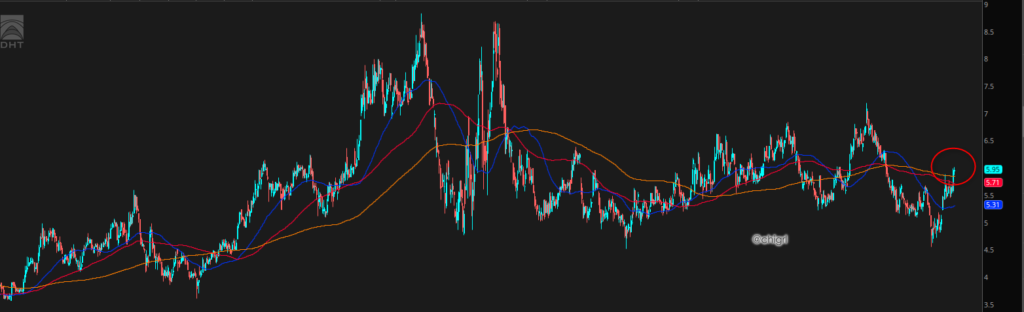

New stock mentioned: DHT

CHARTS OF INTEREST THIS WEEK

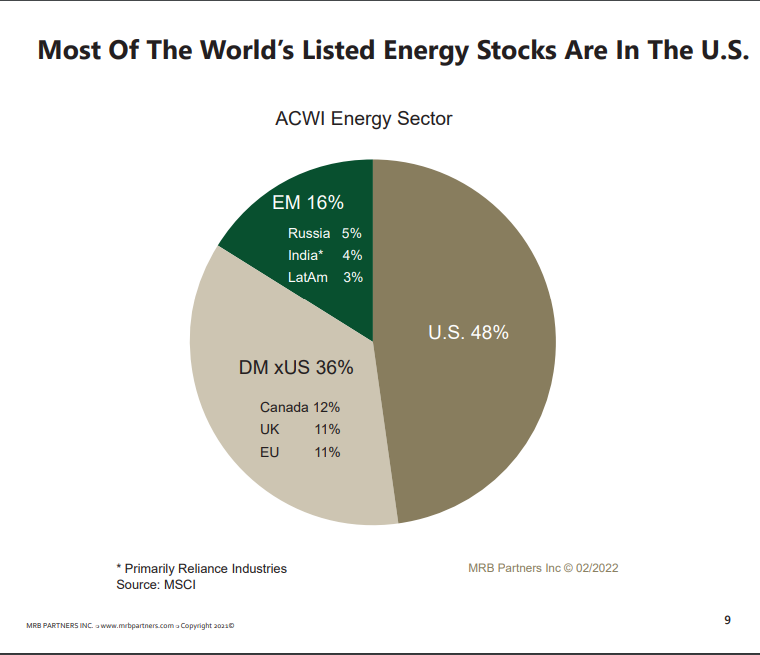

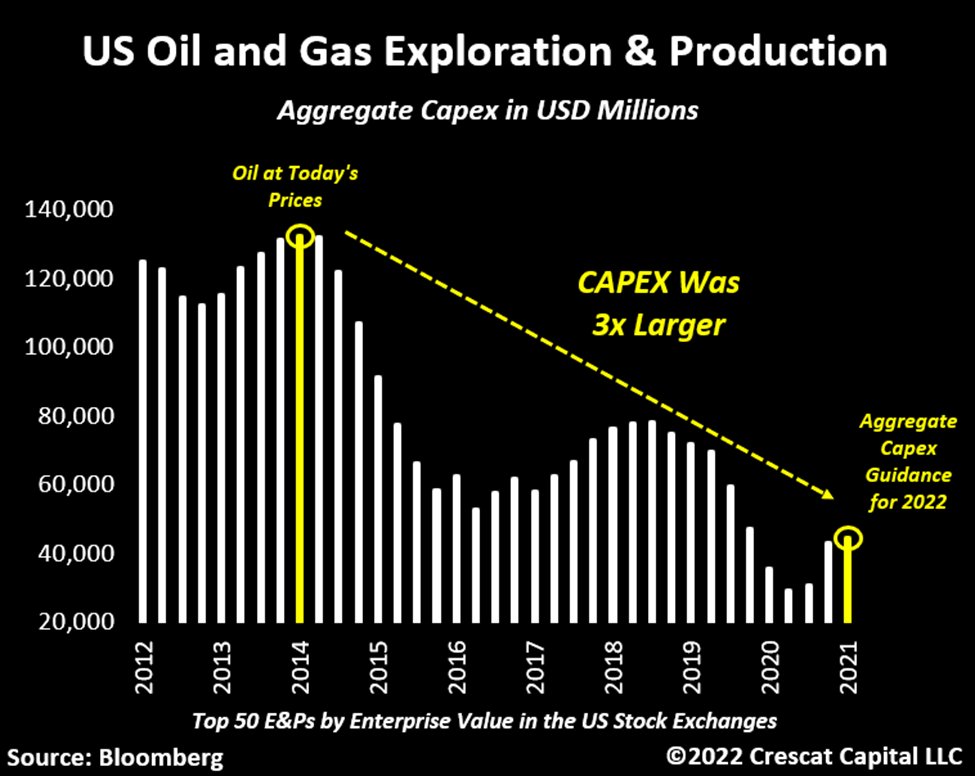

