollar Index daily did get the Sequential sell Countdown 13 with a short-lived pullback. The trend remains intact. Breaking last week’s lows could be the first signal of a trend change.

US Dollar bullish sentiment remains elevated in the middle of the range of the last year.

US Dollar Commitment of Traders

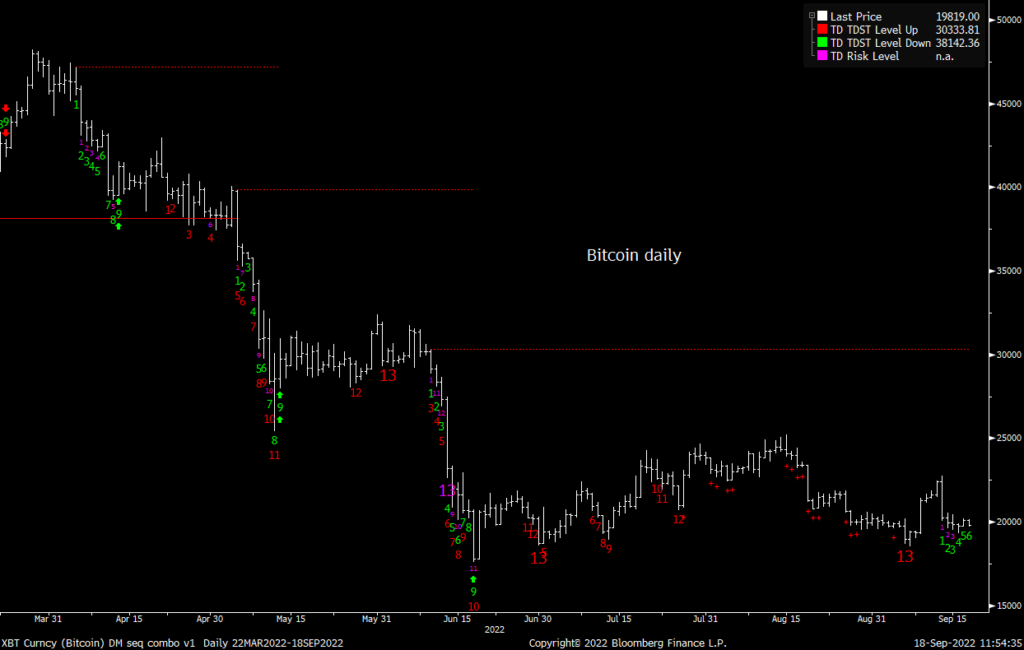

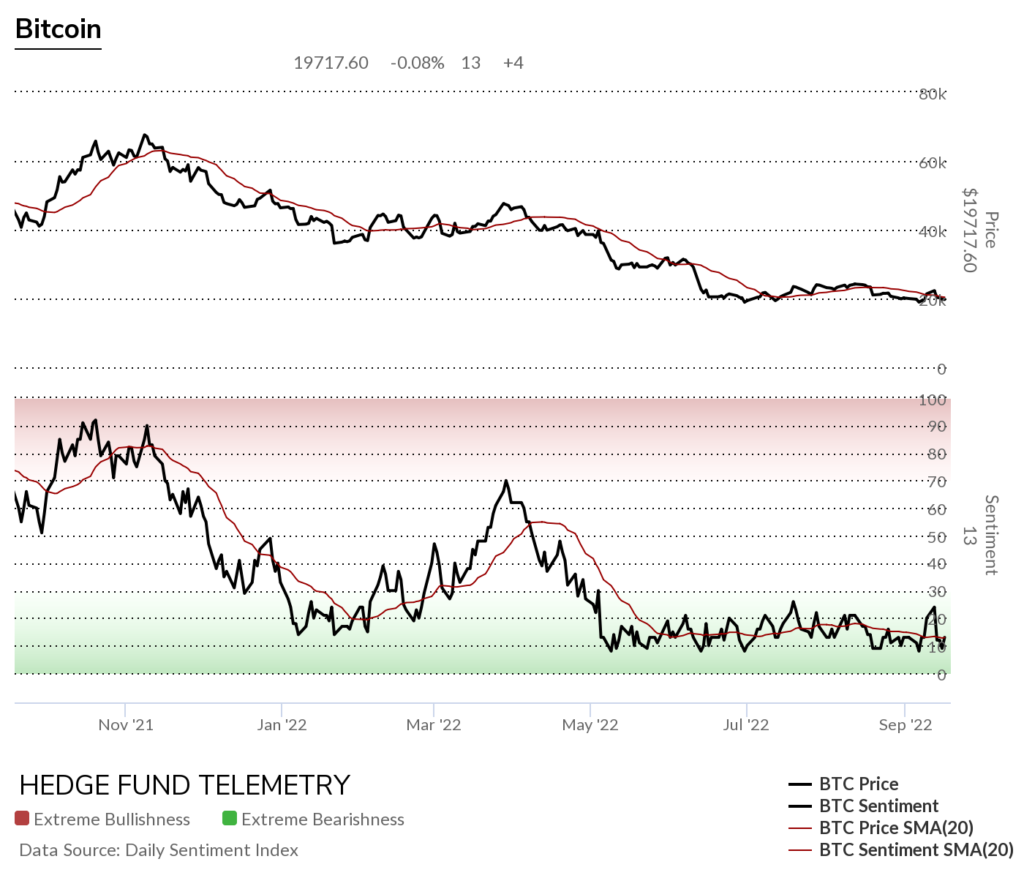

Bitcoin and Ethereum

Bitcoin Daily had a short-lived reversal after the Sequential buy Countdown 13 and right back down. I didn’t expect this signal to last long so why I didn’t get behind it.

