New stocks mentioned: PBR, SQM, XME

BIG NEWS

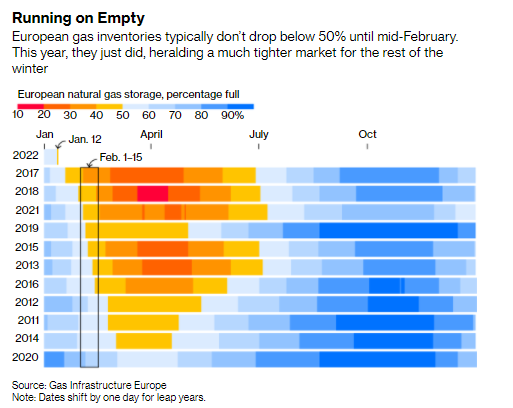

The European energy crisis continues, but I have covered that plenty. I will include some charts that pretty much cover it in the chart section this week.

GEOPOLITICAL RISK

TODAY: Three killed in UAE fuel truck blast, Yemen Houthis claim attack

Three fuel trucks exploded, killing three people, and a fire broke out near Abu Dhabi airport on Monday in what Yemen’s Iran-aligned Houthi group said was an attack deep inside the United Arab Emirates, the region’s commercial and tourism hub.

The UAE, a member of the coalition, has armed and trained local Yemeni forces that recently joined fighting against the Houthis in Yemen’s energy-producing Shabwa and Marib regions.

The Houthi movement has frequently launched cross-border missile and drone attacks on Saudi Arabia but has claimed few such attacks on the UAE, mostly denied by Emirati authorities.

Three people were killed and six wounded when three fuel tanker trucks exploded in the industrial Musaffah area near storage facilities of oil firm ADNOC, state news agency WAM said. It said those killed were two Indians and a Pakistani. -Reuters

NOTABLE: The UAE takes security EXTREMELY seriously. If confirmed, this Houthi drone strike on the UAE capital would take the war between the group and a Saudi-led coalition to a new level. Increased tensions in the area obviously would obviously keep a bid under oil.

CHARTS OF INTEREST THIS WEEK

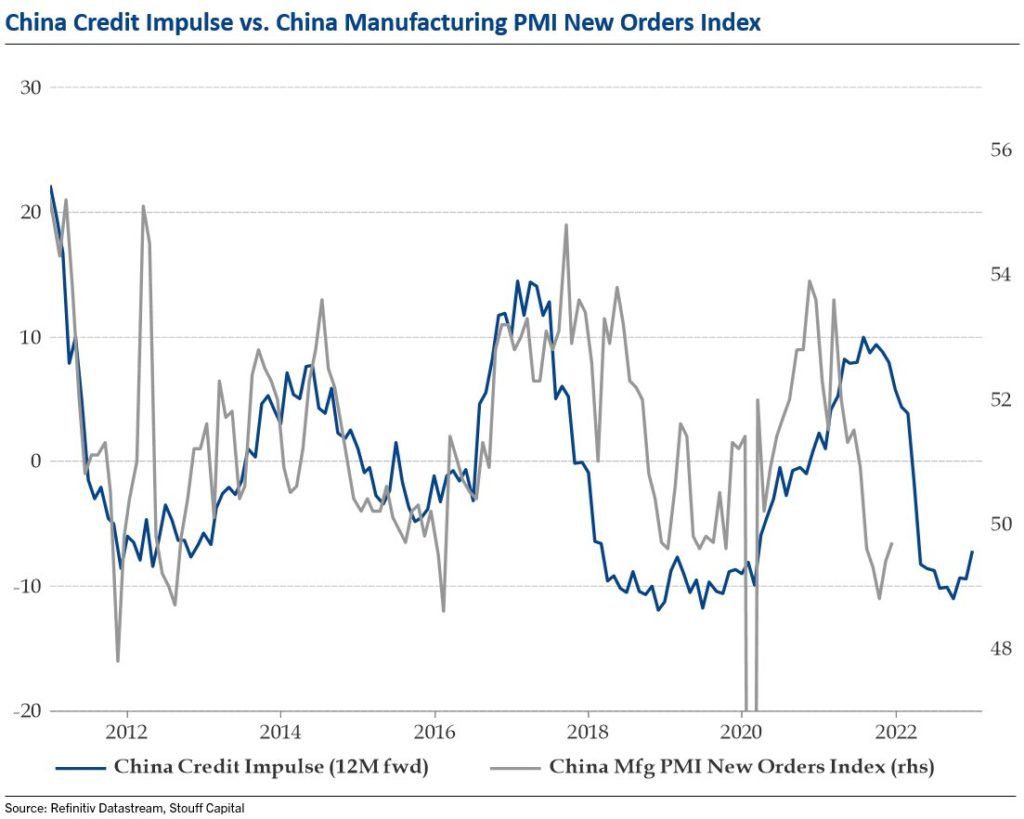

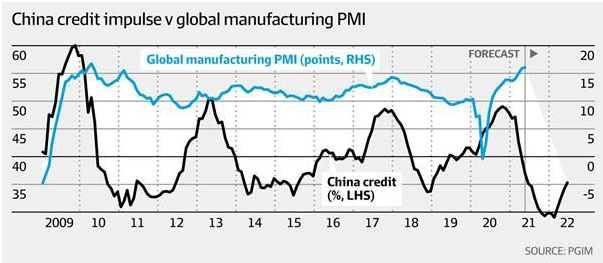

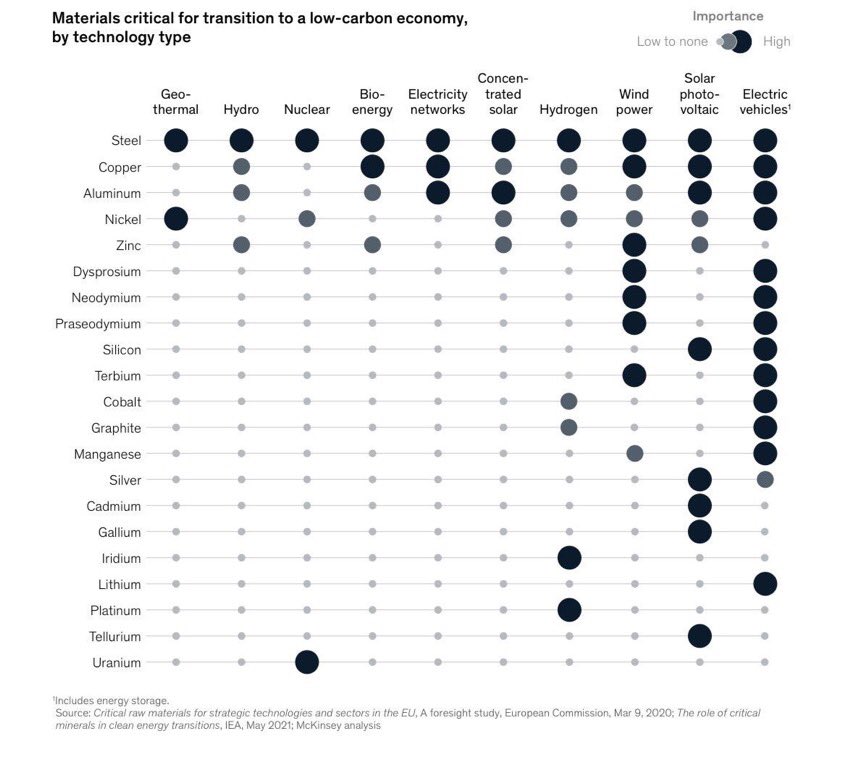

China’s credit impulse is turning up. This bullish commodity, especially metals and energy

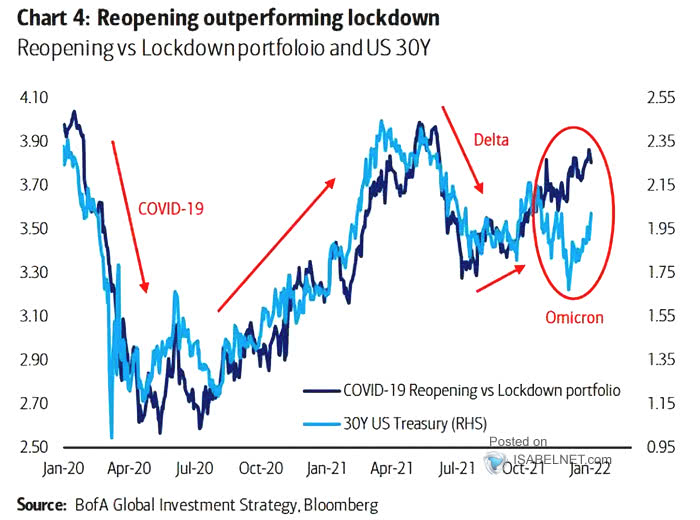

The COVID-19 “reopening portfolio” is outperforming the COVID-19 “lockdown portfolio”

