I’m happy to report our “guest” columnist Dave Newman will now be a regular contributor at Hedge Fund Telemetry. If you have any questions or comments, please send us an email and we’ll get back to you.

“Hyperinflation is going to change everything – it’s happening…” Jack Dorsey

One of my favorite books is called “Superforecasters” by Wharton Professor Phil Tetlock and journalist Dan Gardner. Being a really good forecaster is not about where you went to school if you have a Ph.D., or about being famous and articulate. It is about building curiosity about what the drivers are of an outcome and constantly re-evaluating and incorporating all new information in an unbiased way.

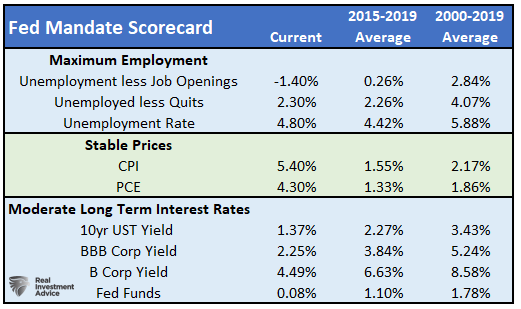

With that in mind, I was struck by a reference to September 2020 FOMC meeting that 2021 PCE inflation would be around 1.5-1.8%. Obviously, with recent readings of 4.3% PCE, that group would not be super forecasters.

So, what should we make of the hyperinflation call by Jack Dorsey? Or of Cathie Wood’s comments that she too thought inflation would spike after QE in 2009 but have since come to believe that “IMHO, the powerful and converging deflationary forces associated with AI, energy storage, robotics, genomic sequencing, and blockchain technology, will bend the curve.” Well, they are both talking their books, ignoring history lessons, but if I had to bet on one versus the other, I would stand more with Cathie on this in the long run. But, that of course, assumes the Fed will be actually willing, use the tools it does have, and for fiscal restraint. There is a doom loop scenario out there that could cause much more inflation, as we saw in the 1970s. Hyper-inflation, however, that’s a marketing spin and maybe misinformation, the thing guys like Dorsey are supposed to minimize.

Anyway, what matters in the here and now? Simple. Inflation is alive and well, and the Fed – largely due to over-exaggerated fear of reduced monetary policy effectiveness at the zero lower bound – has brought in a new flexible average inflation regime that really is a dramatic shift. Here is a table to give some context (a bit dated) where the issues are visible:

If the Fed wants to drive average inflation up, do we know which period, and the time frame they are referencing? We need that information if we have any hope of keeping our expectations anchored. We don’t have anything specific other than a: there have been 20 rate hikes outside the US this year, including the Bank of Canada ending QE early; b. The fed will begin taper shortly. But, we also know from Chairman Powell, that they are sticking to their no rate hikes for now.

“I do think it is time to taper…but I don’t think it is time to raise rates…we need to watch and watch carefully and see if the economy is evolving consistent with our expectations and adapt policy accordingly”

Going back to the super forecaster theme, does it sound like they are incorporating new information with an open mind? Are they thinking about risk/reward? Or are they so concerned about tapering/hiking rates too quickly that they unnerve the markets forcing them to pare back? Are they fearful of what happens to deficit growth if rates are raised given reliance on short-term issuance?

