A lot of gunfights this year… few winning markets

Every once in a while, I get stuck platform surfing, and for whatever reason, I decided late last night to watch what could be the worst movie I have seen in a while, – “Die in a Gunfight” – for a bit. I guess there is a Romeo and Juliet feel to it, as the Capulets and Montagues are renamed, the setting is modern, but it still felt flat and silly. Having said that, and in spite of my aversion to guns generally, and acknowledgment of the horrific violence (309 mass shootings in the US this year!) that we see all too often across our screens, the title resonated with me because of what feels like months now, I have been refraining from doing much in markets largely because I see bullets flying all over the place and see no need to stick my neck out and die in a gunfight.

I adhere to the Buffet idea that investing is about swinging at pitches in your wheelhouse within a generally balanced portfolio that can perform through most conditions. Of course, the natural psychology when money has a negative real return is to try to swing to outperform, to make back what has been lost, but have learned (the hard way) to resist that. It has helped that I got rates right and was able to position well against those firms and funds that benefitted most from rates being excessively low, so I can wait for my pitch. And, while it is certainly plausible to me that we could get another leg up in rates – as I have written and highlighted – it is by no means as clear to me from here as it was 6-12 months ago, but at 2.75% 10yr may have to dip a toe back in on the short side.

In addition, I did find this piece by Dan Morehead at Pantera Capital who spent years at Tiger as head of macro trading (and is now a central player in crypto) to be thought-provoking as it suggests the Fed may have more work than appreciated given a. easy for too long; b. distortion of rates/mortgage markets via QE. Right now, 2023 appears to be pricing 75 bps of rate cuts, as the chart below shows. The positive implication from this chart is that inflation will be brought under control, a soft landing secured; the negative is that we get a recession and further market distress, hard landing scenario. I suspect that is what the market is grappling with. I just read somebody who is buying growth stocks given the breakdown in commodities thinking lower commodities -> less inflation-> lower FF terminal rate , but with lower growth, but at worst a shallow recession —> buy growth stocks. But, of course, that could just be today’s narrative. I mean, we haven’t really started earnings season yet!

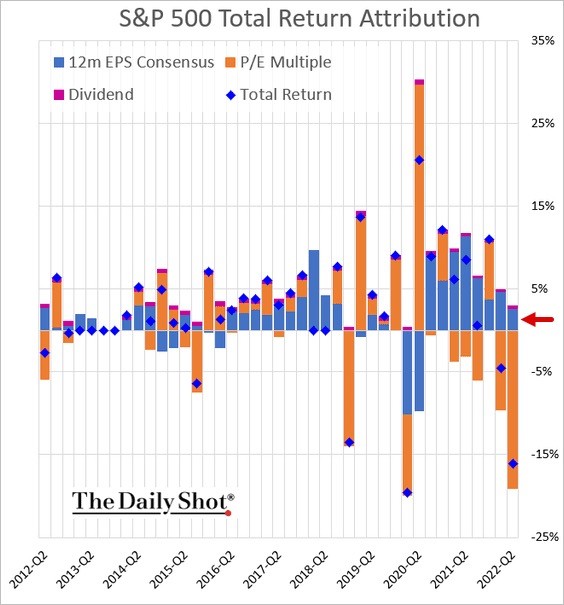

In equity market parlance, this move in rates (and spreads) has had the effect of compressing multiples. That those multiples are being applied to earnings projections that are likely still too high in the near term (slowdown, recession, cost pressures, CB commitment to slaying inflation) but may also be on a forward basis (economic landscape in light of Russia, Covid/China, Oil, supply constraints, weakening balance sheets) suggests this up and a coming quarter for earnings and guidance will be critical. As such, there just isn’t the need to put too many chips on the table, IMHO.

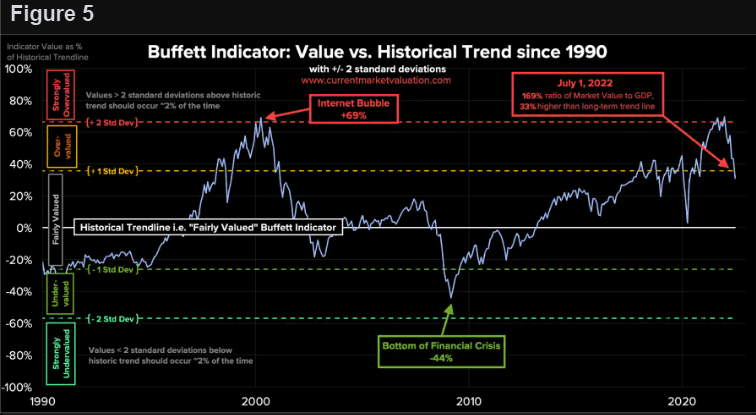

A somewhat different approach to that view is that in a tightening/de-leveraging cycle where valuations have been extended and some excesses are being revealed and naked swimmers are being exposed, it is not always that easy to see where things stand. Maybe this chart helps to see where we are in broad market capitalization to GDP terms.

One thing to keep an eye out for in these markets is the “dollar wrecking ball” and particularly as it flows through to earnings and guidance. And, is interesting to see how the Russian situation is felt most acutely in Europe, where Germany has posted its first trade deficit since 1991! So, if you have the playbook that rates coming off means buy the beaten-up stuff, have at it. But, I still see a lot of paths this can all go, and not convinced we have seen a bottom. Plus, the $ being strong is “good for fighting inflation” as Powell remarked in testimony.

This brings me to the idea of positioning, which as I have articulated prior is still pretty robust.