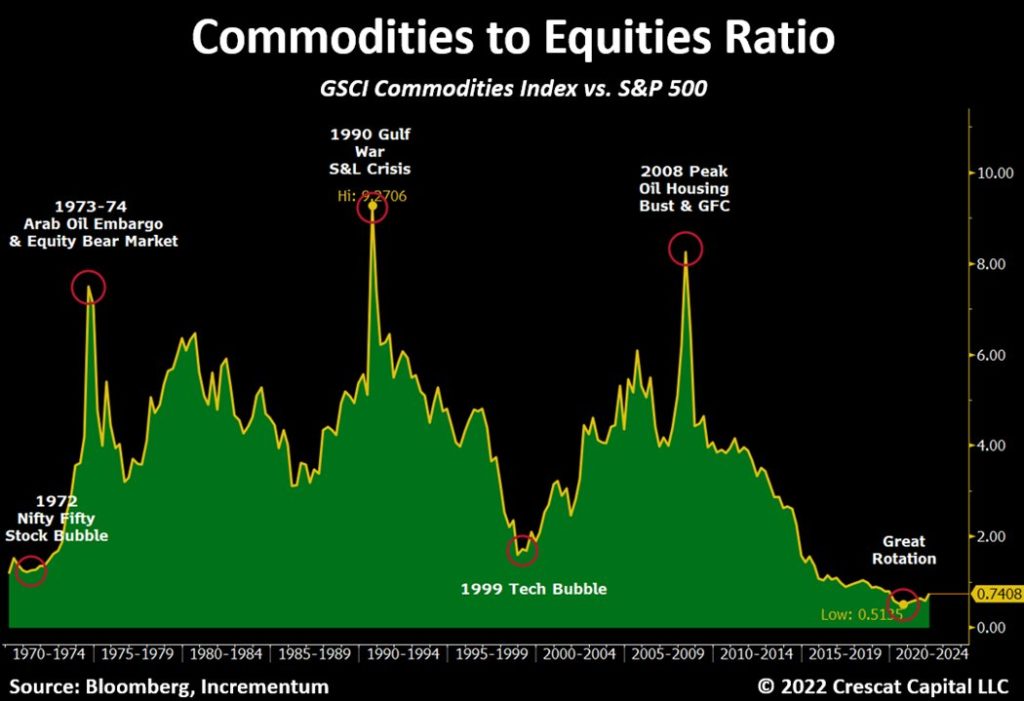

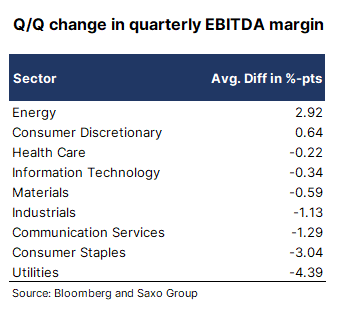

Energy companies show why they should be a core component in equity portfolios over the coming years

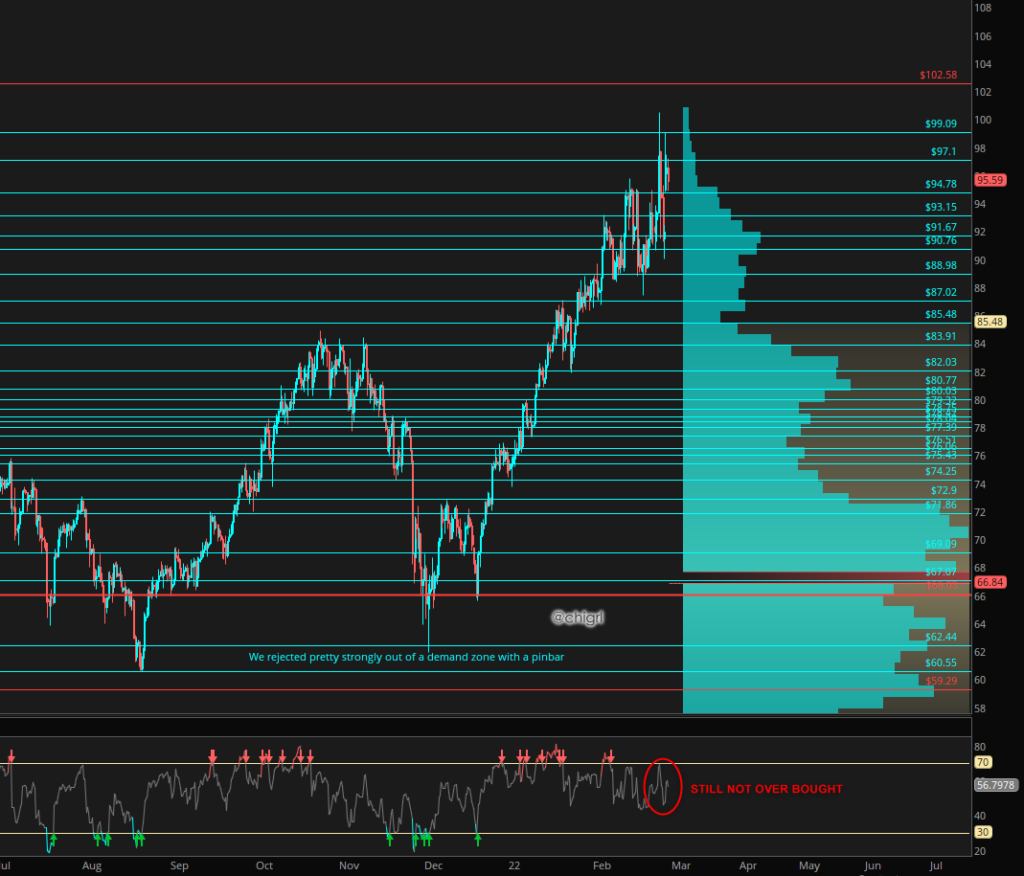

TECHNICALS

Chart is still bullish overall, albeit getting very volatile. I still would like to see some tighter consolidation before we hit summer, but likely that will not happen unless (hopefully) we see some resolve with Russia/Ukraine situation.

OIL, NATURAL GAS, AND COAL

UNITED STATES

Biden halts oil and gas leases amid legal fight on climate cost

The Biden administration is delaying decisions on new oil and gas drilling on federal land and waters after a federal court blocked the way officials were calculating the real-world costs of climate change.

The administration said in a legal filing that a Feb. 11 ruling by a Louisiana federal judge will affect dozens of rules by at least four federal agencies. Among the immediate effects is an indefinite delay in planned oil and gas lease sales on public lands in a half-dozen states in the West, including Wyoming, Montana, and Utah. – YahooNews

NOTABLE: This is just ridiculous in light of surging oil prices. Obviously, this is bullish oil prices but bad news for US energy security. These people just can not get out of their own way.

JOKE OF THE WEEK

Psaki says calls to enhance US oil production are a ‘misdiagnosis’

White House press secretary Jen Psaki on Sunday said calls for the U.S. to boost its own fossil fuel production in response to Russia’s invasion of Ukraine, which has increased oil prices further, were a “misdiagnosis.”

NOTABLE: These people are truly out of touch with reality

EOG

EOG reiterated exactly what I have been saying about supply chain problems and costs this week

U.S. Shale Growth Faces Headwinds on Costs and Equipment, EOG Says

Minimal new drill rigs, frack fleets available for hire: COO

Inflation and brisk competition for the most-sophisticated drilling gear will hinder U.S. oil-supply expansion this year, according to shale giant EOG Resources Inc.

“Inflationary and supply chain pressures” will limit production growth to the lower end of estimates, Chief Executive Officer Ezra Yacob said during a conference call with analysts on Friday. -BBG

NOTABLE: Major forecasters recently boosted estimates for 2022 U.S. oil-production growth to 750,000 and 1 million barrels per day. I just do not see how we get there with all the obstacles. I think these estimates are grossly inflated.

US COAL

US coal industry could face more pressure: EPA’s Regan

The US Environmental Protection Agency (EPA) is working on a host of regulations that could push US companies away from coal-fired generation regardless of the outcome of legal challenges to the agency’s authority over power plants, administrator Michael Regan said.

Between “bread-and-butter regulations that are true to the Clean Air Act” and potential rulings from the Supreme Court “we see a future of tremendous economic pressure on this industry,” Regan told reporters at an event yesterday. “And I think the industry will have to determine how they close and when they close.” -Argus

NOTABLE: The US does not use that much coal anyway, in fact, we were on a steady decline for over a decade, until 2021 when we up-ticked. What is most important to watch is if this extends into the coal mining sector. That said, likely we will see an epic battle from coal-mining states.

