top overnight news and today’s catalysts

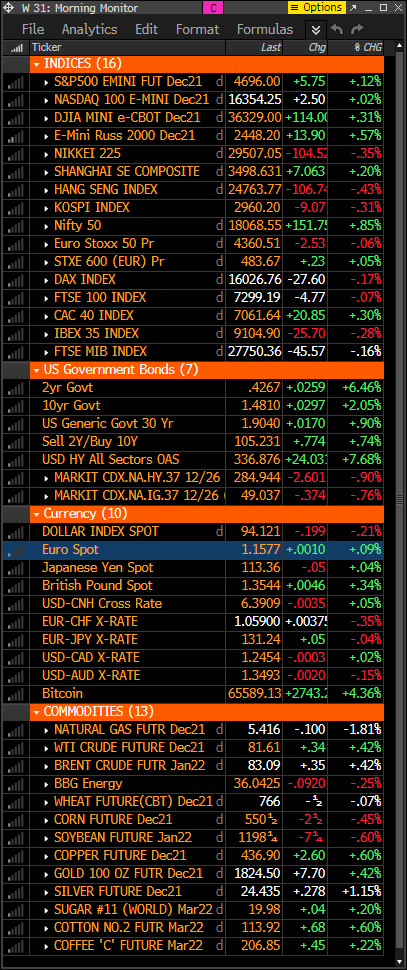

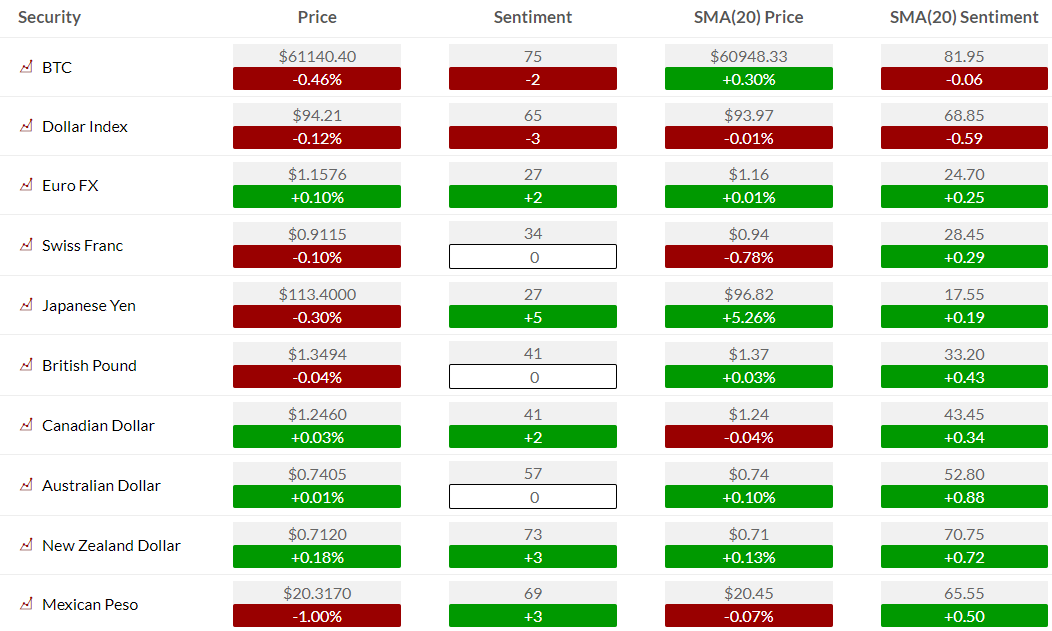

- S&P futures up 0.1% in Monday morning trading after the index finished higher for a fifth straight week last week (and gaining 1%+ for the fourth straight week). Treasuries weaker with a bit of curve flattening after a volatile week of curve shifts last week. Dollar a bit weaker vs the euro but little changed on the yen cross. Gold up 0.1%. Bitcoin up 4.25%. WTI crude up 1.3% after falling for a second straight week last week on the heels of a record winning streak.

- House passed ~$1.2T infrastructure bill focused on roads, bridges and waterways that includes ~$550B in new spending. Some discussion about still complicated path for $1.75T social spending package, though passage in both chambers ultimately expected. FT latest discuss Fed leadership uncertainty and related market risks. White House weighing options to tame oil prices, including SPR release, though some skepticism it will go this route. China October exports surprised to the upside though import growth missed. Taiwan exports hit a record high in October. Multiple reports discussed upcoming plenum in China that could set stage for Xi to rule for life. State grid said China power supply back to normal.

- TSLA down after Twitter users backed CEO Musk selling a $20B+ stake.

market snapshot

no us economic data today

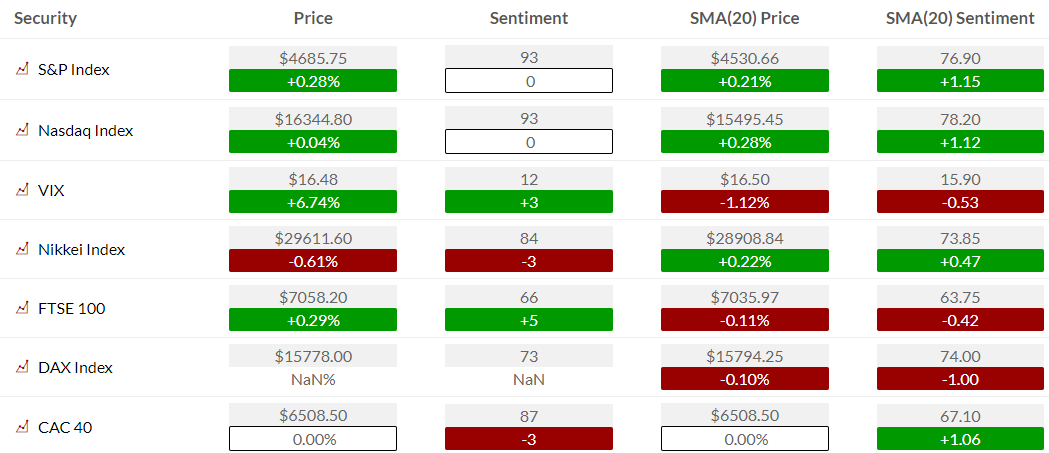

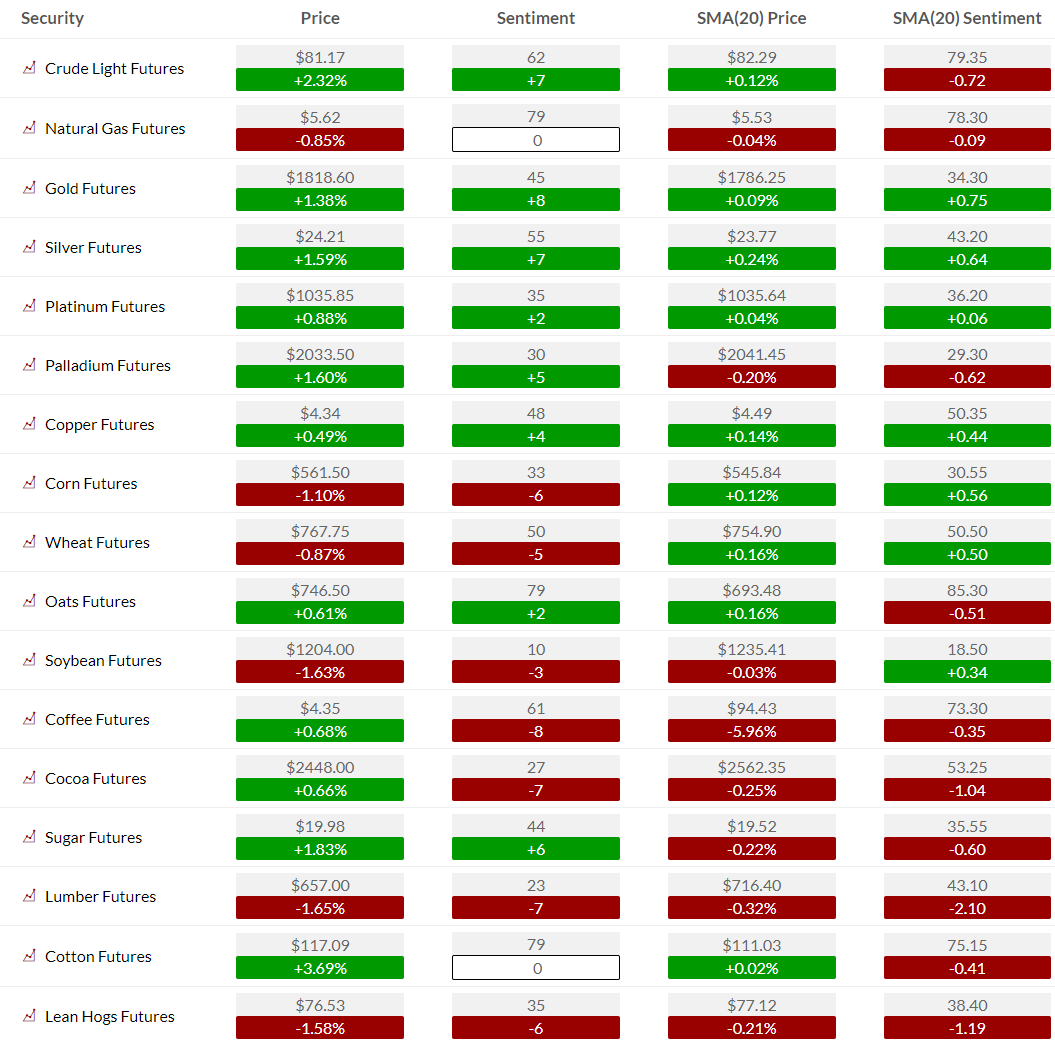

key market sentiment

S&P and Nasdaq bullish sentiment is unchanged at 93%. These are extreme peak levels. Very concerning.

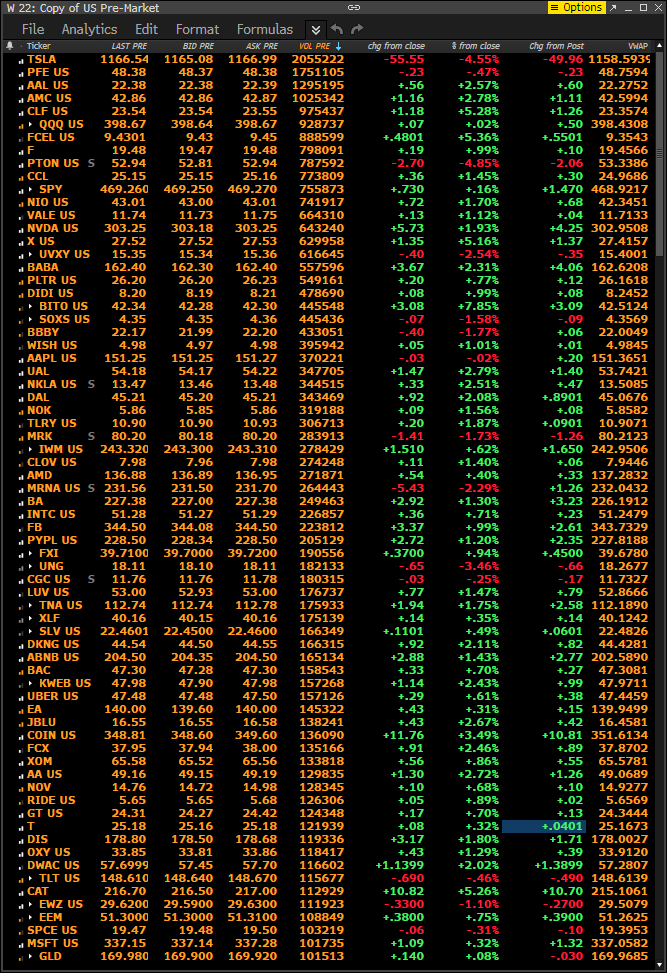

premarket movers

Ranked by highest volume. Watch the price vs the premarket VWAP (on far right). If price is above VWAP = strength and vice versa.

s&P and nasdaq futures charts – game plan

S&P Futures 60 Minute within a trend channel. Potential lower high wave 2. If trading long use 4670 as a near term support of stop

S&P Futures Daily with the Sequential is on day 8 of 13 after recent Combo 13 in play. RSI is overbought at 77

Nasdaq Futures 60 Minute also has a trend channel worth watching. Potential lower high wave 2. If trading long use 16,300 as near term support or stop

Nasdaq Futures Daily on day 9 of 13 with upside Sequential and there is a recent Combo sell Countdown 13 in play. RSI overbought at 78.

