BIG NEWS and under the radar

CHECK OUT THIS CLIP! 1:34 mark > Biden is essentially saying subsidies are in place for people to heat their home. Nat gas and energy to the moon

QUOTES OF THE WEEK

Saudi Arabia’s energy minister Prince Abdulaziz says: we should not compromise the upstream sector for the purpose of achieving more growth in the renewable energy sector and vice versa- Energy Intel

SAUDI ENERGY MIN SAYS WORLD WILL CONTINUE TO NEED FOSSIL FUEL SAUDI ENERGY MIN SAYS WORLD NEEDS TO PAY SERIOUS ATTENTION TO SUPPLY SECURITY || SAYS WE SHOULD NOT COMPROMISE ENERGY SUPPLY SECURITY FOR CLIMATE CHANGE FIGHT-CeraWeek

Saudi Arabia, the world’s top oil exporter, commits to a net-zero emissions target by 2060 (the same year as China). As every other net-zero target, it applies to emissions within the Saudi borders and has no impact on Saudi oil exports-BBG

CHARTS OF INTEREST THIS WEEK

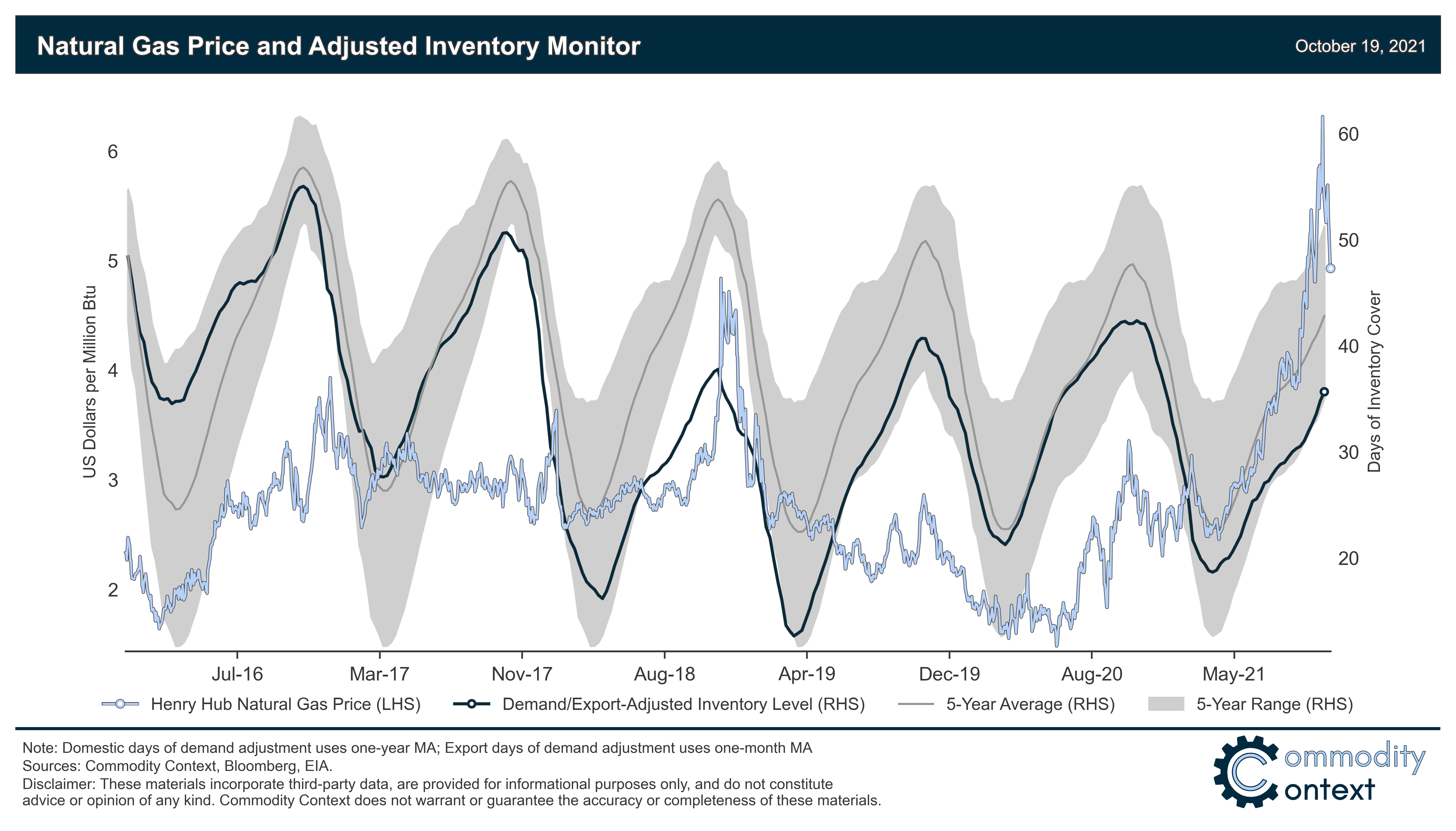

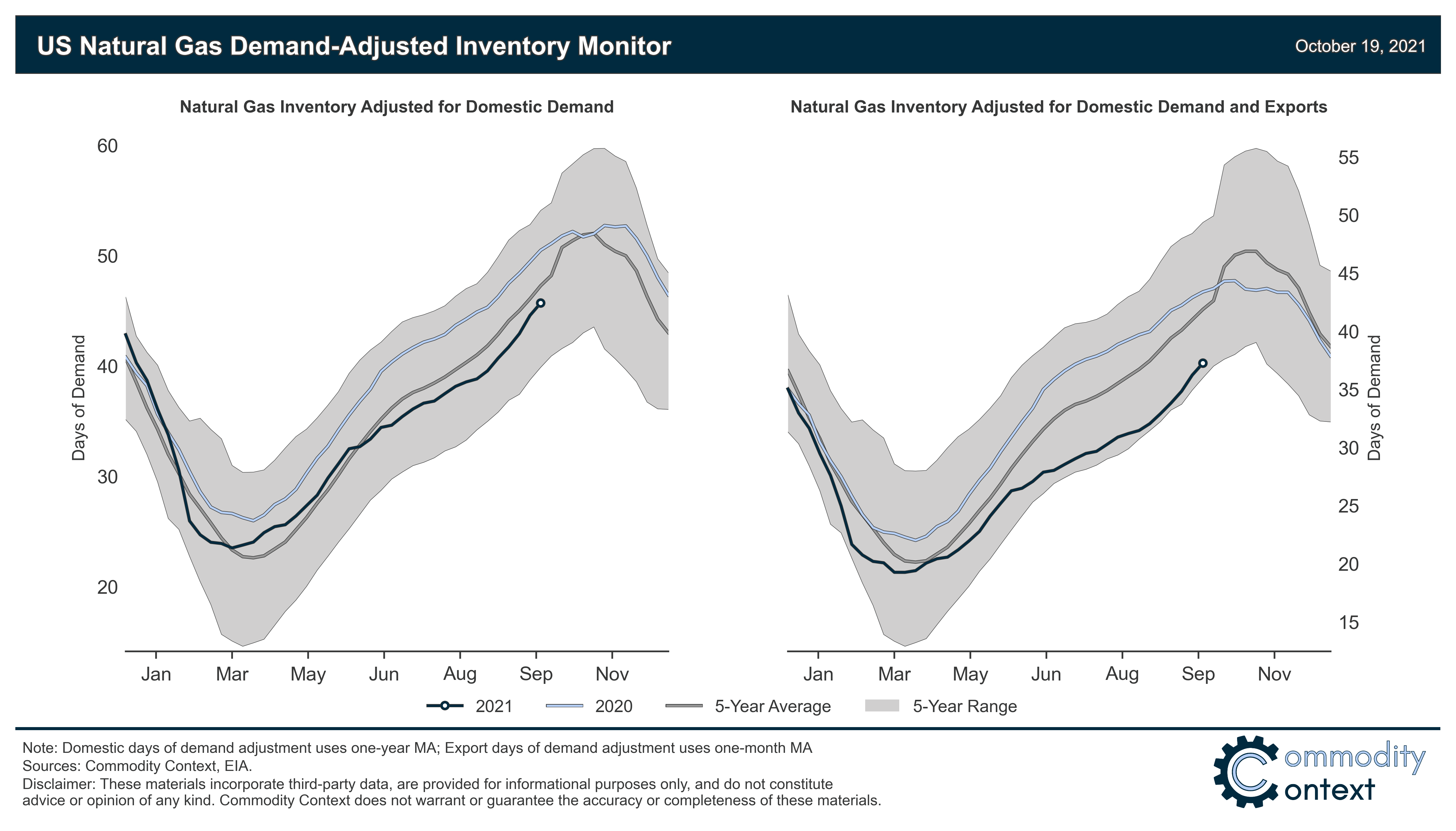

Natural Gas Inventories Lower than They Appear

Effective Inventories Deflated by Export Demand

China durable goods index (as a possible proxy of copper use) not showing weakness

Nickel stock declining steadily at LME too. Not yet red alert. But getting there.

Tin stock at LME at decade lows too.

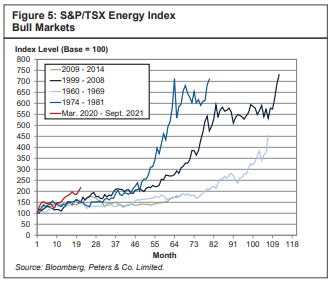

Commodity bull should still have 5-7 years to go

S&P/TSX Energy Index: Bull markets (this thing is just getting started)

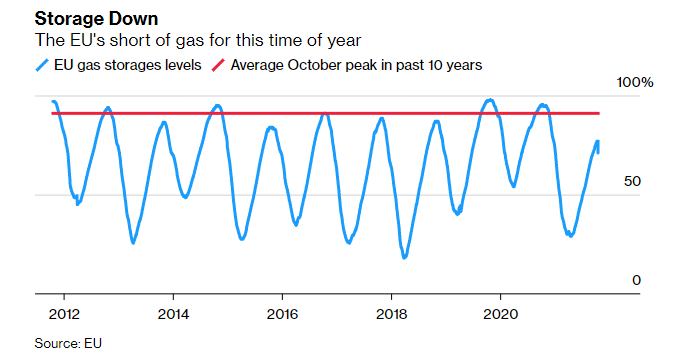

The EU’s short of gas for this time of year

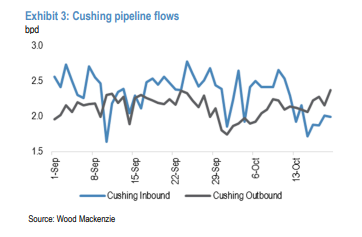

Cushing pipeline flows-DANGER DANGER!

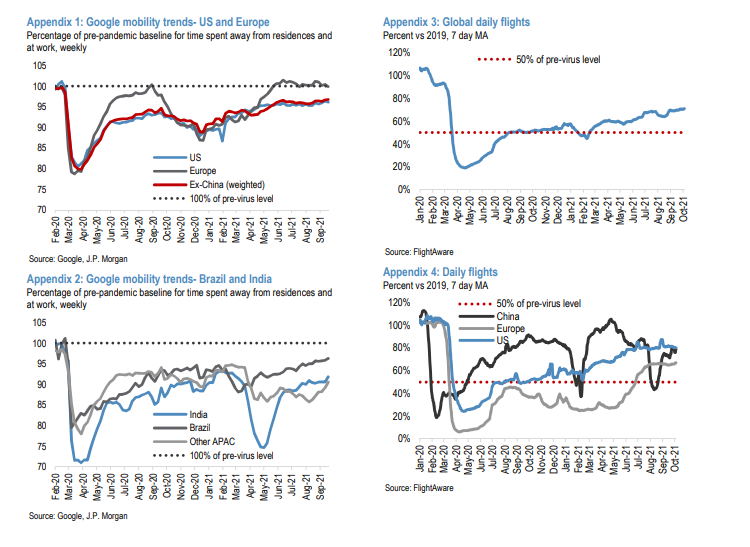

Mobility trends

TECHNICALS

We still keep working off overbought conditions. The chart is still constructively bullish.

OIL AND PRODUCTS

OPEC

OPEC+ Once Again Fails to Pump Enough to Meet Its Output Target

OPEC and its allies once again failed to pump enough oil to meet their output targets, exacerbating the supply deficit as the world recovers from the coronavirus pandemic.

OPEC+ cut its production 15% deeper than planned in September, compared with 16% in August and 9% in July, according to delegates with knowledge of the matter. -BBG

NOTABLE: I talked about this the other week, lots of the smaller producers have been falling behind and it is adding up. Obviously, this is bullish.

FUND MANAGERS

As oil prices skyrocket, fund managers hop on board for the ride

A surge in oil prices is drawing fund managers back into shares of oil and gas companies, even as some remain unsure that the price gains will stick.

Energy stocks in the S&P 500 (.SPNY) are up 53.8% for the year to date compared with a 20.2% gain for the broader index, as rising demand from the global economic reopening collides with supply chain disruptions and inflation fears to boost energy prices to multi-year highs.

The rally has caught many fund managers by surprise and some are scrambling to catch up, betting that commodity prices will remain high in the face of burgeoning demand. Allocations to energy stocks among fund managers increased by 23 percentage points from last month to the largest overweight since March 2012, a BofA Global Research survey showed on Tuesday.-Reuters

NOTABLE: Hate to say I told you so, but, I wrote previously that once investors caught on, it would be a pile-in on this trade. Stay long oil and gas! This may have caught fund managers by surprise, but not us!