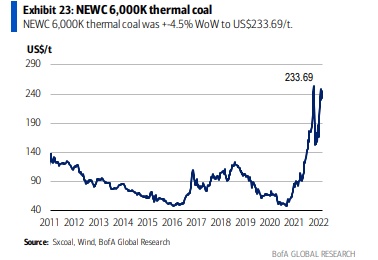

CHINA COAL

China Signals Coal Reliance to Continue With Three New Mines

- Projects to require total investment of almost $4 billion

- Approvals come as much of rest of the world shuns coal

China’s top planning agency approved three different billion-dollar coal mine projects on Monday as the country continues to support the fuel that much of the rest of the world is shunning.

The National Development and Reform Commission gave the go-ahead to two mines in the northwestern province of Shaanxi and another in Inner Mongolia. The three projects will require a total investment of 24.1 billion yuan ($3.8 billion) and produce 19 million tons of coal a year. -BBG

NOTABLE: So much for those COP 26 promises. I always say, with China always watch what they do not what they say. They will never forego growth and energy security on account of the environment.

OPEC PLUS

Compliance levels for OPEC-10 in January reached 133% and for non-OPEC it’s 123%. Combined compliance for the OPEC plus group is 129% -Energy Intel

NOTABLE: It does not matter if this group continues with monthly increases if they are unable to produce current quotas.

IRAN

This week

House Republicans have written to Biden warning against any nuclear deal made with Iran without Congress’ approval

Senate Democrats issued a statement saying that “returning to such an agreement would not be politically sustainable for the US”

NOTABLE: Again, I have been writing about this since December of 2020. No one wants this deal. It is a bipartisan issue.

GERMANY

Huge announcements in German energy policy this weekend:

Berlin will help to build 2 LNG import plants Germany plans to buy more gas outside Russia Berlin will establish a strategic gas reserve. Nothing was said about nuclear and coal phase-out (other than setting up a coal strategic reserve), but Germany rethinking its energy policy is HUGE.

This also comes on the heels of them halting Nord Stream 2 certification due to the Ukraine crisis.

NOTABLE: The Germans are the architects and champions of the Green New Deal, wanting to phase out natural gas entirely. This is great news for the LNG industry. US companies to benefit. I still like Cheniere(LNG) and Antero Resources (AR) as long-term plays.

UK

We saw UK take a turn on fossil fuels this week as well.

Britain to licence new oil and gas North Sea activity -minister

Britain sees a “good, solid” future for the North Sea’s oil and gas industry and will issue new licences to expand output in the future, Energy Minister Greg Hands said on Tuesday.

“We need continued investment into the North Sea,” Hands told the International Energy Week online conference.

The British government will hold new licencing rounds to explore for more oil and gas resources and ensure that they are “compatible” with the country’s climate obligations to cut greenhouse gas emissions, he said. -Reuters

IRAQ

Iraq Shuts Down Two Oil Fields, Further Curtailing OPEC Output

Work at Nasiriya, capable of supplying as much as 80,000 barrels a day, was halted on Saturday because of protests that prevented staff from reaching the site, according to a statement from Thiqar Oil Co.

That followed the closure of the huge West Qurna-2 field on Feb. 21 for maintenance. The field, which can pump 400,000 barrels a day, is scheduled to resume normal operations on March 14, though the companies that run it are trying to restart output sooner. -BBG

NOTABLE: Adding to supply problems, Iraq currently have 480K bpd offline

INDIA

ndia Seeks More Oil for Strategic Reserves as Prices Top $100

- Nation seeks to fill tanks that hold about 8 million barrels

- Yet to proceed with pledged sale of reserves under U.S. pact

India is seeking to expand its emergency oil stockpiles, adding to already-strong demand from domestic refiners that are cranking up run rates amid a recovery in consumption.

The world’s third-largest oil consumer wants to prioritize filling its empty storage tanks as soon as possible, according to Indian government officials with direct knowledge of the matter. The tanks have space to hold about 8 million barrels of oil, they said. -BBG

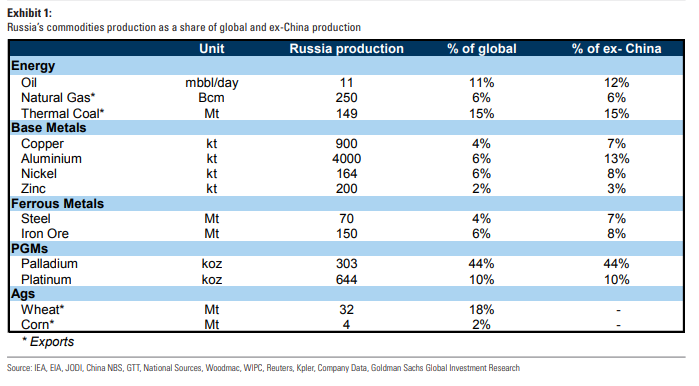

NOTABLE: Demand is rising, and supply is shrinking. If the US, UK, and EU place sanctions on Russian oil…we are going to have a serious problem …globally. Here in the US, we have been draining our strategic reserve and have about 60 days to cover, under EIA guidelines we should have 90 days, in the event of a global emergency. That is why I keep saying the SPR is a national security issue.

