Quick Market Views

Stocks: Not a great jobs report, but the market is ignoring it. The potential China reopening news is gaining more steam. New DeMark Sequential and Combo buy Countdown 13’s on QQQ, NDX. Sentiment is oversold at 10%. I am holding my nose and adding some long trades.

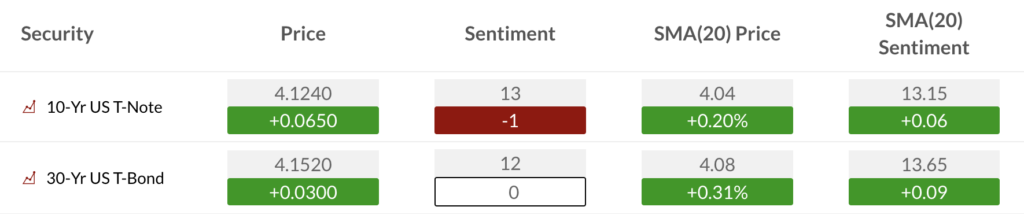

Bonds: Rates were higher and are trying to turn and stay lower.

Commodities: Strong across the board on the China news. Copper is ripping 7%. COPX up nearly 10%.

Currencies: US dollar is down with a risk off type of day. I have several currencies below to look at.

Trade Ideas Sheet: I am covering COIN since the earnings were terrible but this was bought and I will lock in the 12% gain. I will be looking to add it back. I am also covering SPY and ORCL with moderate losses. I will add some long positioning all with 2.5% sized positions: QQQ, SPY, BABA, GOOGL, AMZN, KWEB, MSFT, and STX.

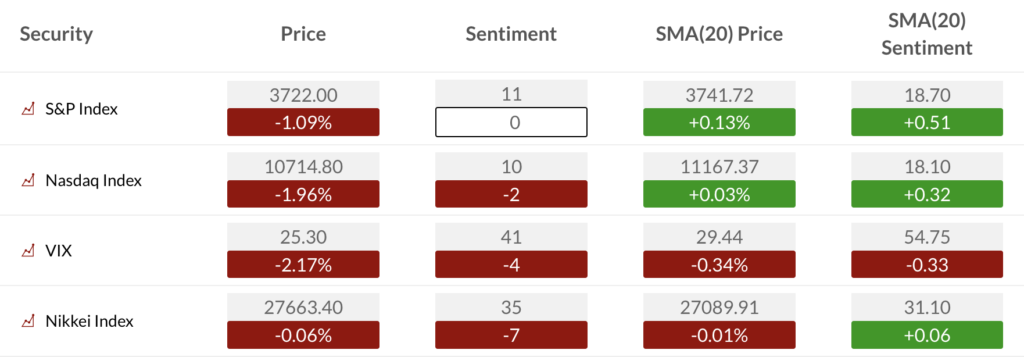

US Market Indexes and Sentiment

Here is a primer on how we use Daily Sentiment Index charts. Lower on this note is bond, currency, and commodity sentiment.

S&P bullish sentiment and Nasdaq bullish sentiment remains oversold

S&P bullish sentiment could bounce from these levels

Here is a primer on the DeMark Setup and Sequential indicators.

S&P futures 60-minute time frame still has the downside wave patter of wave 4 of 5 but this could also lift in a new upside pattern.

S&P 500 Index daily is holding the 20 day which doesn’t mean much but this could be a higher low

Nasdaq 100 futures 60-minute time frame has a decent bottom with the Countdown 13’s

Nasdaq 100 Index daily with some DeMark exhaustion Countdown 13’s

Trade ideas – adding longs

KWEB and BABA are my China proxies to be long

GOOGL, MSFT and AMZN have some DeMark exhaustion signals at deep oversold levels. Adding long

STX has some exhaustion as well.

currency update

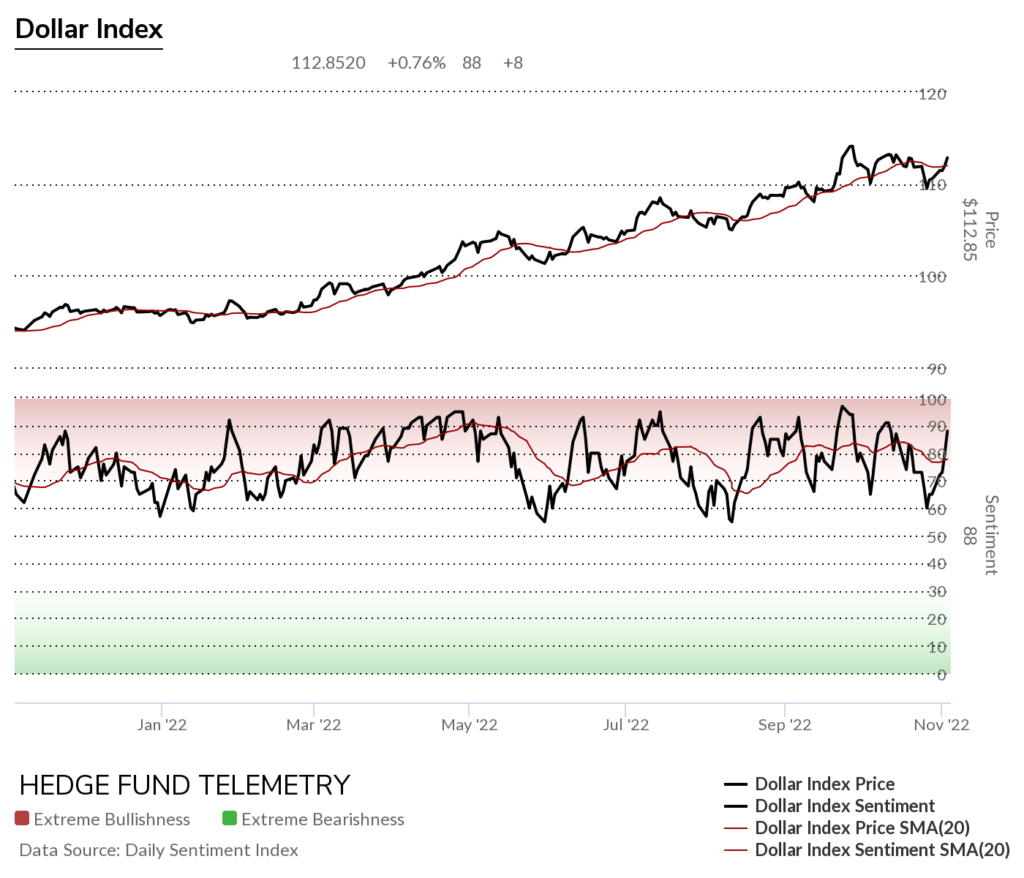

US dollar index reversal? Still too early to tell

Dollar bullish sentiment is elevated and remains bullish until the low end of sentiment breaks.

USDJPY The Yen intervention might have started something. And this one is way too early to tell