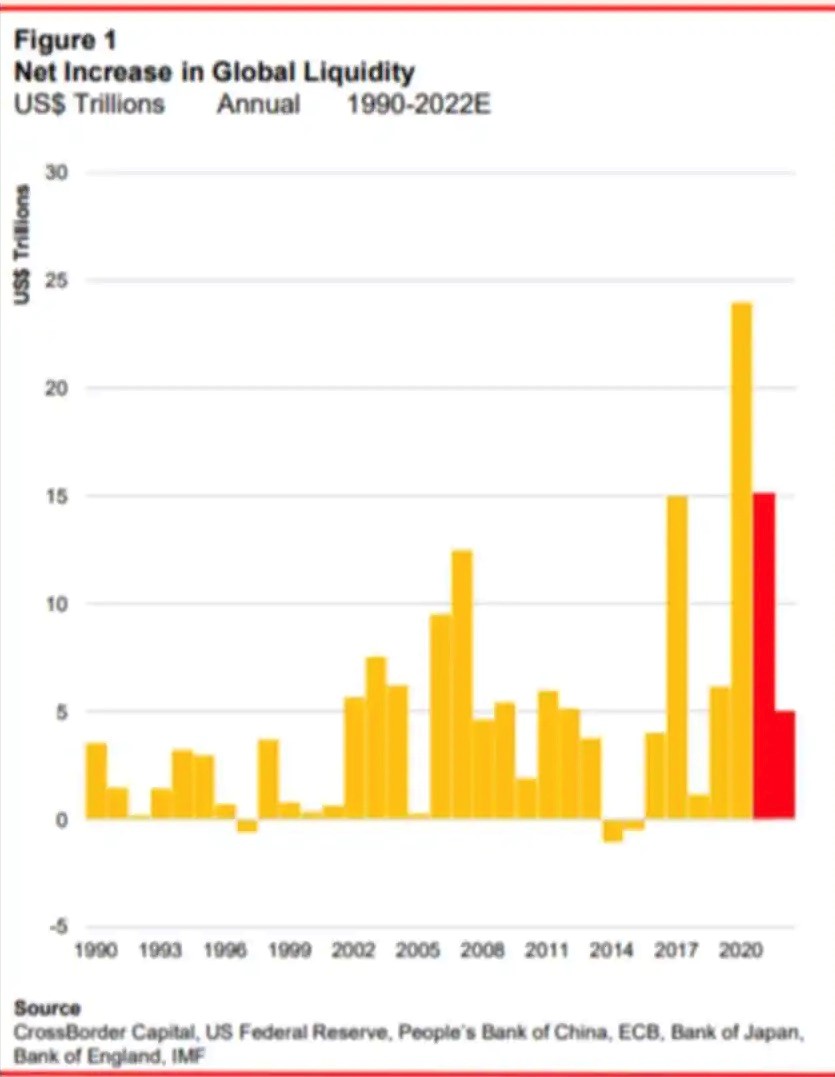

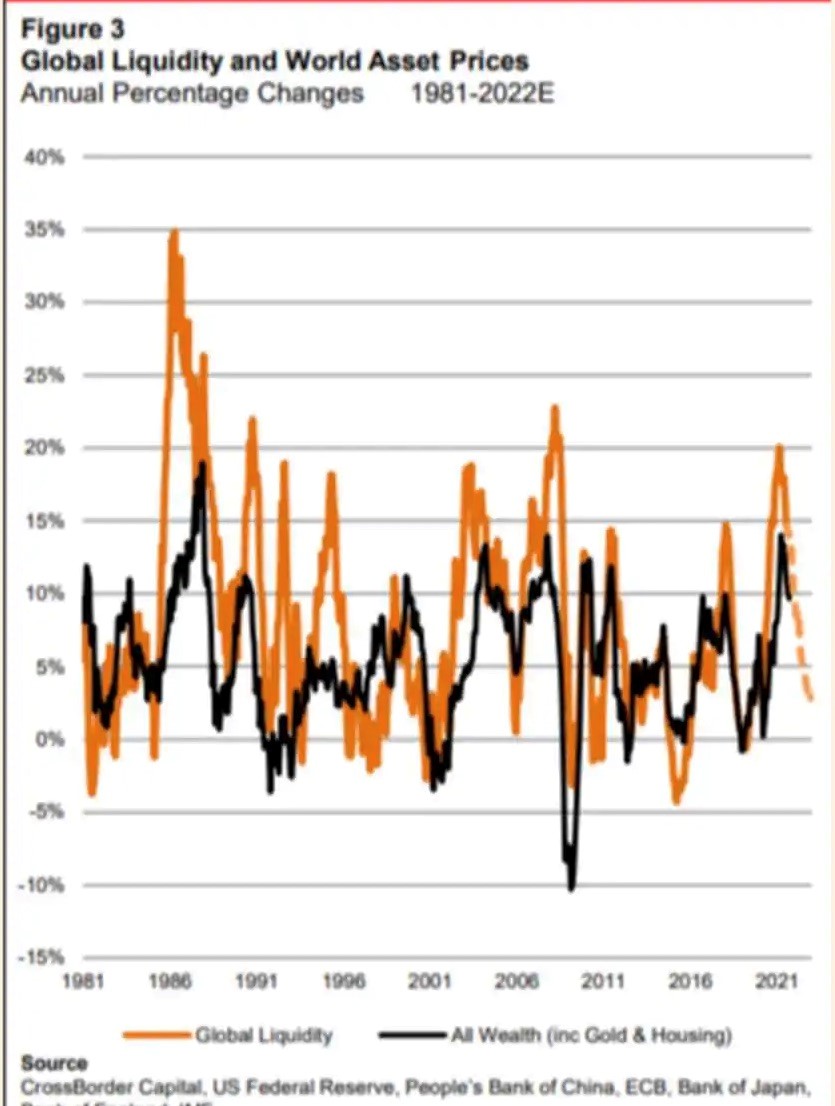

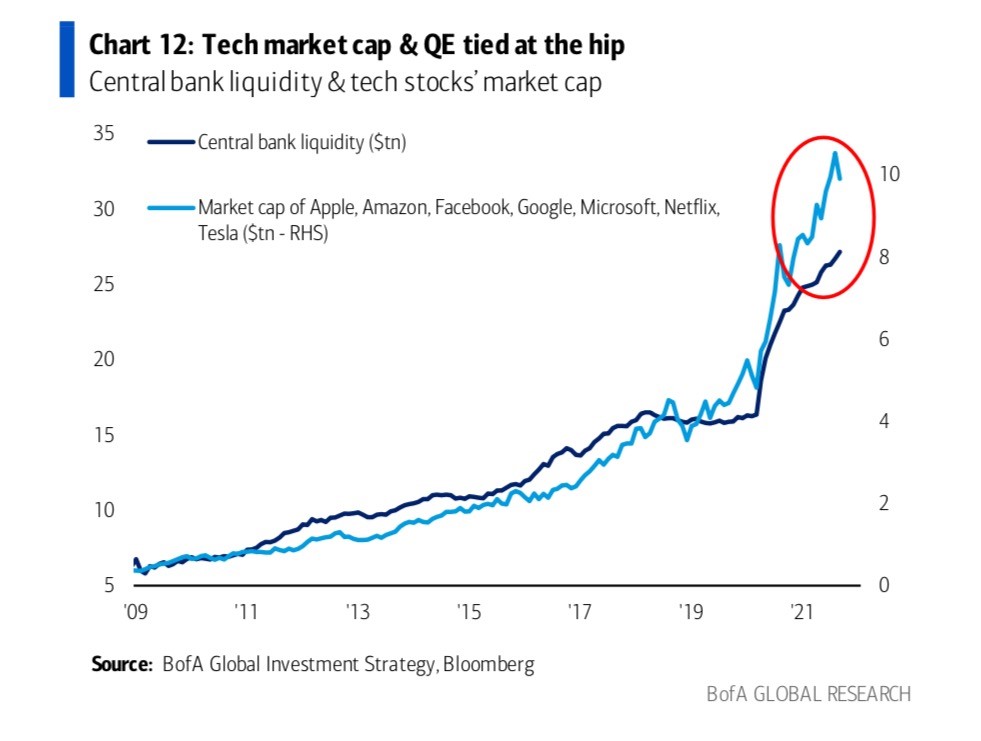

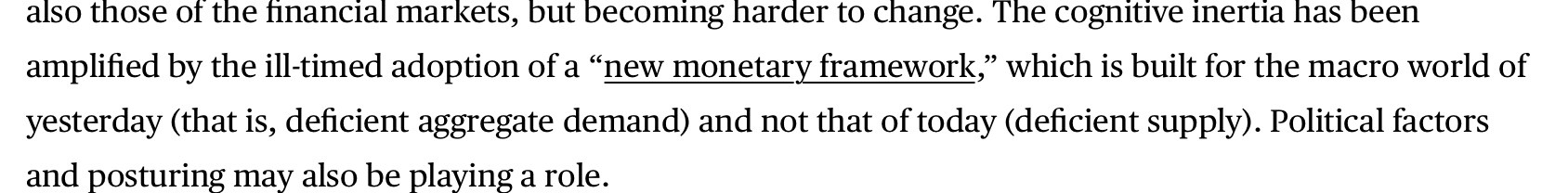