Bitcoin Bullish Sentiment remains under pressure

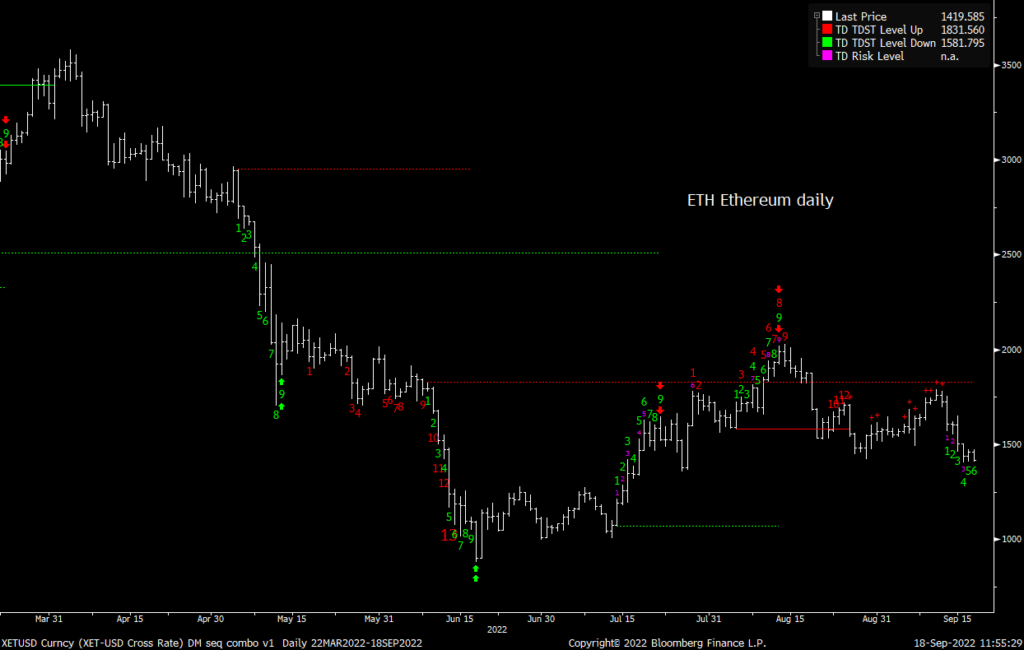

Ethereum Daily also fading

Major USD Crosses

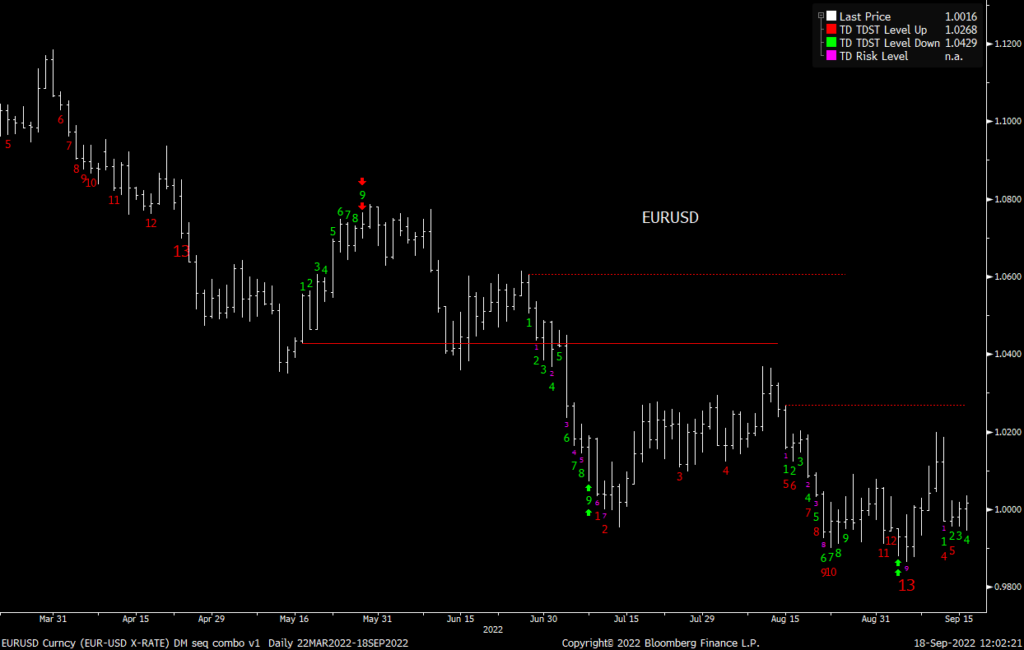

EURUSD Euro / US Dollar did not get a solid response after the recent Sequential 13. A secondary Sequential is possible now

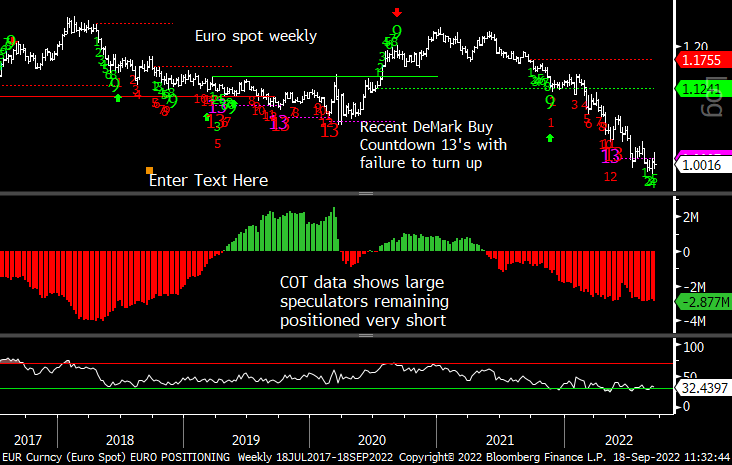

Euro bullish sentiment remains under pressure

Euro Commitment of Traders

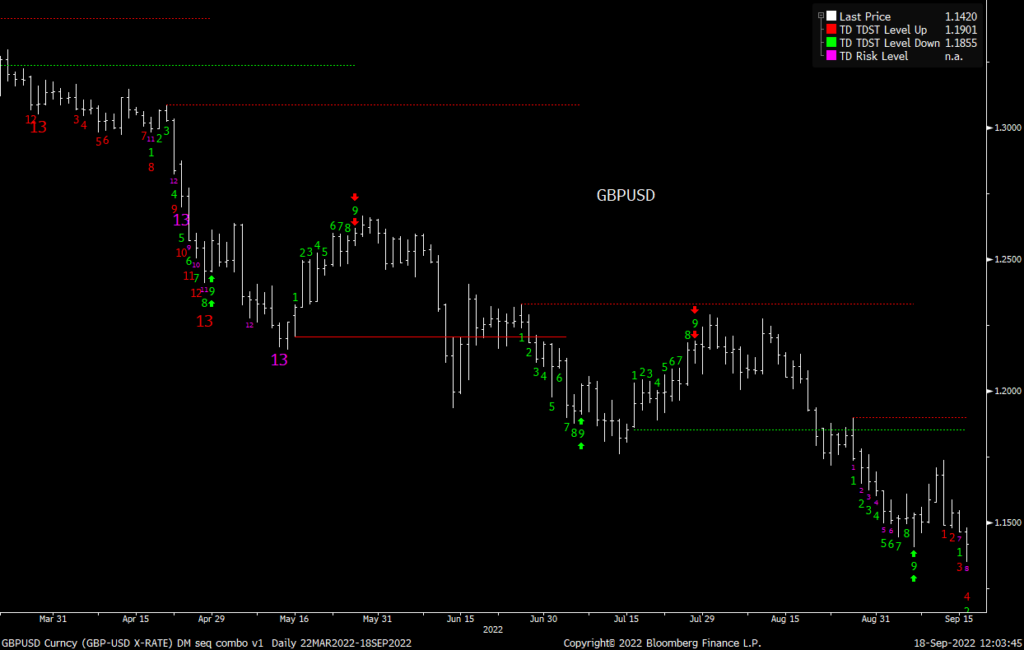

GBPUSD British Pound Sterling / US Dollar with a new low last week and a Sequential in progress

