HAPPY NEW YEAR!!!

2021 looks to be off to a good start for the energy markets. Inventories are drawing globally (we still have inventory to work through). Asia demand is looking very strong, and we are seeing a strong demand in shipping (air, land, and sea) that is compensating for losses elsewhere in the West. I also want to note, we have commodity index rebalance at the beginning of January which will lead to an additional 80-100M barrels in purchases.

OPEC+ MEETING JANUARY 3-4

OPEC+ JTC (Joint Technical Committee) meet today to discuss the state of the oil market and Monday is the JMMC (Joint Ministerial Monitoring Committee) meets to put for a recommendation on whether or not to increase production another 500K BPD for February. (Note: this is only a recommendation, it can be overturned by the alliance)

Of course, the traditional drama surrounding this meeting as rumors that Russia and Algeria are for an increase and the rest of the alliance is not.I think the media is playing up the hype more than needs to be, and they will likely come to the consensus to hold off any increases for February.

“There is concern about the emergence of a pernicious new strain of the virus. Last night I saw on the news there are now about 30 countries that have reported this new strain,” said Opec’s Secretary General Barkindo at the JTC today.

(Complete JTC press release HERE)

Unreported by Western media, but in the Russian language media TASS, Novak said when the UK announced the new Covid strain, “During these two days the situation, in my opinion, has changed, it is changing quite actively. Serious lockdowns have now been introduced regarding travel to the UK. A new strain of coronavirus has appeared, and this has affected, among other things, the fact that today we see a significant correction in oil prices in the markets. We haven’t seen that two days ago,” he said.

I think Russia is well aware of the situation and with Brent oil at almost $52 they will not want to rock the market. I would also note that their current 2021 fiscal budget is based on $45 oil and they faced a $39 billion budget revenue shortfall in 2020.

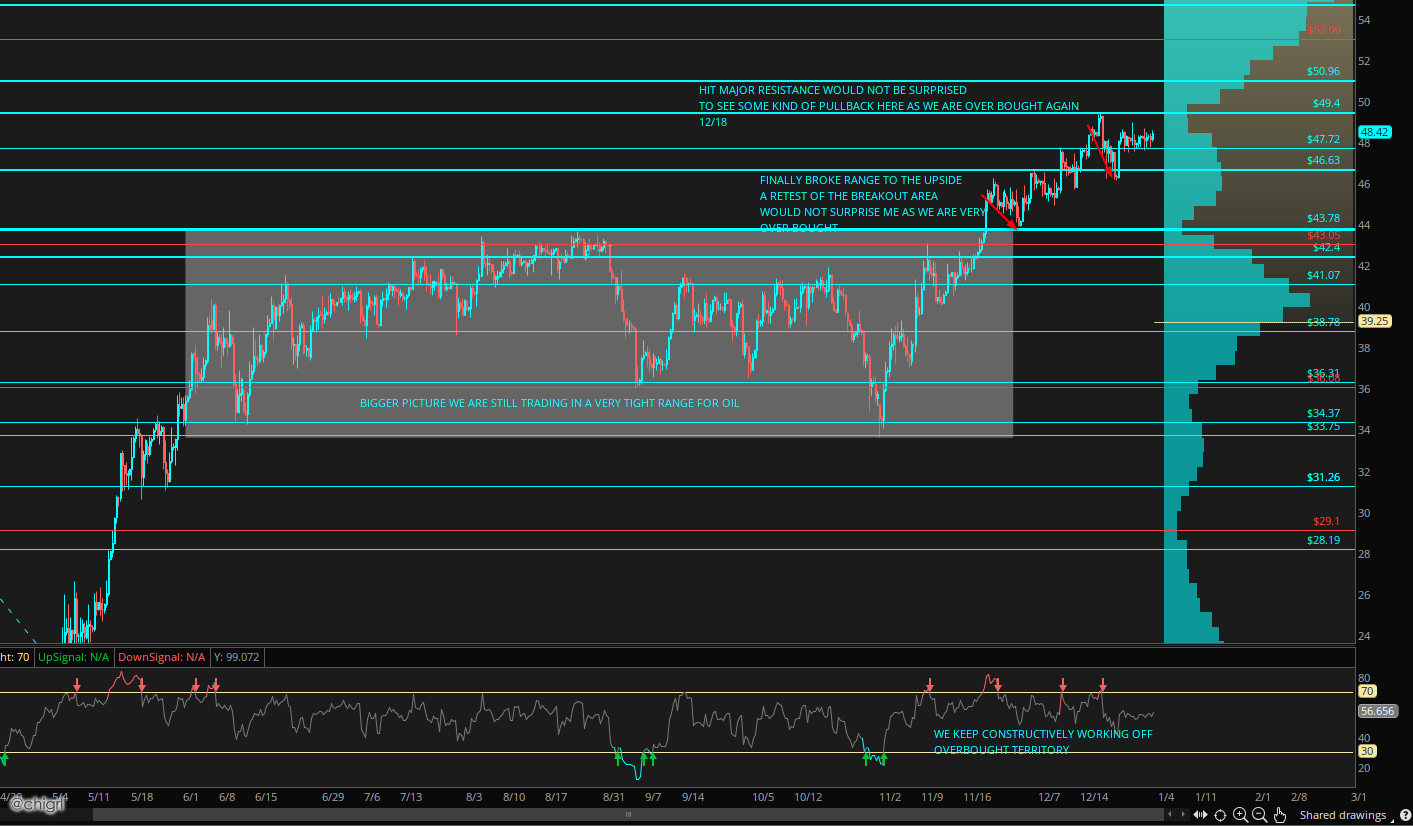

TECHNICALS

Technically, we are still constructively working off overbought conditions. We have taken a pause of the two weeks, as I noted in the 12/18 note would likely happen. This chart still remains constructively bullish.

FUNDAMENTAL DATA

CHINA: China has allocated the 1st batch of its crude oil import quota for independent refiners (teapots) and traders: 122.59 million tonnes, up 18% y-on-y according to BBG. In fact, several crude oil importers in Asia have recently been inquiring about the possibility of securing additional term volumes from producers in the Mideast Gulf region, starting in the second half of 2021via Energy Intelligence

IRAN: Iran’s parliament has lowered the government’s oil export target from 2.3 million to 1.5 million to manage expectations, news agency ISNA reported Jan 2. The proposed budget had aimed to sell over 2 million b/d of crude both in domestic and international markets. However, the figure was questioned due to strict US sanctions and the COVID-19 impact on demand. Both factors have capped Iran’s sales below 1 million b/d over the past year. -Platts

I also wanted to address this persistent rumor by a couple of western publications that the Chinese pouring money into Iran with joint development projects in particular the South Pars field. This rumor is FALSE.

“According to oil price’s website has made some strange claims in an article that differs greatly from what we know about the development plan of the world’s largest gas field. Oil Price’s most important claim goes back to the continued Chinese presence in Iran even after sanctions were imposed. According to the report, China is still helping Iran develop this Phase of South Pars as well as some Iranian oil fields, but through smaller companies, with fewer forces and a different contractual structure that requires them to make specific short-term commitments, such as drilling in a field. According to the author of the paper, Petropars’s Simon Watkins is China’s Iranian partner in these small contracts. However, Hekmat Sharifi, head of public relations at Pars Oil and Gas Company, who is a contractor for the project, denied all the allegations in an interview with Donya-e-Eghtesad, saying drilling in the field was being carried out by the company and that MAPNA would take part in the work.” – Donya-e-Eqtesad

(Donya-e-Eqtesad is considered to be an advocate of free markets, and does not have any formal affiliation with the government of Iran)

LIBYA: Libya lowered their 2021 forecast from 1.6MBPD to 1.2MBPD (which is their current production) -Libyan Observer

Also I am hearing rumblings out of Libya that the oil blockade may be coming back. Attorney general has ruled against the oil account freeze, which is the reason Haftar lifted the blockade. If so, this likely will take 1MBPD off the market in short order, which obviously would be bullish for the market.

INDIA: December diesel demand crawled up to 97% of pre-pandemic level. petrol demand during the month more or less maintained the pace of annual growth at 8.7%. Refineries are running at 100% capacity.

SHIPPING

I have discussed in prior weeks the massive increase in shipping. This has remained unabated.

AIR: The air freight industry is having to purchase more planes to to get some needed capacity relief with Qatar Airways, China Airlines and AirBridgeCargo add adding new-builds to their fleets

“A wavelet of Boeing 777 freighters entering commercial service is providing a dose of relief to shippers struggling to find capacity ever since passenger airlines closed down most international flights nine months ago due to the pandemic. Qatar Airways and China Airlines are the latest carriers to add the 777 freighter to their fleets, as they set their sights on expansion in 2021. Qatar Airways’ cargo division on Friday took delivery of three production 777 cargo planes built by Boeing, adding to the 21 twin-engine aircraft it already operates. Qatar Airways Cargo now has 30 all-cargo aircraft in its fleet, including two 747-8s and four Airbus A330s.” -American Shipper

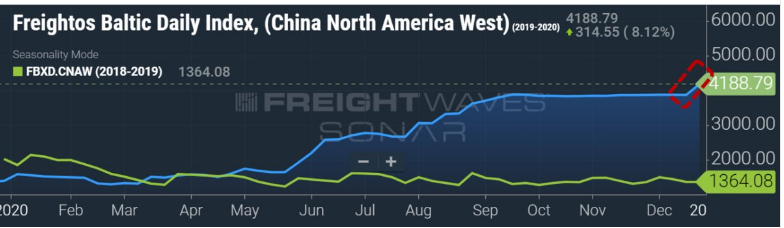

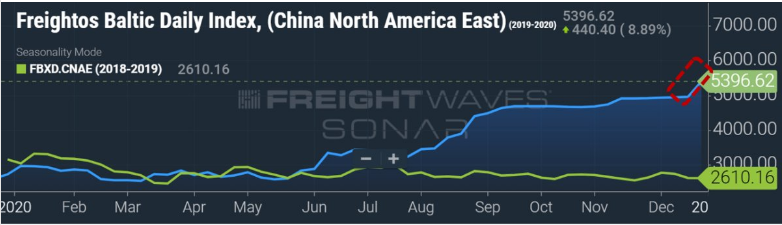

SEA: Trans-Pacific freight shipping rates for both Asia-West Coast and Asia-East Coast just popped to new all-time highs, and have basically been straight up since September. In addition, surging demand for ocean freight and the resulting global equipment shortage pushed rates up across most of the major ex-Asia lanes this week. -American Shipper

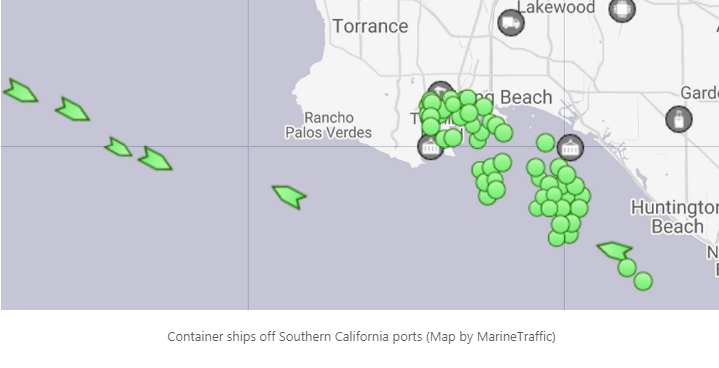

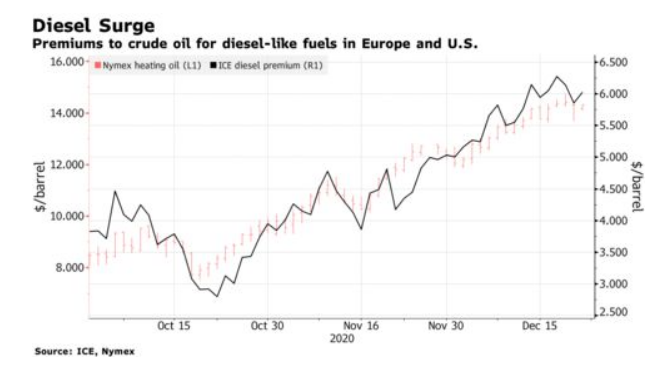

LAND: The is a pile-up of cargo ships sitting off the Long Beach coast waiting to unload. This in turn is creating a massive surge in demand for truck tonnage for deliveries across the United States, pushing up premiums to crude oil for diesel.

PROPANE

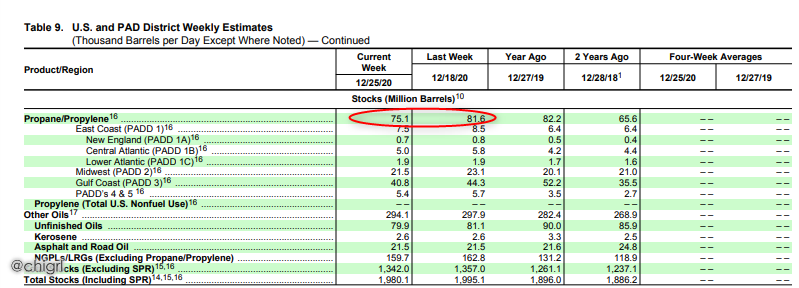

US: I have brought this up over the last couple of months, but December is proving that the propane market is hotter than ever. EIA showed a HUGE draw this past week. The Mont Belvieu propane price is up by almost 40%, blasting past 75 cents a level not seen since February 2019, when WTI at Cushing was trading at $57/bbl. As 2020 cold weather finally arrived in U.S. propane country, exports hit the highest levels ever recorded. December Gulf Coast export volumes which are 92% of the U.S. total are up 21% over last month, and 39% above December 2019. So both international and domestic demand is pulling hard on supplies at the same time.

*AR (Antero Resources) the actionable idea pick 10/18 note, is the US second biggest NGL (natural gas liquids) producer, will be the beneficiary

KSA: Saudi Aramco sets propane, butane prices for January 2021 Aramco hiked its January 2021 contract prices for propane to $550 a ton, a $100 per ton increase compared to December 2020 prices, as demand in Asia is strong.

OIL STOCKS

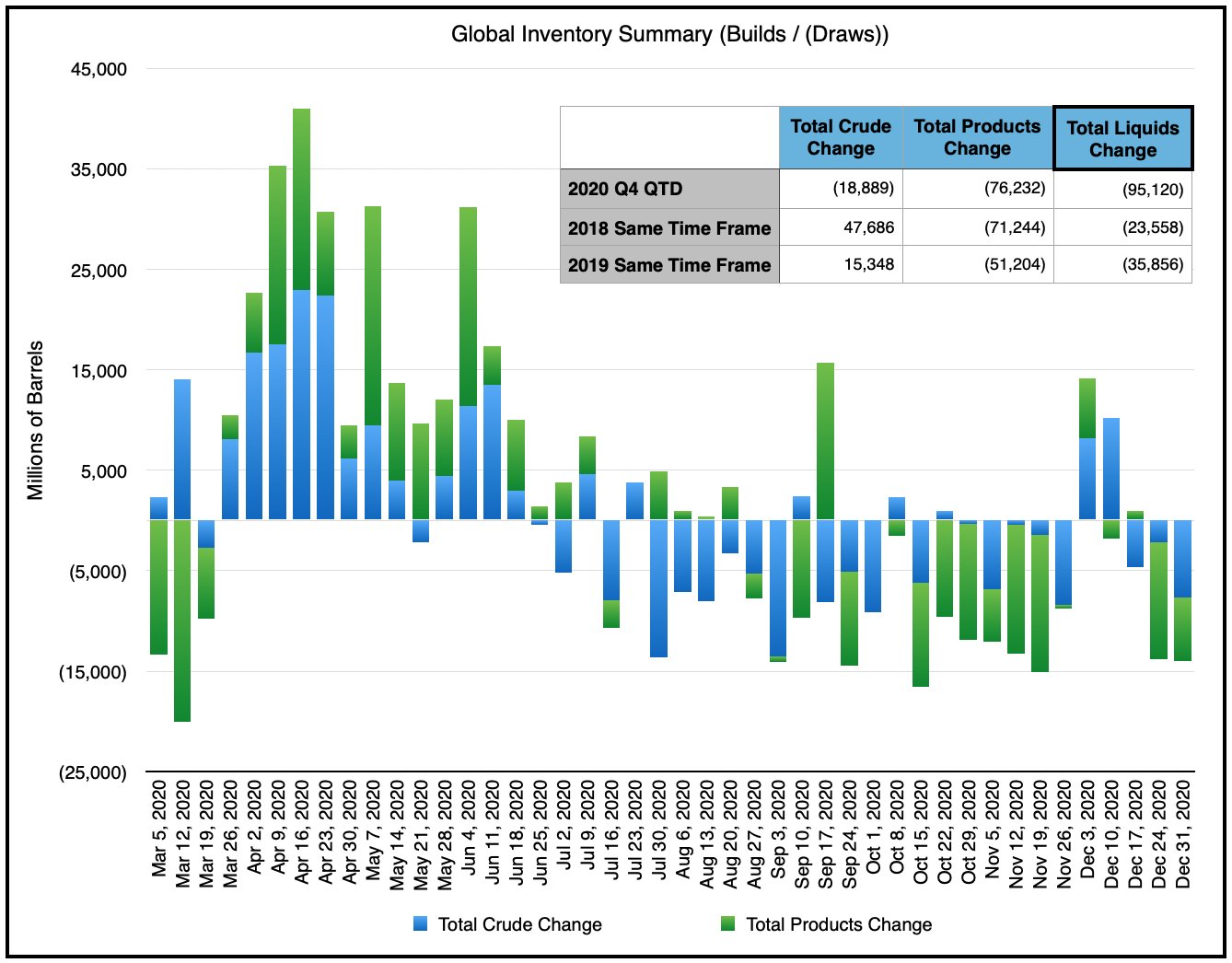

GLOBAL OIL STOCKS: December 20th: 13.8M barrel draw. Products led the way with 11.8M draw. Crude was 2.3M.

December 25th: 14M barrel draw. Crude led the way w/7.7M draw & products w/6.3M. This was mostly a Western draw. Japan did not report. Back-to-back weeks of 13-14M draw.

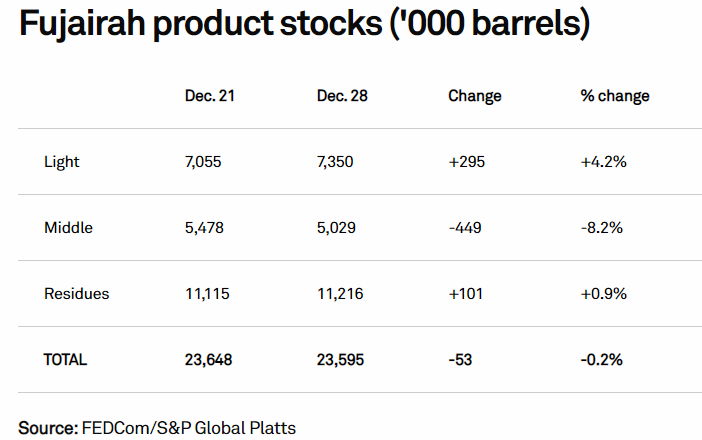

FUJAIRAH OIL DATA: Oil product stocks dip just 0.2% (53K barrels) as year-end trading slows. Total inventory levels stand a 23.595 million barrels. Light distillate stocks increased 295,000 barrels, up 4.2% week on week, and now total 7.350 million barrels. Middle distillate inventories, including jet fuel and diesel, fell 449,000 barrels, or 8.2%, in the week to 5.029 million barrels

Stocks of heavy distillates, including fuel for power generation and bunkers, rose 101,000 barrels, up 0.9% on the week, to 11.216 million barrels. The gasoil market East of Suez was seeing some downward pressure due to demand concerns in the UK amid tighter lockdown measures from the emergence of a new strain of coronavirus, as well as a unfavorable arbitrage economics that have diverted surplus barrels from Asia and the Middle East westward -Platts

This is a bit concerning, but I am not completely worried about this as it is the end of the year, and most buyers have already secured their supplies for the holidays, as well as suppliers covering their books into the end of the year.

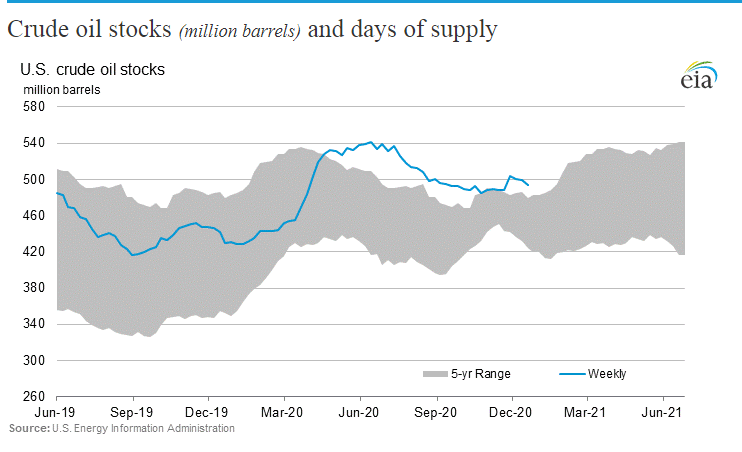

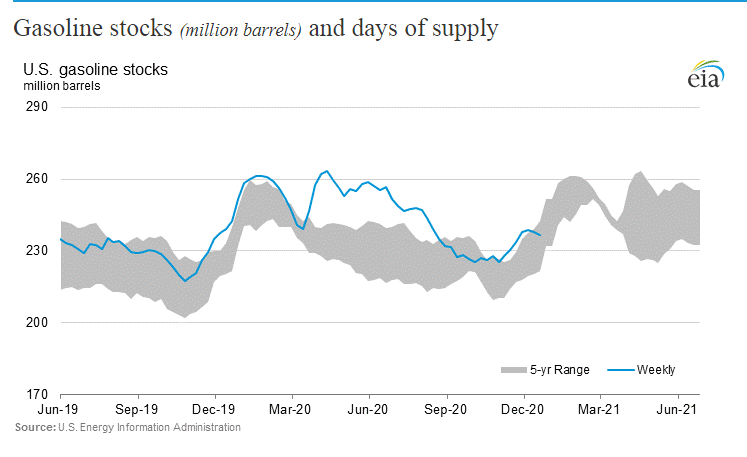

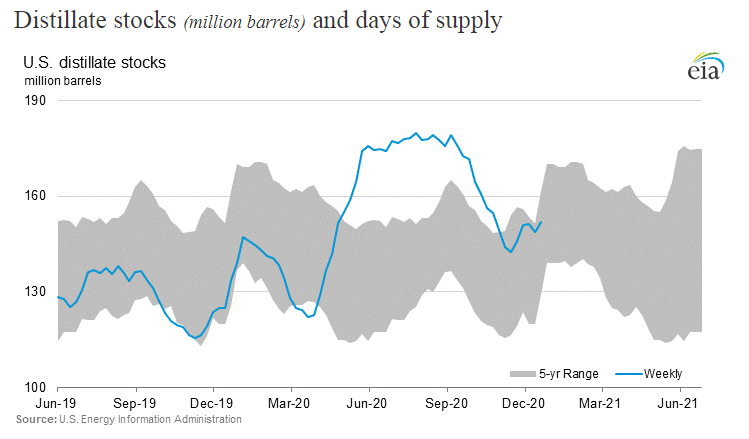

EIA: Crude: -6.065M, Cushing: 0.027M, Gasoline: -1.192M, Distillates: 3.095M

Gasoline stocks are back into the 5 year average

Distillate stocks have also fallen back into the 5 year average

DAILY SENTIMENT (DSI) HEADING INTO NEXT WEEK