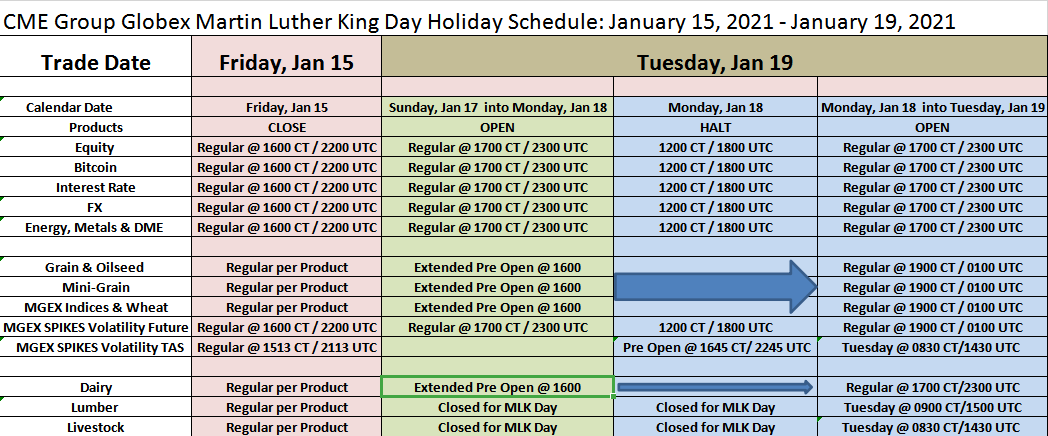

REMINDER

Tomorrow is Martin Luther King Jr. Day, equities are closed and CME is on a shortened schedule.

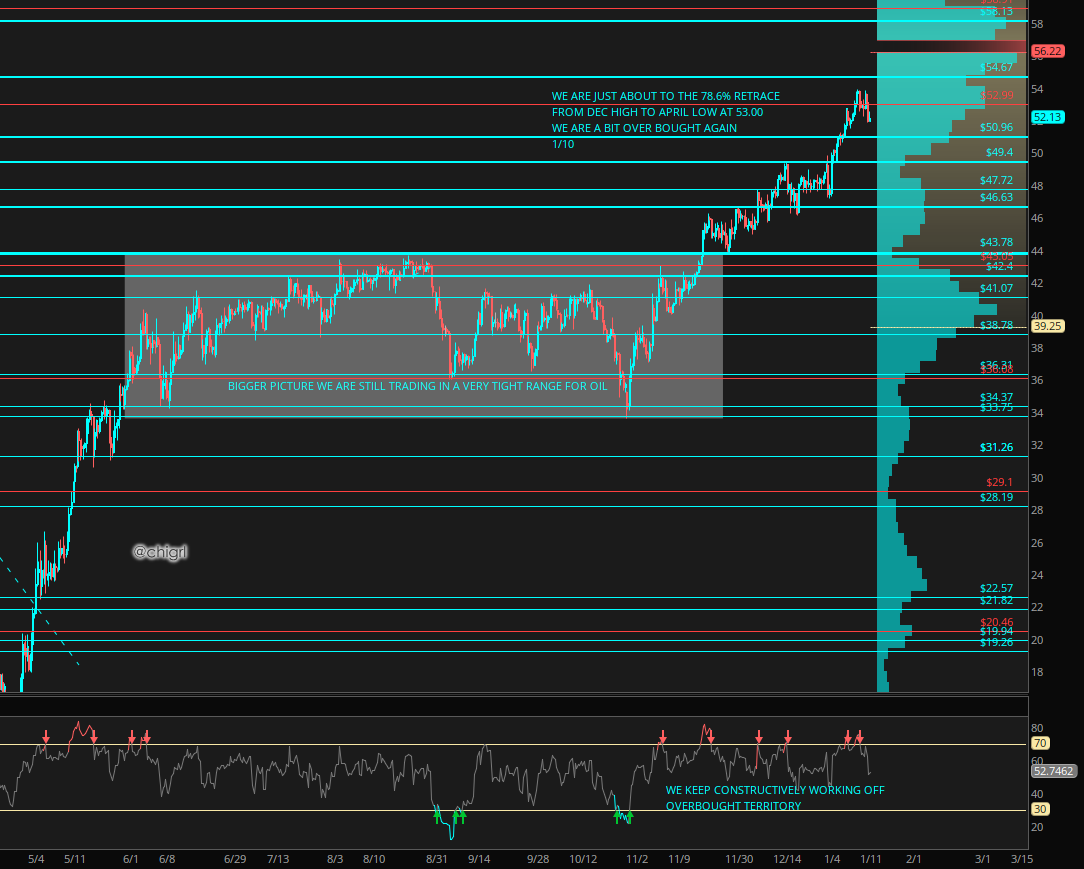

TECHNICALS

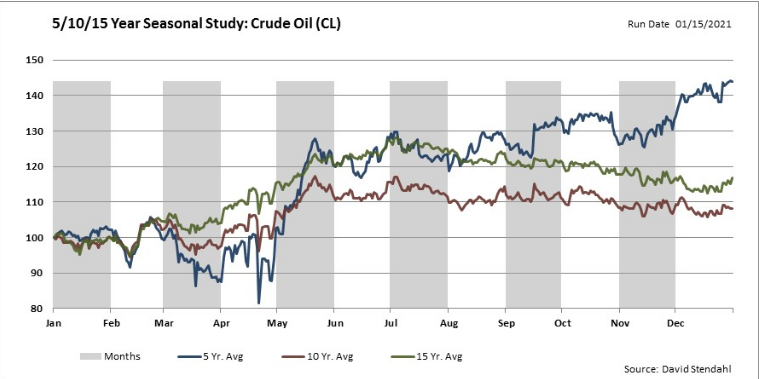

Last week we made it a bit higher than 53.00, before pulling back on overbought territory. Although we are constructively working off some of that stretched territory, I would not be surprised if we saw a bit more pullback over the next couple of weeks, or at the very least some consolidation, before a slightly bigger pullback in the first couple weeks of February due to seasonal tendencies; then a resumption of the uptrend. (see seasonal chart) Also, there is a possibility that some uncertainty with the incoming administration as far as policy is concerned may cause the broader markets to sell off initially.

