New stocks mentioned SBSW and NTR

BIG NEWS

Obviously, Russia/Ukraine continues to dominate the headlines.

On Monday 28 February, the US and Europe issued more sanctions, this time against the Russian Central Bank

Additional Measures Against the Russian Financial System

PRESS STATEMENT

“In coordination with our allies and partners, the United States is taking further measures today against the Russian financial system in response to Russia’s continuing premeditated war against Ukraine. Unwavering in our support for Ukraine’s sovereignty and territorial integrity, we will continue to act with our allies and partners in imposing costs on Russia if it continues its war of choice.

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has prohibited any U.S. person from conducting any transaction involving the Central Bank of the Russian Federation, the National Wealth Fund of the Russian Federation, or the Ministry of Finance of the Russian Federation. In addition, OFAC imposed blocking sanctions on the Russian Direct Investment Fund, a known slush fund for President Putin and his inner circle, two of its subsidiaries, and CEO Kirill Dmitriev.

We took today’s actions to impair Russia’s ability to use its international reserves in ways that undermine the impact of our sanctions, as well as to prevent Russia from accessing its wealth fund for use in its ongoing war against Ukraine.

The United States will continue to coordinate closely with our partners and allies to impose severe consequences on Russia for its war against Ukraine. We share with our partners and allies unity of purpose, resolve, and determination to hold Russia to account for its aggression, particularly those responsible for this war of choice.”

So how does this all affect energy…

UNITED STATES

US allows energy deals with Russian banks until June 24

The United States allowed energy-related financial transactions with Russian banks subject to new US sanctions to continue until June 24, the Finance Ministry said in a statement.

As follows from the general license of the American department, energy-related transactions are allowed with Russian banks Vnes-heconombank, Otkritie, So-vcombank, Sberbank, VT-B. This list also included the Russian Central Bank. -Frontier Post

API

API sent a letter to the Secretary of Energy after it was suggested that the US stop oil exports (the most ridiculous idea EVER)

BP

BP to Exit Rosneft Stake and May Take a $25 Billion Hit

BP Plc moved to dump its shares in oil giant Rosneft PJSC, taking a financial hit of as much as $25 billion by joining the campaign to isolate Russia’s economy.-BBG

SHELL

Shell will exit all its Russian operations, including a major liquefied natural gas plant -Reuters

GERMANY

Germany plans new legislation to ensure gas storage is full for winter

“Germany is to maintain a national gas reserve in the future,” the ministry said in a statement. “This will ensure that the gas storage facilities are always sufficiently filled. In future, the market players will have to guarantee this.”

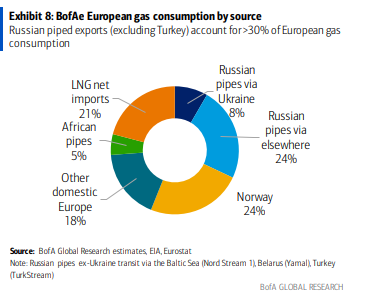

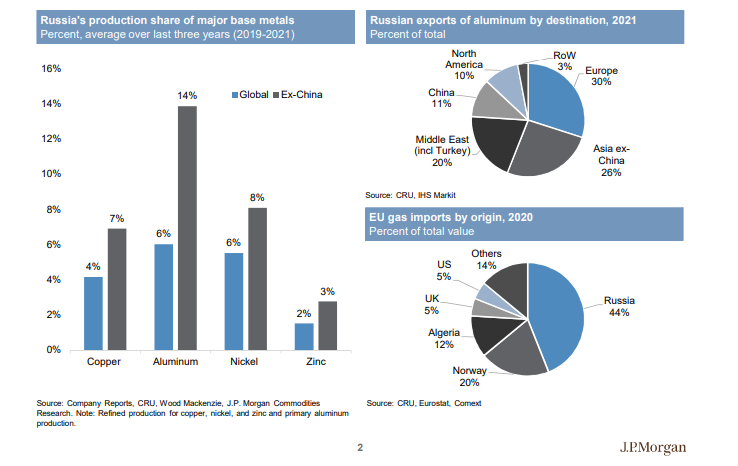

RUSSIAN GAS TO EUROPE

Lots of news flying around about Russian supplies to Europe.

Westbound natural gas flows through the Yamal-Europe pipeline stopped on Friday but resumed again on Saturday while Gazprom’s bids for additional transit capacity via Ukraine stand at high levels, data from pipeline operators shows.

Flows to Germany via the Mallnow metering point stood at about 101,119 kilowatt hours per hour (kWh/h) earlier on Friday morning and were about 13.5 million kilowatt-hours per hour overnight. -Reuters

From an insider friend:

“Hi there. All Russian (Gazprom) lines into Europe-Turkey working currently and flowing. NS1 is at full, give or take. The tree links via Ukraine (I use the European names, Progress, Brotherhood, and Soyuz) also flowing, with at times flows at the Velke metering station in the Ukrainian-Slovakia border at two-month highs, BlueeStream and TurkStream also flowing (but sorry, can not remember from the top of my head current flows). And then about Yamal, that´s the most intriguing one. Yes, Gazprom stopped flowing into Germany in late Dec, but since the invasion, it has flown 8 times (not full days, but a few hours each day) in response to customer demand… The must, I don’t know what´s the word, ironic of all is that Europe is today buying more gas from Russia than two weeks ago. That´s it. ”

KEY POINT HERE: Europe is indeed still buying gas, and more than two weeks ago.

SHIPPING

Oil Shipping Costs Soar for Key Routes on Russian Invasion

Freight rates for hauling crude from Russia are surging as sanctions imposed on the country push up the risks of carrying cargoes on those routes, while a scramble for alternative supplies boosts the rates for other passages. Shipowners are offering at least double the last transacted rate to carry so-called ESPO crude from Kozmino, which loads oil from Russia’s Far East, to ports in China -BBG

OIL RESERVE RELEASE

The U.S. and its allies are discussing a coordinated release of about 60 million barrels of oil from their emergency stockpiles after Russia’s invasion of Ukraine pushed crude prices above $100. -BBG

NOTABLE: First this is the equivalent of a half-day of OPEC production. It is NOTHING and will not affect the price of oil in any meaningful way. Second, draining the US SPR during a war and possible sanctions on Russian oil is a terrible idea. It is a matter of national security.

SELF SANCTIONING

Although there are no formal sanctions on Russian oil or gas, we are seeing some self sanctioning.

LNG buyers

Several liquefied natural gas buyers have paused further purchases from Russia due to the quickly evolving wave of sanctions from the West, adding to worries over tight global supplies of the super-chilled fuel.

