I am a pattern watcher and tape reader. One of the more simple intraday patterns that has been concerning me is when there is a gap open higher and then a fade lower with a lower close under the open. The opposite pattern is bullish, and we haven’t seen a lot of that pattern lately. The ETF monitor I post twice a day with VWAP levels also is very good at spotting underlying supply and demand.

The trap door market in the last few weeks has made it very difficult to position either long or short. This isn’t the first time we’ve seen this pattern in 2022. It is one of the reasons why bear market bounces are so precarious. Traders after being beaten down all year have quicker trigger fingers and considering the amount of short-dated options that are traded each day exacerbates the volatility.

I had a subscriber email tell me I am not giving enough trade ideas. My explanation was simple. This is not a market that one can have conviction, as follow-through is elusive. I have pushed to find potential long ideas recently with mixed results. On all of them, I have stressed 2% small-sized positions to limit the losses to small nicks rather than open wounds. A positive theme with earnings could work today and fail the next day. Banks and airlines come to mind. It’s not easy. This is not my first time with this type of market condition.

I have some very interesting thoughts from the guy who was the largest car carrier for Tesla. Some earnings previews.

TRADE IDEAS

EXPE did not get the lift as expected with the positive airline earnings, so I’m taking this long off with a 4.7% loss. Again it’s a 2% sized position. I am going to increase the short exposure on SPY and QQQ to the max size 5% from 2.5%. My cash levels remain near 50%, and that illustrates my caution. There will be opportunities soon, we just have to be patient.

US MARKETS

Here is a primer on the DeMark Setup and Sequential indicators.

S&P futures 60 minute still has the dueling wave patterns. The only change is the downside wave (yellow) has qualified downside wave 3. There is a downside DeMark Sequential on bar 8 of 13 (not shown)

S&P 500 daily another ugly reversal lower. The Secondary Sequential is now on day 9 of 13.

The Nasdaq 100 futures 60 minute still has the dueling wave patterns.

NDX index daily another reversal to the lows.

Russell 2000 IWM daily

Tesla logistics problems from the source

I receive a lot of DM’s on Twitter. A lot of crypto garbage and a lot of pretty girl bots who say “Hi how is your trade going?” And then I get 5+ imposters a week trying to scam people. That’s Twitter! Then every so often I get something that is incredible. This is from a guy who ran the largest car carrier company that Tesla used in the past. I thought the logistics problem was just a made up excuse for demand declines that many people have discussed online. For Tesla to guide the next quarter’s deliveries to increase when they can’t and probably won’t be able to deliver more cars is a continued risk.

My company supported tesla logistics for over 10 years. Around early 2020 during pandemic, we terminated our relationship with tesla due to constant pressure and them not understanding business of logistics. I warned them multiples time logistics will crash. I notified logistics team director and all management levels near him. Each one was terminated eventually. My assumption Elon was not advised by anyone what is really happening. In 2019 my company moved around 56,000 tesla units for tesla. They were past due for over 90 days at one point with balance 18,000,000$. Sometime around 2017-2018 tesla logistics pushed Elon to purchase trucking companies. If you recall this was on the news. I declined that deal and advised not to do it. They still purchased one company in ca, which I advised them was under huge investigation. They ended up taking all their junk equipment without drivers. So they were played by inter team for personal Gains ( I assume) in additional inter team without any understanding pushed Elon to buy trucks, which they did at 30%~50% over market value. I came to Fremont spend with them 5 days and again explained it’s not a smart move, due to liabilities and expense level for in house trucks. To this day I am aware they only ran 30-40 trucks and rest just rust outside Fremont. This was around 100 million project when tesla was already past due to multiple vendors

They never realized to replace carrier my size is almost impossible. Most major carriers are under contract and can’t provide capacity full time. No one wanted to hear this. Instead logistics team hired one art major guy with no experience and one swim teacher. Both made it their addenda to brink family and relatives into trucking business. Games stared on all levels. For example: tesla has inter system to move single sold units dealer to dealer and to personal homes where no dealers are in the area. To support this effort I had special department solo for tesla needs with around 10 employees. I explained and we were super successful, since we can use our equipment ( at that point my fleet had 75 brand new all 2020 matching to tesla color custom build trucks) plus outside carriers. Internal team by bringing their *friends and family decided to expose my bids and made sure next bid in line was 5$ less…. This way they can award it@to next guy in line. What upper management did not understand, that next guy was just one man show. No real insurance and nothing behind ( meaning equipment or any resources). So he would simply post that brand new tesla car on forums for any carrier to take so he can make 50-100$. Problem begins asap. Not all trucks can support tesla weight especially model x. Car would be delayed, damaged…. Again I advised tesla to be careful and pay attention to insurance and equipment…. No response. You can imagine if someone told Elon: you have thousands of sold cars, due to stupidity of your logistics team you can’t collect money because they are trying to show you they saved 50$….