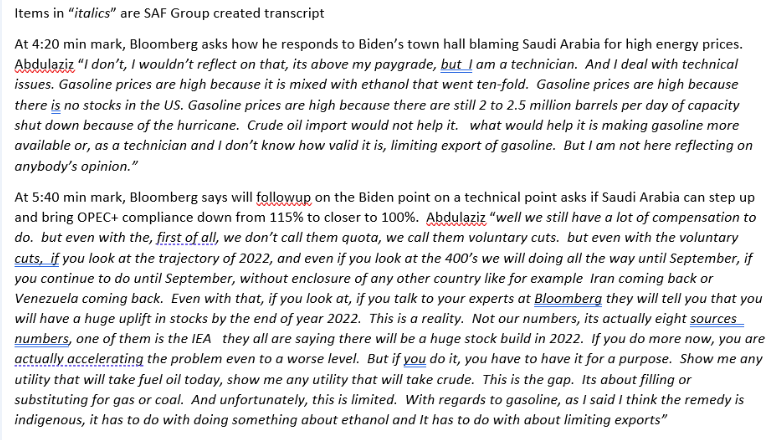

BLOOMBERG INTERVIEW WITH SAUDI ENERGY MINISTER

Response to Biden’s Townhall meeting blaming KSA for high energy prices

Link to interview here, transcript below >> https://www.bloomberg.com/news/videos/2021-10-24/saudi-energy-minister-oil-rebound-can-t-be-taken-for-granted?sref=d39KtWbu

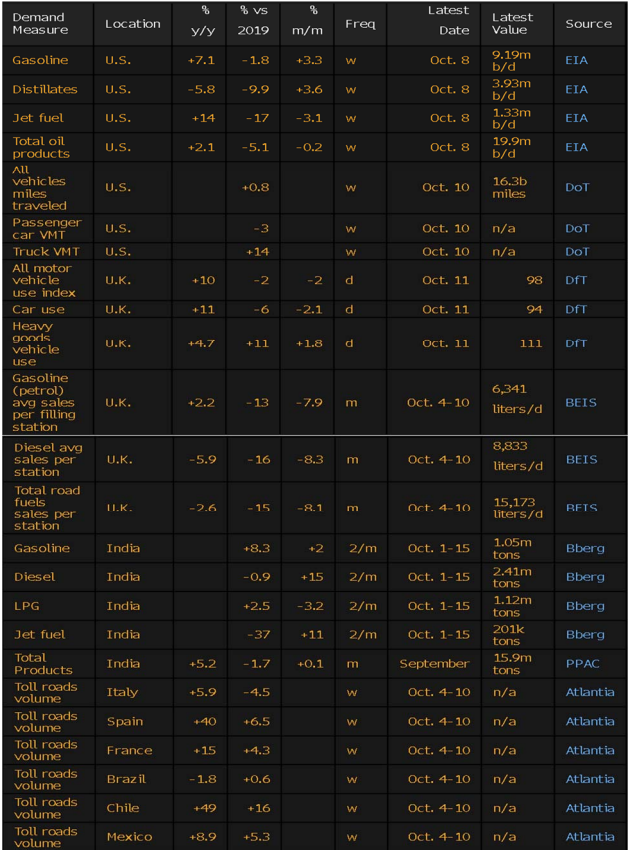

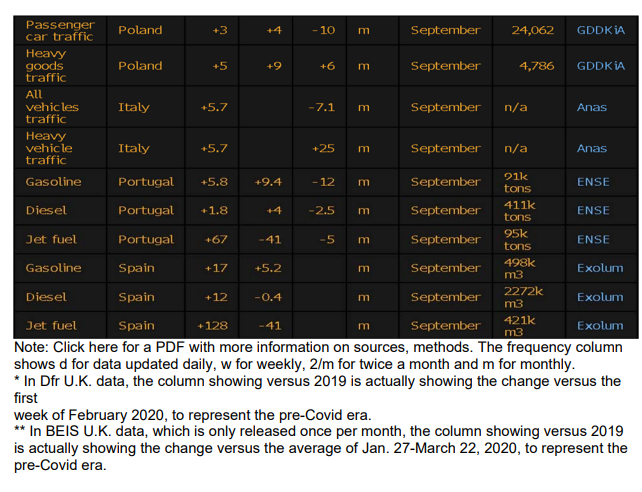

BLOOMBERG OIL DEMAND MONITOR

Indian Diesel, Brazil City Traffic Buoyant

Surging traffic levels in Brazilian cities and stronger diesel sales in India highlight a continued

improvement in oil demand in key regions, while fuel sales stabilized in the U.K. after an unusual peak.

Indian diesel sales in the first half of October were 15% higher than a month earlier — narrowing a deficit versus

2019 to about 1% from 7% — helped by the onset of annual festivals, according to preliminary data from officials with direct knowledge of the matter. Gasoline sales in the subcontinent are already comfortably above the pre-pandemic level.

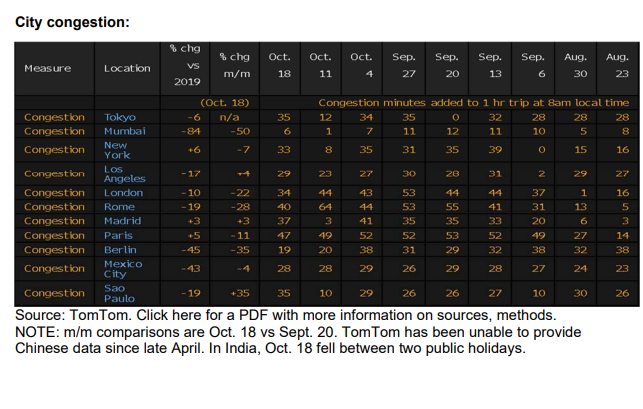

Traffic levels in Sao Paulo moved up a gear. The Brazilian city had the most congestion for a Monday so far this year,

according to daily average measurements from TomTom NV. Traffic has also intensified recently in Rio de Janeiro,

though the trend is less clear nationwide. The volume of cars on Brazilian toll roads was only 0.6% above 2019

levels in the week ended Oct. 10, its weakest showing in four weeks, according to motorway operator Atlantia

Group, and a far cry from Chile where volumes are up 16%.

Atlantia also tracks toll roads in France, Spain, and Italy, with all three hovering a few percentage points above or below the same week of 2019 in the past five weeks.

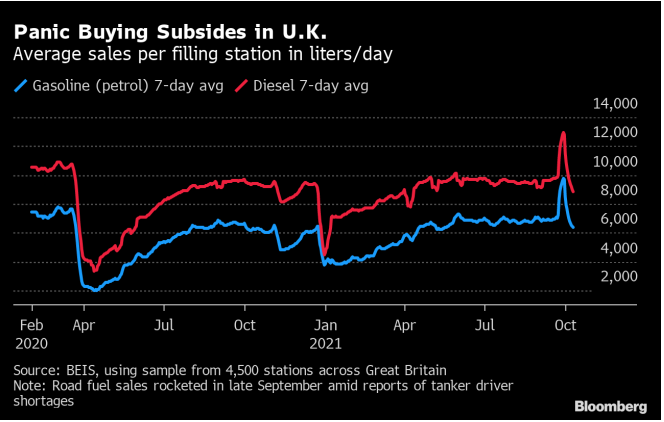

Elsewhere, road fuel sales in the U.K. have reverted back to a little below normal 2019 levels, after a spate of panic buying in late September, according to sales data collected by the government from 4,500 filling stations.

