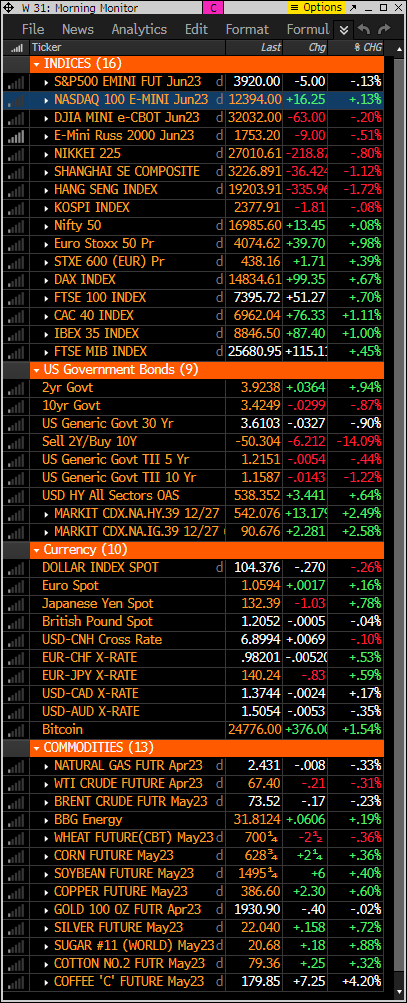

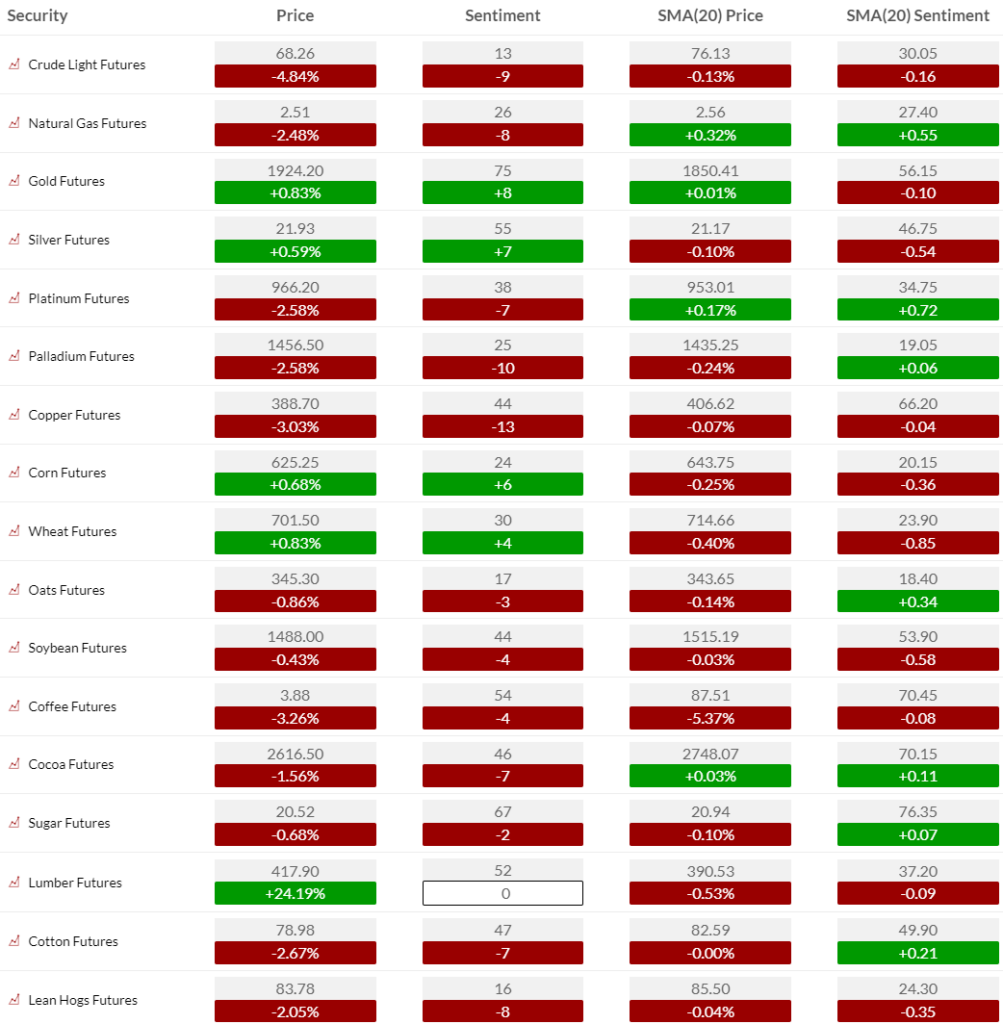

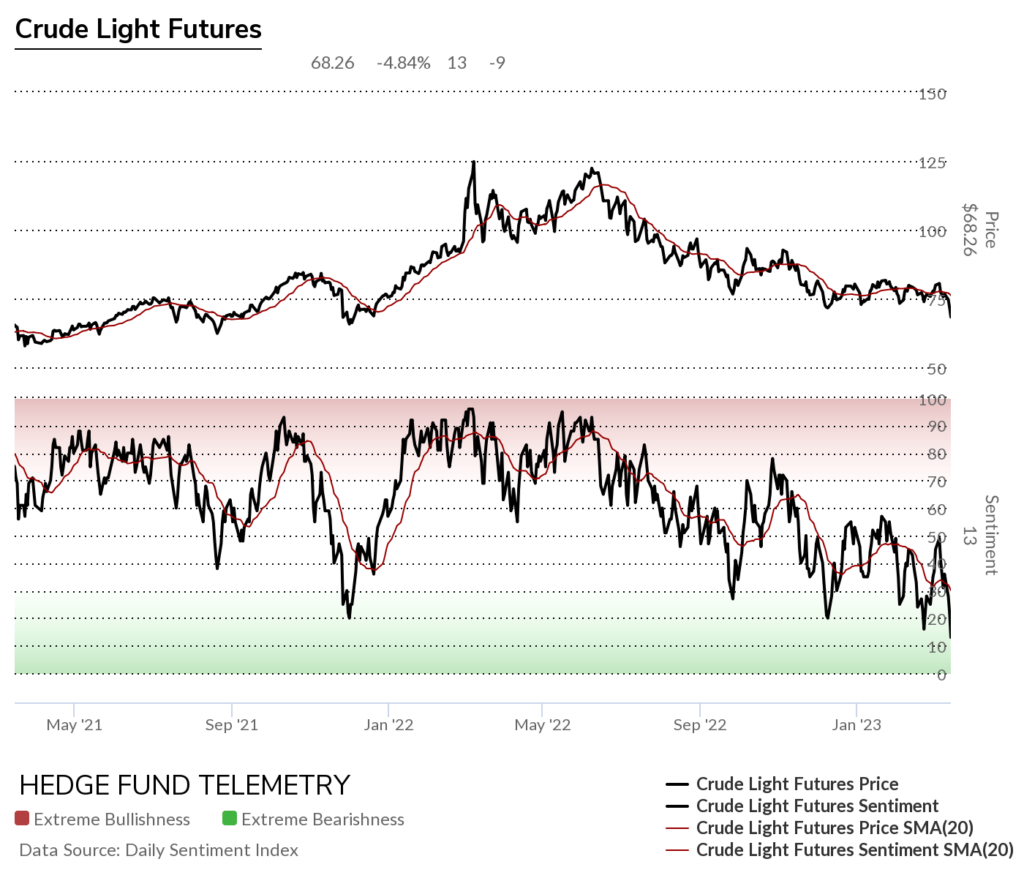

- S&P and Nasdaq futures little changed in Thursday morning trading in fairly choppy premarket trading. Comes after a mostly lower finish on Wednesday, though stocks finished at best levels after late afternoon rally. Treasuries firmer with some curve flattening; 2Y yield holding just below 4.0% and 2Y/10Y spread around -50 bps after falling near -42 bps on Wednesday. Dollar index down 0.25%, with some weakness against euro and yen and higher vs sterling. Gold is flat, up over 3% for the week. Bitcoin is up 1.5%. WTI crude flat, off ~12% for the week. Crude bullish sentiment is now at lows last seen in April 2020. (see below)

- Market coming off several very volatile days in a row, which has continued this morning with a high velocity of updates around global banking story. Some relatively better sentiment driven by Credit Suisse receiving liquidity line from Swiss National Bank, adding some stability to European banking concerns. Global banking issues also putting central bank actions into focus with ECB this morning 9:45am ET, with press conference at 11:15am ET and Fed next week. Market pricing around the Fed rate path outlook has also been very volatile as the banking situation has potentially changed the Fed’s reaction function now that it has to balance financial stability concerns with still-elevated inflation that isn’t falling as fast as the central bank would like. However, recent moves from US and European regulators and central banks have caused markets to pull back from deepest fears,. Market median peak fed funds rate holding at ~4.87%, indicating at least one rate hike left this cycle. And the Fed seen cutting as soon as July as recession fears remain elevated.