Some importers from Asia to South America have decided to temporarily halt buying spot LNG shipments from Russia as they wait for more clarity on restrictions against banks and companies, according to traders. Across the board, traders say they are being more cautious about buying LNG or using vessels from Russian entities. -BBG

Asian Oil Buyers Hunting for More Saudi Crude on Crisis Fears

Asian oil buyers are trying to secure more crude from Saudi Arabia to be shipped in the next few months as the Russian invasion of Ukraine threatens to disrupt global flows and even create an energy crisis.

Customers in the world’s biggest crude-importing region are putting in inquiries to Saudi Aramco for shipments arriving in May. – BBG

Major buyers of Russian oil struggle with bank guarantees

At least three major buyers of Russian oil have been unable to open letters of credit from Western banks to cover purchases -Reuters

India’s IOC no longer accepts Russian, Kazakh crude on FOB basis

India’s top refiner Indian Oil Corp will no longer accept cargoes of Russian crude oil and Kazakh CPC Blend cargoes on a free-on-board (FOB) basis due to insurance risk, according to a tender notice-Reuters

UK

Workers at Stanlow oil refinery have been instructed by their union not to handle a cargo of Russian oil on board a German ship. Unite has told the site’s owners Essar its members will under no circumstances unload Russian oil regardless of the vessel’s nationality.-BBC

NOTABLE: There are currently 1.5M barrels of Russian oil off the market at 1.0M barrels of products off the market due to all of this.

This brings us to today-Sunday 6 March

Blinken on CNN: “We are now talking to our European partners and allies to look in a coordinated way at the prospect of banning the import of Russian oil while making sure that there is still an appropriate supply of oil on world markets. That’s a very active discussion as we speak”

NOTABLE: This is the most serious discussion we have seen so far to use oil as a weapon. We will have to wait and see if they are willing to take this risk. The world needs Russian oil right now. Even IF we see an Iran deal here are the problems:

1. It has no support in Congress from either the Republicans or the Democrats – bipartisan issue

2. Judging from the last deal in 2015, it will probably take 4 months to get 500K barrels to market

3. There are currently 1.5M barrels off-market due to Russia we don’t know how/if how temporary this is and if this problem will grow

4. OPEC+ already can’t produce enough, compliance is over 146%

5. In 4 months we hit high demand season ..we will need it

6. If Iran is able to produce again, as they are still a member of OPEC, they will be brought back into the collective deal.

7. I maintain that this was already baked into the market this summer. So aside from a market knee-jerk reaction, it means nothing, in that it does not change the overall fundamentals of this market.

8. Over the medium/longer-term….this deal will have little to no impact.

Russian oil exports

Some other observations:

Senior U.S. officials traveled to Venezuela on Saturday to meet with the government of President Nicolás Maduro. The trip is the highest-level visit by Washington officials to Caracas, Venezuela’s capital, in years – NYT

NOTABLE: One can only assume that this is about oil. That said, Venezuela and Russia have been strategic partners throughout the years of US sanctions on Russia and Venezuela owes Russia billions in foreign aid. Unless the US wants to pick up the tab for them, which I doubt, this trip is likely fruitless. In addition, Venezuela’s oil production is abysmal. They do not produce any meaningful amounts due to years of corruption and neglect. Then there is also the part where the US does not even recognize Maduro as the President of the country.

Venezuela oil production

January 2022 oil production was 755K bpd (Russia produces 10.1M bpd )

CHARTS OF INTEREST THIS WEEK

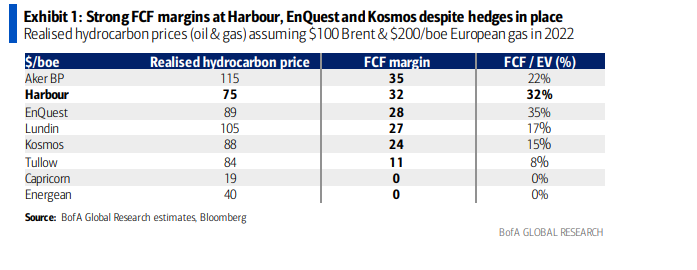

European E & P

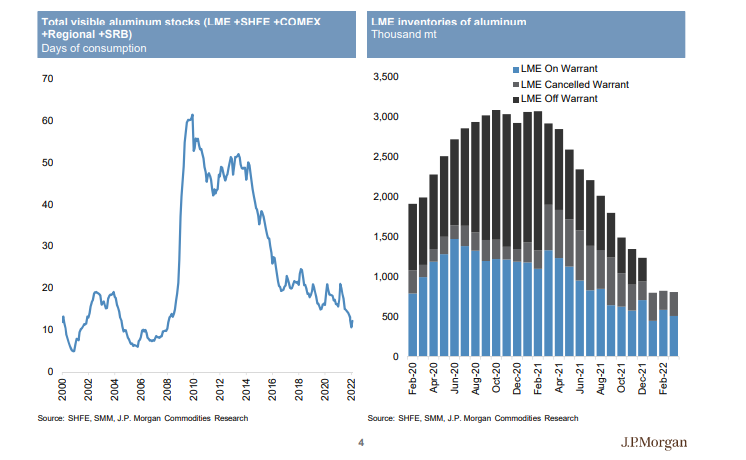

Aluminium

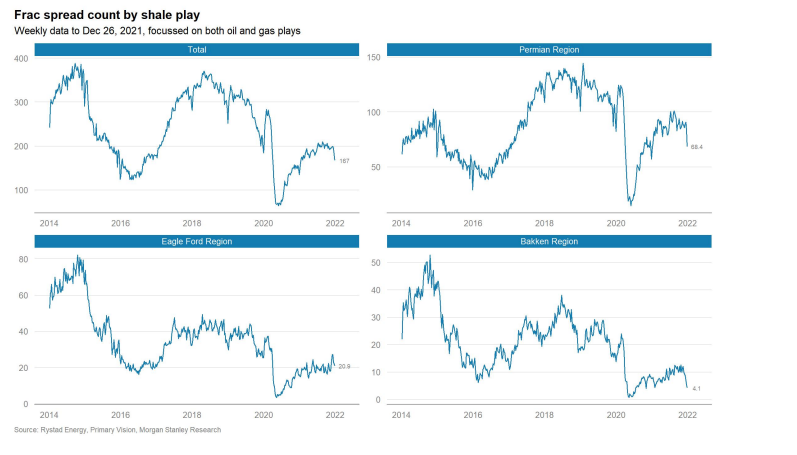

A frac spread (or sometimes referred to as a frac fleet) is a set number of equipment that a pressure pumper (oil field service company) uses for hydraulic fracturing.

This includes a combination of fracturing pumps (also referred to as frac pumpers and/or pumping units), data trucks, storage tanks, chemical additive and hydration units, blenders, and other equipment needed to perform a frac stimulation.

Counting the number of frac spreads is a better indicator of how much oil will come online than counting active rigs

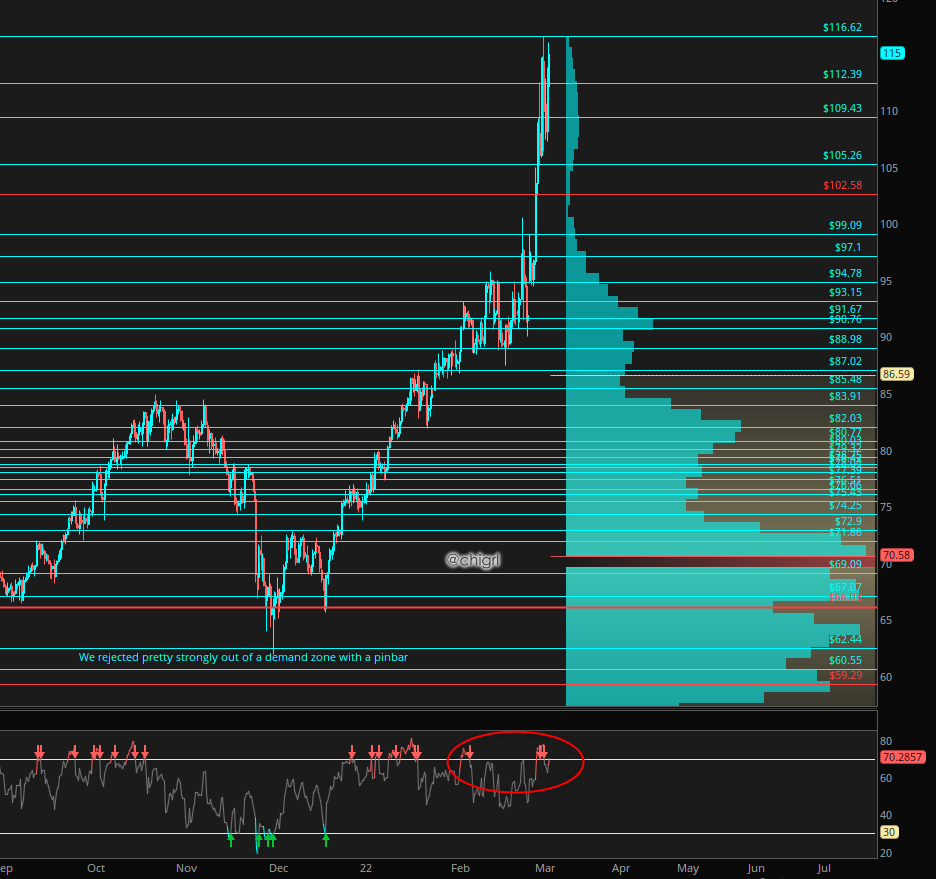

TECHNICALS

We still continue to work off overbought levels. The trend is your friend.

OIL, PRODUCTS, AND NATURAL GAS

UNITED STATES

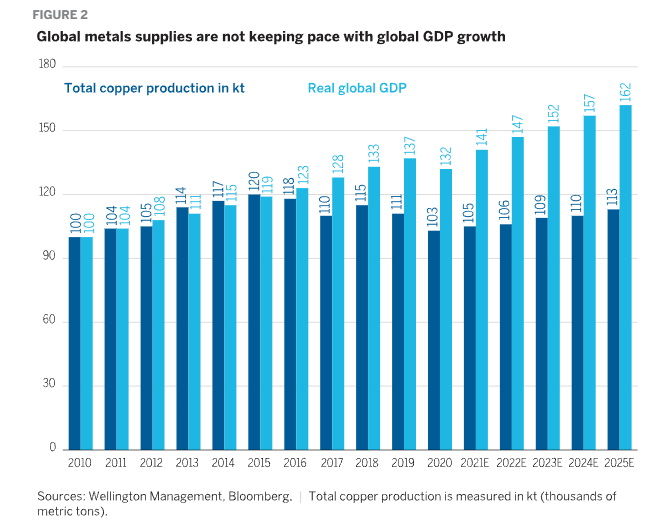

There are growing calls for the United States drillers just to “turn on the taps” again

NOTABLE: You don’t just “open a valve” to increase oil production.

It is extremely capital and time-intensive to extract hydrocarbons

You have to get permits approved, construct locations, drill the well, frac the well, build production infrastructure, etc. We are talking 6 months at least for this.

Other constraints on top of this that I have mentioned in previous weeks are the fact that we have labor shortages, and the industry is plagued with the same supply-chain problems that other industries are when it comes to sourcing parts.

OPEC

So, why is OPEC not increasing oil production?

The answer, multiple Opec-plus sources say, is that the group believes the oil market’s current geopolitical risk premium is beyond its control — and that, with Russia a core member, it’s not worth testing the group’s cohesion by swerving from their existing output plans.

Limited Impact

Despite Brent reaching new highs of above $115 per barrel, delegates insist there is no physical shortage of oil that would require a change in output policy. Delegates tell Energy Intelligence they see the geopolitical risk premium adding as much as $20/bbl to the oil price, and argue that putting more supply into a red-hot market would do nothing to change that. Opec-plus’ inaction has drawn criticism from some in the energy world and accusations that it is supporting high prices that favor producers, including Russia.

Energy Intelligence understands that for now, Saudi Arabia and the United Arab Emirates — the countries that hold the lion’s share of spare capacity in the group — do not want to add more barrels to the market unilaterally.

Delegates believe that adding more supply would do little to bring down prices. They point out that when the IEA announced this week that it would coordinate a release of some 60 million barrels from storage, prices actually rose.

Opec-plus sources say there is no way to gauge the extent to which Russian oil exports will be hit or for how long, and without that data in hand it would be difficult for the producer group to act.

Geopolitics Also at Play

With little influence over the risk premium or the global politics behind it, Opec-plus sources say the group is focusing instead on maintaining strong relations among key member states, so it has the ability to continue managing markets going forward. -Energy Intelligence

NOTABLE: I have noted that this is a changed OPEC alliance since June of 2020. I think this article says it all. Expect tight markets.

OPEC meeting was this week as well. No change to plan 400K increase. (note that does not mean they will be able to produce that much, OPEC February compliance was up to 146% in Feb v 129% in Jan)

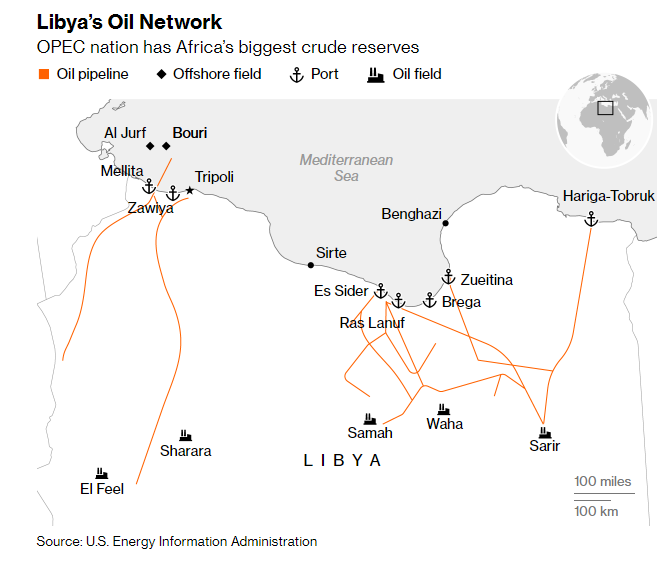

LIBYA

Libya’s Oil Production Drops as Political Crisis Deepens

Libya’s oil production has fallen below 1 million barrels a day, as the OPEC member plunges deeper into political crisis just as prices surge following Russia’s invasion of Ukraine.

Output is down to 920,000 barrels daily, Oil Minister Mohammed Oun said in a response to a query from Bloomberg. It stood at roughly 1.2 million barrels on Wednesday.

State-controlled National Oil Corp. on Sunday halted shipments from the ports of Zawiya and Mellitah after militias shut down Sharara, the country’s biggest field, and El Feel. The fields serve the two western terminals, which have been put under force majeure, a clause in contracts allowing exports to be suspended.

The drop marks another supply problem for Organization of Petroleum Exporting Countries. Major importers, including the U.S. and Japan, have called on the group to raise output quickly to help bring down fuel prices. -BBG

NOTABLE: There have been ongoing problems with Libya for years, but this is just another blow to the oil supply.

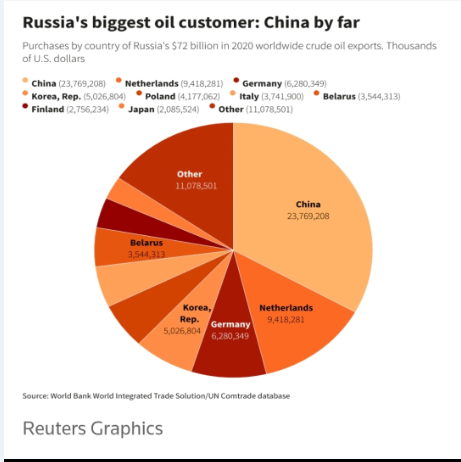

CHINA

Chinese refiners tap alternative payments to keep Russian oil flowing

Chinese refiners are paying for Russian crude oil using cash transfers to maintain imports from Russia’s Fast East, as banks shy away from financing the oil because of sanctions, sources with knowledge of the matter said.

Chinese buyers are looking to maintain purchases of ESPO Blend crude exported from Russia’s Far East Kozmino port using other payment methods as they cannot secure letters of credit from banks, trade sources said.

“For those done deals, payments are being sorted out with buyers doing Telegraphic Transfer as bank financing becomes very difficult,” said a Singapore-based Chinese trading executive.

Telegraphic transfer, equivalent to cash pre-payment, requires buyers to transfer funds to sellers up front, a challenge for some cash-strapped independent refiners with each Aframax tanker-sized cargo now costing more than $85 million, the sources said.

Some sellers are providing open credit, but this raises their risk exposure, they added -Reuters

NOTABLE: China is Russia’s largest customer. China also loves cheap oil. They are probably getting a HUGE discount. Shell actually just bought a cargo at a $28 discount, I can only imagine China is getting the same if not better.

CANADA

Trans Mountain Can Proceed with Work on Key Pipeline Terminals: Regulator

Trans Mountain now expects to finish the expansion in the third quarter of 2023, when it will nearly triple the capacity of the pipeline running from Alberta to the Pacific Coast to 890,000 bbl/d of oil. -hARTeNERGY

NOTABLE: Great news for Canadian oil companies as this opens up the capacity to ship to Asia and not have to rely so heavily on the United States.

