Every writer has a process, even financial writers. For me, everything begins with what is moving, where the money is flowing, which client segment appears to be most active, common narratives, potential changes in policy, political winds that could impact or hamstring sound policy or the functioning of markets, and some other issues that are always lurking or under the surface but for whatever reason, are not currently in focus. I also like to keep in mind a generalized notion of growth, earnings, inflation, rates trajectories, and whether positioning and sentiment are perhaps too extreme relative to expectations.

Within that, one needs to keep in mind that the vast bulk of money is allocated and left alone, and there around sound reasons for that, which I have discussed a number of times in the past. Not that there are some environments where passive is better than active and vice versa or when getting ahead of tectonic shifts makes sense, but by and large, it helps to appreciate noise from the signal. In the past few weeks, I have tried to characterize the market as very noisy, driven by short-covering, short gamma, call options buying, weaker/meme names lagging, buyback flows, and lack of ECM-related selling. All things of course matter, to some extent, but they are noisy and not always reflective of true themes and trends. I included in a note last month about quarterly rebalancing flows, and I mentioned that to a large asset manager friend and wondered if had heard anything like that, and his response was: “I don’t know, I don’t pay attention to that stuff.” He is a large-cap growth manager, trying to find good companies that he can invest in for years. The point is, participating in the market means you have to understand who is playing, what makes them act, as well as the fundamental underpinnings of the system architecture.

Now, If you come from the side of the business that requires volume/churn or you have an extraordinary and sustainable edge in active investing and exploiting very short-term risk premium extraction, you might say the more active the better. In the book about Rennaissance’s James Simons called, “The Man Who Solved the Market” we get some insight into the models they run. It almost seems like what you see watching a poker tournament on TV where each player knows the odds of winning instinctively or an expert card counter playing blackjack, where each market price movement across an array of markets and other sources of potential market driving information to collide to generate odds of winning and losing by entering trade x or y. Or maybe, you just appreciate that there is a very sophisticated game being played by super-smart insiders, and you try to play the game a different way. Sometimes the talking heads at CNBC or wherever are onto something, but these days, getting truly unique and actionable insight is harder. Buffet says that investing does not require us to swing at pitches that are not in our wheelhouse.

And, I see that approach on golf courses all the time, particularly down here in Florida. Yesterday, I played with guys ranging from my age to over 80 in a sub 14 handicap weekly game. The best player in our group – certainly not me – was a great ball striker. He took risks (some worked, some didn’t) and he put poorly (and gave himself some putts liberally). Our oldest player, at one time the club champion, was steady Eddie. Short drives, approach rarely on the green but chipped and put like a pro. The point is, to know yourself, what works for you, and how to manage yourself to meet your objectives, which should be well understood and reasonable.

One of the reasons I rail on bubbly markets or am on the lookout for potential causes of a crisis is because unlike a recreational golfer who has a bad round, poor economic and money management has a real impact on real lives. Plus, there is always some very easy-to-spot baloney going on that feels “pump and dumpy” to me. It reminds me of the being at Moore Capital, and in the middle of the financial crisis, you would literally see sell-side research trying to entice investors into buying all sorts of crisis-related assets and securities, knowing full well they were just trying to unload their inventory. All of that made me very aware of the game that is played, what can drive excesses, and how collective excesses can turn into a crisis, with the most unsuspecting left-holding bags of poop. But, mostly, it makes me pretty cynical about people who are (over) selling stuff. Partially because I have cleaned up my fair share of derivatives portfolios that got dumped on unsuspecting portfolio managers who did not quite understand the mechanics of how things really worked.

Things like FOMO, YOLO, TINA, and “TTID – this time is different” tend to resurface during bubbles when everybody suspends common sense or thinks they will be able to get out before the crap hits the fan. Eventually, and in hindsight, we learn that maybe it was not such a great idea to go for an elevated green from 220 yards, with a downhill lie, over water, with a 15 mile an hour wind in your face. There are times to play it smart – to be like steady Eddie! Sure, you may not perform at par, but you won’t blow up. But, then again, if Jean Van De Velde in 1999 had just played it intelligently versus rolling up his pants and trying to play from the water, he would be remembered as a (British) Open Champion, and not the real-life version of Tin Cup!

Things that caught my attention this week:

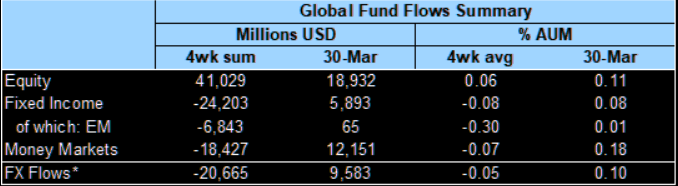

The Flows:

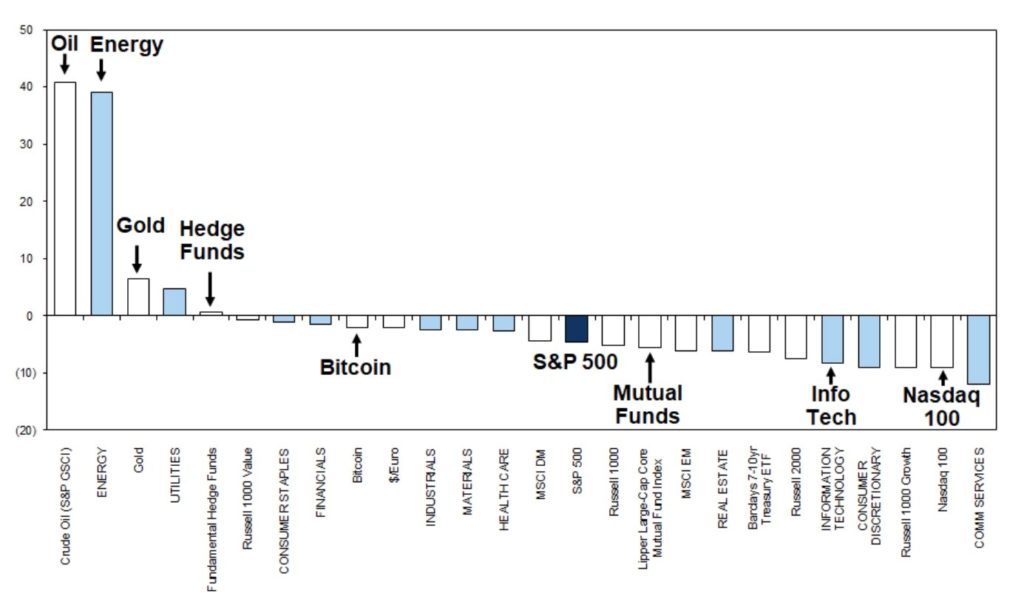

My son is 25, he got a bonus recently, and he has some savings. Of course, he is going to put money to work. The economy is doing fine if perhaps slowing down and facing some headwinds, but people have jobs, companies make profits, and excess cash flow over requirements gets put to work. Whether they are putting them in the exact right spots given how assets move over the foreseeable future is not the point. Sure, much has been said about buying commodities for inflation-proof portfolios, and these assets have done quite well. But, for long-term investors, the story is to just put money to work in reasonably priced assets. There may not be as many reasonably priced assets as the constant flow being put to work right now would imply, and one could make the argument this is creating a late-cycle trap warranting defensiveness and caution. I am in that camp.

For the past 4 weeks:

For the week ended March 31;

What’s been working and not working YTD:

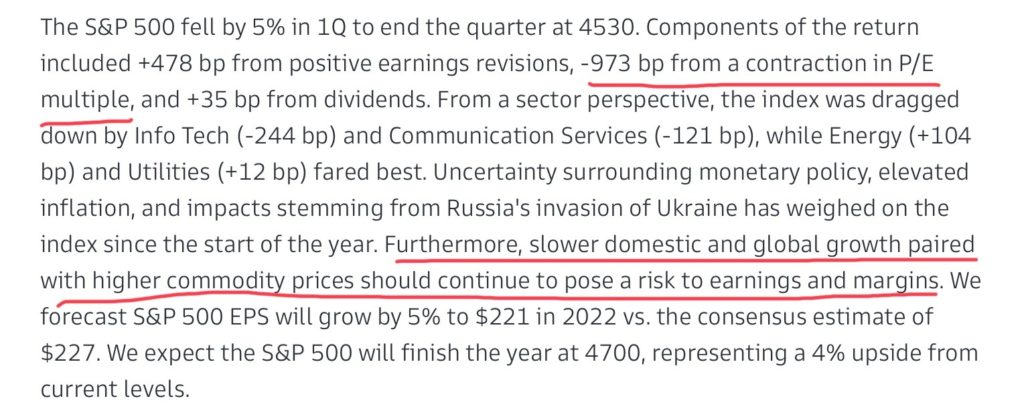

As GS pointed in their quarterly review:

I think it is plausible that they are right about the end of the year, and just about every firm – except Morgan Stanley (see below) who continues to be cautious suggesting recent moves are typical bear market rally variety – is calling for higher index levels by year-end. Of course, one has to reconcile that with everybody’s hair on fire about yield curve inversions.

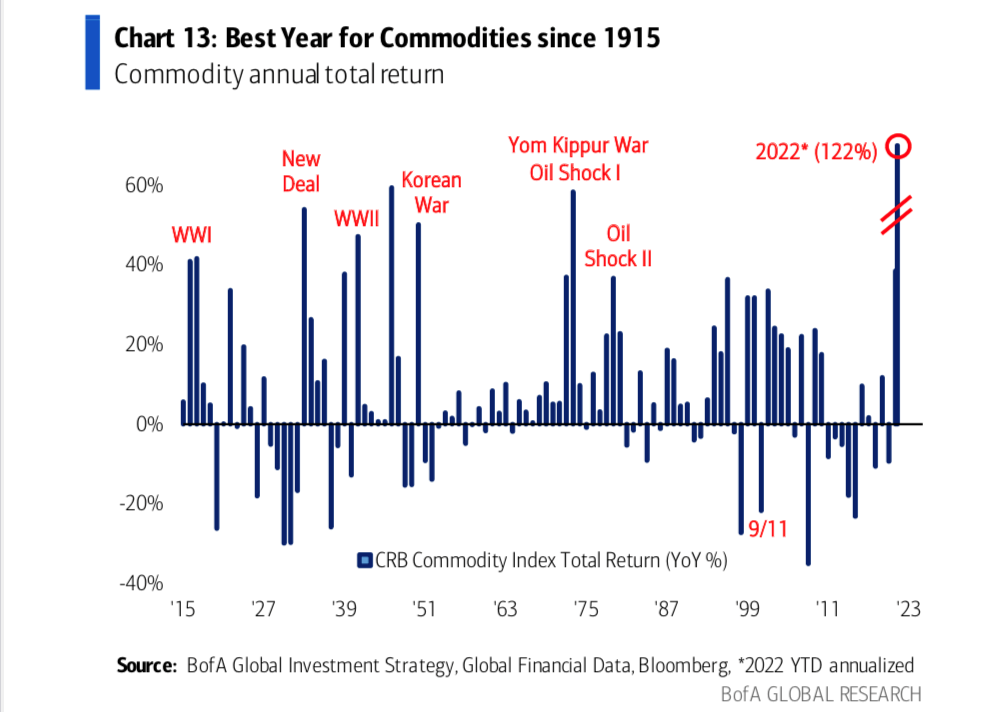

Anyhow, the place to be this year has been in commodities – plain and simple.

Housing Markets:

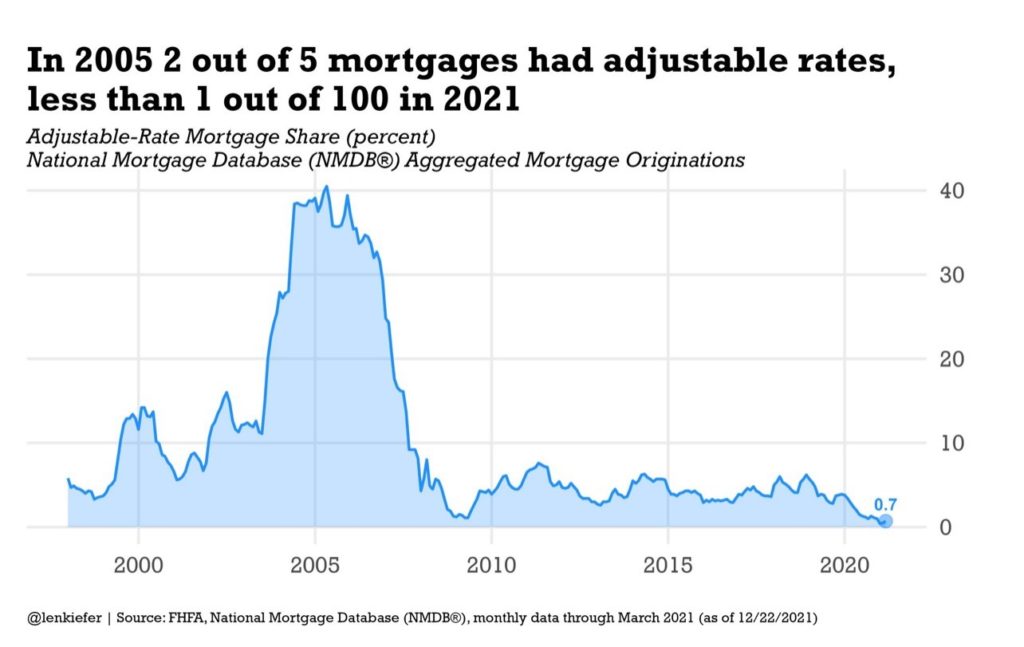

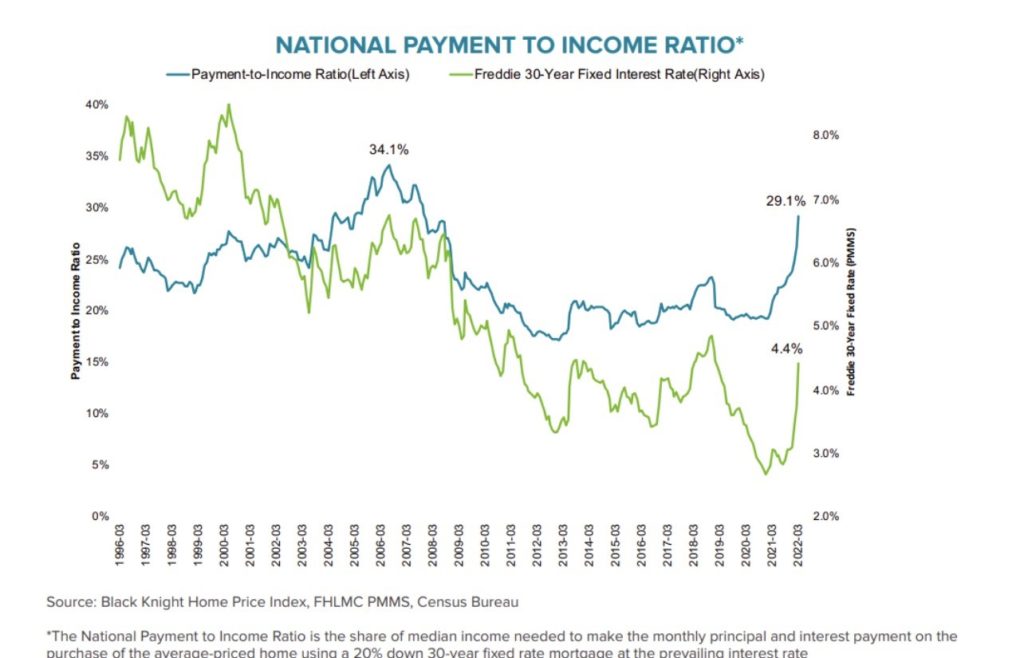

Residential housing markets have continued their upward march, and this is in spite of some of the moves in mortgage rates. Unlike the period before the GFC, the issue is more about affordability, than it is of whether rate hikes will cause a delinquency spiral because of over-extended borrowers and teaser rate mortgages repricing. As the chart below highlights, much smaller percentages have adjustable rates amidst tighter mortgage requirements generally.

In the past year, I have engaged in three real estate transactions. I sold one property in CT and bought one in CT and one in Florida. I am no real estate expert, but I do keep an eye on this stuff since I have these properties, and brokers from both locations suggest those markets are still pretty hot. In CT, the drivers are somewhat similar to what we saw during the pandemic and the WFH movement. Additionally, I am hearing that buyers just want out of NYC given concerns over crime, safety, and schooling. In Florida, there are some of these concerns, as well as the early retirement wave, shifting some financial assets into real assets, and inflow from California due to tax considerations.

I suspect NYC and even some parts of Florida may get impacted by sanctions on Russian oligarchs. Listening to a podcast with Bill Browder (who wrote Red Notice and is pretty insightful about Putin/Oligarchs/Money Laundering), he remarked that one reason sanctions are not biting as hard as they could is that so many have turned a blind eye to the source of funds in the west – ie. carefully crafted money laundering. Browder claims it is more a London issue (due to their budget/legal structure – some call it Londongrad – see 60 minutes piece on that ), but his remedy would be to close all western gateways and go after enablers (lawyers, accountants, etc). Such could put a crimp on some pricier real estate.

That being said, and personal anecdotes aside here is a decent article on some of the what is driving real estate. And, although firms like Zillow are no longer in the game, there are still many new investor cohorts like OpenDoor in real estate that are providing a floor to housing markets.

The net result of all of this is that home affordability is declining. Some of this is a low supply factor (see above and note inversion of Y-axis) aided by the GFC, some of this is demand factors noted above, and some of this is financing factors getting a bit tighter.

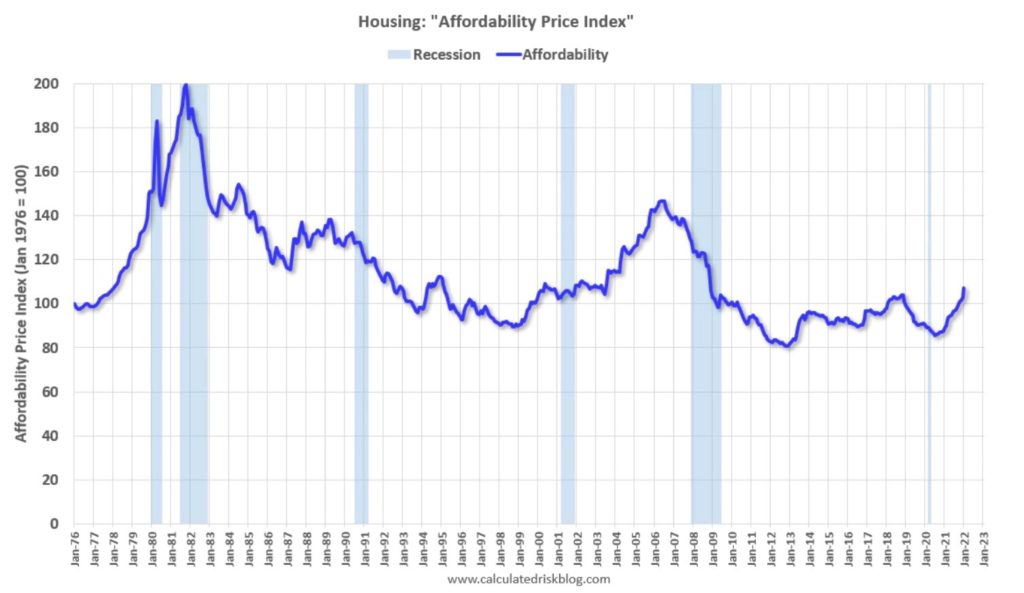

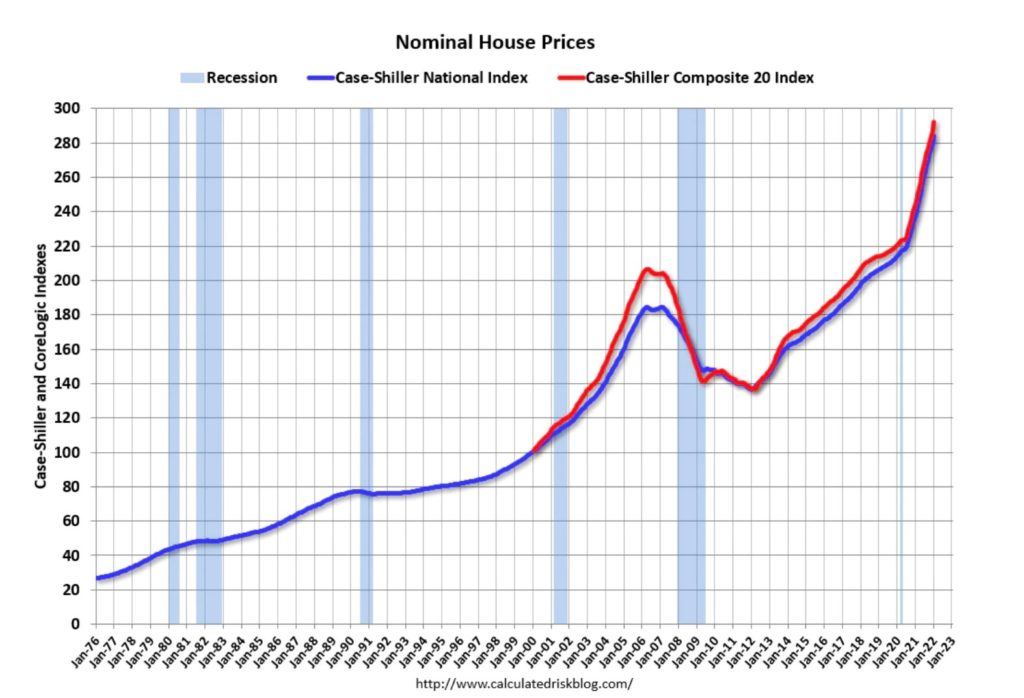

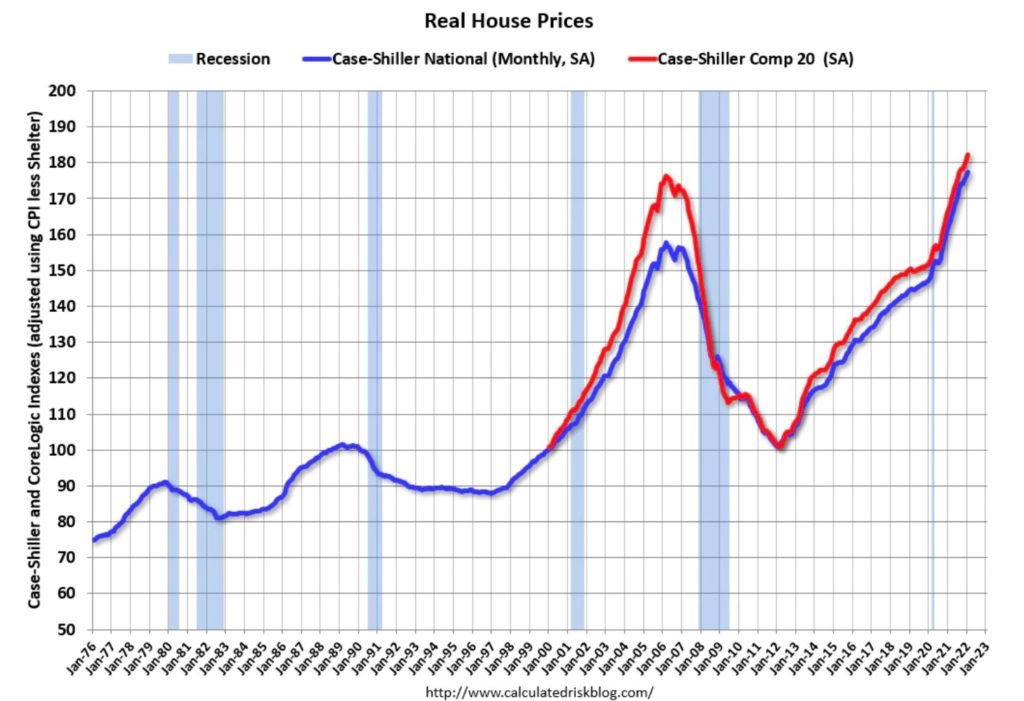

The following charts come from CalculatedRiskblog.com, and they have a very good Substack worth subscribing to. Note that while affordability is the highest since the GFC (lower is more affordable), and mortgage payments are up a fair bit due to prices/rates, affordability is not particularly strained.

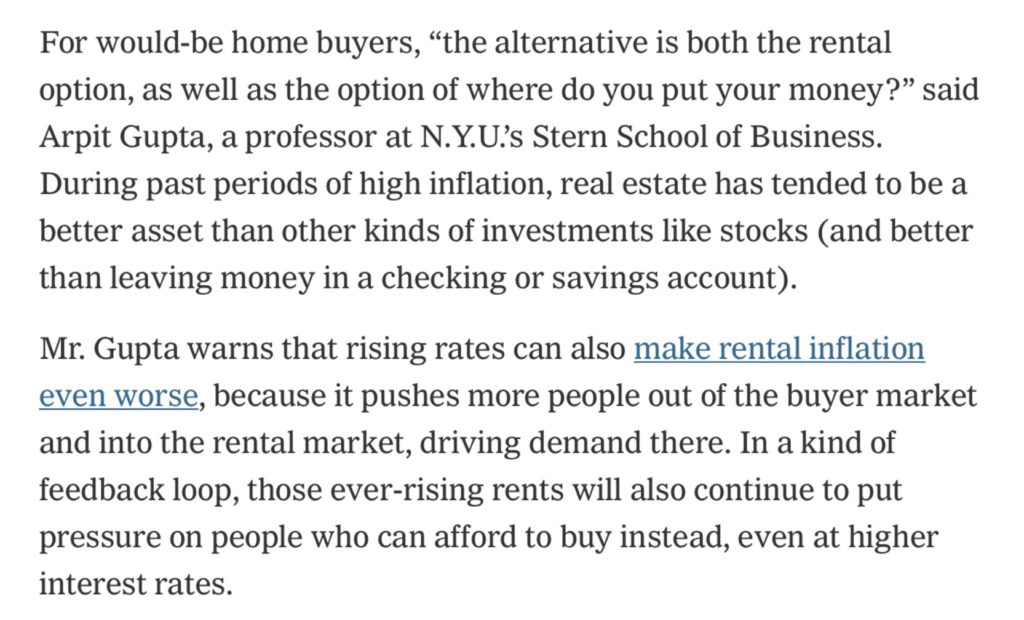

When we dig a bit deeper, and the NYTimes did a good article on this, you can uncover what these aggregates mean to buyers and to whether demand will cool off.

But, as this Bloomberg opinion piece “The Housing Market is Hot, but Certainly not Unhinged” points out, the market and implied rental inflation embedded in current prices (what they liken to an inflation break even concept) is a bit elevated, but not materially so. . The article does a good job of outlining how breakeven rental inflation is not nearly as timely as inflation breakevens, but close enough to get the picture.

As to the point of whether these prices to rent statistics work as a leading indicator, here is a good piece from the Fed on that.

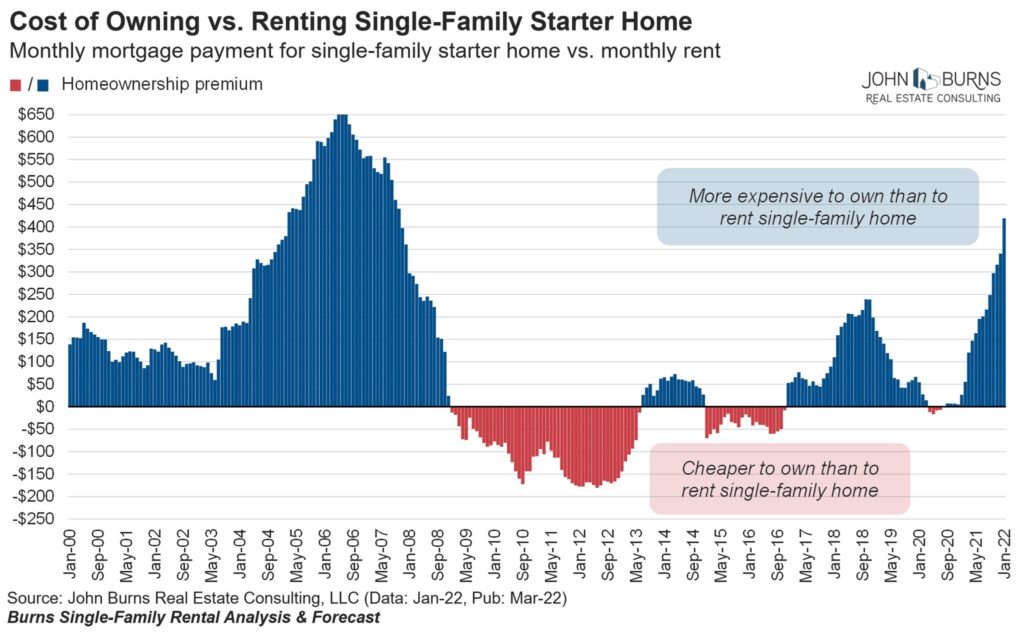

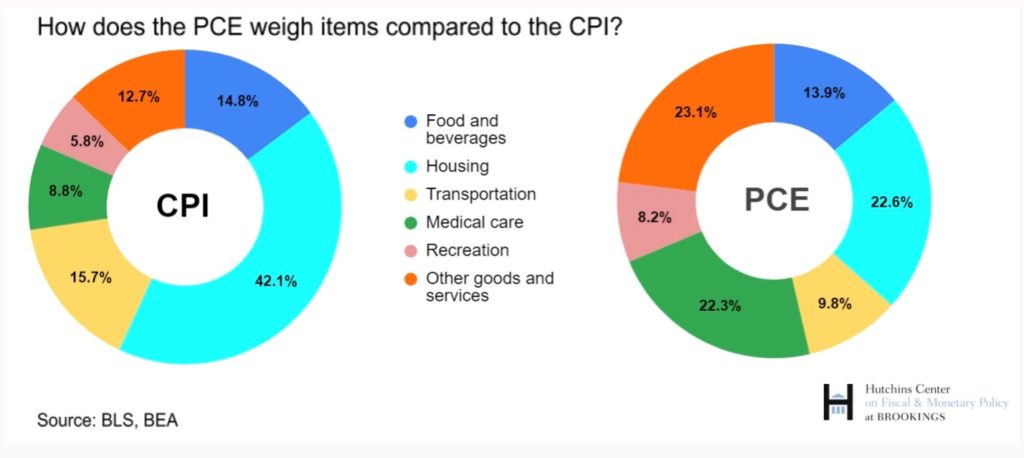

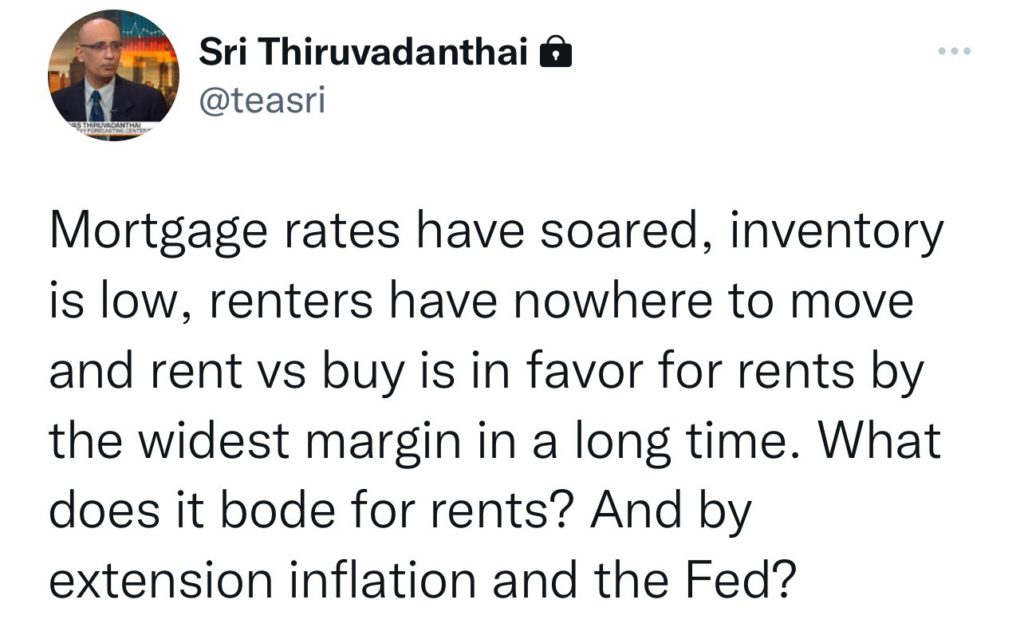

As relates to renting, here is a comment that while renting now appears to have some value, the incentives for buying likely remain given the inflationary impulses that remain. Also, note, OER (Shelter costs differ by index – see above) lags in inflation statistics and rents, now relatively cheap, should continue to rise.

And, this all comes back to what the above means for Fed policy given the importance housing/shelter has on the economy/consumption basket?

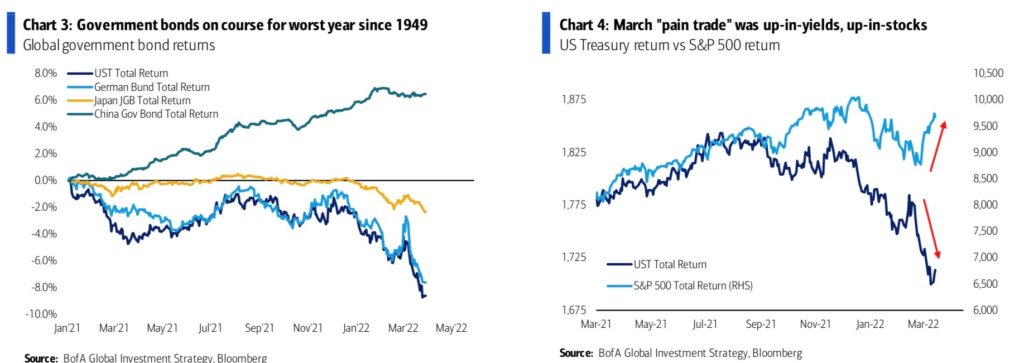

Inflation and the Fed:

I went through the speech from Vice Chair Lael Brainerd, and it is crystal clear that the Fed is going to continue to act. Financial conditions, as I have stated ad nauseam, are not tight, and this recent stock market rally is providing nice cover to continue to move on rates and QT, which the minutes on Wednesday are expected to spell out and are causing a ruckus in the rates market. As I wrote last week, the whisper is for a BS reduction of $90-100B per month for the next 3 years. Headwinds for sure! If there is any doubt whatsoever about what this means, read Bill Dudley on this. . This is not something you see every day from an ex-Fed official.

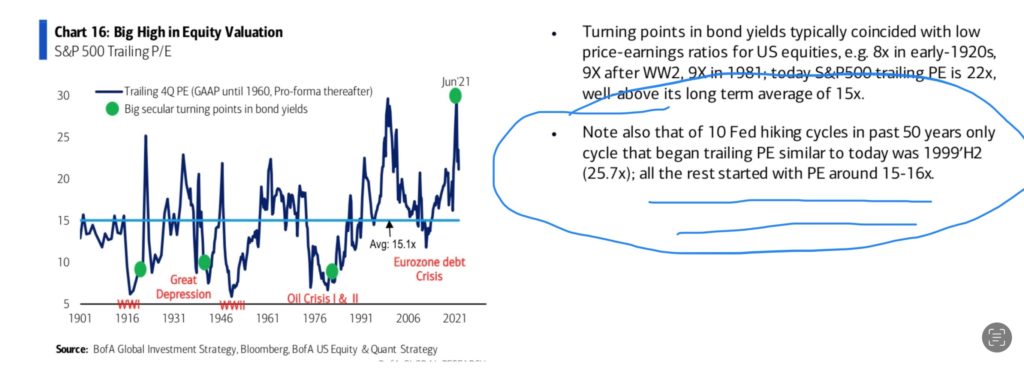

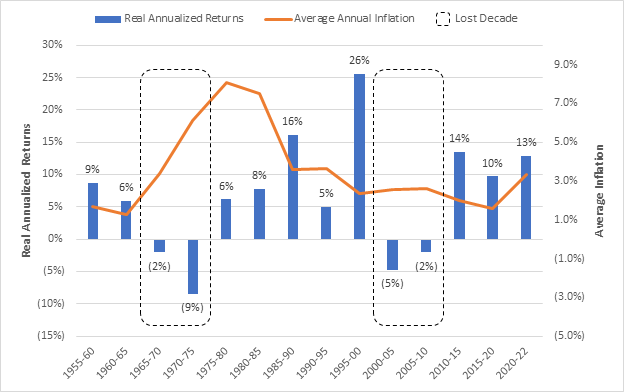

We don’t always know – as Buffet said eloquently – who is swimming naked until the tide goes out, but I suspect we will find out. I would not be shocked if we go through a multi-year rough patch / lost decade. Not my base case, but as I allude to below in other tidbits, there are some things out there that could point to a reduction in earnings, margins, and multiples for a bit. That just maybe the payback for what was a very market accommodative period.

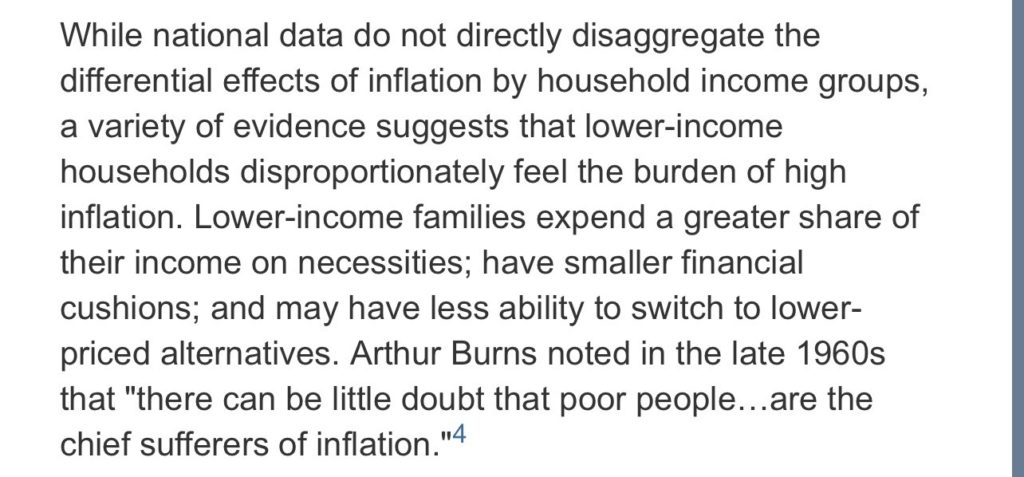

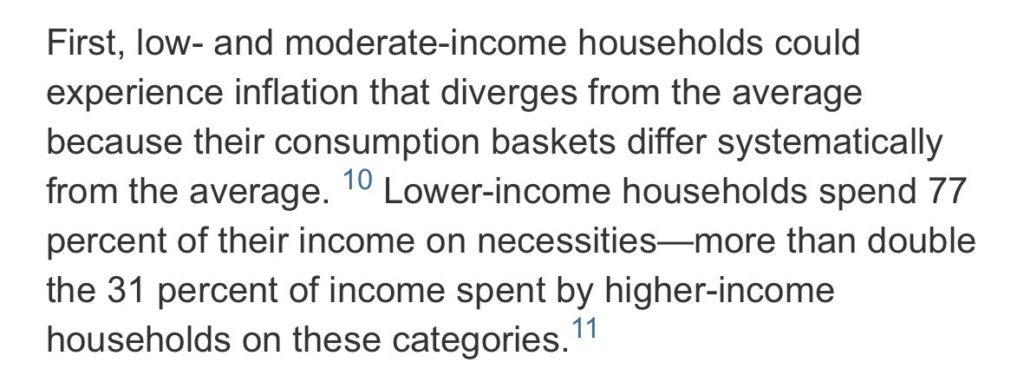

Anyhow, in the speech by Brainerd, the focus was on the differing inflation experiences within the country. As noted above in the CPI v PCE pie charts, inflation at the aggregate level is still at that level estimated and not exact, and certainly not experienced the same way by all citizens, but clearly, the tipping point has been reached.

Of course, the logical question is what the Fed was thinking in terms of inflation that it kept rates at the zero bound and continued QE, but suffice it to say that it had a benign view of inflation and was more focused on the employment question. But, now, we are about to learn much more about the Fed and inflation dynamics than we have for quite some time. I am not sure the market will be or is a material consideration for the Fed for another 15-20%. If GS or the ilk think the upside is 5% or so from here, that looks like a bad risk-reward as the Fed reverses course.

Anyhow, John Cochrane at Stanford shares some insights that are on point on what the Fed is thinking, which may or may not be rational.

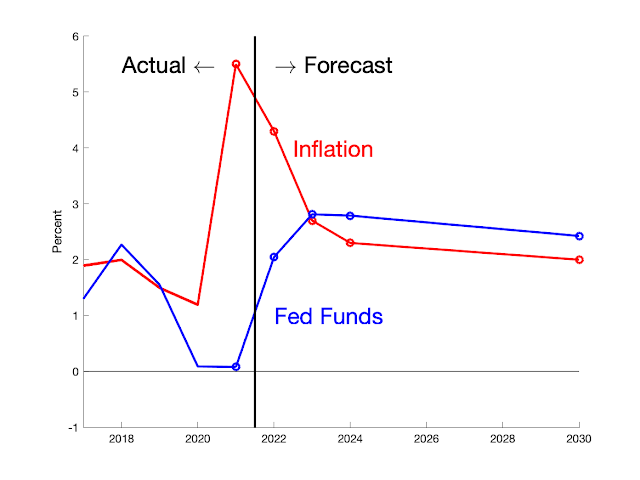

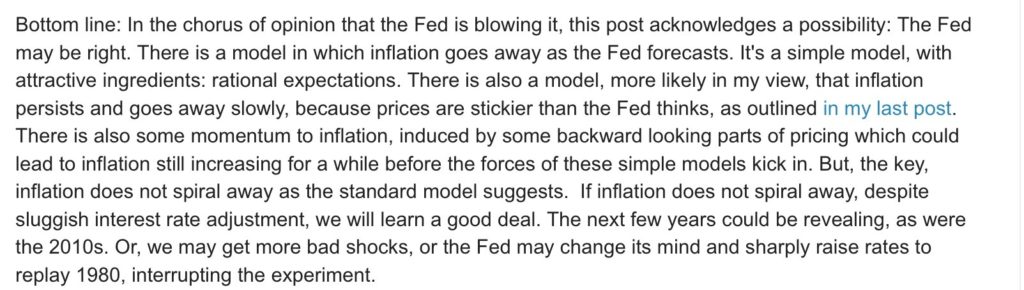

Here is a chart he constructed from the March dot plots and he took it out to 2030.

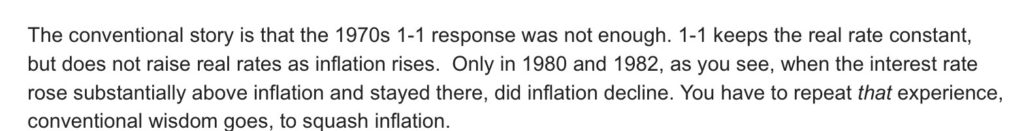

The critical point is that after building a simple model, Cochrane imputes that the Fed believes that inflation will correct on its own without needing to raise rates above the inflation rate, which is something Larry Summers suggests is absurd. Cochrane states:

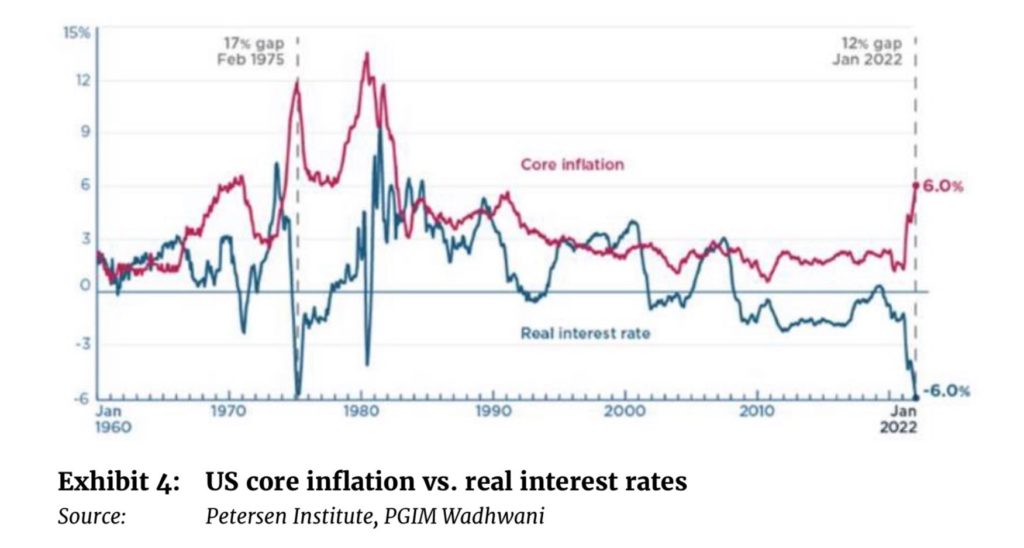

As we can see from the chart above, the required rate the Fed is currently well south of what economic orthodoxy learned from the 1970/early 1980 experience (or Taylor Rule) would imply. Cochrane asks what might the Fed – with all of its bright minds and PhDs – is thinking :

At some point, we all have to accept that Fed is walking a tightrope high above the ground, but even Cochrane suggests there is some coherency in what it is attempting and while he is skeptical, he allows for the possibility that they may end up being right:

Now, there is still a lot of commentaries out there – Cathie Wood no less – arguing that all of the points above are missing the key point that tightening into a slowing economy risks doing major harm. I find all of that a bit nonsensical (except perhaps Scott Minerd’s points on greater use of QT and restricting credit vs Fed Funds) on the basic grounds that at this point in the cycle, given where inflation, the labor market are, normalizing makes sense, and at least getting something closer to neutral. Whether the natural real rate is zero or thereabouts is not the point, because real rates are simply too negative. We have learned the lessons in the history of rates being kept too low for too long and how this creates allocation issues and speculative excesses.

As for Cathie’s comments, her basic view is that we live in a world of deflationary forces due to technology, but that is hardly new information and not accounted for by the Fed (see the model above suggesting inflation eases largely on its own w/o Volcker tightening). And, she is talking about her book a bit – shocking, I know. The Fed has statutory mandates for macroeconomic prudence, and inflation is a problem, as should be blindingly obvious right now. Anyway, here is her thread, if you didn’t see it. My only comment is that the yield curve is inverted causing the Fed to back off from dealing with obvious inflation and overheating is unconvincing because it would assume, as above, that this largely goes away on its own, and that longer-term inflation swaps markets are not at risk of de-anchoring, which I have shown in the presentation from the LSE’s Richards Reis, are, in fact, at such risk.

Where might the next risk event come from?

Well, obviously if the situation in Ukraine widens out cross NATO red lines. Seeing some of the destruction, death, displacement, hardship, and cruelty/genocide, it is clear that Putin does not have a Western moral compass, is a war criminal, and is rapidly becoming this century Hitler/Stalin.

As I have argued before, the world, and with it, trade, supply chains, and finance is moving in a less positive fashion, but then again, some of the movements can be positive for some countries such as Mexico, that John Authers wrote about in Bloomberg. Whether, we ever get to a world where there are two blocs – the West/Democracy and Autocrats/Fascists – that don’t cooperate, don’t mingle, don’t trade – ie. Cold War – with a risk of hot wars (either proxy or worse), I cannot handicap. The directionality seems clear though and the adjustment period from where we were to something in that area code is likely to be very turbulent.

And yet, the market seems to still believe that Europe and the West are unwilling to go the distance and put maximum pressure on Putin, and or this will go away happy with some negotiated settlement where Putin takes some more (valuable) land and Ukraine sits in constant fear of additional attacks. That may be a temporary situation, but it won’t change directionality. And, if the Chinese were thinking that Europe was spineless and an easy mark to splinter the West, here is an interesting thread from the EU/s Foreign Affairs chief on their conversations from last week with China.

And, after some atrocities in northern Ukraine, Europe is stepping up some sanctions on coal purchases in its first attempt to absorb more direct pain in order to inflict some on Russia. Maybe because we all have short attention spans as we watch these developments, we lose sight of that much is being done to be able to pull the cord on Russia’s reliance. Whether it is agreements with Qatar or building LNG conversion plants, the move is on. Maybe not fast enough, maybe not bold enough to stop Putin from unspeakable actions, but movement nevertheless.

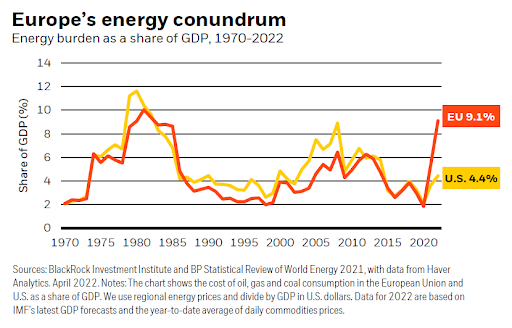

Some of this is why I am short BTPs and other European rate duration because a. they are going to experience some further inflation; b. going to need to finance an expansion of defense and energy security priorities, including subsidies. Not to mention, there is the bit of a French election that is one of the first national statements on how a population wants to proceed given new information. France has a lot of things on its plate, but at least the energy piece (nuclear) is less exposed.

While all of this remains high on my radar, I read a great piece from Credit Suisse’s Zoltan Poszar who noted the ECB this past Friday deciding against offering emergency lending assistance to commodity traders, which may have dramatic consequences. Zoltan is very bright, and he has a ton of experience in financial architecture, managing through a crisis, but he is right to be worried about strained commodity markets losing credit support at this point.

Other Tidbits:

– As I suggested, the SEC is overstepping a bit on climate rules.

– Why do I struggle with a lot of pseudo-scientific analysis to support certain political aims. Not questioning the importance of the movements, just the pseudo-science/motivated research that often supports moving it faster and with more authority than it would otherwise. We see this often with consulting research vs academic or peer-reviewed research.

– Student loan support extended. Not surprised. That legislation dog won’t hunt, but it is too enticing politically to use administrative action to kick the can.

– Starbucks is suspending buybacks and plowing the money into investing in stores and people. Well, given here in Florida, I have to travel 6 miles to get to a Starbucks, I welcome the investment near my property.