Commitment of Traders – The Basics

The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are considered the “smart money” since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, comprises hedge funds, mutual funds, and commodity trading advisors. These speculative traders have no interest in the underlying physical commodity business.

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation, please see the bottom of this note.

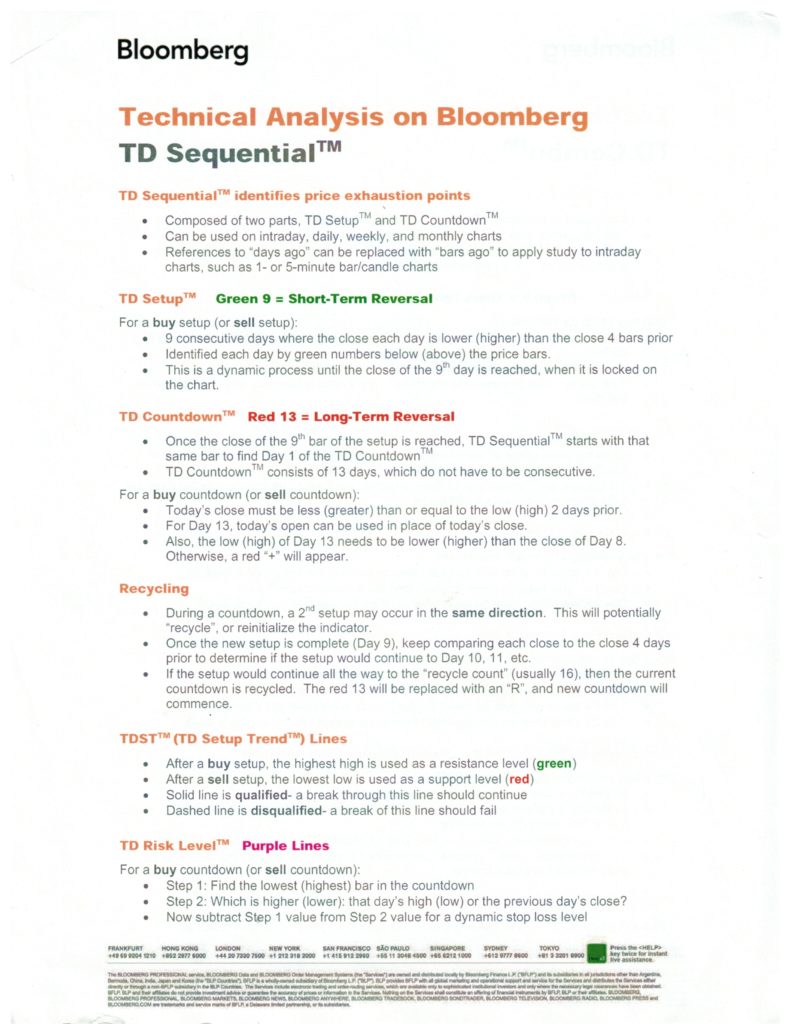

DeMark Indicators basics at the bottom of this note

Highlights and themes

It’s been really simple. The US Dollar sentiment remains oversold with DeMark buy Countdown 13’s in play with several crosses including Euro and Yen and exhaustion signals in play. With so many other markets and assets correlated with the Dollar, it will be very important to respect a reversal. As usual, I will have the US Dollar on First Call. Crypto has had a good run in the last two weeks after I spotted the upside Sequential Countdown starting. Now we should watch for upside DeMark exhaustion Countdown 13’s nearing.

Currency Sentiment Overview

Currency sentiment highlights still shows US Dollar sentiment oversold at 20%. Bitcoin made it to the midpoint 50% level and is getting closer to DeMark exhaustion signals so this might be limited.