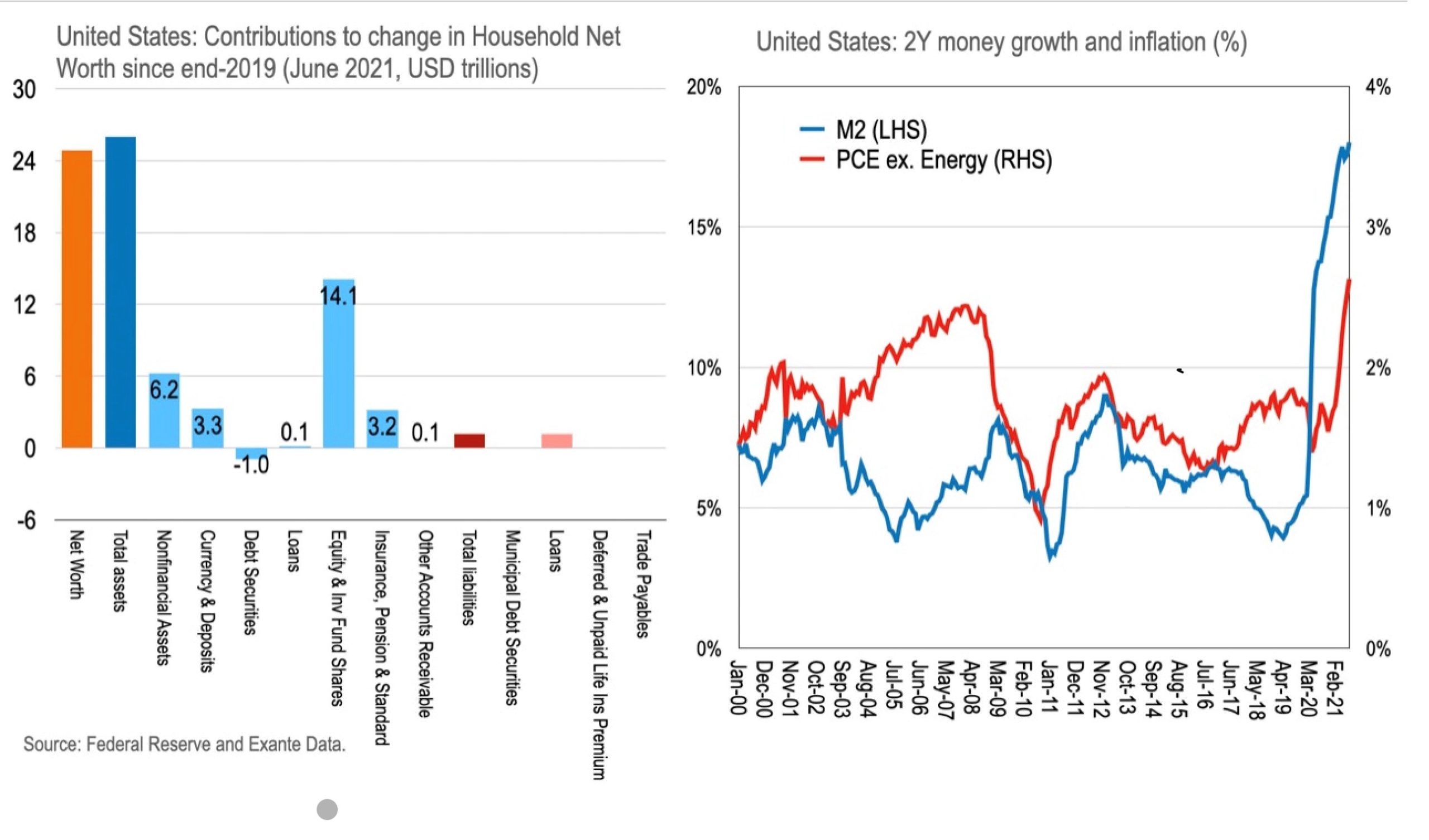

It is important to recognize the asymmetry of the Fed’s monetary policy. They know they are kind of boxed in by the lower bound, they have used the wealth channel (see below from Ex Ante Data) and don’t want that to revert too abruptly, and we are heavily indebted (and growing). They want some more inflation, but not too much for too long.

For a good take on Fed view (albeit, from dove Evans), listen to this interview of Evans at Princeton from late September. It struck me as a bit too confident/complacent.

So, we are left with what we are experiencing and observing in terms of inflation, and about to hit the holiday spending season when the realities of inflation are going to be front and center. And, we don’t the Fed’s reaction function is, and that’s the big change. As Mohammad El Erian mentioned this week:

Some other things that caught my attention this week:

Greatest peacetime surge in household wealth since recorded

My friends at Ex Ante Data are really excellent and this piece came across my email this week.

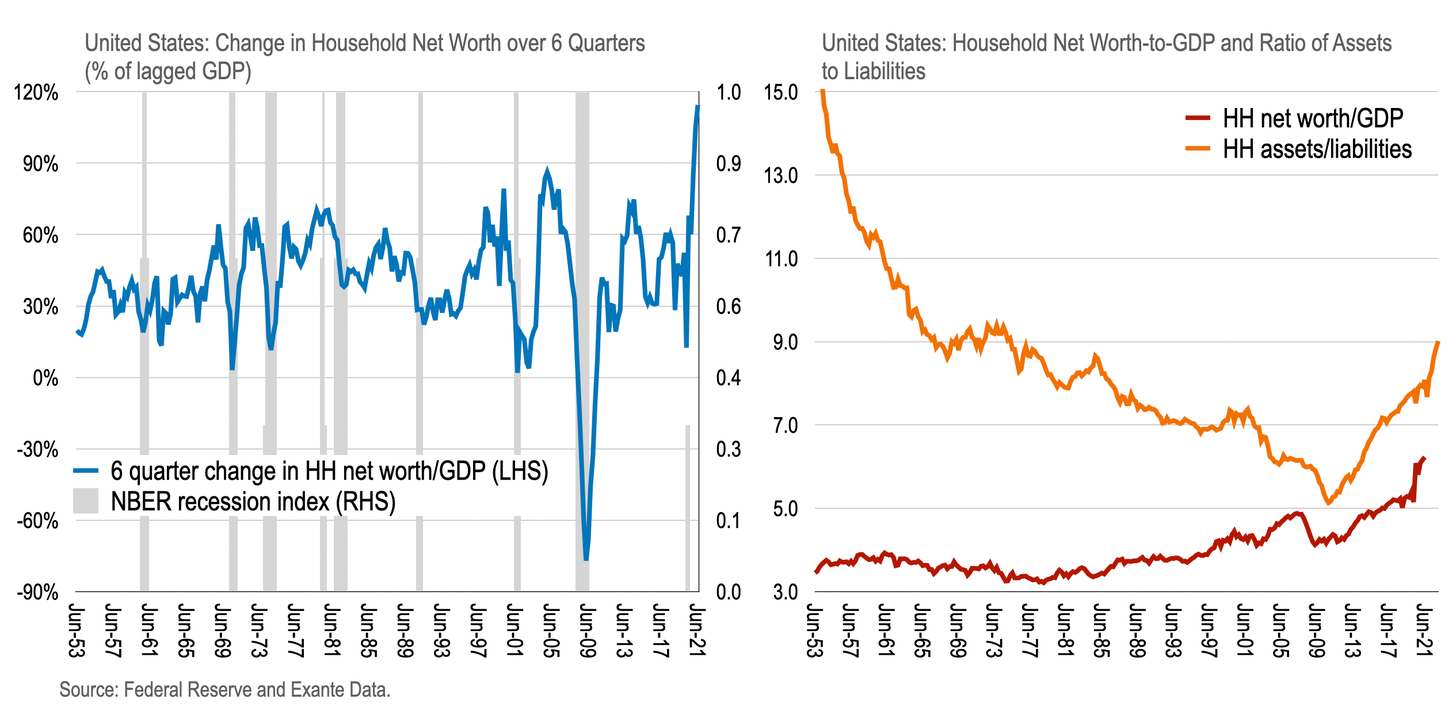

What struck me – outside of the charts above, was near the bottom:

Fed governors have a strong sense of economic history and central bank history. When pressed, Evans mentioned that the Fed would not make the same mistakes as the 1970s, because they know that history intimately. That is very different than the political realities. Leaders in the 1970’s were not stupid. They just used a lot of wishful thinking, and a lot of spin in order to buy time and hope things reverted. That should sound familiar.

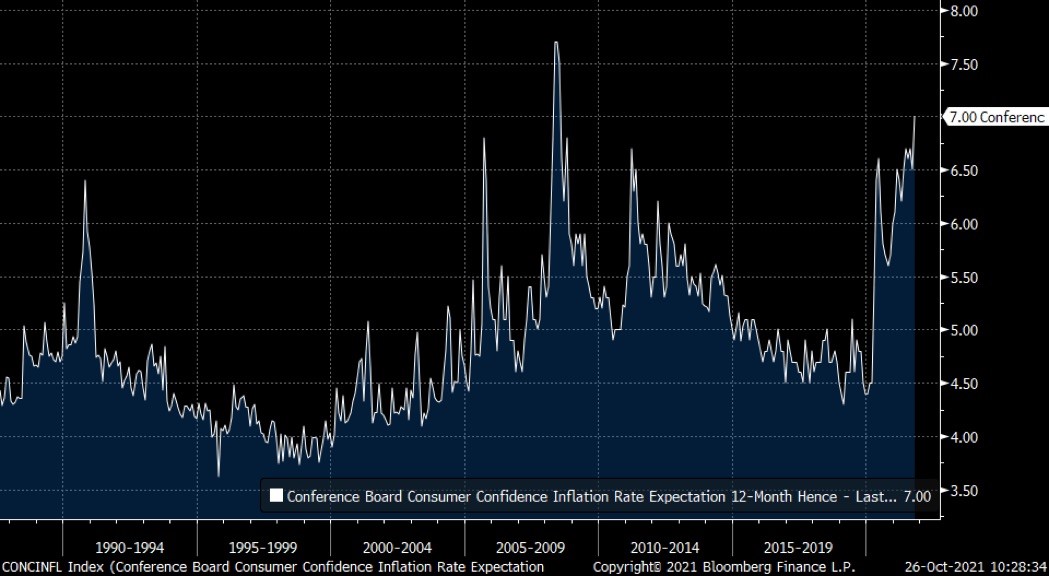

But, as El Erian and Ex Ante state, this time may be different. That is the risk/reward equation I am constantly referring to. They have to act when they can. In fact, in one section, Evans talked about Jeremy Rudd’s piece (that I have shared prior) on expectations being overhyped and the criticality of keeping the genie in the bottle because the costs of putting it back are severe, and it grows. The 1970s were a period when it was clear things were changing in terms of inflation (for whatever reason), and the Fed sat idly by until Volcker and Reagan – through a painful process – acted.

Evans gave Rudd his due, mentioning that sure, there are some nonlinearities our models would not pick up if in fact inflation permeated the economy. It looks like we are getting there.

Are we creating problems for ourselves?

Like many, I found the Town Hall meeting between Anderson Cooper and Joe Biden to be a bit odd, particularly the bit where he says the way to drive the oil prices lower is to get the Saudi’s to pump more oil.

I happened to read a book this week about Ulysses S Grant this week (Brett Baier: To Rescue the Republic) and it became somewhat clear to me, that while our nation winds toward the right decisions, it can be quite circuitous, as we have a messy political process and a bit of attention deficit disorder.

To me, that we are even talking about the plight of African Americans in 2021 as we are, is just mind-boggling. It is failure to nip the problem in the bud, to do the right things. It was not for lack of awareness, as much as political prioritization, misplaced faith in fellow citizens, and issue fatigue. In management speak, it is called not solving a $1 problem before it becomes a $100 problem. I don’t want to come across as minimizing anything or comparing apples and oranges, because climate change and post-slavery treatment are of course different, but it speaks to the costs of making decisions sub-optimally. And, since we are extremely polarized politically, as then, we are susceptible to making enormous errors.

Grant and immediate successors were very concerned with the plight of African Americans. In a conversation with Germany’s Bismarck, who he met after his Presidency on an international tour, he stated very clearly that his goals were to “not only to save the Union but to destroy slavery.” And yet, when pressed in the contested election of 1876, he made a bargain to get Republican Rutherford Hayes elected that would also reduce Army presence in the South. That helped usher in Jim Crow and kept the African Americans on the obviously disappointing “less than” path, and the aftermath is still felt today.

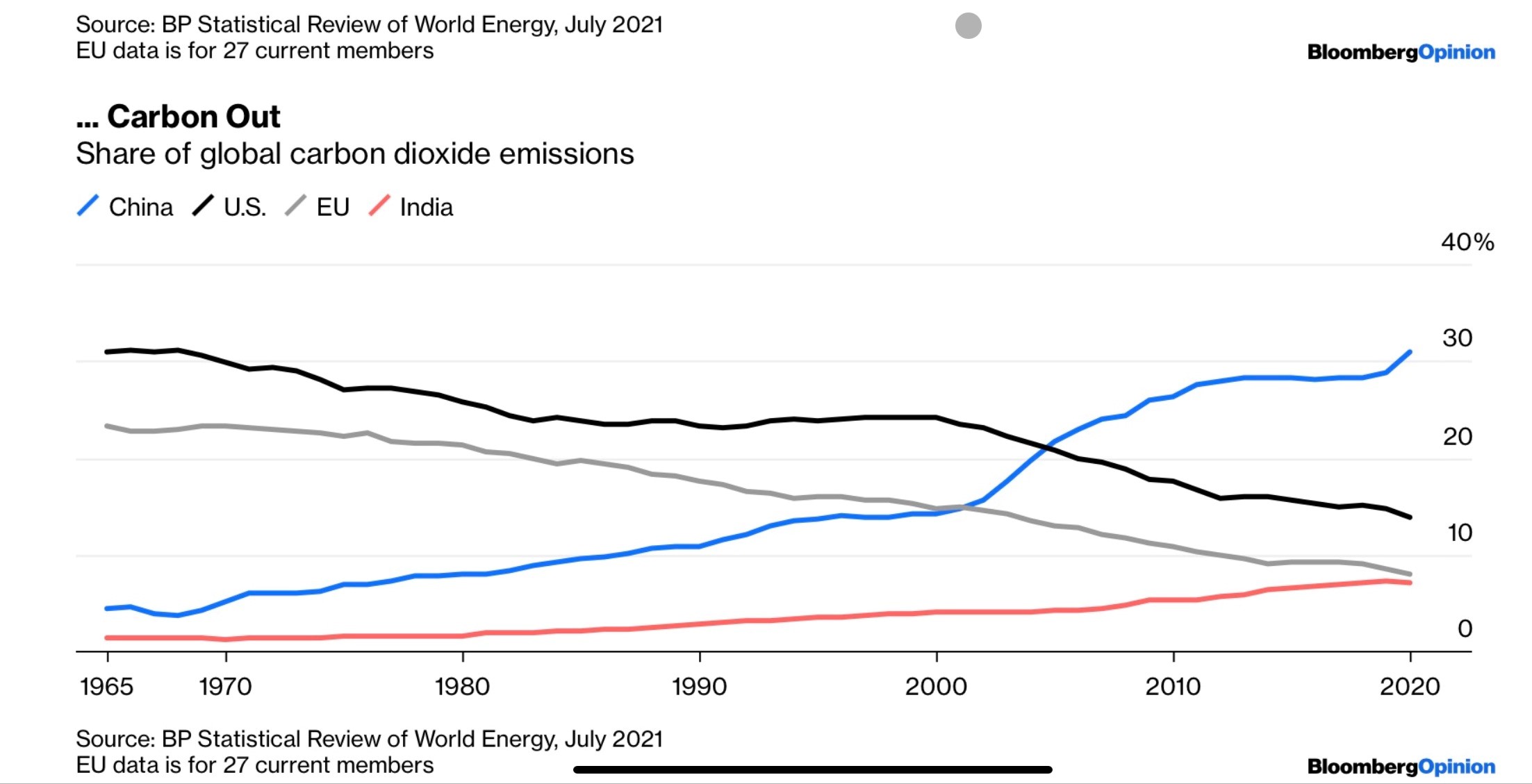

So, I get that climate change is something that is best dealt in the here and now. It is a legitimate problem that needs attention, but we have to be super careful about how the transition takes place. Looking at the carbon emissions chart above, it’s clear we are moving in the right direction and should continue on and accelerate the path. But, as we read this week – and I wrote about weeks ago – our relentless focus on ESG, using moral suasion and capital allocation – is putting us behind the eight ball in the here and now as we are demonizing fossil fuels, which has reduced capacity.

