Commitment of Traders – The Basics

The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are considered the “smart money” since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, comprises hedge funds, mutual funds, and commodity trading advisors. These speculative traders have no interest in the underlying physical commodity business.

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation, please see the bottom of this note.

DeMark Indicators basics at bottom of this note

PLEASE NOTE: Last week had a data feed disruption on several markets. We get two data sets each day and combine them on the charts. We haven’t had a problem in quite a while, and our programmers will be working on updating them this week. The raw data on the monitors is correct; however, several charts have not been updated in a week. I just noticed this after this note was published.

HIGHLIGHTS AND THEMES

Continued wide dispersion within the commodity market has winners and losers. Overbought markets that have worked, including cocoa, sugar, cattle, and hogs, might top soon. Sideways action with cotton and crude. Natural gas failed its recent bounce and could be at risk lower if the current lows break with a secondary DeMark Sequential Countdown. I still like on the upside coffee with grains having some upside potential, including corn, wheat, and soybeans. Copper might develop into a long this week with clear upside resistance as the hurdle. Gold and silver are moderately overbought, with DeMark Sequentials getting late into the Countdowns.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily continues to trade making lower highs. It has a DeMark Sequential buy Countdown 13 from early December that is still valid, although this lacks upside momentum. Clear breakout levels above November highs would get some notice.

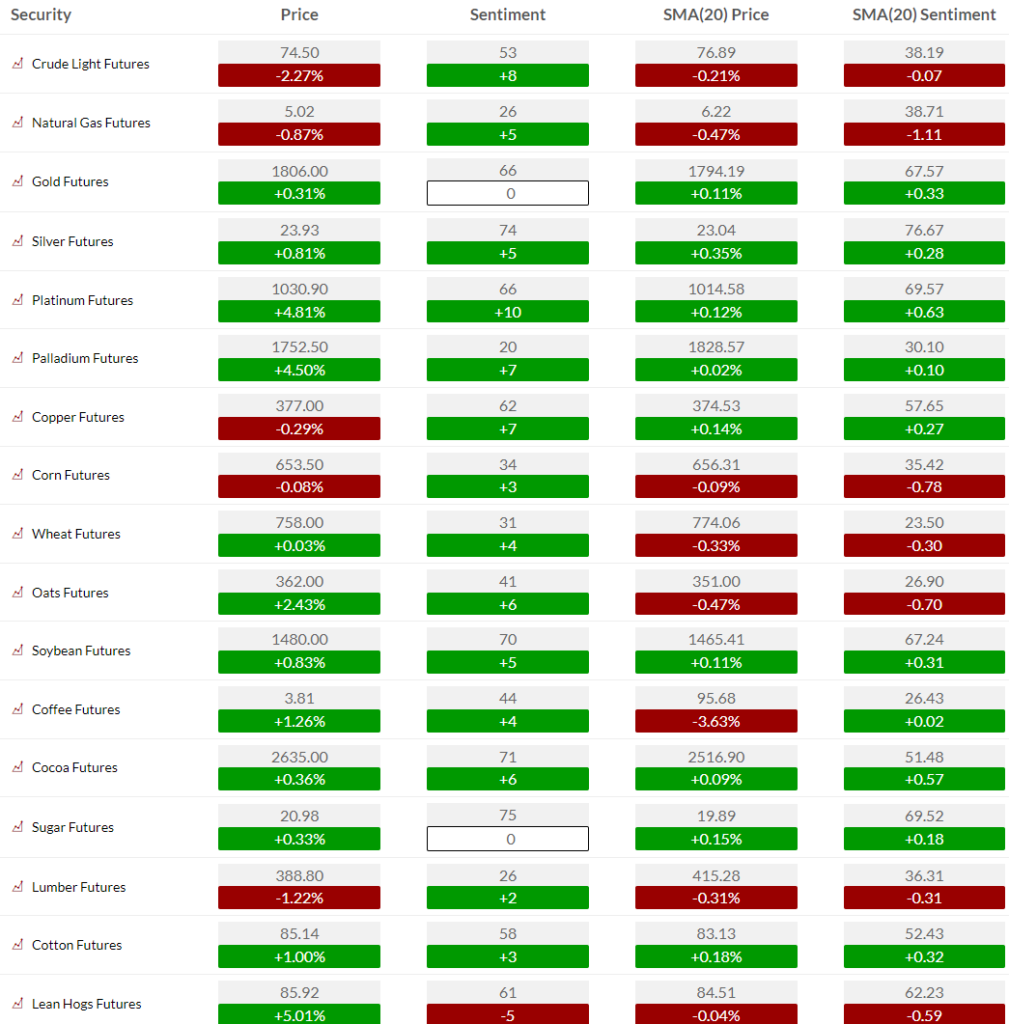

COMMODITY SENTIMENT OVERVIEW

A strong day overall on Friday

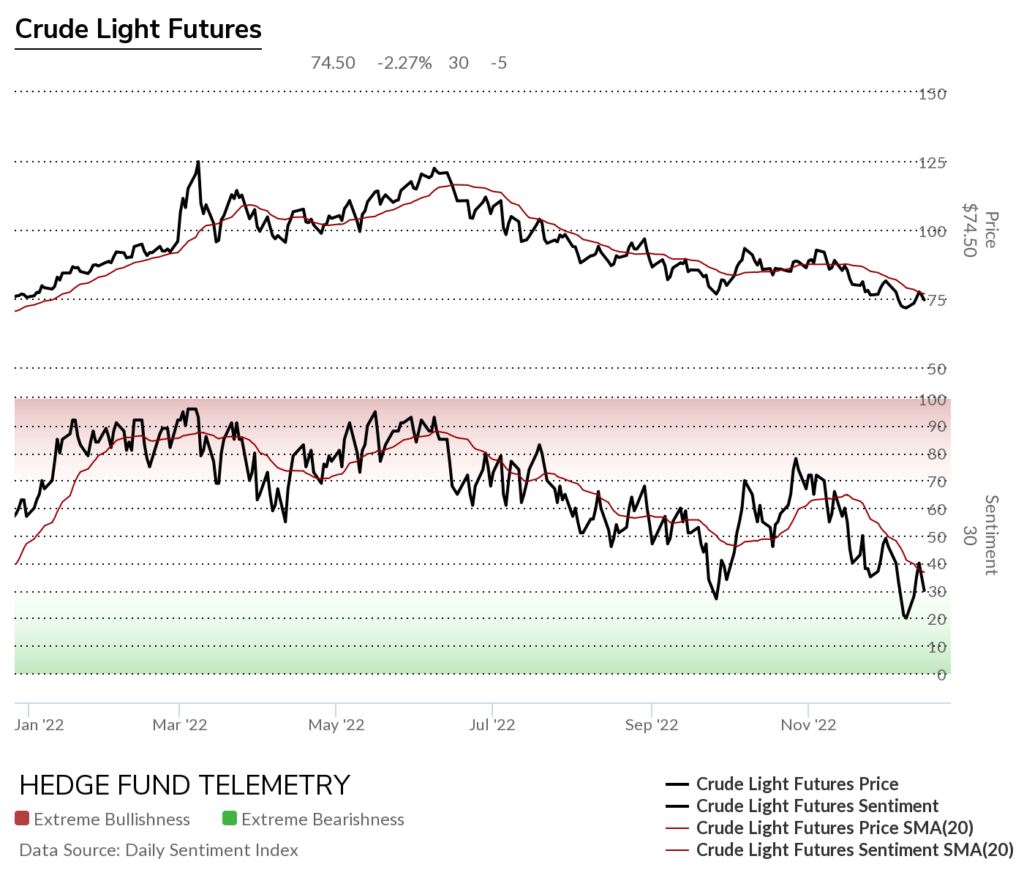

OIL AND ENERGY

Bloomberg Energy Subindex Daily remains under pressure and is at risk of making lower lows

Bloomberg Energy Subindex Weekly topped in Q2

WTI Crude futures daily trades better than I’d expect with the DeMark Sequential in progress.