TANKER RATES

Global oil tanker rates jolt higher on high fuel prices, risk premiums

Oil tanker rates are soaring globally as traders scramble to cope with jitters over possible disruption in Russian supplies, as well as war risk premiums for ships plying the Mediterranean region following Moscow’s invasion of Ukraine.

Shipowners are also grappling with higher fuel costs -Reuters

NOTABLE: I am going to add a tanker play here.

DHT Holdings Inc (DHT)

DHT is an independent crude oil tanker company. Their fleet trades internationally and consists of crude oil tankers in the VLCC segment

We just broke above the 200 day and retested

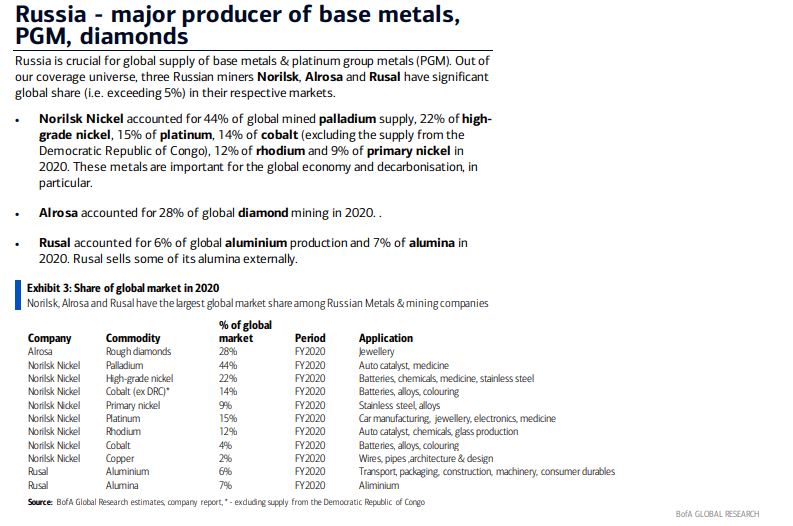

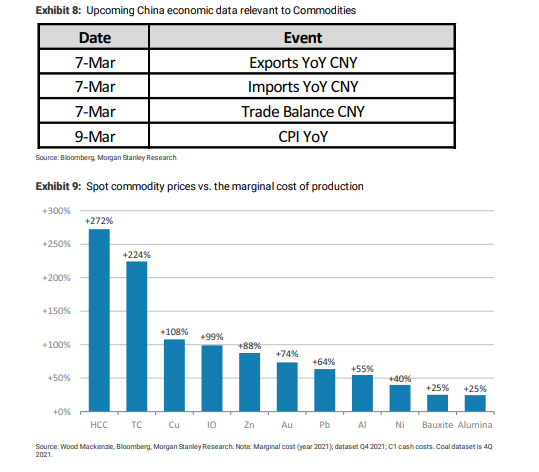

MATERIALS

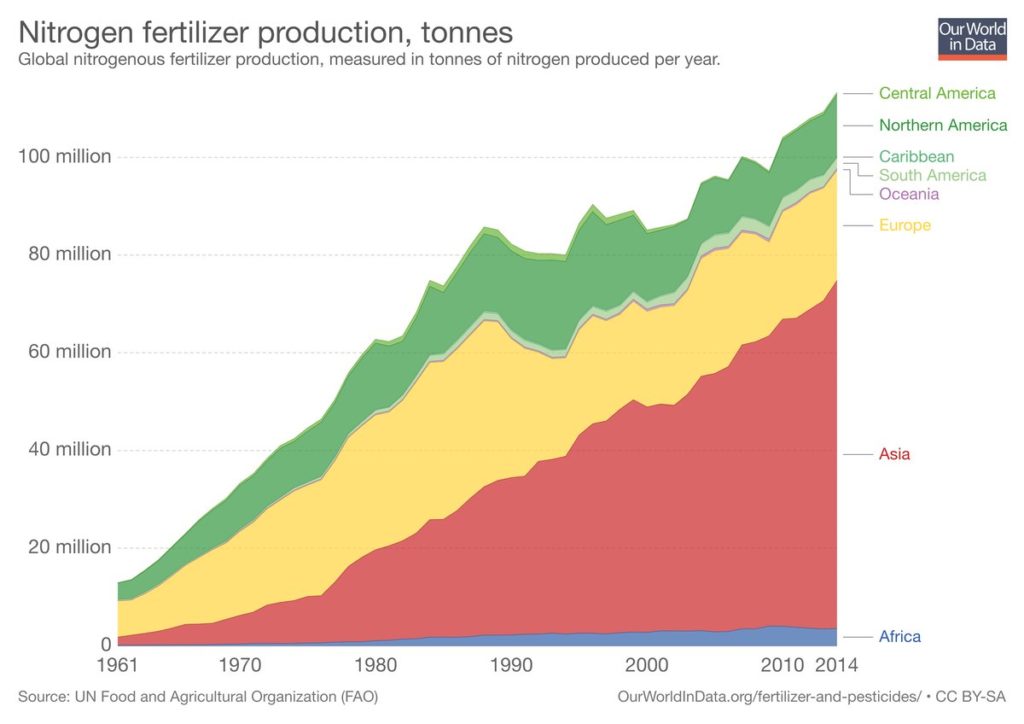

FERTILIZER

China has banned phosphate/urea exports until June 2022.

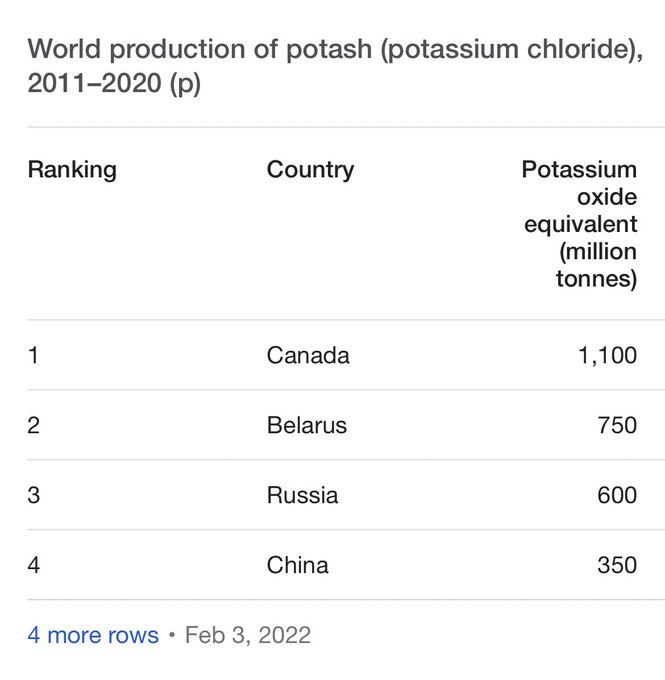

Russia banned exports of nitrogen fertilizer until June 2022. Looks like Potash will go offline for the #2 and #3 producer via sanctions.

This has never happened in a globalized world dependent on modern agriculture.

NOTABLE: US fertilizer prices jumped over $150 on the invasion of Ukraine as well. Stay long fertilizers. MOS, IPI, CF

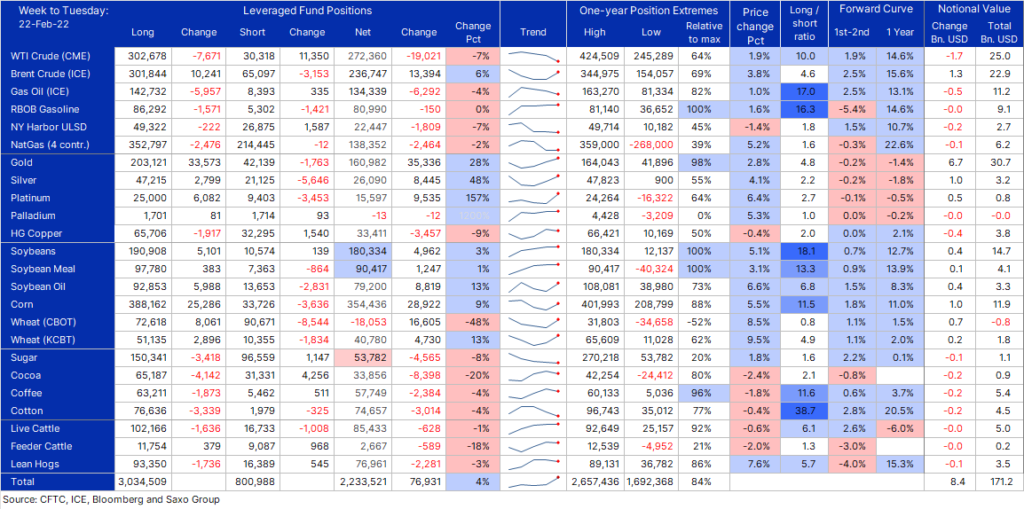

COMMITMENT OF TRADERS AS OF FEB. 22

COT on commodities in week to Feb 22 saw speculators react to the Ukraine crisis by adding length to gold and silver as well as all grains contracts. Crude oil selling extended into the fifth week (WTI -19k, Brent +13.4k) with all softs also seeing net selling-SAXO

