I’m happy to report our “guest” columnist Dave Newman will now be a regular contributor at Hedge Fund Telemetry. If you have any questions or comments, please send us an email and we’ll get back to you.

“The only thing useful banks have invented in 20 years is the ATM.” Paul Volcker in 2009

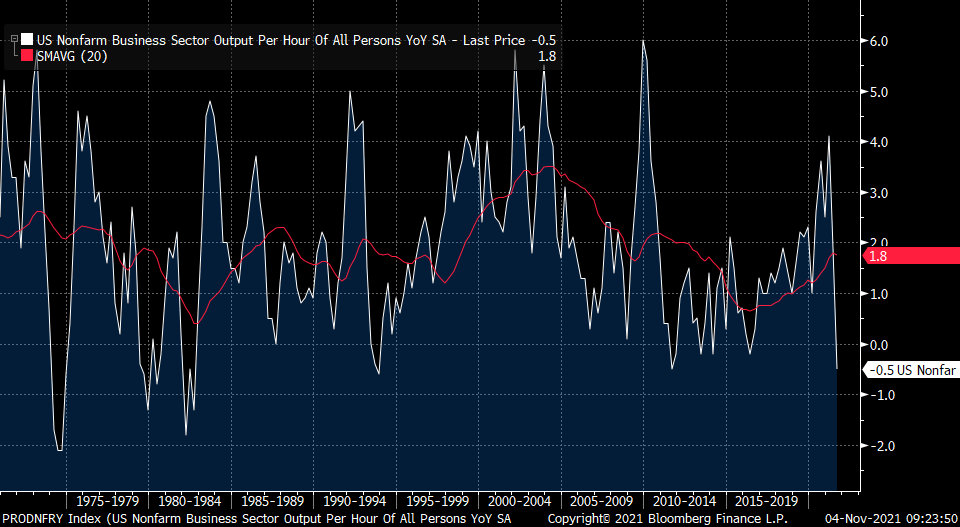

Why that quote? There is always a lot of sizzle going on, and not always a lot of steak. On that, a lot of people like to talk about all the productivity-enhancing technology we are seeing and will continue to see due to AI, robotics, autonomous driving, mobile computing, etc. I am not ignoring that, because it is real. But, there may be more sizzle around productivity generally based upon the chart of it going quite a ways back.

Raoul Pal is a really smart guy. What he has managed to do with Real Vision is extremely impressive, and many of his calls on the market have been exceptional. He appears to have a great combination of being most articulate, well networked, excellent lateral thinker, and extremely commercial. No surprise why he has been as successful as he has been.

He wrote a Twitter thread the other day that got me thinking, and I have included it in here, with the main argument being that the market now has 86 million new participants, and facing debt, limited savings, they took their government issues checks and eschewed boomer investments that targeted 10-15% annual returns, and instead, shot for the moon. They have industries and companies they like, and they clearly don’t like the establishment of banks, short-sellers, hedge fund managers, etc. They are not keen to build wealth as boomers were taught to by their depression and inflation remembering parents.

But, Raoul’s is a compelling notion, and it fits with the fact patterns we have seen. Anyway, Hertz signs a deal to buy 100K Tesla’s, and the P/S ratio expands from already high levels for an $800B market cap company, to an unheard of 30 P/S and $1.2T company, and so one could do the math and figure that those 100K sales had some super special properties.

And, Hertz is trying to lock into a new investor ecosystem – aka the crowd – that AMC and GME know much about. Avis, with a sizable short interest, shows solid recovery in the earnings announcement, and the stock goes parabolic! Can you imagine what happens if they try to buy some Teslas? What is interesting, unlike prior experiences of parabolic moves, the stocks don’t come back to earth, as evidenced by AMC and CME. AMC now is using some of its capital to get into the popcorn game.

And, that brought me to arguments that Matt Levine made regarding company behavior in the meme regime. Are boards and managers not doing their job by becoming meme stocks, because doing so could reduce their costs of capital? We saw some of this stuff a few years back when the ice tea company changed its name to include blockchain, but the market was somewhat sane then. But, Raoul points out that between the democratization of finance, the risk-taking disposition of the cohort, and social media, we have a perfect storm where sizzle does not need to produce steak, it just needs to keep sizzling. All Matt is saying is to exploit it. But, the reason he is saying that, is because there is a bit of corporate finance in there. If the Fed QE brings real rates highly negative, failure to lock in those rates is not acting in the interest of stakeholders. And, because the litany of real smart short-sellers or even long/short equity players have to manage their capital wisely given enhanced asymmetric risk, there are not that many other players willing to risk capital to exploit inefficiencies other than for corporations to do so.

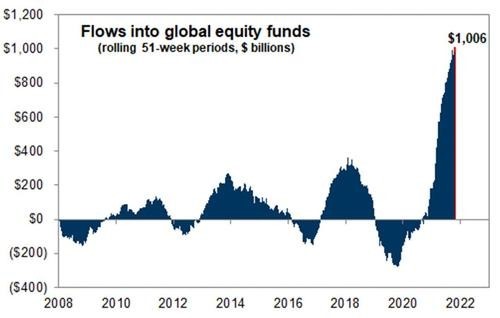

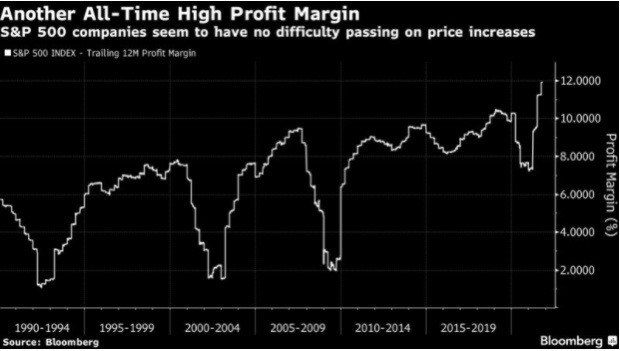

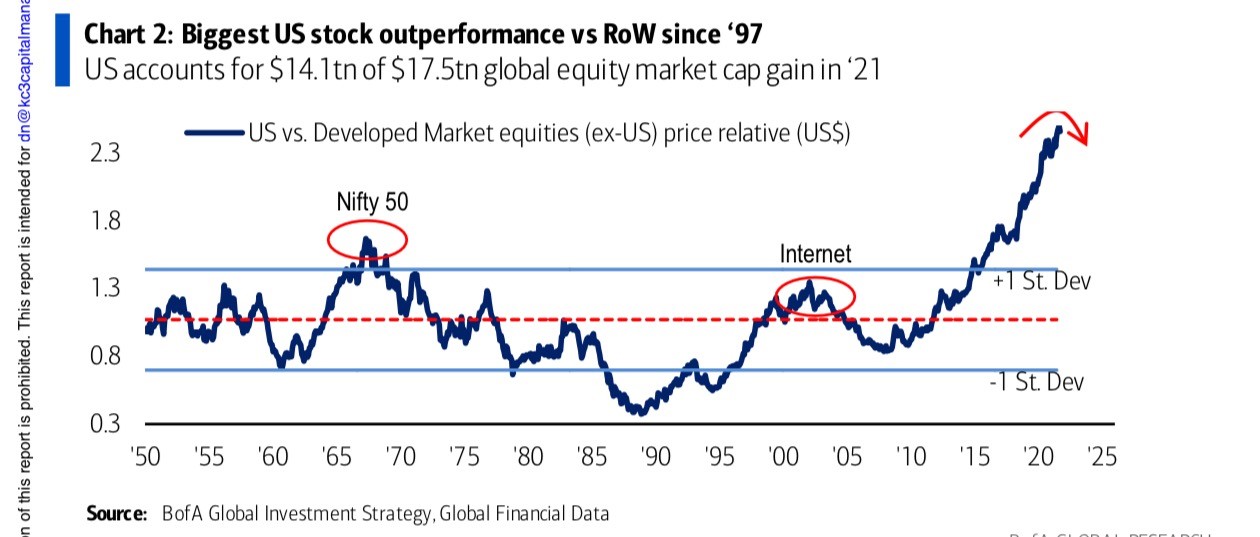

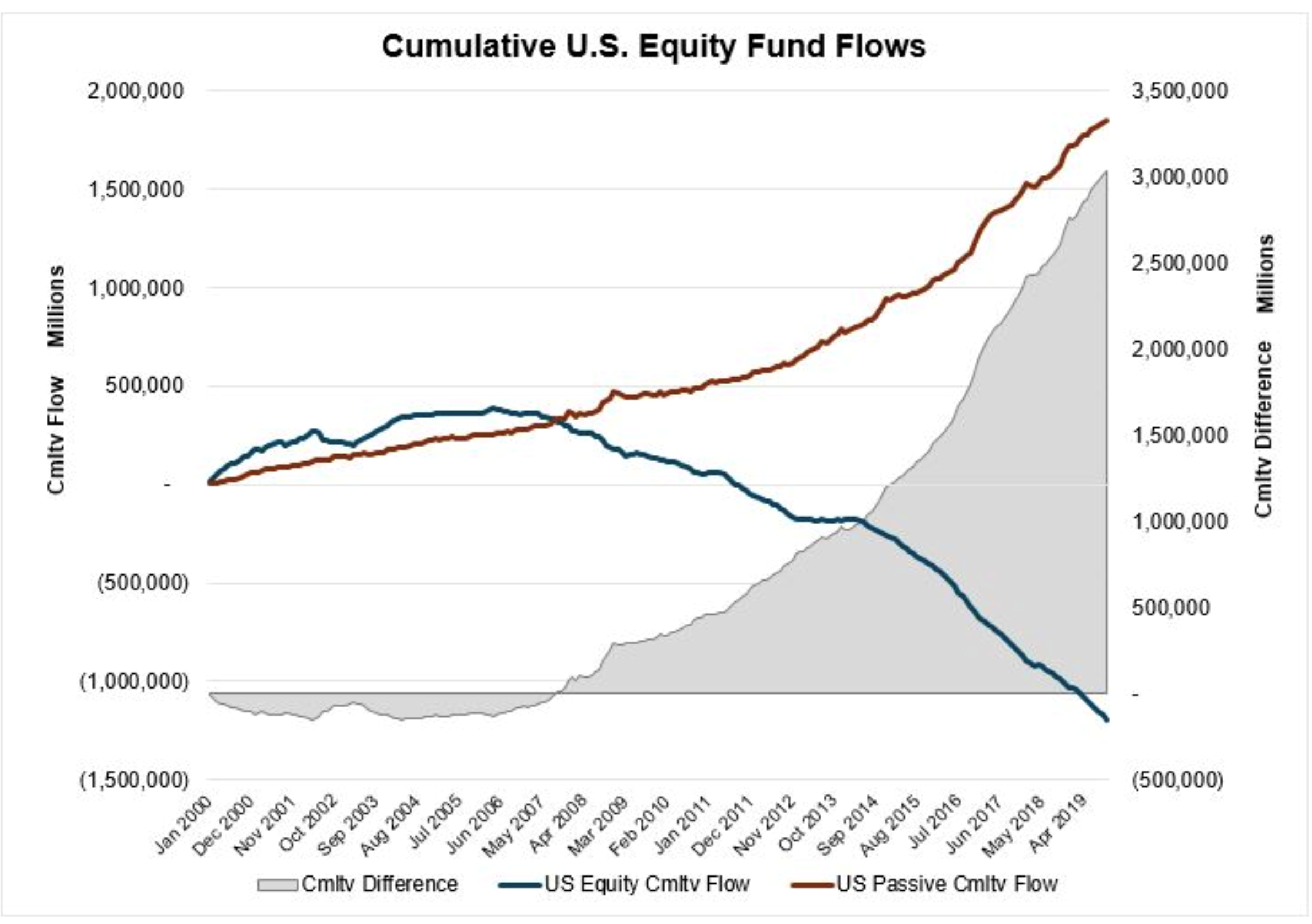

Now, many of us who have lived through bubbly periods, know that narratives can change quickly. We have seen a gargantuan flow movement into equities (see below) – and for reasons discussed prior related to buybacks, return on capital, margins – US Equities. And, with the Fed doing an extremely dovish taper while spouting somewhat contradictory statements on inflation and maximum employment – and with the normal positive flow seasonality – should see more of the same! This past week BAML noticed more funds into equities. Even after the taper, the Fed is still extremely accommodative, so why not?

Now, it has been my call that some reversion in margins (stagflation theme) and equity flows (rebalancing, market power/concentration) should take place. Maybe Peloton is the beginning of more reversions, but it is pretty painful to sit in any shorts waiting for that to happen. But, equally, as we are learning with Peloton and also with Zillow, running companies, allocating capital, not always easy.

Things that caught my attention this week:

Index Investing:

Just finished the book Trillions by Robbin Wigglesworth at the FT, and it is a great read. One could argue – and in fact, Warren Buffett has – that low-cost index investing is one of the great advancements of finance. I have written before that Ben Graham and his approach to value investing was one of the first attempts to bring more discipline and “science” to investing. This came about after the ‘29 crash when it was clear there was a lot of hopefully excess speculation. And, this ushered in the beginning of pooled capital and mutual funds (with strict guidelines) and the idea that investing was a professional endeavor that not everybody is capable of doing well. Don’t tell that to the crowd above.

