Commitment of Traders – The Basics

The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are considered the “smart money” since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, comprises hedge funds, mutual funds, and commodity trading advisors. These speculative traders have no interest in the underlying physical commodity business.

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation, please see the bottom of this note.

DeMark Indicators basics at bottom of this note

HIGHLIGHTS AND THEMES

- Continued dispersion within the Commodity Markets

- Bloomberg Commodity Index hit a new low

- Energy is mixed with the potential for upside in the short term while the intermediate time frame still is a concern.

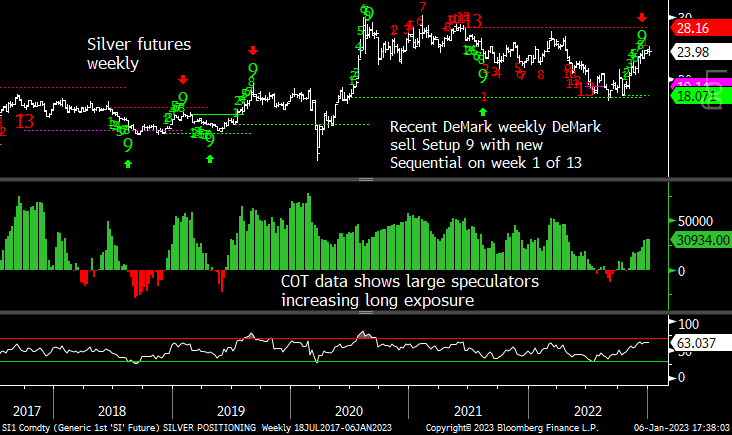

- Gold and Silver have very limited upside from here with some exhaustion signals and overbought sentiment conditions.

- Cotton and Copper have breakout potential, and Cocoa, Sugar, and Livestock could continue lower

- Grains struggling to hold support, notably wheat

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily broke to a new low and did qualify the DeMark Combo 13. There is potential for an upside reversal in the coming days/weeks. I will be all over this if it occurs.

Bloomberg Commodity Index Weekly is still on week 6 of 9 with the Setup with a downside Propulsion target of 104.84. I want a buy Setup 9 and reversal in late January.

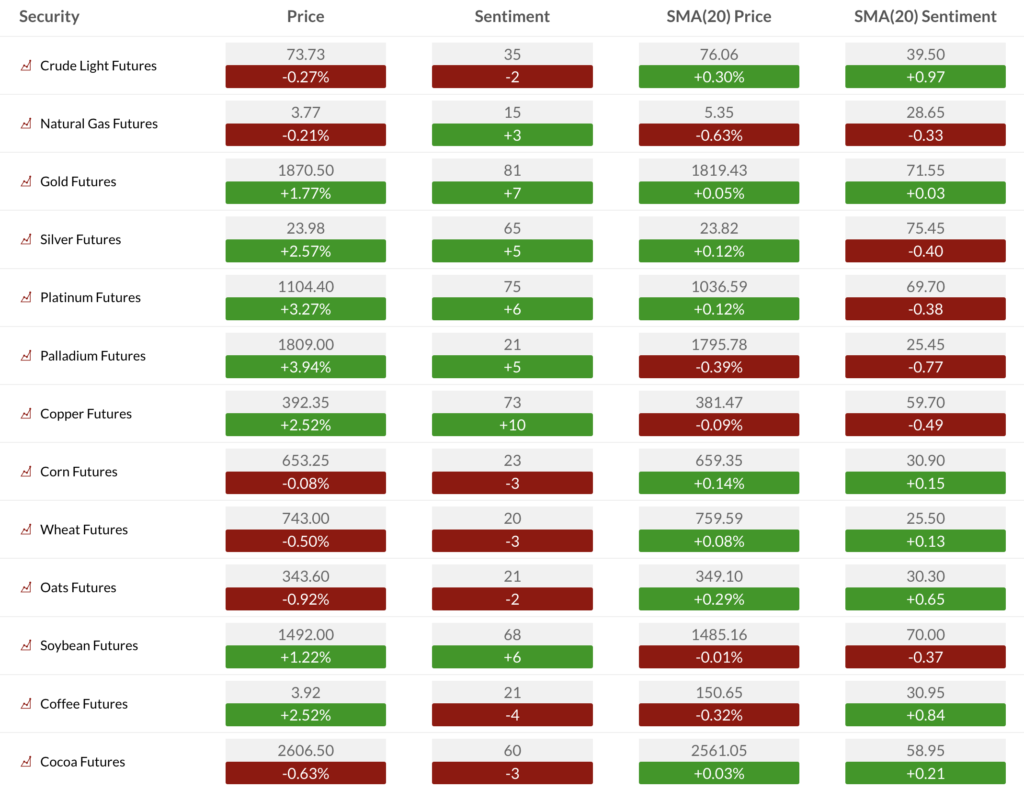

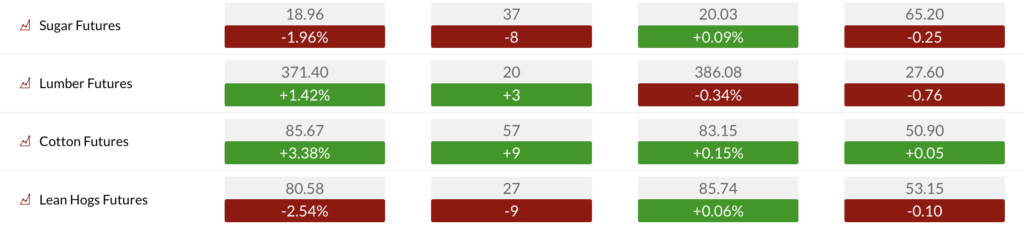

COMMODITY SENTIMENT OVERVIEW

Dispersion across the commodity markets continue.

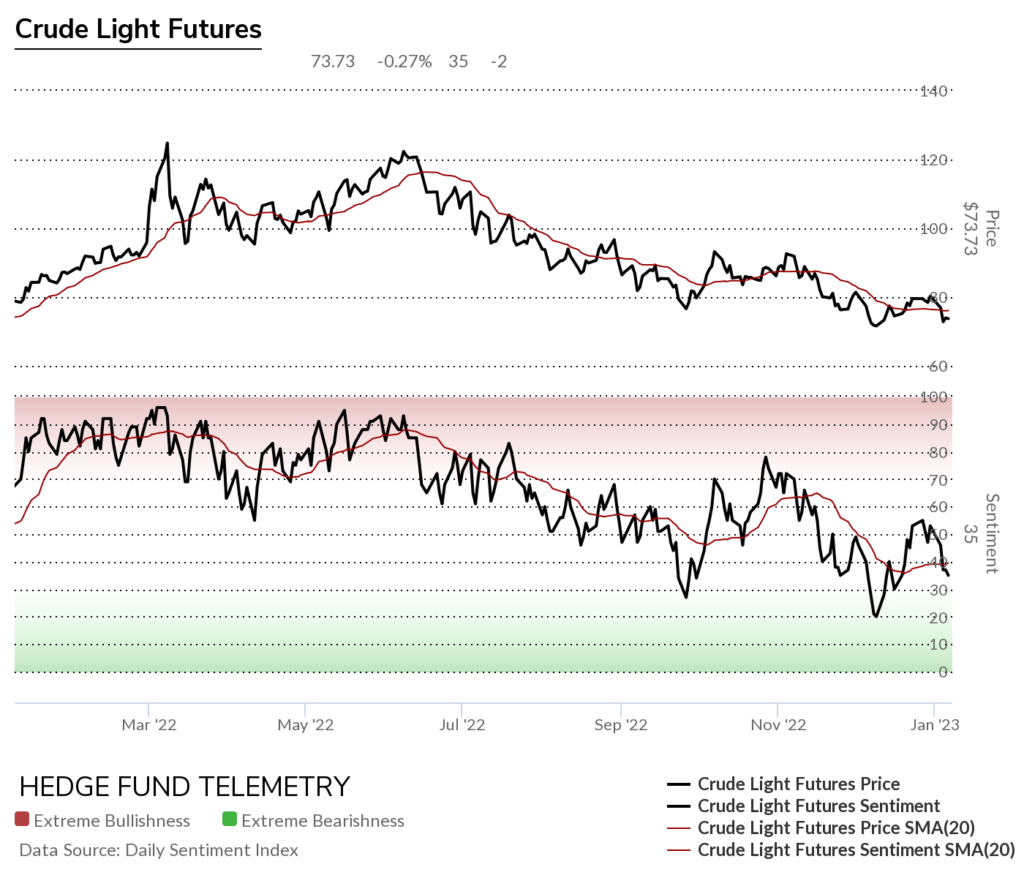

OIL AND ENERGY

Bloomberg Energy Subindex broke lower and has a new Combo 13 with the Sequential Countdown getting closer to the 13 and wave 5 price objective of 37.59 now achieved.

Bloomberg Energy Subindex also is on week 6 of 9 with the Setup. Tough to make a call to buy looking at this drop

WTI Crude futures daily held the recent lows and has the Sequential pending on day 10 of 13

Brent Crude futures daily did get the Sequential buy Countdown 13.

WTI Crude futures bullish sentiment did make another lower high and could chop lower.

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. The weekly Sequential on week 8 of 13 is concerning on an intermediate term basis.

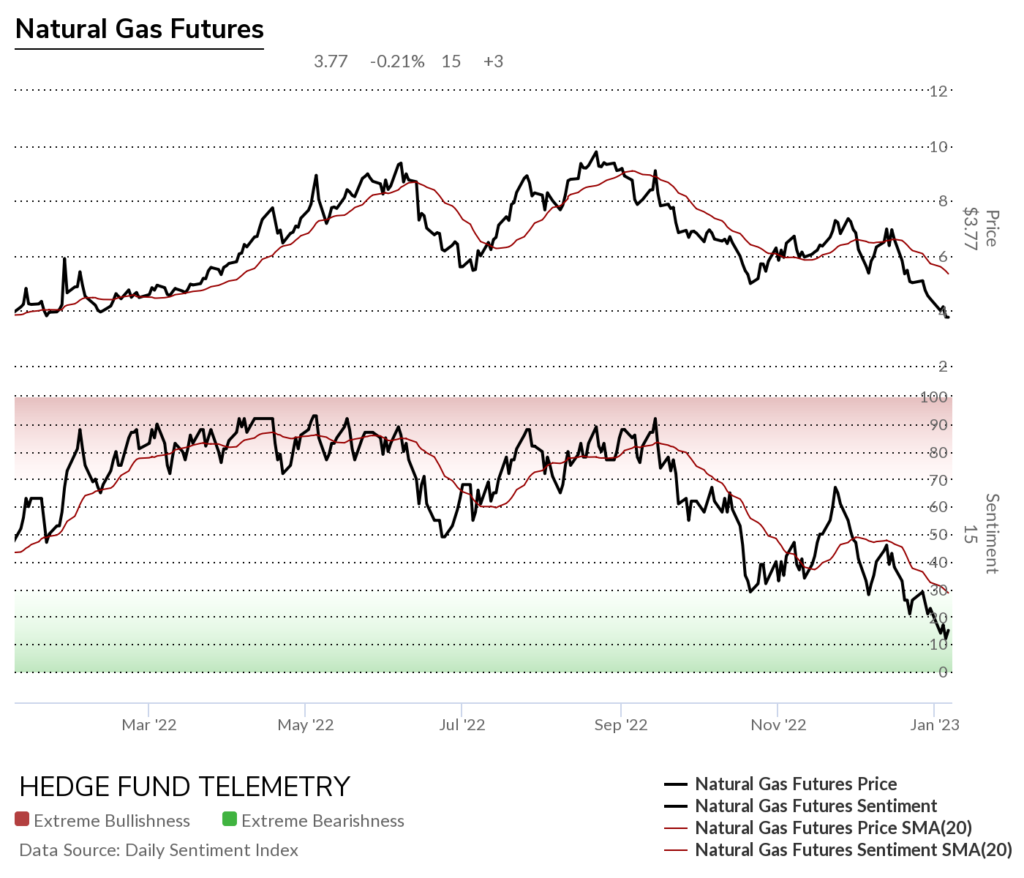

Natural Gas futures daily made another new low with the Sequential still in progress. It’s oversold, and a few bounces are likely even with the Sequential in progress.

Natural Gas futures bullish sentiment is very oversold

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Concerning is the weekly Sequential on week 3 of 13

Gasoline Daily made another lower high. And there is a Sequential still in progress.

Gasoline futures Commitment of Traders also has a downside Sequential on the weekly

Metals

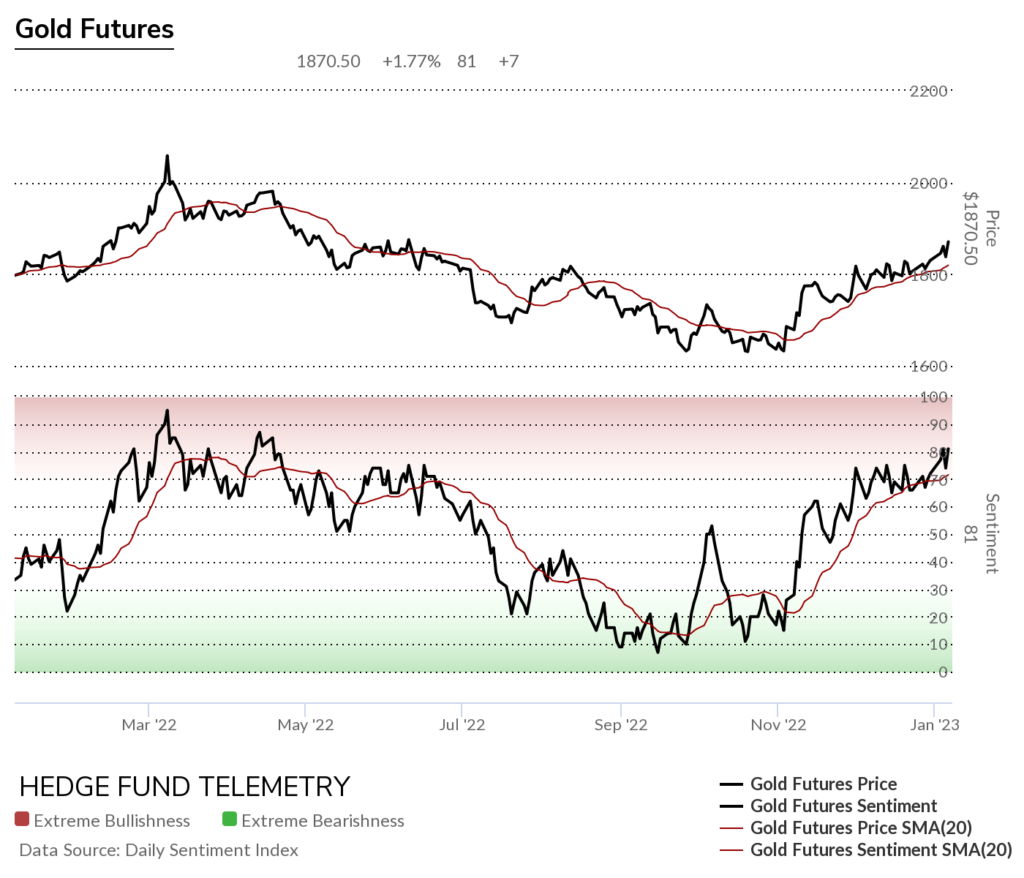

Gold futures daily has the Sequential and could get the Combo sell Countdown 13 this week.

Gold futures bullish sentiment is now in the extreme zone over 80%

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

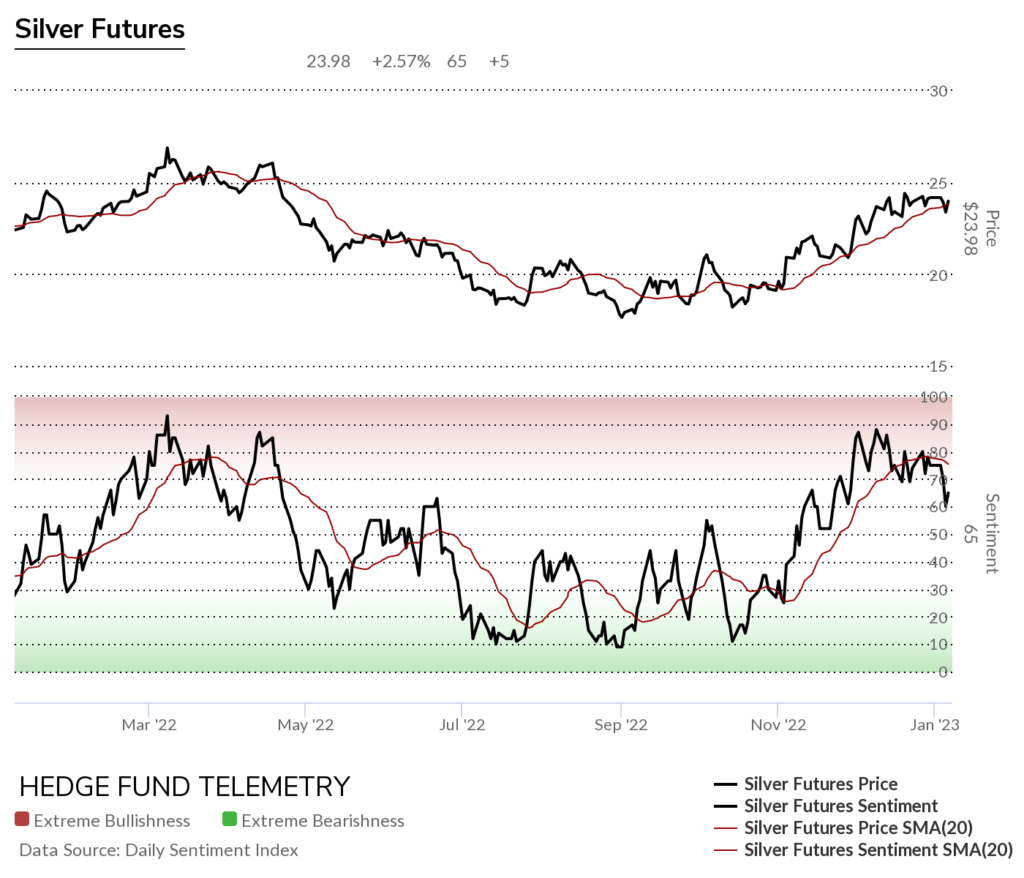

Silver futures daily is lagging gold with the Sequential and Combo still in progress.

Silver futures sentiment backed off last week after reaching overbought levels

Silver Commitment of Traders

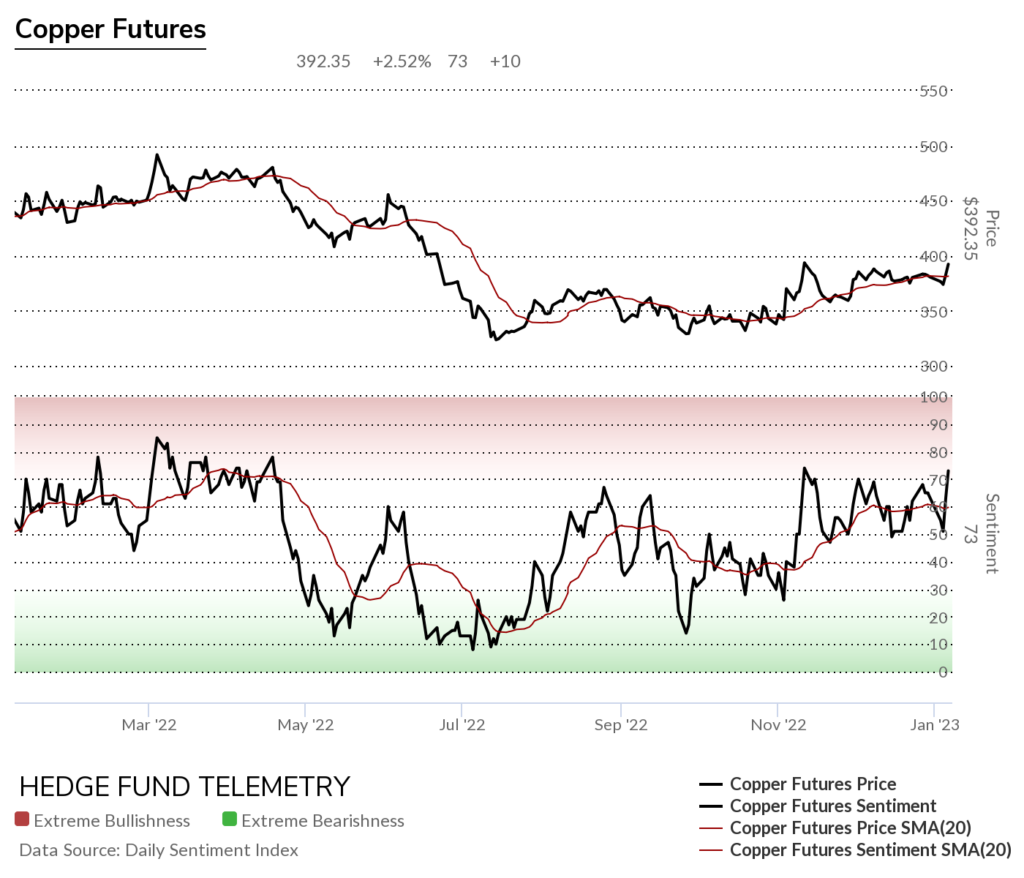

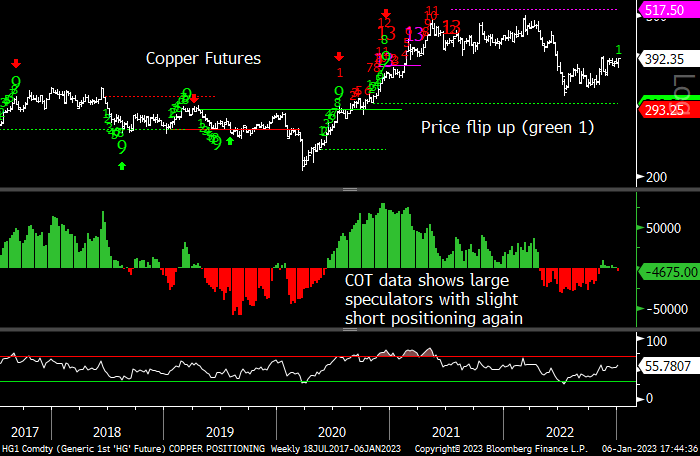

Copper futures daily did qualify into upside wave 5 still with resistance at 400

Copper futures bullish sentiment improved after holding 50%

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

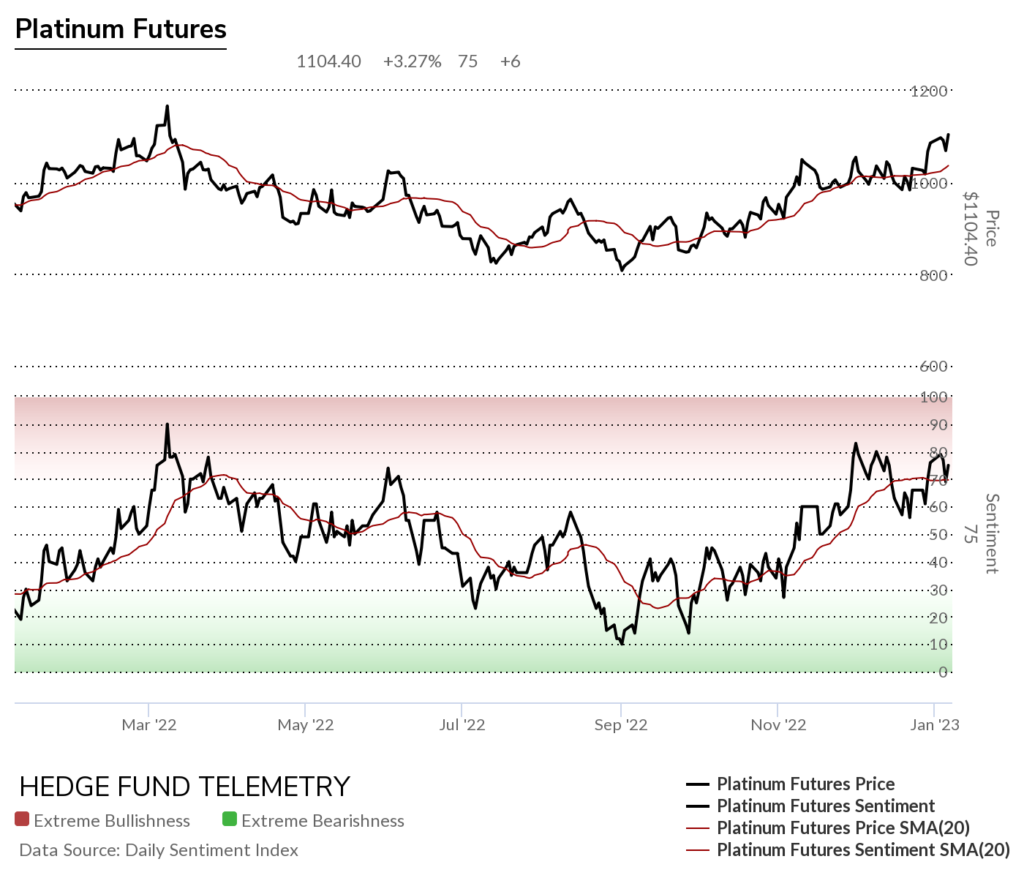

Platinum daily with a sell Setup 9. Continuation or pullback will be known this week.

