There are many times I consider if I need or want something in many aspects of my life. When one needs something, it’s more urgent and essential, and when one wants something, it’s a desire. Putting this into trading and investment perspectives is important to consider. One of the main reasons short-term day traders fail is that they typically need to make money every day because they need to make money to live. And day traders typically take larger risks with sizing so big that the tiniest wiggle can shake them out quickly at a loss. Needing to make money like this increases anxiety and stress. It is nearly impossible to maintain a consistent process when one needs to make money trading short term.

It becomes more of a desire if you want to make money trading or investing. I want to make money when I trade and invest, and learned the more I simply want to make money; my stress level decreases as I follow my process by using my indicators, sizing properly within 5% the max size, and allowing my trades to work. Sometimes my trades do not go my way out of the gate but there are a lot of horses that find their stride on the backstretch into the home stretch. Sizing properly allows for more patience too. The best investors I know want to make money and are confident they can win more times than they lose as they follow their process and intuitively know when to make trades or investments. For newer investors, I hope this note resonates. For those more experienced, I am sure they have needed to make money and learned to want to make money.

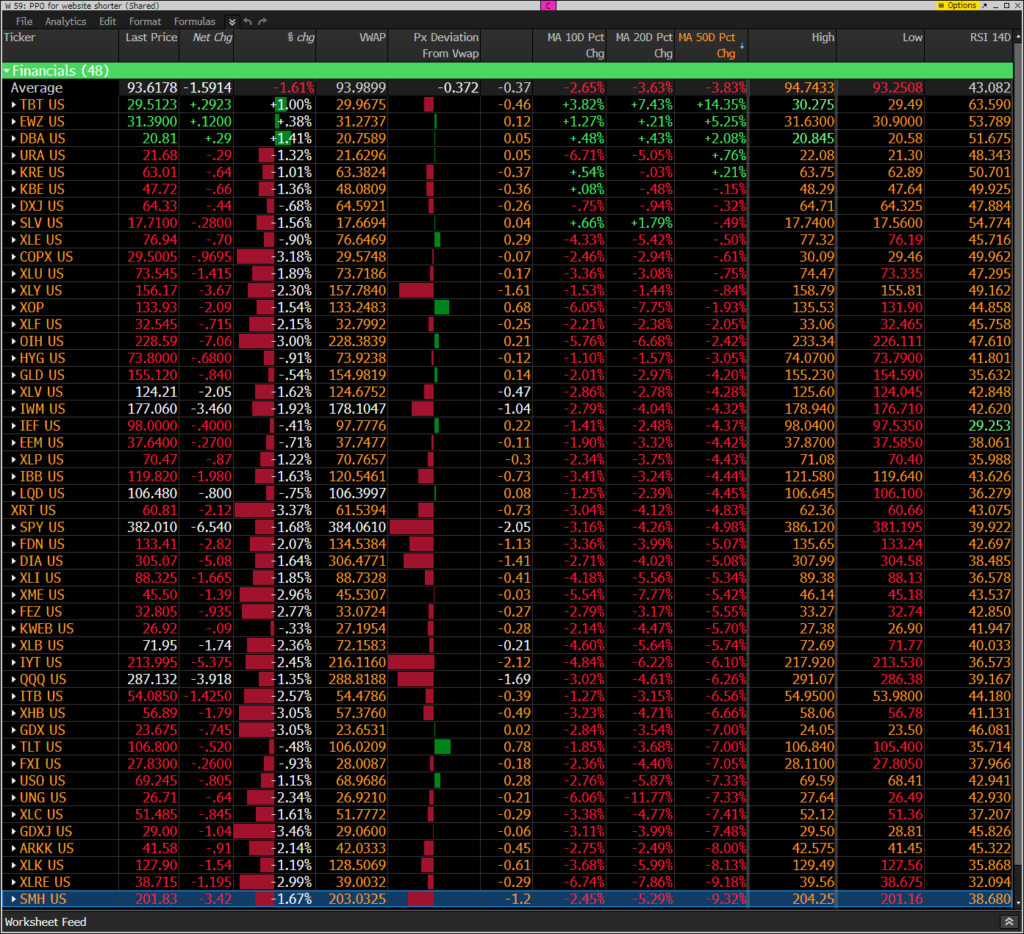

The last hour has seen some swings in the markets. At this moment of posting, it’s up. Several of the VWAP levels are surpassed on the monitor below. Breadth remains very weak.

TRADE IDEAS

Ahead of tomorrow’s Fed meeting and Powell’s press conference, there is no trading edge, even if we have a strong idea that Powell will raise 75bps. The market’s reaction could swing on a comment in the press conference. Looking at the daily charts of the major indexes and the sector ETFs below, I want to press and add a lot more short exposure. I won’t because, again, the market reaction is the wild card. I still like and I am holding the October 7th expiration QQQ 280-265 put spread I paid $3.50 last Friday.

US MARKETS

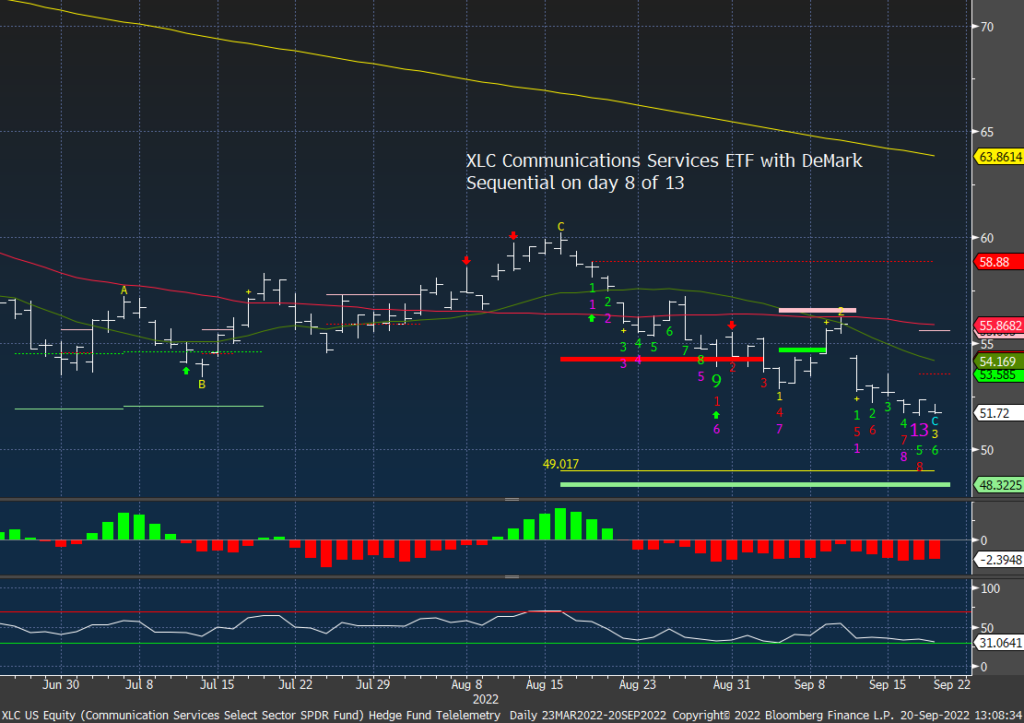

Here is a primer on the DeMark Setup and Sequential indicators.

S&P 500 futures 60-minute time frame lost the upside pattern as described earlier if a new low occurred. This is back in downside wave 5 with a potential wave 5 price objective of 3786.

S&P daily with Sequential Countdown in progress

Nasdaq 100 daily ditto

US SECTOR ETF FOCUS

Overall, many sectors have downside DeMark Sequential Countdowns in progress, similar to the main indexes. Several are moving towards the June lows.

XLK Technology

SMH Semiconductors

XLY Consumer Discretionary

XLI Industrials

XLF Financials

KBE Banks

XLE Energy

Energy XOP

XLV Healthcare

Biotech IBB

XLP Consumer Staples

XLC Communications Services

XLB Materials

GDX Gold Miners

XLRE Real Estate

XLU Utilities

IYT Transports

ITB Housing

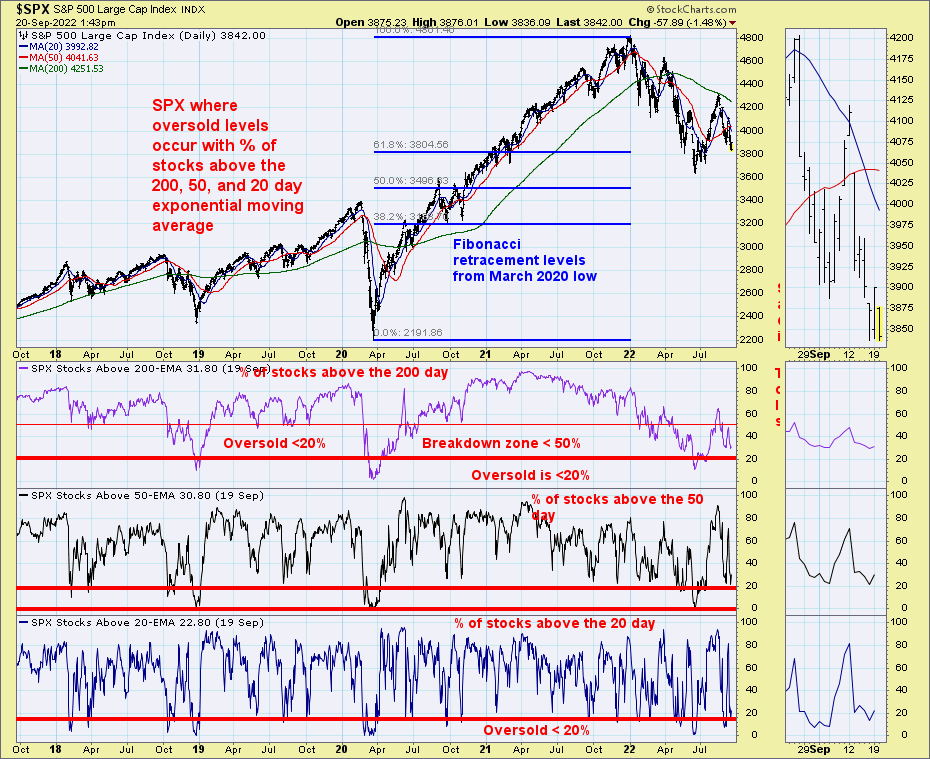

Internals – are not fully oversold

S&P 500 percentage of stocks above the 20, 50, and 200-day moving averages shows the 20 and 50 day at 20% and that is oversold however this year it’s been lower before turning

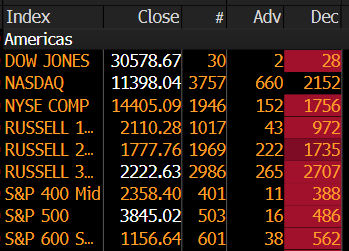

Advance decline data is not oversold

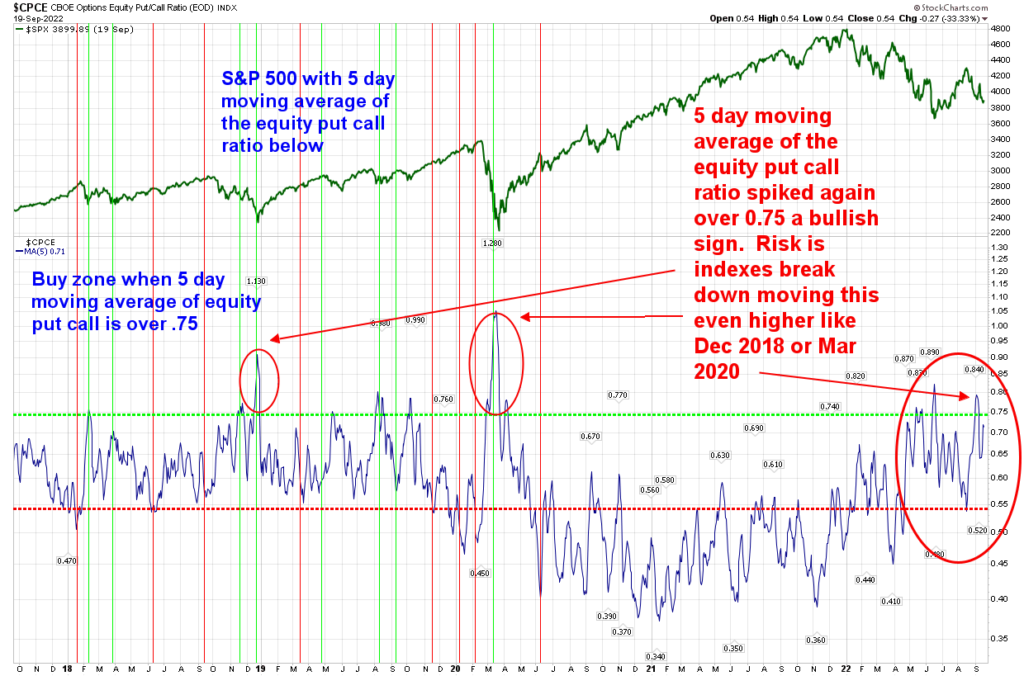

5-Day Moving Average Equity Put/Call Ratio is moving higher again after a brief moment of heavy call buying on the short-lived bounce

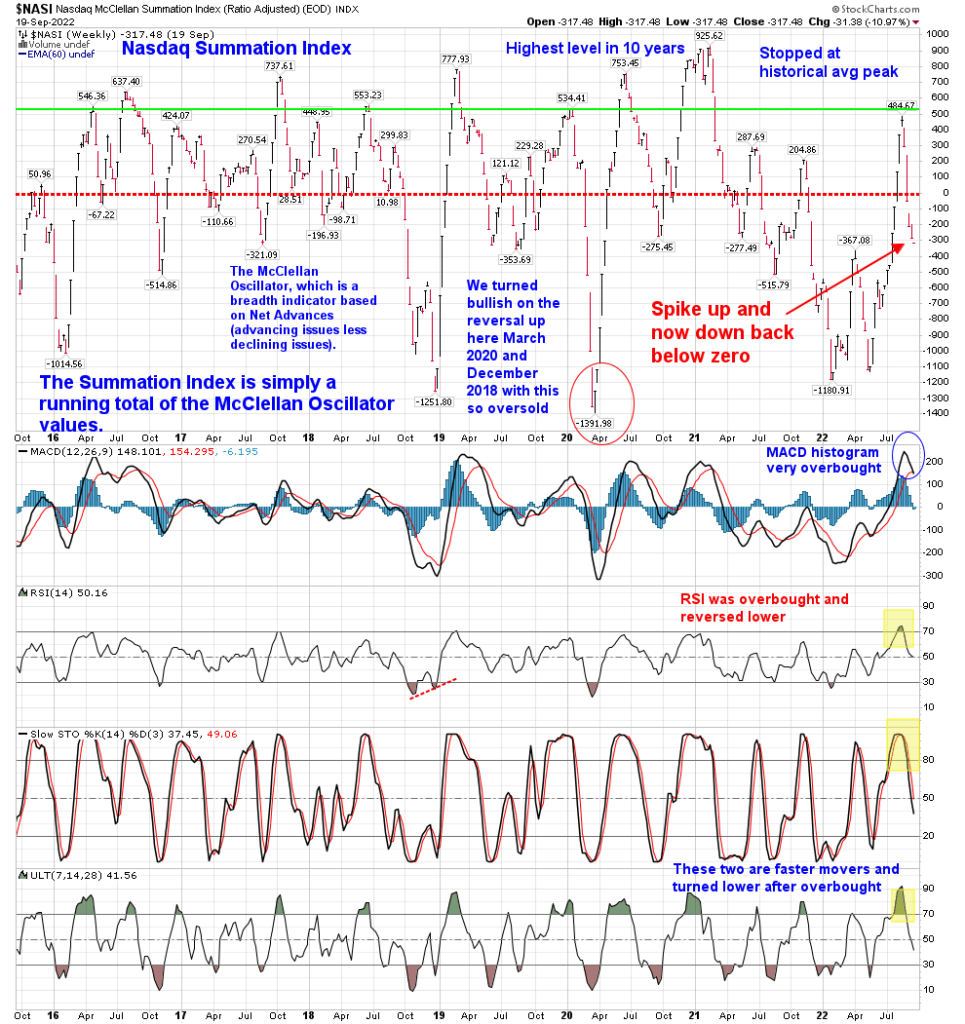

Nasdaq Summation Index weekly is reversing down under zero when the market tends to fully understand the markets are in turmoil