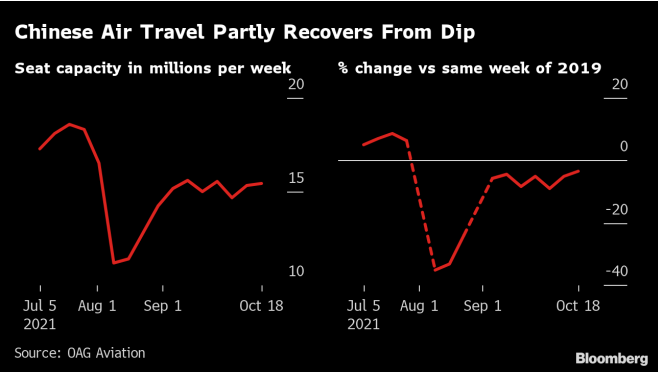

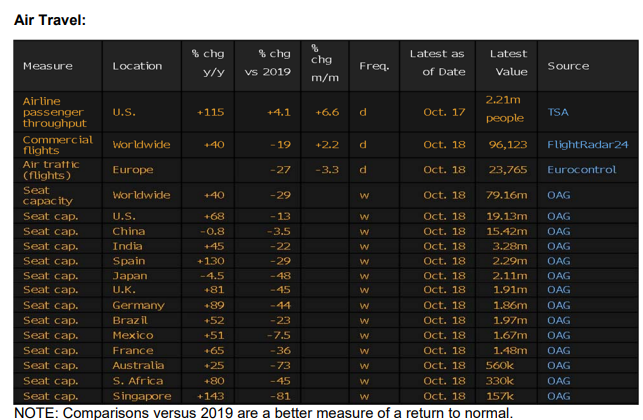

Air travel in China easily outperformed other nations for most of the pandemic but had its own slump in August and September amid a raft of travel restrictions as the country sought to contain coronavirus outbreaks in various cities. The number of seats offered by airlines there has recovered but hasn’t yet risen above levels seen for the same week in 2019, according to weekly estimates from OAG Aviation.

Among major markets, China’s seat capacity is 3.5% below two years ago, and the runners-up are Mexico and the U.S., with deficits of 7.5% and 13%, respectively. Singapore is one of the furthest behinds, with capacity down 81% from 2019. The city-state recently announced it is opening up air travel again to some countries, without needing passengers to quarantine.

NATURAL GAS AND LIQUIDS

GAZPROM

This week’s ESP spot natgas sale scheduled from Gazprom is out. Nothing offered for 2021. -Gazprom

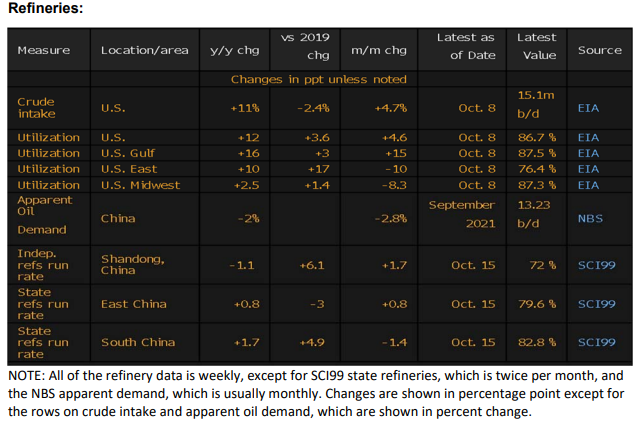

Capacity auction results for Gazprom natgas transit via Poland and Ukraine.

Mallnow – 30.1mcm/d (of possible 86.5)

Sudzha – 0.0mcm/d (of 9.8)

Sokhranovka – 0.0mcm/d (of 5.2)

NOTABLE: This is bullish TTF (Dutch nat gas) as these flows are identical to October, so expect flat flows for November relative to October

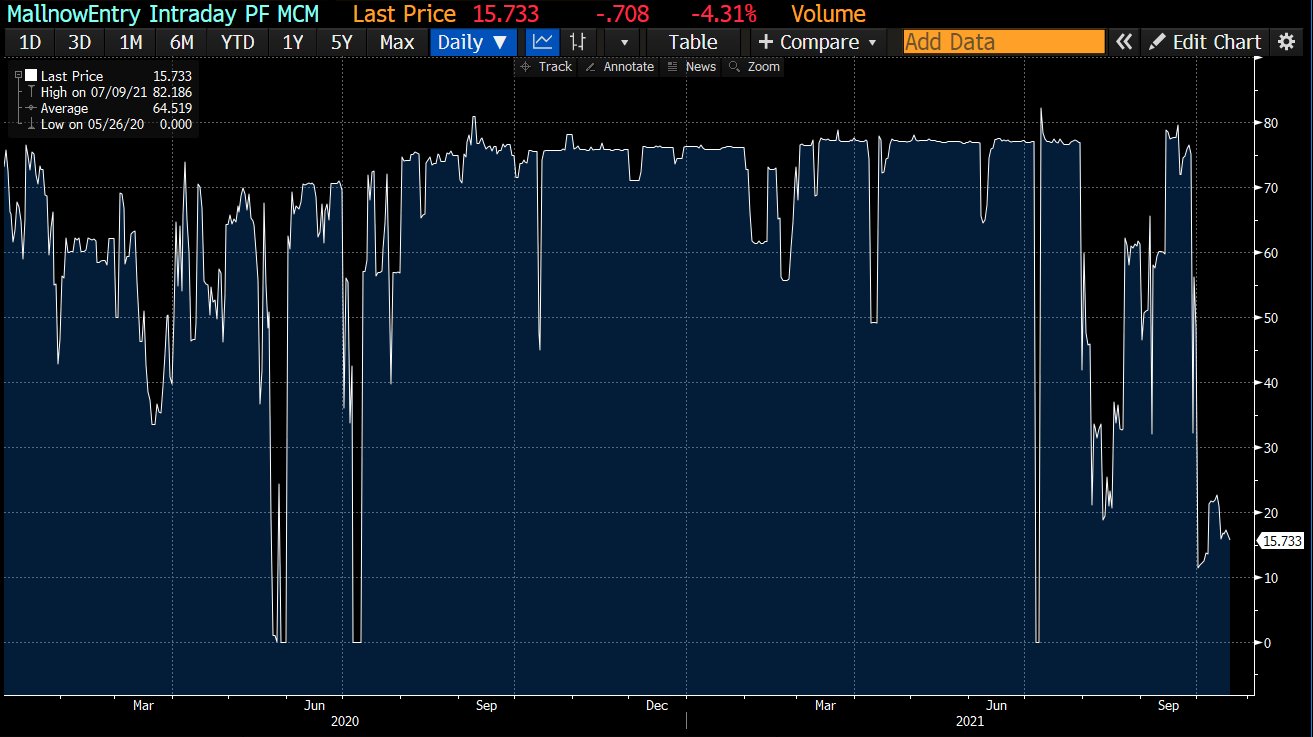

This chart is inflows via the Mallnow compressor station near the German-Poland border year-to-date. This is a good proxy for Russian natural gas flows into Western Europe via Germany. Keeping at very low levels.