There is a new guy in charge, young used to run a restaurant…. No prior experience… I have send him a message yesterday of course no response. They can’t explain to Elon how they internally destroyed one of the top carriers plus many carriers left with me, and they lost about 50% of moving capacity. I managed around 400 trucks alone under my umbrella for Tesla!

what they don’t realize other OEMs will have a huge push as well companies under contract cannot provide additional equipment to Tesla, because they have their own obligations. At which point you end up using all garbage carriers with old beat-up equipment, which will cause more delays and more damage. imagine a supermarket full of products, but all the registers are closed.

I have sold all operations to Amazon!!! Somehow they saw much bigger, potential versus Tesla, uneducated, swim teacher, and art major.

earnings previews

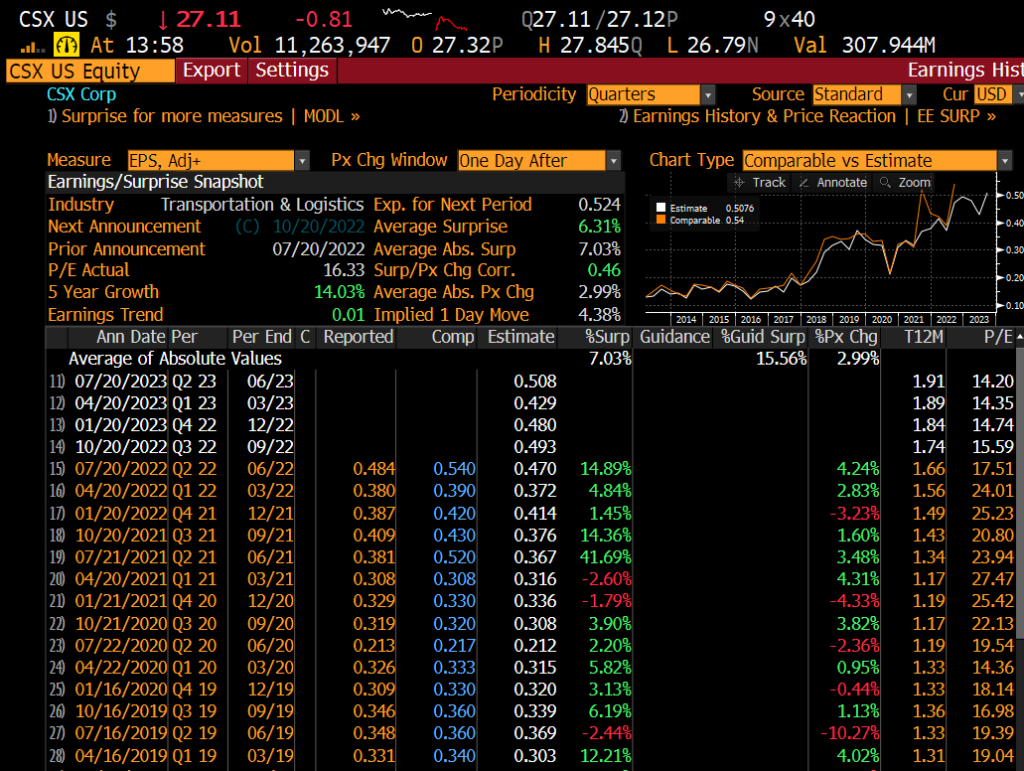

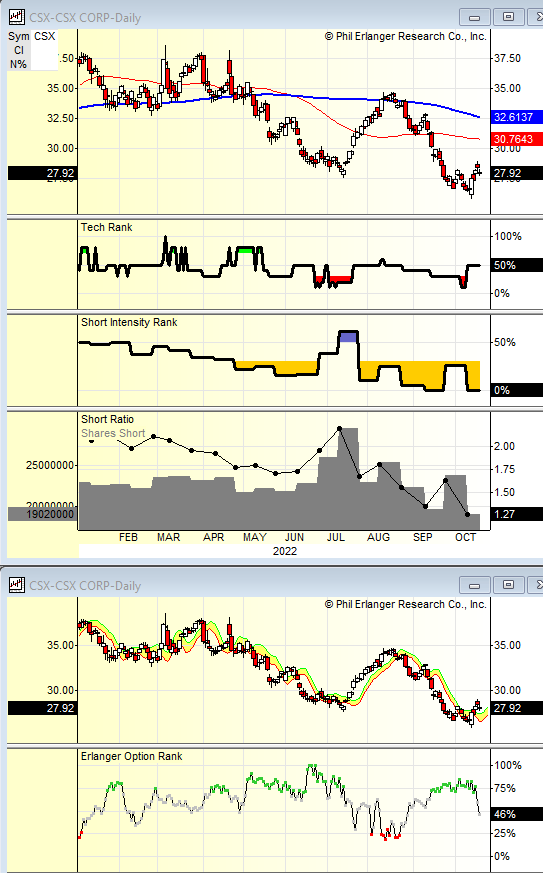

CSX had as short live bounce and now continues the Sequential on day 9 of 13. 26 support

