Welcome to the Hedge Fund Telemetry Commodity Weekly! We are very excited about this new weekly note that will be a good overview of the major commodity markets using our charts with DeMark analysis, charts of bullish sentiment, and the weekly Commitment of Traders data. We have been urged for a while by our subscribers to launch this stand-alone research product offering. We will also be launching a Currency Weekly next week. Both of these new research weekly reports will require a separate subscription and as a current subscriber to Hedge Fund Telemetry, we have discounted the notes by 50%. These are available “a la carte” for a yearly rate of $500 each however we are offering them at $250 each. For “small institutions” and “large institutions” subscribers these reports are included in your subscription.

We will be sending this weekly to all current Hedge Fund Telemetry subscribers through the end of the year. If you would like to sign up now (which would be most appreciated) here is the link to find the offerings. Your discount will apply at checkout.

There are also detailed explanations of Commitment of Trader data and a DeMark Sequential primer at the bottom of this note. Please let us know your thoughts by email.

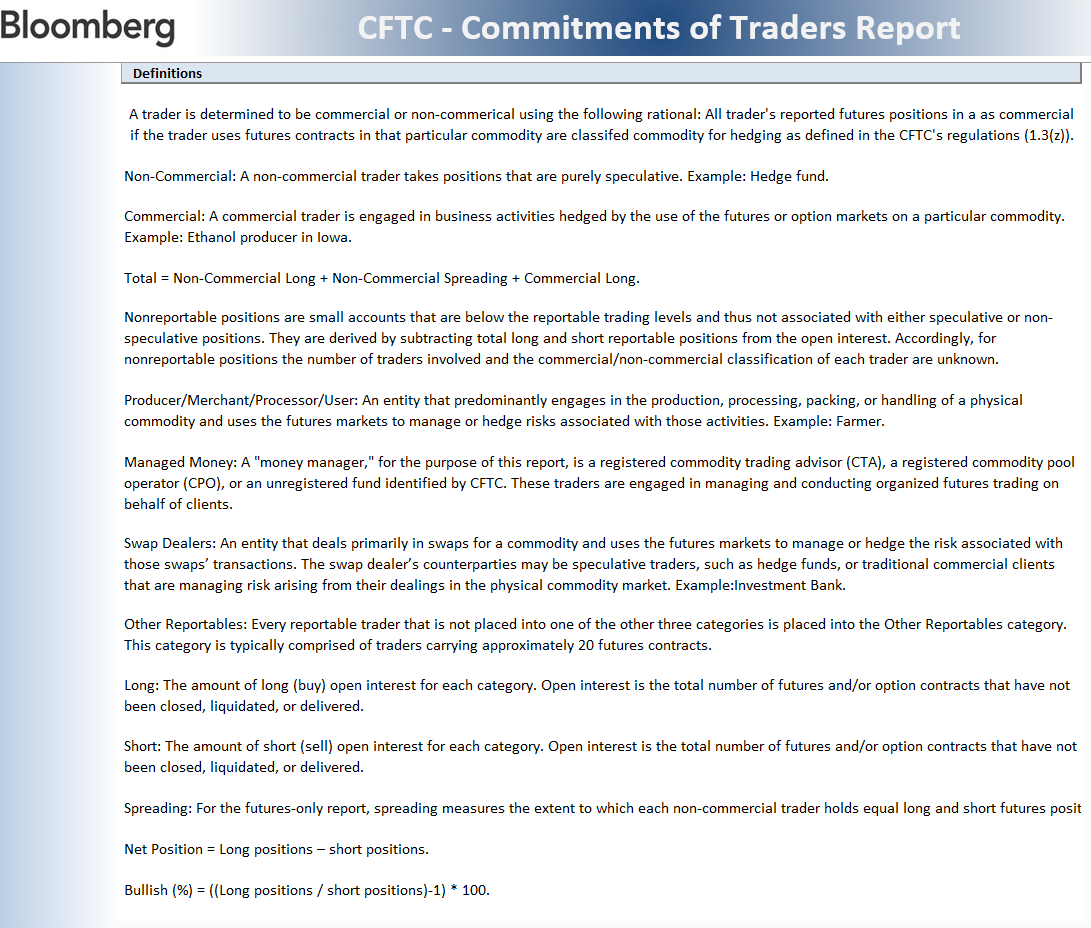

Commitment of Traders – The Basics

The Commitments of Traders (CoT) is a weekly report released by the Commodity Futures Trading Commission (CFTC). The CoT report outlines how different types of traders are positioned in the futures markets. There are two main types of traders in a CoT report: commercials and money managers.

Commercials are the actual producers and users of a commodity that use the futures markets to hedge. A commercial producer in the corn market could be a farmer who sells corn futures to lock in his selling price. Commercial traders are thought of as the “smart money” since they are in tune with the physical commodity business and likely have superior supply/demand information. The other main CoT trader type, money managers, is composed of hedge funds, mutual funds, and commodity trading advisors. These are speculative traders who have no interest in the underlying physical commodity business.

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation please see the bottom of this note.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily

Bloomberg Commodity Index Weekly

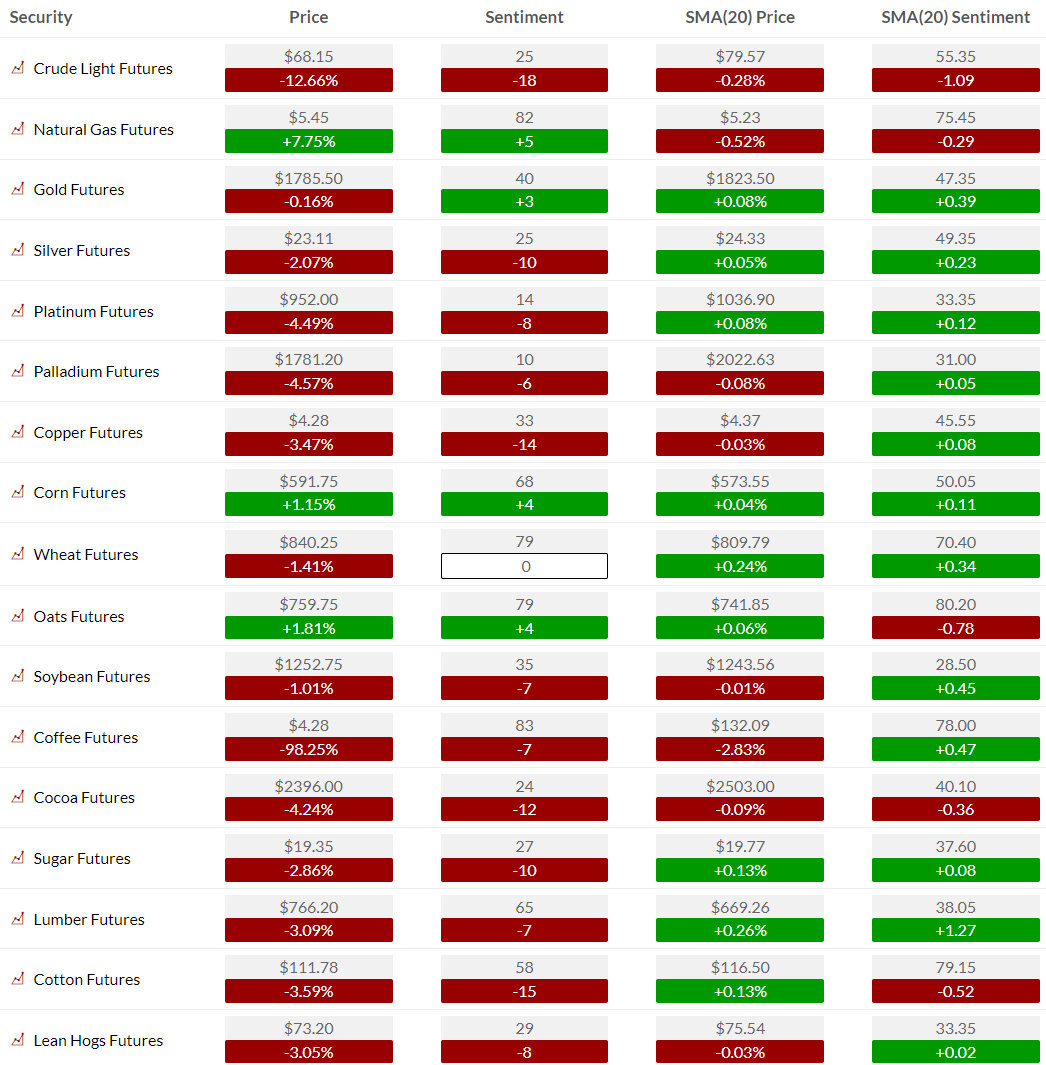

COMMODITY SENTIMENT OVERVIEW

OIL AND ENERGY

WTI Crude futures daily

Brent Crude futures daily

WTI Crude futures bullish sentiment broke 50% two weeks ago and now is getting oversold

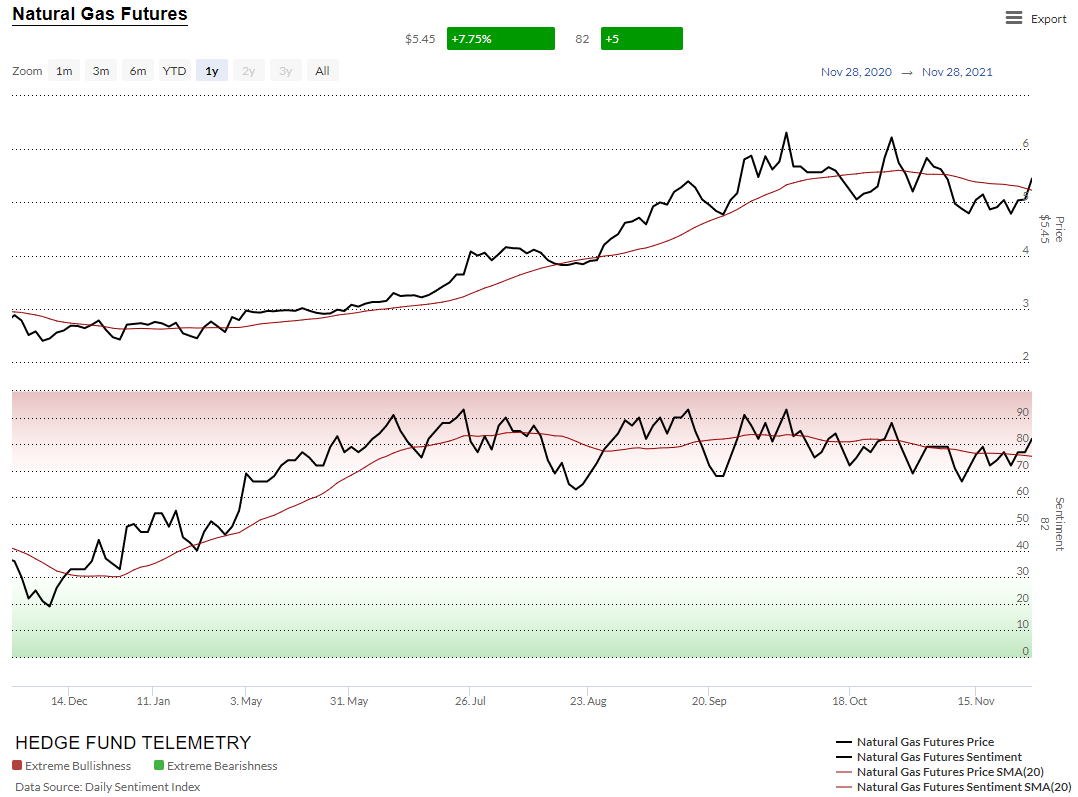

Natural Gas futures daily

Natural Gas futures bullish sentiment has been elevated for a while now. Below 70% might shift this lower

Gasoline RBOC futures daily

Gasoline futures bullish sentiment – sorry we don’t have this and it’s correlated with crude for that matter

