From the economists who brought you the smash-hit movie “Inflation is Transitory” now has made the next Summer blockbuster hit “Soft Landing.” Here’s the premise: A global pandemic never seen before causes the Fed to flood the markets with trillions in stimulus never in this magnitude.

The Fed and Jerome Powell (played by George Clooney) is deemed the hero for saving the economy, doubling the stock market, and creating untold millionaires because “stocks only go up.” There was no longer any risk buying stocks, even stocks that are structurally bankrupt become what is known as “meme stocks” and buying on margin and buying call options is taught on TikTok by seasoned traders with three months experience. Over $1 trillion of new inflows into the markets occurs in one year, a record and more than the past 20 years cumulatively. Despite a global pandemic people are printing money in front of their computers and iPhones buying stocks every day and crypto at night.

Prices on everything go up jointly due to the money that has flooded into the markets and supply chain disruptions after a difficult reopening. For the Fed and politicians, they have been assuring everyone that inflation is just transitory until they “discover” it really isn’t transitory. That’s the part in the movie with the big surprise which is just as dramatic as when Bruce Willis discovers he’s actually dead in the “Sixth Sense.” Nobody will see it coming!

Part of the backdrop is how the public was led down a path by the most trusted and America’s sweetheart grandmother economist former Fed chairperson and now Secretary of the Treasury Janet Yellen. How could you not believe everything she says? By the way, this was Betty White’s last acting role as Janet Yellen. The Oscar buzz is going to be huge.

Whew, that’s a relief only a few more months

Another $1.75 Trillion in government stimulus will drive inflation down. That’s never happened before but we probably should just trust what she says.

They are on the case.

So far nearly through the first quarter of 2022, we should remember she was confident.

Ok, I guess she’s right. Who could have seen the Omicron variant coming and spiking fuel prices? Only someone with credentials like hers.

Hope is actually a strategy! Inflation will go back down to 2% by the end of the year.

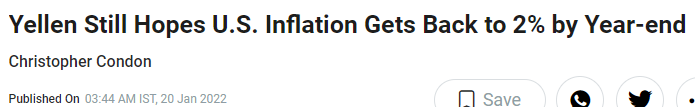

For the newly minted millennial TikTok financial influencer millionaires, the struggle is real.

President Biden (played by Robert DeNiro) last night announced his administration would go after those who are taking advantage of people who are price gouging. Let’s start here and then go after the oil companies for jacking up gas prices. It’s an outrage to fill up a G Wagon weekly for $175 (assuming full service).

In March 2022, Fed Chairman Powell was testifying in front of Congress assuring them that the Fed has a plan to slow inflation by raising rates, ending QE, and allowing balance sheet runoff. It’s called “Soft Landing” whereas the Fed attempts to raise rates just enough to cool inflation avoiding recession and keeping unemployment low. Many stuntmen were used during filming, especially during the Fed’s $9 Trillion balance sheet runoff scenes.

I don’t want to spoil the ending of “Soft Landing” because just like when in the middle of the story the Fed and Treasury Secretary discovered “transitory” was more structural, the ending is even more climatic.

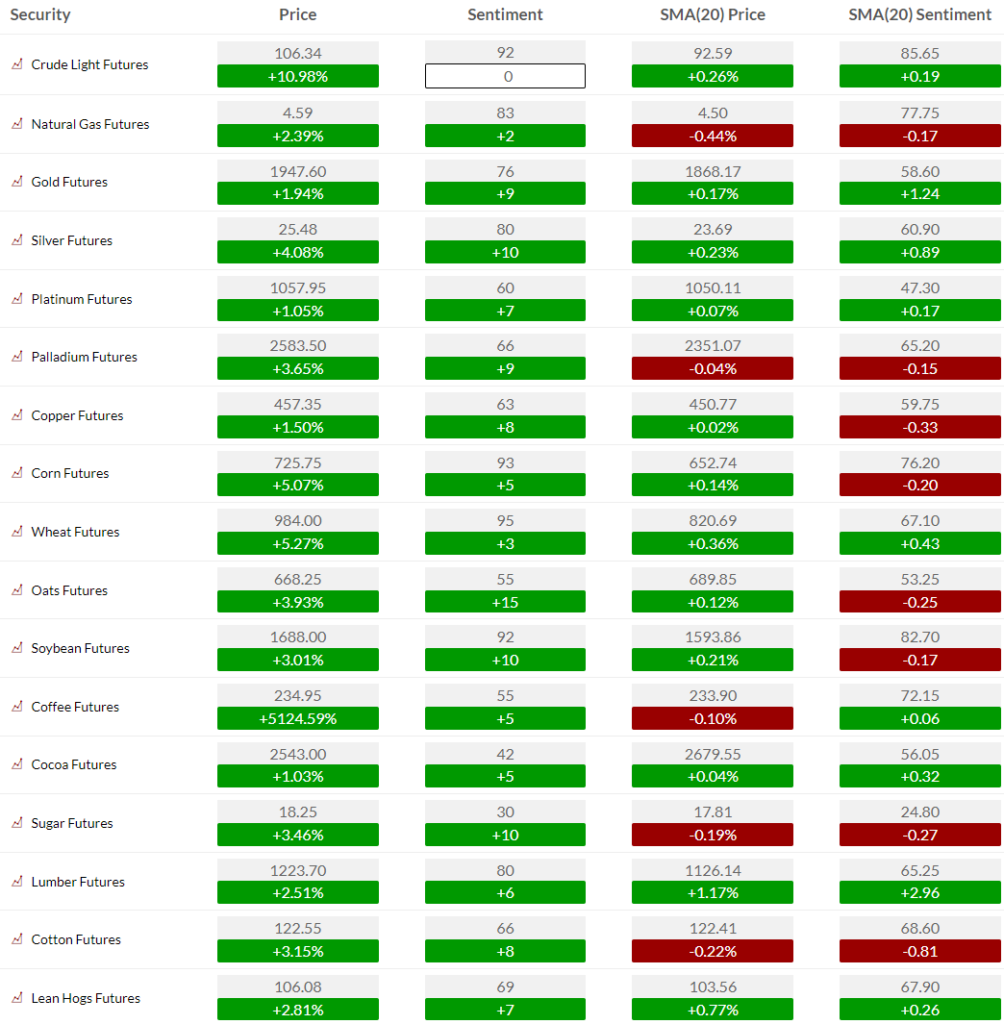

As mentioned the other day we should expect mixed headlines out of Europe with either further escalation or cease-fire to whip around the markets. Today is a “cease-fire” rally day with confirmed all the people who put the Ukraine flag on their Twitter profile picture going back to “laser eyes.” Breath is good and every sector is green. This is exactly the type of trap a negative headline will cut you off at the knees. I don’t trust the coast is clear and still, believe the bigger market issue is inflation and what the Fed will do in a few weeks. Powell set the bar at 25bps in front of Congress however the CPI inflation report is going to come in hotter than Kim Kardashian’s Centurian American Express causing risk to the Fed needing to bump it up to 50bps. Early on First Call, I mentioned how I have never seen overall commodity bullish sentiment as high as today. This is unlikely to drop dramatically overnight as inflationary prices for food and materials are getting into the economy and pricing to the consumer may stay higher longer even if there is moderation with Ukraine settling down.

TRADE IDEAS

Regarding REKR my little microcap idea that has not worked… yet the news is getting good, here is a link to White Castle as they deploy Rekor’s AI technology in their drive-throughs. Essentially Rekor’s cameras remember your license plate and your credit card and previous orders are saved thus you can pull up and ask if you want the same thing and then you drive through pick up your food without the need to pay. I expect a lot of companies to deploy Rekor’s systems as the TAM is huge for drive-through restaurants and other types of companies. FYI note the “MasterCard” in the URL. This is a big deal to see MasterCard involved.

PARA, one of my favorite long ideas continues higher and I’m glad we stayed with it after the recent drop. Way too much value here. And I am adding a 3% sized short with XOM. See below.

US MARKET SENTIMENT

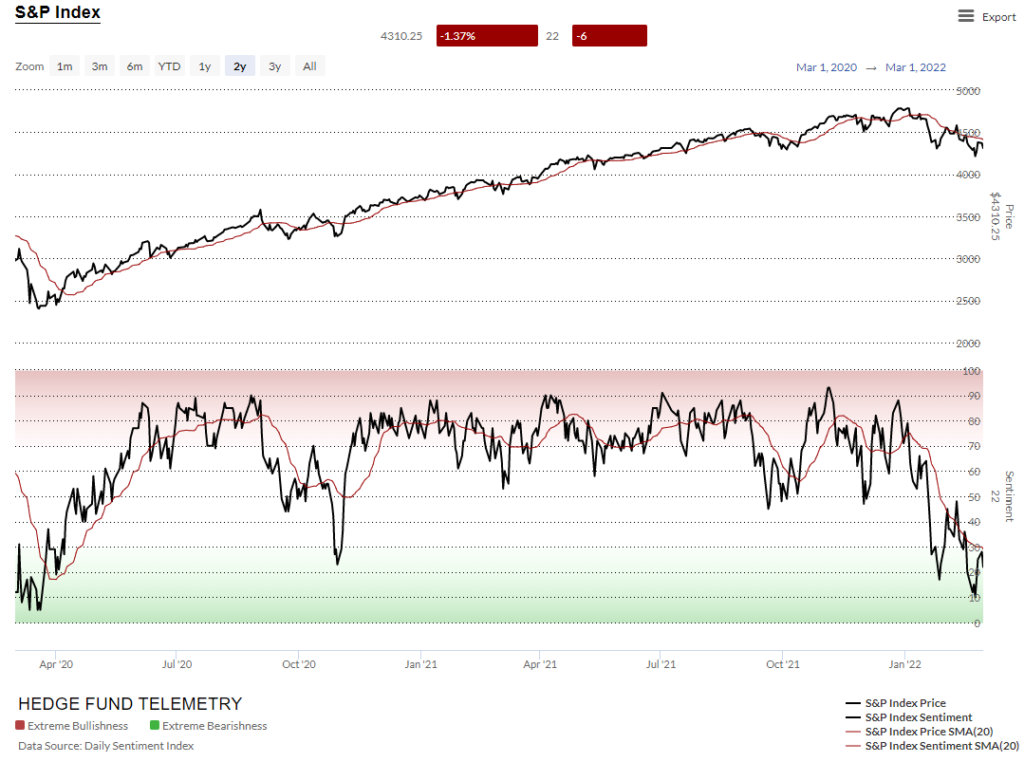

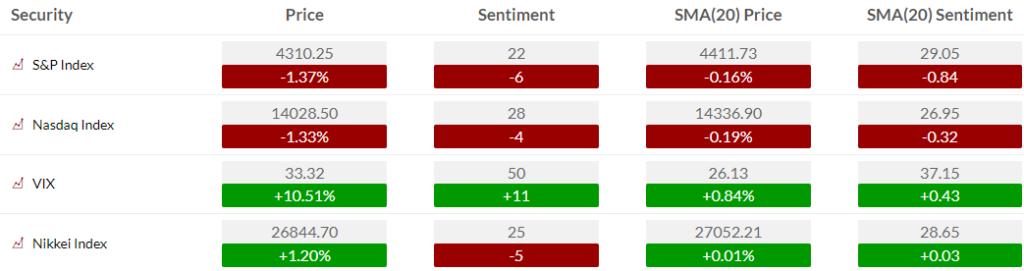

Here is a primer on how we use Daily Sentiment Index charts. S&P bullish sentiment and Nasdaq bullish sentiment dropped again and remain under pressure. It isn’t uncommon to see choppy sentiment action at lows. Sentiment

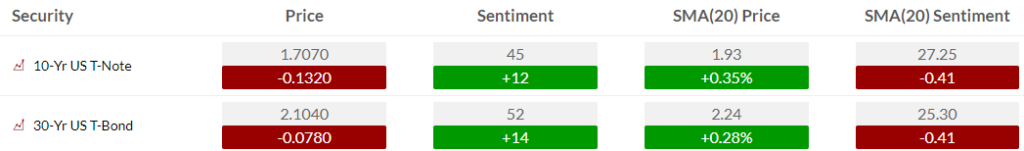

Bond bullish sentiment spiked in one of the bigger moves in a while of oversold levels

Commodity bullish sentiment

US MARKETS

Here is a primer on the basics of the DeMark Setup and Sequential indicators.

S&P futures 60 minute did qualify into upside wave 5 and has a DeMark Sequential sell Countdown 13 in play.

S&P 500 daily like the other big indexes just trying to consolidate here yet this is another lower high probably

The Nasdaq 100 futures 60 minute just grinding and chopping lacking real commitment on direction

NDX index daily

Russell 2000 IWM daily has the Sequential on day 9 of 13

Dow Jones

TODAY’S FOCUS – wti crude and Xom

WTI Crude is up huge again on the daily I’m waiting for the next DeMark Sequential sell Countdown 13. The daily and weekly RSI is extremely overbought. These high prices are really like economic cyanide as it will directly hit the consumer spending data going forward.

Weekly also has an Aggressive Sequential 13

I’m shorting a 3% sized position in XOM with the Sequential sell Countdown 13 making a lower high here

coffee update – stay short

I remain short Coffee. You can either short the futures (high caffeine voltility) or JO the ETF (decaf)

FACTORS, GOLDMAN SACHS SHORT BASKETS AND PPO MONITOR UPDATE

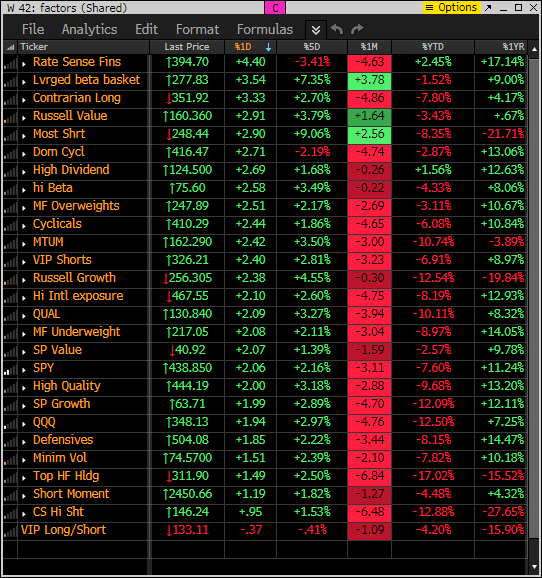

Factor monitor now has a reset YTD performance column. Factor monitor now has a reset YTD performance column. Nearly everything is down YTD. This is a real buying type of day as the most shorted baskets are up but relatively underperforming.

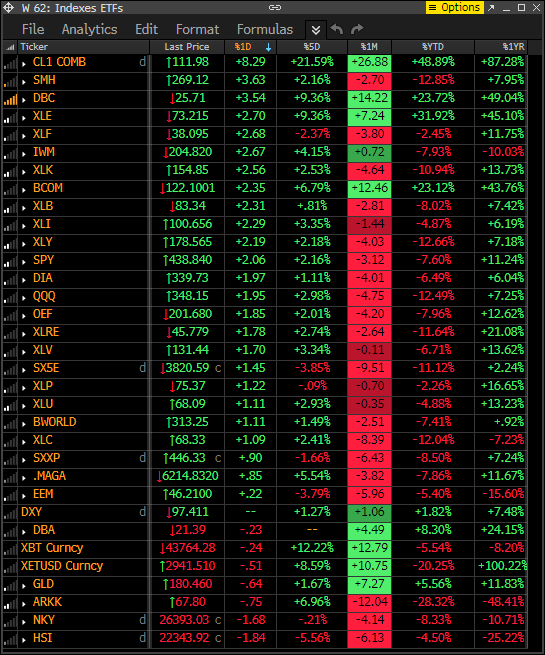

This is similar to the above monitor with various ETFs other indexes as I wanted to show the same 5 day, 1 month rolling as well the YTD and 1 year.

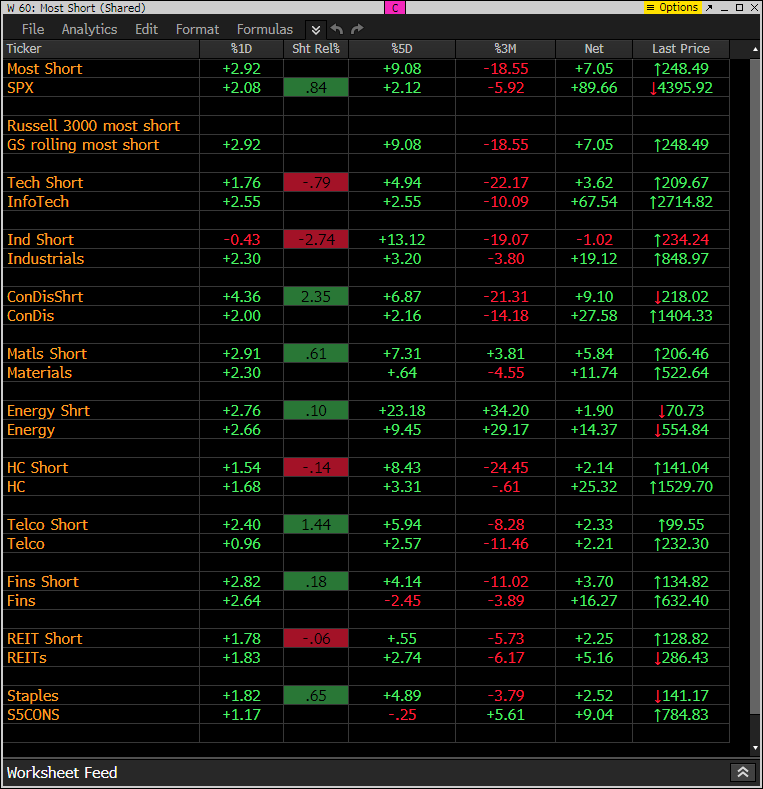

This is the monitor that has the S&P indexes and the Goldman Sachs most shorted baskets. Today the shorts are getting squeezed today although it’s real buying with the S&P indexes up strong too

The PPO monitor (percentage price oscillator) force ranks ETF’s by percentage above/below the 50 day moving average. For information on this monitor please refer to this primer. This monitor is offered to Hedge Fund Telemetry subscribers who are on Bloomberg. A bullish day ex metals and anything defensive that has been working recently

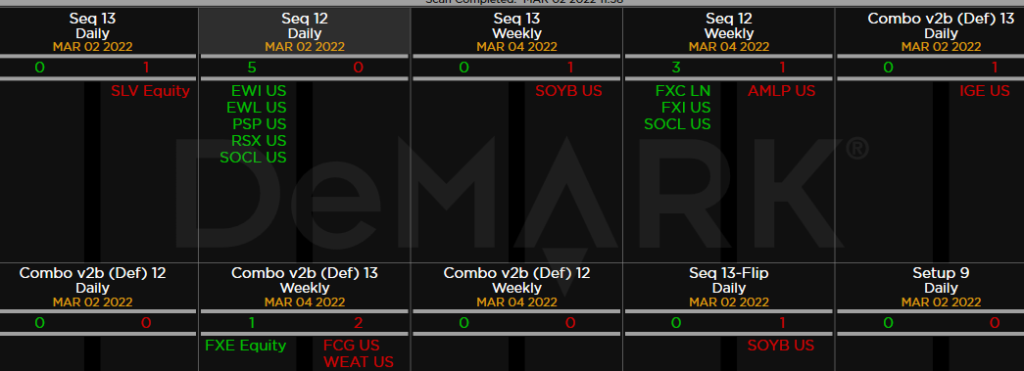

DEMARK OBSERVATIONS

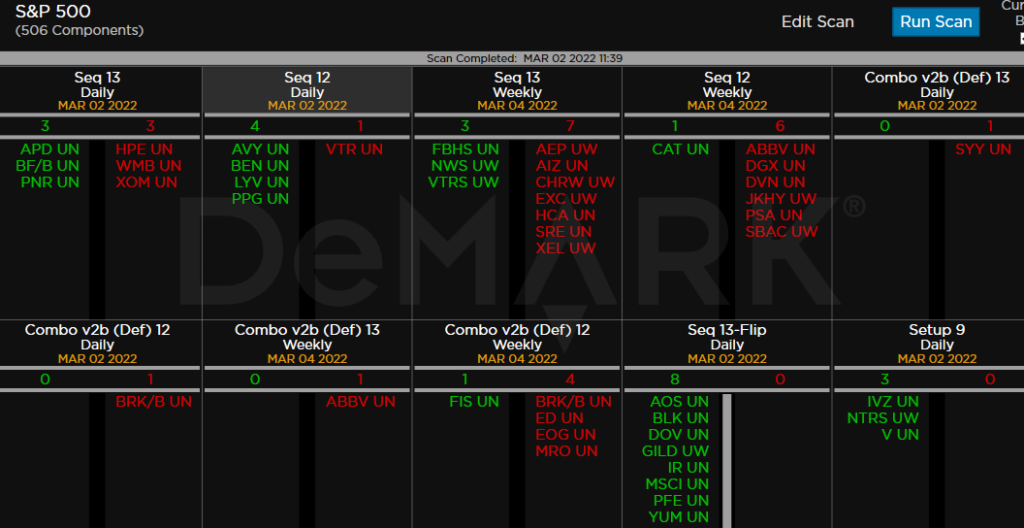

Within the S&P the DeMark Sequential and Combo Countdown 13’s and 12/13’s on daily and weekly time periods. For information on how to use the DeMark Observations please refer to this primer. Worth noting: Two-sided action with both buy and sell Countdowns. Keep an eye on the price flips in green as new buys. A “price flip” is defined as a contra-trend move identified by a close that is higher/lower than the close four price bars earlier. In order to complete Setup 9 there must be nine consecutive closes higher/lower than the close four price bars earlier. If this pattern is interrupted the Setup will cancel and disappear from the chart

ETFs among a 160+ ETF universe. Silver SLV Sell Countdown 13. Watch RSX tomorrow for a buy Countdown 13.