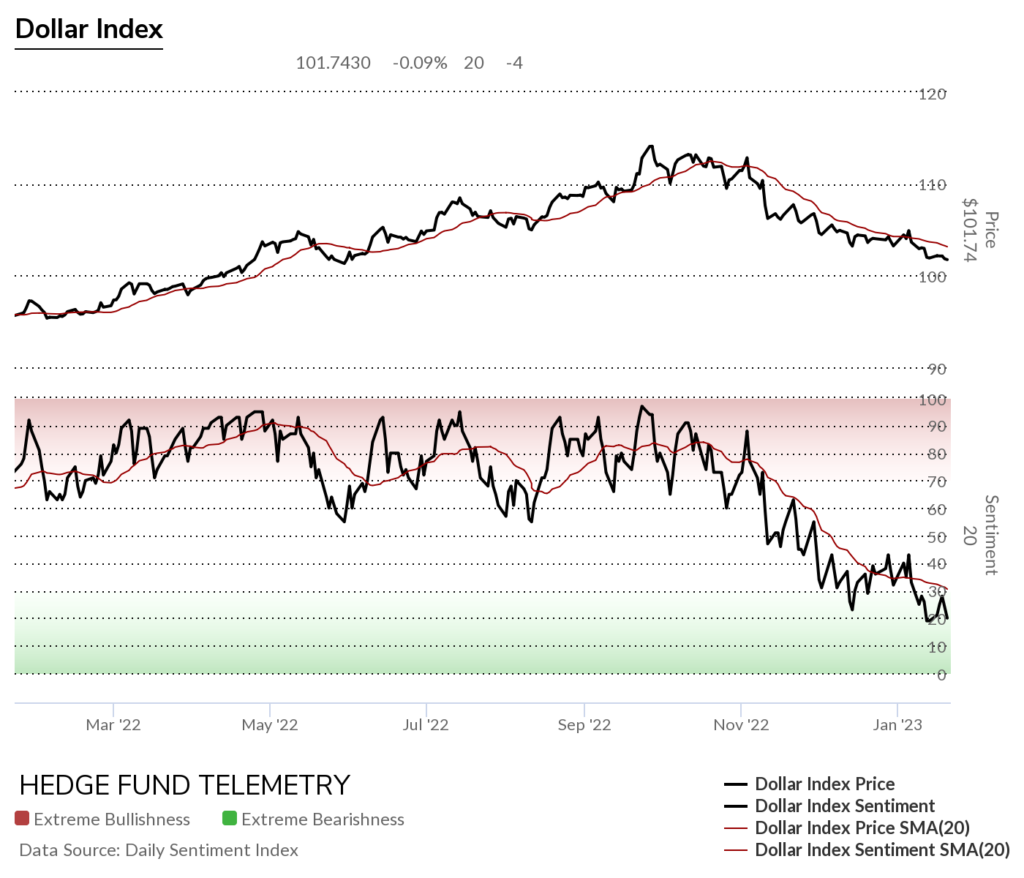

US Dollar Indexes

DXY US Dollar Index daily has the Combo 13 still in play in downside wave 5. A reversal from here is still probable.

US Dollar bullish sentiment remains oversold under pressure.

US Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Will the current Sequential continue?

Crypto

Bitcoin Daily has had a good run in the last few weeks when I spotted the new Sequential Countdown continuing the upside after the Setup 9. It’s late in the Countdowns and should get the Sequential and maybe Combo 13’s this week. There is a new Aggressive Sequential that is giving an early heads up with coming Sequential exhaustion.

Bitcoin Bullish Sentiment made it to the midpoint 50% level. It hit 70% at the last peak.

Ethereum Daily also has a new Aggressive Sequential 13 that worked well at its last peak.