Indexation roots began with Louis Bachelier – a somewhat periphery French professor and mathematician – who wrote a paper around 1900 to explain stock price movements and their seemingly random movement principles. That paper was unearthed in the 1950s by a University of Chicago statistician and passed along to influential economist Paul Samuelson, and it began the decades-long research that sought to come up with principles for stock price behavior. It passes along the minds of Markowitz (Modern Portfolio Theory), Sharpe (CAPM), and Fama / French (EMH, Factors) and includes some ahead of their time other research acolytes and market professionals at Wells Fargo, American National Bank of Chicago, John Bogle, Dimensional Fund Advisors, to the American Stock Exchange, Larry Fink and the ETF. Inside all of that, was the basic premise of random walk, underperformance from active managers for the most part, and not worth the fees they charged.

Although the charts below are a bit dated, it tells the story. In 2000 there were 88 ETFs with $70B, and now there are 7000 ETF’s globally with $7.7T, and approaching the amount of actively managed funds.

Now, the vast bulk of newer entrants are around specific sectors and themes. Of course, flows could get interrupted, and they do from time to time. It is hard to argue, unless you are an average active manager, that this is all that bad because fees and costs have been rung out. It is a disruption with win-win properties. That said, there are governance issues, issues with exploiting the tax status of the ETF wrapper (for actively managed ETF’s), excess leverage or poorly designed ETF/ETP’s – see (USO, XIV) and the use of capital as a political weapon – which I have covered before – but this is a part of the new market paradigm. And, so is the importance of MSCI, FTSE Russell, and the S&P, where inclusion or removal can dramatically change market values.

Indexation versus speculation?

So, the thing that I find somewhat puzzling, is how to square the notion of cheap indexation as a key tool to building wealth with the new investor cohort that is chasing all sorts of gewgaws. Perhaps, the story of Tesla and its inclusion last year is a part of the game being played. Passive indexation provides the backdrop of money going into markets, generally unconcerned with valuation, and barbell that with stocks that have characteristics that can be exploited, and hope company crosses the threshold into wider indexation.

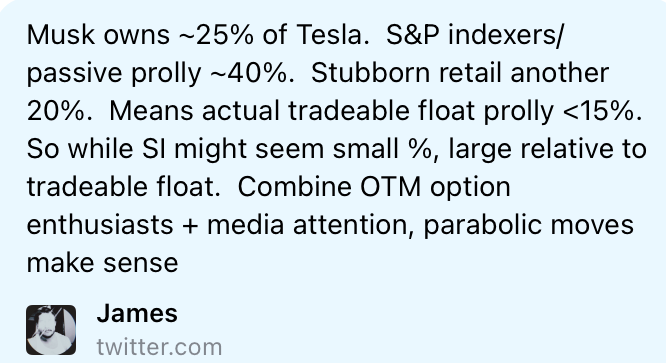

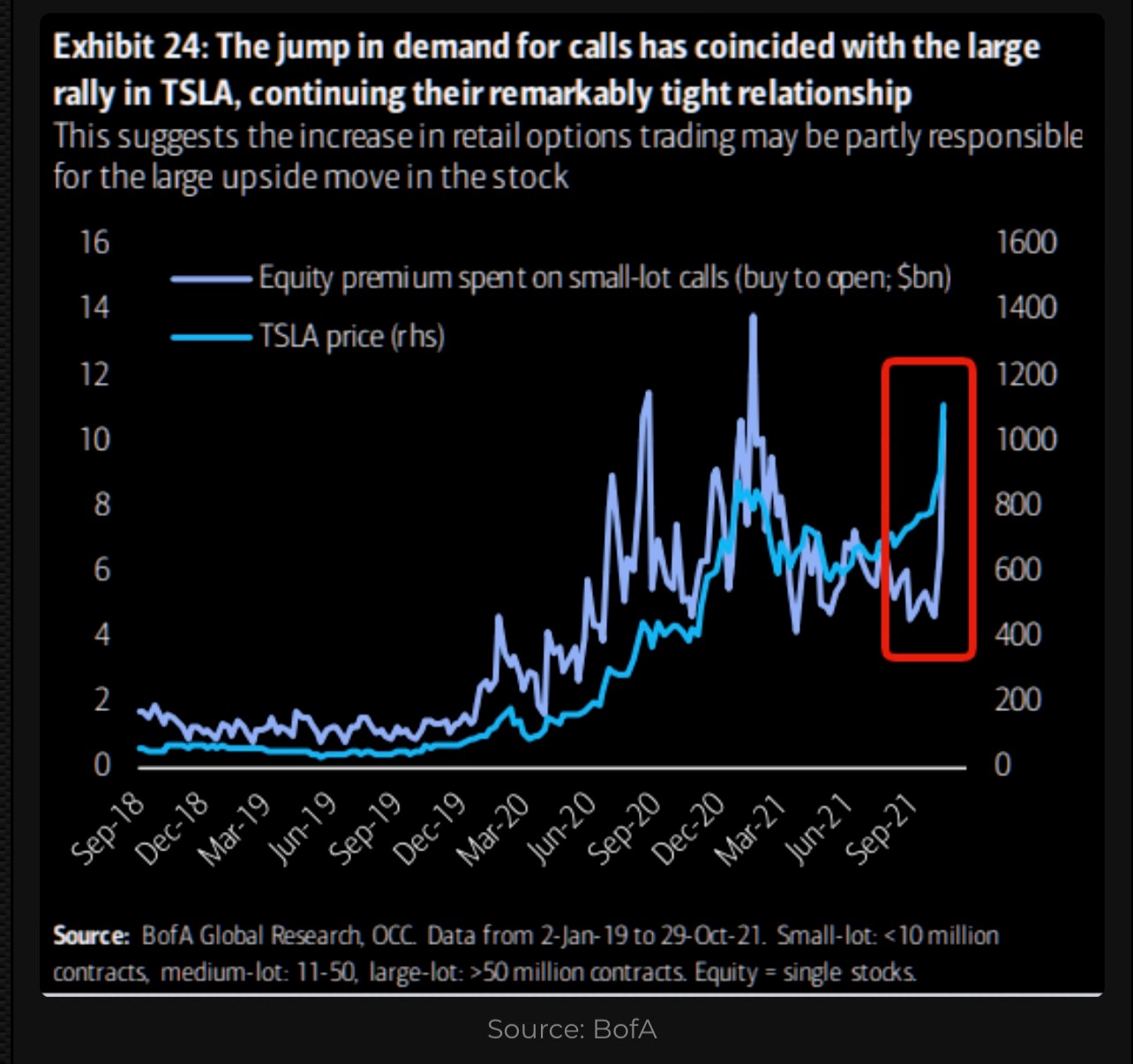

One of those characteristics is available float and a durable, almost religious type of investor base. Here is a Twitter comment from a Tesla bull that is trying to explain the parabolic move in Tesla post-Hertz. Fwiw, option enthusiasts are one thing, but this amount of buying (see chart) is not like stamp collecting enthusiasts. These are people looking to do some damage – and it happens every week! How hard is it for the SEC to see who the actors are behind this?

And, without turning this into a Tesla thing, the bottom line is that Tesla, like MSFT, Cisco, AOL did before in the 1990s, to understand this market – one where a lot of people have done well, and some exceptionally well – requires one to understand the devotion of this cohort, and also, those smart players who are going with it and re-enforcing it, like the guy from Singapore portrayed. Could be Archegos 2.0.

So, guys like David Trainor at New Constructs or Aswath Damadoran at NYU (valuation guru) are just ignored for the Cathie Woods of the world. And yet, Trainor – who bulls would suggest having been so wrong and should be ignored – was in Barron’s suggesting the stock was $1T overvalued!

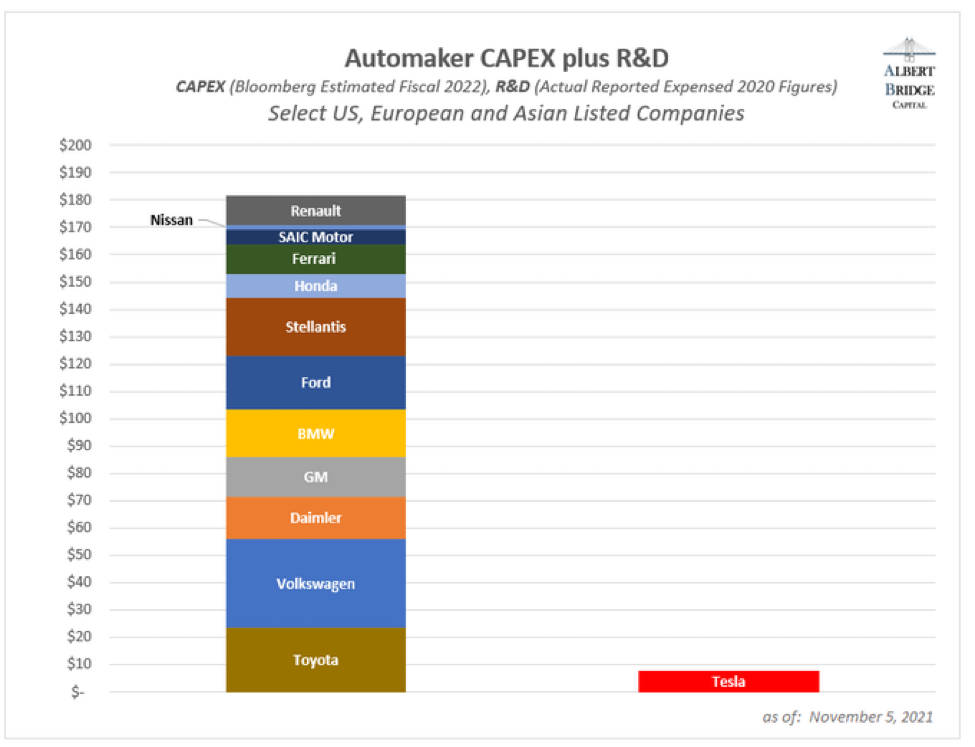

And, to add some common sense spin, here is a table of actual Capex + R&D investment in the auto industry. Now, just because the Yankees, Dodgers, and Cubs spend a lot of money, does not mean they win the World Series. Tesla maybe has the secret sauce. But, generally speaking, unless management is entirely incompetent, valuations correlate with Capital + R&D spend.

Inflation….again!

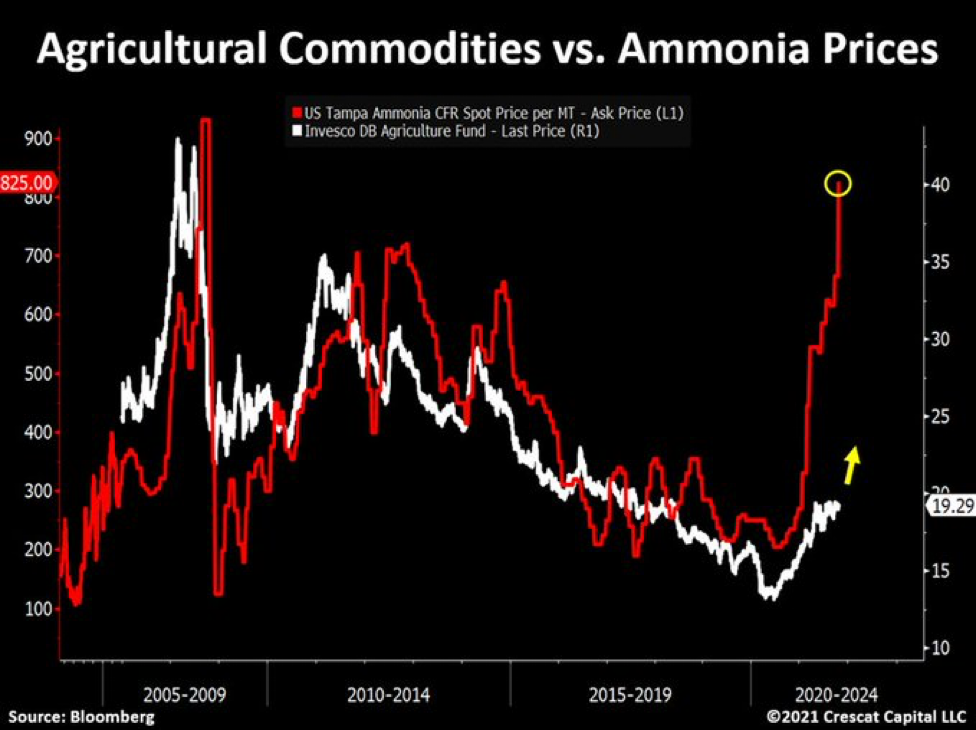

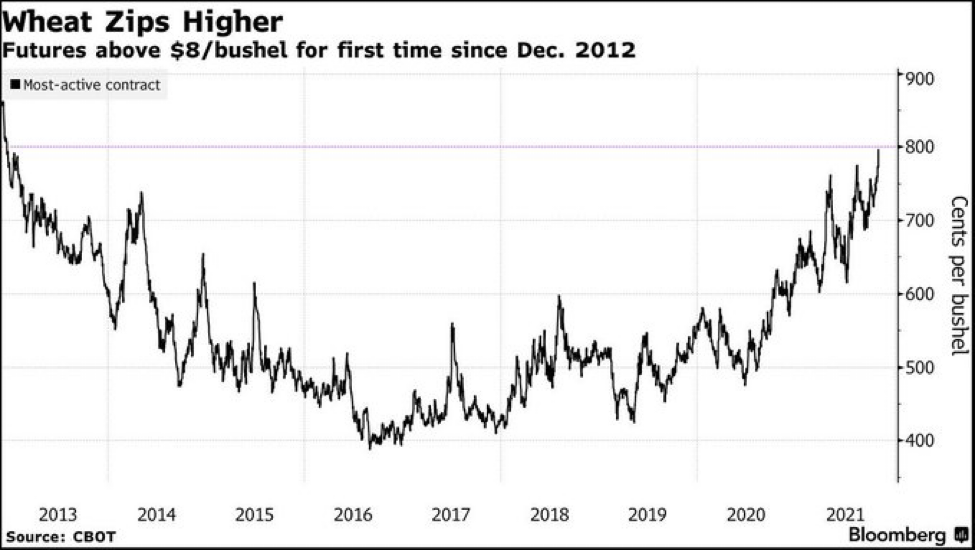

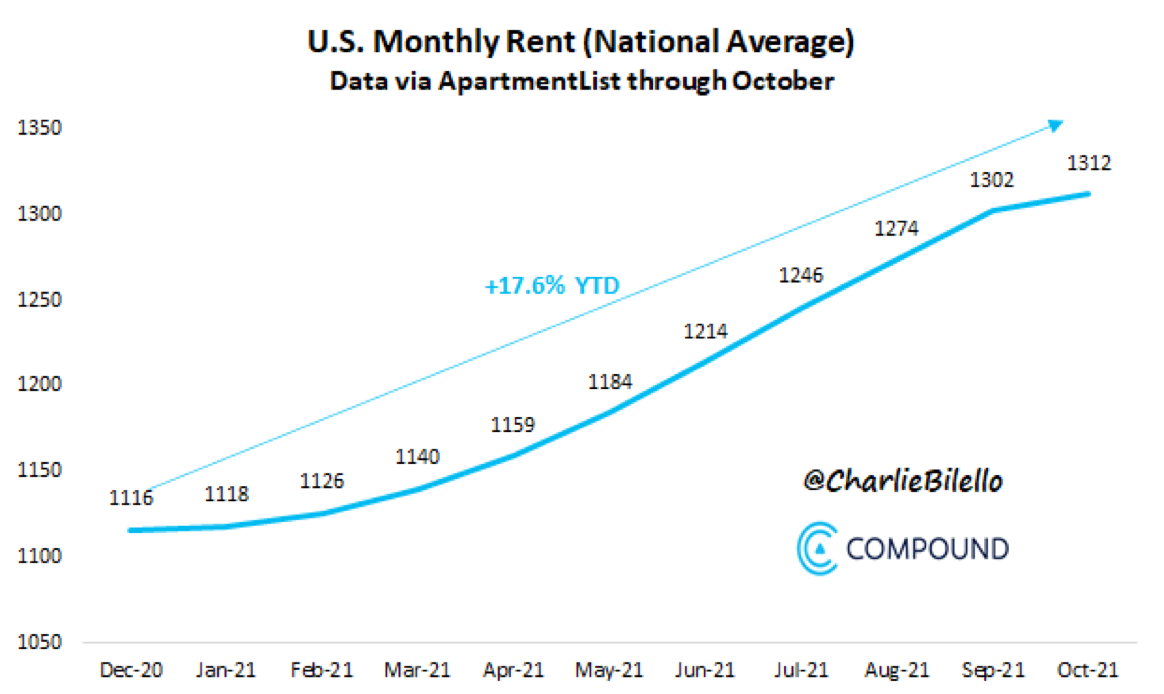

Trust me, the last thing I want to come across as is somebody who is banging the drum endlessly on inflation. But, the simple fact is, it is still quite topical, and particularly so after the Fed suggests they are concerned about it, the administration sounds like Gerald Ford’s, and nobody is doing anything about it. So, here are some charts and tables that suggest we are not out of the woods yet. As I wrote a few weeks back, this was likely to be a rolling issue.

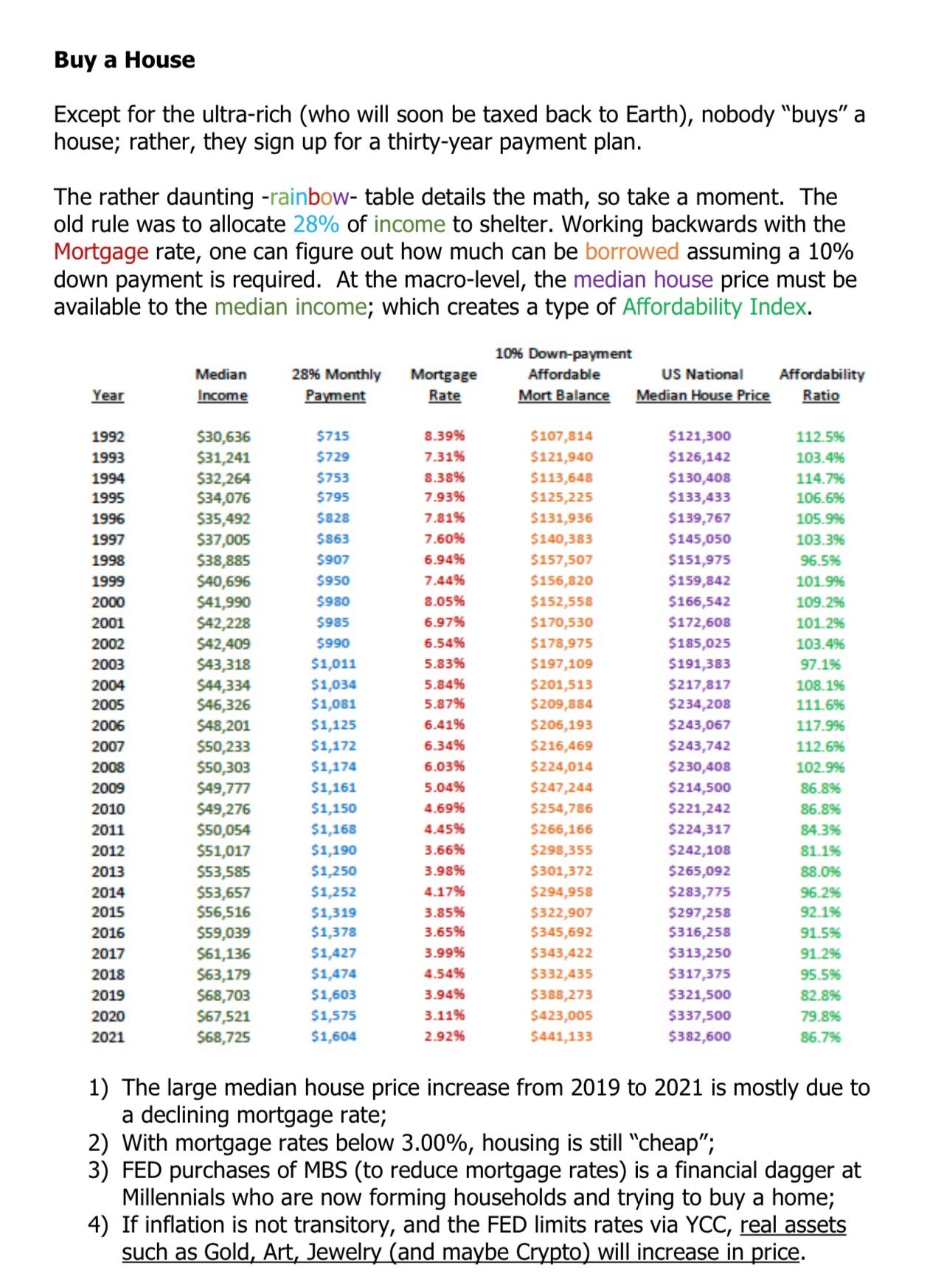

This last table is from Hayley Bassman, and it basically suggests that housing remains reasonably affordable, at least at the median level. In fact, it is as affordable now as the 2006-2008 period was unaffordable. The implication -> housing prices/rents should stay elevated.

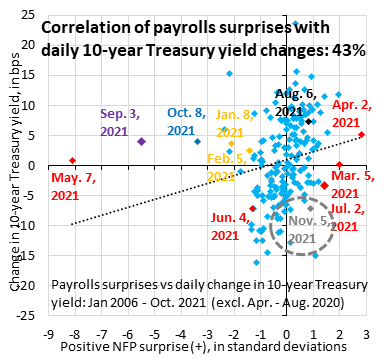

As for my position in bonds, where I am short futures, I acknowledge it is crowded and at times painful. I do try to trade it around. It is no fun these days trying to think about what should happen as we normalize, without appreciating that the path can be indirect. As Robin Brooks at IIF noted today, the 10year note should have been higher by 3bps, and instead, was down 7bps. I bought some back after the curve started to steepen post FOMC and Powell, and I will be offering them all the way up to 164, where there is plenty of congestion.

Anyhow, my view is based upon 4 things:

1. Inflation will stay elevated, and the Fed will stay accommodative. The BOE had the chance to be the first major CB to hike, and it blinked. Mild taper while still buying more than after the GFC, is hardly restrictive.

2. Terminal rates – the longer this goes on, the more likely it is that terminal rates will rise MORE than expected. Currently, the market expects the hiking cycle to go no further than 1.5-2%. I can see that view given the debt loads, but it isn’t particularly clear to me why no term premium and inflation risk premium would not be priced. And, I have a bit of support in that view from guys like Bill Dudley.

3. In 2019, average 30-year rates were 2.58%. We are not that far, with Friday’s employment numbers, from being near maximum employment. Inflation is higher, short rates are lower, asset prices are screaming, and the Dems can see the writing on the wall regarding 2022. They will jam through what they can now. That’s how it works now. Biden is not going to triangulate. He doesn’t have the political finesse, nor concern over his future, for that. A combination of the above should suggest at least a 30y move to the median of 2.58%, which is still pretty low.

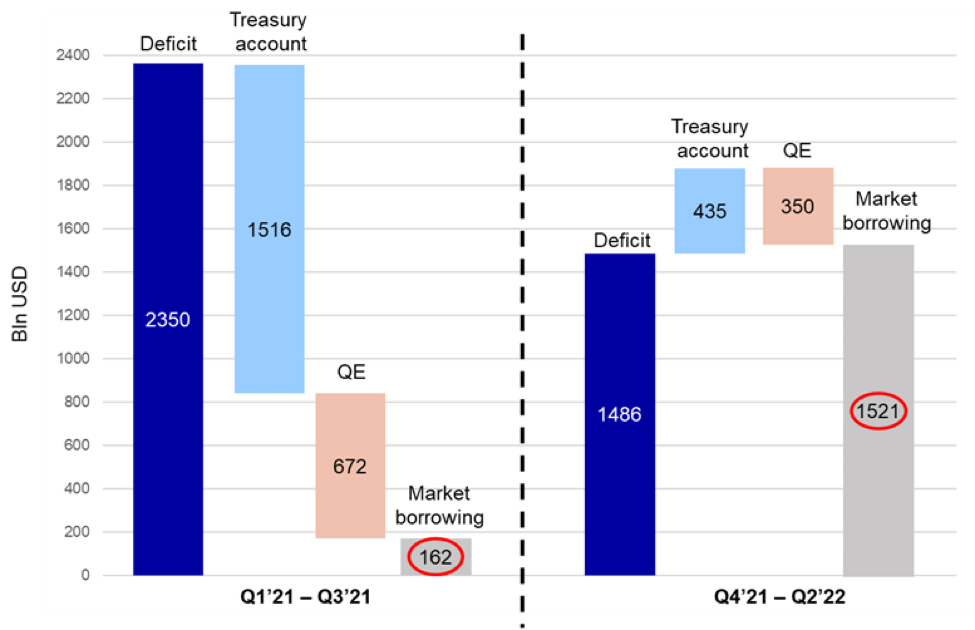

4. Change in funding equation. This chart is from 42 Macro’s Darius Dale (big-time fan). Given where inflation is and nominal 30year rates below 2%, I cannot imagine why the Treasury would not issue more notes and bonds going forward.