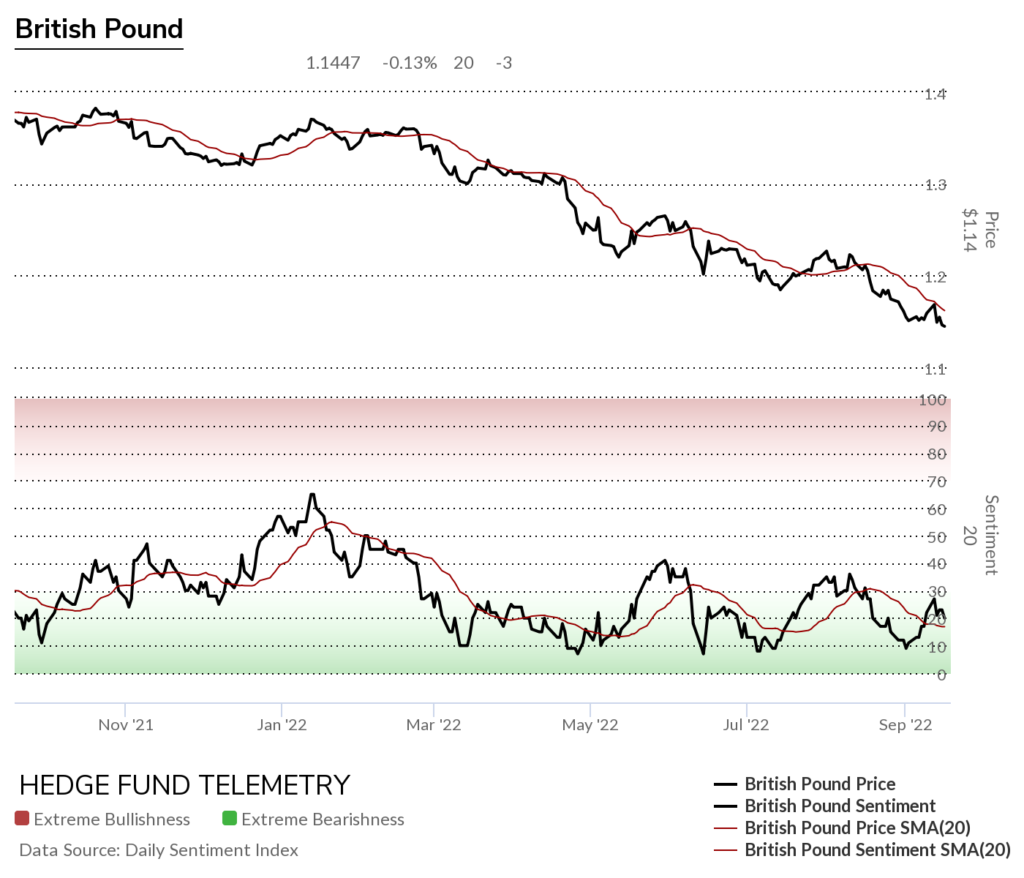

British Pound Sterling bullish sentiment remains under pressure

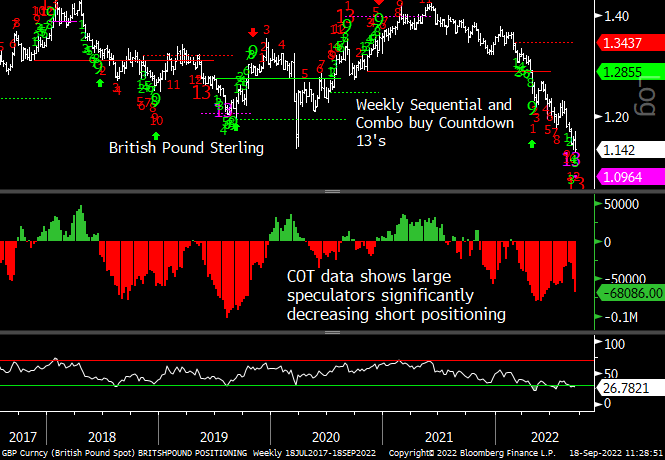

British Pound Sterling Commitment of Traders. New weekly buy Countdown 13’s are in play. After the daily in-progress bottoms could combine with the weekly to mark a good bottom.