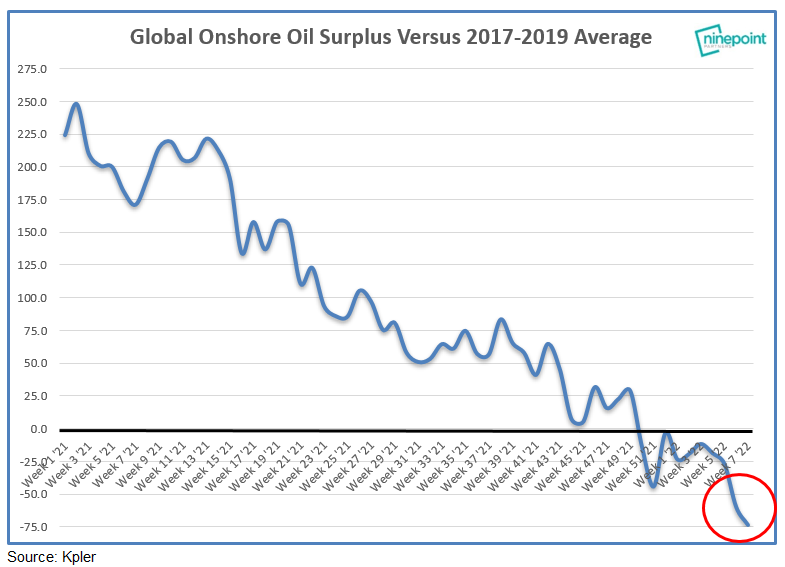

CRUDE OIL AND PRODUCT INVENTORIES

GLOBAL INVENTORIES

VORTEXA GLOBAL FLOATING STORAGE

Vortexa crude Oil floating storage for 02/25 est 94.20 MMB, +2.93 MMB WoW vs revised up 91.27. Been holding ~100 MMB for the past few months despite high prices, OPEC+ monthly increases, normal seasonal softness & still Covid impacts

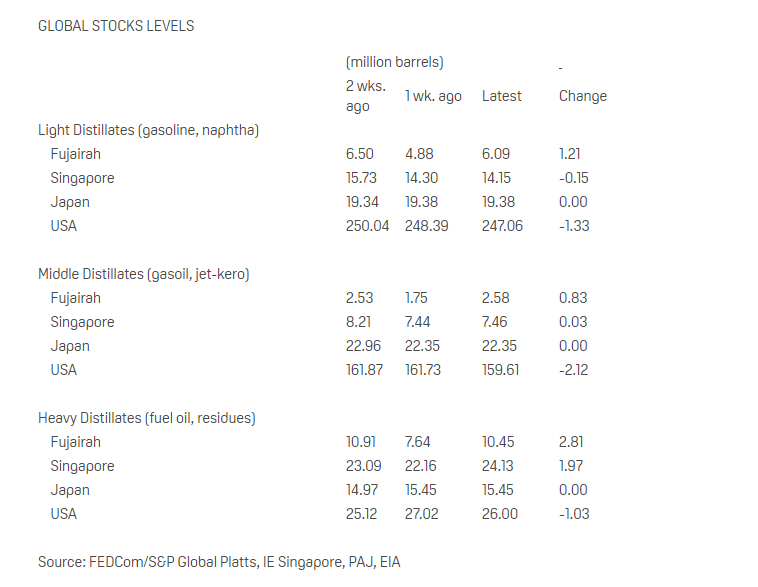

FUJAIRAH DATA

As of Monday, February 21, total oil product stocks in Fujairah were reported at 19.118 million barrels –a strong rebound from the record low levels recorded last week. Total stocks rose 4.852 million barrels with overall stocks up 34.0 % week-on-week, this is the single largest overall gain in stocks since stock reporting began at the start of 2017.

Stocks of light distillates, including gasoline and naphtha, increased by 1.21 million barrels or 24.8% on the week to 6.087 million barrels

Stocks of middle distillates, including diesel and jet fuel, increased by 832,000 barrels or 47.6% on the week to 2.579 million barrels

Stocks of heavy residues increased 2.81 million barrels or 36.8% on the week to 10.452 million barrels. Most buyers managed to secure February-loading ex-wharf marine fuel 0.5%S parcels earlier in January, but owing to dwindling stocks, upstream suppliers have lesser oil to offer for balance of month requirements, according to market sources. -PLATTS

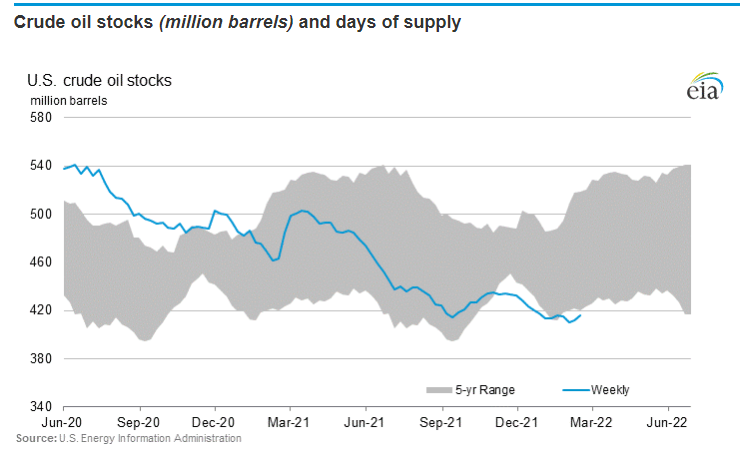

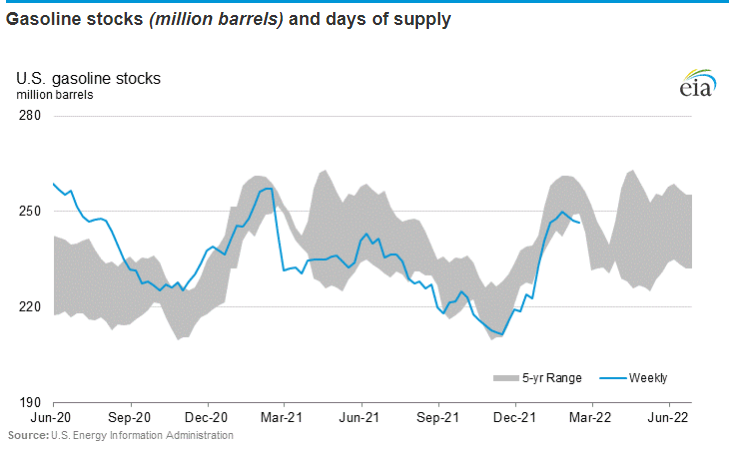

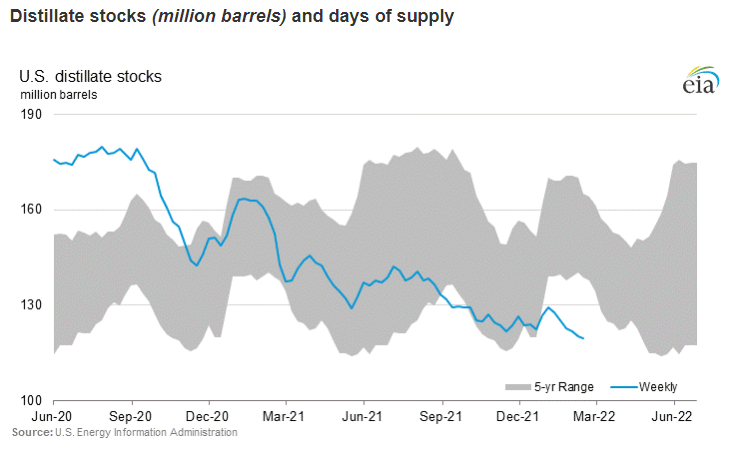

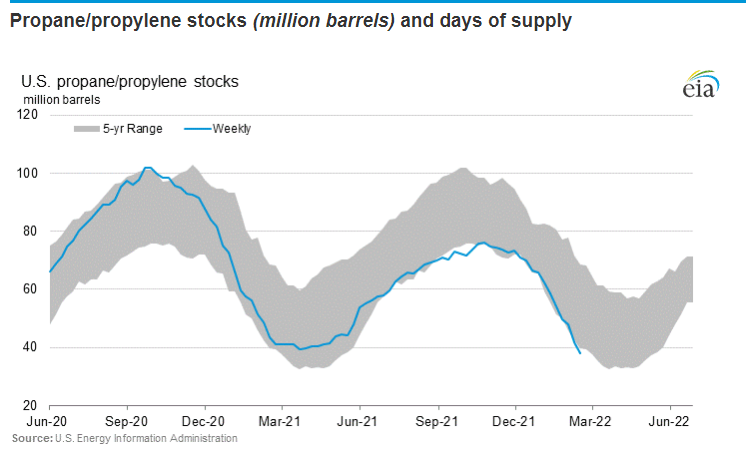

EIA