Metals

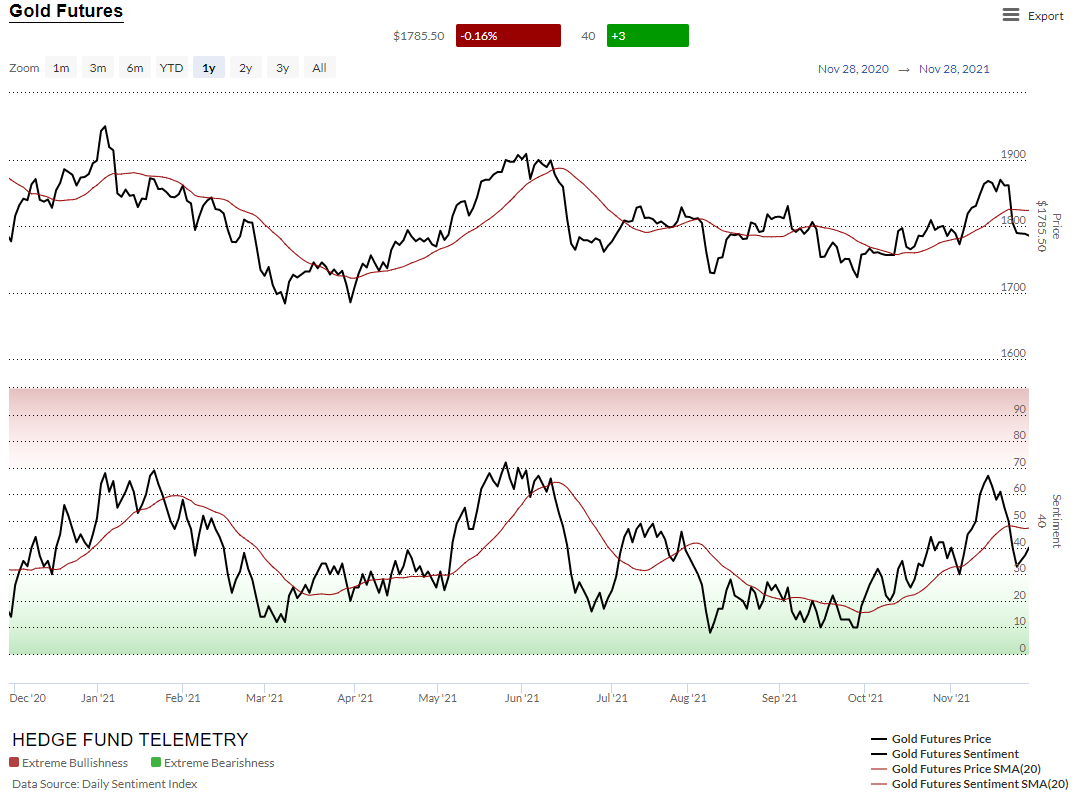

Gold futures daily

Gold futures bullish sentiment a sharp drop holding 30%. Higher lows? Maybe but might be tough