The implied move after earnings is 4.38%.

The Erlanger short interest data is shows very few shorts involved with the short intensity at 0% and only 1.27 days to cover. There was some recent put action with the Options Rank green dots however that has moderated. Risk is lower.

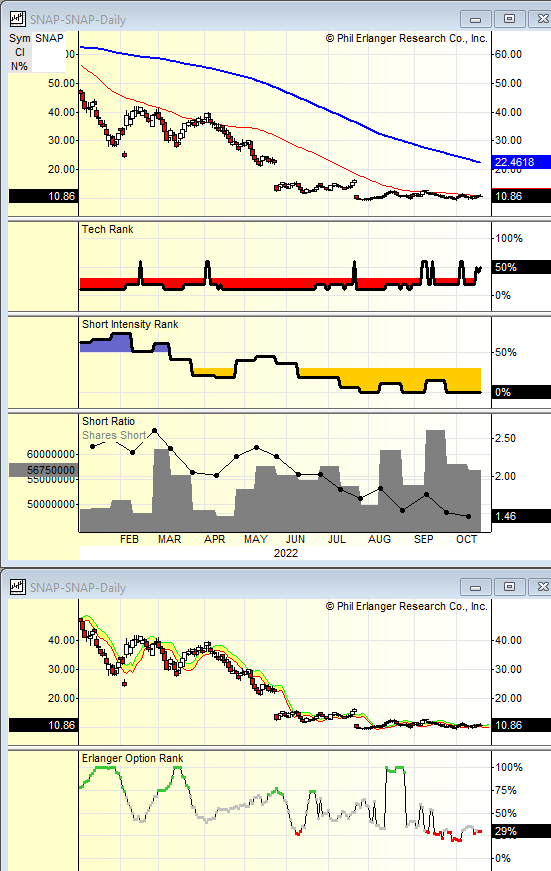

SNAP has experienced several large gaps on the downside and remember when they guided lower and the whole market dropped hard? Who knew SNAP was a bellwether? There is a recent DeMark Sequential buy Countdown 13 and it’s already lifted 20%. Sure this is a big base but it also could be a flatlining heart rate.

It’s not often we see an implied move of 23%!! This one has had some extreme moves in the past up and down. I don’t need to get involved with the unpredictable nature with a huge implied move.

The Erlanger data shows shorts not being a factor with the short intensity at 0%. The Options Rank shows red dots illustrating call buying. That is very bearish.