- Initial jobless claims lower than expected after last week’s weaker print. February housing starts and building permits both well ahead of estimates and at fastest pace since September. March Philly Fed Index weaker than expected after yesterday’s disappointing Empire report. Headlines include the White House threatening to ban TikTok unless owner ByteDance sells the app. First Republic Bank considering options including a potential sale however it was downgraded to junk. I do not believe there will be a premium price if sold so be careful if trading long. US government still working on finding a SVB buyer, with reports saying it will only sell it to another bank. A number of press reports have flagged rising recession fears, while Goldman Sachs said it now sees 35% chance of recession, cut US GDP growth forecasts given tighter bank lending standards. FT reported CFTC assessing risk from 0DTE options. Given speed of recent developments and market volatility, markets pricing in 25-bps hike, though sell-side mostly backing 50-bps move. I think the Fed the either pauses or hikes 25bps.

- META and SNAP among better social media names after updates around potential TikTok ban. CS to borrow $54B from Swiss National Bank, while CDS fell from most extreme levels. ADBE beat with net new ARR and cloud growth a bright spot. DG results in line with preannounce and reiterated guidance, though management flagged ongoing mix pressures, higher shrink levels. FIVE margin guidance disappointed with EPS growth back-half weighted.

- Key Upgrades/Downgrades: Block, Inc. upgraded to buy from neutral at Mizuho Securities USA. Redburn initiates LULU sell, NKE sell, PUM.GR buy, and UA buy. FedEx upgraded to buy from hold at Stifel. Susquehanna upgrades INTC to neutral from negative, QCOM positive from negative, SWKS positive from neutral. Foot Locker upgraded to outperform from market perform at Telsey Advisory Group.

market snapshot

economic reports today

Claims remain very low, which is important since the Non-Farm Payroll and the unemployment rate for March was calculated this week. Employment remains very strong.