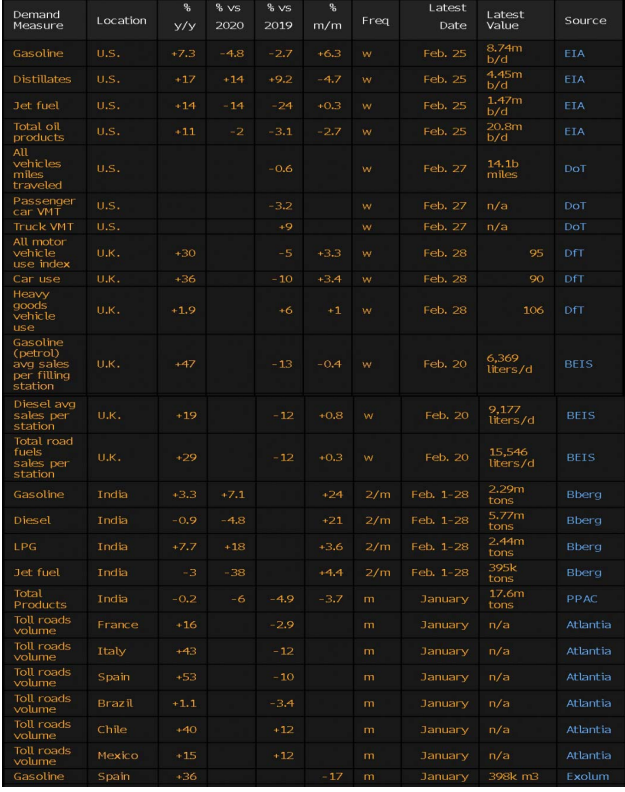

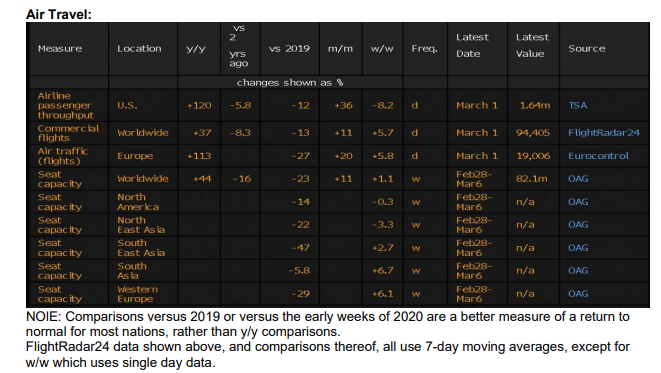

BLOOMBERG OIL DEMAND MONITOR

High Prices Cloud Outlook for Gasoline Use

Commerical flight numbers worldwide still rising slowly

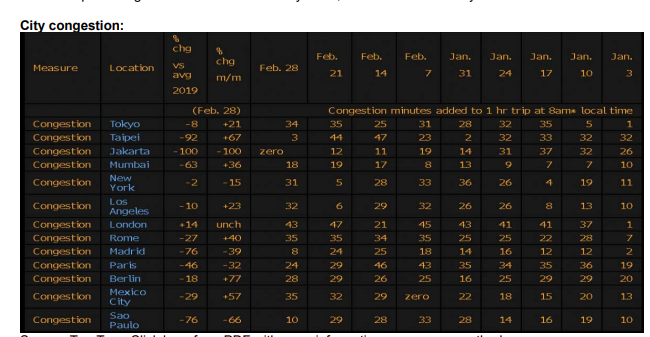

London congestion exceeded 2019 levels Monday; New York near

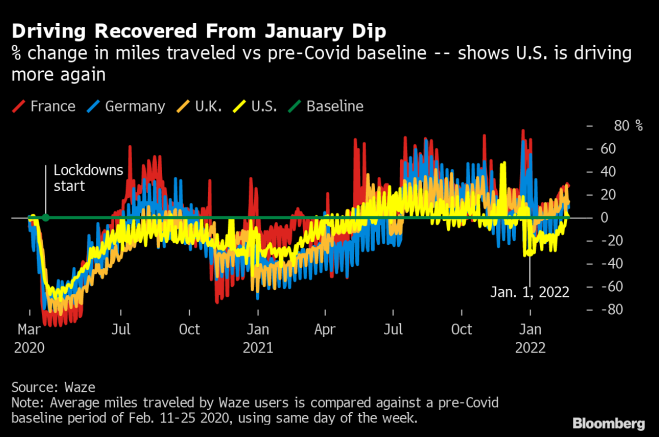

High prices look set to cloud the outlook for gasoline demand, which hasn’t yet convincingly

exceeded pre-pandemic levels in all parts of the world.

Demand for gasoline in the U.S., the world’s biggest consumer, was comfortably near the five-year average last week but still 2.7% below the equivalent period of 2019, and service-station sales of the same fuel in the U.K. in the week ended Feb. 20 trailed pre-pandemic levels by 13%, government statistics show.

Gasoline sales in India, however, rebounded strongly in February amid a steady decline in coronavirus cases, and were about 7% above February 2020, before the pandemic hit the country, according to refinery officials with direct knowledge of the matter.

Consumers around the world are facing extreme retail prices, with regular gasoline above $3.60 a gallon in the U.S. for the first time since 2014. With Russia’s invasion of Ukraine and the ensuing sanctions causing additional strain on the security of oil supply, demand destruction is probably the only thing that can prevent oil prices marching even higher, Goldman Sachs Group Inc. analysts wrote in a note dated Feb. 27.

A broad measure of road use is provided by satellite navigation information company Waze, a subsidiary of Google. The average number of miles driven per day by Waze users across the U.S. has recovered from an early 2022 dip and is now slightly above a pre-Covid February 2020 baseline. Germany has made a similar recovery, joining the U.K. and France, which also show the increase in car use. Driving habits are resuming around the world as the infection wave caused by the omicron variant of the coronavirus continues to recede.

Out of 13 world cities regularly examined in this monitor, only London showed more congestion on Monday morning than typical levels for that time of week in 2019, according to data collected from in-car navigation devices by TomTom NV. New York was very close, lagging the pre-pandemic benchmark by only 2%. Driving picked up on Tuesday in Taipei after a national Taiwanese holiday sapped commuting on Monday

The latest weekly snapshots of vehicle mobility from the U.S. and U.K. transport ministries, using roadside sensors, show little change from previous weeks. The number of vehicle miles driven on U.S. interstate highways was 0.6% below 2019 levels, after being 0.5% above the prior week. In the U.K., the use of all vehicles was 5% below a prepandemic benchmark. Car use has generally stayed below the pre-Covid era while heavy goods vehicles and vans are being driven more.

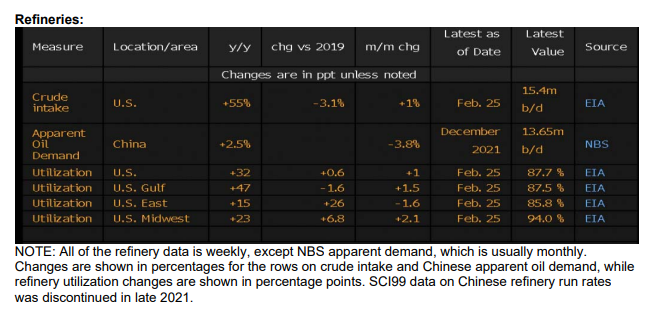

U.S. refinery activity has been broadly steady for the last several months. The latest data shows a large year-overyear change, though that’s because unusual freezing temperatures hobbled oil field operations in Texas this time last year, reducing the amount of crude delivered to refineries. Gulf Coast refineries operated at 87.5% capacity last week, compared with only 40.9% a year earlier.

Airline Activity

Air traffic data continues to show Europe and parts of Asia lagging behind a recovery in activity in North and South America, even though flight numbers are higher than they were in January.

The daily number of worldwide commercial flights tracked by FlightRadar24, excluding various categories such as military travel and helicopters, shows the latest figures still stuck between the depressed levels of this time a year ago and the pre-pandemic situation in 2019 and 2020, but nevertheless on a slowly rising trend.

MATERIALS

EUROPE

Europe faces building material shortages as energy prices soar

NOTABLE: This will only get worse if sanctions are placed on Russian oil and gas. Europe may be shooting itself in the foot.

URANIUM

U.S. utilities push White House not to sanction Russian uranium

The U.S. nuclear power industry is lobbying the White House to allow uranium imports from Russia to continue despite the escalating conflict in Ukraine, with cheap supplies of the fuel seen as key to keeping American electricity prices low, according to two sources familiar with the matter.

The United States relies on Russia and its allies Kazakhstan and Uzbekistan for roughly half of the uranium powering its nuclear plants – about 22.8 million pounds (10.3 million kg) in 2020 – which in turn produce about 20% of U.S. electricity, according to the U.S. Energy Information Administration and the World Nuclear Association -Reuters

NOTABLE: Definitely something to keep an eye on. If there was a collective ban between US and Europe uranium prices would explode (more so than they already have this week). I am still long UROY for a uranium play.

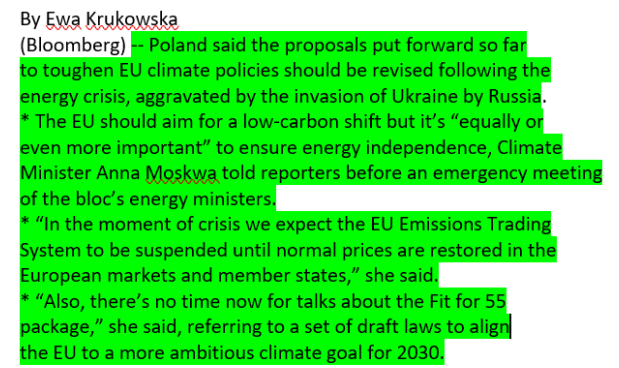

CARBON MARKET

This week we saw a big pullback in the carbon markets.

Poland seeks suspension of the EU carbon market.

NOTABLE: I can not imagine this passes, but this is something I will keep my eye on. That said I remain long this market via KRBN. This may be a good spot to get long with a tight stop if you were unable to get in last May when the position was initiated.

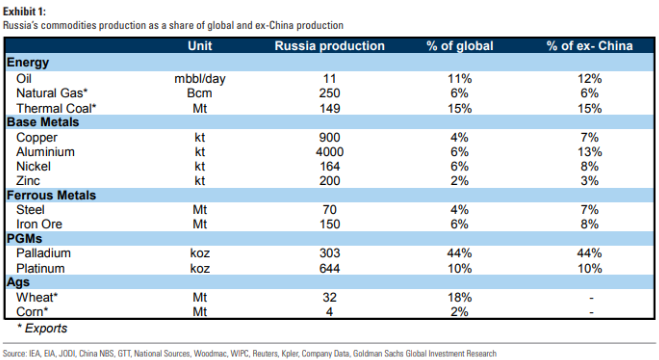

PALLADIUM

Russia’s Palladium Exports Face Disruption From Flight Bans

Palladium supplies from top producer Russia face disruption from widespread flight bans, with companies looking to find alternative means to export the precious metal.

The metal that’s mostly used in catalytic converters is almost always transported by passenger planes. With most of Europe’s airspace closed to flights from Russia, miners like MMC Norilsk Nickel PJSC are examining alternative routes to supply customers, according to a person familiar with the matter. -BBG

NOTABLE: Russia supplies 44% of the global palladium market.

NEW TRADE IDEA

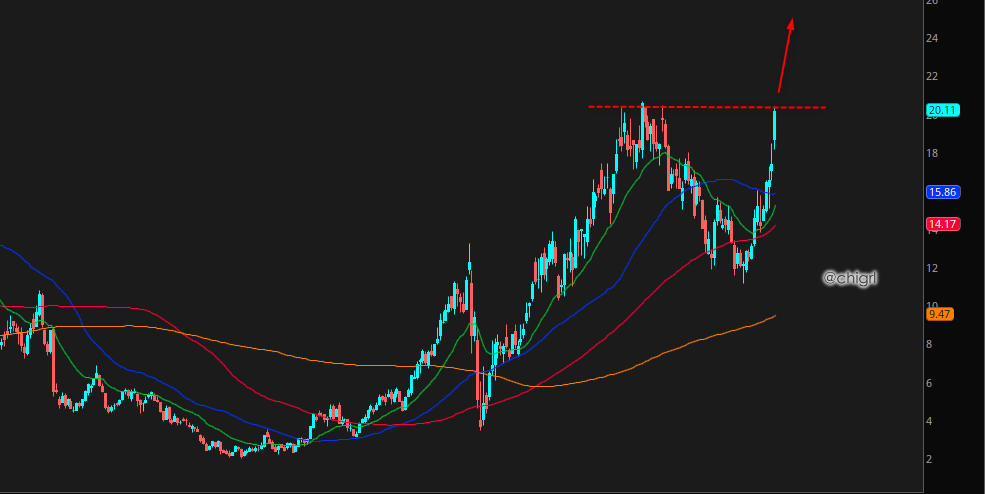

Sibanye Stillwater (SBSW)

Sibanye-Stillwater Limited is an international precious metals mining concern with global operations in North and South America and Southern Africa. The company’s diverse portfolio of operations includes gold mining operations in South Africa, as well as PGM mining operations in Zimbabwe, Canada and Argentina.

A break above this recent high would be supremely bullish

COAL

Russia is a material coal supplier, at ~15% of the global met and thermal coal market.

Russian coal accounts for 30% of Europe’s met coal imports and 60% of their thermal coal imports.

NOTABLE: I love BTU even more for this play. It is a very volatile stock (not for the faint of heart) BUT it generally provides generous pullbacks to maneuver in and out of. I trade around a core position on this one.

FERTILIZER

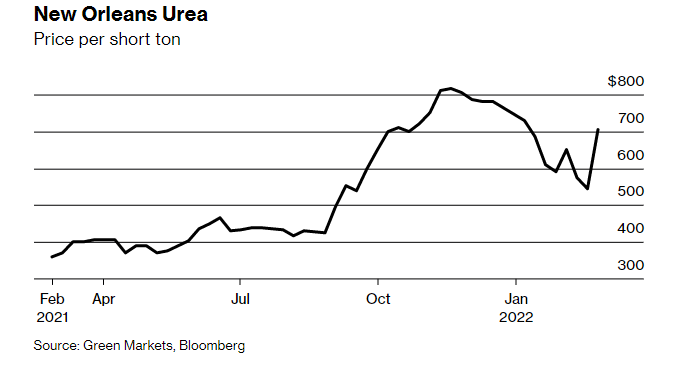

Soaring Fertilizer Prices Are About to Increase the Cost of Food

Russia is a major supplier of every crop nutrient, and higher supermarket bills will be a ripple effect of its invasion of Ukraine.

Pandemic-induced supply bottlenecks and the rising cost of natural gas, a key production input, are among the factors sending fertilizer prices soaring. Add disruptions stemming from Russia’s invasion of Ukraine, and consumers will be paying more for almost every plate of food. “You think they squawk about having gas go from three to four dollars a gallon?” says Riensche. “Wait until the grocery bill is $1,000 a month.”

Russia is a major low-cost exporter of many kinds of crop nutrients. “No other nation has the same breadth of readily exportable fertilizer supply,” says Alexis Maxwell, an analyst with Bloomberg’s fertilizer analysis and news publication Green Markets. “Their fertilizers move to all continents.”

If the global trade in fertilizer is further disrupted, it will mean higher costs for farmers across the globe, and in turn more food inflation at a time when global food prices have already been hitting record highs. Prices for the widely used nitrogen fertilizer urea in New Orleans surged 29% from the previous week—a record for the 45-year Green Markets index—after Russia invaded Ukraine.-BBG

NOTABLE: Just another reason to stay long MOS, IPI, and/or CF. Nutrien (NTR) is also another option.

Also, I maintain a long position in Invesco DB Agriculture Fund (DBA) mentioned in November 2021 and Darling Foods (DAR) mentioned in January 2022.

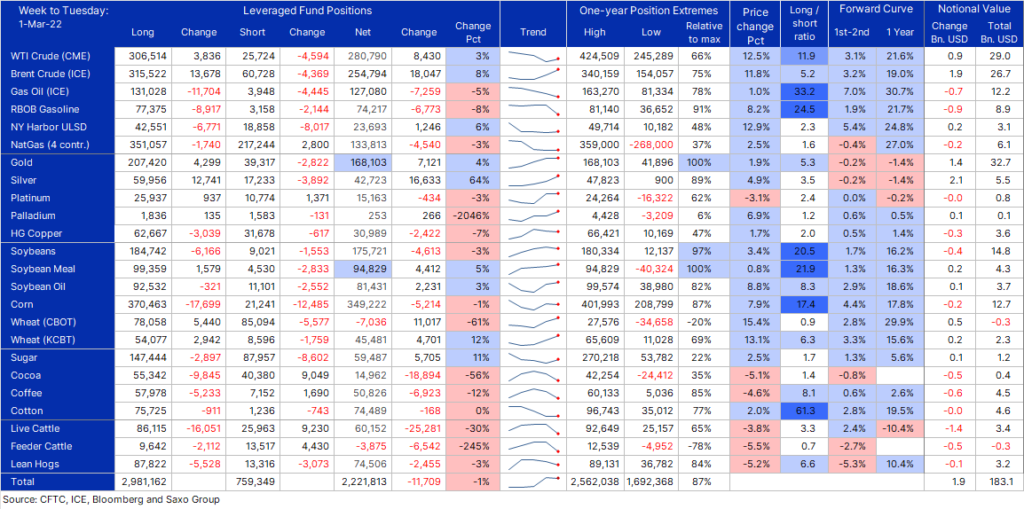

COMMITTMENT OF TRADERS

COT on Commodities in wk to March 1 showed specs cut long and short positions amid increasingly difficult trading conditions and surging volatility. Net length added to crude oil gold silver & wheat with net selling seen in fuel products, copper corn cocoa coffee & cattle – SAXO

(keep in mind this is lagging data)