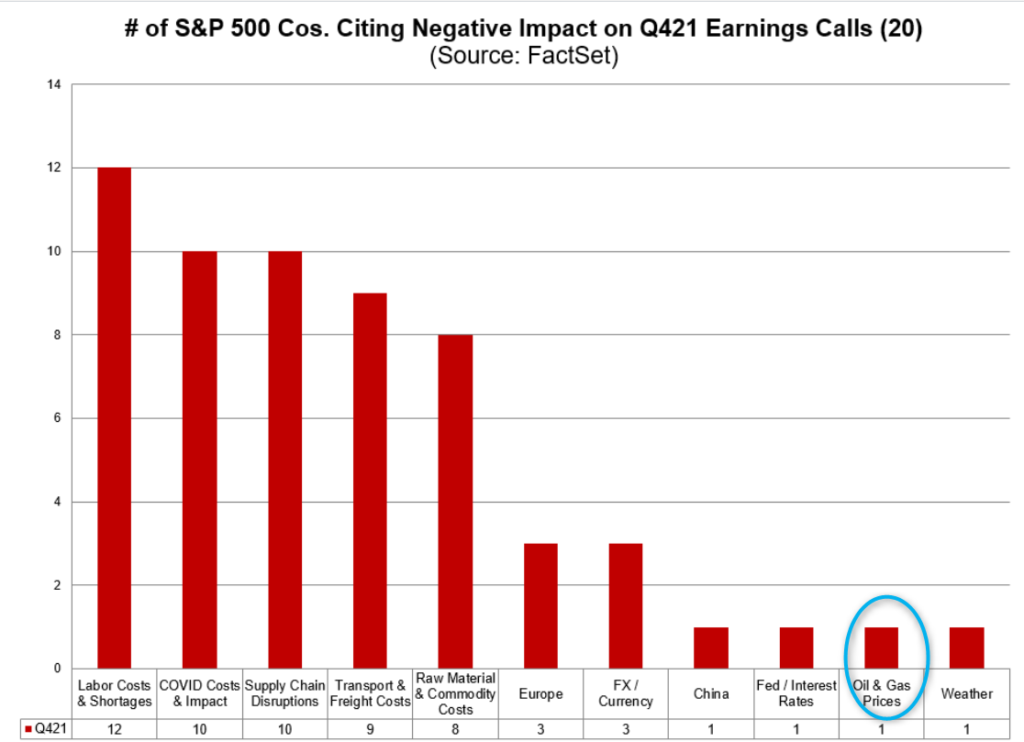

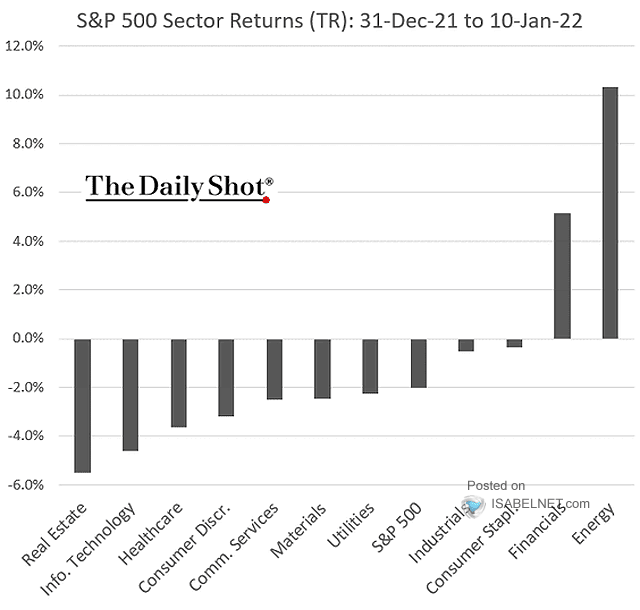

So far, energy prices are a low concern for companies according to Q4 earnings calls

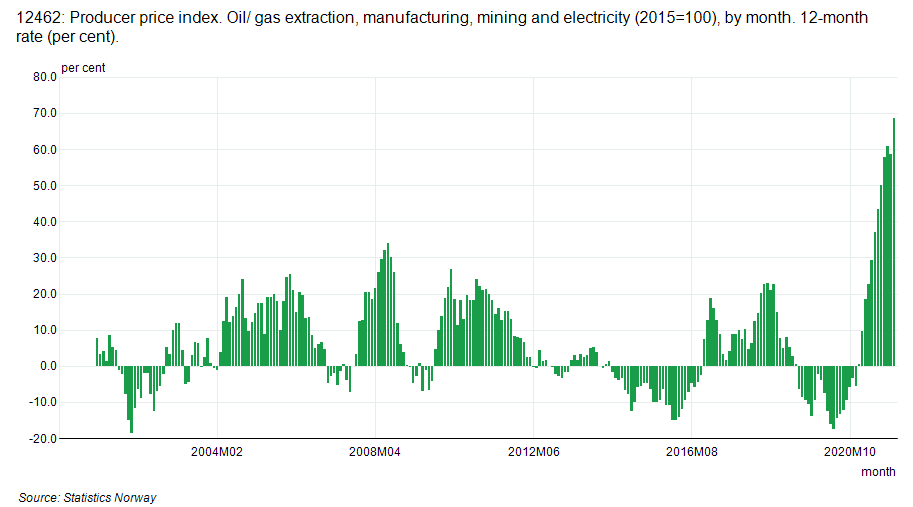

Norway Producer Prices were up 68.7 from a year ago! At these unprecedented levels of inflation, it doesn’t matter if they are transitory or not.

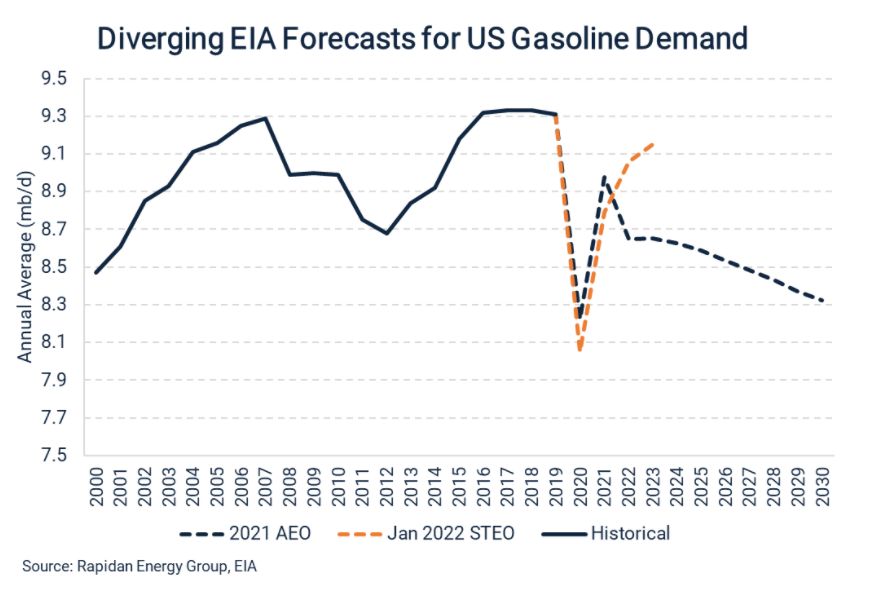

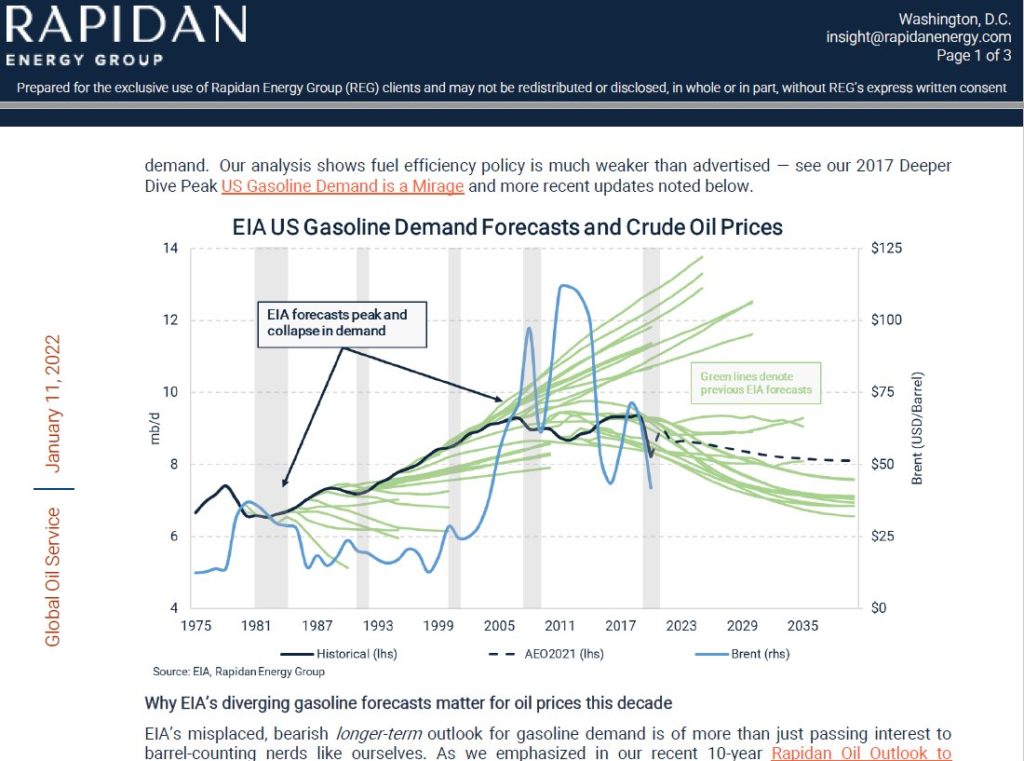

EIA STEO came out this week. Demand isn’t collapsing as they and others expected.

But back in the 1980s, the last time EIA prematurely predicted peak demand, a lot less capital bet on it. Climate is now a much bigger deal, but the consensus is way too rosy on transition speed -Bob McNally