MOLDOVA

Moldova introduced a state of emergency as it battles a severe shortage of natural gas and talks with Russia’s Gazprom stall. The state of emergency will allow Moldova to accelerate gas purchases from alternative suppliers, according to Prime Minister

NOTABLE: This is a global phenomenon. Bullish nat gas

UK

Small UK energy retailer GOTO Energy Limited goes down, with 22,000 clients. Since mid-August, a total of 13 UK gas and electricity retailers have collapsed, hitting ~2 million households-BBG Javier Blas

UNITED STATES

China signs huge LNG deals with U.S. supplier Venture Global

China has agreed on three huge liquefied natural gas (LNG) deals with U.S. exporter Venture Global LNG as the world’s second-biggest economy looks to secure long-term supplies amid soaring gas prices and domestic power shortages.

According to documents posted on the U.S. Department of Energy website, the agreements with China’s state oil giant Sinopec include two 20-year deals for a combined 4 million tonnes of LNG per year.

Those deals bring Venture Global’s plant in Plaquemines, Louisiana, with an export capacity of up to 20 million tonnes per annum (mtpa), one step closer to a final investment decision which is expected by the end of this year.-BBG

NOTABLE: This is incredibly bullish for US nat gas.

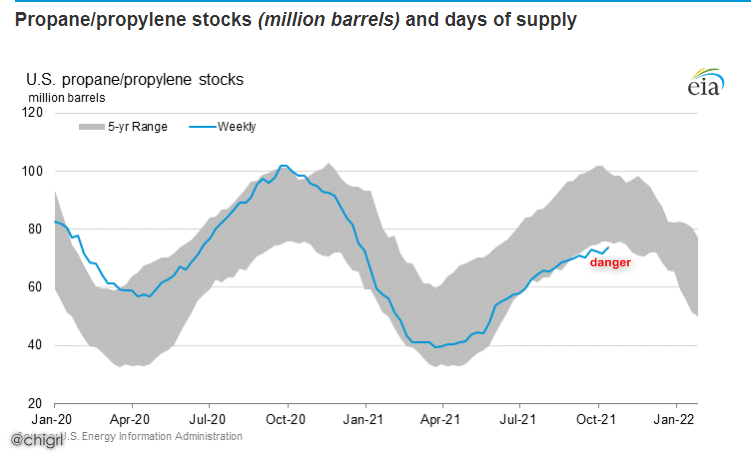

UNITED STATES PROPANE

Looks like people finally caught onto the propane problem that I wave been warning about since July.

U.S. Propane Market Headed for ‘Armageddon’ This Winter, IHS Says

U.S. propane prices are so high and supplies so scarce that the market appears headed for “armageddon” during the depths of winter, according to research firm IHS Markit Ltd. -BBG

NOTABLE: Good thing we have been positioned for this for months. AR, OXY, PXD, EOG, and DVN are the top 5 NGL producers in the United States

INDIA

Gas Squeeze Has India Requesting Cargoes Not Wanted in 2015

The global energy shortage has prompted India to ask Qatar, the world’s biggest supplier of liquefied natural gas, for around 50 cargoes it deemed too expensive six years ago.

State-linked importer Petronet LNG Ltd. asked Qatargas to deliver the cargoes in the coming year, on top of the approximately 115 cargoes that its long-term contract stipulates for 2022, according to people familiar with the discussions. Normally, companies do not retroactively claim cargoes after initially declining them. -BBG

NOTABLE: I keep stressing that nat gas will be most important moving forward in this whole energy transition scenario, particularly for emerging markets. I love this trade over the next decade.

COAL

GLOBAL

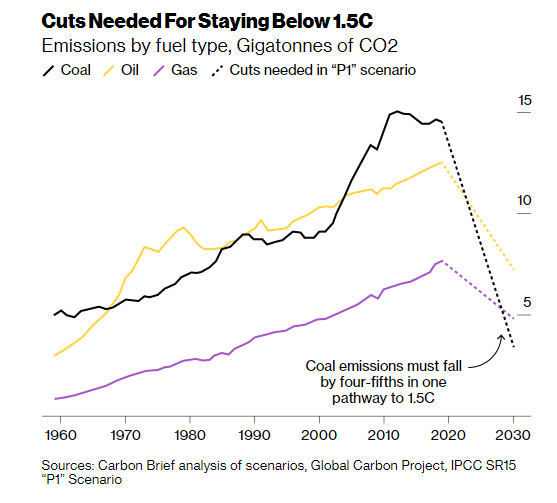

COP Aims to End Coal, But the World Is Still Addicted

Never in human history has a ton of coal cost more. Governments and utilities across the globe are willing to pay record sums to literally keep the lights on. That’s the bruising reality that global leaders must face at the high-stakes climate talks in Glasgow this month as hopes fade for a deal to end the world’s reliance on the dirtiest fuel -BBG

NOTABLE: Good luck with that. Most of Asia is adding coal capacity.

CHINA

China Tears Up the Rule Book in the Race to Fix Its Energy Crisis

China’s government has also ordered coal miners to spare no expense in boosting output, calling on the sector to deliver over 12 million tons of the fuel a day in the final three months — the equivalent of adding 100 million tons, roughly what commodities giant Glencore Plc produces in a year.-BBG

SAUDI ARABIA

The Aramco chief said the oil company will replace crude burning for power with natural gas in 10 years.

“We understand the road will be complex and the transition will have challenges. But we’re confident we can meet them and accelerate our efforts to a low-emission future.”

He stressed the need for an orderly energy transition by taking a holistic view of the entire scenario. -Arab News

UNITED STATES

Democrats Struggle to Replace Climate Plan Manchin Rejected

Manchin told reporters on Capitol Hill that he’s not watering down climate goals and defended his opposition to the clean energy plan.

“We want to make sure we have reliable power,” Manchin said. The coal mines “are not going to close.”-BBG

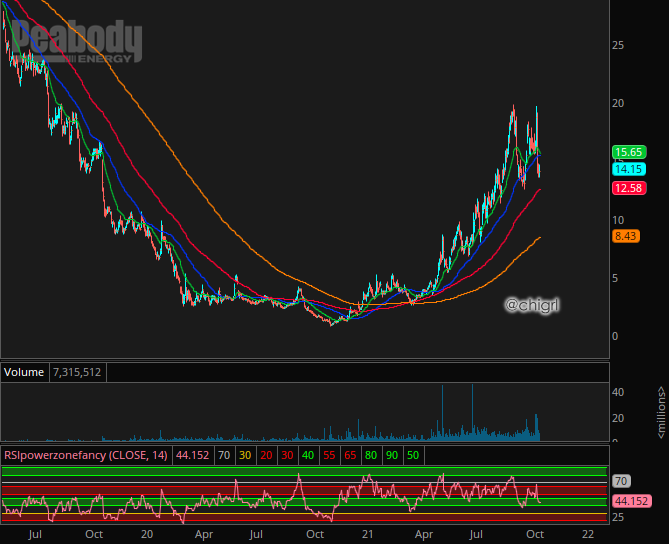

NOTABLE: I exited half my BTU position at 19.43 (pretty much the top of lat last run..I sent a note out on that) will look to rebuy between 13.25-12.50

NUCLEAR

Interesting developments on nuclear this week.

- Germany -where the energy crisis is worsening and experts are recommending that nuclear power plants be kept online longer after all.

- France-French push to classify nuclear power ‘green and sustainable’ divides Europe. French President Emmanuel Macron unveiled a $1.16 billion program to develop mini-nuclear reactors.

- UK- to fund new nuclear power station as part of net zero drive

- EU-Ursula von der Leyen, President of the EU commission said this week: “We will also assess how the gas, electricity and ETS markets function. We need more renewables. They are cheaper, carbon-free and homegrown. We also need a stable source, NUCLEAR, and during the transition, gas.”

NOTABLE: You may as why EU hates nuclear so much…here is why: “The inclusion of nuclear” on the approved sustainable energy list “has been a subject of intense debate,” one EU official close to the matter told Yahoo News. “While nuclear energy is consistently acknowledged as a low-carbon energy source, opinions differ notably on the potential impact on other environmental objectives.” Those include the still-unsolved problem of how to dispose of radioactive waste, which may be hazardous for millennia.

That said, it looks like they may be coming around. COP26 will be interesting in this respect.

We are long UROY for this play. It is definitely not too late to get in on this trade.

SIDE NOTE: US–NASA is talking about nuclear-powered space crafts as opposed to chemical powered ones

MATERIALS

CHINA

China’s power crunch is double-inflationary. The 1st and immediate impact is rising energy prices (LNG, coal, oil). The 2nd, which will take a bit more time to be noticed in full, is a big rise in other commodity costs as China is forced to cut its own output to save energy. We’re beginning to see the first signs in aluminum, but others are coming, like magnesium and urea fertilizers. And it’s not just price spikes, more concerning is that we are seeing signs of de facto export restrictions too in some corners of the market-BBG Javier Blas

NOTABLE: We are seeing secondary and tertiary effects from the fossil fuel crunch. It is impossible not to be bullish on energy and materials

COPPER

Trafigura Played Key Role in Draining LME Copper Inventories

Trafigura Group withdrew a significant proportion of copper that’s been pulled from London Metal Exchange warehouses, contributing to wild swings in prices, according to people familiar with the matter.

The drawdown has made the trading house the talk of the copper market, helping to drive available stocks to the lowest since 1974 and pushing a key spread to the highest on record. It’s also helped to spur outright copper prices higher, with benchmark futures up about 13% since the start of the month and approaching record highs set in May. -BBG

This caused the LME cash-to-3-month spread to surge over $1,000 per tonne, a record high. From a historical perspective, the previous peak was $330 per tonne in 1996-97 during the Sumitomo’s Hamanaka trading scandal.

This forced LME to introduce emergency measures to ensure “orderliness and continued liquidity” in the copper market. Among them, the LME has set limits on the nearest-term spreads and allowances for holders of some short positions to avoid delivery of metal

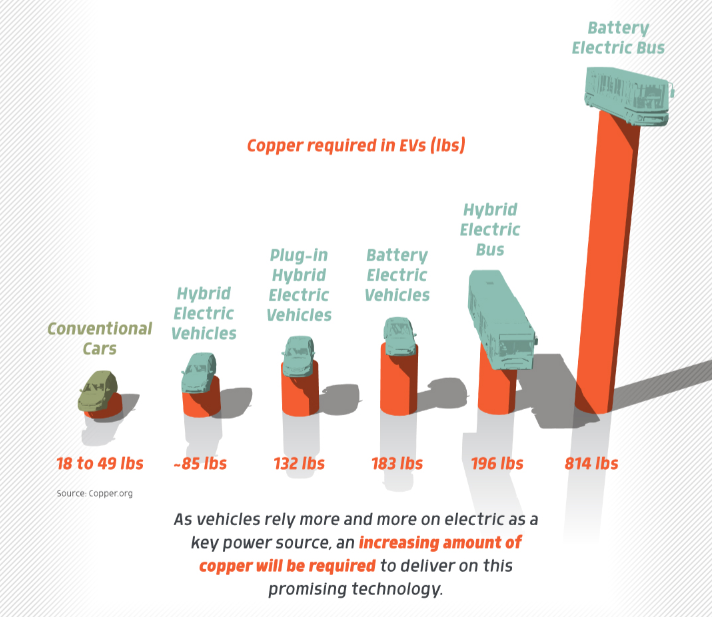

NOTABLE: This is only going to get worse as the world pushes for more and more EVs. I remain bullish on copper long-term. FCX and BHP are longs for this (talked about these last week.

IRON ORE

Vale to slow down iron-ore production in Q4 due to low prices

Brazilian miner Vale said on Tuesday it was slowing down the production of low-margin iron-ore in the fourth quarter by about four million tonnes due to low prices and could cut back output in 2022 if prices did not rise.

Vale said in a securities filing that iron ore output for the year is now expected to fall within the lower half of its target range, currently set at between 315-and 335-million tonnes.

The miner added that it would reduce its offerings of low-margin products in 2022 by 12-million to 15-million tonnes if the current scenario did not change. -Mining Weekly

NOTABLE: This should help sink iron ore prices and be bullish for VALE. I will look to reenter this trade and write a follow-up note on it.

FERTILIZER

China’s Curbs on Fertilizer Exports to Worsen Global Price Shock

The new measures implemented by Chinese authorities follow a customs regulation that kicked in on Oct. 15 requiring additional inspection of fertilizer exports. It also follows a notice from the National Development and Reform Commission, China’s top economic planner, that called for stable fertilizer supplies and prices given its importance to agricultural production and food security.

The General Administration of Customs added new inspection requirements on 29 categories of products including urea to ammonium nitrate, according to notice this month. Despite that, the blistering rally in China’s fertilizer market shows no sign of cooling, with benchmark urea futures holding near a record. -BBG

NOTABLE: I suspect many other countries will follow suit and halt exports. We have been long MOS and IPI since 2020. These are still buyable on dips.

BATTERY CELLS

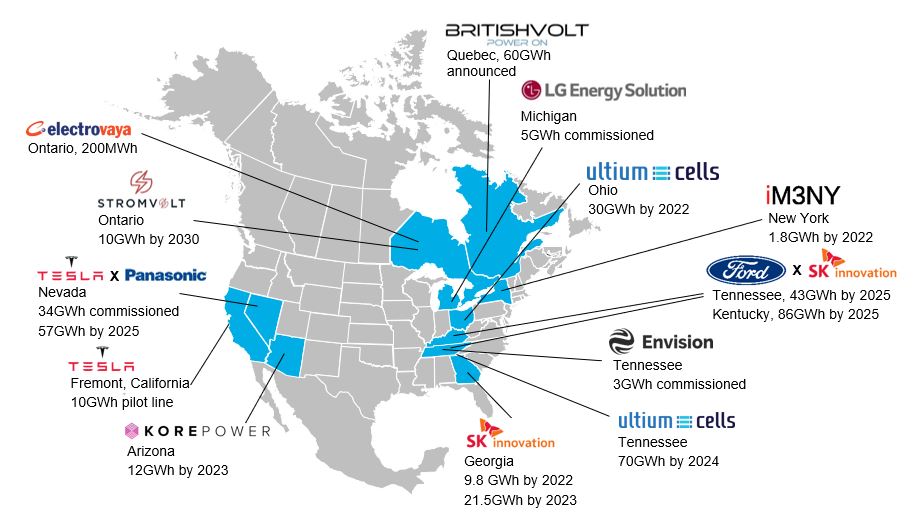

Canada Emerges as Cornerstone of North American Battery Supply Chain

Britishvolt, a UK-headquartered cell manufacturing startup, plans to build a 60GWh plant in Quebec. While Stromvolt, a Canadian headquartered startup, is planning a 10GWh plant in Ontario. Combined with announcements south of the border, North America has plans for over 400GWh of capacity to be built this decade. This is still short of the 508GWh annual demand the region will have by 2030, so expect more announcements to come. BBG

NOTABLE: Definitely a sector to keep an eye on. There are rumors that Britishvolt may float on the London Stock Exchange, so I will keep watch on that.

COP26

Document leak reveals nations lobbying to change key climate report

An adviser to the Saudi oil ministry demands “phrases like ‘the need for urgent and accelerated mitigation actions at all scales…’ should be eliminated from the report”.

A huge leak of documents seen by BBC News shows how countries are trying to change a crucial scientific report on how to tackle climate change.

The leak reveals Saudi Arabia, Japan, and Australia are among countries asking the UN to play down the need to move rapidly away from fossil fuels.

It also shows some wealthy nations are questioning paying more to poorer states to move to greener technologies.

This “lobbying” raises questions for the COP26 climate summit in November.

The leak reveals countries pushing back on UN recommendations for action and comes just days before they will be asked at the summit to make significant commitments to slow down climate change and keep global warming to 1.5 degrees.

The leaked documents consist of more than 32,000 submissions made by governments, companies, and other interested parties to the team of scientists compiling a UN report designed to bring together the best scientific evidence on how to tackle climate change-BBC

NOTABLE: Fossil fuels are here to say much longer than people think. The energy transition is going to take much longer than people think as I keep repeating. I was just on a podcast this week talking about this. If you missed it you can see it here: https://youtu.be/Qr0i8BCmuoE I was also on Sky News in Australia this week talking about this: https://youtu.be/wDC77TEegDY

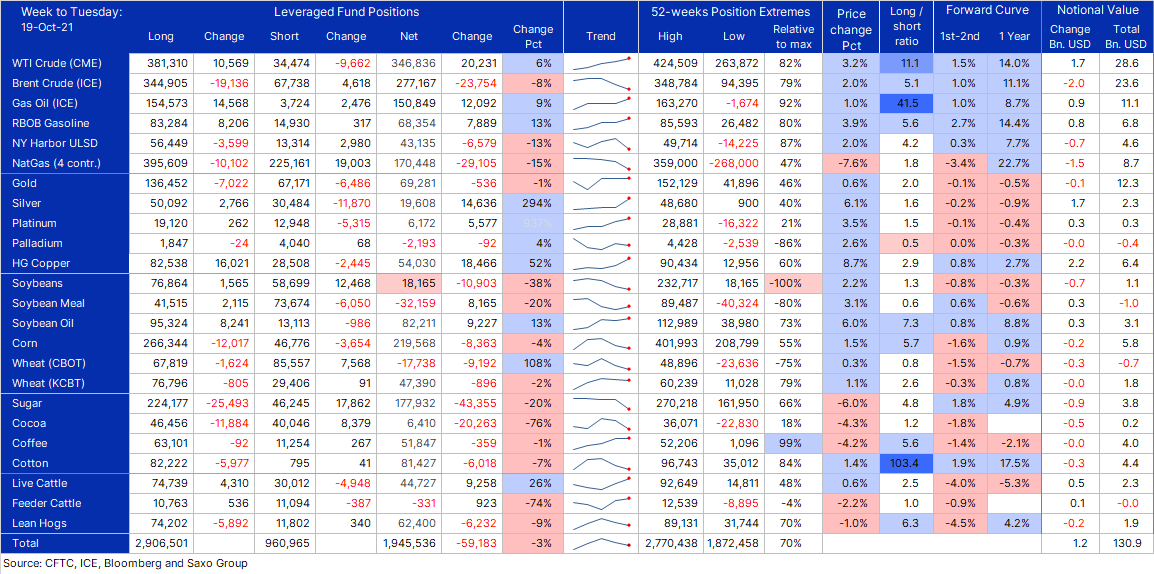

COMMITMENT OF TRADERS (as of Tuesday 19 Oct.)

COT on commodities in week to Oct 19 saw funds cut bullish bets for a second week. This despite broad price gains (ex natgas and softs) lifting the BCOM index to a fresh multi-year high. Top 3: WTI, copper, and silver. Bottom 3: Brent, natgas, sugar. -SAXO

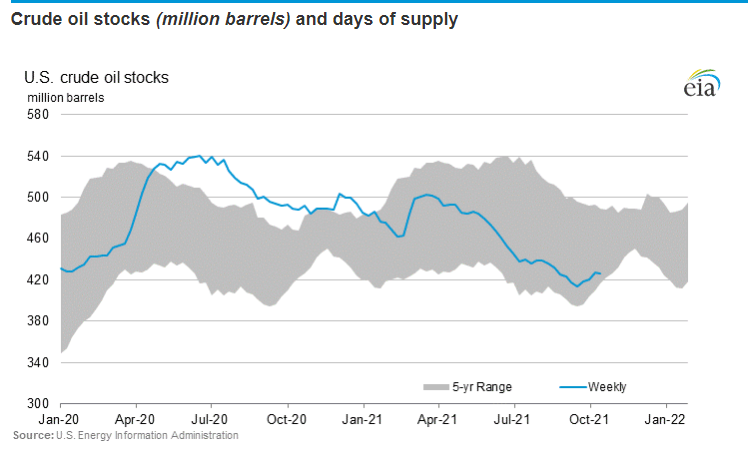

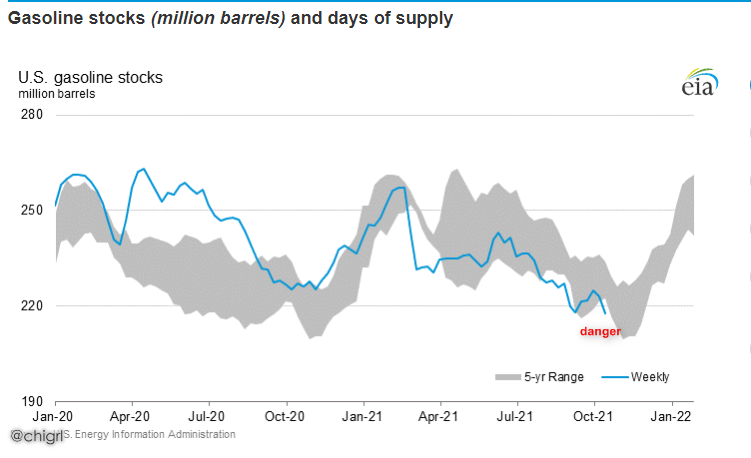

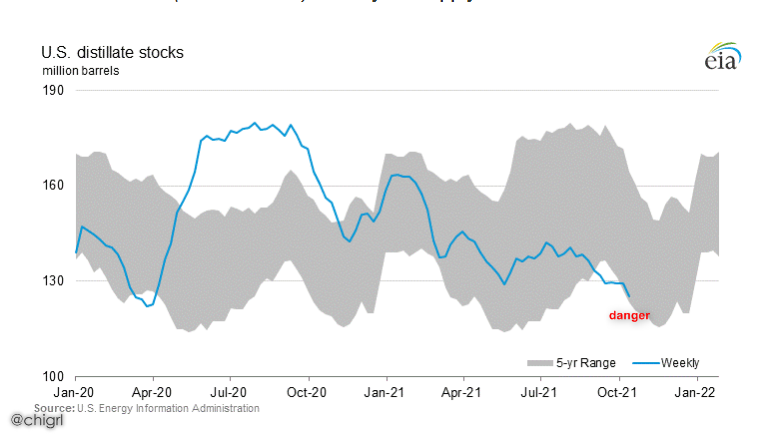

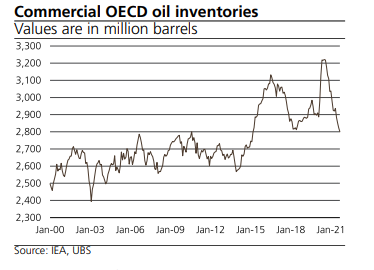

OIL INVENTORIES

CHINA

Signs of crude oil tightness abound. China, having long bucked global stock draws, is now leading them. Since COVID’s onset, China had spent much of its time building stocks while the world was destocking. Since May, it drew drawn by 550kb/d, roughly half the world pace. Last week, it drew by 2 mb/d, or twice the world pace -Kayrros

EGYPT

Egypt, a key transit country for Arab Gulf crude, is at pre-Covid lows -Kayrros

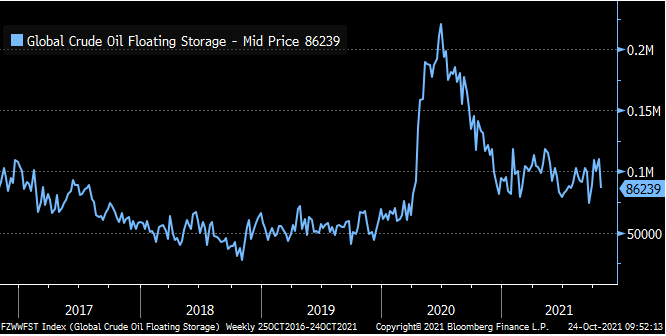

GLOBAL FLOATING STORAGE

Crude Oil in Floating Storage Rises by 609.00k Bbl in Past Week: Vortexa

The amount of crude oil held around the

world on tankers that have been stationary for at least 7 days

rose to 101.46m bbl as of Oct. 15, Vortexa data show.

* That’s up 0.6% from 100.85m bbl on Oct. 8

* Asia Pacific down 5.2% w/w to 72.73m bbl

* Middle East up 43% w/w to 8.10m bbl

* West Africa up 14% w/w to 7.78m bbl; highest since July

2020

* Europe up 63% w/w to 4.57m bbl

* North Sea up 118% w/w to 2.74m bbl

* Company Exposure:

** Asia: Cosco Shipping Energy Transportation Co., HMM Co. Ltd.,

Mitsui O.S.K. Lines Ltd., Nippon Yusen KK

** Europe: Euronav NV, Frontline, Vopak

** U.S.: DHT Holdings, International Seaways, Nordic American

Tankers, Teekay Tankers, Tsakos Energy Navigation

Vortexa crude oil floating storage for 10/22 est 86.24 mmb. Big revisions to Oct 15 est, now est 110.12 mmb vs 97.41 mm est as of 10/16. 10/22 is +7.31 mmb vs recent 06/25 trough of 78.92 mmb. But -134.3 mmb vs 06/26/2020 peak 220.54 mmb

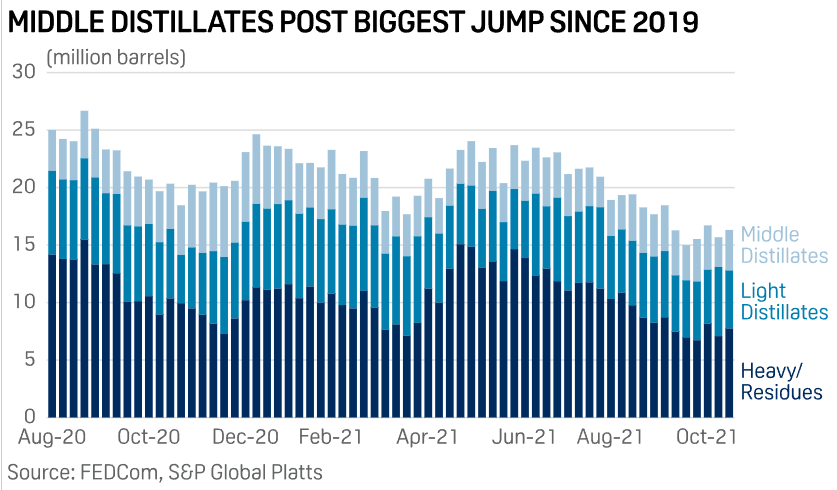

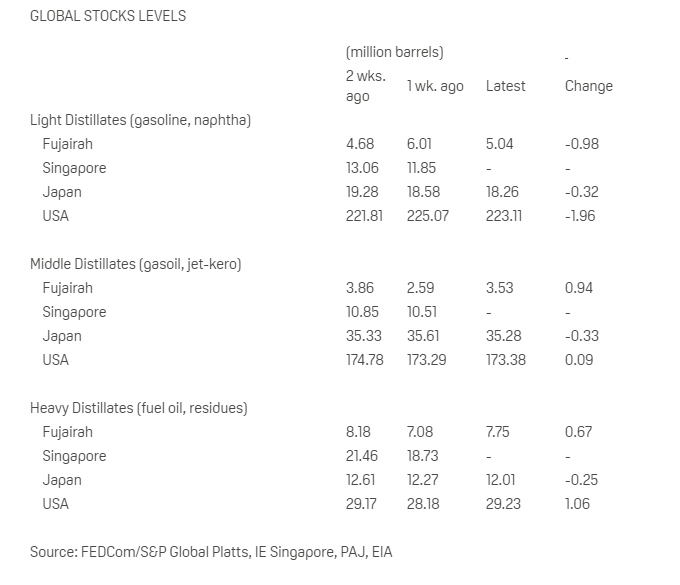

FUJAIRAH DATA

The total inventory was 16.318 million barrels on Oct. 18, up 4% from a week earlier, according to Fujairah Oil Industry Zone data provided exclusively to S&P Global Platts on Oct. 20

Heavy distillates used for power generation and marine bunkers climbed 9.4% to 7.751 million barrels, a two-week high.

Middle distillates jumped 36% to 3.529 million barrels, the biggest increase since November 2019 after hitting an 18-month low a week earlier.

Light distillate inventories, including gasoline and naphtha, declined to 5.038 million barrels on Oct. 18, down 16% from a week earlier and the lowest in two weeks.-PLATTS

EIA