There is a curse of when the media (or someone declares themselves) the next Warren Buffet.

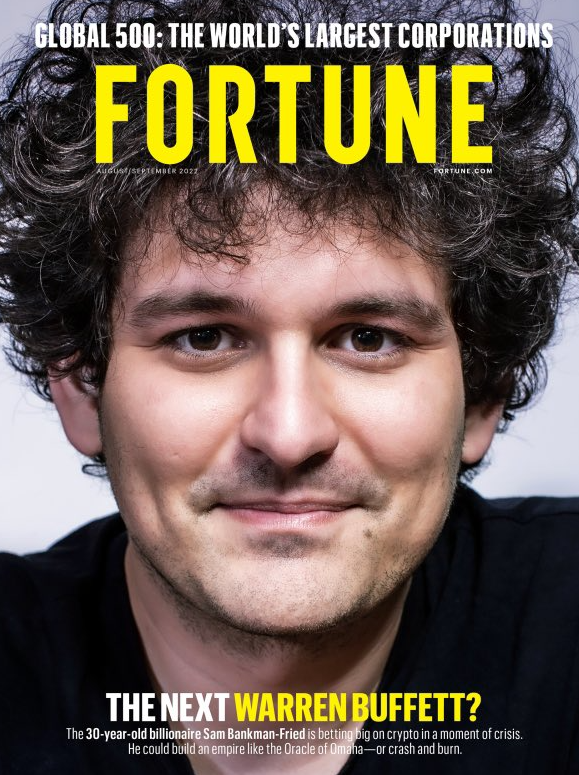

I started putting this note together yesterday, and there’s quite a lot of breaking news today with this “next Warren Buffett.” Sam Bankman-Fried is the head of FTX, a crypto exchange. With all of the carnage in the past year, “SBF,” as he’s known, was the white knight bailing out overleveraged, illiquid, and essentially insolvent crypto coins and exchanges. Despite the crypto market’s implosion, he seems to have unlimited assets to accumulate. Last summer, he even signed the “Giving Pledge” that billionaires sign to give away their wealth over time to charity. This weekend a competitor and collaborator, CZ of Binance, tweeted they took out their investment in FTX’s coin or whatever it was, causing SBF to tweet out a thread with the notable quote, “Assets are fine.” Today as FTX’s assets were under question as they halted withdrawals, SBF and CZ announced Binance will buy FTX and help cover the liquidity crunch. So they hope because it’s probably a lot worse than SBF will ever admit. That was quite a fast fall of SBF’s crypto empire. This story is not over.

Cathie Wood continues to make the rounds on business TV and conferences, preaching the same story about her investing style of innovation, future technologies and all things that will make her clients rich. We shouldn’t hear about her being the next Warren Buffett again, with her fund down 80% off the highs.

I listened to a few of this guy’s YouTube videos. This one was just incredible. “Healthy, wealthy, and wise” is the name of his channel. It was just remarkable.

Here is another You

This wasn’t such a good take using Bitcoin and crypto as a hedge for ARKK

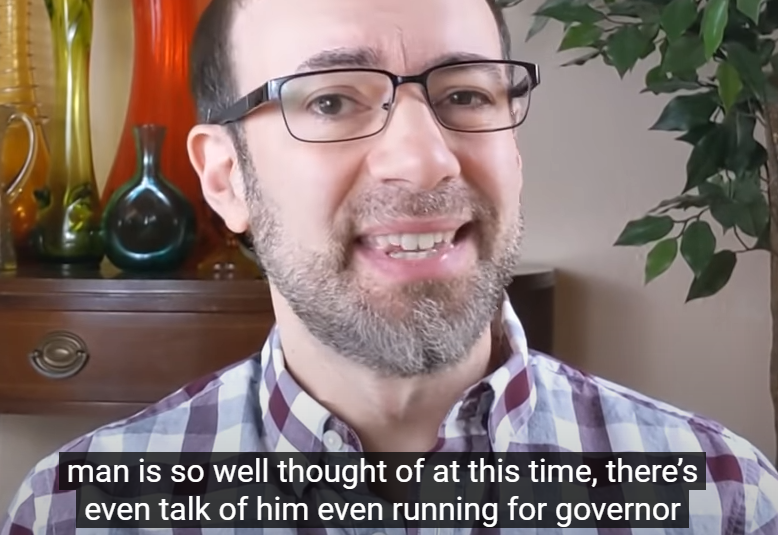

Chamath Palihapitiya might be one of the most annoying people in Silicon Valley. He declared he was the “next Warren Buffett” after he put out an annual report contrasting his performance vs Warren Buffett. Online, he was blasted and fact-checked hard. Since 2021 most of his SPACs are down significantly with some down more than 90% while he cashed out at the highs.

Josh Brown, a CNBC commentator, declared Chamath the “next Warren Buffett.” There are many reasons why I don’t watch CNBC, and I recommend you watch Bloomberg if you’re interested in all markets and not “the stocks of the day.”

Back to this guy again. It’s so absurd. Regarding Chamath’s “talk running for California Governor.”

There was a documentary about Bill Ackman being the “next Warren Buffett.” I like Bill and think he’s very smart and a good, albeit inconsistent, money manager. He digs in too deep at times and shouldn’t go full “public short activist” again.

Bill Ackman lost a ton on Valeant Pharmaceuticals as it nearly went bankrupt. Valeant was the largest Canadian company by market cap at one point. That also has a curse, as so was Nortel Networks, Blackberry, and recently Shopify.

Larry Fink of Blackrock was touted as the “next Warren Buffett” in 2018 when the rage was buying unicorns and private companies. I’m not sure how this worked out but $10 billion for BlackRock could have been an odd lot loss.

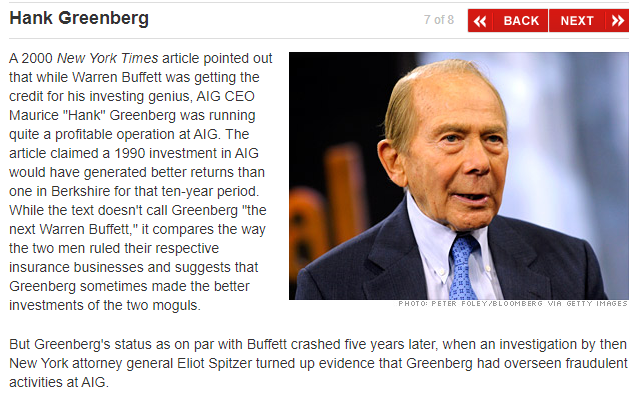

Hank Greenberg was the CEO of AIG and created a mammoth firm that ended up being one of the biggest blowups during the GFC.

I’ll give LeBron credit as he has probably invested well over the years and considering he called himself “King James” early on was egotistical, something very much not Warren Buffett. Those Crypto.com commercials that ran on TV for months drove me crazy.

Mark Zuckerberg has assembled many good assets at FB, notably Instagram for $1 billion and now he’s bet the company’s future on everyone wearing a swim mask to communicate.

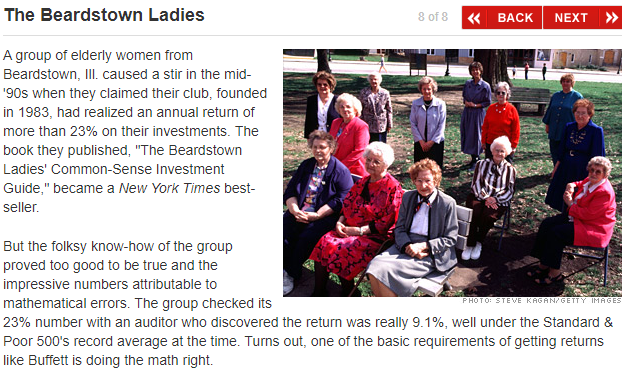

Remember the Beardstown Ladies investment club, which put up incredible returns when the markets went up? Probably some smart women but not the “next Warren Buffett.”

I know a guy here in Greenwich a hedge fund allocator who made a $1 million bet with Warren Buffett that hedge funds would outperform the S&P. This bet was made when the S&P was at the lows, and I think anyone would have told him not to make this bet.

Eddie Lampert is a friend of mine. We ride bikes when he’s in town. I’ve spent some time with him alone on the roads and have had some interesting conversations. I’ll say he’s among the smarter creative and deep-thinking guys I’ve met in finance. I remember one day we were riding, and I asked if I should buy some Sears as it dropped that day. He said, “Don’t ever buy it.” At first, he bought Kmart and Sears as a real estate play which became a victim of Amazon and saturated brick-and-mortar retail stores. It put a regrettable stain on his career, and now he remains under the radar.

There are a lot of stories about how to turn your kid into the “next Warren Buffett.”

Seth Klarman is a brilliant value investor with a solid reputation, and I’d say if he worked with Buffett and Munger early in his career, he would be running Berkshire Hathaway right now. Some good principles are below to remember.

This was published when all the rage was quant funds replicating value and growth strategies.

Michael Burry is an unusual guy and money manager, to say the least. So is Warren Buffett! The last quote is the most important thing to remember from this post. Set out on your own path, run money your way and by your rules. In the end, there will never be another Warren Buffett.

TRADE IDEAS

Earlier, when the breaking news on FTX getting bought (bailed out) by Binance spiked crypto, I paused from saying I was going to re-short COIN as it was lifting into the green. I will short a 2% sized position and add if this moves higher. Not the most precise entry, so keep the size down. I will take profits on some long ideas: SPY, QQQ and turn short 2.5% sized positions with both. I am cutting some long exposure: Selling down to 1% sized positions from 2.5% sized positions: GOOGL, AMZN, MSFT, STX, META. UPDATE: META WAS A 2% POSITION AND NOW 1%

US MARKETS

Here is a primer on the DeMark Setup and Sequential indicators.

S&P futures 60 minute sell Setup 9 – a higher low wave 4 of 5 pullback is probable

S&P 500 daily

The Nasdaq 100 futures 60 minute also with sell Setup 9

NDX index daily

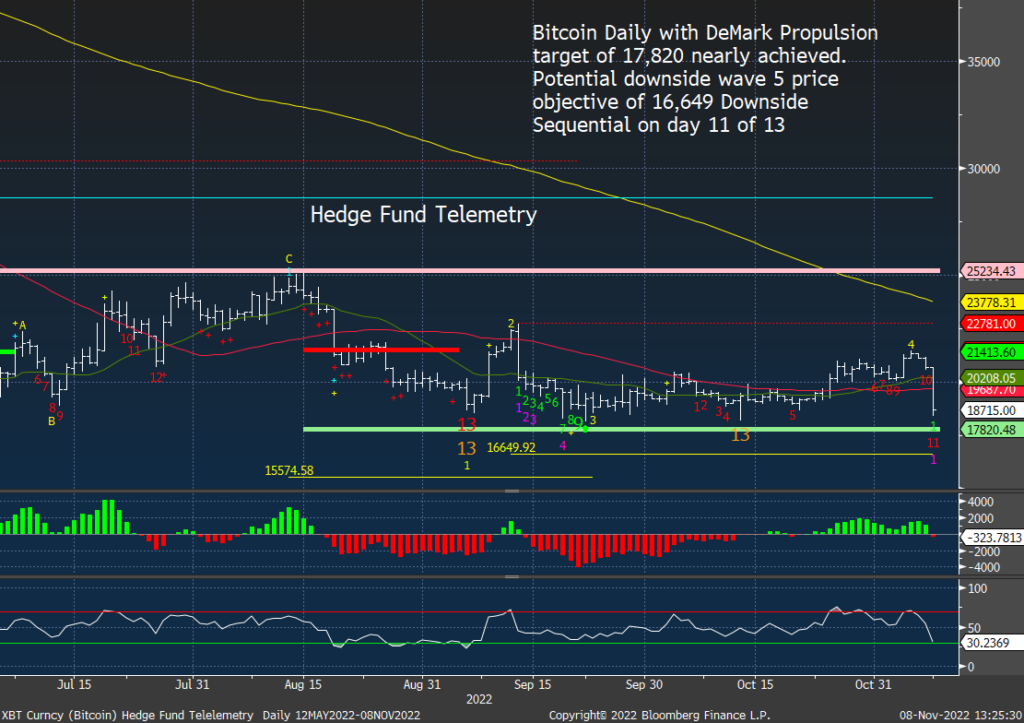

crypto continues lower

Crypto has accelerated lower midday

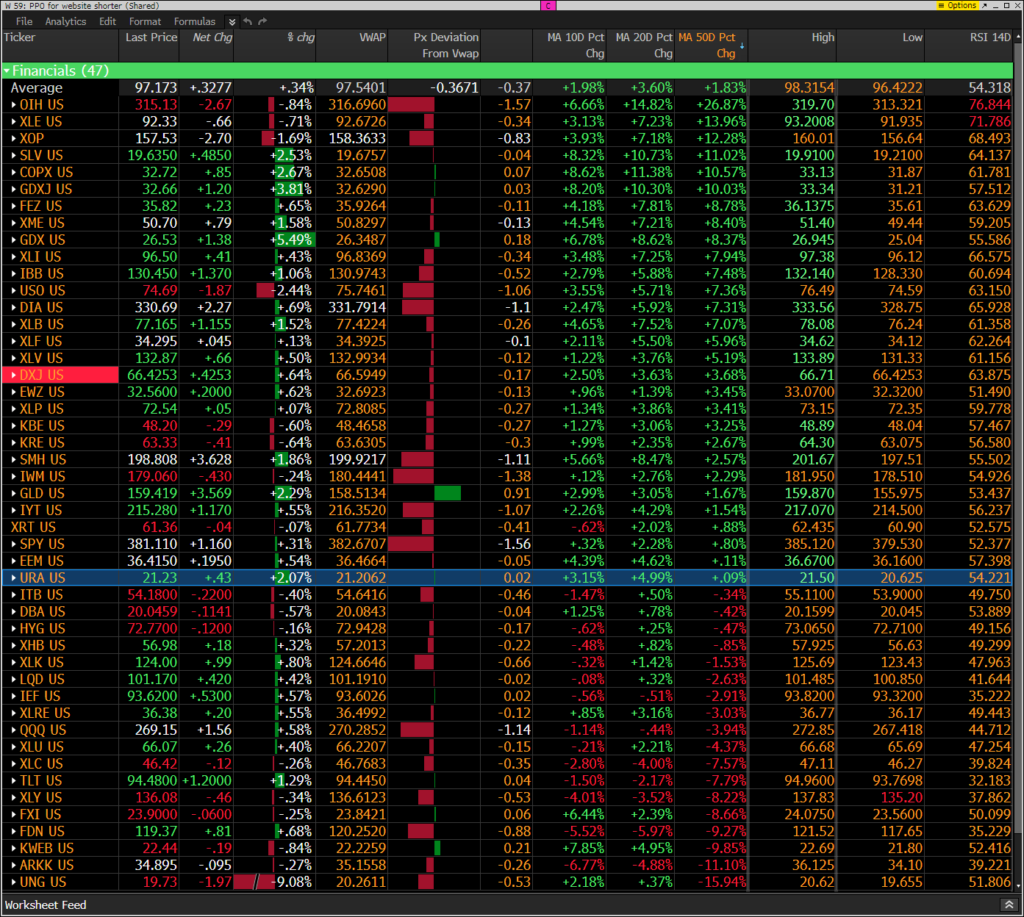

PPO MONITOR UPDATE

The PPO monitor (percentage price oscillator) force ranks ETF’s by percentage above/below the 50 day moving average. For information on this monitor please refer to this primer. This monitor is offered to Hedge Fund Telemetry subscribers who are on Bloomberg. Losing VWAP levels fast.