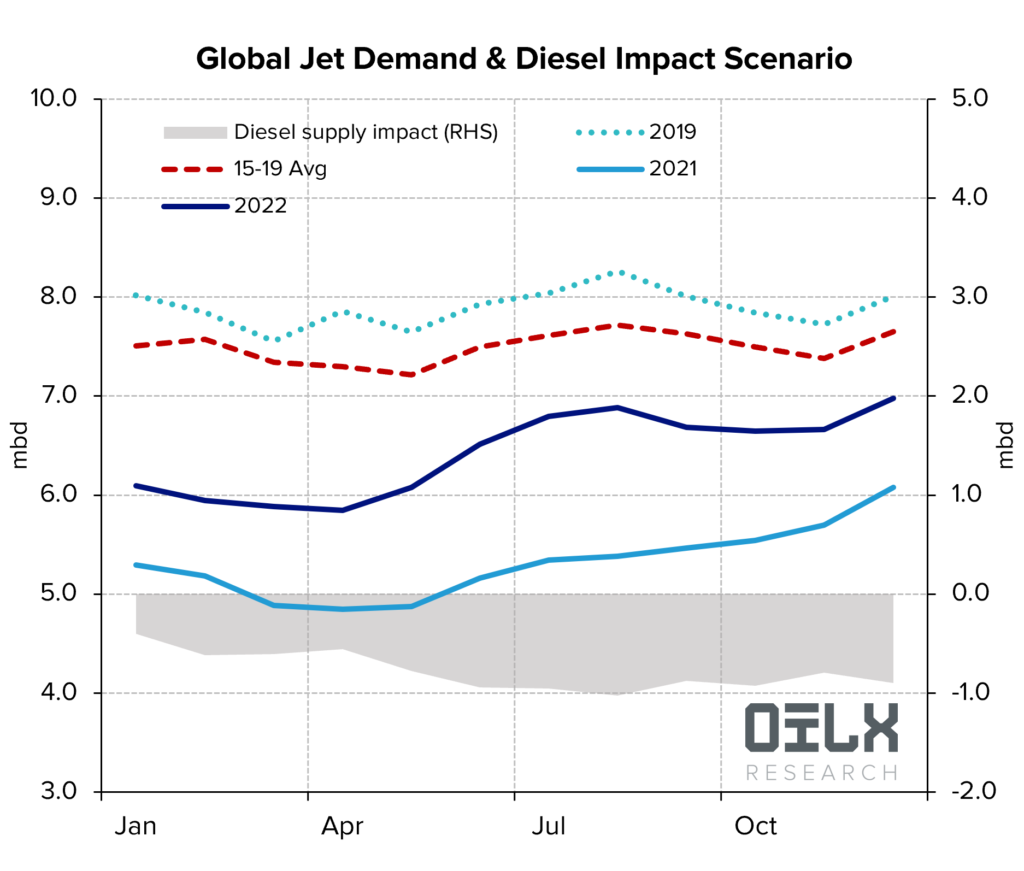

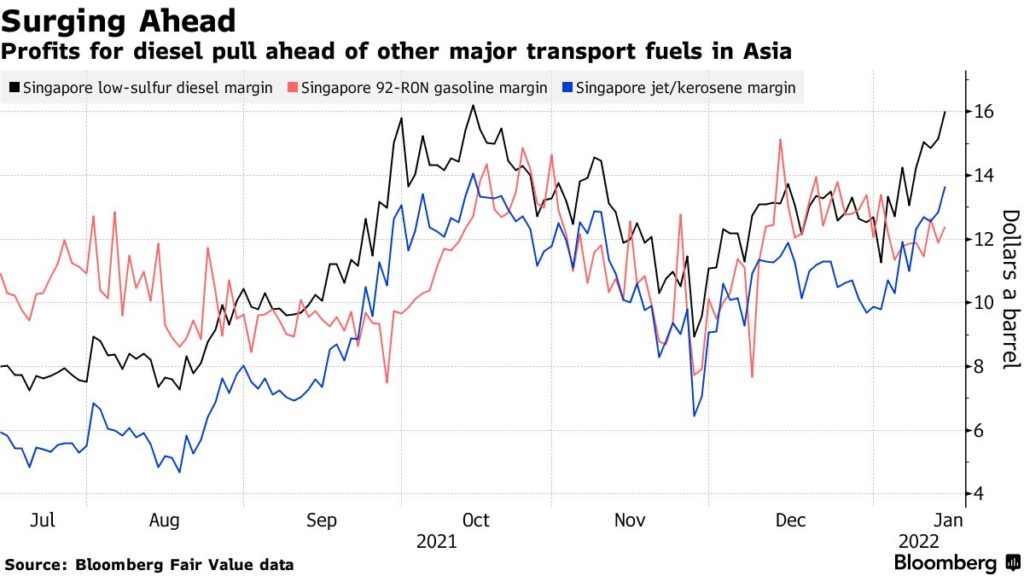

Jet cracks are gaining momentum amid improved expectations for the summer.

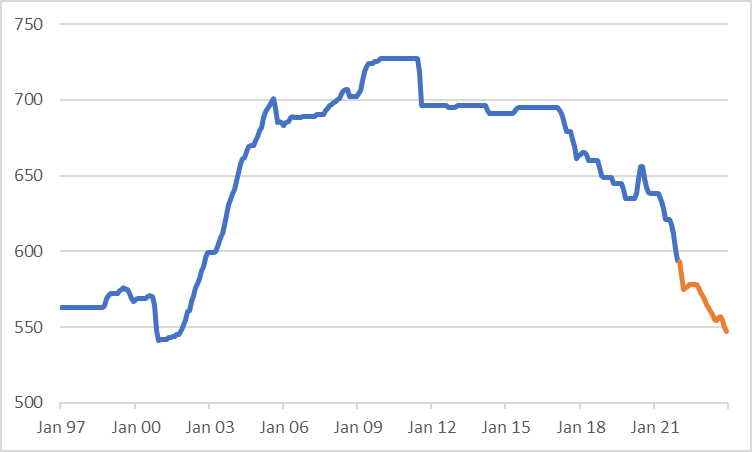

US SPR inventories (this is ungood) We need to stop using the SPR as a piggy bank as we may face a real crisis.

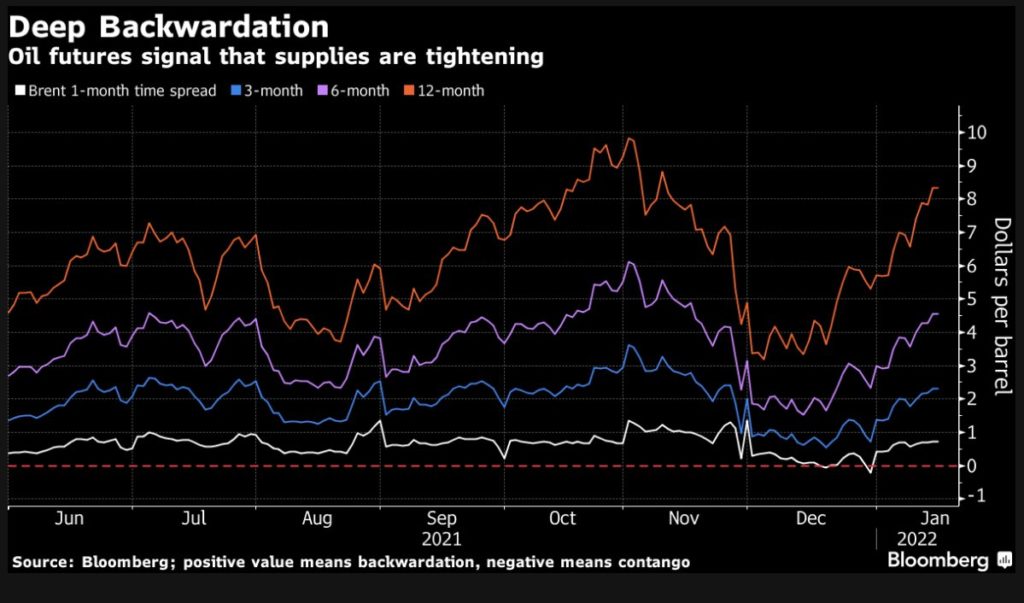

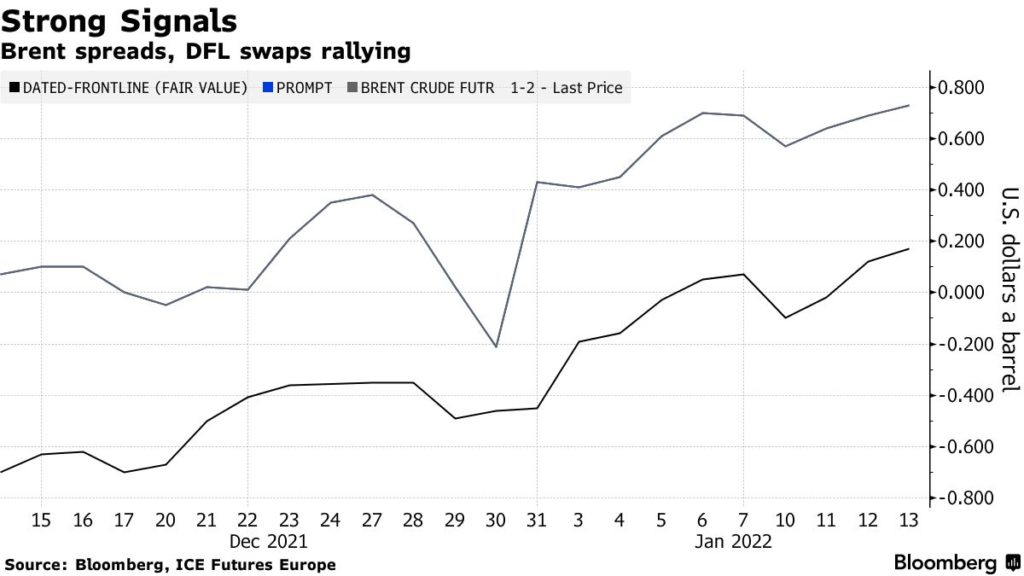

The Day-to-Day Market for Physical Oil Cargoes Is Booming

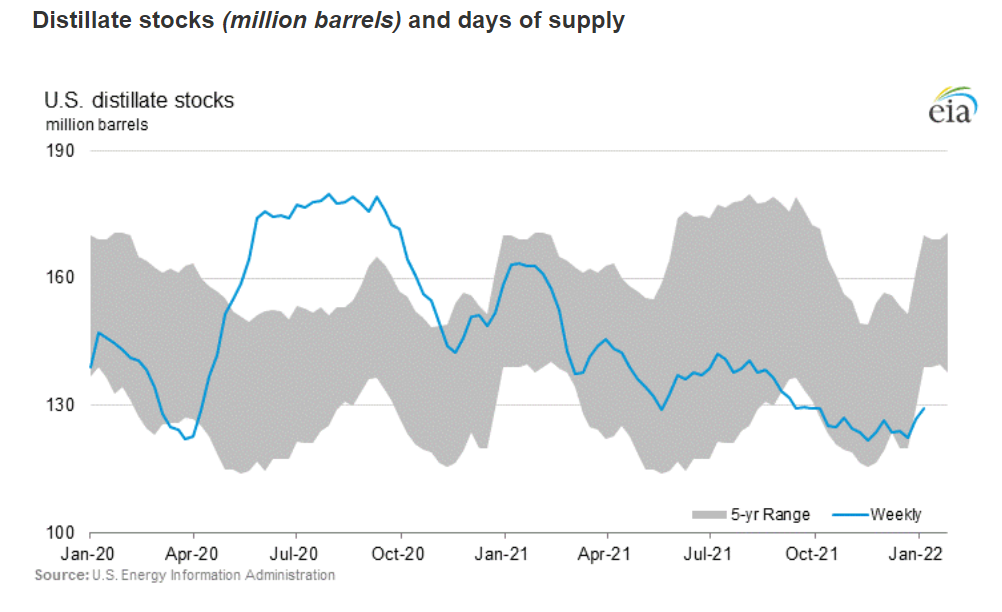

Diesel Markets Are Soaring All Over the World

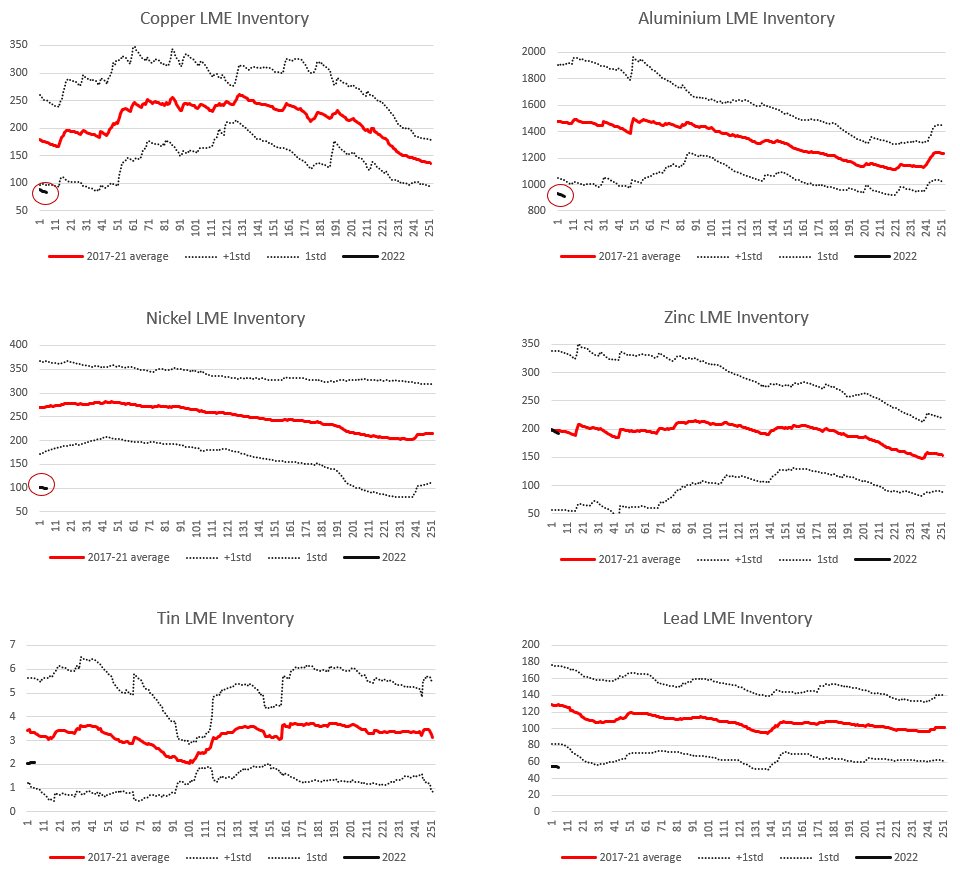

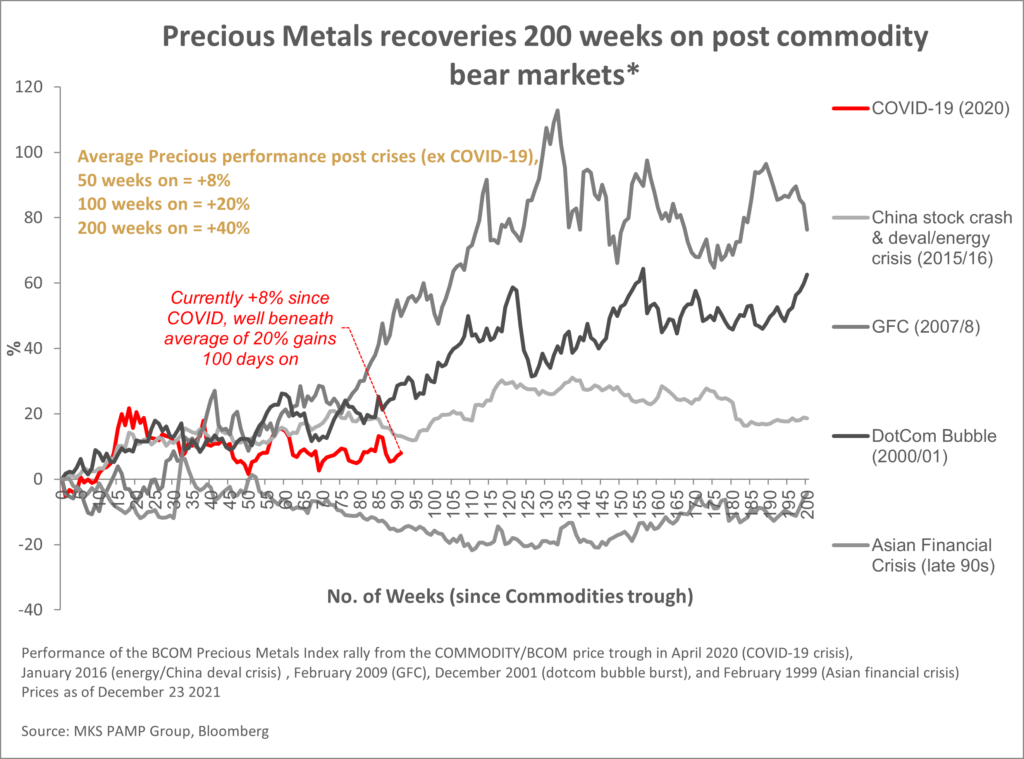

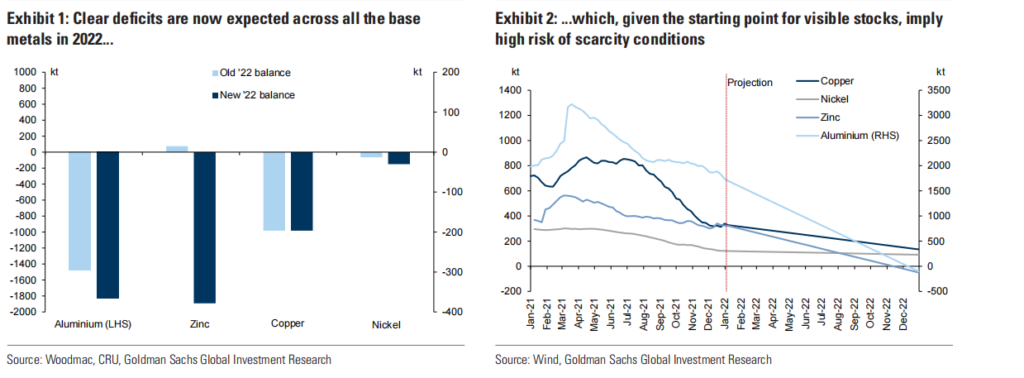

Metals inventories are LOW

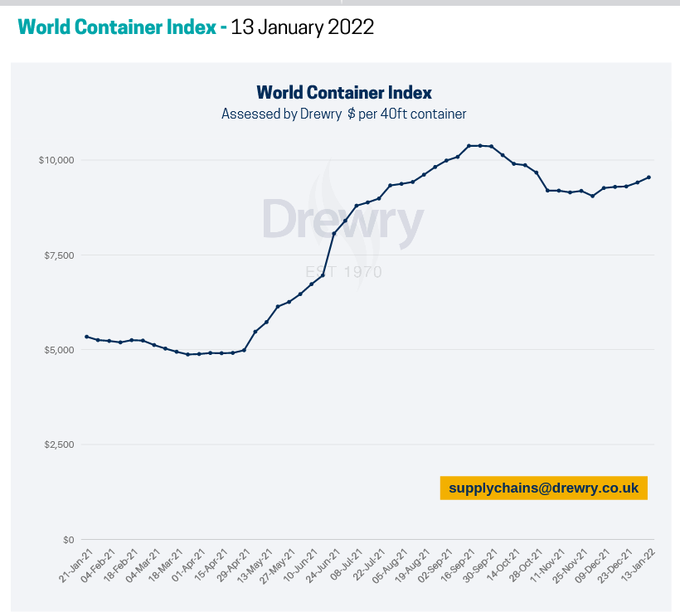

World Container Index increased 1.4% to $9,544.66 per 40ft container this week and remains 82% higher than a year ago

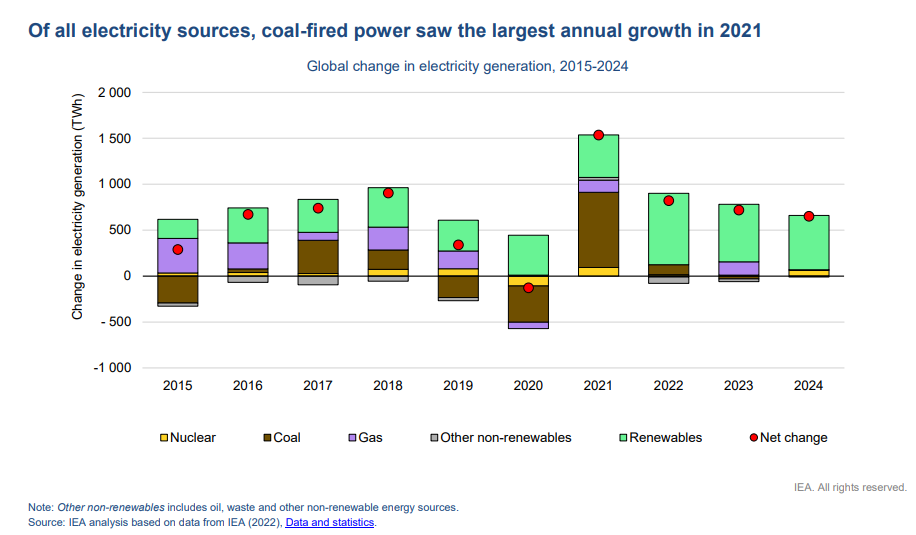

Of all electricity sources, coal-fired power saw the largest annual growth in 2021 (it must have killed IEA to admit this…their forecasts going forward seem completely unrealistic given the data for 2021) HERE IS A LINK TO ENTIRE REPORT (keep in mind IEA is a shill for the WEF now but there is some good stuff in there)

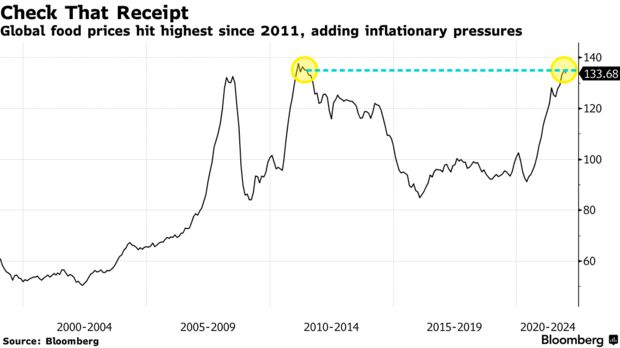

Food Prices Are Back to Where They Were in the 2011 Crop Crisis. I was running a trade desk in the summer of 2012 at the Chicago Board of Trade. The summer of 8 buck corn…just wait..I think the next few years will make that look like a walk in the daisies.

TECHNICALS

We are in VERY overbought territory and hitting a reject zone. I would like to see this pull back a bit to work off that overbought territory to propel us higher. I am not a fan of parabolic markets as they tend to take the elevator down. That said, long term I am super bullish on this market.

OIL AND NATURAL GAS

OPEC+

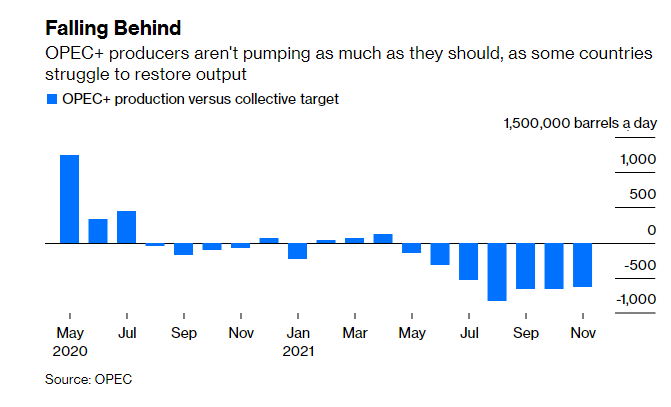

OPEC+ producers aren’t pumping as much as they should, as some countries struggle to restore output. there was another deficit in December.

That gap’s not going to close any time soon. In fact, the deficit won’t ever be recouped unless those in the group with spare capacity are allowed to make up the production shortfalls of those without. This seems unlikely. The deficit is only going to get bigger as the target continues to rise by 400,000 barrels a day each month, which the OPEC forecast assumes it will. That means that the supply won’t be anywhere near as big as feared, or hoped for, depending on your point of view. -Julian Lee

NOTABLE: 14 out of the 18 members with quotas fell short of their December targets. Platts Analytics expects sustainable spare production capacity will shrink to 800,000 b/d by June if it maintains its monthly quota rises, creating “an uncomfortably thin market buffer in the second half of the year.” Obviously, this is bullish unless we see a major slowdown in demand, which also does not seem likely as China just lowered rates for the first time in two years today to spark growth and China credit impulse is turning back up (see chart section)

UNITED STATES

Biden to ramp up regulatory push on climate

US president Joe Biden is setting out an aggressive regulatory agenda this year to reduce greenhouse gas emissions, as Democratic lawmakers remain deadlocked over how to enact ambitious climate policy through a major spending bill.

The highest-profile climate regulations will introduce limits on methane emissions from existing oil and gas facilities, an action that environmental agency EPA intends to finish by October. But the administration could have a trickier path as it attempts to propose a rule by this summer to limit greenhouse gas emissions from power plants. The US Supreme Court in 2016 halted EPA’s first attempt at power plant CO2 regulation, and the court on 28 February will hear a case brought by states and industry groups that want to permanently curtail EPA’s climate authority over power plants.

The White House as early as next month separately plans to reverse former US President Donald Trump’s decision to water down enforcement of a 1970 law to eliminate consideration of climate change when the government studies how its actions could affect the environment. US public land regulator BLM also plans to propose and finalize broad changes to how it collects royalties and limits flaring on oil and gas producers located on federal land.-ARGUS

NOTABLE: This is literally going to have the opposite effect that Biden is looking for to reduce energy costs. These measures will drive energy prices even higher. GREENFLATION IS REAL!

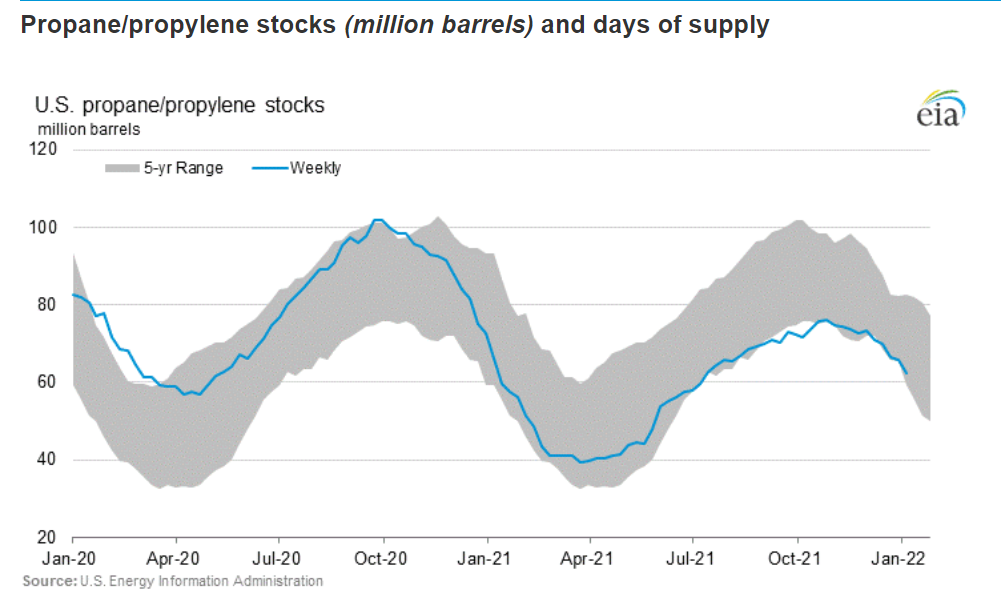

NEW ENGLAND

U.S. power prices in New England for Tuesday jumped to their highest since January 2018 as homes and businesses cranked up their heaters to escape the region’s coldest day of the winter.

Next-day power prices jumped to $186 per megawatt-hour (MWh), their highest since January 2018.

That compares with $50.89 per MWh in 2021 and a five-year (2016-2020) average of $37.05.

Spot gas prices were also much higher than normal at $20.50 per million British thermal units (mmBtu)

New England does not have enough gas pipeline capacity to supply all the fuel needed for both heat and power generation on the coldest days, so many gas-fired plants switch to more expensive oil and liquefied natural gas (LNG) when temperatures drop. -Reuters

NOTABLE: I keep saying North America will not be immune to the energy crisis in Europe. Here is a prime example. New England has fought natural gas for years and has refused to expand pipeline capacity. Here we are.

KAZAKSTAN

Kazakhstan’s daily oil and gas condensate production fell 6% in early January from December levels, according to two industry sources and Reuters calculations, as mass anti-government protests rocked the country.

Output from Kazakh oil fields fell to 1.766 million barrels per day (bpd) in the first nine days of the month from an average 1.882 million bpd in December, calculations showed and the sources said, citing preliminary daily output data – Reuters

NOTABLE: Kazakstan is part of the “plus” group in OPEC+. This group continues to be plagued with output problems

CANADA

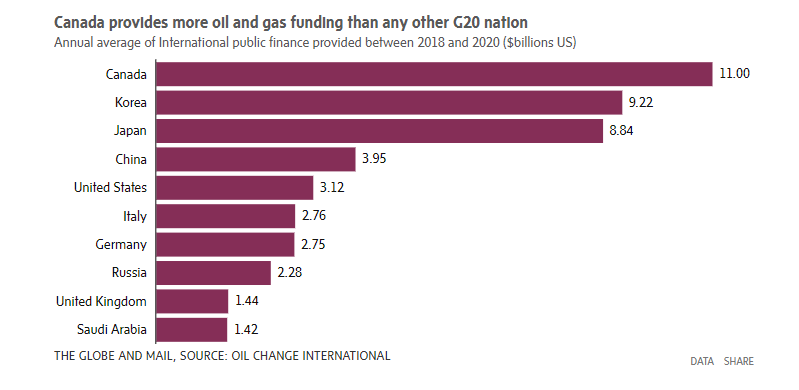

Canada has committed to halt financing to the oil and gas industry

Trudeau’s mandate letter to new Environment Minister Steven Guilbeault ordered him to “develop a plan to phase out public financing to the fossil fuel sector, including by federal Crown corporations.”

Canada is the world’s fourth-largest oil producer and exporter.

In Glasgow, Canada declared it would “end new direct public support for the international unabated fossil fuel sector by the end of 2022.” The term “international” is key. In a statement, EDC said it provided about $800-million in direct financing to international companies and projects in 2020. That’s a fraction of its overall oil and gas support. -Globe and Mail

NOTABLE: Again, starving the oil and gas industry, while renewable technology is not yet viable to provide baseload energy, is just an incredibly short-sighted and ill-thought out policy. Unfortunately, we the consumers will have to pay the price with our wallets. It is policies like this that are driving the energy crisis in Europe and North America will not be immune. Look for continued oil and gas prices well into 2025.

UGANDA

Uganda: Gen Saleh – Are Local Firms Ready for Uganda’s Oil Boom

According to Uganda National Oil Company’s Commercial Specialist, Edith Tushabe Atuhurira, for every US$ 1 invested in the petroleum industry, there is a trickle-down of US$ 9 into other sectors of the economy. She, therefore, called upon Ugandans and Ugandan companies to prepare accordingly and ensure to benefit from the ongoing investments in the petroleum industry and the trickle-down that comes along with it.

Makerere Vice Chancellor Prof Barnabas Nawangwe applauded the industry for making huge strides in 2021 and noted that the next phase of the industry will provide the academia, government, and private sector with international industry exposure and a good avenue to learn new things.-AllAfrica

NOTABLE: South America and Africa will be places to continue to watch for growth in this arena. While Europe and North America, continue to shoot themselves in the foot. EM economies need to “catch up,” I think these areas are ripe for opportunity.

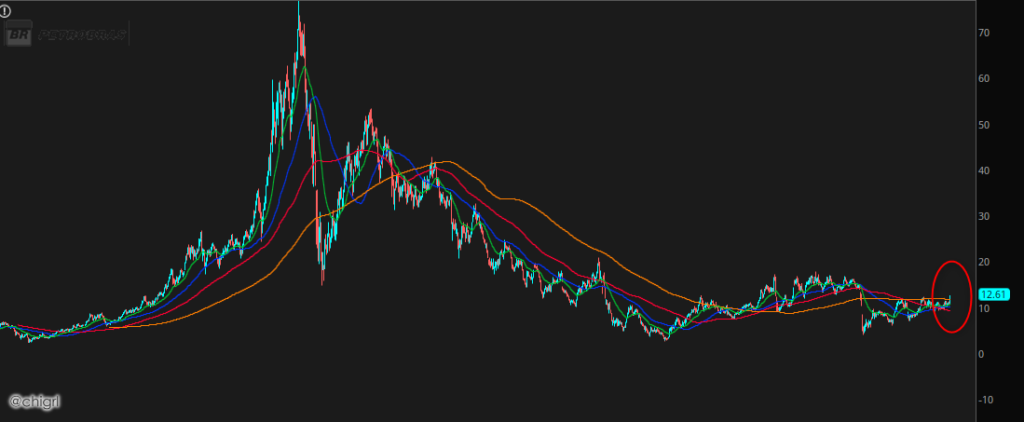

TRADE IDEA: Petróleo Brasileiro S.A. – Petrobras (PBR) is just starting to break over the 200 day

I like this long with a stop under 9.47

GERMANY

Germany to Triple Speed of Emissions Cuts After Missed Targets

“We are making every effort to make up for the lag,” Habeck said in a statement. “To do this, we have to triple the speed of our emissions reduction and do significantly more in less time.”

With nuclear off the table, Germany has little choice but to expand the use of gas-fired power plants to meet the demand for its manufacturing sector and for an expansion of electric cars. In the short term, an ongoing energy crunch could boost demand for coal, which isn’t due to be phased out until 2030 at the earliest.-BBG

NOTABLE: Meanwhile they have had to increase their coal and gas usage just to keep the lights on. These people can not get out of their own way. Expect this crisis to continue for years.

**Under the radar this past week, there was a blackout in Berlin affecting 370,000 households and this included not only power but hot water as well. (expect more of this)

MICROSOFT

Microsoft Invests $50 Million in Alcohol-to-Jet Fuel Biorefinery

NOTABLE: I mentioned biodiesel many times last year. I still think this is a place to be. Valero (VLO) and Marathon Petroleum Corp (MPC) continue to be my top 2 picks for this.

CHINA

China agrees with U.S. to release oil reserves near Lunar New Year

China will release crude oil from its national strategic stockpiles around the Lunar New Year holidays that start on Feb. 1 as part of a plan coordinated by the United States with other major consumers to reduce global prices, sources told Reuters

NOTABLE: their last release was 629K barrels. Given that most of the country’s production shuts down during Chinese New Year, this is a non-event. They still need to keep the country going.

CANADA

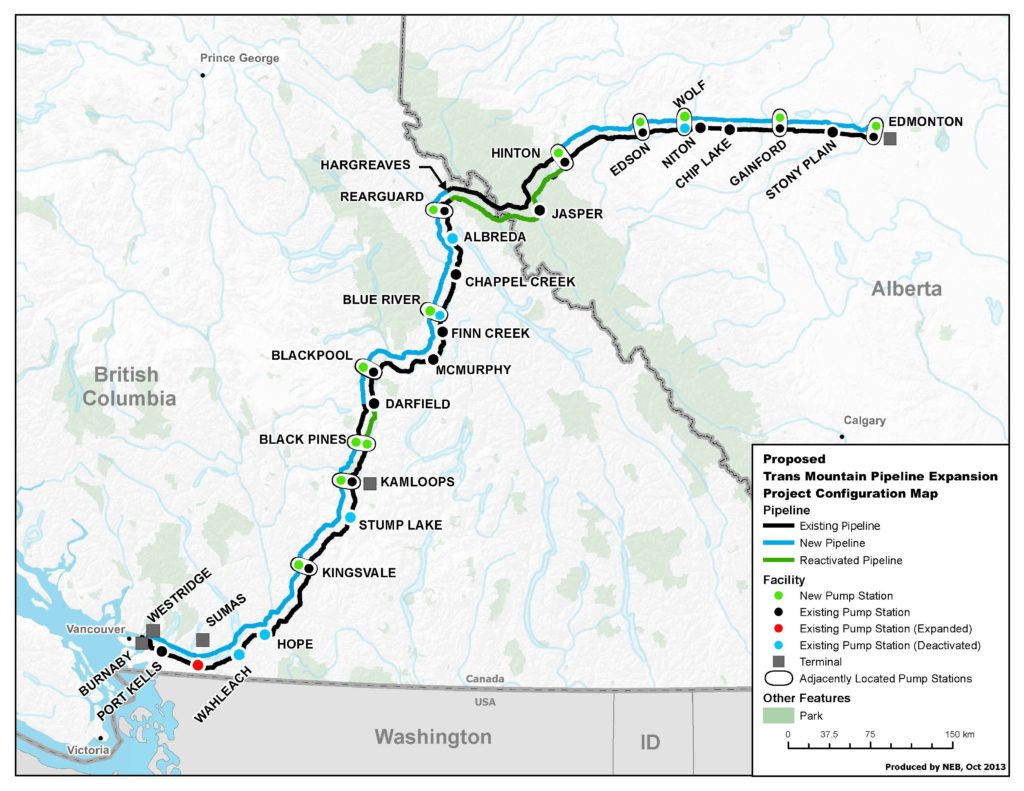

Good news for Canada…Trans Mountain oil pipeline returns to normal operating pressure

The Trans Mountain pipeline returned to normal operating pressure on Saturday, it said in a statement, after functioning at reduced pressure for over a month.

The Canadian government-owned oil pipeline, which ships 300,000 barrels a day of crude oil and refined products from Alberta to the Pacific Coast, was operating at a reduced capacity since Dec. 5 and was closed for 21 days prior to that after November’s record-breaking rainstorm in British Columbia.

Trans Mountain is a key oil export route and nearly two-thirds of its volumes in the first half of 2021 were light oil deliveries heading to U.S. refineries, said IHS Market Vice President Kevin Birn, citing Canada Energy Regulator data.-CTV

NOTABLE: TransMountain brings oil from Alberta to the coast. This means access to a port and increase volumes to Asia. Bullish Canadian oil sands. CVE and CNQ still remain the top picks.

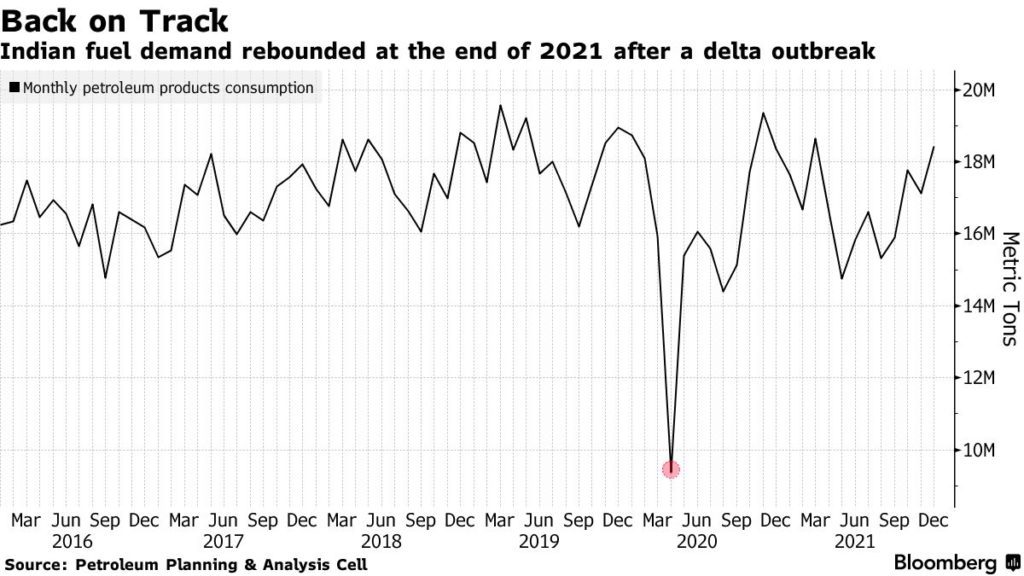

BLOOMBERG OIL DEMAND MONITOR

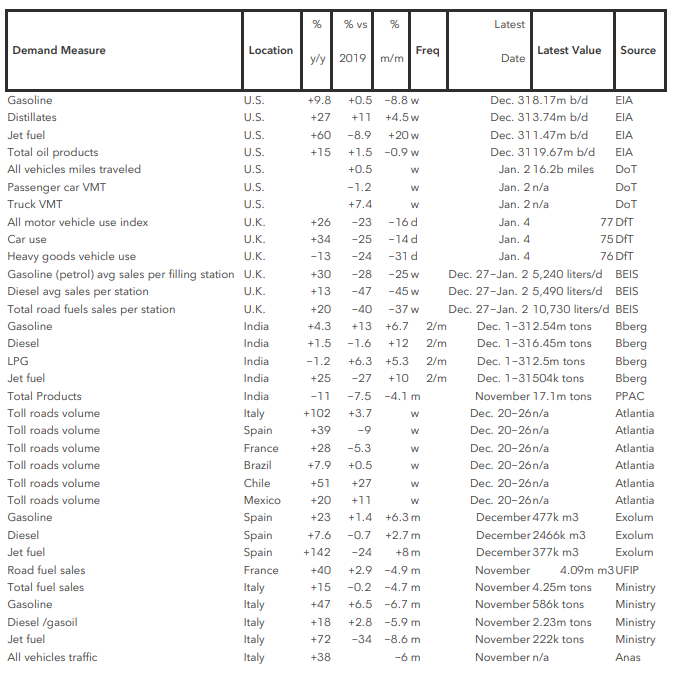

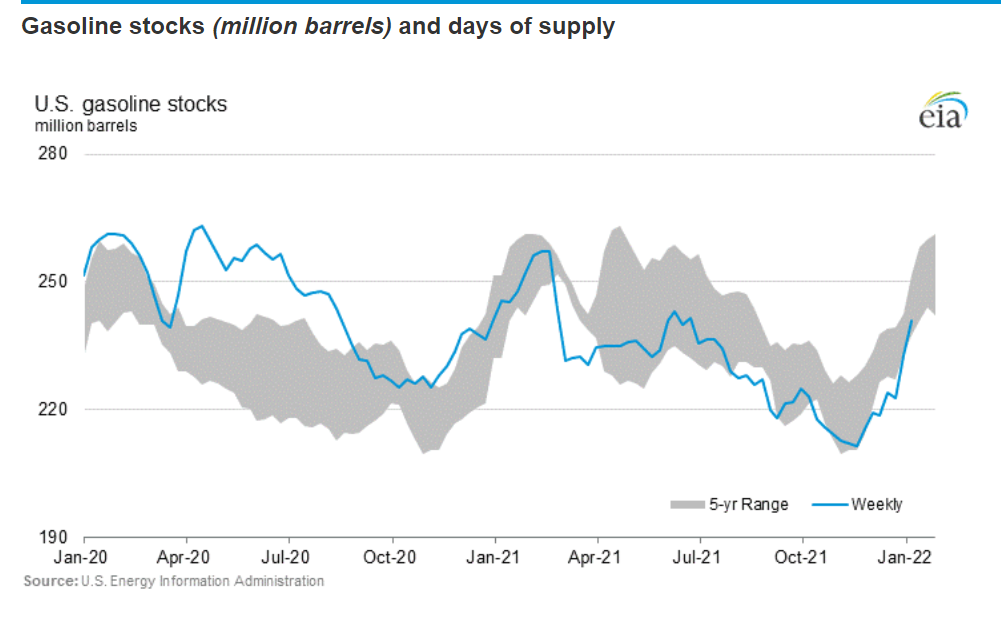

Gasoline Sales Resilient to Omicron

Gasoline sales largely remained resilient over the past month in countries including India, the U.S.

and Spain and city traffic is growing again around the world after holidays that have made it hard to tell whether the omicron variant of coronavirus is impeding demand for oil-based fuels.

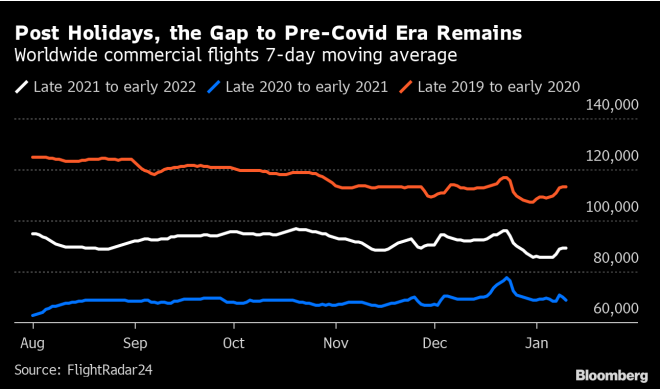

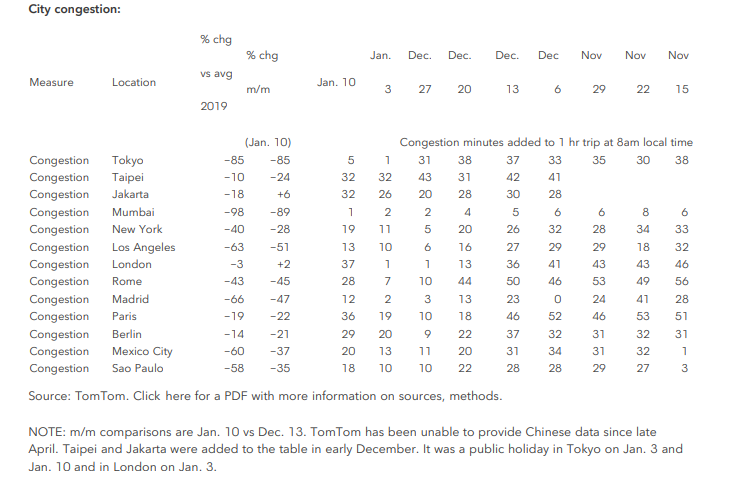

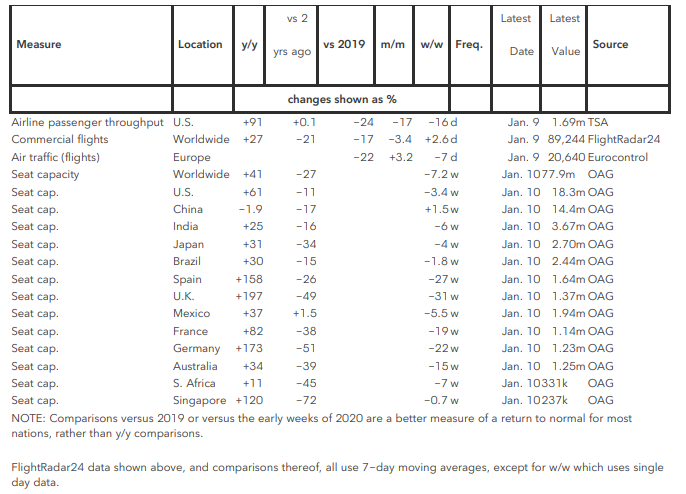

Flight data, which is more easily monitored day to day, shows that despite the usual year-end dip, there hasn’t yet been overly dramatic fall-off inactivity. Worldwide commercial flights over the seven days ended Jan. 9 were about 17% and 21% below the same periods of 2019 and 2020, respectively, according to FlightRadar24, which is very similar to percentages seen during the past three months.

With the holiday season over, inner-city road traffic picked up during the past week in most locations, particularly in

Europe, though congestion is still lower than early-December readings, data from TomTom NV showed. And all world cities regularly tracked in this monitor showed congestion levels at 8 a.m. on Monday morning that were lower than typical levels seen in 2019. The closest was London, which trailed the pre-pandemic average by 3%. New York was 40% down.

Coronavirus case numbers are surging around the globe as the easy-transmissible omicron variant spreads, with records reached in the past few days in New York, the Philippines, Australia and parts of Japan. Some locations are further along that timeline than others, and London “may well be past the peak” of its omicron wave, Kevin Fenton, the city’s regional director for public health, said on Sunday.

While road congestion information is updated daily, actual sales data take longer to be published. The latest numbers for the U.K. are for the week ended Jan. 2, showing total road fuel sales 40% below the pre-lockdown baseline of the first week of February 2020. While those sales numbers appear weak, the period straddles the New Year holiday so isn’t a good indicator of how omicron is affecting driving habits.

A broader nationwide measure of traffic in the U.S. — vehicle miles on interstate highways in the week ended Jan.2 — was 0.5% above the same week of 2019. That reading, which includes cars and trucks, was a little different from the prior week when it was 1% above.

Resilient demand and stubbornly high oil prices appear to be justifying, at least for now, the OPEC+ oil producer alliance’s decision last week to press ahead with planned production increases, adding another 400,000 barrels a day in February

Gasoline demand has generally been trending a few percentage points above 2019 levels in many major consuming countries. That’s true for monthly November data in Italy, Portugal and Brazil and also for Spain and India, where more timely December data is available. The U.S. provides an estimate each week, with the latest reading for the week ended Dec. 31 some 0.5% higher than the pre-pandemic year.

Among those same countries, estimates of distillate or diesel consumption are also higher than 2019 in the U.S., Italy, and Brazil and are slightly below in India, Spain, and Portugal.

Jet fuel demand remains lower than the pre-pandemic levels in all of the countries previously mentioned, as travel restrictions continue to hobble airlines, though the margin varies considerably. The latest weekly estimate from the Energy Information Administration shows a deficit of just 8.9% in the U.S. while December estimates for India and Spain show consumption down by about 25% versus two years earlier.

Airline Seat Capacity Reductions

The most recent data may nevertheless be troubling for airlines. The number of seats offered by airlines for the week starting Jan. 10 fell in almost all major markets except China, when compared with figures for the week starting Jan. 3, according to OAG Aviation. The number of seats has also been revised down for the full month and later this quarter.

“This week has seen a considerable adjustment in January capacity with 8.7 million seats taken out in the last week for the full month, a reduction of 2.4%,” OAG said in a note. “Capacity has also been reduced through February and March, with a further 8.3m seats removed over these two months.”

Much of the most recent capacity reduction is in Europe, where omicron is affecting international travel, OAG said. Heathrow Airport Ltd., which operates the U.K.’s biggest airport, said there’s still significant doubt over the speed at which demand will recover

“At least 600,000 passengers canceled travel plans from Heathrow in December due to omicron and the uncertainty caused by swiftly imposed government travel restrictions,” the company said Tuesday.

MATERIALS

LITHIUM

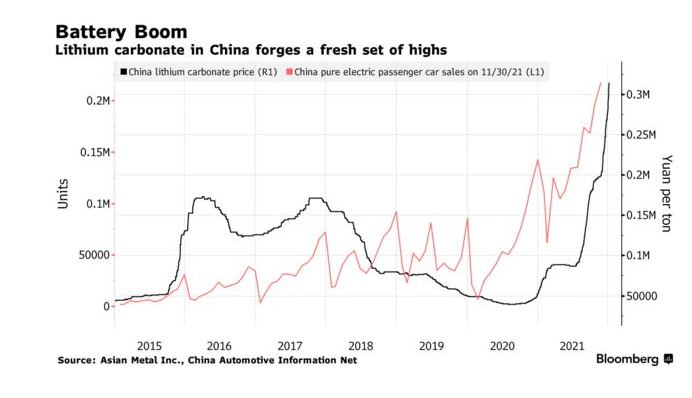

Supply Squeeze Risks Are Pushing Lithium Higher and Higher

Lithium has burst into 2022 with a fresh price spike that hands electric-vehicle makers more warning of even sharper cost pressures to come.

Supplies of the mainstay battery material face a series of near-term risks that threaten deeper shortages just as demand accelerates with rising global EV adoption. An already-tight market is being roiled by everything from plant maintenance and Winter Olympics curbs in China, to pandemic-related labor shortages in Australia.

That’s set to ratchet up the squeeze on EV manufacturers after a year that saw global lithium prices almost quadruple. Lithium carbonate in China is up 13% already this year at a new record, adding to a gain of more than 400% in 2021.

“The lithium market is extremely tight at present, so spot prices are very sensitive to any supply disruptions,“ Alice Yu, an analyst at S&P Global Market Intelligence, wrote in an email.-BBG

NOTABLE: last week I posted a long idea for Piedmont Lithium Inc. (PLL) I maintain that call.

Sociedad Quimica y Minera de Chile (SQM) is also another option. I like this one as Chile has pushed ahead to issue more contracts for mining.

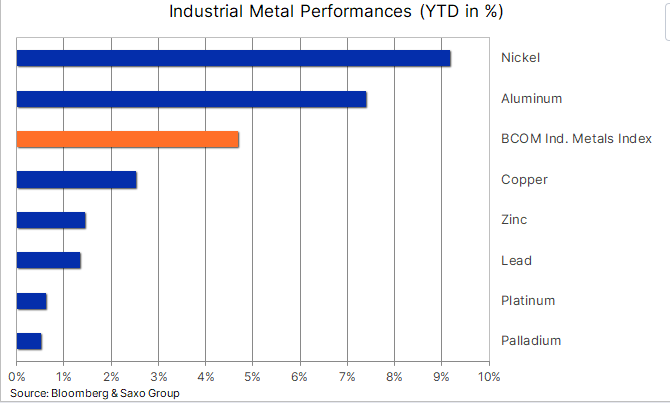

INDUSTRIAL METALS

The industrial metal sector has, just like crude oil, started 2022 with strong gains led by nickel and aluminum, and following months of sideways trading, copper is now also breaking higher. The prospects for rising electrical vehicle demand, tight supplies and signs China is stepping up its policy response to a slowing economy have all helped reduce some of the macro risks that have weighed on the market in recent months, especially those stemming from China’s beleaguered property sector.

While the decarbonization of the world remains a key long-term driver for industrial metals demand and with that the risk of even higher prices, the short-term focus remains squarely on China where decades of high growth has paused with some economists seeing growth falling below 5% in 2022. Chinese authorities are widely believed to have set their sights on a growth rate of at least five percent for this year, and the policy response to ensure that is now underway. Not least considering how economic and social stability is very important to the Communist Party in the run-up to its 20th National Congress, 2022, a key party meeting held every five years and due sometime during the second half.

China’s cabinet has already signaled a desire to speed up the pace of 102 major projects outlined in its 2021-25 development plan. Many of the areas pinpointed will require industrial metals in some sort as they focus on energy security, affordable housing, infrastructure developments, and logistics.

All developments that are likely to drive increasingly tight market conditions across the sector, not least nickel which has reached a decade high as demand from battery producers, due to strong EV trends, has put the spotlight on a tightening supply outlook. Despite months of worrying about the Chinese property market, copper stocks have remained low and as a result, exposed to a pickup in demand. -SAXO

NOTABLE: SPDR S&P Metals and Mining ETF (XME) is an excellent way to play this, just as a broad basket of metals and mining stocks.

XME has been consolidating here for a while…if we can break above $49 it could fly

CARBON CREDITS

France

The problems encountered on the N4s and on the Penly 1 reactor have led EDF to revise its nuclear production downwards by 30 TWH for 2022.

(EDF is France’s largest nuclear provider)

NOTABLE: 30TWh of lost 2022 nuclear output will now have to be produced from lignite/coal/gas. That’s an extra 20-25Mt of carbon emissions that nobody had in their EU-ETS model, or an extra 2% emissions for the EU-ETS as a whole this year. This is yet another reason to be bullish on carbon credits. I still love long EUA futures and/or KRBN.

*Another option is KEUA (that said liquidity is a problem so keep that in mind if you choose this option)

COPPER

“We need enormous sustained growth in copper and nickel.” — Robert Friedland

FUN FACTS

Price increases over last year (CPI report)

Gasoline: +49.6%

Used Cars: +37.3%

Gas Utilities: +24.1%

Meats/Fish/Eggs: +12.5%

New Cars: +11.8%

Overall CPI: +7%

Food at home: +6.5%

Electricity: +6.3%

Food away from home: +6.0%

Apparel: +5.8%

Transportation: +4.2%

Shelter: +4.1%

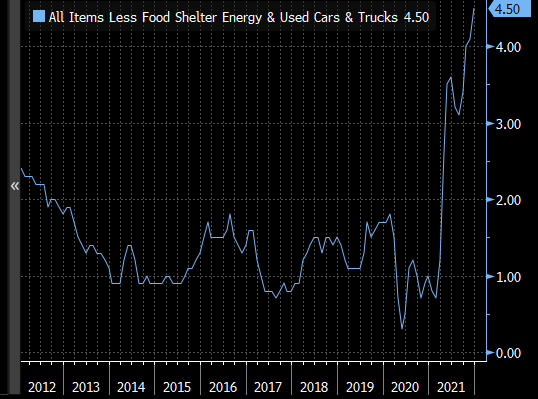

Last year the BLS started publishing CPI excluding Food, Shelter, Fuel & Used Cars. The idea was to exclude the main transitory effects. Unfortunately, CPI Excluding Everything You Want To Exclude, is still rising, to 4.5%-John Authers

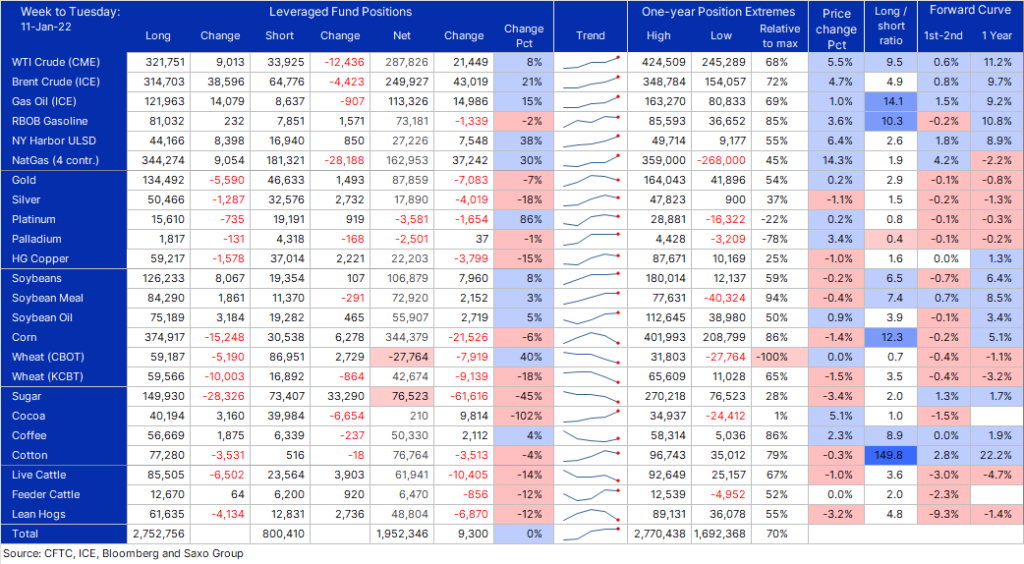

COMMITTMENT OF TRADERS

COT on commodities in week to Jan 11 (remember this is lagging data) saw buying of energy led by crude oil and natgas as well as soybeans. With a few exceptions all over contracts saw net selling led by sugar, corn, cattle, and gold. The nominal exposure rose $4 bn to $129 bn. -SAXO

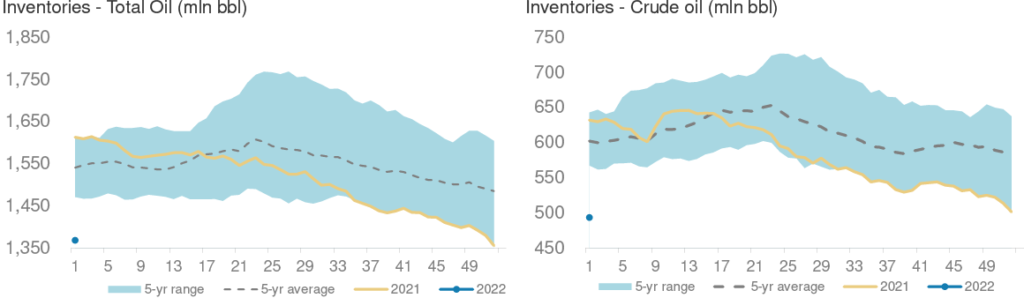

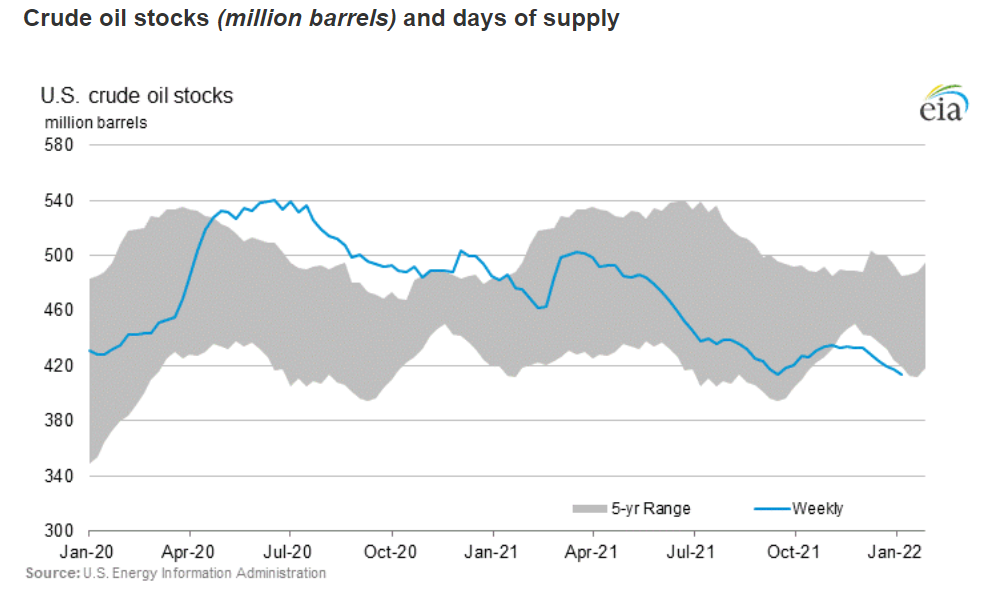

OIL INVENTORIES

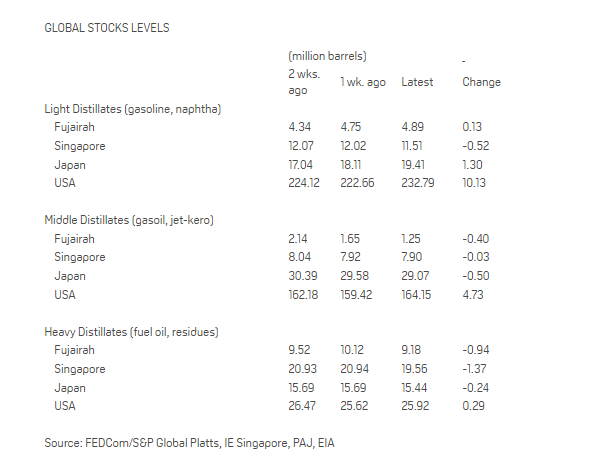

GLOBAL OIL INVENTORIES

Global oil inventories drew by 0.8 mln bbls last week

GLOBAL FLOATING STORAGE

Crude Oil in Floating Storage Falls 18% in Past Week: Vortexa

The amount of crude oil held around the

world on tankers that have been stationary for at least 7 days

fell to 83.20m bbl as of Jan. 14, Vortexa data show.

* That’s the lowest since September and down 18% from

101.58m bbl on Jan. 7

* Asia Pacific down 24% w/w to 58.90m bbl; lowest since

September

* West Africa up 51% w/w to 10.82m bbl

* Middle East up 36% w/w to 4.92m bbl

* Europe up 30% w/w to 3.22m bbl

* U.S. Gulf Coast down 54% w/w to 870.00k bbl

* North Sea up 0.3% w/w to 589.00k bbl

* Company Exposure:

** Asia: Cosco Shipping Energy Transportation Co., HMM Co. Ltd.,

Mitsui O.S.K. Lines Ltd., Nippon Yusen KK

** Europe: Euronav NV, Frontline, Vopak

** U.S.: DHT Holdings, International Seaways, Nordic American

Tankers, Teekay Tankers, Tsakos Energy Navigation

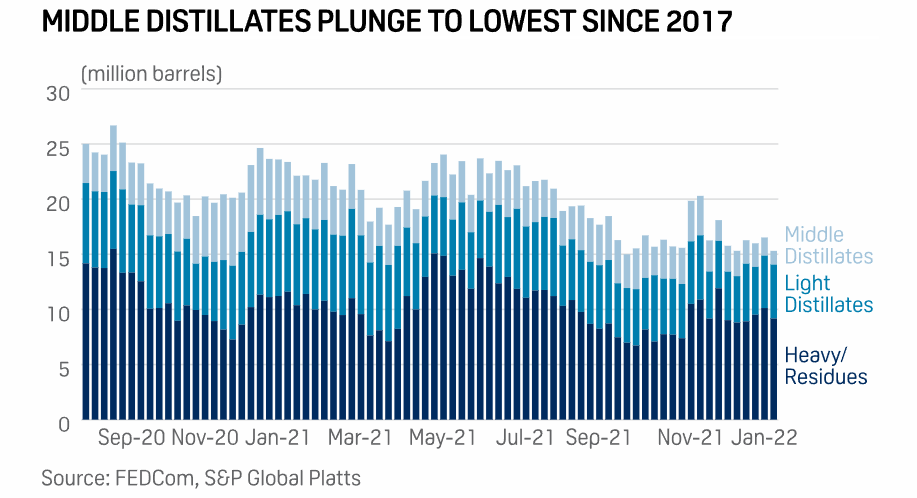

FUJAIRAH DATA

Oil product stocks fall to near-record low after big shipment of diesel

Total inventories were 15.309 million barrels as of Jan. 10, down 7.3% from a week earlier and the lowest since the record low of 14.998 million barrels was set in September 2021, according to Jan. 12 data from the Fujairah Oil Industry Zone.

Heavy distillates stocks including fuel for power generation and for shipping stood at 9.178 million barrels as of Jan. 10, down 9.3% from a week earlier and the lowest in three weeks.

Middle distillates including diesel and jet fuel led the way, plunging 24% over the same period to 1.246 million barrels, the lowest since December 2017, according to the data that has been provided exclusively to S&P Global Platts since January 2017.

Light distillates including gasoline and naphtha at Fujairah bucked the trend of shrinking stockpiles and rose to 4.885 million barrels as of Jan. 10, up 2.8% from a week earlier to a three-week high. -PLATTS

EIA

HAVE A GREAT WEEK ALL!!