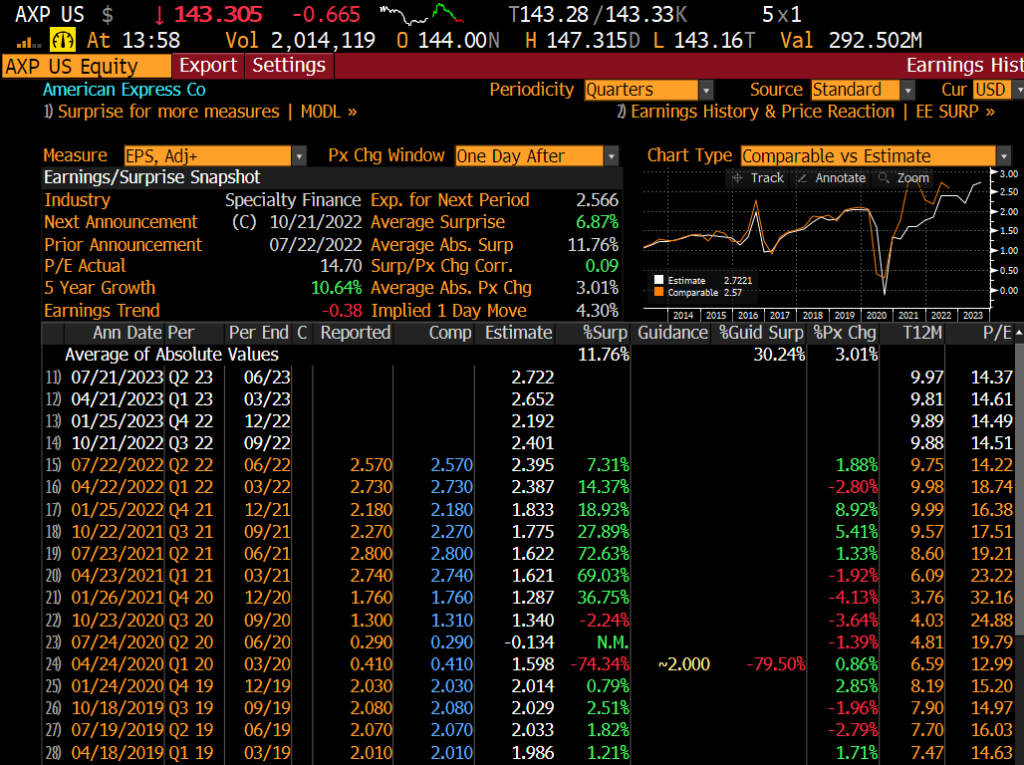

AXP has bounced and I expect decent trends especially with travel. There isn’t much of an edge with the chart.

The implied move is 4.3%. A little boring.

The Erlanger data shows shorts are not involved enough to squeeze this. There has been moderate put buying on the Options Rank with the green dots.