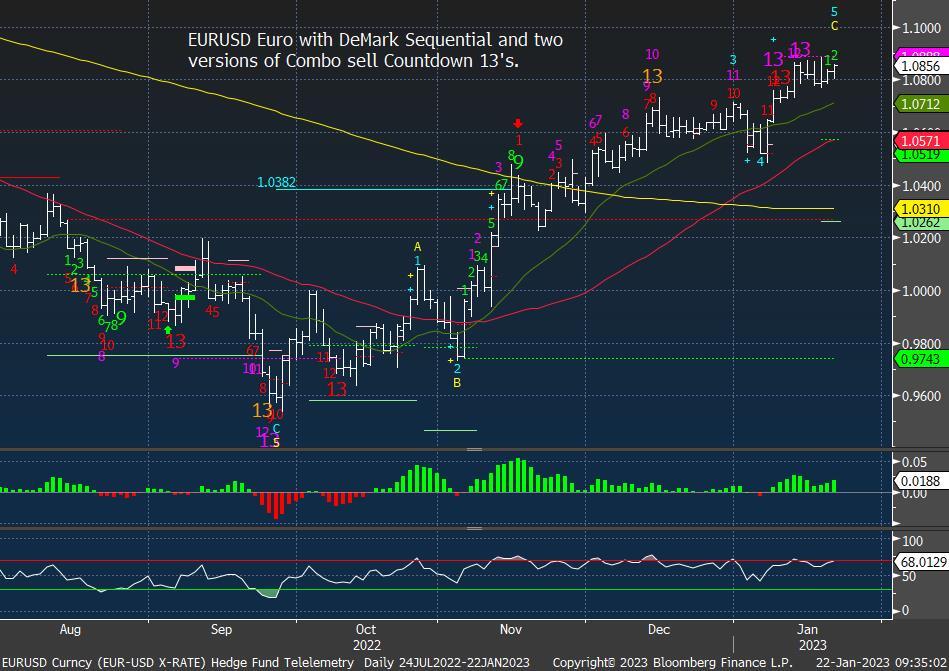

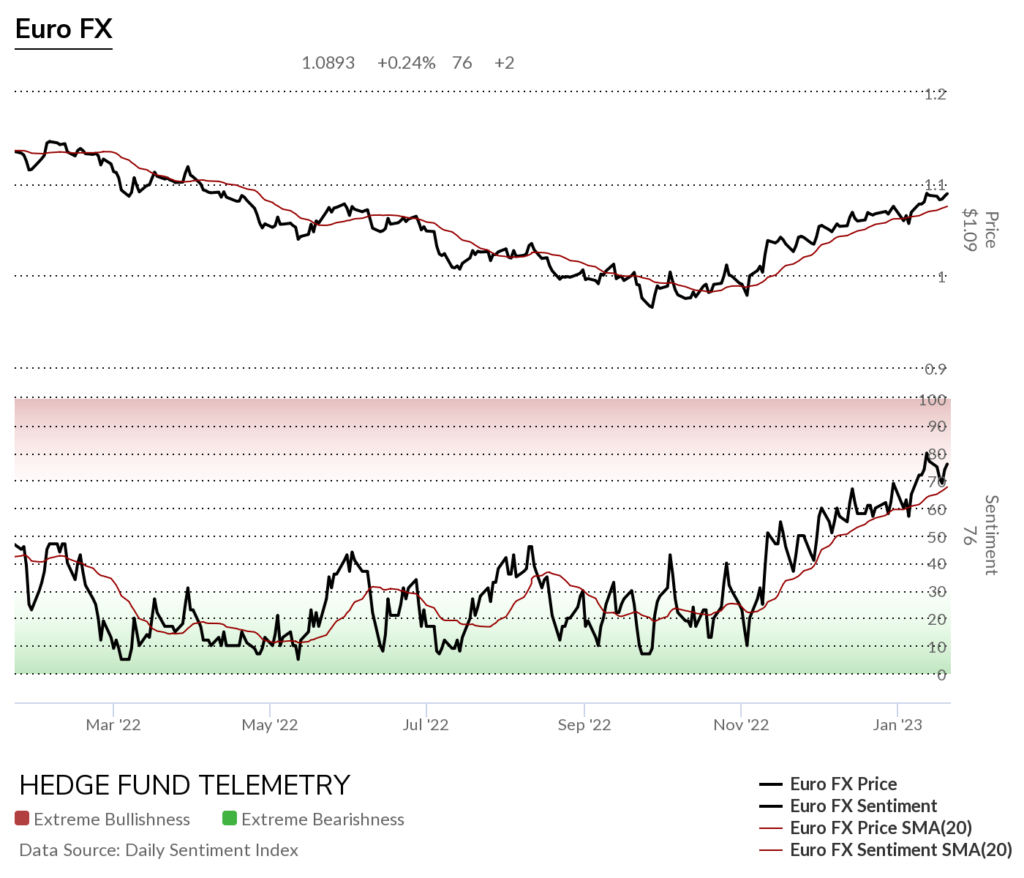

Major USD Crosses

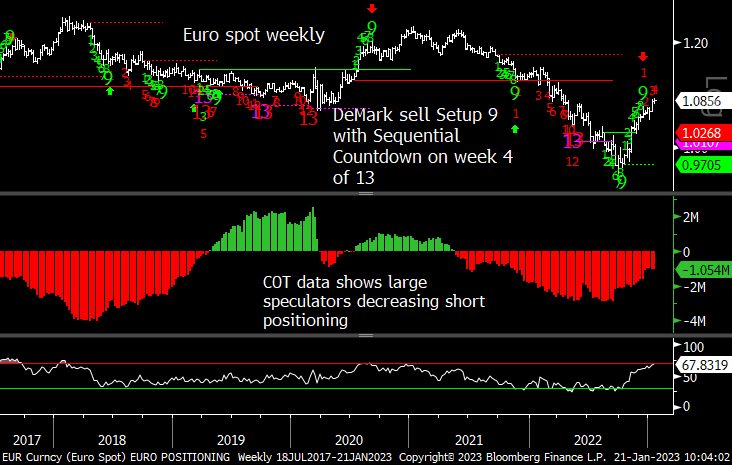

EURUSD Euro / US Dollar also has potential for a reversal

Euro bullish sentiment has been elevated. Watch for the reversal under the 20 day moving average of sentiment for a potential confirmation of reversal

Euro Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

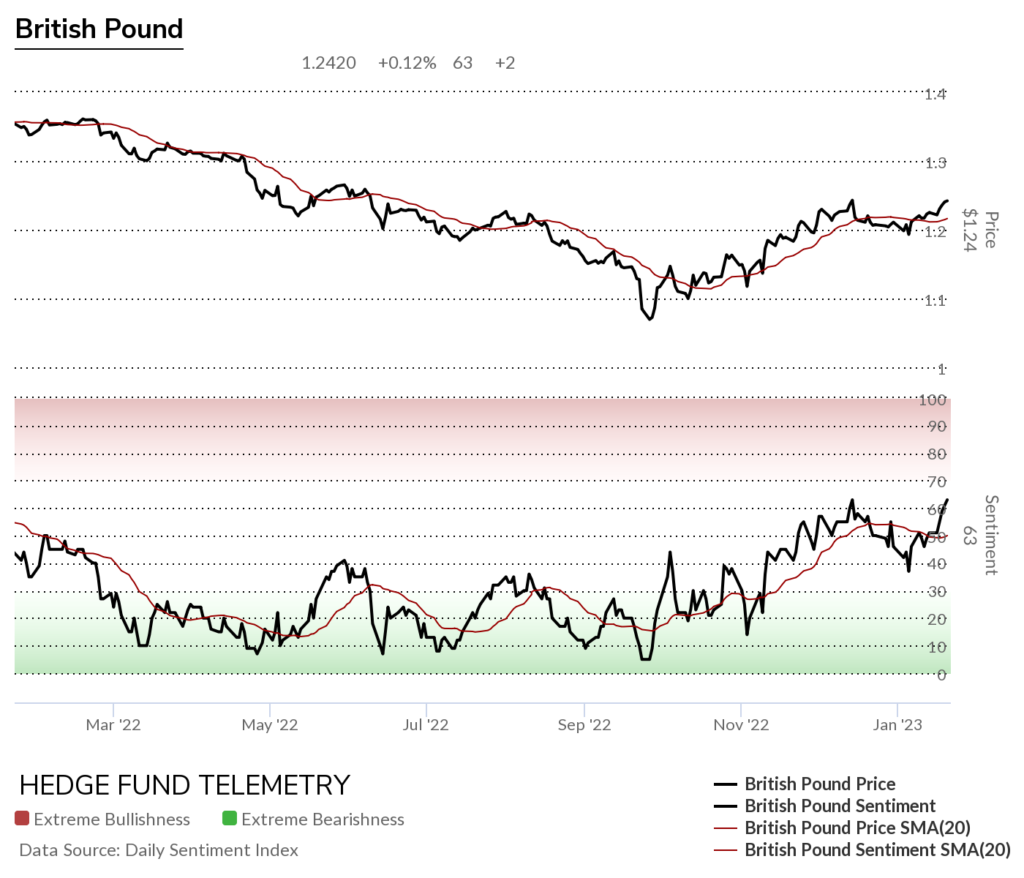

GBPUSD British Pound Sterling / US Dollar still has a lower high wave 2 of 5. If this makes a new high, it will revert back to the upside wave 5 and the downside patter will cancel

