Commitment of Traders – update

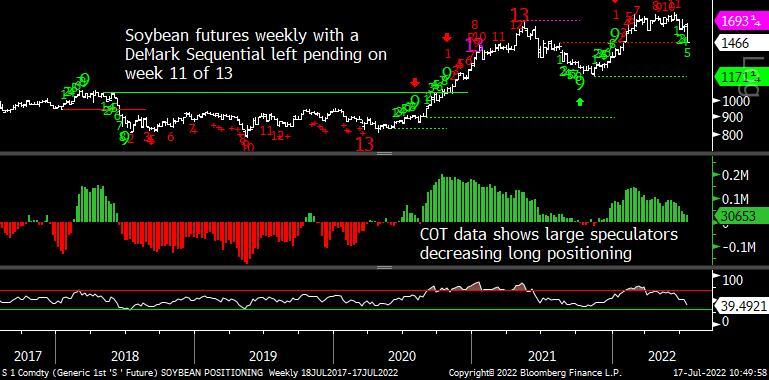

I’ve made changes to the COT charts. I used to take the Bloomberg excel charts and highlight just the large speculator’s data, but now I am including in large speculators the money managers’ data too. They also have the weekly DeMark indicators on the charts as a bonus. We might have some more tweaks in the coming weeks. Let us know your thoughts.

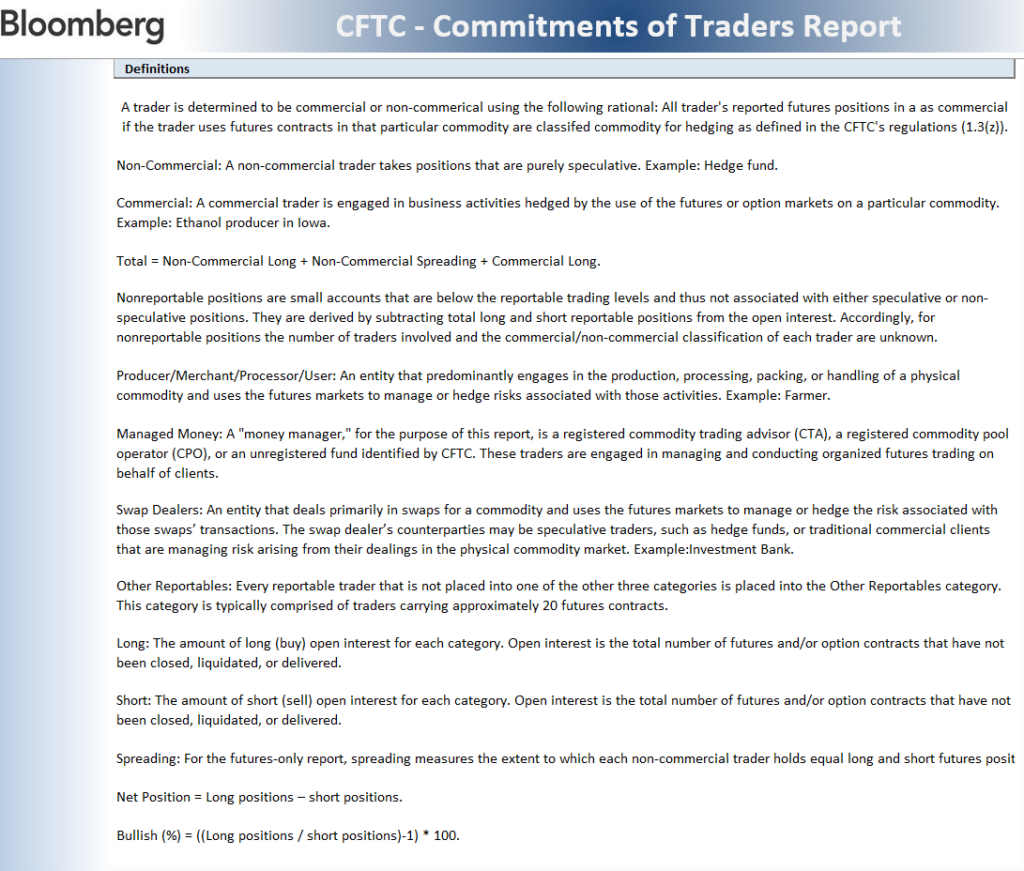

CoT data is most meaningful at extremes when either commercial traders or speculators are super net long or net short. The charts below are mostly self-explanatory by looking at the color-coded type of traders. For a more detailed explanation, please see the bottom of this note.

highlights and themes

The overall Bloomberg Commodity indexes on daily and weekly remain under pressure. Energy and metals continue with risk lower with DeMark Sequential Countdowns in progress. These are now in downside wave patterns, and any bounces will be corrective lower high waves that can be sold.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily drifted up thanks to the energy sector continuing to rise while the other commodities mostly were well off their highs. Risk remains lower with the DeMark Sequential Countdown in progress, especially with energy still barely holding support

Bloomberg Commodity Index Weekly

COMMODITY SENTIMENT OVERVIEW

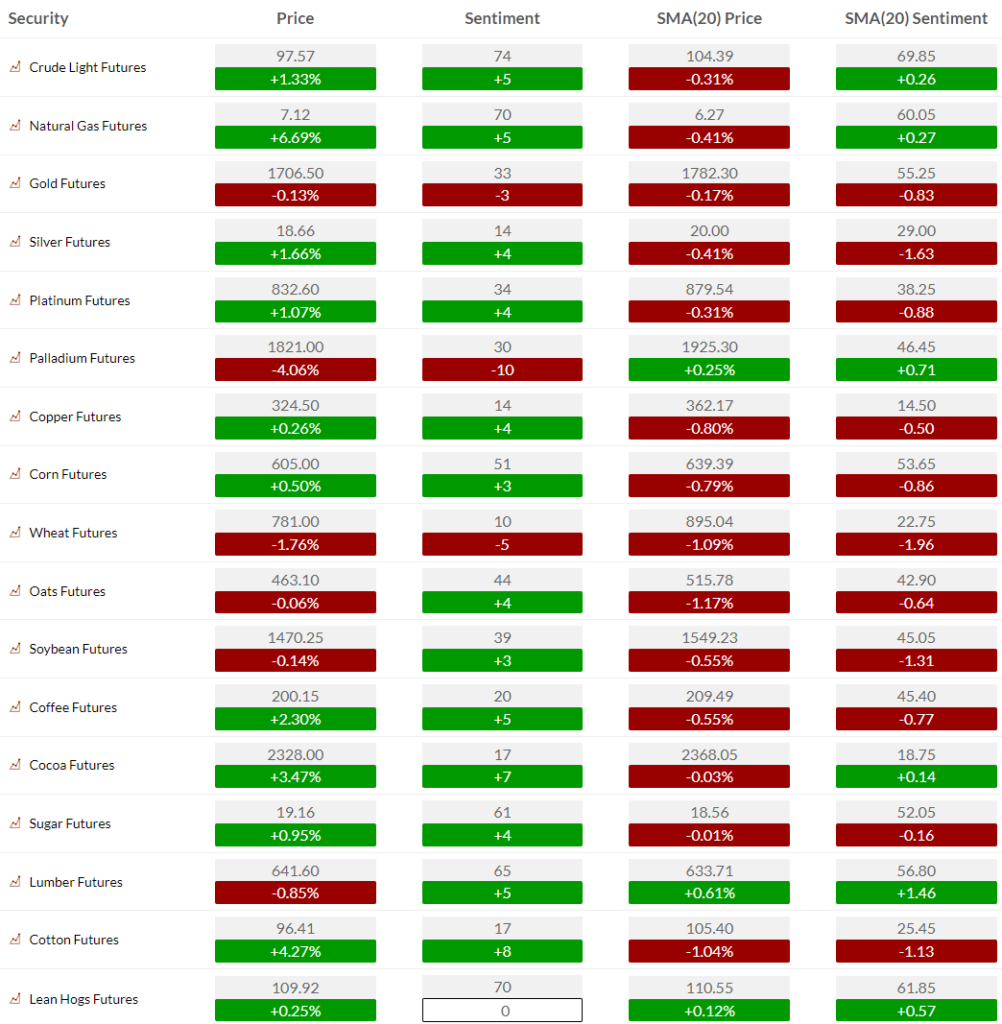

OIL AND ENERGY

Bloomberg Energy Subindex weekly shows the peak with the DeMark exhaustion signals