Brent Crude futures daily also has made a lot of lower highs in the last 6 months

WTI Crude futures bullish sentiment remains under pressure

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

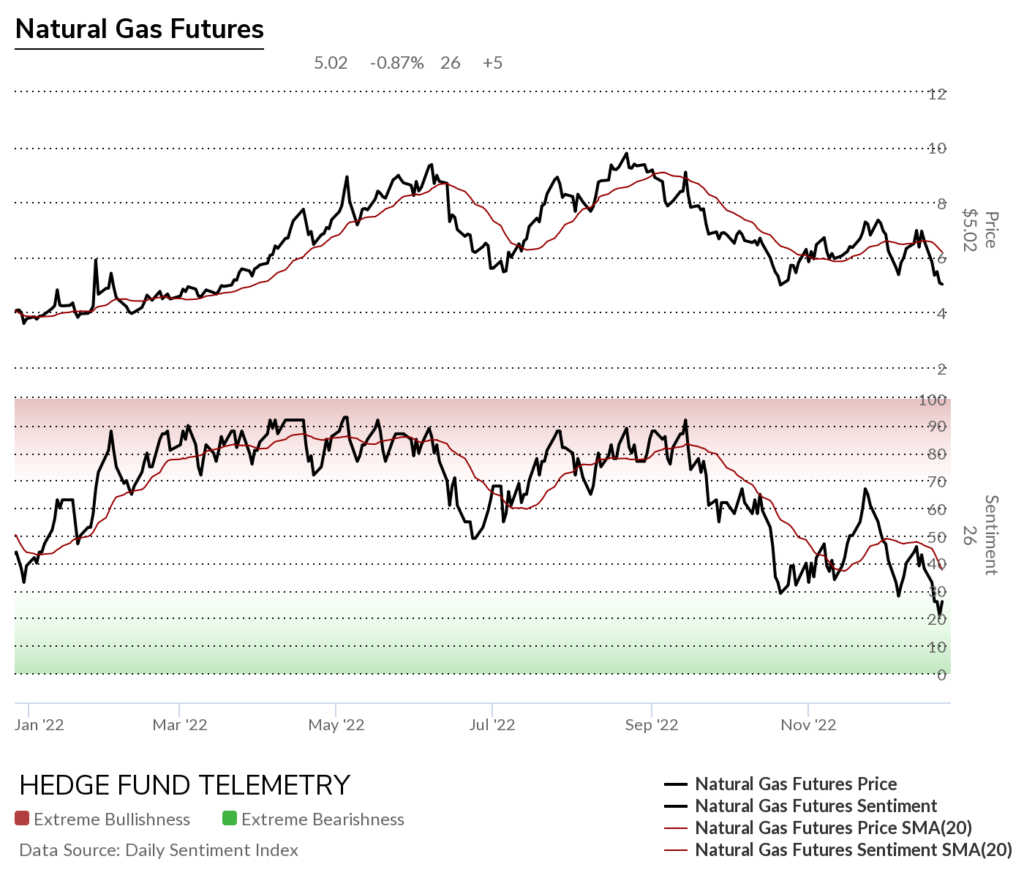

Natural Gas futures daily had a brief bounce after the buy Countdown 13’s and now has a secondary Sequential in progress at risk for lower levels.

Natural Gas futures bullish sentiment is under pressure making a new 1 year low this past week

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators with a price flip down after bouncing with the weekly buy Setup 9

Gasoline futures Daily was up likely due to the risk of the cold weather

Gasoline Commitment of Traders. The chart has support at 202

Metals

Gold futures daily is stalling and could make move a little higher to qualify the Sequential sell Countdown 13

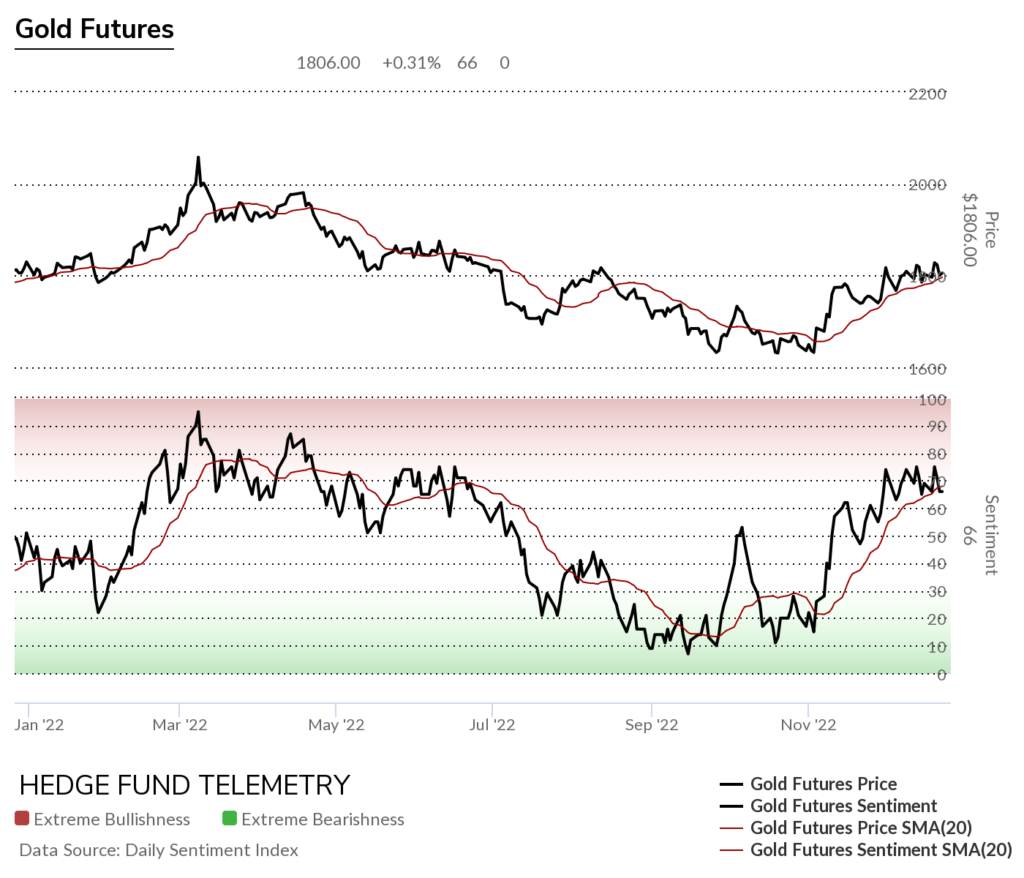

Gold futures bullish sentiment stalling in the elevated zone

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Silver futures daily is a little closer to the Sequential sell Countdown 13.

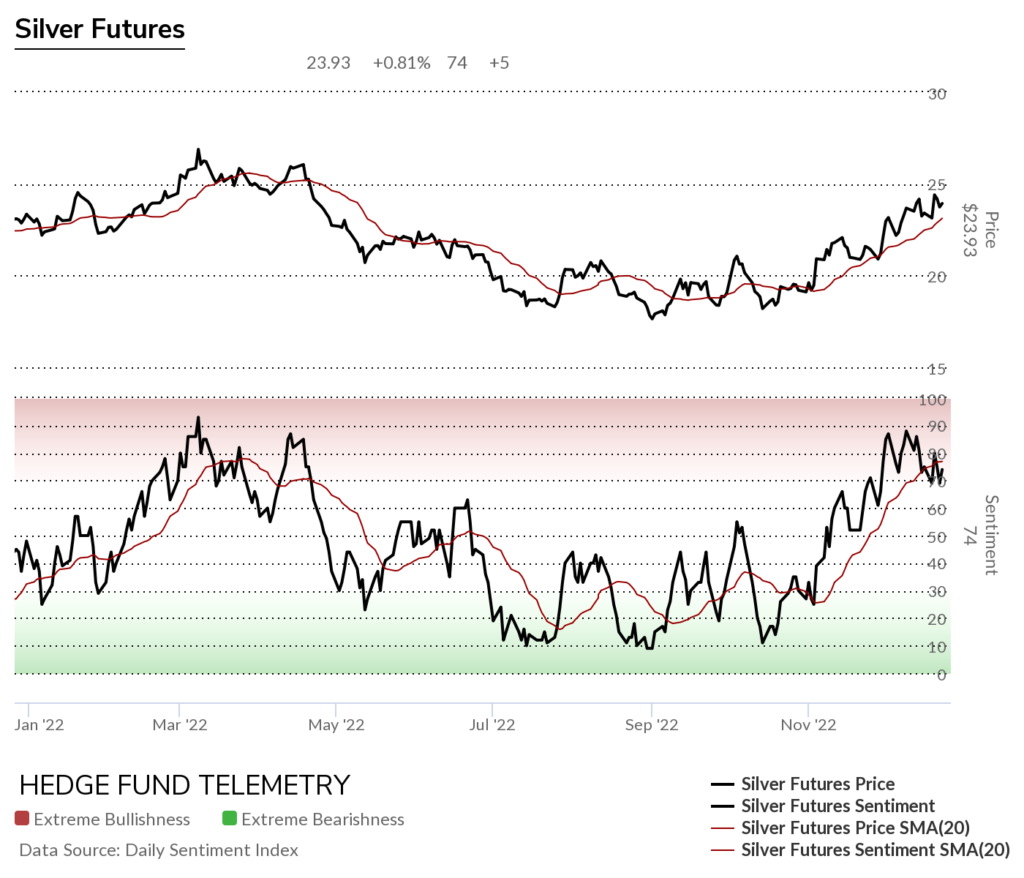

Silver Futures Bullish Sentiment recently peaked near 90%

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Copper futures daily could be making a higher low wave 4 of 5. A move higher would qualify upside wave 5

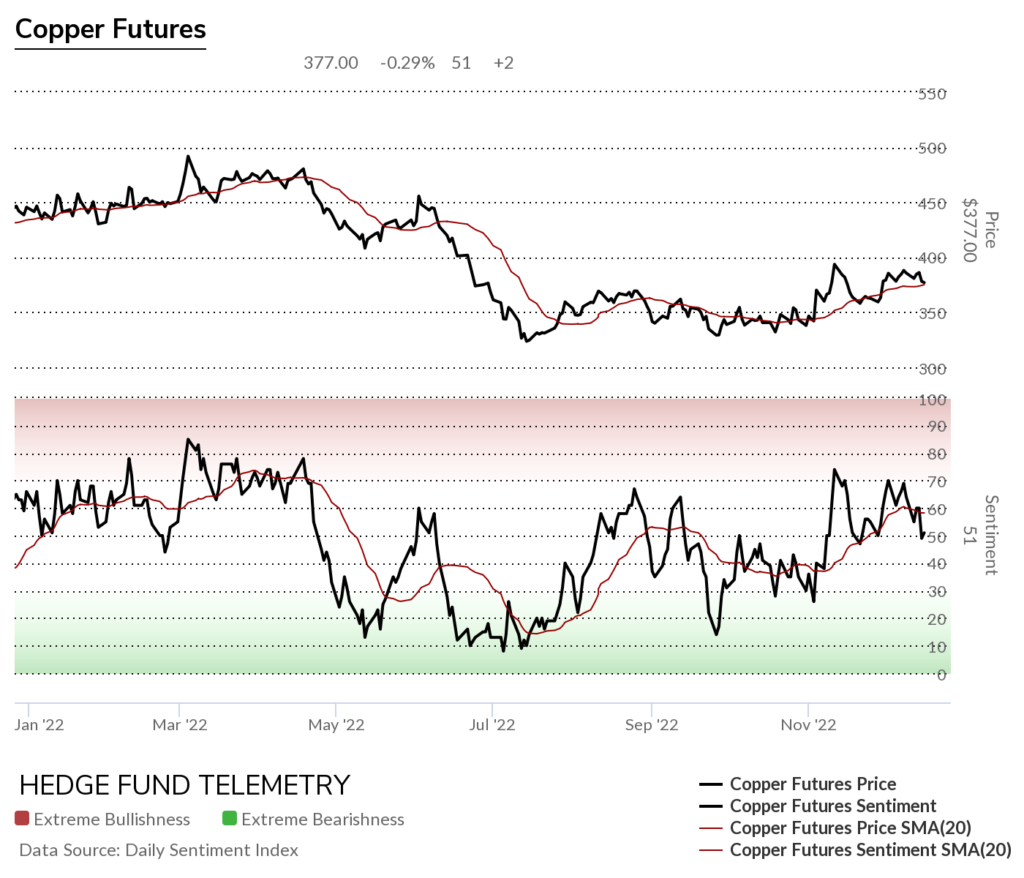

Copper futures bullish sentiment is trying to hold the majority line at 50%

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Platinum daily

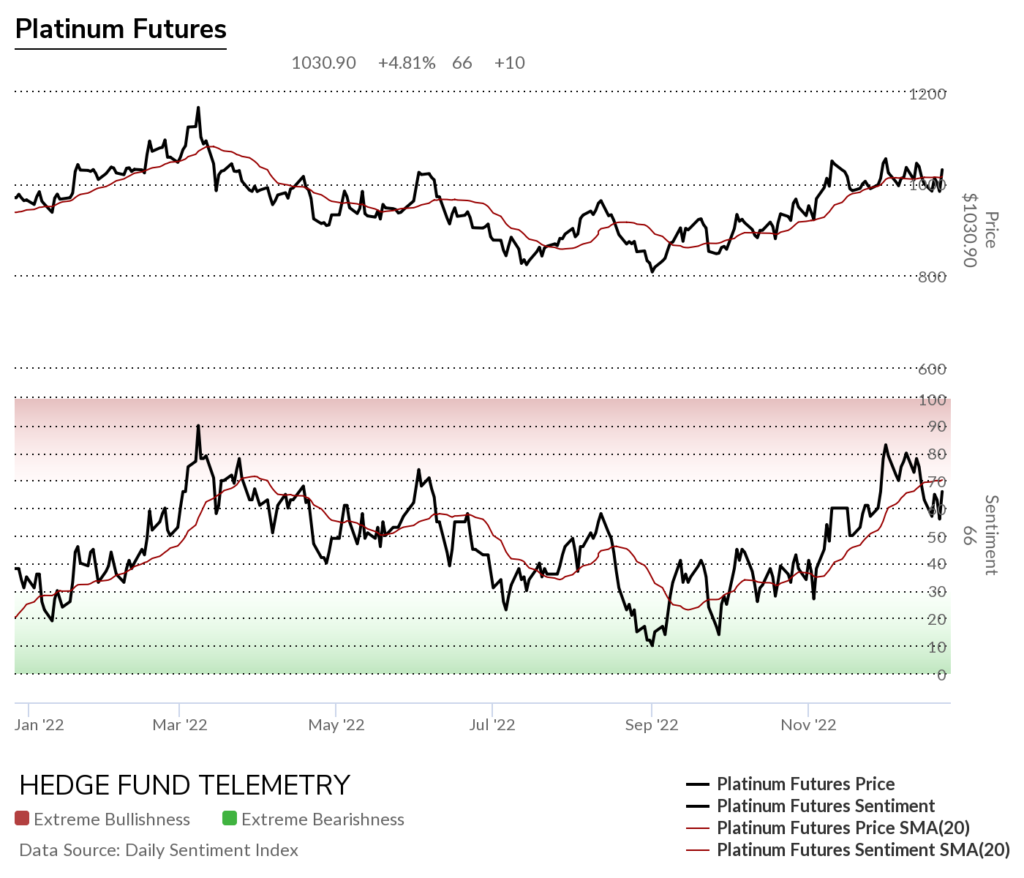

Platinum bullish sentiment

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

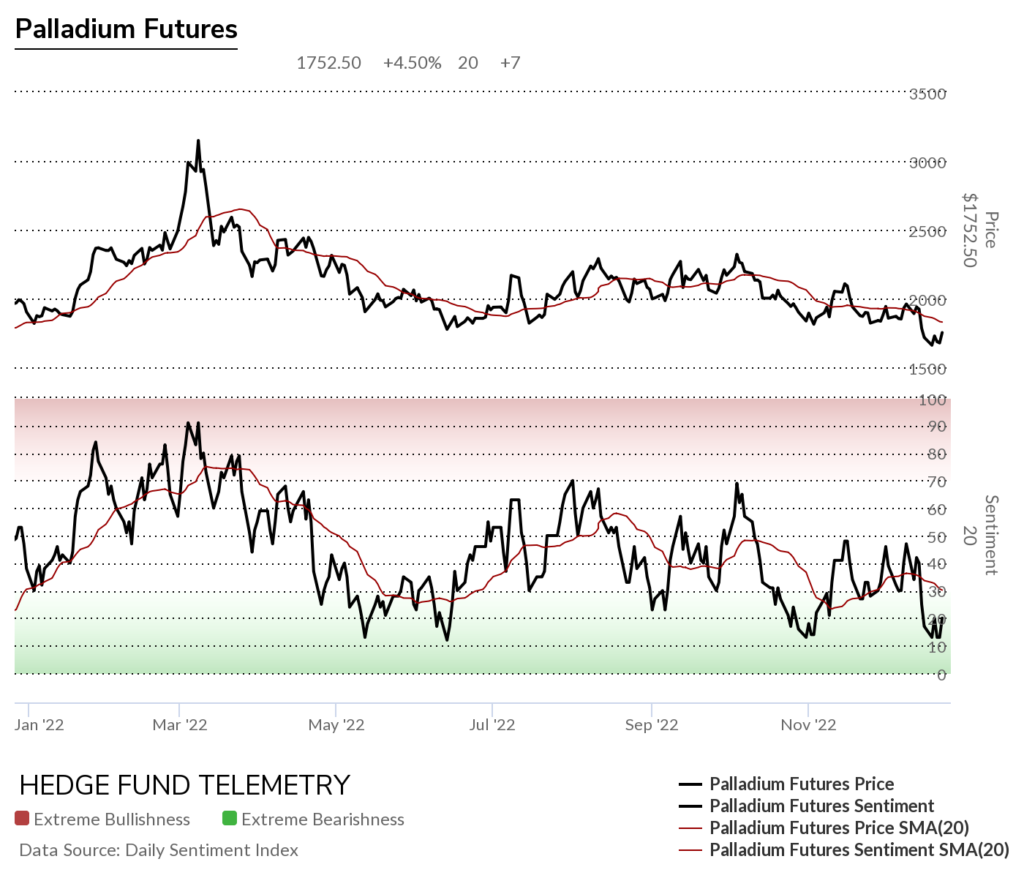

Palladium daily still at risk of making lower lows

Palladium bullish sentiment has been oversold

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. The Sequential on the downside still suggest more downside risk.

Grains

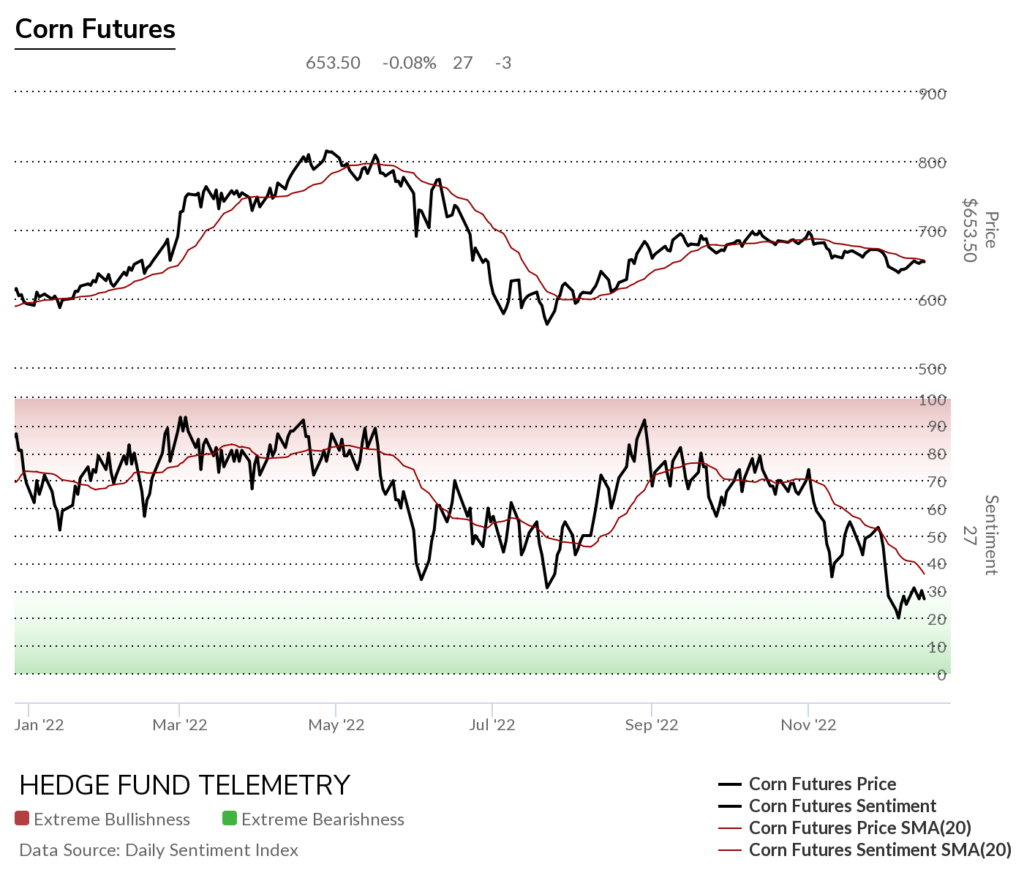

Corn futures daily had a good week and could continue while 700 is major resistance

Corn futures bullish sentiment remains under pressure

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

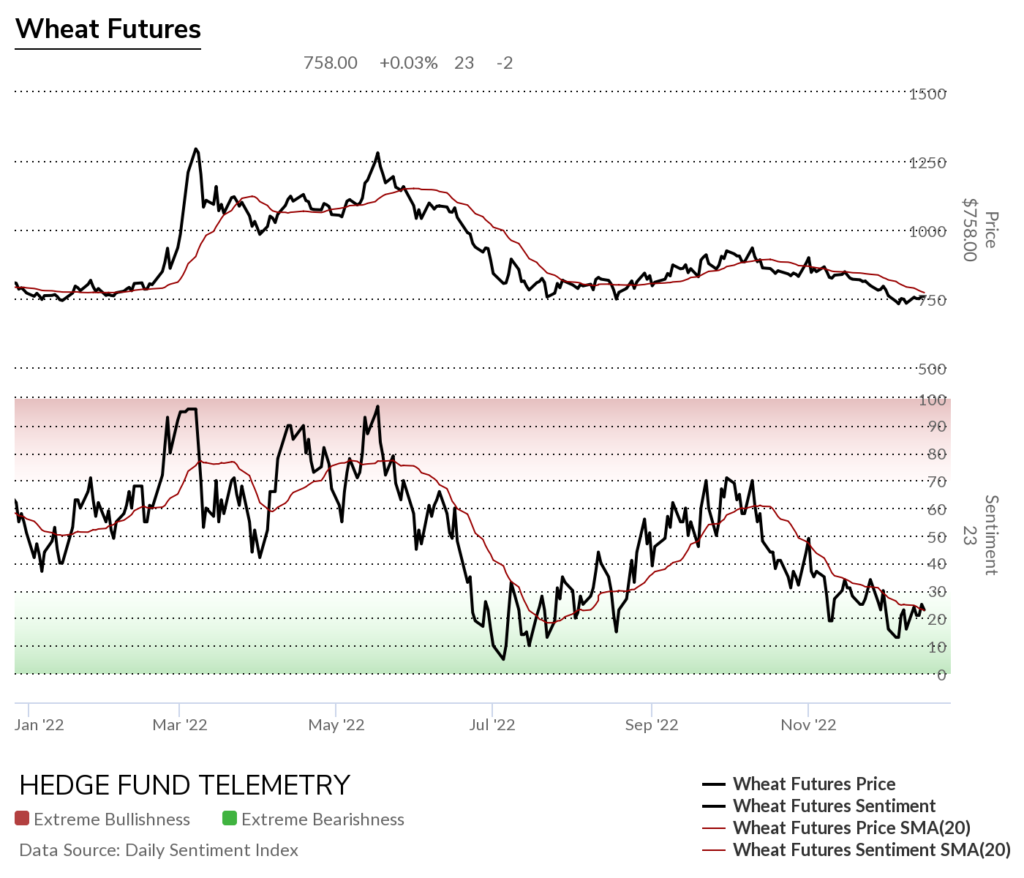

Wheat futures daily is trying to make a turn and after the recent Combo 13 could have some room on the upside

Wheat futures bullish sentiment is oversold, and I’m watching the sentiment reading and the 20 day moving average of sentiment for an upside confirmataion

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

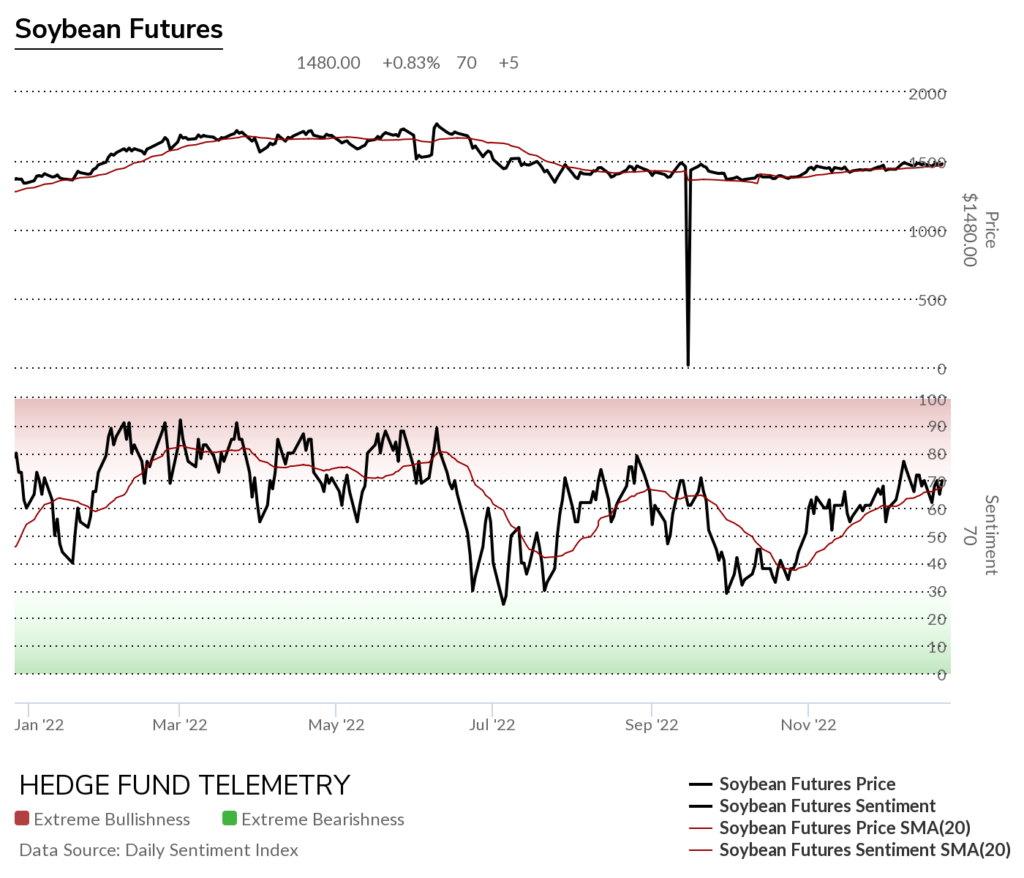

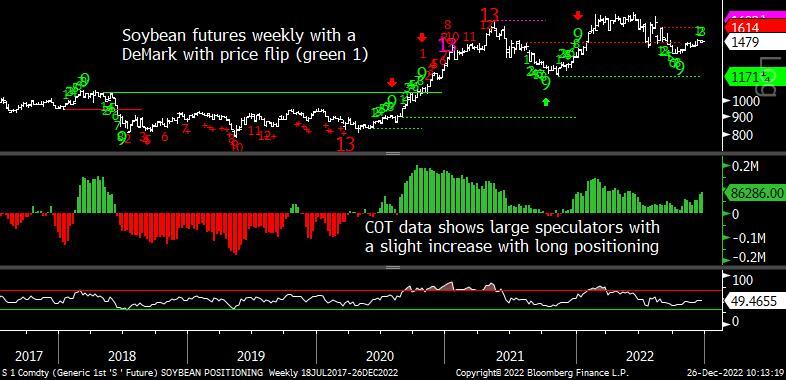

Soybean futures daily has been making higher lows drifting higher – a rarity in commodities.

Soybean futures bullish sentiment remains supportive above 50%

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

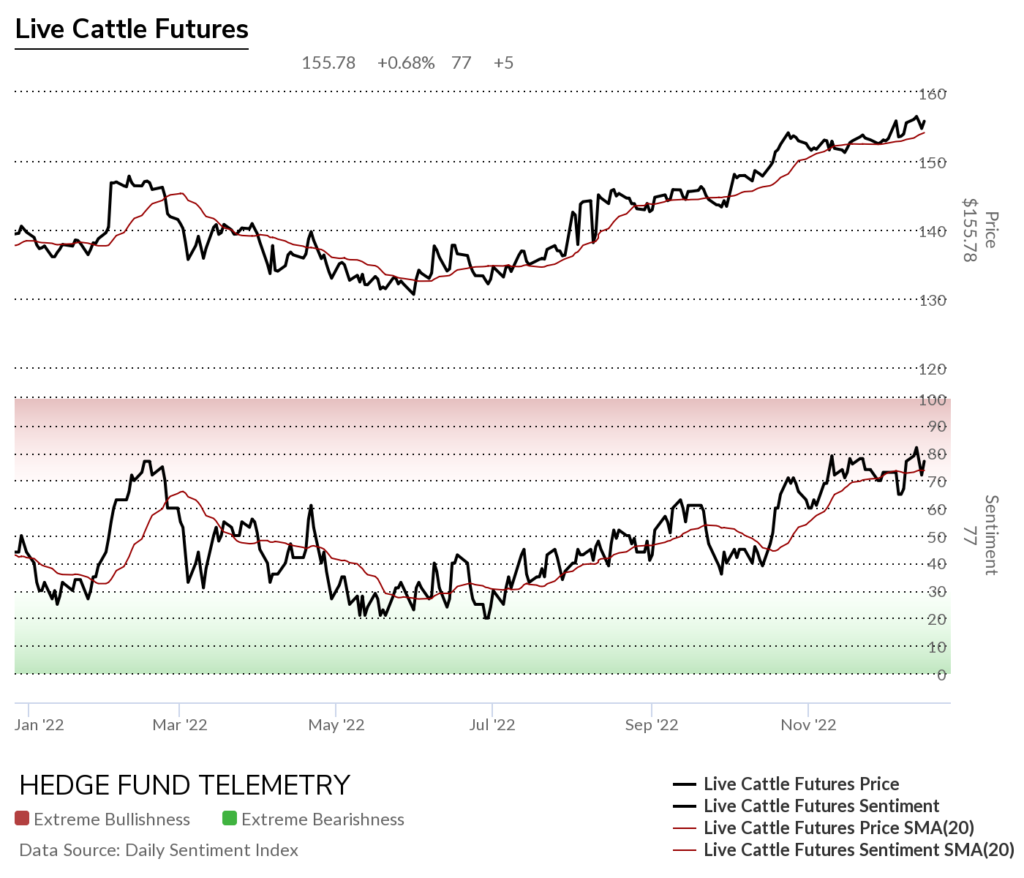

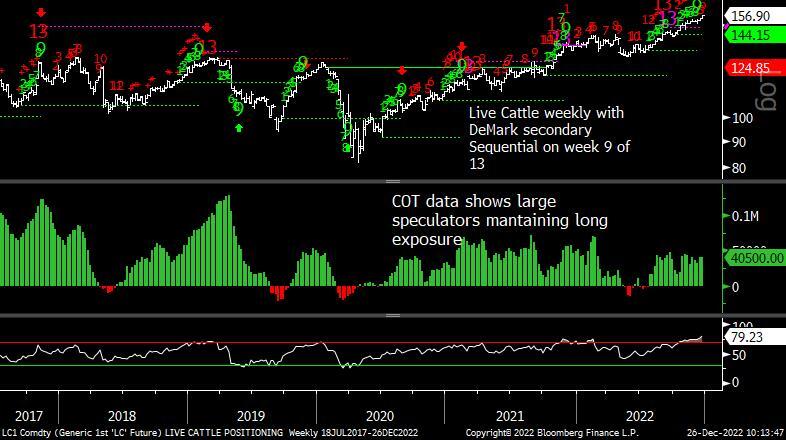

Cattle futures daily is trying to break out to 1 year highs.

Cattle futures bullish sentiment is in the elevated zone and might continue higher.

Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

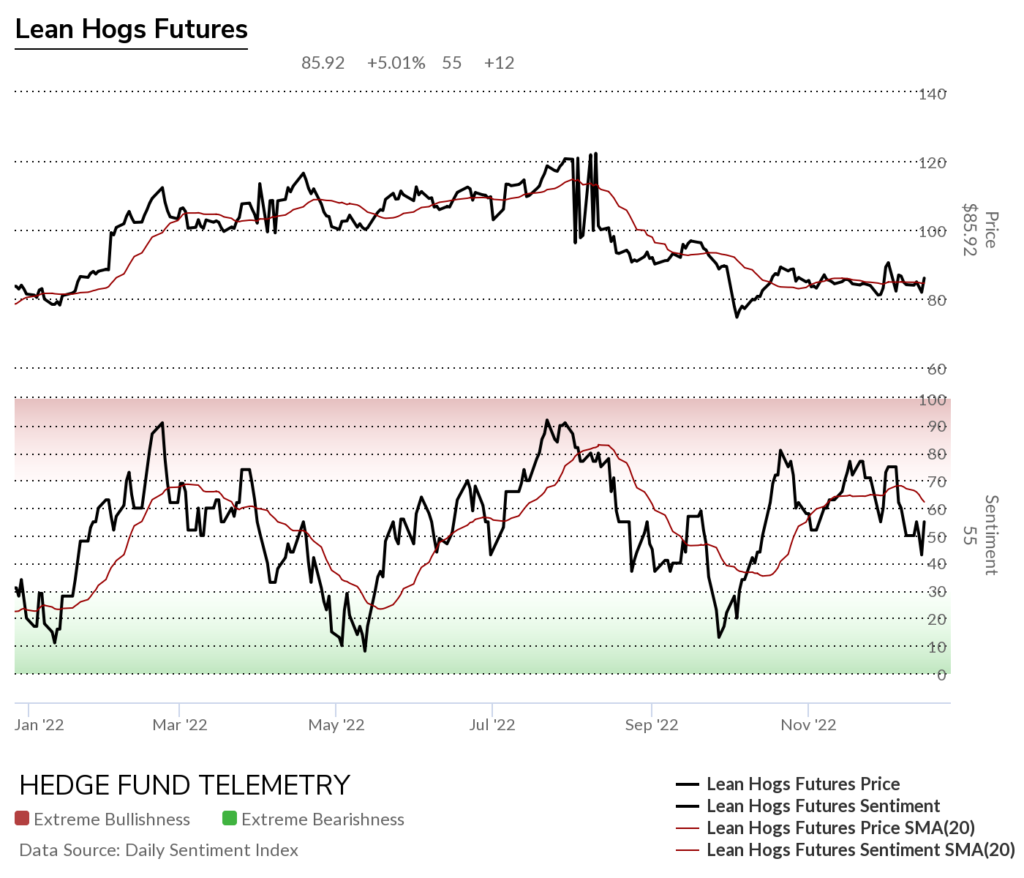

Lean Hogs futures daily has more work to do to breakout to the upside, and if this moves higher, the pending DeMark Sequential 13 will qualify. I have doubts if this will breakout.

Lean Hogs bullish sentiment is trying to hold the majority line at 50%

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

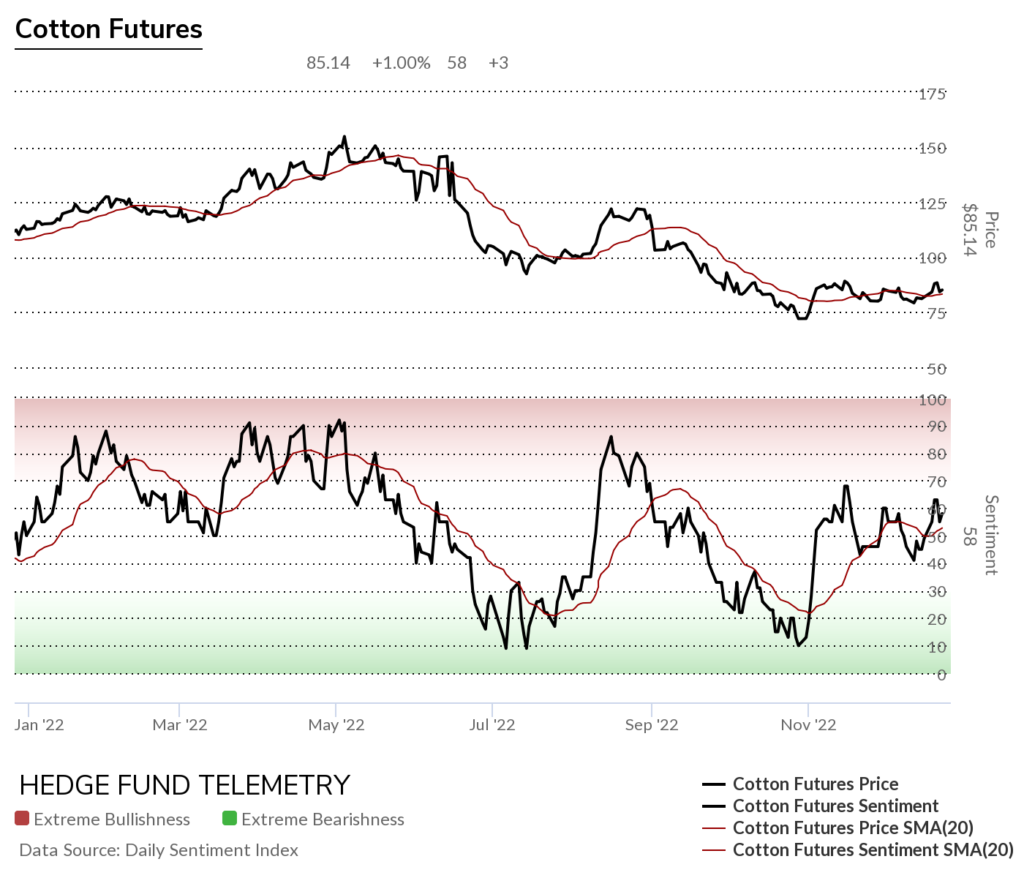

Cotton futures daily has been going sideways and might lose the Setup count tomorrow

Cotton futures bullish sentiment lacks momentum

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

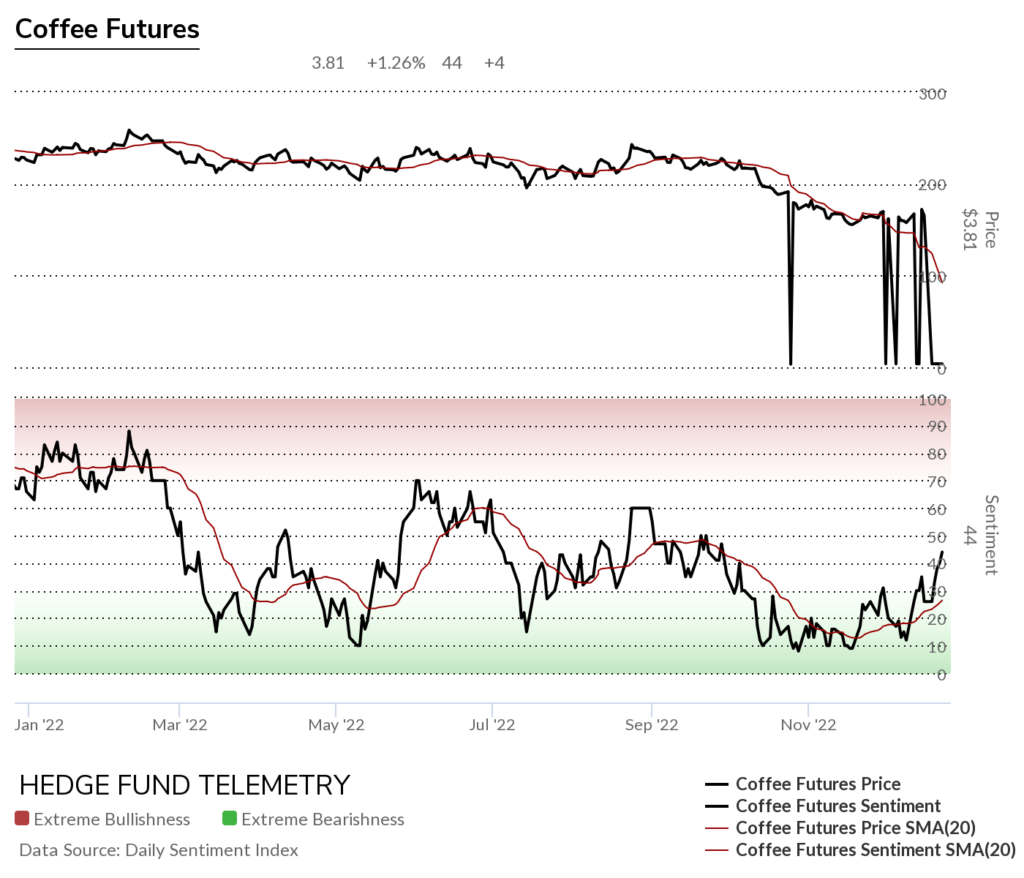

Coffee futures daily has make higher lows in the last month and I still like this on the upside

Coffee futures bullish sentiment has some data feed issues. Regardless sentiment is looking better for a try over 50% the majority line this week

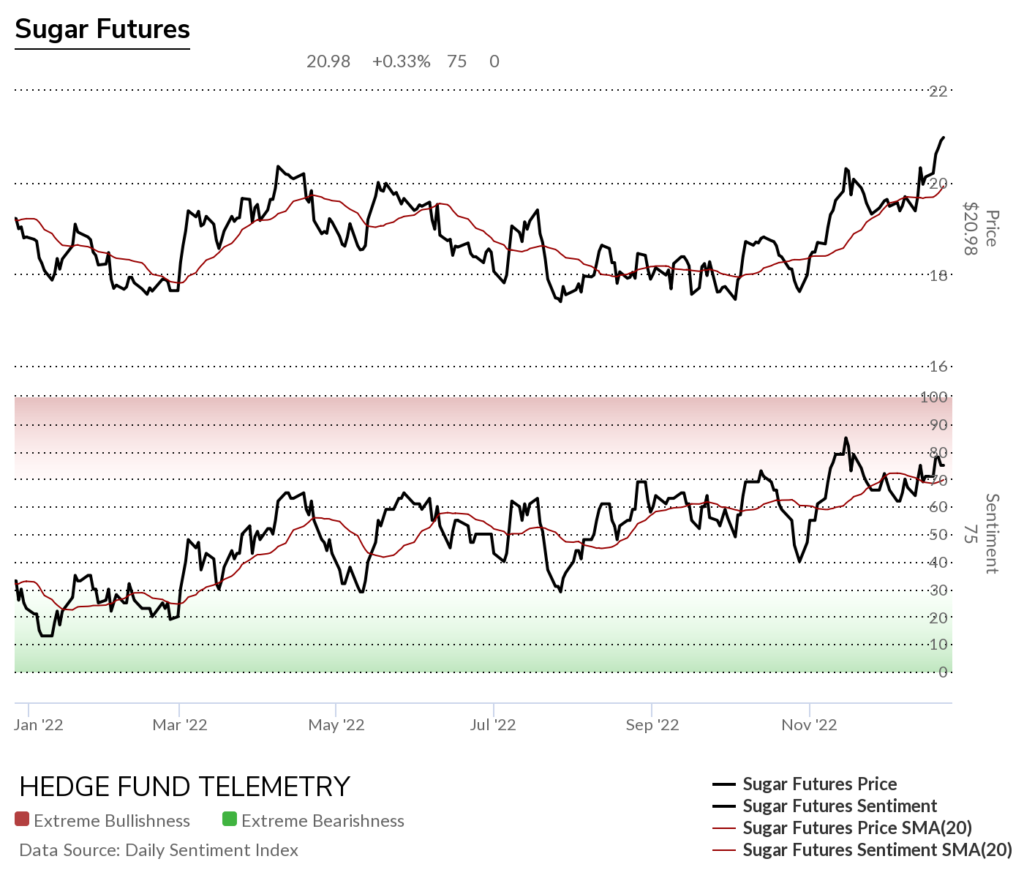

Sugar futures daily is now overbought and should stall this week. I’m giving up sugar for January.

Sugar futures bullish sentiment is in the elevated zone

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

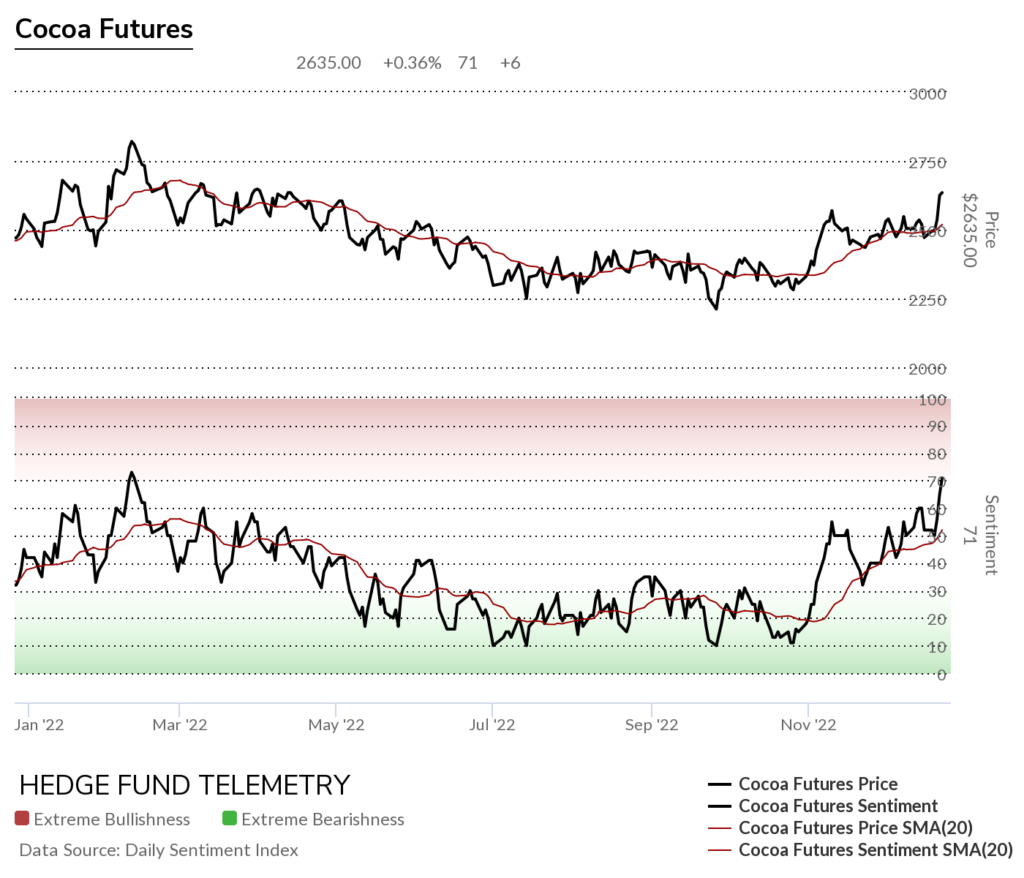

Cocoa futures daily is another one that might have limited upside from here.

Cocoa futures bullish sentiment is making a 1 year high and is in the elevated zone

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

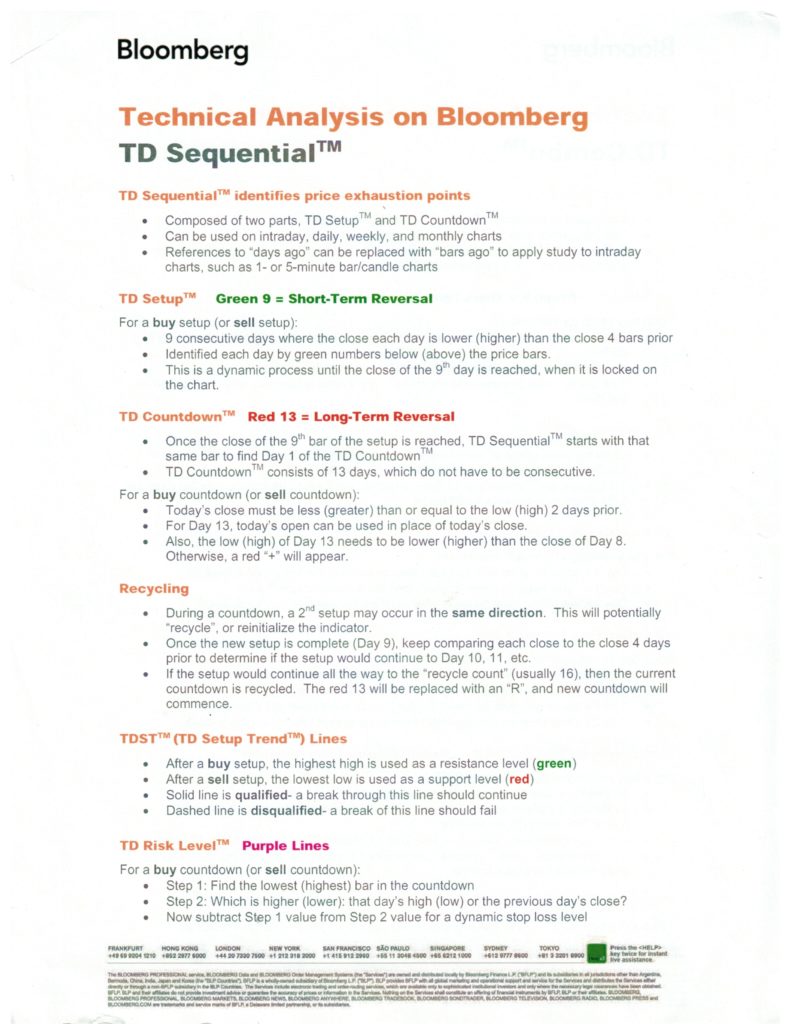

DeMark Sequential Basics

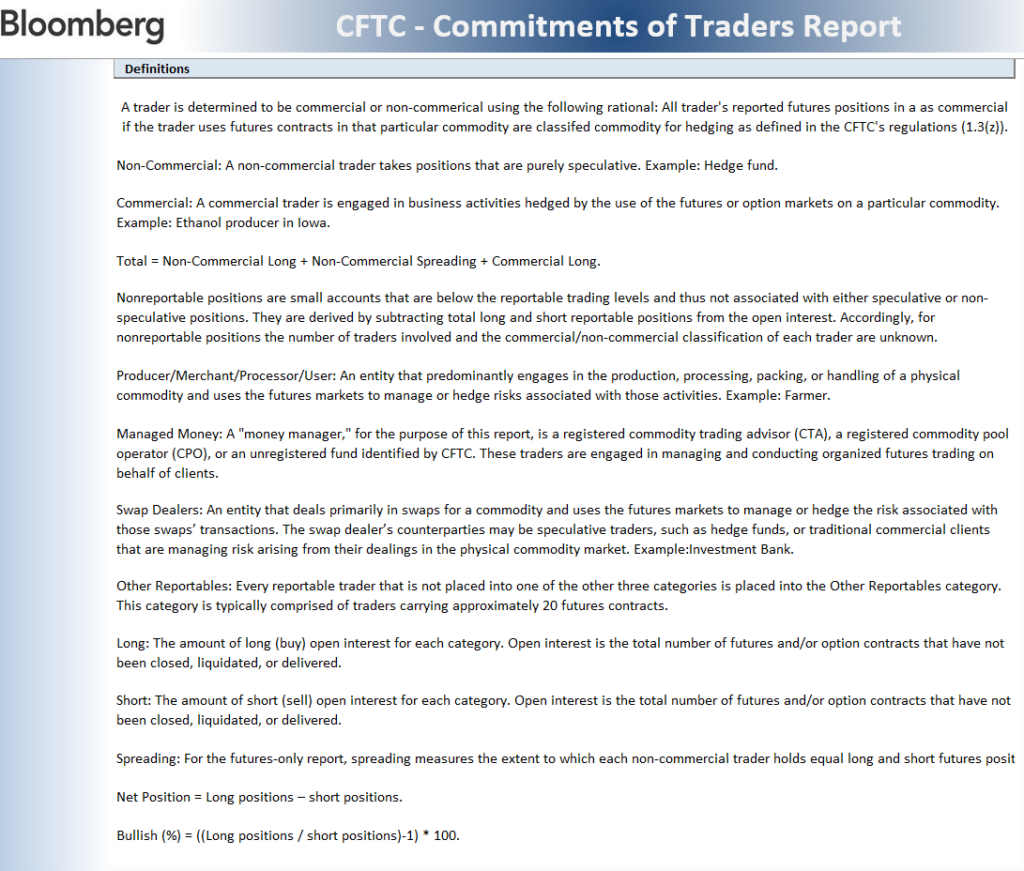

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS