BIG NEWS

Aside from the sell-off last week, which I wrote about on Friday. It is notable that we rebounded nicely on Friday, if you recall I wrote:

“CTA’s do not fully deleverage in reaction to a one-day volatility event, but if the vol spike continues for 2-3 days, then they will have no choice but to sell. I do not expect this to turn into a major sell-off, despite everyone screaming oil is going to zero again. We have had three large sell-offs 9%-13% over the past year, including this one (since the April 2020 debacle), and the market has rebounded sharply. Fundamentals remain strong and the physical market continues to tighten. In addition, crude prices have gotten a little ahead of themselves, the pullback has been overdue, presenting new buying opportunities.”

Things are still hot in the Middle East

On Friday, there were more missile attacks on Saudi Aramco facilities. The Houthis said they struck an Aramco refinery in the Saudi capital using six bomb-laden drones. The state news agency said that the attack, which took place at 6:05 a.m. local time, caused a fire that was later controlled with no impact on oil supplies or derivatives.

By Friday afternoon, the Saudis issued a statement saying the missiles used in the attacks on Saudi Aramco facilities, for which Yemen’s Tehran-backed Houthi group has claimed responsibility, were made in Iran, a Saudi minister said.

“All of the missiles and drones that came into Saudi are Iranian-manufactured or Iranian-supplied,” Adel Al-Jubeir, minister of state for foreign affairs, said in an interview with Arab News published Friday afternoon. “Several of them, as we’ve said, came from the north; several came from the sea.”

On Saturday, Saudi-led coalition warplanes pounded Yemeni rebels’ military bases in retaliation for a weekend attack on the heart of the kingdom’s economy.

The raids on the Yemeni capital, Sana’a, targeted military camps, as well as Houthi rebel facilities near the city’s airport and in its suburbs, residents and rebel-run Al-Masirah TV said. A separate strike hit a rebel target in the port province of Hodeidah. -BBG

Obviously, the oil price is sensitive to moves in the Middle East. We may see a reaction on the open Sunday night. That said as long as oil facilities remain unscathed the moves will likely be muted.

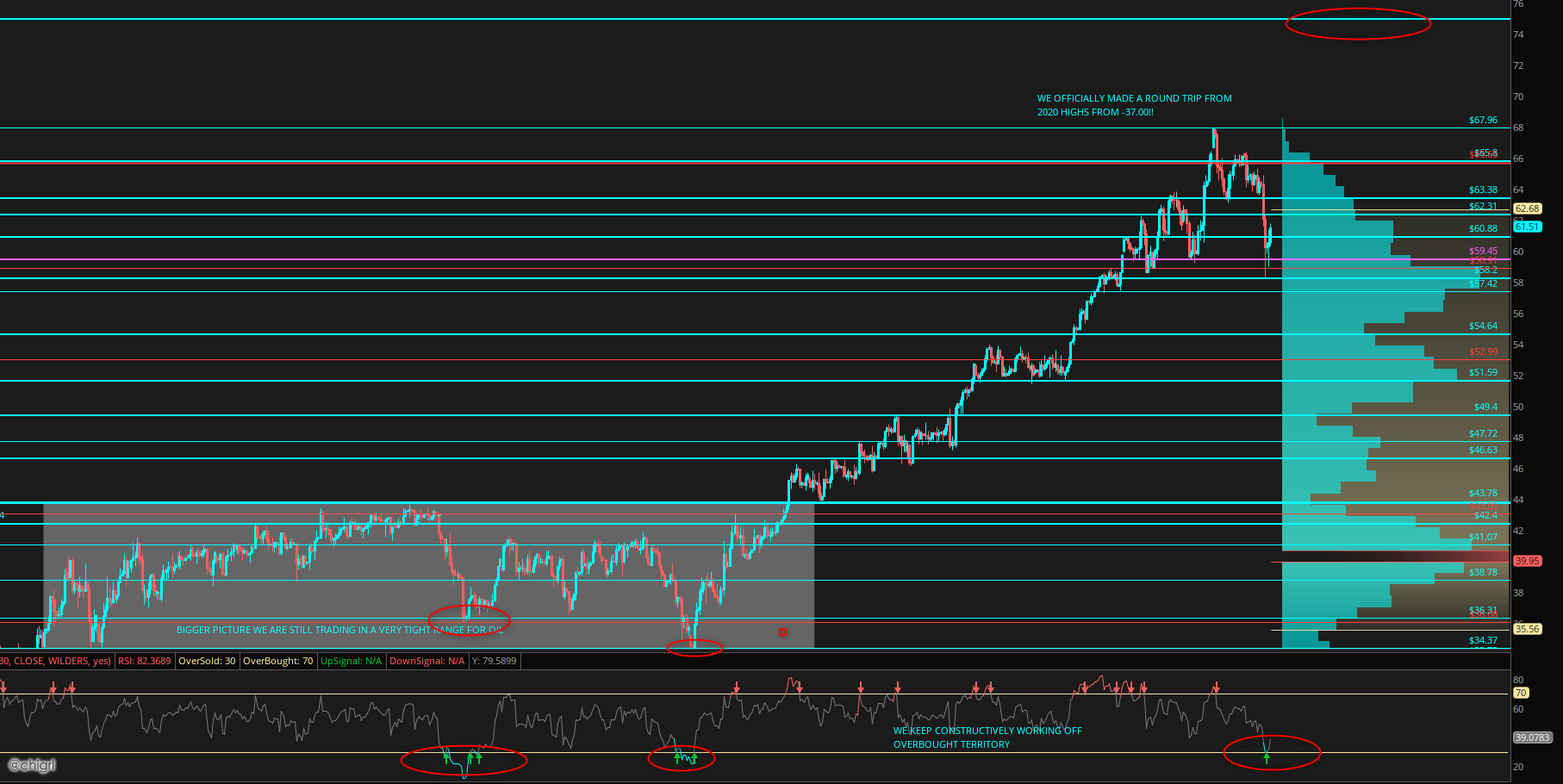

TECHNICALS

We had a welcome sell-off…I got the first buy signal in a very long time. We may consolidate some, but an overall target of $75 is still in play.

FUNDAMENTALS

UNITED STATES

INTERIOR SECRETARY: The Senate voted on Monday to confirm Deb Haaland to be secretary of the Interior Department, ending a tumultuous confirmation process and positioning her to oversee a vast reshaping of energy development on public lands.

Republican Sens. Lindsey Graham of South Carolina, Dan Sullivan of Alaska, Lisa Murkowski of Alaska, and Susan Collins of Maine joined Democrats in a 51-40 vote.

Other Republicans tried in vain to block Haaland because of her past stance of opposing fossil fuel development, but she still got the least amount of “yes” votes ever for an interior secretary nominee.

Biden promised a ban as one of his signature campaign pledges to help combat climate change, but Democratic lawmakers are calling for the administration to reform the process of oil and gas leasing on federal lands without ending it.

Haaland stressed during her confirmation the pause won’t be permanent while reiterating her interest in resetting how public lands are used to focus more on renewable energy development and conservation.- Washington Examiner

We have to remember, Haaland is a former congresswoman from New Mexico. New Mexico has the most oil production of Federal lands.

Also on Monday the pause was lifted and the the Biden Administration said that the

U.S. Bureau of Land Management (BLM) office staff would resume processing oil and gas drilling permits later this week following a two-month period when those approvals were limited to senior officials in Washington.

In an emailed statement, the Interior Department said BLM officials would process applications for permits “and related sundry activities on valid, existing leases in a timely manner.”

The permit ban was never really enforced. Permits have been issued this whole time as I discussed back in January, but I guess “technically” it is back to business as usual for now.

Back when the leasing pause was first initiated back in January, The Western Energy Alliance filed a lawsuit in Wyoming, which is still going through the court system that characterizes the leasing pause as “an unsupported and unnecessary action” that’s “inconsistent” with the terms of the Mineral Leasing Act.

Again, if the administration tries to pursue a permanent ban, this will be held up in courts for a very long time, as I have mentioned before.

TEXAS

KEYSTONE XL: On Wednesday, Texas Attorney General, AJ Paxton announced that Texas and Montana are filing a multistate complaint against the Biden administration for revoking the 2019 Presidential Permit for the Keystone XL pipeline. The suit is joined by attorneys general from Alabama, Arkansas, Georgia, Indiana, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Utah, and Wyoming.

The lawsuit states that President Biden does not have the unilateral authority to change the energy policy that Congress has set. The power to regulate interstate and international commerce, including granting or rejecting permits for oil pipelines that cross an international border, resides with Congress, not the President. Paxton said:

“Since his first day in office, President Biden has made it his mission to undo all the progress of the previous administration, with complete disregard for the Constitutional limits on his power. His decision to revoke the pipeline permit is not only unlawful but will also devastate the livelihoods of thousands of workers, their families, and their communities,” Attorney General Paxton said. “This administration continues to tout imaginary green-energy jobs, without any recognition that their actions in the real world will make it impossible for hard-working Americans to put food on the table.”

“The power to regulate foreign and interstate commerce belongs to Congress — not the President. This is another example of Joe Biden overstepping his constitutional role to the detriment of Montanans,” Attorney General Knudsen said. “There is not even a perceived environmental benefit to his actions. His attempt to cancel the Keystone XL Pipeline is an empty virtue signal to his wealthy coastal elite donors. It shows Biden’s contempt for rural communities in Montana and other states along the pipeline’s path that would benefit from and support the project.”

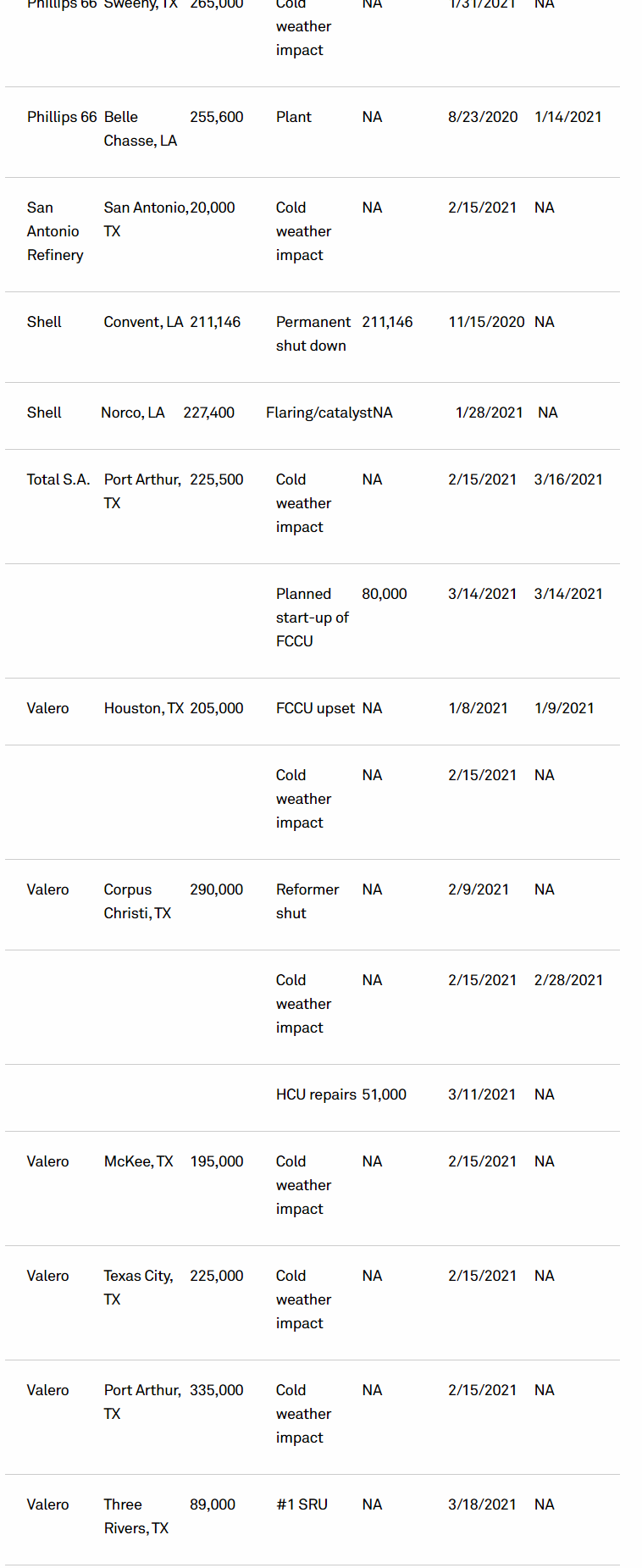

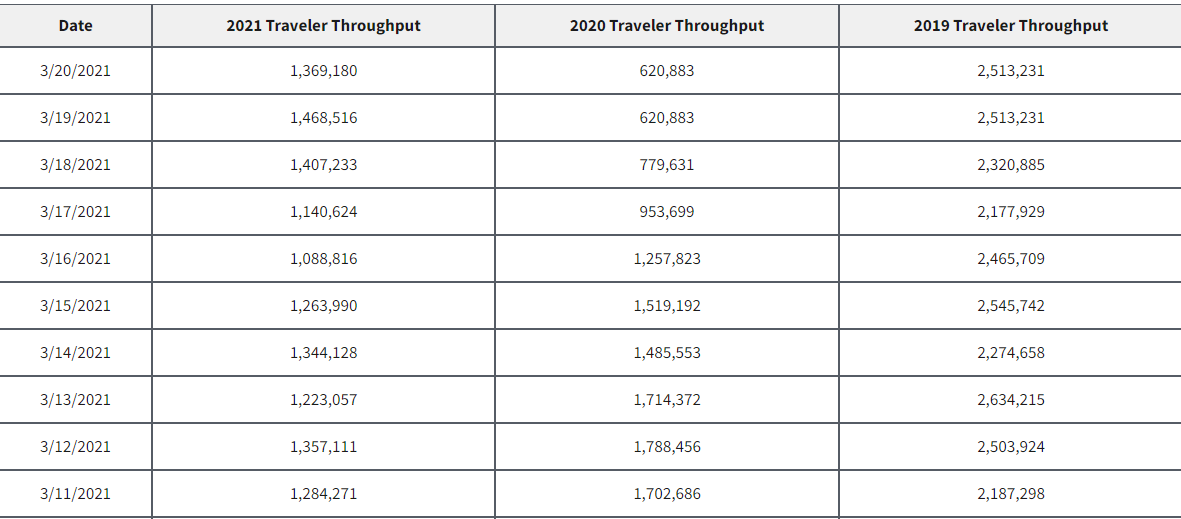

PADD III REFINERY ROUND UP (Polar vortex impacted refineries): There are still some refineries offline, but we are getting there. We should see an uptick in refinery utilization this week.

Owner Refinery Capacity Unit Name Unit b/d Start End

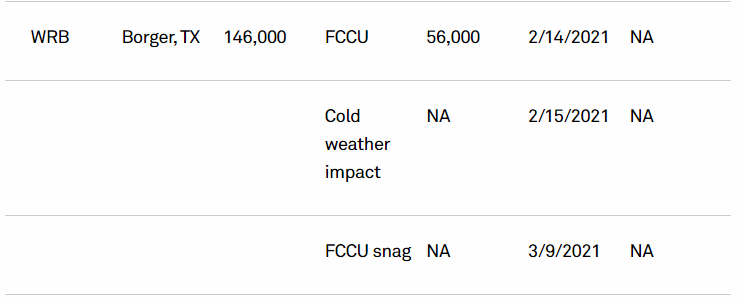

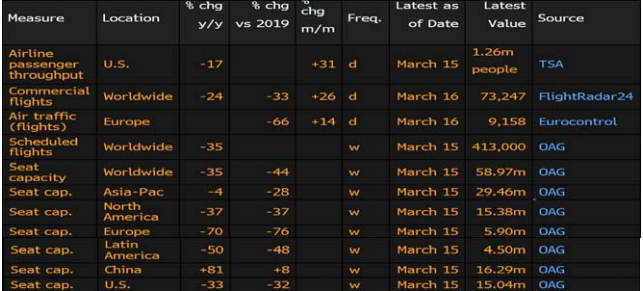

TSA: Air travel in the United states continues to pick up.

Passenger throughput on Friday hit a high post-pandemic high of 1.468M and has been over the 1M mark for 10 consecutive days. Good news for jet fuel.

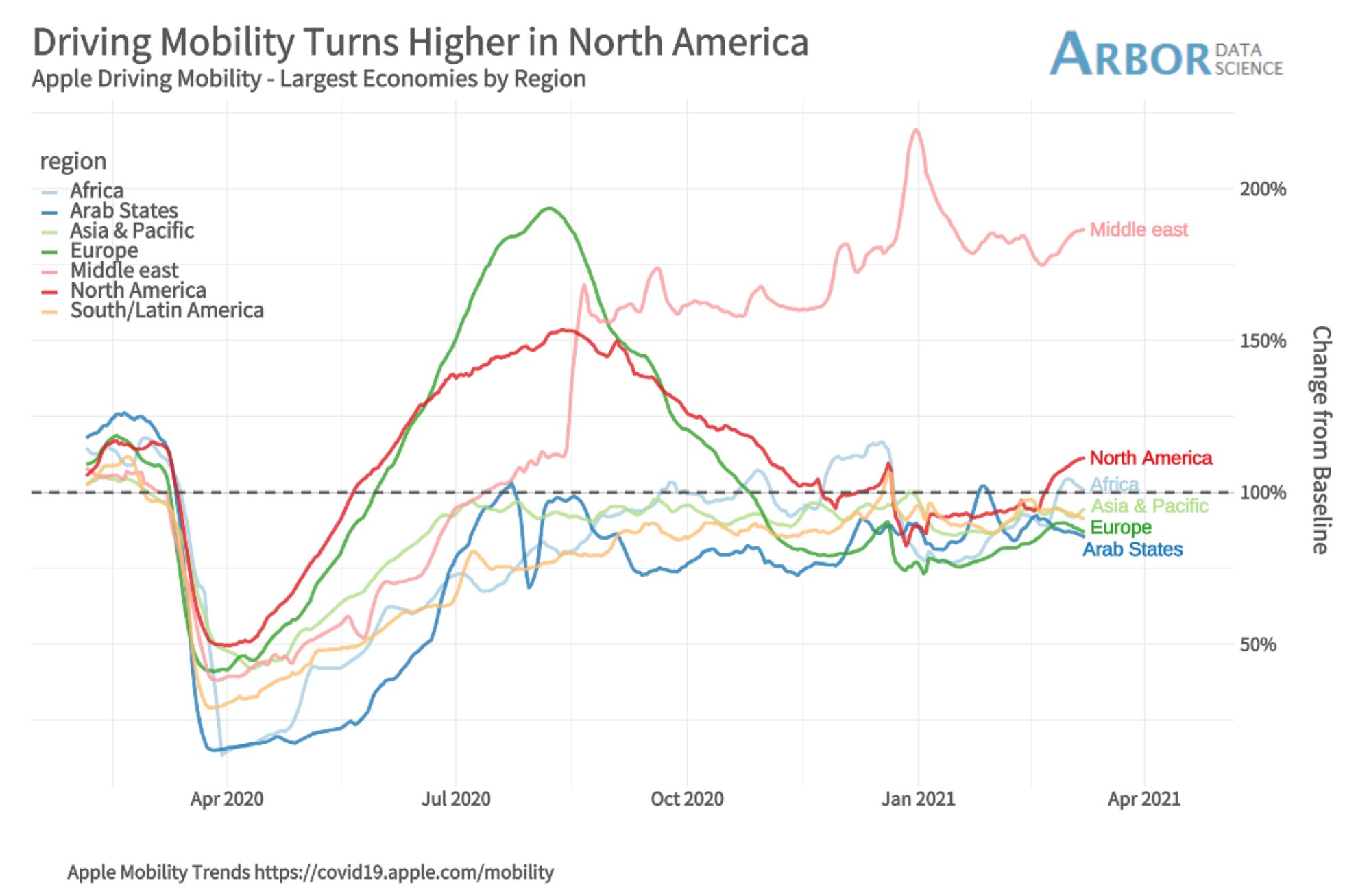

DRIVING: Driving mobility trends in North America are trending higher. I expect this to continue as we head into spring break and summer driving season.

INDIA

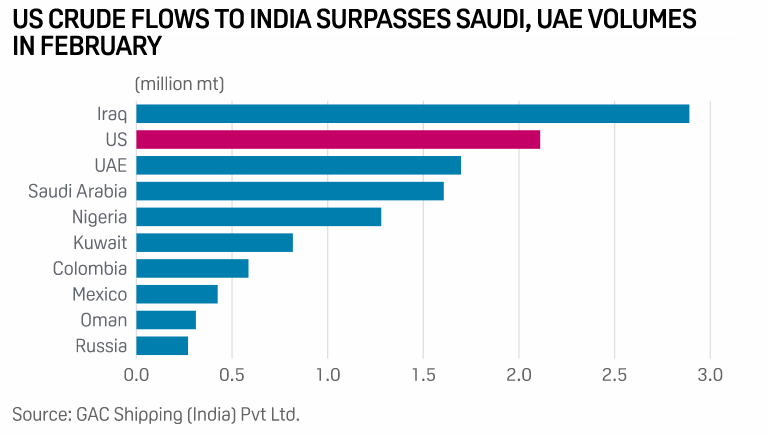

Last week I mentioned that India has asked state refiners to speed up the diversification of oil imports to gradually cut their dependence on the Middle East after OPEC+ decided last week to largely continue production cuts in April and how that would be good news for the United States.

Well, low and behold, the US displaced Saudi Arabia from the second spot in February and it looks as though this trend will continue.

US crude imports by India stood at 12.69 million mt in 2020, up nearly 29% from a year earlier, helping the country move up to fifth position from sixth in 2019, data from GAC Shipping (India) Private Ltd. showed.

In February, inflows from the US were 2.11 million mt, about 32% higher than 1.61 million mt inflows from Saudi Arabia. This pushed the US to the second spot. Iraq retained its position as the top supplier, with shipments of 2.89 million mt in the same month.

RAILWAY MERGER

Canadian Pacific (CP) to acquire Kansas City Southern (KSU) in $25 billion freight-rail deal

Canadian Pacific Railway Ltd. agreed to acquire Kansas City Southern in a merger valued at about $25 billion that would create the first freight-rail network linking Mexico, the U.S., and Canada.

The companies said Sunday their boards agreed to a deal that values Kansas City at $275 a share in a combination of cash and stock. Kansas City investors will receive 0.489 of a Canadian Pacific share (CP), -1.37% CP, -1.36%, and $90 in cash for each Kansas City (KSU) common share held.

If approved by regulators, the deal would unite two of the major North American freight carriers, linking factories and ports in Mexico, farms, and plants in the midwestern U.S. and Canada’s ocean ports and energy resources. -WSJ

This is an excellent fit and will help streamline agriculture and energy transit across the continent. With pipelines being cancelled (Keystone XL) and ENB line 3 and 5 in danger, rail is the next affordable option. Food and energy prices are rising, transportation costs are a big factor, if we can reduce these, it is better for the consumer.

Canadian Pacific= Red Kansas City Southern= Orange

UK

The government is reportedly considering a moratorium on the issuance of new licenses as part of a number of measures in the run-up to the UK hosting COP26 climate change talks in Glasgow in November, according to the Telegraph. The UK’s the North Sea produces about 1 million b/d of mainly light sweet crude that forms the backbone of the Dated Brent benchmark, which is used to price two-thirds of the world’s oil.

I see this as highly unlikely, as there are too many jobs and too much money at stake. Demand continues to be strong in Asia and looks so out to 2050.

IRAN

Today, Supreme Leader Ali Khamenei says Iran is in no hurry to reach an agreement on the nuclear deal, adding that the US should fully lift sanctions first.

Again, I do not see a return to this agreement anywhere in the near future, if at all.

INDIA

India’s Oil Refining Capacity to Grow 77% by 2030: Oil Ministry

India’s crude oil refining capacity is expected to reach 443 million tons/year by 2030

* NOTE: India’s current refining capacity is at 250.2 million tons/year, according to the Petroleum Planning & Analysis Cell

* The new capacity addition includes the proposed 60 million tons/year mega refinery on India’s west coast

* India’s oil demand is expected to rise to 8.7 million barrels/day or about 435 million tons/year by 2030 from 4.4 million barrels now, according to Kumar, who’s the joint secretary of the refinery at the Ministry of Petroleum and Natural Gas

* Most of the new refining capacity will include petrochemical plants to meet India’s growing demand

* Petrochemical intensity of Indian refineries to double to 7% by 2030, expanding petrochemicals exposure to 15%‐20%

* While demand for gasoline and diesel will continue until at least 2040, greater growth will come from petrochemical products

* India needs largescale infrastructure for importing feedstock for petrochemicals as well as augment local production

* India’s demand‐supply gap for petrochemical products is expected to widen going ahead as requirement rises, Ajay Shah, president of the polymer chain at Reliance Industries, said.

** This will require India to build a world‐scale cracker every year -BBG

While the West is trying to move away from fossil fuels, demand will grow in Asia. This is BULLISH.

UAE MURBAN

On March 29, Saudi Arabia’s control over the Mideast oil supply could be loosened, possibly forever. On that day, traders on the Intercontinental Exchange (ICE) will begin buying and selling a futures contract based on Murban crude oil, which is produced by Abu Dhabi National Oil Co. Anyone who buys Murban oil will be able to sell it anywhere in the world, as they already can with West Texas Intermediate crude from the U.S. and Brent crude from Britain’s North Sea. The difference is that Murban volumes are much larger than those of the American and British crudes. The lack of destination controls will set Abu Dhabi apart from Saudi Arabia, which zealously controls who can buy and consume each shipment of its oil. -BBG

Traders will be keeping a close eye on this contract. I do not believe this will hurt WTI futures contract volumes as it is a heavier crude grade than WTI, known as light sour, compared to WTI that is light, sweet. Crude grades are not interchangeable.

Likely it will have a very small effect on Brent futures contract volumes, as the Brent contract is mostly a financial contract. In addition, Brent is also a different crude grade than Murban, Brent is medium, sour, though the two can somewhat be interchanged, depending on the refinery.

(Light crude means that it is lower in sulfur content, sour is higher in sulfur content)

BLOOMBERG OIL DEMAND MONITOR

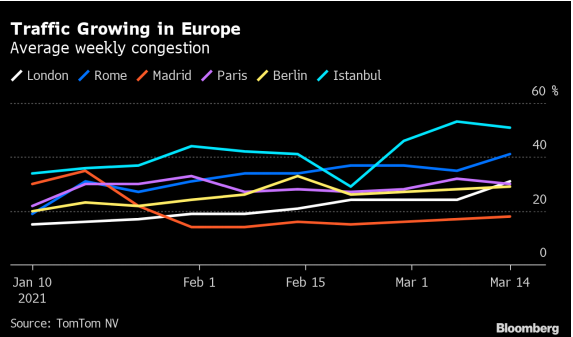

London Traffic Exceeds 2019 on Vaccine Boost

Monday-morning traffic congestion in London nudged above 2019 levels for the first time since early December as the U.K. benefits from one of the fastest coronavirus vaccination rollouts in Europe and a staged relaxation in quarantine rules.

A road journey in the U.K. capital at 8 a.m. on Monday that would take an hour on empty roads had 40 extra minutes of congestion, 5% more than typical 2019 levels, according to location technology company TomTom NV. In doing so, London swapped places with Rome, which dropped from 9% above last Monday to 73% below.

Traffic congestion has broadly been trending higher since the start of the year in Istanbul and five western European capitals, which together comprise six of Europe’s nine largest cities. Stricter lockdowns in countries suffering from another surge in infections could slow that advance, while a faster delivery of inoculations may entice more commuters back onto the roads.

Farther east, daily data from TomTom shows congestion levels in Beijing and Shanghai are firmly above the 2019 norm by a comfortable margin. Those two, plus London, were the only places to reach that threshold on Monday out of 13 cities regularly studied in this weekly monitor.

Diesel and gasoline sales by India’s biggest fuel retailers rose above year-earlier volumes in the first half of March. That’s the first time since October that the twice-monthly survey by Bloomberg News has shown both fuels above the 2020 level.

The weekly data in the graph below masks an even more recent decline in traffic intensity in Rome since Monday, when most of Italy returned to lockdown because infections are rising again.

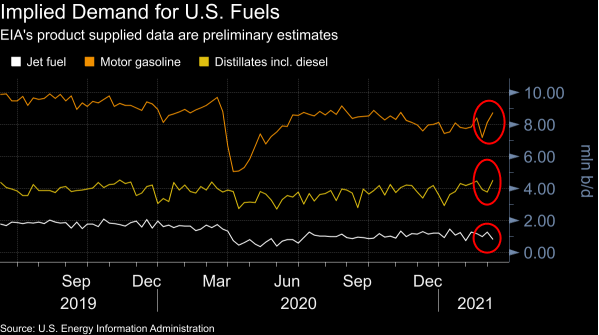

The US implied energy demand for fuels; gasoline and distillates look good jet fuel still the laggard, but this week’s TSA passenger throughput looks strong…I think this trend will continue as states open up, vaccines rolled out, and we head into summer

Traffic congestion in key cities

Airline passenger throughput in key cities

NATURAL GAS

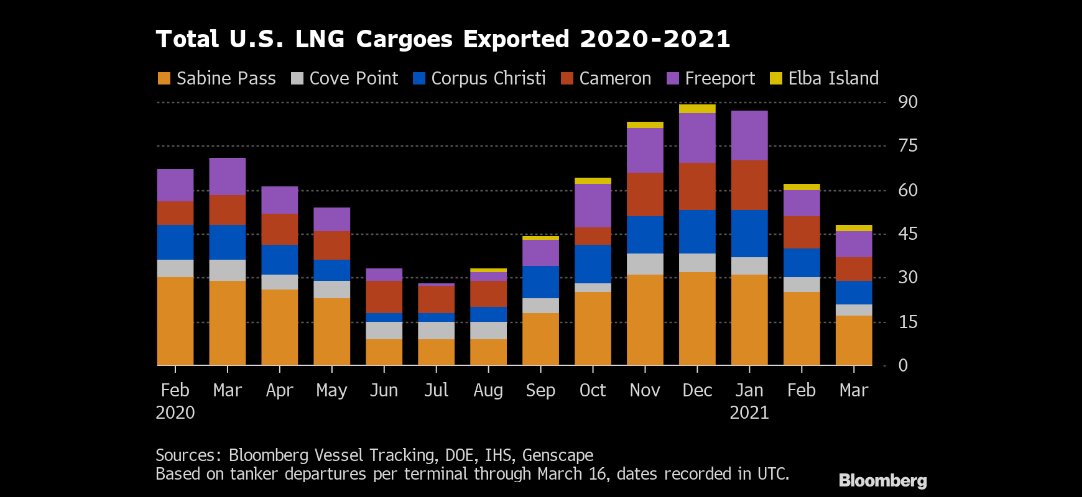

US LNG Exports Hit New Record

Gas flows to US LNG export terminals hit a record on Friday, and are nearing 12 bcf/day

New projects will soon be hitting max capacity, so it is unlikely exports can boom much more from here

Exports will get another bump later this year with the start up of the Calcasieu Pass plant

US LNG exports are on pace for a monthly record.

The pace of US exports in March is slightly above the 2.9 cargo-per-day record set in December, as 48 tankers have left export terminals through March 16.

MATERIALS

CANADA

The U.S. government is working to help American miners and battery makers expand into Canada, part of a strategy to boost regional production of minerals used to make electric vehicles and counter Chinese competitors. On Thursday, the U.S. Department of Commerce held a closed-door virtual meeting with miners and battery manufacturers to discuss ways to boost Canadian production of EV materials, according to documents seen by Reuters.

Conservationists have strongly opposed several large U.S. mining projects, leading officials to look north of the border to Canada and its supply of 13 of the 35 minerals deemed critical for national defense by Washington.

Tesla Inc, Talon Metals Corp, and Livent Corp were among the more than 30 attendees at Thursday’s meeting who discussed ways Washington can help U.S. companies expand in Canada and overcome logistical challenges, according to the documents. -Reuters

Something to keep an eye on. This would be bullish for Canadian miners of EV-related materials and battery manufacturers.

ALUMINUM

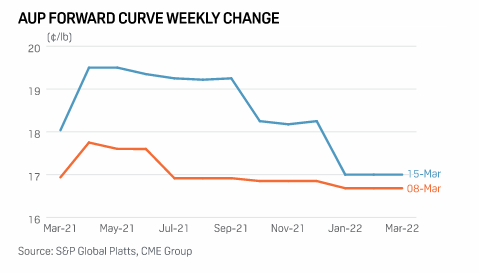

US aluminum premium futures spiked on supply concerns.

AUP total volume was 1,673 lots or 41,825 mt for the week ended March 12. Open interest finished the week at 24,979 lots on March 12, up 373 lots from the March 5 close.

The spot to six-months spread settled at a 0.50 cents/lb contango on March 15.

Cash to three-months spread on the LME settled at a $25.25/mt contango

Cash/December spread settled at a $40.50/mt contango.

CME Group’s AUP Midwest premium futures again rallied across the whole curve on March 15, back to May 2019 levels, as the spot premium to a 21-month high, as concerns around supply and inventory restocking continued.

With prices rallying further into 2021, the market is starting to see participants selling the front-month contracts and buying further dated strips in 2021 in order to capture some of the backwardation and restock inventories, which entailed started to flatten the curve.-Platts

MINERS

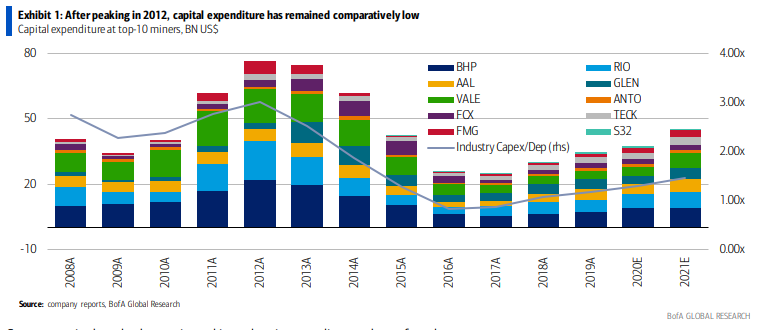

Miners need to increase CAPEX according to the latest report from BofA. In other words, we are set for shortages as, like oil, CAPEX has been majorly cut, in order to gain investor confidence (good governance); the sacrifice being that we will be heading for supply shortfalls in the future (loss of projects in the pipeline)= bullish metals/miners.

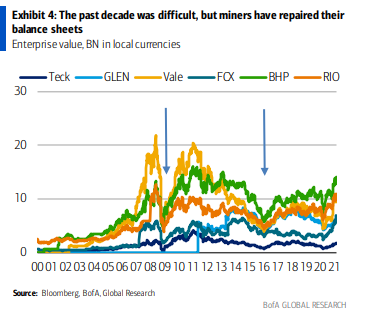

Mine supply has faced headwinds In the wake of the GFC, and after an initial rebound of prices as governments and central banks stimulated economies, metals faced headwinds. To that point, many mined commodities went through a bear market that lasted almost a decade.

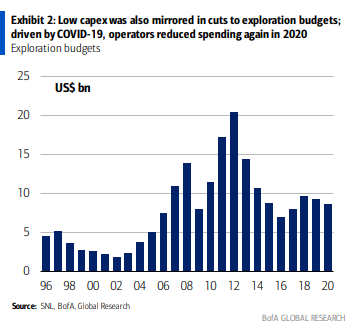

Capex remains comparatively low. Not surprisingly, miners tightened the belt, reduced expenses, and repaired balance sheets. Capital expenditure peaked in 2012 and then dropped for almost half a decade. True, spending has recovered slightly since 2017, but it is still running well below the levels seen between 2011 and 2013.

Capex restraint has also been mirrored in exploration spending, a subset of total capex, which has remained subdued. Indeed, partially influenced by COVID-19, miners reduced outlays once again in 2020.

Miners have left behind the difficulties seen over the past 10 years That discipline has been reflected in a confluence of factors. Miners have recovered from the difficulties seen in the past 10 years.

COPPER

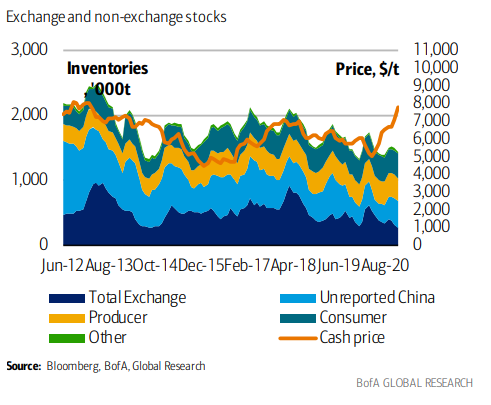

As you know, I have been bullish on copper as inventories are in decline, EV manufacturing picks up, and economies emerge from lockdowns.

BofA had an interesting chart on this this week.

Reported and unreported copper inventories have overall declined

IEA

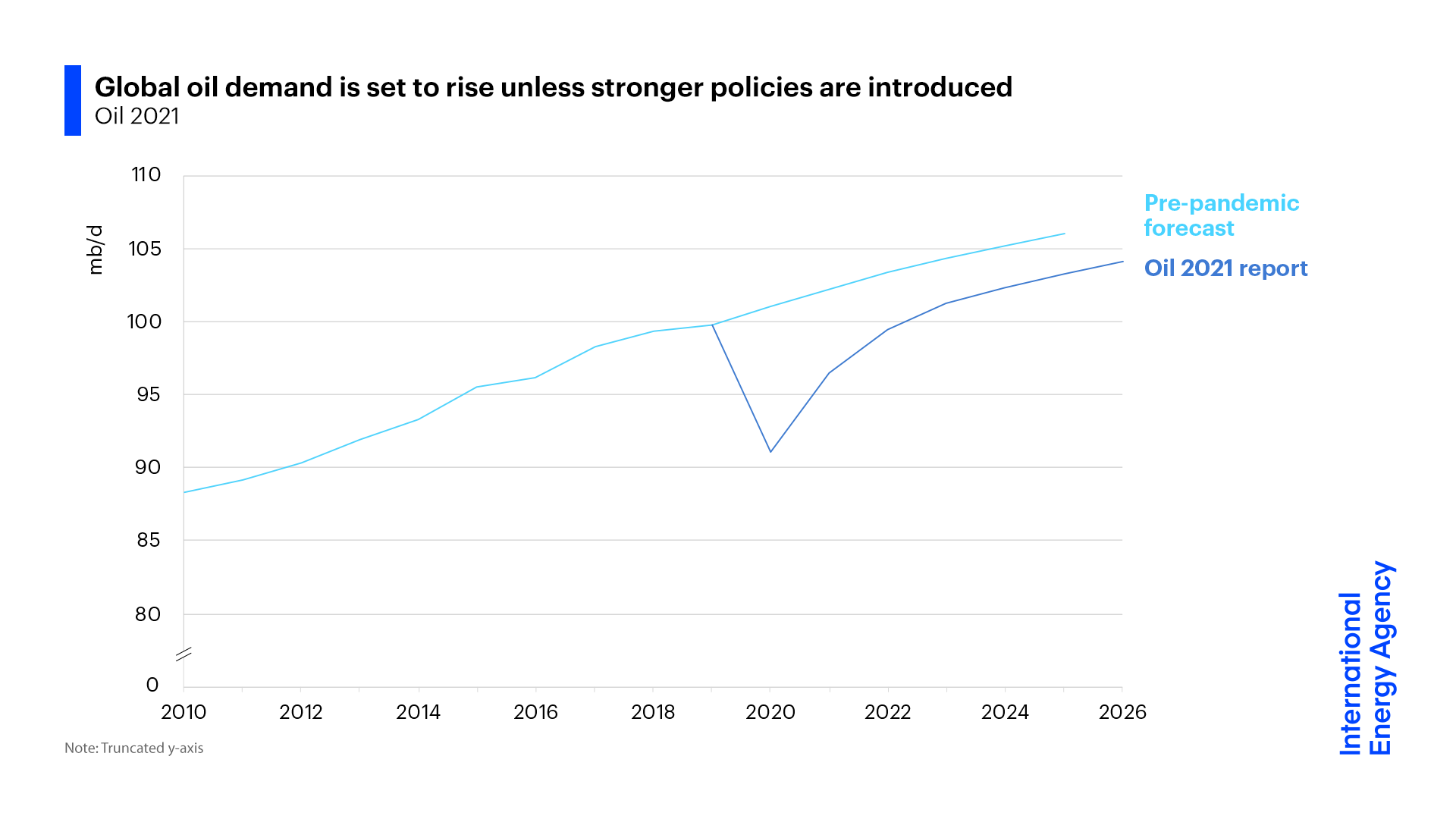

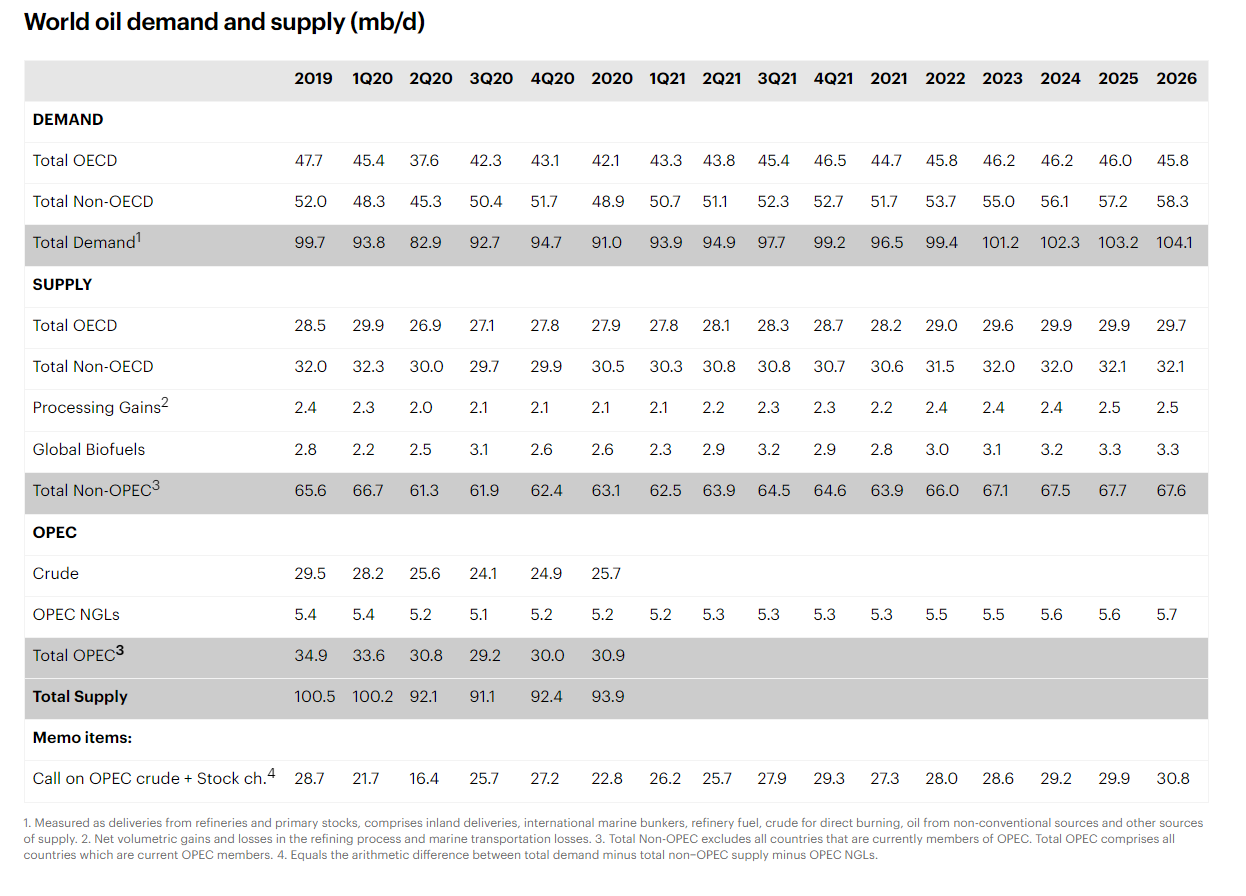

IEA’s 2021-2026 oil demand outlook was released this week. They expect steady demand growth.

Faith Birol, Director of the IEA, said “For global oil demand to peak anytime soon, bold action is needed to improve fuel efficiency standards, boost EV sales & curb oil use in the power sector. Without these & behavioral changes, global demand is set to rise every year through 2026.