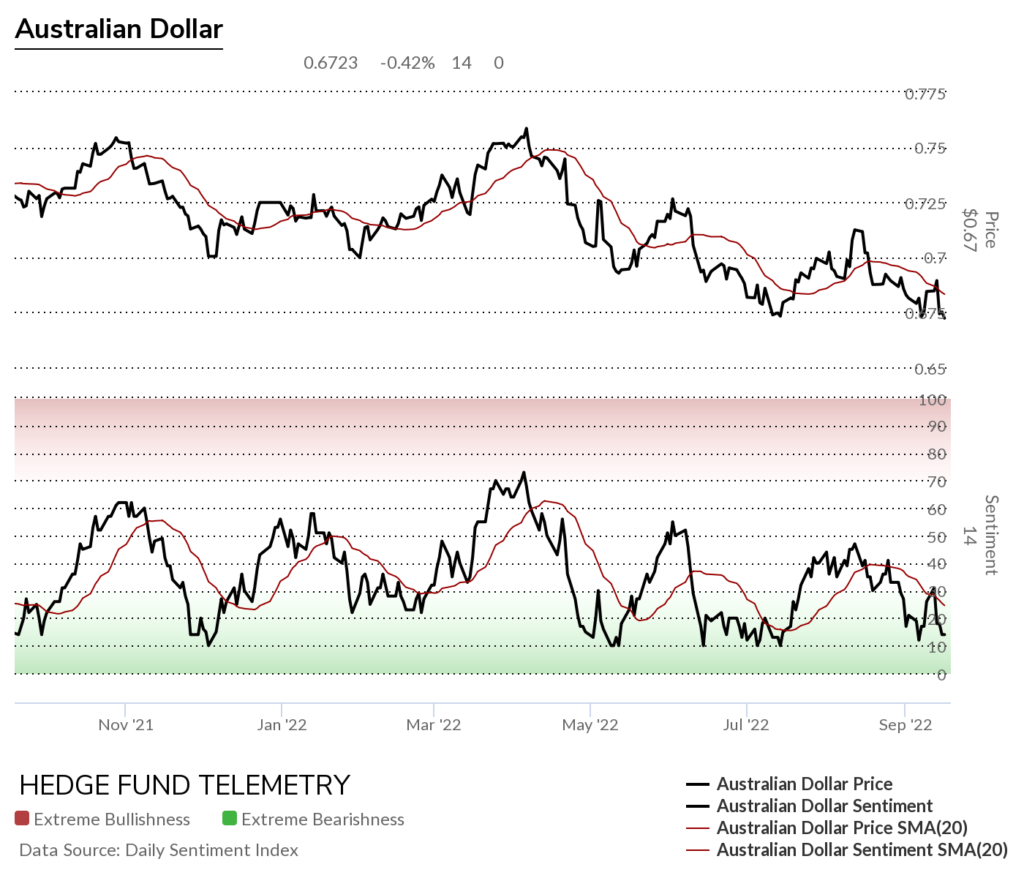

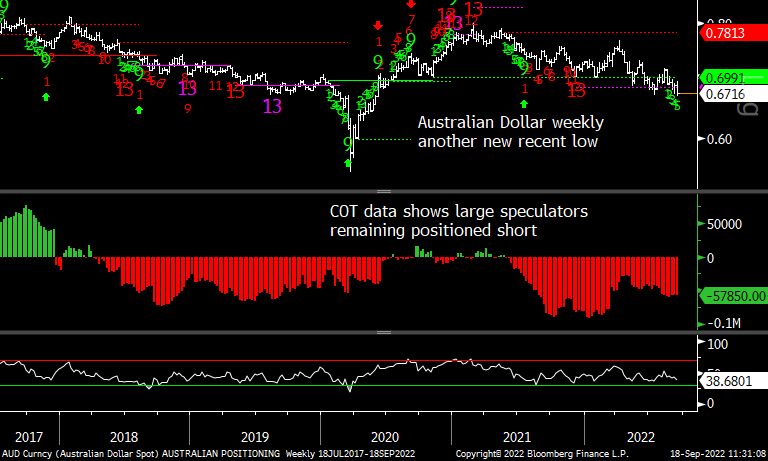

AUDUSD Australian Dollar / US Dollar with a Sequential in progress

Australian Dollar bullish sentiment remains under pressure

Australian Dollar Commitment of Traders

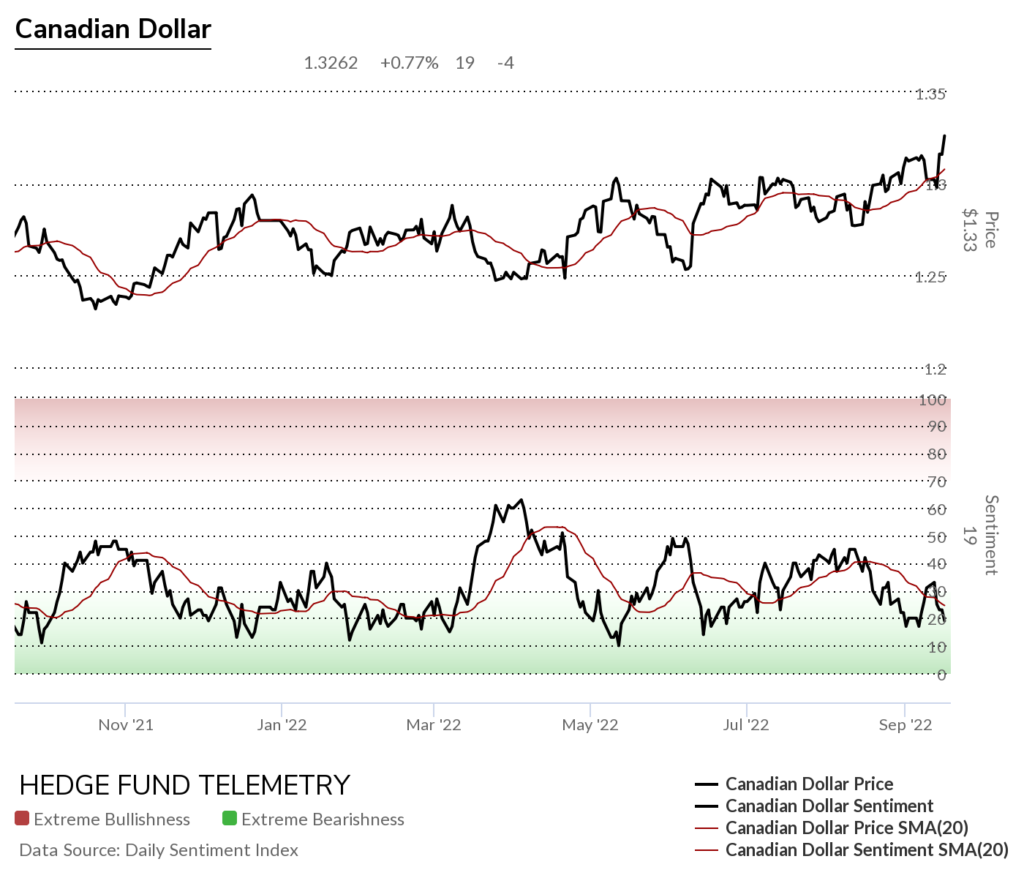

USDCAD US Dollar / Canadian Dollar

Canadian Dollar bullish sentiment remains under pressure

Canadian Dollar Commitment of Traders

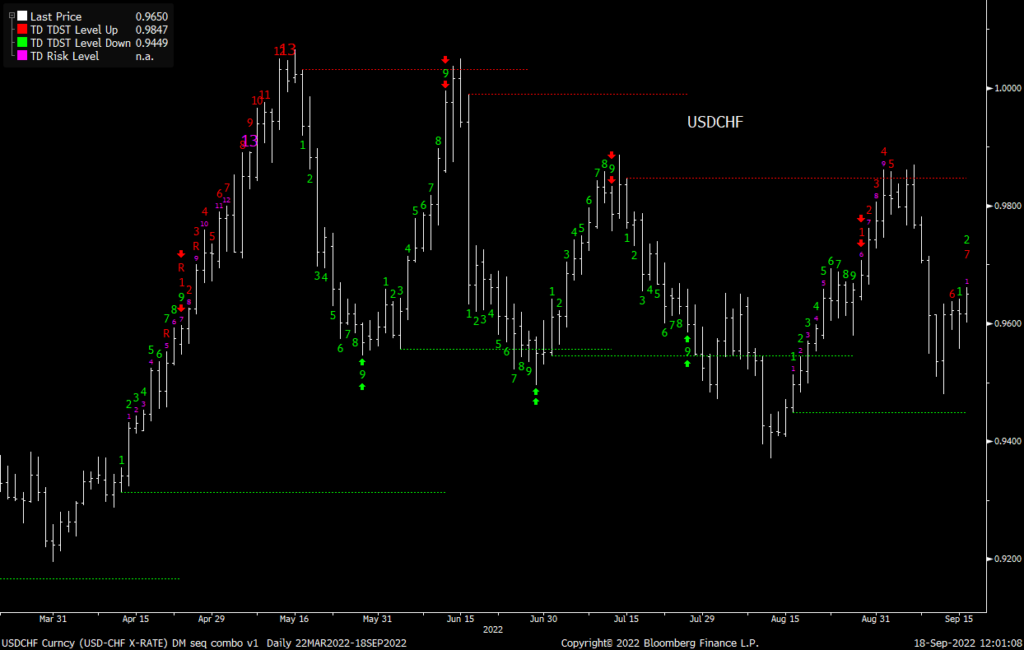

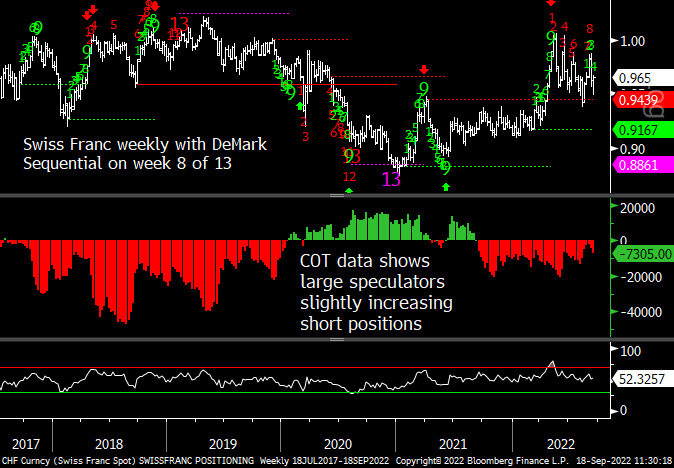

USDCHF US Dollar / Swiss Franc choppy within TDST levels (red and green dotted lines)