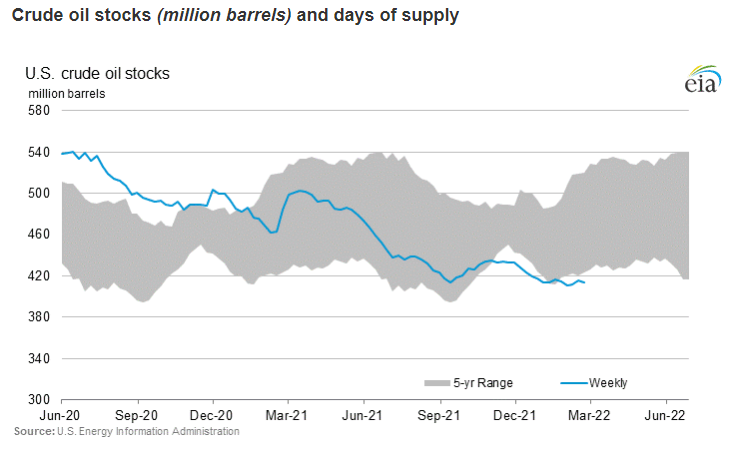

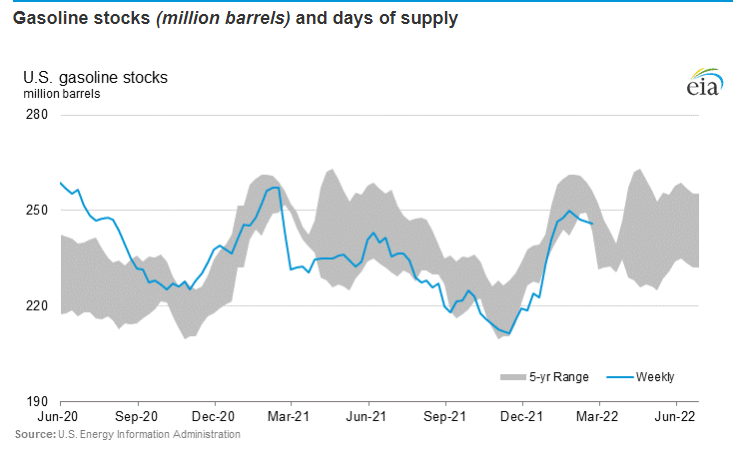

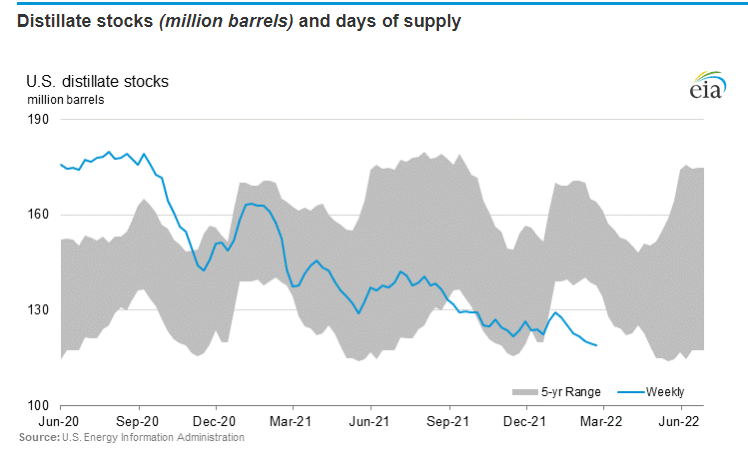

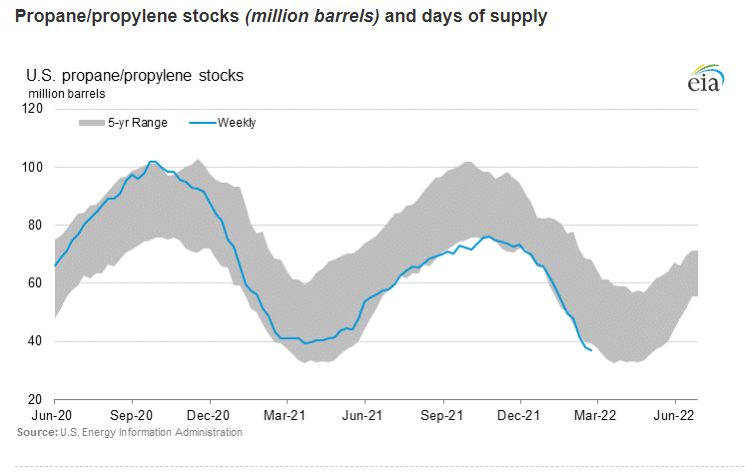

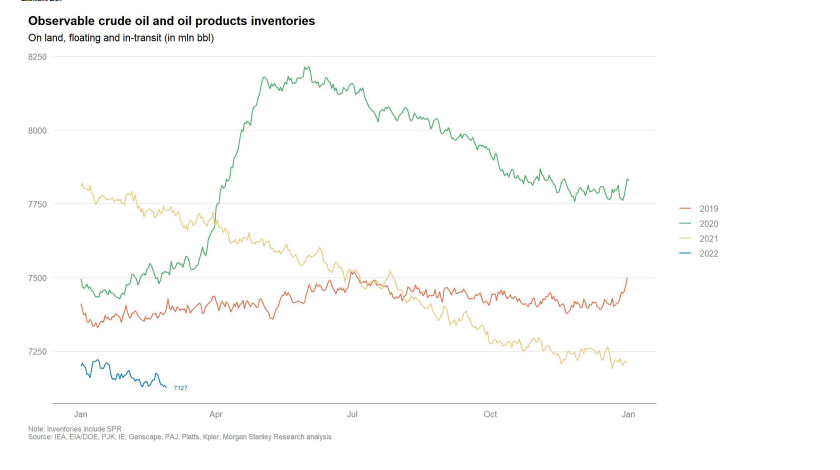

CRUDE OIL INVENTORIES

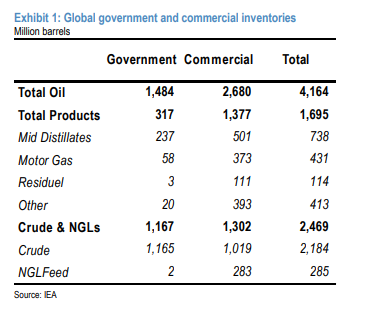

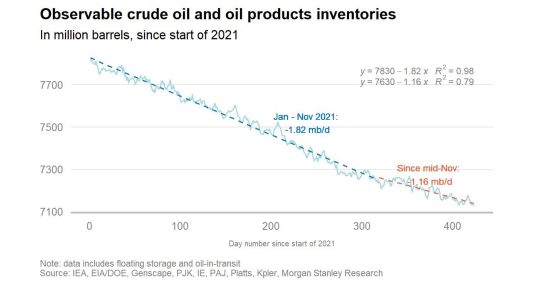

GLOBAL OIL INVENTORIES

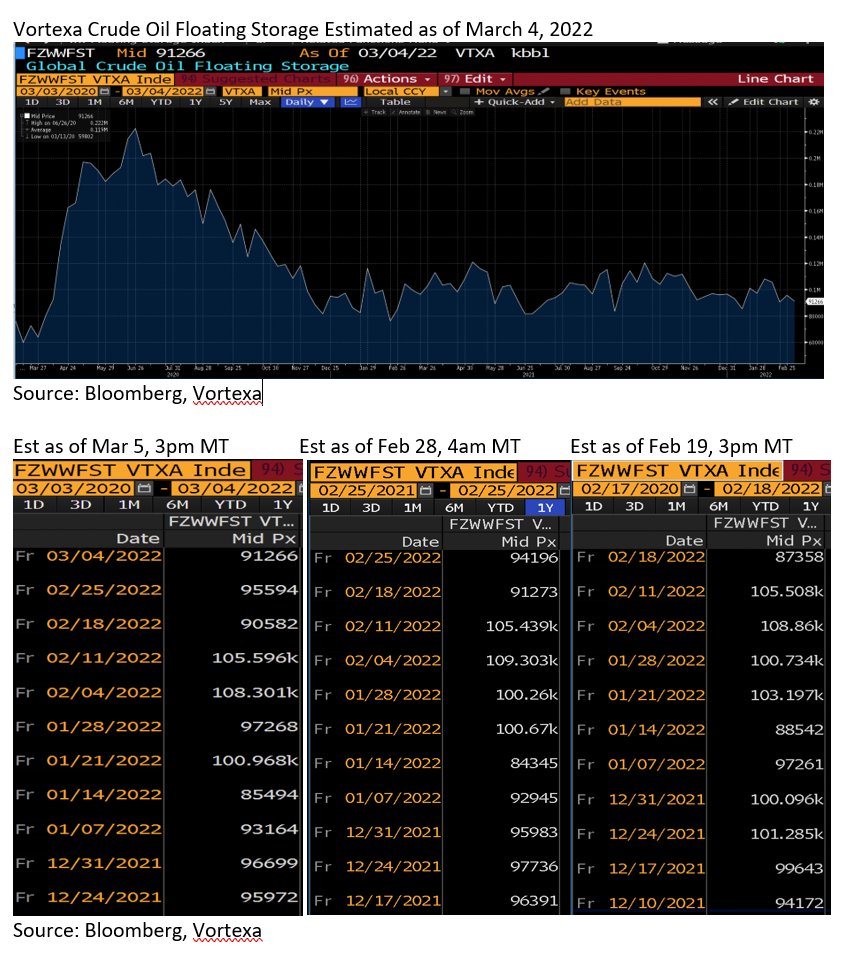

VORTEXA FLOATING STORAGE

Vortexa crude oil floating storage for 03/04 est 91.27 mmb, -4.32 mmb

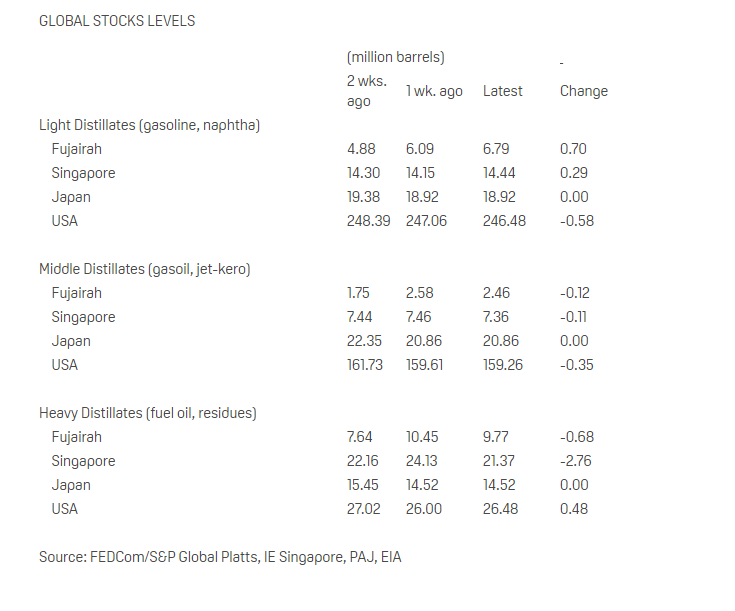

FUJAIRAH DATA

As of Monday, February 28, total oil product stocks in Fujairah were reported at 19.024 million barrels – marginally down from last week’s levels. Total stocks fell 94,000 barrels with overall stocks down 0.5% week-on-week. Middle distillates and heavy residues posted draws which were largely offset by a build in light distillate stocks.

Stocks of light distillates, including gasoline and naphtha, increased by 700,000 barrels or 11.5% on the week to 6.787 million barrels.

Stocks of middle distillates, including diesel and jet fuel, fell by 115,000 barrels or 4.5% on the week to 2.464 million barrels. Volatility stemming from the uncertainty surrounding the escalation in the Russia-Ukraine conflict on energy markets continued to buoy the gasoil complex, with steepening backwardation reflecting a strengthening market.

Stocks of heavy residues fell 679,000 barrels or 6.5% on the week to 9.773 million barrels.

EIA