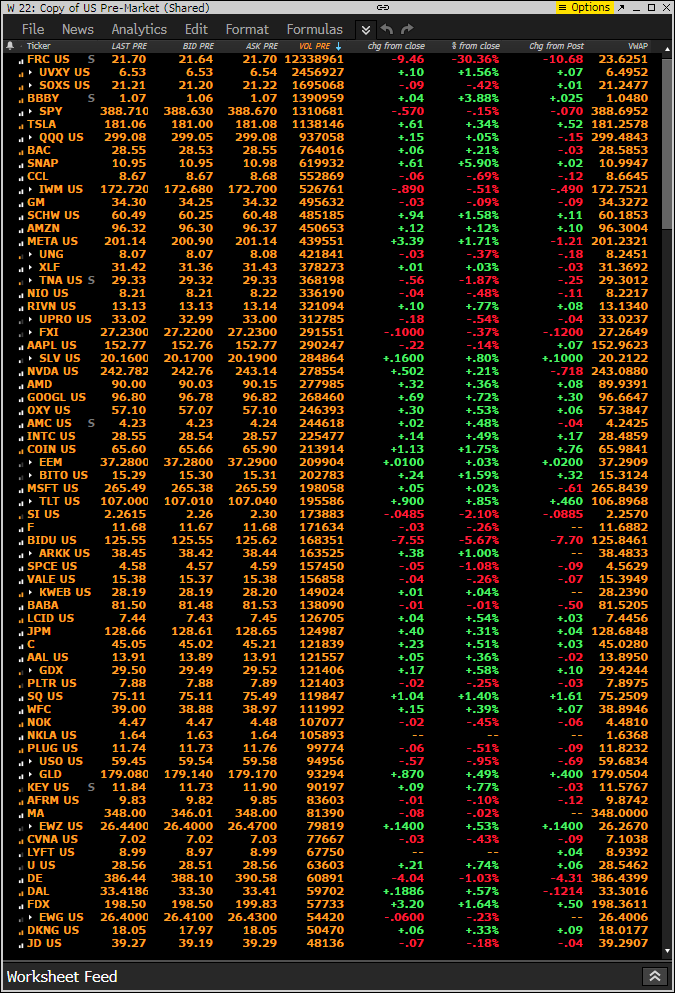

premarket trading

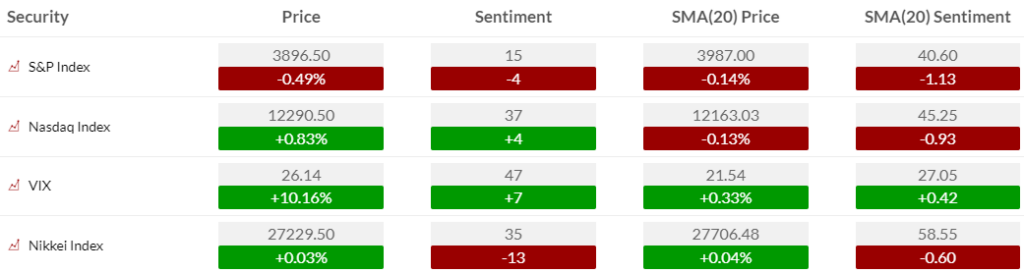

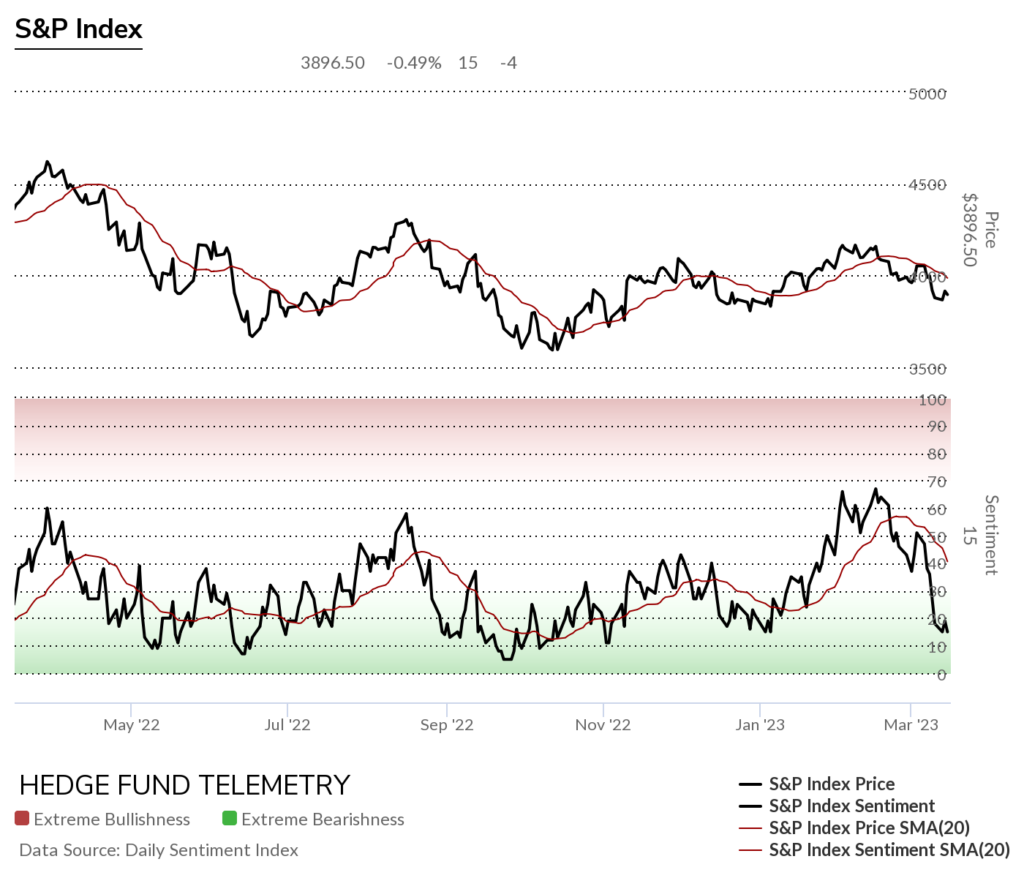

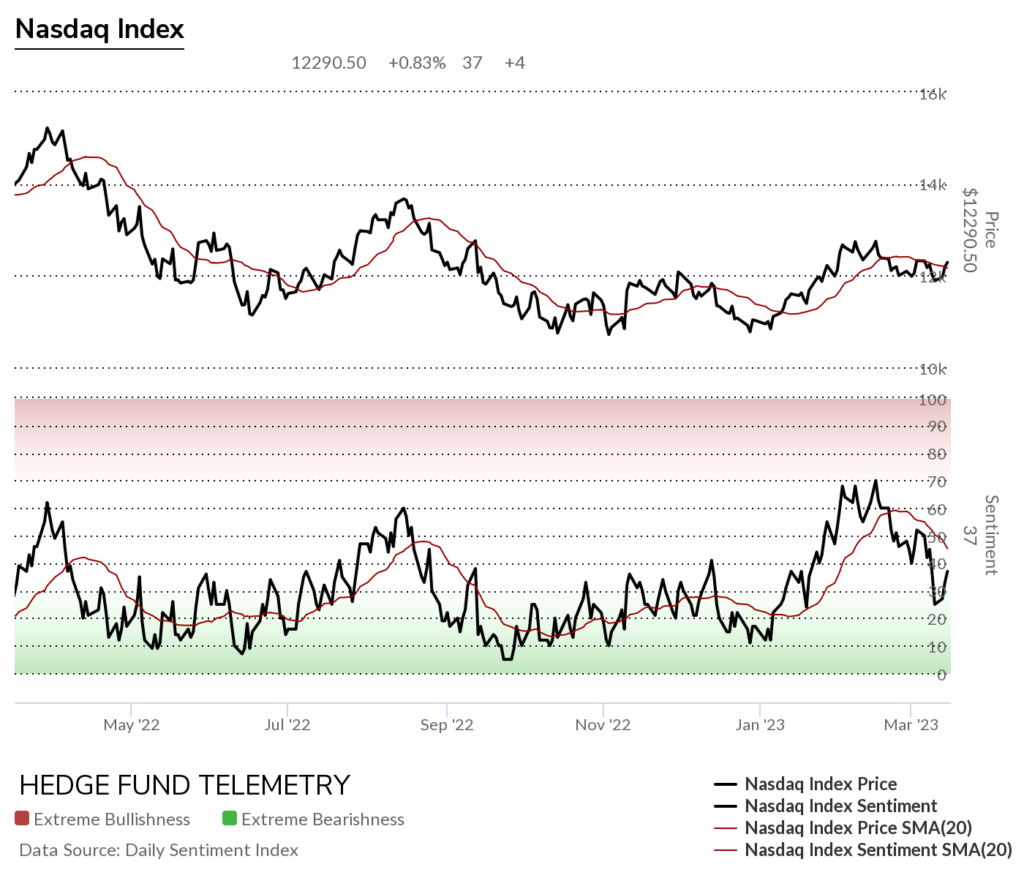

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment has been VERY MIXED with the S&P remaining in the oversold zone <20% while the Nasdaq sentiment has been improving.

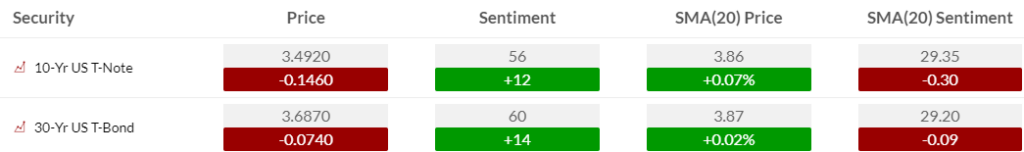

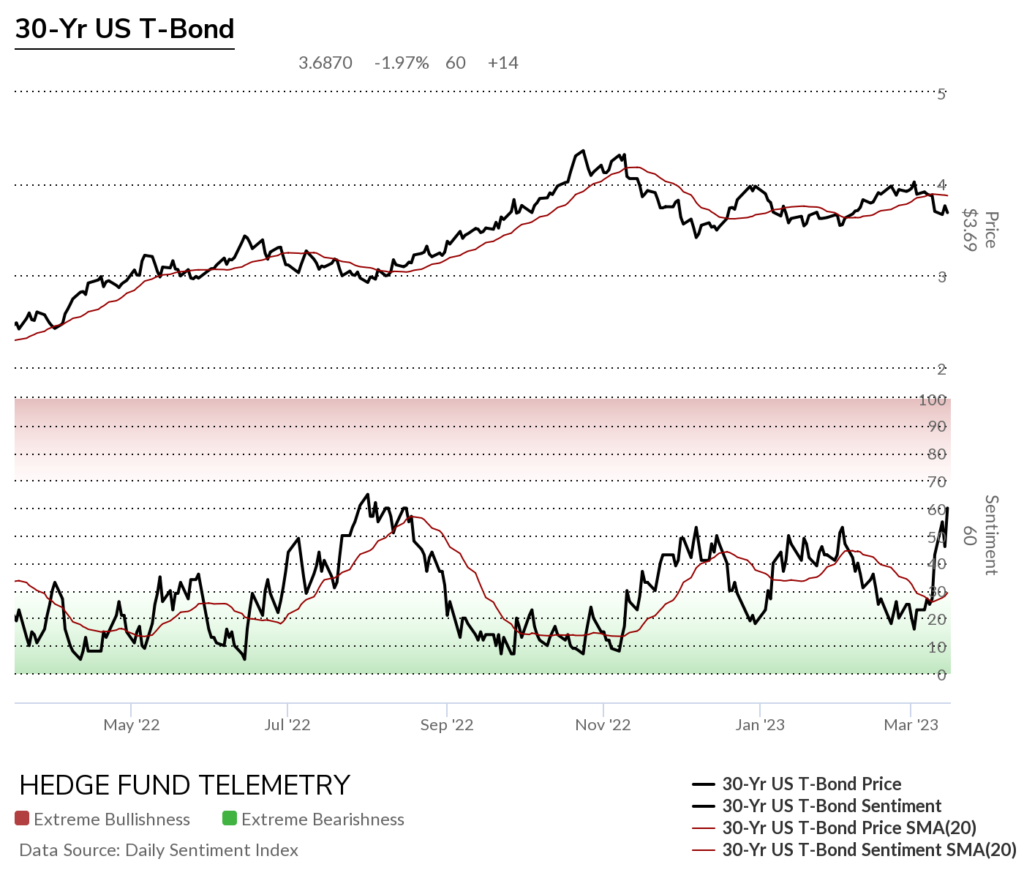

Bond bullish sentiment shows bond sentiment nearing the highs seen last summer. (see chart below)