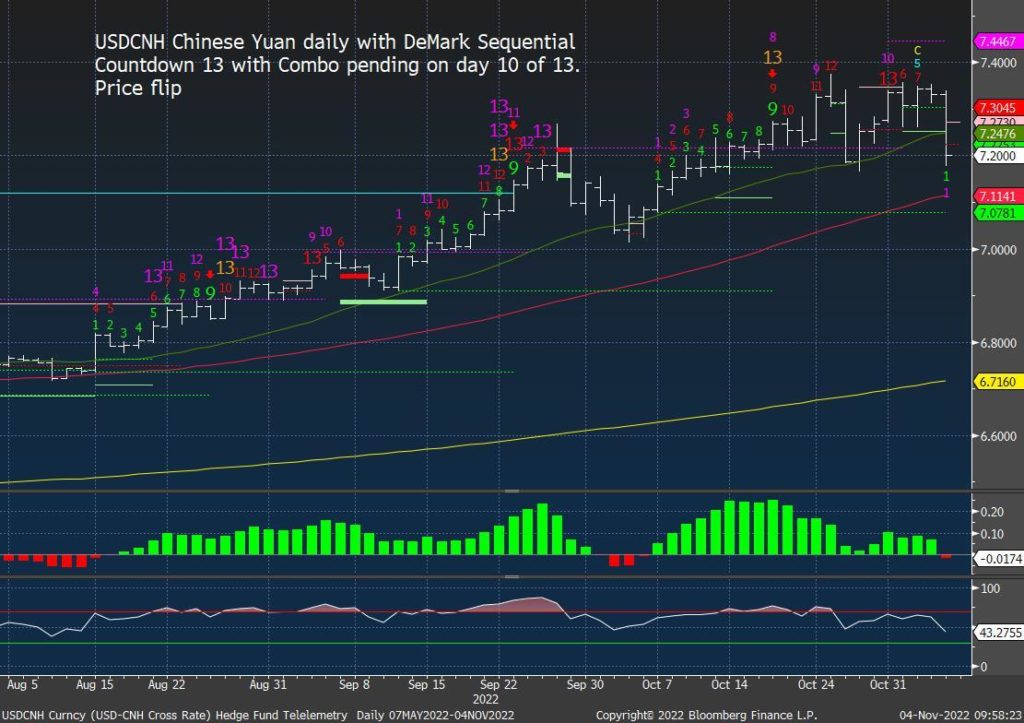

USDCNH has had a huge move today. Down 2% .. 3 st dev move. Largest down move ever someone tells me

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. For information on this monitor please refer to this primer. This monitor is offered to Hedge Fund Telemetry subscribers who are on Bloomberg. Strong day

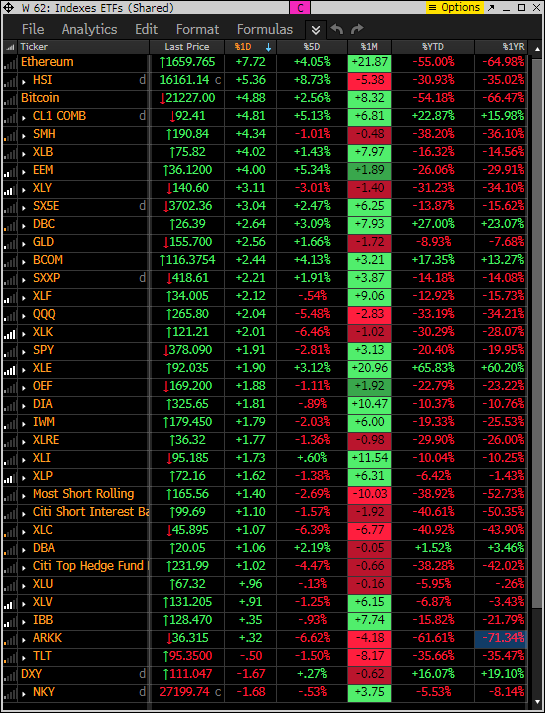

Index ETF and select factor performance

This ranks today’s performance and has 5-day, 1-month, and 1-year rolling performance YTD.

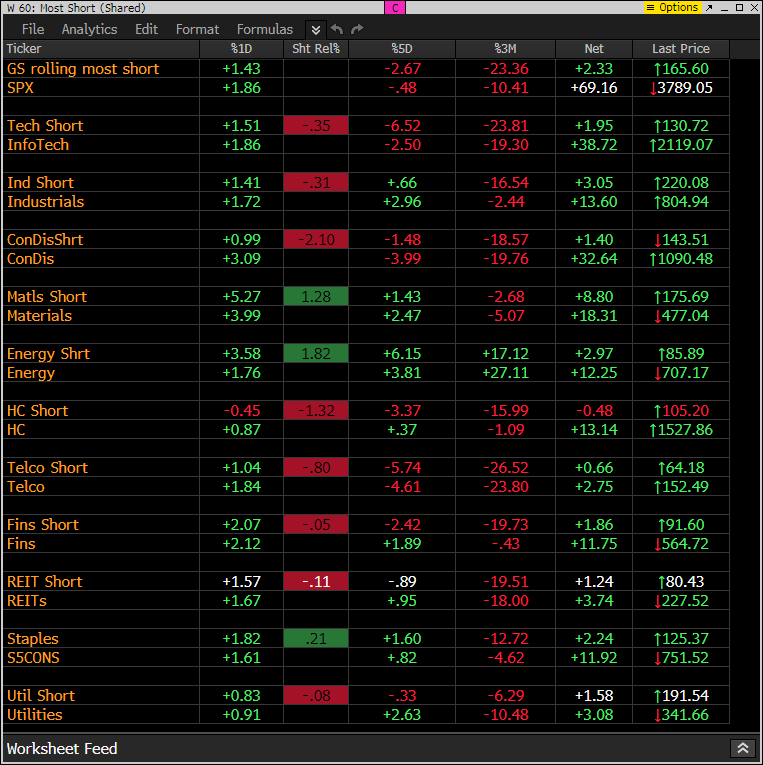

Goldman Sachs Most Shorted baskets vs S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Today the shorts are seeing some covering however this is real money buying as the S&P indexes are stronger

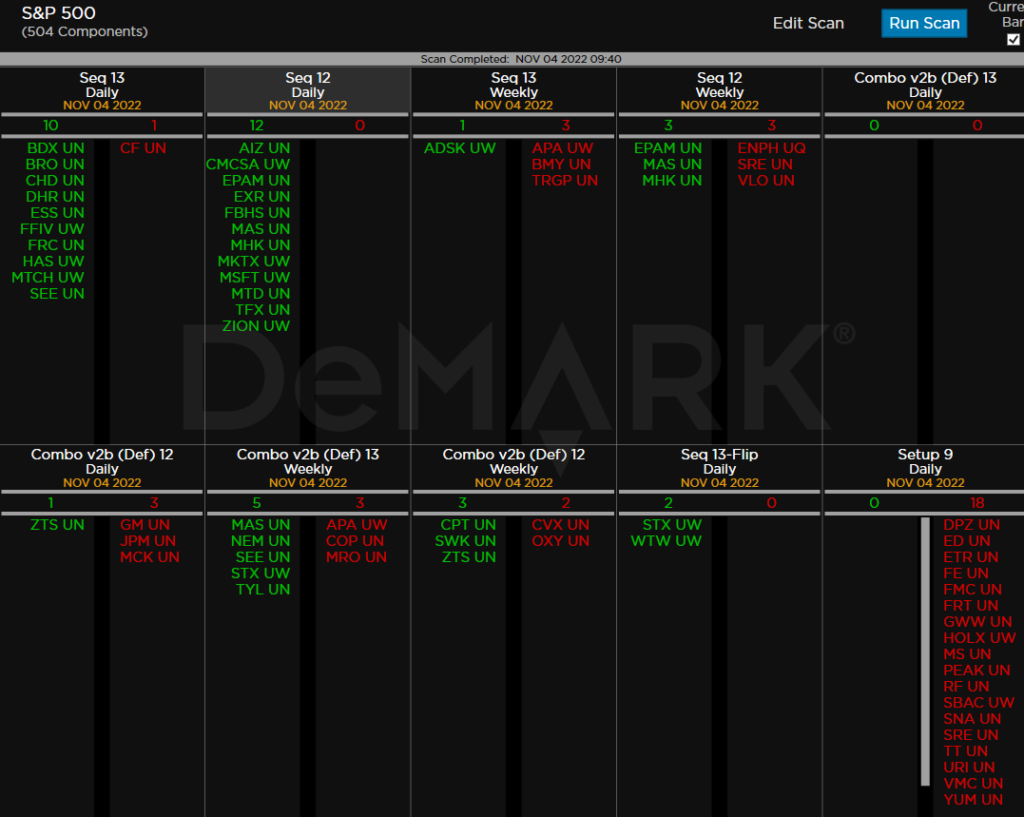

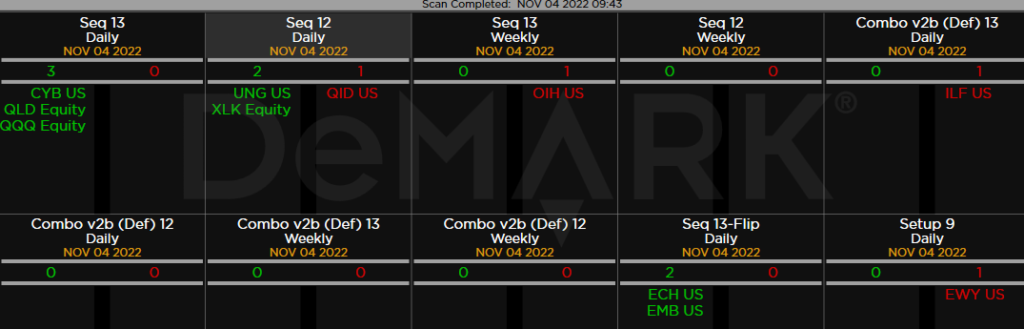

DeMark Observations

Within the S&P the DeMark Sequential and Combo Countdown 13’s and 12/13’s on daily and weekly time periods. For information on how to use the DeMark Observations please refer to this primer. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting:

Major ETFs among a 160+ ETF universe.

Bond, Currency, and Commodity Bullish Sentiment

Bond bullish sentiment

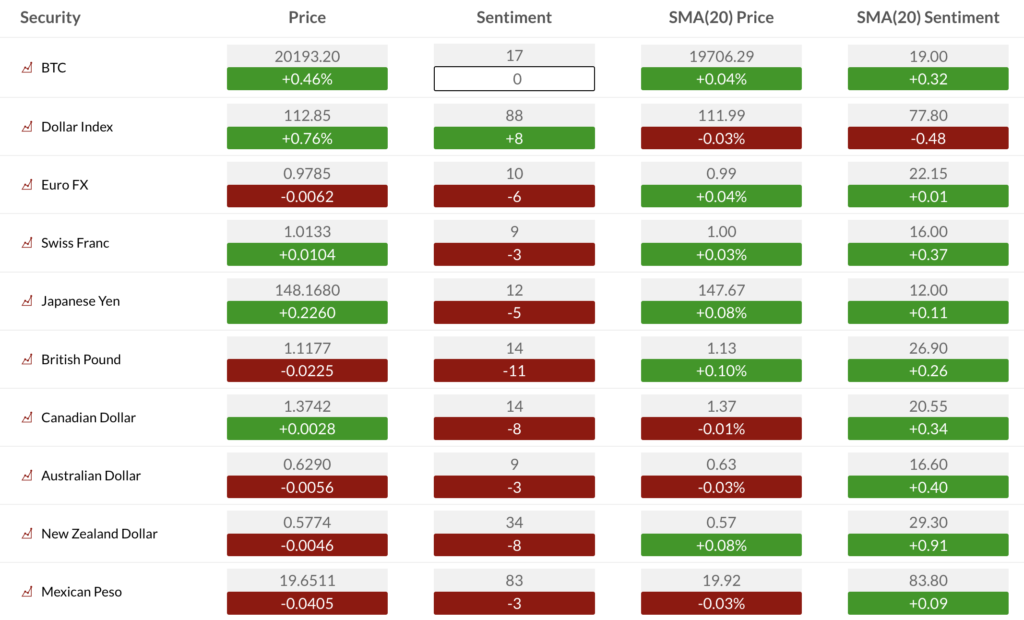

Currency bullish sentiment

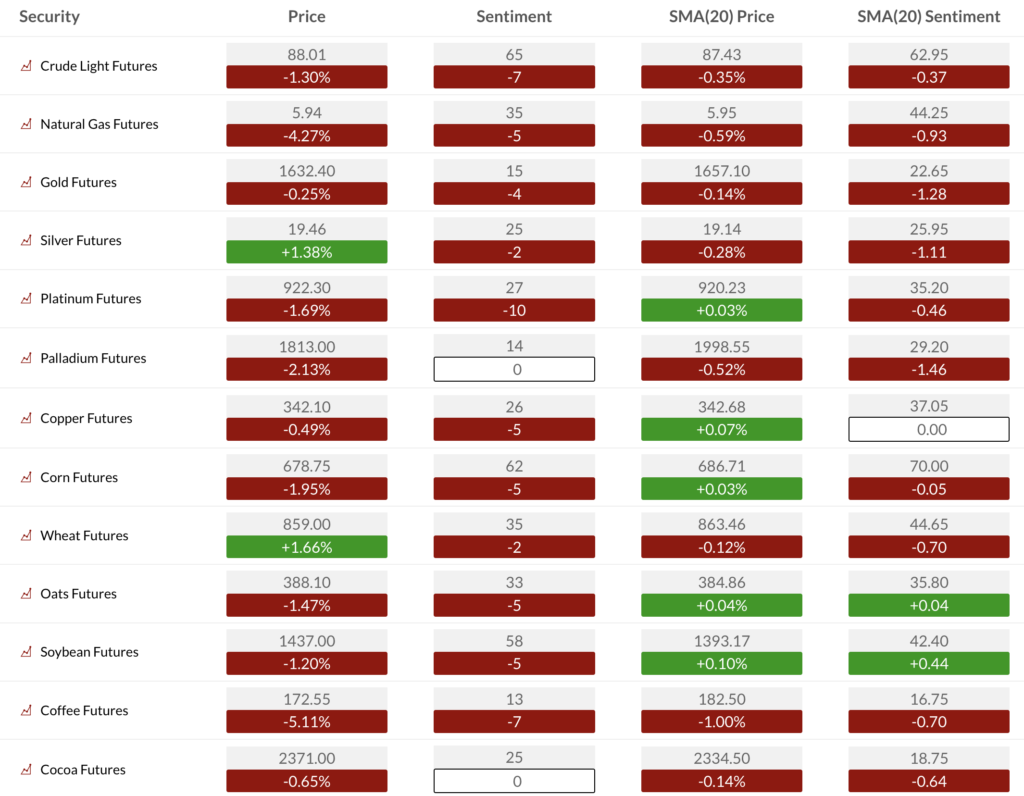

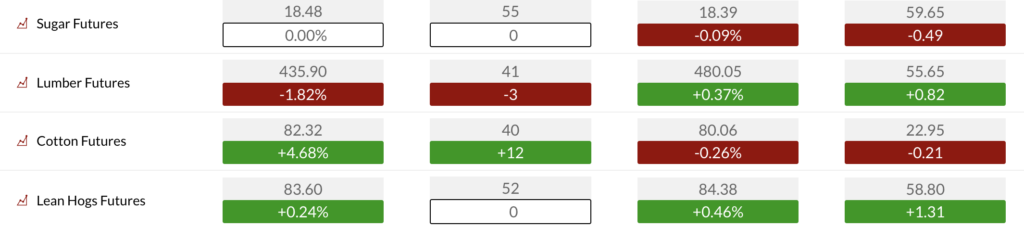

Commodity bullish sentiment

If you have any questions or comments please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research