BIG NEWS

BELARUS FLIGHT HIJACKING

A RyanAir flight from Athens to Vilnius carrying the famous Belarusian journalist, Roman Protasevich was hijacked and diverted to Minsk, where he is wanted by authorities.

According to the Editor in Chief of Nexta tv:

“What we know so far: KGB operatives boarded the plane in Athens this morning together with Roman Protasevich (he noticed dodgy-looking ppl taking pics of him at the gate). Then when the plane has entered Belarus airspace KGB officers initiated a fight with the Ryanair crew insisting there’s an IED onboard. Eventually, the crew was forced to send out SOS (literally moments before the plane would’ve left Belarus airspace). MiG-29 took off and escorted it to Minsk. Security services entered the plane and arrested Protasevich.”

Later more was revealed by LawFare:

According to media reports, on the afternoon of May 24, 2021, Ryanair Flight FR4978 was on route from Athens, Greece to Vilnius, Lithuania. The aircraft—bearing tail number SP-RSW—was registered in Poland. One of its passengers was Roman Protasevich—a Belarusian journalist and dissident who played a key role in protests against Alexander Lukashenko’s regime in the wake of the contested 2020 presidential elections. Sofia Sapega, a Russian law student and his partner, was traveling with him.

Two officers of the Belarusian secret police, the KGB, were also onboard. Once the plane was in Belarusian airspace, those officers told the pilot of Flight FR4978 that there was an explosive device onboard and that an immediate emergency landing was required. At this point, a Belarusian Air Force MiG-29 appeared alongside and “escorted” the aircraft—not to the nearest airport in Vilnius, but to Minsk, Belarus. On landing, Protasevich and Sapega were detained. Six hours later, Flight FR4978 was allowed to resume transit to Vilnius—minus six passengers on its original manifest, including Protasevich and Sapega. Certain reports have offered harrowing accounts of Protasevich’s reaction. Told the aircraft had been diverted: he shook and held his head in his hands. While being led away in Minsk, he was reported to have said, “I’ll get the death penalty here.”

There was, of course, no explosive device onboard Flight FR4978. The claim that there appeared to have been a ruse by Belarus to force the aircraft to land in Minsk so that Protasevich and Sapega could be arrested. For its part, Belarus has admitted there was no bomb—but rather than own up to its actions, it has concocted a narrative whereby Hamas made the threat in order to secure a ceasefire with Israel in Gaza. Given that the actual ceasefire was obtained on May 21—three days before Flight FR4978 took off—this story seems, to put it mildly, wildly implausible.

Of course this broke all sorts of international laws including:

State sponsored hijacking

State sponsored piracy

Use of armed force against an aircraft

Breaking of Council of the International Civil Aviation Organization (ICAO) article 87 of the Chicago Convention which specifically prohibits the use of military force against passenger flights

Article 1(1)(e) of the Montreal Convention creates an international crime where a person unlawfully and intentionally “communicates information which he knows to be false, thereby endangering the safety of an aircraft in flight.” Secondly, per Article 10 of the Montreal Convention, a state must “in accordance with international and national law, endeavor to take all practicable measures for the purpose of preventing the offenses mentioned in Article 1.”

The EU immediately responded followed by the United States.

The European Union agreed Monday to impose sanctions on Belarus, including banning its airlines from using the airspace and airports of the 27-nation bloc, amid fury over the forced diversion of a passenger jet to arrest an opposition journalist.

Reacting to what EU leaders called a brazen “hijacking” of the Ryanair jetliner flying from Greece to Lithuania on Sunday, they also demanded the immediate release of the journalist, Raman Pratasevich, a key foe of authoritarian Belarusian President Alexander Lukashenko.-ABC News

Later the EU also announced that they will look at hitting Belarus’s big potash exports as well as its oil and financial sectors with new sanctions, as punishment for forcing down a Ryanair flight to arrest a journalist, EU foreign ministers said. * -Reuters

On Friday, The White House announced that the United States will reimpose sanctions on Belarus next week after the forced diversion of a Ryanair flight to the country on May 23 and the arrest of an opposition journalist on board.

In a scathing statement Friday night, White House press secretary Jen Psaki called the incident “a direct affront to international norms” and called on President Alexander Lukashenko to allow a “credible international investigation” into the events and “immediately release all political prisoners.”

Psaki said the U.S. will reimpose “full blocking sanctions against nine Belarusian state-owned enterprises” on Thursday, which would prohibit Americans from engaging in transactions with those entities. -ABC News

SO WHY DOES THIS MATTER?

*Potash is the potassium-rich salt that is used in fertilizer, and Belarus produces 20% of the world’s supply.

The EU statistics agency said the bloc imported 1.2 billion euros ($1.5 billion) worth of chemicals including potash from Belarus last year, as well as more than 1 billion euros worth of crude oil and related products such as fuel and lubricants.

NOTABLE: This bodes well for fertilizer companies such as Mosiac (MOS) and Intrepid Potash (IPI) as well as European and United States chemical companies.

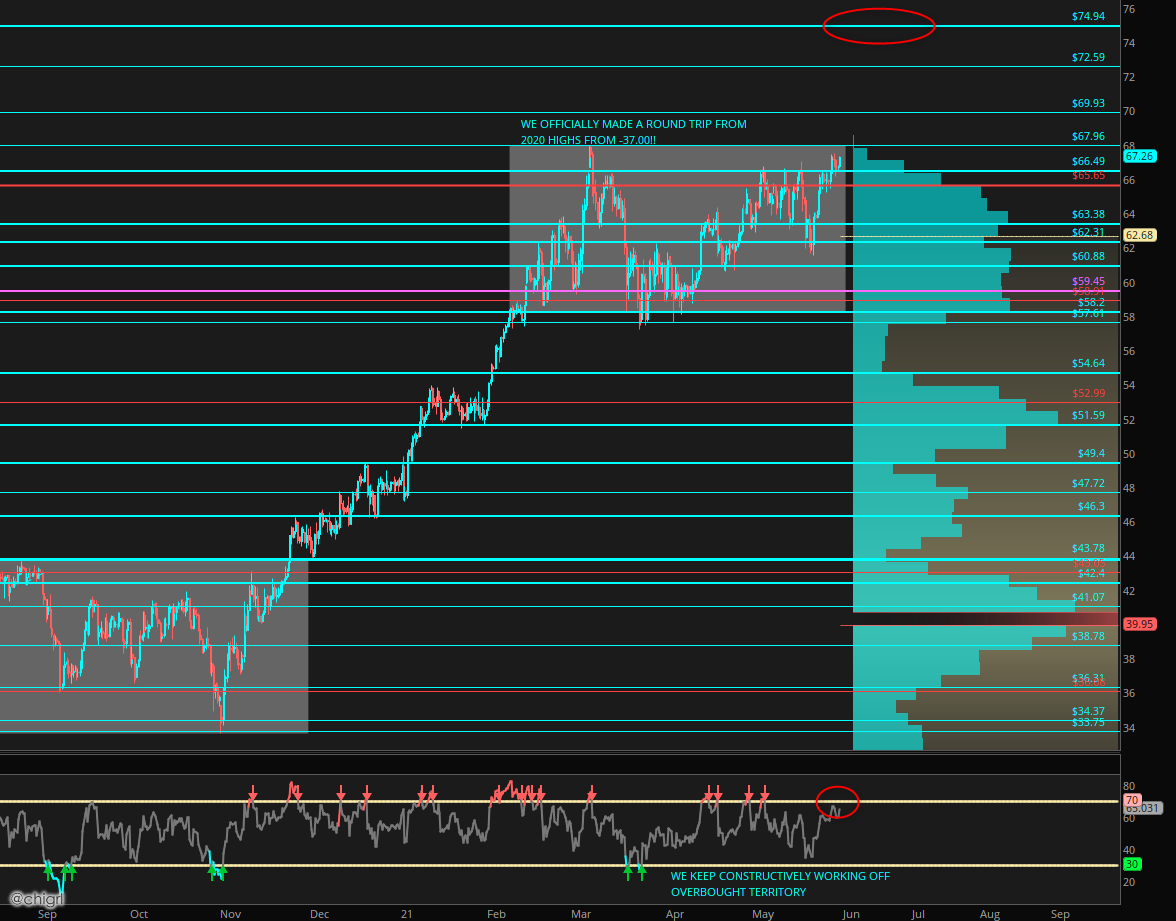

TECHNICALS

The chart is still constructively bullish, that said we may get a pullback here soon as we are reaching overbought territory. 75.00 is still the Q3 target.