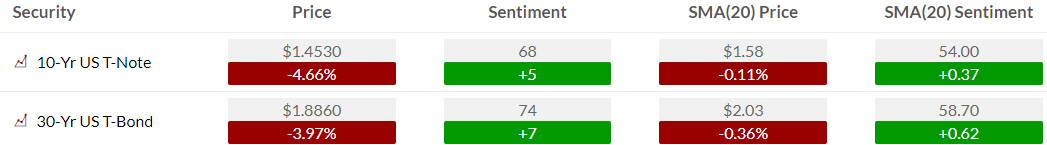

Extra charts we are watching – US 10 YEAR and Europe

The US 10 year yield daily time frame has backed off from 1.70% and now qualified the corrective wave 4 pullback. The new upside wave 5 potential price objective is 1.984%. Holding the 50 day for now which doesn’t have any statistical significance

Bitcoin daily and Ethereum both with some DeMark upside exhaustion near and triggering. Bitcoin should trigger tomorrow while Ethereum did today. Confirmation of these signals will be price flips down and break of 60,915 and 4,454

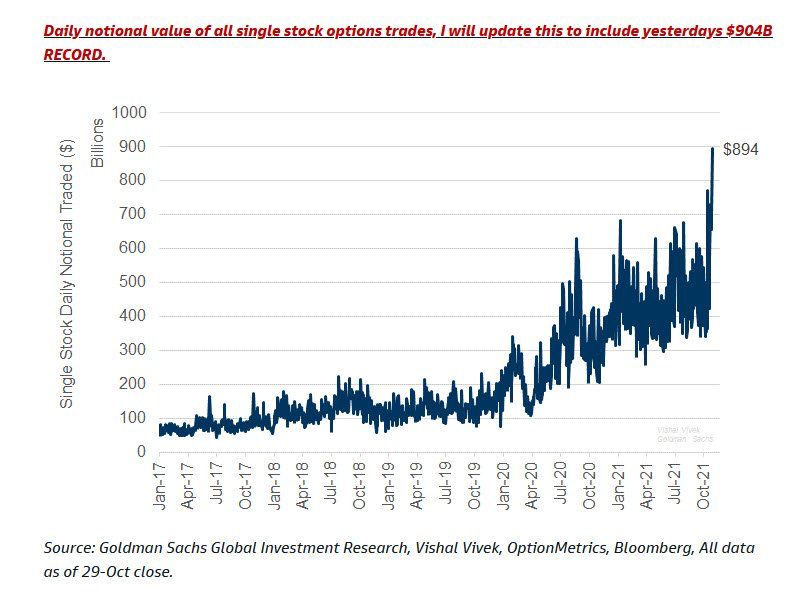

From GS. Add this to the “where were the signs” folder

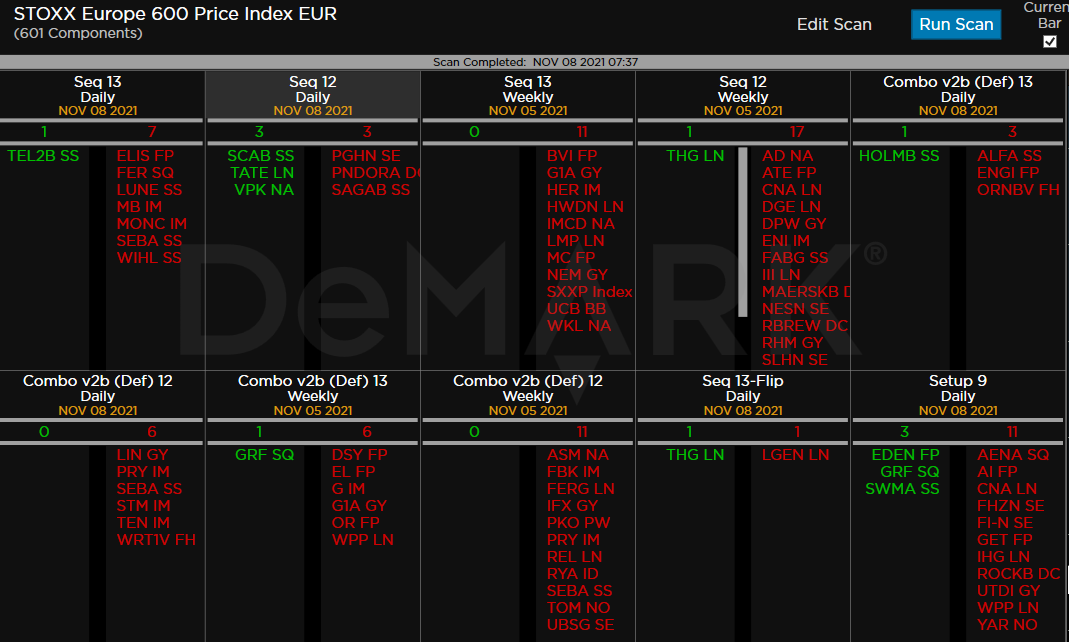

Euro Stoxx 600 demark observations

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.