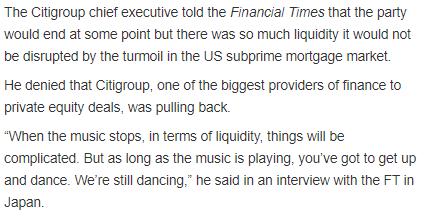

Chuck Prince was the CEO of Citigroup for four years, handpicked by the architect of Citigroup Sandy Weill. He was famous for saying “… as long as the music is playing, you’ve got to get up and dance. We’re still dancing.” This was July 2007.

The subprime crisis was just starting with a few signs of market stress. Liquidity at that time seemed abundant as I remember every equity investor telling me there was so much liquidity, however, it was in hindsight easy to see the liquidity starting to dry up. Everyone was confident that they would be able to exit ahead of any change of conditions. This was also from July 2007.

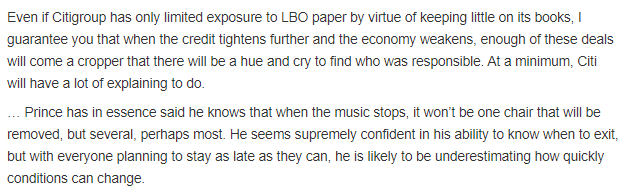

Chuck Prince resigned on November 3, 2007, after announcing a $5.9 billion write-down and a sharp drop in profit. The stock was at 400 and ultimately dropped to under 10 (this post reverse split) and I’d say he was supremely confident knowing when to exit. Brilliant move on HIS exit! He was also correct saying that “when the music stops, it won’t be one chair that will be removed, but several, perhaps most.“

There’s been a lot of people in 2021 who have issued concerns about the current environment. The one notable as I mentioned last week was David Tepper. In short, he said he didn’t like any market. I asked a few of my friends what they thought of his comments and I heard a few comments: “He’s worried about the Fed QE tapering” “He’s seeing liquidity from his turret starting to dry up” “Valuations, speculation, and wild inflows can turn into outflows suddenly.” David Tepper was famous for going on CNBC years ago and stating the Fed would pump massively and he was spot on for years. We might look back at David Tepper’s recent comments and realize the big boys were the ones who saw it early and like Chuck Prince was “supremely confident knowing when to exit.” It might not be this month or quarter, maybe not even Q1 2022 when things become incredibly clear just as the great financial crisis took time to implode. The early signs are worth noting.

When Tesla goes up 50% in a few weeks gaining something near $400 billion in market cap all due to a 100k fleet order for their low-end car to Hertz, speculation is off the charts. Nothing like this ever happened in my life and I’ve been through a few market cycles. The 90s tech boom has nothing on this insanity. I’ve thought about how Game Stop with a $25 billion market cap nearly collapsed Robinhood due to liquidity, concentration, and leverage. What will happen if (and when) Tesla drops by $400 billion in short order? Oh, I’ll have people on Twitter tell me in a snarking way “it’s just back to where it was a month ago.” The same thing happened with Game Stop as it went back to where it was a month previously but the damage was done enough to have Congressional hearings. Could this be a systemic MARKET risk developing? It’s not like Tesla has valuation support. And the amount of call options being traded each day is astounding. Charlie Munger once called derivatives “financial weapons of mass destruction.” All of the Tesla traders, I am sure are supremely confident knowing when to exit. The risk is they all hit the sell button at once and that might just happen soon.

Sorry for the recent late notes. I’ve been without Tyler who does the formatting. He’s back this week so notes should come out earlier.

trade ideas

No changes. Some shorts coming in a little today while a few are not. Choppy.