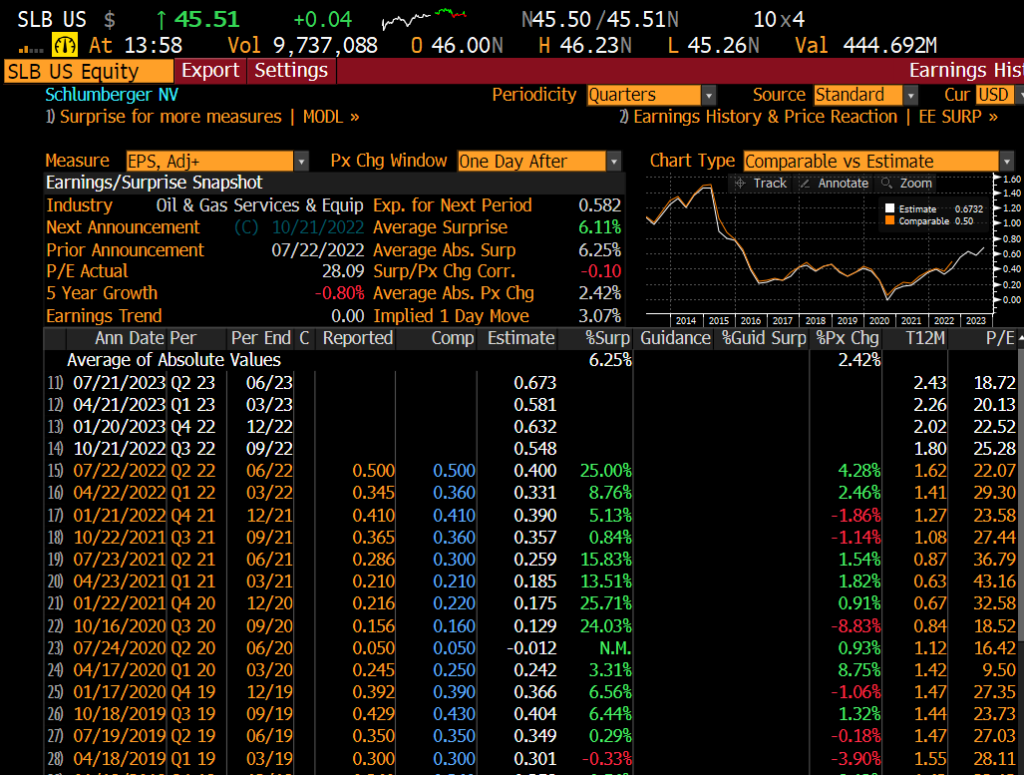

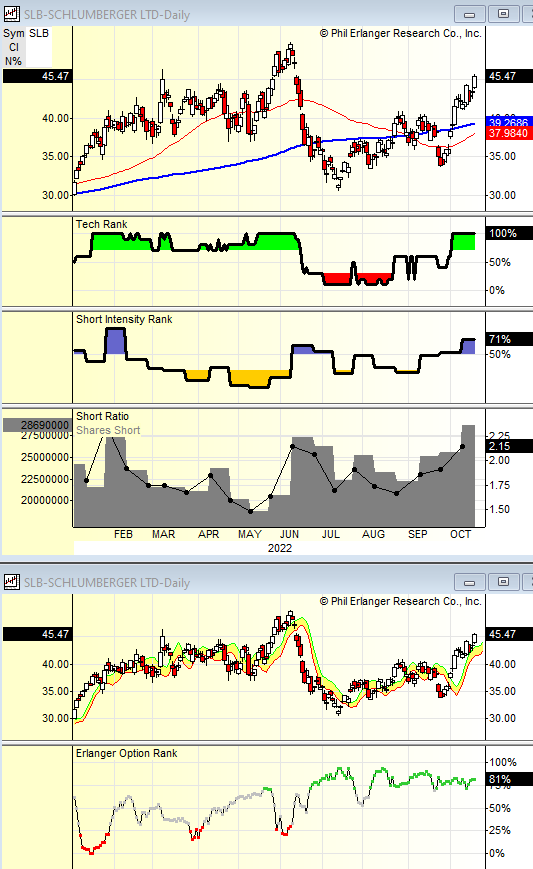

SLB has some upside exhaustion with the Combo 13’s

The implied move is 3%

Shorts have piled into SLB in the last couple of months. There is moderate put buying. I’m mixed since there are exhaustion signals while the short interest is high enough to squeeze higher.

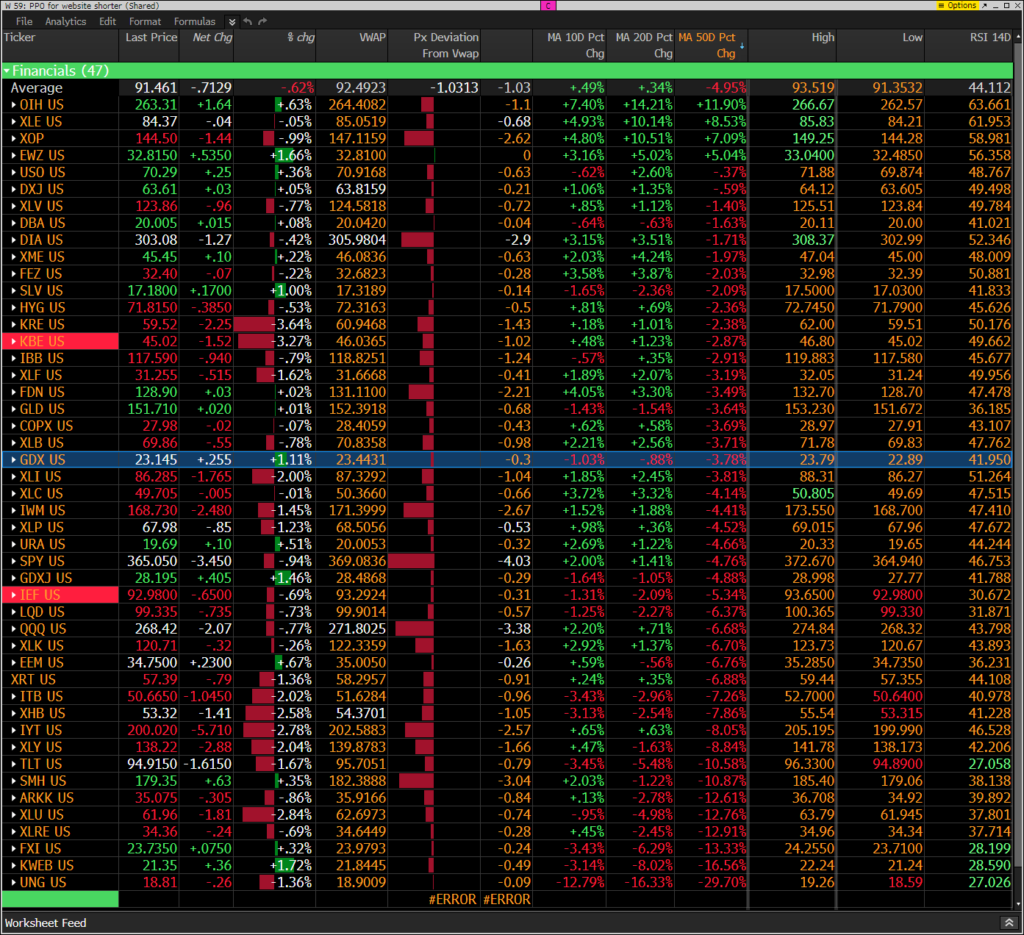

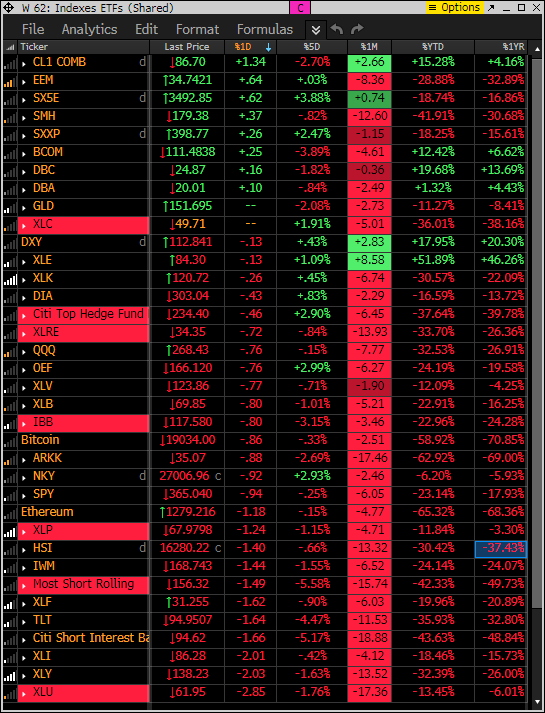

FACTORS, GOLDMAN SACHS SHORT BASKETS AND PPO MONITOR UPDATE

Factor monitor

This is similar to the above monitor with various ETFs other indexes

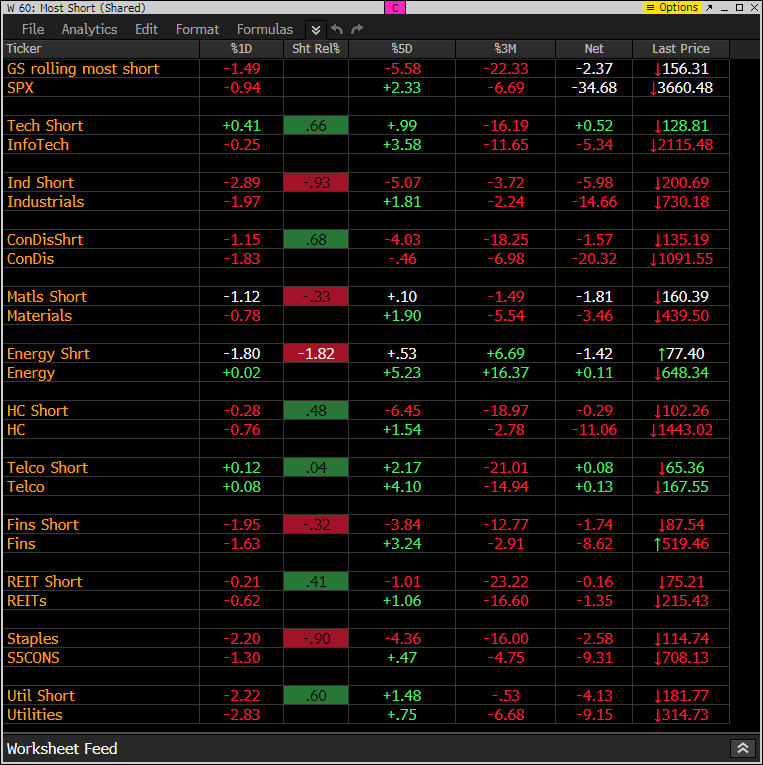

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets.

The PPO monitor (percentage price oscillator) force ranks ETF’s by percentage above/below the 50 day moving average. For information on this monitor please refer to this primer. This monitor is offered to Hedge Fund Telemetry subscribers who are on Bloomberg. Nearly everything is below today’s VWAP levels.