5/10/15 year seasonal chart (keep in mind April 2020 skewed the averages, particularly the 5 year to the downside)

S&P 500 Breadth is decelerating

FUNDAMENTALS

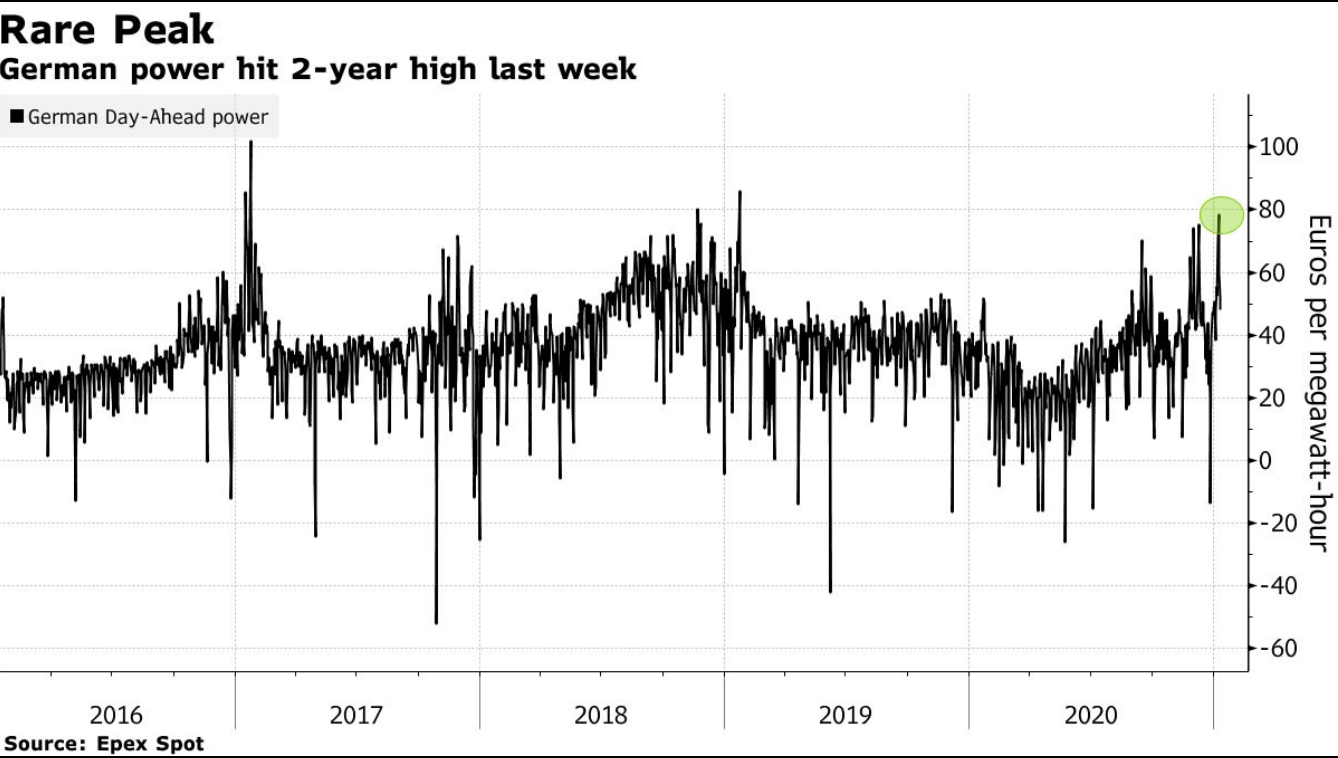

EUROPE: The big news this week was the polar vortex that has hit Europe is showing no signs of abating. In Sweden, a utility is paying for hotels for its customers after heavy snow brought down sections of the power grid cutting supplies while French households were advised to delay doing their laundry to save energy. The extreme, widespread cold took markets by surprise. In Spain, the government is considering ways to intervene in the electricity market when there are sharp price increases, as happened when demand surged during the cold spell that blanketed Madrid in a rare snowfall. Some consumer bills in the regulated market are linked to wholesale prices that are at the highest in a decade. The spikes in energy demand during the bitter winter, coupled with weak wind generation, power plant closures, and liquefied natural gas tanker delays highlighted the shortcomings of global energy systems in weather conditions that are only set to get more volatile. There could be more to come. -BBG

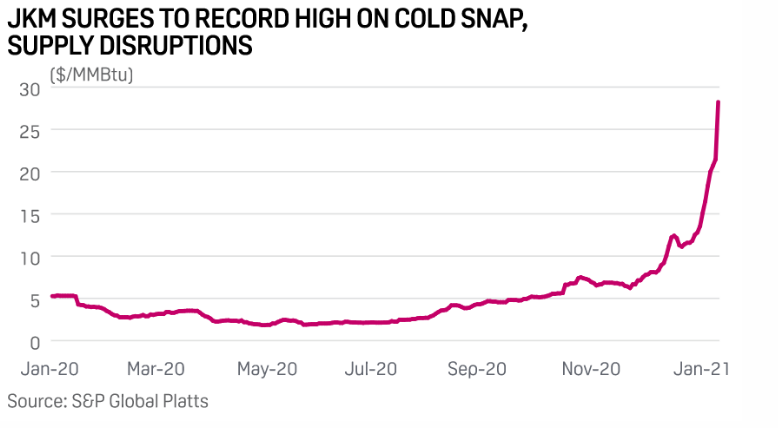

NORTH AMERICA: The Polar Vortex is headed our way, as I mentioned last week. LNG could see a price spike. I bought 16 April 21 UNG calls, as mentioned on last weeks report.

In addition, if the price spike in Europe and Asia utilities repeats itself in North America, it may give a boost to utility equities.

UTES ETF just broke daily resistance on Friday, which could be a sign of things to come over the next couple of weeks.

