Today’s Fed meeting press conference will be no doubt one of the most important as the Fed pivots. There are four unknowns that Fed Chairman Powell will have to clarify. The first is the timing of the first hike (market expectations is March). Second, is the first hike going to be 25bps or a ‘credibility rebuilding’ 50bps? Third, how many hikes does the FOMC expect in 2022? (Fed guidance has been 3 and now the market expects 4) Fourth, any comments on balance sheet runoff will be the wildcard as to how much, when would it would start, and long-term plans. This could spook the markets as it did last month when Powell first mentioned it.

Markets hate uncertainty and tend to sell off into uncertainty and buy when the outcome becomes evident or at least consensus. The market might be in believing the consensus with the rise in equities from earlier in the week. Investors have expected Powell to be hawkish and he has to be as President Biden has publically passed the buck on the inflation problem to the newly reappointed Powell. But there is hope that Powell will throw out some dovish comments to soothe the equity markets. He might and it wouldn’t be a bad thing or something he’d lose credibility on. He would lose credibility if he backtracked on some of the plans he’s already laid out just to calm the equity markets. Notice I didn’t say credit markets? One of the true signs of a market correction that is on the scary side of terrifying is when investment grade and high yield spreads widen… and blow out. The credit markets in 2020 were blowing up perhaps a bigger concern for the Fed back in March 2020 as to why they announced they would buy credit ETFs.

Powell does have some cover if he stays on his hawkish script since the credit markets have remained relatively calm perhaps disappointing the equity markets. There’s always a sacrificial lamb when faced with a handful of tough choices. Powell has a very tough job ahead to control inflation and this is the time when being a Fed Chairman won’t make a lot of friends in the markets.

Powell has to land a 900 at this press conference and that’s not an easy trick. The markets will be listening to every word at 2:30 pm ET today.

By the way, in case you did not know I grew up in LA, and “our LaCrosse” was called skateboarding. It was what we did every day for fun in skateparks, halfpipe ramps (my parents were crazy to allow me to build a half-pipe for the neighborhood), and going back and forth to school. Tony Hawk, a skinny kid we used to see at the skateparks back then changed the sport as he brought effortless acrobatic tricks into the mainstream. He’s also apparently worth $150 million through his branding on his Activision video games for over 20 years, marketing tons of products, and winning just about every skateboard competition for decades. Despite Tony getting older at 53 he still is There are a lot more rich skateboarders vs LaCrosse players. Do you hear that mom?

TRADE IDEAS

I’m still long my trading longs SPY, QQQ, and IWM added the other day near the lows. I am raising my sell stops to the 2 day VWAP levels: SPY 435, QQQ 347, IWM 198.75. Normally I will watch when something trades near my stop and will make a determination if that price holds or cleanly breaks. I am setting stops in my box if these are hit today. There could be some volatility with the Fed so I’m giving myself some room and with these up over 3.5% already if I lose 1% and get stopped out so be it. We can always add back. LRCX reports later today and I am going to cover my short +13%. I recently covered half of my TSLA short when it was lower and will hold my 2.5% sized short into the numbers tonight. I looked for a put spread but there was nothing that made any sense as premiums are so high. No other changes. If there is something to do after the Fed I will put out a short note later.

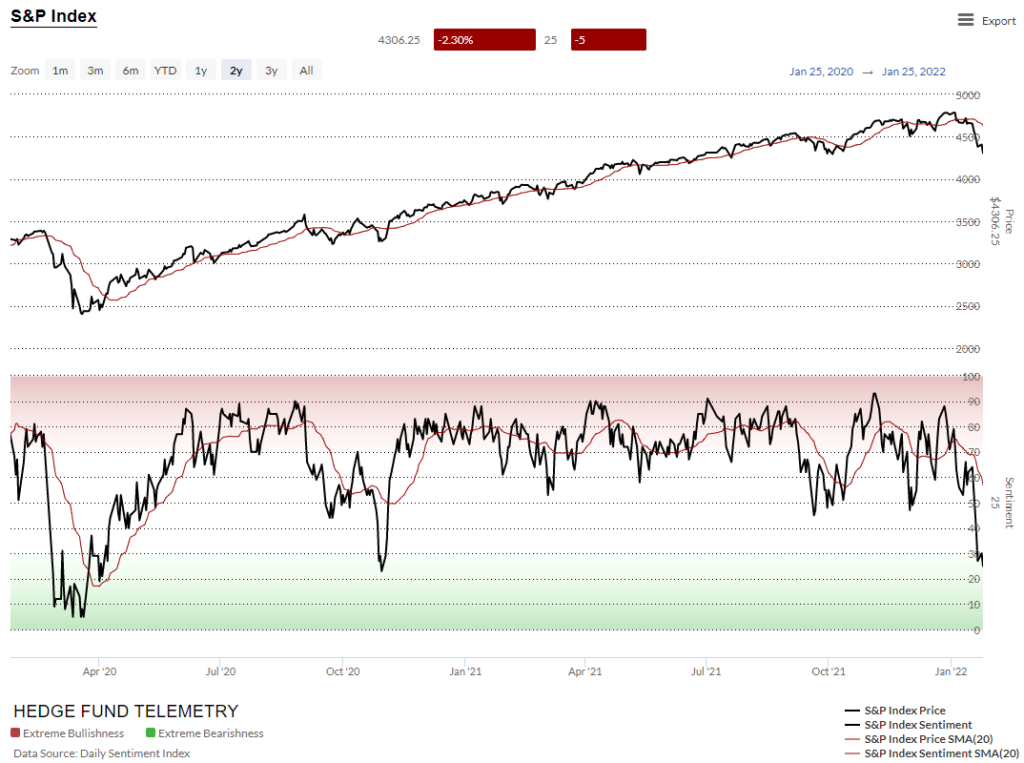

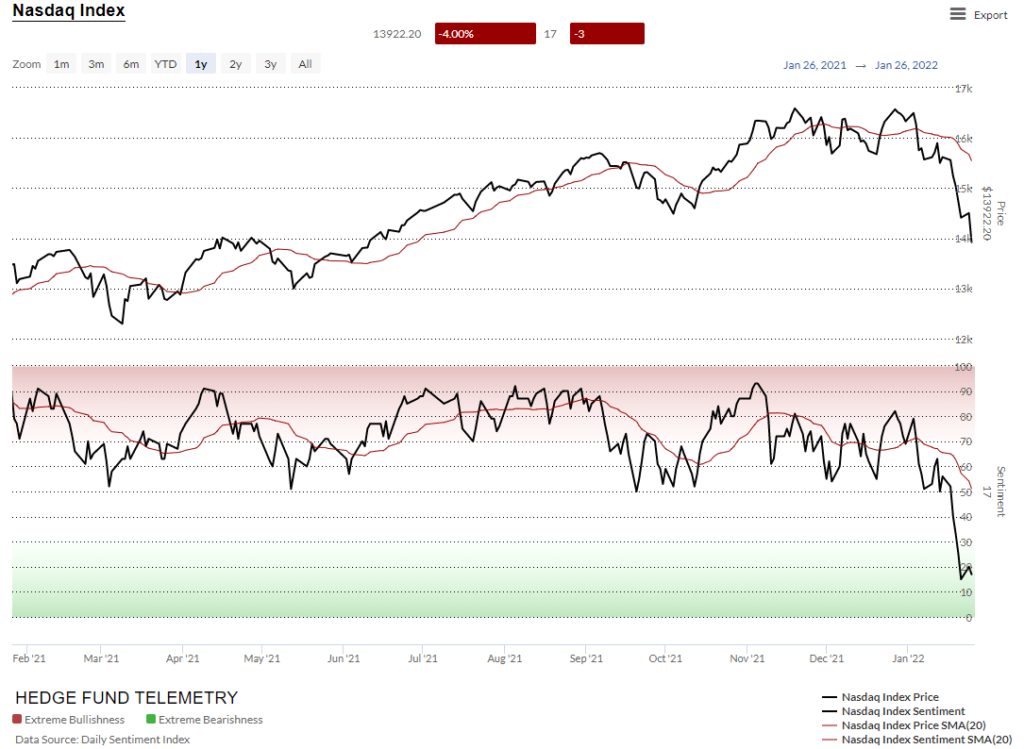

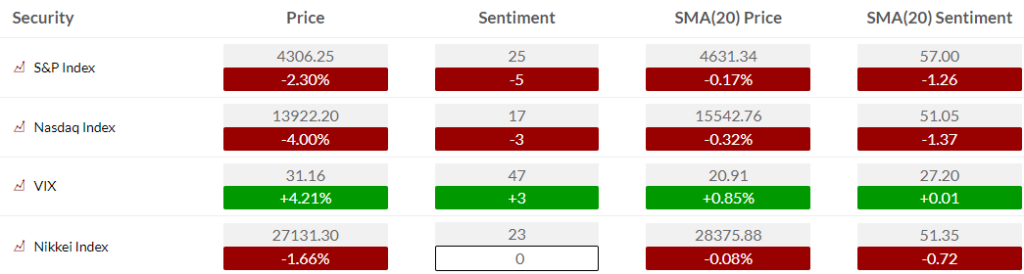

US MARKET SENTIMENT

Here is a primer on how we use Daily Sentiment Index charts. S&P bullish sentiment and Nasdaq bullish sentiment dropped again yesterday and remain under pressure. Yes, oversold but they can chop around down here and I would like to see the 20 day moving average of sentiment catch down and then see sentiment cross higher

Equity Bullish Sentiment

US MARKETS

Here is a primer on the basics of the DeMark Setup and Sequential indicators.

S&P daily with buy Setup 9. One thing that is nagging at me is how the price is off the highs today which is evident on many other charts. Setup 9’s can work at inflection points and can see reversals of a few days likely or longer possible. The risk is that if this fails to turn and this reverses down a new Sequential Countdown will start continuing the downside trend. You’ll know if that happens!

SPY daily similar with 4363 TDST an important level to watch for downside break

Nasdaq 100 index daily has been well under the TDST level and that’s a slight negative for the potential for the Setup 9 to make a durable turn higher.

Russell 2000 IWM daily did get the full downside exhaustion signals and this has been very oversold in a downside wave 5. This should see a bounce however a stronger momentum surge is needed.

Dow Jones also has the buy Setup 9 and this one too is way under the TDST support (green dotted line). 34,000 is the big support level that must hold

Palladium update

Palladium continues to be the best-looking metal trade

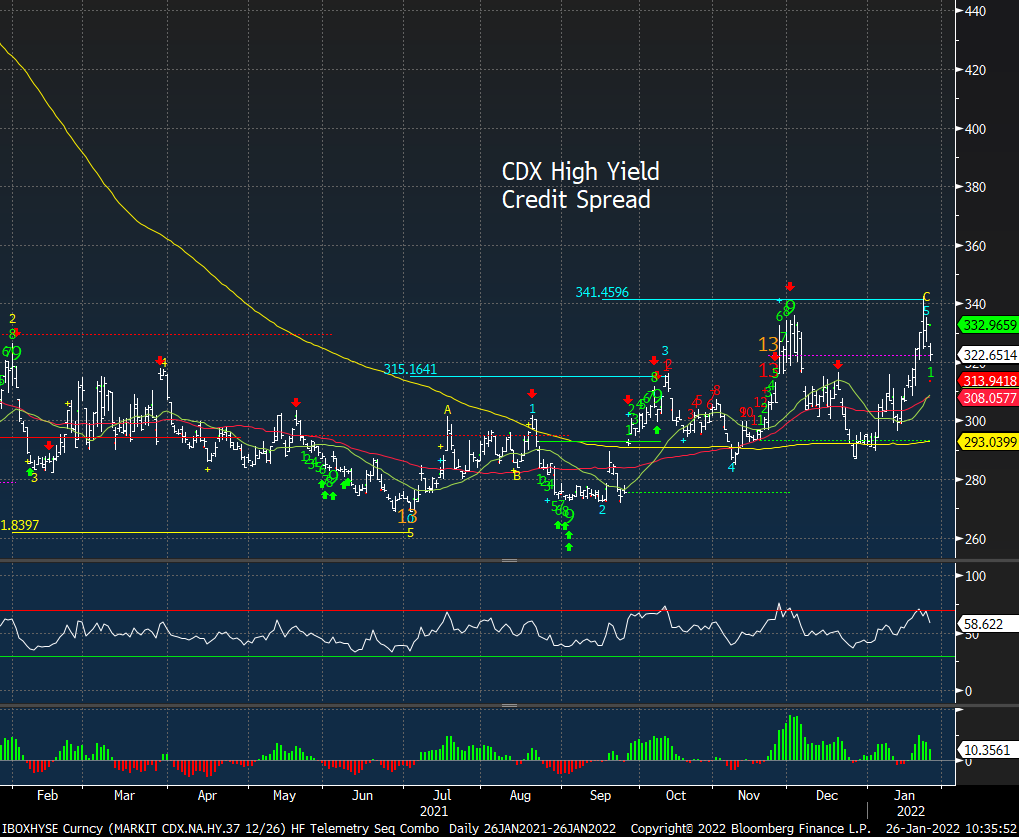

TODAY’S FOCUS – credit spreads very subdued

Credit spreads are usually a very good tell when the markets get volatile as they widen (on the charts move higher). So far there really hasn’t been much of a wiggle with both high yield and investment grade despite the equity and bond volatility.

To put it into perspective those charts above are the last 6 months and as you see here what happened in late 2018 and in Q1 2020.

Energy – crude update

WTI Crude Futures and Brent Crude daily both have further upside potential with both on day 6 of 13 with the DeMark Sequential Countdown.

Brent Crude

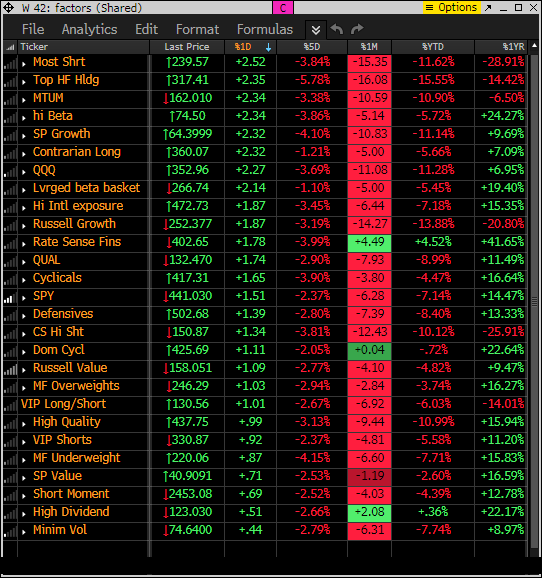

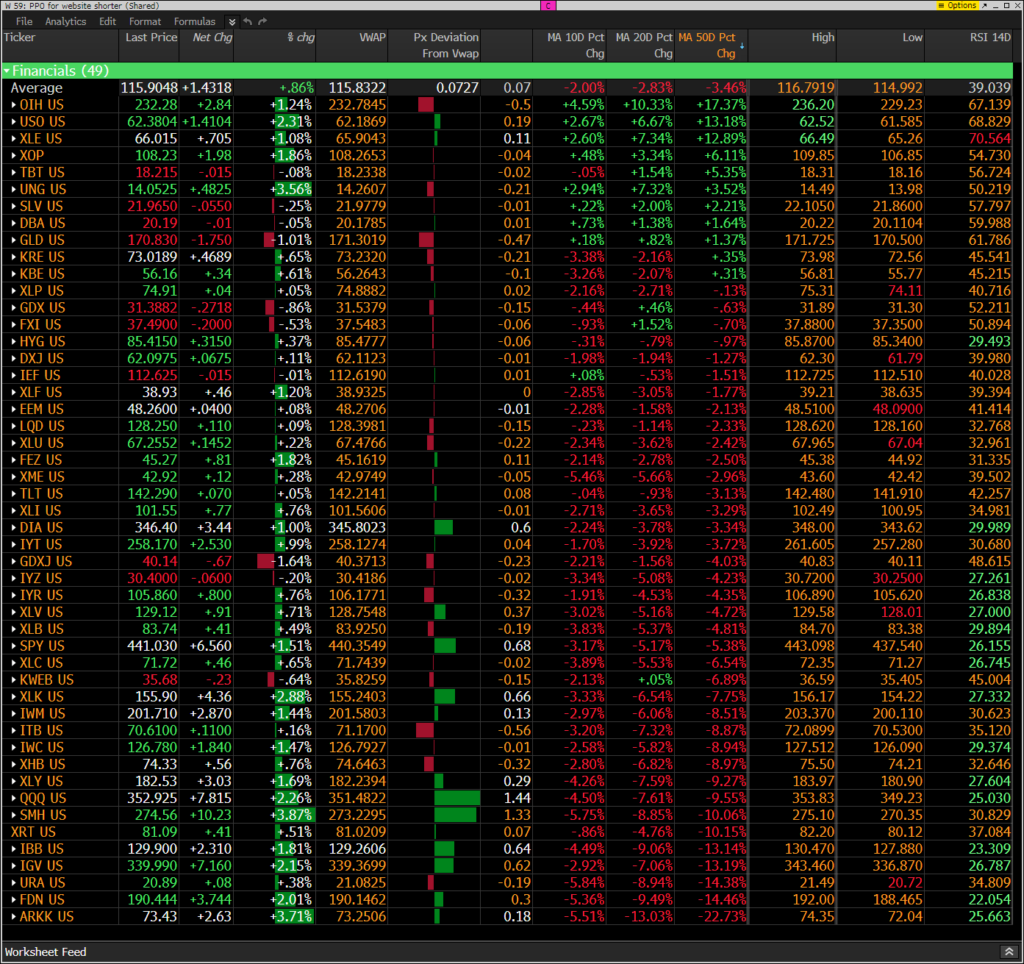

FACTORS, GOLDMAN SACHS SHORT BASKETS AND PPO MONITOR UPDATE

Factor monitor now has a reset YTD performance column. Factor monitor now has a reset YTD performance column. Nearly everything is down YTD. What is working best today are those factors that have been down the most in the last month and YTD. Let’s see if this continues. Shorts getting squeezed.

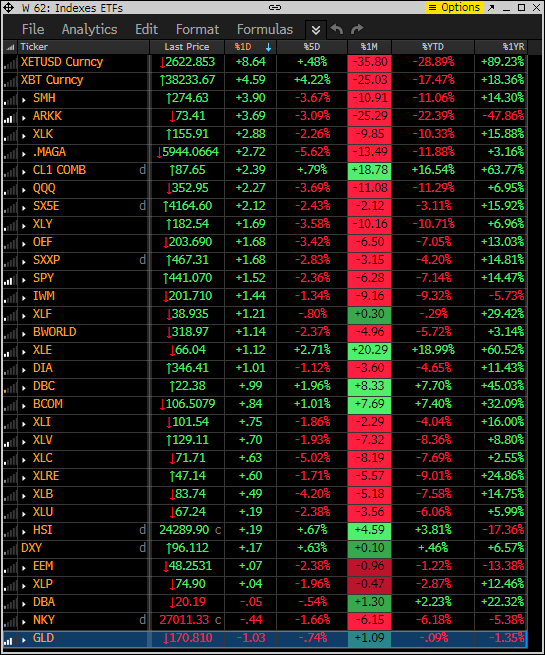

This is similar to the above monitor with various ETFs other indexes as I wanted to show the same 5 day, 1 month rolling as well the YTD and 1 year. What is working best today are the ETFs, cryptos that have been down the most in the last month and YTD. Let’s see if this continues.

This is the monitor that has the S&P indexes and the Goldman Sachs most shorted baskets. Today the shorts baskets are up more than the S&P weighted indexes as a sign of shorts getting squeezed.

The PPO monitor (percentage price oscillator) force ranks ETF’s by percentage above/below the 50 day moving average. For information on this monitor please refer to this primer. This monitor is offered to Hedge Fund Telemetry subscribers who are on Bloomberg. Energy is still at the top of the monitor continuing as the strongest sector. Financials doing OK in top 1/3 of the monitor. Those at the bottom have been the most oversold seeing the strongest gains today.

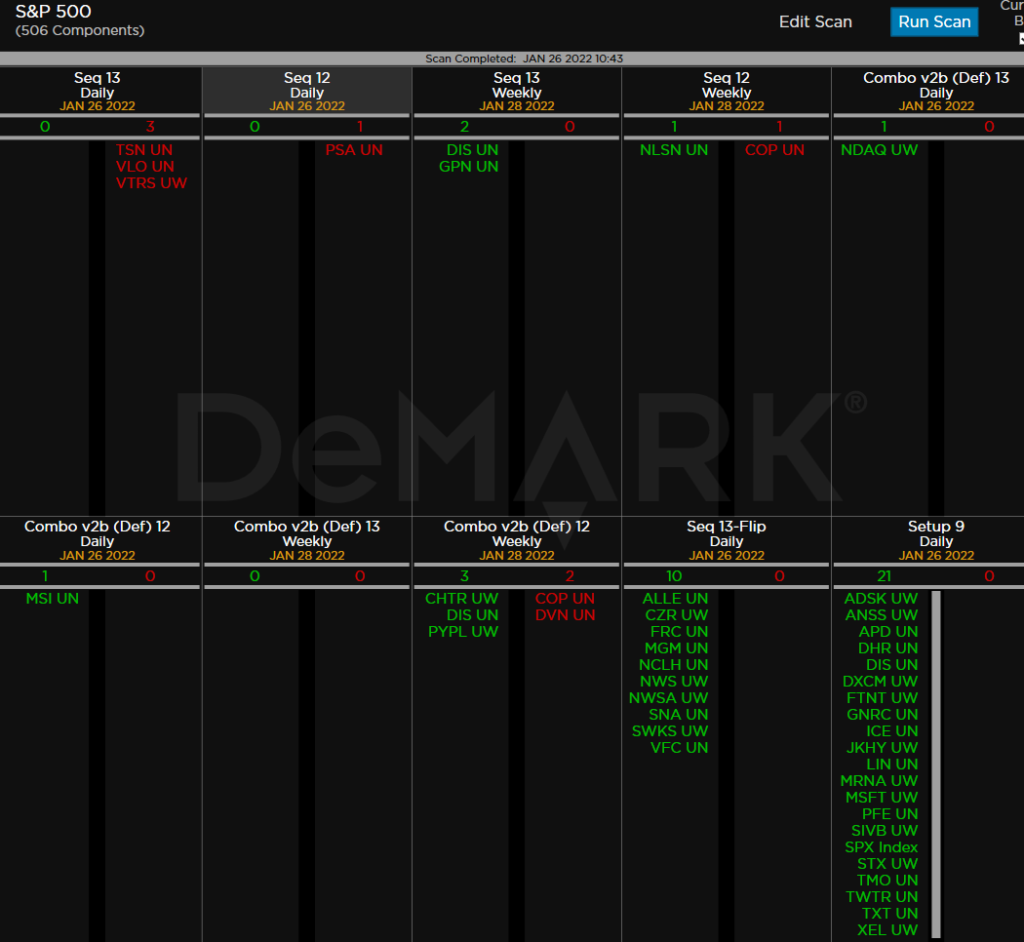

DEMARK OBSERVATIONS

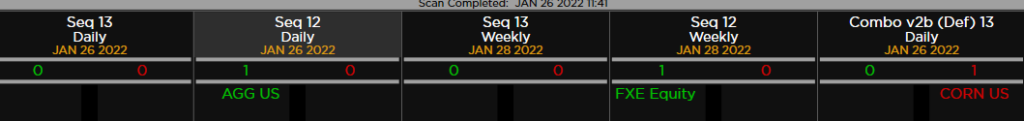

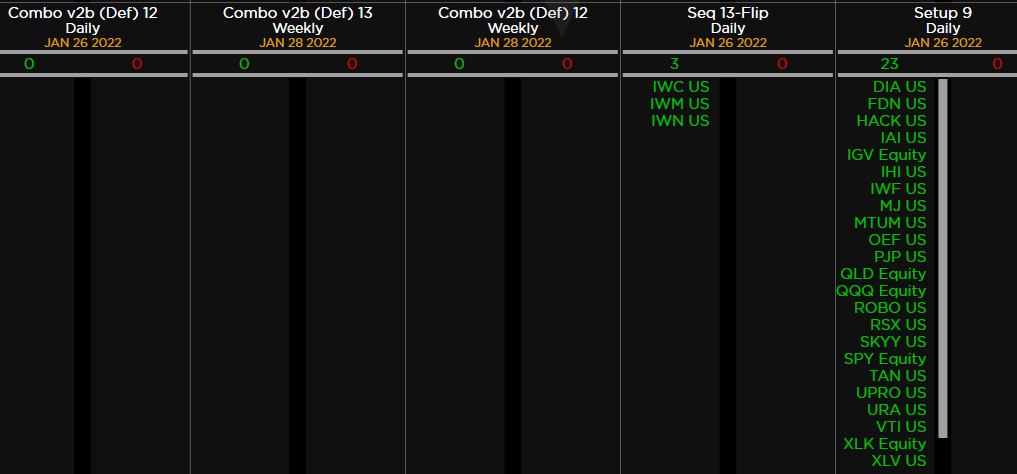

Within the S&P the DeMark Sequential and Combo Countdown 13’s and 12/13’s on daily and weekly time periods. For information on how to use the DeMark Observations please refer to this primer. Worth noting: A lot of buy Setup 9’s and 10 price flips up. These are giving some signs of a turn up. Follow through needed

ETFs among a 160+ ETF universe. Watching IWC, IWM, IWN with price flips adding to upside confirmation. A “price flip” is defined as a contra-trend move identified by a close that is higher/lower than the close four price bars earlier. There is a lot of buy Setup 9’s today too.