British Pound Sterling bullish sentiment made a new high although price did not

British Pound Sterling Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

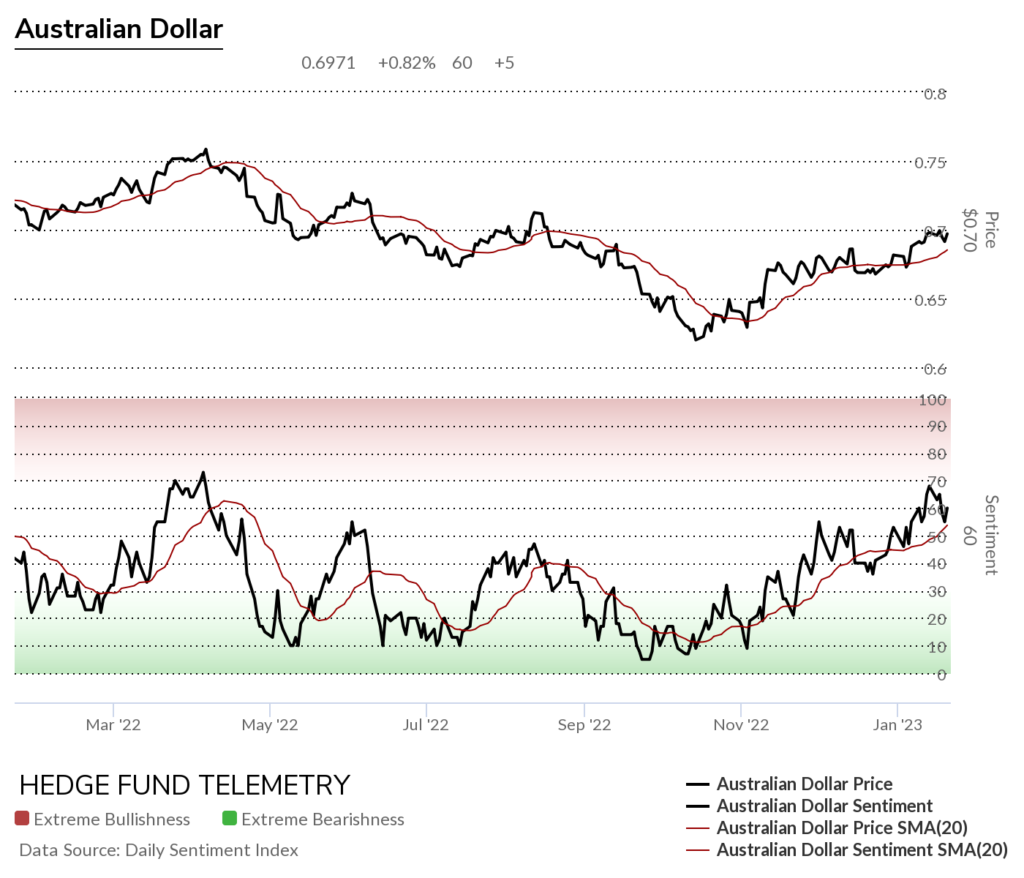

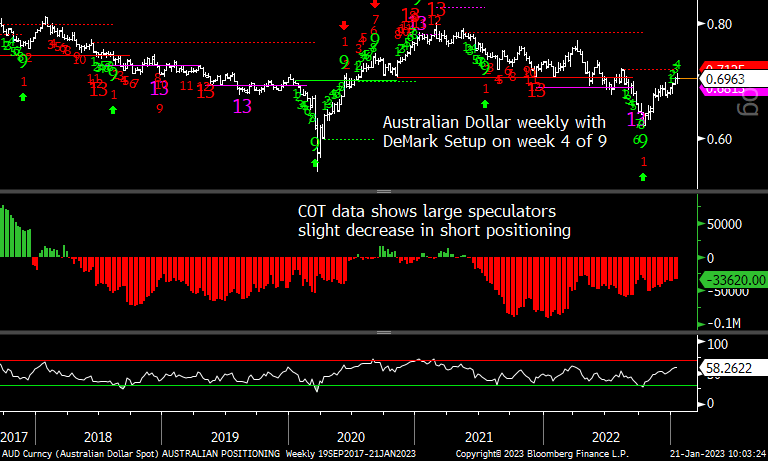

AUDUSD Australian Dollar / US Dollar

Australian Dollar bullish sentiment stalling

Australian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

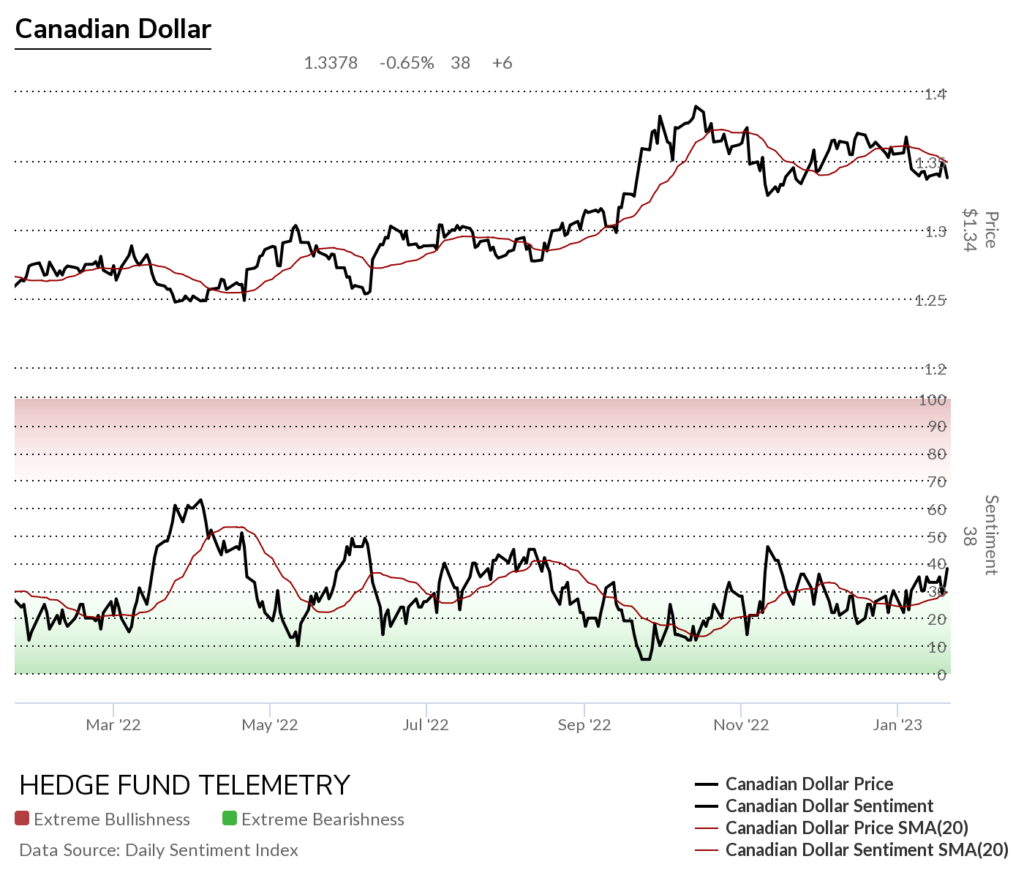

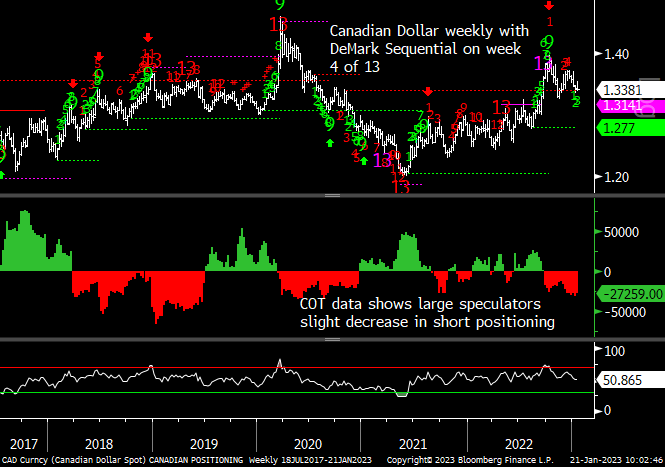

USDCAD US Dollar / Canadian Dollar

Canadian Dollar bullish sentiment might just sneak higher

Canadian Dollar Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

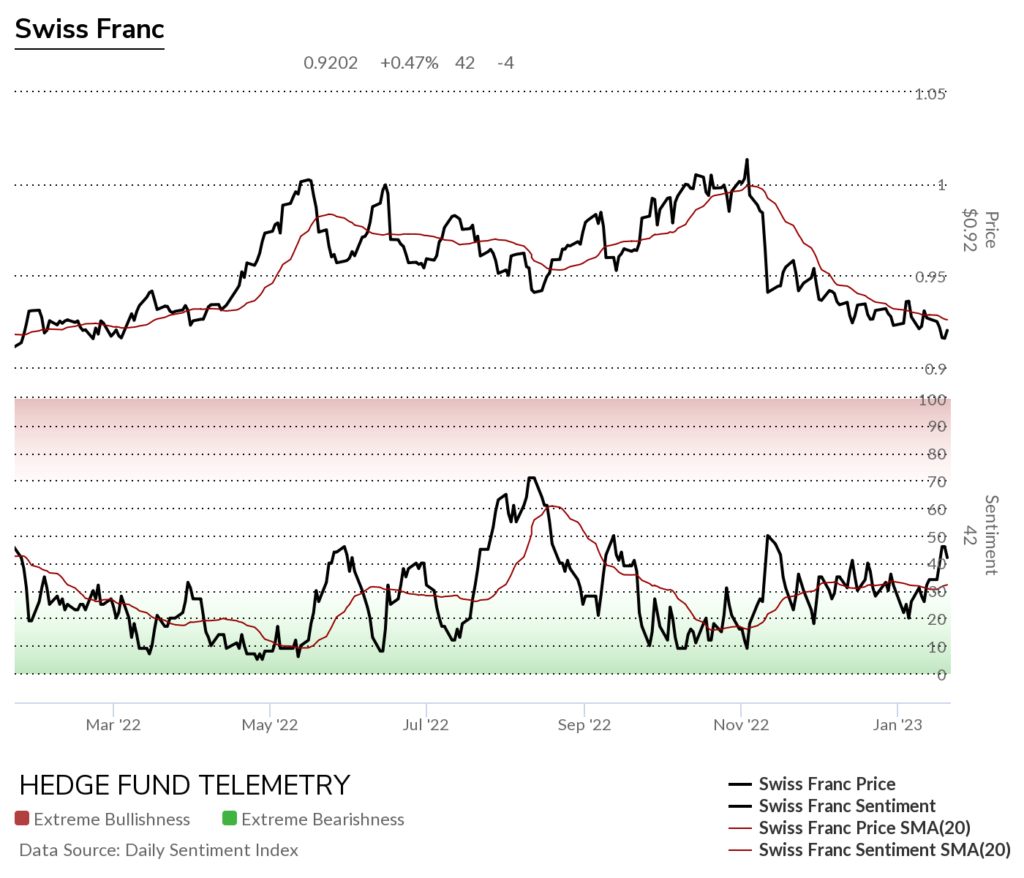

USDCHF US Dollar / Swiss Franc still has reveral potential

Swiss Franc bullish sentiment continues to stall at 50%

Swiss Franc Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDJPY Japanese Yen still has the potential to reverse.

Japanese Yen Bullish Sentiment stalling and breaking the 20-day moving average of sentiment is possible and then watch 50%.

Japanese Yen Commitment of Traders has seen large speculators significantly decrease short exposure

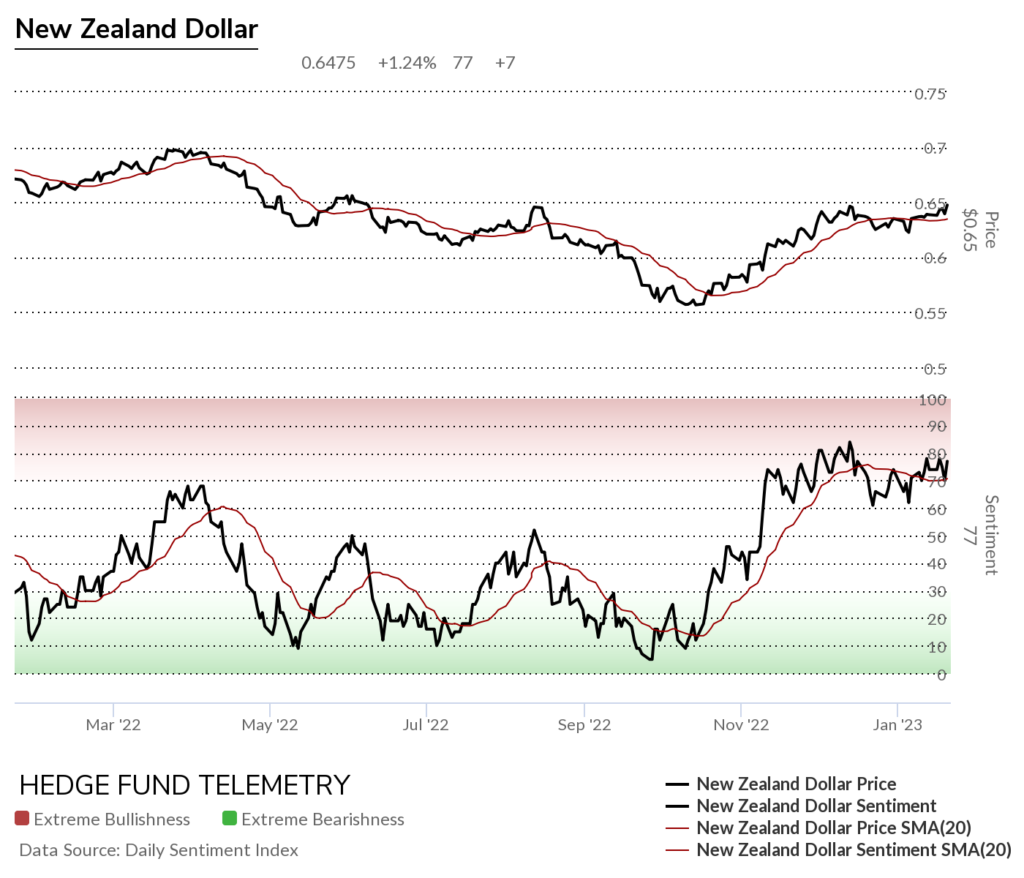

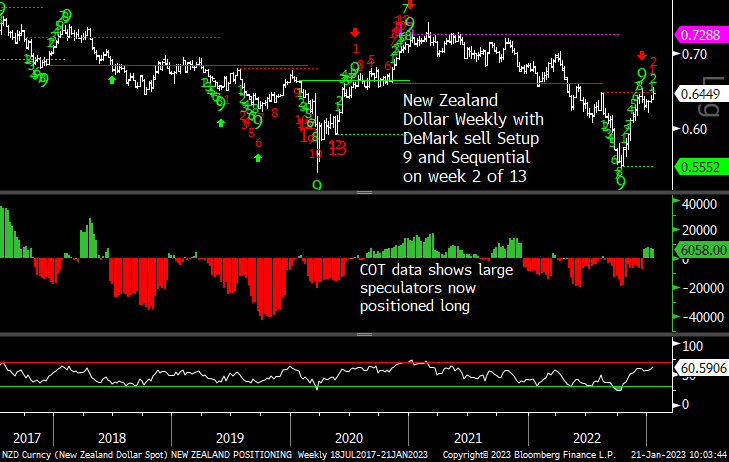

USDNZD New Zealand Dollar at support with new buy Setup 9. Important to watch if this breaks or bounces this week.

New Zealand Dollar Bullish Sentiment

New Zealand Dollar Commitment of Traders

RISK On Risk Off

This cross is often used as a risk-on / risk-off indicator

EURAUD Euro / Australian Dollar

Three major Yen crosses – potential for reversal vs Yen

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

USDTRY US Dollar / Turkish Lira