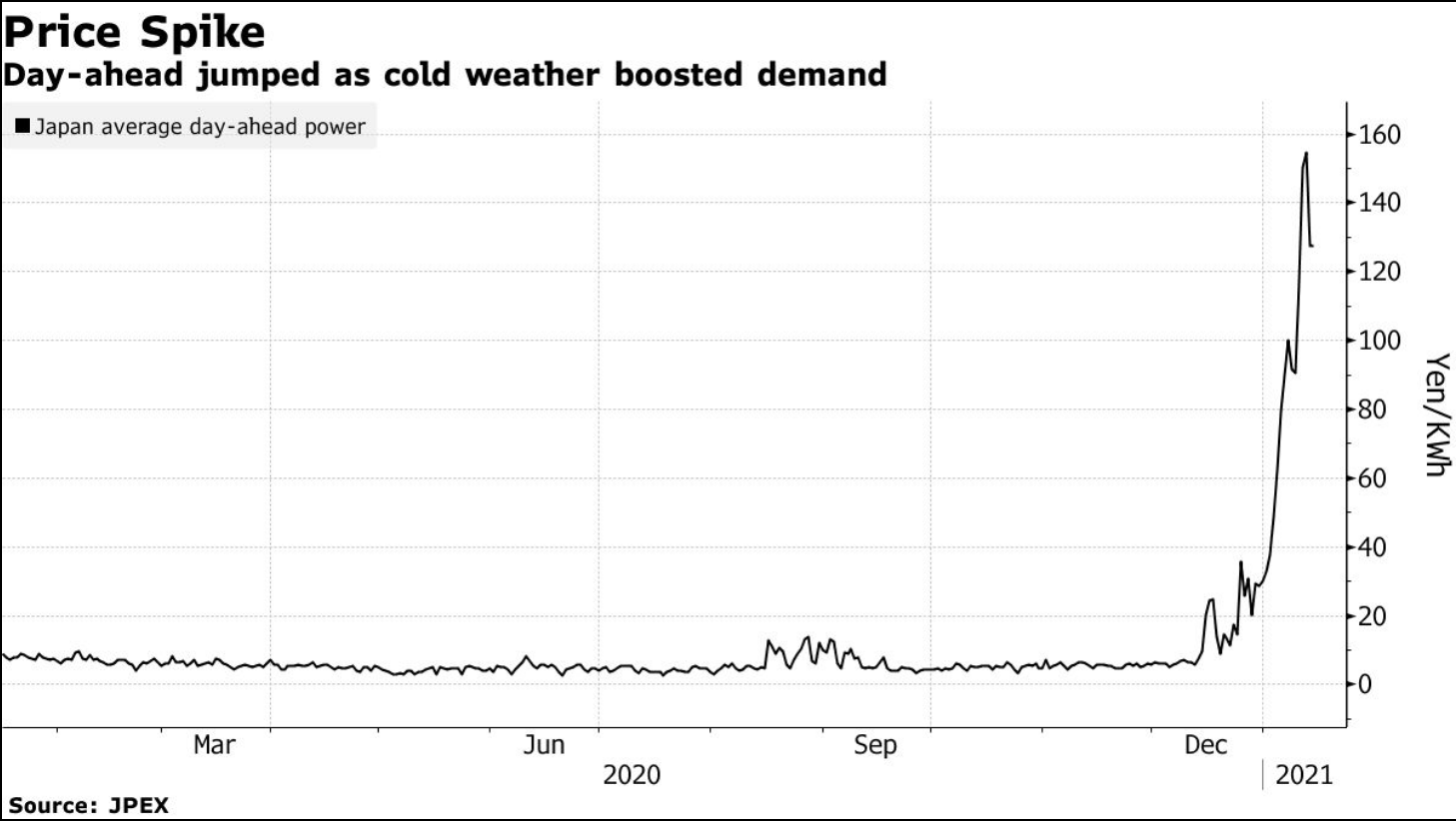

Japan power price spike

Germany power price spike

LNG prices are still surging in Asia. This comes even as bids for early February deliveries surged past $30/MMBtu for JKM

PAKISTAN: Pakistan is facing a gas shortage, too, despite running its two LNG terminals at full capacity in January. The Asian nation has cut gas supplies to industries and limited flows to compressed natural gas stations to a few days a week as residential demand more than doubled compared to the summer and was higher than in previous winters.-BBG

Spot LNG prices LNG-AS have nearly tripled since early November as freezing temperatures across North Asia boosted demand and depleted inventories. Since July, prices are up over 1,000%

CHINA: China is struggling to keep the lights on after some of the lowest temperatures since 1966 boosted domestic demand just as manufacturing ramped up after the pandemic. Ice is also wreaking havoc on grid infrastructure, while the frigid weather disrupted transport and delayed LNG tankers at Qingdao.

Big industrial users are first in line to have electricity supplies cut, followed by commercial buildings, in order to keep supply safe for residential consumers. -BBG

LIBYA: In November Libya started ramping production and reached 1.24M bpd, as I wrote about at the time. I also have been pointing out some of the weakness in their ability to continue such a robust return to the market.

This week, Libya’s NOC to reduce 200,000 b/d of Waha Oil output due to a pipeline leak. It is important to note that repairs at NOC pipelines and tanks were obstructed throughout the January-October of last year because of blockades at onshore eastern ports and western crude fields. There is also a lack of funding. Aside from the production output at Waha, the Es Sider crude grade, exports already look set to decline by nearly 23% on the month to 200K BPD in January. We are likely to see further problems and reductions in output.

NIGERIA: Loadings of Nigeria’s key export grade Forcados are on force majeure due to the shutdown of the Trans Forcados pipeline, terminal operator Shell said late Jan. 14. This takes 250K BPD off the market for at least two weeks.

INDIA: The Indian government is planning to allow domestic airlines to increase flight capacity and sees air traffic returning to pre-pandemic levels in two to three months, officials at the civil aviation ministry said. -Argus

Some good news for Jet fuel consumption.