FUNDAMENTALS

SHELL, EXXON MOBIL, CHEVRON

Rough week for the super majors

SHELL

Milieudefensie, the Dutch arm of the Friends of the Earth environmental organization, together with 17 thousand citizens had sued Shell for its climate-damaging activities—and won. The verdict implies that Shell has to reduce its 2030 carbon emissions by 45 percent compared to 2019.

NOTABLE: I fully expect Shell to file an appeal

CHEVRON

Chevron shareholders on Wednesday voted in favor of a proposal to cut emissions generated by the use of the company’s products, a move that underscores growing investor push at energy companies to reduce their carbon footprint.

Shareholders voted 61% in favor of the proposal to cut so-called “Scope 3” emissions, according to a preliminary count announced by Chevron at its annual general meeting.

Although the proposal does not require Chevron to set a target of how much it needs to cut emissions or by when, the overwhelming support for it shows growing investor frustration with companies, which, they believe, are not doing enough to tackle climate change. -Reuters

EXXON MOBIL

Exxon Mobil’s shareholders have voted to replace at least two of the company’s 12 board members with members that were assumed better suited for fighting climate change. Exxon said that because of the complexities of the voting process, inspectors might not be able to certify final voting results for “some period of time.” It was unclear whether one additional board member was also unseated in the shareholder vote.

NOTABLE: I loved Exxon Mobil for sticking to their core business as an oil producer as an investment over the next 5-10 years…need to see how this turns out. Two is still a minority on the board, I am not sure how much they will actually accomplish.

OVERALL NOTABLE: This is actually super bullish oil price longer-term and super bullish for smaller players, oil demand is not going away anytime soon, which means smaller companies will be forced to make up for the major’s loss. I really like Devon (DVN) for this play, or if you prefer an ETF- SPDR S&P Oil & Gas Exploration & Production (XOP) looks really interesting.

UNITED STATES

States warn banks — Drop coal, oil, and natural gas and we drop you.

More than a dozen Republican state treasurers are threatening to pull assets from large financial institutions if they agree to decarbonize their lending and investment portfolios, Axios has learned.

Why it matters

The state officials signing the letter collectively manage more than $600 billion in assets in state treasuries, pension funds, and other government accounts, according to publicly available financials and information provided by the state treasurer offices.

Those states work with large financial institutions to invest and grow those funds, to support state spending and retirement payments to former workers.

Even for sizable investment banks, such funds can be some of their largest accounts.-Axios

COPY OF LETTER HERE

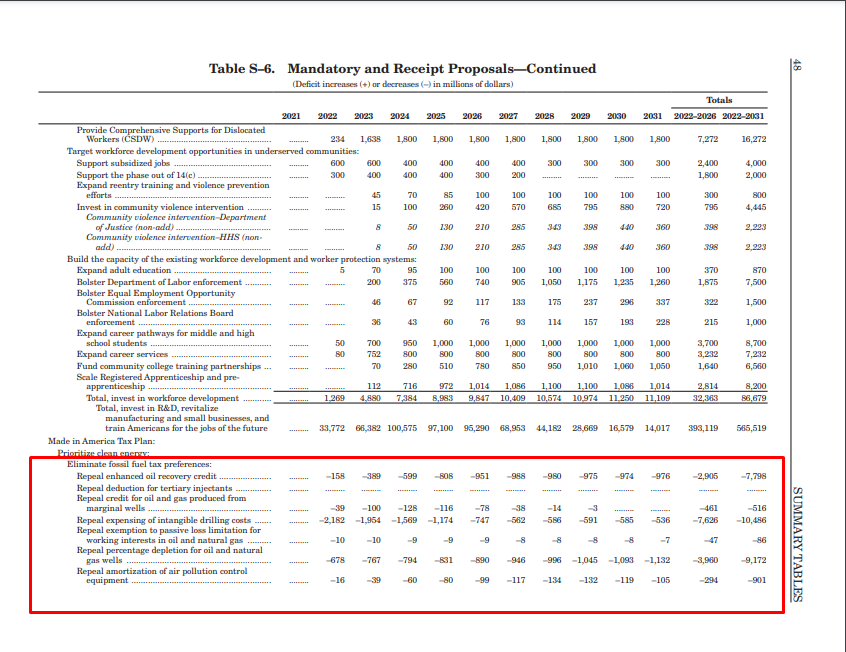

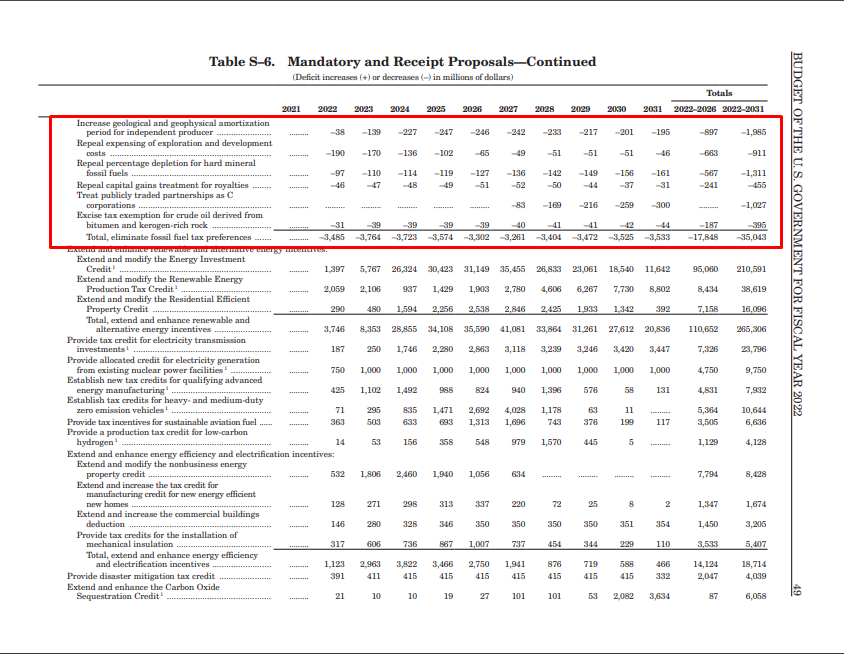

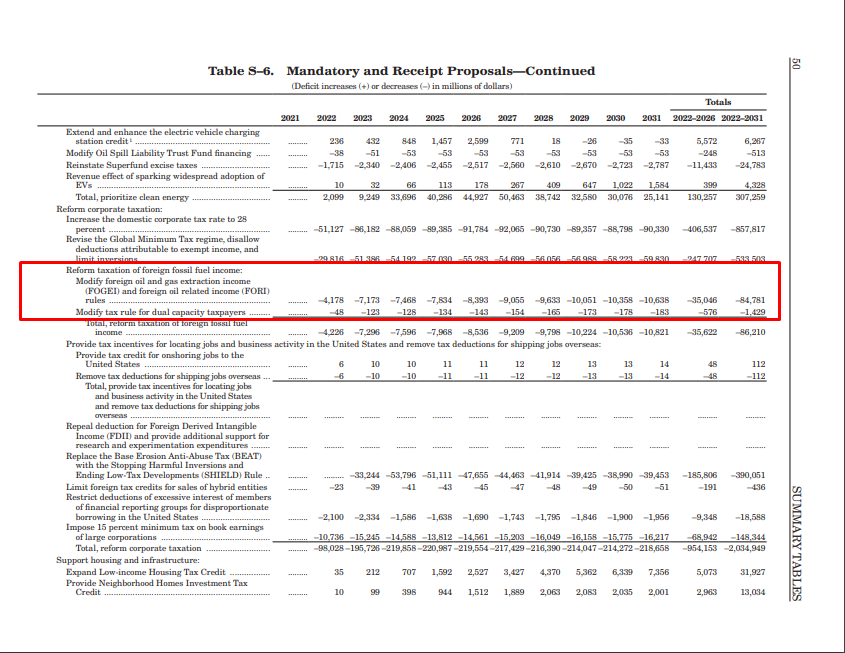

BIDEN PROPOSED BUDGET 2022 BUDGET

Although this has not passed, yet, the proposal is a huge hit to the US oil and gas industry. A total of $53B in 2022-2026 and $120B in 2022-2031. This hits everyone from smaller E&P to super majors.

LINK TO FULL BUDGET PROPOSAL

NOTABLE: Not only does this hurt US energy security, by curtailing development, it also sets up for a future energy crisis, as I do not believe the renewable energy transition will happen as quickly as intended which leaves a massive transition gap.

MERGERS

Another merger this past week

“Cabot Oil & Gas Corporation (“Cabot”) (NYSE: COG) and Cimarex Energy Co. (“Cimarex”) (NYSE: XEC) today announced that they have entered into a definitive agreement whereby the companies will combine in an all-stock merger of equals. The combination will bring together two industry-leading operators with top-tier oil and natural gas assets to create a diversified energy leader that is positioned to drive enhanced free cash flow generation and returns for investors through market cycles. Under the terms of the agreement, which has been unanimously approved by the Boards of Directors of both companies, Cimarex shareholders will receive 4.0146 shares of Cabot common stock for each share of Cimarex common stock owned. The exchange ratio, together with closing prices for Cabot and Cimarex on May 21, 2021, reflects an enterprise value for the combined companies of approximately $17 billion. Upon completion of the transaction, Cabot shareholders will own approximately 49.5% and Cimarex shareholders will own approximately 50.5% on a fully diluted basis” -Cabot press release

NOTABLE: Since the 2016 oil crash, I have been noting that many mergers and acquisitions would be happening, albeit, this one came out of the left-field a bit. I believe consolidation in the industry is actually a strength, as it curtails excesses of the past and forces better governance, if companies still wish to have access to capital. I suspect we see a few more before all is said and done.

INDIA

India was hit with a second cyclone in 10 days. Ships at anchorage have been asked to move to a safer area in the sea while oil and gas installations will go into “survival” mode as they brace for Cyclone Yaas to make landfall between Dhamra Port and Balasore on the Odisha coast.

Indian Oil Corp (IOC), the nation’s biggest oil firm, stopped unloading crude oil at Paradip in Odisha and asked all ships to move 250 nautical miles away from the path of the cyclone.

Both Paradip Port Trust and Dhamra Port have asked all vessels at anchorage to move to a safer area in the sea, while those alongside berths have been asked to keep their main engines ready to move to sea at short notice.

“Oil industry officials are in close coordination with Paradip and Haldia Port authorities on the berthing and de-berthing of vessels/barges at jetties.

“Activities at all project sites have been temporarily suspended, and the workers have been moved out to ensure their safety. All ships carrying petroleum products and crude oil have been advised to keep a safe distance from the cyclone’s path,” the statement said.-NDTV

NOTABLE: The damage is still being surveyed on land (there are a lot of refineries in that area), but ports are reopened for vessels, as checked by Tanker Trackers.

CHINA

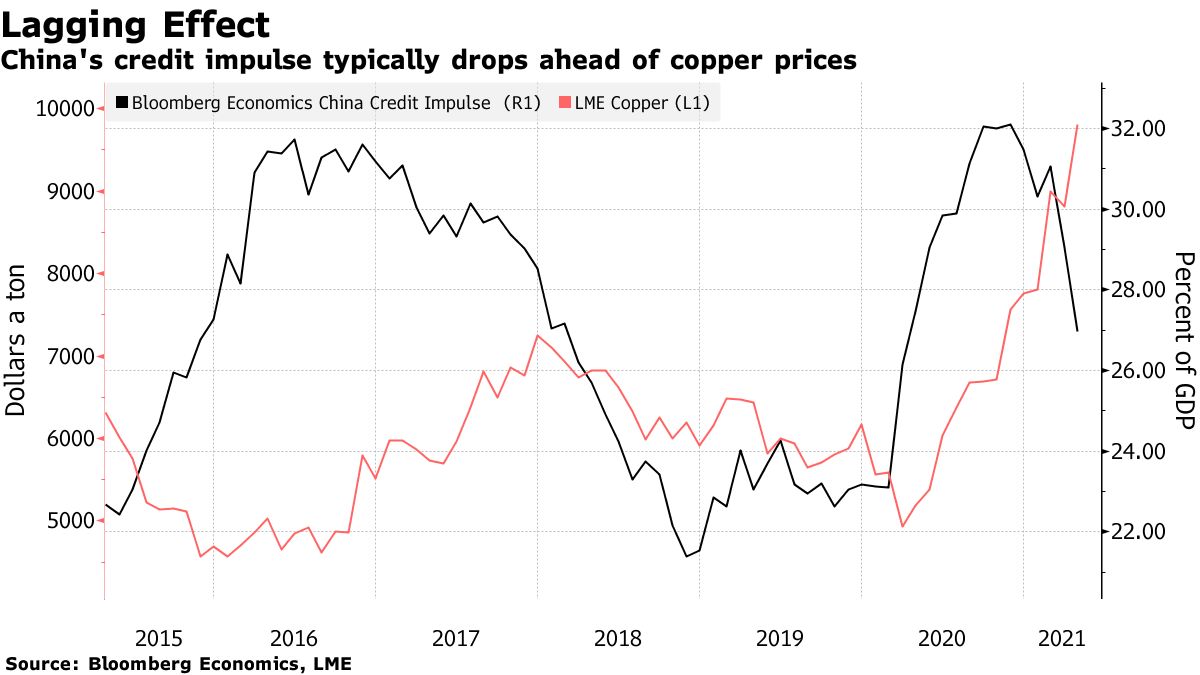

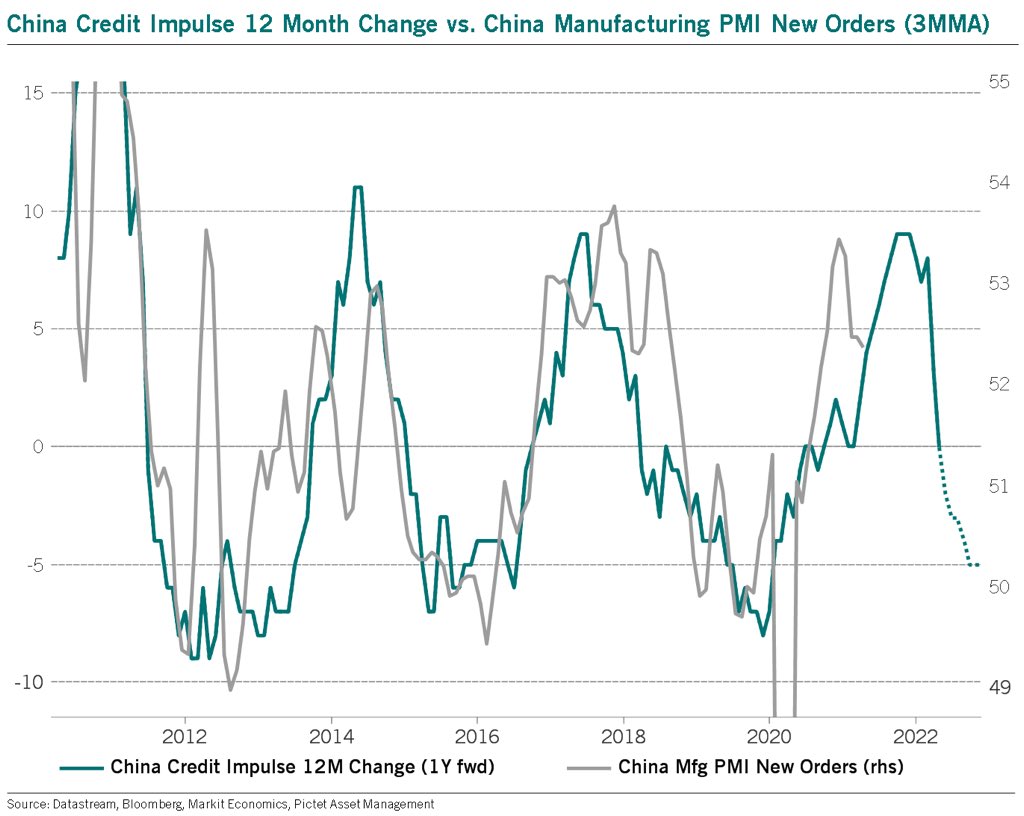

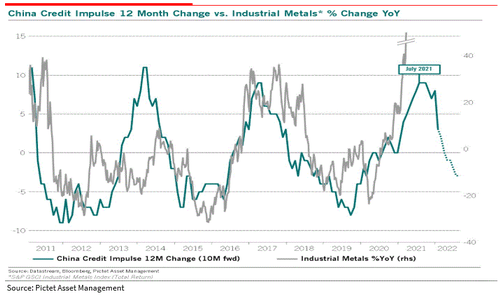

China credit impulse chart. These charts were making the rounds this week.

NOTABLE: I have two things to say about this.

- China currently trying to manipulate commodity market prices. But, at the end of the day, they will never sacrifice “growth” on account of price.

- The problem is there are real fundamental issues pointing toward supply deficits surrounding many commodities, which will naturally drive up prices. There are transitory (on varying time frames) issues i.e. supply chain, shipping. All of which are outside of China’s control.

Growth factors in the US and Europe are just starting as we emerge from the Covid crisis and Europe starts opening up this summer, so I doubt China will be able to keep a lid on commodity prices, in particular industrial metals needed for the energy transition.

***JUST IN TODAY MAY 31, 2021: China Says It Will Allow Couples to Have 3 Children, Up From 2

This China headline is one of the most bullish macro headlines I have seen in a while. Global consumption growth expectations are too low.

COLOMBIA

Oil Companies Close The Taps As Fear Of Civil War Grows In Colombia

Key Latin American U.S. ally and the region’s fourth-largest oil producer Colombia finds itself rocked by anti-government protests which are now into their third week. This has even reignited fears of renewed civil war in the strife-torn Andean country. Colombia’s anti-government protests began with a national strike on 28 April 2021 called by various civil society and trade union groups in response to President Duque’s proposed tax reform. A massive fiscal black hole where the budget deficit had reached nearly 9% of GDP is ratcheting up pressure on the cash-strapped national government in Bogota -Reuters

NOTABLE: Although Colombia is not a huge producer, they are still barrels taken off the market

NORWAY

Not everyone is cutting oil investment, in fact, Norway has increased its 2021-2022 oil investment forecast, ironically this comes on the heels of the IEA report saying that all investments must stop now in the industry.

The biggest business sector in Norway now expects to invest 181.9 billion Norwegian crowns ($21.95 billion) this year, up from a forecast of 173.6 billion made in February, the SSB said.

“The upward adjustment for 2021 is driven by higher estimates within the categories of fields on stream and field development,” SSB said in a statement.

“Among other things, two new plans for development and operation (PDO) have been submitted,” it added. -Reuters

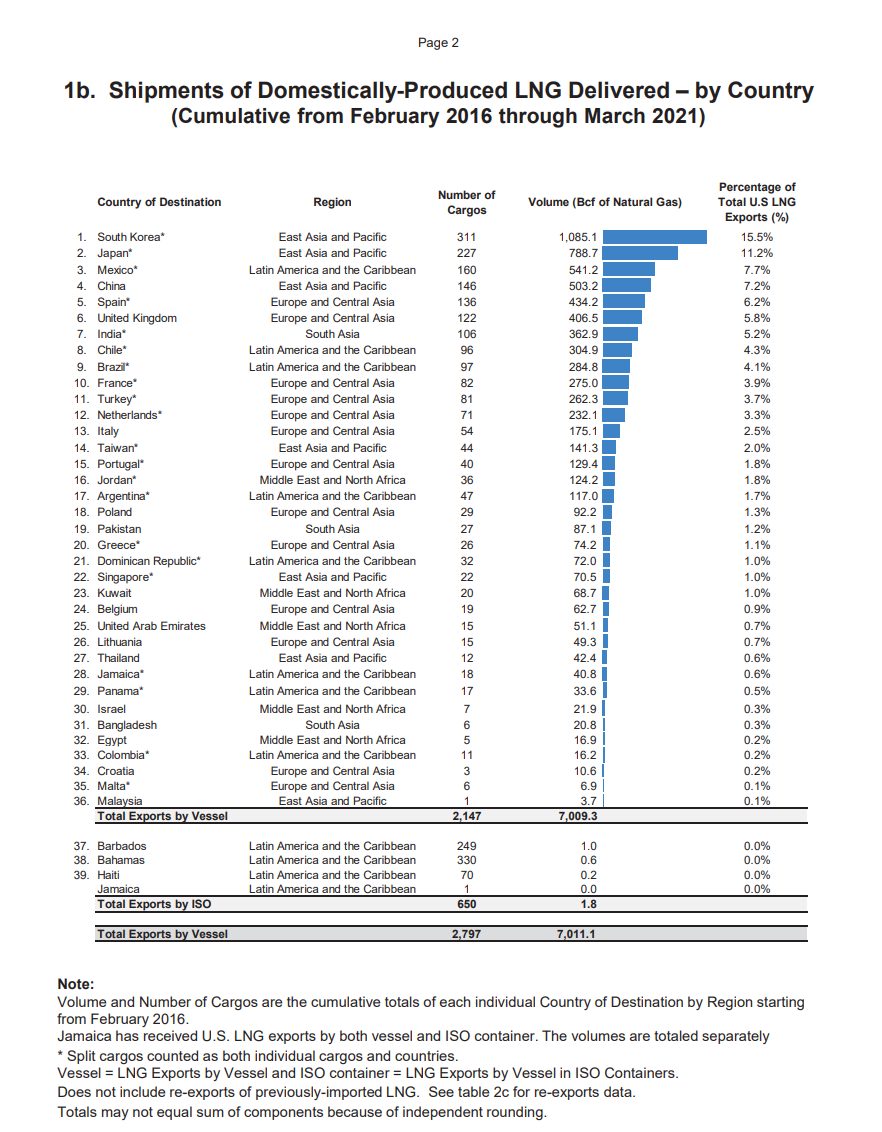

RUSSIA

Russia is also set to increase oil and natural gas output over the next 15 years.

On the 13th of May, the Russian government adopted the general framework for developing the country’s oil and gas industry until 2035 prepared by the Ministry of Energy. According to the strategy, Russia is to maximize the extraction and monetization of hydrocarbons before the world completely transitions to zero- and low-emission sources

Oil is the most important hydrocarbon extracted in Russia. The revenue earned on oil export is responsible for about a third of the entire budget income. According to the government plans, which are included in, among others, the Russian Federation Energy Strategy Until 2035, in the next 15 years the oil sector is to focus on increasing output at currently exploited and known oil deposits, as well as upping oil processing at domestic refineries.

Russians forecast that gas production in 2035 will reach between 838 bcm and 1.34 tcm, depending on the variant (pessimistic, realistic, optimistic). In 2020, 693 bcm of gas was produced in Russia.

Export (via pipes and LNG) is to reach between 330 bcm and 471 bcm a year. In 2020 Russia exported 242 bcm.-Bizness alert

NOTABLE: This is a bullish for Russian oil and gas companies. They will happily try and fill the void the West seems adamant about creating with green policies.

IRAN

OPEC + reassured the market that they will take into account Iran’s return to the market should this happen.

The countries participating in the OPEC+ oil production cuts agreement consider the possibility of Iranian oil returning to the global market, Deputy Prime Minister Alexander Novak told reporters on Wednesday.

“Potentially we bear in mind such a possibility. Iran has the recovery potential. We have always stated that anti-Iran sanctions are discriminatory,” he said.

“We have to consider Iran’s potential,” Novak said, adding that Iran “belongs to OPEC and OPEC+ and the balance will be calculated accordingly.”

NOTABLE: I have stated before, that this OPEC+ alliance is very different from the one in the past. Everything changed last April and they are a c more responsible and cohesive group. This has paid off in spades looking at oil prices. I see no reason for this to change IF Iran returns to the market any time soon.