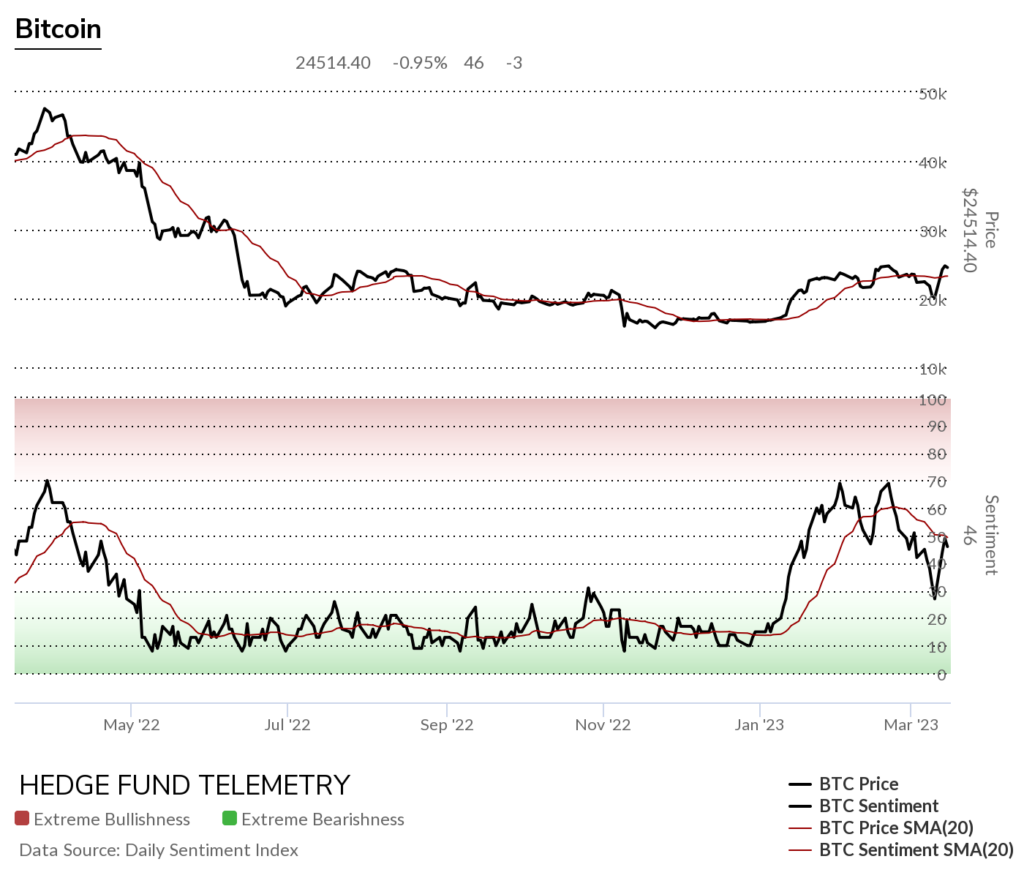

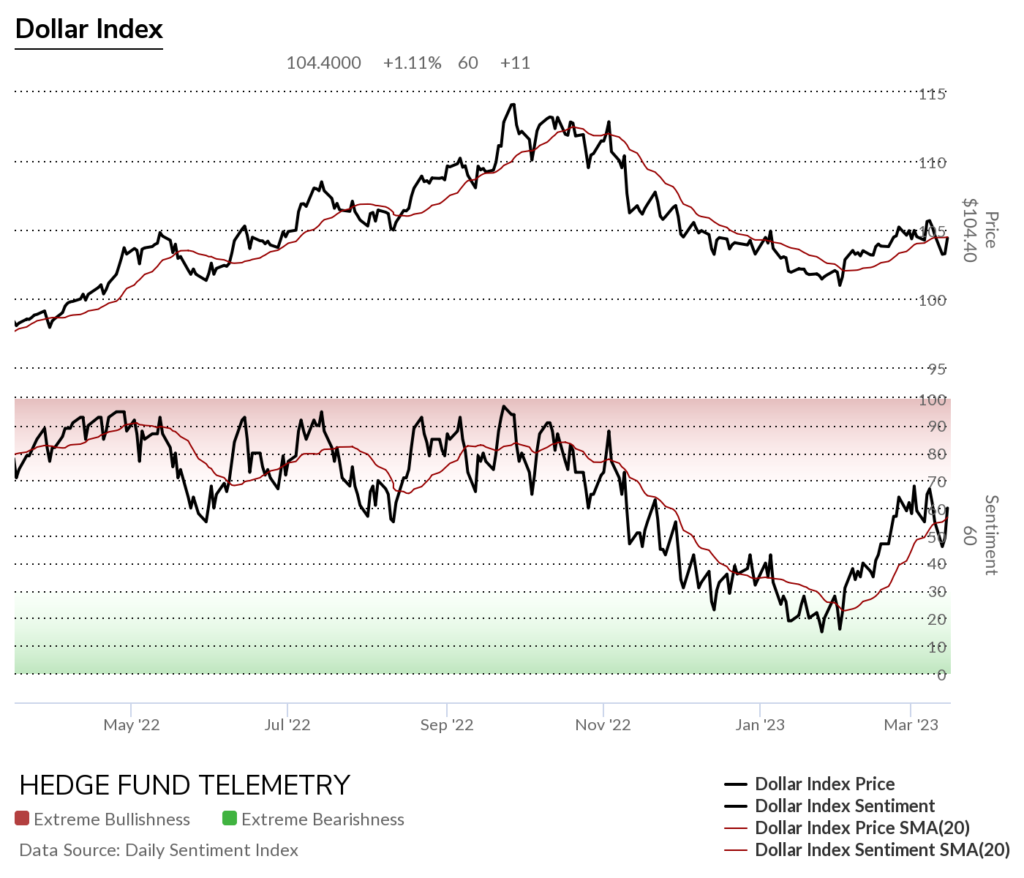

Currency bullish sentiment shows US Dollar strength in a risk-off type of move. (see chart below) Bitcoin sentiment might make a negative divergence (see chart below)

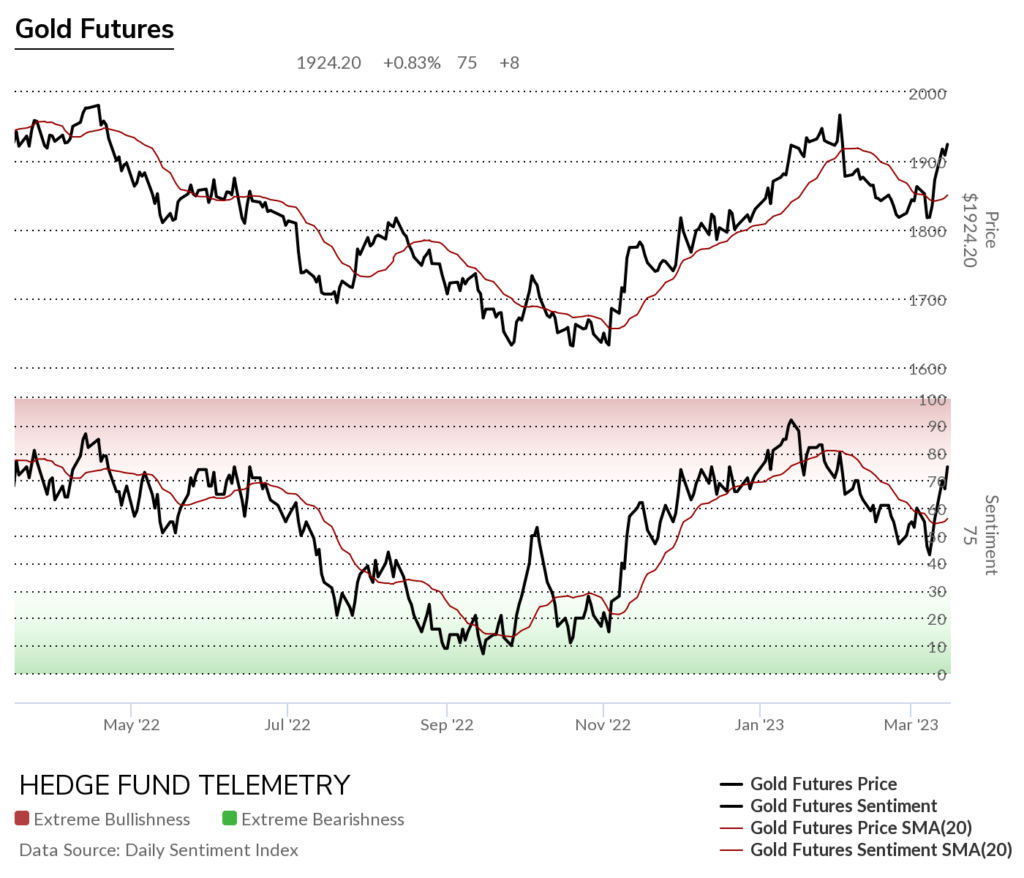

Commodity bullish sentiment has crude sentiment at the lowest level since April 2020 (chart below).

Gold futures bullish sentiment spiking back into the elevated zone >70%.

US MARKETS

S&P futures 60-minute time frame has seen choppy difficult action with Setup 9’s working well at price inflection points

The S&P futures 240 minute is a time frame between the 60 minute and daily that I watch for important Sequential Countdown which is rare. If it happens it could be a good signal for a trading bottom

S&P futures daily are still under pressure trading slightly below the open and well below the overnight highs.

NDX 60 minute time frame at resistance

NDX futures daily has had a Sequential in progress. Remember that a Sequential can work in sideways markets and will not necessarily need a new high to complete the Sequential to 13. The 13th day will need to close higher than the close of the 8th red bar close.

extra Charts we’re watching

WTI Crude is near downside exhaustion and we should see it next week. This might not be THE bottom since this downside move is wave 3 of 5. A corrective lower high wave 4 of 5 is the next move. Wave 4 qualifies when there is a 13-day closing high. Once that occurs, a downside wave 5 price objective will appear. Wave 5 will qualify when this wave 3 is broken to the downside. There will be a very important crude bottom if and when that occurs.

Crude bullish sentiment is at 13% the lowest level since April 2020.

The daily US Dollar Index is down slightly today and is now on day 5 of 13 with the Countdown.

US Dollar bullish sentiment bounced near ~50% and has resistance at 68%

US 10 Year Yield is struggling to hold here and could get the buy Setup 9 which has seen price inflection on both the downside and upside in the last 6 months.

30 year bond sentiment is at levels going back to the highs from last Summer

Bitcoin daily is, as of now back in upside wave 5 with the Setup on day 4 of 9.

Bitcoin bullish sentiment could make a lower high negative divergence vs price – a potential sign of a top.