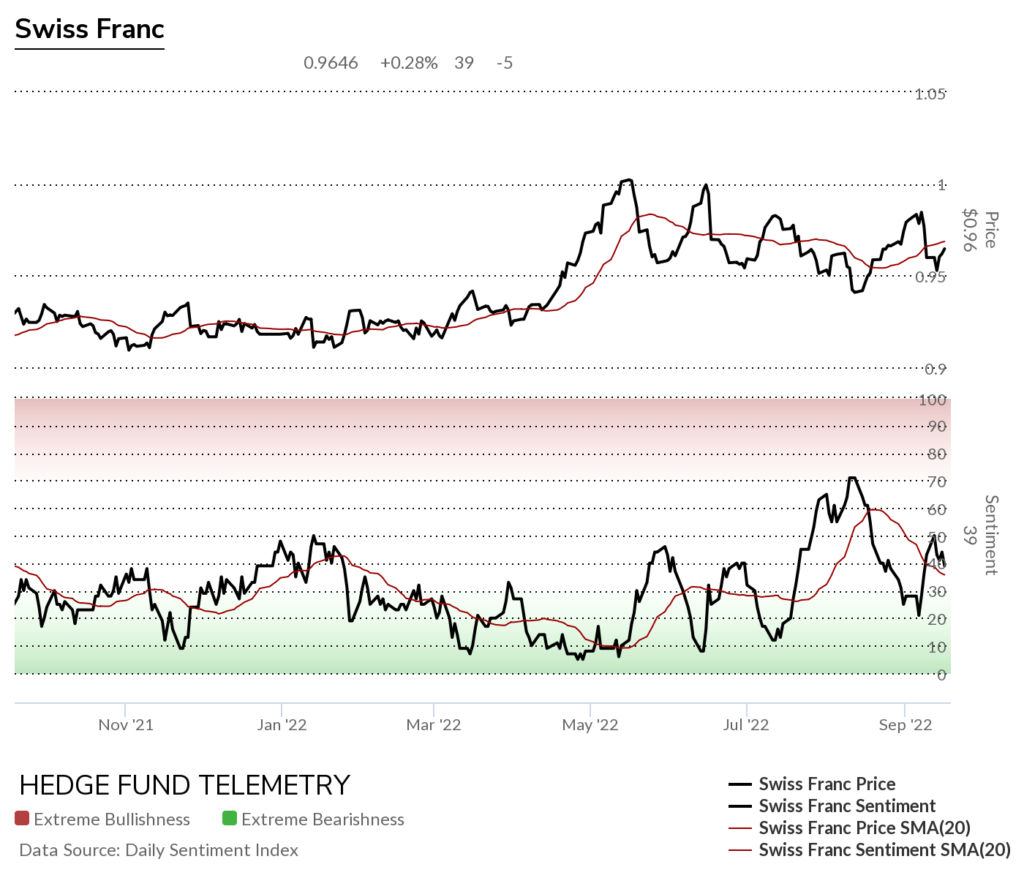

Swiss Franc bullish sentiment choppy stopping last week at the 50% level again

Swiss Franc Commitment of Traders

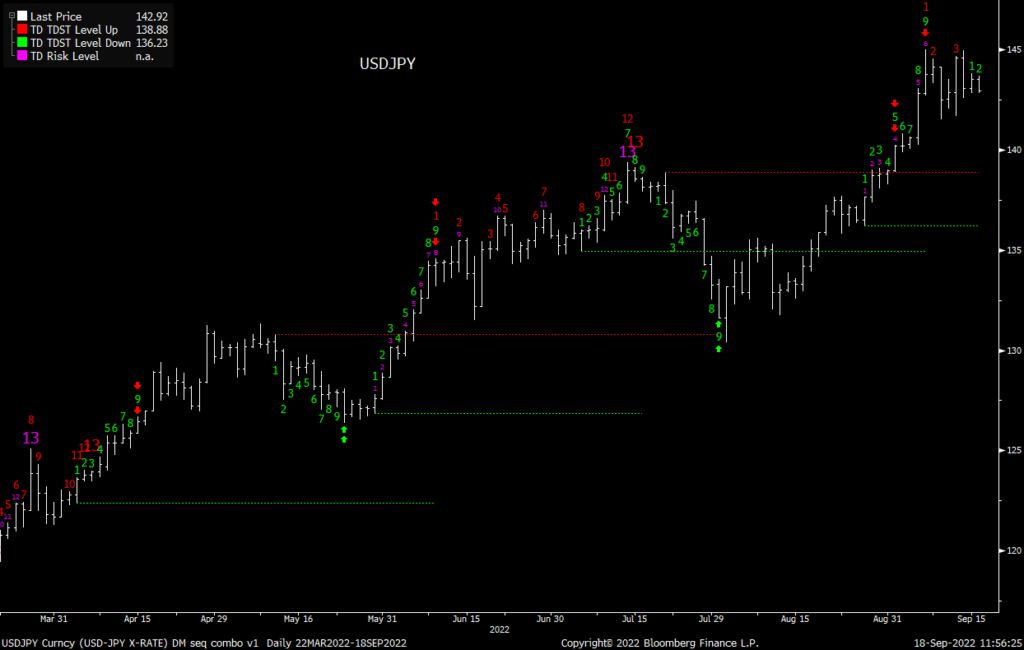

USDJPY US Dollar / Japanese Yen with a Sequential in progress

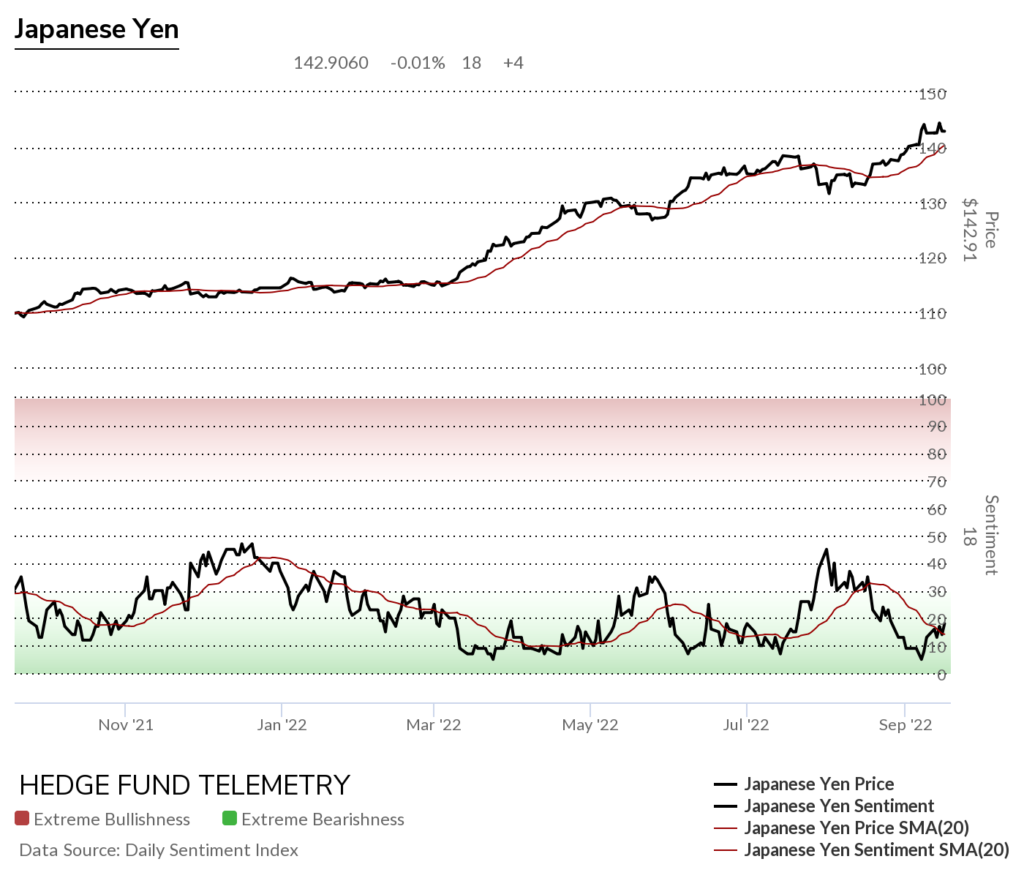

Japanese Bullish Sentiment did make a very low sentiment reading earlier last week