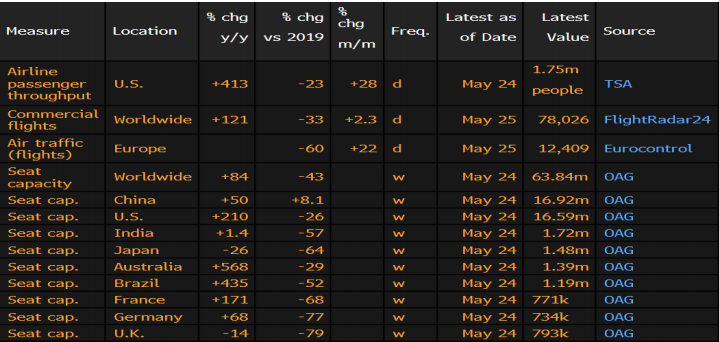

BLOOMBERG OIL DEMAND MONITOR

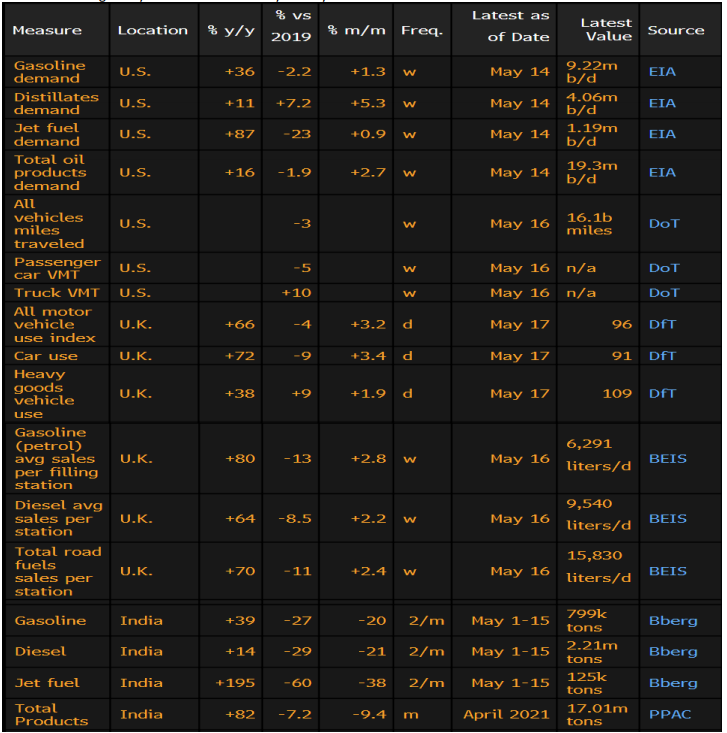

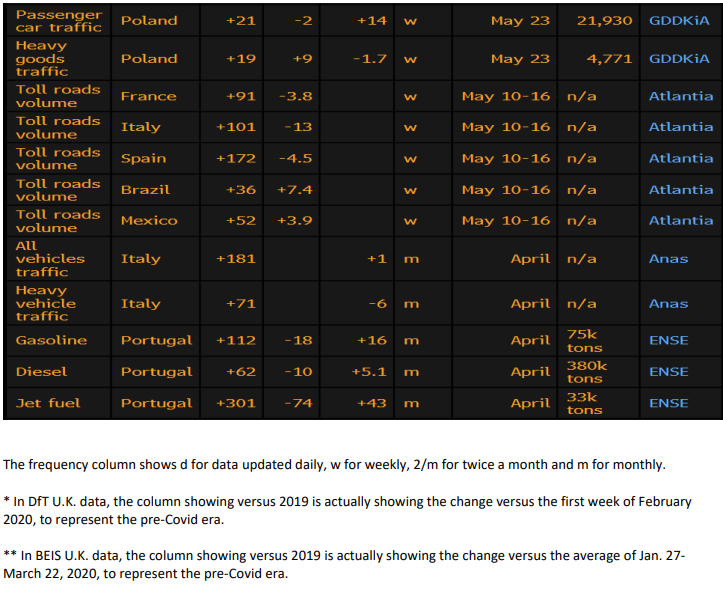

Airline seat capacity surged by a fifth in the U.K. in the past week while slumping 12% in India, highlighting how varying strategies for combating coronavirus are playing out in travel patterns and fuel consumption.

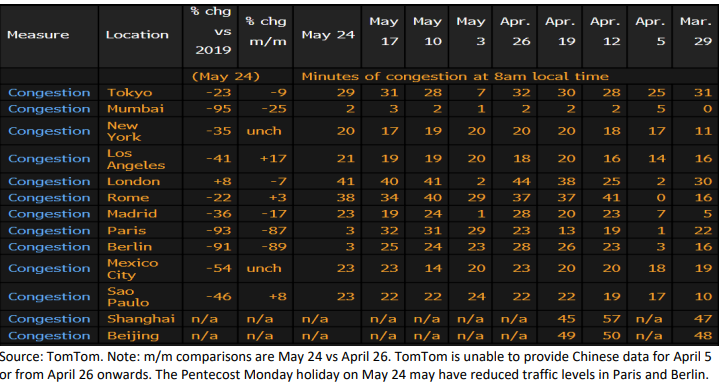

The U.K., where the government says about 70% of adults have had at least one dose of vaccine, is progressing toward its goal of ending social distancing measures in about a month’s time and London is the only one of Europe’s five biggest capital cities where road congestion on Monday morning was above the 2019 average. New York was down 35%, about the same as Madrid.

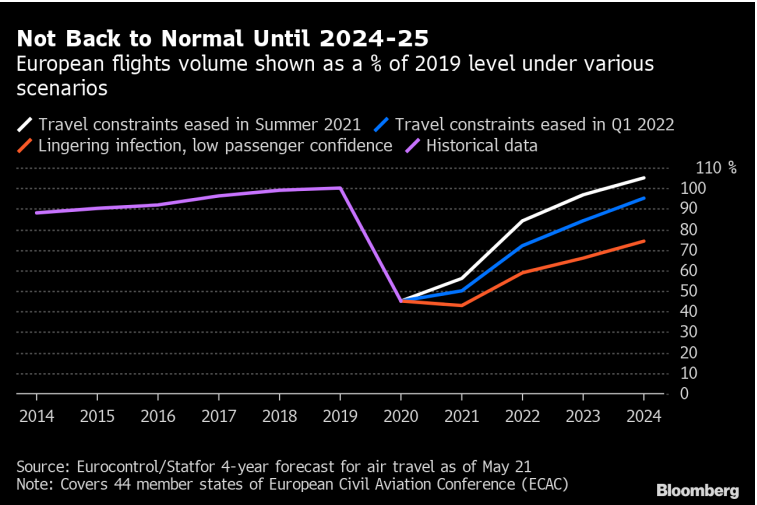

Air travel in the U.K. was particularly badly hit during the past year and is now catching up, as is Spain, according to weekly seat capacity estimates from OAG Aviation. Even so, traffic management agency Eurocontrol doesn’t expect overall European flight numbers to return to the pre-pandemic normal until 2024 or 2025 and estimates that activity in the region is currently 60% lower than two years ago.

Airline seat capacity in India was 57% below the equivalent week of 2019 on May 24, compared with deficits of only 50% and 29% on May 17 and April 26, respectively.

The declines in Indian airline activity and a smaller step back in China offset gains in Europe and the U.S., leaving global seat capacity near 64 million last week, or 43% behind the same week of 2019, according to OAG, which is the same percentage decline as at the start of May.

European travel remains precarious though. On Sunday, French Foreign Affairs Minister Jean-Yves Le Drian told RTL radio that the country was considering stricter measures for passengers arriving from the U.K. because of the spread of a coronavirus variant first identified in India.

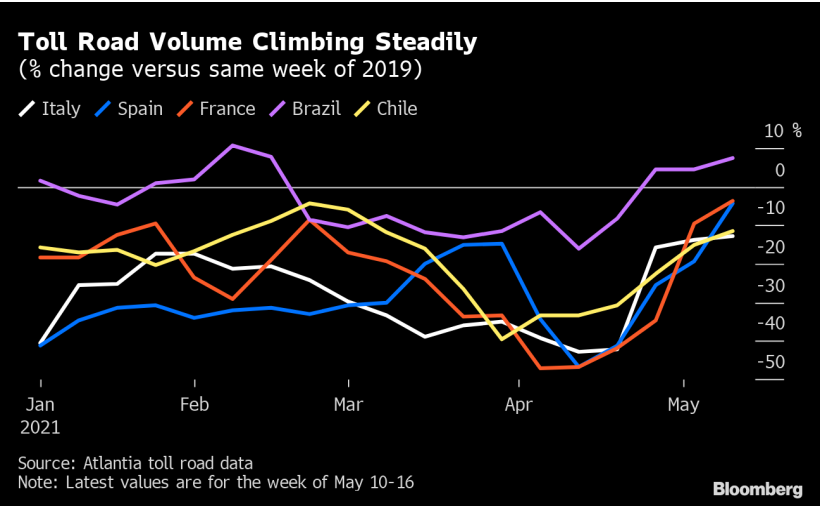

Roads are steadily getting busier in many countries.

Toll road traffic in France and Spain is now just a few percentage points away from matching 2019 levels, according to the latest weekly data from Atlantia Group, which manages about 13,000 kilometers (8,000 miles) of toll motorways worldwide.

Atlantia data for Brazil has been above 2019 for three weeks now. Separately, government data from Poland, the U.S., and U.K. show passenger car traffic levels for the latest weeks measured were down 2%, 5%, and 9%, respectively, versus pre-pandemic times.

THIS IS THE MOST IMPORTANT BIT

A permanent shift away from mass transit could help boost demand for oil-based fuels in a post-Covid scenario, BofA Global Research analysts including Francisco Blanch said in a report last week. Even if electric vehicle sales reach 34% by 2030, an acceleration in miles driven of 20% could push peak oil demand levels to 109 million BY 2027.

Road Congestion

Air Traffic

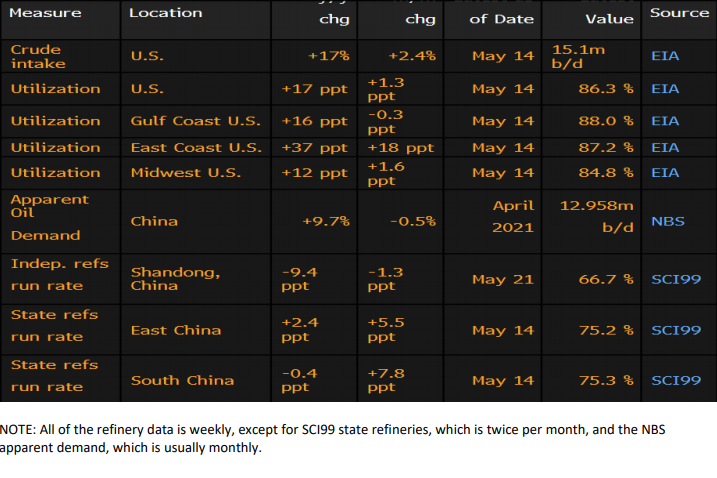

Refineries

NATURAL GAS

EUROPEAN UNION

I knew this was coming….

EU countries seek to prolong bloc’s funding for gas projects.

European Union countries will seek to prolong EU support for cross-border natural gas projects, a stance at odds with the European Commission’s plan to end such funding, according to a draft document.

The EU’s “TEN-E” rules define which cross-border energy projects can be labeled Projects of Common Interest (PCI), giving them access to certain EU funds and fast-tracked permits.

The EU is rewriting the rules in line with its climate change goals, as it seeks to reach zero net greenhouse gas emissions by 2050.

The Commission proposed new TEN-E rules in December, which excluded dedicated oil and gas infrastructure.

The draft, seen by Reuters, said projects in Malta and Cyprus that currently have PCI status should retain it until those countries are fully connected to the European gas network.

That could help ensure the completion of Greece, Cyprus, and Israel’s Eastmed pipeline to supply Europe with gas from the eastern Mediterranean. The countries aim to reach a final investment decision by 2022 and complete the project by 2025.

The proposal, due to be discussed by EU ambassadors next week, also said that until 2030 investments to retrofit gas pipelines to carry hydrogen should be allowed to continue carrying natural gas blended with hydrogen. -Reuters

Notable: Gas is THE cheap energy transition fuel, the EU will have to adopt this proposal, there is simply too much on the line. It will be hard for Germany to push against this considering NordStream2 is still being built.

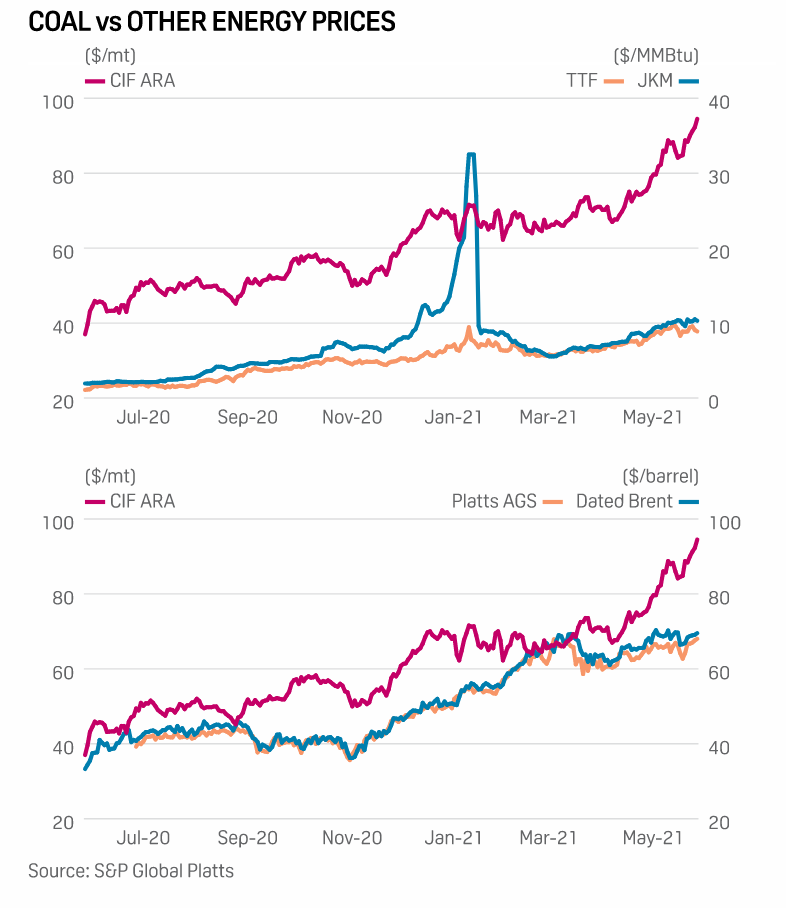

INTERESTING CHART

POWER SHORTAGES

JAPAN

Japan power futures contracts for July and August delivery have surged by roughly 20% over the last two months in anticipation of a supply crunch. Hokkaido Electric Power Co., which operates on Japan’s northernmost island, expects to provide as much as 14% more power capacity to the main island of Honshu this summer compared to last year.-BBG

Futures for July and August have jumped 20% over the last two months in anticipation of a supply crunch due to:

Outlook for hot weather

Power plant retirements

Rally in LNG and coal spot prices

Japan’s government will urge power providers to get stocked up on fuel and has requested the end-users curb their consumption.

Japan is also going into the summer with a thinner LNG surplus than previous years, the Nikkei reports And a tightening spot market will make it difficult for utilities to purchase shipments for prompt delivery if there is a sudden blast of hot weather-Nikkei

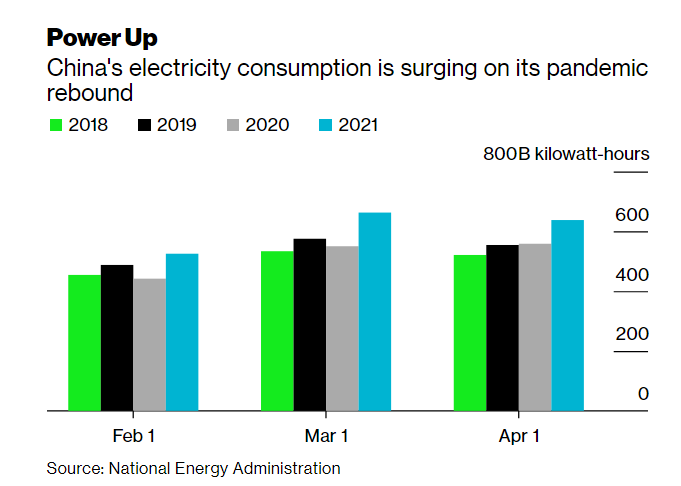

CHINA

“The power supply in Guangdong has had some problems recently, and in some cities, industrial plants have had to move their working time to off-peak hours,” Yu Zhai, an analyst with Wood Mackenzie Ltd., said by phone. “This electricity shortage could be a problem from now through the summer.”

In China, the export- and heavy industry-led rebound has caused a surge in electricity use, with consumption climbing 20% through April compared with last year, and up 15% from 2019 levels when Covid-19 wasn’t a factor. Temperatures in Guangdong, in the southern region of the country, have also been higher than normal. -BBG

NOTABLE: Demand for natural gas and coal in Japan and China seems unabated and will continue throughout the summer. This is obviously bullish in these commodity prices.

UNDER THE RADAR

TAIWAN

Taiwan is also experiencing power problems and experiencing rolling blackouts. It should be noted that Taiwan is also the largest semiconductor manufacturer, this will only add to chip shortage problems.

In addition, The power shortages are raising concerns that Taipei’s ambitious plan to decommission all its nuclear power plants by 2025 and replace them with gas and renewable energy could be delayed- BBG

COAL

Coal rally continues amid concerns on supply availability to meet demand

Seaborne coal prices have been bullish over the past year, largely rising from pandemic lows last spring as global energy demand resumes and economies strengthen.

The prices are signaling a lack of supply as producers scramble to rehire furloughed workers and reconnect supply chains.

“People need to get over the price and become more concerned about availability,” said a US-based coal consultant. “This market is so inelastic. The demand for energy in Q3 has spiked and they can’t find the coal.”

“Coal is telling the market something is wrong,” said the US consultant. “The demand for energy is increasing faster than supply. It’s starting to smell like 2007.”

Despite environmental pressures, coal remains the world’s number one fuel for power generation, partly because it’s generally more competitive than gas. Even with the rally in coal pricing this still bears out, as increased gas demand has supported higher coal pricing, particularly in Asia and Europe.

US thermal coal exports in the first quarter totaled 9.4 million mt, up from 7.5 million mt in the same period last year. According to a European source, “a significant increase in US exports is looming.”-PLATTS

NOTABLE: I talked about coal last week, this just reaffirms my long conviction on Peabody Energy (BTU) as US exports are set to pick up.

MINING

Interesting report evaluating many mining companies

2020 Responsible Mining Index Report

LINK TO REPORT

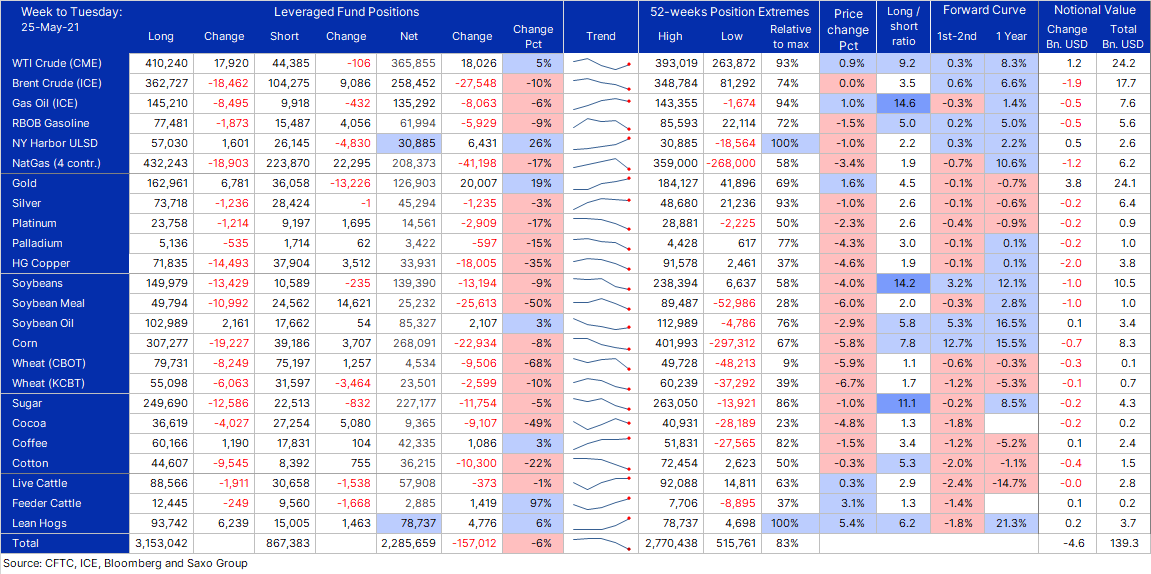

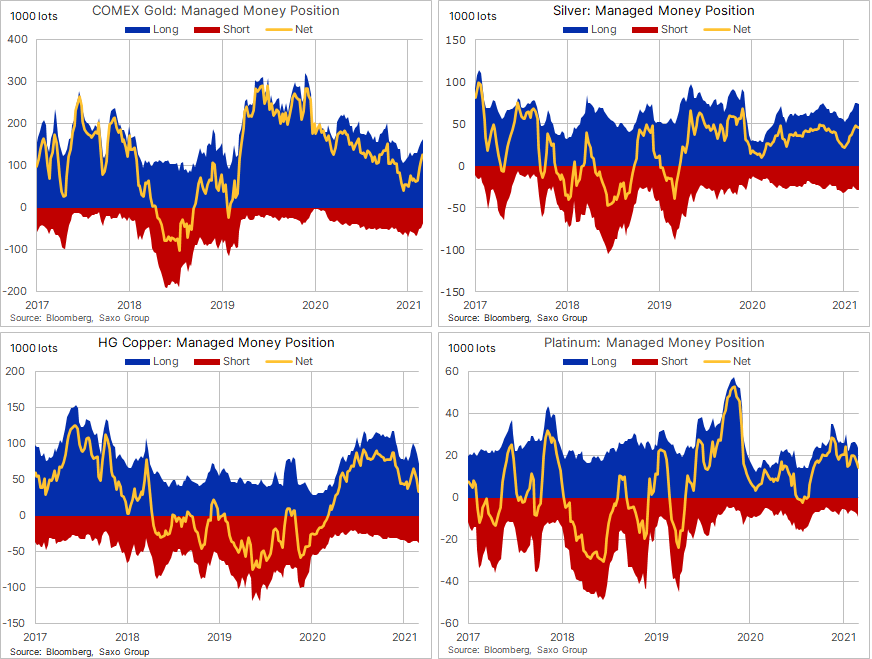

COMMITMENT OF TRADERS -as of Tuesday 25 May

COT on commodities in wk to May 25 showed the impact of the recent price corrections. Broad selling except gold and WTI was led by natgas, Brent crude oil, copper, soybeans, and corn

COT on metals in wk to May 25 saw gold buying extend into a 4th week with the net long rising 20k lots to a four-month high at 126.9k lots. Bullish copper bets slumped 35% to 33.9k lots, a ten-month low. Silver and platinum both struggling to keep up with gold were net sold-SAXO

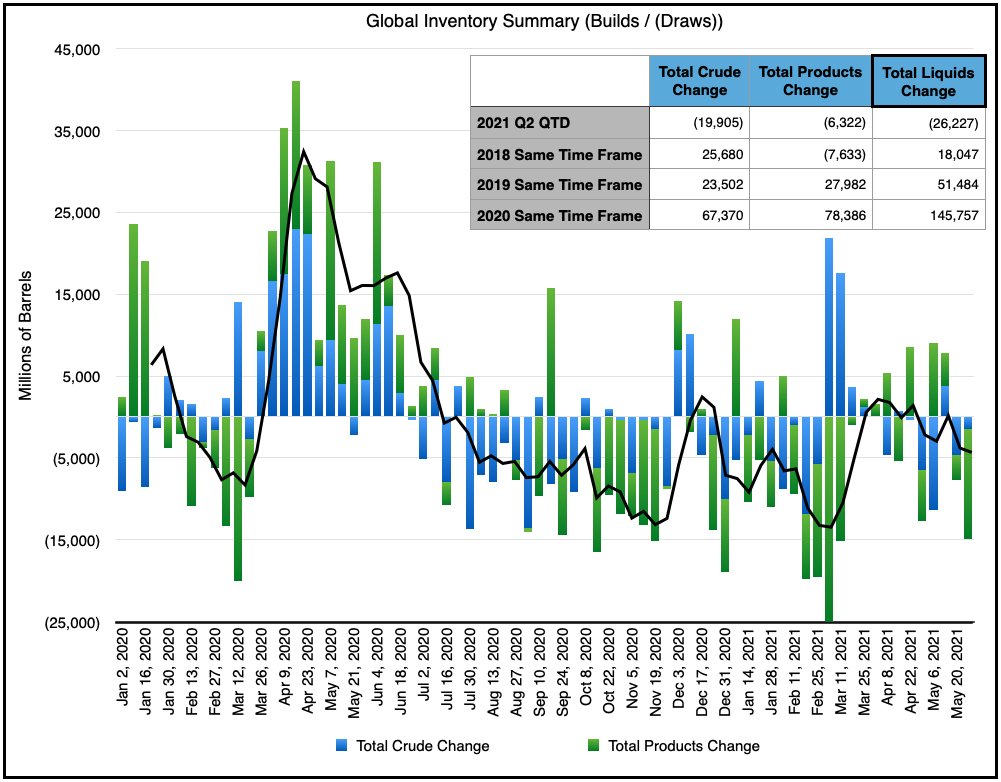

OIL INVENTORIES

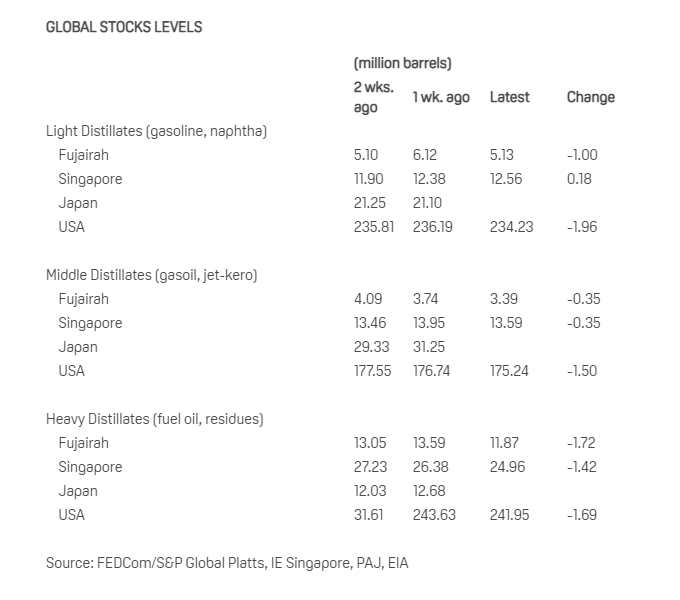

GLOBAL OIL INVENTORIES

Global oil inventories drew this wk by 14.8M barrels (1.4M crude & 13.4M products). For Q2 QTD we’re pulling significantly more crude, products pull similar to 2018 levels. Black line is 4 wk avg. Heading into summer now, when demand is at its peak

GLOBAL FLOATING STORAGE

Crude Oil in Floating Storage Falls 9.4% in Past Week: Vortexa

The amount of crude oil held around the world on tankers that have been stationary for at least 7 dayfell to 101.66m bbl as of May 21, Vortexa data show.

* That’s down 9.4% from 112.17m bbl on May 14

* Asia Pacific down 20% w/w to 67.49m bbl

* Europe up 24% w/w to 7.60m bbl

* Middle East down 2.8% w/w to 7.35m bbl

* West Africa up 16% w/w to 4.57m bbl

* U.S. Gulf Coast up 580% w/w to 3.43m bbl

* North Sea up 27% w/w to 2.55m bbl

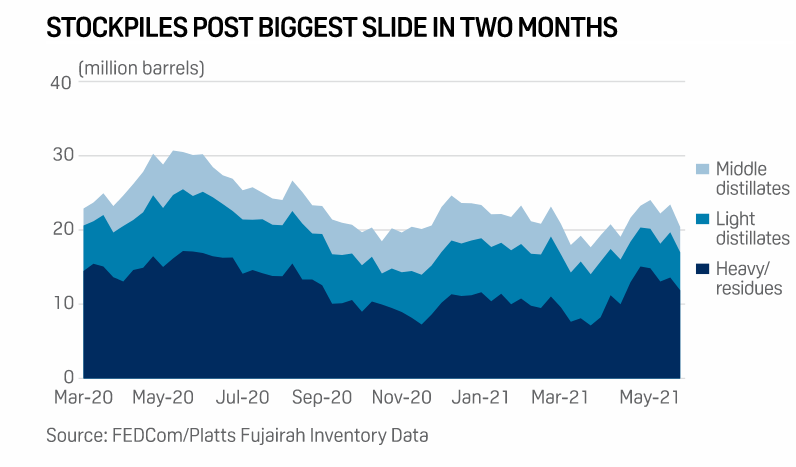

FUJAIRAH DATA

Oil product stocks drop to six-week low

The total inventory was 20.389 million barrels on May 24, down 13% from a week earlier and the lowest since April 12, according to Fujairah Oil Industry Zone (FOIZ) data shared exclusively with S&P Global Platts May 26. It was the biggest drop in percentage terms since early March while the actual decline of 3.056 million barrels was the biggest retreat since the end of 2019 when stockpiles stood at 18.568 million barrels.

Inventories of light distillates came to 5.127 million barrels on May 24, the lowest in two weeks, while heavy distillates stood at 11.869 million barrels, a six-week low, the FOIZ data showed. Middle distillates stood at 3.393 million barrels, a four-week low. -PLATTS

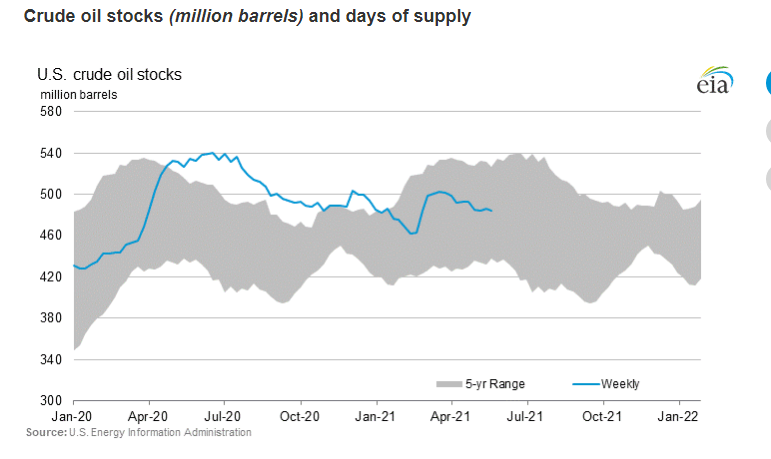

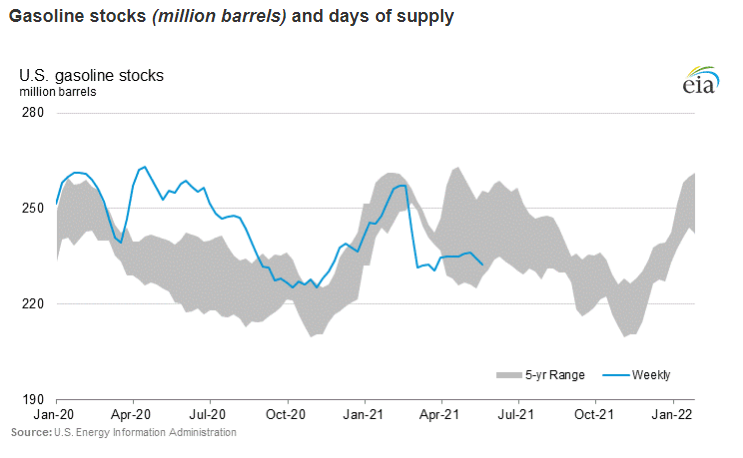

EIA

Another nice draw in crude stocks this week.

Healthy gasoline draw, especially for this time of year when we generally have builds as refiners gear up for summer driving demand.

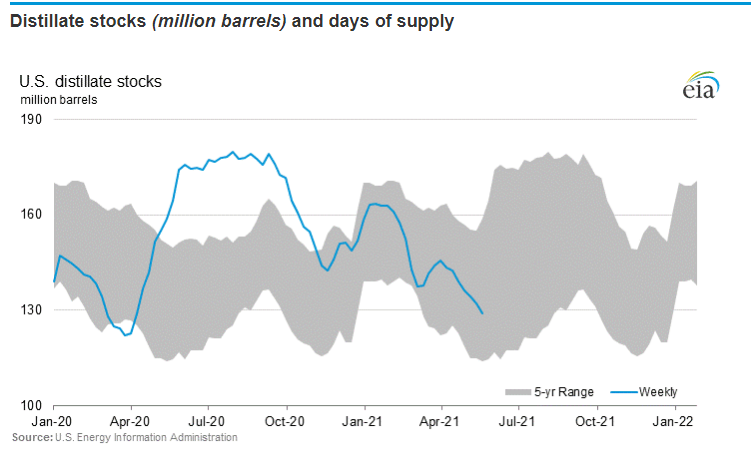

Huge distillate draw, butting us at the lower bounce of the 5 year average.

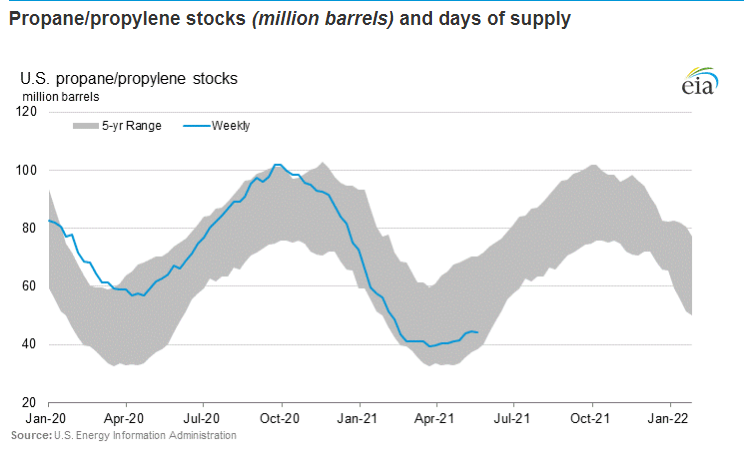

Slight propane draw this week, we should see some builds in the coming weeks, or we have a longer-term problem.

And that concludes this weeks report, lots of ideas! Stay safe and enjoy the holiday today!