Funny of course, to see Larry Fink in particular, along with Steve Schwartzmann, make the point this week. . And, here, large Dutch Pension Fund ABP has done its part to help increase capital costs (and likely capacity) in the space by reducing its fossil fuel portfolio by $17bln.

And, as we can see, China, well, they have some work to do, and Xi’s decision to stay away from Glasgow for the global pow wow is telling. And, as Niall Ferguson wrote in a Bloomberg piece, China has conditions on their reductions:

The answer to the problem of weaning ourselves off of fossil fuels coherently s nuclear power. Even Japan is moving back in that direction. And, that is why I am long Uranium (CCJ).

And, for some giggles, check out this congressman in a hearing where people from the energy industry were getting abused.

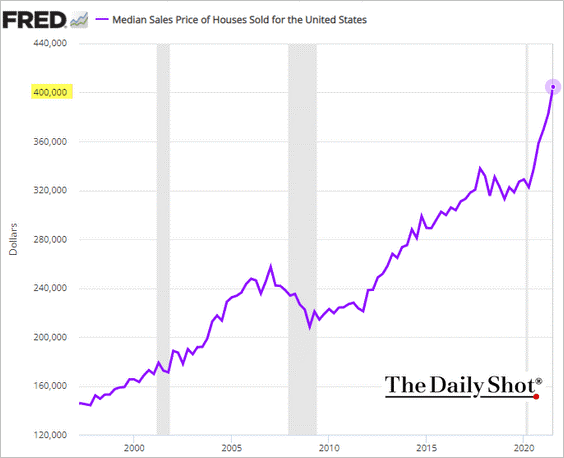

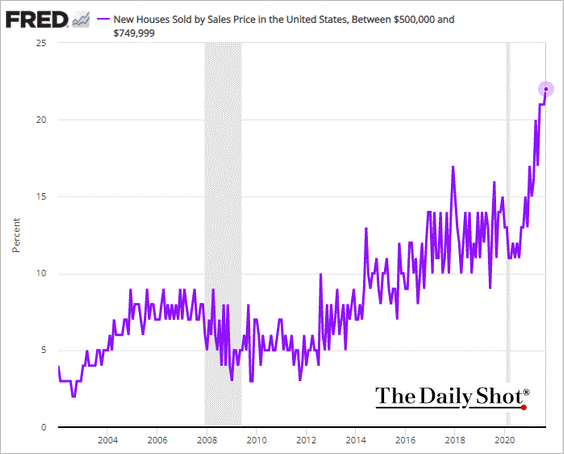

Housing

This goes hand in hand with the enormous increase in household wealth that Ex Ante described above. Tell me why again the Fed is buying mortgages? QE and the Fed’s balance sheet ascension have some bad distributional properties. Add them with existing economic structure imbalances, that the Administration wants to address, and it becomes clear (to me at least) that the net result is that we will be chasing our tails, 1970’s style. Housing affordability is an issue, let’s subsidize that, etc, etc.

Liquidity

Nobody would ever argue that liquidity is not important for investing. So is solvency. Solvency is developed through productivity and prudence. When solvency is questioned or uncertain, problems emerge in a modern economy built on credit, trust, and confidence.

One of the most important interactions is between solvency and liquidity. To get the liquidity, you need to show solvency. When there is excess liquidity, and not enough available positive real return investments, those tests of investment worthiness start to get diluted. Maybe I start to become a bit laxer if I am making decisions, lose a little bit of discipline, start believing all the hype, think I am a super forecaster because I was smart enough in the past year to ride the wave. It is why we read Minsky and people like Howard Marks, to see when the transfer of liquidity for assets, in hopes of a greater return, is becoming foolish. I have no clue what Shiba is, etc, but well, it is hard to believe it deserves the market cap it does.

Anyhow, here are 2 charts that certain markets and analysts may be ignoring. Rates of change matter in investing, and while we will continue to be generally quite accommodative monetarily, the risks that some excess speculation coming home to roost is picking up.