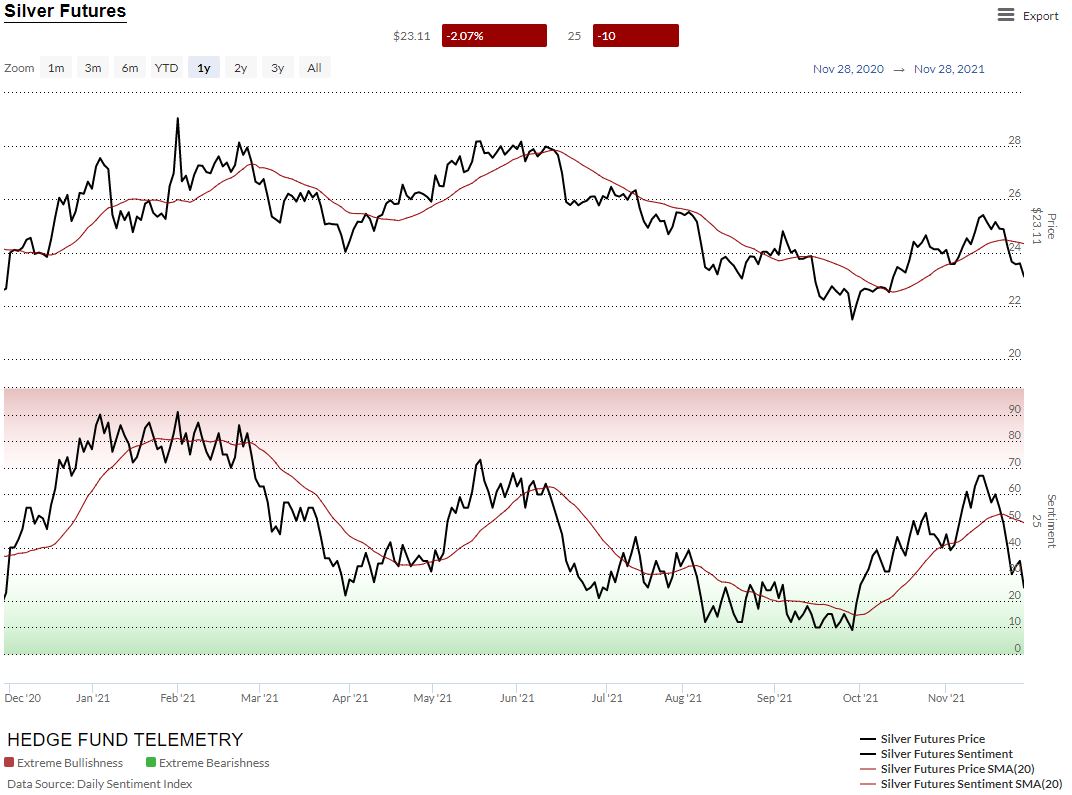

Silver futures daily

Silver futures bullish sentiment has dropped hard in recent weeks

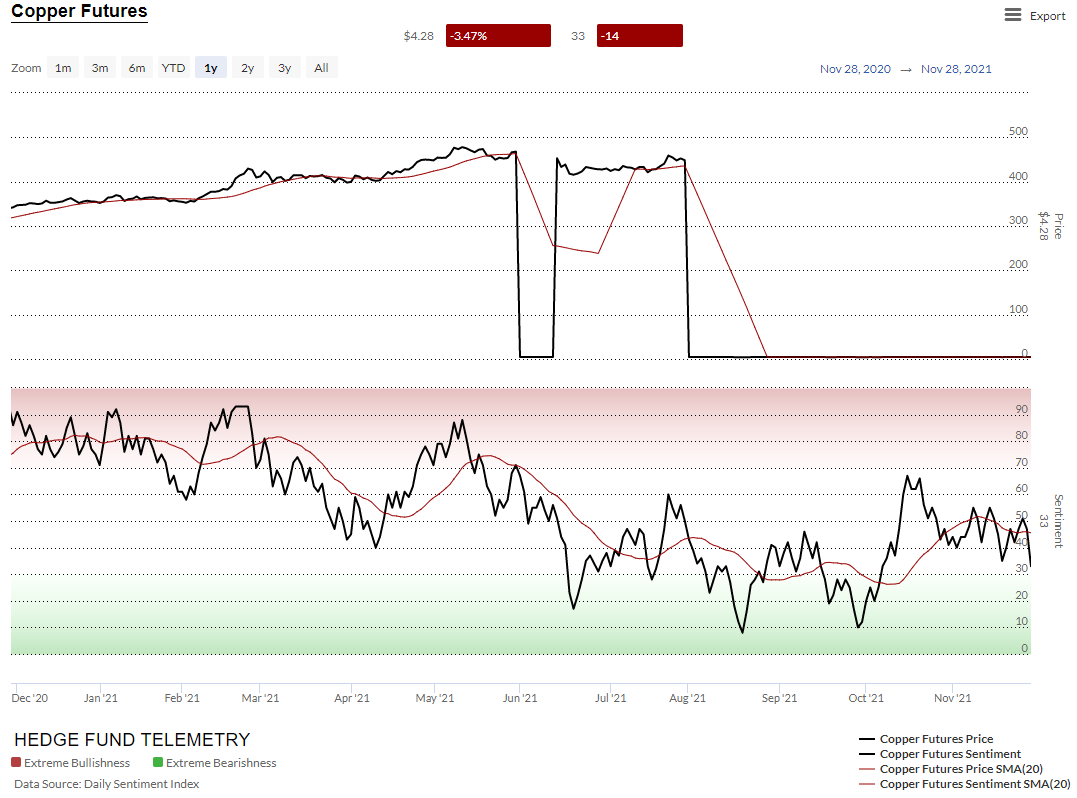

Copper futures daily

Copper futures bullish sentiment – sorry for the price action mess. Getting futures data can be tricky. More important is the sentiment below making lower highs

Platinum daily

Platinum bullish sentiment is and has been in the oversold zone failing at 50% again

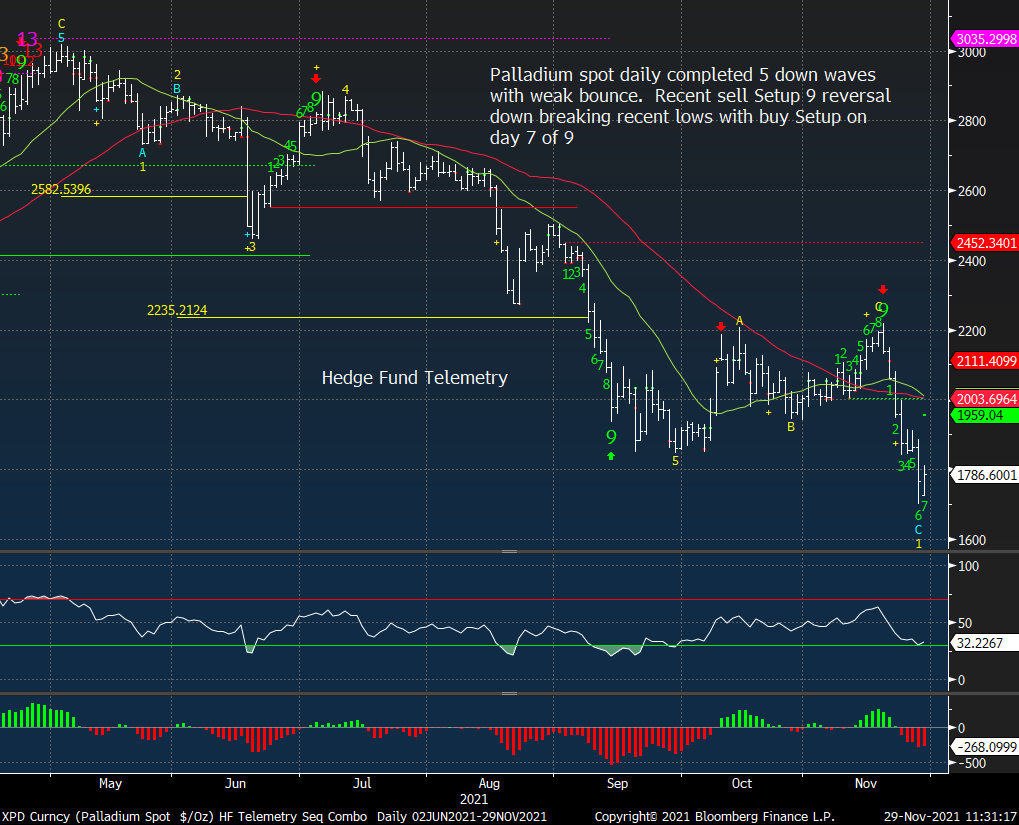

Palladium daily

Palladium bullish sentiment same as Platinum

Grains

Corn futures daily

Corn futures bullish sentiment has continued higher but will it stall here with price?

Wheat futures daily

Wheat futures bullish sentiment has been extreme and overbought

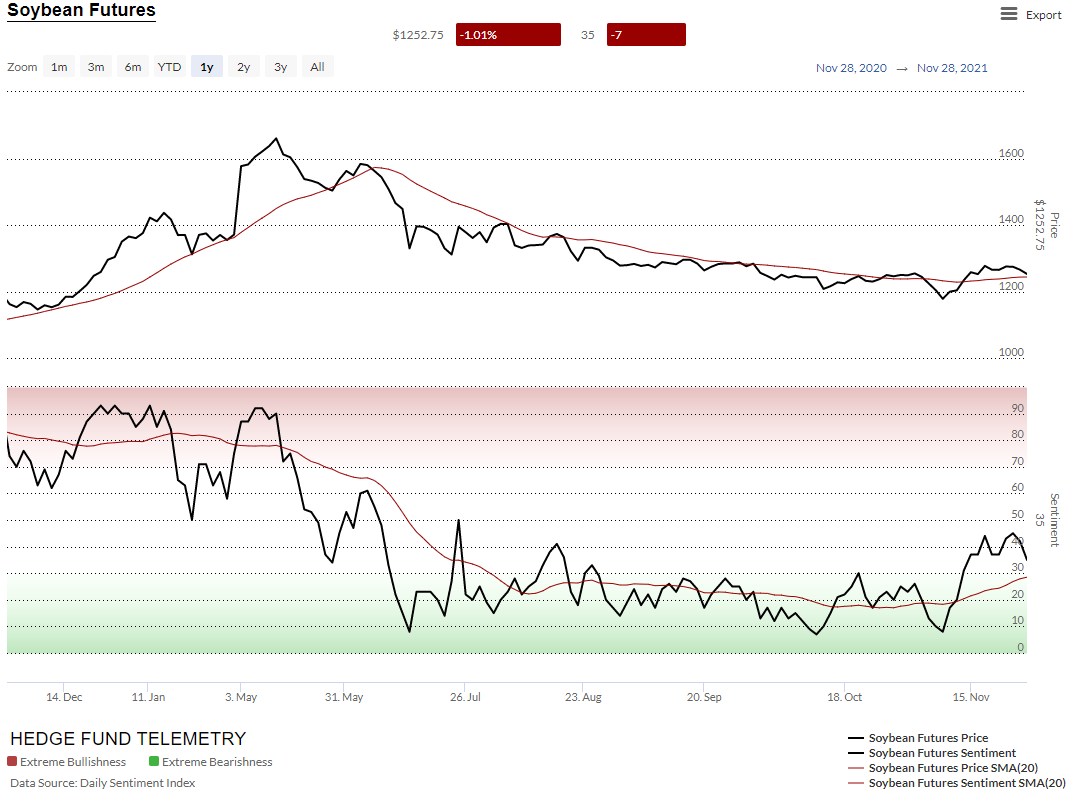

Soybean futures daily

Soybean futures bullish sentiment failing below the 50% level

Livestock

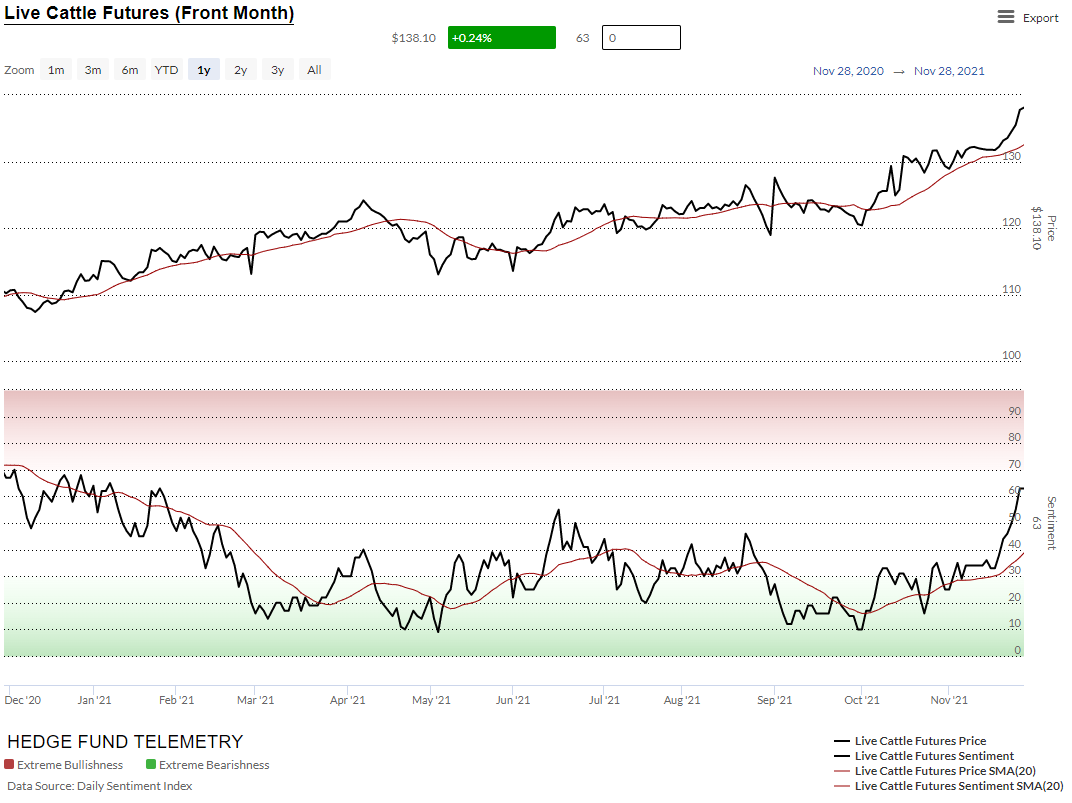

Cattle futures daily

Cattle futures bullish sentiment is rising fast at the highest levels in a year

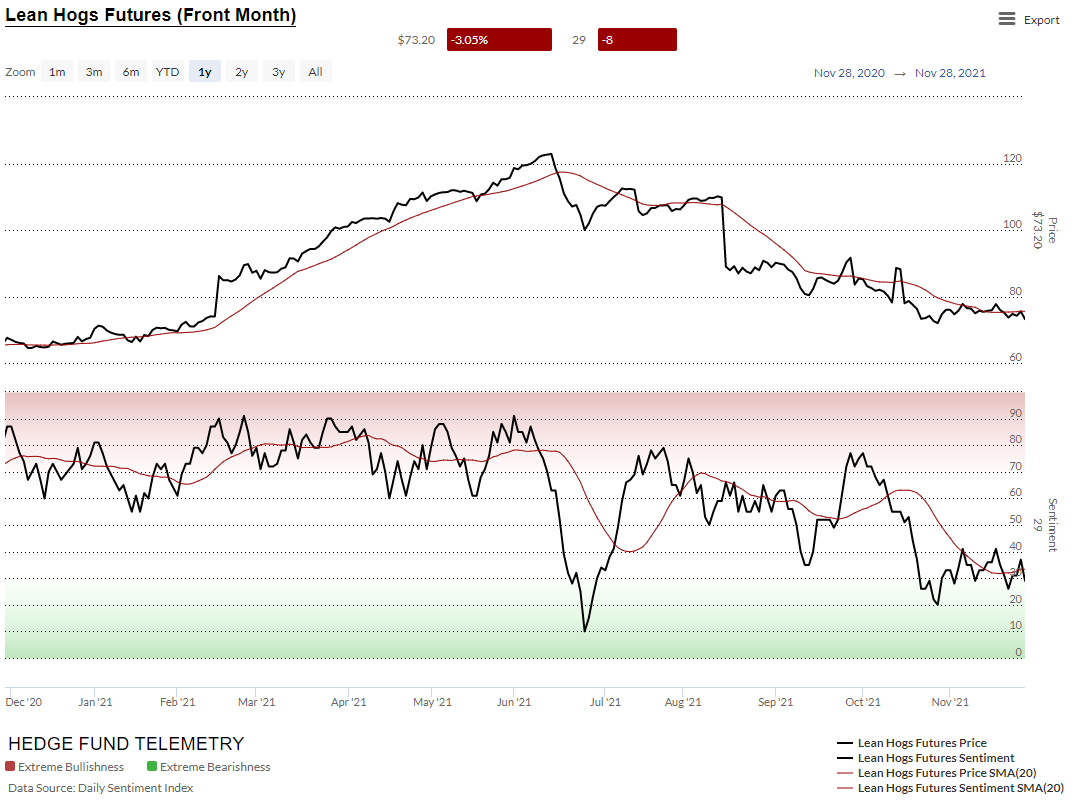

Lean Hogs futures daily

Lean Hogs bullish sentiment remains below 50% and grinding lower

Softs

Cotton futures daily

Cotton futures bullish sentiment starting to break lower

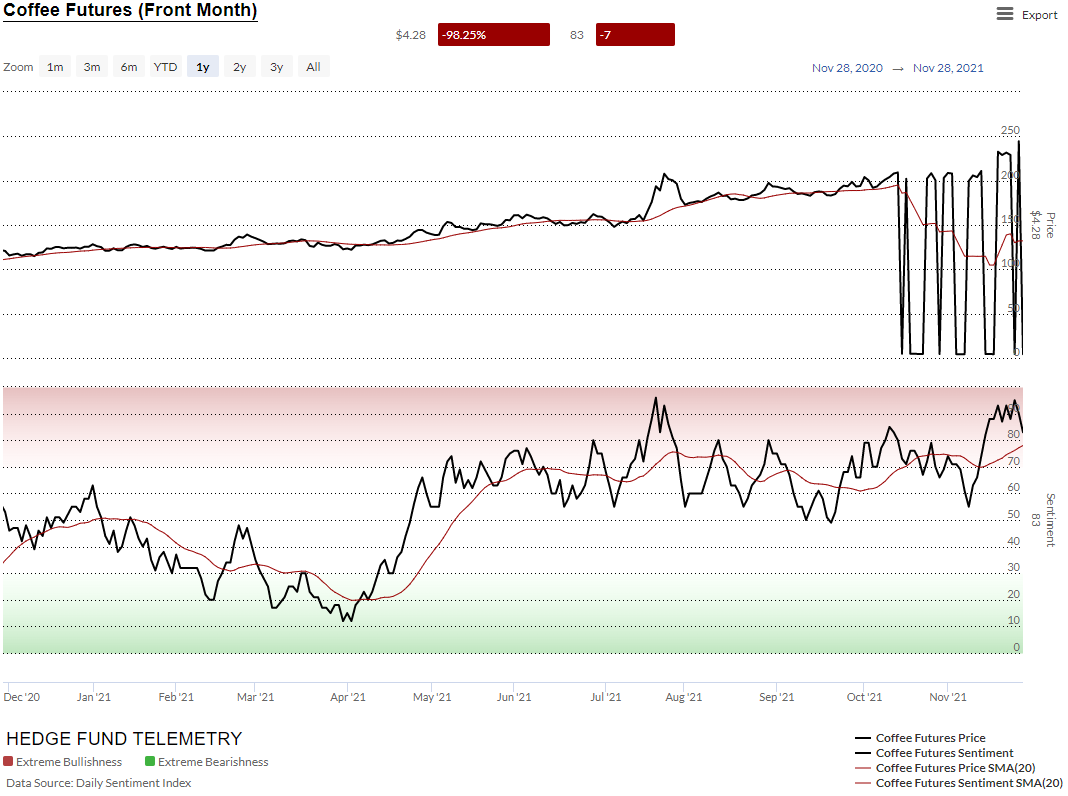

Coffee futures daily

Coffee futures bullish sentiment: again sorry for the pricing on this one. This sentiment has been VERY extreme and should be faded

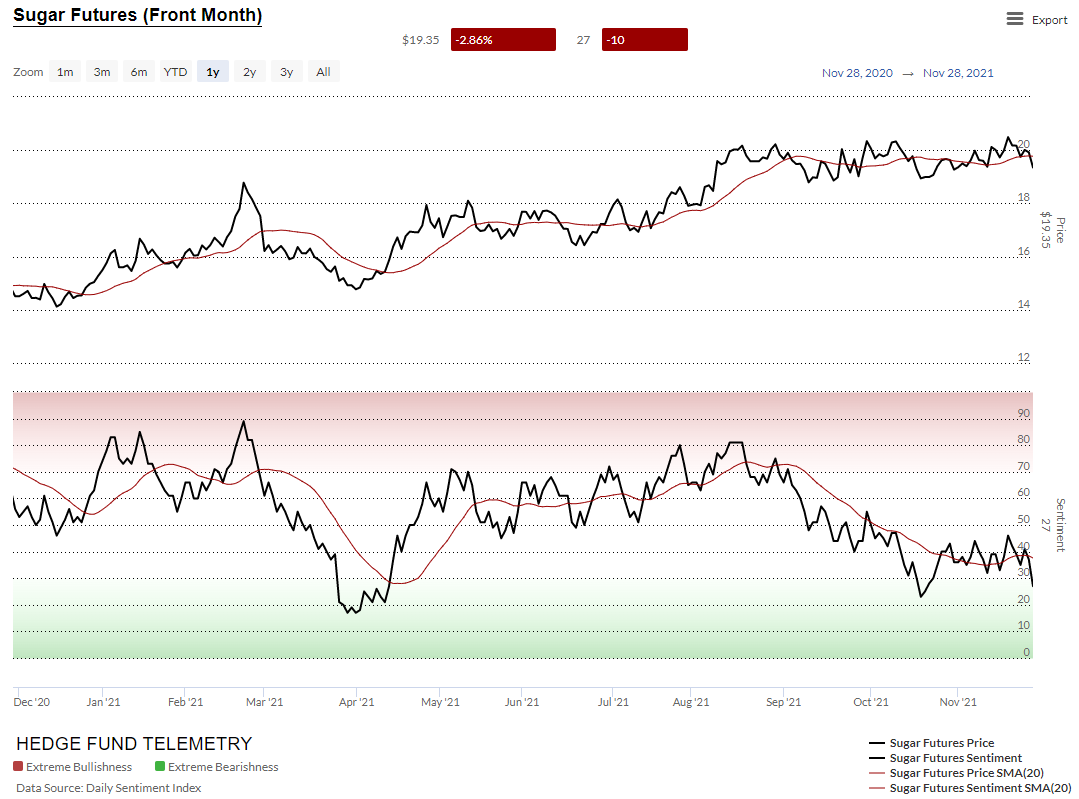

Sugar futures daily

Sugar futures bullish sentiment remains depressed and could work even lower.