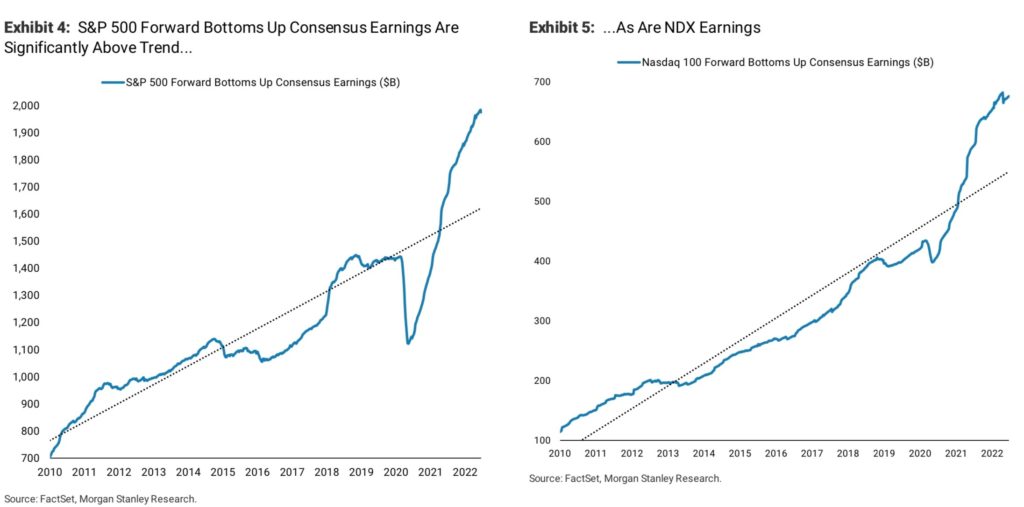

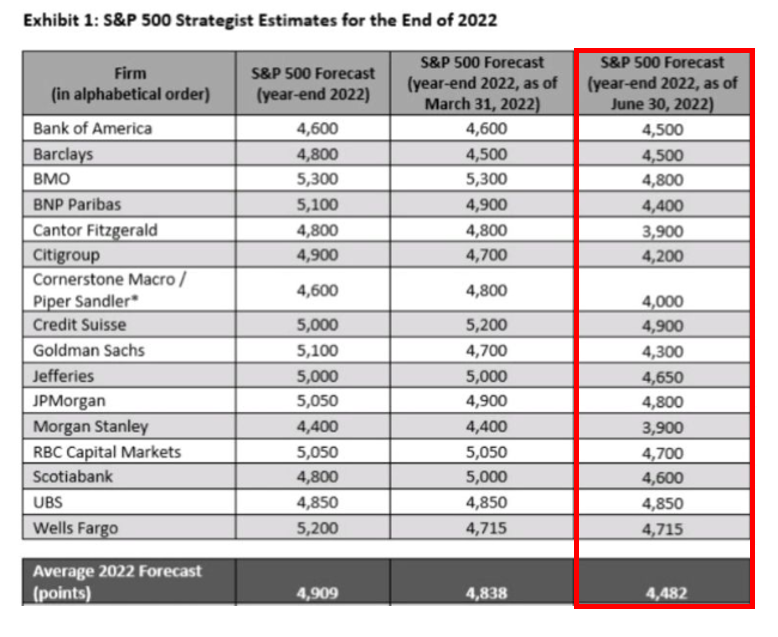

And, forward earnings estimates are still rather high, as MS shows. Notice that as of last week, most stock forecasts seem to be in the soft landing camp and continued strong earnings.

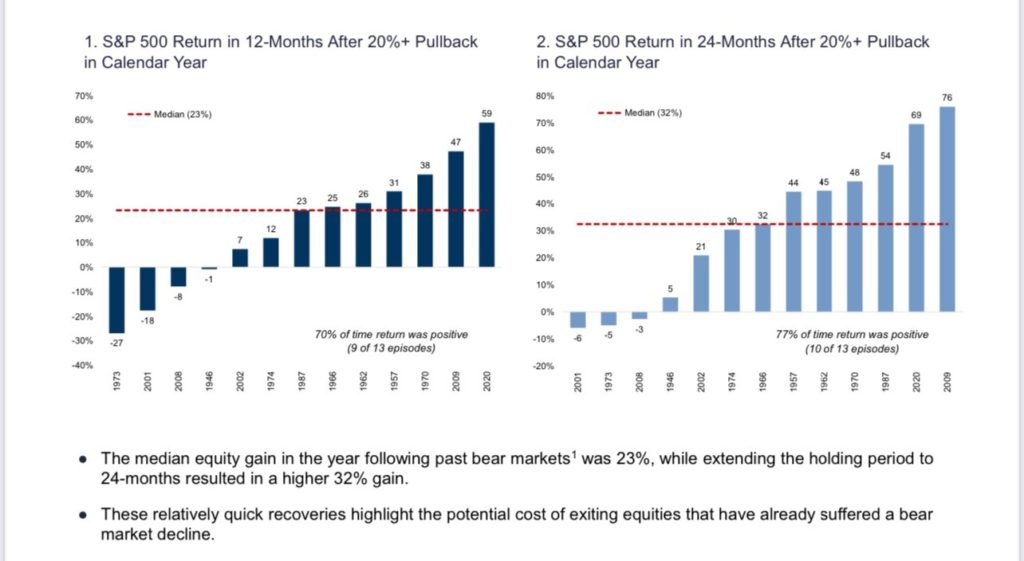

It is important to keep all of the things in the mind of course because recession probabilities have picked up, it is still not the base case. The institutional investing and sell-side are of course biased toward optimism. And, I generally share that, because being out of the market or trying to time the market can be very tough for building real wealth over long periods of time, and markets can snap back (see below charts from GS), but my sense is that there are too many not fully incorporating the changing paradigm and may be stepping in too early (ie. I have not seen capitulation).

Things that caught my attention this week:

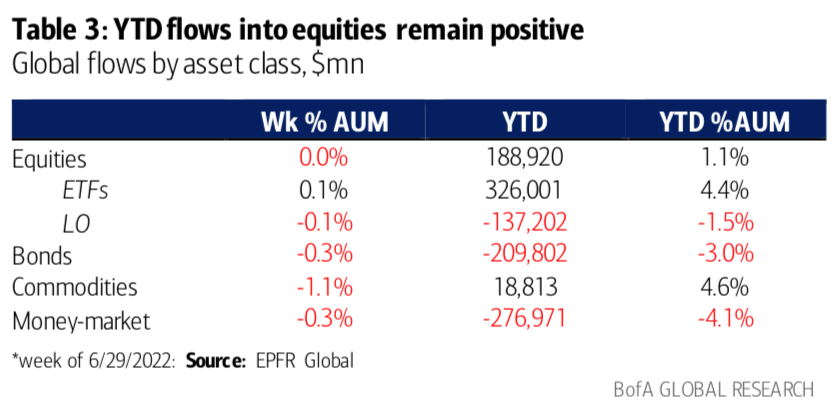

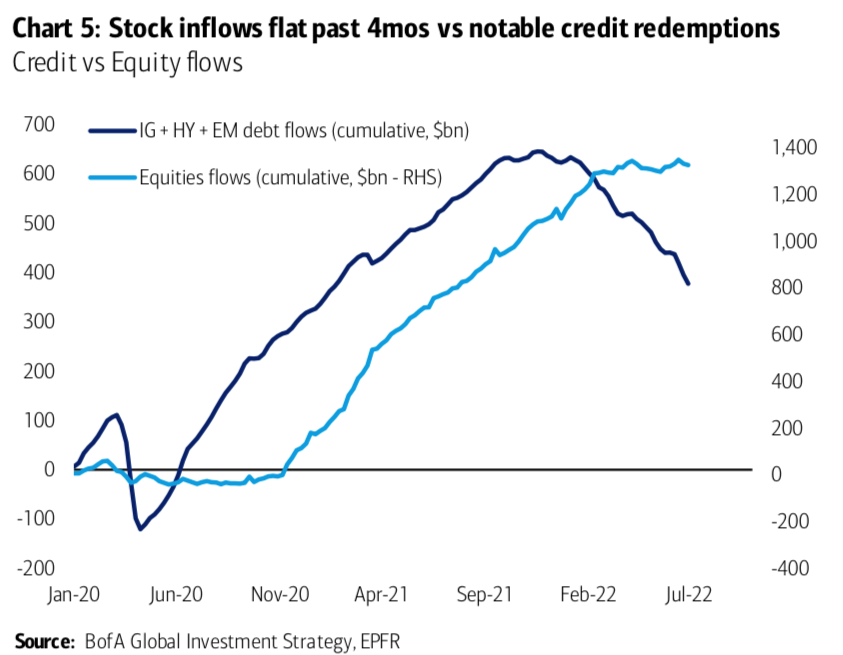

Flows:

Equity flows are still positive for the year, but flattening out as credit continues to see redemptions.