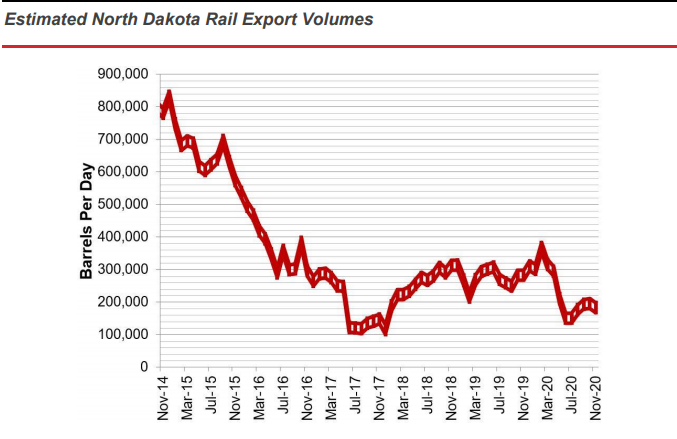

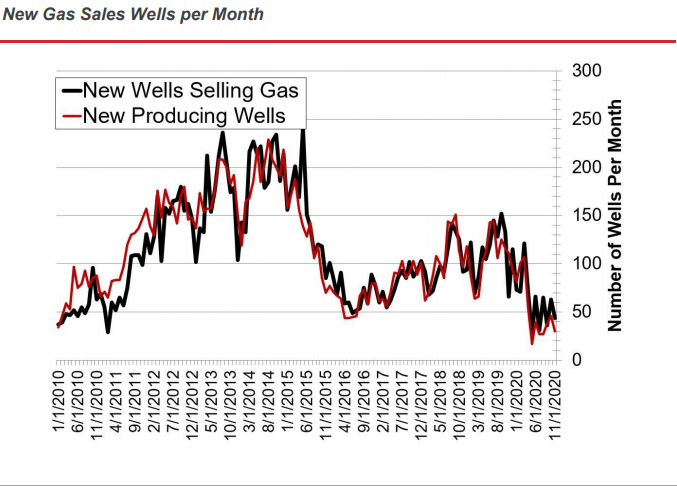

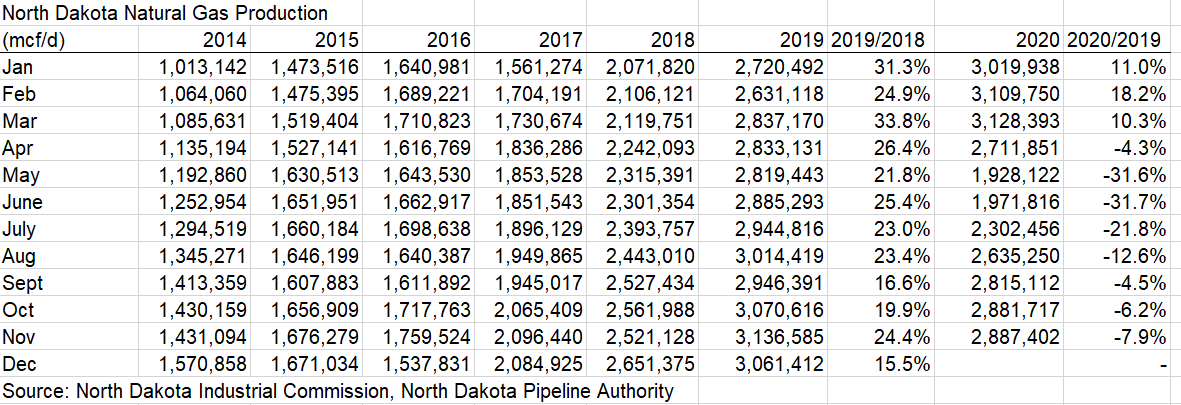

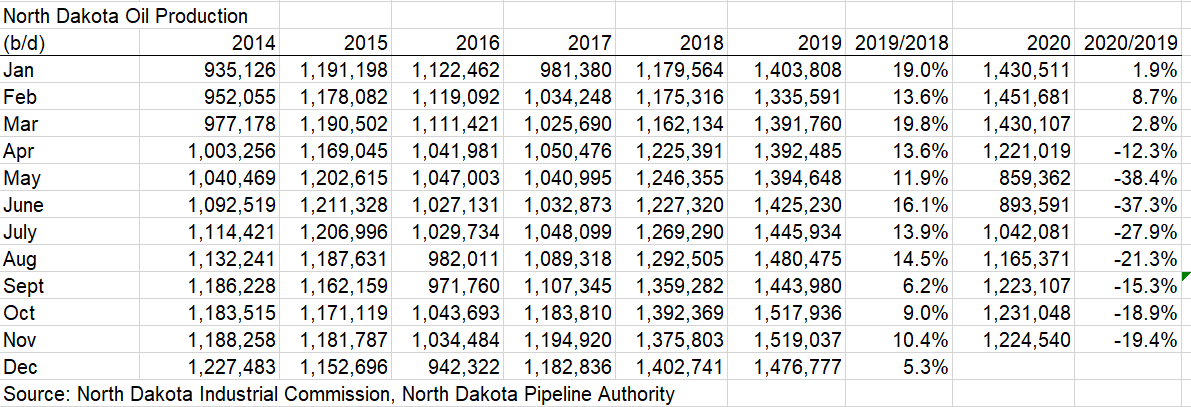

NORTH DAKOTA: I have been talking about how US production is likely never to reach 2019 levels of 13.5M bpd ever again. North Dakota November 2020 Production update was released this week confirming weakness. Rail export volumes are still extremely low, crude oil and natural gas production are still well off the highs.

I also wanted to address, the speculation that Saudi reduction of 1M BPD would give shale the greenlight to overproduce, but I do not see this happening given there is simply not enough inventory in the drilling pipeline to be able to do so. You need six months’ worth of inventory pre-drilled just to keep your production pace steady. As you can see in the charts below, there has been simply too much activity curtailed.