USDBRL US Dollar / Brazilian Real

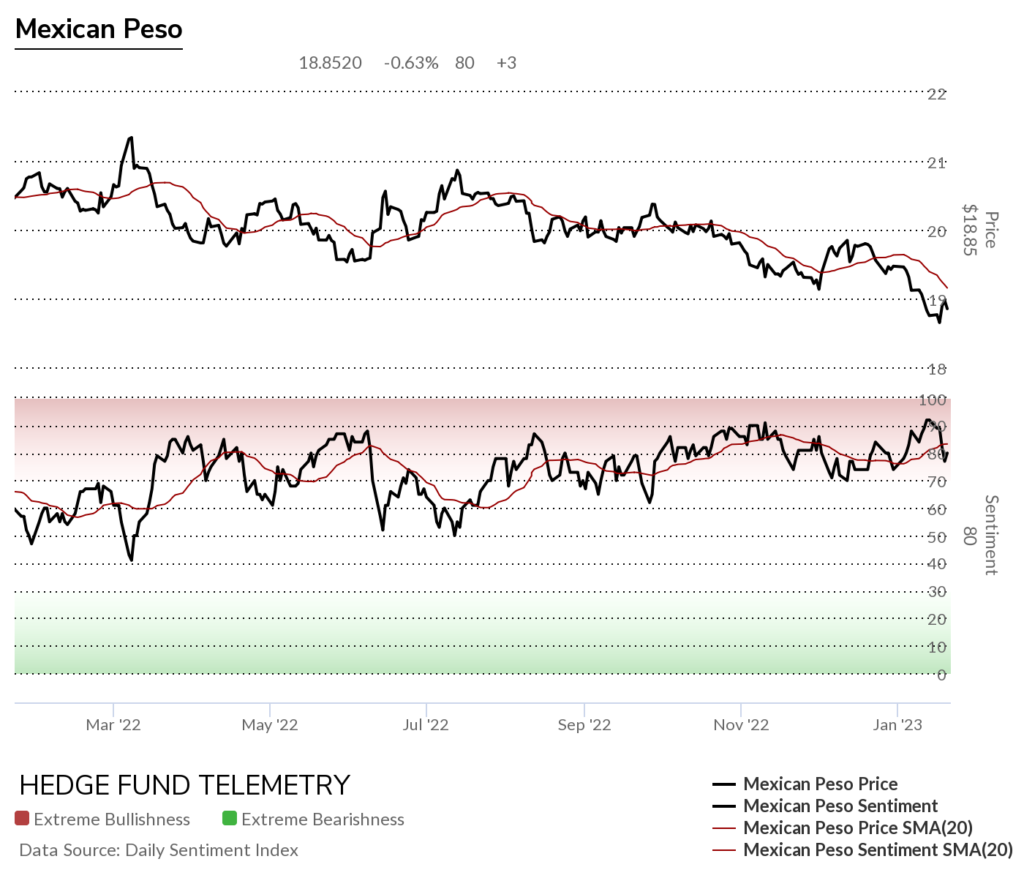

USDMXN US Dollar / Mexican Peso

Mexican Peso bullish sentiment remains in overbought zone

Mexican Peso Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

USDZAR US Dollar / South African Rand reversed however Friday gave back some gains

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan) still has some exhaustion signals pending.

DeMark Sequential Basics from Bloomberg

More detailed Commitment of Traders explanation