Global oil supply & demand are today living in two separate worlds, with demand set to rise much faster than supply. This can’t go on indefinitely. We hope it will be resolved by new government policies to bring down demand. If not, we risk a return to damaging price volatility.”

In other words, markets are tightening and set to get tighter unless rapid change happens.

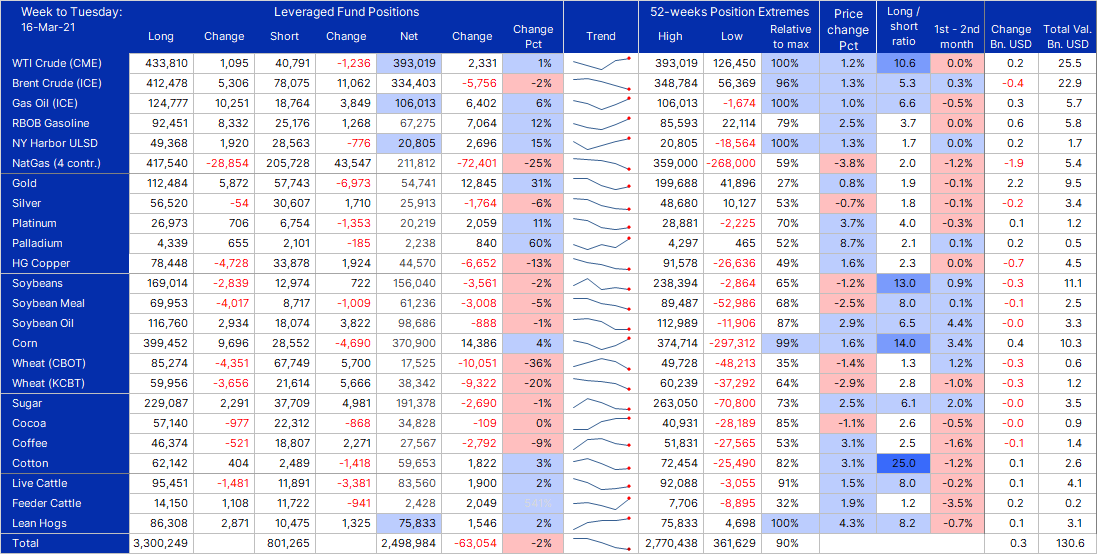

COMMITMENT OF TRADERS

COT on commodities in week to March 16 saw a third consecutive (small) reduction. Overall a mixed bag with no clear thread. Biggest increases in corn, gold, and fuel while selling hit natgas wheat and copper.

OIL INVENTORIES

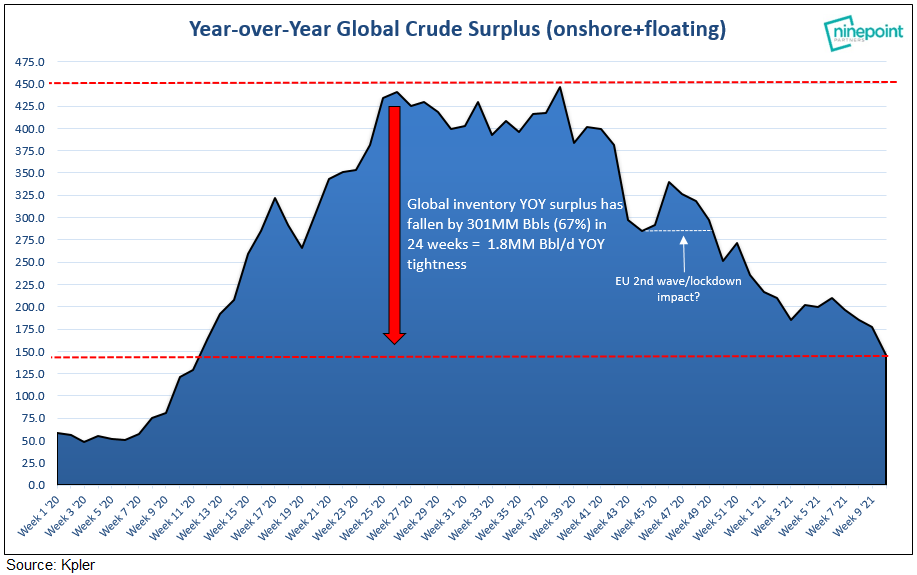

GLOBAL OIL INVENTORIES

Global inventories continue to fall with the COVID-induced glut now down 67% to 145MM Bbls. With Q1 seasonal weakness nearly behind us pace of decline to accelerate = normalized inventories by end of May via Ninepoint

FLOATING STORAGE

Crude Oil in Floating Storage Falls 3.3% in Past Week: Vortexa

* Asia Pacific down 16% w/w to 63.52m bbl

* Middle East up 77% w/w to 10.10m bbl; highest since August

* Europe down 12% w/w to 9.88m bbl

* U.S. Gulf Coast up 14% w/w to 6.44m bbl; highest since July

* North Sea down 36% w/w to 3.18m bbl

* West Africa up 118% w/w to 2.87m bbl

* Company Exposure: ** Asia: Cosco Shipping Energy Transportation Co., HMM Co. Ltd., Mitsui O.S.K. Lines Ltd., Nippon Yusen KK

** Europe: Euronav NV, Frontline, Vopak

** U.S.: DHT Holdings, International Seaways, Nordic American Tankers, Teekay Tankers, Tsakos Energy Navigation

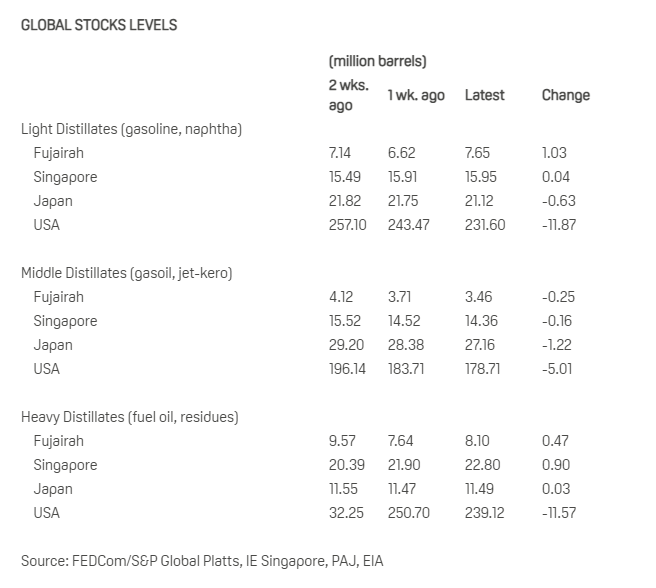

FUJAIRAH DATA

The total inventory stood at 19.217 million barrels, an uptick of 1.251 million barrels from the week ended March 8, according to the data provided exclusively to S&P Global Platts.

Light distillate stocks in Fujairah, such as gasoline and naphtha, rose by 15.6% to 7.652 million barrels.

Demand for gasoline from the Middle East will likely rise in the run-up to the Muslim holy month of Ramadan as Muslim countries around the world boost their gasoline stockpiles, but the extent of the rise will be difficult to anticipate due to COVID-19 pressures

Heavy distillates, including fuel for power generation and bunkers, increased by 6.1% to 8.104 million barrels, the data showed.

Middle distillate stocks in Fujairah, including jet fuel and diesel, fell 6.7% on the week to 3.461 million barrels. -Platts

We were at over 23M barrels in February, although we had an uptick this week, overall we are still drawing.

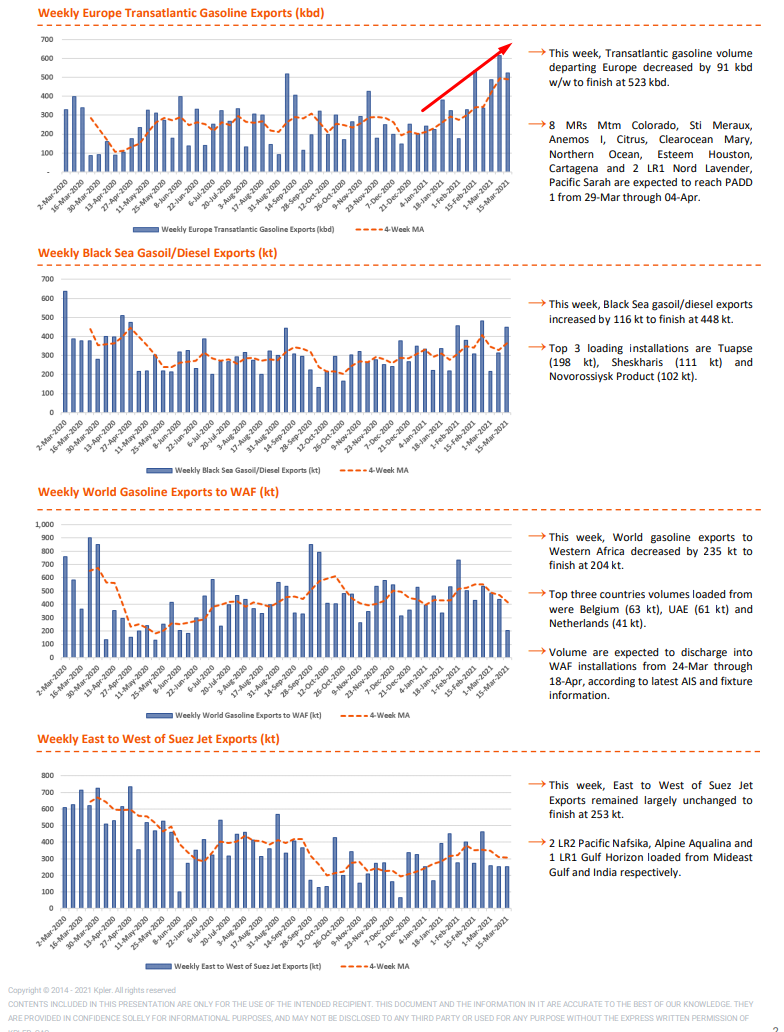

CPP WEEKLY FLOWS

This data looks strong, with the exception of West Africa.

EIA

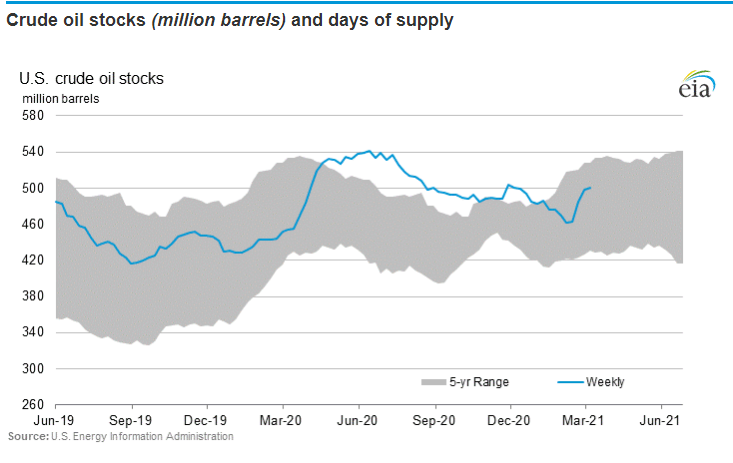

Another week where inventories were obfuscated by refinery outages due to the polar vortex. A crude build was expected. We are still well within the 5-year average.

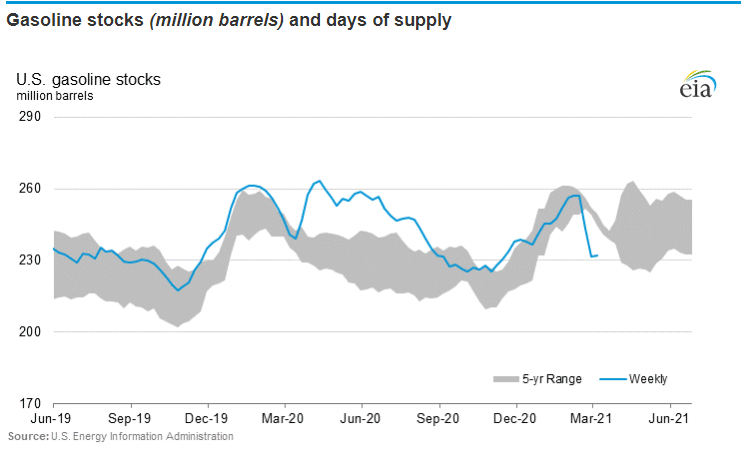

I would have liked to see a bigger draw in gasoline, as I mentioned on Wednesday note, that said we are still below the 5 year range, can not complain.

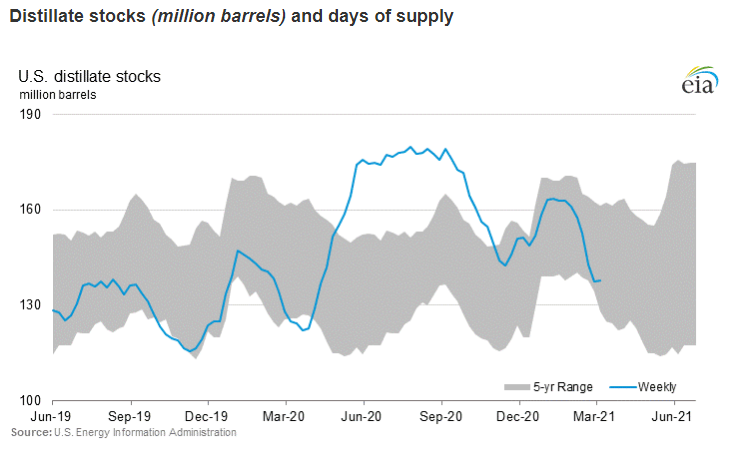

The same goes for distillates stocks, I would have preferred a draw, but again we are below the 5 year average.

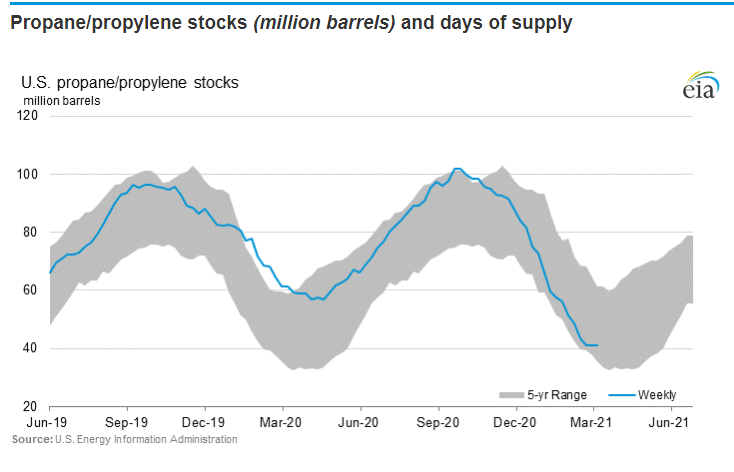

Propane got a welcome reprieve with a slight build.

DAILY SENTIMENT INDEX