FACTORS, GOLDMAN SACHS SHORT BASKETS AND PPO MONITOR UPDATE

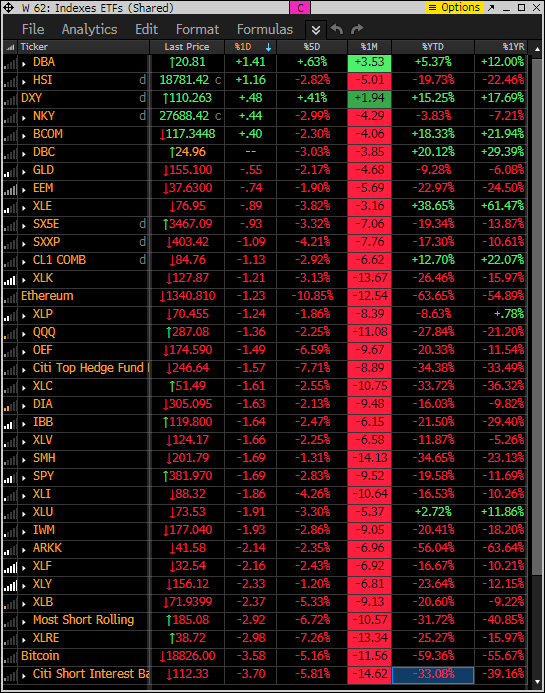

Factor ETFs and other indexes just brutal day, 5 day and 1 month rolling.

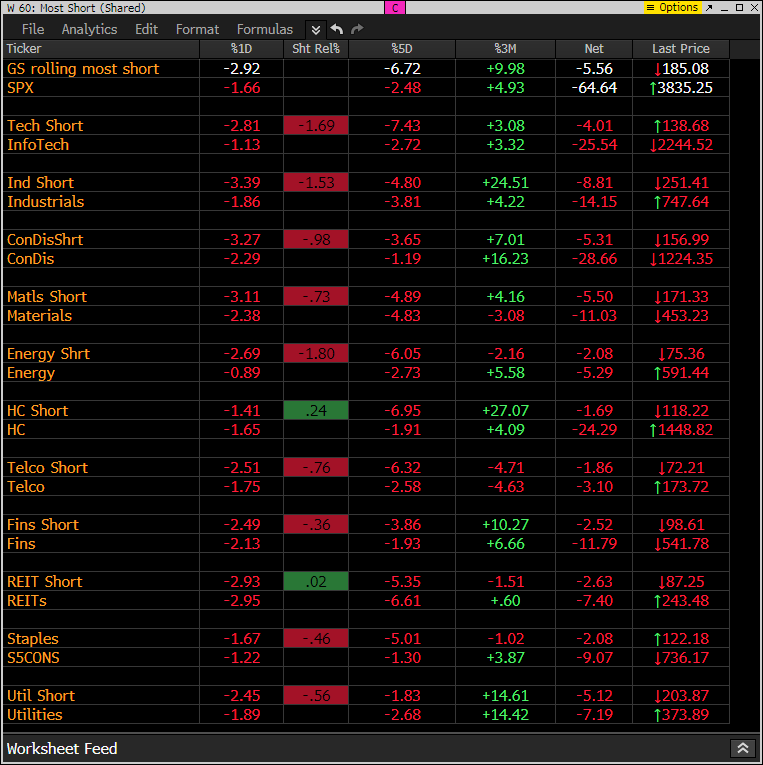

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Today the shorts are clearly working while the S&P indexes are a broadly lower

The PPO monitor (percentage price oscillator) force ranks ETF’s by percentage above/below the 50 day moving average. For information on this monitor please refer to this primer. This monitor is offered to Hedge Fund Telemetry subscribers who are on Bloomberg. Notable: A VERY heavy day with many 20 day new lows