North Dakota Natural Gas Production -still well below the beginning of the year

North Dakota Oil Production-still very curtailed

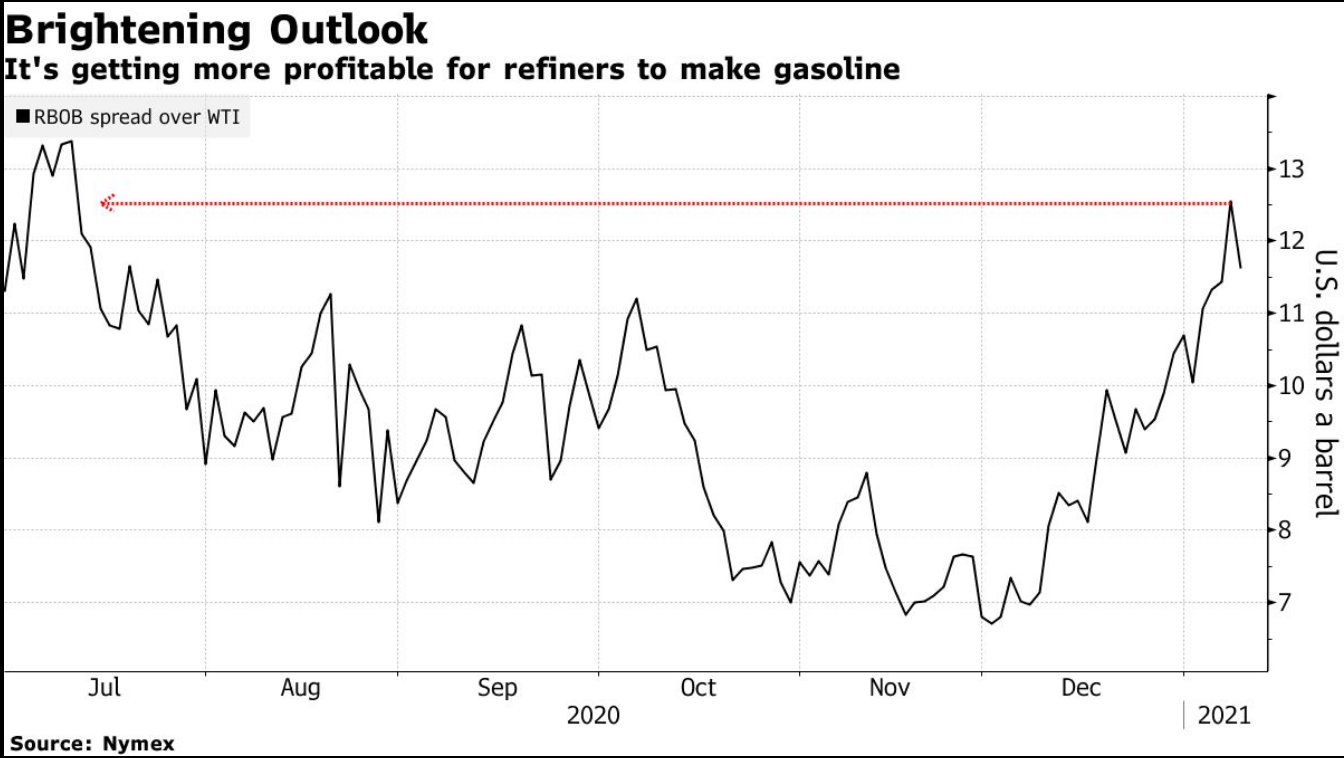

REFINING: Good news for refining stocks. Refiner crack spreads have rallied over the last several months on improved product demand outlooks. The spread between West Texas Intermediate crude and gasoline futures on the Nymex climbed above $12 a barrel Friday and has floated near that level as refiners start to build up gasoline inventories for expected higher summer demand.

OTHER NOTABLE NEWS

EXXON MOBIL (XOM): Exxon Mobil had a rough week. The SEC is investigating ExxonMobil over whistleblower complaint last fall alleging the energy giant overvalued one of its most important oil and gas properties. Several people involved in valuing a key asset in the Permian Basin, currently the highest-producing U.S. oil field, complained during an internal assessment in 2019 that employees were being forced to use unrealistic assumptions about how quickly the company could drill wells there to arrive at a higher value, according to a copy of the complaint. Likely this SEC review will end up with a slap on the wrist fine at the maximum and they should recover.

On Friday, another blow came when Exxon said on Friday that its latest exploration well in the prolific Stabroek block off Guyana’s coast did not find oil in its target area, the second setback to its drilling campaign in recent months.

GOLDMAN SACHS: GS announced forecasts returns of 5.8%, 9.5%, and 10.2% on commodities over 3, 6, and 12 month horizon on the S&P GSCI index this week. They are clearly bullish.

NORDSTREAM2: Zurich Insurance Group will drop out of Russia’s Nord Stream 2 project in the face of looming U.S. sanctions against European companies that support the construction of the $11 billion gas pipeline. Roadblocks are adding up.

Something to watch with the incoming administration, is if they remove sanctions. This will be a good tell on foreign and energy policy.