Platinum bullish sentiment has been overbought

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

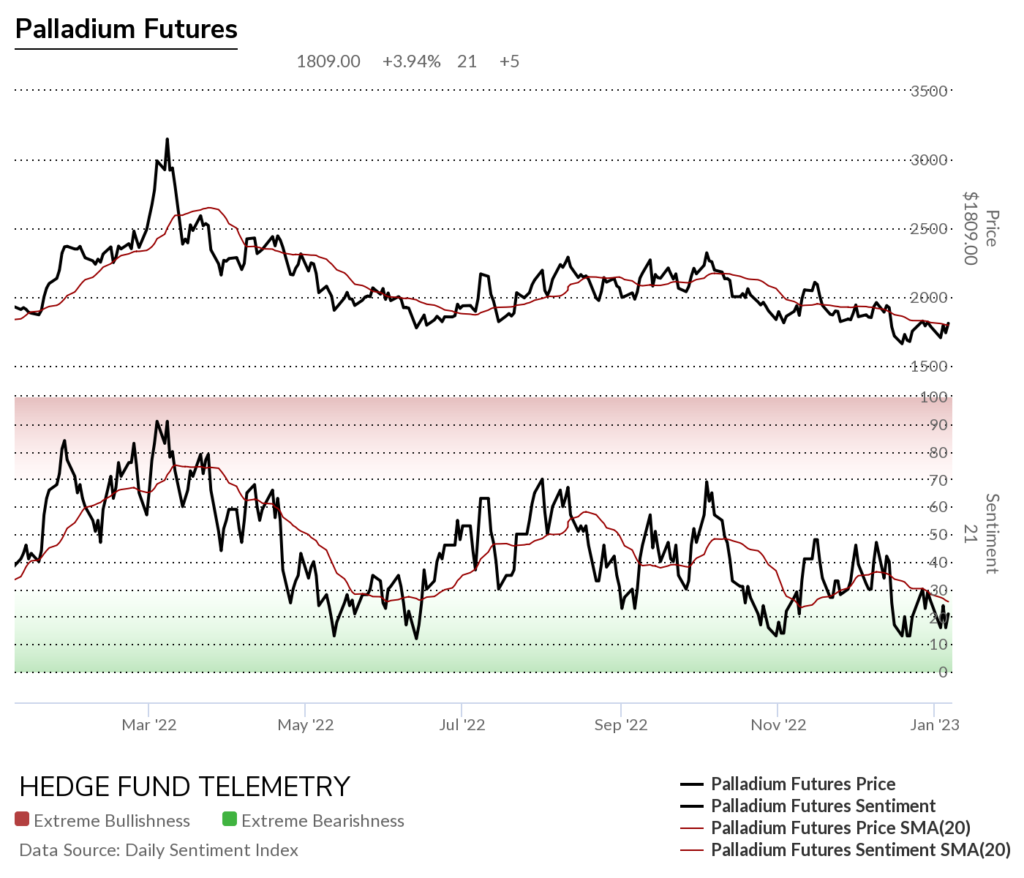

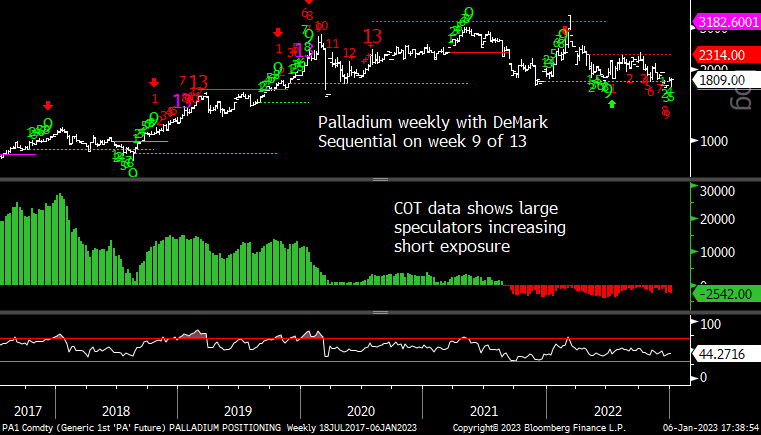

Palladium daily held the recent lows and could bounce a little more this week although there has been several lower highs in the last quarter

Palladium bullish sentiment remains under pressure

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

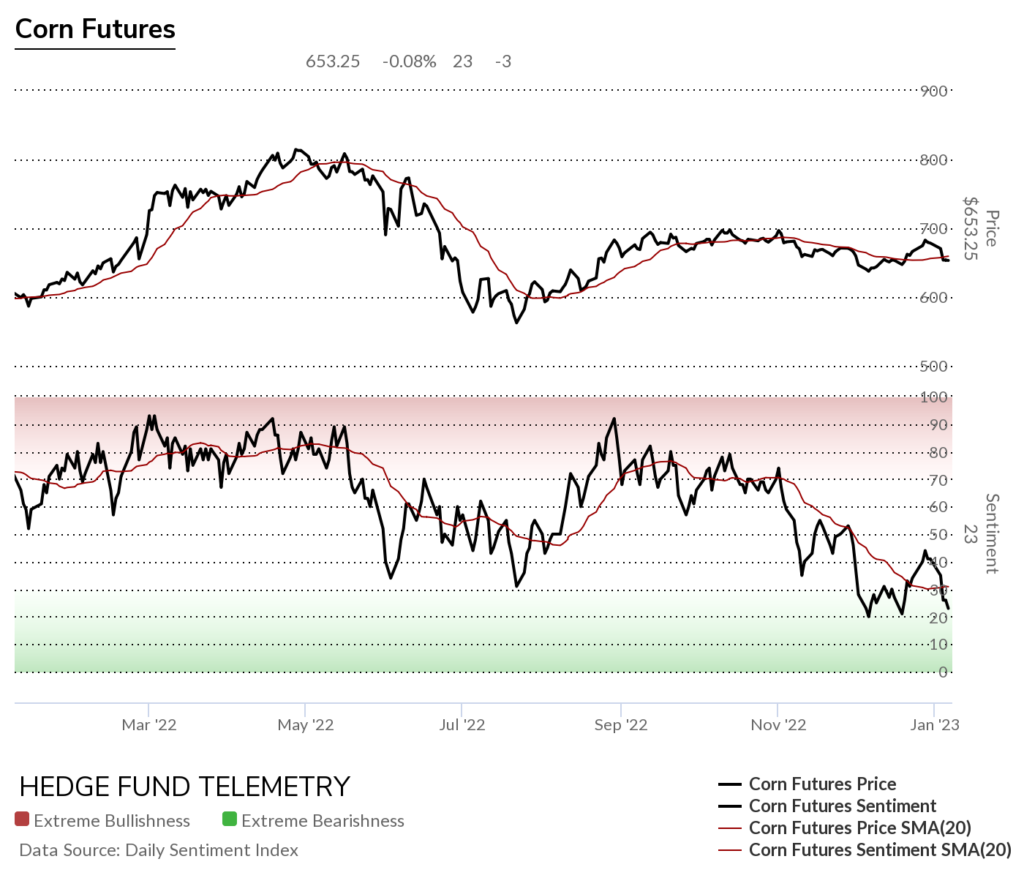

Corn futures daily could break lower after failing at the 200 day

Corn futures bullish sentiment remains under pressure

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

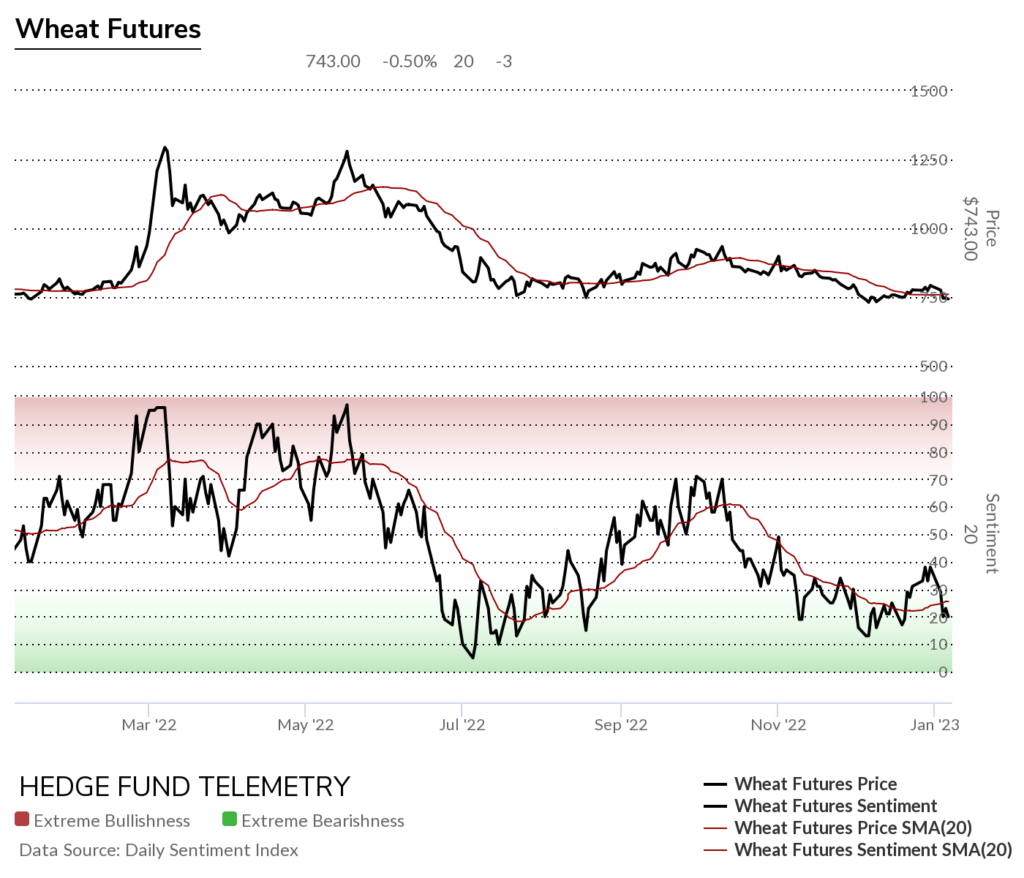

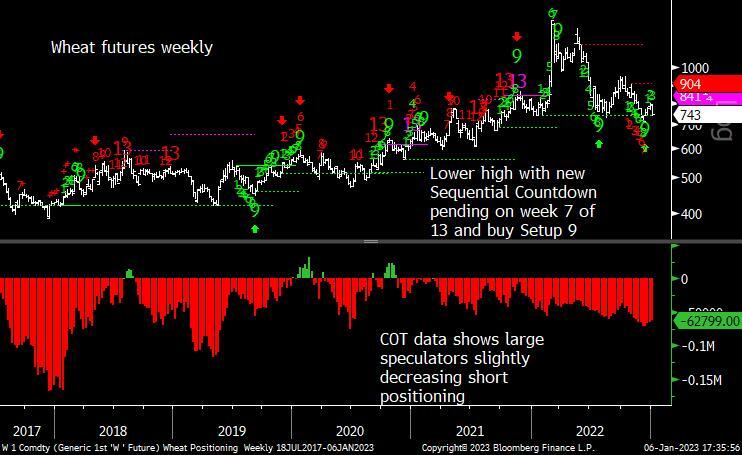

Wheat futures daily reversed after the recent sell Setup 9. I’ll have thoughts if this breaks the recent lows this week.

Wheat futures bullish sentiment remains under pressure

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

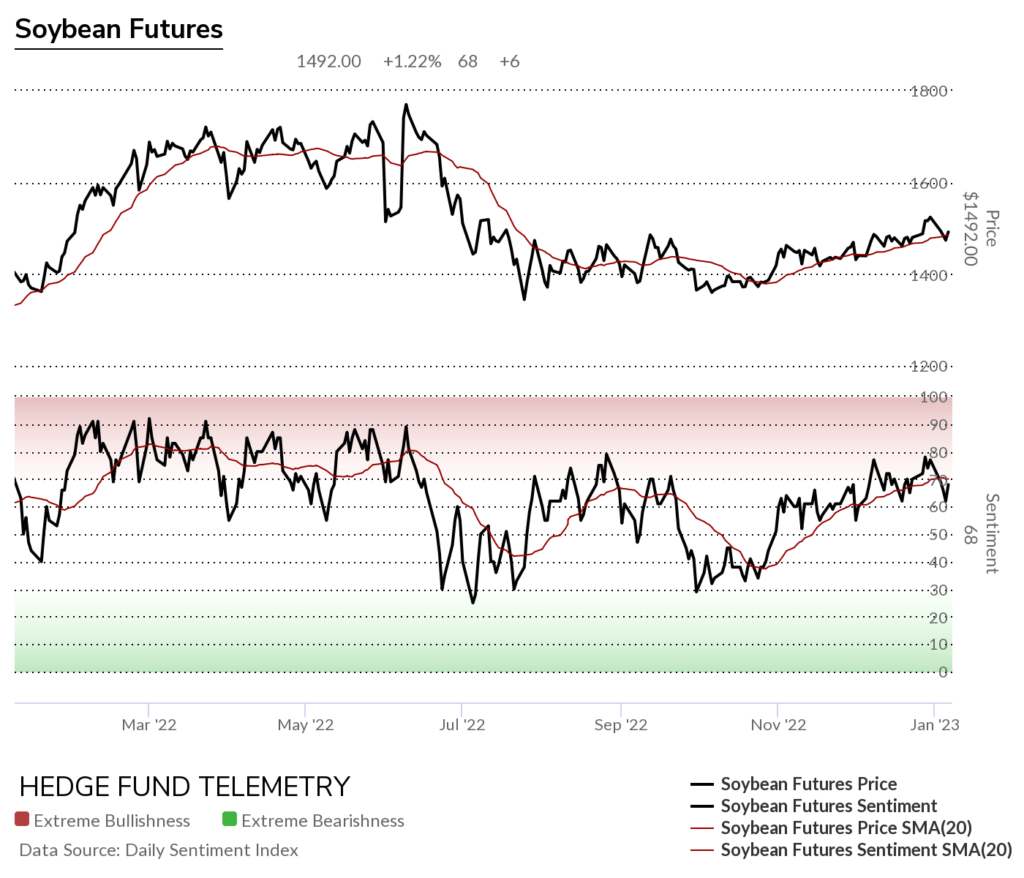

Soybean futures daily backed off but holding 50 day is a positive

Soybean futures bullish sentiment stalled

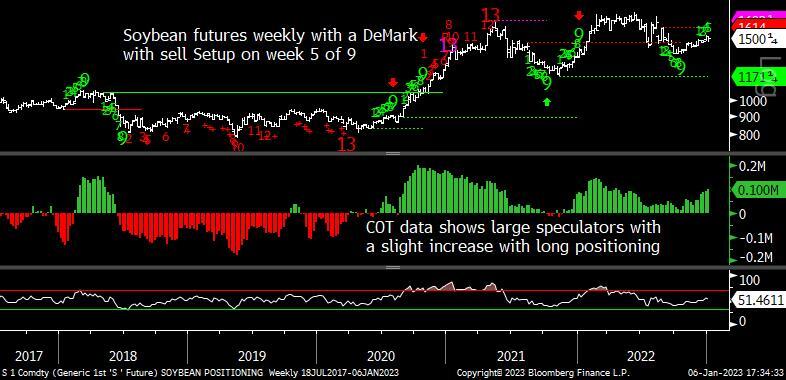

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

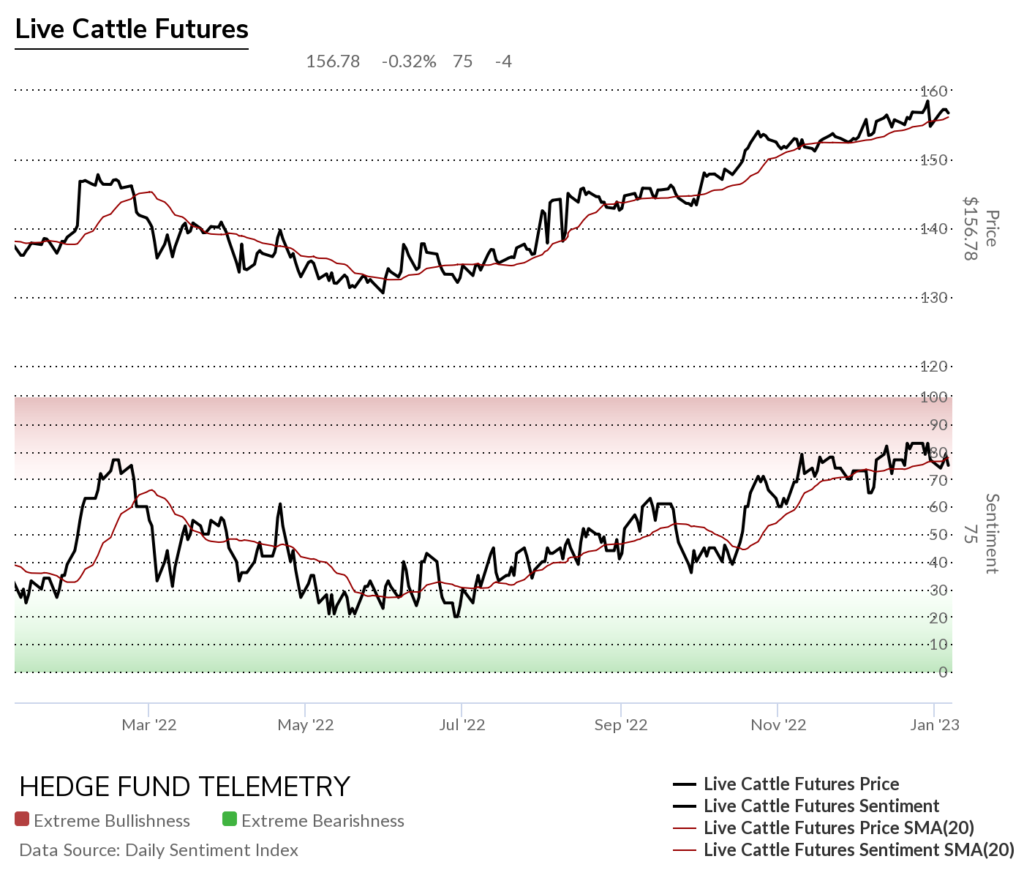

Cattle futures daily should back off some more

Cattle futures bullish sentiment has been overbought

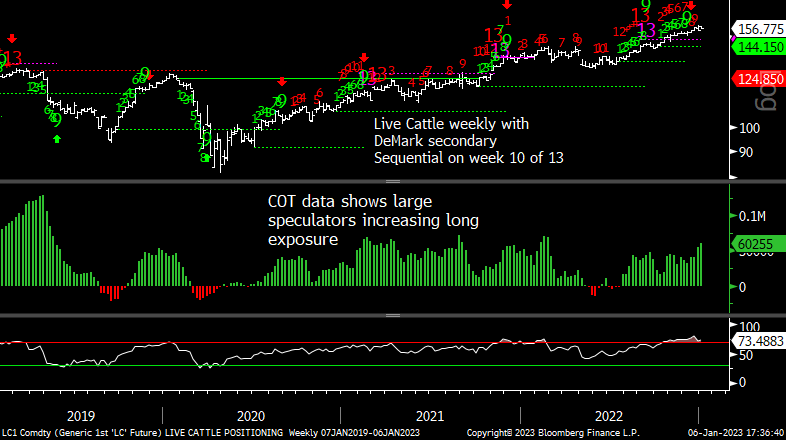

Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

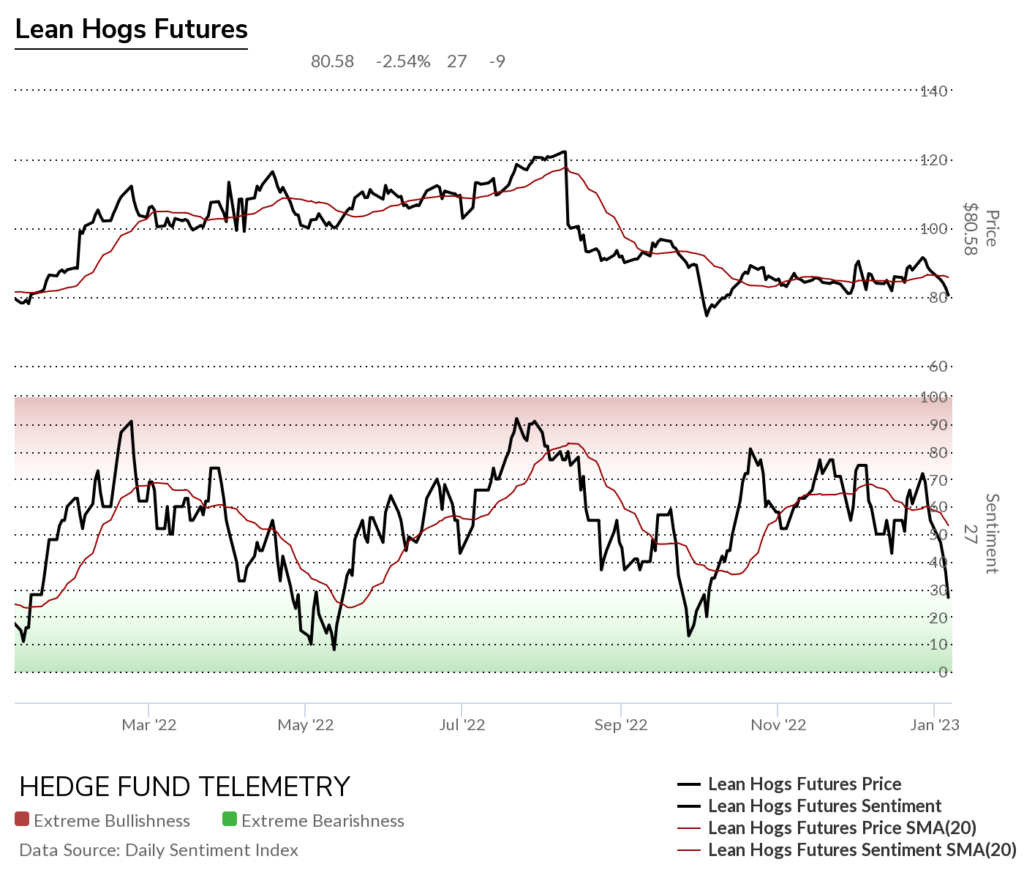

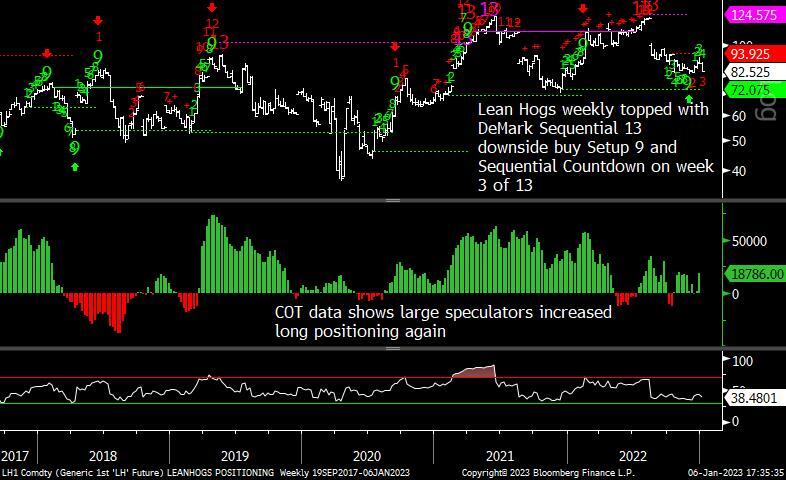

Lean Hogs futures daily continued to break down hard

Lean Hogs bullish sentiment very weak action and could go lower to other lows under 20%

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

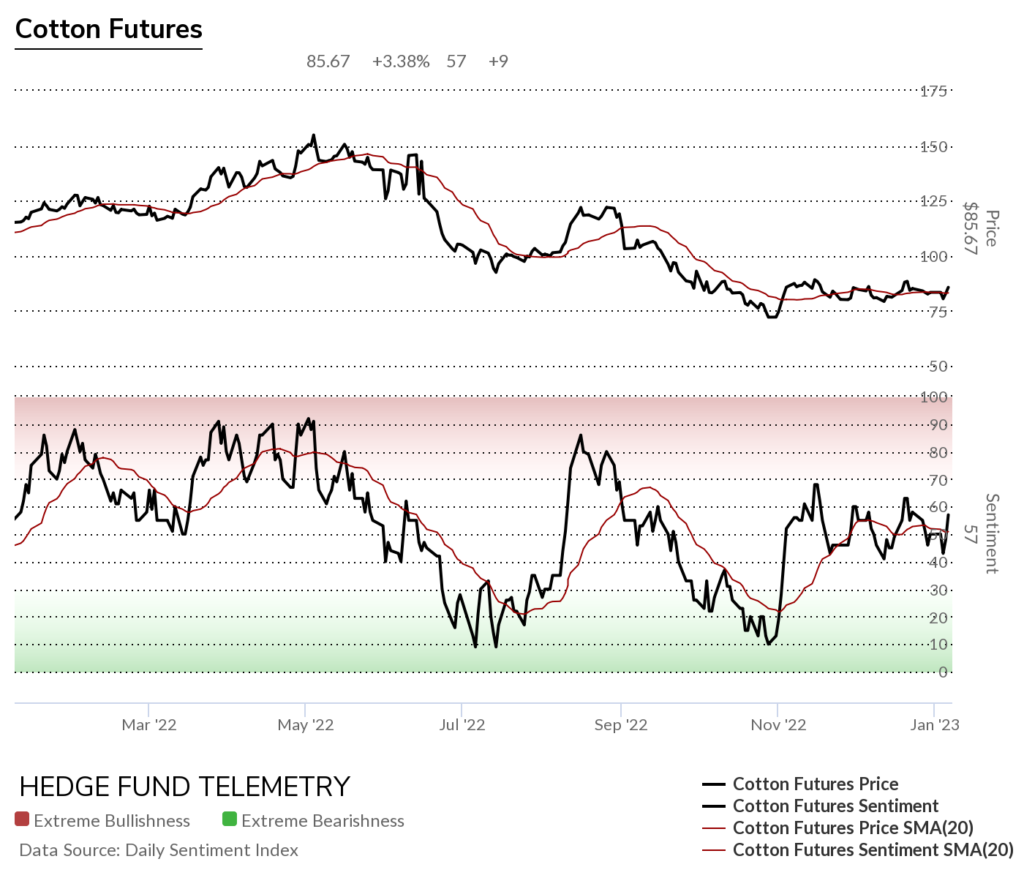

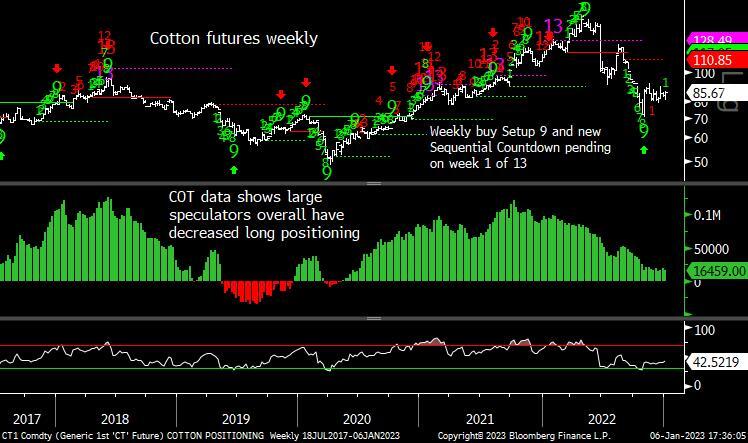

Cotton futures daily sideways and still has resistance at 90

Cotton futures bullish sentiment back over 50% and could make another run higher

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

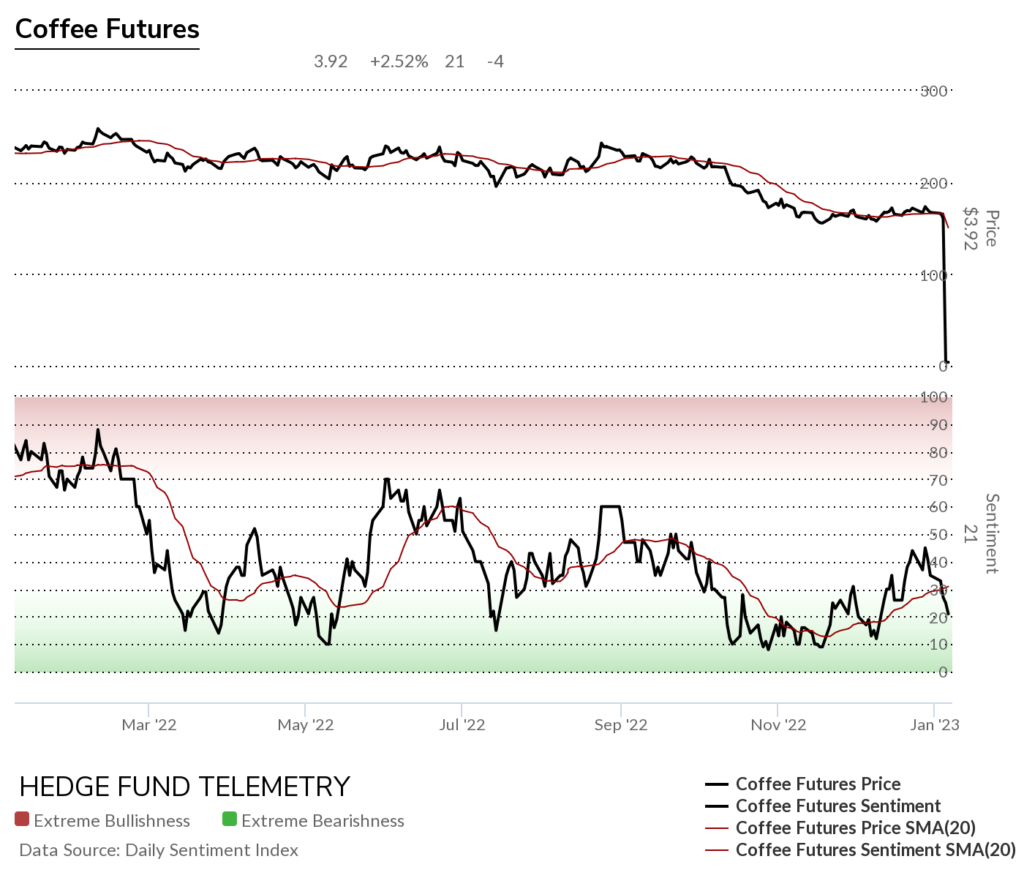

Coffee futures daily backed off more than expected and still holding recent lows. There is a new upside wave 5 price objective if the lows hold.

Coffee futures bullish sentiment has fallen off again

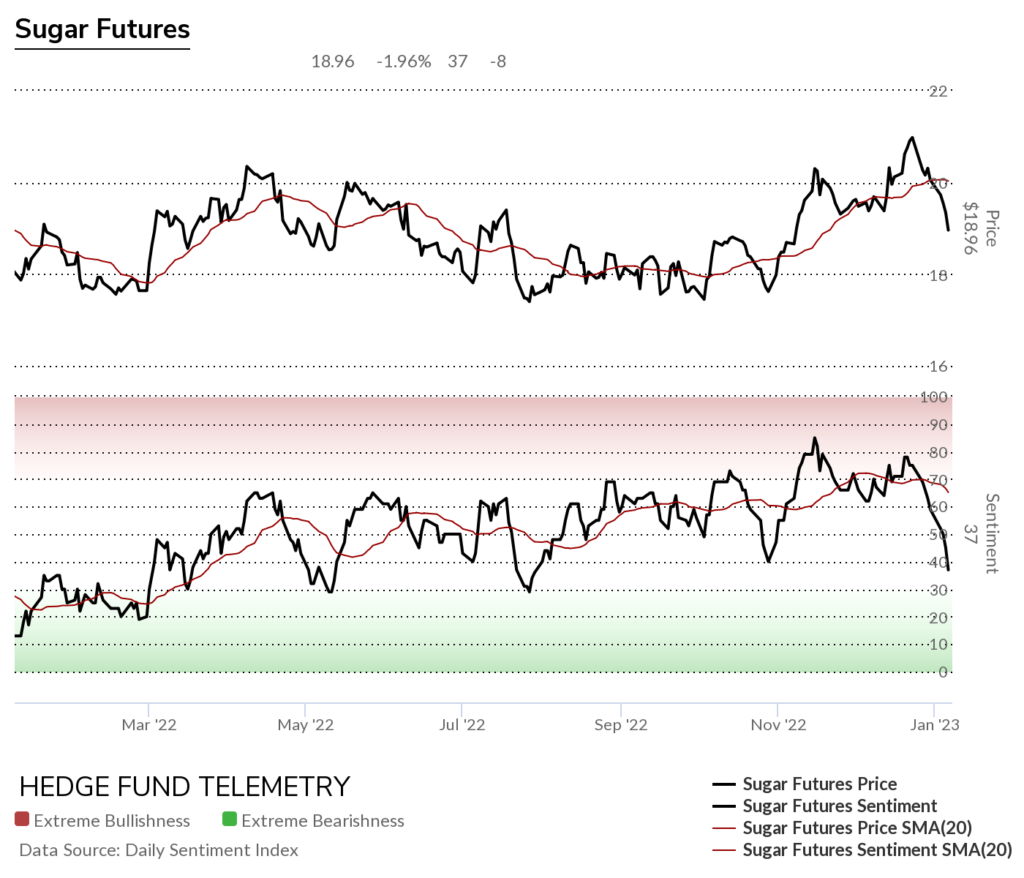

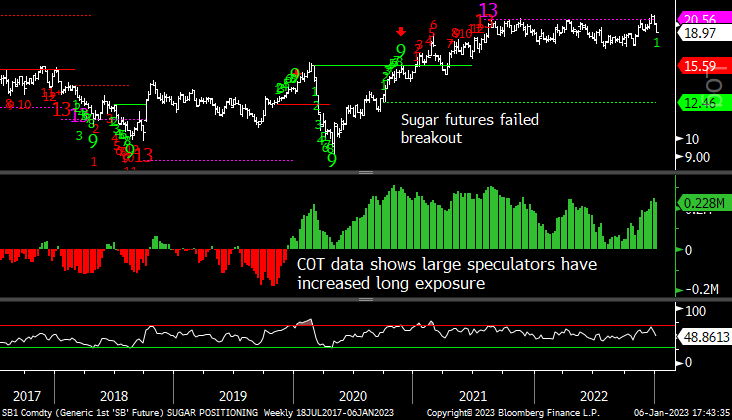

Sugar futures daily continued lower all last week

Sugar futures bullish sentiment broke the November low in sentiment

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

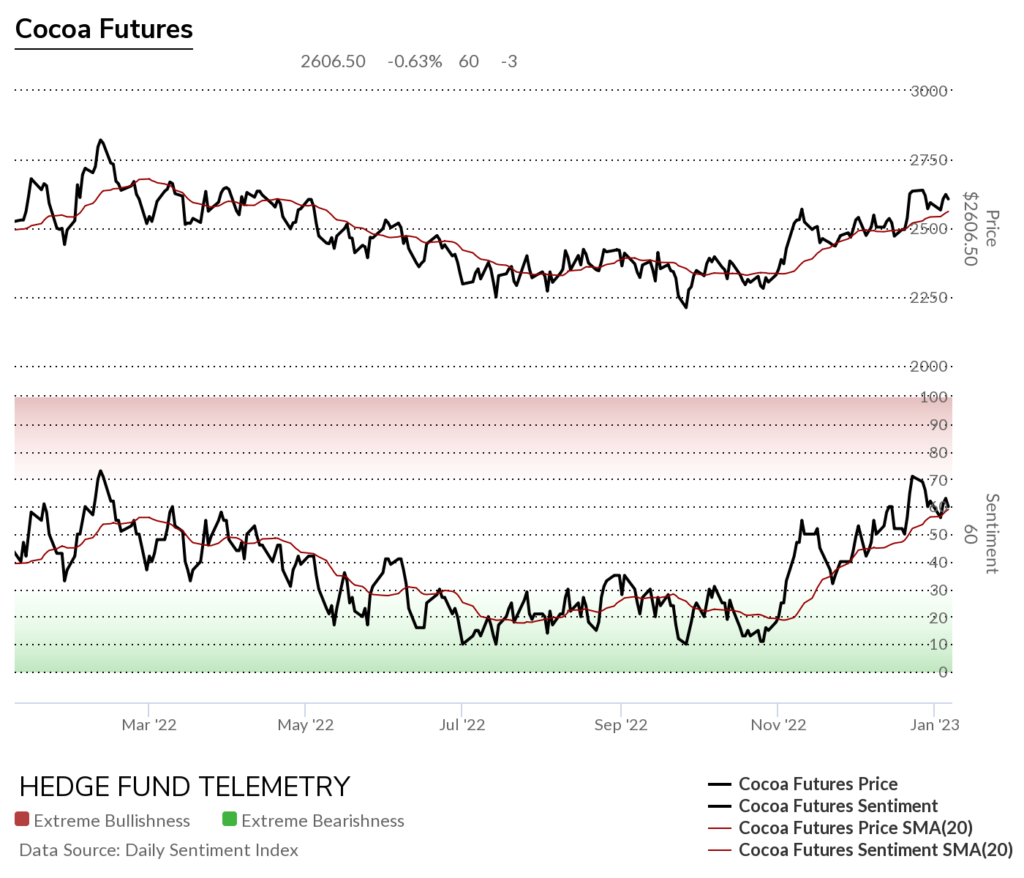

Cocoa futures daily should work lower from here

Cocoa futures bullish sentiment stalled

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

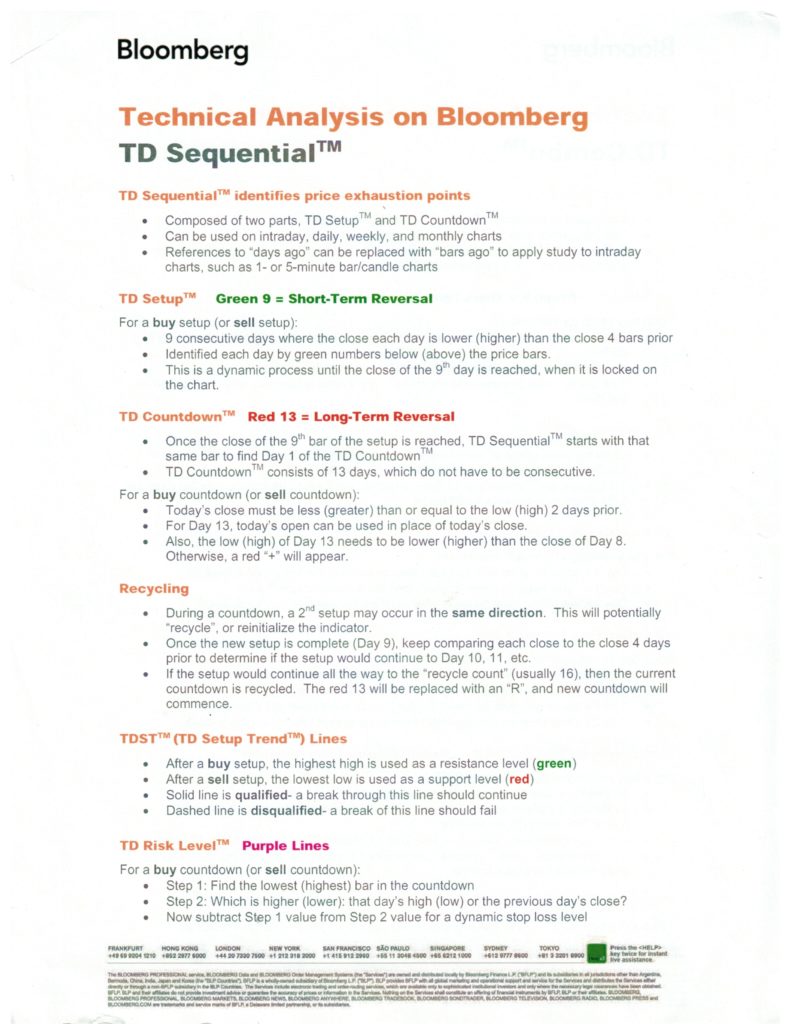

DeMark Sequential Basics

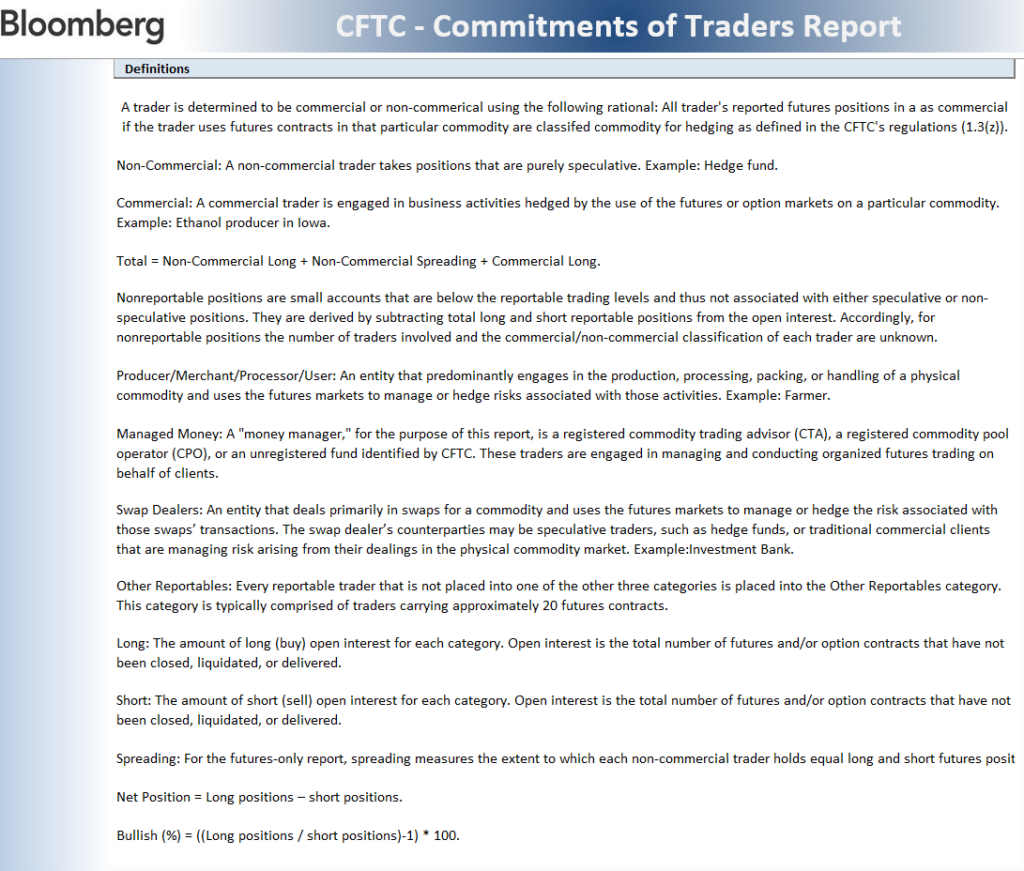

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS