I kept coming across the term TLDR on social media, and I thought maybe it was the ticker symbol for Teldar Paper, the fictional stock from the movie Wall Street. I associated myself greatly with Bud Fox, the bright, hard-working kid from Queens, that goes astray under the tutelage of Gordon Gekko. It is easy to cross lines, and I worked with and for some people who pushed much further into that than I ever could. The saga of Bud Fox was always in my mind and remained a cautionary tale. The recent “slap heard around the world” at the Oscars reminded me of when Michael Douglas took a swipe at a wired Bud in Central Park. I think a lot of market participants felt like Bud did last week, particularly if not in tune with TT’s calls!

Anyhow, I have seen that movie like 100 times. The first is when I had just graduated college and was in the credit training program at Manufacturers Hanover Trust (aka Manny Hanny), where classmates were wearing suspenders and bright yellow ties to accessorize their Brooks Brothers suits. It was a very respectable program. I spent a year or so after the program doing audits as I was in commercial finance, which lent against inventory and receivables. I did an audit at Willougby’s, the now-defunct photography chain, which was stultifying. It wasn’t until I did an audit counting inventory at the South Brooklyn Casket Company that I said, “enough.” I found a job doing foreign exchange trading. I sometimes think about how my career would have evolved had I stayed at Manny Hanny, but I was impatient, and I wanted something on a trading floor, where the banter was like being in a locker room or on a team bus.

Anyhow, TLDR, I found out, means “Too Long, Didn’t Read.” So, with that in mind – I thought I would make the piece a bit punchier/shorter.

Things that caught my attention this past week:

The Rally:

I mentioned a few weeks back about large-scale portfolio quarterly rebalancing, which may have been playing a part, but I think this quick blurb from GS trading desk tells the story well.

1. Liquidity as measured by S&P’s top of book depth and bid/ask spread is currently in the bottom 5th percentile on a 5-year look back.

2. The absence of hedge fund / long-only community’s trading activity (due to total lack of conviction) means systematic (buying), retail (buying), corporate (buying), and Equity Capital Market (not selling/issuance) dynamics are currently having an outsized impact on price action at the greater index level (making this an incredibly difficult tape to read/trade).

3. The move higher last week appears to be frustrating investors even more than the prior week’s did

Putting aside the after-the-fact commentary, here is a table of some of the biggest winners from the past 2-week rally.

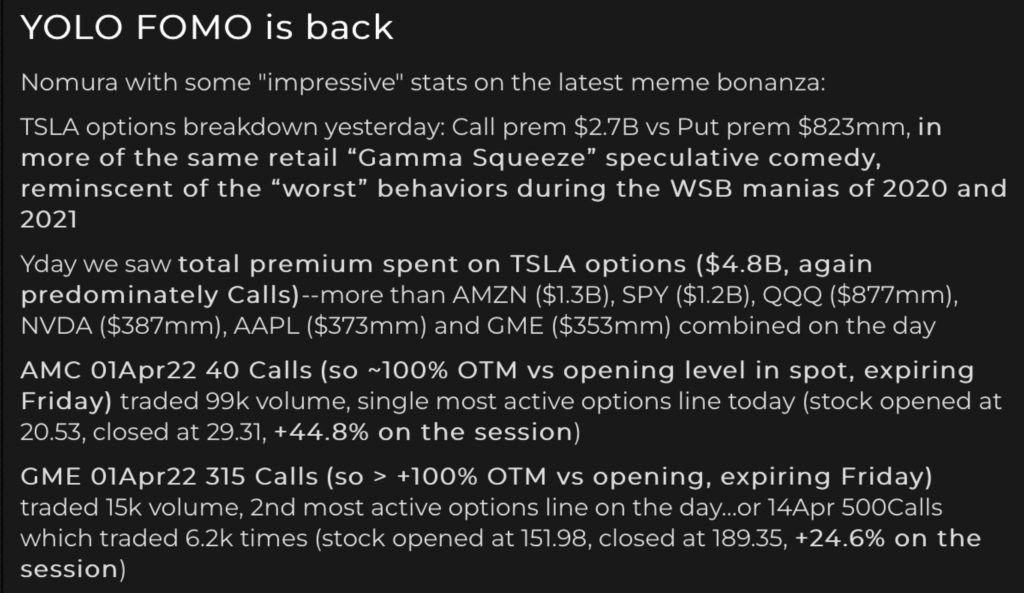

Never mind the rally in rates as the 10yr trades @ 2.40 (up 80bps or 50%) which should impact longer duration plays (and some with weaker balance sheets), the APES are running the show. Enough said.

The thing to always keep in mind is that price can drive narratives, and narratives can stick around until actual information disproves it. This morning, I was reading Adam Jonas piece where he cannot explain the Tesla price action after the possible future stock split and posits that there must be some greater, more fundamental reason for the move, such as access to materials and supply chains. But, the story is meme call option buying.

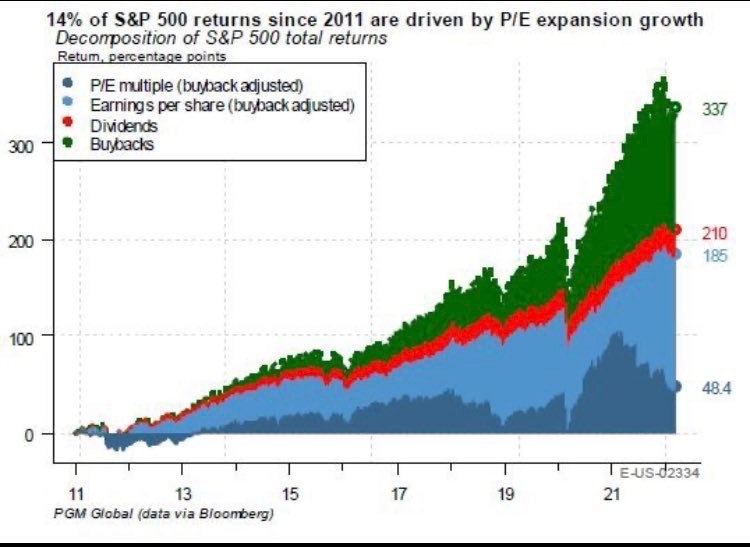

On point 2 above, the strength of buybacks continues to be robust. I have shown chart after chart on that. Capital return in the form of buybacks is what happens when firms are performing well (margins, cash generation in excess of maintenance/growth requirements, EPS and compensation management, etc). Of course, this is a political football, but it has been a constant source of buying/demand. Here is a good chart from @MacroAlf on buybacks relative to other forms of equity returns since 2011.

The Flows:

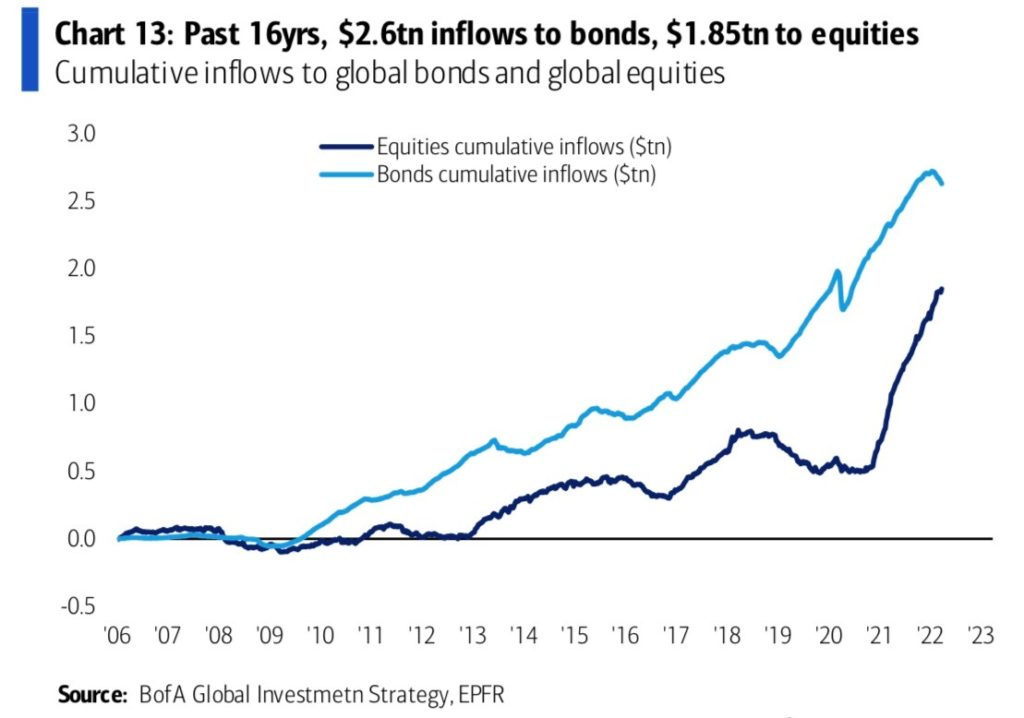

Not much to speak of, but bond outflows (largely credit) and commodity inflows continue.

Here is a good chart of flows since the GFC:

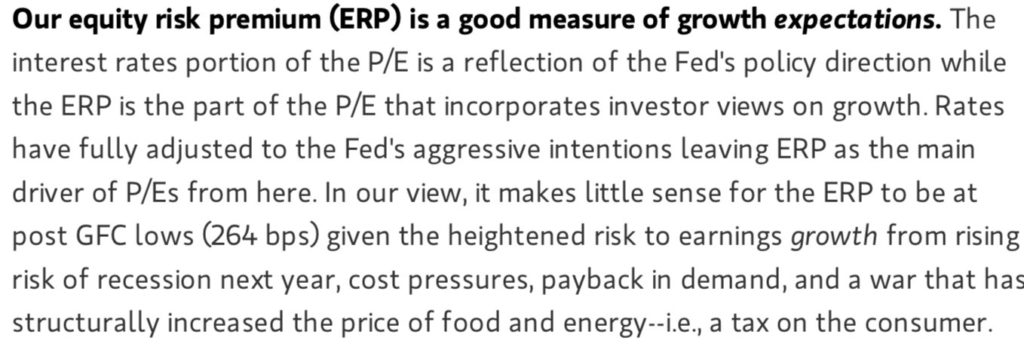

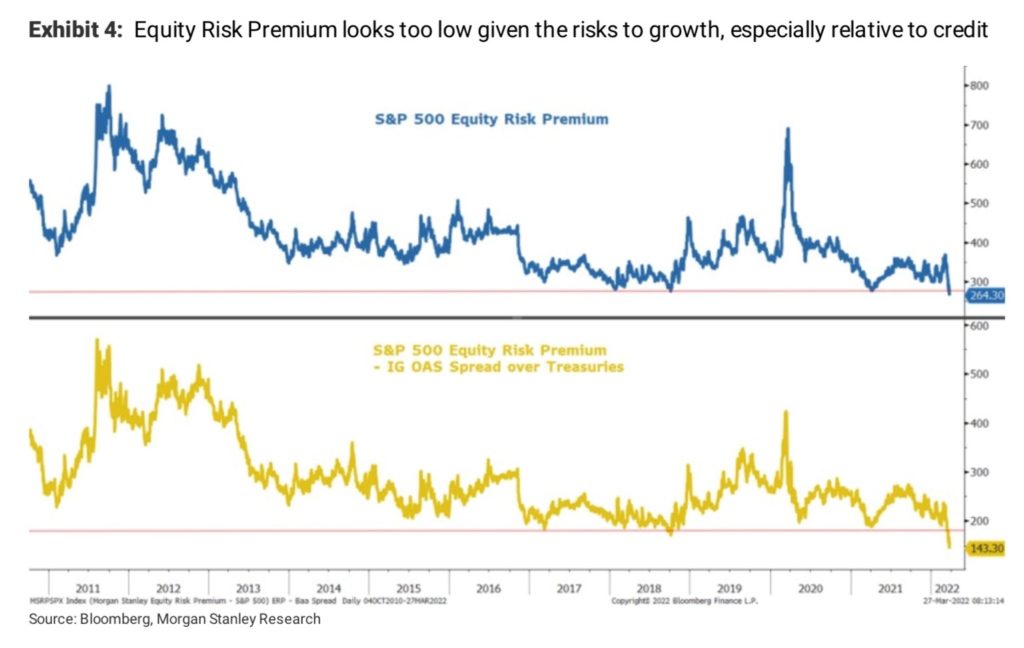

Equity Risk Premium (ERP):

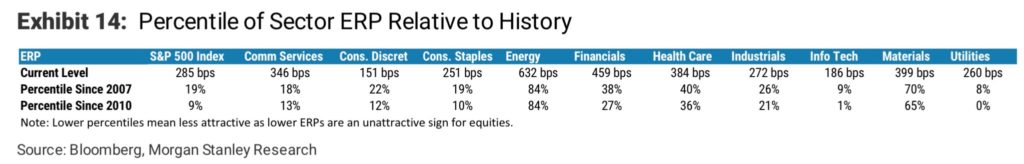

Sometimes it pays to take a step back and revisit basic principles. Buying equities is the most junior claim on the cash flows an investor can have. As such, they are riskier, and should have a premium relative to less risky parts of the capital structure, and also risk-free rates. The ERP is one measure that tries to determine whether equity investors are being adequately paid for the risks they are bearing, and recently, they have re-visited post-GFC lows.

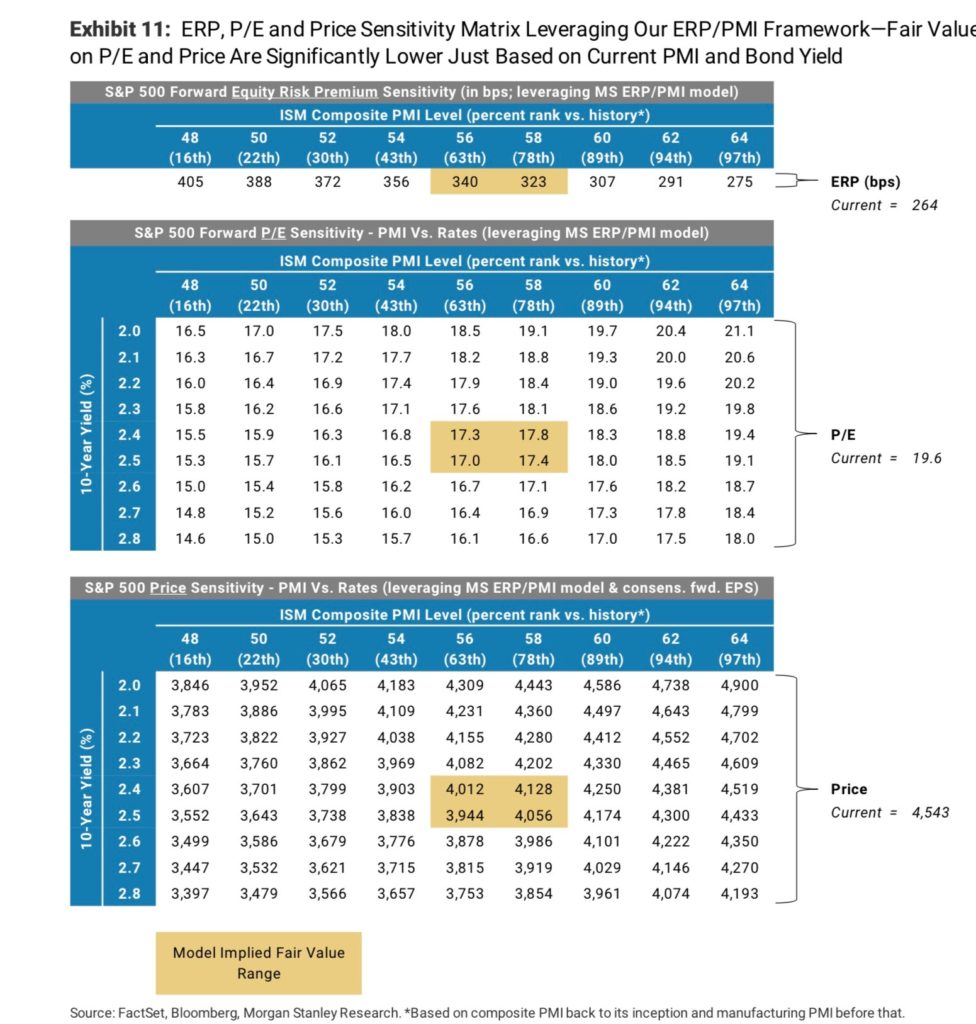

According to Mike Wilson, at Morgan Stanley, the answer to that is no.

Note the sectors below that are inexpensive territory (Cons Discretionary and Info Tech).

Another way to see how the equity market may be disconnected from other risky assets is to look at how it is trading versus other parts of the capital structure (similar to the bit above vs OAS). Here is a chart of SPX vs BGB, which is Blackstone’s Strategic Credit Fund, a portfolio of loans and other fixed-income instruments of predominantly US Corporate Issuers, including first and second lien loans (senior secured) and high yield bonds. There are obvious differences, but the directionality should be similar over time.

Rates and the Yield Curve:

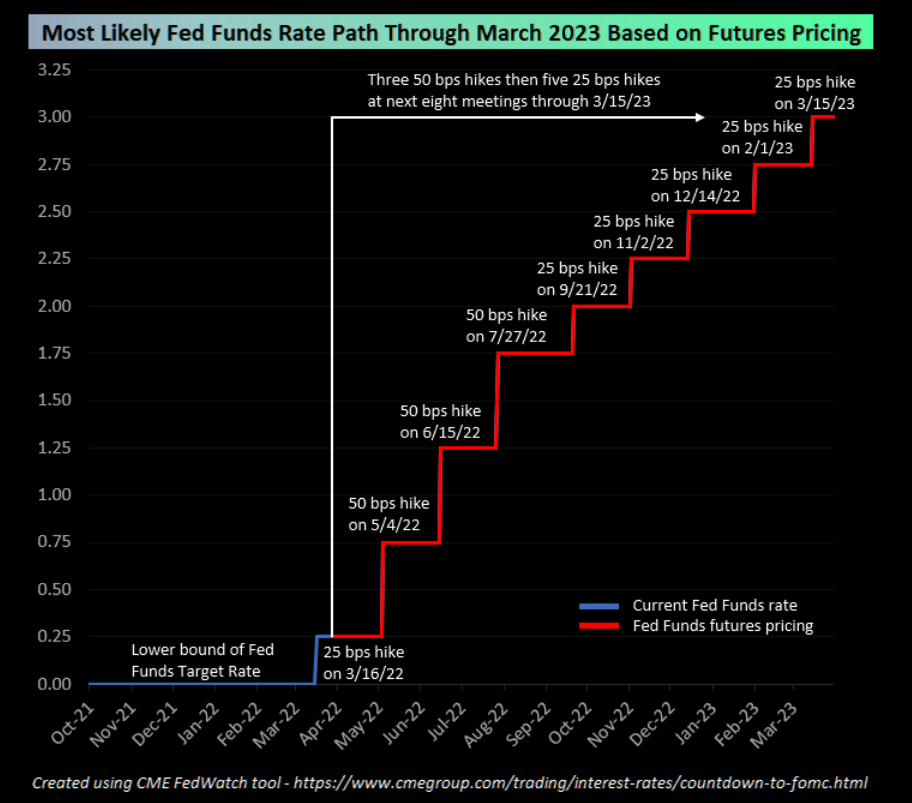

I have written quite a bit on this prior, but to Wilson’s point above, the market does appear to be taking rate hikes in stride, for now. Current FF pricing is assuming 3 50BPS hikes and a terminal rate of 3%. That’s some decent tightening, not to mention an expected $1T of annual QT for the next 3 years.

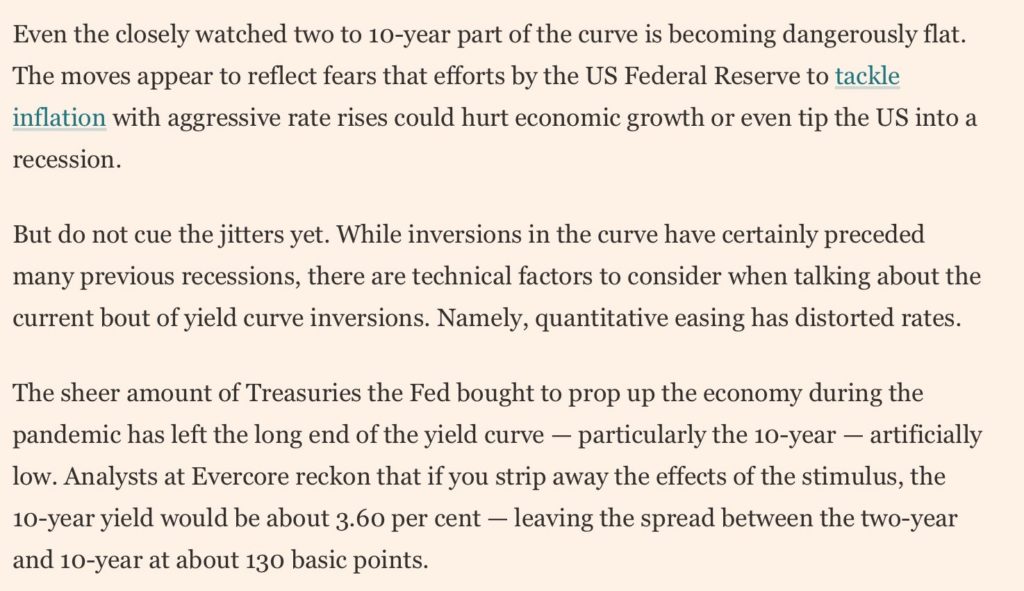

I have also written about the yield curves and what they may or may not be saying, or which ones to focus on. There have been countless articles and commentary about yield curves recently now that certain parts of the curve are inverting, so I don’t want to add to that, although this is a good piece on it. I have also included a reference to a 2019 Fama and French research piece on the yield curve inversions as an investment strategy.

The bottom line is, yield curves tell us a bit about incentives for credit creation by banks and investor expectations for rate paths, and flattening may suggest some growth slowdown/recessionary risk out in the future, so worth keeping on the radar. But, we also live in a world of QE and YCC, so longer-dated maturities may distort expectations. Here is the blurb from the FT worth highlighting:

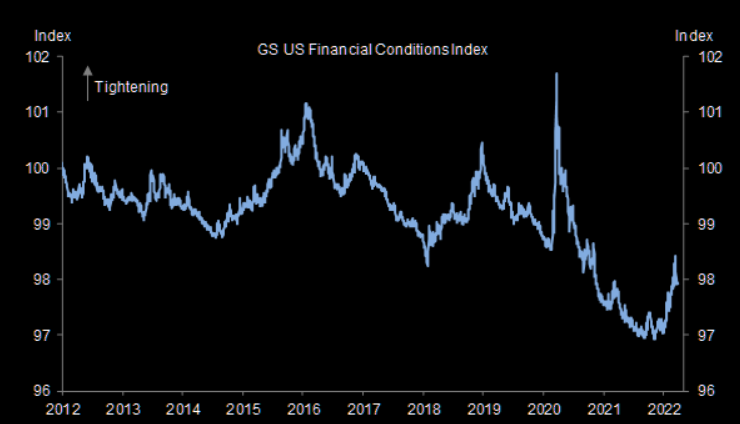

All that said, the market is clearly on the same page as the Fed as to the path of rates. But, it is not really on the same path as relates to financial conditions, which are still pretty easy.

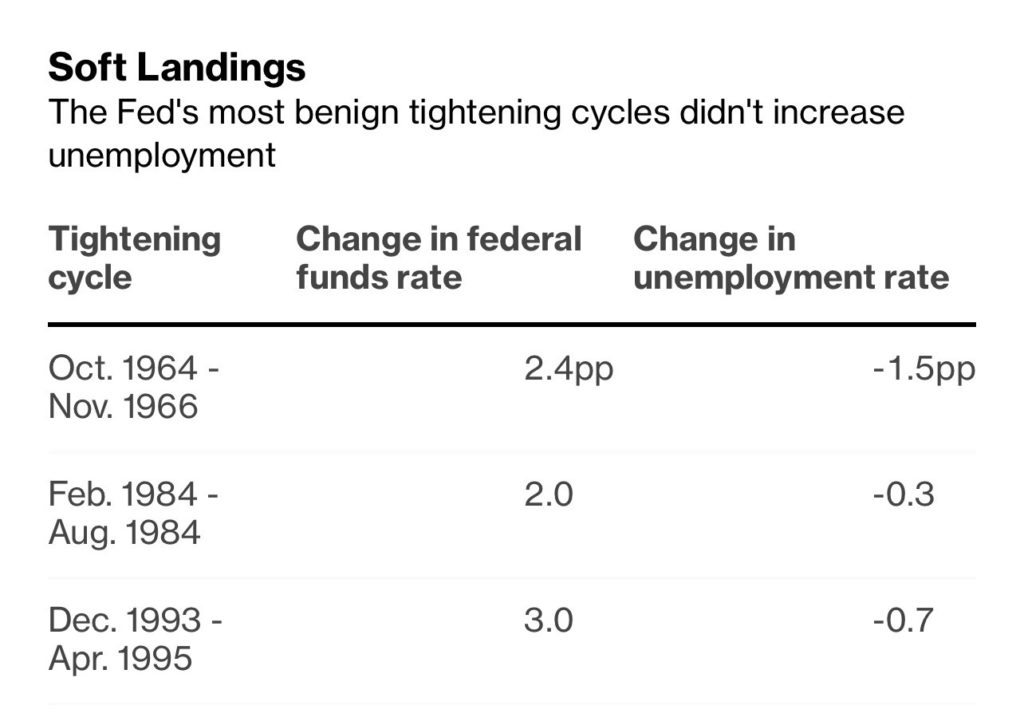

On the matter of whether the Fed can engineer a soft landing – something I wrote about prior to referencing a new book by Alan Blinder – Bill Dudley thinks that the ship has sailed, suggesting the Fed has made a recession inevitable. Notice Dudley’s reference to AIT, the policy that I have railed on just about every week since I have been writing for HFT. One important point he makes is that in previous soft landings, unemployment moved lower, wherein in this one, he expects, given the labor market tightness, for unemployment to eventually move higher.

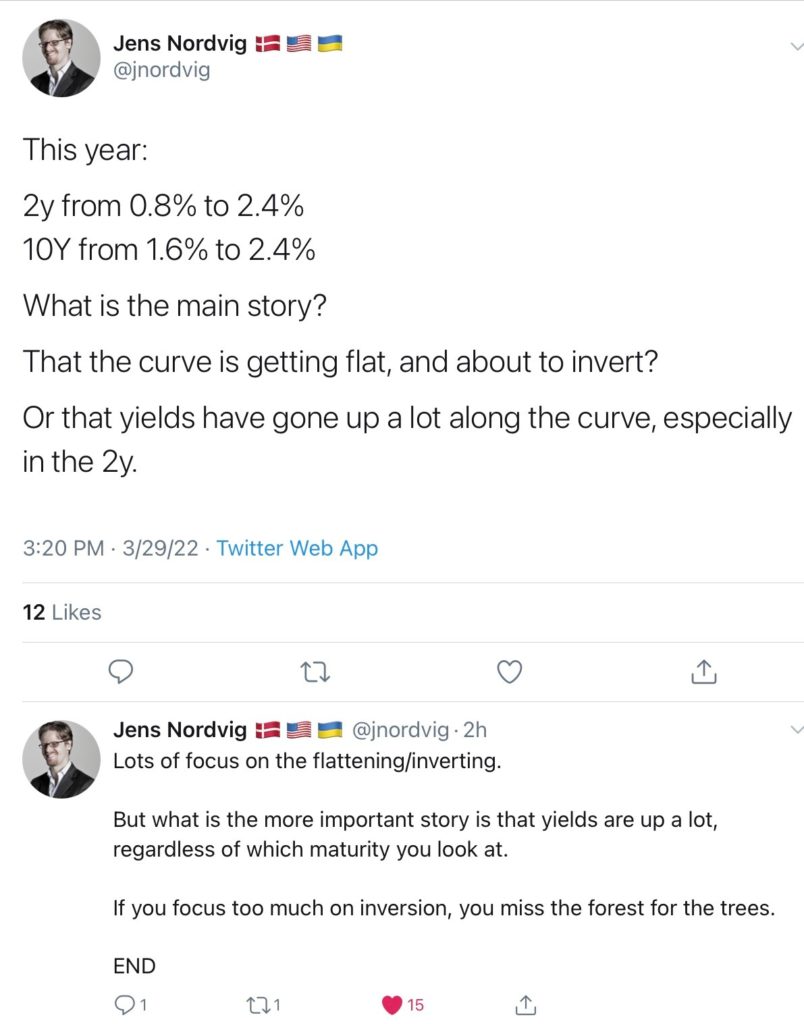

And lastly, my good friend Jens Nordvig at Ex Ante had this Twitter comment that all of this inversion this and that seems to forget:

Other Tidbits:

Earnings Season

As we are set to embark on another earnings season, note that SPX500 estimates have not moved up or down much recently and stabilized around $52.

Real Estate:

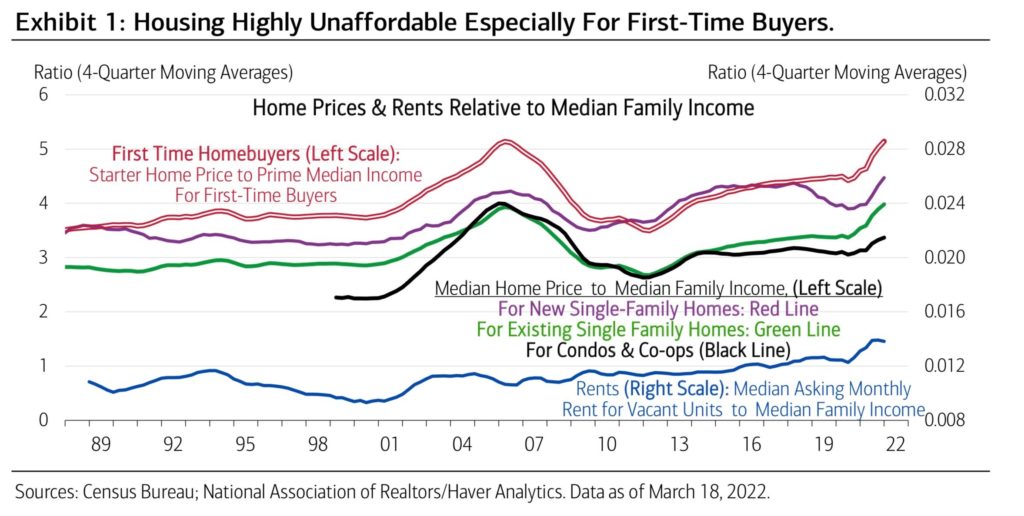

More food for thought and a good chart about how real estate prices may be in for a bit of a correction, slowdown, and likely part of the Fed’s desire to tighten conditions, given the role housing plays in the economy. Perhaps a part of the problem is the new entrants into the market (financial investors, WFH buyers). But nevertheless, between the cost of education, student debt, rent/mortgage, broader inflation, newer cohorts are facing some challenges.

FX and the $

The story in currencies in the past week has been the JPY weakness given the relative actions of the BOJ (continued Yield Curve Control) and relative to the Fed. I highly doubt the Treasury cares about this for many reasons, including the strategic importance of Japan for keeping China and North Korea in check, because $ strength given the sanctions taken against Russia and concerns over loss of $ hegemony, is not a bad thing. Not to mention the Fed’s goal of tightening financial conditions.

I was going to include a great piece by Joe Politano from Apricitas blog that pretty much restates my earlier arguments that $ hegemony is not going anywhere, and in fact may be strengthening. But, this piece by Adam Tooze (Columbia economic historian) includes that piece and other points. And, this is another good piece that makes similar points but also takes a bat to some widely discussed narratives.

WTF of the Week:

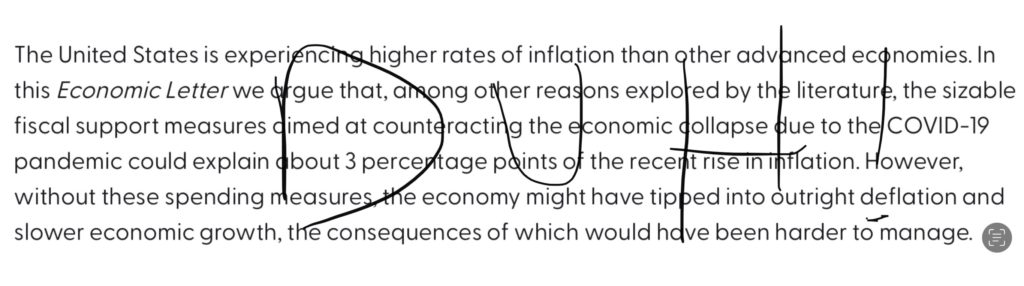

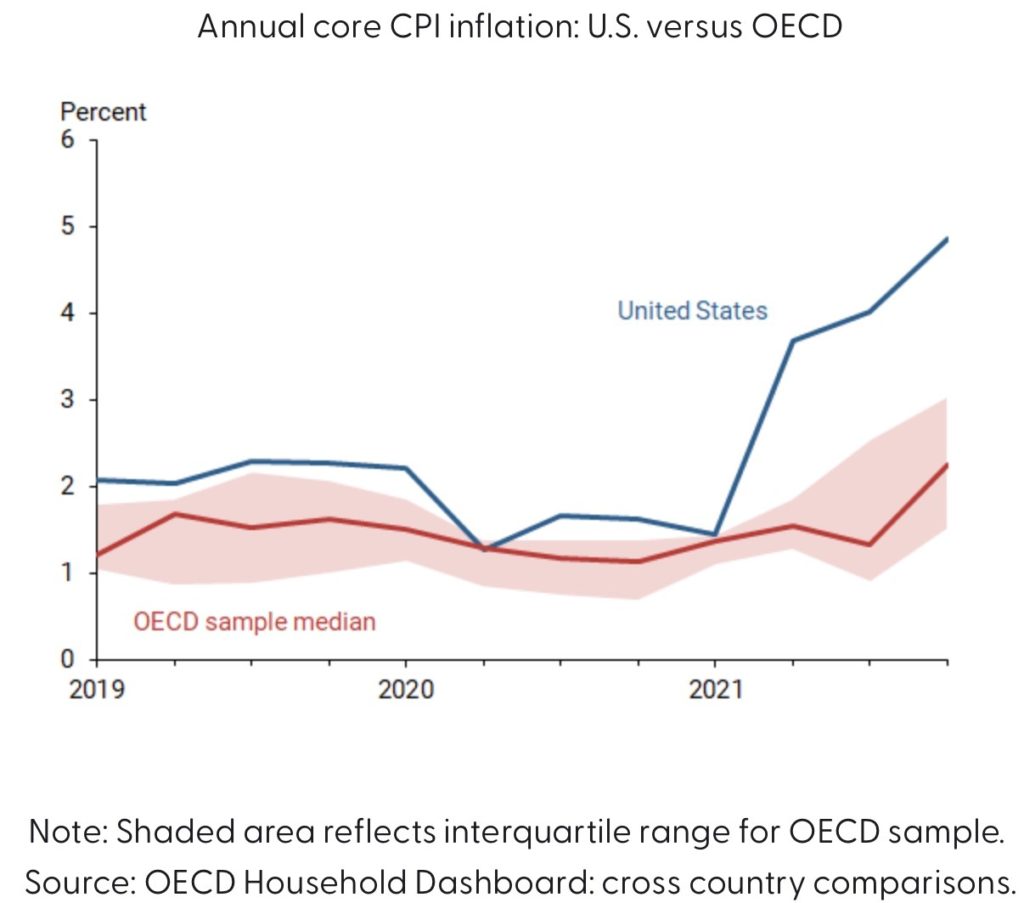

I try to read as much research as I can throughout each week, but this piece by the SF Fed about why inflation is higher in the US vs elsewhere brings to mind the old joke about how many lawyers it takes to screw in a lightbulb. I mean, seriously?

This reminds me of the debates during the Bernanke Fed about initial QE that many felt was not wise, largely because a. It would be difficult to unwind and b. because it would give a false sense of ongoing support and create all sorts of “allocative” distortions (ie. Inequality). Yes, at that point, they were the only game in town given what happened during Obama’s first midterms, but they crossed the Rubicon.

Anyhow, keep in mind this chart when we hear politicians talking about supply chains because that’s a global problem.

Chart of the Week:

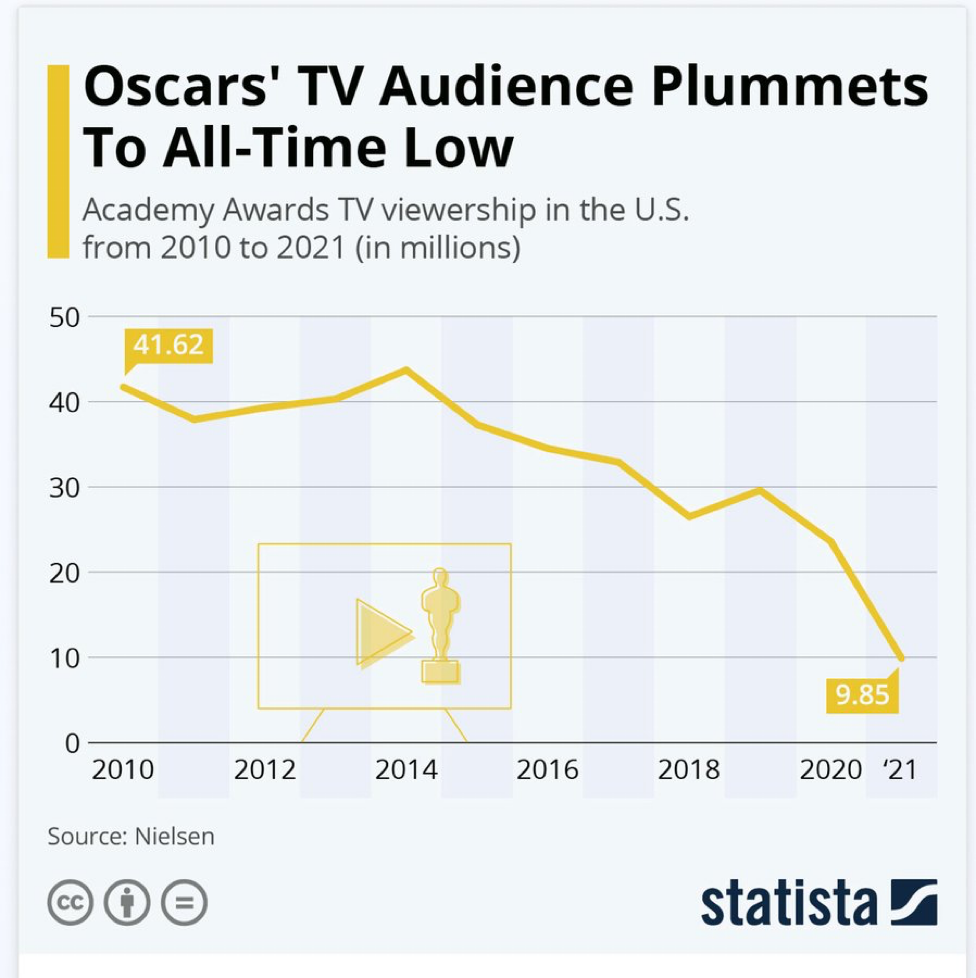

Maybe the AMC call buyers should take a gander at this chart!

This does give rise to the question of whether the “slap” was staged. All I can say about any of this is that too many award shows are about political statements. On some level, all of that is fine, because Americans internalize important facts differently based on what they read and watch and movie-making has always tried to make social/cultural statements. It is just there is no place to hide, too many are banging on about the same themes. Additionally, these people live extraordinarily charmed lives, and the public is perhaps a bit turned off by award shows where participants get $130K worth of gifts and tell the public what they should think.