Commitment of Traders – The Basics

The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are considered the “smart money” since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, comprises hedge funds, mutual funds, and commodity trading advisors. These speculative traders have no interest in the underlying physical commodity business.

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation, please see the bottom of this note.

DeMark Indicators basics at the bottom of this note

HIGHLIGHTS AND THEMES

The Bloomberg Commodity Index has a DeMark buy Setup 9 that is still in progress; however, last week, it slipped on a banana peel and dropped quickly due to crude experiencing a sharp spike lower. The weekly chart with the Commodity Index is getting closer to the buy Countdown 13.

- Energy has been volatile. Crude bounced back after the sudden spike lower. Importantly the weekly chart with WTI Crude did qualify the DeMark Sequential buy Countdown 13. Natural Gas just can’t seem to hold any turn higher.

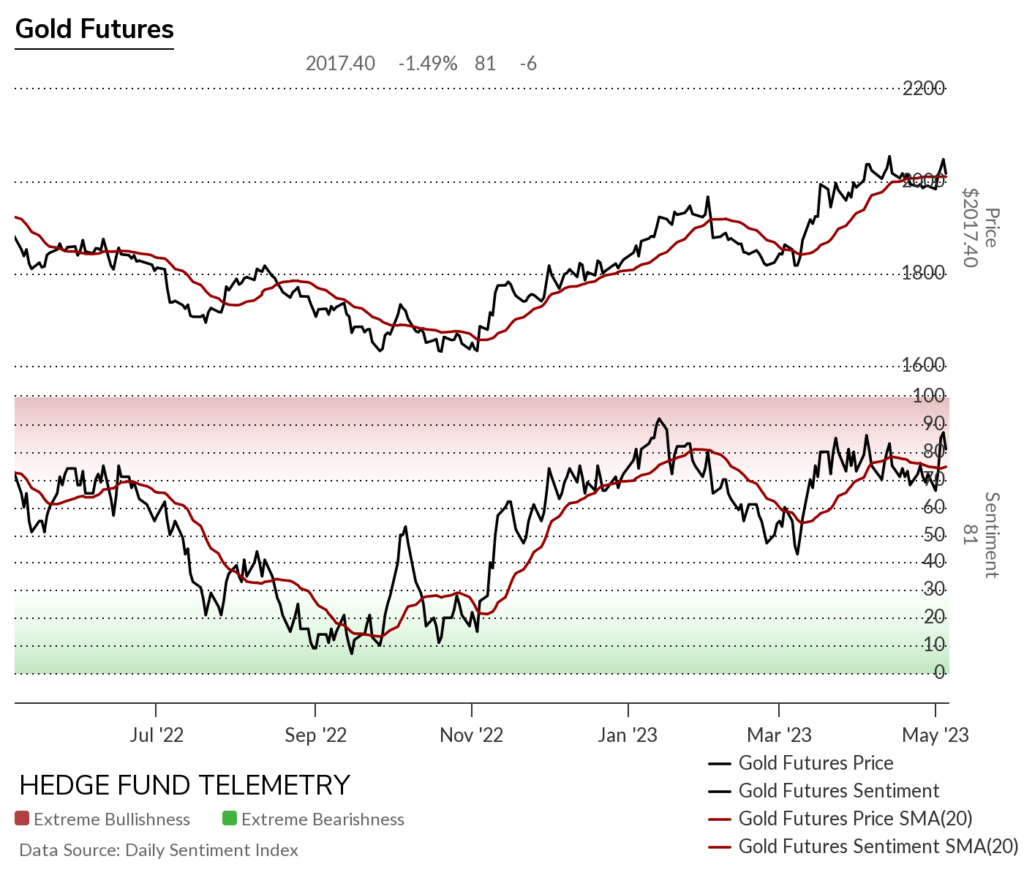

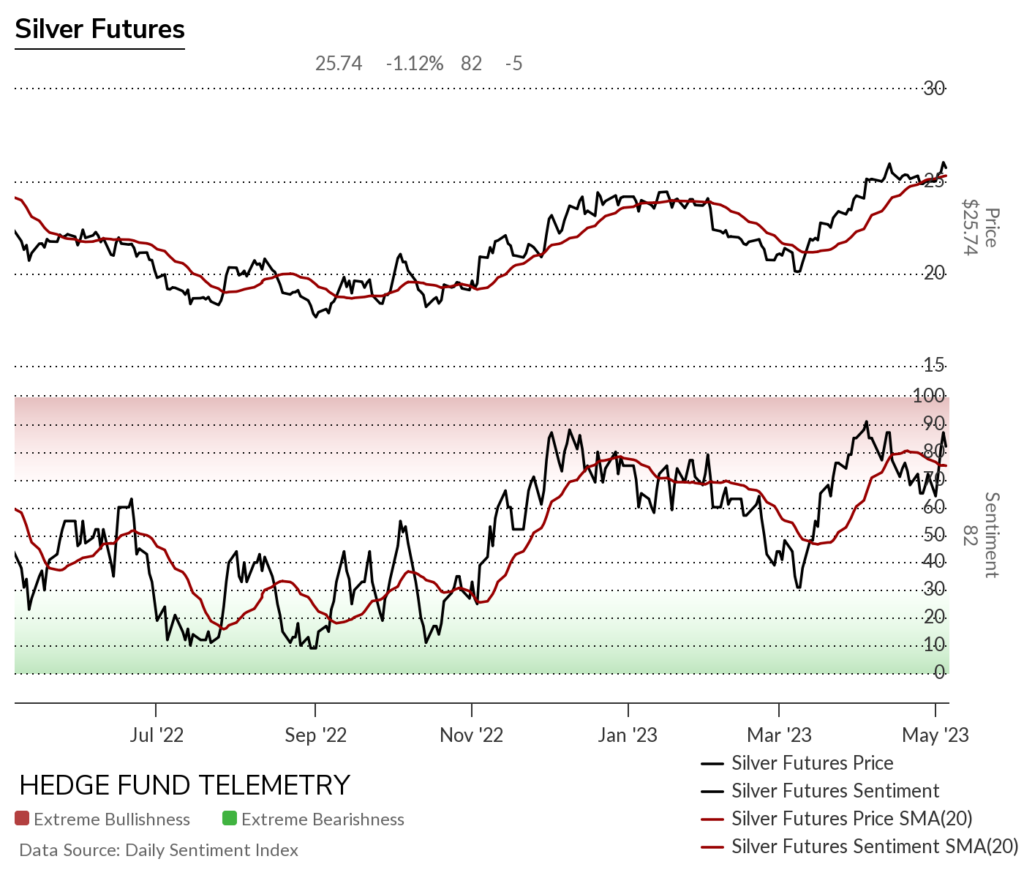

- In metals, Silver has a new DeMark sell Countdown 13. Gold is close to Sequential 13. Sentiment with gold and silver have to be watched closely when they spike over 90%

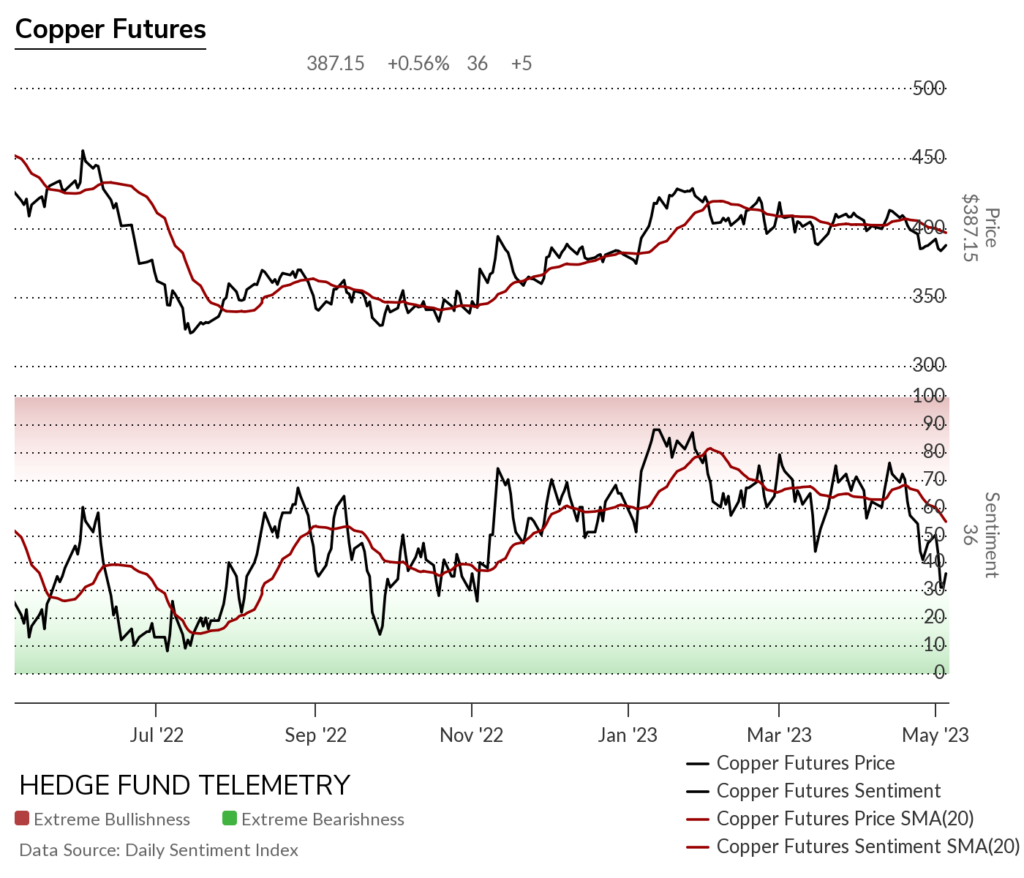

- Copper can turn higher after a recent DeMark buy Countdown 13.

- Softs look toppy however Coffee might try and bounce this week

- Livestock with cattle and hogs look to move lower

- Grains: Corn, Wheat, and Soybeans have potential to turn higher

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily did move down to the downside wave 5 price objective and still has the buy Setup 9 in play, although we need to watch to see if the Sequential continues.

Bloomberg Commodity Index Weekly is getting closer to the Sequential buy Countdown 13

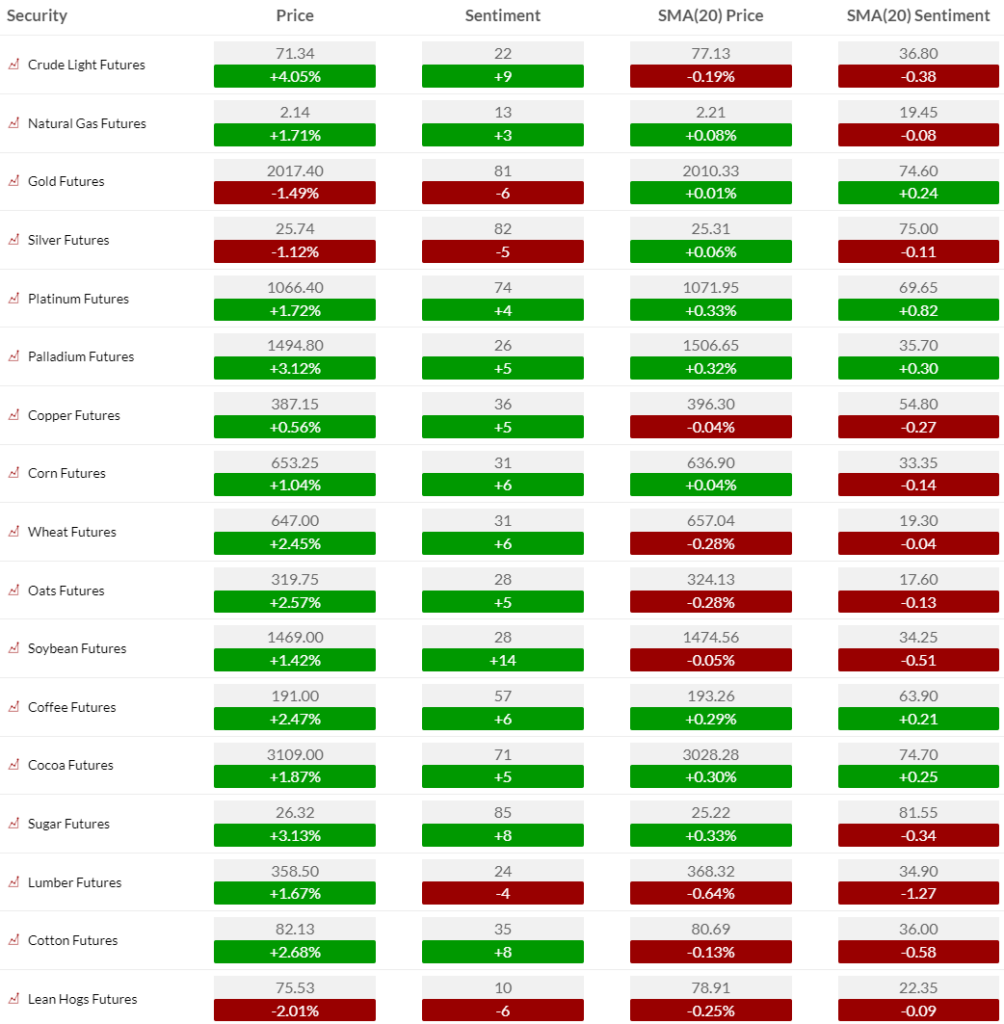

COMMODITY SENTIMENT OVERVIEW

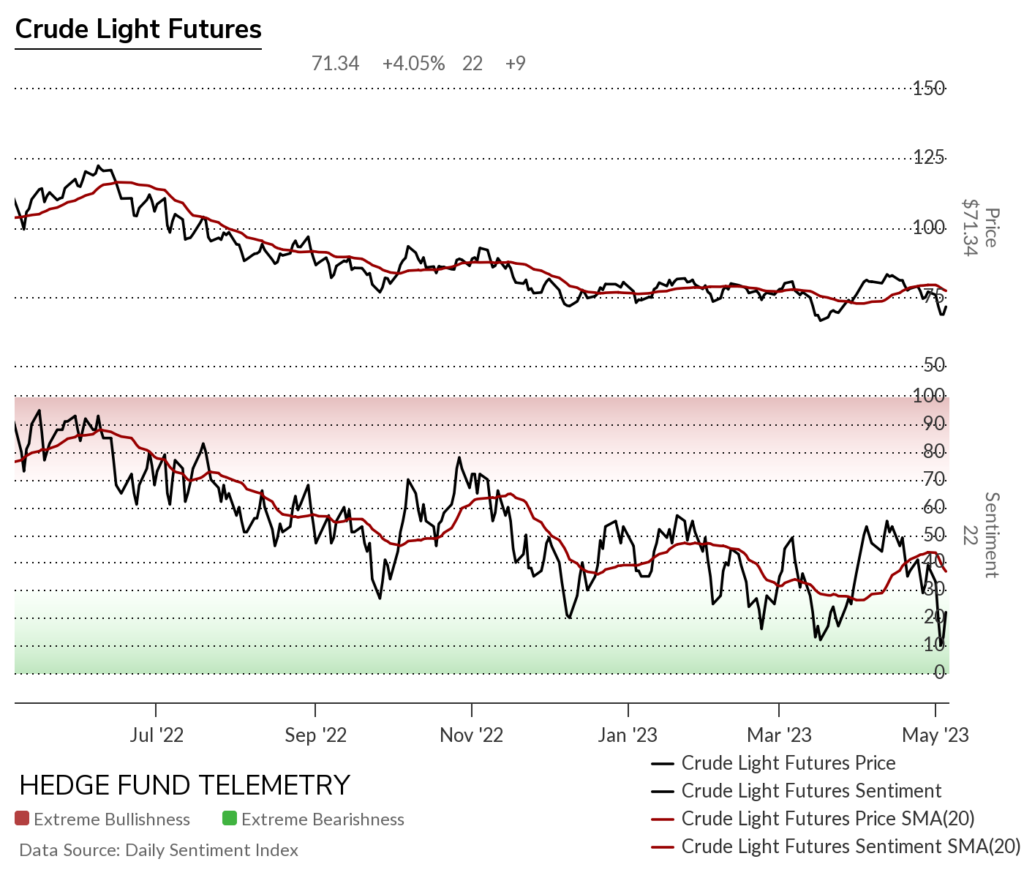

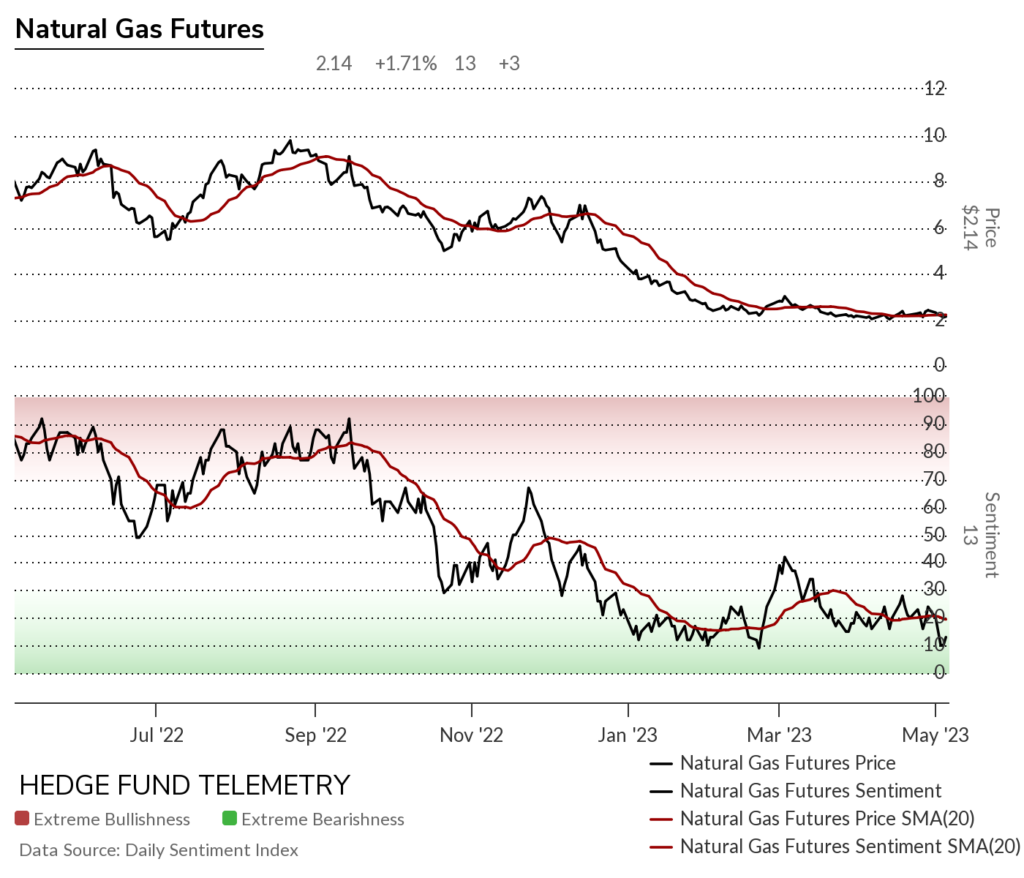

OIL AND ENERGY

Bloomberg Energy Subindex daily is oversold, and the downside Propulsion (green line) was achieved last week. A buy Setup 9 and a possible new Sequential are pending on day 4 of 13.

Bloomberg Energy Subindex weekly broke to a new low giving back the entire move of 2022.

WTI Crude futures daily surprised me last week with the sudden shock spike lower. There is a new Sequential Countdown that started however, the snapback of most of the drop will make me watch to see if 75 can be recaptured.

WTI Crude futures bullish sentiment hit 10%, the lowest level since April 2020, and bounced 12 points in the last few days.

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. THIS IS POTENTIALLY IMPORTANT if the weekly Sequential buy Sequential 13 can turn higher in the next few weeks.

Natural Gas futures daily has not been able to make any turn higher. Oversold conditions remain.

Natural Gas futures bullish sentiment remains under pressure hitting 10% this week, where is bounced in March.

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. There are both Combo and Sequential buy Countdown 13’s still in play with no response

Gasoline RBOB daily back to lows with similar Sequential situation

Gasoline futures COT data with not much change

Metals

Gold daily backed off nearly with Sequential near 13. There is an Aggressive Sequential sell Countdown 13.

Gold futures bullish sentiment hit 87% in the extreme zone over 80% and backed off

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. There is weekly Sequential in progress on week 9 of 13

Silver daily did get the Sequential and Combo sell Countdown 13’s

Silver bullish sentiment also has been in the extreme zone

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Copper futures daily did get the Sequential buy Countdown 13 lacking response so far

Copper futures bullish sentiment bounced off 30%

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

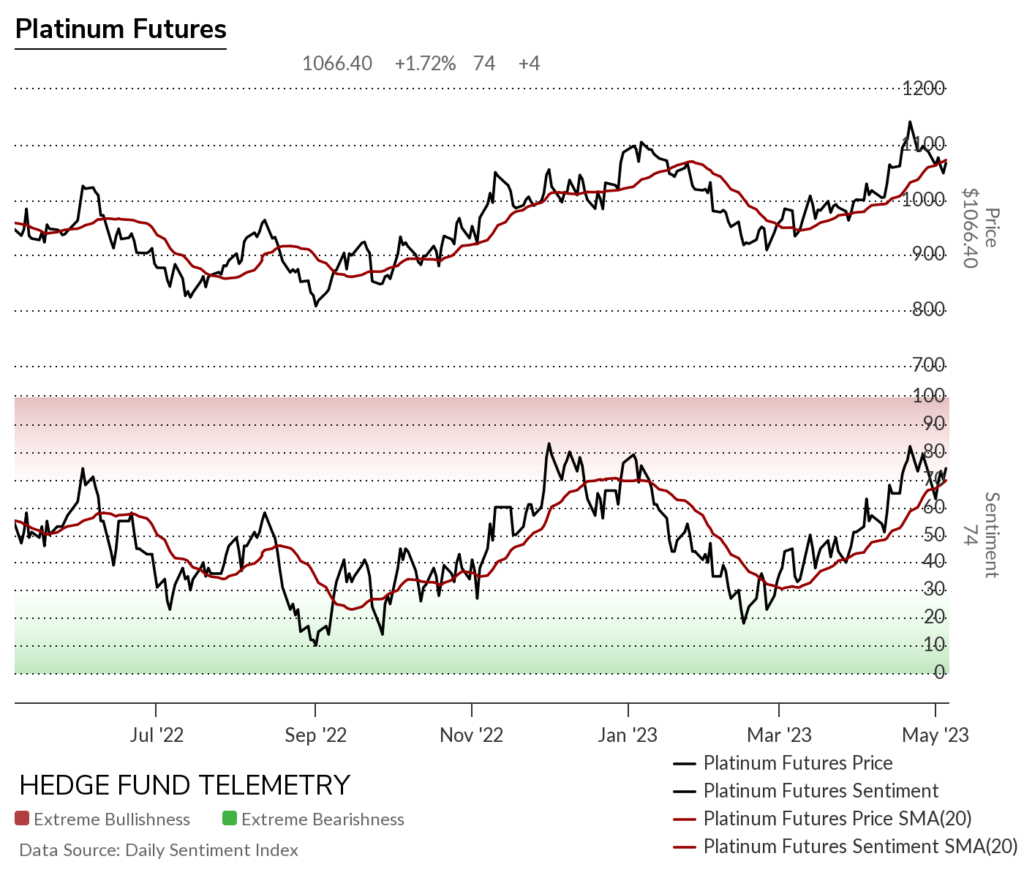

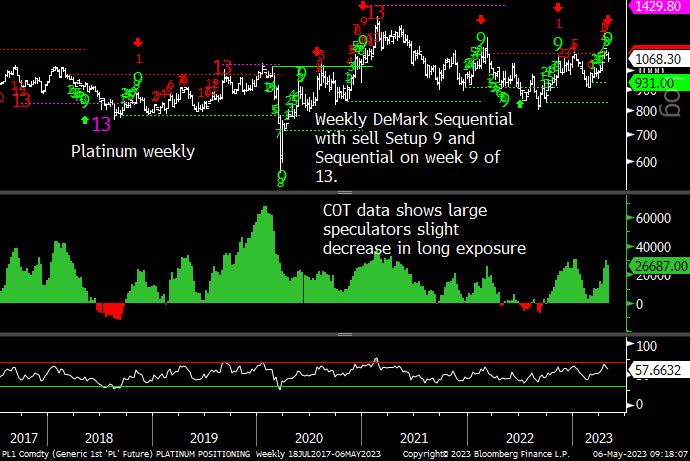

Platinum daily

Platinum bullish sentiment bounced off the 20 day moving average of bullish sentiment. Can it hold this week?

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Sell Setup 9 backed off several time in the past

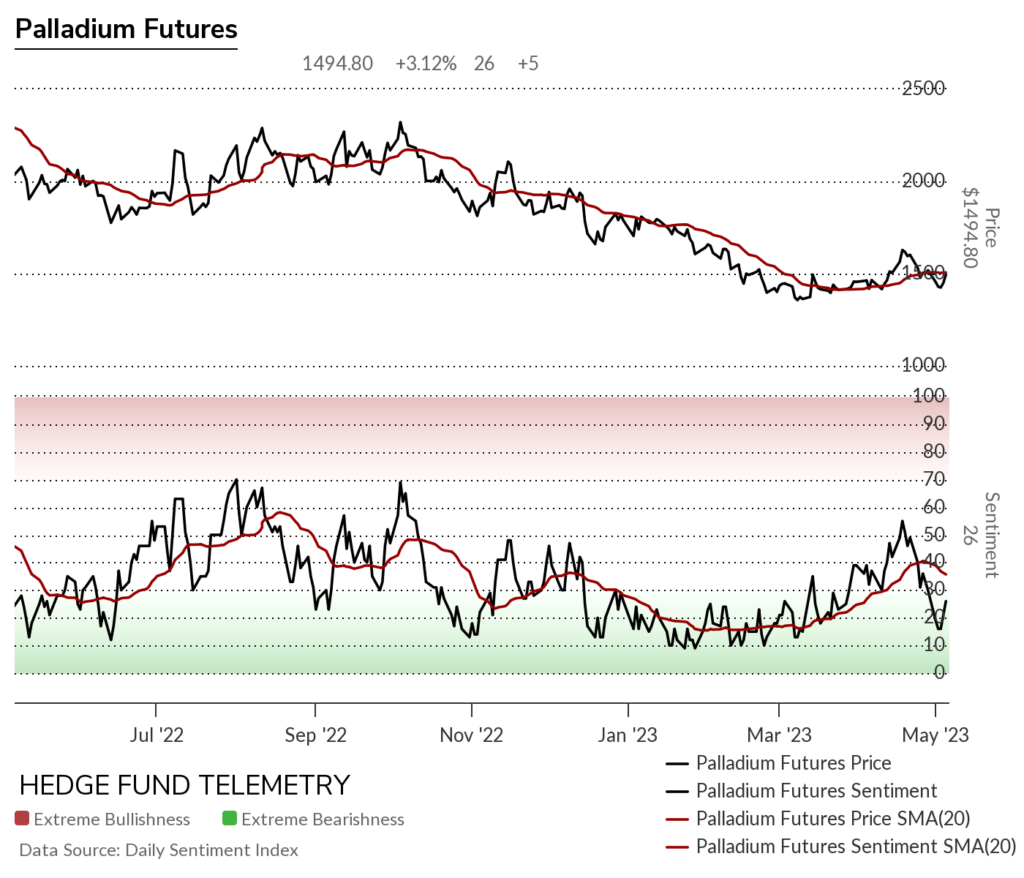

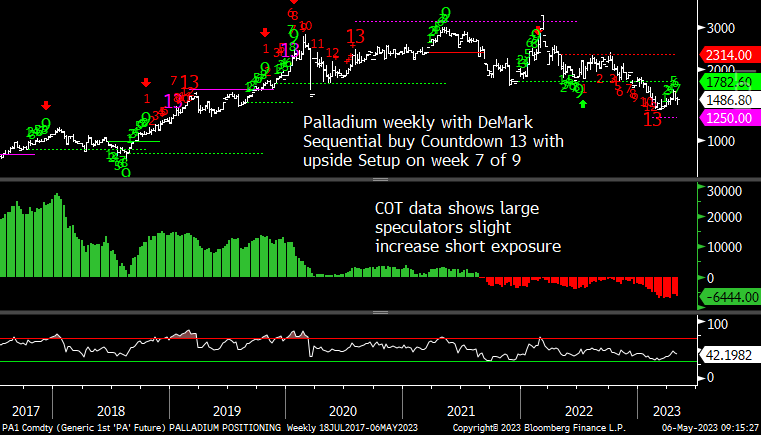

Palladium daily

Palladium bullish sentiment

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Recent buy Countdown 13 did reverse off the lows.

Grains

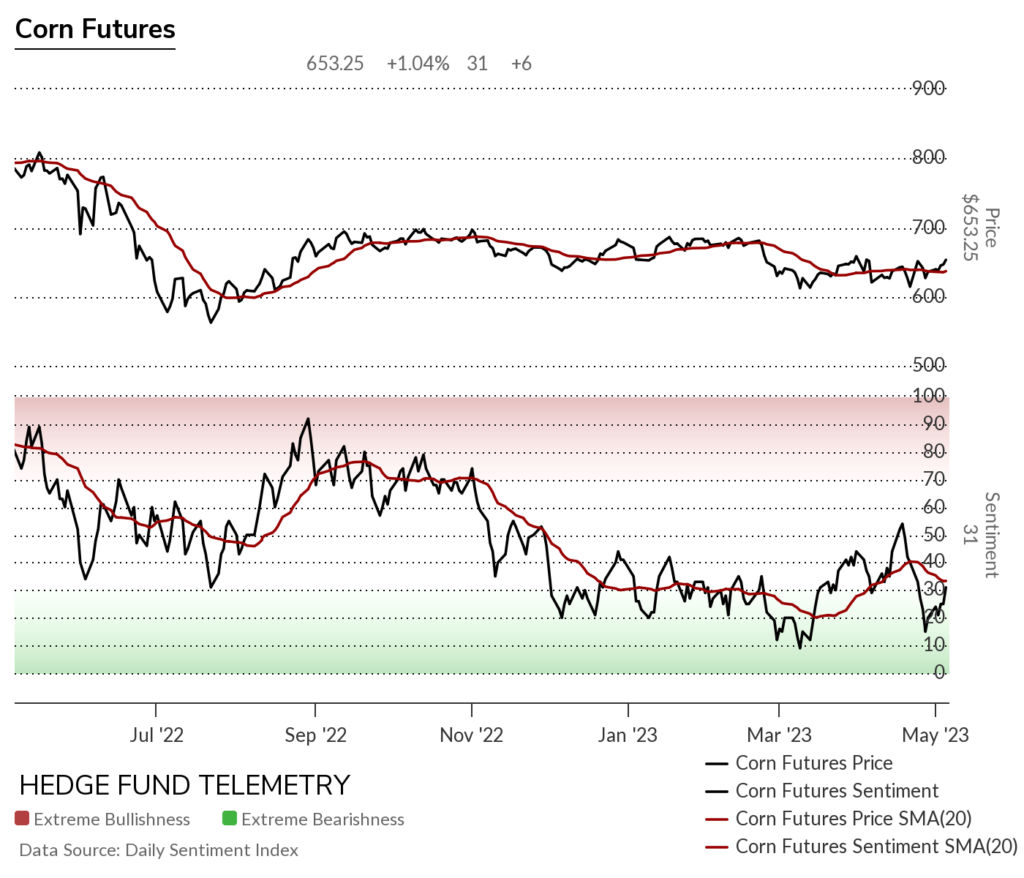

Corn futures daily with a new buy Setup 9 and reversal off oversold RSI levels.

Corn futures bullish sentiment

Corn futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

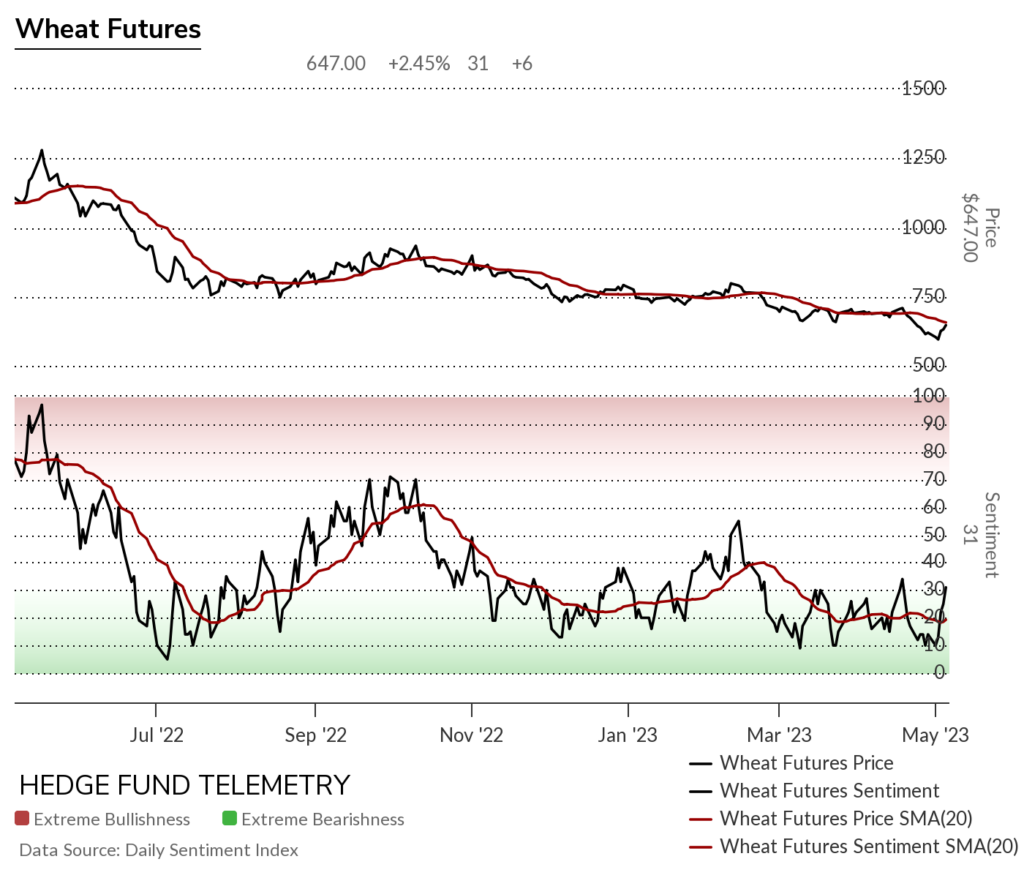

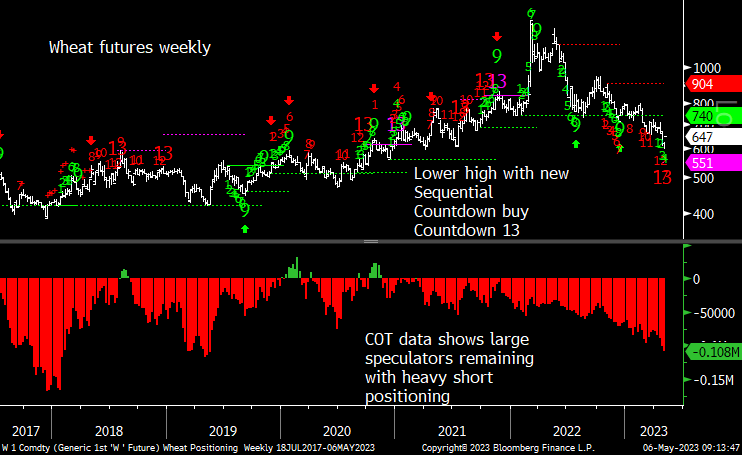

Wheat futures daily has been frustrating with lack of any bullish response that lasts for more than a few weeks.

Wheat futures bullish sentiment

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. A new weekly Sequential buy Countdown 13 in play could be important.

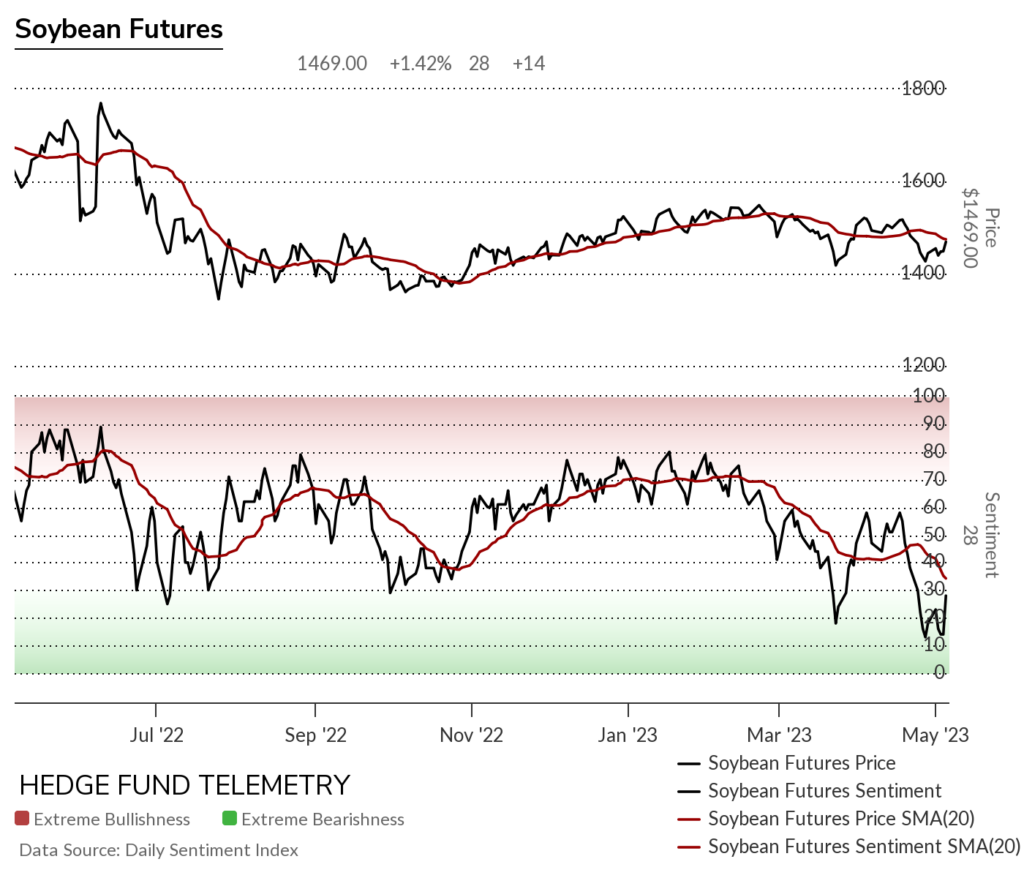

Soybean futures daily with new Sequential buy Countdown 13

Soybean futures bullish sentiment hit oversold levels not seen in over a year.

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

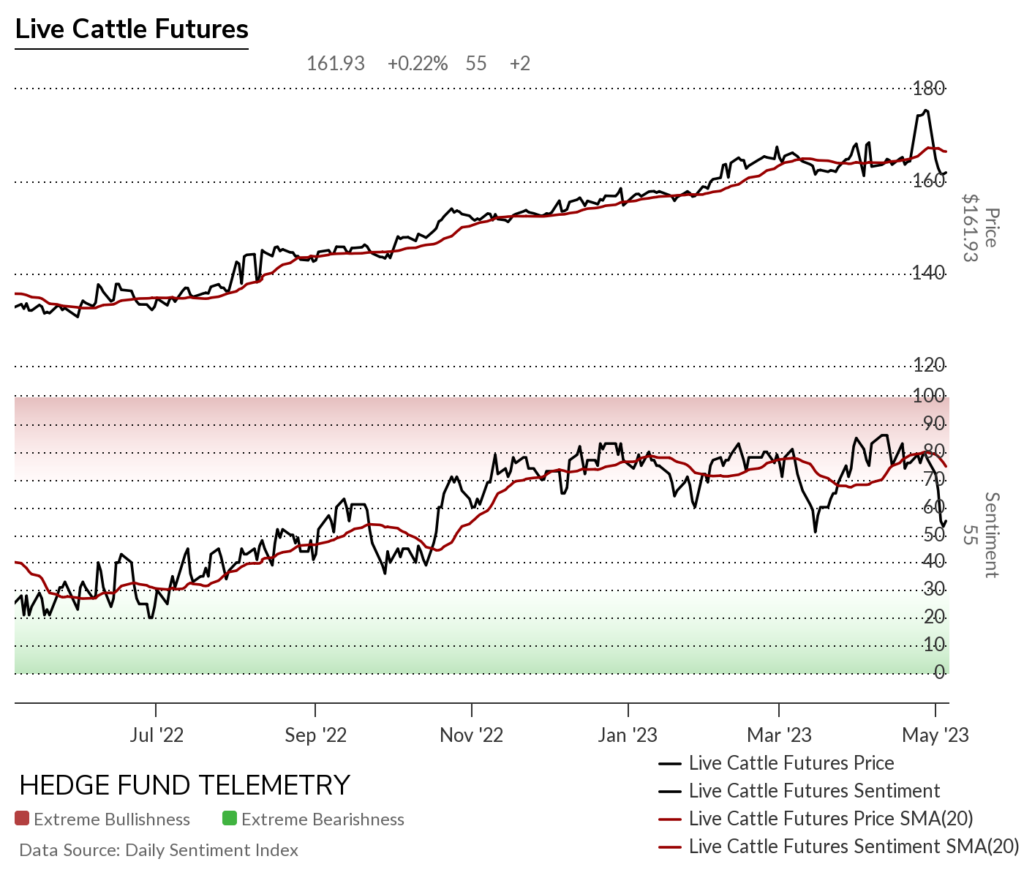

Cattle futures daily has a Sequential but keep an eye on the TDST level

Cattle futures bullish sentiment holding 50% midpoint support as of now.

Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. New Sell Countdown 13

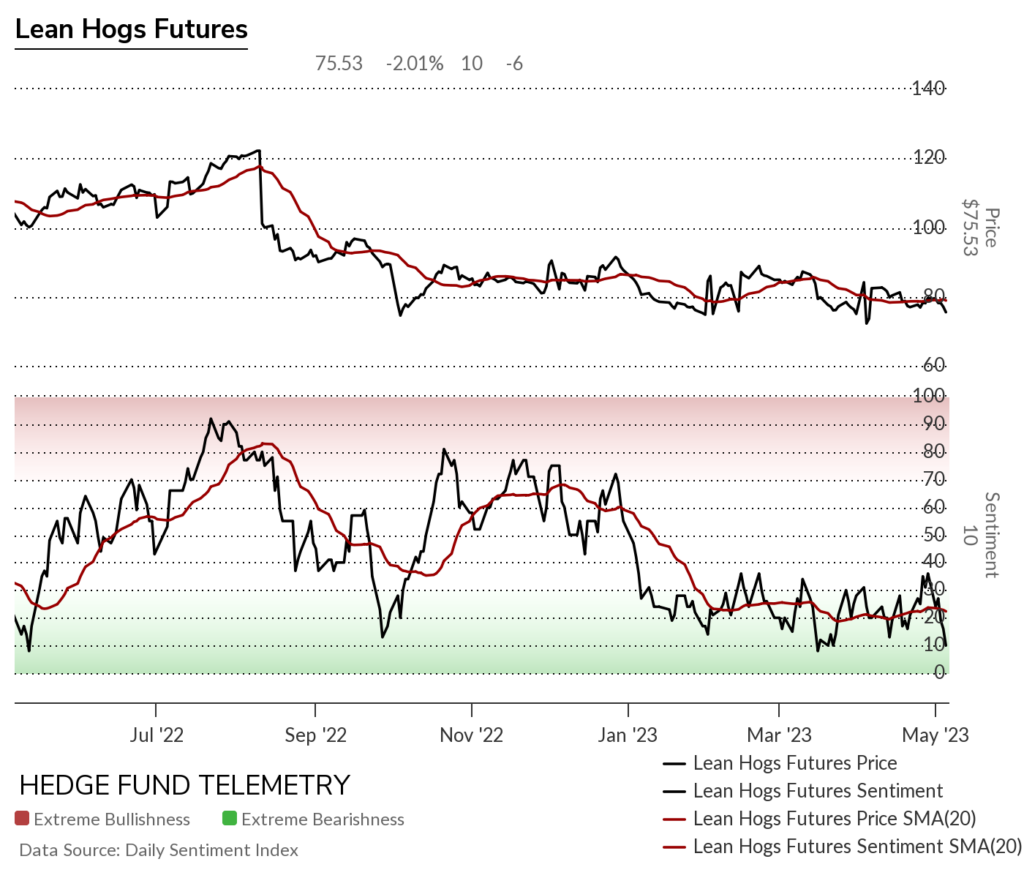

Lean Hogs futures daily now in downside wave 5 of 5

Lean Hogs bullish sentiment remains under pressure

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

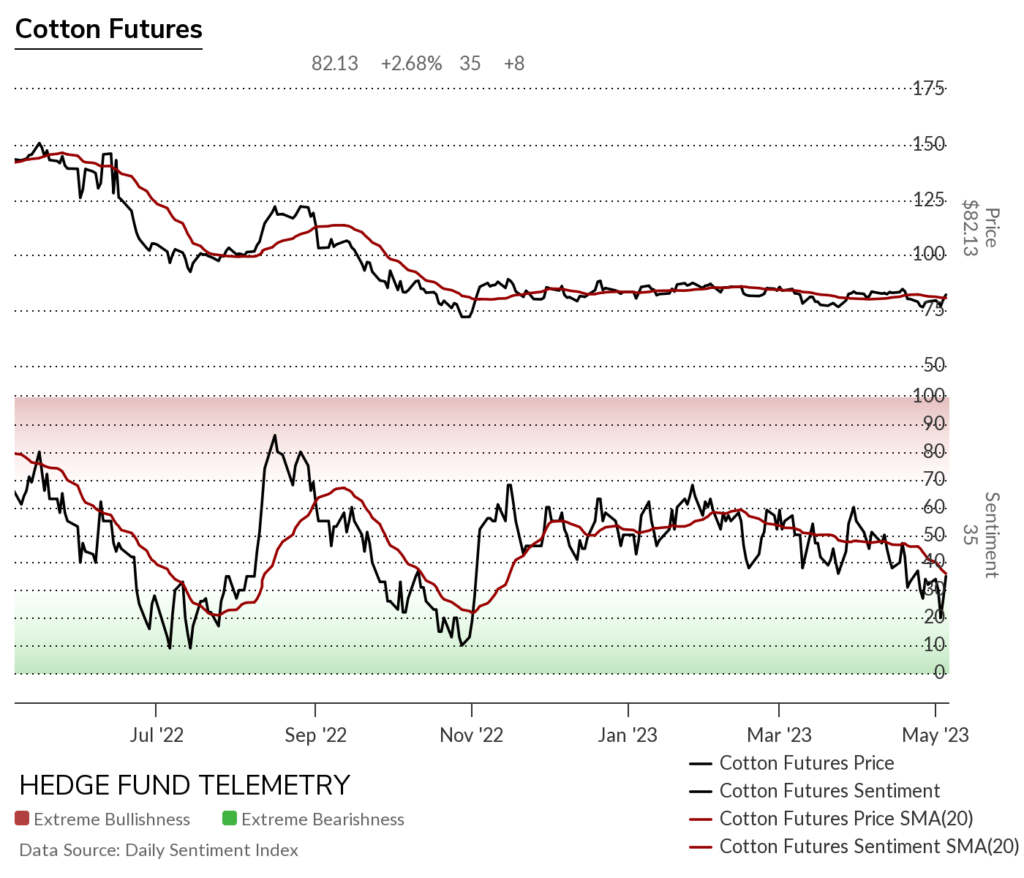

Cotton futures daily range bound

Cotton futures bullish sentiment

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators. Downside Sequential on week 8 of 13

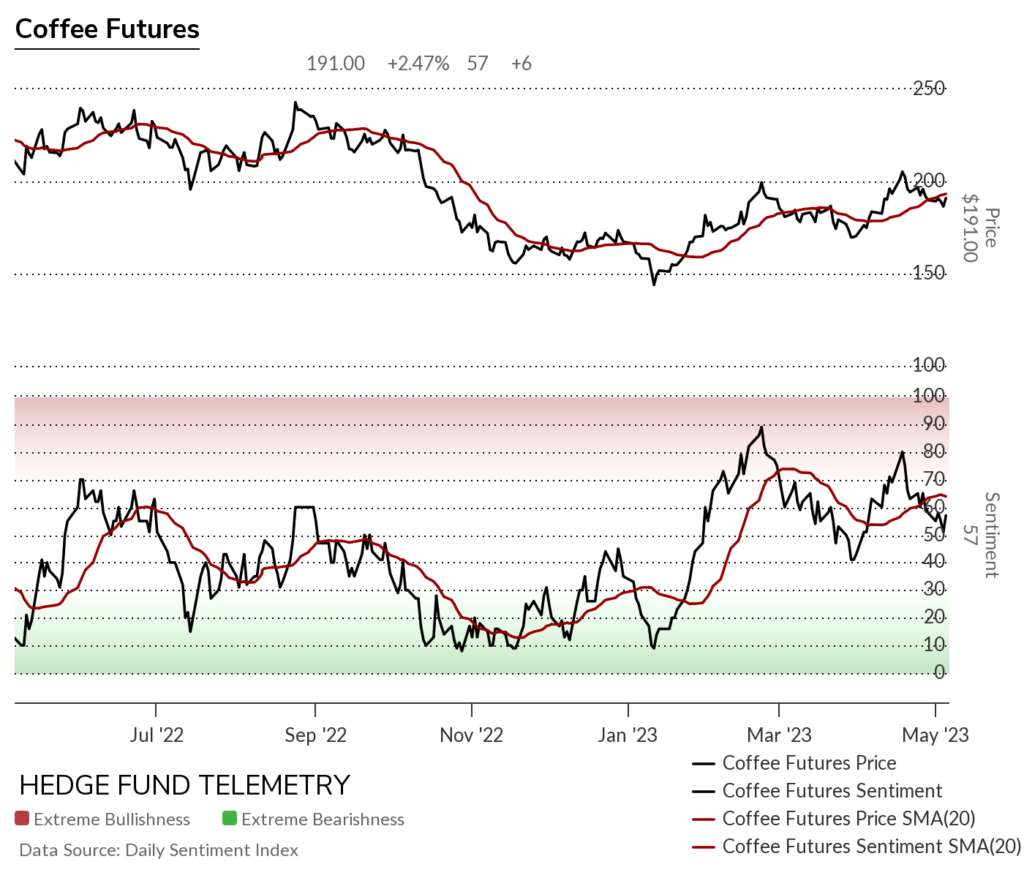

Coffee futures daily will be interesting to watch if this bounces after the latest buy Setup 9

Coffee futures bullish sentiment

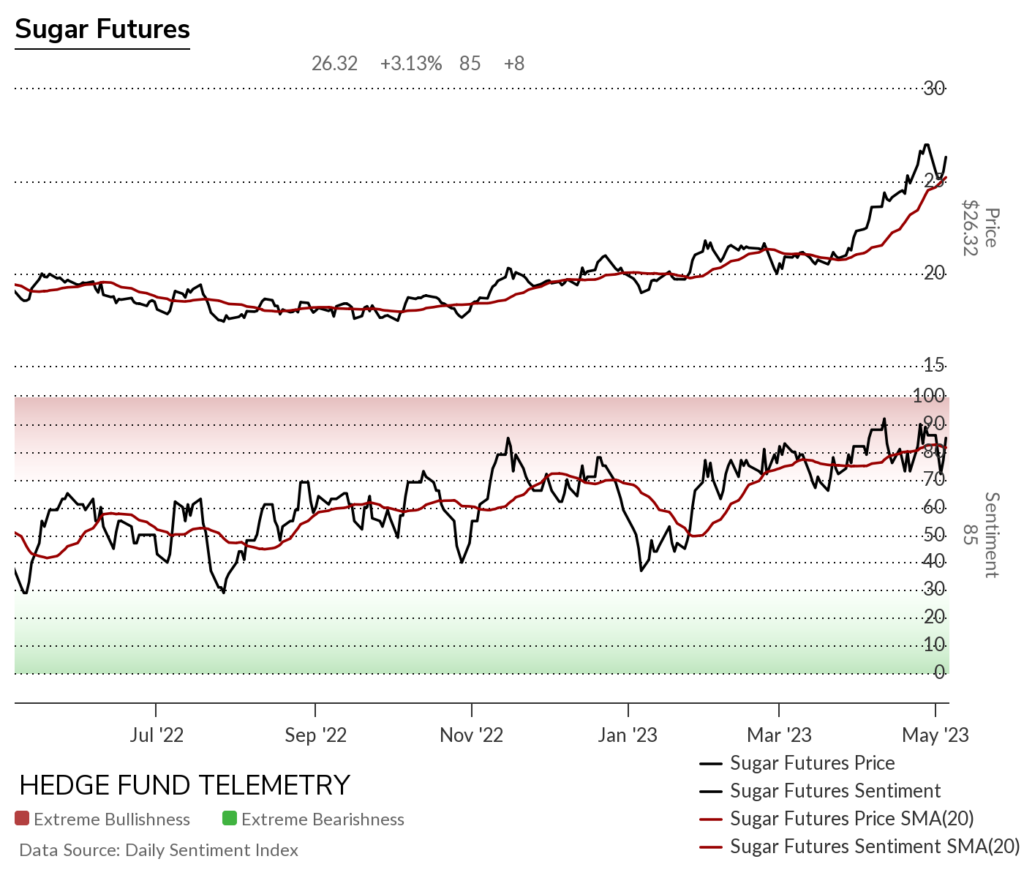

Sugar futures daily should back off lower even with Friday’s spike

Sugar futures bullish sentiment has been in the extreme zone touching 90% a few times.

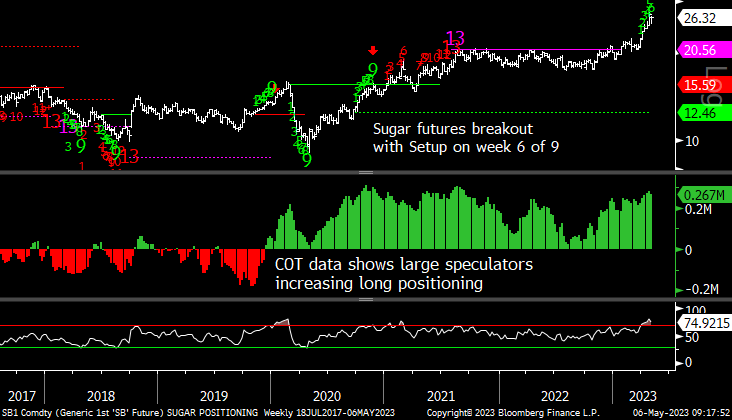

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

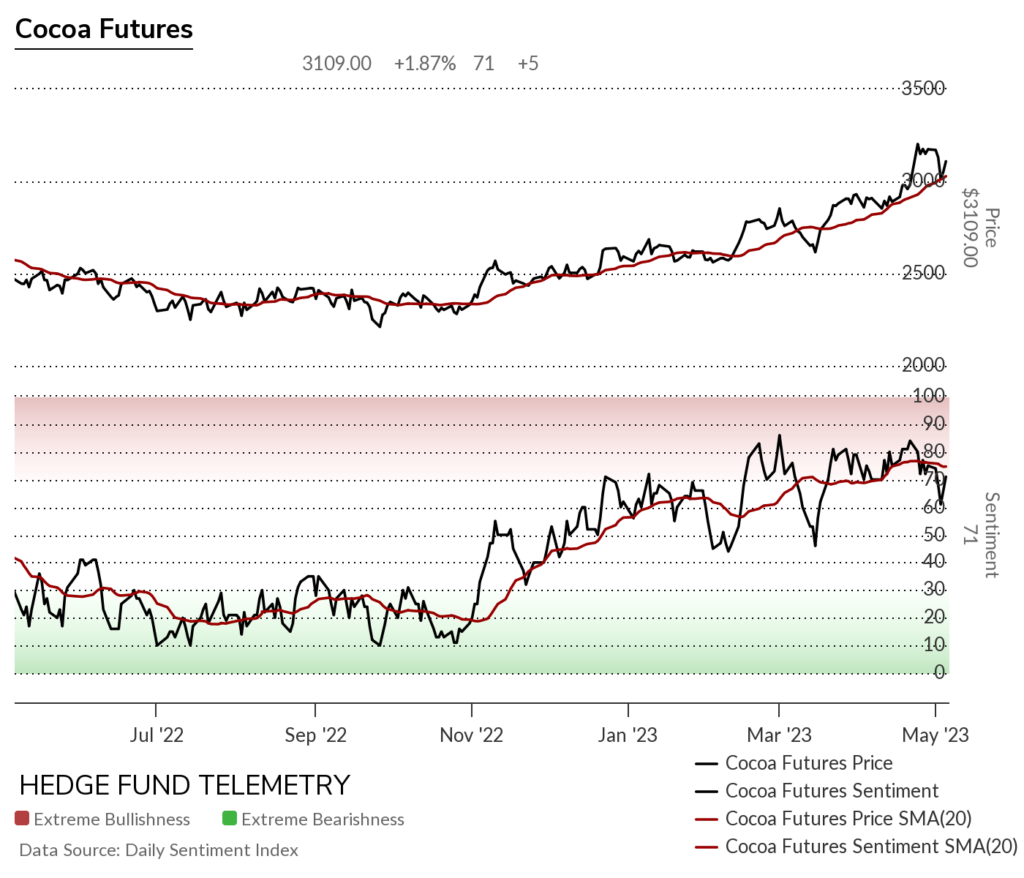

Cocoa futures daily

Cocoa futures bullish sentiment

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

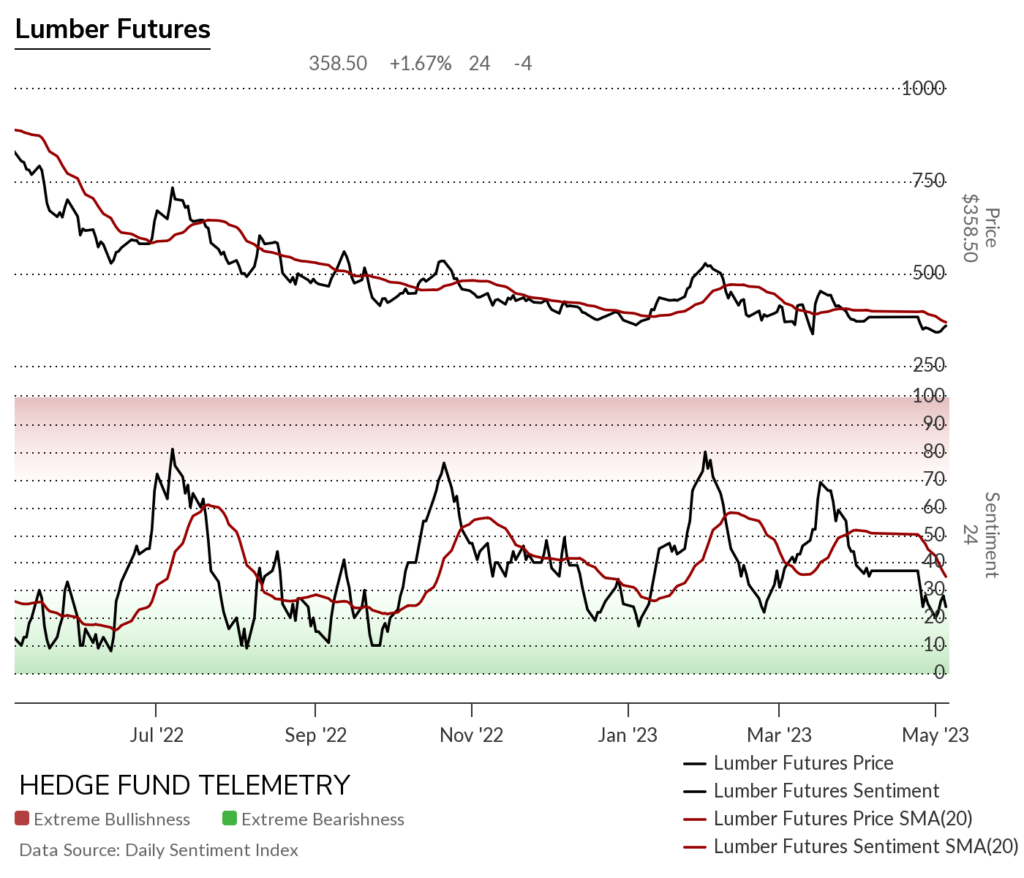

Lumber futures daily

Lumber bullish sentiment

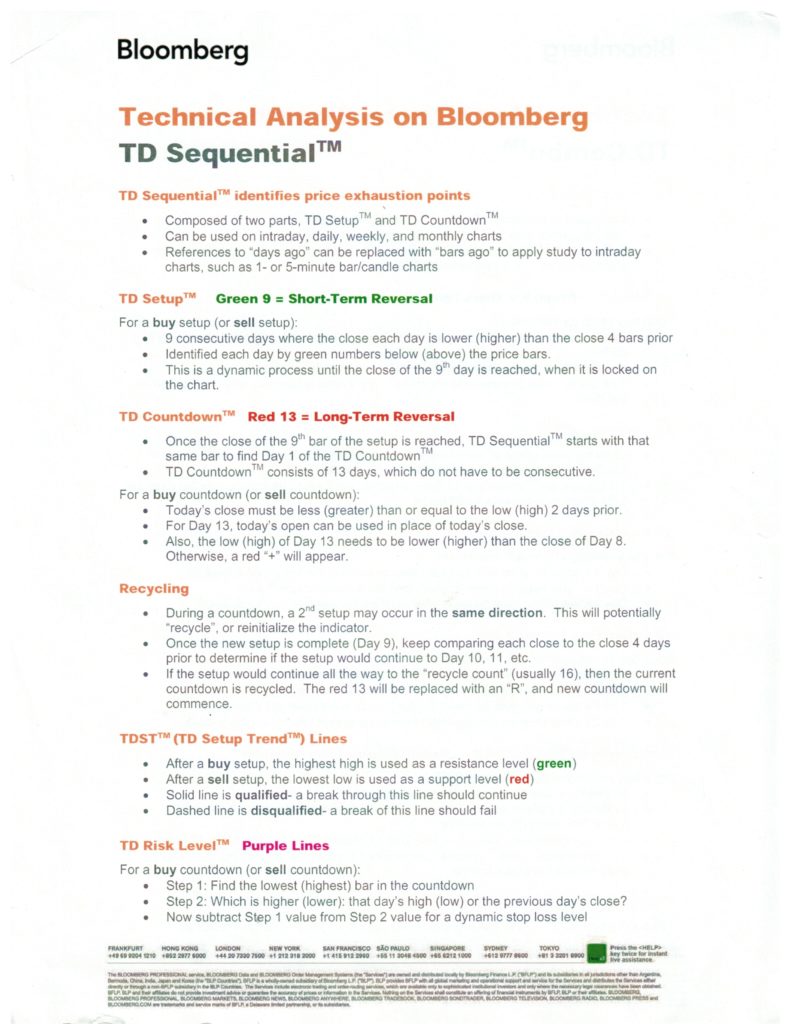

DeMark Sequential Basics

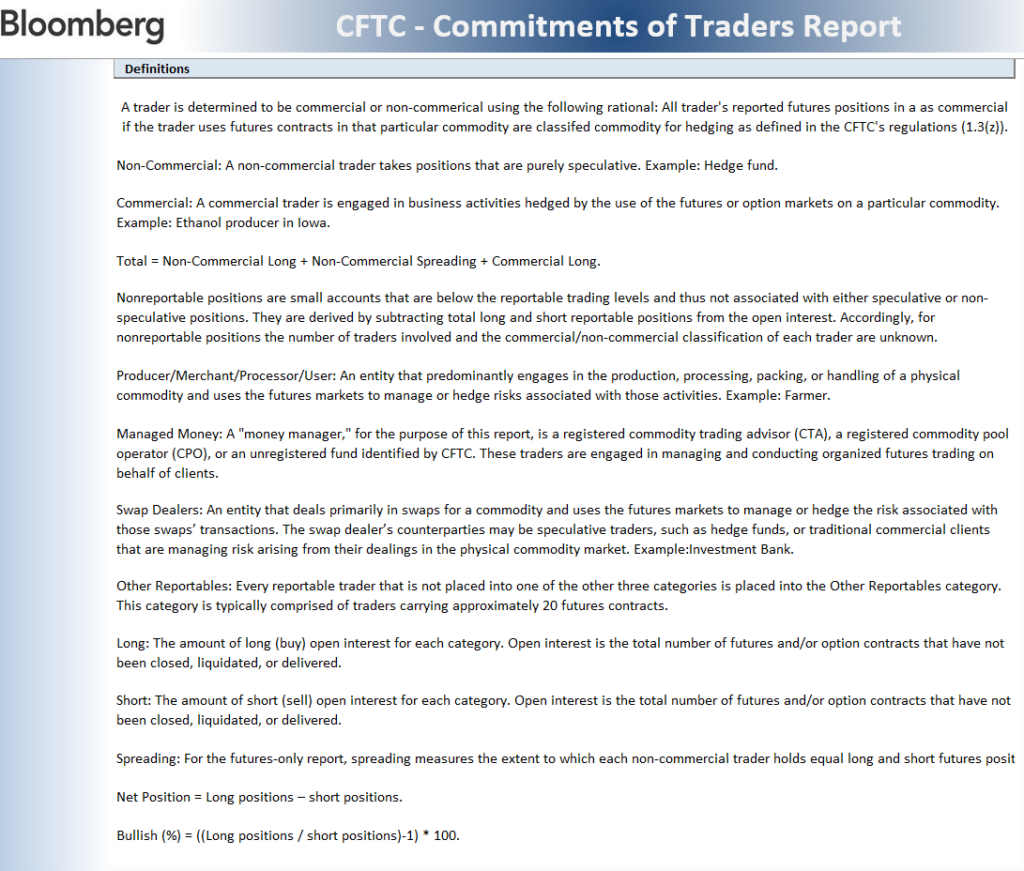

DETAILED COMMITMENT OF TRADERS DEFINITIONS