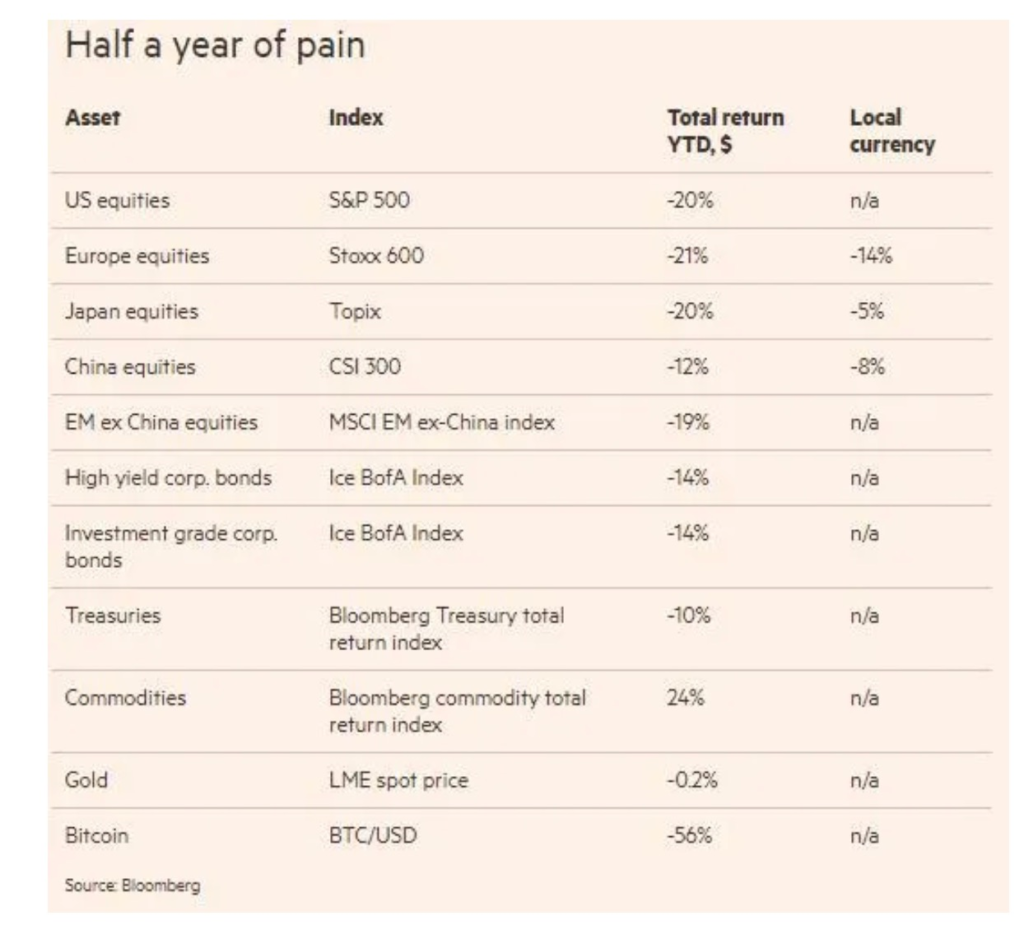

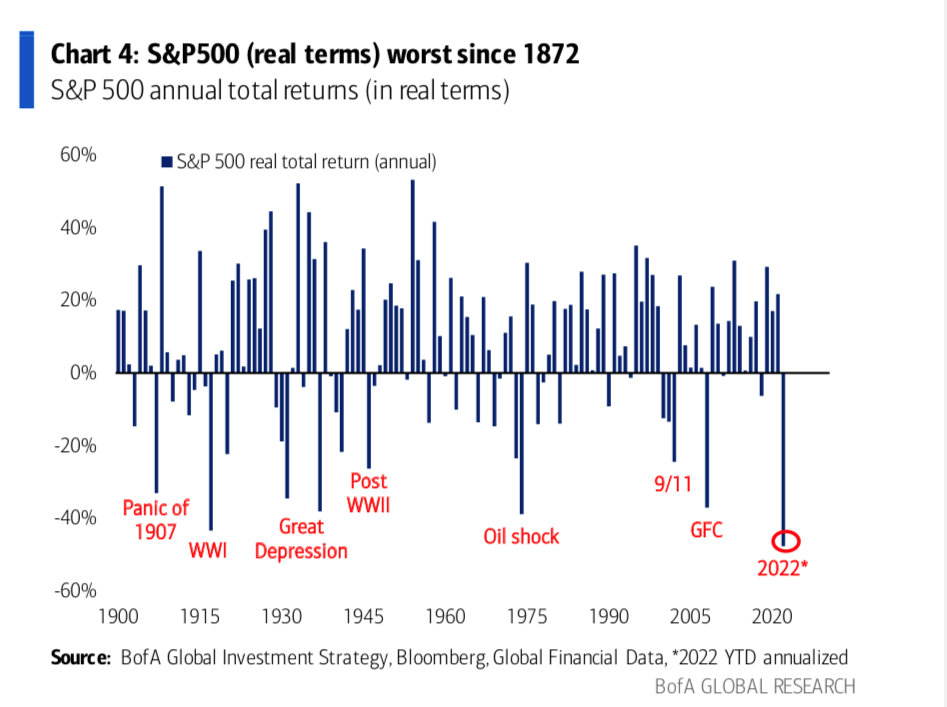

This chart is a bit misleading because 2022 is annualized while the others are actual, but there is no doubt it has been a rough go.

Inflation bits and bobs:

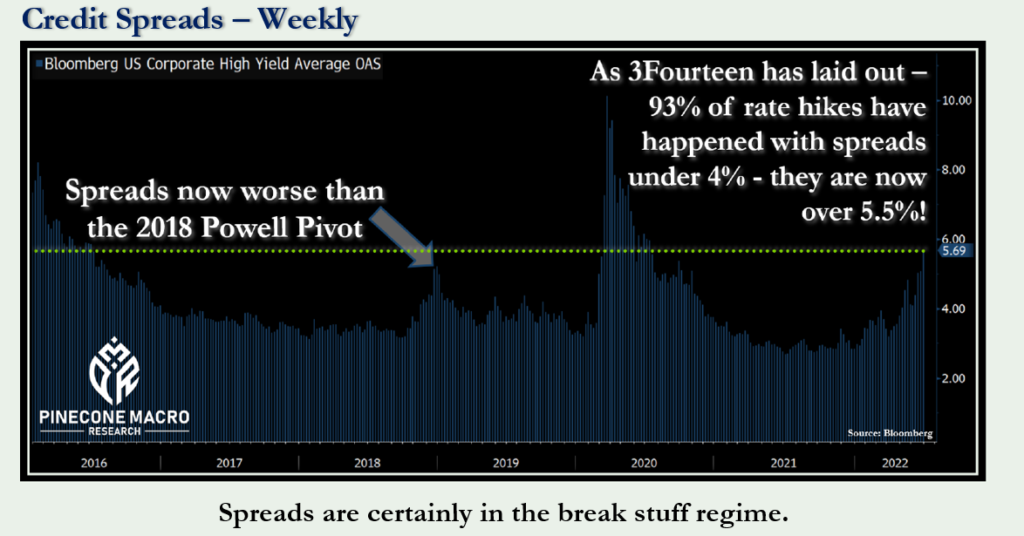

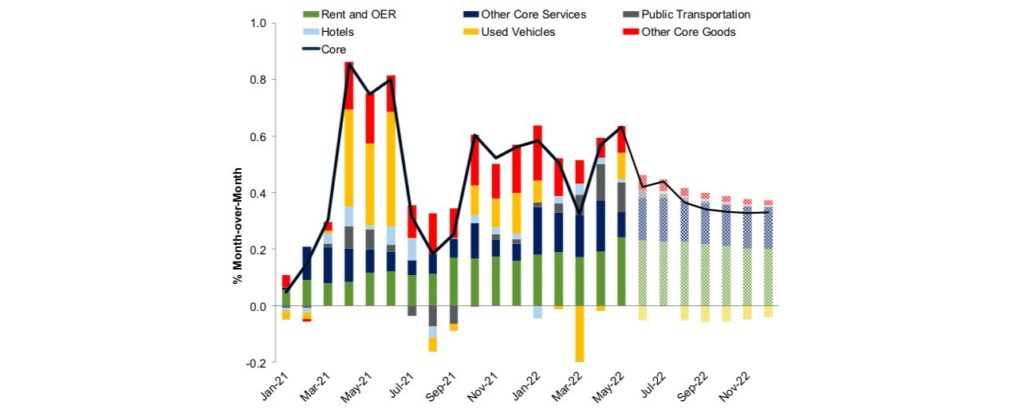

As noted above, with commodities coming off, there is some excitement that maybe inflation is peaking. That is certainly plausible. However, there is peaking, and then there is the target. As this chart from Pinecone Macro notes, we are still going to be tightening even with HY spreads widening (risk markets suffering) —> paradigm shift.

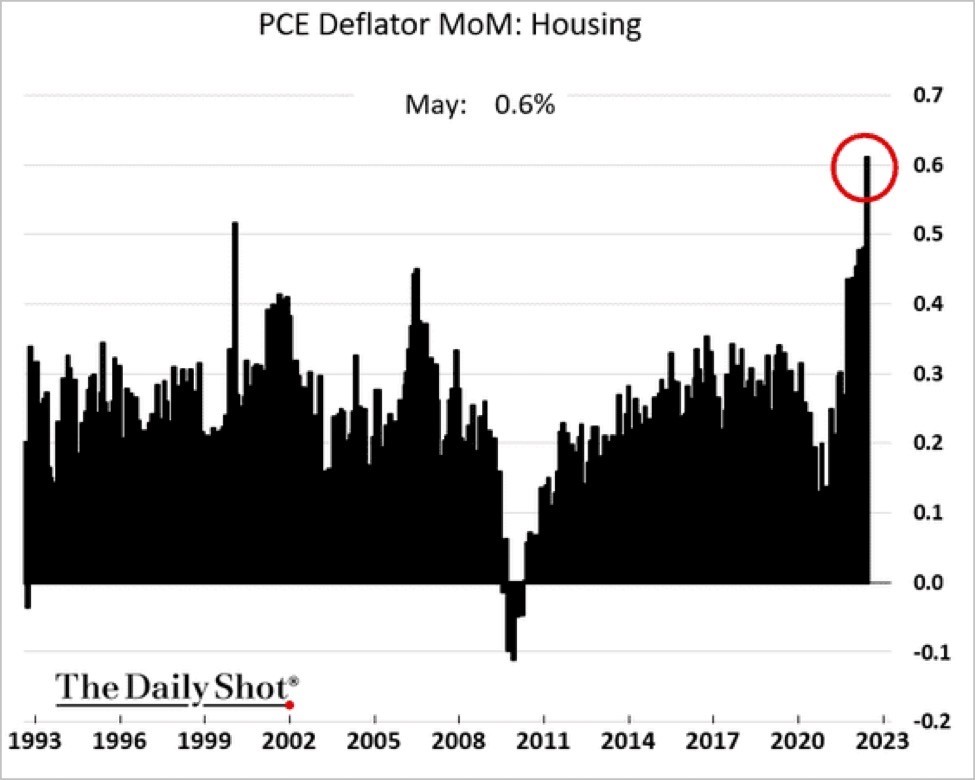

And, looking at Pantera’s work suggests that OER is not properly accounted for (it has rents at +5%, which is still lagging current developments as noted below) and if they were, inflation would be quite a greater than 10%.

Even Fed’s Powell commented as much in Portugal amidst the conference calling for the end of an era of low rates and moderate inflation: “We now understand better how little we understand about inflation.” Wow! I have said this for over a year: inflation is one complex phenomenon.

I read that as a regime/paradigm shift, as ECB’s Lagarde outlines:

And, this was an interesting bit of information from The Street, which suggests that the dollar strength is likely to export inflation overseas to help manage against FX headwinds. Once again, it points to incorporating a new regime into business operations going forward.

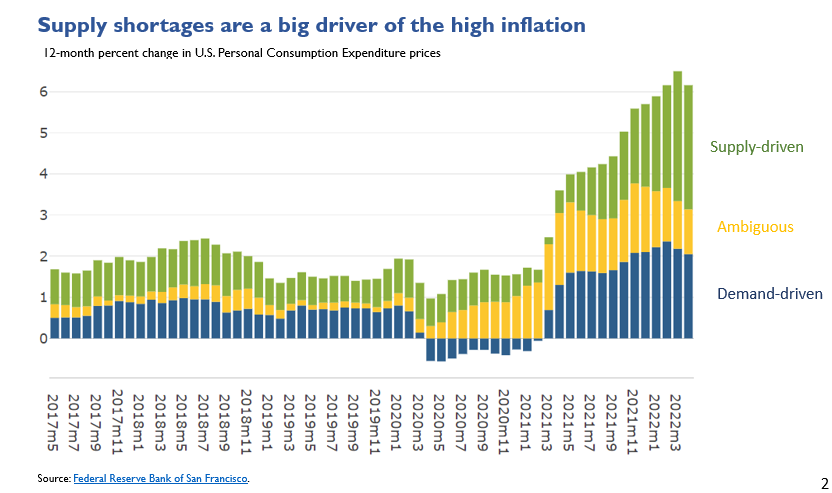

Yes, supply shortages are a big driver, but the demand side also picked up and what we know is that the bulk of the supply-driven issues is caused by excessive demand that was a response to avoid having a Covid-driven supply and demand-side issue, which would have occurred had authorities not acted. Not sure I see (other than political) the value in splitting hairs because it does not really matter at this point. Inflation too high —> do what you can to remove the pressure. Case in point, housing, where the supply/inventory issues existed prior to CoVid, has become more pressing now that demand for housing has increased. And, supply shortages are not easy to sort through in the short term.

Not worth commenting on policies relating to California sending out checks to help with gas price inflation, the Administration beating up mom and pop gas retailers, Elizabeth Warren calling for excessive profits taxes, Energy Secretary Granholm arguing for more EVs, or comparing our inflation to the rest of the world, blah blah blah. It’s just what happens when things go off the rails. Politicians feel the need to do something/anything and to hope the situation reverts/supply situations improve, and the Fed does not go overboard. Simply put, and I have remarked about this before: don’t let the genie out of the bottle in the first place. Once it is unleashed, things happen, in somewhat unpredictable ways. In any event, here is what GS suggests is the likely core inflation outcome for the bulk of 2022 (even assuming further Fed hikes) – which is still elevated relative to the target!

Other Tidbits:

Nuclear is a part of the green energy solution:

Yeah, I know, CCJ has come off quite a bit, but I still like it for the simple fact that nuclear is a part of the solution to clean energy. Here is a good article on the subject from the NYTimes entitled “Nuclear Power Gets New Push in the US, Winning Converts.”

Crypto:

The hits are likely to keep coming as that system deflates and we learn about what all of those 18% return products were, and that in a pinch, getting access to assets was not simple. In fact, what we are learning now is that there was a fair bit of structuring against the crypto bubble, as this article notes, and the impact of the bubble bursting, as FT notes, is disproportionately African American investors who thought this was the chance to get in the ground floor of new wealth-generating opportunity. I am looking forward to the hearings and blame game if – as I expect – more shoes to drop.

On whether we will correct further, read the note from Pantera, and this article where Morehead says he expects to see more shoes to drop. Once again, it all just got very far ahead of itself.

Pre-agreed bank financing it may struggle to unload: Good article here in Bloomberg suggesting some caution required for banks as they are struggling to distribute buyout financing. The money quote (at least to me) is:

Is “Wokeism” on its Heels?

I have two articles on this that caught my attention. The first is a note from a tenured professor at UCLA in anthropology, who highlights how the current operating landscape on campuses is unrecognizable, with professors turning on each other (hardly collegial). I don’t know the other side of it, but I have friends in academia and they have shared similar stories, and my kids were inundated with this stuff while in college.

The second article, oddly enough, is an interview with Jesse Powell, the CEO of Krakken and he makes some really good and insightful points about the importance of cultural cohesion and how too much sensitivity just is wasteful. As he explains, losing a great programmer (what he calls a 10X employee) can be bad, but if that programmer is disruptive, and gets bent out of shape with things outside the execution of the company’s primary mission, then they have to go. Ultimately, this all may be within the realm of a changing landscape for employees. I saw this in the late 1990s at JPMorgan as we had the mantra that there was a “war for talent” that quickly morphed into layoffs. The world changes and companies are not political enterprises. Incorporating best practices, and treating people respectfully and inclusively – fine. That serves a purpose. Bending over backward to a crowd that like the guy who had to take some work days off after the Roe v Wade, is probably not going to cut it going forward.

WTF?

A very dear and courageous friend recently passed away after an 8-year battle with cancer. He was on opioids and all sorts of pain killers to help him navigate through that journey. In the very end, he was given Fentanyl. He remarked how incredibly powerful it was. Not sure how this became a thing, but it is a big problem (as are opioids). Anyway, here is a story about two men who were busted with 150,000 fentanyl pills, but were released without bail.