TEXAS, TEXAS, TEXAS!

The big news this week was the snow and ice storms in Texas. Power outages plagued the state and rolling blackouts were initiated. First, we have to understand that Texas is not on the national grid, they have their own, as they did not want to be under federal regulations. There seemed to be a battle of the blame on whether it was the fault of fossils fuels as oil and natural gas lines were forced to shut down, as freezing can occur when water in the gas stream mixes with temps below 32°F; or the fault of renewables as wind turbines froze and snow-covered solar panels, rendering them inoperable. In reality, it was just a systemic failure. Demand went up and failures across all energy sources, coal, natural gas, wind, solar, and nuclear occurred simultaneously. Texas has seen huge snow/ice storms in the past, most notable being, the Panhandle Blizzard of 1957, Houston Snowstorm of 1960, San Antonio Snowstorm of 1985, Winter Storm Goliath of 2015, and the North American Ice Storm of 2017. That said, their systems are not winterized, which also added to problems (if you are wondering why places in the Midwest and Northeast, for example, have a ton of snow without the same problems). Likely they will incorporate some changes after this failure.

How will this effect the energy sector as a whole over the next couple of weeks?

3.5M bpd or oil production was halted this past week for three days, and up to 5.2M bdp of refinery capacity taken offline.

Refineries shut down this week starting from the 15th

Phillips 66 207K bpd, Ponca City

Phillips 66 256K bpd, Sweeney

Citgo 165K bpd, Corpus Christi

Citgo 435K bpd, Lake Charles

Marathon 450K bpd, Galveston Bay

ExxonMobile 575K bpd, Baytown

ExxonMobile 348K bpd, Beaumont

Total 245K bpd, Port Arthur

LyondellBasell 265K bpd, Houston

Holly Frontier 140K bpd , El Dorado

Valero 350K bpd, Port Arthur

Valero 125K bpd, Meraux

Valero 200K bpd, McKee

Valero 190K bpd, Memphis

Valero 210K bpd, Houston

Delek 74K bpd, Tyler

Motiva 610K bpd, Port Arthur

Shell 340K bpd, Deer Park

Chevron 115K bpd, Pasedena

CVR 75K bpd, Wynnewood

The question remains when will these refineries be able to get up running again.

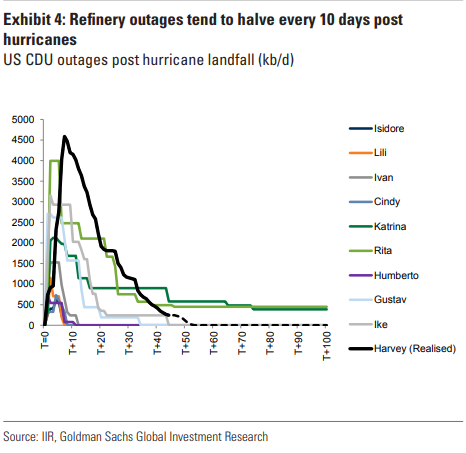

My thoughts are that this will be similar to post hurricanes; recovery on refinery runs tends to be slower than that of well production. That said refineries are worse prepared for freezing cold weather than for seasonal storms. Risk is prolonged refining downtime. If we use the hurricanes as a base model, then we are looking at refinery outages that tend to halve every 10 days post hurricanes. The polar vortex will result in tighter product vs. crude balances as recovery on refinery runs tend to be slower to return than well production. This should put a definite floor under gasoline.

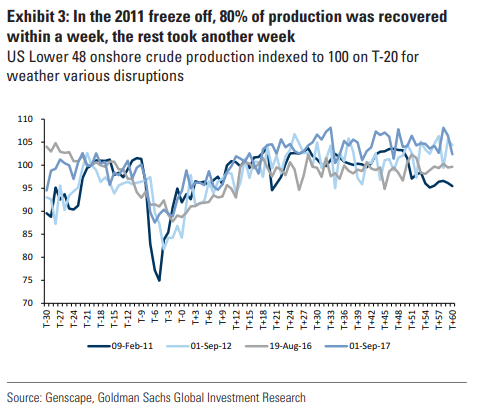

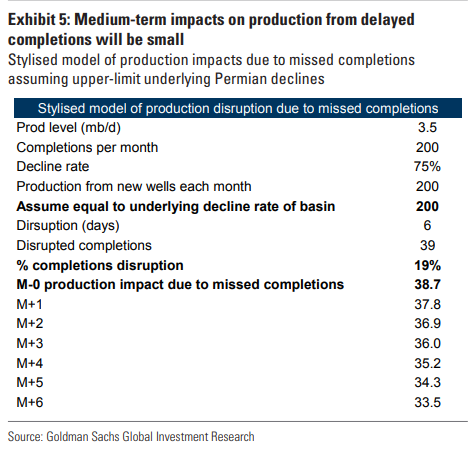

As far as oil production, this is much easier to get back up again. In the 2011 freeze-off, 80% of production was recovered within a week, the rest took another week. Medium-term impacts on production from delayed completions will be small.

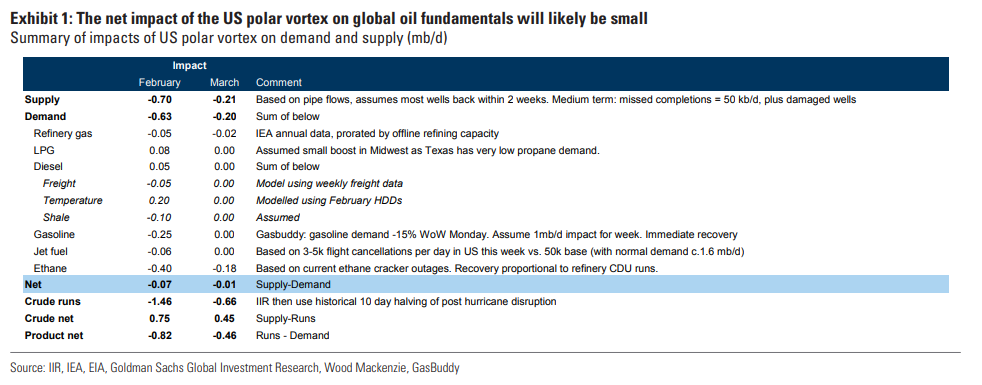

On the demand side, the bearish impacts are comparably large. Industrial and shale downtime will reduce refinery gas (-50 kb/d) and diesel consumption (-150 kb/d). Additionally, blocked roads and canceled flights will limit road gasoline demand (-250 kb/d) and jet fuel demand (-60 kb/d) respectively. On the other hand, cold temperatures and power outages should lead to some offsets from heating demand for LPG (+80 kb/d) and diesel-powered generators (+200 kb/d). The most important impact on US product supplied (although that is technically not end-use demand) will be on ethane intake (-400 kb/d) from downtime to USGC ethylene units which use ethane as a feedstock Goldman Sachs noted.

Summary of impacts of US polar vortex on demand and supply (mb/d)

The one thing I disagree with is their forecast on propane demand, with people out of power, I believe demand was stronger. If you can’t cook on your stove due to power outages, you can on your gas grill.

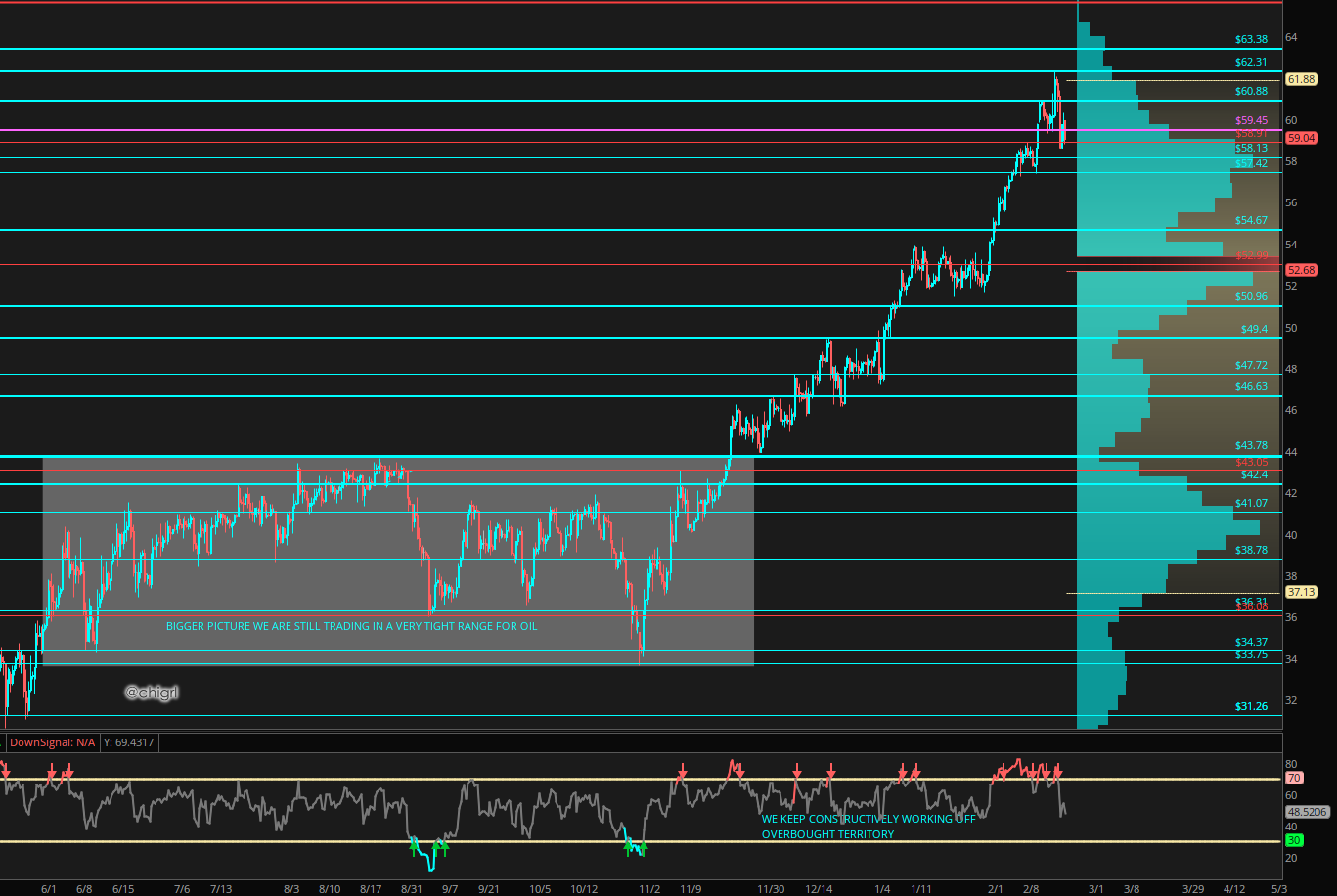

TECHNICALS

Oil bounced on the Texas news, along with another excellent crude oil inventory report. We were very overbought and started to work some of that off on Friday. I would not be surprised to see even more of a pullback this, as the market has gotten a little ahead of itself. A retest of 57.42 area seems likely. Should we see a large pullback in the broader markets, I would not rule out a bigger pullback to 54.67area. The overall chart is still bullish.

FUNDAMENTALS

US: Apparently the Biden administration is still issuing permits for oil and gas drilling on federal lands, however, there is a backlog.

Bloomberg: The Biden administration is slowly issuing drilling permits nationwide, though a backlog of thousands of applications pending before field offices appears to be delaying some authorizations.

Roughly 5,505 applications for permits to drill onshore are now pending before the Interior Department’s Bureau of Land Management. Almost all of them — some 99.5% — are currently under review in the bureau’s state offices, according to Interior Department data. The remainder is awaiting review from top career officials at the bureau.

So much for those executive orders.

INDIA: Indian state refiners’ gasoline sales in the first two weeks of February fell below pre-pandemic levels, the first decline in about six months, preliminary industry data showed, as record-high retail prices hit consumption. Diesel sales, which are related closely to economic growth and account for about 40% of overall refined fuel sales in India, fell by 8.6% in the first half of February, the largest decline since August last year, the data showed.

Gasoline and gasoil prices in India have risen to a record high, mirroring global markets. Taxes account for about 61% of retail gasoline prices and about 56% of diesel prices.

State fuel retailers sold 1.03 million tonnes of gasoline and 2.84 million tonnes of diesel from Feb. 1-15, the data provided by an industry source showed. -Reuters

India demand is important, let’s see how the last two weeks of February turned out. The problem is the cost of oil has risen so fast, and Indian taxes are extremely high. It is curbing demand.

RUSSIA: Russia is actually keeping its end of the OPEC cut bargain. In fact, Russia crude and condensate production said to be around 10.115mbpd so far in February, -44kbpd vs. January, Russia crude production cap was raised by 65kbpd m/m for February at the last Opec+ meeting.

LIBYA: Exports from all terminals in the region were suspended due to bad weather conditions last week, no word on resumption. (always problems with Libya)

NATURAL GAS

INDIA: India’s LNG development plans. India commissioned its sixth LNG import terminal last year, and it has four more under construction that are expected to come online by 2023. Its terminal expansion coincides with the country trying to put in place a major gas pipeline grid to cover around two-thirds of the country.

India’s LNG and gas development has also given it considerable bargaining power with producers as it tries to move away from pricing based on oil-indexation to term deals based on spot prices – a new development in LNG contracting.

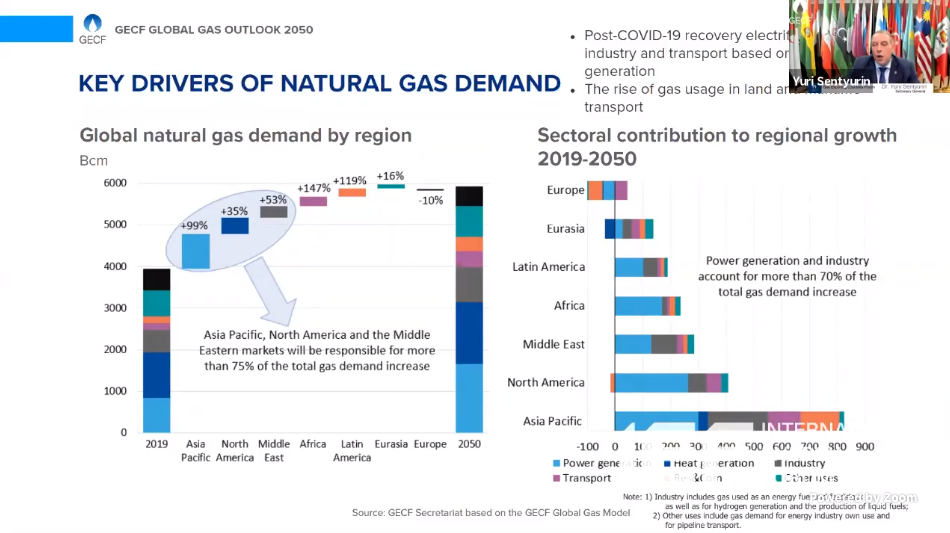

Natural gas consumption growth expected from 2020-2050

Asia: +99%

Africa: +147%

Latina America: +119%

There are several large projects currently in Africa as well.

Natural Gas projects in Africa:

Tanzania: $30B

Mozambique Rovuma $22.4B

Mozambique LNG: $15B

Nigeria GRIP: $20B

Nigeria Train-7: $10B

Companies involved in these projects: Total, Shell, ExxonMobile, Ophir Energy, Pavillion Energy, Mitsui & Co, ENH, Bharat PetroResources, PTTP, and Indian Oil

I really like natural gas exposure, outside of the United States, and outside of the majors, as a longer-term investment.

NORDSTREAM 2: : The Biden Administration is expected to unveil new sanctions on companies helping build Nordsream 2 this coming week. We will see if this heats up things politically between the US and Germany.

COPPER

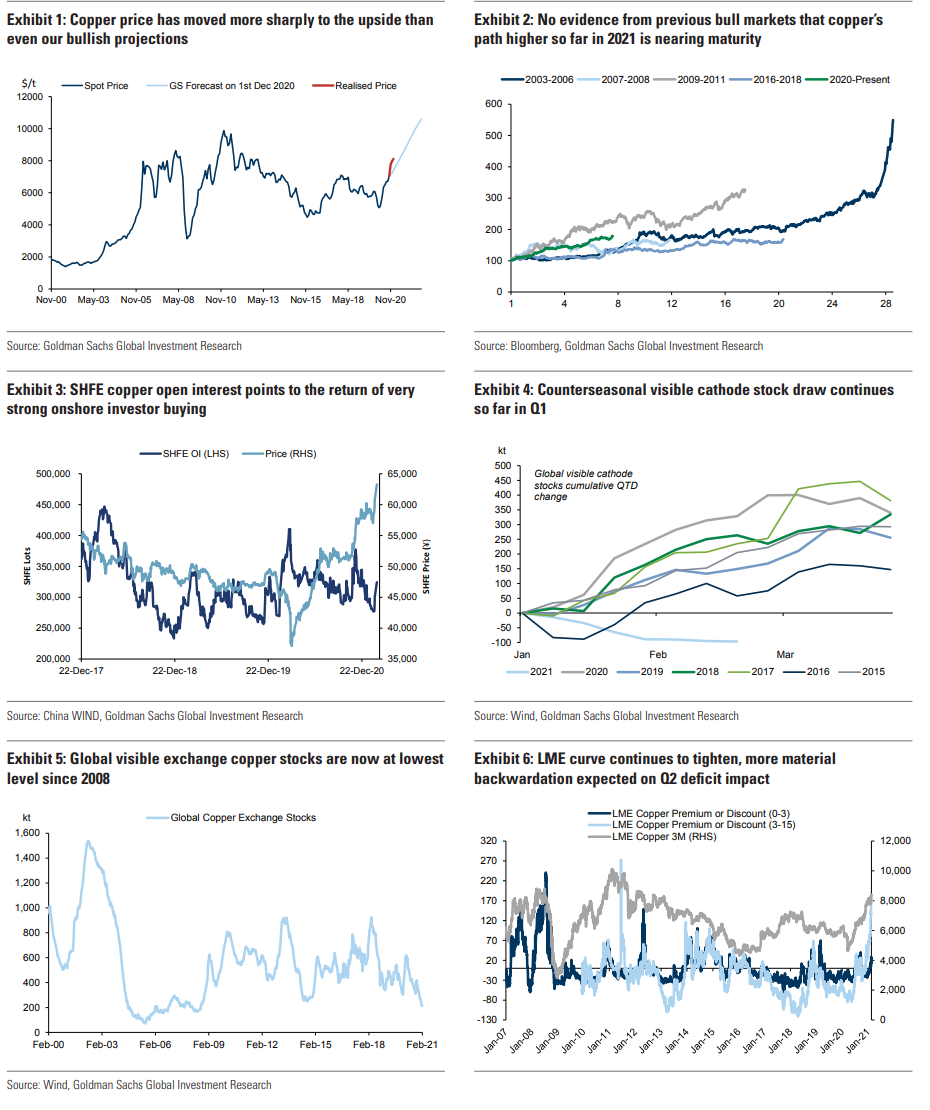

Goldman had an interesting copper report this week.

China’s return from the LNY holiday has heralded a burst of onshore investor copper buying after the holiday season with limited inventory builds evident so far. This latter trend during a period of what should be peak surplus generation onshore has particularly bullish implications given that the market is now on the cusp of the tightest phase in what we expect to be the largest deficit in a decade. The very low starting point for inventories at the beginning of this year has been further exacerbated by a counter-seasonal stock draw so far in Q1 on a scale only seen once before in recent history (in 2004). These trends point towards a high risk of scarcity conditions over the coming months. In this context, the fundamental outlook for copper remains extremely bullish with no evidence that the current price levels are yet stimulating softening effects to reverse both spot and forward fundamental tightening trends. We continue to forecast the largest deficit in 10 years in 2021 (327kt), followed by an open-ended phase of deficits as peak copper supply (2023/24) and a record 10-year supply gap on the horizon. To reflect the rising probability of scarcity pricing our new 3/6/12M copper targets increase to $9,200/$9,800/$10,500/t (from $8,500/9,000/10,000/t previously). We consider below the key bullish increments for copper supporting the revision higher in price targets.

This bodes well for our VAIL position.

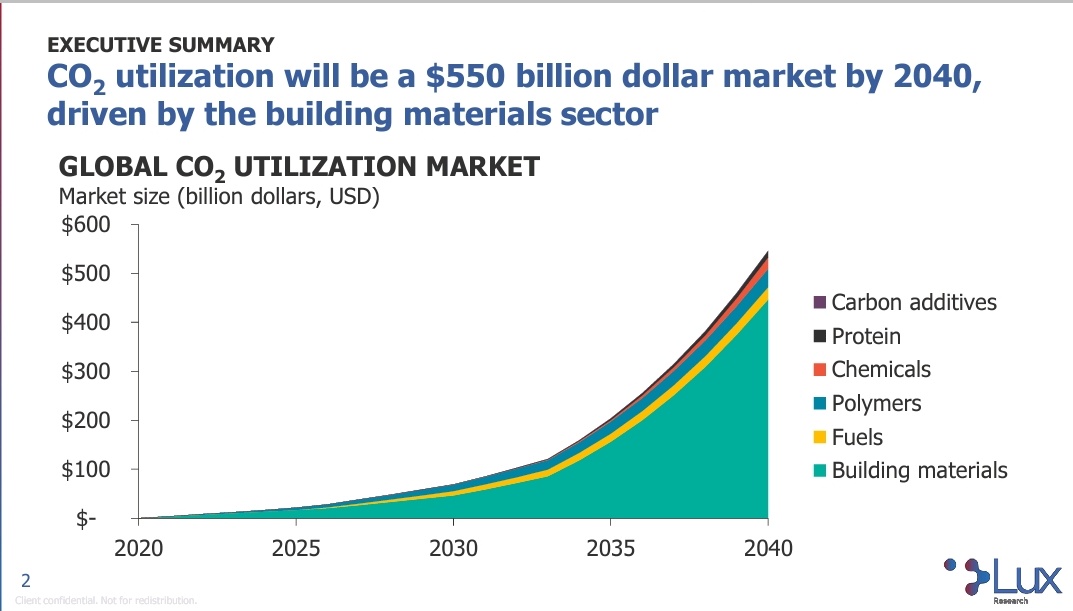

CARBON CAPTURE

Over the years, carbon capture has waned in the United States, however, I believe that the US is set to see a bigger push in this space, particularly with Jennifer Granholm at the helm of the energy department, as she is more on the progressive end of the spectrum.

CO 2 utilization will be a $550 billion dollar market by 2040, driven by the building materials sector.

CEMEX receives funding to develop carbon capture in the cement industry. CEMEX has been awarded a grant from the US Department of Energy (DOE) to develop a pilot carbon capture unit.

The project will take place at CEMEX’s cement plant in Victorville, California. Last year, CEMEX announced its target of reducing CO2 emissions by 35%/t of cementitious products by 2030. It also has a longer-term ambition to produce net-zero CO2 concrete by 2050.-The Chemical engineer

*THIS WEEK’S ACTIONABLE TRADE IDEA: LONG CEMEX (CX)

OTHER NOTABLE NEWS

GERMANY: Germany turns back to coal and natural gas as millions of its solar panels are blanketed in snow and ice. The freezing weather has rendered its 30,000 wind turbines to idleness. It is not just the wind turbines. Solar panels covered with snow are also rendered useless. You may call it “coal comfort” as a total collapse in the wind and solar output leaves freezing Germans desperate for coal-fired power.-World News Era

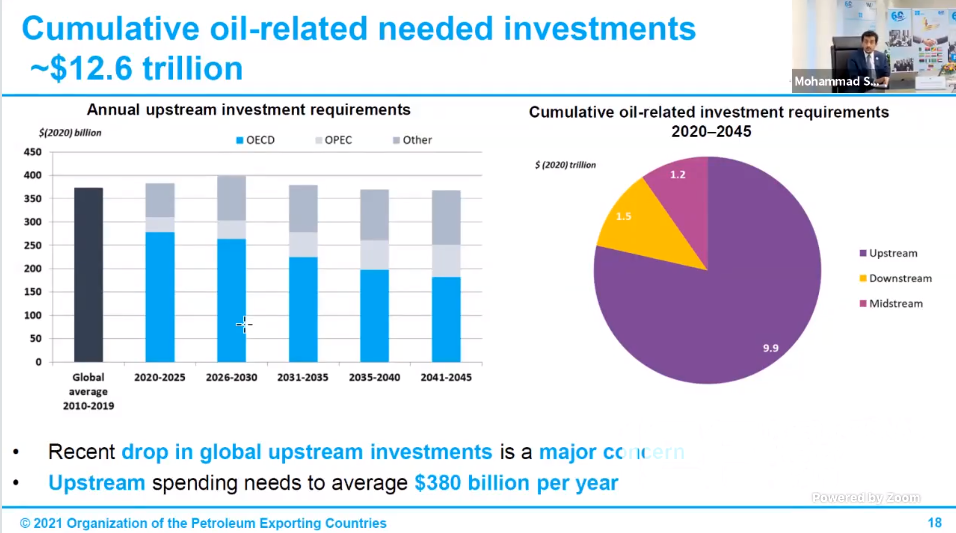

I have long argued that is it going to take a lot longer to transition over than people expect. We are going to need 380B a year in new spending to keep up with the demand to 2045. That is 12.6Trillion dollars. There is nowhere near that in the pipeline. We are setting ourselves up for an energy supply crisis.

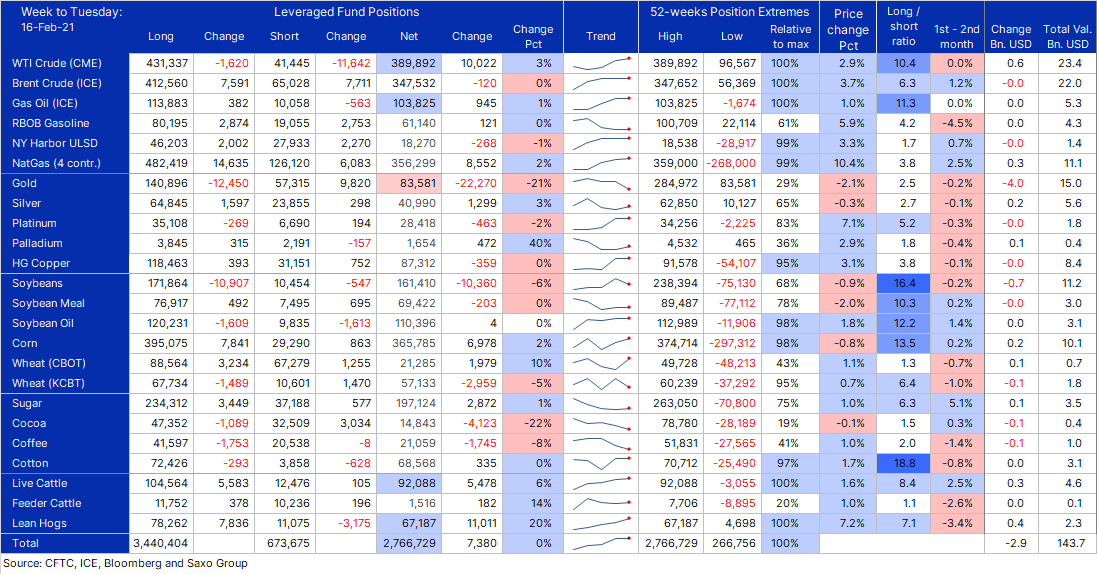

COMMITMENT OF TRADERS

Commodities in wk to Feb 16 saw funds keep an unchanged record-long across 24 futures at 2.8 million lots ($144 bn). The biggest changes were increased length in oil, natgas, and livestock while gold and soybeans longs were reduced.

OIL INVENTORIES

GLOBAL OIL INVENTORIES

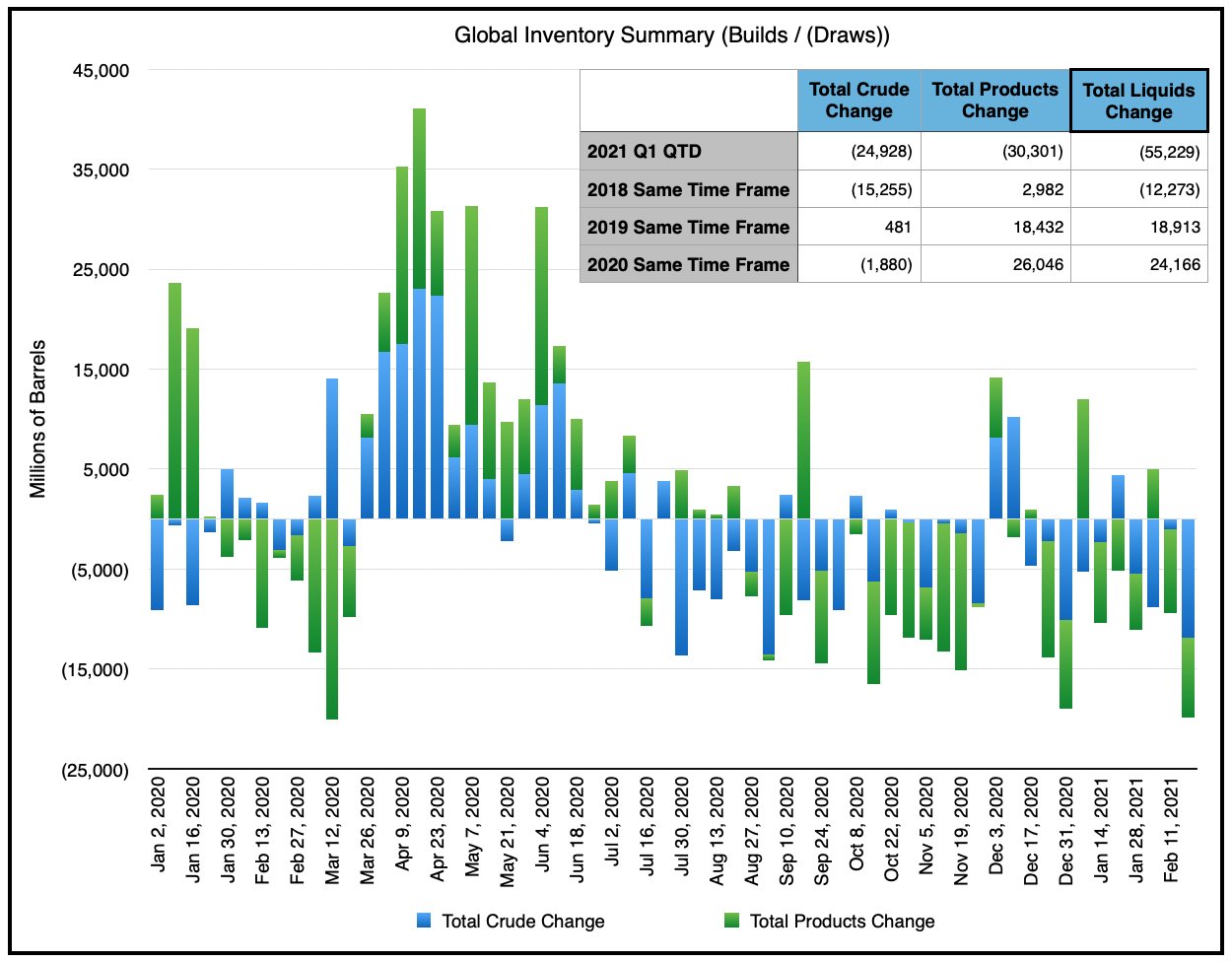

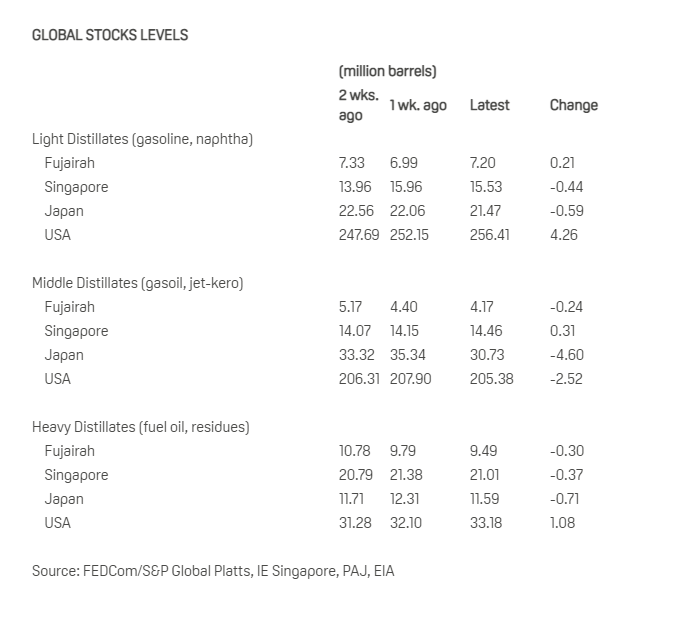

Weekly inventory for Feb 12. Draw 19.8M bbls, 15.3M from US & 4.5M outside of the US. This isn’t normal (seasonality we should build), and demand hasn’t fully recovered yet.!! Still, on trend for ~2M bpd draw in Q1.

FUJAIRAH DATA

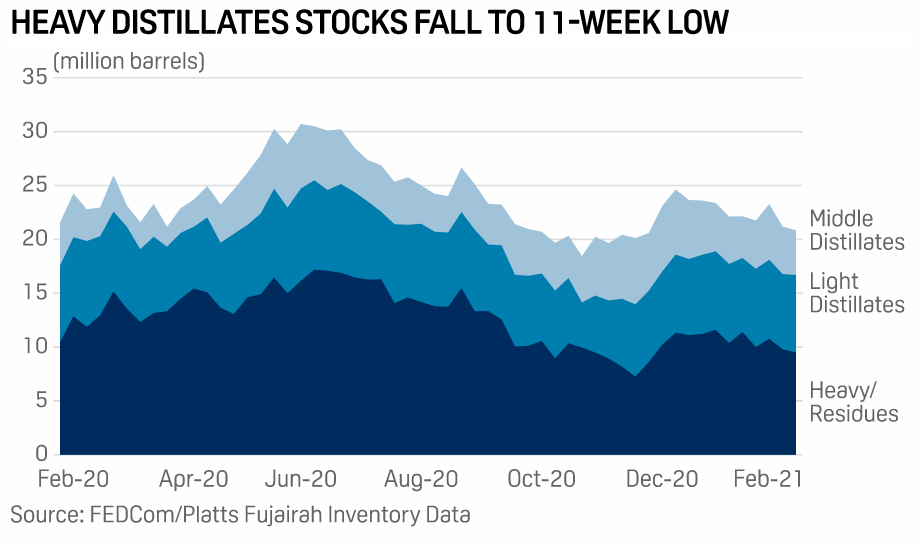

Oil products stocks drop to 2021 low as fuel oil exports set a record high. Total inventory was 20.854 million barrels on Feb. 15, down 1.6% from a week earlier and the lowest since Nov. 30, according to Fujairah Oil Industry Zone, or FOIZ, data released Feb. 17 exclusively to S&P Global Platts.

Heavy distillates, including marine bunkers and fuel oil, dropped 3% over the same period to 9.487 million barrels, also the lowest since Nov. 30.

Fuel oil exports for the week started Feb. 8 were 440,000 b/d, setting a record 447,000 b/d for the four-week moving average, according to data intelligence firm Kpler. Shipments for the most recent week were heading for Singapore, Sri Lanka, Kenya, Mauritius, and Sudan.

Middle distillates stocks stood at 4.166 million barrels as of Feb. 15, a four-week low and down 5% from a week earlier. The category includes gasoil, diesel, and jet fuel.

Light distillates, including gasoline and naphtha stocks, rose to 7.201 million barrels as of Feb. 15, up 3% from a week earlier and the highest in two weeks. -PLATTS

This looks fantastic.

EIA

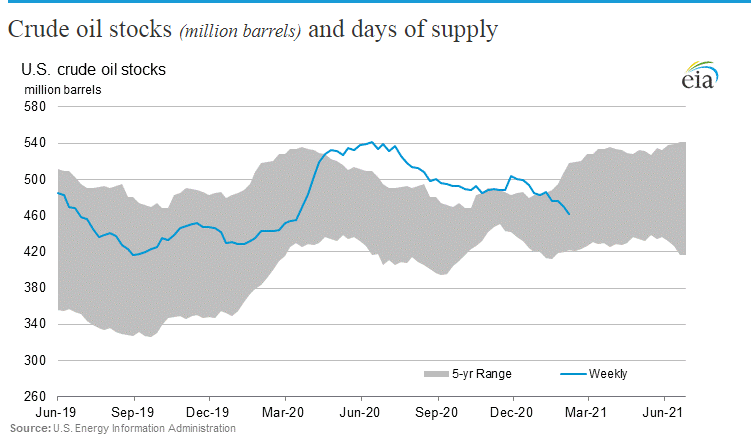

Crude oil stocks continue to drop., we are well within the 5 year average.

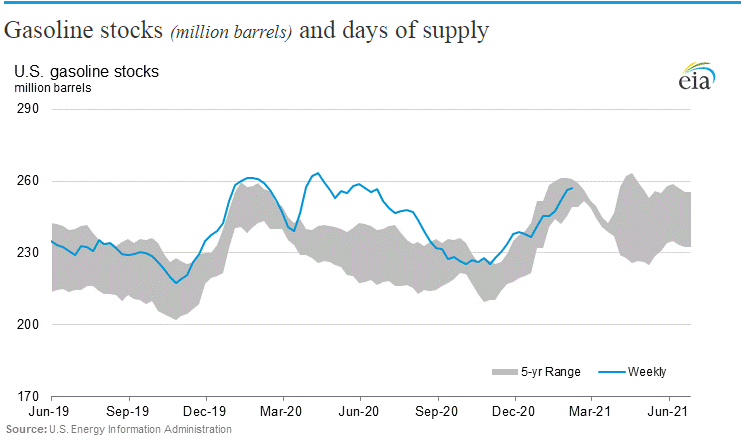

Gasoline stocks are a bit high, but not unusual for this year. We are well within the levels seen at the five prior years for this week (see Thursday’s report). Until refineries are back up and running, likely we see draws over the next couple of weeks.

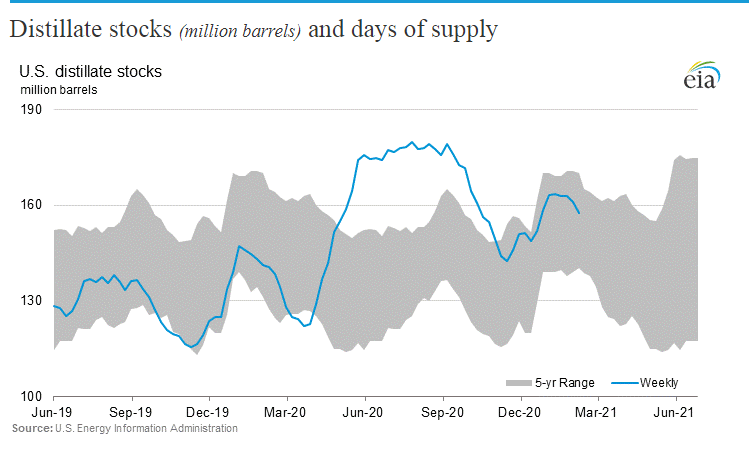

Distillates are drawing again, this is a good sign. again, we likely see more declines over the next couple of weeks due to refinery shut-ins.

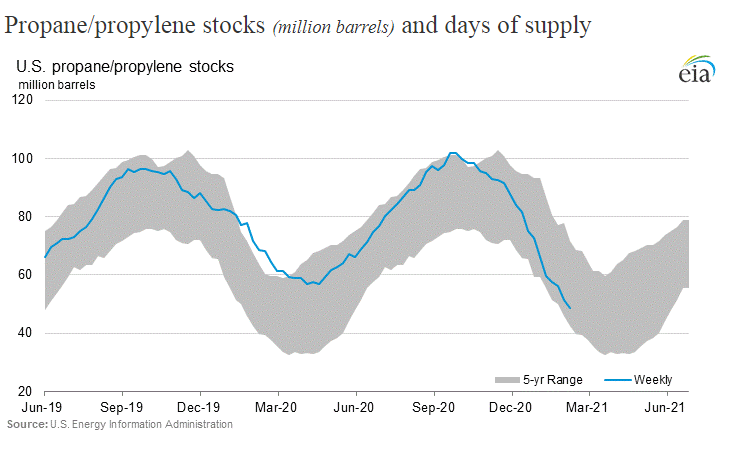

Propane, the beast, chart pretty much says it all.

DAILY SENTIMENT INDEX HEADED INTO NEXT WEEK