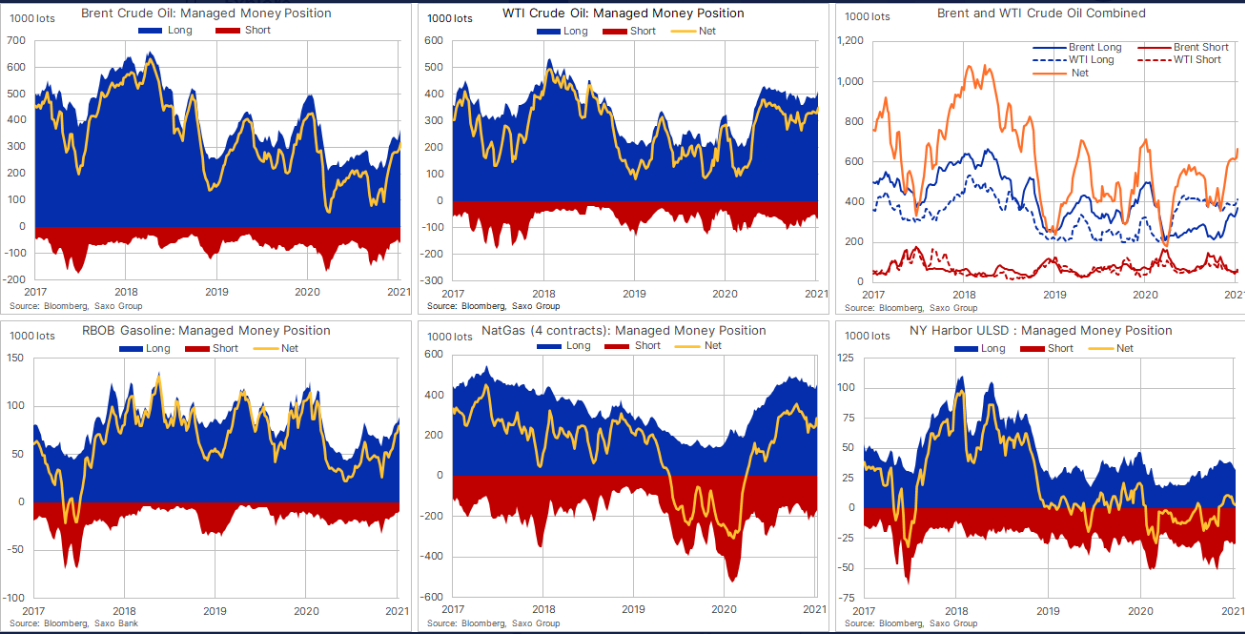

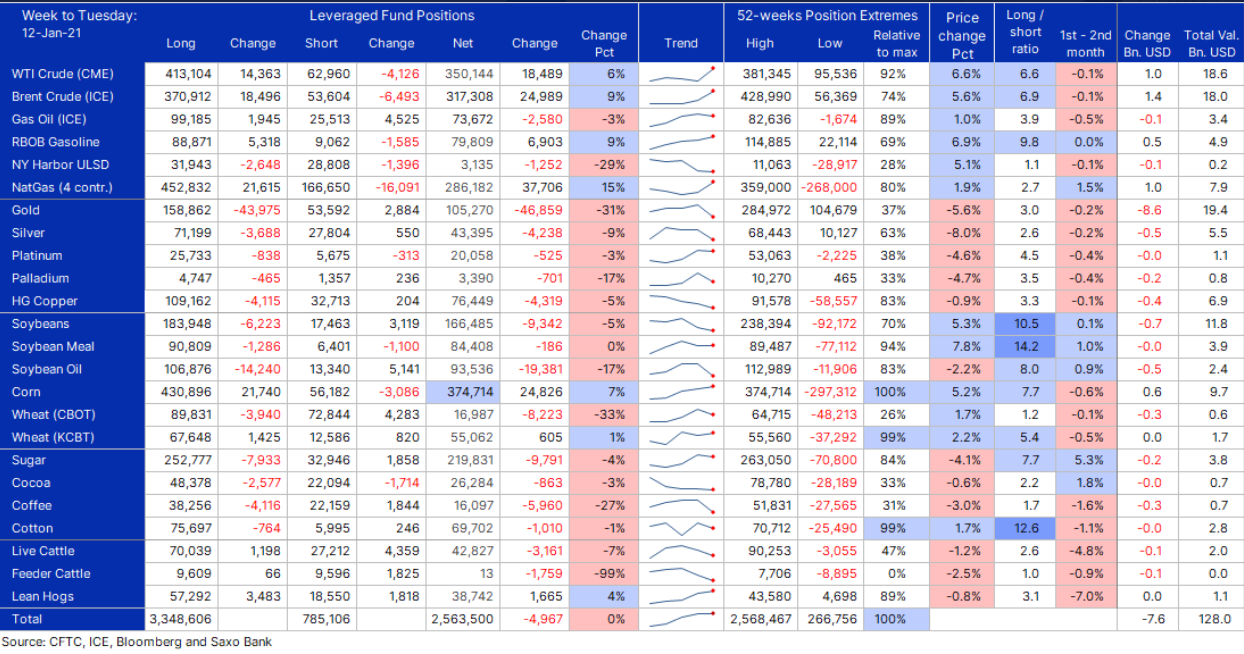

CFTC COT

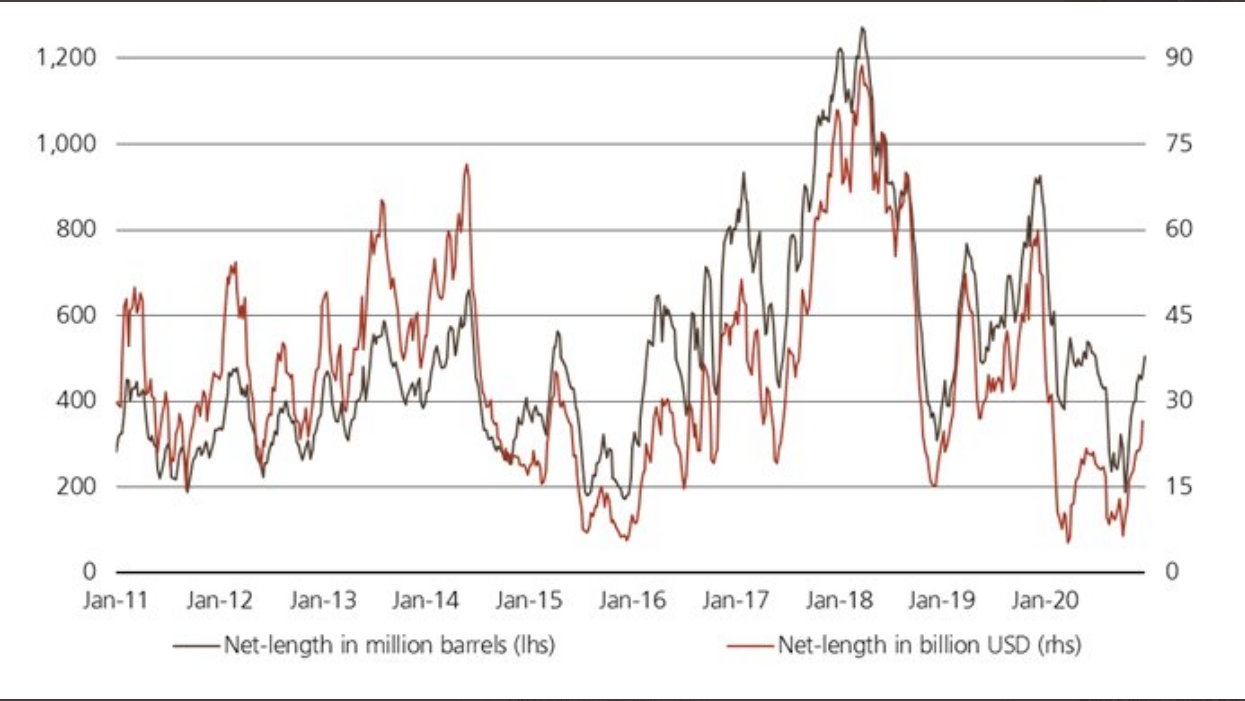

The Commitment of Traders on energy as of 1/12/2021: the tailwind of the Saudi oil production cut saw speculators increase crude oil longs in WTI and Brent to a one-year high. That said, the market is still not overly long, comparatively, as total open interest is still well below prior years.

Crude net-positioning of non-commercial accounts. Brent and WTI futures and options combined.

COT Commodities

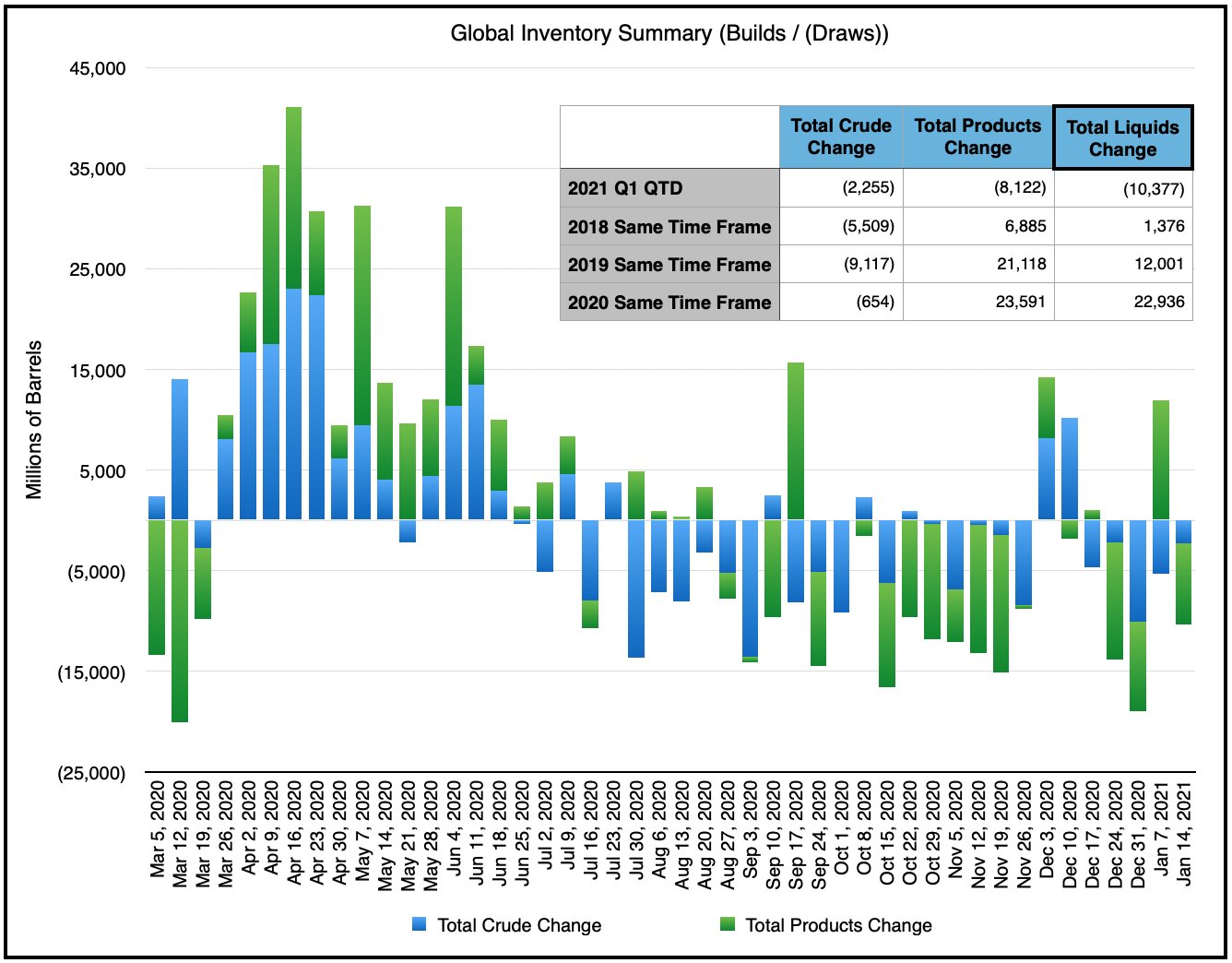

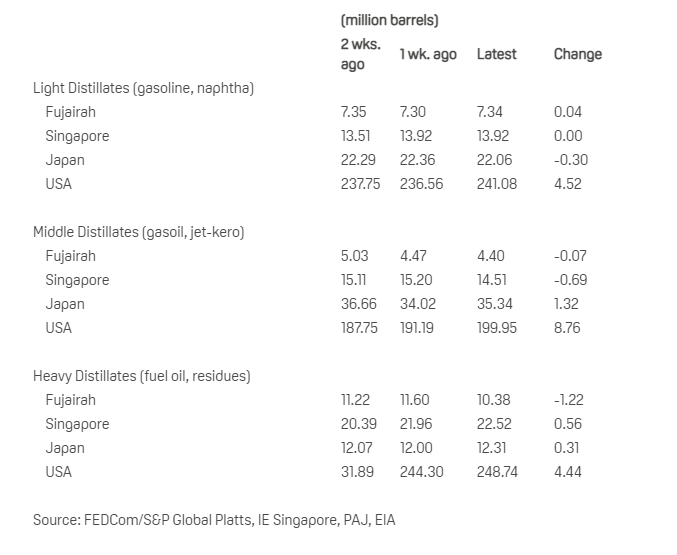

GLOBAL OIL INVENTORIES

10M draw, surprisingly strong. If inventories continue grinding down at current rates, could see redux of price action in 2018 despite excess inventories.

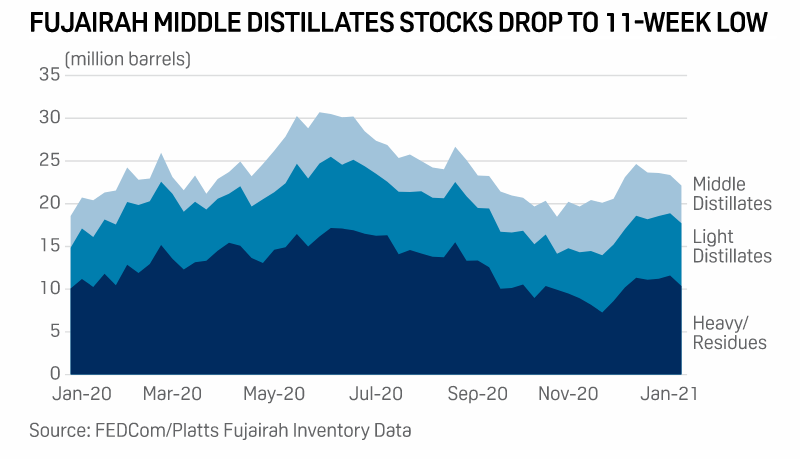

FUJAIRAH OIL INVENTORIES

Product stocks fell for 4th week, longest slide since October 2020

Stocks are down 10% in the past four weeks, led by a 27% drop in middle distillates such as gasoil, diesel, jet fuel and kerosene. Middle distillates. As of Monday, January 11 total oil product stocks in Fujairah were reported at 22.122 million barrels. This is the first time they have been below 23 million barrels since the end of November. Total stocks fell by 1.249 million barrels or 5.3% week on week, with a large draw in heavy residues, a smaller draw in middle distillates and a small build in light distillates. -Platts

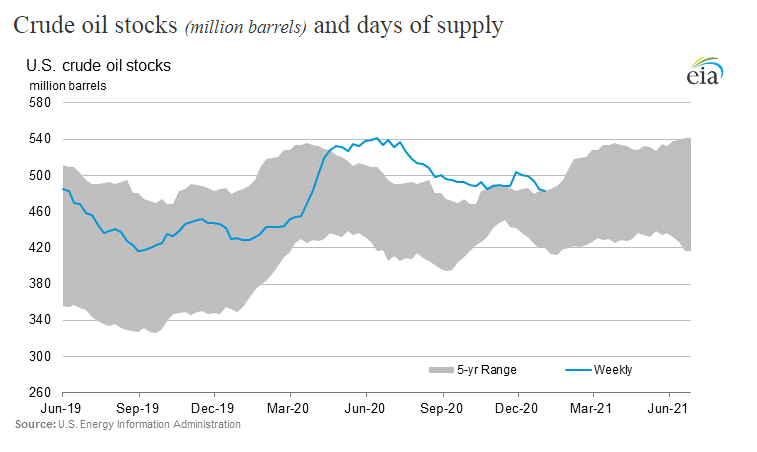

EIA US OIL AND PRODUCT INVENTORIES

Crude: -3.247M barrels. We have just about fallen back into the 5 year average.

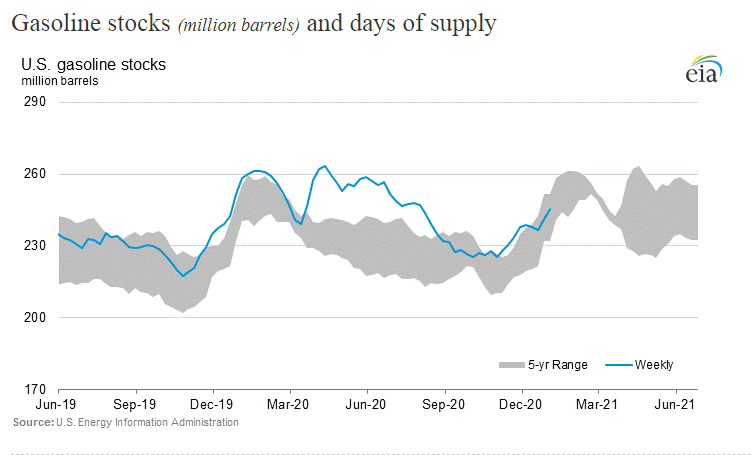

Gasoline: + 4.395M. Although we had a build, we are still within the 5-year average as we are in a seasonal soft season.

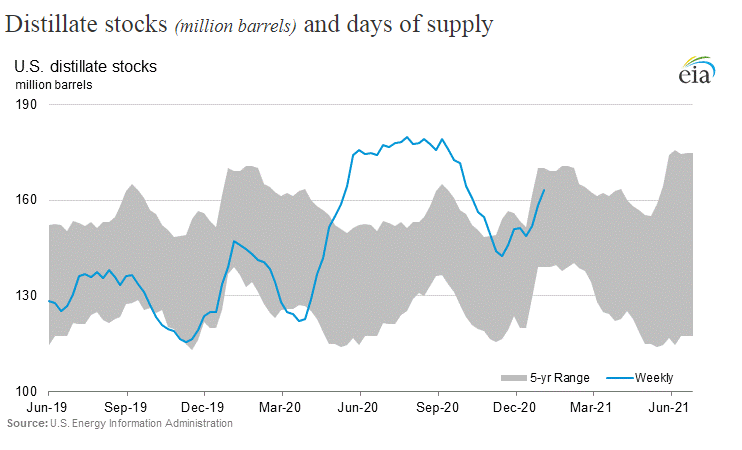

Distillates: +4.786M. Again, we are still within the 5 year average. Holiday air travel subsided after January 4th, which is also a contributor to this build.

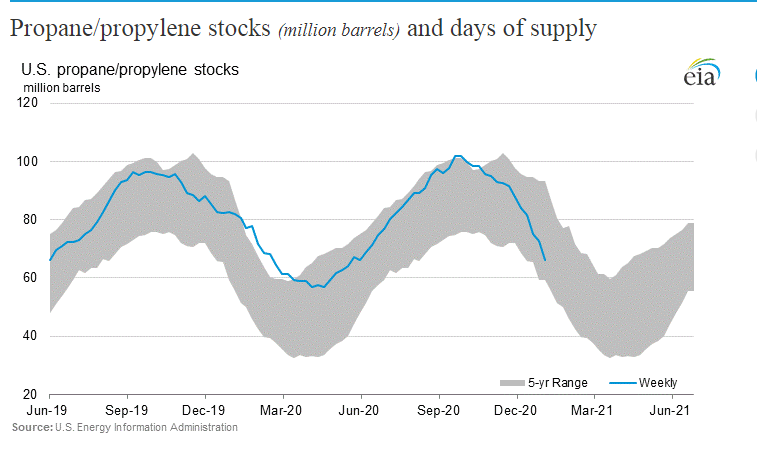

Propane: Again, fantastic draw again. This is super bullish for NGL (Natural Gas Liquids) producers.

NOTABLE EARNINGS NEXT WEEK

TUESDAY: HAL

FRIDAY: SLB

DAILY SENTIMENT (DSI) HEADED INTO NEXT WEEK