Japanese Yen Commitment of Traders has large speculators add back short exposure

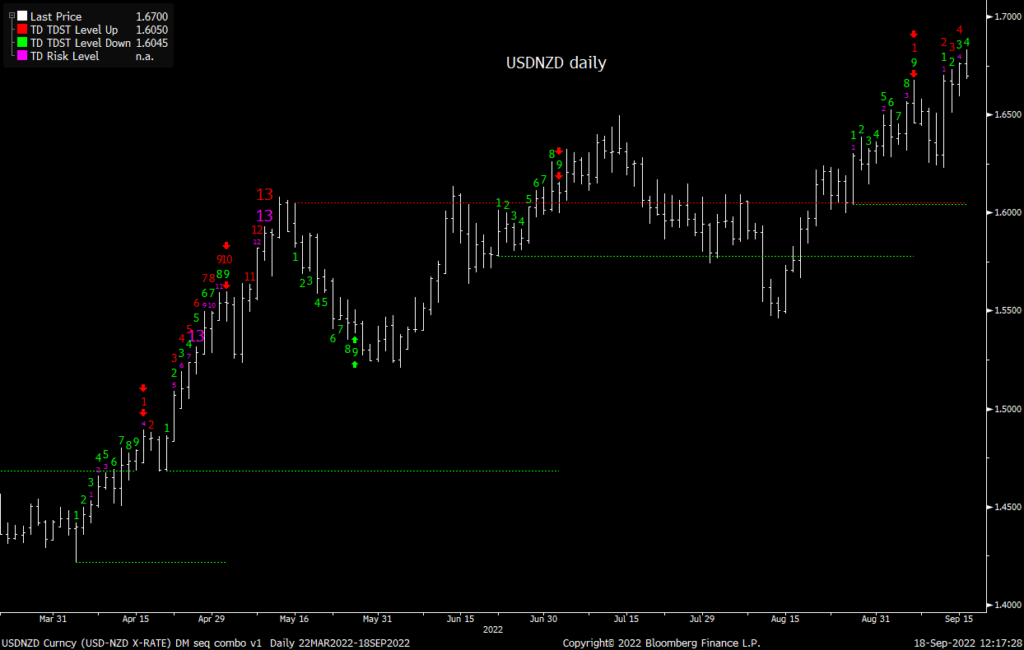

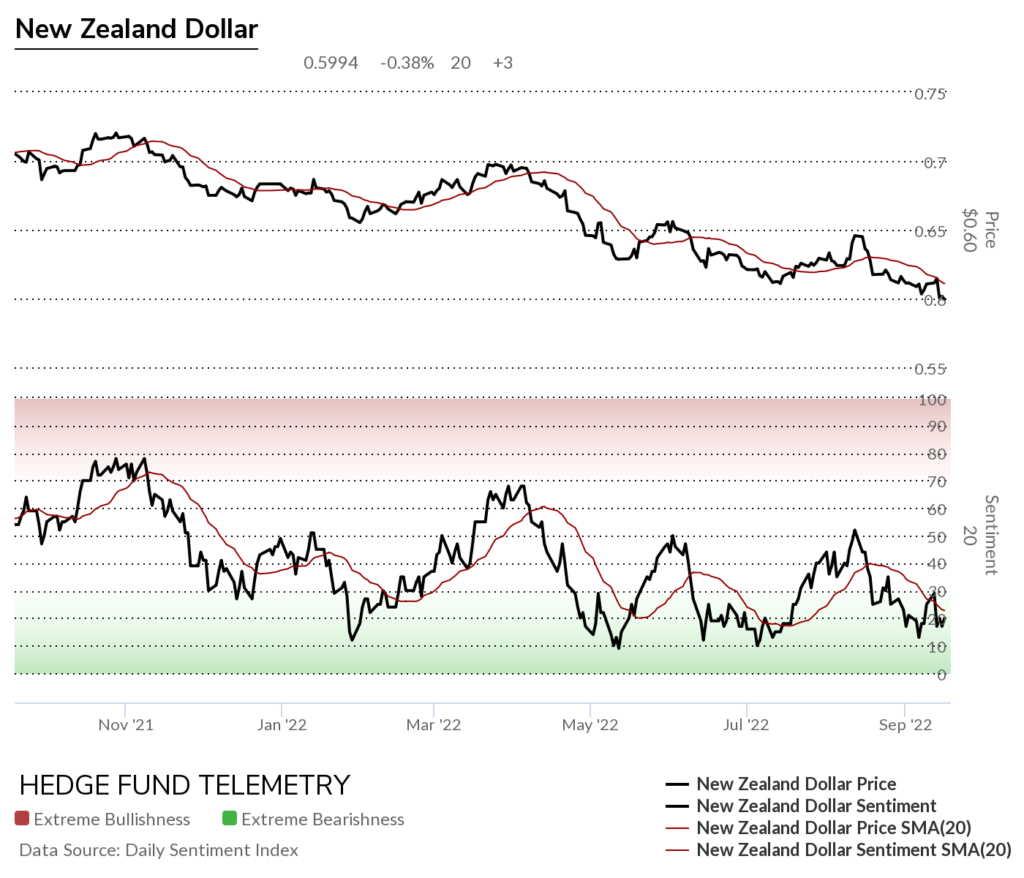

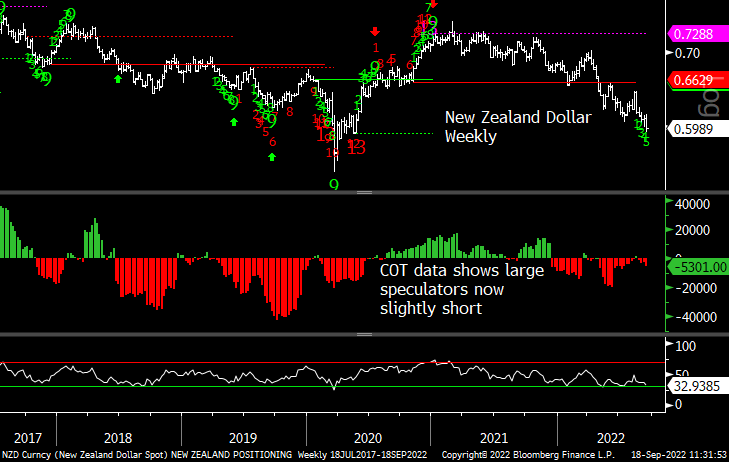

USDNZD US Dollar / NewZealand Dollar with a Sequential in progress

New Zealand Dollar Bullish Sentiment remains under pressure

New Zealand Dollar Commitment of Traders

RISK On Risk Off

This cross is often used as a risk-on / risk-off indicator

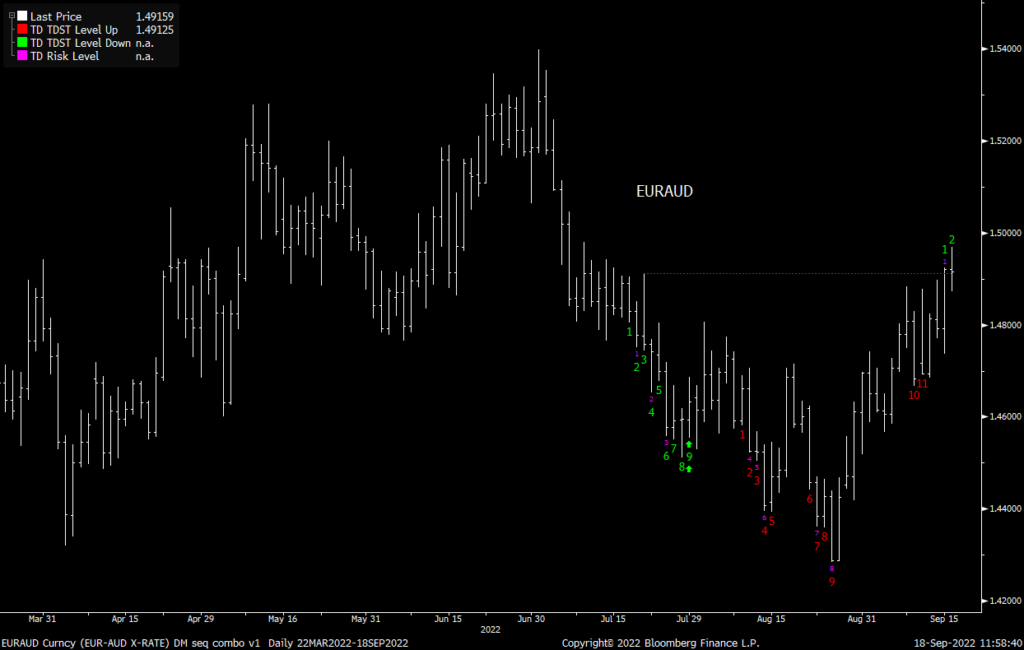

EURAUD Euro / Australian Dollar

Three major Yen crosses

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

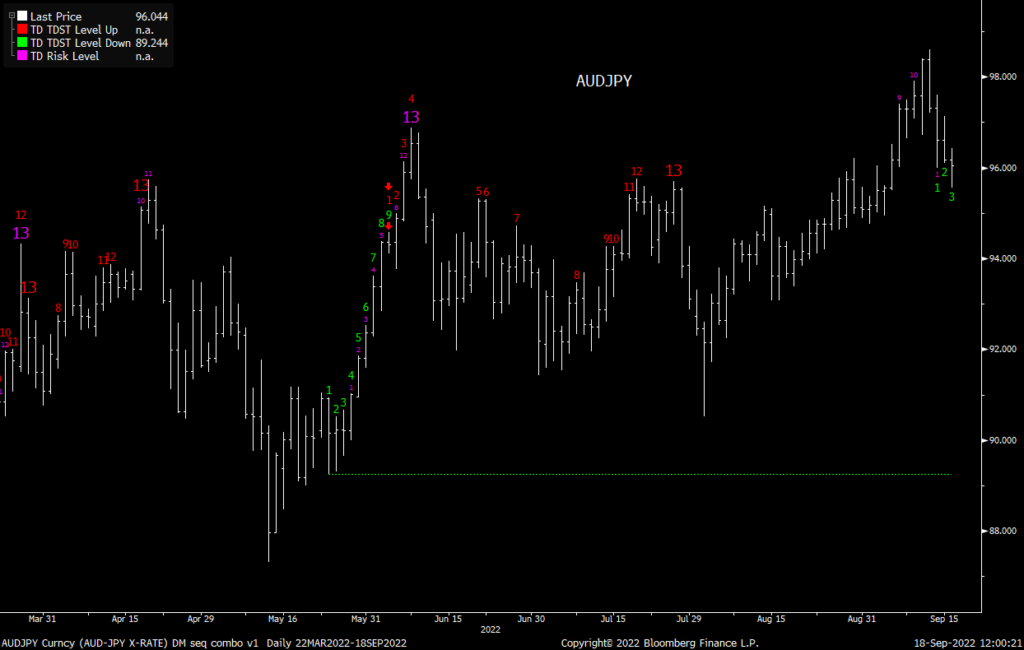

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

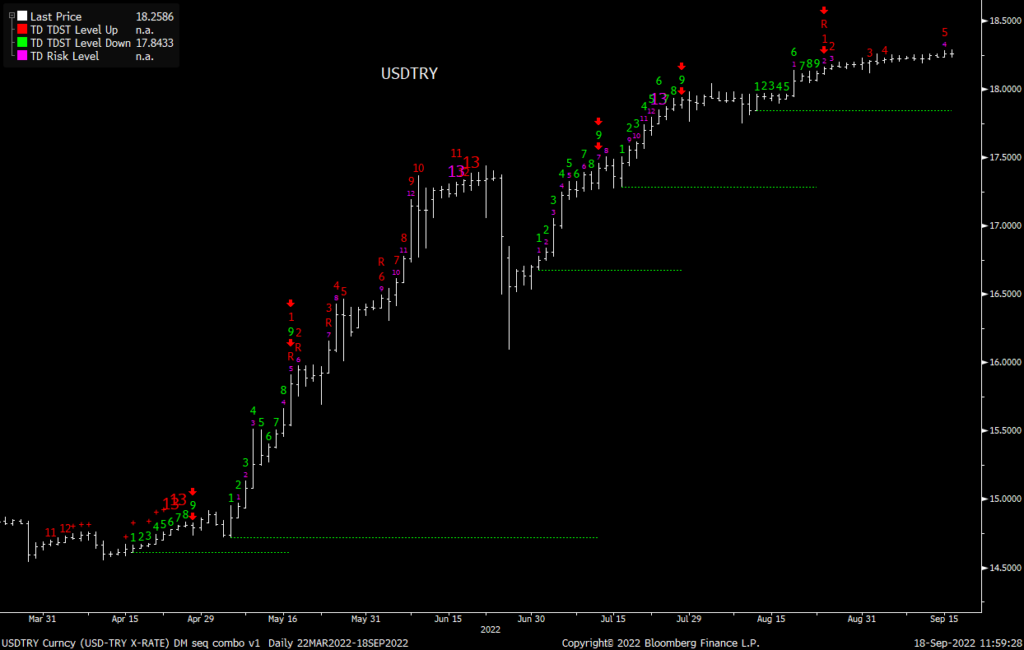

USDTRY US Dollar / Turkish Lira

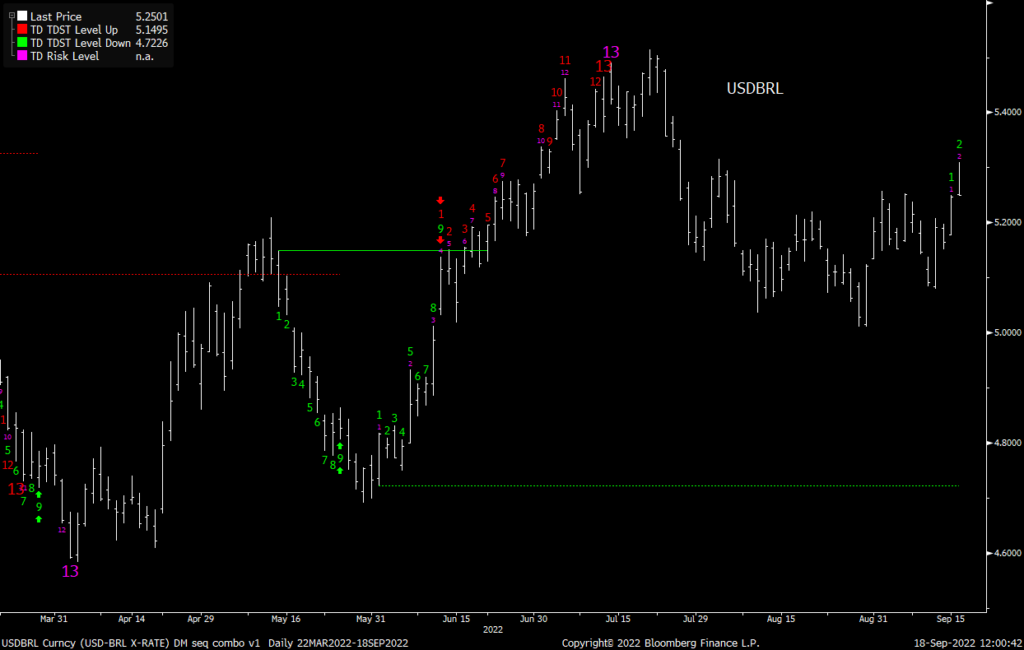

USDBRL US Dollar / Brazilian Real

Brazilian Real Commitment of Traders

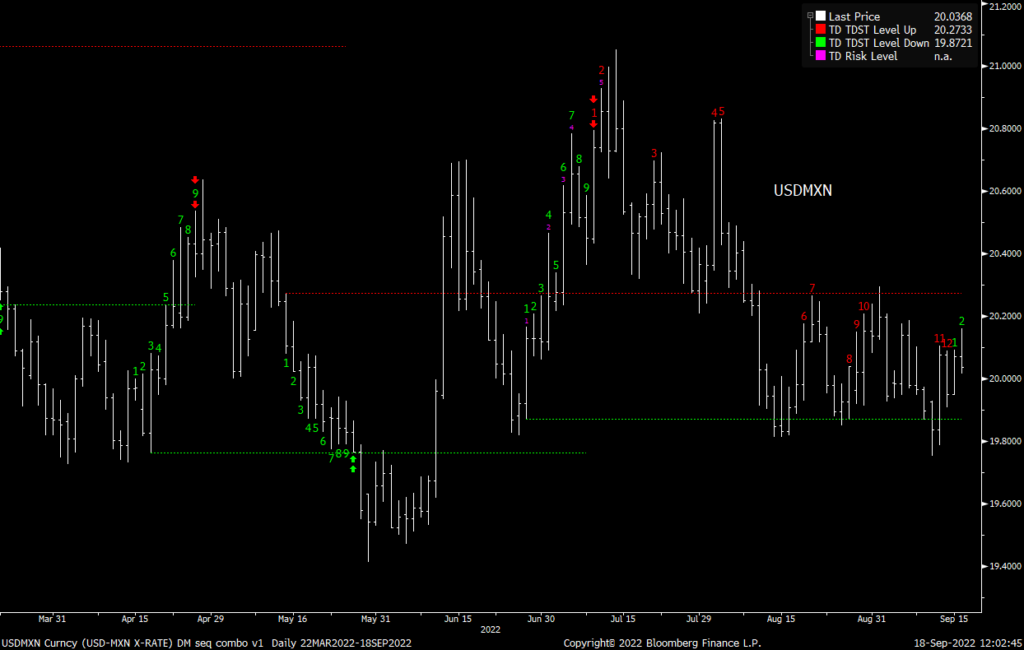

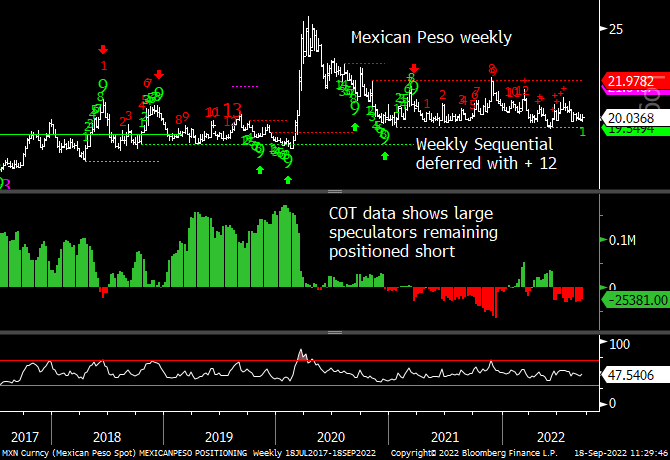

USDMXN US Dollar / Mexican Peso in a TDST range now

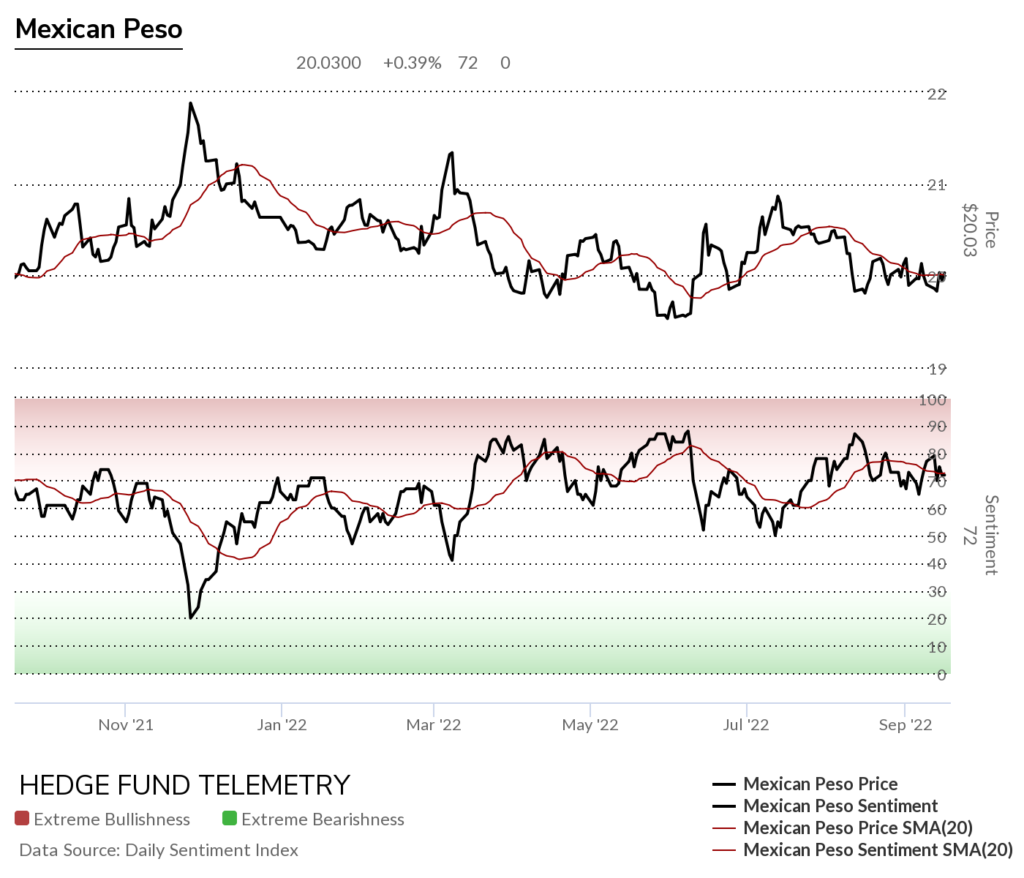

Mexican Peso bullish sentiment steady

Mexican Peso Commitment of Traders

USDZAR US Dollar / South African Rand

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan) did not get the response after the recent 13’s. Secondary Sequential on day 10 of 13

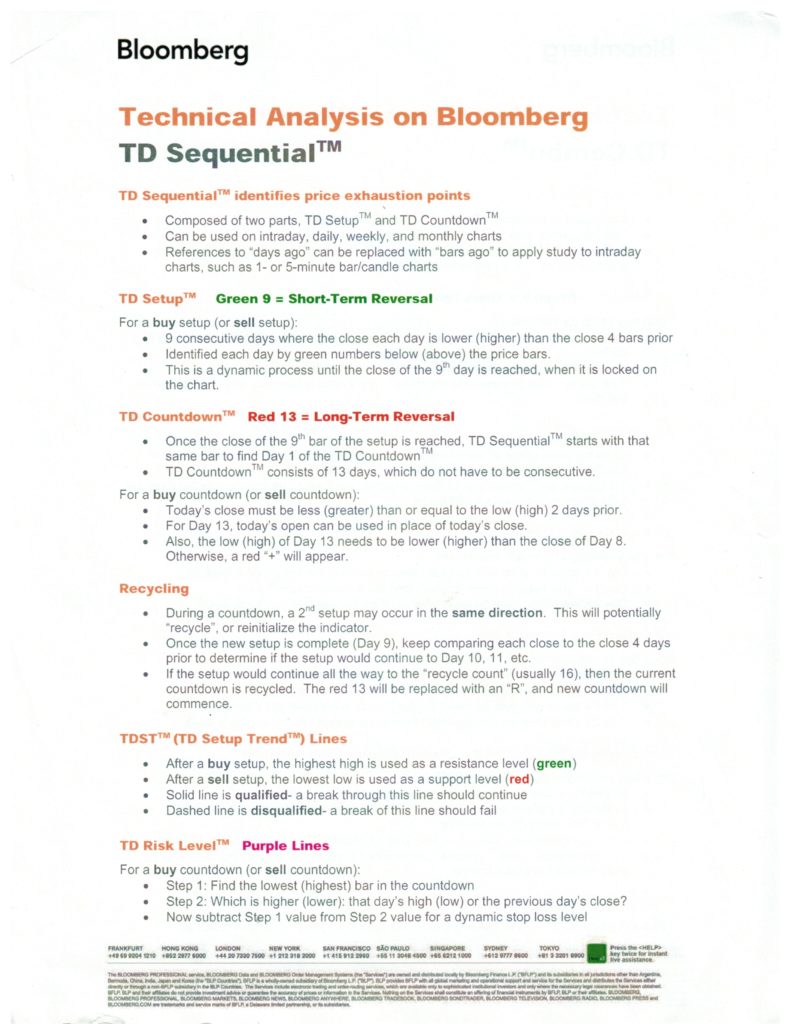

DeMark Sequential Basics from Bloomberg

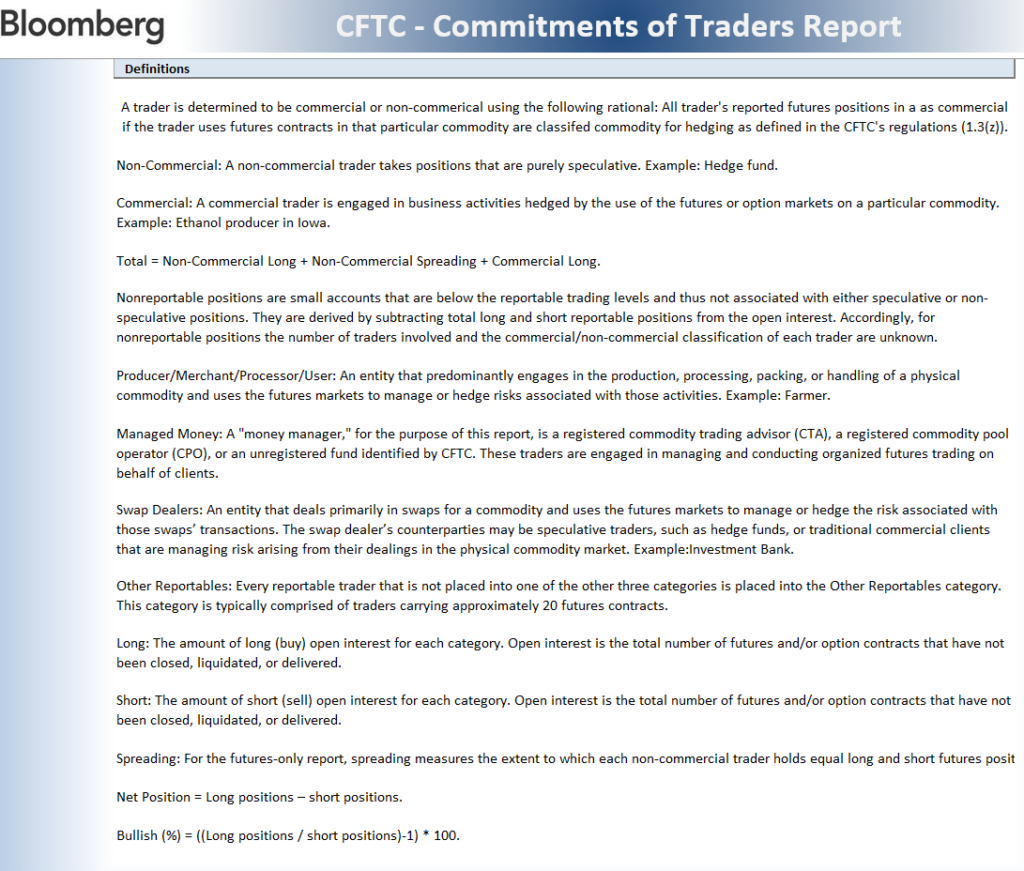

More detailed Commitment of Traders explanation