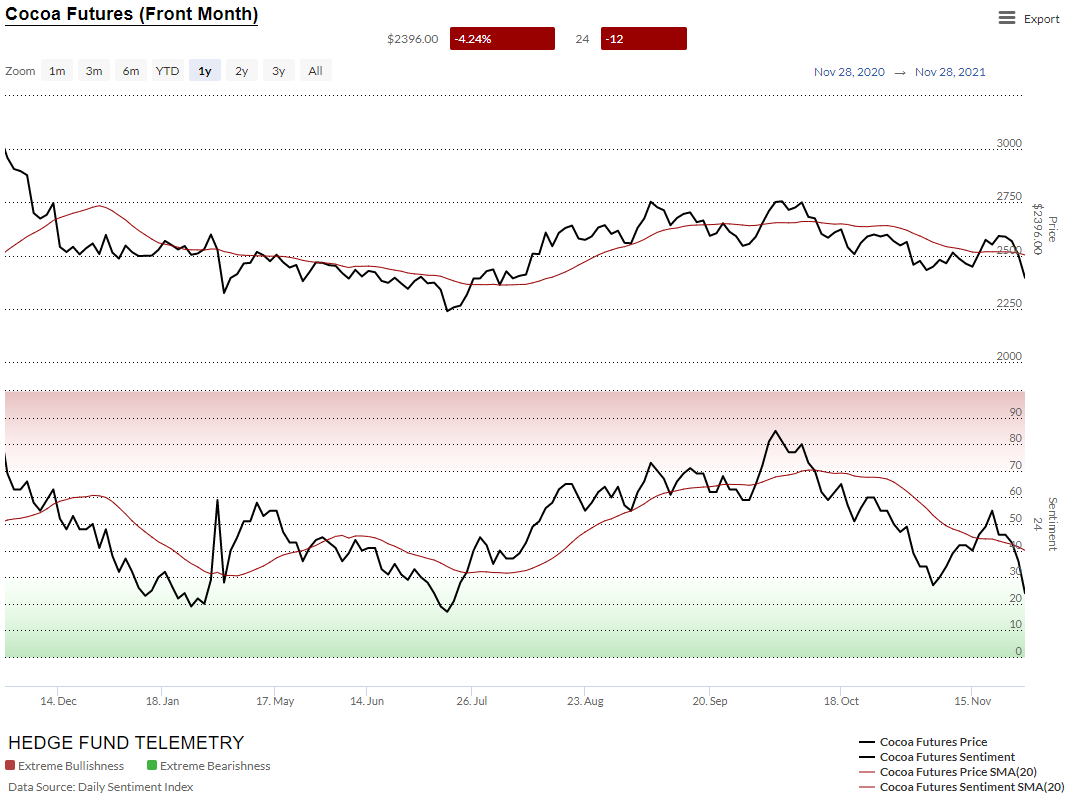

Cocoa futures daily

Cocoa futures bullish sentiment also making a new 6 month low

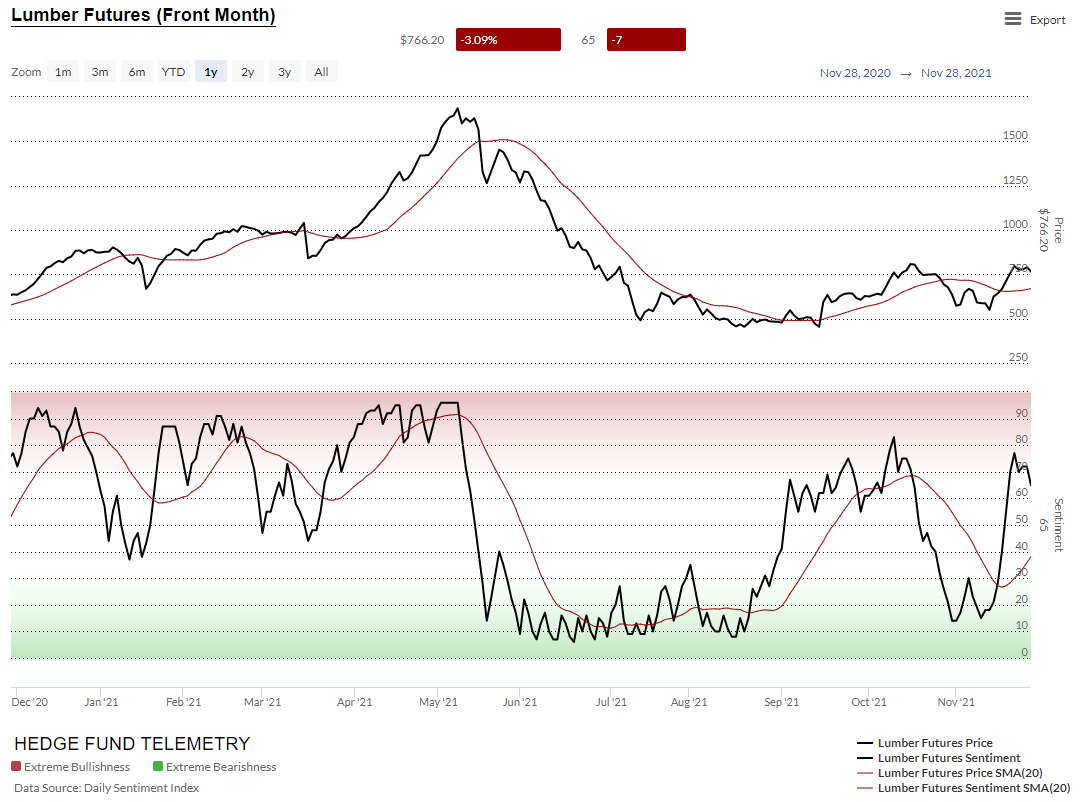

Lumber futures daily

Lumber bullish sentiment stalled here and trust me this one can move fast up and down from extreme levels

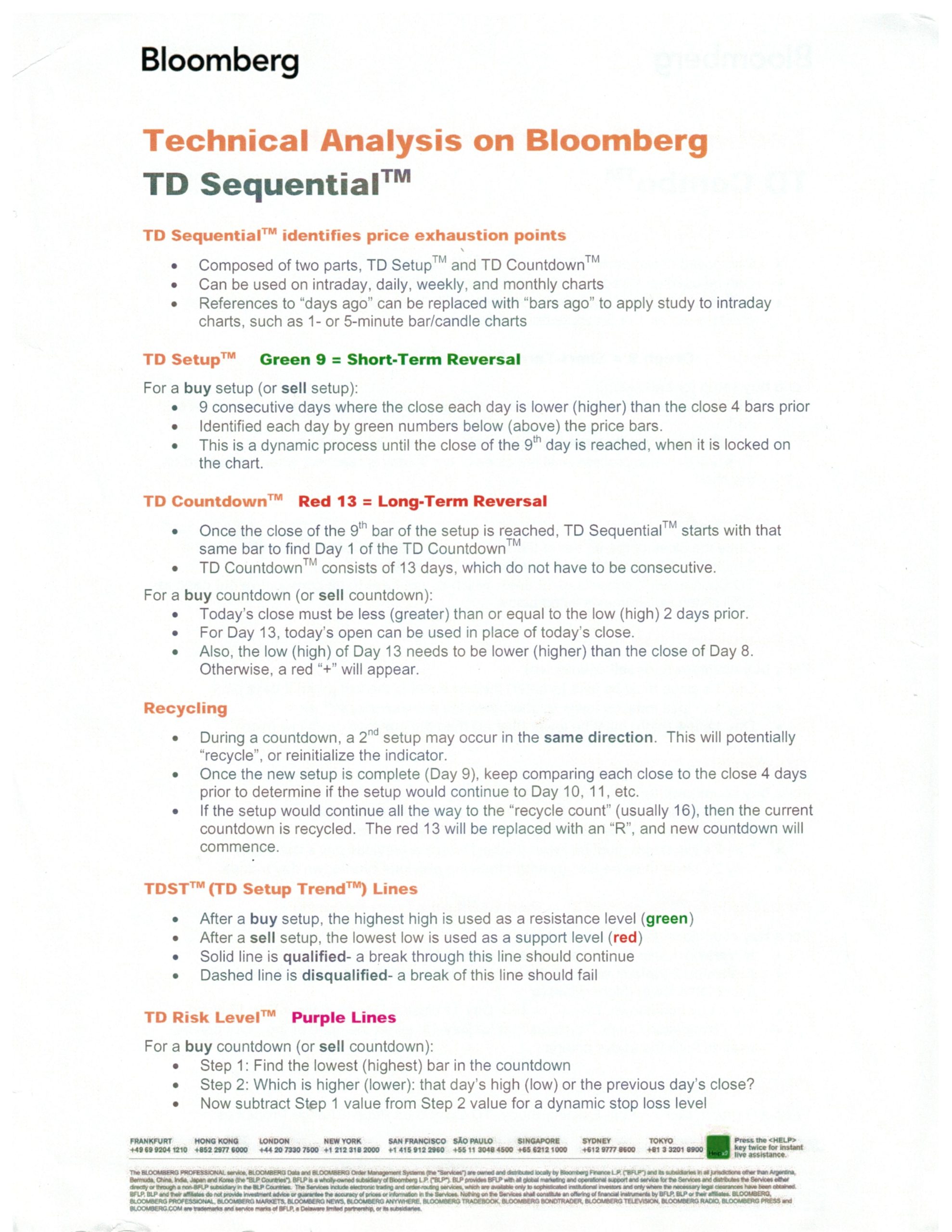

DeMark Sequential Basics

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS