Highlights and themes

It’s pretty simple. The US Dollar domination continues to lift into historical bull sentiment levels with crosses with equally bearish sentiment levels. The Yen has been possibly the driver of the USD strength and there are some cracks on some of the JPY crosses. Overall the setup is there for a turn and as much as I might be the boy who cried wolf, the setup is there.

Currency Sentiment Overview

Currency sentiment highlights show the first day in 5 with the dollar bullish sentiment at 95%. The 20 day moving average at a very extreme 90%

US Dollar Indexes

DXY US Dollar Index daily with a new Combo 13

DXY US Dollar Index weekly also with a new Combo 13 and Sequential sell Countdown in progress

Bloomberg US Dollar Index daily ignored the recent Countdown 13’s

Bloomberg US Dollar Index weekly also ignoring the 13’s

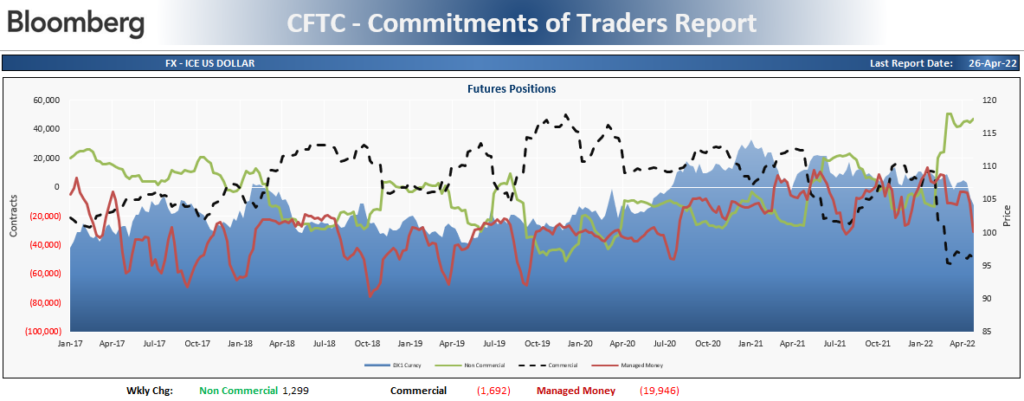

US Dollar bullish sentiment dropped for the first time in 6 days. That 90% level for the 20 day moving average is something I’ve never seen before

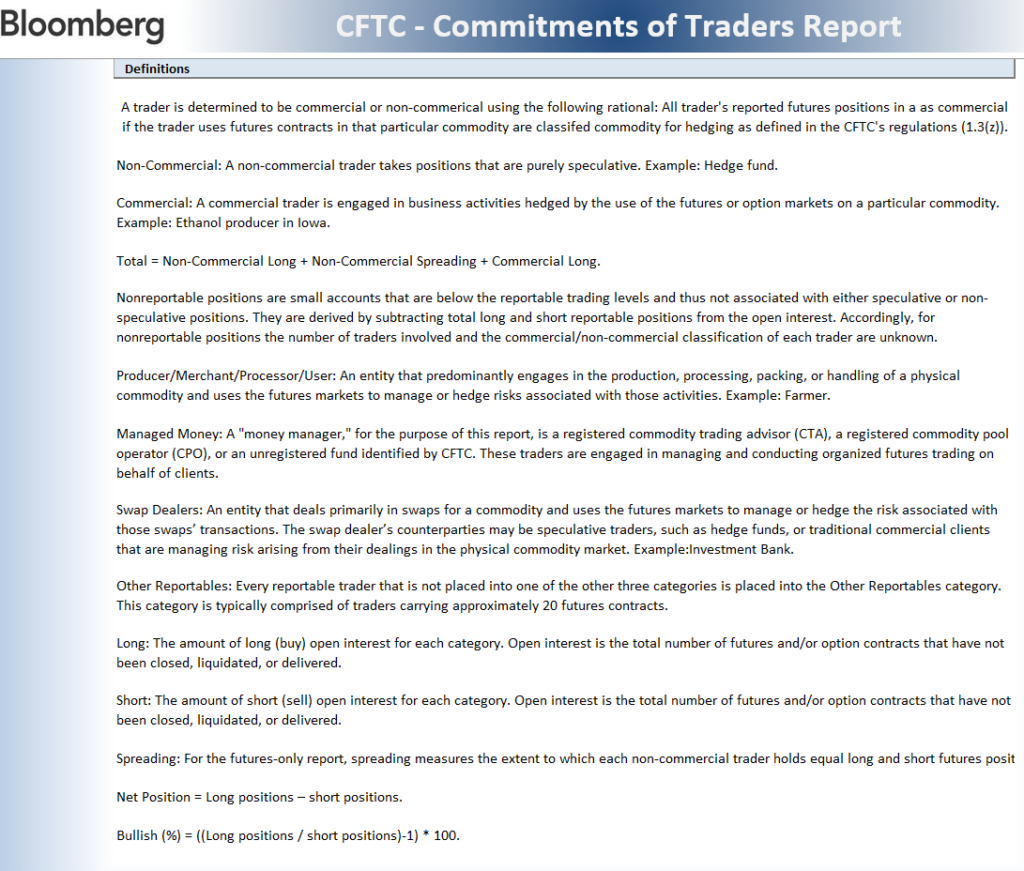

US Dollar Commitment of Traders shows speculators increased long exposure. (ignore the managed money data on all the following currencies)

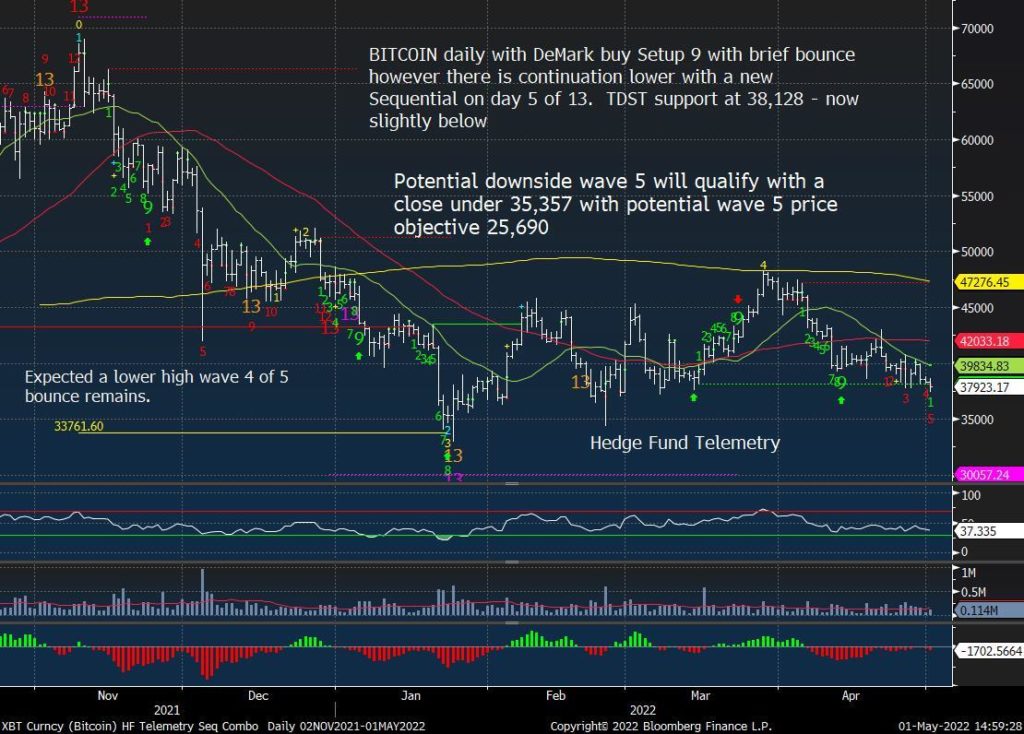

Bitcoin

Bitcoin Daily

Bitcoin bullish sentiment broke lower while 38,000 has held support

Ethereum Daily fading

Major USD Crosses

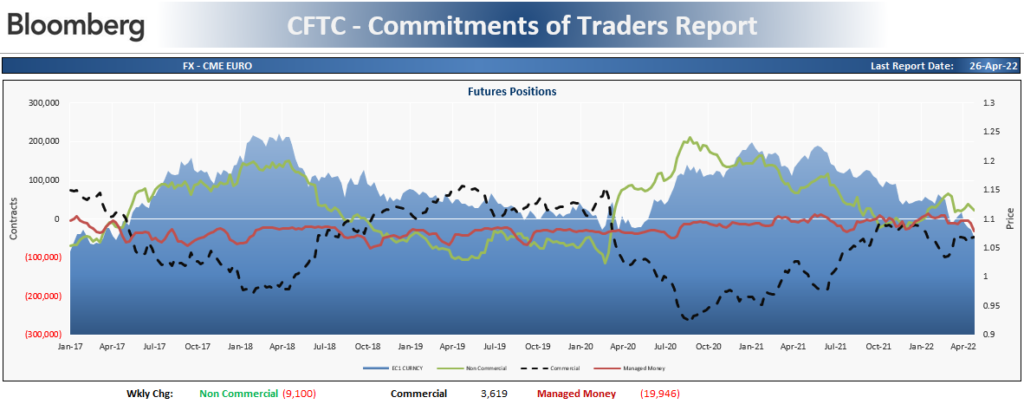

EURUSD Euro / US Dollar

Euro bullish sentiment has been under pressure and perhaps can turn from here

Euro Commitment of Traders shows speculators decreasing long exposure

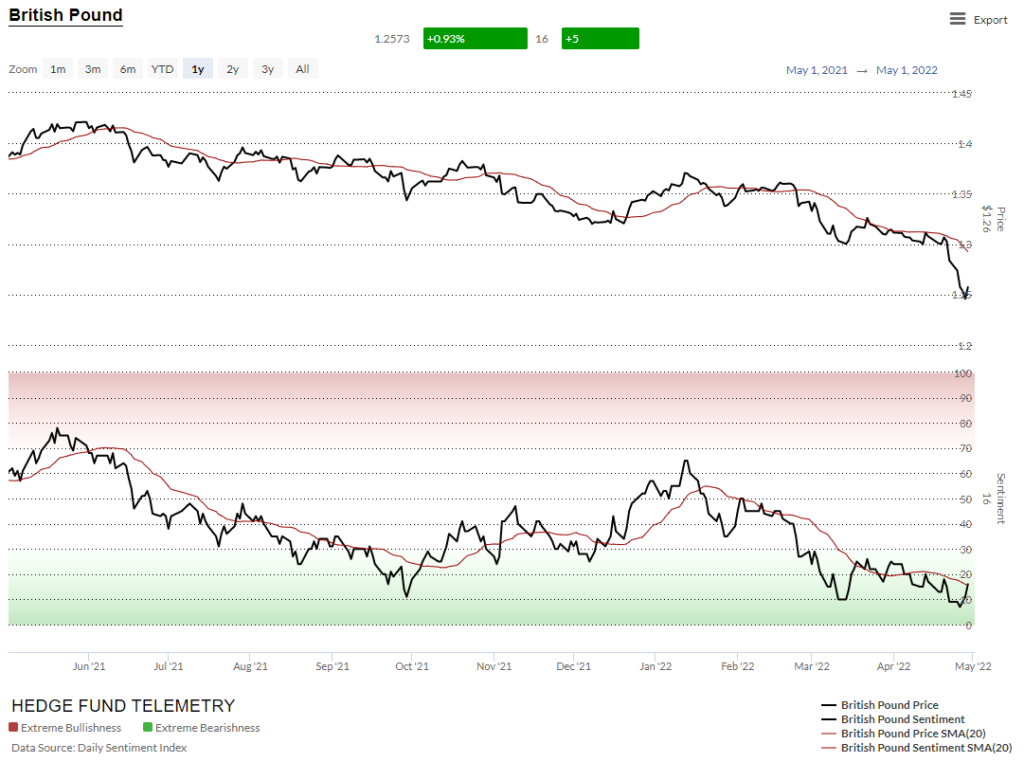

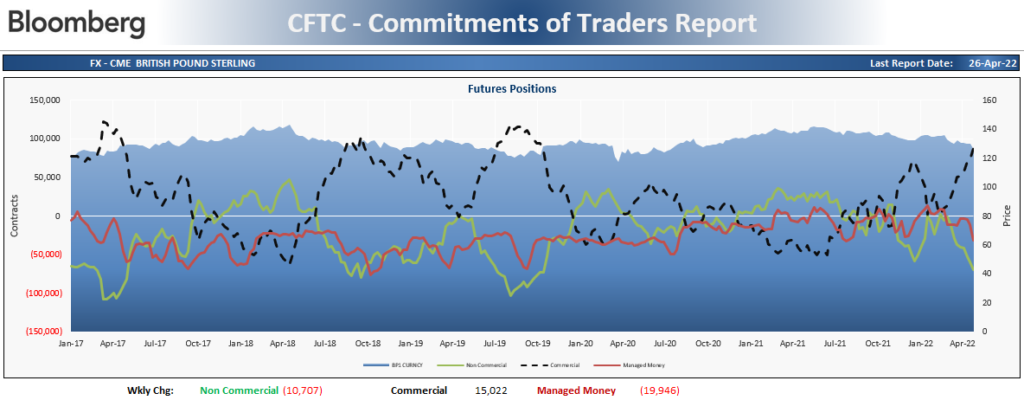

GBPUSD British Pound Sterling / US Dollar

British Pound Sterling bullish sentiment bounced and let’s watch and see if it can continue

British Pound Sterling Commitment of Traders shows speculators continue to short

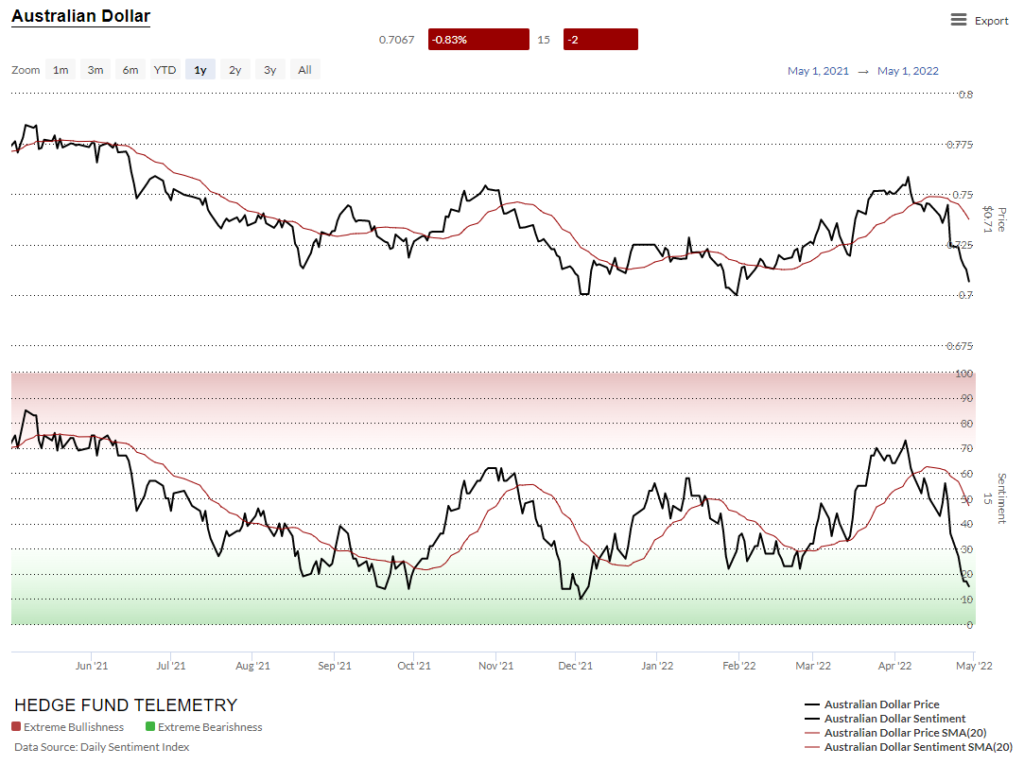

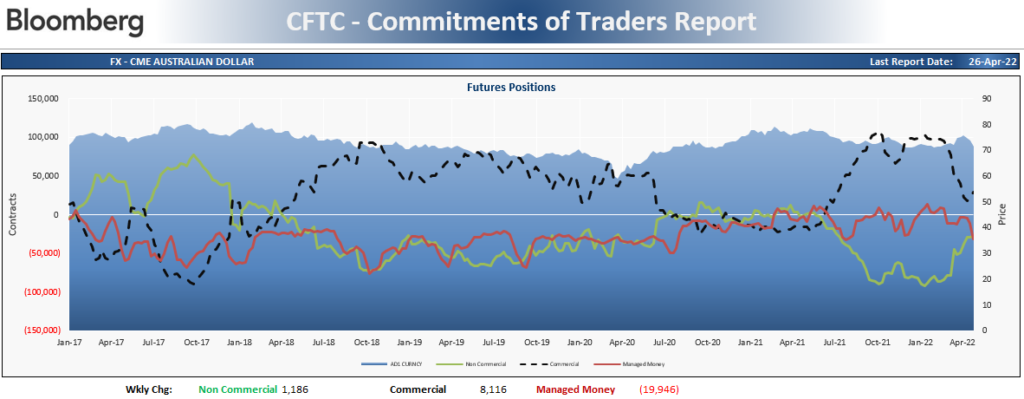

AUDUSD Australian Dollar / US Dollar

Australian Dollar bullish sentiment is oversold and has been slammed

Australian Dollar Commitment of Traders shows speculators covering a little again

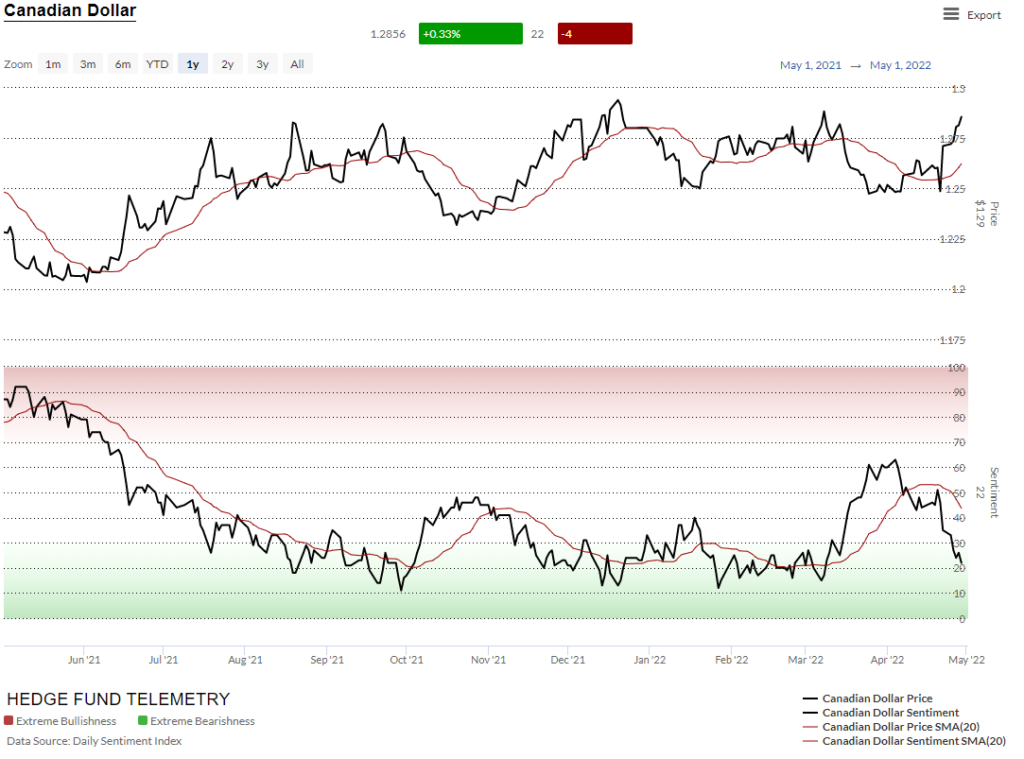

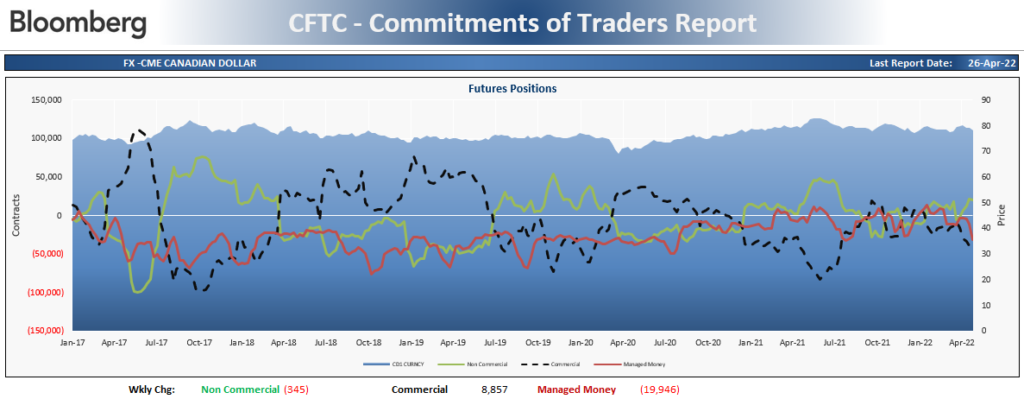

USDCAD US Dollar / Canadian Dollar

Canadian Dollar bullish sentiment continues lower

Canadian Dollar Commitment of Traders is tightly wound

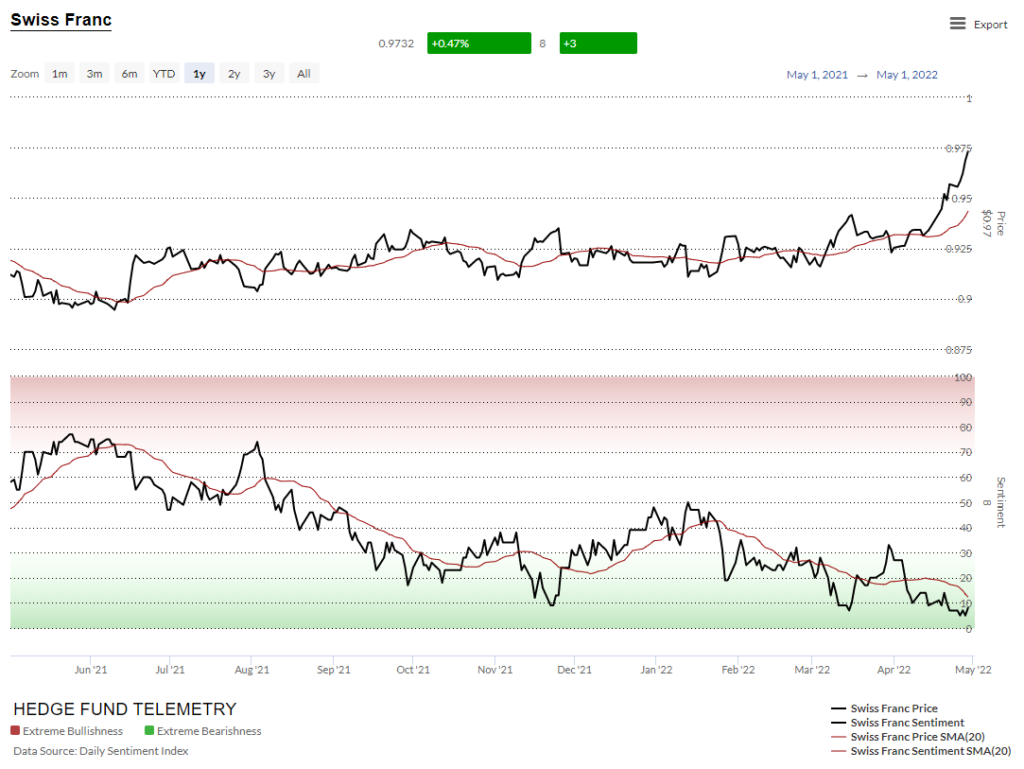

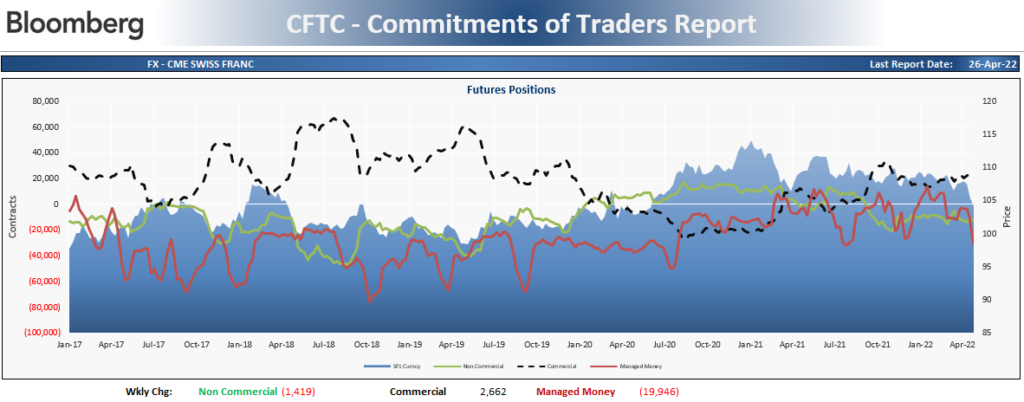

USDCHF US Dollar / Swiss Franc

Swiss Franc bullish sentiment remains under EXTREME pressure

Swiss Franc Commitment of Traders saw speculators going more short

RISK On Risk Off

This cross is often used as a risk-on / risk-off indicator

EURAUD Euro / Australian Dollar

Three major Yen crosses – important

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

USDTRY US Dollar / Turkish Lira

USDBRL US Dollar / Brazilian Real

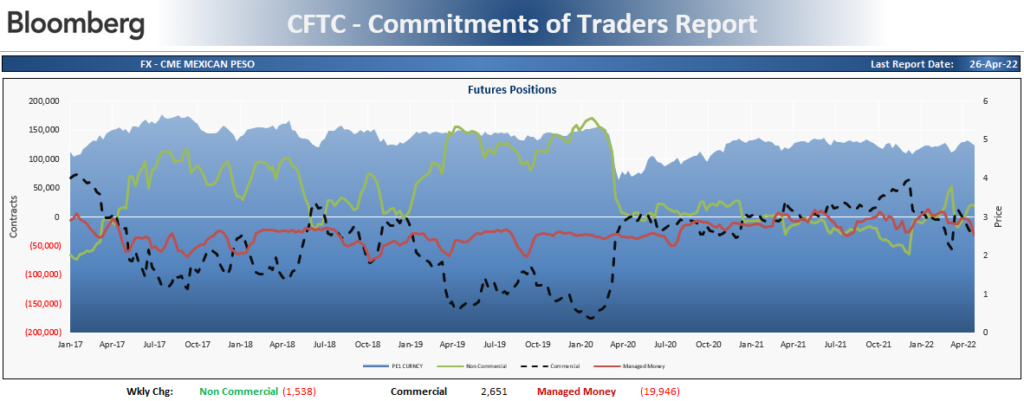

USDMXN US Dollar / Mexican Peso

Mexican Peso bullish sentiment little changed this week

Mexican Peso Commitment of Traders is tightly wound

USDZAR US Dollar / South African Rand

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan)

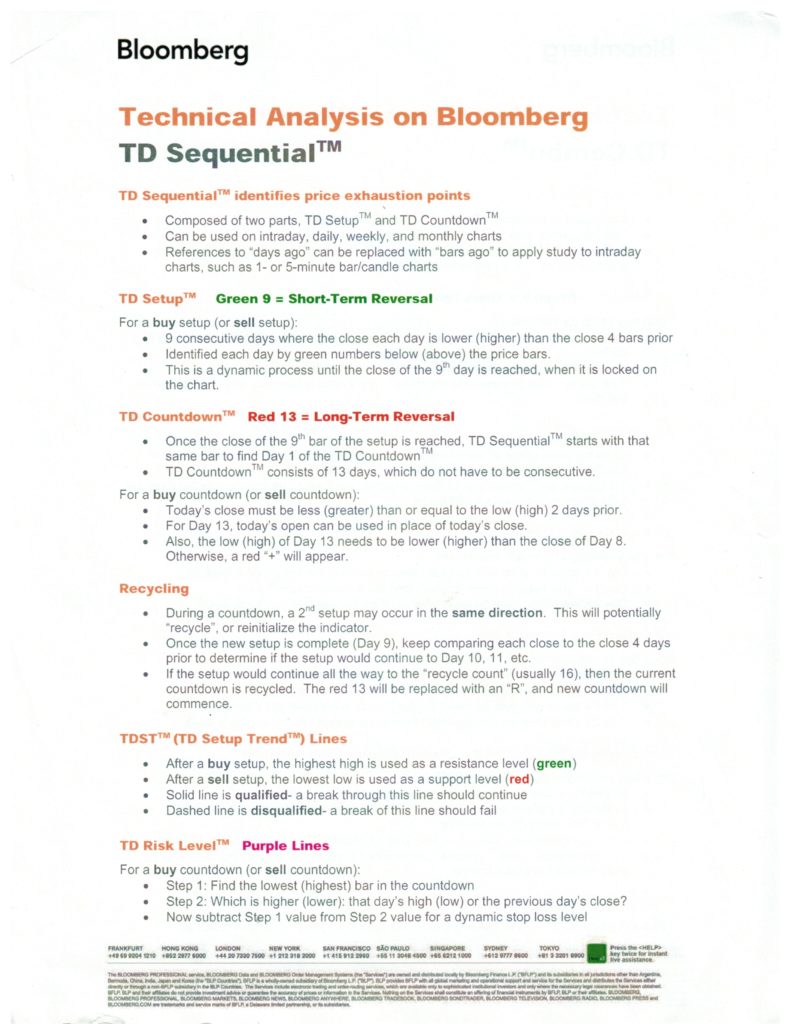

DeMark Sequential Basics Bloomberg

More detailed Commitment of Traders explanation