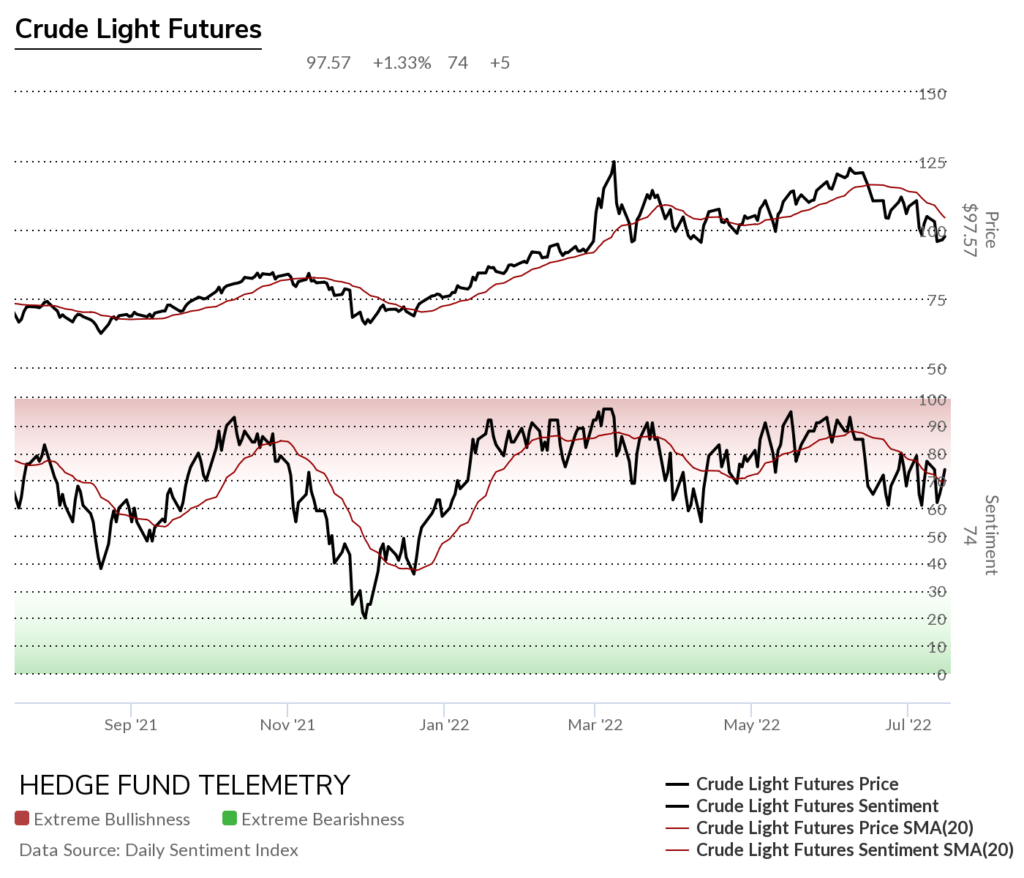

WTI Crude futures daily

WTI Crude Weekly

Brent Crude futures daily has downside DeMark Countdown’s in progress at support. Watch the TDST support at 92.57

WTI Crude futures bullish sentiment still is holding the 60% level the low end of the YTD range

WTI Crude futures Commitment of Traders

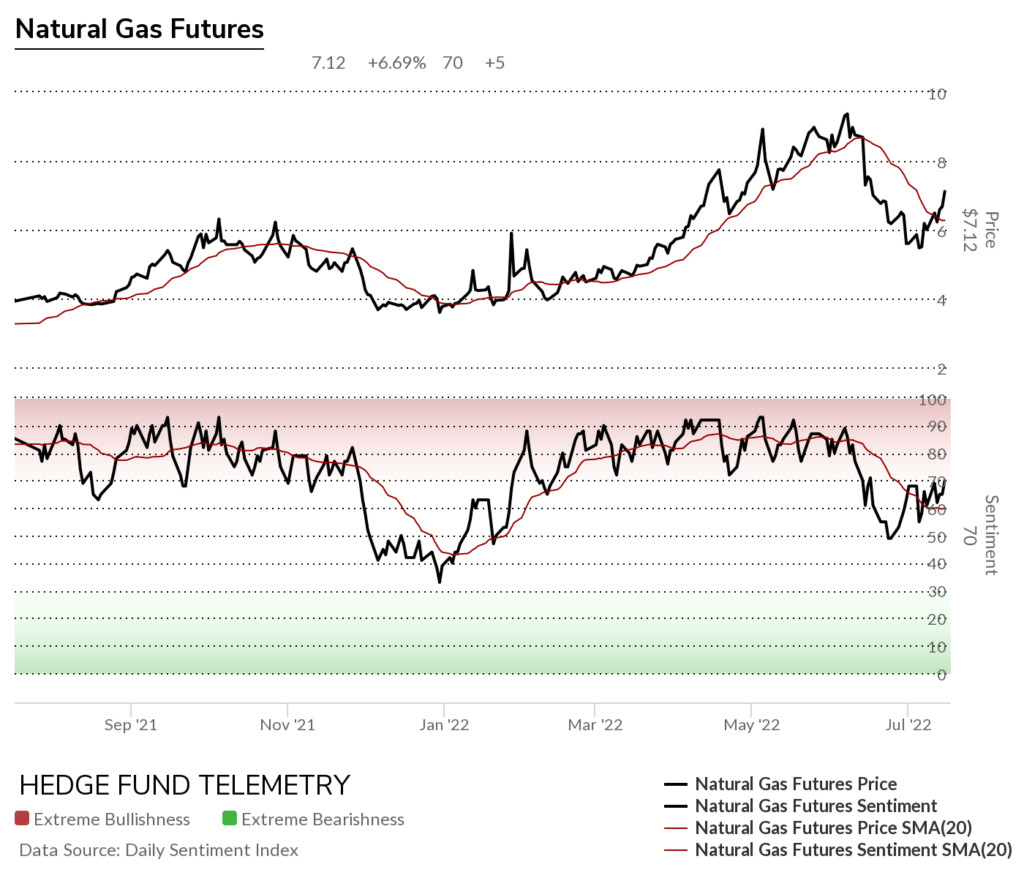

Natural Gas futures daily with a potential lower corrective high wave 2 of 5 (downside wave pattern)

Natural Gas futures bullish sentiment held the 50% midpoint majority line.

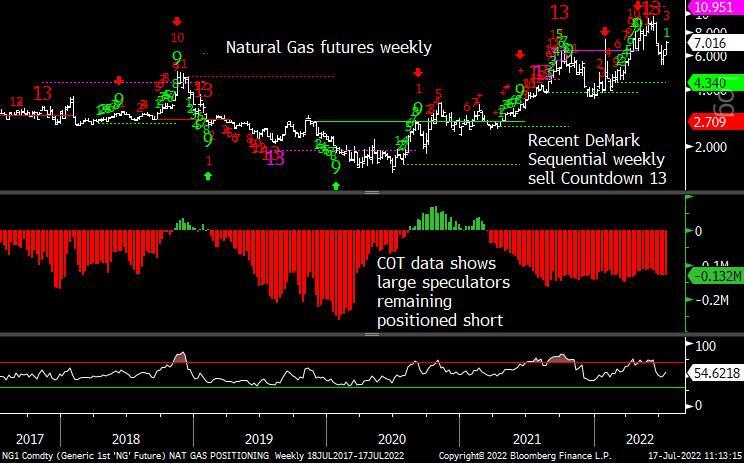

Natural Gas futures Commitment of Traders

Gasoline futures peaked with the DeMark sell Countdown 13’s

Gasoline Commitment of Traders

Metals

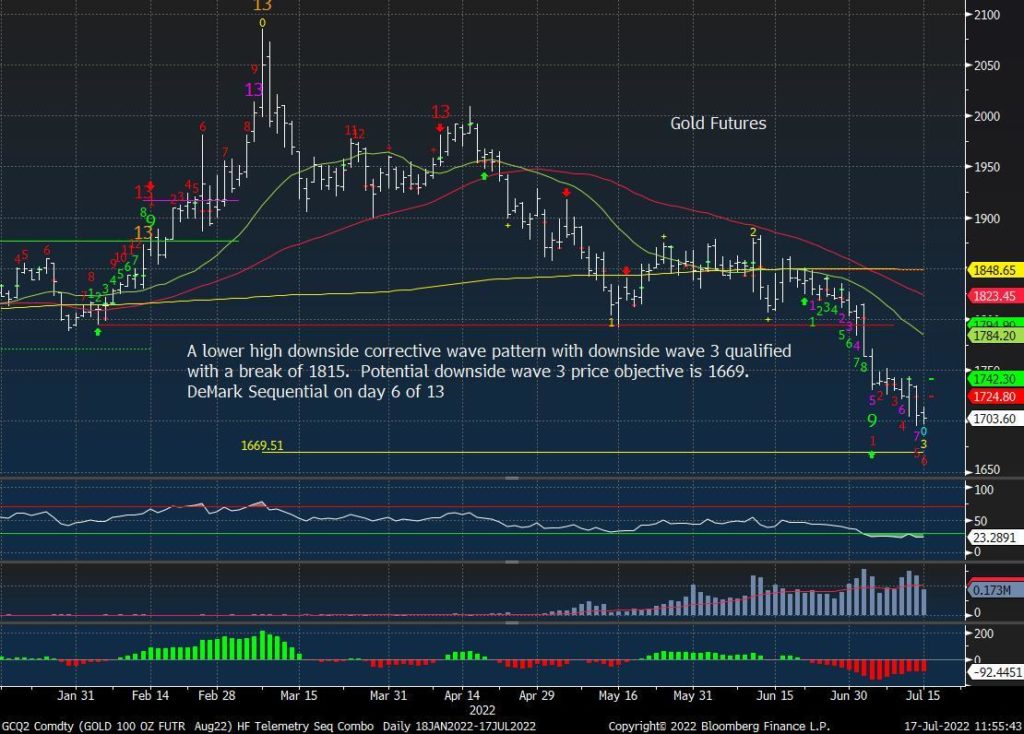

Gold futures daily still has risk lower with the DeMark Sequential Countdown in progress nearing downside wave 3 of 5 price objective of 1669. A lower high corrective lower high wave 4 is expected after the buy Countdown 13

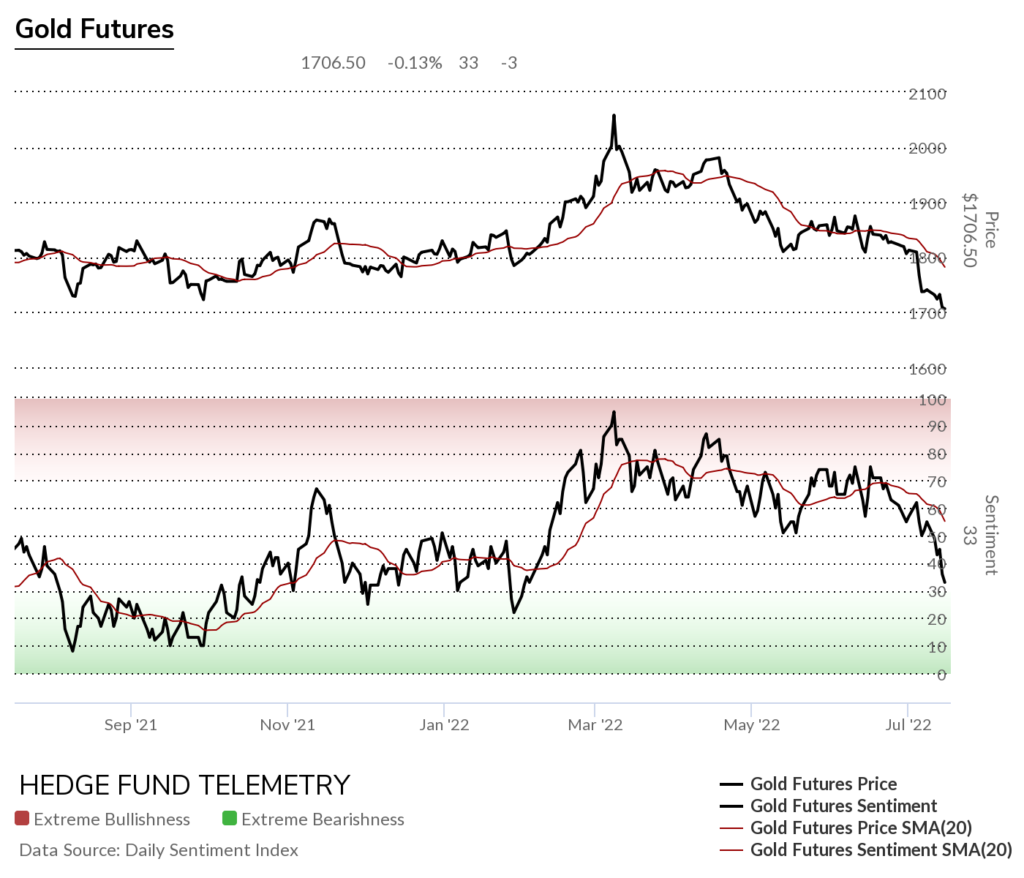

Gold futures bullish sentiment finally broke the 50% midpoint majority level

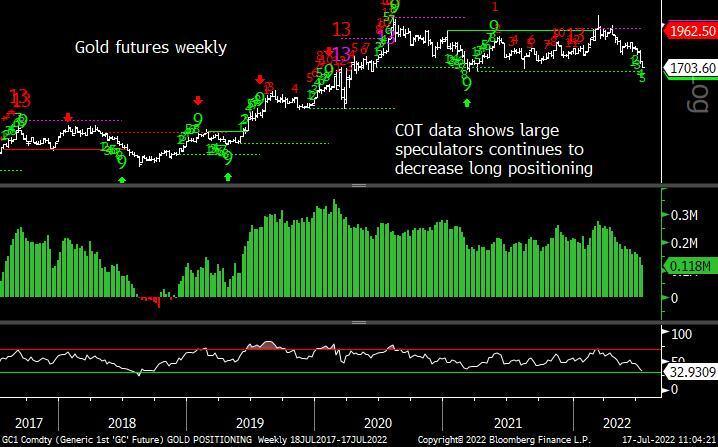

Gold futures Commitment of Traders

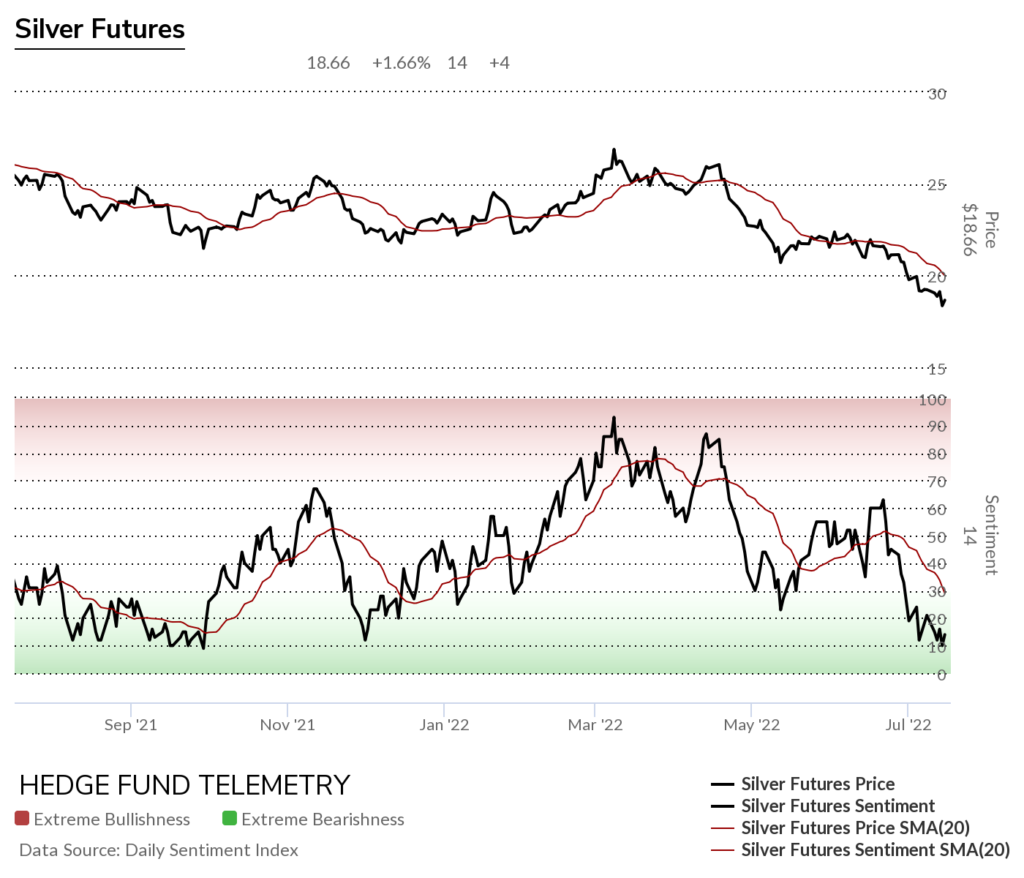

Silver futures daily

Silver futures bullish sentiment is oversold and could stay down here for a while as it did last year at this time.

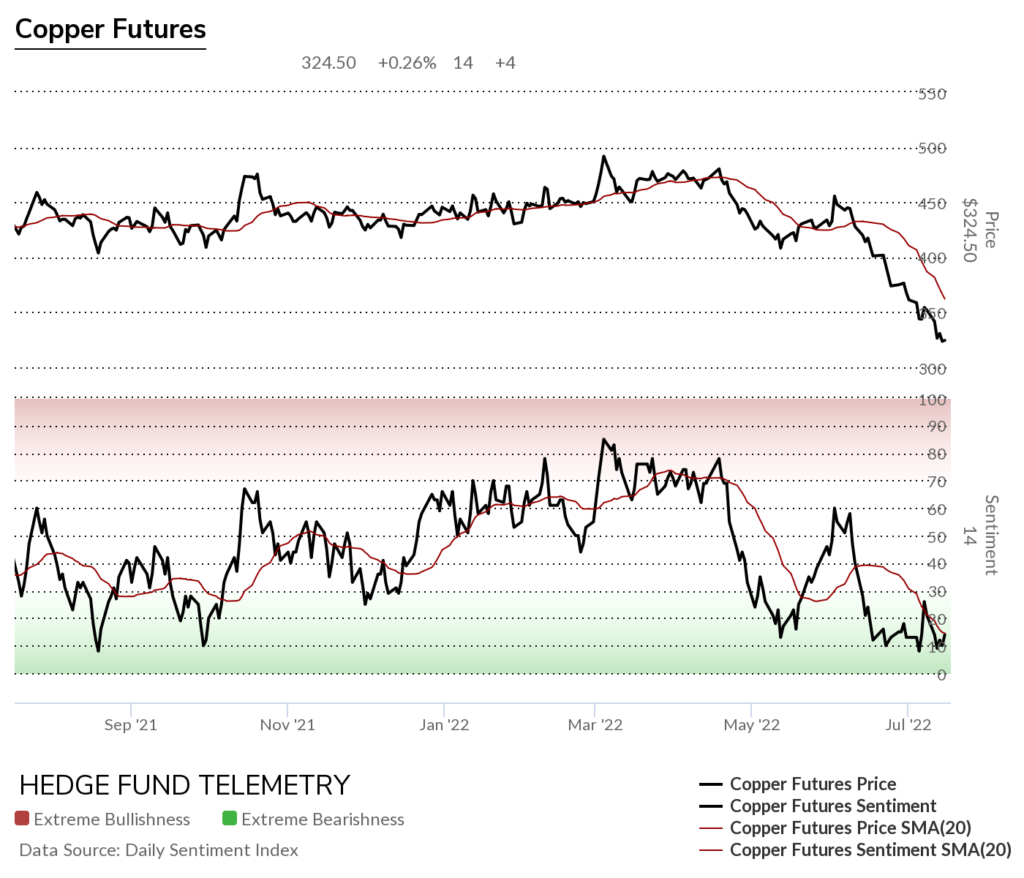

Copper futures daily nearly with the Sequential buy Countdown 13

Copper futures bullish sentiment is deeply oversold

Copper futures Commitment of Traders

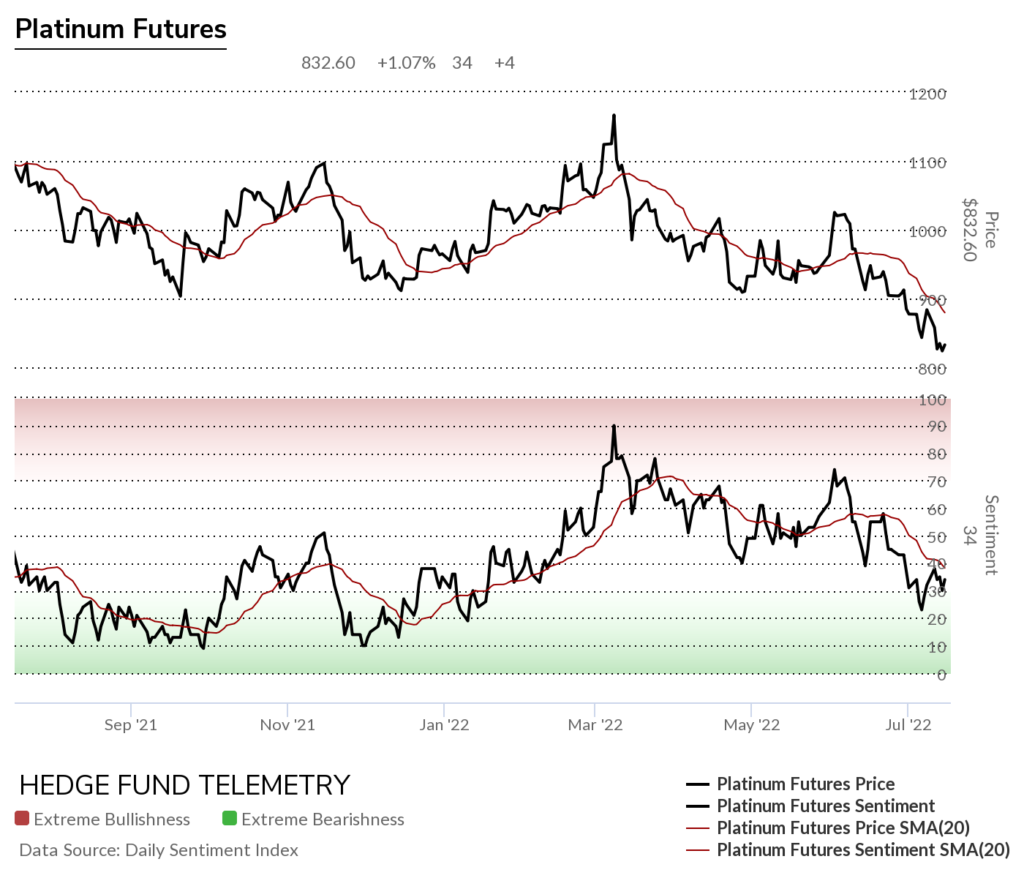

Platinum daily drifts lower

Platinum bullish sentiment is not as oversold as the price action suggests

Platinum Commitment of Traders now turning net bearish

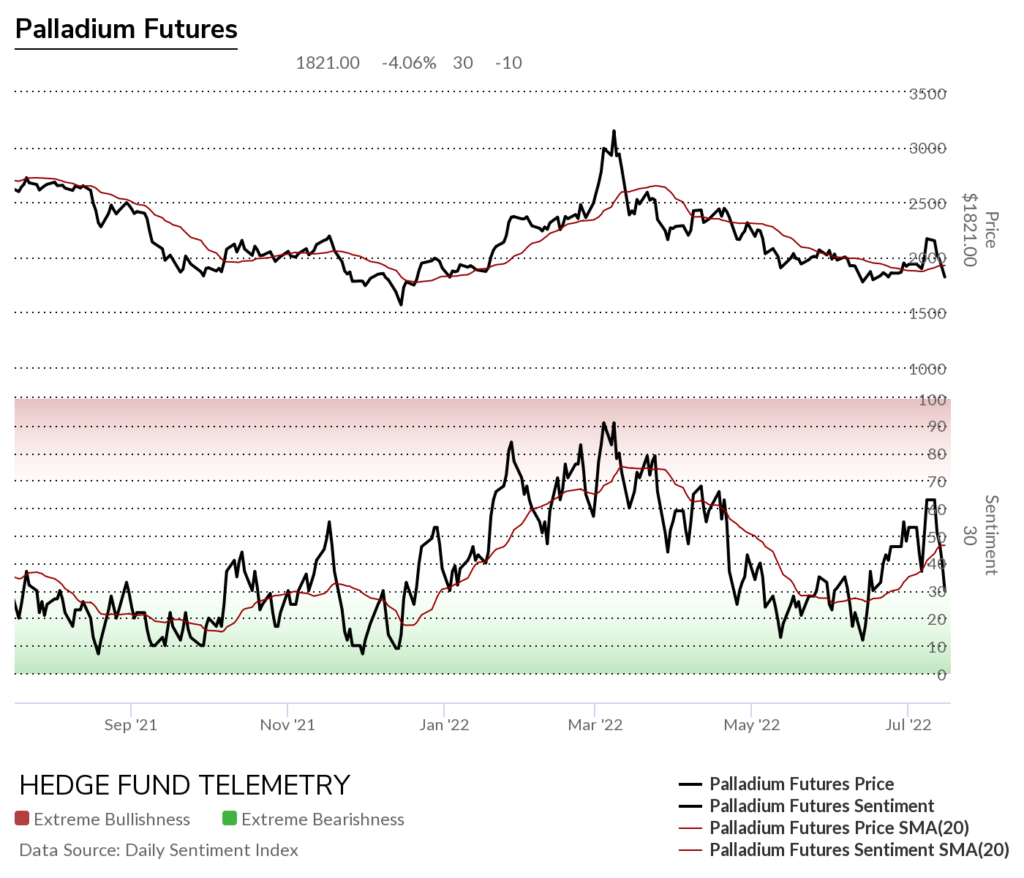

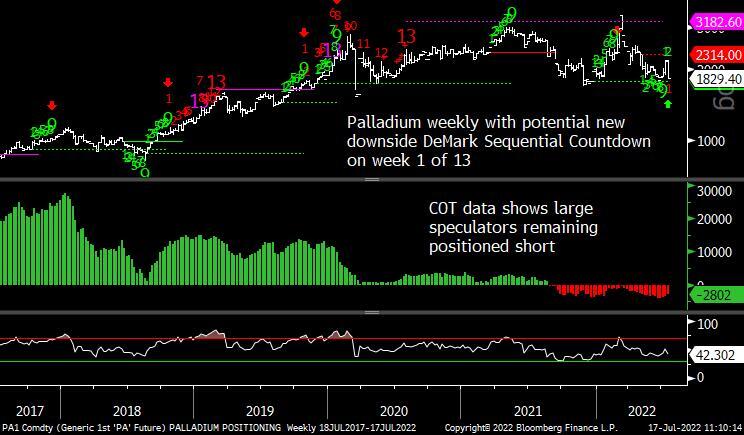

Palladium daily with potential for downside wave 5

Palladium bullish sentiment tried to bounce but failed hard this week

Palladium Commitment of Traders

Grains

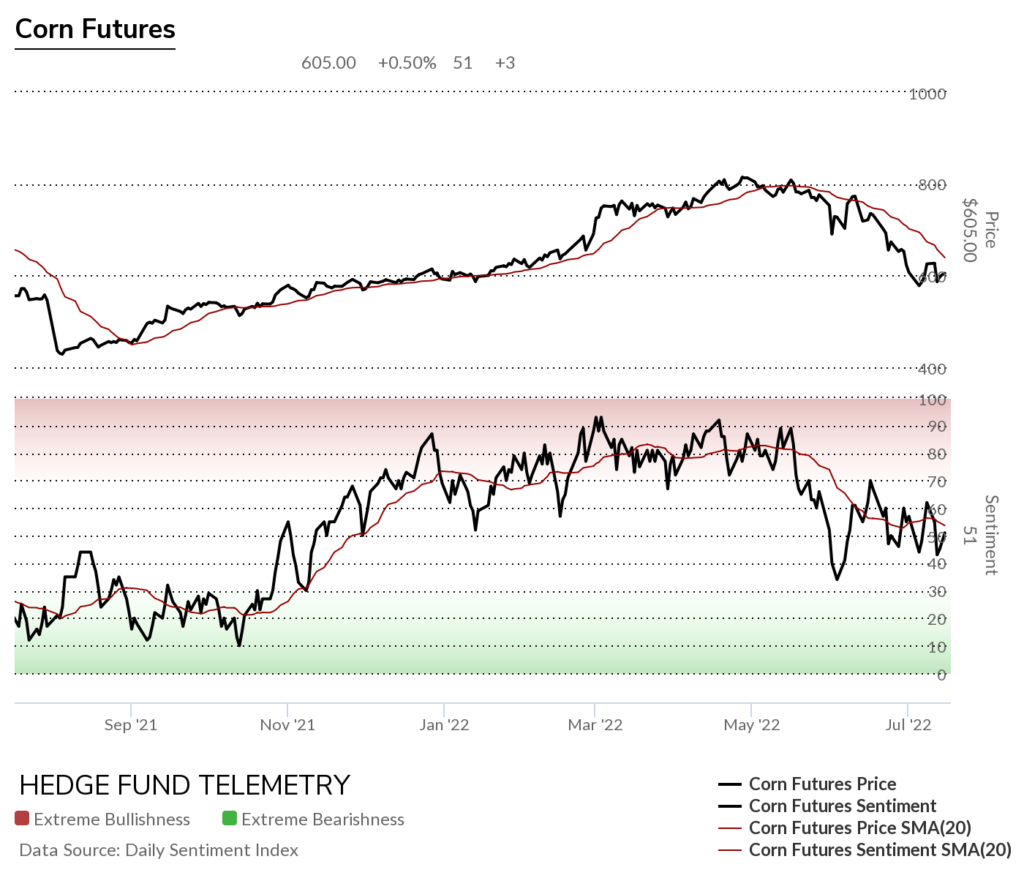

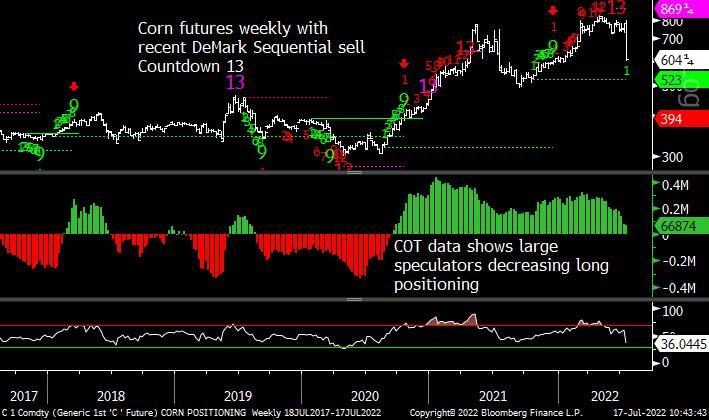

Corn futures daily remains under pressure with the Sequential in progress

Corn futures bullish sentiment holds up despite the price action

Corn futures Commitment of Traders

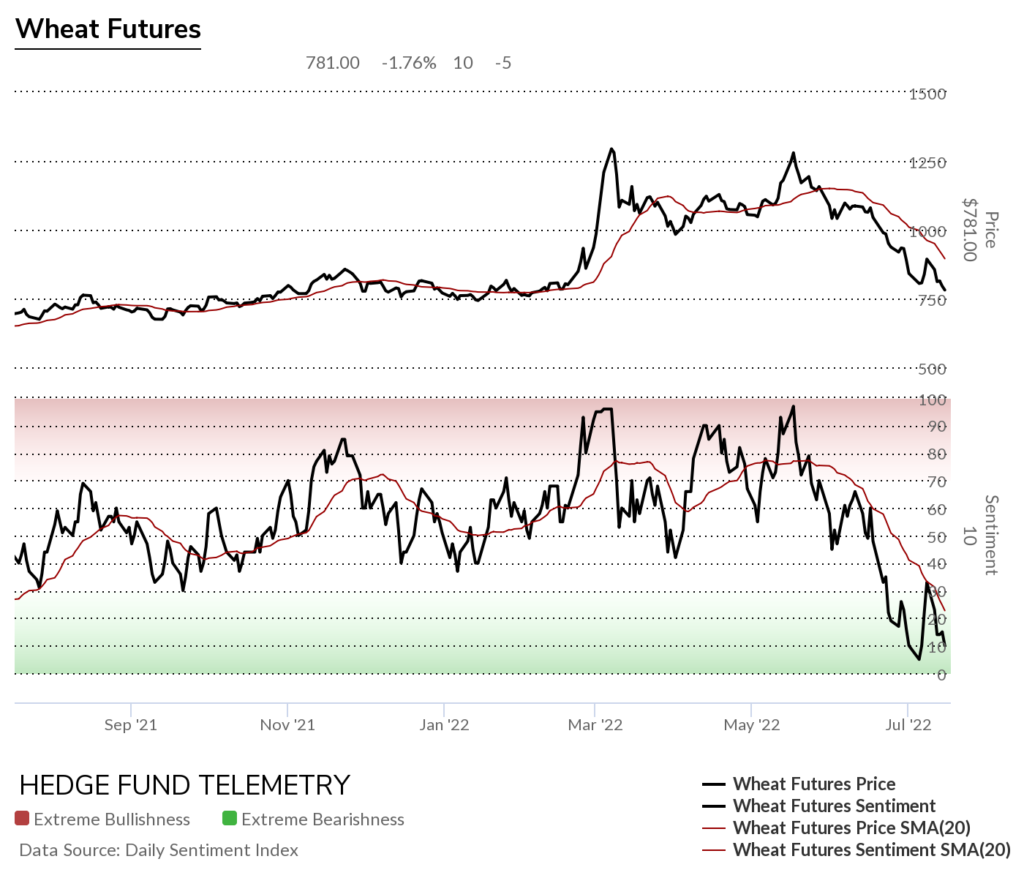

Wheat futures daily with a new Combo 13 and a secondary Sequential continuing trend lower

Wheat futures bullish sentiment remains under pressure

Wheat futures Commitment of Traders

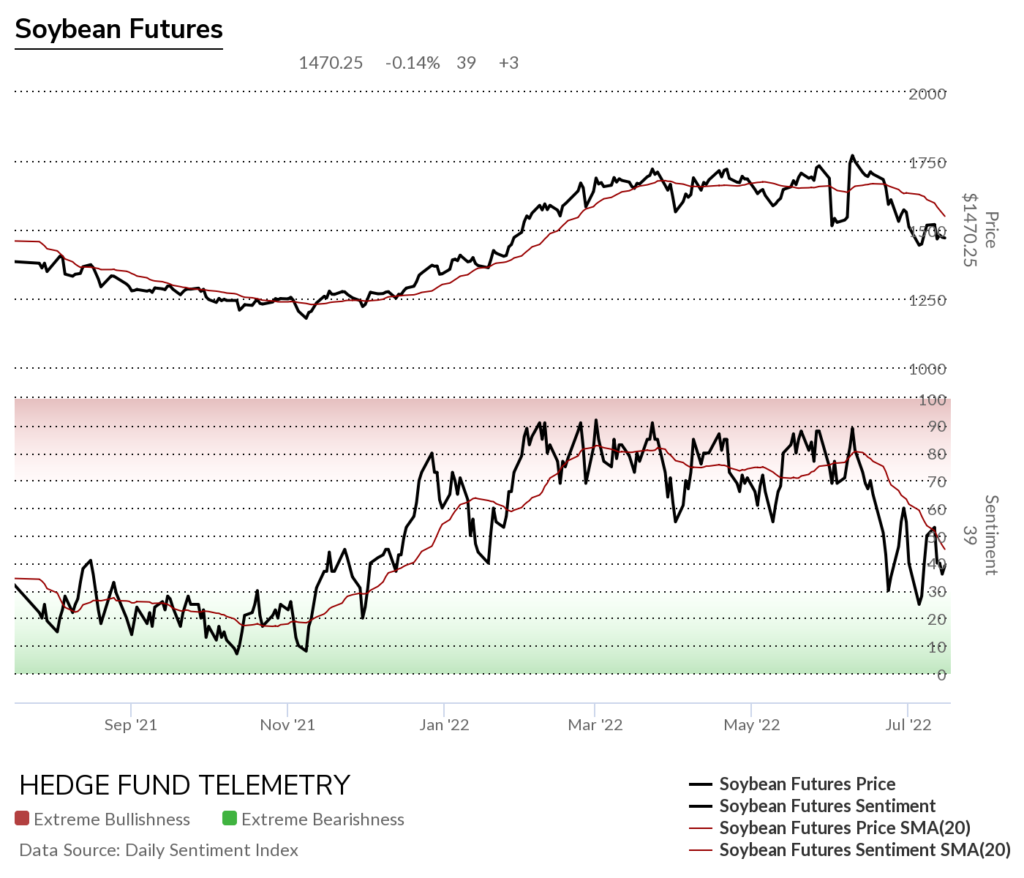

Soybean futures daily drifting lower

Soybean futures bullish sentiment choppy and weak

Soybean futures Commitment of Traders

Livestock

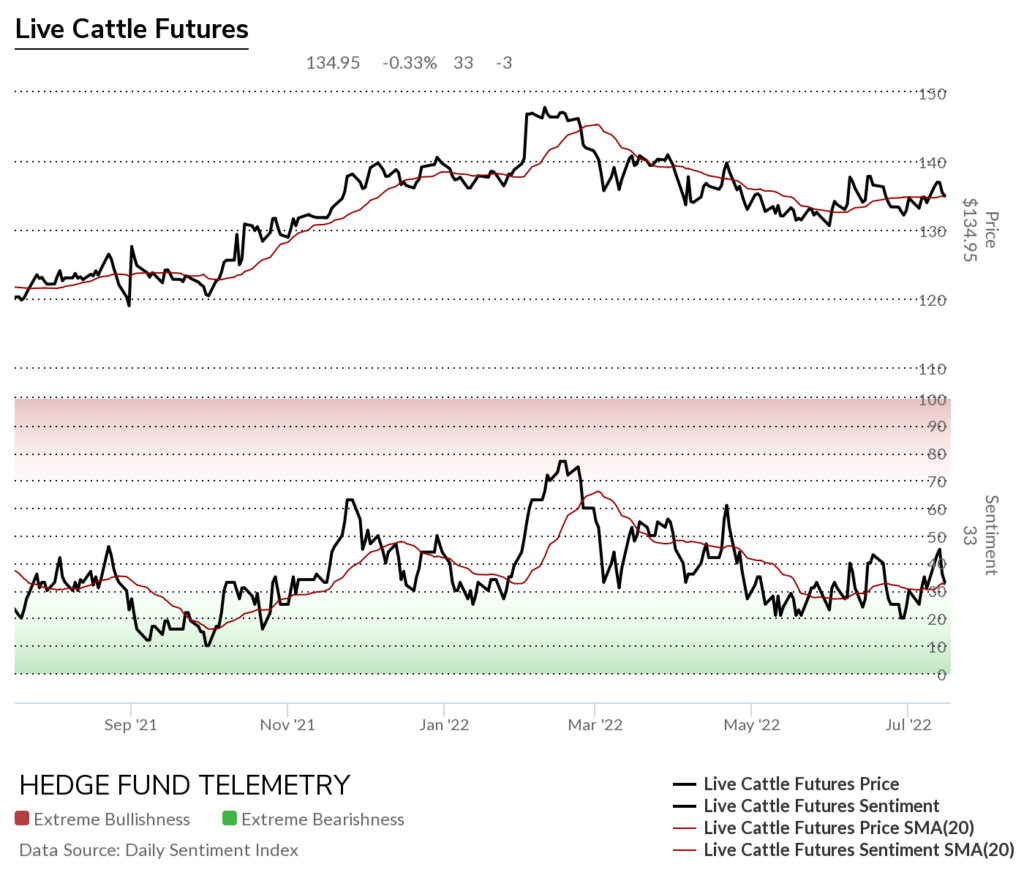

Cattle futures daily messy with no response with the latest Sequential and that’s likely due to this not being on the lows

Cattle futures bullish sentiment remains under pressure under 50%

Cattle futures Commitment of Traders

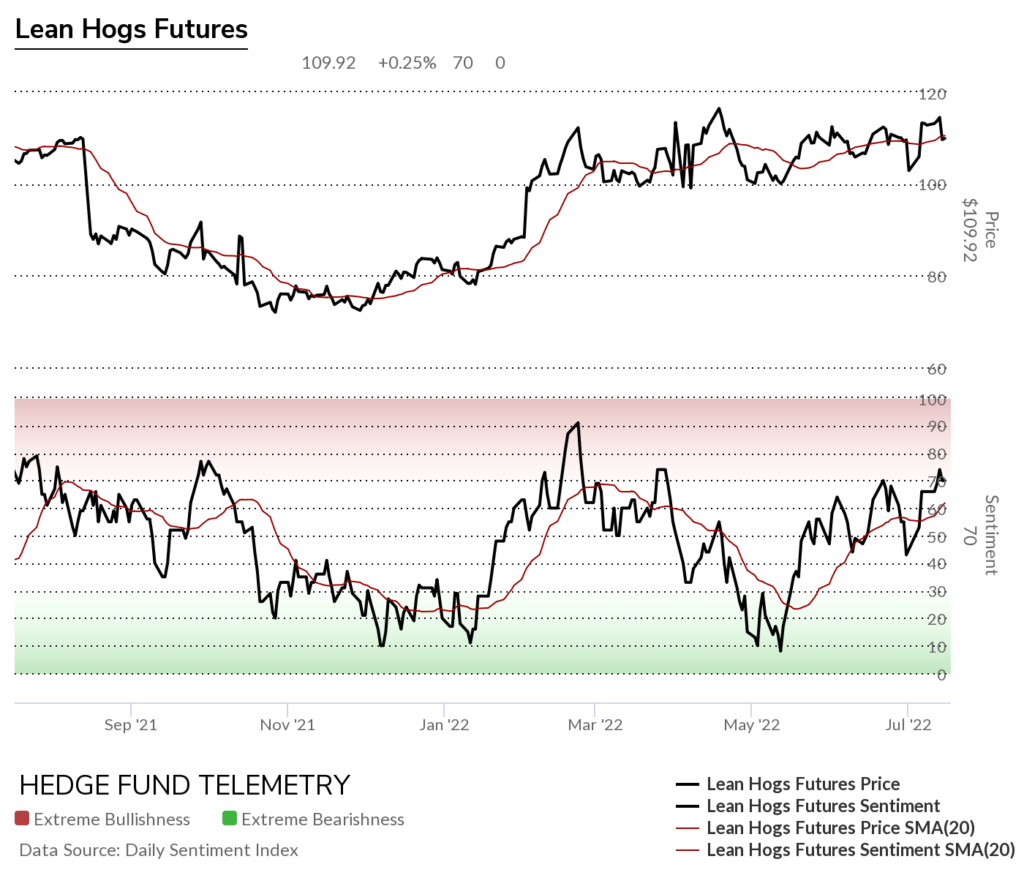

Lean Hogs futures daily sideways

Lean Hogs bullish sentiment doesn’t look bad and above 50% is supportive of an attempt higher

Lean Hogs Commitment of Traders

Softs

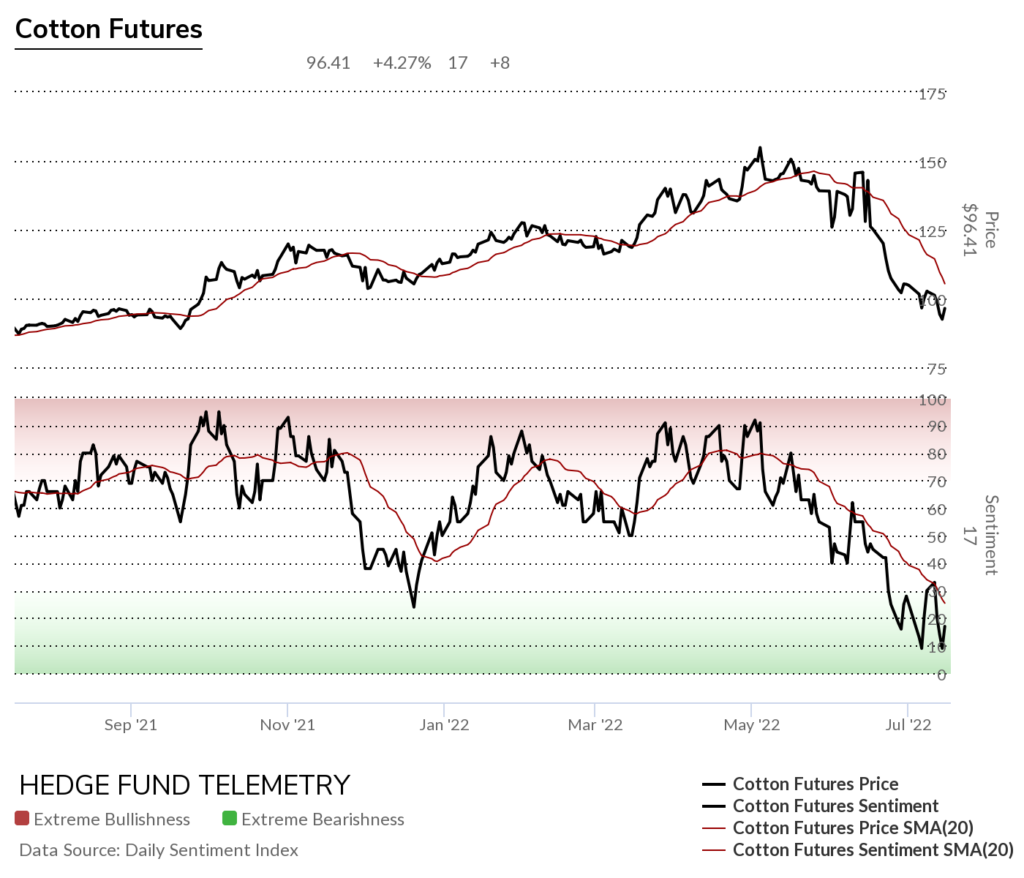

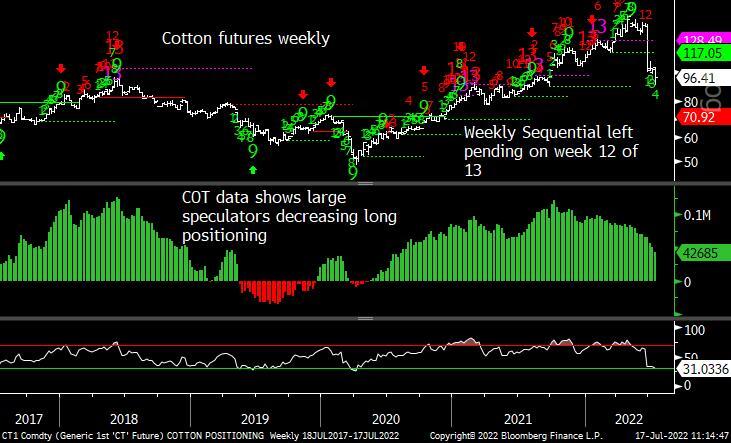

Cotton futures daily could bounce with these latest buy Countdown 13’s

Cotton futures bullish sentiment hit a very oversold reading and might bounce with the 13’s

Cotton Futures Commitment of Traders

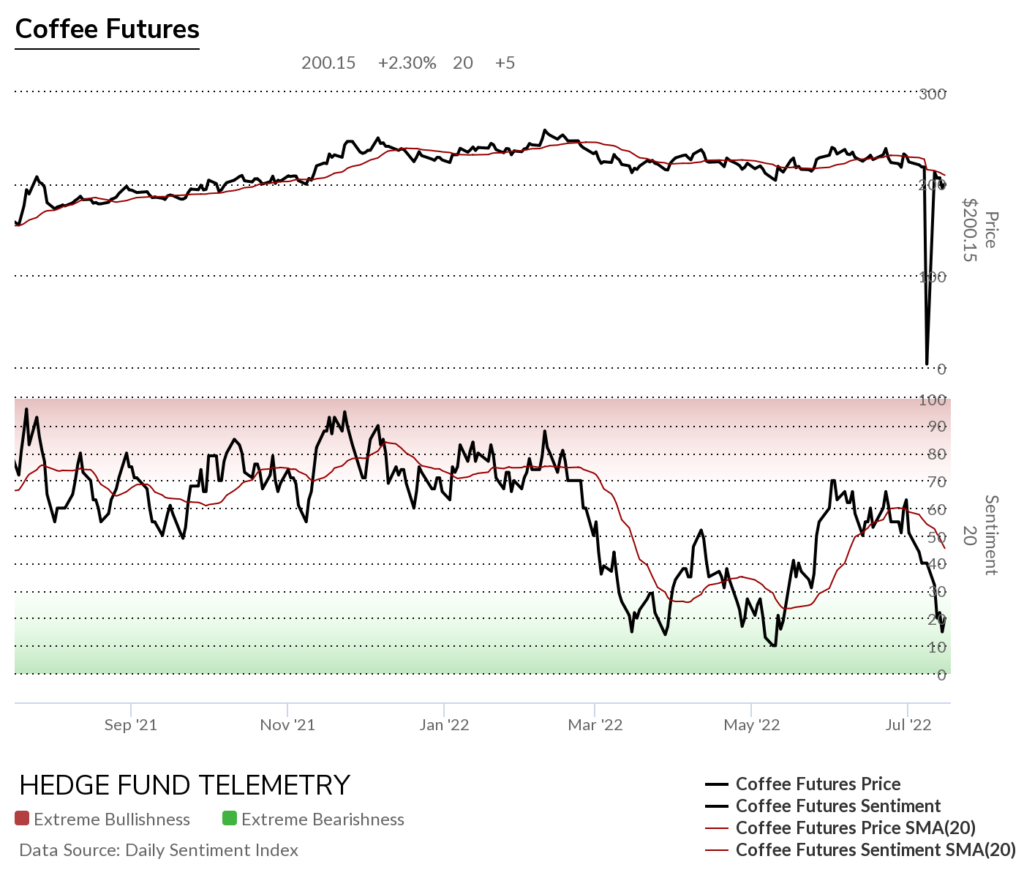

Coffee futures daily with a new Combo buy Countdown 13

Coffee futures bullish sentiment did get oversold enough for a bounce to occur

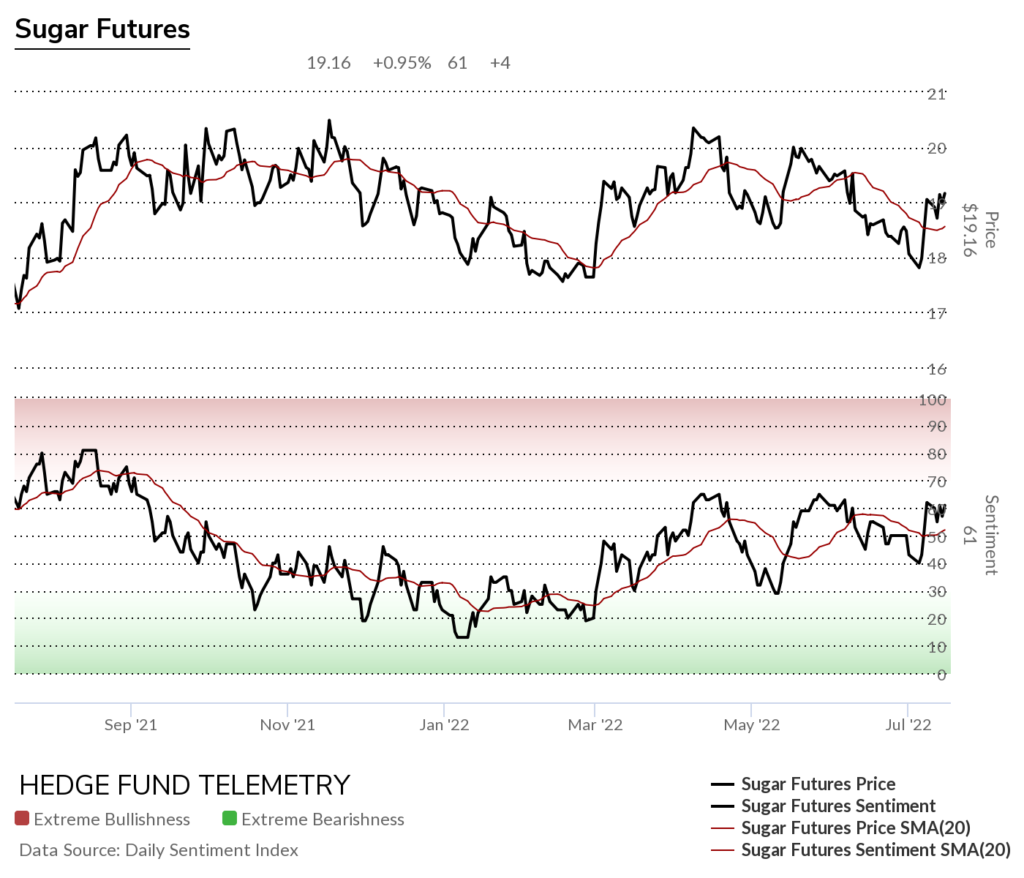

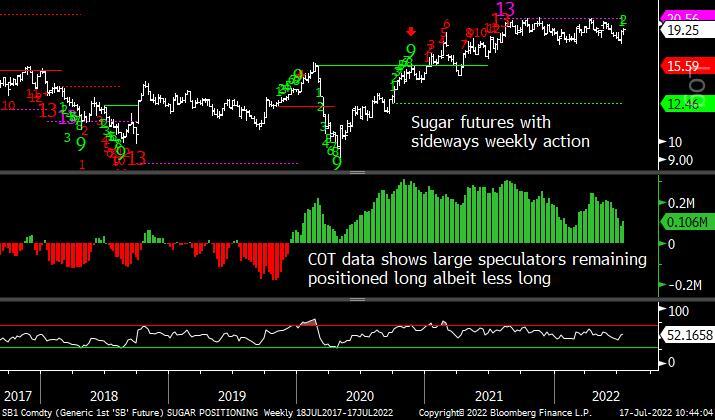

Sugar futures daily bounced with the recent Sequential buy Countdown 13 yet this could be a lower high corrective wave 4 of 5 with another move lower into downside wave 5

Sugar futures bullish sentiment stalling at previous high of range

Sugar futures Commitment of Traders

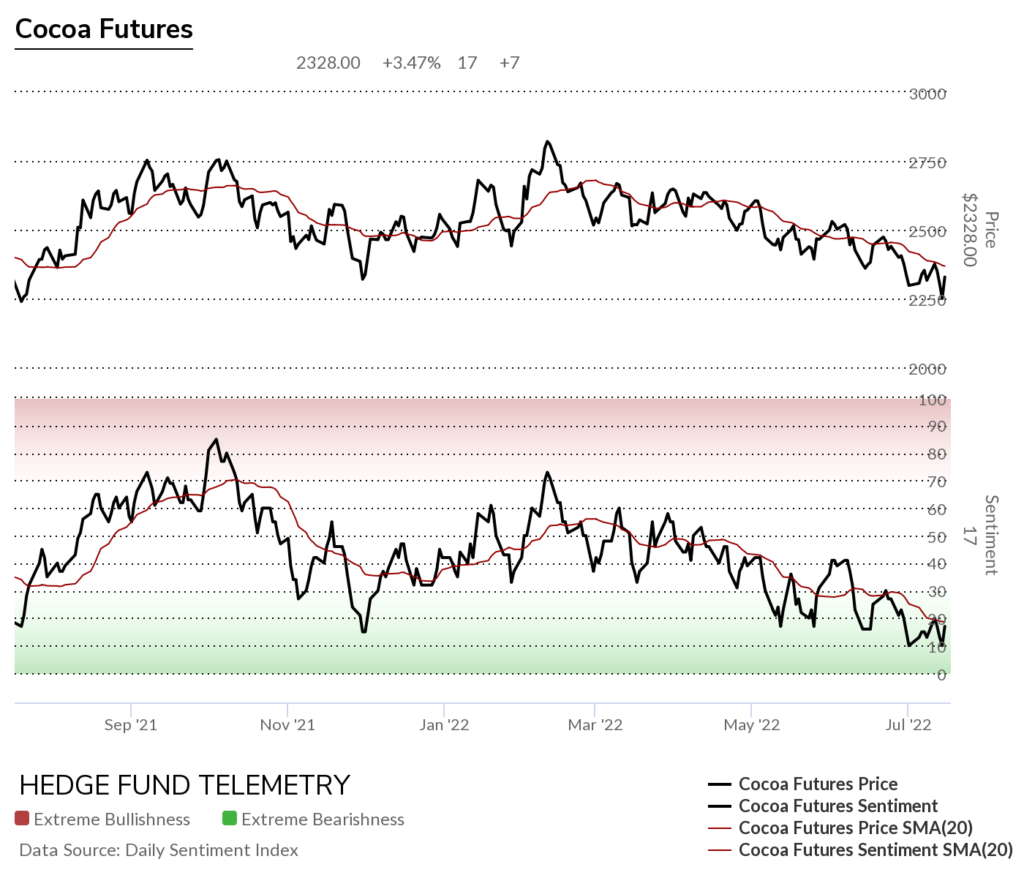

Cocoa futures daily failed to produce a bounce with the recent Combo 13. It’s still in play so a move over the 20 day would improve the odds

Cocoa futures bullish sentiment remains oversold and under pressure

Cocoa futures Commitment of Traders

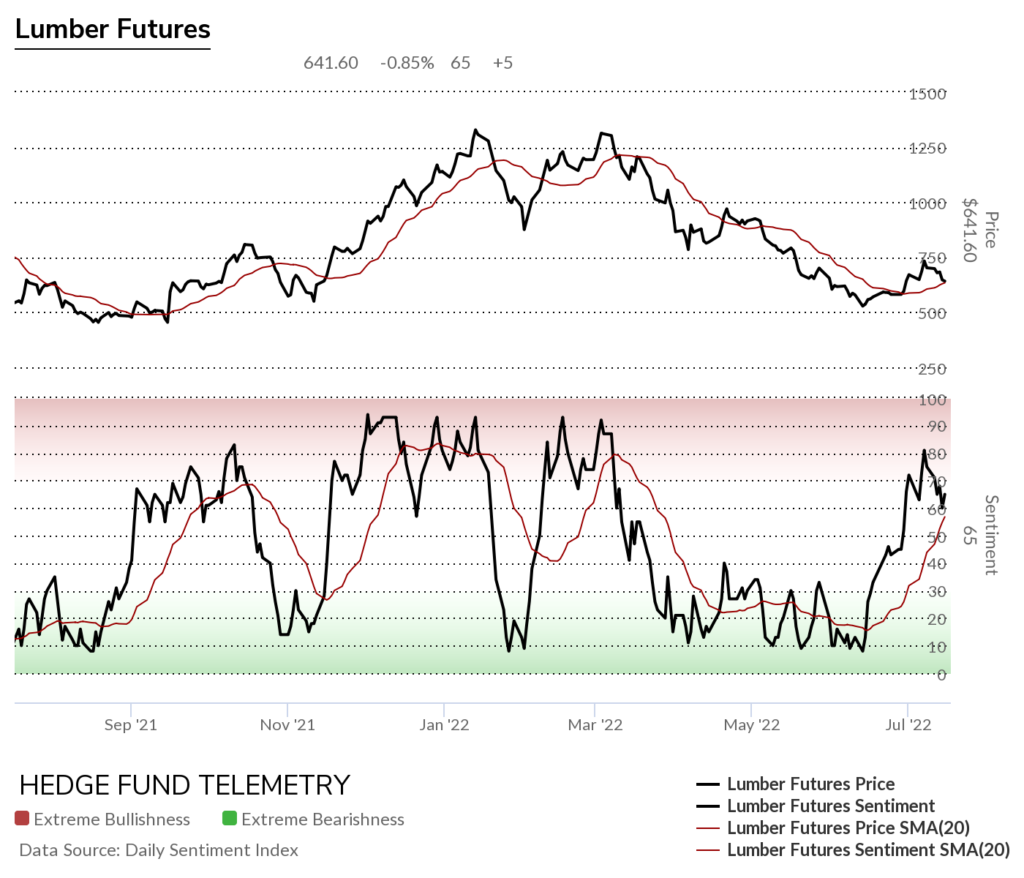

Lumber futures daily has potential for an upside move

Lumber bullish sentiment can be rather wild. Still risk to the upside to an extreme level

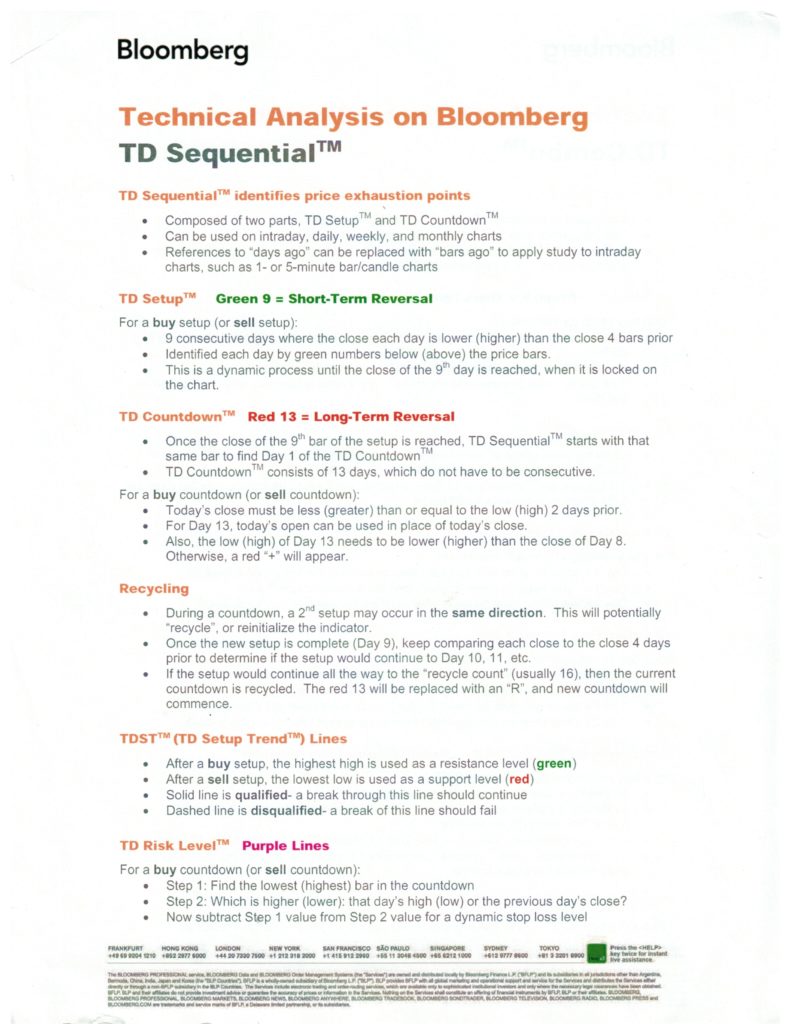

DeMark Sequential Basics

MORE DETAILED COMMITMENT OF TRADERS DEFINITIONS