Highlights and themes

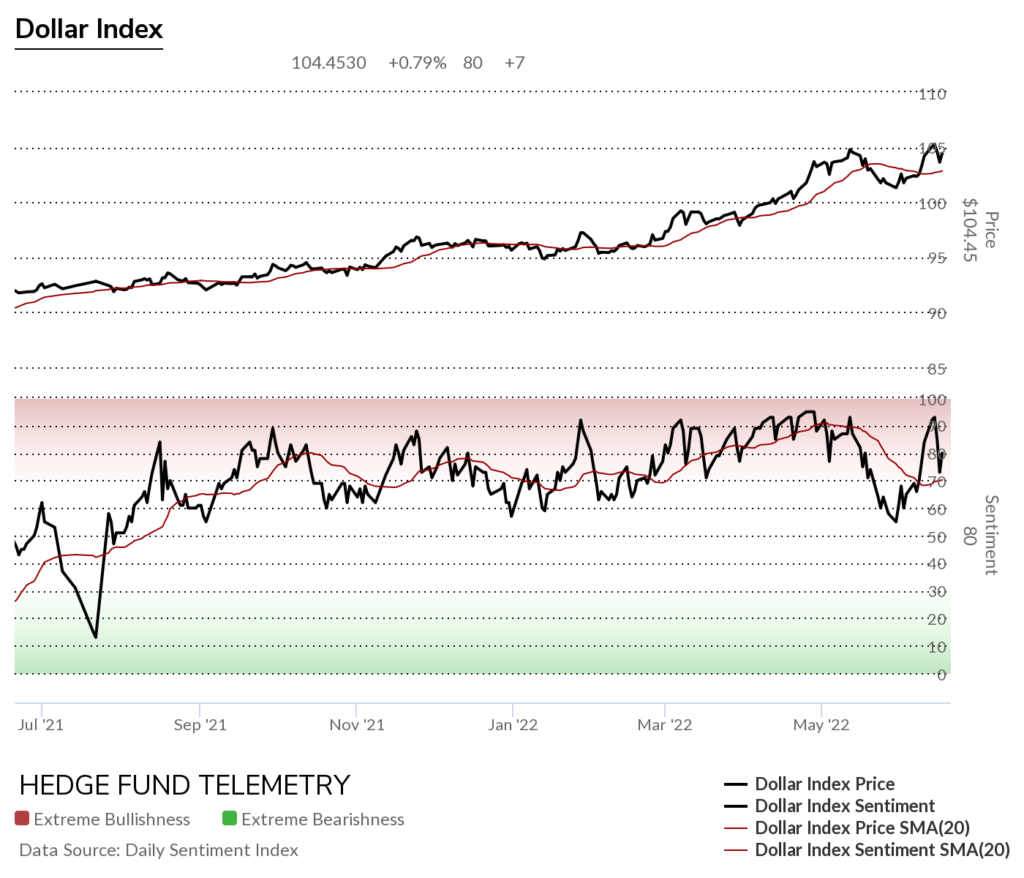

- With the current overall market volatility, the US Dollar remains the safe haven

- Several central bank actions saw a sharp reaction with the Swiss Franc and no change of direction with the Yen

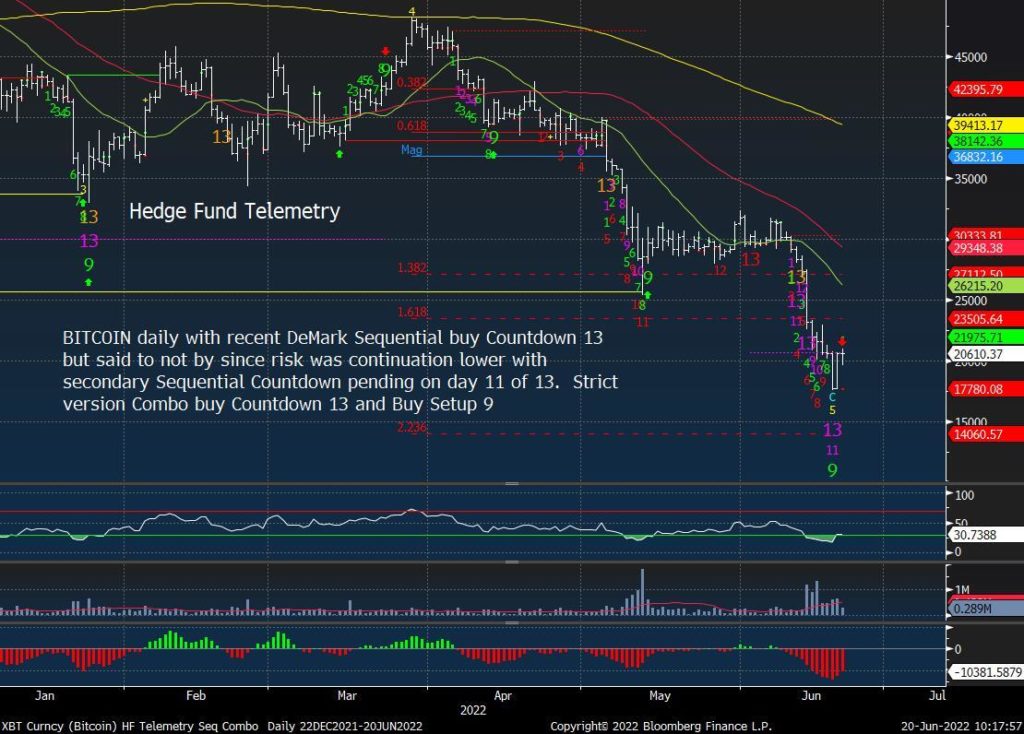

- Crypto with Bitcoin and Ethereum has downside DeMark buy Countdown 13’s developing

Currency Sentiment Overview

Currency sentiment highlights shows the US Dollar remaining the safe haven with all of the volatility

US Dollar Indexes

DXY US Dollar Index daily

DXY US Dollar Index weekly

Bloomberg US Dollar Index daily

Bloomberg US Dollar Index weekly

US Dollar bullish sentiment did test the lower end of the range but rebounded back to 93% and remains in the extreme zone over 90%

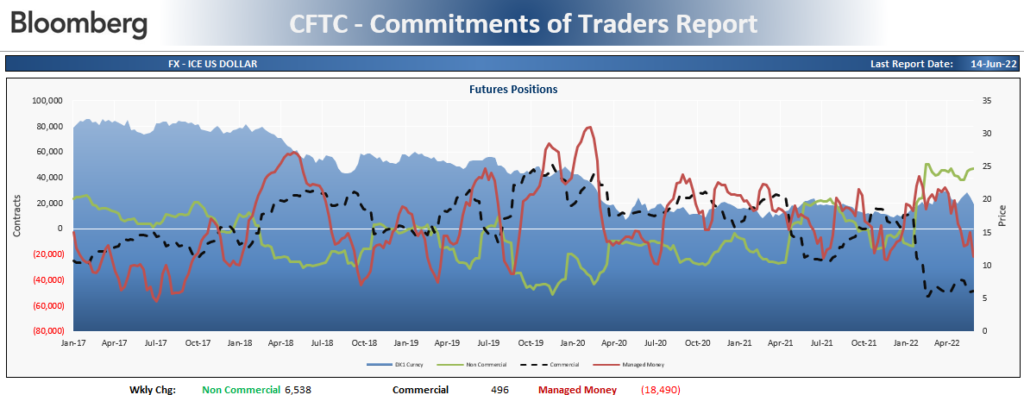

US Dollar Commitment of Traders shows speculators increasing long exposure

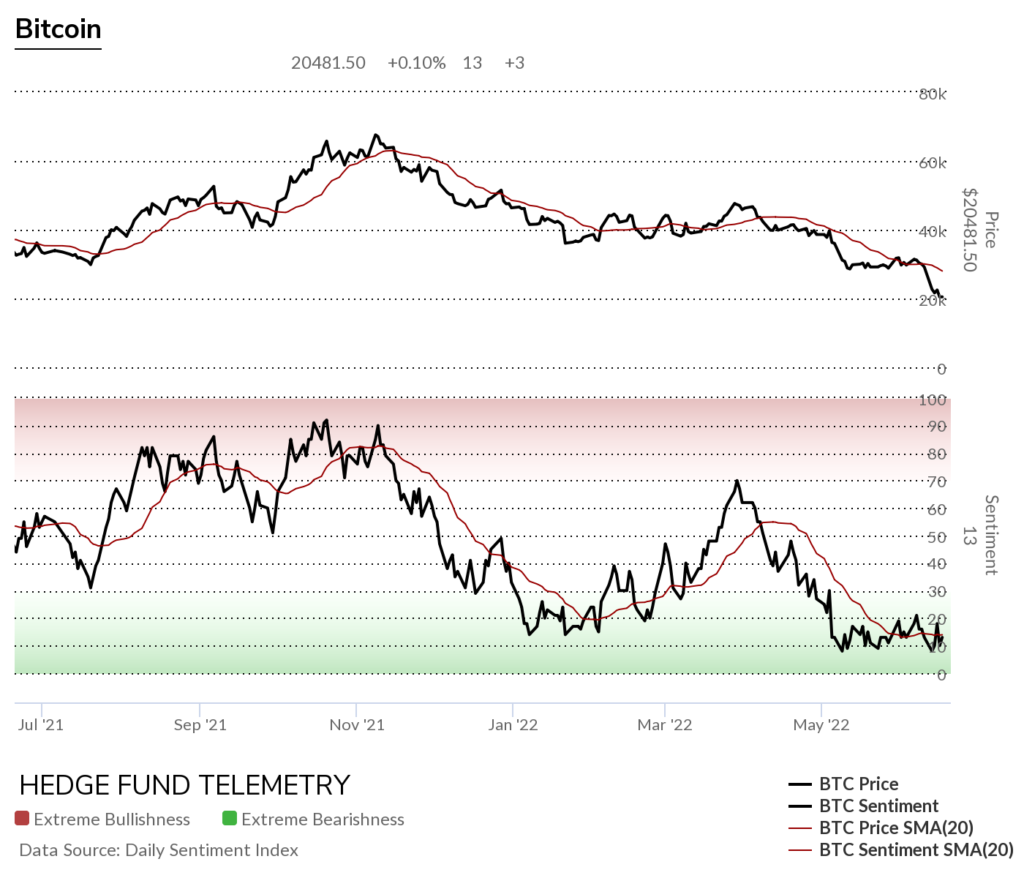

Bitcoin and Ethereum – potential bottoming

Bitcoin Daily does have some exhaustion signals in place and might get a few more this week

Bitcoin Weekly finally achieved the downside wave 3 of 5 price objective with a new Sequential buy Countdown 13. Keep in mind the next wave is a corrective wave 4 of 5 lower high wave bounce. Then a lower low wave 5 in the horizon

Bitcoin Bullish Sentiment has been under severe pressure for the last two months

Ethereum Daily did get both the Sequential and Combo buy Countdown 13’s achieving the downside wave 5 price objective of 958

Ethereum Weekly also hit the downside wave 3 of 5 price objective with the new DeMark Sequential buy Countdown 13. The wave 4 of 5 comments above on Bitcoin applies here too

Major USD Crosses

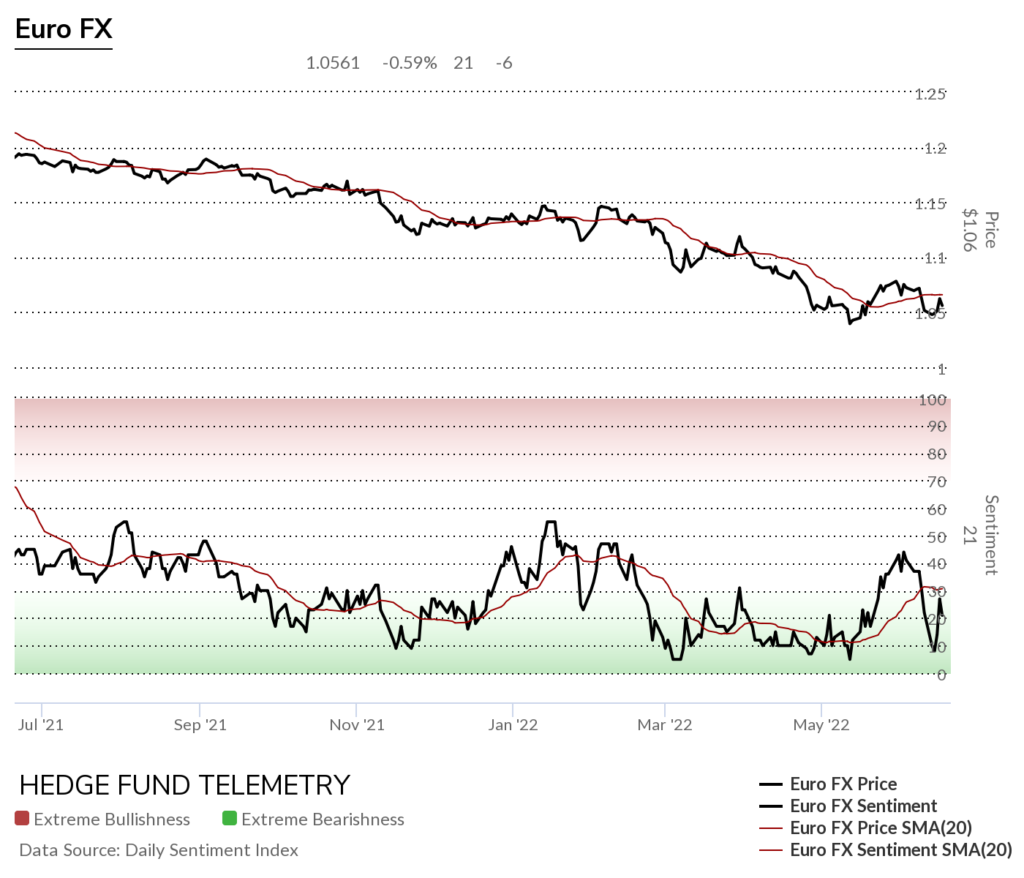

EURUSD Euro / US Dollar with a higher low wave 2 of 3

Euro bullish sentiment bounced off extreme lows again

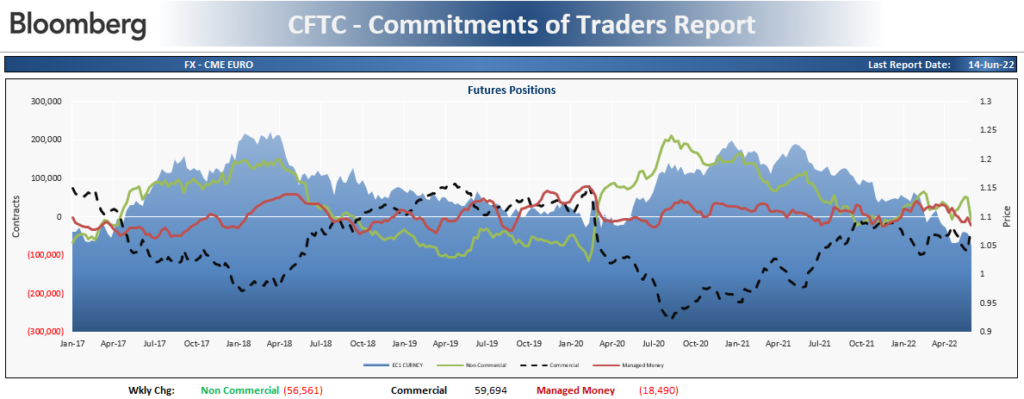

Euro Commitment of Traders shows speculators significantly increasing SHORT exposure

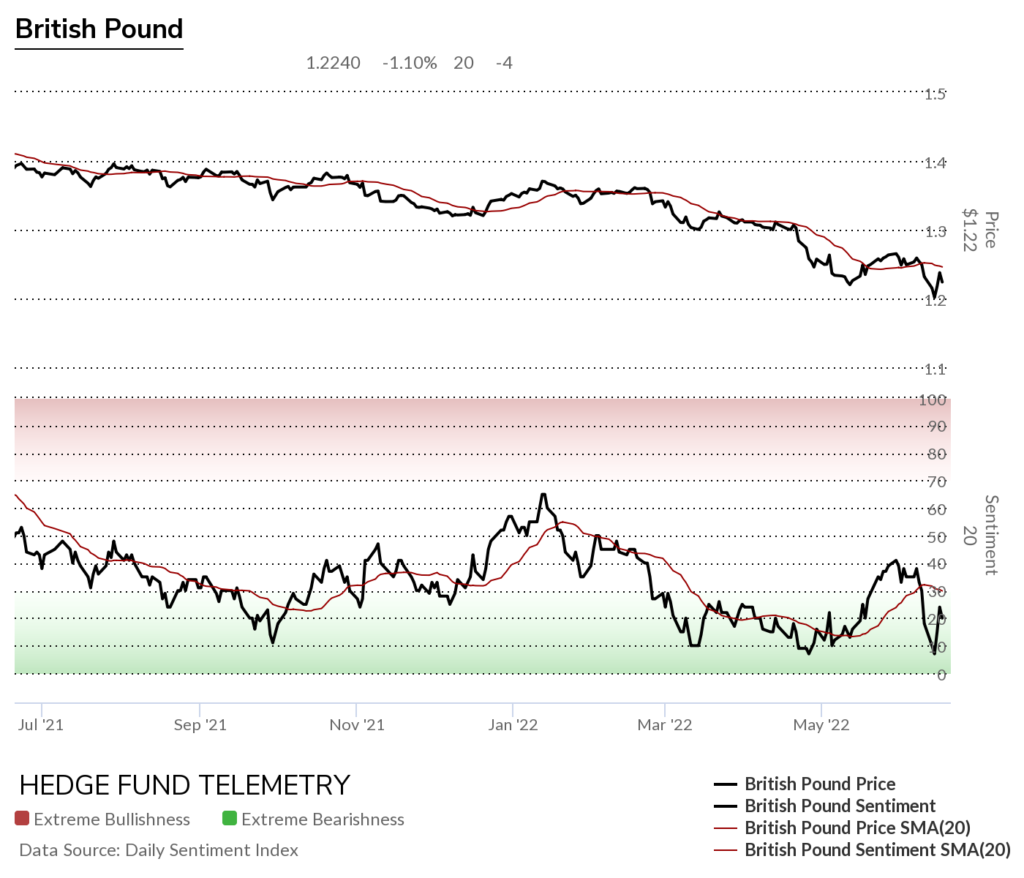

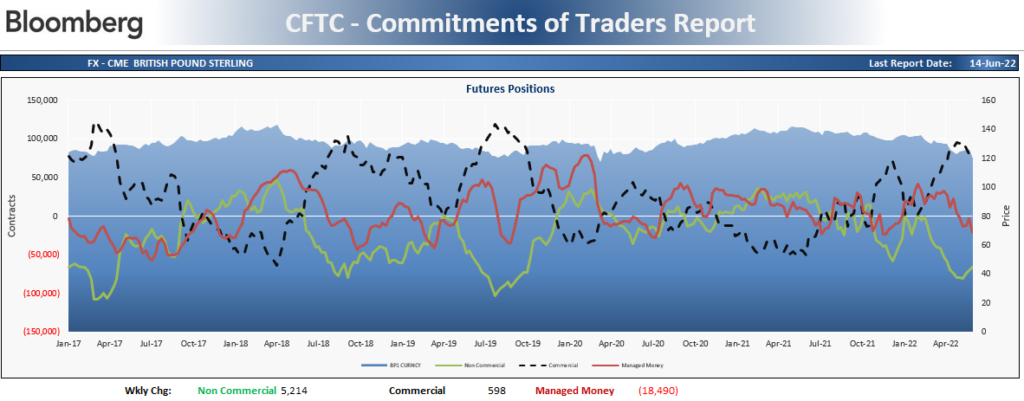

GBPUSD British Pound Sterling / US Dollar made another lower low

British Pound Sterling bullish sentiment bounced off extreme lows last week

British Pound Sterling Commitment of Traders shows speculators decreasing SHORT exposure

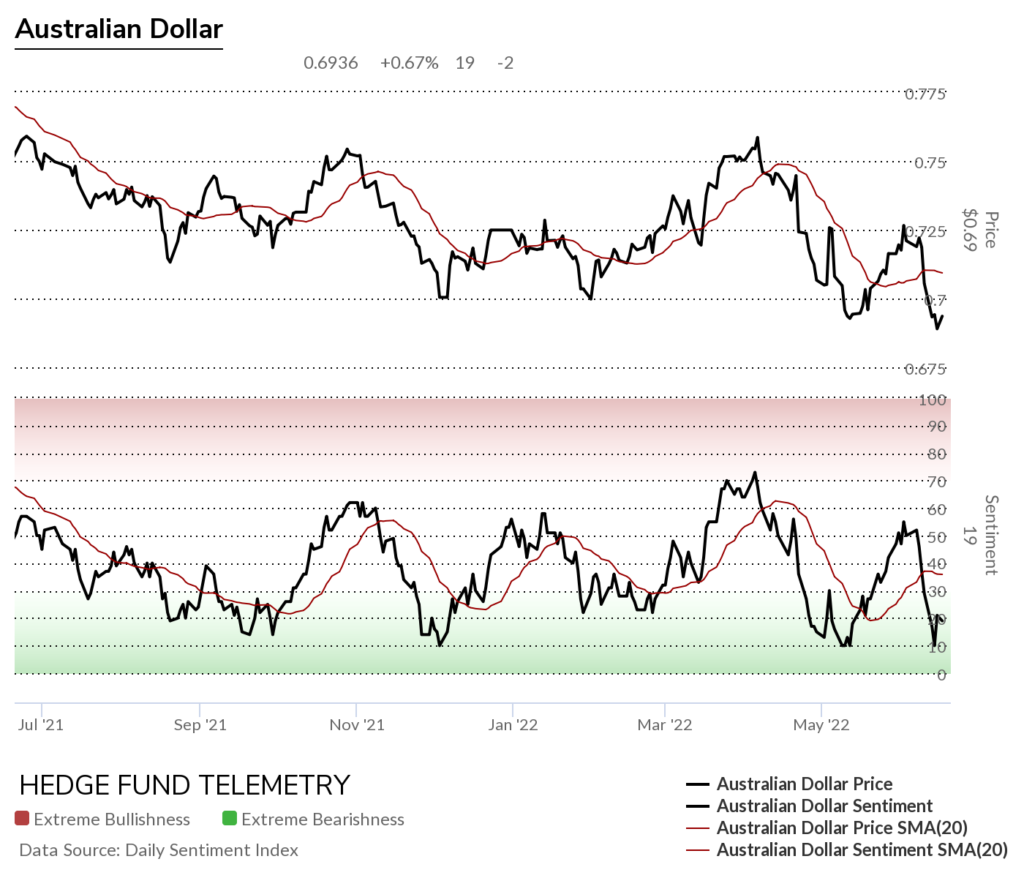

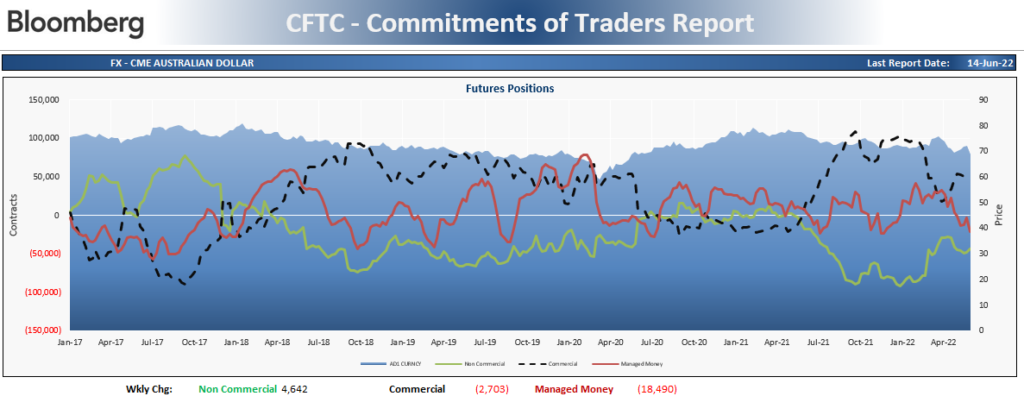

AUDUSD Australian Dollar / US Dollar

Australian Dollar bullish sentiment also hit extreme lows last week

Australian Dollar Commitment of Traders shows speculators decreasing SHORT exposure

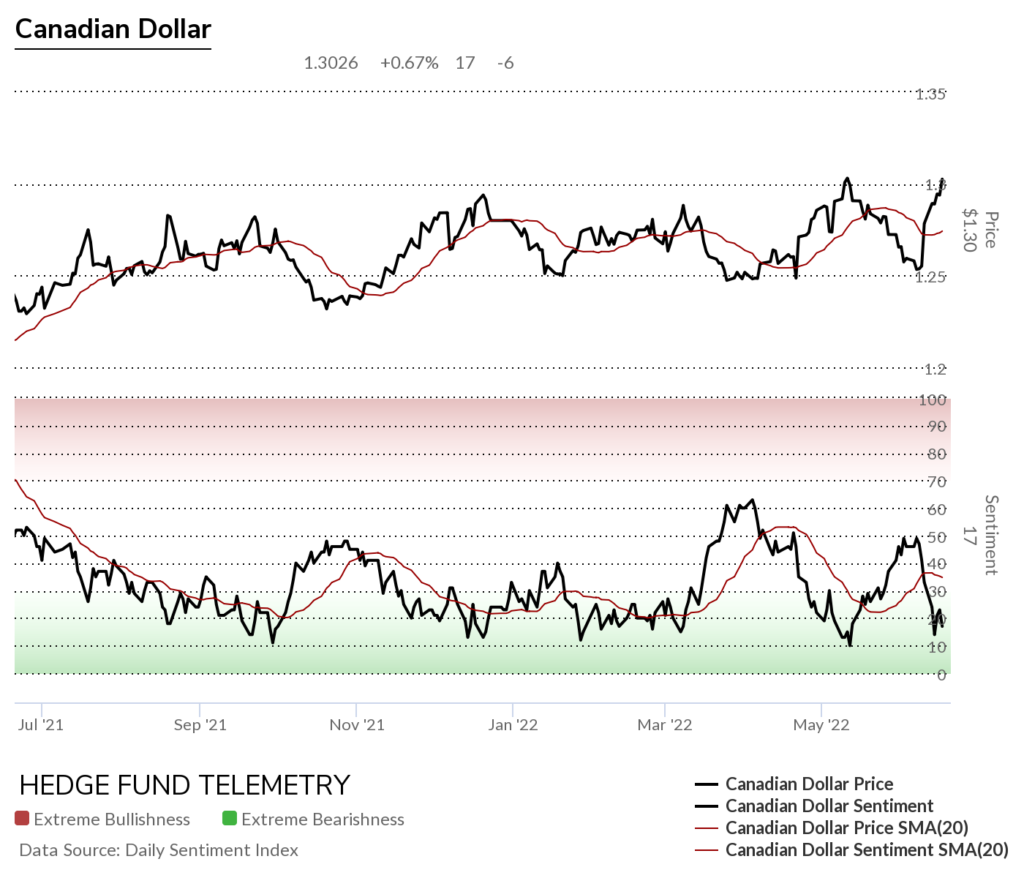

USDCAD US Dollar / Canadian Dollar

Canadian Dollar bullish sentiment failed to get through the midpoint 50% level and is back to the lows

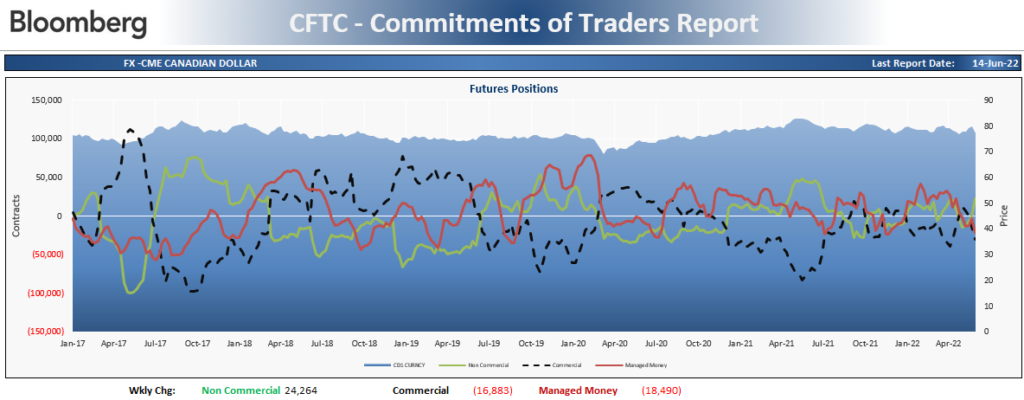

Canadian Dollar Commitment of Traders shows speculators increasing long exposure

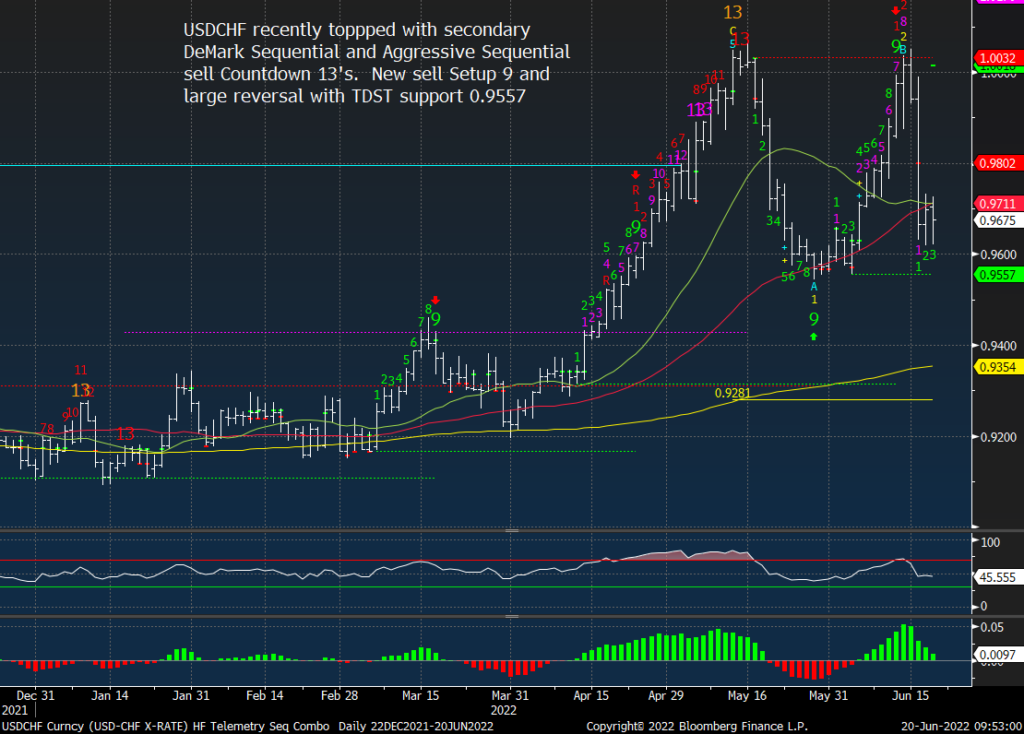

USDCHF US Dollar / Swiss Franc had quite a week with the SNB surprise news

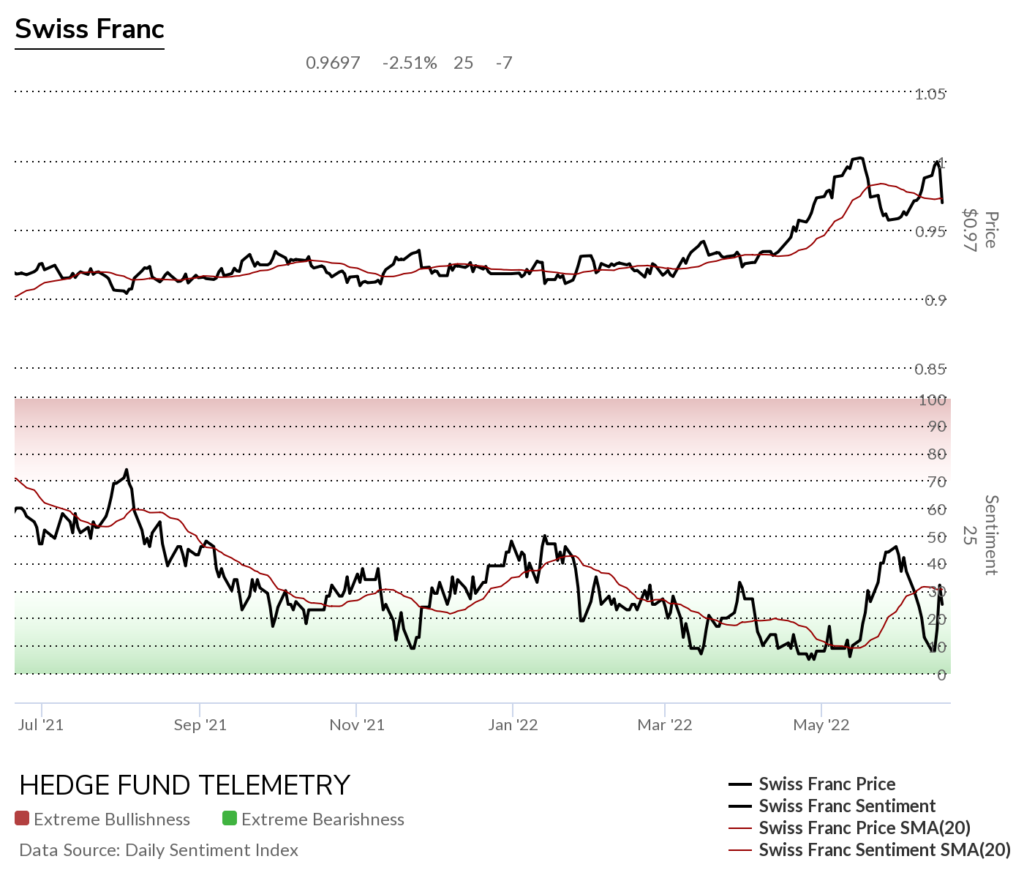

Swiss Franc bullish sentiment bounced off the extreme lows

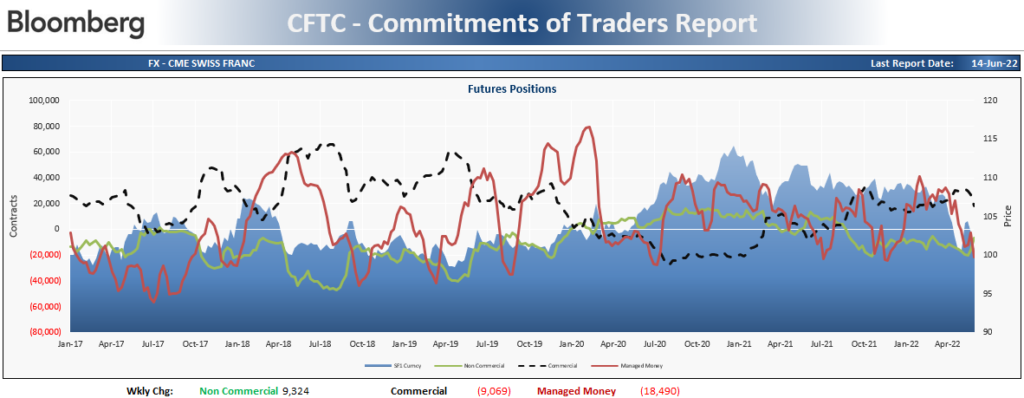

Swiss Franc Commitment of Traders shows speculators decreasing short exposure

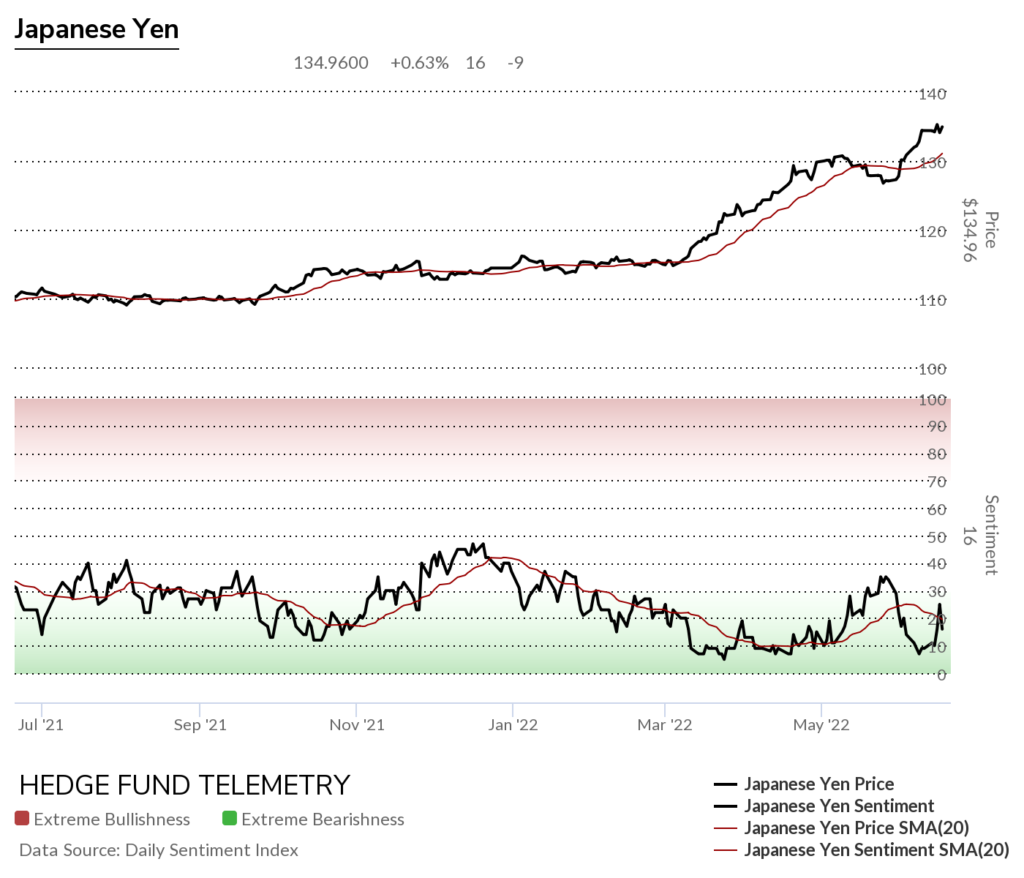

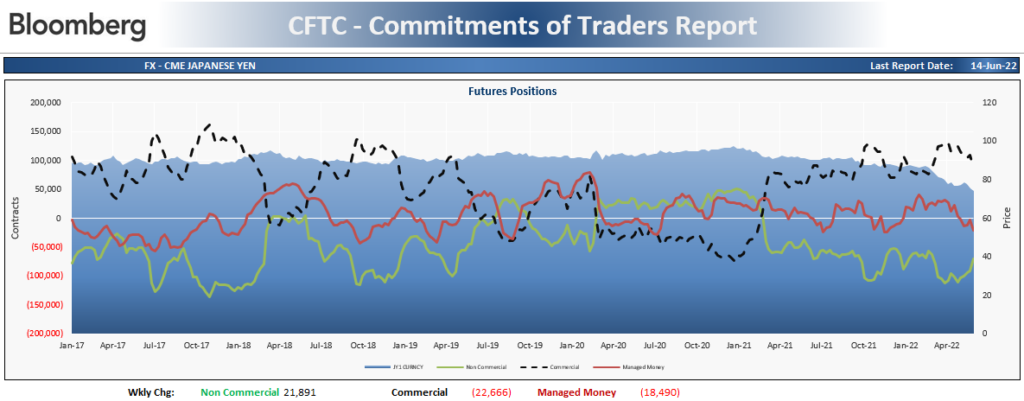

USDJPY US Dollar / Japanese Yen could not reverse with no change after the BoJ meeting

Japanese Yen Bullish Sentiment remains under pressure

Japanese Yen Commitment of Traders shows speculators decreasing significantly SHORT positioning

RISK On Risk Off

This cross is often used as a risk-on / risk-off indicator

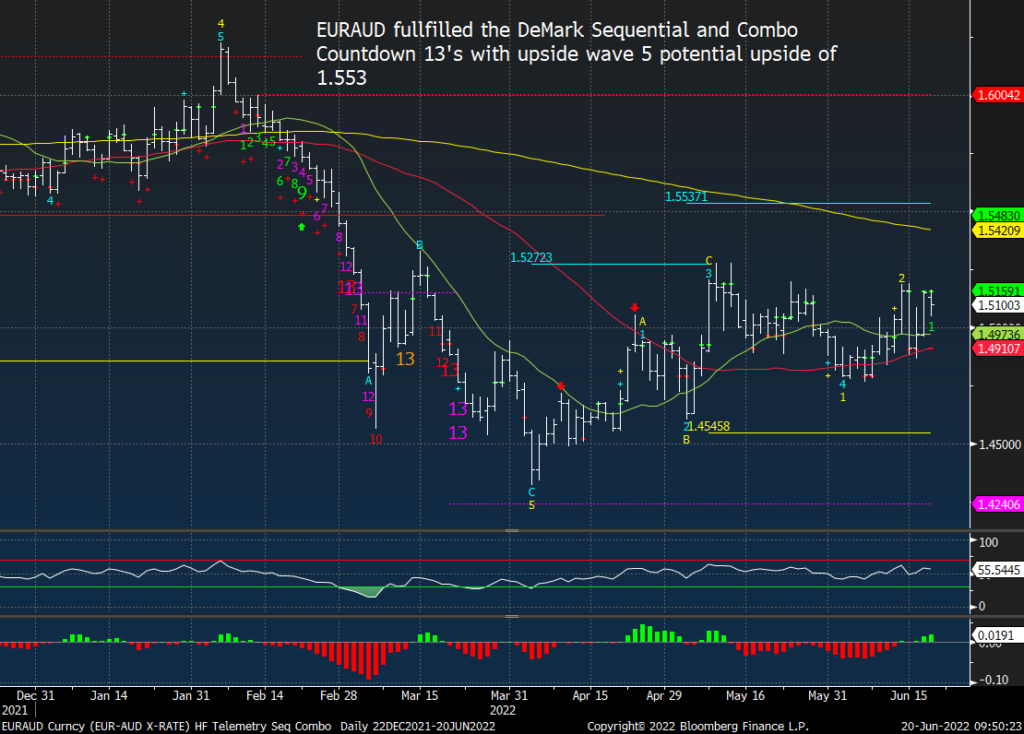

EURAUD Euro / Australian Dollar

Three major Yen crosses

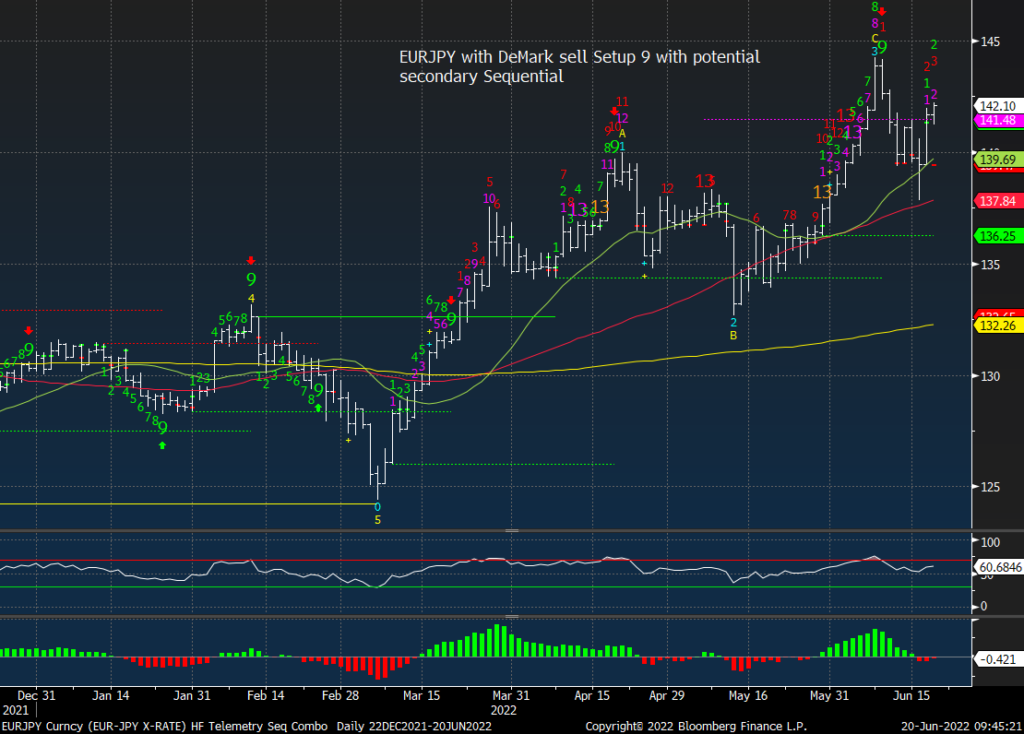

EURJPY Euro / Japanese Yen

GBPJPY British Pound Sterling / Japanese Yen

AUDJPY Australian Dollar / Japanese Yen

US Dollar vs Emerging Markets

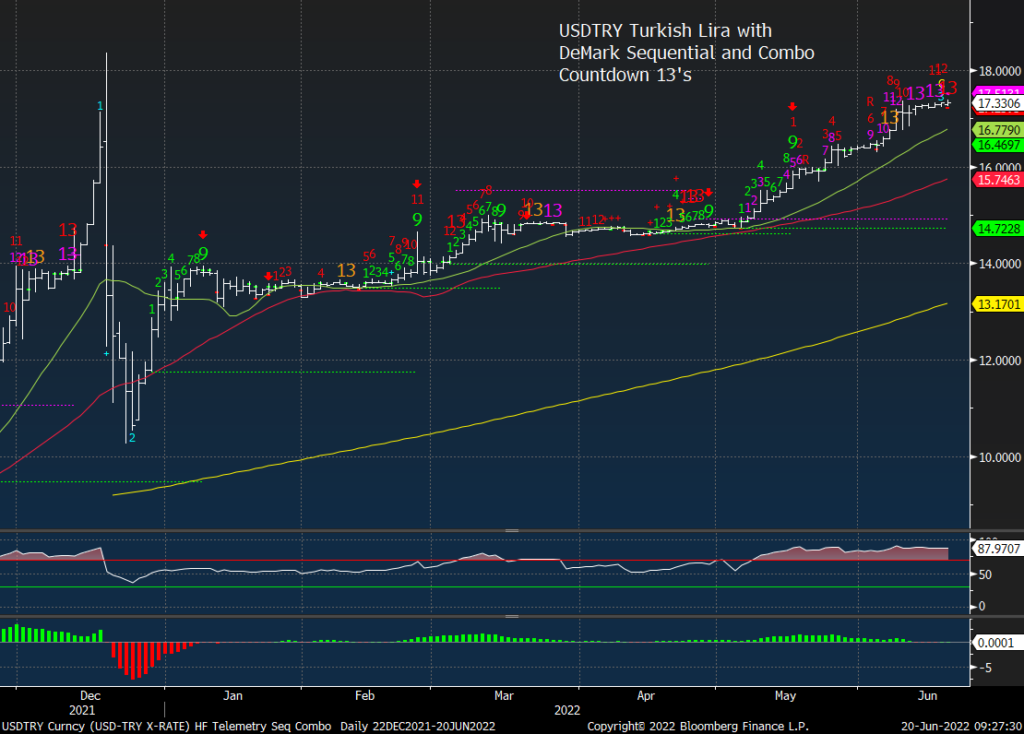

USDTRY US Dollar / Turkish Lira

USDBRL US Dollar / Brazilian Real

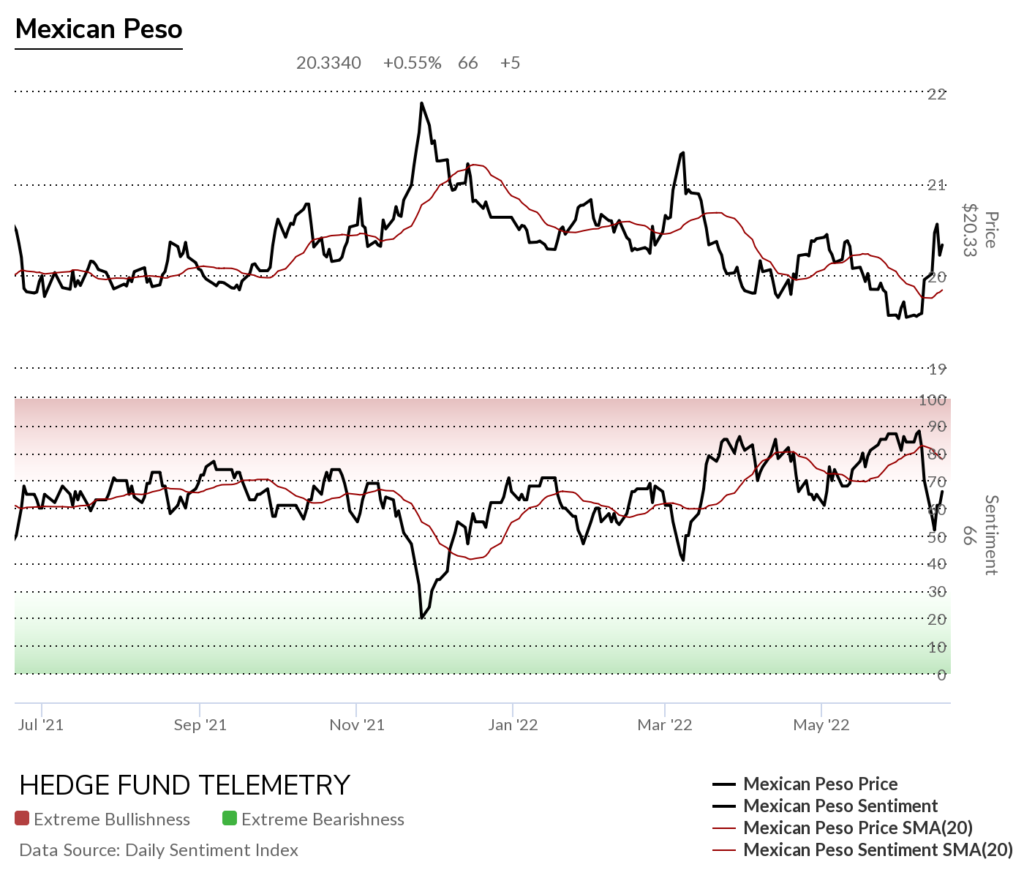

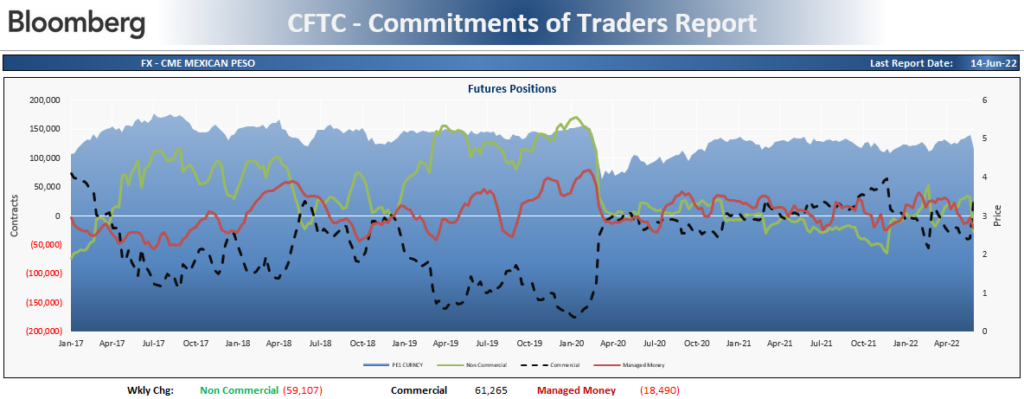

USDMXN US Dollar / Mexican Peso

Mexican Peso bullish sentiment holding the 50% midpoint level

Mexican Peso Commitment of Traders shows speculators significantly decreasing long exposure

USDZAR US Dollar / South African Rand

USDCNH US Dollar / Chinese Offshore Renminbi (Yuan)

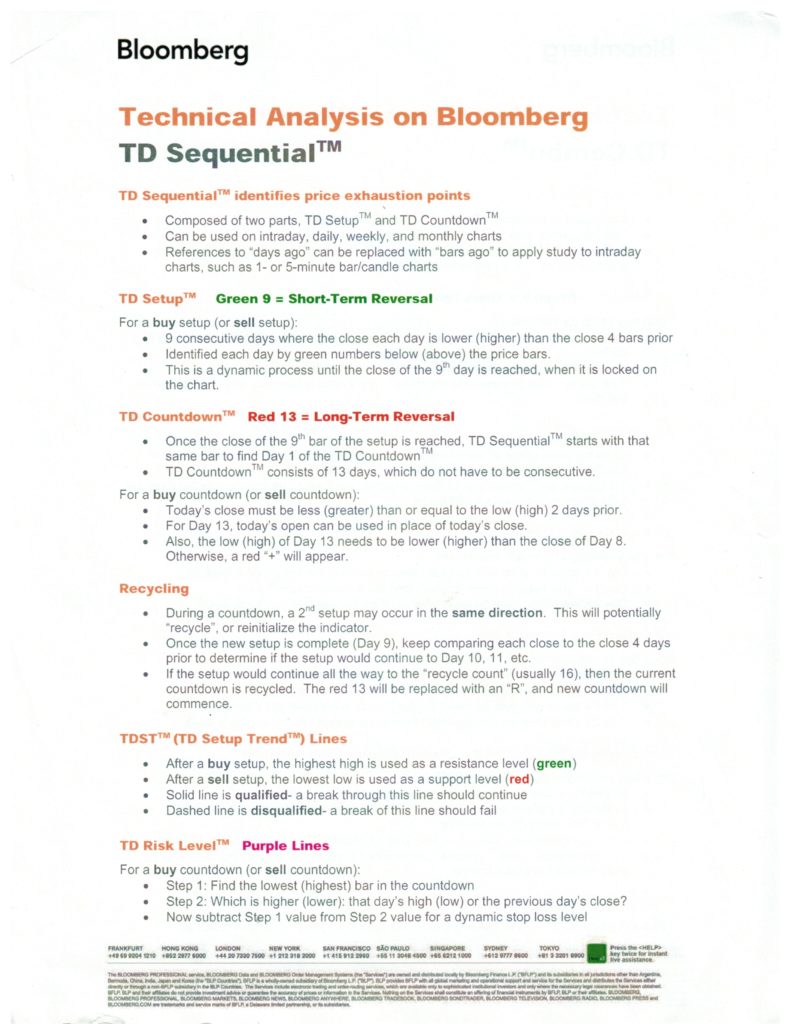

DeMark Sequential Basics from Bloomberg

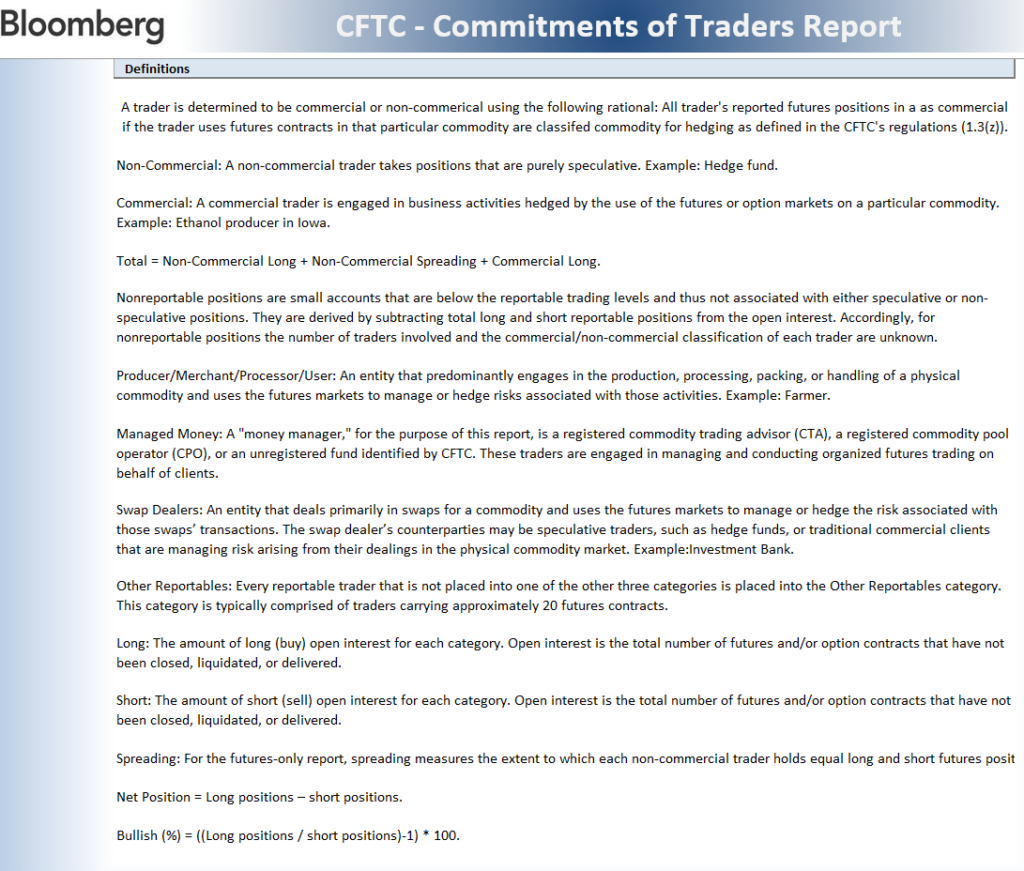

More detailed Commitment of Traders explanation